Die kleine Falkland-Schwester von Desire Petroleum mit 3,5Mrd Barrel!? - 500 Beiträge pro Seite

eröffnet am 26.05.08 23:34:37 von

neuester Beitrag 20.12.16 15:13:07 von

neuester Beitrag 20.12.16 15:13:07 von

Beiträge: 451

ID: 1.141.556

ID: 1.141.556

Aufrufe heute: 0

Gesamt: 27.920

Gesamt: 27.920

Aktive User: 0

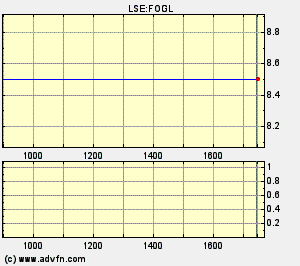

ISIN: GB00B0FVQX23 · WKN: A0F6YF

0,1585

EUR

-1,25 %

-0,0020 EUR

Letzter Kurs 22:58:43 Lang & Schwarz

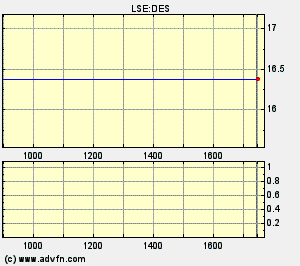

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,046 | +27,24 | |

| 2,049 | +26,56 | |

| 2,030 | +25,77 | |

| 2,040 | +24,54 | |

| 42,40 | +20,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,38 | -8,27 | |

| 6,6800 | -8,99 | |

| 101,30 | -9,43 | |

| 4,6700 | -10,19 | |

| 5,2200 | -10,31 |

The most Undervalued Falkland-Play IMO!

Zwar noch nicht ganz so weit wie Desire, aber im JV mit Desire. Vielleicht auch nicht ganz so viel Cash wie Desire aber nur ein Drittel der MK von Desire.

Eine Wette auf den Ölpreis! Hochspekulativ! Aber spannend zu beobachten!

Ich habe eine Anfrage laufen, warum besser hier zu investieren und nicht in die anderen Falkland-Plays.

Zu den Falkland-Vorkommen ist mir bekannt, dass hier noch einer der größten Erdvorkommen an Öl lagern.

Ergänzungen und Meinungen sind von euch gefragt. Genug Cash für das Jahr ist vorhanden.

Die High-Potential Areas liegen in direkter Nachbarschaft zu dem Desrire JV.

Da ich kein Öl-Spezi bin, bitte ich um rege Ergänzung der Öl-Profis!

Also reinhauen!

http://www.rockhopperexploration.co.uk/

Zwar noch nicht ganz so weit wie Desire, aber im JV mit Desire. Vielleicht auch nicht ganz so viel Cash wie Desire aber nur ein Drittel der MK von Desire.

Eine Wette auf den Ölpreis! Hochspekulativ! Aber spannend zu beobachten!

Ich habe eine Anfrage laufen, warum besser hier zu investieren und nicht in die anderen Falkland-Plays.

Zu den Falkland-Vorkommen ist mir bekannt, dass hier noch einer der größten Erdvorkommen an Öl lagern.

Ergänzungen und Meinungen sind von euch gefragt. Genug Cash für das Jahr ist vorhanden.

Die High-Potential Areas liegen in direkter Nachbarschaft zu dem Desrire JV.

Da ich kein Öl-Spezi bin, bitte ich um rege Ergänzung der Öl-Profis!

Also reinhauen!

http://www.rockhopperexploration.co.uk/

Antwort auf Beitrag Nr.: 34.175.470 von mrbk1234 am 26.05.08 23:34:37Ich habe Desire mit über 200 % Gewinn verkauft, weil inzwischen zu teuer.

Ich bin bei Falkland Oil schon länger dabei, was imo die beste der Falkland-Aktien ist, wo ich auf den entsprechenden Thread verweise.

Es ist wohl der einzige Explorer weltweit, der auf Öl im Wert von weit über 1 Billion Dollar (= 1000 Milliarden Dollar)(!!) sitzt und es ein JV mit BHP Billiton gibt.

Näheres aber im FOGL-Thread.

Ich bin bei Falkland Oil schon länger dabei, was imo die beste der Falkland-Aktien ist, wo ich auf den entsprechenden Thread verweise.

Es ist wohl der einzige Explorer weltweit, der auf Öl im Wert von weit über 1 Billion Dollar (= 1000 Milliarden Dollar)(!!) sitzt und es ein JV mit BHP Billiton gibt.

Näheres aber im FOGL-Thread.

Für eine aktuelle Diskussion enthistorisiert.

Danke an den Mod!

Bin durch Zufall auf diesen Wert gestoßen. Ist hier irgendwer investiert? Wie seht ihr denn hier die Aussichten für 2009? Welche Erwartungen habt Ihr?

Der Umsatz ist ja relativ dünn...

Wenn Ihr Infos habt, immer her damit!

Makalu

Bin durch Zufall auf diesen Wert gestoßen. Ist hier irgendwer investiert? Wie seht ihr denn hier die Aussichten für 2009? Welche Erwartungen habt Ihr?

Der Umsatz ist ja relativ dünn...

Wenn Ihr Infos habt, immer her damit!

Makalu

Wie die aktuellen Zahlen und Fortschritte sind, weiß ich nicht. Ich glaube eine Neubewertung muss her! Du fängst an...

Antwort auf Beitrag Nr.: 36.584.005 von mrbk1234 am 15.02.09 22:38:11werde mich die Woche mal dransetzen. Wird wohl ein Stückchen Arbeit werden.

So, ich mache dann mal einen kleinen Anfang.

Ausschnitt aus dem Halbjahresbericht vom November 2008 - man, die Kosten sind ja explodiert. Die onlineübersetzerbedingten Fehler bitte ich zu entschuldigen. Man kann aber lesen, was gemeint ist.

Den rest des Berichtes/Orginalbericht findet man samt der Zahlen auf der Webseite der Company -was sagt ihr dazu?

Aus dem Halbjahresbericht werde ich zum Cashbestand nicht so ganz schlau. Wer kann helfen?

Hier der Link zum Bericht : http://www.rockhopperexploration.co.uk/press/Interim_031208.…

Die Gruppe hat einen Verlust während des Sechsmonatszeitraums zu 30. September 2008 von erlitten $1,183k ($725k: 2007) welches mit einem Fehlbetrag je Aktie von 1.50 Cents übereinstimmt (0.96 Cents: 2007). Der Verlust hat sich über erhöht Vergleichsabschnitt hauptsächlich als Funktion einer Zunahme der Verwaltungskosten und der Gebühr für Anteil gründete Vergütung.

Verwaltungskosten stiegen um $302k von $761k auf $1,063k. $133k der Zunahme war unten, die Kosten zu bezahlen, besonders erhöhte Prämienzahlung für die zwölf Monate zu 30. April. Die meisten der Balance lag an den größeren Niveaus von bewirtschaften heraus die Tätigkeit, die erheblich zu den Aufstiegen in den Spielraumkosten $63k, Honorare von $80k beiträgt und Drucken und Marketing von $18k.

Die geben für Marketing 18.000 aus aber hauen sich die ZTaschen mit dicken Prämien voll? Und das nach 6 Monaten des Geschäftsjahres? Geschäftsjahresende ist übrigens der 31.03. Da kommt sowas sicherlich nochmal!

Die Anteil gegründeten Unkosten von $469k vergleichen mit $117k während des vorhergehenden Zeitraums. erhöhte Gebühr reflektiert die Anerkennung aller restlichen Kosten der dritten Scheibe von Wahlen, die alle am 15. August 2008 bekleideten. Hallo ? das ist das DREIFACHE!!! Kann mir das jemand erklären?

Finanzieren Sie Einkommen während des Zeitraums, der auf $195k erhöht wird ($160k: 2007) wegen des größeren Niveaus der Kapital auf Ablagerung nach dem Legen im Mai. Jedoch der Ertrag auf den durchschnittlichen Barguthaben von $7,830k ($5,547k: 2007) fiel wirklich von 5.8% bis 4.6% resultierend aus Fällen in die niedrige Rate und in die Zentralbankrate und auch der niedrigeren Rückkehr, die von der besseren Sicherheit vorhanden ist.

Reinvermögen der Gruppe hat um $6,077k seit dem Jahr beendet 31. März 2008 hauptsächlich wegen der Billigkeit zugenommen, die im Mai 2008 dieses angehobene $7,226k nach Unkosten setzt.

Hier noch zwei Meldungen die relativ aktuell sind:

Quelle Website der Company

15 January 2009

Director’s Dealing

Rockhopper Exploration plc ("Rockhopper" or the "Company") announces that on 13 January 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 6 December 2008, 1,000,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 1.24 per cent. of the issued Ordinary Share capital of the Company, were secured in favour of an FSA authorised asset manager of which he is a private client as part of general security arrangements in respect of credit provided to him by the asset manager. Mr. Visick remains the registered holder and beneficial owner of all of the Ordinary Shares referred to above (being 1,000,000 Ordinary Shares), and retains control of the voting rights attached to such Ordinary Shares.

Mr. Visick is interested in 17,982,443 Ordinary Shares representing 22.33 per cent. of the issued Ordinary Share capital of the Company. 192,500 of these Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, are held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), of which Mr. Visick is a trustee and beneficiary. In addition, 512,508 of these Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr. Visick's IPS pension fund, of which he is the sole beneficiary.

No other director of the Company has granted security over or entered into any financial instruments relating to any of their holdings of Ordinary Shares in the Company.

21 January 2009

Director’s Dealing

Rockhopper Exploration plc ("Rockhopper" or the "Company") announces that on 21 January 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 21 January 2009, 14,750,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 18.32 per cent. of the issued Ordinary Share capital of the Company, were secured in favour of an FSA authorised private bank of which he is a private client as part of general security arrangements in respect of credit provided to him by the private bank. Mr. Visick remains the registered holder and beneficial owner of all of the Ordinary Shares referred to above (being 14,750,000 Ordinary Shares), and retains control of the voting rights attached to such Ordinary Shares.

Mr. Visick is interested in 17,982,443 Ordinary Shares representing 22.33 per cent. of the issued Ordinary Share capital of the Company. 192,500 of these Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, are held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), of which Mr. Visick is a trustee and beneficiary. In addition, 512,508 of these Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr. Visick's IPS pension fund, of which he is the sole beneficiary.

Meinungen?

Ausschnitt aus dem Halbjahresbericht vom November 2008 - man, die Kosten sind ja explodiert. Die onlineübersetzerbedingten Fehler bitte ich zu entschuldigen. Man kann aber lesen, was gemeint ist.

Den rest des Berichtes/Orginalbericht findet man samt der Zahlen auf der Webseite der Company -was sagt ihr dazu?

Aus dem Halbjahresbericht werde ich zum Cashbestand nicht so ganz schlau. Wer kann helfen?

Hier der Link zum Bericht : http://www.rockhopperexploration.co.uk/press/Interim_031208.…

Die Gruppe hat einen Verlust während des Sechsmonatszeitraums zu 30. September 2008 von erlitten $1,183k ($725k: 2007) welches mit einem Fehlbetrag je Aktie von 1.50 Cents übereinstimmt (0.96 Cents: 2007). Der Verlust hat sich über erhöht Vergleichsabschnitt hauptsächlich als Funktion einer Zunahme der Verwaltungskosten und der Gebühr für Anteil gründete Vergütung.

Verwaltungskosten stiegen um $302k von $761k auf $1,063k. $133k der Zunahme war unten, die Kosten zu bezahlen, besonders erhöhte Prämienzahlung für die zwölf Monate zu 30. April. Die meisten der Balance lag an den größeren Niveaus von bewirtschaften heraus die Tätigkeit, die erheblich zu den Aufstiegen in den Spielraumkosten $63k, Honorare von $80k beiträgt und Drucken und Marketing von $18k.

Die geben für Marketing 18.000 aus aber hauen sich die ZTaschen mit dicken Prämien voll? Und das nach 6 Monaten des Geschäftsjahres? Geschäftsjahresende ist übrigens der 31.03. Da kommt sowas sicherlich nochmal!

Die Anteil gegründeten Unkosten von $469k vergleichen mit $117k während des vorhergehenden Zeitraums. erhöhte Gebühr reflektiert die Anerkennung aller restlichen Kosten der dritten Scheibe von Wahlen, die alle am 15. August 2008 bekleideten. Hallo ? das ist das DREIFACHE!!! Kann mir das jemand erklären?

Finanzieren Sie Einkommen während des Zeitraums, der auf $195k erhöht wird ($160k: 2007) wegen des größeren Niveaus der Kapital auf Ablagerung nach dem Legen im Mai. Jedoch der Ertrag auf den durchschnittlichen Barguthaben von $7,830k ($5,547k: 2007) fiel wirklich von 5.8% bis 4.6% resultierend aus Fällen in die niedrige Rate und in die Zentralbankrate und auch der niedrigeren Rückkehr, die von der besseren Sicherheit vorhanden ist.

Reinvermögen der Gruppe hat um $6,077k seit dem Jahr beendet 31. März 2008 hauptsächlich wegen der Billigkeit zugenommen, die im Mai 2008 dieses angehobene $7,226k nach Unkosten setzt.

Hier noch zwei Meldungen die relativ aktuell sind:

Quelle Website der Company

15 January 2009

Director’s Dealing

Rockhopper Exploration plc ("Rockhopper" or the "Company") announces that on 13 January 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 6 December 2008, 1,000,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 1.24 per cent. of the issued Ordinary Share capital of the Company, were secured in favour of an FSA authorised asset manager of which he is a private client as part of general security arrangements in respect of credit provided to him by the asset manager. Mr. Visick remains the registered holder and beneficial owner of all of the Ordinary Shares referred to above (being 1,000,000 Ordinary Shares), and retains control of the voting rights attached to such Ordinary Shares.

Mr. Visick is interested in 17,982,443 Ordinary Shares representing 22.33 per cent. of the issued Ordinary Share capital of the Company. 192,500 of these Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, are held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), of which Mr. Visick is a trustee and beneficiary. In addition, 512,508 of these Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr. Visick's IPS pension fund, of which he is the sole beneficiary.

No other director of the Company has granted security over or entered into any financial instruments relating to any of their holdings of Ordinary Shares in the Company.

21 January 2009

Director’s Dealing

Rockhopper Exploration plc ("Rockhopper" or the "Company") announces that on 21 January 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 21 January 2009, 14,750,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 18.32 per cent. of the issued Ordinary Share capital of the Company, were secured in favour of an FSA authorised private bank of which he is a private client as part of general security arrangements in respect of credit provided to him by the private bank. Mr. Visick remains the registered holder and beneficial owner of all of the Ordinary Shares referred to above (being 14,750,000 Ordinary Shares), and retains control of the voting rights attached to such Ordinary Shares.

Mr. Visick is interested in 17,982,443 Ordinary Shares representing 22.33 per cent. of the issued Ordinary Share capital of the Company. 192,500 of these Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, are held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), of which Mr. Visick is a trustee and beneficiary. In addition, 512,508 of these Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr. Visick's IPS pension fund, of which he is the sole beneficiary.

Meinungen?

Zu beachten sind aber die weit wichtigeren Punke aus dem Bericht vom Dezember:

Prospective reserve update:

≥ Increase estimates from 1.2 billion barrels recoverable

on an unrisked basis to 1.8 billion barrels recoverable in

licences PL032 and PL033

≥ Overall total reserve potential increased to 4.3 billion barrels

recoverable

Operational highlights:

≥ Seismic anomaly over the Sea Lion Fan strongly suggestive

of oil within the system

≥ Benthic sampling completed over licences PL023 and PL024

≥ Work on Shell well 14/5-1A confirms significant gas shows

≥ New low risk gas prospect identified with proven gas with

potential to contain multi-Tcf reserves

≥ Farm out discussions continue

≥ Signs of easing in rig rates and availability

Financial highlights:

≥ Placing of new shares in May 2008 raised £3.6 million

≥ Total cash and deposit balances at period end of £4.8 million

Hier werden 4,8 Mio angegeben, die tauchen aber im Bericht nicht wieder auf, oder habe ich mich verguckt?

Prospective reserve update:

≥ Increase estimates from 1.2 billion barrels recoverable

on an unrisked basis to 1.8 billion barrels recoverable in

licences PL032 and PL033

≥ Overall total reserve potential increased to 4.3 billion barrels

recoverable

Operational highlights:

≥ Seismic anomaly over the Sea Lion Fan strongly suggestive

of oil within the system

≥ Benthic sampling completed over licences PL023 and PL024

≥ Work on Shell well 14/5-1A confirms significant gas shows

≥ New low risk gas prospect identified with proven gas with

potential to contain multi-Tcf reserves

≥ Farm out discussions continue

≥ Signs of easing in rig rates and availability

Financial highlights:

≥ Placing of new shares in May 2008 raised £3.6 million

≥ Total cash and deposit balances at period end of £4.8 million

Hier werden 4,8 Mio angegeben, die tauchen aber im Bericht nicht wieder auf, oder habe ich mich verguckt?

Antwort auf Beitrag Nr.: 36.590.823 von Makalu8000 am 17.02.09 01:14:01Meinungen? Ideen? Ansichten?

Diskussion erwünscht!

Diskussion erwünscht!

Antwort auf Beitrag Nr.: 36.604.836 von Makalu8000 am 18.02.09 17:30:34Ich hatte Rockhopper auf der Watch, aber zum Glück nicht gekauft.

Die Aktie ist auf dem Niveau aber billig.

Gasprojekte sind in der Gegend nicht interessant, weil es an der Infrastruktur fehlt.

Bei dem jetzigen Ölpreis sind offshore Projekte nicht interessant.

Ich würde einsteigen, wenn die entweder einen Partner finden oder es bei Falkland Oil losgeht (erst 2010).

Die Aktie ist auf dem Niveau aber billig.

Gasprojekte sind in der Gegend nicht interessant, weil es an der Infrastruktur fehlt.

Bei dem jetzigen Ölpreis sind offshore Projekte nicht interessant.

Ich würde einsteigen, wenn die entweder einen Partner finden oder es bei Falkland Oil losgeht (erst 2010).

Antwort auf Beitrag Nr.: 36.794.636 von Urlaub2 am 18.03.09 17:54:09Ich würde einsteigen, wenn die entweder einen Partner finden oder es bei Falkland Oil losgeht

schaunmermal was geht

schaunmermal was geht

Antwort auf Beitrag Nr.: 36.794.636 von Urlaub2 am 18.03.09 17:54:09Na der Kursverlauf der letzten Zeit war aber nicht schlecht.

Leider viel zu wenige Stücke gehandelt.

is eben eine nette Beimischung fürs Depot.

Leider viel zu wenige Stücke gehandelt.

is eben eine nette Beimischung fürs Depot.

Ups, da waren ja news...

und keine schlechten...

Resourcenupdate vom 22. Mai

http://www.rockhopperexploration.co.uk/pdf/CPRReportAndExplo…

Directors dialing vom 27. Mai

Rockhopper Exploration plc ("Rockhopper" or the "Company") today announces that on 26 May 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 26 May 2009, he had repaid the loan, previously announced on 15 January 2009, which had been secured over 1,000,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 1.24 per cent. of the issued Ordinary Share capital of the Company. On the same day, the Company received notification that on 26 May 2009 Mr Visick disposed of by way of gift, the following shares to a number of newly created trusts, each with a charitable object. Mr Visick and his family are specifically excluded from being beneficiaries to these trusts.

The Charles Darwin Settlement 500,000 shares

The Islands Settlement 652,300 shares

The South Atlantic Settlement 500,000 shares

The North Falklands Settlement 500,000 shares

TOTAL 2,152,300 shares

Following these gifts, Mr. Visick is beneficially interested in 15,830,143 Ordinary Shares representing 19.75 per cent. of the issued Ordinary Share capital of the Company. This total includes 192,500 Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), where Mr. Visick is a trustee and beneficiary. In addition, 512,508 of the Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr Visick's IPS pension fund, of which he is the sole beneficiary.

For further information, please contact:

Rockhopper Exploration plc www.rockhopperexploration.co.uk

Sam Moody - Managing Director 01722 414 419 Aquila Financial Ltd www.aquila-financial.com Peter Reilly 0118 978 4100 Canaccord Adams Limited

Jeffrey Auld / Eli Colby / 020 7050 6500 Henry Fitzgerald-O'Connor Notes to editors

www.rockhopperexploration.co.uk The Rockhopper Group started trading in February 2004 to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Group, floated on AIM in August 2005, is currently the largest licence holder in the North Falkland Basin and has a 100 per cent. interest in four offshore production licences which cover approximately 3,800 sq. km. These licences have been granted by the Falkland Islands government

Quelle: http://www.rockhopperexploration.co.uk/pdf/DirectorsDealings…

hört, hört....

und keine schlechten...

Resourcenupdate vom 22. Mai

http://www.rockhopperexploration.co.uk/pdf/CPRReportAndExplo…

Directors dialing vom 27. Mai

Rockhopper Exploration plc ("Rockhopper" or the "Company") today announces that on 26 May 2009 it received notification from Mr. Richard Visick, a non-executive director of the Company, that on 26 May 2009, he had repaid the loan, previously announced on 15 January 2009, which had been secured over 1,000,000 of his beneficially held ordinary shares of GBP0.01 each in the Company ("Ordinary Shares"), representing 1.24 per cent. of the issued Ordinary Share capital of the Company. On the same day, the Company received notification that on 26 May 2009 Mr Visick disposed of by way of gift, the following shares to a number of newly created trusts, each with a charitable object. Mr Visick and his family are specifically excluded from being beneficiaries to these trusts.

The Charles Darwin Settlement 500,000 shares

The Islands Settlement 652,300 shares

The South Atlantic Settlement 500,000 shares

The North Falklands Settlement 500,000 shares

TOTAL 2,152,300 shares

Following these gifts, Mr. Visick is beneficially interested in 15,830,143 Ordinary Shares representing 19.75 per cent. of the issued Ordinary Share capital of the Company. This total includes 192,500 Ordinary Shares, representing 0.24 per cent. of the issued Ordinary Share capital of the Company, held in the name of Legal and Commercial Trustee Retirement Benefit Scheme (pension fund), where Mr. Visick is a trustee and beneficiary. In addition, 512,508 of the Ordinary Shares, representing 0.64 per cent. of the issued Ordinary Share capital of the Company, are held in Mr Visick's IPS pension fund, of which he is the sole beneficiary.

For further information, please contact:

Rockhopper Exploration plc www.rockhopperexploration.co.uk

Sam Moody - Managing Director 01722 414 419 Aquila Financial Ltd www.aquila-financial.com Peter Reilly 0118 978 4100 Canaccord Adams Limited

Jeffrey Auld / Eli Colby / 020 7050 6500 Henry Fitzgerald-O'Connor Notes to editors

www.rockhopperexploration.co.uk The Rockhopper Group started trading in February 2004 to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Group, floated on AIM in August 2005, is currently the largest licence holder in the North Falkland Basin and has a 100 per cent. interest in four offshore production licences which cover approximately 3,800 sq. km. These licences have been granted by the Falkland Islands government

Quelle: http://www.rockhopperexploration.co.uk/pdf/DirectorsDealings…

hört, hört....

hat sich gut entwickelt. Der steigende Ölpreis kann hier nicht schaden....

Ich bleib weiter dabei! Das Ende der Fahnenstange ist noch nicht ereicht.

Sind noch andere Investierte hier?

Ich bleib weiter dabei! Das Ende der Fahnenstange ist noch nicht ereicht.

Sind noch andere Investierte hier?

Das Board hat mal wieder zugelangt. Da kommt bald was, denke ich. Hier die news:

30 June 2009

Rockhopper Exploration PLC (“The Company”)

Director’s Dealings

The Company announces that it received notification today from Samuel Moody, Peter Dixon-Clarke and David Bodecott that on the same date they acquired ordinary shares of 1 pence each in the Company (“Ordinary Shares”). The Company also received notification on Monday 29 June 2009 from Pierre Jungels that on the same date he acquired Ordinary Shares. Details of the number of shares purchased and price paid are set out below:

Number of shares price paid

purchased

Pierre Jungels 150,000 shares 32 pence per share

Executive Chairman

Samuel Moody 242,980 shares 31.25 pence per share

Managing Director

Peter Dixon-Clarke 108,510 shares 31.25 pence per share

Finance Director

David Bodecott 108,510 shares 31.25 pence per share

Exploration Director

Following the share purchases the holdings of the Directors are:

Number of shares % of issued share capital

held

Pierre Jungels 866,074 1.08

Executive Chairman

Samuel Moody 1,128,435 1.40

Managing Director

Peter Dixon-Clarke 253,639 0.31

Finance Director

David Bodecott 199,510 0.25

Exploration Director

For further information please contact:

30 June 2009

Rockhopper Exploration PLC (“The Company”)

Director’s Dealings

The Company announces that it received notification today from Samuel Moody, Peter Dixon-Clarke and David Bodecott that on the same date they acquired ordinary shares of 1 pence each in the Company (“Ordinary Shares”). The Company also received notification on Monday 29 June 2009 from Pierre Jungels that on the same date he acquired Ordinary Shares. Details of the number of shares purchased and price paid are set out below:

Number of shares price paid

purchased

Pierre Jungels 150,000 shares 32 pence per share

Executive Chairman

Samuel Moody 242,980 shares 31.25 pence per share

Managing Director

Peter Dixon-Clarke 108,510 shares 31.25 pence per share

Finance Director

David Bodecott 108,510 shares 31.25 pence per share

Exploration Director

Following the share purchases the holdings of the Directors are:

Number of shares % of issued share capital

held

Pierre Jungels 866,074 1.08

Executive Chairman

Samuel Moody 1,128,435 1.40

Managing Director

Peter Dixon-Clarke 253,639 0.31

Finance Director

David Bodecott 199,510 0.25

Exploration Director

For further information please contact:

ich würde ja gern noch ein paar ins Depot packen, aber das, was da im ask liegt ist ja einfach unverschämt teuer...

wird immer schlimmer.

Heute wurde der Kurs durch 251 St. um knapp 10% hochgezogen?!?!?!

Unglaublich!

Heute wurde der Kurs durch 251 St. um knapp 10% hochgezogen?!?!?!

Unglaublich!

hmmmm, was sagt ihr denn zu dem Kursverlauf?

Ist hier denn noch irgendjemand dabei?

Für den Kursanstieg (zwar bei sehr dünnen Umsätzen) ist es hier sehr still. Wo geht denn die Reise hin? Was meint Ihr?

Sehen wir die 60 Cents dieses Jahr noch?

Ist hier denn noch irgendjemand dabei?

Für den Kursanstieg (zwar bei sehr dünnen Umsätzen) ist es hier sehr still. Wo geht denn die Reise hin? Was meint Ihr?

Sehen wir die 60 Cents dieses Jahr noch?

Antwort auf Beitrag Nr.: 37.723.573 von Makalu8000 am 06.08.09 13:22:24hi,

ich bin schon länger an bord( auch bei FOGL/FIH) und werde es auch bleiben

60 cent? ... es ist deutlich mehr drin.

ob noch dieses jahr weiß ich natürlich auch nicht.

einfach mal abwarten

ich bin schon länger an bord( auch bei FOGL/FIH) und werde es auch bleiben

60 cent? ... es ist deutlich mehr drin.

ob noch dieses jahr weiß ich natürlich auch nicht.

einfach mal abwarten

Was ist denn hier heute los?

Antwort auf Beitrag Nr.: 37.954.441 von Makalu8000 am 10.09.09 14:23:20Desire drillt schon bald in der Region

Antwort auf Beitrag Nr.: 37.954.602 von MaloneBS am 10.09.09 14:43:28gerade bekommen:

PRESS RELEASE

11 September 2009

Rockhopper Exploration plc (“Rockhopper” or “the Company”)

Farm Out – Letter of Intent

Rockhopper Exploration, the North Falkland Basin oil and gas explorer, is pleased to announce that it has agreed terms with a third party energy company for a farm-in to one of the Company’s licences, through a contribution, at a promote, to the costs of drilling one well on the licence and to certain back costs. A Letter of Intent to farm in has been signed and discussions continue to progress the agreement this into a fully binding joint venture.

The Letter of Intent and any subsequent agreement remains subject to certain approvals by the Falkland Islands Government and both parties. A further announcement, including the terms of the proposed farm in, will be made once the necessary approvals are in place.

Rockhopper also welcomes the announcement made yesterday by Desire Petroleum plc (“Desire”) regarding a Letter of Intent it has signed with Diamond Offshore Drilling for the hire of a rig for a North Falkland Basin drilling campaign commencing in February 2010, where a minimum of 4 wells will be drilled and additional slots may be available for Desire and/or its partners. The Company hopes to drill a minimum of two wells on its operated acreage (owned 100%) as part of this larger campaign with Desire

PRESS RELEASE

11 September 2009

Rockhopper Exploration plc (“Rockhopper” or “the Company”)

Farm Out – Letter of Intent

Rockhopper Exploration, the North Falkland Basin oil and gas explorer, is pleased to announce that it has agreed terms with a third party energy company for a farm-in to one of the Company’s licences, through a contribution, at a promote, to the costs of drilling one well on the licence and to certain back costs. A Letter of Intent to farm in has been signed and discussions continue to progress the agreement this into a fully binding joint venture.

The Letter of Intent and any subsequent agreement remains subject to certain approvals by the Falkland Islands Government and both parties. A further announcement, including the terms of the proposed farm in, will be made once the necessary approvals are in place.

Rockhopper also welcomes the announcement made yesterday by Desire Petroleum plc (“Desire”) regarding a Letter of Intent it has signed with Diamond Offshore Drilling for the hire of a rig for a North Falkland Basin drilling campaign commencing in February 2010, where a minimum of 4 wells will be drilled and additional slots may be available for Desire and/or its partners. The Company hopes to drill a minimum of two wells on its operated acreage (owned 100%) as part of this larger campaign with Desire

Preliminary Results for the year ended 31 March 2009 - Sep 22, 2009

www.rockhopperexploration.co.uk/pdf/PreliminaryResults_to_31…

www.rockhopperexploration.co.uk/pdf/PreliminaryResults_to_31…

Rockhopper Issues Statement Regarding Media Speculation

08 October 2009

Rockhopper, the North Falkland Basin oil and gas explorer, notes the recent media speculation that the Company is actively pursuing an equity financing.

Rockhopper today confirms, as previously announced on 11 September, 2009, that it hopes to drill a minimum of two wells on its operated acreage (owned 100%) as part of a larger campaign with Desire Petroleum PLC. The Company further confirms that management are considering a variety of options to finance the cost of the drilling campaign, including a placing of equity.

The Rockhopper Group started trading in February 2004 to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Group, floated on AIM in August 2005, is currently the largest licence holder in the North Falkland Basin and has a 100 per cent. interest in four offshore production licences which cover approximately 3,800 sq. km. These licences have been granted by the Falkland Islands government.

08 October 2009

Rockhopper, the North Falkland Basin oil and gas explorer, notes the recent media speculation that the Company is actively pursuing an equity financing.

Rockhopper today confirms, as previously announced on 11 September, 2009, that it hopes to drill a minimum of two wells on its operated acreage (owned 100%) as part of a larger campaign with Desire Petroleum PLC. The Company further confirms that management are considering a variety of options to finance the cost of the drilling campaign, including a placing of equity.

The Rockhopper Group started trading in February 2004 to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Group, floated on AIM in August 2005, is currently the largest licence holder in the North Falkland Basin and has a 100 per cent. interest in four offshore production licences which cover approximately 3,800 sq. km. These licences have been granted by the Falkland Islands government.

Sieht vernünfig aus.

explorer dort unten:

Argos Resources

Arcadia Petroleum

BP

BHP Billiton

Borders & Southern

Desire Petroleum

Falkland Oil & Gas

Repsol

Rockhopper Exploration

quelle:

http://maximumprofit.wordpress.com

Argos Resources

Arcadia Petroleum

BP

BHP Billiton

Borders & Southern

Desire Petroleum

Falkland Oil & Gas

Repsol

Rockhopper Exploration

quelle:

http://maximumprofit.wordpress.com

£50 million placing of 92,592,593 new ordinary shares at 54p each - Oct 27, 2009

www.rockhopperexploration.co.uk/pdf/RockhopperExplorationPla…

www.rockhopperexploration.co.uk/pdf/RockhopperExplorationPla…

£50 million share placing - Nov 12, 2009

www.rockhopperexploration.co.uk/pdf/ResultofGeneralMeeting12…

"... Further to Rockhopper's announcement about the share placing dated 26 October 2009 (“Placing Announcement”), the Board of Rockhopper confirms that the assignment agreement (“Assignment Agreement”) between Rockhopper, Desire and Diamond in relation to the rig services contract between Desire and Diamond has today been signed by each of the parties. The Assignment Agreement remains conditional on Rockhopper depositing in an escrow account certain amounts to be paid by Rockhopper for two of Desire's rig slots. Further details of the proposed drilling campaign are included in the Placing Announcement. ..."

www.rockhopperexploration.co.uk/pdf/ResultofGeneralMeeting12…

"... Further to Rockhopper's announcement about the share placing dated 26 October 2009 (“Placing Announcement”), the Board of Rockhopper confirms that the assignment agreement (“Assignment Agreement”) between Rockhopper, Desire and Diamond in relation to the rig services contract between Desire and Diamond has today been signed by each of the parties. The Assignment Agreement remains conditional on Rockhopper depositing in an escrow account certain amounts to be paid by Rockhopper for two of Desire's rig slots. Further details of the proposed drilling campaign are included in the Placing Announcement. ..."

aus dem fogl-schräd geklaut...malonebs ist hoffentlich nicht böse:

http://www.walesonline.co.uk/news/uk-news/2009/12/03/swansea…

Swansea-raised oil man Colin Phipps predicted Falklands bonanza

...The largest North Sea oilfield, the Forties, contained five billion barrels. But the British Geological Survey has pointed to the highly oil-prone nature of the Falklands source rock, estimating the north area of the islands alone contains some 60 billion barrels of oil.

Martin Li of the Investors’ Chronicle which has been reporting huge interest in Falklands oil, said: “The Falklands area splits into two separate provinces, the north basin and south basin, each of which has very different characteristics. In the north basin, where Desire and another company Rockhopper are active (together with private company Arcadia), the water is relatively shallow at 100 to 600m, the targets are large and drilling conditions relatively benign – similar to those in the North Sea.”

http://www.walesonline.co.uk/news/uk-news/2009/12/03/swansea…

Swansea-raised oil man Colin Phipps predicted Falklands bonanza

...The largest North Sea oilfield, the Forties, contained five billion barrels. But the British Geological Survey has pointed to the highly oil-prone nature of the Falklands source rock, estimating the north area of the islands alone contains some 60 billion barrels of oil.

Martin Li of the Investors’ Chronicle which has been reporting huge interest in Falklands oil, said: “The Falklands area splits into two separate provinces, the north basin and south basin, each of which has very different characteristics. In the north basin, where Desire and another company Rockhopper are active (together with private company Arcadia), the water is relatively shallow at 100 to 600m, the targets are large and drilling conditions relatively benign – similar to those in the North Sea.”

Antwort auf Beitrag Nr.: 38.510.371 von BaronOppenSAL am 04.12.09 15:00:44Habe mich vor ein paar Tagen auch sehr über die news der Ocean Guardian gefreut  . Das Falkland Projekt schlägt nun wieder grössere Wellen. Bin zwar nur in FOGL investiert, aber werde auch bei einem Erfolg von Rockhopper oder Desire damit profitieren.

. Das Falkland Projekt schlägt nun wieder grössere Wellen. Bin zwar nur in FOGL investiert, aber werde auch bei einem Erfolg von Rockhopper oder Desire damit profitieren.

Afirman que en Malvinas hay petróleo para 60 mil millones de barriles

http://www.minutouno.com.ar/1/hoy/article/121400-Afirman-que…

Las Islas Malvinas nadan en petróleo. O al menos eso es lo que sostienen medios británicos, que informaron hoy que bajo las islas, en el subsuelo marino, hay suficiente crudo para llenar unos 60 mil millones de barriles.

De acuerdo a los sitios de Telegraph y The Sun, las empresas inglesas Rockhopper Exploration, Desire Petroleum, Falkland Oil and Gas and Borders y la Southern Petroleum se encuentran explorando el archipiélago de norte a sur.

Para explicar la importancia del descubrimiento, explican que la mayor reserva de petróleo del mundo -Ghawar, en Arabia Saudita- contiene unos 80 mil millones de barriles....

ALSO hier nun meine Spanischkenntnisse zum Besten:

In den Falklands lagern nach Schätzung ca. 60 Billionen barrel und um eine Vorstellung der Grössenordnung zu erhalten: das weltweit grösste Oelfeld, Ghawar, liegt in Saudi-Arabien und umfasst ca. 80 Billionen barrel.

Jetzt fehlt nur noch der Kaiser: Ohzapft iss!

. Das Falkland Projekt schlägt nun wieder grössere Wellen. Bin zwar nur in FOGL investiert, aber werde auch bei einem Erfolg von Rockhopper oder Desire damit profitieren.

. Das Falkland Projekt schlägt nun wieder grössere Wellen. Bin zwar nur in FOGL investiert, aber werde auch bei einem Erfolg von Rockhopper oder Desire damit profitieren. Afirman que en Malvinas hay petróleo para 60 mil millones de barriles

http://www.minutouno.com.ar/1/hoy/article/121400-Afirman-que…

Las Islas Malvinas nadan en petróleo. O al menos eso es lo que sostienen medios británicos, que informaron hoy que bajo las islas, en el subsuelo marino, hay suficiente crudo para llenar unos 60 mil millones de barriles.

De acuerdo a los sitios de Telegraph y The Sun, las empresas inglesas Rockhopper Exploration, Desire Petroleum, Falkland Oil and Gas and Borders y la Southern Petroleum se encuentran explorando el archipiélago de norte a sur.

Para explicar la importancia del descubrimiento, explican que la mayor reserva de petróleo del mundo -Ghawar, en Arabia Saudita- contiene unos 80 mil millones de barriles....

ALSO hier nun meine Spanischkenntnisse zum Besten:

In den Falklands lagern nach Schätzung ca. 60 Billionen barrel und um eine Vorstellung der Grössenordnung zu erhalten: das weltweit grösste Oelfeld, Ghawar, liegt in Saudi-Arabien und umfasst ca. 80 Billionen barrel.

Jetzt fehlt nur noch der Kaiser: Ohzapft iss!

The North Falkland Basin - Westhouse Securities - Dec 8, 2009

http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…

kann man das direkt anklicken...ich glaube ich bin zu doof dafür

http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…

kann man das direkt anklicken...ich glaube ich bin zu doof dafür

Antwort auf Beitrag Nr.: 38.586.792 von BaronOppenSAL am 17.12.09 13:55:44http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…" target="_blank" rel="nofollow ugc noopener">

http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…

http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…

Antwort auf Beitrag Nr.: 38.586.853 von Hafturlaub am 17.12.09 14:03:37http://www.oilbarrel.com/fileadmin/content/pdfs/Brokers_Note…

test

test

Rumours in advance of Falklands drilling

Published 12.01.2010 14:49:39 by John Bradbury

City commentator Evolution Securities has speculated that online bulletin boards will be rife with rumour and gossip in the period between spudding and completion of new wells off the Falklands by Desire Petroleum and Rockhopper Exploration.

After the two companies made a presentation to analysts in London yesterday, Evolution reported that Desire and Rockhopper have indicated they will only issue regulatory news releases on the spudding and completion of those forthcoming wells in the North Falklands.

“However, with wells expected to take less than 30 days, we expect the bulletin boards to be rife with rumour and gossip in the intervening period,” Evolution commentated today.

The Ocean Guardian rig was due to commence the first well for the two companies next month and is now travelling down to the South Atlantic.

Desire and Rockhopper are on course to spud the first of up to ten wells from next month Evolution observed, with the plan to test a number of different play types in order to extend their understanding of the geology of the North Falklands Basin, and the two companies intend to share exploration drilling results.

“The principal risk is the presence of decent reservoirs, sufficient to hold and flow commercial levels of oil, given that they will be within a muddy basin,” the commentator stated.

Published 12.01.2010 14:49:39 by John Bradbury

City commentator Evolution Securities has speculated that online bulletin boards will be rife with rumour and gossip in the period between spudding and completion of new wells off the Falklands by Desire Petroleum and Rockhopper Exploration.

After the two companies made a presentation to analysts in London yesterday, Evolution reported that Desire and Rockhopper have indicated they will only issue regulatory news releases on the spudding and completion of those forthcoming wells in the North Falklands.

“However, with wells expected to take less than 30 days, we expect the bulletin boards to be rife with rumour and gossip in the intervening period,” Evolution commentated today.

The Ocean Guardian rig was due to commence the first well for the two companies next month and is now travelling down to the South Atlantic.

Desire and Rockhopper are on course to spud the first of up to ten wells from next month Evolution observed, with the plan to test a number of different play types in order to extend their understanding of the geology of the North Falklands Basin, and the two companies intend to share exploration drilling results.

“The principal risk is the presence of decent reservoirs, sufficient to hold and flow commercial levels of oil, given that they will be within a muddy basin,” the commentator stated.

Artikel von letzter Woche, zeigt aber ganz gut was alles an Logistik um die Rig herum nötig ist:

Friday, January 8th 2010 - 12:45 pm UTC

Falkland Islands: Drilling preparations step up a gear onshore

AS the semi-submersible drilling rig Ocean Guardian, contracted by Desire Petroleum from Diamond Drilling, continues to make its way south, a number of oil operators are scheduled to visit the Falklands to meet with government officials this month.

Desire Petroleum’s Chairman Stephen Phipps, Chief Executive Officer Dr Ian Duncan and Finance Director Eddie Wisniewski are due to arrive next week for a round of meetings with government officials and others. They will be accompanied by Ben Romney from Buchanan (Desire’s PR consultancy) and Robert Watts, a journalist from the oil industry magazine Upstream.

Three representatives from Rockhopper Exploration are also scheduled to arrive next weekend.

The Ocean Guardian, under tow by the Maersk Traveller, is still on schedule to arrive in early February; Desire’s Falklands representative Lewis Clifton confirmed this week.

A second Maersk anchor handling tug supply vessel is due to arrive late this month, and the third rig support ship, a platform supply vessel, will complete the offshore drilling support package, he said.

The pace dockside is about to pick up with the first of two cargo ships, Thor Leader, carrying oil equipment from UK, arriving next week. The second cargo ship, Honest Rays, arrives on January 15. Mr Clifton said discharge operations would be undertaken 24 hours a day until the 14,000 tons of equipment onboard were sorted and stored, pending the arrival of the Ocean Guardian.

Onshore specialised support personnel will begin arriving in Stanley during the next few days. Mr Clifton said up to 12 personnel would be based in Stanley for the duration of the drilling programme.

As with oil rig workers, these personnel will rotate 28 days on and 28 days off.

The shore support personnel will be largely based out of the integrated pipe yard and laydown facility being constructed at Coastel Road by Byron McKay Port Services, of which Mr Clifton is a director. The facility will include modularised office and warehouse accommodation, and the silo plants (muds and cement bulk storage), although other private sector facilities will also be utilised.

Mr Clifton said Byron McKay Port Services had secured an on-shore services support contract, and were working with AGR Petroleum Services - the oil operator’s contractor - to provide the ship-shore-ship logistics support interface.

A number of local appointments have been made to support the contract terms. These include an aviation coordinator and a number of operatives, slings men, labourers and stevedores. A two week training programme for operatives was undertaken during early December under training guidance brought in from Aberdeen, said Mr Clifton, adding that security personnel would also be appointed for the duration of the drilling programme.

Helicopter support operations are to be provided by British International with an airframe due to arrive on the Ministry of Defence freighter next week. Mr Clifton said work was also progressing towards bringing back on line the helicopter refuelling facility at Cape Dolphin on East Falkland, which was set up during the last drilling round in 1998. However, unlike in 1998 when the Borgny Dolphin oil rig was visible off Cape Pembroke, the Ocean Guardian is unlikely to come into sight on arrival, said Mr Clifton.

Source: Penguin News

Friday, January 8th 2010 - 12:45 pm UTC

Falkland Islands: Drilling preparations step up a gear onshore

AS the semi-submersible drilling rig Ocean Guardian, contracted by Desire Petroleum from Diamond Drilling, continues to make its way south, a number of oil operators are scheduled to visit the Falklands to meet with government officials this month.

Desire Petroleum’s Chairman Stephen Phipps, Chief Executive Officer Dr Ian Duncan and Finance Director Eddie Wisniewski are due to arrive next week for a round of meetings with government officials and others. They will be accompanied by Ben Romney from Buchanan (Desire’s PR consultancy) and Robert Watts, a journalist from the oil industry magazine Upstream.

Three representatives from Rockhopper Exploration are also scheduled to arrive next weekend.

The Ocean Guardian, under tow by the Maersk Traveller, is still on schedule to arrive in early February; Desire’s Falklands representative Lewis Clifton confirmed this week.

A second Maersk anchor handling tug supply vessel is due to arrive late this month, and the third rig support ship, a platform supply vessel, will complete the offshore drilling support package, he said.

The pace dockside is about to pick up with the first of two cargo ships, Thor Leader, carrying oil equipment from UK, arriving next week. The second cargo ship, Honest Rays, arrives on January 15. Mr Clifton said discharge operations would be undertaken 24 hours a day until the 14,000 tons of equipment onboard were sorted and stored, pending the arrival of the Ocean Guardian.

Onshore specialised support personnel will begin arriving in Stanley during the next few days. Mr Clifton said up to 12 personnel would be based in Stanley for the duration of the drilling programme.

As with oil rig workers, these personnel will rotate 28 days on and 28 days off.

The shore support personnel will be largely based out of the integrated pipe yard and laydown facility being constructed at Coastel Road by Byron McKay Port Services, of which Mr Clifton is a director. The facility will include modularised office and warehouse accommodation, and the silo plants (muds and cement bulk storage), although other private sector facilities will also be utilised.

Mr Clifton said Byron McKay Port Services had secured an on-shore services support contract, and were working with AGR Petroleum Services - the oil operator’s contractor - to provide the ship-shore-ship logistics support interface.

A number of local appointments have been made to support the contract terms. These include an aviation coordinator and a number of operatives, slings men, labourers and stevedores. A two week training programme for operatives was undertaken during early December under training guidance brought in from Aberdeen, said Mr Clifton, adding that security personnel would also be appointed for the duration of the drilling programme.

Helicopter support operations are to be provided by British International with an airframe due to arrive on the Ministry of Defence freighter next week. Mr Clifton said work was also progressing towards bringing back on line the helicopter refuelling facility at Cape Dolphin on East Falkland, which was set up during the last drilling round in 1998. However, unlike in 1998 when the Borgny Dolphin oil rig was visible off Cape Pembroke, the Ocean Guardian is unlikely to come into sight on arrival, said Mr Clifton.

Source: Penguin News

Getting my bearings in Port Stanley

I’m sitting in the Malvina House Hotel in Port Stanley, the capital of wild and stunningly beautiful Falkland Islands. I’m a new face in town - but I am not the only one.

Rob Watts Tuesday, 19 January, 2010, 11:55 GMT

Preparations are stepping up for the upcoming drilling campaign off these windy, rocky South Atlantic islands, and officials from the two key operators involved, Desire Petroleum and Rockhopper Exploration, are also visiting the islands, which have a permanent population of about 3000.

Getting here involves a journey of 30 hours, door to door. The Air Bridge between the UK and the islands is a twice weekly flight operated by Air Tahiti Nui out of RAF Brize Norton, with a refuelling stop at Ascension Island.

As we readied ourselves to disembark at the Mount Pleasant airbase, I did a double take. Gentle Polynesian rhythms were being piped through the cabin - is this South Pacific meets the South Atlantic?

I’m in the Falklands this week to talk about the first exploration work to be carried out off the Falklands for 12 years, and, just as importantly, to find out what the islanders themselves think.

Relations between the companies seem good, judging by the scene in the Malvina House’s restaurant last night.

Sitting around the same table, enjoying Upland goose pate - a local speciality - and toothfish were Desire’s chairman Stephen Phipps, its chief executive Ian Duncan, Rockhopper‘s chief executive Sam Moody, and Dave Bodecott, Rockhopper’s exploration director.

All are preparing for a series of meetings this week with Falkland Island officials and agencies before Diamond Offshore’s semi-submersible drilling rig Ocean Guardian gets to work next month.

Earlier in the day, I joined Duncan and Phipps on a brief tour around Port Stanley and some nearby beaches, home to a colony of Magellanic penguins.

The signs warning of unexploded mines and fences around the dunes, however, are an uneasy reminder of Argentina’s 1982 invasion of the islands and the short conflict the UK fought to retake them.

Almost 1000 people died on both sides and Argentina still claims sovereignty of the Falklands, which it calls Las Malvinas.

Despite the reminders of the past, Duncan and Phipps are concentrating on the future.

Duncan told me: “We are excited. After 12 years of waiting we can’t wait to get started.”

It is also easy to see that the logistics operation is in full swing, with drilling equipment being unloaded at Stanley’s docks and construction work taking place on a nearby yard to house it.

The relative peace in and around Stanley is in direct contrast to the excitement this frontier campaign has created 8000 miles away at home in the UK, where investors’ imaginations have been well and truly captured.

As one investment banking contact in the City told me last week: “I’ve been in the job for 30 years and have never seen anything like it.”

If oil is found, though, the current flurry of activity will be nothing compared to what easily be a Klondike-style rush, and one wonders what might happen in this far-off corner of the world.

As another contact said to me before I left on my journey. “What’s the saying? It is a better thing to travel hopefully than to arrive?”

Rob Watts will be giving UpstreamOnline's readers a taster of life in the Falkland Islands this week. A full package of exclusive news and features covering the upcoming Falklands campaign will be published in Upstream's newspaper edition on 5 February.

I’m sitting in the Malvina House Hotel in Port Stanley, the capital of wild and stunningly beautiful Falkland Islands. I’m a new face in town - but I am not the only one.

Rob Watts Tuesday, 19 January, 2010, 11:55 GMT

Preparations are stepping up for the upcoming drilling campaign off these windy, rocky South Atlantic islands, and officials from the two key operators involved, Desire Petroleum and Rockhopper Exploration, are also visiting the islands, which have a permanent population of about 3000.

Getting here involves a journey of 30 hours, door to door. The Air Bridge between the UK and the islands is a twice weekly flight operated by Air Tahiti Nui out of RAF Brize Norton, with a refuelling stop at Ascension Island.

As we readied ourselves to disembark at the Mount Pleasant airbase, I did a double take. Gentle Polynesian rhythms were being piped through the cabin - is this South Pacific meets the South Atlantic?

I’m in the Falklands this week to talk about the first exploration work to be carried out off the Falklands for 12 years, and, just as importantly, to find out what the islanders themselves think.

Relations between the companies seem good, judging by the scene in the Malvina House’s restaurant last night.

Sitting around the same table, enjoying Upland goose pate - a local speciality - and toothfish were Desire’s chairman Stephen Phipps, its chief executive Ian Duncan, Rockhopper‘s chief executive Sam Moody, and Dave Bodecott, Rockhopper’s exploration director.

All are preparing for a series of meetings this week with Falkland Island officials and agencies before Diamond Offshore’s semi-submersible drilling rig Ocean Guardian gets to work next month.

Earlier in the day, I joined Duncan and Phipps on a brief tour around Port Stanley and some nearby beaches, home to a colony of Magellanic penguins.

The signs warning of unexploded mines and fences around the dunes, however, are an uneasy reminder of Argentina’s 1982 invasion of the islands and the short conflict the UK fought to retake them.

Almost 1000 people died on both sides and Argentina still claims sovereignty of the Falklands, which it calls Las Malvinas.

Despite the reminders of the past, Duncan and Phipps are concentrating on the future.

Duncan told me: “We are excited. After 12 years of waiting we can’t wait to get started.”

It is also easy to see that the logistics operation is in full swing, with drilling equipment being unloaded at Stanley’s docks and construction work taking place on a nearby yard to house it.

The relative peace in and around Stanley is in direct contrast to the excitement this frontier campaign has created 8000 miles away at home in the UK, where investors’ imaginations have been well and truly captured.

As one investment banking contact in the City told me last week: “I’ve been in the job for 30 years and have never seen anything like it.”

If oil is found, though, the current flurry of activity will be nothing compared to what easily be a Klondike-style rush, and one wonders what might happen in this far-off corner of the world.

As another contact said to me before I left on my journey. “What’s the saying? It is a better thing to travel hopefully than to arrive?”

Rob Watts will be giving UpstreamOnline's readers a taster of life in the Falkland Islands this week. A full package of exclusive news and features covering the upcoming Falklands campaign will be published in Upstream's newspaper edition on 5 February.

FALKLANDS ARE “GO” FOR OIL EXPLORATION

By J. Brock (FINN)

Desire Chairman, Stephen Phipps has confirmed that the exploration rig, Ocean Guardian, is progressing well and scheduled to arrive in Falklands waters early in February, weather and sea conditions depending.

During an interview with FINN he also confirmed that the integrated pipe and lay-down facility at Coastel Road being constructed by Byron McKay is nearing completion with plans to base a majority of the shore support personnel from that area.

As reported last month on FINN there will be a financial benefit for the economy for entities involved in the pipe and lay-down facility, the movement of oil related cargo from FIPASS, People renting accommodation for shore based workers, Hotels accommodating workers and transport services. “Twelve Rooms at the Malvina House Hotel, 15 seats on the airbridge as well as the increased port activity is a significant contribution to the Falklands’ economy” said Mr Phipps.

Mr Phipps went on to say that once exploratory drilling is complete then these revenue streams will be dried up until there is another round of exploratory drilling possibly by FOGL, BHP Billiton and Borders & Southern.

Ocean Guardian is a semi-submersible rig suitable for exploring in shallower waters. This means that after Desire Petroleum finish their prospects in tranches C, D, and F, and Rockhopper Exploration end their drilling campaign in former Shell tranches, then BHP Billiton’s shallower prospects of Endeavour, Loligo and Nimrod could be drilled.

According to Mr Phipps there will be little information coming from the site. There will be an announcement when drilling commences and another when target depth is reached and how long it took to drill that depth. After a while the results of the drill will be announced.

Besides Desire’s Chairman, the CEO, Mr Ian Duncan, Finance Director Mr Eddie Wisniewski and PR Consultant Mr Ben Romney from Buchanan are visiting Also in the Falklands this week is Mr Sam Moody of Rockhopper Exploration. Rockhopper have discovered natural gas in one of their prospects.

When asked about what hydrocarbons products were being explored Mr Phipps said that “the main thought process is oil because that’s what’s believed to be there.” He shied away from commenting about natural gas.

When the exploration process is over and if hydrocarbons have been found, the exploration well will be tested. If no hydrocarbons have been found, exploratory wells will be plugged and abandoned. “If we can, we would like to stay, but that depends on rig availability,” said Mr Phipps.

In a tight rig market this could only be a wish, rather than a firm way forward. However, many exploratory rigs in other parts of the world have been kept for exploitation purposes in the past. This adds to a tight rig market, so if a rig can be secured for Falklands’ waters all the better.

At the end of the day after all the exploration is finished there will be slack hydrocarbons based revenue streams. To investors, I say, hang in there. The next few months could be interesting indeed.

http://sartma.com/art_7323.html

By J. Brock (FINN)

Desire Chairman, Stephen Phipps has confirmed that the exploration rig, Ocean Guardian, is progressing well and scheduled to arrive in Falklands waters early in February, weather and sea conditions depending.

During an interview with FINN he also confirmed that the integrated pipe and lay-down facility at Coastel Road being constructed by Byron McKay is nearing completion with plans to base a majority of the shore support personnel from that area.

As reported last month on FINN there will be a financial benefit for the economy for entities involved in the pipe and lay-down facility, the movement of oil related cargo from FIPASS, People renting accommodation for shore based workers, Hotels accommodating workers and transport services. “Twelve Rooms at the Malvina House Hotel, 15 seats on the airbridge as well as the increased port activity is a significant contribution to the Falklands’ economy” said Mr Phipps.

Mr Phipps went on to say that once exploratory drilling is complete then these revenue streams will be dried up until there is another round of exploratory drilling possibly by FOGL, BHP Billiton and Borders & Southern.

Ocean Guardian is a semi-submersible rig suitable for exploring in shallower waters. This means that after Desire Petroleum finish their prospects in tranches C, D, and F, and Rockhopper Exploration end their drilling campaign in former Shell tranches, then BHP Billiton’s shallower prospects of Endeavour, Loligo and Nimrod could be drilled.

According to Mr Phipps there will be little information coming from the site. There will be an announcement when drilling commences and another when target depth is reached and how long it took to drill that depth. After a while the results of the drill will be announced.

Besides Desire’s Chairman, the CEO, Mr Ian Duncan, Finance Director Mr Eddie Wisniewski and PR Consultant Mr Ben Romney from Buchanan are visiting Also in the Falklands this week is Mr Sam Moody of Rockhopper Exploration. Rockhopper have discovered natural gas in one of their prospects.

When asked about what hydrocarbons products were being explored Mr Phipps said that “the main thought process is oil because that’s what’s believed to be there.” He shied away from commenting about natural gas.

When the exploration process is over and if hydrocarbons have been found, the exploration well will be tested. If no hydrocarbons have been found, exploratory wells will be plugged and abandoned. “If we can, we would like to stay, but that depends on rig availability,” said Mr Phipps.

In a tight rig market this could only be a wish, rather than a firm way forward. However, many exploratory rigs in other parts of the world have been kept for exploitation purposes in the past. This adds to a tight rig market, so if a rig can be secured for Falklands’ waters all the better.

At the end of the day after all the exploration is finished there will be slack hydrocarbons based revenue streams. To investors, I say, hang in there. The next few months could be interesting indeed.

http://sartma.com/art_7323.html

Falkland News, wie die obige auch unter http://www.falklandnews.com/

intresting.....rockhopper are at NAPE EXPO in Houston on the 10-12 feb with a stand.....looking to do more deals....intresting as they are the only falklands oilie there....working hard to get a major partner or a second farmin....

http://www.expocadweb.com/nap10/ec/forms/attendee/index.aspx…" target="_blank" rel="nofollow ugc noopener">

http://www.expocadweb.com/nap10/ec/forms/attendee/index.aspx…

http://www.expocadweb.com/nap10/ec/forms/attendee/index.aspx…

RNS Number : 5019G

Rockhopper Exploration plc

02 February 2010

Rockhopper Exploration Plc

("Rockhopper" or the "Company")

Drilling Programme Update

Rockhopper Exploration plc (AIM: RKH), the North Falkland Basin oil and gas exploration company, is pleased to announce that it has been formally assigned two slots with the Ocean Guardian drilling rig ("Ocean Guardian"), to drill Sea Lion and Ernest, during its forthcoming drilling campaign in the Falklands. This assignment is pursuant to a rig contract between Desire Petroleum PLC ("Desire") and Diamond Offshore Drilling (UK) Limited ("Diamond") and an assignment document between Desire, Diamond and Rockhopper dated 12th November 2009.

The Ocean Guardian is due to arrive in the Falklands in February 2010. The first well to be drilled by the rig, due to spud in mid February 2010, will be Liz (Rockhopper: 7.5 per cent interest), located on the western margin of the North Falkland Basin and operated by Desire (92.5 per cent interest).

The second well to be drilled by the Ocean Guardian upon its release from Liz will be Sea Lion (Rockhopper: 100 per cent owned and operated). The prospect is located on the eastern basin margin of the North Falkland Basin and is in close proximity to the Shell well 14/10-1, which recovered live oil.

Rockhopper will then be assigned either the third or fourth slot to drill the Ernest well. Ernest is located in licence PL024 and has a positive CSEM (Controlled Source Electromagnetic Anomaly).

The Ocean Guardian drilling rig departed the Cromarty Firth in Scotland on Thursday 26 November en route to Liz, in the North Falkland Basin.

Further information regarding the upcoming drilling campaign is contained in Rockhopper's announcement about the recent share placing dated 26 October 2009.

For further information, please contact:

Rockhopper Exploration

Sam Moody - Managing Director

Tel. +44 (0)1722 414 419

M: Communications

Patrick d'Ancona or Ben Simons

Tel. +44 (0)20 7920 2340

Canaccord Adams

Jeffrey Auld/ Elijah Colby/ Henry Fitzgerald O'Connor

Tel. +44 (0) 20 050 6500

Notes to Editors

Rockhopper was established in February 2004 with a strategy to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Company floated on AIM in August 2005 and is currently the largest licence holder in the North Falkland Basin with a 100 per cent. interest in four offshore production licences PL023, PL024, PL032 and PL033 which cover approximately 3,800 sq. km. Rockhopper has also farmed in to licences PL03 and PL04 which are operated by Desire Petroleum in which it holds a 7.5% Promoted Interest. These licences have been granted by the Falkland Islands government.

An extensive work programme has been carried out over a number of years on all of the licences in which Rockhopper has an interest. This has including 2D and 3D Seismic and Controlled Source Electromagnetic Mapping (CSEM). A number of well prospects have been identified, including Sea Lion and Ernest (on 100% owned Rockhopper licences) and Liz, Ann and Ninky (on Desire Petroleum licenses in which Rockhopper holds a 7.5% Promoted Interest). In November 2009 the Company completed an equity placing to raise gross proceeds of £50 million which covers the anticipated costs of these wells, including contingencies. The Ocean Guardian Drilling rig has been contracted to carry out a drilling campaign on each of these prospects during 2010.

Rockhopper Exploration plc www.rockhopperexploration.co.uk

Rockhopper Exploration plc

02 February 2010

Rockhopper Exploration Plc

("Rockhopper" or the "Company")

Drilling Programme Update

Rockhopper Exploration plc (AIM: RKH), the North Falkland Basin oil and gas exploration company, is pleased to announce that it has been formally assigned two slots with the Ocean Guardian drilling rig ("Ocean Guardian"), to drill Sea Lion and Ernest, during its forthcoming drilling campaign in the Falklands. This assignment is pursuant to a rig contract between Desire Petroleum PLC ("Desire") and Diamond Offshore Drilling (UK) Limited ("Diamond") and an assignment document between Desire, Diamond and Rockhopper dated 12th November 2009.

The Ocean Guardian is due to arrive in the Falklands in February 2010. The first well to be drilled by the rig, due to spud in mid February 2010, will be Liz (Rockhopper: 7.5 per cent interest), located on the western margin of the North Falkland Basin and operated by Desire (92.5 per cent interest).

The second well to be drilled by the Ocean Guardian upon its release from Liz will be Sea Lion (Rockhopper: 100 per cent owned and operated). The prospect is located on the eastern basin margin of the North Falkland Basin and is in close proximity to the Shell well 14/10-1, which recovered live oil.

Rockhopper will then be assigned either the third or fourth slot to drill the Ernest well. Ernest is located in licence PL024 and has a positive CSEM (Controlled Source Electromagnetic Anomaly).

The Ocean Guardian drilling rig departed the Cromarty Firth in Scotland on Thursday 26 November en route to Liz, in the North Falkland Basin.

Further information regarding the upcoming drilling campaign is contained in Rockhopper's announcement about the recent share placing dated 26 October 2009.

For further information, please contact:

Rockhopper Exploration

Sam Moody - Managing Director

Tel. +44 (0)1722 414 419

M: Communications

Patrick d'Ancona or Ben Simons

Tel. +44 (0)20 7920 2340

Canaccord Adams

Jeffrey Auld/ Elijah Colby/ Henry Fitzgerald O'Connor

Tel. +44 (0) 20 050 6500

Notes to Editors

Rockhopper was established in February 2004 with a strategy to invest in and carry out an offshore oil exploration programme to the north of the Falkland Islands. The Company floated on AIM in August 2005 and is currently the largest licence holder in the North Falkland Basin with a 100 per cent. interest in four offshore production licences PL023, PL024, PL032 and PL033 which cover approximately 3,800 sq. km. Rockhopper has also farmed in to licences PL03 and PL04 which are operated by Desire Petroleum in which it holds a 7.5% Promoted Interest. These licences have been granted by the Falkland Islands government.

An extensive work programme has been carried out over a number of years on all of the licences in which Rockhopper has an interest. This has including 2D and 3D Seismic and Controlled Source Electromagnetic Mapping (CSEM). A number of well prospects have been identified, including Sea Lion and Ernest (on 100% owned Rockhopper licences) and Liz, Ann and Ninky (on Desire Petroleum licenses in which Rockhopper holds a 7.5% Promoted Interest). In November 2009 the Company completed an equity placing to raise gross proceeds of £50 million which covers the anticipated costs of these wells, including contingencies. The Ocean Guardian Drilling rig has been contracted to carry out a drilling campaign on each of these prospects during 2010.

Rockhopper Exploration plc www.rockhopperexploration.co.uk

Falkland Islands set for more success in 2010

Fiona Bond

02.02.10 00:01

In just over a decade, the Falkland Islands - with its rich oil reserves - has transformed itself into a hotbed for London's leading mining houses.

In 1998, the British-ruled territory was considered to have poor hydrocarbon reserves, and the North Falkland Basin had just six wells under its belt, all of which were plugged and abandoned.

Fast forward to 2010 and an estimated £327 million has been ploughed into offshore projects as British-based companies clamour to get their hands on the territory believed to hold up to 60 billion barrels of oil.

While oil prices were just $10 a barrel in the late 1990s, today it has a price tag of almost $75 a barrel and the stakes are a lot higher.

The region, split into the North and Southern Basins, has attracted the attentions of Desire Petroleum (DES), Rockhopper Exploration (RKH), Falkland Oil and Gas (FOGL), Borders and Southern Petroleum (BOR) and, most recently, mining heavyweight BHP Billiton (BLT).

Rockhopper Exploration and Desire Petroleum have become the two principal operators of the North Falkland Basin, while its fellow oil producers concentrate on tackling the South Basin.

David Hart of WestHouse Securites, says that while the Northern Basin lacks the expanse of the South and East Falkland Basins, he believes "reserves in the hundreds of millions of barrels of oil can be reasonably expected."

Rockhopper Exploration, first admitted to AIM in 2005, was attracted to the acreage as it was deemed relatively low risk in exploration terms, with both proven oil and gas.

After raising a hefty £50 million in October 2009, Rockhopper - which owns a 100% interest in Licences PL023, PL024, PL032 and PL033 and has farmed-in to Licences PLO3 and PLO4 - is now bracing itself for the "most exciting period" since its inception.

It has teamed up with partner Desire to embark on a drilling programme starting this month, after securing the Ocean Guardian rig from Diamond Offshore Drilling.

While the terms of the contract are for a four well, eighty-day campaign, operator Desire retains the option to drill a further six wells for itself or its partner.

Since announcing the securing of the rig, Desire's share price has climbed steadily, rising as much as 27% in the last month. Rockhopper enjoyed similar success, rising over 18% throughout January.

Hart of WestHouse Securities, adds: "Clearly, 2010 is a big year for the North Falkland Basin explorers and we expect a steady diet of drilling news beginning in February. Having studied prior drilling data and numerous technical studies of the region over the years, we believe the two companies are now ideally placed to pursue a successful drilling programme assuming the geology works.

"Despite the raised awareness of the two groups' intentions, both are still substantially undervalued according to our valuations."

In the more daring south of the region operates Falkland Oil & Gas and Borders & Southern Petroleum.

The South Basin possesses a single rich source rock which spreads across the entire Southern Basins, from the Magallanes Basin in Argentina to the Maurice Ewing Bank some 800 kilometres east of the Islands. However, it poses a greater risk to explorers and shareholders alike due to the fact it has not yet been penetrated and remains in the very earliest stage of exploration.

Nevertheless, while Rockhopper and Desire have a lower risk profile, the rich resources of the Southern Basins mean Borders and Falkland Oil and & Gas could be faced with greater opportunities should their drilling activities come up trumps.

Fox Davies Capital believes said that there is a "fair chance of success in the 10 or so wells that will be drilled in 2010/11".

Falkland Oil & Gas is to embark on a drilling programme in the southeast of the region in April, along with partner and mining heavyweight BHP Billiton - which farmed in for 51% in 2009 - and has an option on the third drilling slot on the rig commissioned by Desire and Rockhopper.

Falkland Oil & Gas's shares have doubled during the course of 2009, leaving the company worth £228 million and shot up 21% in January alone.

Just as recently as November, Falkland Islands Holdings netted a handsome £3.1 million profit after offloading three million shares in Falkland Oil and Gas proving the company's growing worth.

Finally, Borders, which holds a 100% equity interest and operatorship of five production licences covering an area of 20,000 kilometres, is expected to start drilling towards the close of the year.

In January 2009, the company announced an initial review of its 3D seismic interpretations which, it said, highlighted three principal play fairways.

"Within these play fairways, multiple prospects were generated that, in common with analogous geological settings, could deliver in the success case multi-billion barrels of total recoverable reserves," Lionel Therond of Fox Davies Capital notes.

"We believe that the presence of companies such as BHP and Petrobras as farm-in partners respectively with Falkland Oil & Gas and across the Argentinean border in the Malvinas Basin to the West with Repsol, emphasise the attractiveness of the whole area," Therond added.

All four of the AIM-listed Falklands-focused groups have outperformed the AIM Oil&Gas Index over the last five years, as greater exploration opportunity helped to drive share prices higher. While they temporarily faulted in the second half of 2008 as the onslaught of the financial crisis took its toll, they were back on form by the start of 2009 and have gained 40-60% over the past three months.

With such success under their belts, 2010 could become a bumper year for the mining minnows.

Fiona Bond

02.02.10 00:01