Cardero Resource Corp. (CDU) - It’s not only ore, it’s much more: Zahlen, Daten, Fakten und Diskussi - 500 Beiträge pro Seite (Seite 7)

eröffnet am 15.05.11 12:28:41 von

neuester Beitrag 31.03.22 17:25:22 von

neuester Beitrag 31.03.22 17:25:22 von

Beiträge: 4.628

ID: 1.166.193

ID: 1.166.193

Aufrufe heute: 0

Gesamt: 658.870

Gesamt: 658.870

Aktive User: 0

ISIN: CA14140U2048 · WKN: A142XA

0,1600

CAD

0,00 %

0,0000 CAD

Letzter Kurs 26.01.22 TSX Venture

Antwort auf Beitrag Nr.: 43.202.990 von boersenbrieflemming am 23.05.12 19:08:30...naja auch solche leere "was eigentlich CDU wert wäre" Aussagen hatten wir schon tausendfach. Und was ist bisher eingetroffen?

Ich glaube das kann jeder selbst beantworten.

Ich glaube das kann jeder selbst beantworten.

ECC

May 23, 2012

Ethos Commences Drilling on the Betty Gold Property, Yukon Territory

http://tmx.quotemedia.com/article.php?newsid=51497858&qm_sym…

May 23, 2012

Ethos Commences Drilling on the Betty Gold Property, Yukon Territory

http://tmx.quotemedia.com/article.php?newsid=51497858&qm_sym…

KOR

May 23, 2012

Corvus Gold Hits 5.4m of 16.2 g/t Gold and 1,218 g/t Silver in Yellow Jacket Feeder Zone, North Bullfrog Project, Nevada

http://tmx.quotemedia.com/article.php?newsid=51492952&qm_sym…

May 23, 2012

Corvus Gold Hits 5.4m of 16.2 g/t Gold and 1,218 g/t Silver in Yellow Jacket Feeder Zone, North Bullfrog Project, Nevada

http://tmx.quotemedia.com/article.php?newsid=51492952&qm_sym…

Jetzt sind es noch 0,56 EUR bis... Dann ist Schluss mit diesem Thread.

AWAY

AWAY

Antwort auf Beitrag Nr.: 43.213.237 von away am 25.05.12 21:47:12Nun, es genügt ein Blick ins Bid, um zu sehen dass Du falsch liegst.

DRI

May 25, 2012

Dorato Announces Closing of Non-Brokered Private Placement

http://tmx.quotemedia.com/article.php?newsid=51581721&qm_sym…

May 25, 2012

Dorato Announces Closing of Non-Brokered Private Placement

http://tmx.quotemedia.com/article.php?newsid=51581721&qm_sym…

Coal Slides, But Long-Term Remains Bright

http://www.businessinsider.com/coal-slides-but-long-term-rem…

http://www.businessinsider.com/coal-slides-but-long-term-rem…

USA heute kein Börsenhandel - 28. Mai – Memorial Day

Deutschland und Canada sind offen

Deutschland und Canada sind offen

KOR

Corvus Gold - Corporate Presentation - May 24, 2012

http://www.corvusgold.com/investors/presentation/

Corvus Gold - Corporate Presentation - May 24, 2012

http://www.corvusgold.com/investors/presentation/

Jun 03 - 04, 2012

World Resource Investment Conference

Cardero Group Of Companies, CDU, BAR, KOR, ECC, TV

http://cambridgehouse.com/event/4452/exhibitors

Jennings COAL NOTES: MAY 28, 2012

COVERAGE SUMMARY

Investment Thesis

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $67.0 Previous Close: $0.73 12-Month Target: $3.00 Potential Return 311.0%

Canadian-listed play on metallurgical coal – Metallurgical coal is a major input requirement in global steel manufacturing, with global steel demand expected to grow at a 4% CAGR through 2020. The Carbon Creek project could be producing by early 2014, with full production capacity of 2.9 million tonnes per year (mtpy) achievable by 2016. CDU also announced a 15-year terminal access agreement with Ridley Terminal from 2014- 2028, which ramps up to 0.9 mtpy by 2015 (agreement subject to RTI’s capacity expansion from 24 to 30 mtpy).

Positive PEA results – On a 75% basis, the project has a post-tax NPV of $752 million at an 8% discount rate, an IRR of 29.3% and 3-year payback from the production start. The PEA also includes an upgraded resource estimate, with a 46% increase in M&I resources to 167 mt and an 87% increase in Inferred resource to 167 mt.

Well-established metallurgical coal producing region – The Carbon Creek project is located in the Peace River Coalfield in northeast B.C. Other operators/developers in the region include Xstrata (LSE-XTA) (via its recent acquisition of First Coal), Anglo American (LSE-AAL) and Walter Energy (TSX; NYSE-WLT).

Experienced management team – Mr. Michael Hunter, the President of CDU, was also a co-founder of First Coal. CDU also recently appointed a new Chief Operating Officer, Mr. Angus Christie (ex-Anglo Coal).

Near-term catalysts

o Q2/12 – Obtaining the outstanding mining licence. o Q3/12 – Pre-feasibility study.

o Potential monetization of non-core assets.

COVERAGE SUMMARY

Investment Thesis

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $67.0 Previous Close: $0.73 12-Month Target: $3.00 Potential Return 311.0%

Canadian-listed play on metallurgical coal – Metallurgical coal is a major input requirement in global steel manufacturing, with global steel demand expected to grow at a 4% CAGR through 2020. The Carbon Creek project could be producing by early 2014, with full production capacity of 2.9 million tonnes per year (mtpy) achievable by 2016. CDU also announced a 15-year terminal access agreement with Ridley Terminal from 2014- 2028, which ramps up to 0.9 mtpy by 2015 (agreement subject to RTI’s capacity expansion from 24 to 30 mtpy).

Positive PEA results – On a 75% basis, the project has a post-tax NPV of $752 million at an 8% discount rate, an IRR of 29.3% and 3-year payback from the production start. The PEA also includes an upgraded resource estimate, with a 46% increase in M&I resources to 167 mt and an 87% increase in Inferred resource to 167 mt.

Well-established metallurgical coal producing region – The Carbon Creek project is located in the Peace River Coalfield in northeast B.C. Other operators/developers in the region include Xstrata (LSE-XTA) (via its recent acquisition of First Coal), Anglo American (LSE-AAL) and Walter Energy (TSX; NYSE-WLT).

Experienced management team – Mr. Michael Hunter, the President of CDU, was also a co-founder of First Coal. CDU also recently appointed a new Chief Operating Officer, Mr. Angus Christie (ex-Anglo Coal).

Near-term catalysts

o Q2/12 – Obtaining the outstanding mining licence. o Q3/12 – Pre-feasibility study.

o Potential monetization of non-core assets.

Das interessante ist im Übrigen, dass das Kursziel von Cardero bei 3 Dollar belassen wurde, während zum Beispiel Cline deutlich (von 3 auf 1,75 Dollar) herabgestuft wurde.

KOR

May 29, 2012

Corvus Gold Appoints Carl Brechtel as Chief Operating Officer and Retains Quentin Mai for Investor Relations Support

http://tmx.quotemedia.com/article.php?newsid=51618564&qm_sym…

May 29, 2012

Corvus Gold Appoints Carl Brechtel as Chief Operating Officer and Retains Quentin Mai for Investor Relations Support

http://tmx.quotemedia.com/article.php?newsid=51618564&qm_sym…

Antwort auf Beitrag Nr.: 43.221.828 von ixilon am 29.05.12 16:41:52Dann doch wieder ein Job für Quentin. Wo war er zuletzt? Abzu?

Ich zeig Dir mal, was mich heute genervt hat:

5:44:53 T 0.71 -0.04 500 90 Barclays 99 Jitney K

15:44:44 T 0.71 -0.04 1,000 90 Barclays 99 Jitney K

14:40:01 T 0.72 -0.03 500 99 Jitney 79 CIBC K

14:40:01 T 0.72 -0.03 1,500 99 Jitney 79 CIBC KW

14:40:01 T 0.72 -0.03 500 1 Anonymous 79 CIBC KW

11:01:19 T 0.76 0.01 1,000 2 RBC 79 CIBC K

11:01:19 T 0.76 0.01 1,000 2 RBC 79 CIBC K

11:01:19 T 0.75 1,000 1 Anonymous 79 CIBC K

10:35:02 T 0.76 0.01 500 90 Barclays 1 Anonymous K

10:00:15 T 0.78 0.03 100 124 Questrade 33 Canaccord E

5:44:53 T 0.71 -0.04 500 90 Barclays 99 Jitney K

15:44:44 T 0.71 -0.04 1,000 90 Barclays 99 Jitney K

14:40:01 T 0.72 -0.03 500 99 Jitney 79 CIBC K

14:40:01 T 0.72 -0.03 1,500 99 Jitney 79 CIBC KW

14:40:01 T 0.72 -0.03 500 1 Anonymous 79 CIBC KW

11:01:19 T 0.76 0.01 1,000 2 RBC 79 CIBC K

11:01:19 T 0.76 0.01 1,000 2 RBC 79 CIBC K

11:01:19 T 0.75 1,000 1 Anonymous 79 CIBC K

10:35:02 T 0.76 0.01 500 90 Barclays 1 Anonymous K

10:00:15 T 0.78 0.03 100 124 Questrade 33 Canaccord E

Antwort auf Beitrag Nr.: 43.224.219 von boersenbrieflemming am 30.05.12 00:14:38Volumen ein Witz. und so bröckelt es und bröckelt es und nach dem nächsten doom day an der Börse ...

auch das 500 Mio Preisschild ist nach wie vor ein Witz ...

auch das 500 Mio Preisschild ist nach wie vor ein Witz ...

heute schon ganze 5 k gehandelt

Antwort auf Beitrag Nr.: 43.228.647 von Sstocktrader am 30.05.12 19:23:51...was fuer ein grosses Interesse an der Aktie noch herrscht....

Aus der Richtung stimmt es - ich haette jetzt gerne die Coal License und Siganle zur Finanzierung, damit die Haengepartie hier beendet ist und wir mal wieder hoehere Kurse und Volumen sehen.

China's coal demand set to rebound

China's record imports of coal in April, at 25.05 million tonnes, up 90.1% year on year, indicate rather robust trends for commodity demand, despite concerns over a slowing economy.

Author: Shivom Seth

Posted: Monday , 28 May 2012

MUMBAI (MINEWEB) -

China's demand for coking coal imports appears to be robust. The Asian major is set to import as much as 50 million tonnes of coking coal in 2012. Imports have already jumped in April, as importers have taken advantage of cheap overseas supplies.

In April, China imported 25.05 million tonnes of coal of all types (lignite included), higher by 17.1% from a month earlier, and 90.1% higher than a year ago.

Data released by the General Administration of Customs showed that imports of anthracite amounted to 3.36 million tonnes, down 11.8% month on month and dropping 10.5% year on year, while that of coking coal (at 5.09 million tonnes), thermal coal (at 7.23 million tonnes) and lignite (at 5.18 million tonnes), rose 22.9%, 35.6% and 20.2% respectively, from a month earlier.

As compared to last year, coking coal was up 59.7%, thermal coal was up 312.5% and lignite was up 140.9%, allaying fears of a slowing economy.

China's General Administration of Customs has decided to include lignite into the categories of imported coal this year, to give a better reflection of China's coal imports. That means, excluding lignite, the imports of hard coal expanded 14.56% from a month ago to 19.87 million tonnes in April.

Data indicates that these figures are still 10.25% less than the record high seen last November.

The world's largest coking coal producer, China is said to have the world's third largest coal reserves at 114 billion tonnes. The country's coal output reached 838 million tonnes during the first quarter, up 5.8% year on year, official data showed.

Though the nation's coal demand has faltered since the fourth quarter of last year as economic growth decelerated, Wang Xianzheng, chairman of the China Coal Industry Association, said at a meeting that supply and demand would continue to be roughly balanced during the second quarter.

At a Coaltrans conference in Beijing recently, industry players said they expect a 10% jump in imports from a year ago. Most of the rebound is seen coming through early fourth-quarter, as the impact of more monetary policy easing and economic rebound starts to flow through, Sun Xuefeng, manager at Sinosteel Raw Materials was quoted by agencies as saying.

China imported 44.6 million tonnes of coking coal in 2011, a 5.5% decline from a year ago, as the government's year long clampdown on the property sector hammered steel producers.

April has also seen higher imports from the Guangdong province, the economic hub in southeastern China. The area recorded a surge in coal imports during the first four months of the year, despite a slowdown in demand as impacted by a faltering domestic economy.

Guangdong imported 19.91 million tonnes of coal in the January to April period, growing 87.5% year on year, according to data recently released by the National Development and Reform Commission. The volume represents 34.23% of the province's total coal purchases during the same period.

The country is on a drive to rationalise the coal industry and develop cleaner and more advanced technology to reduce carbon emissions for the sector by spending more than $79 billion a year during its 12th Five-Year Plan period (2011-2015).

http://www.mineweb.com/mineweb/view/mineweb/en/page38?oid=15…

China's coal demand set to rebound

China's record imports of coal in April, at 25.05 million tonnes, up 90.1% year on year, indicate rather robust trends for commodity demand, despite concerns over a slowing economy.

Author: Shivom Seth

Posted: Monday , 28 May 2012

MUMBAI (MINEWEB) -

China's demand for coking coal imports appears to be robust. The Asian major is set to import as much as 50 million tonnes of coking coal in 2012. Imports have already jumped in April, as importers have taken advantage of cheap overseas supplies.

In April, China imported 25.05 million tonnes of coal of all types (lignite included), higher by 17.1% from a month earlier, and 90.1% higher than a year ago.

Data released by the General Administration of Customs showed that imports of anthracite amounted to 3.36 million tonnes, down 11.8% month on month and dropping 10.5% year on year, while that of coking coal (at 5.09 million tonnes), thermal coal (at 7.23 million tonnes) and lignite (at 5.18 million tonnes), rose 22.9%, 35.6% and 20.2% respectively, from a month earlier.

As compared to last year, coking coal was up 59.7%, thermal coal was up 312.5% and lignite was up 140.9%, allaying fears of a slowing economy.

China's General Administration of Customs has decided to include lignite into the categories of imported coal this year, to give a better reflection of China's coal imports. That means, excluding lignite, the imports of hard coal expanded 14.56% from a month ago to 19.87 million tonnes in April.

Data indicates that these figures are still 10.25% less than the record high seen last November.

The world's largest coking coal producer, China is said to have the world's third largest coal reserves at 114 billion tonnes. The country's coal output reached 838 million tonnes during the first quarter, up 5.8% year on year, official data showed.

Though the nation's coal demand has faltered since the fourth quarter of last year as economic growth decelerated, Wang Xianzheng, chairman of the China Coal Industry Association, said at a meeting that supply and demand would continue to be roughly balanced during the second quarter.

At a Coaltrans conference in Beijing recently, industry players said they expect a 10% jump in imports from a year ago. Most of the rebound is seen coming through early fourth-quarter, as the impact of more monetary policy easing and economic rebound starts to flow through, Sun Xuefeng, manager at Sinosteel Raw Materials was quoted by agencies as saying.

China imported 44.6 million tonnes of coking coal in 2011, a 5.5% decline from a year ago, as the government's year long clampdown on the property sector hammered steel producers.

April has also seen higher imports from the Guangdong province, the economic hub in southeastern China. The area recorded a surge in coal imports during the first four months of the year, despite a slowdown in demand as impacted by a faltering domestic economy.

Guangdong imported 19.91 million tonnes of coal in the January to April period, growing 87.5% year on year, according to data recently released by the National Development and Reform Commission. The volume represents 34.23% of the province's total coal purchases during the same period.

The country is on a drive to rationalise the coal industry and develop cleaner and more advanced technology to reduce carbon emissions for the sector by spending more than $79 billion a year during its 12th Five-Year Plan period (2011-2015).

http://www.mineweb.com/mineweb/view/mineweb/en/page38?oid=15…

CDU: 0.75 CAD +0.04 +5.6% 29.7k

Neues Face Sheet ist online - das war ja einige Zeit mit einem Coming Soon belegt. Eine schöne Zusammenfassung und natürlich - wie erwartet - alleine das Carbon Creek Projekt.

ARBON CREEK METALLURGICAL COAL

DEPOSIT - HIGHLIGHTS

• Norwest Corporation completed an

independent Preliminary Economic Assessment for Cardero on Carbon Creek and has outlined

a metallurgical coal resource estimate of 166 Mt Measured & Indicated plus 167 Mt Inferred (ASTM Coal rank mvB), as of October, 2011

• Phase I port allocation secured at Ridley Terminals, Prince Rupert BC

• Chief Operating Officer hired – Mr. Angus Christie (previously Anglo Coal)

• Project Description accepted by regulatory agencies – critical 1st step in securing a mine permit

• Simple Geology - amenable to surface and underground operations

• High quality metallurgical coal products

• Regional Infrastructure (power, port & rail)

• Significant M&A activity in region

• Peace River Coal Field - Recent history of successful mine permitting in the region

http://www.cardero.com/i/pdf/CarderoFactsheet_w.pdf

ARBON CREEK METALLURGICAL COAL

DEPOSIT - HIGHLIGHTS

• Norwest Corporation completed an

independent Preliminary Economic Assessment for Cardero on Carbon Creek and has outlined

a metallurgical coal resource estimate of 166 Mt Measured & Indicated plus 167 Mt Inferred (ASTM Coal rank mvB), as of October, 2011

• Phase I port allocation secured at Ridley Terminals, Prince Rupert BC

• Chief Operating Officer hired – Mr. Angus Christie (previously Anglo Coal)

• Project Description accepted by regulatory agencies – critical 1st step in securing a mine permit

• Simple Geology - amenable to surface and underground operations

• High quality metallurgical coal products

• Regional Infrastructure (power, port & rail)

• Significant M&A activity in region

• Peace River Coal Field - Recent history of successful mine permitting in the region

http://www.cardero.com/i/pdf/CarderoFactsheet_w.pdf

Danke Dir. Fact Sheet meintest Du.

Cardero is currently undertaking a pre-feasibility study to be completed Q3 2012.

Mal sehen wie sich die Märkte bis Ende des Jahres entwickeln.

Cardero is currently undertaking a pre-feasibility study to be completed Q3 2012.

Mal sehen wie sich die Märkte bis Ende des Jahres entwickeln.

Antwort auf Beitrag Nr.: 43.231.697 von stockrush am 31.05.12 12:31:08Ja, Fact Sheet natuerlich. So ist das mit der iOS Rechtschreibkorrektur (iPad).

Ein User wies mich darauf hin - es gibt einen Fehler auf Seite 2, des aktuellen FS.

Best Case $170/t mit IRR 46.3% - das müssen (aus dem Kopf) $270/t sein. Da hat sich die IR vertippt.

Ein User wies mich darauf hin - es gibt einen Fehler auf Seite 2, des aktuellen FS.

Best Case $170/t mit IRR 46.3% - das müssen (aus dem Kopf) $270/t sein. Da hat sich die IR vertippt.

Antwort auf Beitrag Nr.: 43.231.831 von boersenbrieflemming am 31.05.12 12:52:01Märkte...

Da kommt noch ein Tag, an dem man nur die Hand aufhalten muss, und schon hat man sie voller Gratisaktien... Das ist dann der finale Explorer Sell Off.

Da kommt noch ein Tag, an dem man nur die Hand aufhalten muss, und schon hat man sie voller Gratisaktien... Das ist dann der finale Explorer Sell Off.

Antwort auf Beitrag Nr.: 43.233.344 von lale93 am 31.05.12 17:11:10CDU hat im Moment -gottseidank- keine finanziellen Probleme und das ist derzeit viel wert. Das wir für Kurssteigerungen aber etwas mehr als jetzt brauchen, das ist wohl allen klar.

Den Artikel fand ich nicht uninteressant. ;-)

Weak coking coal equities disguise true potential

PUBLISHED: 30 MAY 2012 00:01:00 | UPDATED: 30 MAY 2012 09:25:16

DAN HALL

Australian-listed coking coal developers and explorers have suffered their worst rout since the global financial crisis as investors flee the stockmarket amid broad global economic uncertainty.

http://www.afr.com/p/personal_finance/portfolio/weak_coking_…

Weak coking coal equities disguise true potential

PUBLISHED: 30 MAY 2012 00:01:00 | UPDATED: 30 MAY 2012 09:25:16

DAN HALL

Australian-listed coking coal developers and explorers have suffered their worst rout since the global financial crisis as investors flee the stockmarket amid broad global economic uncertainty.

http://www.afr.com/p/personal_finance/portfolio/weak_coking_…

Cardero Resources (CDY: 0.76, +0.05, +7.04%) is seeing its price rise on above-normal volume today, as 177,800 shares, 1.5 times the stock's average daily volume, have moved. At 75 cents, the stock price has risen 5.7%. The stock has lost momentum over the last three months, losing 38 cents (-33.6%) from $1.13 on March 6, 2012. The stock has climbed a step closer to its 50-day moving average, sitting at just 90.1% of the mark.

Read more: http://www.foxbusiness.com/markets/2012/06/01/sprott-physica…

Read more: http://www.foxbusiness.com/markets/2012/06/01/sprott-physica…

So, ist das nun das beginnende Licht am Ende des Tunnels?

Fast hätte ich vergessen hier noch den Kurs reinzustellen - es ist schön zu sehen, wie die CDU bei dem gestrigen "Goldrausch" mitgezogen hat:

CDU: 0.79 CAD +0.07 +9.7% 140.2k

CDY: 0.7511 USD +0.0411 +5.8% 200.8k

Das macht Lust auf mehr.

CDU: 0.79 CAD +0.07 +9.7% 140.2k

CDY: 0.7511 USD +0.0411 +5.8% 200.8k

Das macht Lust auf mehr.

Jennings Capital:

COAL NOTES: JUNE 4, 2012

COVERAGE SUMMARY

Investment Thesis

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $73.0 Previous Close: $0.79 12-Month Target: $3.00 Potential Return 279.7%

COAL NOTES: JUNE 4, 2012

COVERAGE SUMMARY

Investment Thesis

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $73.0 Previous Close: $0.79 12-Month Target: $3.00 Potential Return 279.7%

TV

Trevali Mining - Corporate Presentation - June 2012

http://www.trevaliresources.com/i/pdf/TrevaliPresentation.pd…

Trevali Mining - Corporate Presentation - June 2012

http://www.trevaliresources.com/i/pdf/TrevaliPresentation.pd…

Die Juni-Praesentation ist online.

Projektfahrplan auf Seite 14.

http://www.cardero.com/i/pdf/ppt/Cardero-June-2012.pdf

Zudem die erste chinesische Ausgabe:

http://www.cardero.com/i/pdf/ppt/Cardero-June-2012Translated…

Projektfahrplan auf Seite 14.

http://www.cardero.com/i/pdf/ppt/Cardero-June-2012.pdf

Zudem die erste chinesische Ausgabe:

http://www.cardero.com/i/pdf/ppt/Cardero-June-2012Translated…

Trevali:

Trevali Further Expands Mineralization at Stratmat Deposit in New Brunswick

Highlights include: 9.4 Metres at 6.4% Zn, 2.9% Pb, 0.4% Cu, 81.3 g/t Ag & 1.79 g/t Au 15.26 Metres at 6.1% Zn, 3.3% Pb, 0.28% Cu, & 29.5 g/t Ag Mineralized System Now Defined Over 2.2 Kilometres Strike by 800 Metres Wide - Remains Open for Expansion

http://www.marketwatch.com/story/trevali-further-expands-min…

--

Bei der CDU sieht im Moment das Bid interessant aus.

Trevali Further Expands Mineralization at Stratmat Deposit in New Brunswick

Highlights include: 9.4 Metres at 6.4% Zn, 2.9% Pb, 0.4% Cu, 81.3 g/t Ag & 1.79 g/t Au 15.26 Metres at 6.1% Zn, 3.3% Pb, 0.28% Cu, & 29.5 g/t Ag Mineralized System Now Defined Over 2.2 Kilometres Strike by 800 Metres Wide - Remains Open for Expansion

http://www.marketwatch.com/story/trevali-further-expands-min…

--

Bei der CDU sieht im Moment das Bid interessant aus.

Macht die Dicke im Moment sehr gut:

CDU: 0.83 +0.07 9.2 195.1k

An der chinesischen Präsentation wird es wohl nicht liegen.

CDU: 0.83 +0.07 9.2 195.1k

An der chinesischen Präsentation wird es wohl nicht liegen.

Ask

0.88 6,500 3

0.86 4,500 1

0.85 8,500 6

0.84 10,500 7

0.83 1,000 1

Bid

0.81 5,500 4

0.80 40,000 10

0.79 6,000 4

0.78 17,500 8

0.77 6,000 5

Das ist nur eine Momentaufnahme - das Bid (Anzahl der Order) ist recht nett.

0.88 6,500 3

0.86 4,500 1

0.85 8,500 6

0.84 10,500 7

0.83 1,000 1

Bid

0.81 5,500 4

0.80 40,000 10

0.79 6,000 4

0.78 17,500 8

0.77 6,000 5

Das ist nur eine Momentaufnahme - das Bid (Anzahl der Order) ist recht nett.

BAR

June 6, 2012

Balmoral Provides Northshore Property Update

http://tmx.quotemedia.com/article.php?newsid=51840699&qm_sym…

June 6, 2012

Balmoral Provides Northshore Property Update

http://tmx.quotemedia.com/article.php?newsid=51840699&qm_sym…

Fast vergessen. ;-)

CDU: 0.84 +0.02 2.4% 87.3k

--

Bisher noch keine Spur von .... Sell in june or get harpooned.

CDU: 0.84 +0.02 2.4% 87.3k

--

Bisher noch keine Spur von .... Sell in june or get harpooned.

Antwort auf Beitrag Nr.: 43.263.312 von boersenbrieflemming am 08.06.12 10:11:04

Morgen

Naja, ein wenig gepiekst wurden die Cardero`s ja bereits

Morgen

Naja, ein wenig gepiekst wurden die Cardero`s ja bereits

Antwort auf Beitrag Nr.: 43.263.428 von herrscher2 am 08.06.12 10:37:35gepiekst ... das ist schoen ausgedrueckt.

Antwort auf Beitrag Nr.: 43.263.461 von boersenbrieflemming am 08.06.12 10:48:30

Wie turbulent und knochenhart das Dasein an der Börse (für Anleger und Firmen) seit geraumer Zeit ist, zeigt ein Junior Uranexplorer von mir.

Gestern kam die Nachricht, dass sie ihre Liegenschaften in Namibia nicht mehr weiter betreuen und nähren wollen (Fukushima-Schock) und einen Geschäftsmodellwechsel durchführen.

Sie kaufen in Texas Pekan-Nuss Plantagen und versuchen so ihr Überleben zu sichern....

Vom erfolgversprechenden Uranexplorer zum Nuss-Züchter - Unglaublich....

Wie turbulent und knochenhart das Dasein an der Börse (für Anleger und Firmen) seit geraumer Zeit ist, zeigt ein Junior Uranexplorer von mir.

Gestern kam die Nachricht, dass sie ihre Liegenschaften in Namibia nicht mehr weiter betreuen und nähren wollen (Fukushima-Schock) und einen Geschäftsmodellwechsel durchführen.

Sie kaufen in Texas Pekan-Nuss Plantagen und versuchen so ihr Überleben zu sichern....

Vom erfolgversprechenden Uranexplorer zum Nuss-Züchter - Unglaublich....

Antwort auf Beitrag Nr.: 43.263.602 von herrscher2 am 08.06.12 11:24:43Vom erfolgversprechenden Uranexplorer zum Nuss-Züchter - Unglaublich....

Bitte um eine BM, wer das ist. Da wird aber noch mehr passieren - man bekommt derzeit im Explorerbereich teilweise schon das Grauen - aber nicht ueberall. Ich will mir nicht ausmalen, was mit den vielen kleinen Brokerhaeusern passiert. Kaum Financings ... PPs.

Wer im Moment kein Geld hat, wird weiter duempeln und auch stuerzen - Cardero hat da ja noch ausreichend (siehe aktuelle Praesentation), deswegen glaube ich nicht, dass wir auf Erdnuesse umsteigen muessen.

Bitte um eine BM, wer das ist. Da wird aber noch mehr passieren - man bekommt derzeit im Explorerbereich teilweise schon das Grauen - aber nicht ueberall. Ich will mir nicht ausmalen, was mit den vielen kleinen Brokerhaeusern passiert. Kaum Financings ... PPs.

Wer im Moment kein Geld hat, wird weiter duempeln und auch stuerzen - Cardero hat da ja noch ausreichend (siehe aktuelle Praesentation), deswegen glaube ich nicht, dass wir auf Erdnuesse umsteigen muessen.

Antwort auf Beitrag Nr.: 43.264.242 von boersenbrieflemming am 08.06.12 14:04:45

.....unterliegt nicht der Geheimhaltung.

Xemplar Energy (XE)

.....unterliegt nicht der Geheimhaltung.

Xemplar Energy (XE)

Ausnahmsweise OT

...................................................

Mr. Ron Mitchell reports

XEMPLAR ANNOUNCES AGREEMENT TO ACQUIRE PECAN PROPERTY AND CHANGE OF BUSINESS

Xemplar Energy Corp. has entered into a purchase agreement with two arm's-length private companies located in Texas, dated June 5, 2012, pursuant to which the company will acquire land and equipment used for the growing, harvesting, sale and exporting of pecan crops in Culberson county, Texas.

The company's current business is the exploration and development of uranium prospects in Namibia. However, the continued weak uranium market, compounded by last year's Fukushima disaster, has led management to investigate cash-generative alternative business opportunities available to the company.

Upon completion of the acquisition, the company will have two distinct business segments which will constitute a change of business under the policies of the TSX Venture Exchange, and is expected that the company will be listed under the industrial industry segment of the exchange.

The company intends to pursue growth strategies within the pecan industry by maximizing the use of the property, consisting of 3,764 acres of land, of which only 680 acres are planted with pecan trees, allowing considerable room for growth. The company also intends to introduce more efficient farming techniques to increase the yield per acre and to take an active role in distribution, trading and export sales. The property has been in production for approximately 40 years and operated by the vendors for the past 20 years................

...................................................

Mr. Ron Mitchell reports

XEMPLAR ANNOUNCES AGREEMENT TO ACQUIRE PECAN PROPERTY AND CHANGE OF BUSINESS

Xemplar Energy Corp. has entered into a purchase agreement with two arm's-length private companies located in Texas, dated June 5, 2012, pursuant to which the company will acquire land and equipment used for the growing, harvesting, sale and exporting of pecan crops in Culberson county, Texas.

The company's current business is the exploration and development of uranium prospects in Namibia. However, the continued weak uranium market, compounded by last year's Fukushima disaster, has led management to investigate cash-generative alternative business opportunities available to the company.

Upon completion of the acquisition, the company will have two distinct business segments which will constitute a change of business under the policies of the TSX Venture Exchange, and is expected that the company will be listed under the industrial industry segment of the exchange.

The company intends to pursue growth strategies within the pecan industry by maximizing the use of the property, consisting of 3,764 acres of land, of which only 680 acres are planted with pecan trees, allowing considerable room for growth. The company also intends to introduce more efficient farming techniques to increase the yield per acre and to take an active role in distribution, trading and export sales. The property has been in production for approximately 40 years and operated by the vendors for the past 20 years................

Da ich hier auch nicht allzu schmal investiert bin hoffe ich doch, dass sie mir bei Gelegenheit einen gut gefüllten Sack Nüsse zur Kostprobe gratis zukommen lassen.....

Antwort auf Beitrag Nr.: 43.264.316 von herrscher2 am 08.06.12 14:22:04Da hat man ja schon Mitleid. Höchstkurs 7.1.2008 bei 8,50 CAD !!!

Auch Riesenumsätze zwischen 1 und 2 Mio in dieser Zeit !!!

Da sieht man: Auch die Masse kann irren.

Auch Riesenumsätze zwischen 1 und 2 Mio in dieser Zeit !!!

Da sieht man: Auch die Masse kann irren.

Antwort auf Beitrag Nr.: 43.264.316 von herrscher2 am 08.06.12 14:22:04Da wuerde ich glatt die IR einmal anschreiben - aber bitte vergesse nicht die Nusstüte dann zu verzollen. Unglaubliche Geschichte.

"The price of $225/mt applies to Anglo American's flagship German Creek brand, a premium low-volatile HCC, while premium mid-vol HCC Moranbah North was settled at $221/mt FOB, sources said."

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Metals/768…

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/Metals/768…

Peabody Shows China Is Coal's Best Recovery Bet

....

In an early May coal industry outlook reacting to a weaker than expected first quarter earnings season, Credit Suisse analyst Richard Garchitorena noted that met coal is currently the only "bullish" part of the industry. The analyst forecast that coking coal us expected to rise to over $230 a ton in the second half of 2012 from present levels hovering around $220.

http://www.thestreet.com/story/11577087/1/peabody-shows-chin…

Lesenswerter Artikel.

....

In an early May coal industry outlook reacting to a weaker than expected first quarter earnings season, Credit Suisse analyst Richard Garchitorena noted that met coal is currently the only "bullish" part of the industry. The analyst forecast that coking coal us expected to rise to over $230 a ton in the second half of 2012 from present levels hovering around $220.

http://www.thestreet.com/story/11577087/1/peabody-shows-chin…

Lesenswerter Artikel.

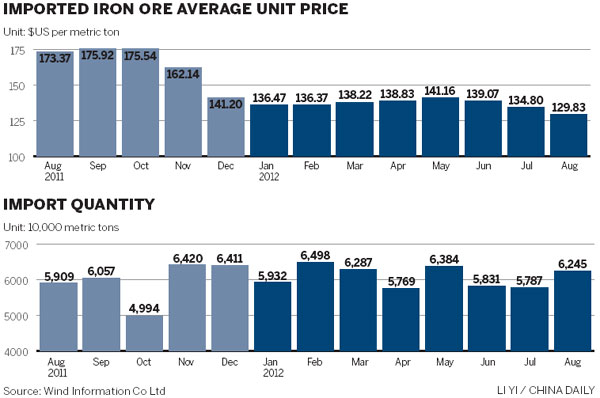

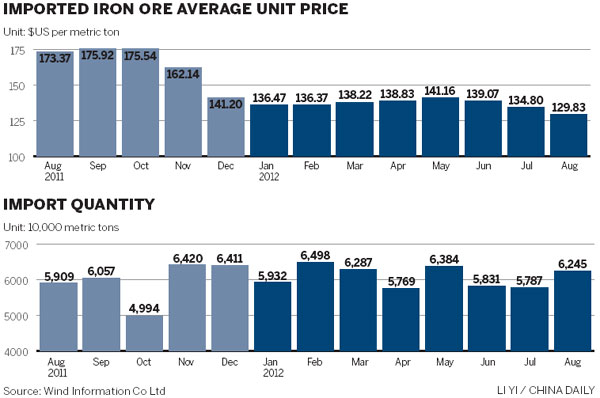

Antwort auf Beitrag Nr.: 43.274.979 von boersenbrieflemming am 12.06.12 15:11:32zum bullishen ausblick passen folgende nachrichten

eisenerz läuft rund

http://www.minenportal.de/artikel.php?sid=20795#Rekordwerte-…

angestrebte verdreifachung der kohleproduktion bis 2020.

http://www.minenportal.de/artikel.php?sid=20793#Rio-Tinto-st…

eisenerz läuft rund

http://www.minenportal.de/artikel.php?sid=20795#Rekordwerte-…

angestrebte verdreifachung der kohleproduktion bis 2020.

http://www.minenportal.de/artikel.php?sid=20793#Rio-Tinto-st…

KOR

June 12, 2012

Corvus Gold Announces Latest Drill Results From Bulk Tonnage Oxide Deposit, North Bullfrog Project, Nevada

http://tmx.quotemedia.com/article.php?newsid=51957233&qm_sym…

June 12, 2012

Corvus Gold Announces Latest Drill Results From Bulk Tonnage Oxide Deposit, North Bullfrog Project, Nevada

http://tmx.quotemedia.com/article.php?newsid=51957233&qm_sym…

...was fuer riesen Umsaetze wir mal wieder haben...

Antwort auf Beitrag Nr.: 43.275.874 von gustel66 am 12.06.12 18:18:18Ja, es koennte mehr sein. Aber Haus 121 kauft.

Jennings Capital - Coal Notes vom 11. Juni 2012:

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $75.0 Previous Close: $0.82 12-Month Target: $3.00 Potential Return 265.9%

Waehrend sie andere Coal-Plays (CMK) herabgestuft haben, bleibt Cardero bei 3 USD. aber im Moment ist es eh eine etwas uhige Zeit.

Jennings Capital - Coal Notes vom 11. Juni 2012:

Cardero Resource Corp. (TSX-CDU) Recommendation: SPECULATIVE BUY Mkt Cap ($mm) $75.0 Previous Close: $0.82 12-Month Target: $3.00 Potential Return 265.9%

Waehrend sie andere Coal-Plays (CMK) herabgestuft haben, bleibt Cardero bei 3 USD. aber im Moment ist es eh eine etwas uhige Zeit.

KOR

12.06.2012 | 15:02 Uhr | Rohstoff-Welt.de

Corvus Gold Inc. meldet Bohrergebnisse von dem North-Bullfrog-Projekt

http://www.rohstoff-welt.de/news/artikel.php?sid=36868#Corvu…

12.06.2012 | 15:02 Uhr | Rohstoff-Welt.de

Corvus Gold Inc. meldet Bohrergebnisse von dem North-Bullfrog-Projekt

http://www.rohstoff-welt.de/news/artikel.php?sid=36868#Corvu…

Ich bin mal raus hier, mir fehlt angesichts des aktuellen Umfeldes hier das Potential. Ich werde mal ein paar Euros zur Seite legen, um ev. andersweitig günstig einsteigen zu können.

Mal sehen, wann die Hängepartie beendet ist. ;-)

Landete gerade in meiner Mailbox.

Balmoral Reports More High Grade Results From Martiniere West; Initiates Summer Drill Program ...

http://www.marketwatch.com/story/balmoral-reports-more-high-…

Balmoral Reports More High Grade Results From Martiniere West; Initiates Summer Drill Program ...

http://www.marketwatch.com/story/balmoral-reports-more-high-…

Es ist ja meine beiderseitige Hoffnung, dass CDU sich 2013/14 zu guten Konditionen von dieser Beteiligung trennen kann.

"Trevali Receives Positive Metallurgical Results From Initial Halfmile Mill Run

Excellent Flotation Characteristics and Good Recoveries Produce Quality Concentrates - Optimal Precious Metal Reporting - Further Optimization Anticipated"

http://www.marketwatch.com/story/trevali-receives-positive-m…

"Trevali Receives Positive Metallurgical Results From Initial Halfmile Mill Run

Excellent Flotation Characteristics and Good Recoveries Produce Quality Concentrates - Optimal Precious Metal Reporting - Further Optimization Anticipated"

http://www.marketwatch.com/story/trevali-receives-positive-m…

So kann man es natürlich auch sehen.

"Anglo American: Met Coal Pricing More Focused On Supplies Than Demand

... Mr. Elliot said analysts are forecasting a hard coking coal price of about $225 a ton in the fourth quarter. He said that U.S. miners are filling the supply gap left by Australian miners but he expects Australian miners will boost production in the future ..."

Read more: http://www.foxbusiness.com/news/2012/06/14/anglo-american-me…

Cardero hat den Fokus auf met coal und nicht die thermal coal (das wird ja leider von den WO-Profis immer verwechselt) ... nun wäre mal langsam eine erste Bewegung von Angus Christie schön ;-)

"Anglo American: Met Coal Pricing More Focused On Supplies Than Demand

... Mr. Elliot said analysts are forecasting a hard coking coal price of about $225 a ton in the fourth quarter. He said that U.S. miners are filling the supply gap left by Australian miners but he expects Australian miners will boost production in the future ..."

Read more: http://www.foxbusiness.com/news/2012/06/14/anglo-american-me…

Cardero hat den Fokus auf met coal und nicht die thermal coal (das wird ja leider von den WO-Profis immer verwechselt) ... nun wäre mal langsam eine erste Bewegung von Angus Christie schön ;-)

Hard coking coal to lift Anglo American growth

BY: ALEX MACDONALD From: The Australian June 15, 2012 12:00AM

GLOBALLY diversified miner Anglo American plans to invest heavily in hard coking coal in Canada and Australia to deliver a compounded annual growth rate of 12 per cent between 2010 and 2020 in terms of production capacity, higher than its peers, the company says. ...

http://www.theaustralian.com.au/business/mining-energy/hard-…

BY: ALEX MACDONALD From: The Australian June 15, 2012 12:00AM

GLOBALLY diversified miner Anglo American plans to invest heavily in hard coking coal in Canada and Australia to deliver a compounded annual growth rate of 12 per cent between 2010 and 2020 in terms of production capacity, higher than its peers, the company says. ...

http://www.theaustralian.com.au/business/mining-energy/hard-…

Antwort auf Beitrag Nr.: 43.277.263 von schnitzale am 13.06.12 06:59:11Du verkaufst CDU am Tiefstpunkt und generierst damit Cash in einer Währung die nur noch einen Schritt vorm Abgrund steht. Bei dem Timing könnte man fast vermuten, dass Du zum CDU Management gehörst.

Stefan

Stefan

Quelle: http://www.reuters.com/article/2012/06/15/idUS107829+15-Jun-…

Cardero Receives Positive Drill Results, Sheini Hills Iron Project, Ghana; Update on Sheini Exploration Program; Termination of LO

* Reuters is not responsible for the content in this press release.

Fri Jun 15, 2012 8:00am EDT

VANCOUVER, BRITISH COLUMBIA, Jun 15 (MARKET WIRE) --

Cardero Resource Corp. ("Cardero" or the "Company") (TSX:CDU)(NYSE

MKT:CDY)(NYSE Amex:CDY)(FRANKFURT:CR5) announces receipt of initial drill

results from Phase I drilling at the Company's Sheini Hills Iron Project,

Ghana ("Sheini").

Drillholes 1 to 7 all intersected thick iron mineralization, with

individual ironstone horizons up to 53 metres in thickness. The best

intersection to date is 30.2 metres grading 45.6% iron and the weighted

average grade from all drillholes to date is 36.2%. Ironstone composition

is haematite-dominated with a negligible magnetite component.

A total of 30 drillholes have been completed to date (Figure 1 - Location

Map: http://media3.marketwire.com/docs/cdu615_F1.pdf), and results have

been received for the first 7 drillholes only (Table 1, Figure 2, Section

1007170). Drilling completed to the north of this section has intersected

thicker iron mineralization, with individual intersections of 125 metres

thickness from surface.

From To thickness Iron Grade

Drillhole (m) (m) (m) (%)

----------------------------------------------------------------

SCD-001 0.0 4 4.0 33.0

and 25.0 59.6 34.6 39.4

SCD002 30.0 66.55 36.6 35.0

SCD003 118.0 141.75 23.8 32.5

----------------------------------------------------------------

SCD004 0.0 3.8 3.8 43.1

and 104.4 126.4 22.0 32.4

and 173.0 206.6 33.6 36.5

SCD005 54.3 84.7 30.4 29.9

SCD006 7.6 45.6 38.0 35.7

----------------------------------------------------------------

SCD007 0.0 9.9 9.9 36.2

and 117.1 147.3 30.2 45.6

----------------------------------------------------------------

Weighted average grade 36.2

Table 1: Results from Initial Sheini Drillholes

(Reported drill intercepts are not true widths. At this time,

there is insufficient data with respect to the shape of the

mineralization to calculate its true orientation in space).

EXPLORATION PROGRAM DETAILS

Phase I exploration at Sheini is targeting two main types of

haematite-dominated iron deposits:

- outcropping haematite ironstones - hard-rock ironstone outcropping on

ridges; and

- surface haematite ferricretes - recent deposits, peripheral to the

ironstone ridges

Cardero is undertaking a large multi-faceted exploration program with the

aim of calculating an initial resource estimate for part of the Sheini

deposit. The Sheini prospecting licences comprise a total strike length

of approximately 50km, measured from north to south. The current work

program is outlined below:

Airborne Geophysics. A 3,500 line kilometre airborne geophysical survey

has been completed and delivery of a final dataset is expected in the

coming weeks. On receipt, Cardero's consulting geophysicist will complete

extensive interpretation and modelling aimed at identification of any

potential direct shipping ore ("DSO").

Mapping. Detailed mapping is ongoing aimed at definition of ironstone and

iron grade between wide-spaced drill sections.

Diamond Drilling. Diamond drilling is focussed on in situ haematite

ironstone ridges over a strike length of 9 kilometres. The ironstone

ridges expose ironstones on dip slopes providing potential for very low

strip ratios. The ironstones are locally folded (Figure 2:

http://media3.marketwire.com/docs/cdu615_F2.pdf) providing locally very

thick ironstone intersections in excess of 100m. At total phase I diamond

drill program of 10,000m is planned, of which 4,500m (30 holes) has been

drilled to date. Detailed drill sections are located 1,600 metres apart,

with infill drill sections at 800 metres apart. On section lines,

drillholes are spaced approximately 100 metres apart. The Company

believes that this drill spacing should be sufficient to provide an

inferred resource calculation.

Reverse Circulation Drilling. Reverse Circulation drilling is focussed on

peripheral surface ferriciretes (recent haematite-cemented ironstone

scree) which occur at surface on the surrounding plains and have been

drilled to 19 metres thickness to date. The ferricrete drilling program

is reverse circulation drilling, will be up to 7,500m and has just begun.

Ferricretes are extensive in the areas peripheral to the ironstone

ridges.

Geotechnical. The drill program is aimed at resource definition, rather

than exploration, and the collection of detailed geotechnical and

engineering data is an integral part of the program.

Metallurgical Testing. Planned metallurgical testing will look at the

potential upgrade of ironstones and ferricretes to potentially saleable

iron ore products. Since all mineralization is haematite and not

magnetite, beneficiation will focus on crushing, grinding and gravity

separation. High-intensity magnetic separation may be required for final

processing.

Resource Estimate. SRK Consulting has been retained to complete an

initial resource estimate. Completion is anticipated to be Q4 2012.

TERMINATION OF LETTER OF INTENT WITH TMT

The Company also announces that it has been advised by its subsidiary,

Cardero Iron Ore (BVI) Ltd. (the "Vendor") that on June 14, 2012 the

Vendor and T.M.T. Resources Inc. ("TMT") mutually agreed to terminate the

Letter of Intent dated April 20, 2012 between the Vendor and TMT with

respect to the sale by the Vendor to TMT of Cardero Iron Ore Ghana (BVI)

Ltd., the parent of Cardero Ghana Ltd. which was previously disclosed in

Cardero's news release of April 30, 2012.

QUALIFIED PERSON

EurGeol Keith Henderson, PGeo, Cardero's Executive Vice President and a

qualified person as defined by National Instrument 43-101, has reviewed

the scientific and technical information that forms the basis for

portions of this news release, and has approved the disclosure herein.

Mr. Henderson is not independent of the Company, as he is an officer and

shareholder.

QA/QC

The work program at Sheini is supervised by Christopher White (Cardero

Resource Corp.) and Dr. Karel Maly (Aurum Exploration Limited), who

together are responsible for all aspects of the work, including the

quality control/quality assurance program. On-site personnel at the

project rigorously collect and track samples which are then security

sealed and shipped to ALS Laboratories, Kumasi, Ghana, for sample

preparation, and onward to OMAC Laboratories (an ALS Group company),

Ireland, for analysis. OMAC's quality system complies with the

requirements for the International Standards ISO 9001:2000 and ISO 17025:

1999. Analytical accuracy and precision are monitored by the analysis of

reagent blanks, reference material and replicate samples. Quality control

was further assured by the use of international and in-house standards.

Blind certified reference material was inserted at regular intervals into

the sample sequence in order to independently assess analytical accuracy.

About Cardero Resource Corp.

The common shares of the Company are currently listed on the Toronto

Stock Exchange (symbol CDU), the NYSE-Amex (symbol CDY) and the Frankfurt

Stock Exchange (symbol CR5). For further details on the Company readers

are referred to the Company's web site (www.cardero.com), Canadian

regulatory filings on SEDAR at www.sedar.com and United States regulatory

filings on EDGAR at www.sec.gov.

On Behalf of the Board of Directors of CARDERO RESOURCE CORP.

Michael Hunter, CEO and President

Cardero Receives Positive Drill Results, Sheini Hills Iron Project, Ghana; Update on Sheini Exploration Program; Termination of LO

* Reuters is not responsible for the content in this press release.

Fri Jun 15, 2012 8:00am EDT

VANCOUVER, BRITISH COLUMBIA, Jun 15 (MARKET WIRE) --

Cardero Resource Corp. ("Cardero" or the "Company") (TSX:CDU)(NYSE

MKT:CDY)(NYSE Amex:CDY)(FRANKFURT:CR5) announces receipt of initial drill

results from Phase I drilling at the Company's Sheini Hills Iron Project,

Ghana ("Sheini").

Drillholes 1 to 7 all intersected thick iron mineralization, with

individual ironstone horizons up to 53 metres in thickness. The best

intersection to date is 30.2 metres grading 45.6% iron and the weighted

average grade from all drillholes to date is 36.2%. Ironstone composition

is haematite-dominated with a negligible magnetite component.

A total of 30 drillholes have been completed to date (Figure 1 - Location

Map: http://media3.marketwire.com/docs/cdu615_F1.pdf), and results have

been received for the first 7 drillholes only (Table 1, Figure 2, Section

1007170). Drilling completed to the north of this section has intersected

thicker iron mineralization, with individual intersections of 125 metres

thickness from surface.

From To thickness Iron Grade

Drillhole (m) (m) (m) (%)

----------------------------------------------------------------

SCD-001 0.0 4 4.0 33.0

and 25.0 59.6 34.6 39.4

SCD002 30.0 66.55 36.6 35.0

SCD003 118.0 141.75 23.8 32.5

----------------------------------------------------------------

SCD004 0.0 3.8 3.8 43.1

and 104.4 126.4 22.0 32.4

and 173.0 206.6 33.6 36.5

SCD005 54.3 84.7 30.4 29.9

SCD006 7.6 45.6 38.0 35.7

----------------------------------------------------------------

SCD007 0.0 9.9 9.9 36.2

and 117.1 147.3 30.2 45.6

----------------------------------------------------------------

Weighted average grade 36.2

Table 1: Results from Initial Sheini Drillholes

(Reported drill intercepts are not true widths. At this time,

there is insufficient data with respect to the shape of the

mineralization to calculate its true orientation in space).

EXPLORATION PROGRAM DETAILS

Phase I exploration at Sheini is targeting two main types of

haematite-dominated iron deposits:

- outcropping haematite ironstones - hard-rock ironstone outcropping on

ridges; and

- surface haematite ferricretes - recent deposits, peripheral to the

ironstone ridges

Cardero is undertaking a large multi-faceted exploration program with the

aim of calculating an initial resource estimate for part of the Sheini

deposit. The Sheini prospecting licences comprise a total strike length

of approximately 50km, measured from north to south. The current work

program is outlined below:

Airborne Geophysics. A 3,500 line kilometre airborne geophysical survey

has been completed and delivery of a final dataset is expected in the

coming weeks. On receipt, Cardero's consulting geophysicist will complete

extensive interpretation and modelling aimed at identification of any

potential direct shipping ore ("DSO").

Mapping. Detailed mapping is ongoing aimed at definition of ironstone and

iron grade between wide-spaced drill sections.

Diamond Drilling. Diamond drilling is focussed on in situ haematite

ironstone ridges over a strike length of 9 kilometres. The ironstone

ridges expose ironstones on dip slopes providing potential for very low

strip ratios. The ironstones are locally folded (Figure 2:

http://media3.marketwire.com/docs/cdu615_F2.pdf) providing locally very

thick ironstone intersections in excess of 100m. At total phase I diamond

drill program of 10,000m is planned, of which 4,500m (30 holes) has been

drilled to date. Detailed drill sections are located 1,600 metres apart,

with infill drill sections at 800 metres apart. On section lines,

drillholes are spaced approximately 100 metres apart. The Company

believes that this drill spacing should be sufficient to provide an

inferred resource calculation.

Reverse Circulation Drilling. Reverse Circulation drilling is focussed on

peripheral surface ferriciretes (recent haematite-cemented ironstone

scree) which occur at surface on the surrounding plains and have been

drilled to 19 metres thickness to date. The ferricrete drilling program

is reverse circulation drilling, will be up to 7,500m and has just begun.

Ferricretes are extensive in the areas peripheral to the ironstone

ridges.

Geotechnical. The drill program is aimed at resource definition, rather

than exploration, and the collection of detailed geotechnical and

engineering data is an integral part of the program.

Metallurgical Testing. Planned metallurgical testing will look at the

potential upgrade of ironstones and ferricretes to potentially saleable

iron ore products. Since all mineralization is haematite and not

magnetite, beneficiation will focus on crushing, grinding and gravity

separation. High-intensity magnetic separation may be required for final

processing.

Resource Estimate. SRK Consulting has been retained to complete an

initial resource estimate. Completion is anticipated to be Q4 2012.

TERMINATION OF LETTER OF INTENT WITH TMT

The Company also announces that it has been advised by its subsidiary,

Cardero Iron Ore (BVI) Ltd. (the "Vendor") that on June 14, 2012 the

Vendor and T.M.T. Resources Inc. ("TMT") mutually agreed to terminate the

Letter of Intent dated April 20, 2012 between the Vendor and TMT with

respect to the sale by the Vendor to TMT of Cardero Iron Ore Ghana (BVI)

Ltd., the parent of Cardero Ghana Ltd. which was previously disclosed in

Cardero's news release of April 30, 2012.

QUALIFIED PERSON

EurGeol Keith Henderson, PGeo, Cardero's Executive Vice President and a

qualified person as defined by National Instrument 43-101, has reviewed

the scientific and technical information that forms the basis for

portions of this news release, and has approved the disclosure herein.

Mr. Henderson is not independent of the Company, as he is an officer and

shareholder.

QA/QC

The work program at Sheini is supervised by Christopher White (Cardero

Resource Corp.) and Dr. Karel Maly (Aurum Exploration Limited), who

together are responsible for all aspects of the work, including the

quality control/quality assurance program. On-site personnel at the

project rigorously collect and track samples which are then security

sealed and shipped to ALS Laboratories, Kumasi, Ghana, for sample

preparation, and onward to OMAC Laboratories (an ALS Group company),

Ireland, for analysis. OMAC's quality system complies with the

requirements for the International Standards ISO 9001:2000 and ISO 17025:

1999. Analytical accuracy and precision are monitored by the analysis of

reagent blanks, reference material and replicate samples. Quality control

was further assured by the use of international and in-house standards.

Blind certified reference material was inserted at regular intervals into

the sample sequence in order to independently assess analytical accuracy.

About Cardero Resource Corp.

The common shares of the Company are currently listed on the Toronto

Stock Exchange (symbol CDU), the NYSE-Amex (symbol CDY) and the Frankfurt

Stock Exchange (symbol CR5). For further details on the Company readers

are referred to the Company's web site (www.cardero.com), Canadian

regulatory filings on SEDAR at www.sedar.com and United States regulatory

filings on EDGAR at www.sec.gov.

On Behalf of the Board of Directors of CARDERO RESOURCE CORP.

Michael Hunter, CEO and President

Termination LOI?

Drill Programm?

Was läuft bei CDU wirklich ab?

Irgendwie gibt es keine klare Linie "mehr" (hat's eigentlich nie gegeben)

Drill Programm?

Was läuft bei CDU wirklich ab?

Irgendwie gibt es keine klare Linie "mehr" (hat's eigentlich nie gegeben)

Antwort auf Beitrag Nr.: 43.287.882 von Kraxler am 15.06.12 14:28:14Da TMT ja nur eine leere Hülle ist, die mit Geld gefüllt werden müsste um dem LOI Taten folgen zu lassen hat sich offenbar kein Geldgeber gefunden, der CDU die Explorationsausgaben von Sheini erstatten möchte.

Jetzt geben wir also noch Geld für ein Resource estimate aus, was uns bis Jahresende (also next year or so) bestätigt was für einen tollen Riesenshaker wir da an Land gezogen haben. Vielleicht wissen wir bis dahin auch ob Vertragspartner Emmaland überhaupt der rechtmäßige Eigentümer ist.

Stefan

Jetzt geben wir also noch Geld für ein Resource estimate aus, was uns bis Jahresende (also next year or so) bestätigt was für einen tollen Riesenshaker wir da an Land gezogen haben. Vielleicht wissen wir bis dahin auch ob Vertragspartner Emmaland überhaupt der rechtmäßige Eigentümer ist.

Stefan

MD&A und Financial Statement sind draussen.

SSEDAR Interim Financial Statements

Ticker Symbol: C:CDU

SEDAR Interim Financial Statements

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/14/2012 $0.80

Friday June 15 2012 - SEDAR Interim Financial Statements

This filing is available at:

http://www.stockwatch.com/nocomp/newsit/newsit_sedardoc.aspx…

SEDAR MD & A

Ticker Symbol: C:CDU

SEDAR MD & A

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/14/2012 $0.80

Friday June 15 2012 - SEDAR MD & A

This filing is available at:

http://www.stockwatch.com/nocomp/newsit/newsit_sedardoc.aspx…

SSEDAR Interim Financial Statements

Ticker Symbol: C:CDU

SEDAR Interim Financial Statements

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/14/2012 $0.80

Friday June 15 2012 - SEDAR Interim Financial Statements

This filing is available at:

http://www.stockwatch.com/nocomp/newsit/newsit_sedardoc.aspx…

SEDAR MD & A

Ticker Symbol: C:CDU

SEDAR MD & A

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/14/2012 $0.80

Friday June 15 2012 - SEDAR MD & A

This filing is available at:

http://www.stockwatch.com/nocomp/newsit/newsit_sedardoc.aspx…

Antwort auf Beitrag Nr.: 43.287.882 von Kraxler am 15.06.12 14:28:14Dann haben sie vielleicht einen anderen Interessenten (oder Probleme die Kohle zu bekommen).

.85 +0.05 6.3 211.3

Kurs nimmt Fahrt auf. ;-)

Kurs nimmt Fahrt auf. ;-)

jubel

Mal sehen, was mit Sheini passiert.

CDU: 0.81 CAD +0.01 +1.3% 295.6k

CDY: 0.82 USD +0.0201 +2.5 % 56.5k

--

Schöne BE. Der LOI zu Sheini wurde ohne Not gekündigt und hätte ohne Probleme noch 4-6 Monate weiterlaufen können, keinen hätte es interessiert. Für mich ein Signal, dass da mehr kommen könnte. Aber das ist alles Spekulation, die Antwort geben dann Fakten und Markt. ;-)

CDY: 0.82 USD +0.0201 +2.5 % 56.5k

--

Schöne BE. Der LOI zu Sheini wurde ohne Not gekündigt und hätte ohne Probleme noch 4-6 Monate weiterlaufen können, keinen hätte es interessiert. Für mich ein Signal, dass da mehr kommen könnte. Aber das ist alles Spekulation, die Antwort geben dann Fakten und Markt. ;-)

Im Bid ist aktuell zumindest etwas.

T:CDU 09:00:10

Price Size Orders

Ask

0.89 2,500 1

0.88 9,000 1

0.87 1,000 1

0.85 5,000 1

0.84 500 1

Bid

0.80 50,000 1

0.78 500 1

0.77 4,000 1

0.75 14,000 2

0.72 500 1

Darauf bin ich ja gespannt:

Drilling completed to the north of this section has intersected thicker iron mineralization, with individual intersections of 125 metres thickness from surface. ;-)

T:CDU 09:00:10

Price Size Orders

Ask

0.89 2,500 1

0.88 9,000 1

0.87 1,000 1

0.85 5,000 1

0.84 500 1

Bid

0.80 50,000 1

0.78 500 1

0.77 4,000 1

0.75 14,000 2

0.72 500 1

Darauf bin ich ja gespannt:

Drilling completed to the north of this section has intersected thicker iron mineralization, with individual intersections of 125 metres thickness from surface. ;-)

Ein paar Auffaelligkeiten ...

CHINA APPROVES $23 BILLION IN STEEL PROJECTS

China’s main planning agency has approved $36 billion in new projects, of which 65 percent are in the steel industry, worth the equivalent of $23 billion. The Baosteel Group, China’s third-biggest mill by output, and Wuhan Iron, the fourth- largest, have won approval to build $21 billion in new steel plants. China’s top planning authority had delayed Baosteel and Wuhan’s mills in 2009, citing industry overcapacity. Baosteel’s project in Zhanjiang port, Guangdong province, will increase its production capacity by 2.3 percent to approximately 53 million tons. The Wuhan mill in Fangchenggang port, in China’s southwestern region, will add 8.5 million tons of annual capacity, or 22 percent. The plants will not only supply steel to south China but also cover the markets of southeast Asia. (bloomberg)

---

CHINA STEEL PRODUCTION STILL NEAR RECORD

Chinese Government data released on Monday showed China's crude steel output rose 2.5% from a year earlier, to 61.234 million tonnes in May. That was also up from 60.575 million tonnes in April. In terms of daily output, the industry group China Iron and Steel Association said on Friday, that the pace had slowed to an average 1.96 million tonnes over the May 21-31 period, down nearly 4% from the previous 10 days and from a record daily run of 2.045 million tonnes in early May. China's strong steel output has sustained its demand for iron ore, with China importing 63.84 million tonnes in May, up 10.7 percent from April. (reuters)

---

IRON ORE STOCKPILES AT CHINESE PORTS REACH ALL-TIME HIGH

Iron ore stockpiles at Chinese ports last week reached an all-time high of around 120 million tons. While higher inventories generally point to slower downstream demand, stock levels surveyed in a sample of 50 smaller mills over the last two weeks have remained around 29.9 days-of-use, compared to ~20-28 days’ worth of stocks last year. Bouts of high port inventories don’t always tell the story of a slowdown that’s here to stay. China’s steel mills have been known to pause buying as a collective tactic to secure cheaper ore prices. (WSJ)

CHINA APPROVES $23 BILLION IN STEEL PROJECTS

China’s main planning agency has approved $36 billion in new projects, of which 65 percent are in the steel industry, worth the equivalent of $23 billion. The Baosteel Group, China’s third-biggest mill by output, and Wuhan Iron, the fourth- largest, have won approval to build $21 billion in new steel plants. China’s top planning authority had delayed Baosteel and Wuhan’s mills in 2009, citing industry overcapacity. Baosteel’s project in Zhanjiang port, Guangdong province, will increase its production capacity by 2.3 percent to approximately 53 million tons. The Wuhan mill in Fangchenggang port, in China’s southwestern region, will add 8.5 million tons of annual capacity, or 22 percent. The plants will not only supply steel to south China but also cover the markets of southeast Asia. (bloomberg)

---

CHINA STEEL PRODUCTION STILL NEAR RECORD

Chinese Government data released on Monday showed China's crude steel output rose 2.5% from a year earlier, to 61.234 million tonnes in May. That was also up from 60.575 million tonnes in April. In terms of daily output, the industry group China Iron and Steel Association said on Friday, that the pace had slowed to an average 1.96 million tonnes over the May 21-31 period, down nearly 4% from the previous 10 days and from a record daily run of 2.045 million tonnes in early May. China's strong steel output has sustained its demand for iron ore, with China importing 63.84 million tonnes in May, up 10.7 percent from April. (reuters)

---

IRON ORE STOCKPILES AT CHINESE PORTS REACH ALL-TIME HIGH

Iron ore stockpiles at Chinese ports last week reached an all-time high of around 120 million tons. While higher inventories generally point to slower downstream demand, stock levels surveyed in a sample of 50 smaller mills over the last two weeks have remained around 29.9 days-of-use, compared to ~20-28 days’ worth of stocks last year. Bouts of high port inventories don’t always tell the story of a slowdown that’s here to stay. China’s steel mills have been known to pause buying as a collective tactic to secure cheaper ore prices. (WSJ)

Cardero receives coal licences for Carbon Creek

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/18/2012 $0.78

Tuesday June 19 2012 - News Release

Mr. Michael Hunter reports

CARDERO ANNOUNCES COAL LICENCES FOR CARBON CREEK METALLURGICAL COAL DEPOSIT

Coal tenure application 414152, which covers a significant portion of Cardero Resource Corp.'s Carbon Creek metallurgical coal property, has been processed by the British Columbia Ministry of Energy and Mines, resulting in the issuance of four coal licenses: 418174, 418175, 418176 and 418177. These coal licenses cover an area of 3,680 hectares that is contiguous to the 10 Crown Granted District Lots leased by the Company (2,600 Ha), which area collectively contains a NI 43-101 measured and indicated resource of 166.7 million tonnes of metallurgical grade coal.

Permits for drilling are expected in advance of the proposed resource definition drill program, scheduled to commence in July 2012. The program will complete collection of all engineering and geological information in support of a Feasibility Study. In addition to the drilling component, the program will include analysis of coal quality necessary to finalize coal product specification to ultimately secure off-take agreement(s). Environmental base line work, which is an essential component of securing a permit to operate a mine, is ongoing and will address all requirements outlined in the Company's Project Description, which was approved by the BC Environmental Assessment Office last month (NR12-11, May 9, 2012).

About Carbon Creek

The Carbon Creek deposit is an advanced metallurgical coal development project located in the Peace River Coal District of northeast British Columbia, Canada. The project has a current (October 1, 2011) resource estimate of 166.7 million tonnes of measured and indicated, with an additional 167.1 million tonnes of inferred, ASTM Coal Rank mvB coal. The Company released results of an independent PEA, including an updated resource estimate) in December 2011, which estimates a post-tax, undiscounted cash flow of $3.1 billion (on a 75% basis). The PEA contemplates production of 2.9 million tonnes of saleable metallurgical coal products per annum (NR11-20, December 12, 2011).

The Company cautions that the PEA is preliminary in nature, and is based on technical and economic assumptions which will be evaluated in further studies. The PEA is based on the current (as at October 1, 2011) Carbon Creek estimated resource model, which consists of material in both the measured/indicated and inferred classifications. Inferred mineral resources are considered too speculative geologically to have technical and economic considerations applied to them. The current basis of project information is not sufficient to convert the mineral resources to mineral reserves, and mineral resources that are not mineral reserves do not have demonstrated economic viability. Accordingly, there can be no certainty that the results estimated in the PEA will be realized.

We seek Safe Harbor.

© 2012 Canjex Publishing Ltd.

--

Mir faellt da ein Stein vom Herzen ...

Cardero Resource Corp (C:CDU)

Shares Issued 91,777,454

Last Close 6/18/2012 $0.78

Tuesday June 19 2012 - News Release

Mr. Michael Hunter reports

CARDERO ANNOUNCES COAL LICENCES FOR CARBON CREEK METALLURGICAL COAL DEPOSIT

Coal tenure application 414152, which covers a significant portion of Cardero Resource Corp.'s Carbon Creek metallurgical coal property, has been processed by the British Columbia Ministry of Energy and Mines, resulting in the issuance of four coal licenses: 418174, 418175, 418176 and 418177. These coal licenses cover an area of 3,680 hectares that is contiguous to the 10 Crown Granted District Lots leased by the Company (2,600 Ha), which area collectively contains a NI 43-101 measured and indicated resource of 166.7 million tonnes of metallurgical grade coal.

Permits for drilling are expected in advance of the proposed resource definition drill program, scheduled to commence in July 2012. The program will complete collection of all engineering and geological information in support of a Feasibility Study. In addition to the drilling component, the program will include analysis of coal quality necessary to finalize coal product specification to ultimately secure off-take agreement(s). Environmental base line work, which is an essential component of securing a permit to operate a mine, is ongoing and will address all requirements outlined in the Company's Project Description, which was approved by the BC Environmental Assessment Office last month (NR12-11, May 9, 2012).

About Carbon Creek

The Carbon Creek deposit is an advanced metallurgical coal development project located in the Peace River Coal District of northeast British Columbia, Canada. The project has a current (October 1, 2011) resource estimate of 166.7 million tonnes of measured and indicated, with an additional 167.1 million tonnes of inferred, ASTM Coal Rank mvB coal. The Company released results of an independent PEA, including an updated resource estimate) in December 2011, which estimates a post-tax, undiscounted cash flow of $3.1 billion (on a 75% basis). The PEA contemplates production of 2.9 million tonnes of saleable metallurgical coal products per annum (NR11-20, December 12, 2011).

The Company cautions that the PEA is preliminary in nature, and is based on technical and economic assumptions which will be evaluated in further studies. The PEA is based on the current (as at October 1, 2011) Carbon Creek estimated resource model, which consists of material in both the measured/indicated and inferred classifications. Inferred mineral resources are considered too speculative geologically to have technical and economic considerations applied to them. The current basis of project information is not sufficient to convert the mineral resources to mineral reserves, and mineral resources that are not mineral reserves do not have demonstrated economic viability. Accordingly, there can be no certainty that the results estimated in the PEA will be realized.

We seek Safe Harbor.

© 2012 Canjex Publishing Ltd.

--

Mir faellt da ein Stein vom Herzen ...

sollte es das erste erfolgreiche projekt werden???

Traue mich nicht mehr nachzukaufen :-(

Traue mich nicht mehr nachzukaufen :-(

schon ein paar Tage her, aber interessant...

20:58 10May12 -Canadian Coal Moles: Jerome Hass and Jimmy Chu

Source: Brian Sylvester of The Energy Report http://www.theenergyreport.com

(5/10/12)

http://www.theenergyreport.com/pub/na/13331

For low-risk returns, Lightwater Partners' Fund Managers Jerome Hass

and Jimmy Chu look seaward. Bulk commodities like metallurgical coal,

they explain, offer greater stability because a small number of major

buyers determine pricing, while shipping logistics provide a yardstick

to determine a project's economics. In this exclusive interview with The

Energy Report, Hass and Chu talk about how international supply is shifting

and which junior stocks may experience a jump in a steady-as-she-goes

market.

The Energy Report: To get started, what differentiates Lightwater Partners

from other hedge funds?

Jerome Hass: Canadian hedge funds tend to be high-risk/high-return strategies

primarily focused in the resource space. We focus on risk-adjusted returns,

as opposed to trying to hit homeruns with individual stocks. As a consequence,

we concentrate on the mid-cap space. That's our investment sweet spot,

rather than the small- or micro-cap names. And we have the in-house research

capability to explore names that are not well covered by the street.

TER: What energy resources best fit your investment strategy?

JH: Generally, we favor the bulk commodity producers. That's not limited

to metallurgical coal or thermal coal; we also look at iron ore, potash

and any other bulk commodities. We like bulk products because of the industry

structure. For example, with base metals, everyone is a price taker; no

single buyer has much price influence. With bulk commodities, major players

and global oligopolies have price influence.

TER: How does metallurgical or "met" coal fit into this desirable bulk

category?

JH: Met coal is an integral requirement for all steel mills that use

blast furnaces. It is baked to form coke, which fuels the blast furnaces.

Arc steel mills use recycled steel as fuel, but there's really no substitute

for met coal in the global space. Most met coal is open-pit mined; moving

it is all about logistics as the cost of shipping is a major factor.

"Junior players in the metallurgical coal mining space are a relatively

new development. They give more torque to the industry." Jerome Hass

TER: Is the met coal space dominated by established energy companies,

or is there room for junior mining firms in that?

JH: Met coal mining has been dominated by major producers and integrated

steel producers, including BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK)

http://www.theenergyreport.com/pub/co/172 , Rio Tinto (RIO:NYSE; RIO:ASX)

http://www.theenergyreport.com/pub/co/184 , Xstrata Plc (XTA:LSE) http://www.theaureport.com/pub/co/576

and Kumba Iron Ore Ltd. (KUMBA:JSE) http://www.theenergyreport.com/pub/co/5065

in Africa. We focus on coal that is not vertically integrated, which

is internationally exported or traded.

Junior players in this space are a relatively new development. They

give more torque to the industry. Juniors have much lower valuations and

much higher growth profiles. There are some junior met coal pure plays;

in fact, there are very few listed large-cap met coal plays globally.

The one exception to that is Walter Energy Inc. (WLT:NYSE) http://www.theenergyreport.com/pub/co/3467

, which is listed in the U.S. and in Canada.

TER: How is international supply and demand for met coal playing out?

JH: The story is China. Over the last 15 years, growth in met coal has

been a function of China's demand, which relates to China's growing importance,

or dominance, even, in the global steelmaking industry. Seaborne met coal

and iron ore were most in demand. Largely because of geographical proximity,

Australia has been China's major coal supplier. This has resulted in a

displacement of supply for Europe that Canadian producers can replace.

India is also increasingly aggressive in the steel space. Its demand for

met coal and iron ore continues to increase.

TER: Is there a danger of an oversupply of met coal? If so, how would

that affect market prices?

Jimmy Chu: I don't think there's a danger of oversupply. Supplies have,

at times, been constrained by weather and labor issues out of Australia,

and we've noticed that some customers are asking companies for an advance

on shipments. As for demand, China is producing steel at an annual run

rate much higher than what the market anticipated a month ago. In the

intermediate term, we don't see an oversupply in met coal, and the demand

side looks good. In the longer term, it comes down to the big players,

China and India. But we feel very bullish on long-term demand for met

coal.

JH: One reason we like the bulk commodities relates to industry discipline.

Large players with pricing influence can effectively manage the supply

of met coal to a degree that's not possible in base metals or in gold.

The majors have proven to be rational competitors and players in the marketplace.

Let's look at Potash Corp. (POT:TSX; POT:NYSE) http://www.theenergyreport.com/pub/co/2187

, which has long exhibited price leadership in the industry. It has announced

production cuts in order to manage price. With a 100-year reserve life,

it is the Saudi Arabia of potash. If it wanted to restrict supply, it

could push that price up, as it did in 2008, but it has generally been

a very rational market player.

Other players that have followed suit with Potash Corp. are The Mosaic

Company (MOS:NYSE) http://www.theenergyreport.com/pub/co/3281 and Agrium

Inc. (AGU:NYSE; AGU:TSX) http://www.theenergyreport.com/pub/co/2674 .

One of the reasons that potash is attractive is that there is effective

supply management. We think the same industry conditions exist in iron

ore and met coal.

TER: What about met coal operations in Canada? Do you have interests

there?

JC: Our preferred play is a small cap called Cardero Resources Corp.

(CDU:TSX; CDY:NYSE.A; CR5:FSE) http://www.theaureport.com/pub/co/648 . We like Cardero because it will send its coal into the seaborne market Asia,

in particular. It holds the Carbon Creek Project in the Peace River region

in British Columbia, which is one of the last remaining regional coal

deposits not controlled by a major company and it has an experienced management

team. The president and co-founder, Michael Hunter, was a co-founder of

First Coal, which was sold to Xstrata Plc for $147 million ($147M) despite

permitting issues, which shouldn't affect the Carbon Creek Project. That

implies a value on Cardero's shares of about CA$2.15. We do not see Cardero

encountering the same permitting issues as First Coal did.

JH: Peace River coal is attractive because it's very high quality. Steel

mills typically blend coal. Currently, Teck Resources Ltd. (TCK:NYSE;

TCK.A:TSX) http://www.theenergyreport.com/pub/co/543 is the market leader

for coal in western Canada. Its met coal attracts a premium price. Consequently,

the Chinese and Japanese and other Asian buyers are excited about the

prospect of having another supplier in the market. I believe someone will

either sign an offtake agreement or a joint venture deal with Cardero

in the near future because, as Jimmy mentioned, there are very few independents

left in western Canada.

TER: How does the geology of Carbon Creek impact development and operation

costs?

JC: The coal seams are wide and canoe shaped. The dips are very shallow,