SANDSTORM GOLD -- ehemals --Sandstorm Resources - Älteste Beiträge zuerst (Seite 90)

eröffnet am 01.01.10 13:25:00 von

neuester Beitrag 09.04.24 07:14:48 von

neuester Beitrag 09.04.24 07:14:48 von

Beiträge: 1.041

ID: 1.155.089

ID: 1.155.089

Aufrufe heute: 0

Gesamt: 67.283

Gesamt: 67.283

Aktive User: 0

ISIN: CA80013R2063 · WKN: A1JX9B · Symbol: AYS1

5,2500

EUR

-0,28 %

-0,0150 EUR

Letzter Kurs 10.05.24 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,6640 | +16,04 | |

| 527,60 | +15,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,6800 | -8,94 | |

| 0,7000 | -10,26 | |

| 324,70 | -10,30 | |

| 8,1000 | -20,59 | |

| 0,6601 | -26,22 |

Mariana Resources Ltd: 1st Quarter Results and Management Discussion and Analysis for the Period Ended 31 March 2017

http://www.minenportal.de/artikel.php?sid=202579&lang=en#Mar…

http://www.minenportal.de/artikel.php?sid=202579&lang=en#Mar…

http://www.usfunds.com/in-the-news/finding-opportunity-in-th…

Finding Opportunity in the Gold Space

In a recent interview with Rachel Lee of Small Cap Power, Frank Holmes discusses his macro view of the gold market, but also touches on a few specific pieces of news in the gold mining space. For starters, Frank talks about the rebalance of the VanEck Vectors Junior Gold Miners ETF (GDXJ) and why this has been both a disruption and an opportunity for investors and fund managers. In addition, Frank chats about a few quality, small-cap gold names he’s looking at right now and what makes them special.

Finding Opportunity in the Gold Space

In a recent interview with Rachel Lee of Small Cap Power, Frank Holmes discusses his macro view of the gold market, but also touches on a few specific pieces of news in the gold mining space. For starters, Frank talks about the rebalance of the VanEck Vectors Junior Gold Miners ETF (GDXJ) and why this has been both a disruption and an opportunity for investors and fund managers. In addition, Frank chats about a few quality, small-cap gold names he’s looking at right now and what makes them special.

Osisko Gold Royalties kaufen Stream und Royalties, der Kurs steigt. Sandstorm kauft S&R, die Aktie fällt. Ich würde umsteigen.

Sehr interessant, wurde leider noch nicht gepostet:

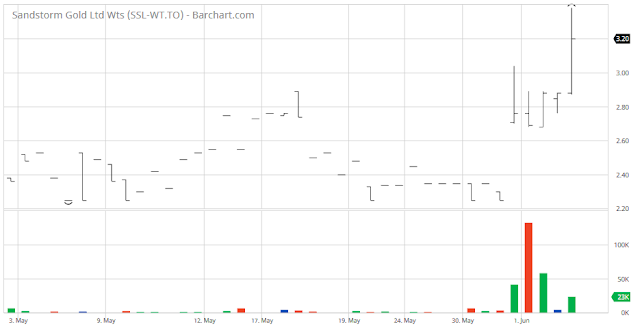

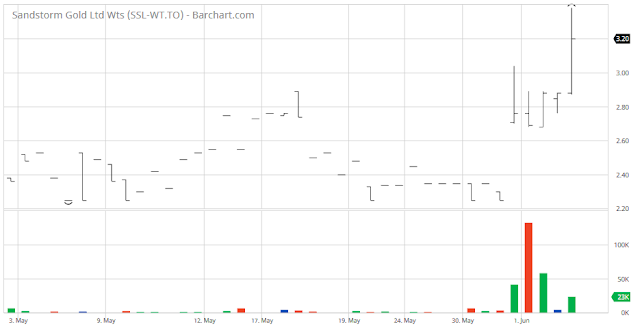

Sandstorm warrants

Before the game is afoot, thou still let'st slip. Check out the action in Sandstorm Gold warrants:

In the last couple of days SSL-WT.to is up a very lot on the biggest volume spike they've seen in a year and...at the same time the SAND stock price has hardly moved.

@Otto

Sandstorm warrants

Before the game is afoot, thou still let'st slip. Check out the action in Sandstorm Gold warrants:

In the last couple of days SSL-WT.to is up a very lot on the biggest volume spike they've seen in a year and...at the same time the SAND stock price has hardly moved.

@Otto

by @newswire on June 9, 2017

S&P Dow Jones Indices Announces Changes to the S&P/TSX Canadian Indices

Results of the Quarterly Review of the S&P/TSX Composite Index

TORONTO, June 9, 2017 /CNW/ - S&P Dow Jones Indices Canadian Index Services will make the following changes in the S&P/TSX Canadian Indices effective prior to the open on Monday, June 19, 2017:

...

S&P/TSX COMPOSITE HIGH BETA INDEX

ADDITIONS

Issue Name Symbol

Paramount Resources Ltd. POU

Raging River Exploration Inc. RRX

Sandstorm Gold Ltd. SSL ...

https://ceo.ca/@newswire/sp-dow-jones-indices-announces-chan…

S&P Dow Jones Indices Announces Changes to the S&P/TSX Canadian Indices

Results of the Quarterly Review of the S&P/TSX Composite Index

TORONTO, June 9, 2017 /CNW/ - S&P Dow Jones Indices Canadian Index Services will make the following changes in the S&P/TSX Canadian Indices effective prior to the open on Monday, June 19, 2017:

...

S&P/TSX COMPOSITE HIGH BETA INDEX

ADDITIONS

Issue Name Symbol

Paramount Resources Ltd. POU

Raging River Exploration Inc. RRX

Sandstorm Gold Ltd. SSL ...

https://ceo.ca/@newswire/sp-dow-jones-indices-announces-chan…

6/13/17

The Sandstorm (SAND) (SSL.to) rally continues

Sandstorm ignoring the weakness in the gold price this morning and pushing higher again. Oversold on the GDXJ rebalance fiasco, SAND is starting to return to a more reasonable level. First stop U$4-handle, but there's plenty left in the tank on its fundies. This chart compares SAND to the gold and silver index (XAU) to underscore the recent alpha-

Credit to those who ignored that blithering idiot Doody, anyone who's visited Hot Maden knows Watson has got the bargain of a lifetime.

@Otto

The Sandstorm (SAND) (SSL.to) rally continues

Sandstorm ignoring the weakness in the gold price this morning and pushing higher again. Oversold on the GDXJ rebalance fiasco, SAND is starting to return to a more reasonable level. First stop U$4-handle, but there's plenty left in the tank on its fundies. This chart compares SAND to the gold and silver index (XAU) to underscore the recent alpha-

Credit to those who ignored that blithering idiot Doody, anyone who's visited Hot Maden knows Watson has got the bargain of a lifetime.

@Otto

Sandstorm Gold Announces Closing Of Mariana Acquisition, Adds Hot Maden Interest To Royalty Portfolio

Vancouver, British Columbia | July 3, 2017

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) is pleased to announce that the Scheme of Arrangement (the “Scheme”) to acquire Mariana Resources Limited (“Mariana”) has become effective in accordance with its terms, following the sanction of the Scheme by the Guernsey Court on June 26, 2017 and the delivery of the sanction court order to the Guernsey Registry earlier today. Accordingly, the acquisition has been completed and Mariana has become a wholly owned subsidiary of Sandstorm.

Under the terms of the Scheme, Scheme shareholders on the register at the Scheme Record Time, being 5.00 p.m. (London time) on June 28, 2017 will receive 0.2573 Sandstorm shares and 28.75 pence in cash for each Scheme share held, subject to rounding for fractional entitlements. Sandstorm has made applications to the Toronto Stock Exchange and NYSE MKT for the new Sandstorm shares to be admitted to trading and such admission is expected to occur within 14 days. The total consideration paid was approximately US$175 million including 32,832,813 new Sandstorm shares issued under the Scheme (at a price of US$3.87 as of the close of trading on June 30, 2017) and cash consideration of approximately US$48 million.

TRANSACTION HIGHLIGHTS

100% increase in production for 19% dilution;

Hot Maden anchor asset is expected to increase the Company’s attributable gold equivalent ounces to more than 135,000 by 2022, increasing operating cash flow to more than US$100 million (based on a US$1,250 per ounce gold price).

Hot Maden is a high-grade, low-cost asset with significant exploration upside;

Preliminary Economic Assessment (effective date of March 1, 2017) projects after-tax NPV and IRR of US$1.37 billion and 153% respectively (100% basis) with estimated all-in-sustaining costs of less than $400 per gold equivalent ounce.

Indicated Mineral Resource of 3.43 million gold equivalent ounces (7.1 million tonnes at 12.2 grams per tonne gold and 2.3% copper) is based on approximately 15,000 metres of drilling from 52 drill holes using a 0.2 gram per tonne gold equivalent cut-off. More than 60 drill holes have been completed subsequent to the release of the Indicated Resource estimate, with many assay results returning significant mineralization.

Total land package is 74 km2 in size with the current focus being a 7 kilometre alteration zone. The majority of the exploration drilling has been over 1 kilometre of the alternation zone and several exploration targets have been identified along strike and parallel to the identified orebody.

Majority operator Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya”) is a strong local partner with experience exploring, developing, permitting and operating projects in Turkey.

Lidya is part of a large Turkish conglomerate called Çalik Holding and is currently partnered with Alacer Gold Corp. on several projects in Turkey including the producing Çöpler mine and the development-stage Gediktepe and Kartaltepe projects.

Acquisition of Mariana includes exploration properties in Côte d’Ivoire, Turkey, and Argentina. Sandstorm has begun the process to spin-out the exploration properties into a separate public company and will retain net smelter return royalties as well as equity in the spin-out. The spin-out process is expected to be completed within 6 to 12 months and has the potential to add incremental value to the acquisition.

For additional information and management commentary on Hot Maden and the Mariana acquisition, visit http://www.sandstormgold.com/hot-maden-acquisition.

Sandstorm’s President & CEO, Nolan Watson remarked, “Today is an exciting day for Sandstorm shareholders as this deal is truly transformative for the Company. Hot Maden is one of the highest grade undeveloped projects in the world and will add high-margin ounces to Sandstorm’s production profile. Opportunities to acquire anchor assets like Hot Maden are rare and with the exploration potential that we see on the property, we anticipate that our 30% interest will continue to grow in value over time.”

Watson added, “Now that the transaction is closed and we are no longer under the marketing restrictions imposed by the U.K. Takeover Code, we are glad to be able to speak more candidly about Hot Maden and the impact that it will have on Sandstorm’s future growth. Encouragingly, a number of high-profile institutional investors have been building positions in the Company including multi-billion dollar asset managers like Blackrock, Fidelity, MAN GLG, and Setanta Asset Management.”

“We are fortunate to be in a strong financial position with no debt, cash on the balance sheet and an undrawn $110 million credit facility available to us. In the short-term we intend to buy-back our shares but we are also working on a number of acquisition opportunities in order to continue to grow the Company. I encourage all of you to join our upcoming webcast as we will be providing a thorough review of the acquisition rationale and Sandstorm’s plans to continue building shareholder value.”

WEBCAST AND CONFERENCE CALL DETAILS

A conference call will be held on Thursday, July 6, 2017 starting at 8:00am PDT to further discuss the acquisition. To participate in the conference call and question and answer period, use the following dial-in numbers and conference ID, or join the webcast using the link below:

Local/International: (+1) 416 764 8688

North American Toll-Free: (+1) 888 390 0546

Conference ID: 90936462

Webcast URL: http://ow.ly/1bm530dc7ts

http://sandstormgold.com/hot-maden-acquisition/

gute videos noch dabei

jetzt ist eigentlich der top zeitpunkt sich paar shares zu schnappen. aquisition abgeschlossen, asset manager kaufen, gold nochmals gut gefallen und sandstorm kauft kurzfristig shares zurück

Vancouver, British Columbia | July 3, 2017

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) is pleased to announce that the Scheme of Arrangement (the “Scheme”) to acquire Mariana Resources Limited (“Mariana”) has become effective in accordance with its terms, following the sanction of the Scheme by the Guernsey Court on June 26, 2017 and the delivery of the sanction court order to the Guernsey Registry earlier today. Accordingly, the acquisition has been completed and Mariana has become a wholly owned subsidiary of Sandstorm.

Under the terms of the Scheme, Scheme shareholders on the register at the Scheme Record Time, being 5.00 p.m. (London time) on June 28, 2017 will receive 0.2573 Sandstorm shares and 28.75 pence in cash for each Scheme share held, subject to rounding for fractional entitlements. Sandstorm has made applications to the Toronto Stock Exchange and NYSE MKT for the new Sandstorm shares to be admitted to trading and such admission is expected to occur within 14 days. The total consideration paid was approximately US$175 million including 32,832,813 new Sandstorm shares issued under the Scheme (at a price of US$3.87 as of the close of trading on June 30, 2017) and cash consideration of approximately US$48 million.

TRANSACTION HIGHLIGHTS

100% increase in production for 19% dilution;

Hot Maden anchor asset is expected to increase the Company’s attributable gold equivalent ounces to more than 135,000 by 2022, increasing operating cash flow to more than US$100 million (based on a US$1,250 per ounce gold price).

Hot Maden is a high-grade, low-cost asset with significant exploration upside;

Preliminary Economic Assessment (effective date of March 1, 2017) projects after-tax NPV and IRR of US$1.37 billion and 153% respectively (100% basis) with estimated all-in-sustaining costs of less than $400 per gold equivalent ounce.

Indicated Mineral Resource of 3.43 million gold equivalent ounces (7.1 million tonnes at 12.2 grams per tonne gold and 2.3% copper) is based on approximately 15,000 metres of drilling from 52 drill holes using a 0.2 gram per tonne gold equivalent cut-off. More than 60 drill holes have been completed subsequent to the release of the Indicated Resource estimate, with many assay results returning significant mineralization.

Total land package is 74 km2 in size with the current focus being a 7 kilometre alteration zone. The majority of the exploration drilling has been over 1 kilometre of the alternation zone and several exploration targets have been identified along strike and parallel to the identified orebody.

Majority operator Lidya Madencilik Sanayi ve Ticaret A.S. (“Lidya”) is a strong local partner with experience exploring, developing, permitting and operating projects in Turkey.

Lidya is part of a large Turkish conglomerate called Çalik Holding and is currently partnered with Alacer Gold Corp. on several projects in Turkey including the producing Çöpler mine and the development-stage Gediktepe and Kartaltepe projects.

Acquisition of Mariana includes exploration properties in Côte d’Ivoire, Turkey, and Argentina. Sandstorm has begun the process to spin-out the exploration properties into a separate public company and will retain net smelter return royalties as well as equity in the spin-out. The spin-out process is expected to be completed within 6 to 12 months and has the potential to add incremental value to the acquisition.

For additional information and management commentary on Hot Maden and the Mariana acquisition, visit http://www.sandstormgold.com/hot-maden-acquisition.

Sandstorm’s President & CEO, Nolan Watson remarked, “Today is an exciting day for Sandstorm shareholders as this deal is truly transformative for the Company. Hot Maden is one of the highest grade undeveloped projects in the world and will add high-margin ounces to Sandstorm’s production profile. Opportunities to acquire anchor assets like Hot Maden are rare and with the exploration potential that we see on the property, we anticipate that our 30% interest will continue to grow in value over time.”

Watson added, “Now that the transaction is closed and we are no longer under the marketing restrictions imposed by the U.K. Takeover Code, we are glad to be able to speak more candidly about Hot Maden and the impact that it will have on Sandstorm’s future growth. Encouragingly, a number of high-profile institutional investors have been building positions in the Company including multi-billion dollar asset managers like Blackrock, Fidelity, MAN GLG, and Setanta Asset Management.”

“We are fortunate to be in a strong financial position with no debt, cash on the balance sheet and an undrawn $110 million credit facility available to us. In the short-term we intend to buy-back our shares but we are also working on a number of acquisition opportunities in order to continue to grow the Company. I encourage all of you to join our upcoming webcast as we will be providing a thorough review of the acquisition rationale and Sandstorm’s plans to continue building shareholder value.”

WEBCAST AND CONFERENCE CALL DETAILS

A conference call will be held on Thursday, July 6, 2017 starting at 8:00am PDT to further discuss the acquisition. To participate in the conference call and question and answer period, use the following dial-in numbers and conference ID, or join the webcast using the link below:

Local/International: (+1) 416 764 8688

North American Toll-Free: (+1) 888 390 0546

Conference ID: 90936462

Webcast URL: http://ow.ly/1bm530dc7ts

http://sandstormgold.com/hot-maden-acquisition/

gute videos noch dabei

jetzt ist eigentlich der top zeitpunkt sich paar shares zu schnappen. aquisition abgeschlossen, asset manager kaufen, gold nochmals gut gefallen und sandstorm kauft kurzfristig shares zurück

Sandstorm Gold Announces Q2 Production Numbers And Hot Maden Drill Results, Amends NCIB

Vancouver, British Columbia | July 5, 2017

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) is pleased to announce that the Company has sold approximately 12,700 attributable gold equivalent ounces1 during the second quarter of 2017. In addition, new high grade gold-copper intercepts from ongoing diamond drilling at the Hot Maden project in north east Turkey (“Hot Maden”) have been reported and continue to confirm the internal continuity of gold-copper mineralisation within the Main Zone resource area and verify the additional resource potential south of the main deposit. Sandstorm has also amended its Normal Course Issuer Bid (“NCIB”) to allow for the purchase of its common shares through the facilities of the NYSE MKT or alternative trading platforms in the U.S.A., in accordance with U.S. federal securities laws and as further described herein.

Hot Maden Drill Results

The Hot Maden assay results have been reported from two drill holes. HTD–111 is a step-out core hole drilled along the southwest side of the southern zone and HTD-128 is an infill core hole drilled within the Main Zone. Highlights from these drill results include:

HTD-111: 26.0 meters @ 4.4 g/t gold and 0.57% copper

HTD-128: 105.5 meters @ 17.4 g/t gold and 2.34% copper

As of July 3, 2017, the total amount of drilling for the year stood at 14,286 metres completed in 40 holes, with three additional holes in progress.

The Toronto Stock Exchange (“TSX”) has accepted the Company’s amended notice (the “Amended NCIB Notice”) with respect to the Company’s NCIB which was originally approved by the TSX on March 31, 2017 and pursuant to which Sandstorm may purchase up to a maximum of 7,597,730 of its common shares over a 12-month period in accordance with TSX rules and applicable securities laws. Pursuant to the Amended NCIB Notice, purchases under the Company’s NCIB have now been extended to include the ability by the Company to also purchase its common shares through the facilities of the NYSE MKT or alternative trading platforms in the U.S.A. Purchases made by the Company through its broker over the NYSE MKT or such alternative trading platforms will be made in open market transactions at prevailing market prices or by other means in accordance with applicable U.S. federal securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Vancouver, British Columbia | July 5, 2017

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) is pleased to announce that the Company has sold approximately 12,700 attributable gold equivalent ounces1 during the second quarter of 2017. In addition, new high grade gold-copper intercepts from ongoing diamond drilling at the Hot Maden project in north east Turkey (“Hot Maden”) have been reported and continue to confirm the internal continuity of gold-copper mineralisation within the Main Zone resource area and verify the additional resource potential south of the main deposit. Sandstorm has also amended its Normal Course Issuer Bid (“NCIB”) to allow for the purchase of its common shares through the facilities of the NYSE MKT or alternative trading platforms in the U.S.A., in accordance with U.S. federal securities laws and as further described herein.

Hot Maden Drill Results

The Hot Maden assay results have been reported from two drill holes. HTD–111 is a step-out core hole drilled along the southwest side of the southern zone and HTD-128 is an infill core hole drilled within the Main Zone. Highlights from these drill results include:

HTD-111: 26.0 meters @ 4.4 g/t gold and 0.57% copper

HTD-128: 105.5 meters @ 17.4 g/t gold and 2.34% copper

As of July 3, 2017, the total amount of drilling for the year stood at 14,286 metres completed in 40 holes, with three additional holes in progress.

The Toronto Stock Exchange (“TSX”) has accepted the Company’s amended notice (the “Amended NCIB Notice”) with respect to the Company’s NCIB which was originally approved by the TSX on March 31, 2017 and pursuant to which Sandstorm may purchase up to a maximum of 7,597,730 of its common shares over a 12-month period in accordance with TSX rules and applicable securities laws. Pursuant to the Amended NCIB Notice, purchases under the Company’s NCIB have now been extended to include the ability by the Company to also purchase its common shares through the facilities of the NYSE MKT or alternative trading platforms in the U.S.A. Purchases made by the Company through its broker over the NYSE MKT or such alternative trading platforms will be made in open market transactions at prevailing market prices or by other means in accordance with applicable U.S. federal securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

das management kauft aktien am markt ein

Jul 7/17 Jul 7/17 Watson, Nolan Allan Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $4.98

Jul 7/17 Jul 7/17 Awram, David Direct Ownership Common Shares 10 - Acquisition in the public market 2,500 $4.92

Jul 7/17 Jul 7/17 Awram, David Direct Ownership Common Shares 10 - Acquisition in the public market 6,000 $4.95

Jul 7/17 Jul 7/17 Watson, Nolan Allan Direct Ownership Common Shares 10 - Acquisition in the public market 20,000 $4.98

Jul 7/17 Jul 7/17 Awram, David Direct Ownership Common Shares 10 - Acquisition in the public market 2,500 $4.92

Jul 7/17 Jul 7/17 Awram, David Direct Ownership Common Shares 10 - Acquisition in the public market 6,000 $4.95

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,42 | |

| +1,40 | |

| +2,53 | |

| +1,41 | |

| -0,37 | |

| 0,00 | |

| +0,64 | |

| -1,51 | |

| +0,59 | |

| -0,89 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 90 | ||

| 83 | ||

| 76 | ||

| 42 | ||

| 33 | ||

| 29 | ||

| 17 | ||

| 17 | ||

| 15 | ||

| 13 |