Gewinnerbranchen der Jahre 2006 bis 2040 (Seite 7955)

eröffnet am 10.12.06 16:57:17 von

neuester Beitrag 16.02.24 09:33:08 von

neuester Beitrag 16.02.24 09:33:08 von

Beiträge: 94.068

ID: 1.099.361

ID: 1.099.361

Aufrufe heute: 0

Gesamt: 3.535.938

Gesamt: 3.535.938

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 20.04.24, 12:11 | 380 | |

| heute 00:04 | 330 | |

| heute 00:14 | 275 | |

| 05.12.14, 17:15 | 200 | |

| 06.03.17, 11:10 | 160 | |

| gestern 21:21 | 142 | |

| 23.10.15, 12:38 | 133 | |

| 10.11.14, 14:54 | 125 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.161,01 | +1,36 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3500 | +1,14 | 60 | |||

| 5. | 4. | 168,29 | -1,11 | 50 | |||

| 6. | Neu! | 0,4400 | +3,53 | 36 | |||

| 7. | Neu! | 4,7950 | +6,91 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 31 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 34.661.269 von spaceistheplace am 06.08.08 16:15:04Ja, habe ich; sie fiel mir bei meiner Querlese hier im April schon auf.

FAST kommt wie ITW als Universalist mit breitester Produkt- und Kundenstruktur daher - = per se ist dieses Geschäftsmodell zwar wenig aufregend, aber dafür relativ krisenresistent, und der Langfristchart zeigt das schön. Bessere Margen als ITW, aber auch ITW hat seine Margen die letzten Jahre stetig verbessert.

Das, bzw. mein, Problem: Das wird entsprechend bezahlt; sieht mir nach typischem US-midcap-Bonus für langjährig etabierte wie erfolgreiche Firmen aus - der Erfolg ist im Kurs bereits für eine gute absehbare Zeit fortgeschrieben. Auch einige große Insiderverkäufe dJ., dazu in Q1.08 vs. Vj. deutlich abnehmender freeCF (was aber erstmal nichts heißen muss).

- Im (US-)midcap-Sektor werde ich eher die Werte präferieren, die erst einen jungen uptrend aufweisen bzw. einen solchen erwarten lassen.

=> Eine nur etwa halb so hoch bewertete ITW bei soliden Bilanzrelationen mit deutlich besseren und stetig verbesserten cashflow-Relationen ziehe (auch) ich vor; zumal nahe den mfr. Tiefs,

Nach der letzten (leichten) Rezession war ITW immerhin mal fast doppelt so hoch bewertet.

Die voluminösen Insiderverkäufe in Mai+Juni bis ans aktuelle Kursniveau herum stören mich etwas. Allerdings sollte aufgrund der für US-Aktien schon sehr guten Bewertungs-fundamentals das downrisk doch recht begrenzt sein.

Eher marginal störend die teilweise schuldenfinanzierten Aktienrückkäufe, da die Schuldenzunahme im Bilanzkontext unkritisch und tendenziell auch schon wieder rückläufig ist.

FAST kommt wie ITW als Universalist mit breitester Produkt- und Kundenstruktur daher - = per se ist dieses Geschäftsmodell zwar wenig aufregend, aber dafür relativ krisenresistent, und der Langfristchart zeigt das schön. Bessere Margen als ITW, aber auch ITW hat seine Margen die letzten Jahre stetig verbessert.

Das, bzw. mein, Problem: Das wird entsprechend bezahlt; sieht mir nach typischem US-midcap-Bonus für langjährig etabierte wie erfolgreiche Firmen aus - der Erfolg ist im Kurs bereits für eine gute absehbare Zeit fortgeschrieben. Auch einige große Insiderverkäufe dJ., dazu in Q1.08 vs. Vj. deutlich abnehmender freeCF (was aber erstmal nichts heißen muss).

- Im (US-)midcap-Sektor werde ich eher die Werte präferieren, die erst einen jungen uptrend aufweisen bzw. einen solchen erwarten lassen.

=> Eine nur etwa halb so hoch bewertete ITW bei soliden Bilanzrelationen mit deutlich besseren und stetig verbesserten cashflow-Relationen ziehe (auch) ich vor; zumal nahe den mfr. Tiefs,

Nach der letzten (leichten) Rezession war ITW immerhin mal fast doppelt so hoch bewertet.

Die voluminösen Insiderverkäufe in Mai+Juni bis ans aktuelle Kursniveau herum stören mich etwas. Allerdings sollte aufgrund der für US-Aktien schon sehr guten Bewertungs-fundamentals das downrisk doch recht begrenzt sein.

Eher marginal störend die teilweise schuldenfinanzierten Aktienrückkäufe, da die Schuldenzunahme im Bilanzkontext unkritisch und tendenziell auch schon wieder rückläufig ist.

Antwort auf Beitrag Nr.: 34.660.802 von spaceistheplace am 06.08.08 15:36:54daher werden wir wohl auch kaum noch solche rapiden Kursanstiege wie in den 80ern und 90ern sehen.

dieser vermutung trete ich entschieden entgegen. space wir werden auch wieder sehr sehr gute lange zeiträume an der börse erleben.

ich denke zwar auch das die nächsten jahre noch bescheiden werden könnten aber das potential das sich dadurch aufstaut wird immer größer. wenn dann alle eingelulltg sind beginnt der nächste superbulle

hier ein artikel zu dem thema.

Is Poor Stock Market Performance a Positive Long-Term Indicator?

posted on: August 06, 2008 | about stocks: DIA / QQQQ / SPY

Font Size:

Print

Email

Most stock market indices declined again in July. The S&P 500 Index had negative returns of 0.8% for the month. (So far, August is down also.) Last month marked the seventh down month in the last nine. The current correction hit its lowest point on July 14, 2008, with the S&P 500 Index closing 22.3% below its October 9, 2007 peak.

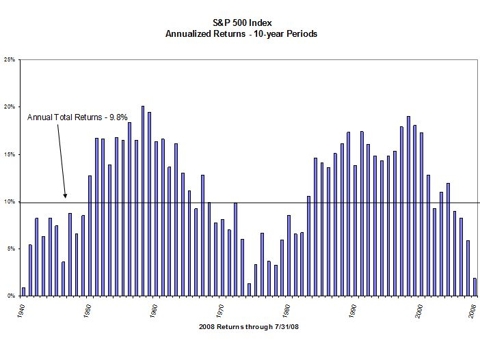

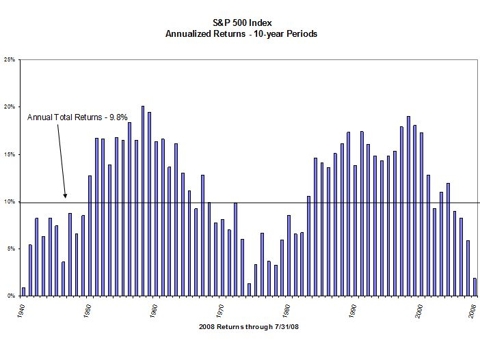

The dismal performance of the last ten months has helped to pull down long-term returns as well. The 10-year annualized total returns for the S&P 500 for the period ending July 31, 2008 is 2.9% – significantly below the 10% historical average (80 years) that is often used as a benchmark for long-term equity performance. It’s ugly enough to make some people question the soundness of equity investing.

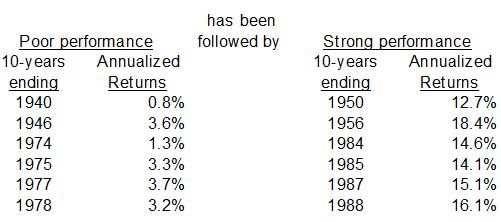

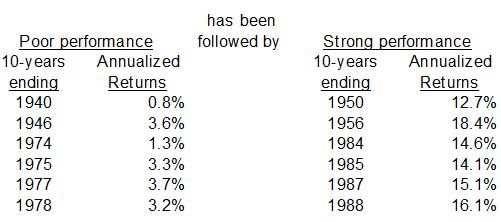

However, low returns for trailing 10-year periods have actually been a bullish indicator for future long-term periods. (To make the analysis simple, I’ll use 10-year periods ending on December 31 as my sample.) Since 1940 there have been six 10-year periods that produced annualized total returns below 5%. The following 10-year periods averaged 15.2%. At this rate money quadruples in 10 years. Each of these six 10-year periods had annualized returns in excess of 12.7%.

The conclusion is that poor performing long-term periods have been followed by strong performing long-term periods. (This pattern is sometimes referred to as a reversion to the mean. This reflects the tendency for statistical observations to return to their long-term averages.) It is fairly easily observed in the following chart.

This phenomenon holds up for one-year periods too. For example, in 15 of the years since 1940, the S&P 500 has had negative total returns. In the one-year periods following these down years, the market has had average annual returns of 15.6%.

It might be considered naive to be optimistic simply because the past has shown a pattern in which periods with strong performance followed periods with poor performance. However, this trend actually portrays the strength of our economic and market systems – both have many self-correcting mechanisms at work.

When gasoline prices rise too high, consumers begin to take mass transit, purchase more fuel-efficient vehicles, or move closer to work. These actions will eventually moderate the cost of energy. When our economy is relatively weak the U.S. dollar falls in value. While a weak dollar has negative implications, one positive aspect is that U.S. exports become more competitive, helping to strengthen the economy.

When assets become overvalued, such as with the technology and housing bubbles, there is a correcting force in the market place. The reverse holds true when assets become significantly undervalued, eventually investment capital will move to these areas.

It is important to keep in mind that recessions are generally short in duration. Since 1980, there have been four recessions which have averaged 9.5 months in length. Over this time span, the U.S. economy had been in a recession 12% of the time and in an expansion phase 88% of the time. Typically stocks begin their recovery before the end of the recession, as the market usually anticipates a recovery before there are visible signs of improvement.

So while it is difficult to find positive things to say about the current economic situation, and it is even more difficult to predict when the economy and equity markets will begin to show real improvement, it is possible to observe that similar past occasions have produced very attractive returns over long-term investment periods.

dieser vermutung trete ich entschieden entgegen. space wir werden auch wieder sehr sehr gute lange zeiträume an der börse erleben.

ich denke zwar auch das die nächsten jahre noch bescheiden werden könnten aber das potential das sich dadurch aufstaut wird immer größer. wenn dann alle eingelulltg sind beginnt der nächste superbulle

hier ein artikel zu dem thema.

Is Poor Stock Market Performance a Positive Long-Term Indicator?

posted on: August 06, 2008 | about stocks: DIA / QQQQ / SPY

Font Size:

Most stock market indices declined again in July. The S&P 500 Index had negative returns of 0.8% for the month. (So far, August is down also.) Last month marked the seventh down month in the last nine. The current correction hit its lowest point on July 14, 2008, with the S&P 500 Index closing 22.3% below its October 9, 2007 peak.

The dismal performance of the last ten months has helped to pull down long-term returns as well. The 10-year annualized total returns for the S&P 500 for the period ending July 31, 2008 is 2.9% – significantly below the 10% historical average (80 years) that is often used as a benchmark for long-term equity performance. It’s ugly enough to make some people question the soundness of equity investing.

However, low returns for trailing 10-year periods have actually been a bullish indicator for future long-term periods. (To make the analysis simple, I’ll use 10-year periods ending on December 31 as my sample.) Since 1940 there have been six 10-year periods that produced annualized total returns below 5%. The following 10-year periods averaged 15.2%. At this rate money quadruples in 10 years. Each of these six 10-year periods had annualized returns in excess of 12.7%.

The conclusion is that poor performing long-term periods have been followed by strong performing long-term periods. (This pattern is sometimes referred to as a reversion to the mean. This reflects the tendency for statistical observations to return to their long-term averages.) It is fairly easily observed in the following chart.

This phenomenon holds up for one-year periods too. For example, in 15 of the years since 1940, the S&P 500 has had negative total returns. In the one-year periods following these down years, the market has had average annual returns of 15.6%.

It might be considered naive to be optimistic simply because the past has shown a pattern in which periods with strong performance followed periods with poor performance. However, this trend actually portrays the strength of our economic and market systems – both have many self-correcting mechanisms at work.

When gasoline prices rise too high, consumers begin to take mass transit, purchase more fuel-efficient vehicles, or move closer to work. These actions will eventually moderate the cost of energy. When our economy is relatively weak the U.S. dollar falls in value. While a weak dollar has negative implications, one positive aspect is that U.S. exports become more competitive, helping to strengthen the economy.

When assets become overvalued, such as with the technology and housing bubbles, there is a correcting force in the market place. The reverse holds true when assets become significantly undervalued, eventually investment capital will move to these areas.

It is important to keep in mind that recessions are generally short in duration. Since 1980, there have been four recessions which have averaged 9.5 months in length. Over this time span, the U.S. economy had been in a recession 12% of the time and in an expansion phase 88% of the time. Typically stocks begin their recovery before the end of the recession, as the market usually anticipates a recovery before there are visible signs of improvement.

So while it is difficult to find positive things to say about the current economic situation, and it is even more difficult to predict when the economy and equity markets will begin to show real improvement, it is possible to observe that similar past occasions have produced very attractive returns over long-term investment periods.

Vorhin habe ich PEP gekauft und auch gleich nen Thread dazu eröffnet:

Thread: PEPSICO (PEP / WKN: 851995).

Nun sollen sie mal steigen....werde mir zur Feier des tages gleich mal nen Liter Pepsi reinhausen...schmeckt zwar nicht so gut wie Coke, aber wurscht!!!

Gruss space

Thread: PEPSICO (PEP / WKN: 851995).

Nun sollen sie mal steigen....werde mir zur Feier des tages gleich mal nen Liter Pepsi reinhausen...schmeckt zwar nicht so gut wie Coke, aber wurscht!!!

Gruss space

habe gerade mal nen FAST-Thread eröffnet.

habe mich mal heute eingelesen und muss sagen, eine klasse Firma, so richtig nach meinem Geschmack!

Thread: FASTENAL (FAST / WKN: 887891) - Befestigungstechnik - Die WÜRTH-Firma aus den USA

Gruss space

habe mich mal heute eingelesen und muss sagen, eine klasse Firma, so richtig nach meinem Geschmack!

Thread: FASTENAL (FAST / WKN: 887891) - Befestigungstechnik - Die WÜRTH-Firma aus den USA

Gruss space

Antwort auf Beitrag Nr.: 34.661.028 von investival am 06.08.08 15:57:04Investival, hast Du Dir schon FAST angeschaut? Könnten Dir gefallen, wenn Du z.B. auch ITW magst...

Prima Kennzahlen:

VALUATION MEASURES

Market Cap (intraday)5: 7.24B

Enterprise Value (6-Aug-08)3: 7.12B

Trailing P/E (ttm, intraday): 27.74

Forward P/E (fye 31-Dec-09) 1: 22.45

PEG Ratio (5 yr expected): 1.34

Price/Sales (ttm): 3.24

Price/Book (mrq): 6.51

Enterprise Value/Revenue (ttm)3: 3.20

Enterprise Value/EBITDA (ttm)3: 15.406

FINANCIAL HIGHLIGHTS

Fiscal Year

Fiscal Year Ends: 31-Dec

Most Recent Quarter (mrq): 30-Jun-08

Profitability

Profit Margin (ttm): 11.81%

Operating Margin (ttm): 19.07%

Management Effectiveness

Return on Assets (ttm): 22.09%

Return on Equity (ttm): 25.08%

Income Statement

Revenue (ttm): 2.22B

Revenue Per Share (ttm): 14.865

Qtrly Revenue Growth (yoy): 16.30%

Gross Profit (ttm): 1.05B

EBITDA (ttm): 462.11M

Net Income Avl to Common (ttm): 262.59M

Diluted EPS (ttm): 1.76

Qtrly Earnings Growth (yoy): 26.40%

Balance Sheet

Total Cash (mrq): 77.12M

Total Cash Per Share (mrq): 0.519

Total Debt (mrq): 0

Total Debt/Equity (mrq): N/A

Current Ratio (mrq): 6.529

Book Value Per Share (mrq): 7.445

Cash Flow Statement

Operating Cash Flow (ttm): 234.81M

Levered Free Cash Flow (ttm): 152.00M

Prima Kennzahlen:

VALUATION MEASURES

Market Cap (intraday)5: 7.24B

Enterprise Value (6-Aug-08)3: 7.12B

Trailing P/E (ttm, intraday): 27.74

Forward P/E (fye 31-Dec-09) 1: 22.45

PEG Ratio (5 yr expected): 1.34

Price/Sales (ttm): 3.24

Price/Book (mrq): 6.51

Enterprise Value/Revenue (ttm)3: 3.20

Enterprise Value/EBITDA (ttm)3: 15.406

FINANCIAL HIGHLIGHTS

Fiscal Year

Fiscal Year Ends: 31-Dec

Most Recent Quarter (mrq): 30-Jun-08

Profitability

Profit Margin (ttm): 11.81%

Operating Margin (ttm): 19.07%

Management Effectiveness

Return on Assets (ttm): 22.09%

Return on Equity (ttm): 25.08%

Income Statement

Revenue (ttm): 2.22B

Revenue Per Share (ttm): 14.865

Qtrly Revenue Growth (yoy): 16.30%

Gross Profit (ttm): 1.05B

EBITDA (ttm): 462.11M

Net Income Avl to Common (ttm): 262.59M

Diluted EPS (ttm): 1.76

Qtrly Earnings Growth (yoy): 26.40%

Balance Sheet

Total Cash (mrq): 77.12M

Total Cash Per Share (mrq): 0.519

Total Debt (mrq): 0

Total Debt/Equity (mrq): N/A

Current Ratio (mrq): 6.529

Book Value Per Share (mrq): 7.445

Cash Flow Statement

Operating Cash Flow (ttm): 234.81M

Levered Free Cash Flow (ttm): 152.00M

und hier noch RESMED, pontius wird es freuien, heute 13% im Plus:

ResMed profit up 66%, shares jump

Investors in ResMed will be having sweet dreams tonight after the sleep management company increased its annual profit by two thirds, sending its shares up more than 13%.

ResMed, which is listed in Australia and based in the US, said it was well positioned to deliver strong growth in fiscal 2009.

Net profit in the year to June 30 jumped 66% to $US110.3 million ($A120.56 million).

Earnings in the fourth quarter rose 7.1% to $US29.63 million ($A32.39 million).

"We were pleased with the strong and balanced growth achieved by our global operations in the past quarter, particularly the accelerated growth experienced in the US market,'' chief executive Kieran Gallahue said.

Mr Gallahue said ResMed was encouraged by the performance of its recent product releases like a new series of flow generators and nasal pillow masks.

"Our industry received positive signals that it is poised for continued growth,'' he said.

These signals included favourable US Medicare rulings and updated insurance policies from private health insurers.

ResMed has recently moved into the diabetes market and Mr Gallahue said the International Diabetes Federation published an important consensus statement on sleep apnoea and diabetes.

There was now an official recommendation to screen all type two diabetes patients suspected of sleep apnoea, he said.

"ResMed is now well positioned to deliver strong growth in fiscal year 2009,'' Mr Gallahue said.

ResMed shares were up 54 cents, or 13.4%, to $4.57.

Fourth quarter revenue rose 23% to a record $US235.2 million, bringing annual revenue to $US835.4 million.

Selling, general and administrative costs jumped 19% in the quarter to $US77.4 million, which translated to 33% of revenue compared to 34% in the previous corresponding period.

The cost increase was primarily due staff increases to support sales growth, and also due to a weak US dollar.

AAP

ResMed profit up 66%, shares jump

Investors in ResMed will be having sweet dreams tonight after the sleep management company increased its annual profit by two thirds, sending its shares up more than 13%.

ResMed, which is listed in Australia and based in the US, said it was well positioned to deliver strong growth in fiscal 2009.

Net profit in the year to June 30 jumped 66% to $US110.3 million ($A120.56 million).

Earnings in the fourth quarter rose 7.1% to $US29.63 million ($A32.39 million).

"We were pleased with the strong and balanced growth achieved by our global operations in the past quarter, particularly the accelerated growth experienced in the US market,'' chief executive Kieran Gallahue said.

Mr Gallahue said ResMed was encouraged by the performance of its recent product releases like a new series of flow generators and nasal pillow masks.

"Our industry received positive signals that it is poised for continued growth,'' he said.

These signals included favourable US Medicare rulings and updated insurance policies from private health insurers.

ResMed has recently moved into the diabetes market and Mr Gallahue said the International Diabetes Federation published an important consensus statement on sleep apnoea and diabetes.

There was now an official recommendation to screen all type two diabetes patients suspected of sleep apnoea, he said.

"ResMed is now well positioned to deliver strong growth in fiscal year 2009,'' Mr Gallahue said.

ResMed shares were up 54 cents, or 13.4%, to $4.57.

Fourth quarter revenue rose 23% to a record $US235.2 million, bringing annual revenue to $US835.4 million.

Selling, general and administrative costs jumped 19% in the quarter to $US77.4 million, which translated to 33% of revenue compared to 34% in the previous corresponding period.

The cost increase was primarily due staff increases to support sales growth, and also due to a weak US dollar.

AAP

heute zerereist es Whole foods, -18%. Die Amis haben keinen Bock mehr auf Bioware...

Whole Foods profit drops, halts dividend

ATLANTA (Reuters) - Whole Foods Market (WFMI.O: Quote, Profile, Research, Stock Buzz), the leading U.S. natural foods grocer, posted a lower quarterly profit that missed Wall Street estimates on Tuesday and suspended its dividend as sales growth slowed, pushing down its stock 17 percent in extended trading.

The former Wall Street darling, which woos high-end shoppers with organic and natural produce at premium prices, cut back its plan to open stores and said it would sell more value items since high gas prices and a weak economy discourage some customers from driving to its stores.

Whole Foods, which a year ago bought rival Wild Oats Markets for $565 million, also forecast current-quarter and full-year profits below analysts' estimates and cut its store growth for 2009.

Results "are not good," said Edward Jones analyst Stephanie Hoff, noting that comparable-store sales growth for the fiscal third quarter was well short of expectations.

"You have a company that used to post above the main-line grocery stores posting more in-line with grocery, so I think that's suggesting a share shift," she said.

But "I don't think that it means it's a permanent shift," Hoff said. "I just think the economy is weighing on everybody."

Whole Foods said sales at established stores rose 1.5 percent in the first four weeks of the current, fiscal fourth quarter. Should that trend continue, the chain said comparable-store sales would rise 5 percent for the full year, down from growth of 7.5 percent to 9.5 percent it forecast earlier this year.

LESS DRIVING

Chairman and Chief Executive John Mackey said higher gasoline prices and the U.S. housing slowdown have led to the weakest comparable-store sales he has seen since he started Whole Foods about 30 years ago.

"With the price of gasoline right now, ... people aren't driving as far, as frequently to our stores as they used to," Mackey said during a conference call.

Consumers' willingness to trade down pose a challenge for the grocer, which had wowed the market for years with its fresh, high-quality meats and produce. The company's shares have fallen 55 percent in the last two years.

Whole Foods, whose high prices have earned it the moniker "Whole Paycheck" among some customers, is cutting costs as well as increasing its value offerings to change its image. "We think that we are misperceived," Mackey said.

The Austin, Texas-based company posted fiscal third-quarter net income of $33.9 million, or 24 cents per diluted share, compared with its year-earlier net income of $49.1 million, or 35 cents a share.

Analysts had expected a profit of 31 cents a share, according to Reuters Estimates.

Charges related to the Wild Oats acquisition lowered earnings by about 3 cents per share, Whole Foods said.

Revenue rose nearly 22 percent in the quarter to $1.8 billion, below the $1.9 billion analysts had expected.

Comparable store sales rose 2.6 percent and identical store sales, excluding two relocated stores and two major expansions, rose 1.9 percent. Those figures are used to gauge health at grocery stores.

Whole Foods suspended its cash dividend and added it was cutting store growth for fiscal 2009 to about 15. The company had previously planned 25 to 30 new stores for 2009.

The chain bought Wild Oats to strengthen its position against mainstream grocers that are carrying more organic, natural and prepared foods. The company said it was mulling how to respond to a U.S. appeals court ruling in late July that overturned a lower court decision allowing the Wild Oats buyout to proceed.

Whole Foods forecast a profit of 13 cents to 15 cents a share for the fourth quarter and 93 cents to 95 cents a share for the full year. Analysts expected 27 cents a share for the quarter and $1.15 a share for the year, according to Reuters Estimates.

For 2009, Whole Foods forecast profit of $1.08 to $1.14 a share on sales growth of 6 percent to 10 percent. Analysts expect profit of $1.53 a share for 2009.

The company's shares fell about 17 percent to $18.93 in trading after the bell from their $22.92 close on Nasdaq.

(Reporting by Karen Jacobs, editing by Richard Chang)

Whole Foods profit drops, halts dividend

ATLANTA (Reuters) - Whole Foods Market (WFMI.O: Quote, Profile, Research, Stock Buzz), the leading U.S. natural foods grocer, posted a lower quarterly profit that missed Wall Street estimates on Tuesday and suspended its dividend as sales growth slowed, pushing down its stock 17 percent in extended trading.

The former Wall Street darling, which woos high-end shoppers with organic and natural produce at premium prices, cut back its plan to open stores and said it would sell more value items since high gas prices and a weak economy discourage some customers from driving to its stores.

Whole Foods, which a year ago bought rival Wild Oats Markets for $565 million, also forecast current-quarter and full-year profits below analysts' estimates and cut its store growth for 2009.

Results "are not good," said Edward Jones analyst Stephanie Hoff, noting that comparable-store sales growth for the fiscal third quarter was well short of expectations.

"You have a company that used to post above the main-line grocery stores posting more in-line with grocery, so I think that's suggesting a share shift," she said.

But "I don't think that it means it's a permanent shift," Hoff said. "I just think the economy is weighing on everybody."

Whole Foods said sales at established stores rose 1.5 percent in the first four weeks of the current, fiscal fourth quarter. Should that trend continue, the chain said comparable-store sales would rise 5 percent for the full year, down from growth of 7.5 percent to 9.5 percent it forecast earlier this year.

LESS DRIVING

Chairman and Chief Executive John Mackey said higher gasoline prices and the U.S. housing slowdown have led to the weakest comparable-store sales he has seen since he started Whole Foods about 30 years ago.

"With the price of gasoline right now, ... people aren't driving as far, as frequently to our stores as they used to," Mackey said during a conference call.

Consumers' willingness to trade down pose a challenge for the grocer, which had wowed the market for years with its fresh, high-quality meats and produce. The company's shares have fallen 55 percent in the last two years.

Whole Foods, whose high prices have earned it the moniker "Whole Paycheck" among some customers, is cutting costs as well as increasing its value offerings to change its image. "We think that we are misperceived," Mackey said.

The Austin, Texas-based company posted fiscal third-quarter net income of $33.9 million, or 24 cents per diluted share, compared with its year-earlier net income of $49.1 million, or 35 cents a share.

Analysts had expected a profit of 31 cents a share, according to Reuters Estimates.

Charges related to the Wild Oats acquisition lowered earnings by about 3 cents per share, Whole Foods said.

Revenue rose nearly 22 percent in the quarter to $1.8 billion, below the $1.9 billion analysts had expected.

Comparable store sales rose 2.6 percent and identical store sales, excluding two relocated stores and two major expansions, rose 1.9 percent. Those figures are used to gauge health at grocery stores.

Whole Foods suspended its cash dividend and added it was cutting store growth for fiscal 2009 to about 15. The company had previously planned 25 to 30 new stores for 2009.

The chain bought Wild Oats to strengthen its position against mainstream grocers that are carrying more organic, natural and prepared foods. The company said it was mulling how to respond to a U.S. appeals court ruling in late July that overturned a lower court decision allowing the Wild Oats buyout to proceed.

Whole Foods forecast a profit of 13 cents to 15 cents a share for the fourth quarter and 93 cents to 95 cents a share for the full year. Analysts expected 27 cents a share for the quarter and $1.15 a share for the year, according to Reuters Estimates.

For 2009, Whole Foods forecast profit of $1.08 to $1.14 a share on sales growth of 6 percent to 10 percent. Analysts expect profit of $1.53 a share for 2009.

The company's shares fell about 17 percent to $18.93 in trading after the bell from their $22.92 close on Nasdaq.

(Reporting by Karen Jacobs, editing by Richard Chang)

Antwort auf Beitrag Nr.: 34.659.825 von clearasil am 06.08.08 13:48:59>> weiß, dass ihr alle solarhasser seid <<

Das stimmt so nicht: Ich 'hasse' nur invests, die am staatlichen Tropf hängen, ergo sich deshalb weiter in unkonsolidierten Branchen tummeln können und jeden Tag neue Wettbewerber auf den Plan rufen, womit die Endlichkeit der kompletten Branchenprosperität immer näher rückt.

Ich mag Firmen, die sich in einem freien Markt behaupten - und ich behaupte, die werden a la longue auch nur (frisches) Geld anziehen.

Finden zB. eine LOOP oder CMG in dieser Krise einen Boden, ist das mit Sicherheit das Erfolg versprechendere Invest, maßt man sich nicht gerade an, unter den allzu vielen ecotechs den Treffer heraus zu filtern.

Das stimmt so nicht: Ich 'hasse' nur invests, die am staatlichen Tropf hängen, ergo sich deshalb weiter in unkonsolidierten Branchen tummeln können und jeden Tag neue Wettbewerber auf den Plan rufen, womit die Endlichkeit der kompletten Branchenprosperität immer näher rückt.

Ich mag Firmen, die sich in einem freien Markt behaupten - und ich behaupte, die werden a la longue auch nur (frisches) Geld anziehen.

Finden zB. eine LOOP oder CMG in dieser Krise einen Boden, ist das mit Sicherheit das Erfolg versprechendere Invest, maßt man sich nicht gerade an, unter den allzu vielen ecotechs den Treffer heraus zu filtern.

Antwort auf Beitrag Nr.: 34.660.612 von investival am 06.08.08 15:19:01Wir brauchen ja gar nicht Rohstoffkonzerne in punkto ASS diskutieren, aber wir sollten tendenziell stg. Einstandspreise Preise für "unsere" ASS-Aktien auf der Agenda haben, imho.

danke investival, leuchtet alles soweit ein. Kklar generell müssen wir uns mit dem Thema Inflation langfristig auseinandersetzen und in diesem Zusammenhang natürlich mit den Zinsen, dem wohl immer noch wichtigsten Einfluss für die Aktienbörsen. daher werden wir wohl auch kaum noch solche rapiden Kursanstiege wie in den 80ern und 90ern sehen.

Jedenfalls sind trotzdem Aktien der beste Inflationsschutz und das um so mehr, in dem man in Firmen investiert, die ihre Preise ohne große Probleme erhöhen können, wie hier schon öfters formuliert.

Gruss space

danke investival, leuchtet alles soweit ein. Kklar generell müssen wir uns mit dem Thema Inflation langfristig auseinandersetzen und in diesem Zusammenhang natürlich mit den Zinsen, dem wohl immer noch wichtigsten Einfluss für die Aktienbörsen. daher werden wir wohl auch kaum noch solche rapiden Kursanstiege wie in den 80ern und 90ern sehen.

Jedenfalls sind trotzdem Aktien der beste Inflationsschutz und das um so mehr, in dem man in Firmen investiert, die ihre Preise ohne große Probleme erhöhen können, wie hier schon öfters formuliert.

Gruss space

Antwort auf Beitrag Nr.: 34.660.612 von investival am 06.08.08 15:19:01- aber nur zur Kenntnisnahme -