Enviro Gold - Profitabilität durch Effizienz?? - 500 Beiträge pro Seite

eröffnet am 31.03.11 11:14:36 von

neuester Beitrag 29.01.12 18:28:26 von

neuester Beitrag 29.01.12 18:28:26 von

Beiträge: 48

ID: 1.165.148

ID: 1.165.148

Aufrufe heute: 0

Gesamt: 1.126

Gesamt: 1.126

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 23:58 | 137 | |

| gestern 23:09 | 121 | |

| heute 00:01 | 102 | |

| gestern 23:31 | 79 | |

| vor 1 Stunde | 78 | |

| gestern 22:15 | 77 | |

| gestern 21:35 | 75 | |

| gestern 22:52 | 75 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.075,00 | +0,33 | 240 | |||

| 2. | 2. | 1,3800 | -1,43 | 98 | |||

| 3. | 3. | 0,1890 | -2,58 | 81 | |||

| 4. | 4. | 170,18 | +4,97 | 79 | |||

| 5. | 5. | 9,3325 | -3,69 | 75 | |||

| 6. | 6. | 7,0010 | +4,17 | 53 | |||

| 7. | 7. | 22,240 | -3,22 | 41 | |||

| 8. | 8. | 0,0160 | -24,17 | 38 |

Hallo Leute,

durch den Letter of Intent zu einer Zusammenarbeit mit Novus Gold bin ich af Enviro Gold gestoßen.

Darauf hin habe ich mir die HP von Enviro angeschaut und es für einen höchst Interressanten Wert gehalten, mir gleich ein paar ins Depot gelegt. Ich habe durch die Verknüpfung von Enviro mit Novus auch schon mal erste Gedanken im Novus Thread gepostet: http://www.wallstreet-online.de/diskussion/1154254-471-480/n…

Für entscheident halte ich: EnviroGold anticipates operating costs of US$325 per oz Au. Total development costs are expected to be US$75 million with project financing provided by Macquarie Bank from Australia

Meiner Auffassung scheinen auch kanadische Experten zu sein, die Enviro angeregt haben, nicht nur an der Heimatbörse (in Australien) sondern auch in Toronto zu handeln http://www.envirogold.com/userfiles/960473.pdf

(Siehe auch meinen Beitrag 480 bei Novus).

Infos:

HP: http://www.envirogold.com/site/

http://fortbridge.files.wordpress.com/2011/03/asx-evg-near-t…

http://www.proactiveinvestors.com.au/companies/news/15104/en…

Ich würde mich sehr über Mit - Diskutierer freuen.

gehtwas

durch den Letter of Intent zu einer Zusammenarbeit mit Novus Gold bin ich af Enviro Gold gestoßen.

Darauf hin habe ich mir die HP von Enviro angeschaut und es für einen höchst Interressanten Wert gehalten, mir gleich ein paar ins Depot gelegt. Ich habe durch die Verknüpfung von Enviro mit Novus auch schon mal erste Gedanken im Novus Thread gepostet: http://www.wallstreet-online.de/diskussion/1154254-471-480/n…

Für entscheident halte ich: EnviroGold anticipates operating costs of US$325 per oz Au. Total development costs are expected to be US$75 million with project financing provided by Macquarie Bank from Australia

Meiner Auffassung scheinen auch kanadische Experten zu sein, die Enviro angeregt haben, nicht nur an der Heimatbörse (in Australien) sondern auch in Toronto zu handeln http://www.envirogold.com/userfiles/960473.pdf

(Siehe auch meinen Beitrag 480 bei Novus).

Infos:

HP: http://www.envirogold.com/site/

http://fortbridge.files.wordpress.com/2011/03/asx-evg-near-t…

http://www.proactiveinvestors.com.au/companies/news/15104/en…

Ich würde mich sehr über Mit - Diskutierer freuen.

gehtwas

Macquarie Bank is a substantial shareholder of EnviroGold with 5.95%.

weiß jemand etwas über die Regularien in Australien, ab wieviel % wer was machen muss???

gehtwas

weiß jemand etwas über die Regularien in Australien, ab wieviel % wer was machen muss???

gehtwas

Man beachte die Umsätze der letzten beiden Tage

Datum Eröffnung Hoch Tief Schluss Volumen

31.03.2011 0,135 0,14 0,13 0,14 3 Mio.

30.03.2011 0,12 0,13 0,115 0,13 2 Mio.

29.03.2011 0,12 0,12 0,115 0,12 669.249

28.03.2011 0,115 0,12 0,115 0,12 126.666

25.03.2011 0,125 0,125 0,12 0,12 605.000

24.03.2011 0,12 0,125 0,12 0,125 1 Mio.

23.03.2011 0,12 0,12 0,115 0,12 601.000

22.03.2011 0,115 0,12 0,11 0,12 352.500

21.03.2011 0,105 0,115 0,105 0,115 1 Mio.

18.03.2011 0,105 0,11 0,105 0,11 707.000

17.03.2011 0,11 0,11 0,10 0,11 2 Mio.

16.03.2011 0,11 0,115 0,105 0,11 795.814

15.03.2011 0,12 0,12 0,11 0,11 3 Mio.

14.03.2011 0,12 0,12 0,115 0,12 676.285

11.03.2011 0,125 0,125 0,12 0,125 906.192

10.03.2011 0,125 0,125 0,12 0,12 366.970

09.03.2011 0,125 0,125 0,125 0,125 650.500

08.03.2011 0,125 0,125 0,12 0,125 711.330

07.03.2011 0,125 0,125 0,12 0,125 244.400

04.03.2011 0,13 0,13 0,12 0,12 4 Mio.

03.03.2011 0,13 0,13 0,125 0,125 579.629

02.03.2011 0,13 0,135 0,125 0,13 659.800

01.03.2011 0,13 0,13 0,125 0,125 884.040

Datum Eröffnung Hoch Tief Schluss Volumen

31.03.2011 0,135 0,14 0,13 0,14 3 Mio.

30.03.2011 0,12 0,13 0,115 0,13 2 Mio.

29.03.2011 0,12 0,12 0,115 0,12 669.249

28.03.2011 0,115 0,12 0,115 0,12 126.666

25.03.2011 0,125 0,125 0,12 0,12 605.000

24.03.2011 0,12 0,125 0,12 0,125 1 Mio.

23.03.2011 0,12 0,12 0,115 0,12 601.000

22.03.2011 0,115 0,12 0,11 0,12 352.500

21.03.2011 0,105 0,115 0,105 0,115 1 Mio.

18.03.2011 0,105 0,11 0,105 0,11 707.000

17.03.2011 0,11 0,11 0,10 0,11 2 Mio.

16.03.2011 0,11 0,115 0,105 0,11 795.814

15.03.2011 0,12 0,12 0,11 0,11 3 Mio.

14.03.2011 0,12 0,12 0,115 0,12 676.285

11.03.2011 0,125 0,125 0,12 0,125 906.192

10.03.2011 0,125 0,125 0,12 0,12 366.970

09.03.2011 0,125 0,125 0,125 0,125 650.500

08.03.2011 0,125 0,125 0,12 0,125 711.330

07.03.2011 0,125 0,125 0,12 0,125 244.400

04.03.2011 0,13 0,13 0,12 0,12 4 Mio.

03.03.2011 0,13 0,13 0,125 0,125 579.629

02.03.2011 0,13 0,135 0,125 0,13 659.800

01.03.2011 0,13 0,13 0,125 0,125 884.040

wenn das mal morgen nicht hilft

Ja heidewitzka -

das war ja mal ein Anstieg - und zwar mit richtig fetten Blöcken hier mal ein paar Beispiele

08.04.2011 04:46:26 0,1900 865.764

08.04.2011 04:33:40 0,1900 618.335

08.04.2011 04:33:40 0,1900 998.700

Volumen knapp 70 Mio St.

was ist denn da los.

was ist denn da los.

gehtwas

das war ja mal ein Anstieg - und zwar mit richtig fetten Blöcken hier mal ein paar Beispiele

08.04.2011 04:46:26 0,1900 865.764

08.04.2011 04:33:40 0,1900 618.335

08.04.2011 04:33:40 0,1900 998.700

Volumen knapp 70 Mio St.

was ist denn da los.

was ist denn da los.gehtwas

hallo gehtwas,

warum werden hier bei "WO" keine aktuellen kurse angezeigt?

hast du einen link, wo man den aktuellen kurs sehen kann?

warum werden hier bei "WO" keine aktuellen kurse angezeigt?

hast du einen link, wo man den aktuellen kurs sehen kann?

Antwort auf Beitrag Nr.: 41.345.295 von Overhead78 am 10.04.11 11:11:45

http://www.comdirect.de/inf/aktien/detail/uebersicht.html?SE…

http://www.comdirect.de/inf/aktien/detail/uebersicht.html?SE…

Antwort auf Beitrag Nr.: 41.346.986 von gehtwas am 11.04.11 09:10:40wird die aktie hier in deutschland (frankfurt) nicht gehandelt?

Antwort auf Beitrag Nr.: 41.348.927 von Overhead78 am 11.04.11 14:52:55Ich glaube nicht.

Es macht aber auch keinen Sinn da alle Umsätze in Australien sind, oder dann hoffentlich auch bald in Toronto. Aber da ist es meiner Meinung besser schon vorher in Australien zu zu schlagen - nur meine Meinung.

Es macht aber auch keinen Sinn da alle Umsätze in Australien sind, oder dann hoffentlich auch bald in Toronto. Aber da ist es meiner Meinung besser schon vorher in Australien zu zu schlagen - nur meine Meinung.

mal an alle Charttechniker

müssen solche gaps immer geschlossen werden?

Wäre schade

Wäre schade

gehtwas

Bei dem Tagesverlauf Gold - schau mer mal ob Montag noch was geht

Weiter riesen Umsatz. 19 Mio Stück mit Blöcken zu 100, 200 300K dazwischen.

- und Ihr schweigt weiter die Wand an.

gehtwas

- und Ihr schweigt weiter die Wand an.

gehtwas

0,20 ist der letzte Widerstand vor dem ATH Ende 2007. Mit dem Handel an der TSX möglicherweise der Weg nach oben frei???

gehtwas

gehtwas

http://www.envirogold.com/userfiles/969844.pdf

Also: Wenn ich das richtig verstanden habe, fangen die 2012 an zu produzieren, und zwar

65.000 Unzen/a Au und 600.000 Unzen Ag/a bei Abbaukosten von 313$/Unze, Laufzeit 7 Jahre.

30% des Goldes sind bereits verkauft für 1358$/unze.

Das wäre Aktuell ein Gewinn vor Steuern ( 3%NSR für Maquarie bereits abgezogen) von

89.167.250$/a (bei einem Siloberpreis von 40$)

Das hört sich meines Erachtens doch gar nicht übel an. Kommentare???

Kommentare???

Weiter soll dann im August noch ein Prefeasability Study vom Azuay Projekt kommen.

gehtwas

Also: Wenn ich das richtig verstanden habe, fangen die 2012 an zu produzieren, und zwar

65.000 Unzen/a Au und 600.000 Unzen Ag/a bei Abbaukosten von 313$/Unze, Laufzeit 7 Jahre.

30% des Goldes sind bereits verkauft für 1358$/unze.

Das wäre Aktuell ein Gewinn vor Steuern ( 3%NSR für Maquarie bereits abgezogen) von

89.167.250$/a (bei einem Siloberpreis von 40$)

Das hört sich meines Erachtens doch gar nicht übel an.

Kommentare???

Kommentare???Weiter soll dann im August noch ein Prefeasability Study vom Azuay Projekt kommen.

gehtwas

Zitat von gehtwas: http://www.envirogold.com/userfiles/969844.pdf

Weiter soll dann im August 2012 noch ein Prefeasability Study vom Azuay Projekt kommen.

gehtwas

EnviroGold Limited - Good progress on Las Lagunas Gold/Silver project

Tuesday , 03 May 2011 EnviroGold Limited

HIGHLIGHTS

•Key modular oxygen plant shipped ahead of schedule.

•Project on schedule for early 2012 start-up of gold and silver production.

•Project to benefit from high gold and silver prices.

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) (EnviroGoldor the "Company") advises that construction on its Las Lagunas gold/silver project in theDominican Republic is progressing well with the critical modular oxygen plant having beenshipped by the supplier ahead of its scheduled requirement.

Mr Brian Johnson, Executive Chairman, said that it was ironic that after substantial delays tothe implementation of the project caused by third parties, planned gold and silver production(65,000 oz Au and 600,000 oz Ag per year) should now commence in January 2012 atsignificantly higher metal prices than originally budgeted.

Shareholders would be interested to know that if current prices prevail for the next two tothree years, annual after tax profits from the first two years of production should be in theorder of US$45 million to US$48 million.

In addition, Macquarie Bank's US$37.5 million project loan would be repaid within 18 monthsof commissioning.

ABOUT ENVIROGOLD

EnviroGold Limited (ASX code: "EVG") is an Australian based mineral resource companyusing patented next generation technology to extract gold and silver from metallurgicallycomplex mineral resources in Latin America.

EnviroGold has agreements with Xstrata Technology to use its ground-breaking AlbionProcess Technology which enables EnviroGold to extract gold and silver from refractory oreor mine tailings and eliminate the threat of acid mine drainage, resulting in a net benefit to theenvironment.

EnviroGold is also applying its expertise to securing gold and silver production from themining of oxide or sulphidic ore using traditional gravity, carbon-in-leach, or heap-leachingprocessing.

The Company's key projects are:

DOMINICAN REPUBLIC

Las Lagunas Gold Tailings Project (100%)

•reprocessing of high grade refractory tailings from the Pueblo Viejo gold mine isexpected to commence in December 2011, at the annual rate of 65,000 oz ofgold and 600,000 oz of silver (JORC Inferred Resource of 5.137 Mt of tailings at3.8 g/t gold and 38.6 g/t silver) (621,000 oz of gold and 6,400,000 oz of silver).

ECUADOR

Azuay Gold Mining Project (earn-in 65%)

•planned expansion of Pinglio and Papercorp small scale underground mines in2012-2013 to produce 50,000 oz of gold per year, and to 100,000 oz per year byend 2014.

San Gerardo Gold Mining Prospect (purchase option 100%)

•planned exploration program of highly prospective 2200ha concession in 2011-2013, to establish a resource sufficient to support an open pit mining operationwith the potential to produce 100,000 oz of gold equivalent per year.

EnviroGold is also actively pursuing additional gold projects in the Dominican Republic,Ecuador and Peru.

gehtwas

Tuesday , 03 May 2011 EnviroGold Limited

HIGHLIGHTS

•Key modular oxygen plant shipped ahead of schedule.

•Project on schedule for early 2012 start-up of gold and silver production.

•Project to benefit from high gold and silver prices.

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) (EnviroGoldor the "Company") advises that construction on its Las Lagunas gold/silver project in theDominican Republic is progressing well with the critical modular oxygen plant having beenshipped by the supplier ahead of its scheduled requirement.

Mr Brian Johnson, Executive Chairman, said that it was ironic that after substantial delays tothe implementation of the project caused by third parties, planned gold and silver production(65,000 oz Au and 600,000 oz Ag per year) should now commence in January 2012 atsignificantly higher metal prices than originally budgeted.

Shareholders would be interested to know that if current prices prevail for the next two tothree years, annual after tax profits from the first two years of production should be in theorder of US$45 million to US$48 million.

In addition, Macquarie Bank's US$37.5 million project loan would be repaid within 18 monthsof commissioning.

ABOUT ENVIROGOLD

EnviroGold Limited (ASX code: "EVG") is an Australian based mineral resource companyusing patented next generation technology to extract gold and silver from metallurgicallycomplex mineral resources in Latin America.

EnviroGold has agreements with Xstrata Technology to use its ground-breaking AlbionProcess Technology which enables EnviroGold to extract gold and silver from refractory oreor mine tailings and eliminate the threat of acid mine drainage, resulting in a net benefit to theenvironment.

EnviroGold is also applying its expertise to securing gold and silver production from themining of oxide or sulphidic ore using traditional gravity, carbon-in-leach, or heap-leachingprocessing.

The Company's key projects are:

DOMINICAN REPUBLIC

Las Lagunas Gold Tailings Project (100%)

•reprocessing of high grade refractory tailings from the Pueblo Viejo gold mine isexpected to commence in December 2011, at the annual rate of 65,000 oz ofgold and 600,000 oz of silver (JORC Inferred Resource of 5.137 Mt of tailings at3.8 g/t gold and 38.6 g/t silver) (621,000 oz of gold and 6,400,000 oz of silver).

ECUADOR

Azuay Gold Mining Project (earn-in 65%)

•planned expansion of Pinglio and Papercorp small scale underground mines in2012-2013 to produce 50,000 oz of gold per year, and to 100,000 oz per year byend 2014.

San Gerardo Gold Mining Prospect (purchase option 100%)

•planned exploration program of highly prospective 2200ha concession in 2011-2013, to establish a resource sufficient to support an open pit mining operationwith the potential to produce 100,000 oz of gold equivalent per year.

EnviroGold is also actively pursuing additional gold projects in the Dominican Republic,Ecuador and Peru.

gehtwas

EnviroGold boosts stake in Azuay gold project in Ecuador to 80%

Friday, May 13, 2011

EnviroGold (ASX: EVG) has increased its shareholding in the Azuay gold project in Ecuador to 80% and intends to restructure the joint venture in order to accelerate development.

EnviroGold previously held a 65% earn-in interest on the Azuay project by entering into agreements with two privately held mining companies with two small gold mining operations in Azuay Region of Southern Ecuador.

The company expects significant exploration potential over the 700 hectare lease areas and the opportunity to expand gold production to 100,000 ounces per year. The aim is to commence development before the end of 2011 with gold production in early 2013.

The initial US$10 million capital of the JV development company, EnviroGold (Azuay) SA (EVGA), will now be established by Empresa Minera Papercorp SA (EMP) transferring its Papercorp underground mine and 250 hectare mining lease, for US$2 million of shares in EVGA.

EMP is a private company that is well connected in Ecuador and its shareholders are expected to be stable and supportive participants in the proposed project.

EnviroGold will grant mining rights to EVGA over five small scale underground mines and 420 hectares of highly prospective surrounding areas within its optioned San Gerardo concession, for US$1.5 million of shares in EVGA.

EnviroGold will also progressively subscribe US$6.5 million for shares in EVGA to be spent on drilling and feasibility study costs, with US$1.3 million advanced to date.

EnviroGold will effectively replace Grumintor SA’s 15% interest which was previously to be earned by the transfer of its Pinglio mine to the JV.

Though Grumintor will not participate in the expansion of mining operations and construction of a process plant, it has expressed an interest in supplying ore to the JV in some form of tolling arrangement.

Grumintor’s withdrawal has also allowed the JV to revert to a single stage development which was previously planned over two stages to reduce the size of initial shareholder loans.

EnviroGold now aims to establish five or six separate mining operations capable of collectively producing ore at the rate of 200,000 onnes per annum (tpa) by first quarter 2014, ramping up to 300,000 tpa by the end of 2014.

A combined gravity/Albion/CIL circuit is planned for installation by the end of 2013 following a development decision in mid 2012.

The company expects the proposed gold extraction process to recover 90% of free milling gold and that bound up in silicates and refractory ore, based on preliminary metallurgical testwork.

The decision to proceed with the development depends on the results of a Feasibility Study for the production of 100,000 ounces (oz) gold per year for a minimum of 12 years, and the current drilling program confirming a mining target of at least 4 million tonnes (Mt) grading 10 grams per tonne (g/t) gold to 12g/t gold.

EnviroGold proposes to truck ore a maximum of five kilometres from the various workings to a suitable plant site on the Papercorp lease, with tailings piped to a valley dam on the adjacent San Gerardo lease.

Development costs will be aboutf US$80 million in addition to EVGA’s capital of US$10 million which will be spent on acquisitions, drilling, metallurgical testwork, and feasibility studies.

Funding is likely to be a mixture of shareholders loans, proceeds from the provision of a gold royalty, and a project loan.

EnviroGold’s total contribution to EVGA for implementation of the project will be in the order of US$20 to US$25 million.

At at a gold price of US$1,200 per oz, the company said it has potential to book after tax profits of about US$380 million over the 12 years following commissioning.

Brian Johnson, EnviroGold's executive chairman, said “EnviroGold will provide US$5.2 million of equity for the Azuay project over the next 15 months, in addition to the US$1.3 million already contributed.

"The company will also exercise its option to purchase the San Gerardo concession for US$4.3 million around December 2012."

EnviroGold’s funding will be sourced primarily from surplus cash generated by the Las Lagunas project in the Dominican Republic. Gold and silver production is expected to commence in January 2012.

Of the San Gerardo purchase price, US$1.5 million will be allocated to 420 hectares covering the five small scale operating mines to be transferred to the Azuay JV, and US$2.8 million to the highly prospective 80 ha Vittoria copper/gold/molybdenum exploration target within the San Gerardo lease.

This area is currently the subject of a soil sampling program in advance of commencement of a drilling program in third quarter this year.

The Azuay project is at the centre of a highly mineralised gold belt with the Papercorp and San Gerardo mines surrounded by reported N143-101 (Canadian JORC equivalent) compliant resources of over 15 million oz of gold.

EnviroGold is also progressing construction on its Las Lagunas gold/silver project in the Dominican Republic with the key modular oxygen plant having been shipped by the supplier ahead of schedule.

The project remains on schedule for early 2012 start-up of gold and silver production and is set to benefit from high gold and silver prices.

http://www.proactiveinvestors.com.au/companies/news/16253/en…

Sorry war ich noch schuldig

gehtwas

Friday, May 13, 2011

EnviroGold (ASX: EVG) has increased its shareholding in the Azuay gold project in Ecuador to 80% and intends to restructure the joint venture in order to accelerate development.

EnviroGold previously held a 65% earn-in interest on the Azuay project by entering into agreements with two privately held mining companies with two small gold mining operations in Azuay Region of Southern Ecuador.

The company expects significant exploration potential over the 700 hectare lease areas and the opportunity to expand gold production to 100,000 ounces per year. The aim is to commence development before the end of 2011 with gold production in early 2013.

The initial US$10 million capital of the JV development company, EnviroGold (Azuay) SA (EVGA), will now be established by Empresa Minera Papercorp SA (EMP) transferring its Papercorp underground mine and 250 hectare mining lease, for US$2 million of shares in EVGA.

EMP is a private company that is well connected in Ecuador and its shareholders are expected to be stable and supportive participants in the proposed project.

EnviroGold will grant mining rights to EVGA over five small scale underground mines and 420 hectares of highly prospective surrounding areas within its optioned San Gerardo concession, for US$1.5 million of shares in EVGA.

EnviroGold will also progressively subscribe US$6.5 million for shares in EVGA to be spent on drilling and feasibility study costs, with US$1.3 million advanced to date.

EnviroGold will effectively replace Grumintor SA’s 15% interest which was previously to be earned by the transfer of its Pinglio mine to the JV.

Though Grumintor will not participate in the expansion of mining operations and construction of a process plant, it has expressed an interest in supplying ore to the JV in some form of tolling arrangement.

Grumintor’s withdrawal has also allowed the JV to revert to a single stage development which was previously planned over two stages to reduce the size of initial shareholder loans.

EnviroGold now aims to establish five or six separate mining operations capable of collectively producing ore at the rate of 200,000 onnes per annum (tpa) by first quarter 2014, ramping up to 300,000 tpa by the end of 2014.

A combined gravity/Albion/CIL circuit is planned for installation by the end of 2013 following a development decision in mid 2012.

The company expects the proposed gold extraction process to recover 90% of free milling gold and that bound up in silicates and refractory ore, based on preliminary metallurgical testwork.

The decision to proceed with the development depends on the results of a Feasibility Study for the production of 100,000 ounces (oz) gold per year for a minimum of 12 years, and the current drilling program confirming a mining target of at least 4 million tonnes (Mt) grading 10 grams per tonne (g/t) gold to 12g/t gold.

EnviroGold proposes to truck ore a maximum of five kilometres from the various workings to a suitable plant site on the Papercorp lease, with tailings piped to a valley dam on the adjacent San Gerardo lease.

Development costs will be aboutf US$80 million in addition to EVGA’s capital of US$10 million which will be spent on acquisitions, drilling, metallurgical testwork, and feasibility studies.

Funding is likely to be a mixture of shareholders loans, proceeds from the provision of a gold royalty, and a project loan.

EnviroGold’s total contribution to EVGA for implementation of the project will be in the order of US$20 to US$25 million.

At at a gold price of US$1,200 per oz, the company said it has potential to book after tax profits of about US$380 million over the 12 years following commissioning.

Brian Johnson, EnviroGold's executive chairman, said “EnviroGold will provide US$5.2 million of equity for the Azuay project over the next 15 months, in addition to the US$1.3 million already contributed.

"The company will also exercise its option to purchase the San Gerardo concession for US$4.3 million around December 2012."

EnviroGold’s funding will be sourced primarily from surplus cash generated by the Las Lagunas project in the Dominican Republic. Gold and silver production is expected to commence in January 2012.

Of the San Gerardo purchase price, US$1.5 million will be allocated to 420 hectares covering the five small scale operating mines to be transferred to the Azuay JV, and US$2.8 million to the highly prospective 80 ha Vittoria copper/gold/molybdenum exploration target within the San Gerardo lease.

This area is currently the subject of a soil sampling program in advance of commencement of a drilling program in third quarter this year.

The Azuay project is at the centre of a highly mineralised gold belt with the Papercorp and San Gerardo mines surrounded by reported N143-101 (Canadian JORC equivalent) compliant resources of over 15 million oz of gold.

EnviroGold is also progressing construction on its Las Lagunas gold/silver project in the Dominican Republic with the key modular oxygen plant having been shipped by the supplier ahead of schedule.

The project remains on schedule for early 2012 start-up of gold and silver production and is set to benefit from high gold and silver prices.

http://www.proactiveinvestors.com.au/companies/news/16253/en…

Sorry war ich noch schuldig

gehtwas

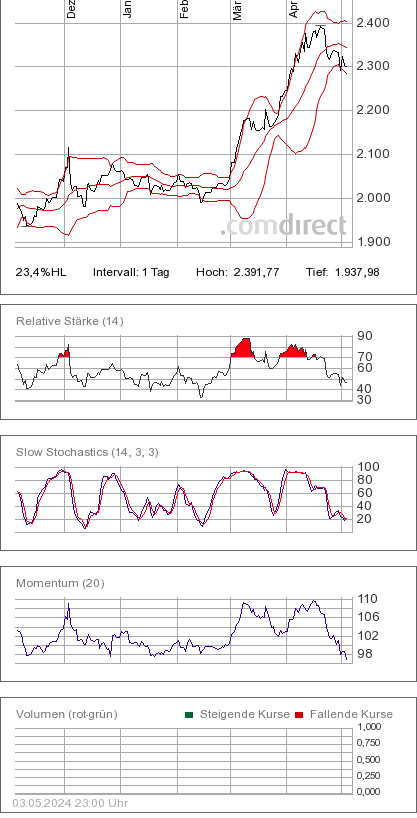

Gold scheint jetzt erst mal das gröbste hinter sich zu haben. Könnte ein "W" werden. möglicherweise liegst an:

Chinesen werden zu größten Goldkäufern weltweit

http://www.spiegel.de/wirtschaft/unternehmen/0,1518,763729,0…

Auch der Chart hat Potential, Slow Sto bullish, RSI ein bißchen abgekühlt. Könnte nächste Woche Richtung 0,21AUD gehen.

gehtwas

Chinesen werden zu größten Goldkäufern weltweit

http://www.spiegel.de/wirtschaft/unternehmen/0,1518,763729,0…

Auch der Chart hat Potential, Slow Sto bullish, RSI ein bißchen abgekühlt. Könnte nächste Woche Richtung 0,21AUD gehen.

gehtwas

Der Handel in Canada scheint näher zu rücken.

http://www.proactiveinvestors.com.au/companies/news/16562/en…

gehtwas

http://www.proactiveinvestors.com.au/companies/news/16562/en…

gehtwas

Zitat von gehtwas: Der Handel in Canada scheint näher zu rücken.

http://www.proactiveinvestors.com.au/companies/news/16562/en…

gehtwas

EnviroGold Limited - Sponsor for TSX Listing

Thursday , 26 May 2011 EnviroGold Limited

Mr Brian Johnson, Executive Chairman of EnviroGold Limited (ASX Code: "EVG"), hasadvised that Toronto-based Haywood Securities Inc. has been appointed to act as sponsor inconnection with the Company's proposed dual listing on the Toronto Stock Exchange ("TSX").

He said that he expected the listing to occur within approximately three months.

The application for the TSX listing will not be accompanied by a share issue

http://www.mineweb.com/mineweb/view/mineweb/en/page674?oid=1…

gehtwas

EnviroGold targets 100,000 gold ounce annual production in Ecuador with full ownership

Tuesday, June 21, 2011 by Proactive Investors

EnviroGold (ASX: EVG) stands to benefit from the upside in the Azuay gold mining project in Ecuador, after the company elected to retain 100% of the project.

The planned expansion at the project in 2012-2013 covers four small scale underground mines within the San Gerardo lease to produce a total of 300,000 tonnes of ore annually.

On the basis of a Scoping Study, forecast production from 2014 to 2026 is 1,134,000 gold ounces, or around 96,000 ounces annually for 12 years.

EnviroGold had previously committed to the involvement of the local minority partner Empresa Minera Papercorp S.A., but has decided not to proceed with that option after receiving recent demands for an increased profit share for transferring their Papercorp mine to a proposed joint venture.

EnviroGold said the demand was made despite the commercial arrangements and basic terms of the joint venture having been formally established.

Brian Johnson, executive chairman of EnviroGold, said “As a result of the decision to progress the Azuay project on its own, EnviroGold will gain significant flexibility in decision making and the rate of progress of development, and also increase its return on funds invested.”

The company is aiming to make a development decision in mid-2012 to expand mining operations in these mines, and to construct a process plant and associated infrastructure.

This would include tailings dams at a site 7 kilometres from the mines and 2 kilometres from a major highway and power grid.

The tight grouping of the four mines will result in efficiency in surface drilling which will commence when environmental approval is received for the San Gerardo property.

The environmental permitting process is well advanced and expected to be handed down within two months.

Exploration continues

EnviroGold is currently conducting channel sampling of high-grade structures and surveying vein sets in 1200 metres of drives within these mines, in advance of developing a computer model which will assist in positioning surface drill holes.

Mining is currently being carried out by contractors in the four mines nominated for expansion, as well as three others on the San Gerardo property, under subleases registered with the Ecuador Mines Department.

Importantly the subleases terminate concurrently with EnviroGold's exercise of the company's US$4.0 million option over the concession in November 2013.

Processing of ore is carried out offsite and the property has no environmental or social liabilities from past operations.

Highlighting the potential, historical mining in the narrow vein (0.5 metres to 1.0 metre) structures on the San Gerardo lease has consistently been in ore grading from 10g/t gold to 15g/t gold.

EnviroGold said the current channel sampling program should confirm this advice provided by mining contractors.

Scoping Study outcomes from 100% EnviroGold

Total Development Costs: US$87 million

EnviroGold Equity: US$27 million

Mining Target: 4.0 million tonnes

Project Life: 12 years

Annual Mining Rate (after 12 months ramp up): 300,000 tonnes

Head grade: 11g/t gold

Average Annual After Tax Profit (Project Life): US$41.6 million

Average Annual Cash Flow (Project Life): US$44.6 million

NPV Project (10% discount rate, USD AUD parity): US$180.3 million

Comment

EnviroGold's two major projects have an Net Present Value (NPV) in excess of $US350 million, yet a market cap. of just $A85 million. Even after factoring in risk and probabilities and the "blue sky" of the San Gerardo property, it makes current valuation look low.

With the appointment of Toronto-based Haywood Securities Inc. as sponsor of the company’s proposed dual listing on the Toronto Stock Exchange, this is likely to tap a wider base of investors in North America that will appreciate better the company's Latin American projects.

It will also likely act as a spur for Haywoods to take a line through similar, but higher valued North American emerging gold producers - acting as a catalyst for re-rating of the company.

EnviroGold will be presenting at the Proactive Investors One2One Forums - Sydney, on Wednesday the 22nd June 2011. For more information, click here.

http://www.proactiveinvestors.com.au/companies/news/17280/en…gehtwas

Tuesday, June 21, 2011 by Proactive Investors

EnviroGold (ASX: EVG) stands to benefit from the upside in the Azuay gold mining project in Ecuador, after the company elected to retain 100% of the project.

The planned expansion at the project in 2012-2013 covers four small scale underground mines within the San Gerardo lease to produce a total of 300,000 tonnes of ore annually.

On the basis of a Scoping Study, forecast production from 2014 to 2026 is 1,134,000 gold ounces, or around 96,000 ounces annually for 12 years.

EnviroGold had previously committed to the involvement of the local minority partner Empresa Minera Papercorp S.A., but has decided not to proceed with that option after receiving recent demands for an increased profit share for transferring their Papercorp mine to a proposed joint venture.

EnviroGold said the demand was made despite the commercial arrangements and basic terms of the joint venture having been formally established.

Brian Johnson, executive chairman of EnviroGold, said “As a result of the decision to progress the Azuay project on its own, EnviroGold will gain significant flexibility in decision making and the rate of progress of development, and also increase its return on funds invested.”

The company is aiming to make a development decision in mid-2012 to expand mining operations in these mines, and to construct a process plant and associated infrastructure.

This would include tailings dams at a site 7 kilometres from the mines and 2 kilometres from a major highway and power grid.

The tight grouping of the four mines will result in efficiency in surface drilling which will commence when environmental approval is received for the San Gerardo property.

The environmental permitting process is well advanced and expected to be handed down within two months.

Exploration continues

EnviroGold is currently conducting channel sampling of high-grade structures and surveying vein sets in 1200 metres of drives within these mines, in advance of developing a computer model which will assist in positioning surface drill holes.

Mining is currently being carried out by contractors in the four mines nominated for expansion, as well as three others on the San Gerardo property, under subleases registered with the Ecuador Mines Department.

Importantly the subleases terminate concurrently with EnviroGold's exercise of the company's US$4.0 million option over the concession in November 2013.

Processing of ore is carried out offsite and the property has no environmental or social liabilities from past operations.

Highlighting the potential, historical mining in the narrow vein (0.5 metres to 1.0 metre) structures on the San Gerardo lease has consistently been in ore grading from 10g/t gold to 15g/t gold.

EnviroGold said the current channel sampling program should confirm this advice provided by mining contractors.

Scoping Study outcomes from 100% EnviroGold

Total Development Costs: US$87 million

EnviroGold Equity: US$27 million

Mining Target: 4.0 million tonnes

Project Life: 12 years

Annual Mining Rate (after 12 months ramp up): 300,000 tonnes

Head grade: 11g/t gold

Average Annual After Tax Profit (Project Life): US$41.6 million

Average Annual Cash Flow (Project Life): US$44.6 million

NPV Project (10% discount rate, USD AUD parity): US$180.3 million

Comment

EnviroGold's two major projects have an Net Present Value (NPV) in excess of $US350 million, yet a market cap. of just $A85 million. Even after factoring in risk and probabilities and the "blue sky" of the San Gerardo property, it makes current valuation look low.

With the appointment of Toronto-based Haywood Securities Inc. as sponsor of the company’s proposed dual listing on the Toronto Stock Exchange, this is likely to tap a wider base of investors in North America that will appreciate better the company's Latin American projects.

It will also likely act as a spur for Haywoods to take a line through similar, but higher valued North American emerging gold producers - acting as a catalyst for re-rating of the company.

EnviroGold will be presenting at the Proactive Investors One2One Forums - Sydney, on Wednesday the 22nd June 2011. For more information, click here.

http://www.proactiveinvestors.com.au/companies/news/17280/en…gehtwas

enviro hat seine Prognosen wie folgt von März bis heute ubgedatet (potential after Tax profits):

-----------alt-------neu

2012----31,1-----38,5

2013----36,2-----38,1

2014----29,1-----61,1

2015----38,6-----64,7

gehtwas

-----------alt-------neu

2012----31,1-----38,5

2013----36,2-----38,1

2014----29,1-----61,1

2015----38,6-----64,7

gehtwas

Envirogold to retain 100% of Azuay gold mining development in Ecuador

June 22, 2011

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) has elected to develop its Azuay gold mining project in Ecuador on a 100% ownership basis.

Key points:

•EnviroGold elects to retain 100% ownership of Azuay gold mining project.

•Company proceeding with studies to expand mining production to 300,000 tpa.

•100% ownership will provide EnviroGold with significant flexibility to accelerate development.

•Company set to benefit from higher returns.

•Channel sampling of high grade veinsets underway on San Gerardo lease.

Click here to view the full announcement.

http://www.envirogold.com/userfiles/2011_06_21%20EVG%20to%20…

Furthermore, EnviroGold has released a presentation which will be used as a reference in future meetings with prospective investors.

Click here to view the presentation.

http://www.envirogold.com/userfiles/2011_06_21%20EVG%20Prese…

Schaut euch die Präsentation an. NPV/share von März bis heute von 27,2 AUD Cent auf 34,1 AUD Cent gestiegen. Das sieht meines erachtens alles sehr gut aus

gehtwas

June 22, 2011

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) has elected to develop its Azuay gold mining project in Ecuador on a 100% ownership basis.

Key points:

•EnviroGold elects to retain 100% ownership of Azuay gold mining project.

•Company proceeding with studies to expand mining production to 300,000 tpa.

•100% ownership will provide EnviroGold with significant flexibility to accelerate development.

•Company set to benefit from higher returns.

•Channel sampling of high grade veinsets underway on San Gerardo lease.

Click here to view the full announcement.

http://www.envirogold.com/userfiles/2011_06_21%20EVG%20to%20…

Furthermore, EnviroGold has released a presentation which will be used as a reference in future meetings with prospective investors.

Click here to view the presentation.

http://www.envirogold.com/userfiles/2011_06_21%20EVG%20Prese…

Schaut euch die Präsentation an. NPV/share von März bis heute von 27,2 AUD Cent auf 34,1 AUD Cent gestiegen. Das sieht meines erachtens alles sehr gut aus

gehtwas

EnviroGold $2.1m placement to develop annual 100,000 gold ounce Azuay project

EnviroGold (ASX: EVG) is undertaking a small placement to fund the ongoing pre-development of the Azuay gold project, located in Ecuador.

EnviroGold will place 15 million shares at $0.14 to a small number of existing shareholders to raise $2.1 million.

The company has also received a commitment from Moonstar Investments Pty Ltd, a trustee company associated with EnviroGold's chairman Brian Johnson, that it will progressively convert 10 million listed options at $0.15 before the 31 December 2011 expiry date.

Azuay offers a substantial potential return for EnviroGold after the company elected to retain 100% of the project.

The planned expansion at the project in 2012-2013 covers four small scale underground mines within the San Gerardo lease to produce a total of 300,000 tonnes of ore annually.

On the basis of a Scoping Study, forecast production from 2014 to 2026 is 1,134,000 gold ounces, or around 96,000 ounces annually for 12 years.

Scoping Study outcomes from 100% EnviroGold

- Total Development Costs: US$87 million

- EnviroGold Equity: US$27 million

- Mining Target: 4.0 million tonnes

- Project Life: 12 years

- Annual Mining Rate (after 12 months ramp up): 300,000 tonnes

- Head grade: 11g/t gold

- Average Annual After Tax Profit (Project Life): US$41.6 million

- Average Annual Cash Flow (Project Life): US$44.6 million

- NPV Project (10% discount rate, USD AUD parity): US$180.3 million

Comment

EnviroGold's two major projects have an Net Present Value (NPV) in excess of $US350 million, yet a market cap. of just $A85 million. Even after factoring in risk and probabilities and the "blue sky" of the San Gerardo property, it makes current valuation look low.

With the appointment of Toronto-based Haywood Securities Inc. as sponsor of the company’s proposed dual listing on the Toronto Stock Exchange, this is likely to tap a wider base of investors in North America that will appreciate better the company's Latin American projects.

It will also likely act as a spur for Haywoods to take a line through similar, but higher valued North American emerging gold producers - acting as a catalyst for re-rating of the company.

http://www.proactiveinvestors.com.au/companies/news/17621/envirogold-21m-placement-to-develop-annual-100000-gold-ounce-azuay-project-17621.html

gehtwas

EnviroGold (ASX: EVG) is undertaking a small placement to fund the ongoing pre-development of the Azuay gold project, located in Ecuador.

EnviroGold will place 15 million shares at $0.14 to a small number of existing shareholders to raise $2.1 million.

The company has also received a commitment from Moonstar Investments Pty Ltd, a trustee company associated with EnviroGold's chairman Brian Johnson, that it will progressively convert 10 million listed options at $0.15 before the 31 December 2011 expiry date.

Azuay offers a substantial potential return for EnviroGold after the company elected to retain 100% of the project.

The planned expansion at the project in 2012-2013 covers four small scale underground mines within the San Gerardo lease to produce a total of 300,000 tonnes of ore annually.

On the basis of a Scoping Study, forecast production from 2014 to 2026 is 1,134,000 gold ounces, or around 96,000 ounces annually for 12 years.

Scoping Study outcomes from 100% EnviroGold

- Total Development Costs: US$87 million

- EnviroGold Equity: US$27 million

- Mining Target: 4.0 million tonnes

- Project Life: 12 years

- Annual Mining Rate (after 12 months ramp up): 300,000 tonnes

- Head grade: 11g/t gold

- Average Annual After Tax Profit (Project Life): US$41.6 million

- Average Annual Cash Flow (Project Life): US$44.6 million

- NPV Project (10% discount rate, USD AUD parity): US$180.3 million

Comment

EnviroGold's two major projects have an Net Present Value (NPV) in excess of $US350 million, yet a market cap. of just $A85 million. Even after factoring in risk and probabilities and the "blue sky" of the San Gerardo property, it makes current valuation look low.

With the appointment of Toronto-based Haywood Securities Inc. as sponsor of the company’s proposed dual listing on the Toronto Stock Exchange, this is likely to tap a wider base of investors in North America that will appreciate better the company's Latin American projects.

It will also likely act as a spur for Haywoods to take a line through similar, but higher valued North American emerging gold producers - acting as a catalyst for re-rating of the company.

http://www.proactiveinvestors.com.au/companies/news/17621/envirogold-21m-placement-to-develop-annual-100000-gold-ounce-azuay-project-17621.html

gehtwas

Alles im plan

EnviroGold construction at Las Lagunas progressing on track with first gold pour early 2012

Monday, July 11, 2011 by John Phillips

EnviroGold (ASX: EVG) continues to move closer to the first gold pour at the Las Lagunas gold project in the Dominican Republic, with construction off the project progressing well.

The assembly of the modular oxygen plant is expected to be completed by the end of August.

Construction of the CIL/Albion processing plant is then due to be completed in December 2011, providing the first gold pour in the March quarter of 2012.

Las Lagunas is a gold tailings project wholly owned by EnviroGold .

The project will be reprocessing high grade refractory tailings from the Pueblo Viejo gold mine to produce around 65,000 gold ounces and 600,000 silver ounces annually for 6.5 years.

The Inferred JORC Resource is; 5.137 million tonnes of tailings at 3.8 grams per tonne (g/t) gold and 38.6g/t silver, for 621,000 gold ounces and 6.4 million silver ounces.

The tailings resulted from inefficient gold recovery by Government-owned Pueblo Viejo mine processing refractory ore (1992-1999) without changing installed technology (suitable only for previously mined oxide ore) - stored in purpose-built dam for later processing with appropriate technology.

Testwork at Xstrata’s Albion pilot plant in Brisbane demonstrated expected recovery of 421,000 gold ounces and 3.9 million silver ounces.

EnviroGold has provided US$36 million of project equity, with Macquarie Bank (ASX: MQG) advancing US$7.5 million for a 3% gold royalty and providing a US$37.5 million project loan (expected 18 month payback).

The forward gold sales of 30% total project production (126,000 ounces) have been effected at US$1358 per ounce less fees, with anticipated operating costs US$302 per gold ounce equivalent.

gehtwas

EnviroGold construction at Las Lagunas progressing on track with first gold pour early 2012

Monday, July 11, 2011 by John Phillips

EnviroGold (ASX: EVG) continues to move closer to the first gold pour at the Las Lagunas gold project in the Dominican Republic, with construction off the project progressing well.

The assembly of the modular oxygen plant is expected to be completed by the end of August.

Construction of the CIL/Albion processing plant is then due to be completed in December 2011, providing the first gold pour in the March quarter of 2012.

Las Lagunas is a gold tailings project wholly owned by EnviroGold .

The project will be reprocessing high grade refractory tailings from the Pueblo Viejo gold mine to produce around 65,000 gold ounces and 600,000 silver ounces annually for 6.5 years.

The Inferred JORC Resource is; 5.137 million tonnes of tailings at 3.8 grams per tonne (g/t) gold and 38.6g/t silver, for 621,000 gold ounces and 6.4 million silver ounces.

The tailings resulted from inefficient gold recovery by Government-owned Pueblo Viejo mine processing refractory ore (1992-1999) without changing installed technology (suitable only for previously mined oxide ore) - stored in purpose-built dam for later processing with appropriate technology.

Testwork at Xstrata’s Albion pilot plant in Brisbane demonstrated expected recovery of 421,000 gold ounces and 3.9 million silver ounces.

EnviroGold has provided US$36 million of project equity, with Macquarie Bank (ASX: MQG) advancing US$7.5 million for a 3% gold royalty and providing a US$37.5 million project loan (expected 18 month payback).

The forward gold sales of 30% total project production (126,000 ounces) have been effected at US$1358 per ounce less fees, with anticipated operating costs US$302 per gold ounce equivalent.

gehtwas

EnviroGold new Chinese substantial shareholder Sinom Investments

2:38 am

EnviroGold (ASX: EVG) has a new substantial shareholder in the Chinese based Sinom Investments, which now holds 29 million shares in Envirogold - or 5.4%.

The interest from Sinom in EnviroGold is no doubt due to the company moving closer to the first gold pour at the Las Lagunas gold project in the Dominican Republic.

Earlier in the month EnviroGold announced at the project that the assembly of the modular oxygen plant is expected to be completed by the end of August.

Construction of the CIL/Albion processing plant is then due to be completed in December 2011, providing the first gold pour in the March quarter of 2012.

Las Lagunas is a gold tailings project wholly owned by EnviroGold.

The project will be reprocessing high grade refractory tailings from the Pueblo Viejo gold mine to produce around 65,000 gold ounces and 600,000 silver ounces annually for 6.5 years.

The Inferred JORC Resource is; 5.137 million tonnes of tailings at 3.8 grams per tonne (g/t) gold and 38.6g/t silver, for 621,000 gold ounces and 6.4 million silver ounces.

The tailings resulted from inefficient gold recovery by Government-owned Pueblo Viejo mine processing refractory ore (1992-1999) without changing installed technology (suitable only for previously mined oxide ore) - stored in purpose-built dam for later processing with appropriate technology.

EnviroGold has provided US$36 million of project equity, with Macquarie Bank (ASX: MQG) advancing US$7.5 million for a 3% gold royalty and providing a US$37.5 million project loan (expected 18 month payback).

The forward gold sales of 30% total project production (126,000 ounces) have been effected at US$1358 per ounce less fees, with anticipated operating costs US$302 per gold ounce equivalent.

http://www.proactiveinvestors.co.uk/companies/news/31088/env…

gehtwas

2:38 am

EnviroGold (ASX: EVG) has a new substantial shareholder in the Chinese based Sinom Investments, which now holds 29 million shares in Envirogold - or 5.4%.

The interest from Sinom in EnviroGold is no doubt due to the company moving closer to the first gold pour at the Las Lagunas gold project in the Dominican Republic.

Earlier in the month EnviroGold announced at the project that the assembly of the modular oxygen plant is expected to be completed by the end of August.

Construction of the CIL/Albion processing plant is then due to be completed in December 2011, providing the first gold pour in the March quarter of 2012.

Las Lagunas is a gold tailings project wholly owned by EnviroGold.

The project will be reprocessing high grade refractory tailings from the Pueblo Viejo gold mine to produce around 65,000 gold ounces and 600,000 silver ounces annually for 6.5 years.

The Inferred JORC Resource is; 5.137 million tonnes of tailings at 3.8 grams per tonne (g/t) gold and 38.6g/t silver, for 621,000 gold ounces and 6.4 million silver ounces.

The tailings resulted from inefficient gold recovery by Government-owned Pueblo Viejo mine processing refractory ore (1992-1999) without changing installed technology (suitable only for previously mined oxide ore) - stored in purpose-built dam for later processing with appropriate technology.

EnviroGold has provided US$36 million of project equity, with Macquarie Bank (ASX: MQG) advancing US$7.5 million for a 3% gold royalty and providing a US$37.5 million project loan (expected 18 month payback).

The forward gold sales of 30% total project production (126,000 ounces) have been effected at US$1358 per ounce less fees, with anticipated operating costs US$302 per gold ounce equivalent.

http://www.proactiveinvestors.co.uk/companies/news/31088/env…

gehtwas

Envirogold updates financial forecasts for Las Lagunas gold tailings project, Dominican Republic

Wednesday , 27 Jul 2011

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) (EnviroGold or the "Company") has updated financial forecasts for its Las Lagunas tailings retreatment project in the Dominican Republic as it approaches production of gold and silver early next year.

It is now probable total capital costs for the development will increase by approximately US$1.0 million to US$82.0 million due primarily to increased construction management and financing costs, and unexpectedly high legal costs of the project's financier which are passed on to the Company.

EnviroGold will meet the cost overrun in addition to the US$36.0 million equity it has already contributed.

The project is fully funded with finance provided by Macquarie Bank in the form of a US$7.5 million advance against a 3% gold royalty, and a US$37.5 million project loan. The Company also has access to an undrawn US$5 million facility from Ban Reservas, a Dominican Government owned Bank.

The project economics are not capital sensitive and have been revised to incorporate reduced power costs which are indexed to falling US LNG prices, other reduced costs of consumables, increased cyanide costs, and a corporate tax rate increased last month by the Dominican Government from 25% to 29%.

Overall, total forecast after tax profits for the 6.5 year project have decreased by 5% to US$202 million based on an assumed average gold price of US$1250 per ounce.

Key statistics and assumptions for the project are set out in the attached Investor Presentation document dated 26 July 2011.

Shareholders will note that the latest Presentation reflects a lesser future emphasis on EnviroGold's utilisation of the Albion oxidation process, and more on the Company's Azuay mining project in Ecuador, and its exploration prospects in the Dominican Republic and Ecuador.

EnviroGold is broadening its horizons as it transitions to a traditional mining group and in the future will place significantly less reliance on the Albion process to grow the Company.

It is probable that EnviroGold will seek Shareholders' approval in the near future to change its name to better reflect its expanded objectives.

Mr Brian Johnson, Executive Chairman of the Company, said "the EnviroGold name was originally chosen to link the Albion process and its environmental benefits when treating refractory ore, during negotiations with owners of prospective projects and Government environmental authorities".

"However, with the Company about to commence an active exploration program of copper/gold and copper/gold/molybdenum prospects, where the product, if mined, would be in the form of a concentrate, the Albion/EnviroGold connection is no longer valid".

The Presentation also sets out anticipated free cash flow from the Las Lagunas project which will only be approximately US$16 million in 2012 due to lower gold sales during production ramp-up, costs of stockpiling tailings which must be built up early in the project, and a commitment to pay the project lenders 50% of cash surplus generated in addition to scheduled repayments.

In 2013 free cash flow is expected to be in the order of US$52 million. (war 38,1), siehe mein Beirtag vom 22.06

The project loan should be repaid in approximately 18 months from the start of production, or sooner if current gold and silver prices persist.

Mr Johnson also said, "the development of the Azuay project in Ecuador would be the Company's primary focus next year, together with drilling of the La Yagua prospect in the Dominican Republic and San Gerardo in Ecuador. Cash generated from the Las Lagunas roject should fund the exploration program and the US$22 million equity required for the Azuay project in 2012-13", Mr Johnson also said

Fazit:

- Wird ein bißchen teurer, ist aber finanziert.

- Das Geld aus las Lagunas finanziert Folgeprojekte (Hier wird zum erstem Mal auch La Yagua (JV mit Novus Gold) erwähnt, was gleich ums Eck liegt.

- Dem Entschluss der Namensänderung entnehme ich dass die jetzt richtig Gas geben wollen. Die Strategie gefällt mir sehr gut. Ich bin sehr zuversichtlich

gehtwas

Wednesday , 27 Jul 2011

Australian-based mineral resources company, EnviroGold Limited (ASX: EVG) (EnviroGold or the "Company") has updated financial forecasts for its Las Lagunas tailings retreatment project in the Dominican Republic as it approaches production of gold and silver early next year.

It is now probable total capital costs for the development will increase by approximately US$1.0 million to US$82.0 million due primarily to increased construction management and financing costs, and unexpectedly high legal costs of the project's financier which are passed on to the Company.

EnviroGold will meet the cost overrun in addition to the US$36.0 million equity it has already contributed.

The project is fully funded with finance provided by Macquarie Bank in the form of a US$7.5 million advance against a 3% gold royalty, and a US$37.5 million project loan. The Company also has access to an undrawn US$5 million facility from Ban Reservas, a Dominican Government owned Bank.

The project economics are not capital sensitive and have been revised to incorporate reduced power costs which are indexed to falling US LNG prices, other reduced costs of consumables, increased cyanide costs, and a corporate tax rate increased last month by the Dominican Government from 25% to 29%.

Overall, total forecast after tax profits for the 6.5 year project have decreased by 5% to US$202 million based on an assumed average gold price of US$1250 per ounce.

Key statistics and assumptions for the project are set out in the attached Investor Presentation document dated 26 July 2011.

Shareholders will note that the latest Presentation reflects a lesser future emphasis on EnviroGold's utilisation of the Albion oxidation process, and more on the Company's Azuay mining project in Ecuador, and its exploration prospects in the Dominican Republic and Ecuador.

EnviroGold is broadening its horizons as it transitions to a traditional mining group and in the future will place significantly less reliance on the Albion process to grow the Company.

It is probable that EnviroGold will seek Shareholders' approval in the near future to change its name to better reflect its expanded objectives.

Mr Brian Johnson, Executive Chairman of the Company, said "the EnviroGold name was originally chosen to link the Albion process and its environmental benefits when treating refractory ore, during negotiations with owners of prospective projects and Government environmental authorities".

"However, with the Company about to commence an active exploration program of copper/gold and copper/gold/molybdenum prospects, where the product, if mined, would be in the form of a concentrate, the Albion/EnviroGold connection is no longer valid".

The Presentation also sets out anticipated free cash flow from the Las Lagunas project which will only be approximately US$16 million in 2012 due to lower gold sales during production ramp-up, costs of stockpiling tailings which must be built up early in the project, and a commitment to pay the project lenders 50% of cash surplus generated in addition to scheduled repayments.

In 2013 free cash flow is expected to be in the order of US$52 million. (war 38,1), siehe mein Beirtag vom 22.06

The project loan should be repaid in approximately 18 months from the start of production, or sooner if current gold and silver prices persist.

Mr Johnson also said, "the development of the Azuay project in Ecuador would be the Company's primary focus next year, together with drilling of the La Yagua prospect in the Dominican Republic and San Gerardo in Ecuador. Cash generated from the Las Lagunas roject should fund the exploration program and the US$22 million equity required for the Azuay project in 2012-13", Mr Johnson also said

Fazit:

- Wird ein bißchen teurer, ist aber finanziert.

- Das Geld aus las Lagunas finanziert Folgeprojekte (Hier wird zum erstem Mal auch La Yagua (JV mit Novus Gold) erwähnt, was gleich ums Eck liegt.

- Dem Entschluss der Namensänderung entnehme ich dass die jetzt richtig Gas geben wollen. Die Strategie gefällt mir sehr gut. Ich bin sehr zuversichtlich

gehtwas

Da ich heute morgen mit meinem Beitrag so viel Interesse geweckt habe, gleich noch mal einer hinterher.

Ich denke ich lege mir noch ein paar Novus zu. Da kommt man jetzt billig ran.

EnviroGold adds exploration potential for copper gold with Novus Gold agreement in Dominican Republic

EnviroGold (ASX: EVG) has entered an agreement enabling the company to explore the highly prospective La Yagua and La Paciencia concessions in the Dominican Republic, where a previous grab sample included grades of 18% copper, 13 grams per tonne (g/t) gold and 29g/t silver.

Clearly, if the sample is anything to go by, as well as the property off axis to known mineralizing belts that host deposits such as the Pueblo Viejo gold deposit being developed by Barrick Gold (NYSE: ABX ), there is significant exploration upside for EnviroGold.

If any gold deposits are discovered on the La Paciencia concession, which are likely to be in refractory ore they could be processed through EnviroGold's Las Lagunas plant.

The copper/gold concessions are located in close proximity to EnviroGold's Las Lagunas gold tailings project which has an expected life of about seven years at an annual production rate of 65,000 ounces gold and 600,000 ounces silver, and is expected to commence production in early 2011.

The shareholders agreement with Novus Gold Corporation (TSXV: NOV) will allow EnviroGold to subscribe for up to a 50% shareholding in Invercropolis SA, the Novus subsidiary which holds the La Yagua and La Paciencia concessions.

EnviroGold has the option to subscribe for US$10 million Invercropolis shares up to 30 June 2014 to establish the 50% shareholding.

EnviroGold has exercised its option to subscribe for an initial US$3.0 million of share capital, of which US$250,000 will be advanced by 31 July 2011, US$500,000 by 31 October 2011, US$750,000 by 31 January 2012 and US$1,500,000 by 30 June 2012.

Funds provided by EnviroGold will be used on exploration focusing on drilling copper/gold/silver targets on the La Yagua property, which is a 9,900 hectare mining concession located 40 kilometres northwest of Santo Domingo, the capital of the Dominican Republic.

Brian Johnson, EnviroGold's executive chairman, said that “the company would become an active explorer in the Dominican Republic, which is highly prospective for gold and copper, and would add a number of concessions to the La Yagua and La Paciencia properties including the wholly-owned 10,000 hectare Bahoruco copper/gold prospect which was applied for in February 2011.

“The country has great geological potential, is politically stable, with good infrastructure and an excellent workforce."

Known mineralising belts in the region host the Pueblo Viejo gold deposit being developed by Barrick, and the Cerro de Maimon mine recently purchased by Perilya (ASX: PEM).

Exploration programs carried out on the La Yagua property have identified significant base/precious metal mineralisation in five follow-up exploration targets.

High grade copper/gold/silver mineralized zones have been discovered in one particular target which is six kilometres long and open for expansion.

Mineralisation of the target is stratabound Volcanogenic Massive Sulfide (VMS) type as is the Cerro de Maimon mine, 19 kilometres to the northwest. The target should be drill ready in the fourth quarter.

The La Paciencia mining concession covers 8,600 hectares located 10 kilometres west of the Pueblo Viejo gold deposit reported to host over 25 million ounces of gold, and underlain by the same geology.

Exploration in 2011-12 will focus on drilling targets outlined by soil sampling, prospecting and geophysics.

EnviroGold has granted Invercropolis an option to purchase the Las Lagunas plant on completion of the Las Lagunas project at independent value but not less than US$30 million, subject to EnviroGold holding a minimum 50% interest in Invercropolis.

Novus will manage the exploration stage of Invercropolis development and EnviroGold will manage any resultant projects.

EnviroGold may increase its shareholding in Invercropolis to 60% between 1 January and 31 December 2015 by purchasing a 10% shareholding from Novus for US$10 million.

Meanwhile, EnviroGold has updated financial forecasts for its Las Lagunas tailings retreatment project.

Total capital costs for the development are expected to increase by about US$1.0 million to US$82.0 million as a result of increased construction management and financing costs, and unexpectedly high legal costs of the project’s financier which are passed on to the company.

EnviroGold said it will meet the cost overrun in addition to the US$36.0 million equity it has already contributed.

The project is fully funded by Macquarie Bank with a US$7.5 million advance against a 3% gold royalty, and a US$37.5 million project loan.

The company also has access to an undrawn US$5 million facility from Ban Reservas, a Dominican Government owned Bank.

Envirogold said the project economics are not capital sensitive and have been revised to incorporate reduced power costs which are indexed to falling US LNG prices, other reduced costs of consumables, increased cyanide costs, and a corporate tax rate increased last month by the Dominican Government from 25% to 29%.

Total forecast after tax profits for the 6.5 year project have decreased by 5% to US$202 million based on an assumed average gold price of US$1250 per ounce.

With the company about to commence an active exploration program of copper/gold and copper/gold/molybdenum prospects, the company is considering change a name change to better reflect its expanded objectives.

In 2013 free cash flow is expected to be in the order of US$52 million. The project loan should be repaid in approximately 18 months from the start of production, or sooner if current gold and silver prices persist.

The development of the Azuay project in Ecuador will be the company’s primary focus in 2012, together with drilling of the La Yagua prospect in the Dominican Republic and San Gerardo in Ecuador.

Cash generated from the Las Lagunas project should fund the exploration program and the US$22 million equity required for the Azuay project in 2012-13.

gehtwas

Ich denke ich lege mir noch ein paar Novus zu. Da kommt man jetzt billig ran.

EnviroGold adds exploration potential for copper gold with Novus Gold agreement in Dominican Republic

EnviroGold (ASX: EVG) has entered an agreement enabling the company to explore the highly prospective La Yagua and La Paciencia concessions in the Dominican Republic, where a previous grab sample included grades of 18% copper, 13 grams per tonne (g/t) gold and 29g/t silver.

Clearly, if the sample is anything to go by, as well as the property off axis to known mineralizing belts that host deposits such as the Pueblo Viejo gold deposit being developed by Barrick Gold (NYSE: ABX ), there is significant exploration upside for EnviroGold.

If any gold deposits are discovered on the La Paciencia concession, which are likely to be in refractory ore they could be processed through EnviroGold's Las Lagunas plant.

The copper/gold concessions are located in close proximity to EnviroGold's Las Lagunas gold tailings project which has an expected life of about seven years at an annual production rate of 65,000 ounces gold and 600,000 ounces silver, and is expected to commence production in early 2011.

The shareholders agreement with Novus Gold Corporation (TSXV: NOV) will allow EnviroGold to subscribe for up to a 50% shareholding in Invercropolis SA, the Novus subsidiary which holds the La Yagua and La Paciencia concessions.

EnviroGold has the option to subscribe for US$10 million Invercropolis shares up to 30 June 2014 to establish the 50% shareholding.

EnviroGold has exercised its option to subscribe for an initial US$3.0 million of share capital, of which US$250,000 will be advanced by 31 July 2011, US$500,000 by 31 October 2011, US$750,000 by 31 January 2012 and US$1,500,000 by 30 June 2012.

Funds provided by EnviroGold will be used on exploration focusing on drilling copper/gold/silver targets on the La Yagua property, which is a 9,900 hectare mining concession located 40 kilometres northwest of Santo Domingo, the capital of the Dominican Republic.

Brian Johnson, EnviroGold's executive chairman, said that “the company would become an active explorer in the Dominican Republic, which is highly prospective for gold and copper, and would add a number of concessions to the La Yagua and La Paciencia properties including the wholly-owned 10,000 hectare Bahoruco copper/gold prospect which was applied for in February 2011.

“The country has great geological potential, is politically stable, with good infrastructure and an excellent workforce."

Known mineralising belts in the region host the Pueblo Viejo gold deposit being developed by Barrick, and the Cerro de Maimon mine recently purchased by Perilya (ASX: PEM).

Exploration programs carried out on the La Yagua property have identified significant base/precious metal mineralisation in five follow-up exploration targets.

High grade copper/gold/silver mineralized zones have been discovered in one particular target which is six kilometres long and open for expansion.

Mineralisation of the target is stratabound Volcanogenic Massive Sulfide (VMS) type as is the Cerro de Maimon mine, 19 kilometres to the northwest. The target should be drill ready in the fourth quarter.

The La Paciencia mining concession covers 8,600 hectares located 10 kilometres west of the Pueblo Viejo gold deposit reported to host over 25 million ounces of gold, and underlain by the same geology.

Exploration in 2011-12 will focus on drilling targets outlined by soil sampling, prospecting and geophysics.

EnviroGold has granted Invercropolis an option to purchase the Las Lagunas plant on completion of the Las Lagunas project at independent value but not less than US$30 million, subject to EnviroGold holding a minimum 50% interest in Invercropolis.

Novus will manage the exploration stage of Invercropolis development and EnviroGold will manage any resultant projects.

EnviroGold may increase its shareholding in Invercropolis to 60% between 1 January and 31 December 2015 by purchasing a 10% shareholding from Novus for US$10 million.

Meanwhile, EnviroGold has updated financial forecasts for its Las Lagunas tailings retreatment project.

Total capital costs for the development are expected to increase by about US$1.0 million to US$82.0 million as a result of increased construction management and financing costs, and unexpectedly high legal costs of the project’s financier which are passed on to the company.

EnviroGold said it will meet the cost overrun in addition to the US$36.0 million equity it has already contributed.

The project is fully funded by Macquarie Bank with a US$7.5 million advance against a 3% gold royalty, and a US$37.5 million project loan.

The company also has access to an undrawn US$5 million facility from Ban Reservas, a Dominican Government owned Bank.

Envirogold said the project economics are not capital sensitive and have been revised to incorporate reduced power costs which are indexed to falling US LNG prices, other reduced costs of consumables, increased cyanide costs, and a corporate tax rate increased last month by the Dominican Government from 25% to 29%.

Total forecast after tax profits for the 6.5 year project have decreased by 5% to US$202 million based on an assumed average gold price of US$1250 per ounce.

With the company about to commence an active exploration program of copper/gold and copper/gold/molybdenum prospects, the company is considering change a name change to better reflect its expanded objectives.

In 2013 free cash flow is expected to be in the order of US$52 million. The project loan should be repaid in approximately 18 months from the start of production, or sooner if current gold and silver prices persist.

The development of the Azuay project in Ecuador will be the company’s primary focus in 2012, together with drilling of the La Yagua prospect in the Dominican Republic and San Gerardo in Ecuador.

Cash generated from the Las Lagunas project should fund the exploration program and the US$22 million equity required for the Azuay project in 2012-13.

gehtwas

So,

ich habe mir dann gestern gleich noch 24K Novus gekauft.

Sollte das was werden in La Yagua, ist das der billigste Weg an diesem Projekt zu partizipieren.

Immerhin hat Enviro für seine 50% 0,32 CAD bezahlt und ich nur 10,5 .

.

gehtwas

ich habe mir dann gestern gleich noch 24K Novus gekauft.

Sollte das was werden in La Yagua, ist das der billigste Weg an diesem Projekt zu partizipieren.

Immerhin hat Enviro für seine 50% 0,32 CAD bezahlt und ich nur 10,5

.

.gehtwas

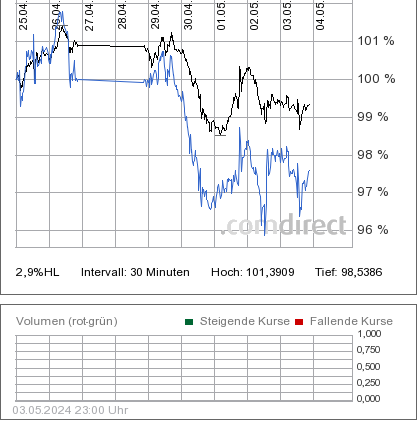

Antwort auf Beitrag Nr.: 41.859.810 von gehtwas am 28.07.11 16:15:53Novus Gold Corp. Registered Shares o.N.

28.07.11 21:52 Uhr

0,145 CAD

+45,00% [0,045]

28.07.11 21:52 Uhr

0,145 CAD

+45,00% [0,045]

Und noch mal das ganze mit Hinweis auf das La Yagua Projekt...

EnviroGold adds exploration potential for copper gold with Novus Gold agreement in Dominican Republic

EnviroGold has entered an agreement enabling the company to explore the highly prospective La Yagua and La Paciencia concessions in the Dominican Republic where a previous grab sample included grades of 18% copper, 13 grams per tonne gold and 29 grams per tonne silver.

Clearly, if the sample is anything to go by as well as the property off axis to known mineralizing belts that host deposits such as the Pueblo Viejo gold deposit being developed by Barrick Gold there is significant exploration upside for EnviroGold. If any gold deposits are discovered on the La Paciencia concession which is likely to be in refractory ore they could be processed through EnviroGold's Las Lagunas plant.

The copper and gold concessions are located in close proximity to EnviroGold's Las Lagunas gold tailings project which has an expected life of about 7 years at an annual production rate of 65,000 ounces gold and 600,000 ounces silver and is expected to commence production in early 2011.

The shareholders agreement with Novus Gold Corporation will allow EnviroGold to subscribe for up to 50% shareholding in Invercropolis SA, the Novus subsidiary which holds the La Yagua and La Paciencia concessions. EnviroGold has the option to subscribe for USD 10 million Invercropolis shares up to June 30th 2014 to establish the 50% shareholding.

EnviroGold has exercised its option to subscribe for an initial USD 3.0 million of share capital of which USD 250,000 will be advanced by July 31st 2011 USD 500,000 by October 31st 2011, USD 750,000 by January 31st 2012 and USD 1,500,000 by June 30th 2012.

Funds provided by EnviroGold will be used on exploration focusing on drilling copper, gold and silver targets on the La Yagua property which is 9,900 hectare mining concession located 40 kilometers northwest of Santo Domingo, the capital of the Dominican Republic.

Mr Brian Johnson executive chairman of EnviroGold said that “The company would become an active explorer in the Dominican Republic which is highly prospective for gold and copper and would add a number of concessions to the La Yagua and La Paciencia properties including the wholly owned 10,000 hectare Bahoruco copper and gold prospect which was applied for in February 2011. The country has great geological potential is politically stable with good infrastructure and an excellent workforce."

(Sourced from www.proactiveinvestors.com.au)

http://www.steelguru.com/metals_news/EnviroGold_adds_explora…

gehtwas

EnviroGold adds exploration potential for copper gold with Novus Gold agreement in Dominican Republic

EnviroGold has entered an agreement enabling the company to explore the highly prospective La Yagua and La Paciencia concessions in the Dominican Republic where a previous grab sample included grades of 18% copper, 13 grams per tonne gold and 29 grams per tonne silver.

Clearly, if the sample is anything to go by as well as the property off axis to known mineralizing belts that host deposits such as the Pueblo Viejo gold deposit being developed by Barrick Gold there is significant exploration upside for EnviroGold. If any gold deposits are discovered on the La Paciencia concession which is likely to be in refractory ore they could be processed through EnviroGold's Las Lagunas plant.

The copper and gold concessions are located in close proximity to EnviroGold's Las Lagunas gold tailings project which has an expected life of about 7 years at an annual production rate of 65,000 ounces gold and 600,000 ounces silver and is expected to commence production in early 2011.

The shareholders agreement with Novus Gold Corporation will allow EnviroGold to subscribe for up to 50% shareholding in Invercropolis SA, the Novus subsidiary which holds the La Yagua and La Paciencia concessions. EnviroGold has the option to subscribe for USD 10 million Invercropolis shares up to June 30th 2014 to establish the 50% shareholding.

EnviroGold has exercised its option to subscribe for an initial USD 3.0 million of share capital of which USD 250,000 will be advanced by July 31st 2011 USD 500,000 by October 31st 2011, USD 750,000 by January 31st 2012 and USD 1,500,000 by June 30th 2012.