Noble Group Ltd. - Die letzten 30 Beiträge

eröffnet am 14.08.15 16:37:27 von

neuester Beitrag 10.08.23 13:10:52 von

neuester Beitrag 10.08.23 13:10:52 von

Beiträge: 51

ID: 1.217.163

ID: 1.217.163

Aufrufe heute: 0

Gesamt: 5.990

Gesamt: 5.990

Aktive User: 0

ISIN: BMG6542T1505 · WKN: A2DQQG

0,0400

EUR

-2,44 %

-0,0010 EUR

Letzter Kurs 16.11.18 Frankfurt

Werte aus der Branche Industrie/Mischkonzerne

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7459 | +41,19 | |

| 1,7000 | +16,44 | |

| 18,020 | +15,51 | |

| 9,1000 | +10,98 | |

| 14,000 | +10,24 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 289,00 | -5,73 | |

| 150,50 | -6,23 | |

| 37,00 | -7,04 | |

| 30,80 | -7,23 | |

| 2,2000 | -11,29 |

Beitrag zu dieser Diskussion schreiben

10.8.2023

Founder of Failed Commodity Trader Noble Sues Over Restructuring

https://news.bloomberglaw.com/securities-law/founder-of-fail…

Elman argues that deal was unfair to minority shareholders

Legal action in Hong Kong seeks disclosure of documents

...

Founder of Failed Commodity Trader Noble Sues Over Restructuring

https://news.bloomberglaw.com/securities-law/founder-of-fail…

Elman argues that deal was unfair to minority shareholders

Legal action in Hong Kong seeks disclosure of documents

...

31.5.

Embattled Noble Group Can’t Repay Remaining Bond on Time

https://www.bnnbloomberg.ca/embattled-noble-group-can-t-repa…

...

Noble Group Holdings Ltd., once Asia’s largest commodity trader before being hit by years of losses and collapsing into a restructuring, is seeking to defer repaying its last remaining bond that comes due next month.

The company has struggled since emerging from a multibillion-dollar debt restructuring in 2018, and earlier this year handed ownership of its trading unit to bondholders. Now it’s in talks to defer repayment of its so-called Asset Co.’s bond, as it won’t be able to sell its assets before the note comes due next month, according to a filing from a UK-based subsidiary.

“Asset Co. lacks an ability to repay the bond on its maturity in June 2022,” according to the annual report of the subsidiary, General Alumina Holdings Ltd., which is dated April 29. “As a result, management of Asset Co. is in constructive negotiations with bondholders to defer the maturity date of the bond for at least two years.”

In a statement to Bloomberg, the company said “it is not a secret that Noble Group Holdings Ltd. is in constructive discussions with holders of the 2022 notes to extend the term, which is why it’s stated in the GAJ annual report.”

...

Following the restructuring of two bonds tied to its trading unit earlier this year, parent Noble Group Holdings owns just two assets: a majority stake in Jamaican alumina refinery Jamalco, and an indirect 8.3% shareholding in Harbour Energy Plc.

Production at Jamalco has been halted since a fire caused major damage in August. And because the stake in Harbour Energy is held through an investment partnership with private equity group EIG Partners, that has limited Noble’s ability to sell it.

They’re the last remaining pieces of the once Singapore-listed Noble in which its former shareholders own a stake. Some Singaporean shareholders lost their savings in when the company collapsed in 2018.

In the annual report, General Alumina Holdings said that a “limited availability of cash” and “inability to monetize its assets until the repayment date of the bond” explained the need to defer repayment of the Asset Co. bond.

“In the case of unsuccessful negotiations with the bondholders, Asset Co. will incur a breach of non-payment, which could then lead to passing of control of Asset Co. to the bondholders,” it said.

...

Embattled Noble Group Can’t Repay Remaining Bond on Time

https://www.bnnbloomberg.ca/embattled-noble-group-can-t-repa…

...

Noble Group Holdings Ltd., once Asia’s largest commodity trader before being hit by years of losses and collapsing into a restructuring, is seeking to defer repaying its last remaining bond that comes due next month.

The company has struggled since emerging from a multibillion-dollar debt restructuring in 2018, and earlier this year handed ownership of its trading unit to bondholders. Now it’s in talks to defer repayment of its so-called Asset Co.’s bond, as it won’t be able to sell its assets before the note comes due next month, according to a filing from a UK-based subsidiary.

“Asset Co. lacks an ability to repay the bond on its maturity in June 2022,” according to the annual report of the subsidiary, General Alumina Holdings Ltd., which is dated April 29. “As a result, management of Asset Co. is in constructive negotiations with bondholders to defer the maturity date of the bond for at least two years.”

In a statement to Bloomberg, the company said “it is not a secret that Noble Group Holdings Ltd. is in constructive discussions with holders of the 2022 notes to extend the term, which is why it’s stated in the GAJ annual report.”

...

Following the restructuring of two bonds tied to its trading unit earlier this year, parent Noble Group Holdings owns just two assets: a majority stake in Jamaican alumina refinery Jamalco, and an indirect 8.3% shareholding in Harbour Energy Plc.

Production at Jamalco has been halted since a fire caused major damage in August. And because the stake in Harbour Energy is held through an investment partnership with private equity group EIG Partners, that has limited Noble’s ability to sell it.

They’re the last remaining pieces of the once Singapore-listed Noble in which its former shareholders own a stake. Some Singaporean shareholders lost their savings in when the company collapsed in 2018.

In the annual report, General Alumina Holdings said that a “limited availability of cash” and “inability to monetize its assets until the repayment date of the bond” explained the need to defer repayment of the Asset Co. bond.

“In the case of unsuccessful negotiations with the bondholders, Asset Co. will incur a breach of non-payment, which could then lead to passing of control of Asset Co. to the bondholders,” it said.

...

Hey faultcode,

betrifft das den Alt-Aktionäre überhaupt noch? Die Aktie ist doch mausetot, oder?

betrifft das den Alt-Aktionäre überhaupt noch? Die Aktie ist doch mausetot, oder?

17.12.2021

The Latest Twist in Its Epic Collapse Is Noble Group’s Second Restructure in Three Years

https://finance.yahoo.com/news/latest-twist-epic-collapse-no…

...

The epic downfall of what was once Asia’s largest commodity trader took another turn, with Noble Group Holdings Ltd. laying out plans for its second restructuring in three years.

The company said Friday it had reached an in-principle agreement with creditors and will reorganize the ownership of some assets after its debt reached an “unsustainable” level. The process will see its debt fall to about $500 million from about $1.5 billion now.

Formerly a behemoth of Asia’s commodity trading landscape, with a market value of more than $10 billion, Noble has collapsed into a shell of its former self amid accusations of improper accounting -- which the company denies -- and billions of dollars in losses. The trader undertook a multibillion-dollar debt restructuring in 2018 which converted much of its debt to equity and handed control to a group of hedge fund creditors led by Taconic Capital Advisors.

The latest restructuring is expected to be completed by March 31. Bloomberg News previously reported the plan.

A cloud has hung over Noble for the past three years amid a probe by a trio of Singaporean authorities into whether the company made false accounting declarations. The investigation -- announced in late 2018 and just days before its previous reorganization was due to be completed -- saw the city-state refuse to have the new entity relist.

A company spokesman on Friday confirmed that the Singaporean probe was ongoing.

The fresh reorganization will see Noble’s so-called TradingCo cease to be a part of the parent and form a new “segregated” business, it said. An interest payment on the trading arm’s 2023 notes that was due Monday will be deferred to Jan. 25. The company will make further announcements about the 2022 notes that mature on June 20.

Noble also said it will exit freight and liquefied natural gas. A presentation released alongside the announcement underlined the company’s shrinking ambitions, outlining plans for the trading group to concentrate on energy and raw materials in Asia, be lower risk and focus on returns. Previously Noble had highlighted its role as diversified, risk-seeking and growth-focused.

The company has already implemented organizational changes and isn’t planning further headcount reductions in 2022, the spokesman said.

Friday’s announcement comes as the company struggles to turn a profit, with Noble reporting a $72 million loss in the nine months ended Sept. 30. One of its key assets, an alumina refinery in Jamaica, was seriously damaged by a fire in August and isn’t due to restart production until the middle of 2022.

The company has also seen the departure of a series of executives, including former chairman James Dubow last week.

...

The Latest Twist in Its Epic Collapse Is Noble Group’s Second Restructure in Three Years

https://finance.yahoo.com/news/latest-twist-epic-collapse-no…

...

The epic downfall of what was once Asia’s largest commodity trader took another turn, with Noble Group Holdings Ltd. laying out plans for its second restructuring in three years.

The company said Friday it had reached an in-principle agreement with creditors and will reorganize the ownership of some assets after its debt reached an “unsustainable” level. The process will see its debt fall to about $500 million from about $1.5 billion now.

Formerly a behemoth of Asia’s commodity trading landscape, with a market value of more than $10 billion, Noble has collapsed into a shell of its former self amid accusations of improper accounting -- which the company denies -- and billions of dollars in losses. The trader undertook a multibillion-dollar debt restructuring in 2018 which converted much of its debt to equity and handed control to a group of hedge fund creditors led by Taconic Capital Advisors.

The latest restructuring is expected to be completed by March 31. Bloomberg News previously reported the plan.

A cloud has hung over Noble for the past three years amid a probe by a trio of Singaporean authorities into whether the company made false accounting declarations. The investigation -- announced in late 2018 and just days before its previous reorganization was due to be completed -- saw the city-state refuse to have the new entity relist.

A company spokesman on Friday confirmed that the Singaporean probe was ongoing.

The fresh reorganization will see Noble’s so-called TradingCo cease to be a part of the parent and form a new “segregated” business, it said. An interest payment on the trading arm’s 2023 notes that was due Monday will be deferred to Jan. 25. The company will make further announcements about the 2022 notes that mature on June 20.

Noble also said it will exit freight and liquefied natural gas. A presentation released alongside the announcement underlined the company’s shrinking ambitions, outlining plans for the trading group to concentrate on energy and raw materials in Asia, be lower risk and focus on returns. Previously Noble had highlighted its role as diversified, risk-seeking and growth-focused.

The company has already implemented organizational changes and isn’t planning further headcount reductions in 2022, the spokesman said.

Friday’s announcement comes as the company struggles to turn a profit, with Noble reporting a $72 million loss in the nine months ended Sept. 30. One of its key assets, an alumina refinery in Jamaica, was seriously damaged by a fire in August and isn’t due to restart production until the middle of 2022.

The company has also seen the departure of a series of executives, including former chairman James Dubow last week.

...

Moin,

im Zuge meines Depot-Ausmistens zum Jahresende bin ich auf meinen Noble-Schrott gestoßen.

Da ich natürlich gerne zumindest einen Verlustvortrag realisieren möchte, würde ich die Teile gern verkaufen. Das ist aber momentan nicht möglich.

Dem bis zum Juni 2020 bestehenden Umtauschangebot von 1:10 für alte zu neuen Noble bin ich nicht explizit nachgekommen, da ich keine Benachrichtigung von meiner Bank erhalten hatte.

Kann ich davon ausgehen, dass der Umtausch automatisch von der Clearingstelle in Singapur veranlasst wurde und ich dann irgendwann in 2021 neue Noble-Aktien eingebucht bekomme?

Thx für Hinweise

im Zuge meines Depot-Ausmistens zum Jahresende bin ich auf meinen Noble-Schrott gestoßen.

Da ich natürlich gerne zumindest einen Verlustvortrag realisieren möchte, würde ich die Teile gern verkaufen. Das ist aber momentan nicht möglich.

Dem bis zum Juni 2020 bestehenden Umtauschangebot von 1:10 für alte zu neuen Noble bin ich nicht explizit nachgekommen, da ich keine Benachrichtigung von meiner Bank erhalten hatte.

Kann ich davon ausgehen, dass der Umtausch automatisch von der Clearingstelle in Singapur veranlasst wurde und ich dann irgendwann in 2021 neue Noble-Aktien eingebucht bekomme?

Thx für Hinweise

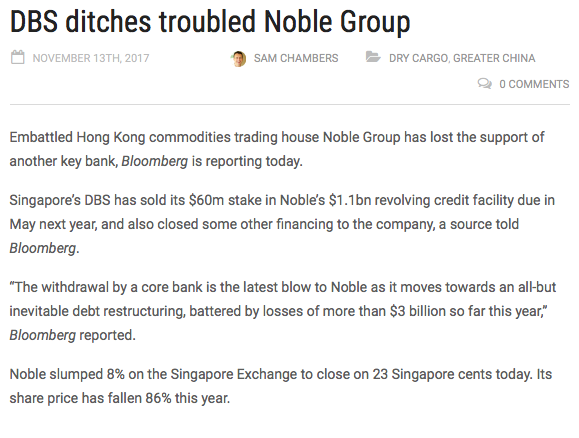

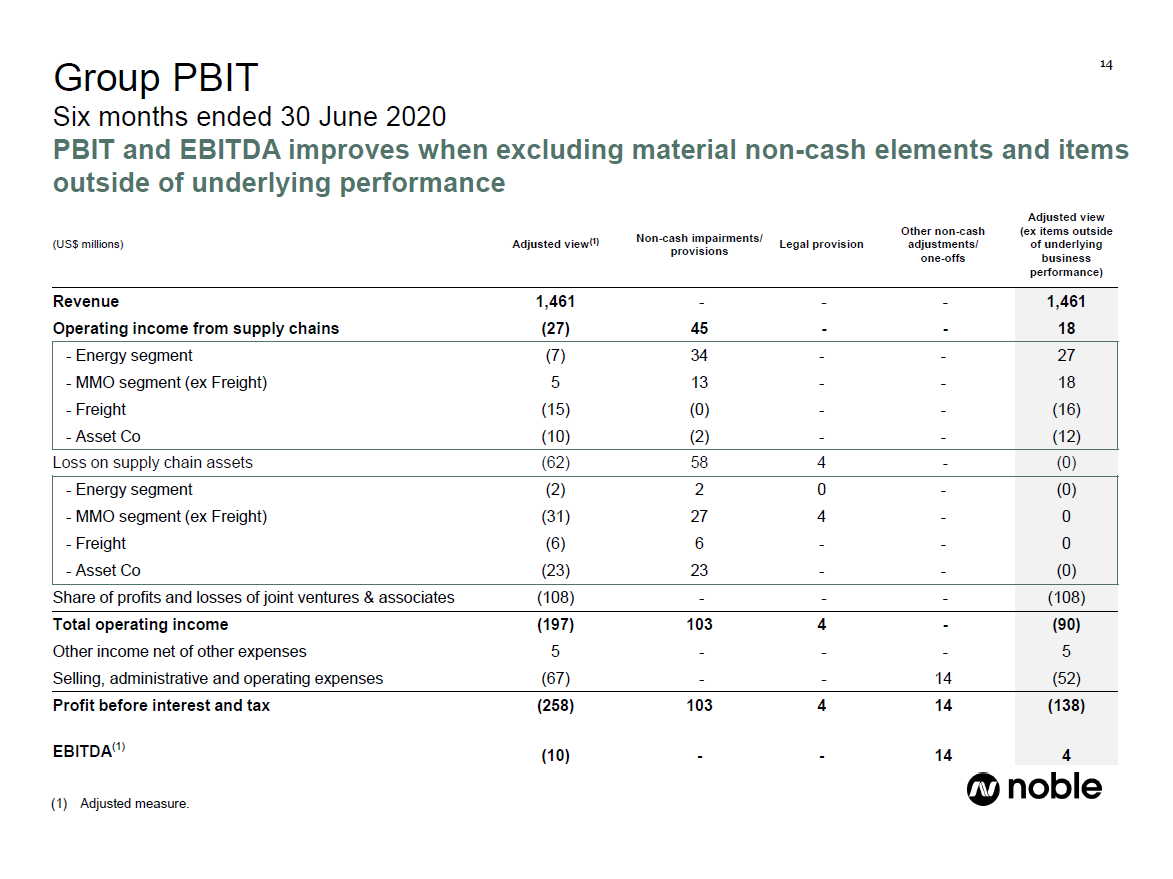

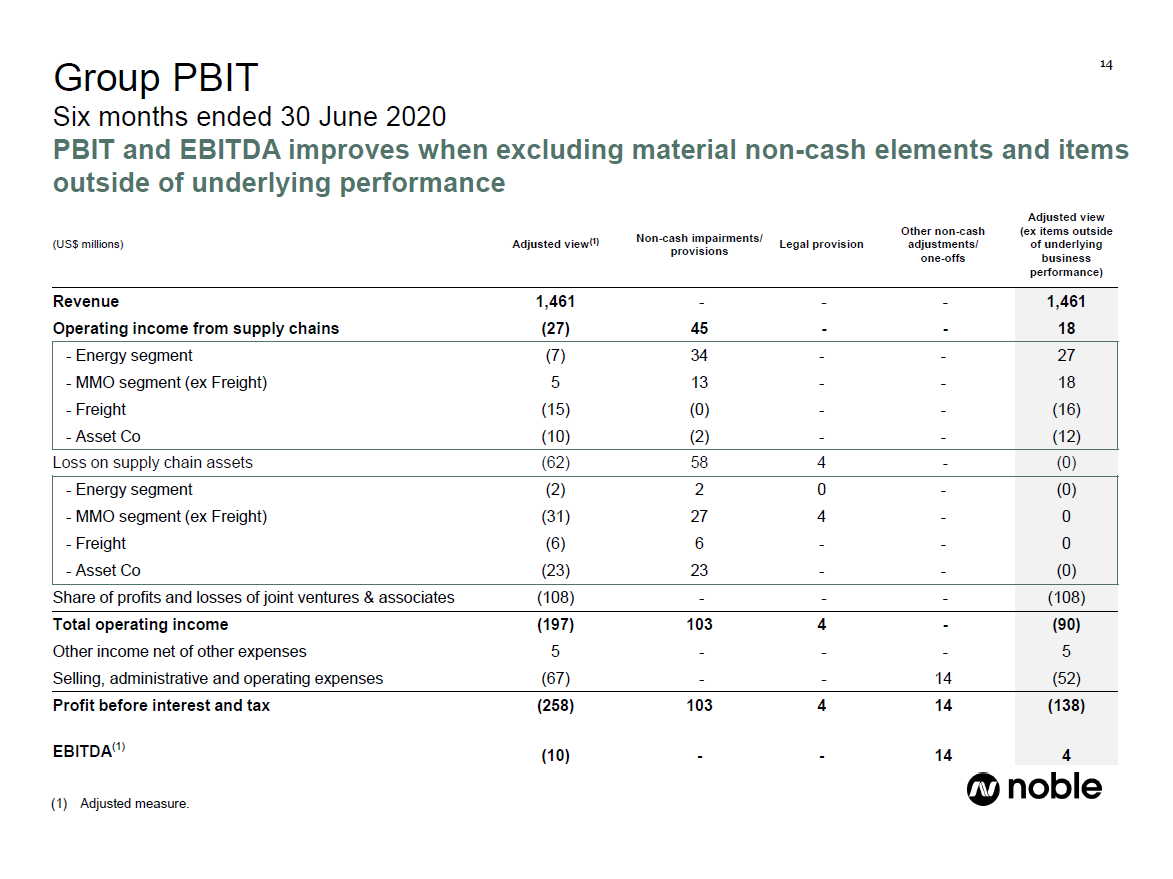

Antwort auf Beitrag Nr.: 62.202.594 von faultcode am 20.12.19 00:02:58die letzten Ergebnisse sind: Noble Group Holdings Limited 1H 2020 Presentation (u.a.)

...

Robust Group cash position of US 452 million with net debt of US 1 328 million at 30 June 2020

...

]Jamalco reorganization in progress, paving the way for an IPO in future

...

Jamalco is a joint venture between Noble Group and Clarendon Alumina Production (CAP) with a focus on bauxite mining and alumina production. --> http://www.jamalco.com/jamalco/

PBIT = Profit Before Interest and Taxes

...

Robust Group cash position of US 452 million with net debt of US 1 328 million at 30 June 2020

...

]Jamalco reorganization in progress, paving the way for an IPO in future

...

Jamalco is a joint venture between Noble Group and Clarendon Alumina Production (CAP) with a focus on bauxite mining and alumina production. --> http://www.jamalco.com/jamalco/

PBIT = Profit Before Interest and Taxes

Antwort auf Beitrag Nr.: 59.827.992 von faultcode am 08.02.19 19:01:05

aus: https://www.noblegroupholdings.com/faq-shareholder/

=> u.a. heißt es da:

If you held your shares of Noble Group Limited at 5:00pm (Singapore time) on 21 November 2018, then you are entitled (subject to certain conditions) to receive one share of Noble Group Holdings Limited for every ten shares of Noble Group Limited you held at that time (fractional entitlements will be rounded up to the nearest whole share of Noble Group Holdings Limited.)

=> ansonsten zieht sich die Reorg bis 2020 demnach hin:

UNDER THE TERMS OF THE COURT APPROVED RESTRUCTURING, IF YOU ARE ENTITLED TO RECEIVE SHARES OF NOBLE GROUP HOLDINGS LIMITED, YOU MUST REGISTER WITH LUCID ISSUER SERVICES LIMITED BY 19 MARCH 2020 OR YOU WILL LOSE YOUR ENTITLEMENT.

Noble Group Holdings Ltd.

wie ging's eigentlich weiter?aus: https://www.noblegroupholdings.com/faq-shareholder/

=> u.a. heißt es da:

If you held your shares of Noble Group Limited at 5:00pm (Singapore time) on 21 November 2018, then you are entitled (subject to certain conditions) to receive one share of Noble Group Holdings Limited for every ten shares of Noble Group Limited you held at that time (fractional entitlements will be rounded up to the nearest whole share of Noble Group Holdings Limited.)

=> ansonsten zieht sich die Reorg bis 2020 demnach hin:

UNDER THE TERMS OF THE COURT APPROVED RESTRUCTURING, IF YOU ARE ENTITLED TO RECEIVE SHARES OF NOBLE GROUP HOLDINGS LIMITED, YOU MUST REGISTER WITH LUCID ISSUER SERVICES LIMITED BY 19 MARCH 2020 OR YOU WILL LOSE YOUR ENTITLEMENT.

Antwort auf Beitrag Nr.: 59.827.788 von faultcode am 08.02.19 18:44:46=> ich habe meine Ordinary Shares einfach zum Bid verkauft, weil diese Position (mittlerweile) einfach zu klein ist, um sie eventuell gebührenpflichtig irgendwie in die New Noble-shares überzuführen; mit dann Listing wo??

=> das herauszuklamüsern oder zu antizipieren ist mir nun zu aufwendig

=> bereits am 31.1. schrieb Noble (http://thisisnoble.com/newsroom/1358-sgx-announcement-action…):

There is currently no publicly quoted price or market for trading either the unlisted shares of New Noble or the shares of Old Noble. The Board of Directors of New Noble is reviewing alternative liquidity opportunities for New Noble shareholders and will update them on any developments in due course.

=> die New Noble-shares müssen eh ne neue ISIN bekommen, und dann guck ich mal weiter, in welcher (finanziellen) Verfassung die New Noble starten wird

--> hoffentlich nur mit sehr wenig Schulden, wenn überhaupt; alles andere würde ich kritisch sehen

=> das herauszuklamüsern oder zu antizipieren ist mir nun zu aufwendig

=> bereits am 31.1. schrieb Noble (http://thisisnoble.com/newsroom/1358-sgx-announcement-action…):

There is currently no publicly quoted price or market for trading either the unlisted shares of New Noble or the shares of Old Noble. The Board of Directors of New Noble is reviewing alternative liquidity opportunities for New Noble shareholders and will update them on any developments in due course.

=> die New Noble-shares müssen eh ne neue ISIN bekommen, und dann guck ich mal weiter, in welcher (finanziellen) Verfassung die New Noble starten wird

--> hoffentlich nur mit sehr wenig Schulden, wenn überhaupt; alles andere würde ich kritisch sehen

SGX Announcement - Application for the Winding-Up of Noble Group Limited

1.2.19http://thisisnoble.com/newsroom/1359-sgx-announcement-applic…

=>

• Application for winding-up of Noble Group Limited (“Old Noble”) to be heard on 8 February 2019,

liquidation process is a procedural step and as anticipated in the circular to shareholders dated 10

August 2018 (“Circular”)

• The liquidation process will have no impact on the business or financial position of Noble Group Holdings Limited (“New Noble”)

• The winding-up application and liquidation process will have no impact on the rights of shareholders of Old Noble to receive shares in New Noble

...

The liquidation of Old Noble has no impact on the right of shareholders of Old Noble to receive

shares in New Noble. Shareholders of Old Noble are again reminded to take the necessary action to claim the shares of New Noble to which they are entitled by registering with the trustee, Lucid Issuer Services Limited (“Lucid”), via the website www.lucid-is.com/nghlregistration and providing the necessary information required by Lucid.

...

Antwort auf Beitrag Nr.: 59.140.440 von faultcode am 05.11.18 15:53:27

https://www.bloomberg.com/news/articles/2018-12-11/noble-gro…

=>

...

-- Trader seeks to push through restructuring via Bermudan court

-- Singapore authorities had blocked relisting of co.’s shares

...Noble Group Ltd. is seeking to pursue its debt restructuring via a Bermudan court, using a local kind of insolvency process, after a key element of its survival plan was blocked by Singapore authorities.

The embattled commodity trader will apply for a Dec. 14 hearing in Bermuda to allow its reorganization through a court-appointed officer, it said in a statement on Tuesday. That means installing a so-called provisional liquidator, according to people familiar with the matter, who the company hopes would implement its “plan B” restructuring.

It’s the latest development in a long-running saga, in which Singapore regulators got involved last month by announcing a probe into the company’s accounts. They followed up by halting a relisting of its shares in the city-state, effectively blocking a $3.5 billion restructuring plan. Once Asia’s largest commodity trader, Noble has been reduced to a rump by billions of dollars in losses and writedowns as well as accusations of inflated profits, which were first made by Iceberg Research in 2015.

Noble Group said last week that it intended to push through its mammoth debt-for-equity restructuring by an “alternative process” that may include a court-appointed officer. The company was considering a “pre-pack” administration, a procedure that allows for a restructuring in court through a pre-agreed plan with creditors, according to a person familiar with the matter.

Alternative Plan

In August, Noble said in a circular that if its first choice failed, the alternative restructuring would involve filing for administration in the U.K. Under that scenario, creditors would aim to swiftly take control of assets and existing shareholders and perpetual bondholders could be wiped out. That also risks triggering clauses allowing some counterparties to walk away from supply contracts, making it harder for Noble to stay in business.

Noble said on Tuesday that its day-to-day operations are unaffected, trade finance facilities will continue to be available and payments to customers and suppliers will be made as usual. The court will appoint an officer to Noble Group only and not to any of its subsidiaries. The effective restructuring date is now expected to be Dec. 18, assuming the court approves it, according to the company.

The company said that current shareholders of Noble would still receive shares in the restructured entity should the plan B restructuring go ahead. Still, it’s not clear how easy it will be for them to be traded as they wouldn’t be listed.

Noble also warned that should the plan B fail, it would be “forced to enter into a full liquidation process”, which would entirely wipe out shareholders and perpetual bondholders, as well as imposing hefty losses on other creditors.

In November, just days before the company was due to complete its reorganization, a trio of Singaporean authorities said they were probing whether Noble made false accounting declarations. Last week, authorities said Noble can’t relist as a new entity in Singapore and that there were “significant uncertainties about the financial position of New Noble”.

Noble Group to Appoint Provisional Liquidator to Enact Debt Deal

11.12.2018https://www.bloomberg.com/news/articles/2018-12-11/noble-gro…

=>

...

-- Trader seeks to push through restructuring via Bermudan court

-- Singapore authorities had blocked relisting of co.’s shares

...Noble Group Ltd. is seeking to pursue its debt restructuring via a Bermudan court, using a local kind of insolvency process, after a key element of its survival plan was blocked by Singapore authorities.

The embattled commodity trader will apply for a Dec. 14 hearing in Bermuda to allow its reorganization through a court-appointed officer, it said in a statement on Tuesday. That means installing a so-called provisional liquidator, according to people familiar with the matter, who the company hopes would implement its “plan B” restructuring.

It’s the latest development in a long-running saga, in which Singapore regulators got involved last month by announcing a probe into the company’s accounts. They followed up by halting a relisting of its shares in the city-state, effectively blocking a $3.5 billion restructuring plan. Once Asia’s largest commodity trader, Noble has been reduced to a rump by billions of dollars in losses and writedowns as well as accusations of inflated profits, which were first made by Iceberg Research in 2015.

Noble Group said last week that it intended to push through its mammoth debt-for-equity restructuring by an “alternative process” that may include a court-appointed officer. The company was considering a “pre-pack” administration, a procedure that allows for a restructuring in court through a pre-agreed plan with creditors, according to a person familiar with the matter.

Alternative Plan

In August, Noble said in a circular that if its first choice failed, the alternative restructuring would involve filing for administration in the U.K. Under that scenario, creditors would aim to swiftly take control of assets and existing shareholders and perpetual bondholders could be wiped out. That also risks triggering clauses allowing some counterparties to walk away from supply contracts, making it harder for Noble to stay in business.

Noble said on Tuesday that its day-to-day operations are unaffected, trade finance facilities will continue to be available and payments to customers and suppliers will be made as usual. The court will appoint an officer to Noble Group only and not to any of its subsidiaries. The effective restructuring date is now expected to be Dec. 18, assuming the court approves it, according to the company.

The company said that current shareholders of Noble would still receive shares in the restructured entity should the plan B restructuring go ahead. Still, it’s not clear how easy it will be for them to be traded as they wouldn’t be listed.

Noble also warned that should the plan B fail, it would be “forced to enter into a full liquidation process”, which would entirely wipe out shareholders and perpetual bondholders, as well as imposing hefty losses on other creditors.

In November, just days before the company was due to complete its reorganization, a trio of Singaporean authorities said they were probing whether Noble made false accounting declarations. Last week, authorities said Noble can’t relist as a new entity in Singapore and that there were “significant uncertainties about the financial position of New Noble”.

Antwort auf Beitrag Nr.: 58.528.425 von faultcode am 24.08.18 16:30:37

By Jonathan Randles

Noble Group Ltd. filed for bankruptcy protection Wednesday in order to prevent creditors in the U.S. from potentially disrupting its plan to restructure $3.5 billion in debt.

The London-based commodities trader filed a petition seeking protection under chapter 15, a section of the bankruptcy code concerning international insolvency, in the U.S. Bankruptcy Court in New York.

Noble said in court papers it is seeking to prevent creditors from taking actions against the company in the U.S. as it pushes forward with a debt-restructuring plan being carried out in parallel proceedings in London and Bermuda.

Shareholders voted to approve that restructuring plan in August; Noble said the proposal is supported by creditors holding 88% of its senior debt.

Lawyers for Noble said in court filings that the company believes the New York bankruptcy filing "will complement the Debtor's primary proceedings in England to ensure the effective and economic administration of the Restructuring and prevent adverse actions in the United States."

Noble said it has bank accounts in New York with JPMorgan Chase & Co. and issued senior bonds due in 2020 that are governed under New York state law.

Noble said in court papers that its difficulties stem from a fall in commodity prices beginning in 2014 until early 2017 that stressed the company's operations. The drop in commodities prices corresponded with downgrades from credit-rating agencies, skittish lenders and an increase in the cost of financing its trading, the company said.

Noble has also been accused of accounting irregularities, first leveled i n early 2015 by a then-anonymous blogger known as Iceberg Research. Noble has denied the allegations.

For the year ended 2017, Noble reported a $4.9 billion net loss, according to court papers.

The company said it retained law firm Kirkland & Ellis LLP and investment bank Moelis & Co. in May 2017 to provide restructuring advice and negotiate with lenders. The restructuring plan was announced in January.

Judge Stuart Bernstein has been assigned to the U.S. bankruptcy case, number 18-13133.

-- Saurabh Chaturvedi contributed to this article.

Write to Jonathan Randles at Jonathan.Randles@wsj.com

(END) Dow Jones Newswires

October 18, 2018 15:55 ET (19:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Noble Seeks U.S. Bankruptcy Protection As It Pursues Debt Restructuring

3:55 pm ET October 18, 2018 (Dow Jones) PrintBy Jonathan Randles

Noble Group Ltd. filed for bankruptcy protection Wednesday in order to prevent creditors in the U.S. from potentially disrupting its plan to restructure $3.5 billion in debt.

The London-based commodities trader filed a petition seeking protection under chapter 15, a section of the bankruptcy code concerning international insolvency, in the U.S. Bankruptcy Court in New York.

Noble said in court papers it is seeking to prevent creditors from taking actions against the company in the U.S. as it pushes forward with a debt-restructuring plan being carried out in parallel proceedings in London and Bermuda.

Shareholders voted to approve that restructuring plan in August; Noble said the proposal is supported by creditors holding 88% of its senior debt.

Lawyers for Noble said in court filings that the company believes the New York bankruptcy filing "will complement the Debtor's primary proceedings in England to ensure the effective and economic administration of the Restructuring and prevent adverse actions in the United States."

Noble said it has bank accounts in New York with JPMorgan Chase & Co. and issued senior bonds due in 2020 that are governed under New York state law.

Noble said in court papers that its difficulties stem from a fall in commodity prices beginning in 2014 until early 2017 that stressed the company's operations. The drop in commodities prices corresponded with downgrades from credit-rating agencies, skittish lenders and an increase in the cost of financing its trading, the company said.

Noble has also been accused of accounting irregularities, first leveled i n early 2015 by a then-anonymous blogger known as Iceberg Research. Noble has denied the allegations.

For the year ended 2017, Noble reported a $4.9 billion net loss, according to court papers.

The company said it retained law firm Kirkland & Ellis LLP and investment bank Moelis & Co. in May 2017 to provide restructuring advice and negotiate with lenders. The restructuring plan was announced in January.

Judge Stuart Bernstein has been assigned to the U.S. bankruptcy case, number 18-13133.

-- Saurabh Chaturvedi contributed to this article.

Write to Jonathan Randles at Jonathan.Randles@wsj.com

(END) Dow Jones Newswires

October 18, 2018 15:55 ET (19:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Fighting to survive: Noble Group's fate hangs on investors restructuring vote --> 27.8.

24 Aug 2018 03:45PMhttps://www.channelnewsasia.com/news/business/fighting-to-su…

=>

...Singapore-listed Noble Group faces a make-or-break shareholders' meeting on Monday (Aug 27) as investors vote on a US$3.5 billion debt restructuring plan that its creditors and board say is vital to prevent insolvency.

...

Noble, whose market value has been nearly wiped out from US$6 billion in February 2015, is expected to win the required simple majority of voters in attendance at the meeting, said multiple sources familiar with the matter. Equity owners include China Investment Corp and Abu Dhabi fund Goldilocks Investment.

Noble did not immediately respond to a request for a comment on the vote.

Noble already has majority support from its creditors and the backing of 30 per cent of its shareholders such as founder Richard Elman, who stepped down as chairman last year.

Under the debt-for-equity swap, it plans to halve its debt after surrendering 70 per cent of control to its senior creditors, mainly made up of hedge funds, while existing shareholders' stakes will dwindle to 20 per cent and its management would get 10 per cent.

"The expectation is for the restructuring to be passed as Noble needs a simple majority at the meeting," said Neel Gopalakrishnan, credit strategist at DBS Group. "It would come as a big surprise if it doesn't come through."

Noble's accounting came under scrutiny in February 2015 when a former employee, Arnaud Vagner, started to publish reports anonymously under the name of Iceberg Research, alleging Noble inflated the prices of derivative contracts the company held to appear more profitable. Noble has always stood by its accounts.

As Noble's shares and bonds plunged after the allegations, the company lost its investment-grade rating, took billions of dollars in impairment losses and lost access to funding. It also changed its chief executive officers.

Desperate to slash debt, Noble sold a string of assets but this was not enough to run a trading business where profit margins are tiny. It posted a record US$4.9 billion loss for 2018 and then defaulted on its debt in March.

"It's just impossible in commodity trading to operate with so high interest costs. It is what people are once again going to realize," Vagner told Reuters, referring to the restructured Noble.

"Is the new team more competent than the previous one? No: It's the same. The share price is down 99 per cent with this management," he said by email.

Noble's restructuring plan gained ground in June 2018 after it won over a key shareholder with a sweetened offer.

If Noble does not obtain shareholders' approval, it will seek to implement a similar restructuring to keep the firm as a going concern but that plan does not provide for shareholders to receive any equity in the new company.

Analysts are still wary of the new company's prospects.

"While its current debt problems will be temporarily fixed post-restructuring, it will need ready access to trade financing which is critical to its business," said Brayan Lai, analyst at Bondcritic, who publishes on independent research platform Smartkarma.

Noble's ability to make profits on a sustainable basis would be the main challenge for its remaining business, said Annisa Lee, head of Asia ex-Japan's flow credit analysis at Nomura.

The Man Who Triggered a $10 Billion Commodity Collapse Finally Speaks

15.8.https://www.bloomberg.com/news/articles/2018-08-15/man-who-t…

=>

Arnaud Vagner has been a mystery for more than three years.

Noble Group, once one of the world’s biggest commodity trading houses, characterized him as a disgruntled former junior employee behind a series of reports by Iceberg Research, an anonymous group that began attacking its accounting practices in 2015.

Even as the combined value of Noble’s equity and debt plunged by about $10 billion since then, Vagner declined to comment publicly or even confirm he was behind Iceberg. With the company now on the brink of a restructuring, he’s ready to talk.

“I am Arnaud Vagner,” he said in an interview by phone from an undisclosed location in Europe, confirming for the first time his link to Iceberg Research. He’s speaking publicly now because he’s trying to organize a legal challenge to Noble’s restructuring plan. “Bad companies have to die,” he said.

After writing down billions of dollars, including on contract valuations questioned by Iceberg, Noble’s market capitalization stands at $115 million. At its peak in 2011, the company was valued at $11.7 billion. Noble defaulted on its bonds and now faces a do-or-die struggle to keep going with a $3.5 billion debt-for-equity rescue that will hand control to creditors.

Vagner said his intended legal challenge, which he has invited others to join, will be easier if he waives his anonymity. “We have to send a message now that after years of fighting we won’t be bullied,” he said. Some people have said they are interested in joining the challenge, he said, without identifying them.

Noble has always denied the allegations made by Iceberg. It is suing Vagner and a Seychelles-registered company in Hong Kong, accusing both of conspiring to damage the company by anonymously spreading false and misleading information. Vagner denies the allegations in the suit, which is ongoing.

Noble declined to comment on the points raised by Vagner in the interview.

Bloomberg News has spoken by phone since 2015 with someone who said they were related to Iceberg. There were also emails. All discussions were off the record, they never identified themselves by name and declined to meet in person. The interview with Vagner was arranged via the same email address, his voice was the same as in previous calls and he had knowledge of specific subjects discussed previously.

Vagner disputes Noble’s characterization of him as a disgruntled former employee looking to profit. He said he’s never held a short position in Noble and fighting the company’s suit has cost him HK$3 million ($380,000) in legal fees. Vagner said he funded himself through profitable short positions in other companies and income from selling research.

It’s never been clear if Iceberg consists of one or several people. Vagner declined to say, although he acknowledged talking to several people about the information he had before the first Iceberg report.

“I cannot say who I worked with because that would go against a non-disclosure agreement,” he said. “After talking to a few people, it didn’t go anywhere and I decided to launch Iceberg.”

During his time as a senior credit analyst at Noble in Hong Kong, Vagner said much of his work consisted of writing reports to show the trading house had proper risk controls in place. He only worked with publicly available information at Noble and has not used anything confidential to write his Iceberg reports, he said.

“Noble made a terrible mistake at the end of their annual reports,” he said, referring to the company’s estimates for how much profit its long-term contracts would realize. “After comparing for years, and it really took a long time, the expectation of realization and what they were actually realizing every year, I reached the conclusion that it was complete bull---t.”

Noble Group reported billions of dollars in net losses in 2017 and 2015 as the commodities trading house wrote down the value of some of its contracts.

The first Iceberg report in 2015 stated that those long-term contracts were probably overvalued by about $3.8 billion. Since then, Noble has written down, or taken reserves against, more than that. “We were too conservative,” Vagner said.

Until now, Vagner’s only appearance as himself was a brief clip in a corporate video for Noble, in which he spoke about the company offering “a new challenge every day.” His life since 2015, he said, has been somewhat more than a challenge. Aside from the lawsuit, he claims to have been the subject of online attacks, though he can’t be sure who is responsible.

Despite that, he says he is proud of his work in the past several years. “It is satisfying because you do it just with your computer and your brain,” he said.

The former credit analyst isn’t done. He’s now turning his attention to regulators, who he said were too slow in their response. “They should have investigated,” he said.

Vagner said he identified himself to the Singapore Exchange in the middle of 2015 and had several phone calls and email exchanges with officials. Eventually, he said, they stopped returning his calls and emails. The SGX has previously said it couldn’t act on the Iceberg research because it was issued anonymously.

The SGX said in a statement on Wednesday that it has been “putting the onus on Noble’s auditors to justify its audit and their accounting practices were reviewed by a Singapore-registered auditor.”

“If there is any failing by any auditor, we will refer the auditor to the appropriate accounting regulatory bodies,” the bourse said. In Singapore, the SGX is both the exchange and the front-line regulator of the stock market.

Vagner also directed his criticism at the company’s banks, of which there have been several dozen over the years.

“The bankers want their bonuses in February, and the world can collapse after that,” he said. “A normal banker doesn’t want to challenge his client.”

The Noble saga is heading to a crucial vote on Aug. 27, when shareholders will decide whether to back the restructuring plan. If they do, they will hand control to the company’s creditors. The current management, including founder Richard Elman, will also get a chunk of the new company.

Vagner doesn’t see the vote as the end of the story.

“If the restructuring is successful, the new Noble isn’t viable and they won’t be able to pay their interest,” he said. “I hope that it will go down.”

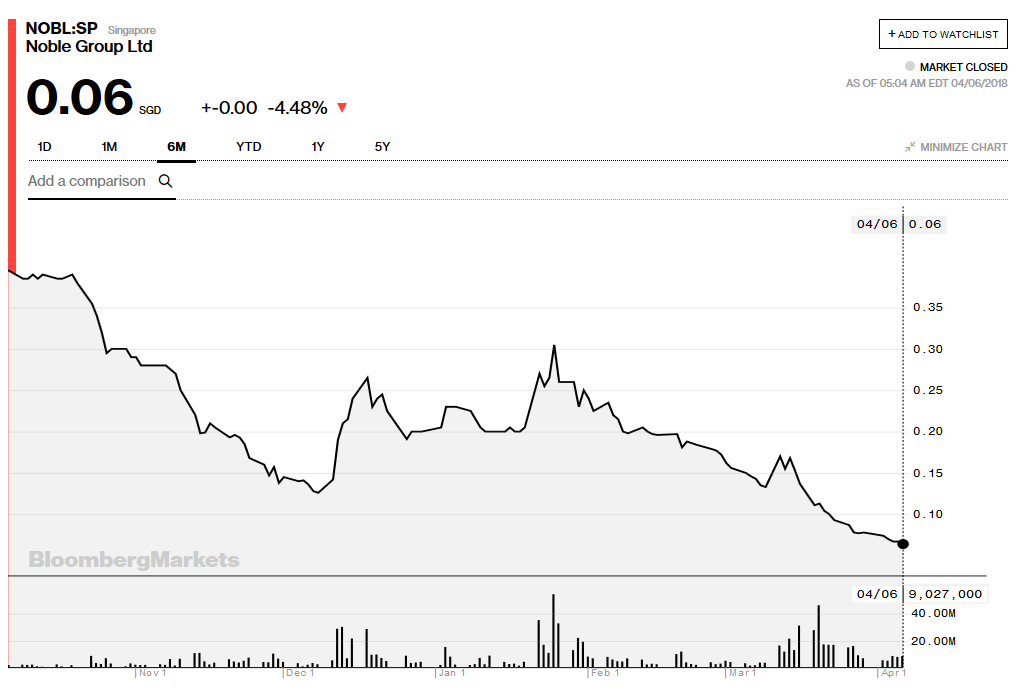

Antwort auf Beitrag Nr.: 58.028.788 von faultcode am 20.06.18 19:35:29heute nochmals +24% in Singapur

=> das ist 3m-Hoch, aber noch kein 6m-Hoch, was mMn schwer werden dürfte kurzfristig, da auch:

• die Liabilities (lt.Bloomberg) mit SGD6b immer noch über den Assets mit SGD5b liegen (2018Q1)

1 Singapur-Dollar (SGD) ~ EUR0.63

MC liegt nun so grob bei SGD230m

=> das ist 3m-Hoch, aber noch kein 6m-Hoch, was mMn schwer werden dürfte kurzfristig, da auch:

• die Liabilities (lt.Bloomberg) mit SGD6b immer noch über den Assets mit SGD5b liegen (2018Q1)

1 Singapur-Dollar (SGD) ~ EUR0.63

MC liegt nun so grob bei SGD230m

Antwort auf Beitrag Nr.: 57.541.569 von faultcode am 14.04.18 01:50:52

https://www.bloomberg.com/news/articles/2018-06-20/noble-gro…

20. Juni 2018, 02:38 MESZ Updated on 20. Juni 2018, 13:42 MESZ

-- Existing shareholders to get 20% stake in restructured firm

-- Trader moves to ‘final stages’ of restructuring, Brough says

Embattled commodity trader Noble Group Ltd. has won over a major opponent of its make-or-break restructuring plan, ending months of accusations and lawsuits. Shares rallied more than 60 percent.

Dissident shareholder Goldilocks Investment Co. has given its irrevocable support to the $3.5 billion debt-for-equity proposal after Noble agreed to grant existing shareholders 20 percent of the revamped company, up from 15 percent previously, the trader said in a statement Wednesday. The two agreed to stop fighting each other in court.

The deal with Goldilocks, which will also be able to nominate a director to Noble’s board, marks a breakthrough after months of bitter public sparring, and paves the way for the restructuring that’ll hand control to senior creditors. Noble and Goldilocks will form a partnership to explore opportunities in the Middle East as part of their agreement, which drew criticism from long-term foe Iceberg Research.

“This absolutely clears the biggest hurdle to the debt restructuring,” said Stan Manoukian, founder of California-based Independent Credit Research LLC. “The threat of liquidation is no longer on the agenda."

The company is also hoping to strike a deal with perpetual bondholders, with whom it reached an in-principle agreement last month. That would allow it to publish its circular to shareholders within the next week or two, according to two people familiar with the process -- a key step toward completing the restructuring. According to an indicative timeline published by the company in March, Noble would be able complete the restructuring about three months after filing the circular.

Noble Group shares surged as much as 67 percent to 9 Singapore cents, before closing at 8.8 cents. Still, the stock remains 56 percent lower this year. On credit markets, defaulted notes due 2020 climbed 1.6 cents on the dollar to 42.7 cents, according to prices compiled by Bloomberg.

Years of Crisis

Goldilocks had urged an investor revolt against Noble Group’s original deal, arguing it was unfair to existing holders. In April, it filed a lawsuit in Singapore seeking to halt the restructuring. It also successfully sought an injunction to block Noble Group from holding its annual general meeting, with the gathering opened and then adjourned. It holds 8.1 percent of the trader.

Noble Group has been in crisis for years after billions in losses, defaulting on its debt, and amid allegations of improper accounting, which it has rejected. After a string of asset sales, the company has been reduced to a rump business focused on Asia, plus a handful of other assets including an alumina refinery.

Iceberg, the group that first published critiques of Noble’s accounting in 2015, pushed back on Wednesday, saying that “20 percent of zero is still worth zero,” according to a statement on Twitter. It flagged “other obstacles to the restructuring,” without giving details.

Sweetened Deal

To bring the complex deal to fruition, Chairman Paul Brough needs approvals from shareholders as well as senior creditors, of which about 85 percent back the plan.

The restructuring agreement has been altered before. Earlier this year, Noble Group sweetened the deal for shareholders by revising the original plan, offering them the 15 percent holding, up from 10 percent.

The remaining equity in the new company is being split between senior creditors and management. Under the latest deal, senior creditors stand to receive 70 percent of the trader, while management’s share will be 10 percent.

In a separate statement, Noble Group said Pinpoint Asset Management Ltd. and Value Partners Ltd., holders of its perpetual securities, withdrew a lawsuit filed against the company on June 13. Perpetuals have been offered $25 million of new bonds in exchange for securities with a face value of $400 million. On Wednesday, the perpetuals rose 0.6 cent, the most in a week, to 7.8 cents.

“Obstacles to the completion of the restructuring are probably getting removed,” said Neel Gopalakrishnan, senior credit strategist at DBS Group Holdings Ltd. “But the key question is still whether, post restructuring, the company will be able to turn around operations for creditors to recover value.”

Noble's Marathon Revamp Nears Finish After Goldilocks Deal

die Leiche lebt: +60% in Singapur:https://www.bloomberg.com/news/articles/2018-06-20/noble-gro…

20. Juni 2018, 02:38 MESZ Updated on 20. Juni 2018, 13:42 MESZ

-- Existing shareholders to get 20% stake in restructured firm

-- Trader moves to ‘final stages’ of restructuring, Brough says

Embattled commodity trader Noble Group Ltd. has won over a major opponent of its make-or-break restructuring plan, ending months of accusations and lawsuits. Shares rallied more than 60 percent.

Dissident shareholder Goldilocks Investment Co. has given its irrevocable support to the $3.5 billion debt-for-equity proposal after Noble agreed to grant existing shareholders 20 percent of the revamped company, up from 15 percent previously, the trader said in a statement Wednesday. The two agreed to stop fighting each other in court.

The deal with Goldilocks, which will also be able to nominate a director to Noble’s board, marks a breakthrough after months of bitter public sparring, and paves the way for the restructuring that’ll hand control to senior creditors. Noble and Goldilocks will form a partnership to explore opportunities in the Middle East as part of their agreement, which drew criticism from long-term foe Iceberg Research.

“This absolutely clears the biggest hurdle to the debt restructuring,” said Stan Manoukian, founder of California-based Independent Credit Research LLC. “The threat of liquidation is no longer on the agenda."

The company is also hoping to strike a deal with perpetual bondholders, with whom it reached an in-principle agreement last month. That would allow it to publish its circular to shareholders within the next week or two, according to two people familiar with the process -- a key step toward completing the restructuring. According to an indicative timeline published by the company in March, Noble would be able complete the restructuring about three months after filing the circular.

Noble Group shares surged as much as 67 percent to 9 Singapore cents, before closing at 8.8 cents. Still, the stock remains 56 percent lower this year. On credit markets, defaulted notes due 2020 climbed 1.6 cents on the dollar to 42.7 cents, according to prices compiled by Bloomberg.

Years of Crisis

Goldilocks had urged an investor revolt against Noble Group’s original deal, arguing it was unfair to existing holders. In April, it filed a lawsuit in Singapore seeking to halt the restructuring. It also successfully sought an injunction to block Noble Group from holding its annual general meeting, with the gathering opened and then adjourned. It holds 8.1 percent of the trader.

Noble Group has been in crisis for years after billions in losses, defaulting on its debt, and amid allegations of improper accounting, which it has rejected. After a string of asset sales, the company has been reduced to a rump business focused on Asia, plus a handful of other assets including an alumina refinery.

Iceberg, the group that first published critiques of Noble’s accounting in 2015, pushed back on Wednesday, saying that “20 percent of zero is still worth zero,” according to a statement on Twitter. It flagged “other obstacles to the restructuring,” without giving details.

Sweetened Deal

To bring the complex deal to fruition, Chairman Paul Brough needs approvals from shareholders as well as senior creditors, of which about 85 percent back the plan.

The restructuring agreement has been altered before. Earlier this year, Noble Group sweetened the deal for shareholders by revising the original plan, offering them the 15 percent holding, up from 10 percent.

The remaining equity in the new company is being split between senior creditors and management. Under the latest deal, senior creditors stand to receive 70 percent of the trader, while management’s share will be 10 percent.

In a separate statement, Noble Group said Pinpoint Asset Management Ltd. and Value Partners Ltd., holders of its perpetual securities, withdrew a lawsuit filed against the company on June 13. Perpetuals have been offered $25 million of new bonds in exchange for securities with a face value of $400 million. On Wednesday, the perpetuals rose 0.6 cent, the most in a week, to 7.8 cents.

“Obstacles to the completion of the restructuring are probably getting removed,” said Neel Gopalakrishnan, senior credit strategist at DBS Group Holdings Ltd. “But the key question is still whether, post restructuring, the company will be able to turn around operations for creditors to recover value.”

Antwort auf Beitrag Nr.: 57.482.651 von faultcode am 06.04.18 16:57:43

12.4.

Noble Group's Shares Soar as Creditor Backing for Deal Tops 75%

https://www.bloomberg.com/news/articles/2018-04-12/noble-gro…

=>

Noble Group Ltd.’s shares surged more than 60 percent after senior creditor support for the company’s restructuring passed a key threshold, removing one source of uncertainty from the controversial deal on which the trading house’s survival depends.

More than 75 percent of Noble Group’s senior creditors have signed the restructuring support agreement, which would see the commodity trader’s debt cut in half and its creditors take control, according to the company.

The deal is crucial to Noble’s survival. Without it, the trader would be forced into liquidation, it said last month. The 75 percent threshold is important, because it is the level of approvals the company needs from creditors to implement the accord under a planned scheme of arrangement.

“It’s a positive development, but the restructuring plan still requires shareholder approval,” said Annisa Lee, head of Asia ex-Japan flow credit analysis at Nomura International (HK) Ltd. “Shareholders want more equity versus the current plan, so that might complicate the restructuring deal.”

Noble said it is still negotiating with shareholders and the Singapore Exchange. Richard Elman, the founder and largest shareholder, is pushing the creditors for a new restructuring deal, people familiar with the matter said this week. The SGX has weighed in against the plan, arguing it isn’t fair to shareholders.

The company has long said it would prefer to secure shareholder approval rather than complete the restructuring via an insolvency and administration process in the U.K. that could damage its commercial relations.

In the run-up to the statement, Noble Group’s battered shares pushed higher, and they extended gains on Friday. The stock jumped by 62 percent, the most on record, to 12.6 Singapore cents, rising for a fourth day in the best run this year. It’s still down 37 percent in 2018.

Noble Group's Shares Soar as Creditor Backing for Deal Tops 75%

Aktie +60% !12.4.

Noble Group's Shares Soar as Creditor Backing for Deal Tops 75%

https://www.bloomberg.com/news/articles/2018-04-12/noble-gro…

=>

Noble Group Ltd.’s shares surged more than 60 percent after senior creditor support for the company’s restructuring passed a key threshold, removing one source of uncertainty from the controversial deal on which the trading house’s survival depends.

More than 75 percent of Noble Group’s senior creditors have signed the restructuring support agreement, which would see the commodity trader’s debt cut in half and its creditors take control, according to the company.

The deal is crucial to Noble’s survival. Without it, the trader would be forced into liquidation, it said last month. The 75 percent threshold is important, because it is the level of approvals the company needs from creditors to implement the accord under a planned scheme of arrangement.

“It’s a positive development, but the restructuring plan still requires shareholder approval,” said Annisa Lee, head of Asia ex-Japan flow credit analysis at Nomura International (HK) Ltd. “Shareholders want more equity versus the current plan, so that might complicate the restructuring deal.”

Noble said it is still negotiating with shareholders and the Singapore Exchange. Richard Elman, the founder and largest shareholder, is pushing the creditors for a new restructuring deal, people familiar with the matter said this week. The SGX has weighed in against the plan, arguing it isn’t fair to shareholders.

The company has long said it would prefer to secure shareholder approval rather than complete the restructuring via an insolvency and administration process in the U.K. that could damage its commercial relations.

In the run-up to the statement, Noble Group’s battered shares pushed higher, and they extended gains on Friday. The stock jumped by 62 percent, the most on record, to 12.6 Singapore cents, rising for a fourth day in the best run this year. It’s still down 37 percent in 2018.

Noble Group's nemesis returns to warn rescue deal has ‘zero chance’

6 April 2018 -- 11:25amhttps://www.telegraph.co.uk/business/2018/04/06/noble-groups…

=>

...Stricken commodities trader Noble Group is on the ropes once again after its nemesis, an anonymous research group named Iceberg, warned its rescue plan had “zero chance of success”.

Singapore-listed Noble, which ships metals around Asia, announced a controversial $3.5bn (£2.5bn) restructuring deal earlier this year that would hand control to some of its biggest creditors and virtually wipe out existing shareholders, leaving them with just 10pc of the company.

The plan incited fury because it would have awarded 20pc of Noble to existing management...

...

Under pressure, the plan was later revised to give management and existing shareholders 17.5pc each.

Iceberg Research, a long-time critic of Noble that first questioned its bookkeeping in a series of explosive reports in 2015, said today: “This plan is absolutely not viable. In fact, it has zero chance of success and everybody at Noble already knows it.”

Iceberg alleges that Noble management wants shareholders to sign up to the plan simply to give them a protection from future lawsuits. “Accepting the release clause would be a terrible mistake,” it added.

Noble is currently seeking shareholders’ approval to press ahead with its rescue plan, warning it will begin an administration process in the UK without it...

=> Endspiel:

Noble Group's Week From Hell Gets Even Worse as Miner Sues

https://www.bloomberg.com/news/articles/2018-03-22/noble-gro…=>...

Noble Group Ltd.’s week of woe just got a lot worse as the trader, which has defaulted and seen founder Richard Elman quit the board, was sued by an Indonesian coal miner for more than a quarter of a billion dollars in a case that may jeopardize some of its remaining business.

In addition to the sum sought, PT Atlas Resources is seeking to cancel marketing deals with Noble Group and one of its units made in 2013, as well as unwinding equity transactions between the two groups, according to a court summary of the lawsuit filed by the miner in the Central Jakarta court this week. On Friday, the Hong Kong-based trader said that while it’s aware of the case, it hadn’t yet been served and it plans to contest the claims...

Noble Group Hit by Lawsuit From Top Holder

https://www.bloomberg.com/news/articles/2018-03-20/noble-gro…=>

* Goldilocks Investment files lawsuit in Singapore’s High Court

* Commodity trader racing to agree debt restructuring proposal

...Goldilocks Investment Co., a major shareholder of Noble Group Ltd., sued the company and executives, including founder Richard Elman, in the Singapore High Court, alleging the trader inflated profits to raise money, according to a copy of a filing just hours before Noble defaults.

The suit also alleges management paid themselves inflated salaries, and then tried a cover-up when the accounts came under increased scrutiny, according to a copy of the case filed by Morgan Lewis Stamford LLC and seen by Bloomberg. As well as Elman, the defendants include Chief Executive Officer Will Randall, Chairman Paul Brough, and Chief Financial Officer Paul Jackaman.

Goldilocks is seeking relief from Hong Kong-based Noble on behalf of shareholders, including about $169 million paid to executives between 2011 and 2017, as well as any interest and damages assessed by the court, according to the lawsuit. The 72-page filing cites allegations made by long-time Noble Group critic Iceberg Research. Goldilocks also wants a declaration from the court that the defendants breached their fiduciary duties...

!! SELBSTBEDIENUNGS-MEGASAFTLADEN !!

Noble Paid Its Co-CEO $20 Million as Losses Hit $5 Billion4.3.:

https://www.bloomberg.com/news/articles/2018-03-04/noble-gro…

=>

...Noble Group Ltd. handed its outgoing co-Chief Executive Officer Jeff Frase a remuneration package worth about $20 million last year, even as the commodity trader slumped to a record loss of almost $5 billion.

The scale of the award, reported in Noble’s annual financial statements last week, is likely to provoke consternation as the embattled trading house attempts to secure agreement from its creditors and shareholders for a restructuring plan that would impose heavy losses.

The remuneration is more than the $15 million than Noble has offered to pay holders of its perpetual bonds, which have a face value of $400 million. Under the current debt restructuring plan, perpetual bondholders, which rank below other debt securities, will suffer a 96.25 percent loss in face value...

--> AU BACKE!! ...was soll man dazu noch sagen..

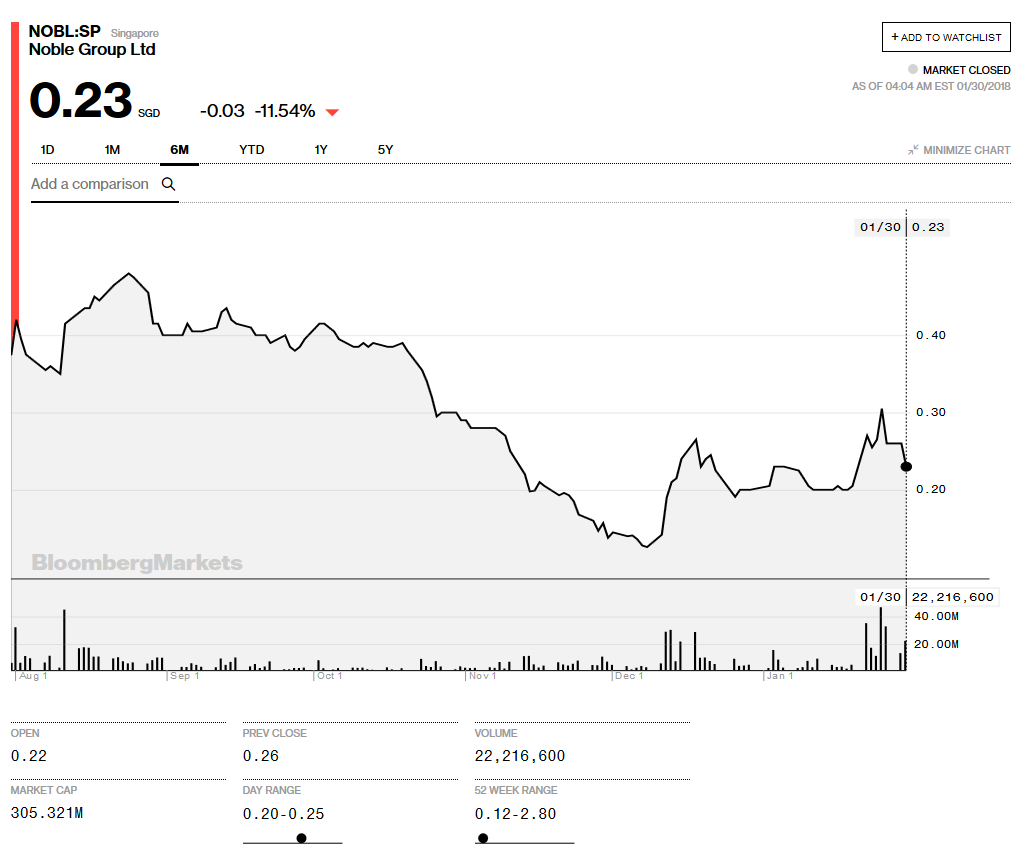

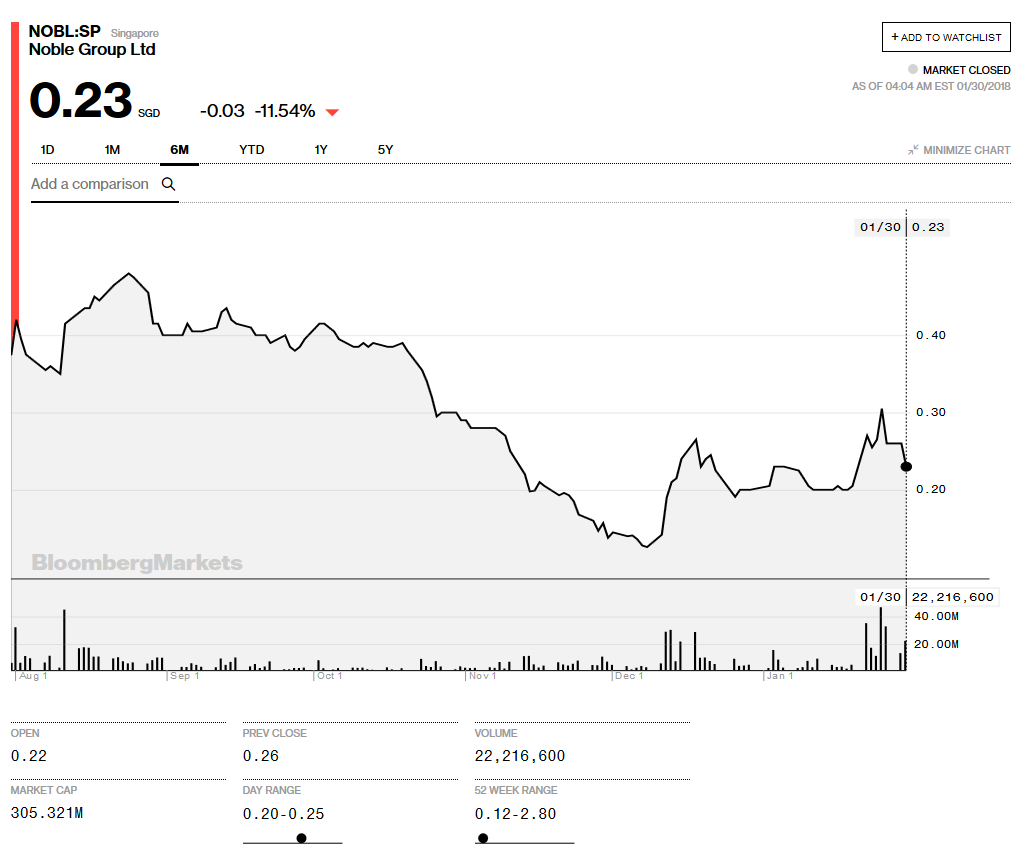

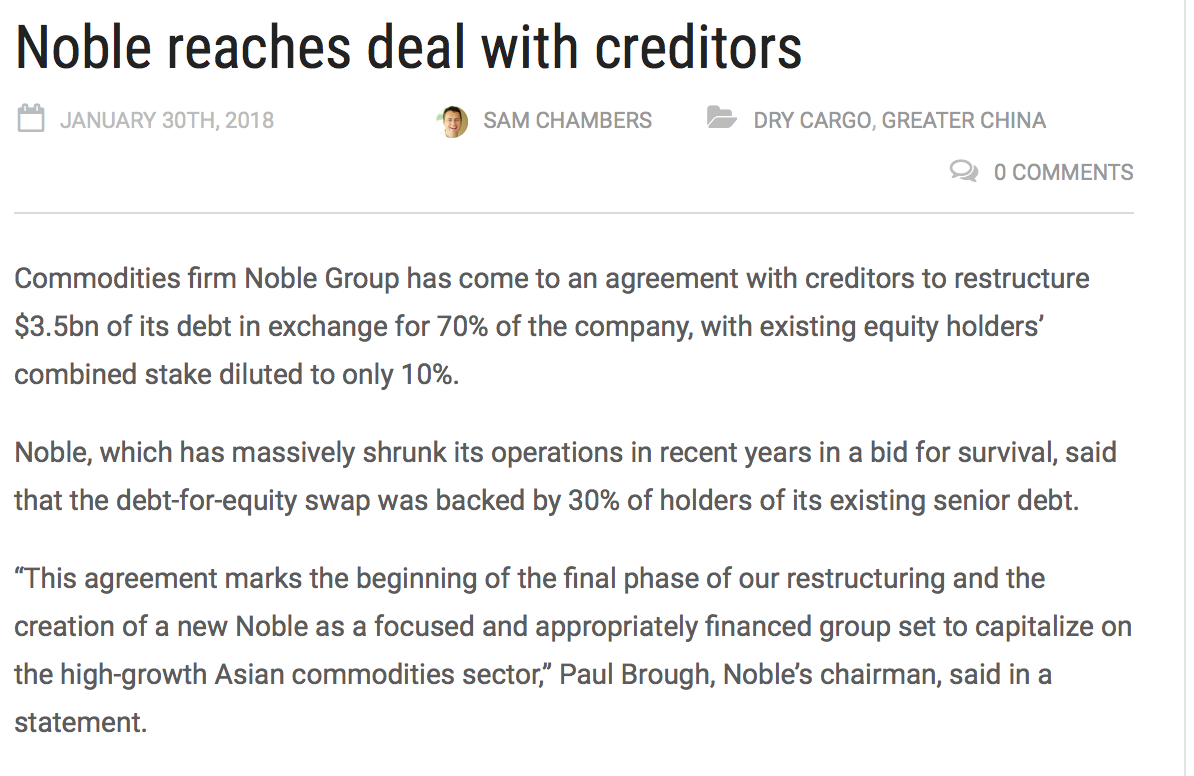

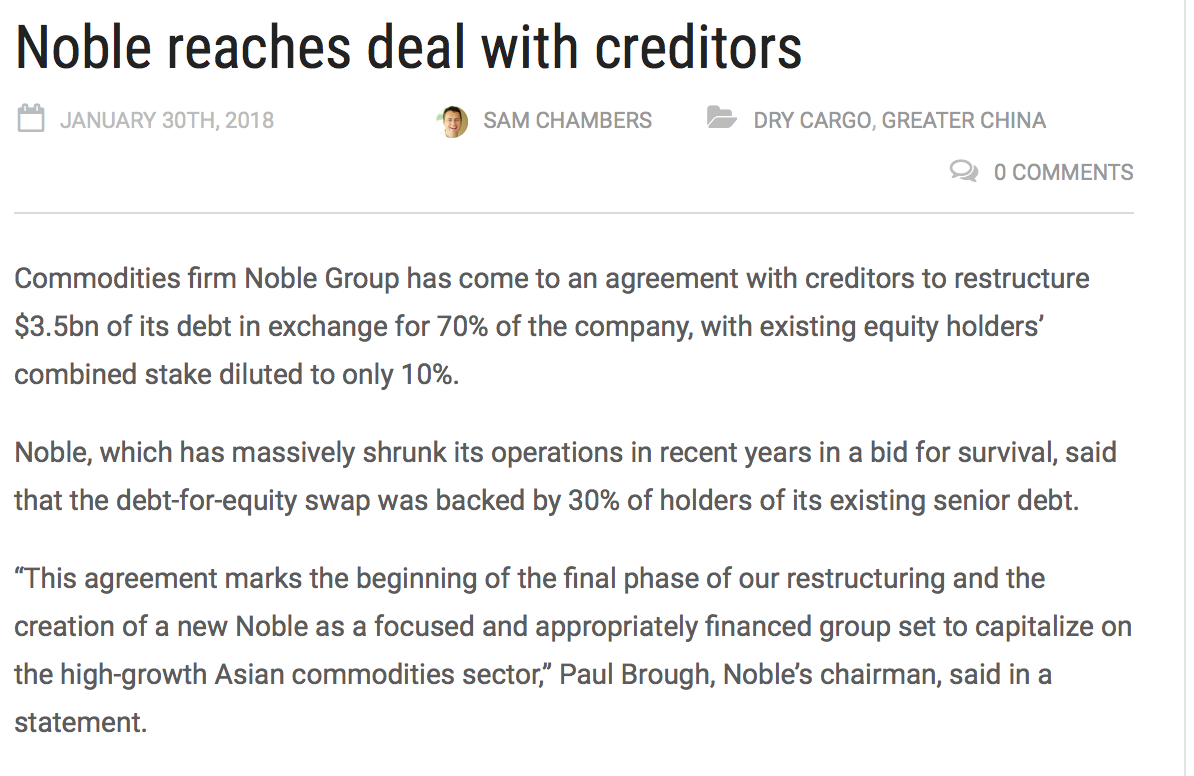

Antwort auf Beitrag Nr.: 56.872.487 von R-BgO am 30.01.18 12:19:10https://www.bloomberg.com/news/articles/2018-01-29/noble-gro…

* Creditors will swap half of $3.5 billion in debt into equity

* Current shareholders will get just 10% of the new company

https://www.bloomberg.com/news/articles/2018-01-30/noble-gro…

* Stock in Singapore pares decline after plummeting 23% at open

* Commodity trader plans debt-for-equity swap with creditors

=>

p.s.: mit meiner Anschauungs-Long-Position von Mitt Juli '17 liege ich mit Schluss gestern Abend bei -60%

CGP-Chart SGX in Singapore Dollar (free!) --> https://www.bloomberg.com/quote/NOBL:SP

=>

30.1.2018:

* Creditors will swap half of $3.5 billion in debt into equity

* Current shareholders will get just 10% of the new company

https://www.bloomberg.com/news/articles/2018-01-30/noble-gro…

* Stock in Singapore pares decline after plummeting 23% at open

* Commodity trader plans debt-for-equity swap with creditors

=>

p.s.: mit meiner Anschauungs-Long-Position von Mitt Juli '17 liege ich mit Schluss gestern Abend bei -60%

CGP-Chart SGX in Singapore Dollar (free!) --> https://www.bloomberg.com/quote/NOBL:SP

=>

30.1.2018:

Antwort auf Beitrag Nr.: 56.843.281 von faultcode am 26.01.18 19:11:46

10% recovery ist doch noch ganz passabel...

Antwort auf Beitrag Nr.: 56.843.203 von faultcode am 26.01.18 19:07:58

1:26 am ET January 26, 2018 (Dow Jones)

0626 GMT - Investors continue to be in wait-and-see mode on Noble, meaning today the debt-laden commodities company's shares have unwound some of this week's pop.

Trading was halted yesterday afternoon for news pending amid reports that a long-awaited debt-restructuring deal may be near.

But the company said late Thursday that it "has not concluded" any deal on debt or asset sales.

Shares are down 11% today, reversing most of yesterday's 15% jump to 3-month highs and cutting the week's surge to 32%...

Nach trading halt: 0.26SGD ==> -14.75%

Quote in Singapur: https://www.bloomberg.com/quote/NOBL:SP1:26 am ET January 26, 2018 (Dow Jones)

0626 GMT - Investors continue to be in wait-and-see mode on Noble, meaning today the debt-laden commodities company's shares have unwound some of this week's pop.

Trading was halted yesterday afternoon for news pending amid reports that a long-awaited debt-restructuring deal may be near.

But the company said late Thursday that it "has not concluded" any deal on debt or asset sales.

Shares are down 11% today, reversing most of yesterday's 15% jump to 3-month highs and cutting the week's surge to 32%...

‘more pain’ ahead ==> debt-to-equity swap (was denn sonst??)

25.1.:Noble Group Strikes Restructure Deal With Lenders

https://www.bloomberg.com/news/articles/2018-01-25/noble-gro…

* Agreement involves debt-to-equity swap and a new investor

* Trader’s bonds extend rally to highest levels since May

=>

Noble Group Ltd. has reached the outline of an agreement with its creditors to restructure about $3.5 billion in debt, paving the way for an investor to take a controlling stake in the company...

The agreement with bondholders and lenders was reached after meetings in London earlier this week, according to Debtwire. If implemented, the plan would give Noble access to working capital at a cheaper cost, and allow creditors to cash-in on shares obtained from a debt-to-equity swap via a sale to the strategic investor, it said.

A framework had been agreed between the parties, with some issues to be worked through, according to the report...

...

New Company

Under the agreement reported by Debtwire, Noble Group would set up a new company, in which employees would own stakes with the option to increase their share if performance targets are met.

Current equity holders, including founder Richard Elman -- who at one point turned a tiny trader into a $10 billion empire -- and China’s sovereign wealth fund, would have a smaller shareholding than employees, according to the report. Creditors would be given a controlling stake, before selling on to the strategic investor, and the company would resurface with about $600 million in debt.

Noble Group said this week it remains in talks with potential investors after a Chinese company, Cedar Holdings Group, was reported by Bloomberg to have made an approach to shareholders.

Debtwire said Cedar is a candidate to enter the company and that talks with other strategic investors had been held.

die Leiche zuckt, aber "Noble Group says to expect ‘more pain’ ahead"

2017-12-15https://www.ft.com/content/3e236506-83a8-36ba-8aab-b52a508d2…

=>

A deal between Noble Group, the troubled commodity trader, and its creditors could involve a debt-for equity swap that would further dilute existing shareholders, its chairman has warned.

Speaking at a shareholder meeting to approve the sale of its oil business to Vitol Group, Noble’s Paul Brough said there would be “more pain” ahead as it tries to restructure its debts to stave off the threat of insolvency.

“As we go forward, I think there will be more pain, but there is hope as well,” Mr Brough was reported as saying by Bloomberg. “So it remains to be seen exactly what the restructuring looks like. We have been talking to our creditors for about a month now. We expect to receive a proposal soon.”

Noble’s biggest shareholder is its founder Richard Elman. He owns 18.3 per cent of the company. Another big investor is China Investment Corporation, China’s powerful sovereign wealth fund. It has a 9.5 per cent stake.

...

Mr Brough told shareholders that Noble expected its lenders to extend a covenant waiver on a $1.1bn credit facility that expires next week.

Noble has $3.7bn of net debt. A $380m bond is due in March and the $1.1bn credit facility has to repaid or refinance in May.

Noble to sell US-based ethanol producer

8.12.http://www.straitstimes.com/business/companies-markets/noble…

=>

Troubled commodity trader Noble Group has found a new buyer in Mercuria Investments US, Inc to dispose of its US-based ethanol producer for a base consideration of US$15.5 million - US$3 million higher than its previous offer from Zeeland Farm Services.

On Nov 27, 2017, Noble had said it would sell its ethanol producing unit - Noble Americas South Bend Ethanol (Nasbe) - to Zeeland Farm for US$12.5 million, plus adjustments for working capital, inventory and debt.

However, in a Singapore Exchange (SGX) filing on Friday, Noble said it has entered into a new equity purchase agreement on Dec 7, 2017, with Mercuria Investments, a unit of Mercuria Energy, on the same terms as its deal with Zeeland Farm, except for the deletion of the provision relating to the go-shop period, and an increase in the base consideration of US$3 million.

Noble is expected to terminate its agreement with Zeeland Farm on Dec 11 at 12.01am (New York time). A termination fee of US$2 million will be incurred.

...

Noble is set to hold a shareholder meeting in Singapore on Dec 15 to vote on the sale of majority of its oil business to Vitol Group. In addition, a coupon payment is due on Dec 24 for Noble's US$400 million perpetual securities, which have collapsed 46 US cents in the past year to 8.5 US cents on Thursday, according to Bloomberg. Noble has already deferred payment on the notes once.

Noble Group to sell four ships to cut debt

https://www.reuters.com/article/us-noble-grp-m-a/noble-group…=>

Struggling commodity trader Noble Group Ltd said on Wednesday it would sell four dry bulk carrier vessels for about $95 million, as it looks to cut debt to keep its business running.

Net proceeds from the disposal, following repayment of bank loans associated with the ships and other costs, will amount to about $30 million, the company said in a statement.

=> immerhin kann man noch überhaupt etwas verkaufen

Zumindest zeigt man guten Willen in dieser Hinsicht; sonst siehe oben.

Zumindest zeigt man guten Willen in dieser Hinsicht; sonst siehe oben. Saukomisch:

https://iceberg-research.com/2017/11/28/open-letter-to-noble…"You lost a fortune but a few people have thrived. For example the current CEO Will Randall, the former CEO Yusuf Alireza and a few others made dozens of millions. They are now excessively rich. We don’t know exactly how much because Noble still refuses to disclose their individual remunerations. When asked to justify this policy, Noble claims the disclosure would “hurt its standing”. “Its what?”, you may ask. Its standing… They have a standing at Noble. This is the corporate version of the middle finger and it is pointed at you and at the shareholders who lost everything."

Bin ja schon länger bei Bestand Null, aber jetzt werfe ich sie auch aus meinem Excel.

Antwort auf Beitrag Nr.: 56.142.341 von faultcode am 09.11.17 13:38:10

Antwort auf Beitrag Nr.: 56.142.341 von faultcode am 09.11.17 13:38:10

umsortiert in Teilportfolio "death-row":