Hewlett Packard Enterprises - Die letzten 30 Beiträge

eröffnet am 11.07.16 13:12:18 von

neuester Beitrag 09.01.24 15:21:44 von

neuester Beitrag 09.01.24 15:21:44 von

Beiträge: 54

ID: 1.234.981

ID: 1.234.981

Aufrufe heute: 0

Gesamt: 5.156

Gesamt: 5.156

Aktive User: 0

ISIN: US42824C1099 · WKN: A140KD · Symbol: 2HP

15,924

EUR

+0,64 %

+0,102 EUR

Letzter Kurs 09:29:58 Tradegate

Neuigkeiten

25.04.24 · Business Wire (engl.) |

24.04.24 · Business Wire (engl.) |

23.04.24 · Business Wire (engl.) |

17.04.24 · Business Wire (engl.) |

16.04.24 · Business Wire (engl.) |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 26,60 | +25,47 | |

| 1,5000 | +20,00 | |

| 145,50 | +20,00 | |

| 8,3800 | +18,03 | |

| 4,0000 | +16,96 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,0700 | -19,41 | |

| 0,8400 | -21,50 | |

| 0,5201 | -30,65 | |

| 7,9500 | -48,21 | |

| 1,0100 | -54,09 |

Beitrag zu dieser Diskussion schreiben

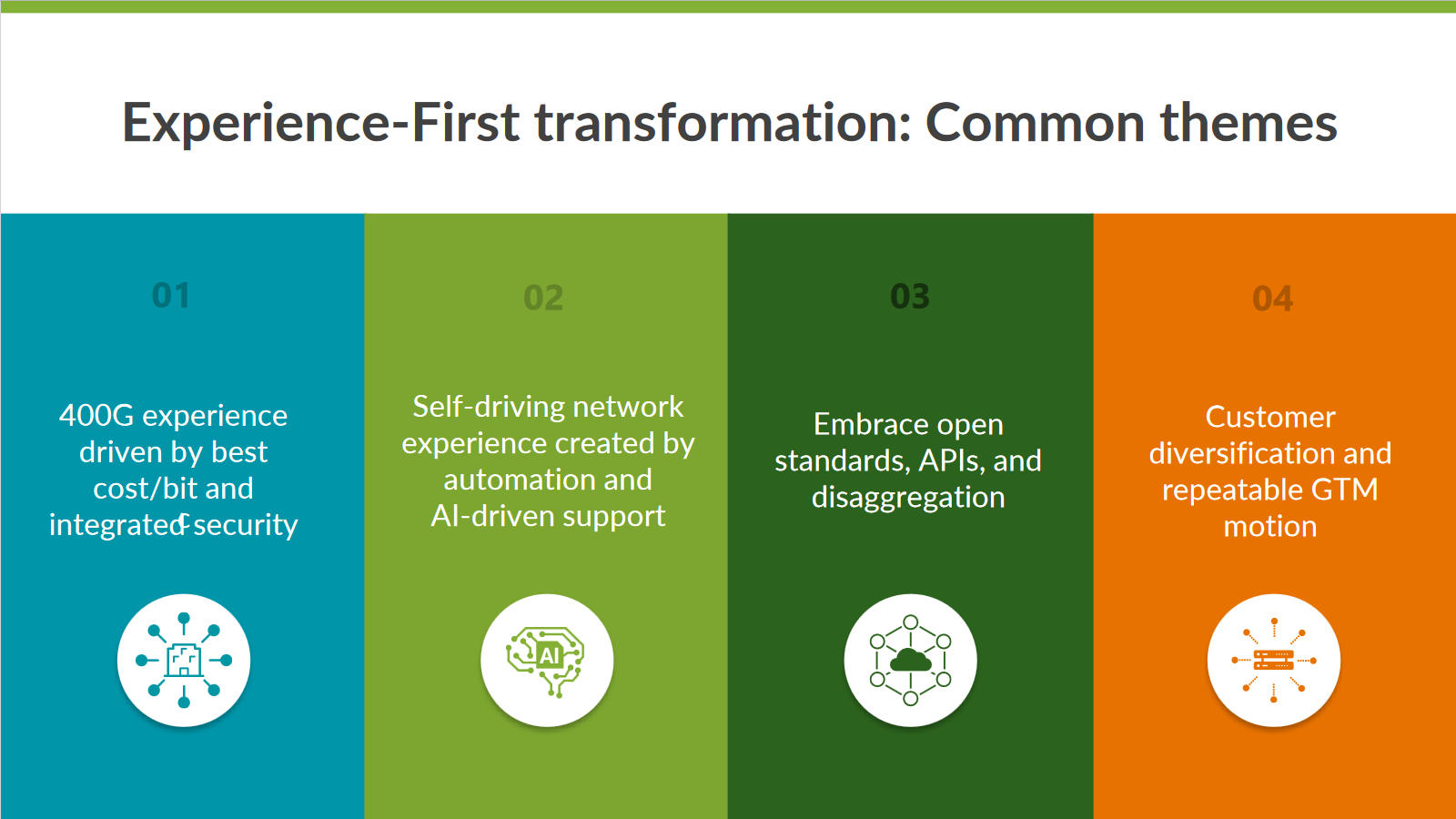

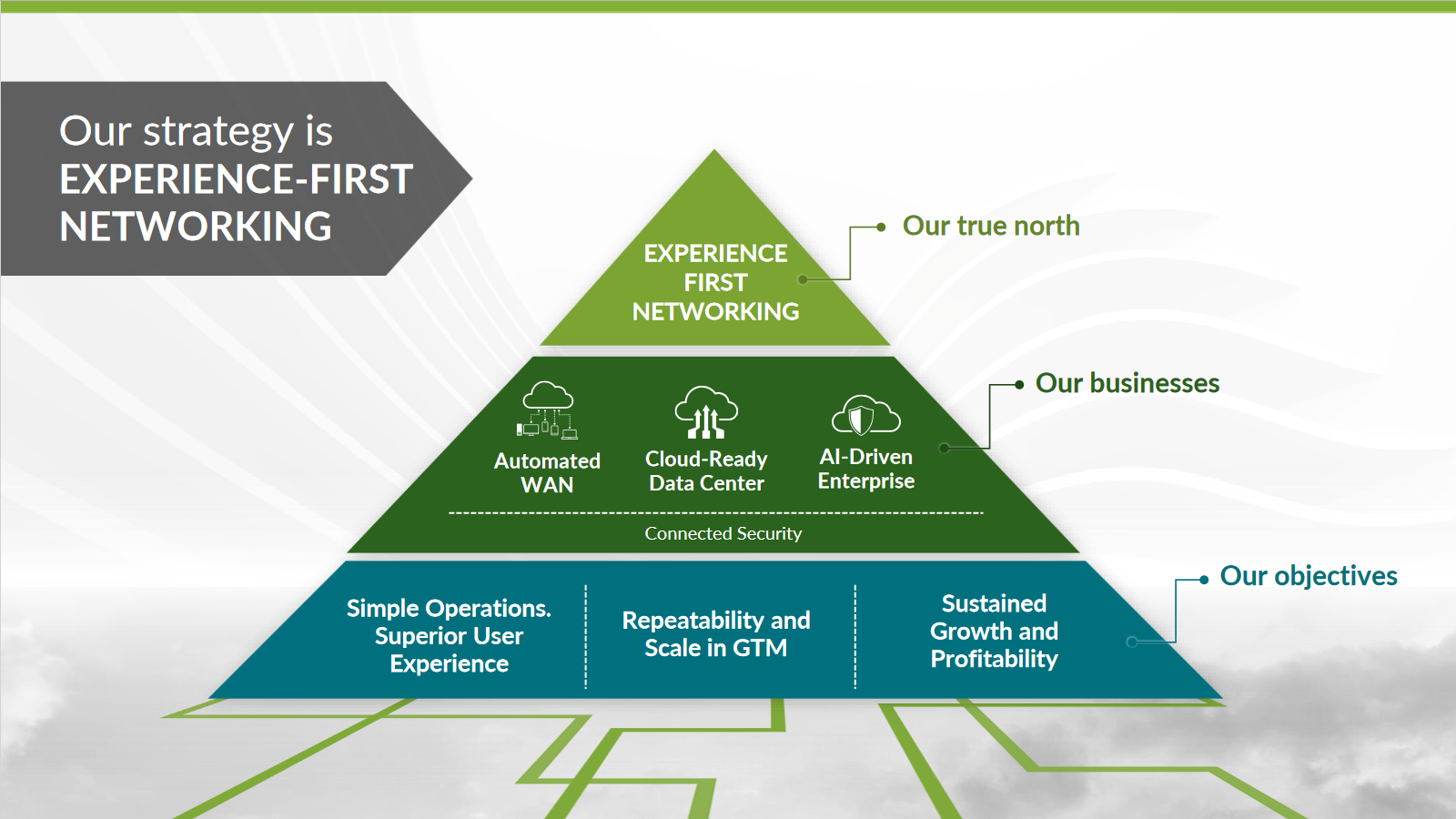

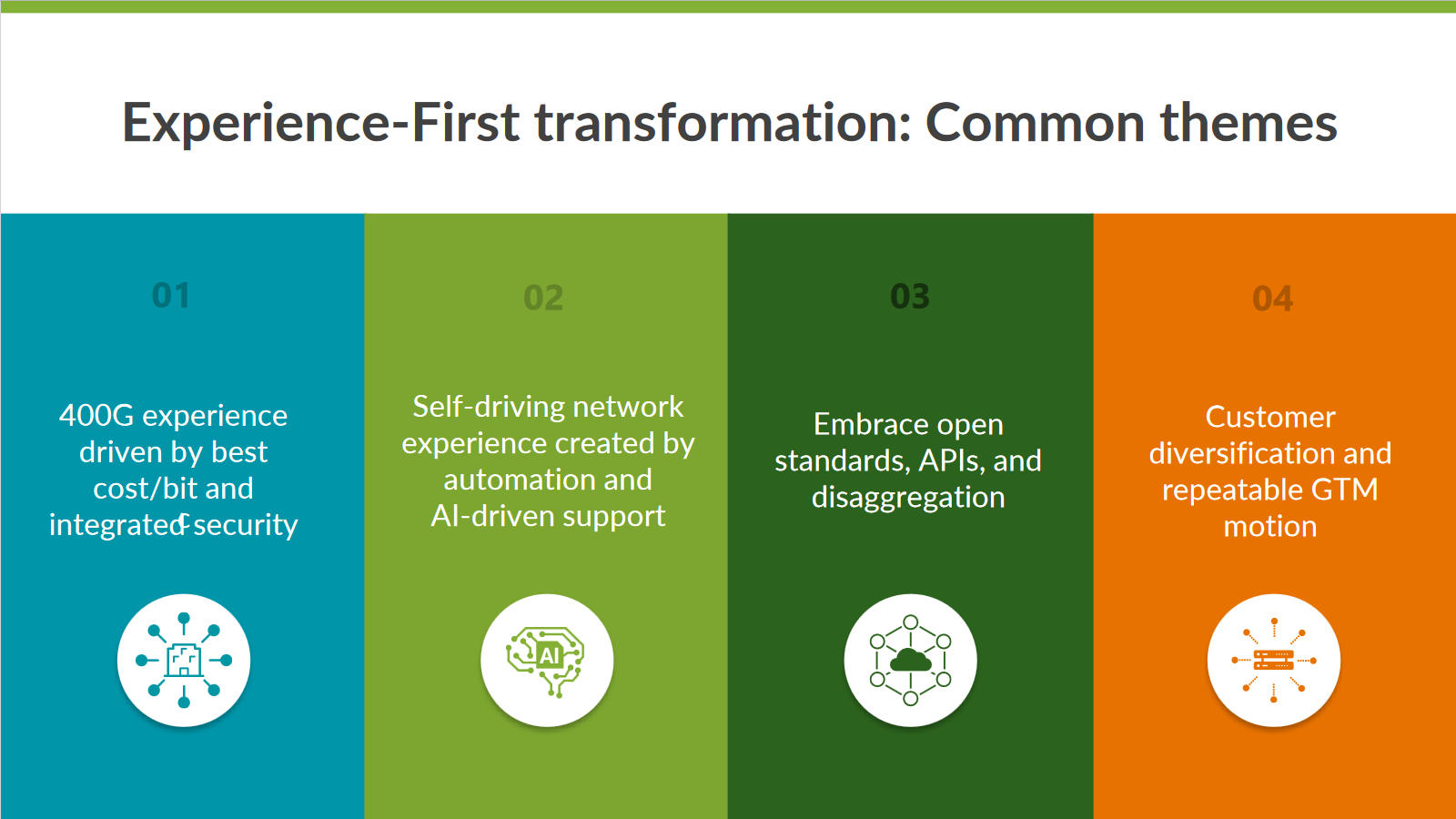

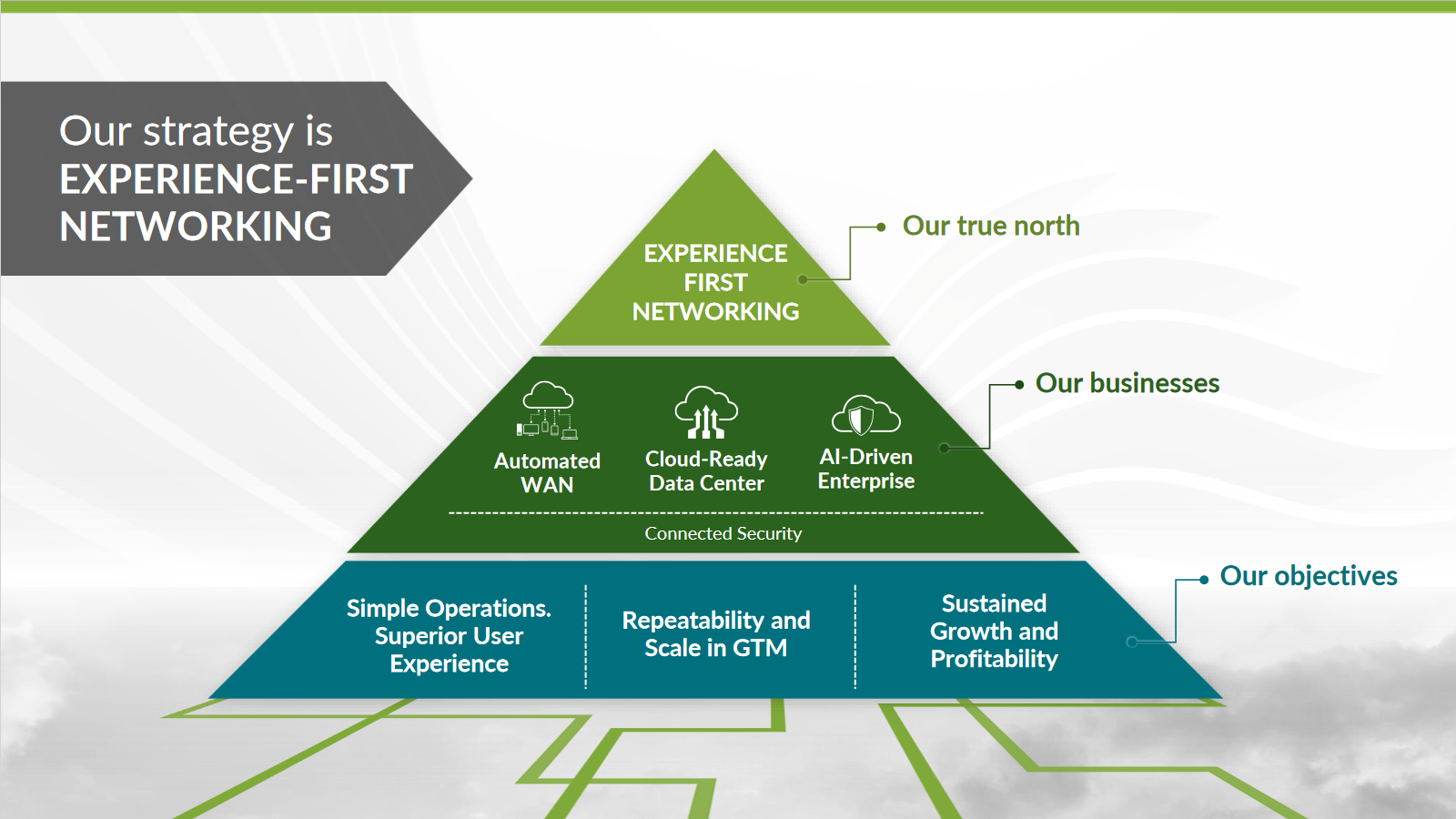

Vielleicht dazu interessant aus der Juniper Networks Investor Relations Presentation October 2023:

https://s1.q4cdn.com/608738804/files/doc_presentations/2023/…

https://s1.q4cdn.com/608738804/files/doc_presentations/2023/…

Hewlett Packard wohl kurz vor milliardenschwerer Übernahme von Juniper

Der Deal könnte Insidern zufolge noch in der aktuellen Woche bekanntgegeben werden. Die Aktien von Juniper legten nachbörslich um 21 Prozent zu.

09.01.2024

Hewlett Packard wohl kurz vor milliardenschwerer Übernahme von Juniper

Hewlett Packard Enterprise befindet sich einem Zeitungsbericht zufolge in fortgeschrittenen Gesprächen über eine rund 13 Milliarden Dollar schwere Übernahme des Netzwerkausrüsters Juniper Networks.

Anzeige

Der fast 100 Jahre alte US-Technologiekonzern wolle mit dem Deal sein Geschäft mit künstlicher Intelligenz (KI) stärken, berichtete das „Wall Street Journal“ am Montag unter Berufung auf mit der Angelegenheit vertraute Personen. Der Deal könnte noch in dieser Woche bekannt gegeben werden. HPE lehnte eine Stellungnahme zu dem Bericht ab. Juniper reagierte zunächst nicht auf eine Anfrage von Reuters.

Der Serverhersteller HPE hatte im vergangenen Jahr angekündigt, einen Cloud-Computing-Dienst auf den Markt zu bringen, der ähnliche KI-Systeme wie ChatGPT betreiben soll. Die Aktien von HPE fielen um 7,7 Prozent, während Juniper im nachbörslichen Handel um 21 Prozent zulegte.

Der Deal könnte Insidern zufolge noch in der aktuellen Woche bekanntgegeben werden. Die Aktien von Juniper legten nachbörslich um 21 Prozent zu.

09.01.2024

Hewlett Packard wohl kurz vor milliardenschwerer Übernahme von Juniper

Hewlett Packard Enterprise befindet sich einem Zeitungsbericht zufolge in fortgeschrittenen Gesprächen über eine rund 13 Milliarden Dollar schwere Übernahme des Netzwerkausrüsters Juniper Networks.

Anzeige

Der fast 100 Jahre alte US-Technologiekonzern wolle mit dem Deal sein Geschäft mit künstlicher Intelligenz (KI) stärken, berichtete das „Wall Street Journal“ am Montag unter Berufung auf mit der Angelegenheit vertraute Personen. Der Deal könnte noch in dieser Woche bekannt gegeben werden. HPE lehnte eine Stellungnahme zu dem Bericht ab. Juniper reagierte zunächst nicht auf eine Anfrage von Reuters.

Der Serverhersteller HPE hatte im vergangenen Jahr angekündigt, einen Cloud-Computing-Dienst auf den Markt zu bringen, der ähnliche KI-Systeme wie ChatGPT betreiben soll. Die Aktien von HPE fielen um 7,7 Prozent, während Juniper im nachbörslichen Handel um 21 Prozent zulegte.

Beat!

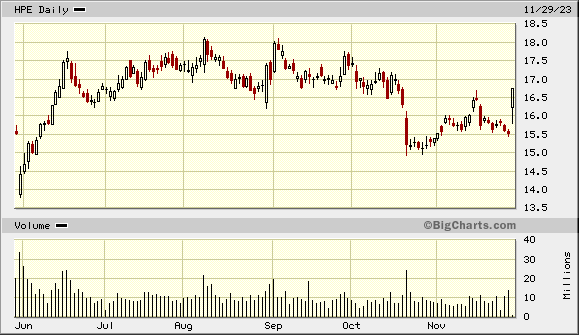

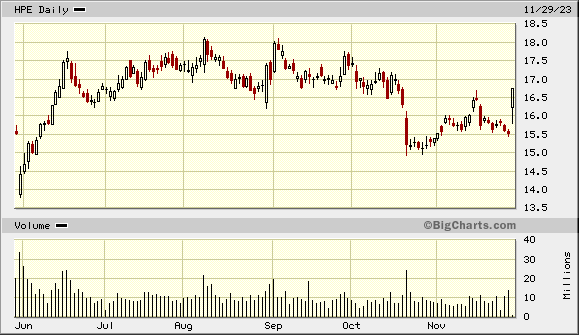

29.11.

Hewlett Packard Enterprise Reports Q4 Results to Close Impressive Fiscal 2023; Raises Dividend in Fiscal 2024

https://www.businesswire.com/news/home/20231128841766/en/

• Driven by strong revenue performance due to momentum in addressing market trends in Edge, Hybrid Cloud, and AI

• Delivered strong full-year cash flow from operations, record-breaking gross margin and free cash flow

...

"In fiscal year 2023, HPE clearly demonstrated that our strategic investments and extraordinary innovation across the growth areas of Edge, Hybrid Cloud, and AI are resonating with customers,” said Antonio Neri, president and CEO of Hewlett Packard Enterprise.

“We delivered record performance against key financial metrics this year. Our steady execution resulted in higher revenue, further margin expansion, larger operating profit, and record-breaking non-GAAP diluted net earnings per share and free cash flow. As we continue to capitalize on growing market opportunities – particularly as customer interest in AI continues to explode – I am confident in our ability to deliver substantial returns to our shareholders, hence why we are raising the dividend in FY 2024.”

...

=>

29.11.

Hewlett Packard Enterprise Reports Q4 Results to Close Impressive Fiscal 2023; Raises Dividend in Fiscal 2024

https://www.businesswire.com/news/home/20231128841766/en/

• Driven by strong revenue performance due to momentum in addressing market trends in Edge, Hybrid Cloud, and AI

• Delivered strong full-year cash flow from operations, record-breaking gross margin and free cash flow

...

"In fiscal year 2023, HPE clearly demonstrated that our strategic investments and extraordinary innovation across the growth areas of Edge, Hybrid Cloud, and AI are resonating with customers,” said Antonio Neri, president and CEO of Hewlett Packard Enterprise.

“We delivered record performance against key financial metrics this year. Our steady execution resulted in higher revenue, further margin expansion, larger operating profit, and record-breaking non-GAAP diluted net earnings per share and free cash flow. As we continue to capitalize on growing market opportunities – particularly as customer interest in AI continues to explode – I am confident in our ability to deliver substantial returns to our shareholders, hence why we are raising the dividend in FY 2024.”

...

=>

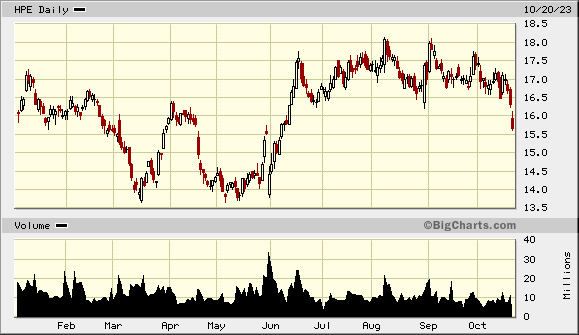

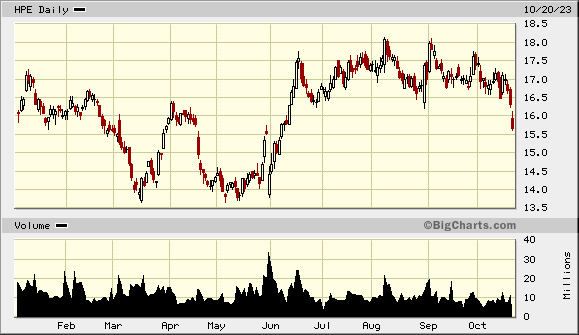

Senkung Ausblick:

19.10.

https://finance.yahoo.com/news/hewlett-packard-enterprise-cu…

...

For 2023, The company now sees EPS in a range of $1.35 to $1.39, down from a prior range of $1.42 to $1.46 a share. But forecasts on adjusted EPS was unchanged in a range of $2.11 and $2.15.

Looking further ahead, the company forecasts in 2024 of 2% to 4% and adjusted EPS of between $1.82 and $2.02 and aims to increased its dividend per share by 8%.

...

19.10.

https://finance.yahoo.com/news/hewlett-packard-enterprise-cu…

...

For 2023, The company now sees EPS in a range of $1.35 to $1.39, down from a prior range of $1.42 to $1.46 a share. But forecasts on adjusted EPS was unchanged in a range of $2.11 and $2.15.

Looking further ahead, the company forecasts in 2024 of 2% to 4% and adjusted EPS of between $1.82 and $2.02 and aims to increased its dividend per share by 8%.

...

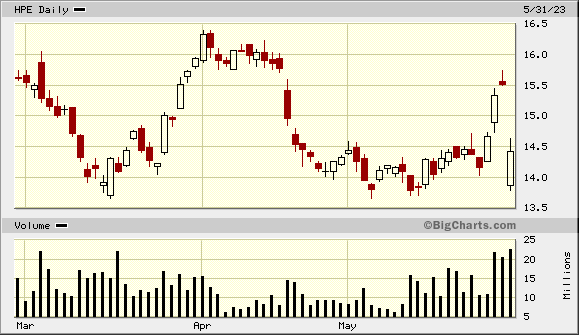

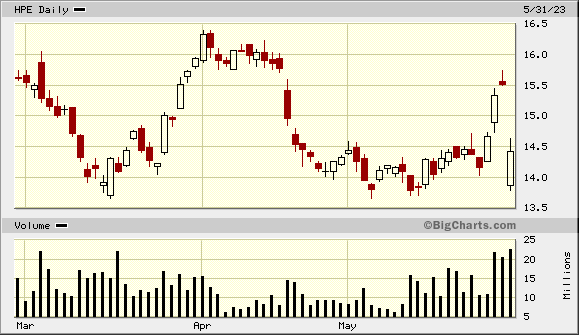

30.5.

Hewlett Packard Enterprise reports fiscal 2023 second quarter results

https://www.wallstreet-online.de/nachricht/16992770-hewlett-…

...

Fiscal 2023 Outlook

HPE estimates fiscal 2023 revenue growth to be in the range of 4%-6% in constant currency(1), and targets fiscal 2023 GAAP operating profit growth to be in the range of 180%-184% and non-GAAP operating profit(4) growth to be in the range of 6%-7%. HPE raises GAAP diluted net EPS to be in the range of $1.42 and $1.50 and non-GAAP diluted net EPS to be in the range of $2.06 and $2.14. Fiscal 2023 non-GAAP diluted net EPS estimates exclude after-tax adjustments of $0.64 per diluted share, primarily related to stock-based compensation expense, amortization of intangible assets, and transformation costs.

Fiscal 2023 Free Cash Flow (3)(5)

Reiterates guidance of $1.9 billion to $2.1 billion.

Fiscal 2023 Capital Returns to Shareholders

Returning approximately 60% of free cash flow to shareholders in dividends and share repurchases.

...

=> wenigstens eine weiße Tages-Kerze:

Hewlett Packard Enterprise reports fiscal 2023 second quarter results

https://www.wallstreet-online.de/nachricht/16992770-hewlett-…

...

Fiscal 2023 Outlook

HPE estimates fiscal 2023 revenue growth to be in the range of 4%-6% in constant currency(1), and targets fiscal 2023 GAAP operating profit growth to be in the range of 180%-184% and non-GAAP operating profit(4) growth to be in the range of 6%-7%. HPE raises GAAP diluted net EPS to be in the range of $1.42 and $1.50 and non-GAAP diluted net EPS to be in the range of $2.06 and $2.14. Fiscal 2023 non-GAAP diluted net EPS estimates exclude after-tax adjustments of $0.64 per diluted share, primarily related to stock-based compensation expense, amortization of intangible assets, and transformation costs.

Fiscal 2023 Free Cash Flow (3)(5)

Reiterates guidance of $1.9 billion to $2.1 billion.

Fiscal 2023 Capital Returns to Shareholders

Returning approximately 60% of free cash flow to shareholders in dividends and share repurchases.

...

=> wenigstens eine weiße Tages-Kerze:

Antwort auf Beitrag Nr.: 73.913.528 von Oginvest am 26.05.23 15:16:02Zur Info dazu:

HPE Is Selling Its 49 Percent Stake In H3C China Subsidiary

January 03, 2023 - ‘HPE is going to get bunch of cash - yet to be defined how much that is – the question is what are they going to do with that cash?’ says Future Tech CEO Bob Venero. ‘Will it be to acquire another company or double down on their cloud services business?’

Hewlett Packard Enterprise Tuesday said in a U.S. Securities and Exchange Commission filing that it intends to sell its 49 percent stake in its H3C Chinese enterprise IT joint venture.

H3C is the exclusive provider of HPE servers, storage and associated IT technical services in China.

HPE owns a 49 percent share in the company while Chinese company Unisplendour Corp. owns a 51 percent share.

The H3C sale could provide a financial windfall for HPE that could be used for acquisitions or other activities.

Financial advisory firm UBS in a research note estimated the value of HPE’s 49 percent equity stake at $3.5 billion to $4.0 billion on a pre-tax basis or $2.50-$2.70 per HPE share after-tax.

“While we expect some debt repayment and share buybacks, given the recent press reports that HPE was interested in acquiring Nutanix, we believe HPE could use a large percentage of the proceeds to pursue a strategic transaction,” UBS said in the research note. UBS said given the steps required to close the deal, it does not expect HPE to receive 100 percent of the proceeds until late in fiscal year 2023 which ends Oct. 31.

...

https://www.crn.com/news/cloud/hpe-is-selling-its-49-percent…

HPE Is Selling Its 49 Percent Stake In H3C China Subsidiary

January 03, 2023 - ‘HPE is going to get bunch of cash - yet to be defined how much that is – the question is what are they going to do with that cash?’ says Future Tech CEO Bob Venero. ‘Will it be to acquire another company or double down on their cloud services business?’

Hewlett Packard Enterprise Tuesday said in a U.S. Securities and Exchange Commission filing that it intends to sell its 49 percent stake in its H3C Chinese enterprise IT joint venture.

H3C is the exclusive provider of HPE servers, storage and associated IT technical services in China.

HPE owns a 49 percent share in the company while Chinese company Unisplendour Corp. owns a 51 percent share.

The H3C sale could provide a financial windfall for HPE that could be used for acquisitions or other activities.

Financial advisory firm UBS in a research note estimated the value of HPE’s 49 percent equity stake at $3.5 billion to $4.0 billion on a pre-tax basis or $2.50-$2.70 per HPE share after-tax.

“While we expect some debt repayment and share buybacks, given the recent press reports that HPE was interested in acquiring Nutanix, we believe HPE could use a large percentage of the proceeds to pursue a strategic transaction,” UBS said in the research note. UBS said given the steps required to close the deal, it does not expect HPE to receive 100 percent of the proceeds until late in fiscal year 2023 which ends Oct. 31.

...

https://www.crn.com/news/cloud/hpe-is-selling-its-49-percent…

Unisplendour Plans Funding For 49% H3C Stake Purchase

May 26 (Reuters) -Unisplendour Corp 000938.SZ:SAYS IT AIMS TO RAISE UP TO 12 BILLION YUAN ($1.74 billion) VIA SHARE PRIVATE PLACEMENT TO FUND ACQUISITION OF 49% STAKE IN H3C

SAYS IT AGREES TO BUY 49% STAKE IN H3C FOR $3.5 BILLION

...

https://www.xm.com/research/markets/stocks/reuters/unisplend…

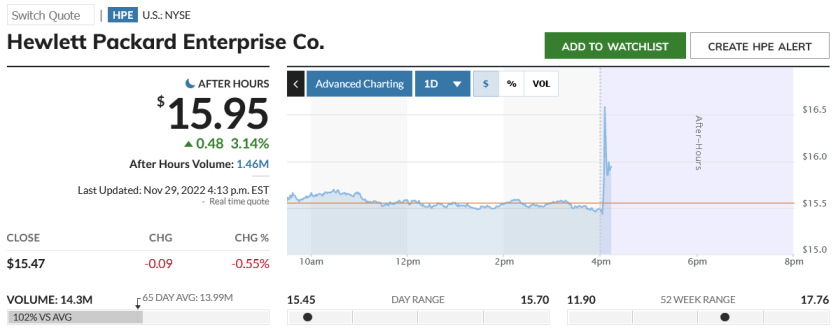

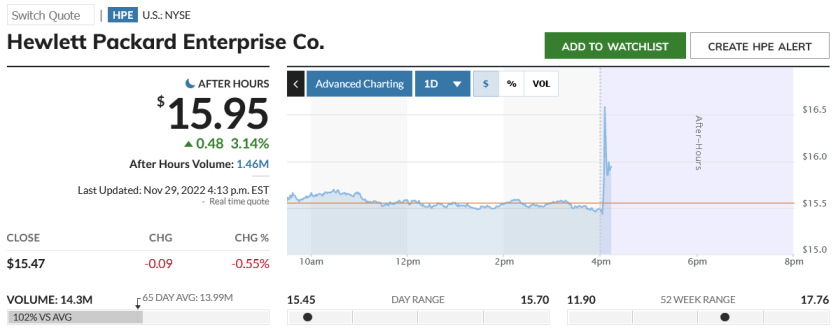

29.11.

HPE’s stock surges on record sales, strong revenue guidance

https://www.marketwatch.com/story/hpes-stock-surges-on-recor…

...

The company forecast fiscal first-quarter sales of between $7.2 billion and $7.6 billion, while analysts polled by FactSet on average have modeled $6.98 billion.

“Our differentiated edge-to-cloud portfolio is driving sustained demand, which is translating to record- or near-record results,” HPE Chief Financial Officer Tarek Robbiati said in a statement announcing the results.

HPE reported a fiscal fourth-quarter net loss of $304 million, or 23 cents a share, compared with net earnings of $409 million, or 31 cents a share, in the year-ago quarter. Adjusted earnings were 57 cents a share.

...

=>

HPE’s stock surges on record sales, strong revenue guidance

https://www.marketwatch.com/story/hpes-stock-surges-on-recor…

...

The company forecast fiscal first-quarter sales of between $7.2 billion and $7.6 billion, while analysts polled by FactSet on average have modeled $6.98 billion.

“Our differentiated edge-to-cloud portfolio is driving sustained demand, which is translating to record- or near-record results,” HPE Chief Financial Officer Tarek Robbiati said in a statement announcing the results.

HPE reported a fiscal fourth-quarter net loss of $304 million, or 23 cents a share, compared with net earnings of $409 million, or 31 cents a share, in the year-ago quarter. Adjusted earnings were 57 cents a share.

...

=>

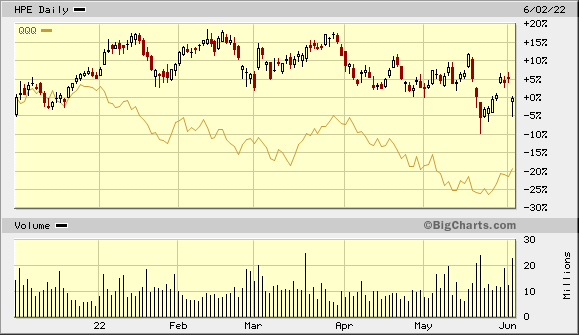

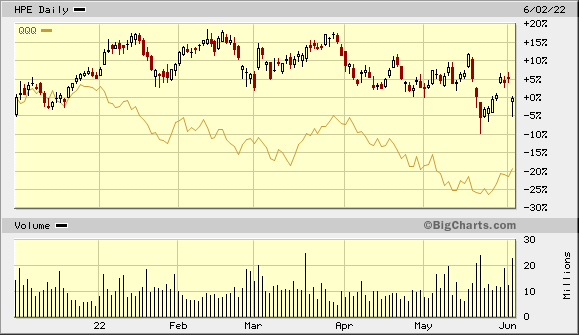

2022Q1 kam nicht so gut an:

1.6.

Hewlett Packard Enterprise Earnings, Q3 Outlook Below Consensus

https://www.wallstreet-online.de/nachricht/15536491-hewlett-…

aber:

“Persistent demand led to another quarter of significant order growth and higher revenue for HPE, underscoring the accelerating interest customers have in our unique edge-to-cloud portfolio and our HPE GreenLake platform,” said Antonio Neri, president, and CEO of Hewlett Packard Enterprise.

“I am optimistic that demand will continue to be strong, given our customers’ needs to accelerate their business resilience and competitiveness. We remain focused on innovating for our customers and on executing with discipline so that we translate that demand into profitable growth for HPE.”

“We are particularly pleased with the resiliency of our gross margins despite the inflationary environment and ongoing supply chain disruptions,” said Tarek Robbiati, EVP and CFO of Hewlett Packard Enterprise. “With record levels of high-quality backlog, we are well positioned for growth in FY22 and beyond, and confident in realizing the financial commitments we set at our Securities Analyst Meeting last October.”

https://investors.hpe.com/

=>

1.6.

Hewlett Packard Enterprise Earnings, Q3 Outlook Below Consensus

https://www.wallstreet-online.de/nachricht/15536491-hewlett-…

aber:

“Persistent demand led to another quarter of significant order growth and higher revenue for HPE, underscoring the accelerating interest customers have in our unique edge-to-cloud portfolio and our HPE GreenLake platform,” said Antonio Neri, president, and CEO of Hewlett Packard Enterprise.

“I am optimistic that demand will continue to be strong, given our customers’ needs to accelerate their business resilience and competitiveness. We remain focused on innovating for our customers and on executing with discipline so that we translate that demand into profitable growth for HPE.”

“We are particularly pleased with the resiliency of our gross margins despite the inflationary environment and ongoing supply chain disruptions,” said Tarek Robbiati, EVP and CFO of Hewlett Packard Enterprise. “With record levels of high-quality backlog, we are well positioned for growth in FY22 and beyond, and confident in realizing the financial commitments we set at our Securities Analyst Meeting last October.”

https://investors.hpe.com/

=>

Antwort auf Beitrag Nr.: 71.620.995 von faultcode am 20.05.22 14:03:44MT: HPE CEO Not Worried About Economy in 2022 -- Market Talk

Today 7:52 AM ET (Dow Jones)

0751 ET - Hewlett Packard Enterprise CEO Antonio Neri says he isn't too worried about the economy this year, but should it worsen in 2023 the company will make more targeted investments.

Neri, in an interview at the World Economic Forum, says the tech firm recently had a meeting where it plans for the next three years. That planning includes a scenario for a potential recession, including "what can I do to come out stronger on the other side," he said. Neri says the strategy would include freeing up capital and reinvesting it strategically. "It's a different game than cutting costs," he added. (emily.glazer@wsj.com)

(END) Dow Jones Newswires

Today 7:52 AM ET (Dow Jones)

0751 ET - Hewlett Packard Enterprise CEO Antonio Neri says he isn't too worried about the economy this year, but should it worsen in 2023 the company will make more targeted investments.

Neri, in an interview at the World Economic Forum, says the tech firm recently had a meeting where it plans for the next three years. That planning includes a scenario for a potential recession, including "what can I do to come out stronger on the other side," he said. Neri says the strategy would include freeing up capital and reinvesting it strategically. "It's a different game than cutting costs," he added. (emily.glazer@wsj.com)

(END) Dow Jones Newswires

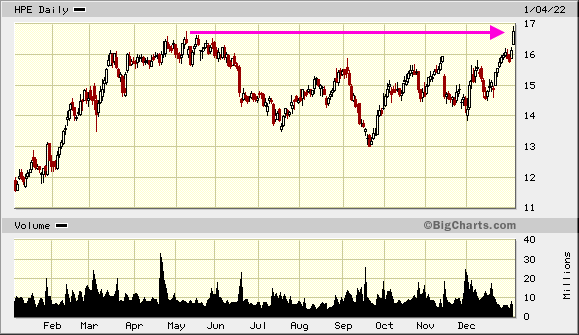

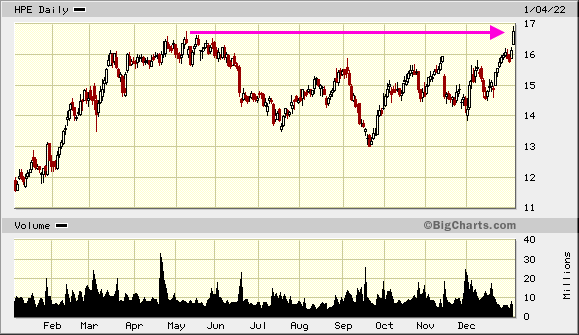

B of A Securities Downgrades Hewlett Packard to Neutral, Lowers Price Target to $16

Today 7:51 AM ET (Benzinga)Print

B of A Securities analyst Wamsi Mohan downgrades Hewlett Packard (NYSE:HPE) from Buy to Neutral and lowers the price target from $19 to $16.

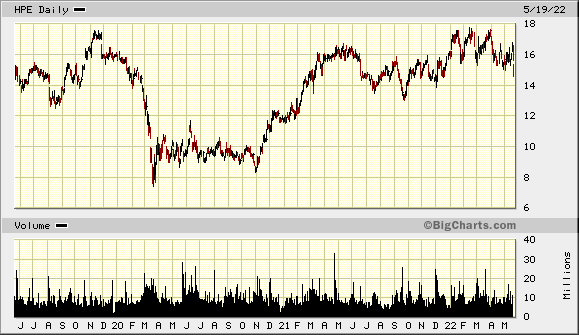

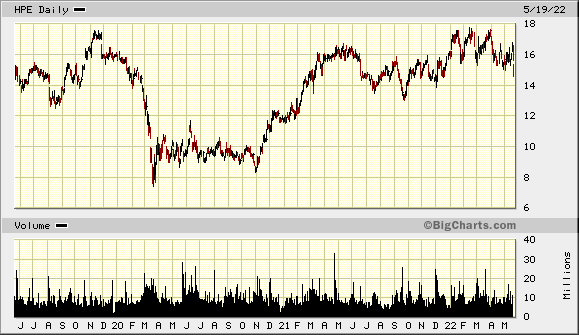

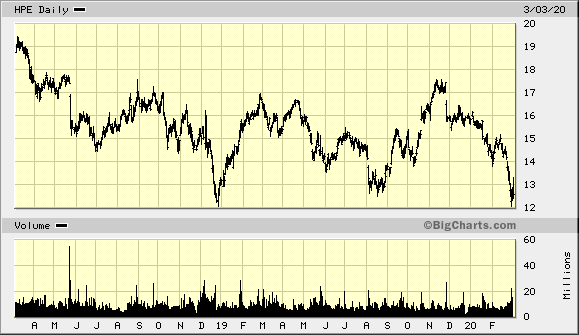

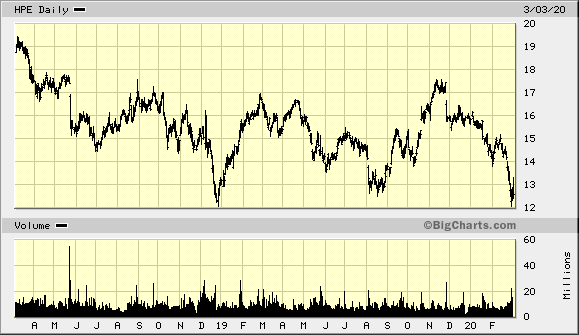

Fun fact: die HPE-Aktie hat die letzten Jahre noch nie $19 gesehen:

Today 7:51 AM ET (Benzinga)Print

B of A Securities analyst Wamsi Mohan downgrades Hewlett Packard (NYSE:HPE) from Buy to Neutral and lowers the price target from $19 to $16.

Fun fact: die HPE-Aktie hat die letzten Jahre noch nie $19 gesehen:

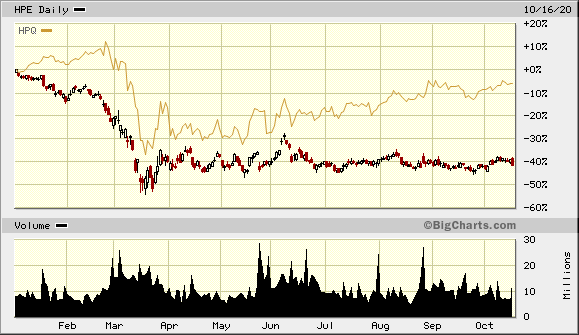

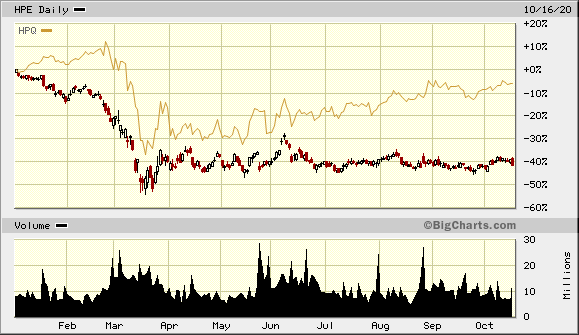

Antwort auf Beitrag Nr.: 70.392.271 von faultcode am 04.01.22 17:18:44Die HP Inc. Aktie rauscht um eingies besser nach oben, als die Hewlett Enterprises.

Mit dem Drucker - und Servicegeschäft ist mehr zu verdienen, scheint mir.

Mit dem Drucker - und Servicegeschäft ist mehr zu verdienen, scheint mir.

Achtung!

4.1.

Barclays Bumps Up Hewlett Packard Enterprise Price Target By 25%

https://www.benzinga.com/analyst-ratings/analyst-color/22/01…

...

• Barclays analyst Tim Long upgraded Hewlett Packard Enterprise Co to Overweight from Equal Weight with a price target of $20, up from $16.

• The price target implies a 23.9% upside.

• Long believes the company's core server and storage market is stabilizing and moving to as-a-service.

• Meanwhile, Long thinks its networking "should see solid growth."

• Further, HP Enterprise's valuation is the lowest in the group.

...

4.1.

Barclays Bumps Up Hewlett Packard Enterprise Price Target By 25%

https://www.benzinga.com/analyst-ratings/analyst-color/22/01…

...

• Barclays analyst Tim Long upgraded Hewlett Packard Enterprise Co to Overweight from Equal Weight with a price target of $20, up from $16.

• The price target implies a 23.9% upside.

• Long believes the company's core server and storage market is stabilizing and moving to as-a-service.

• Meanwhile, Long thinks its networking "should see solid growth."

• Further, HP Enterprise's valuation is the lowest in the group.

...

28.10.

Hewlett Packard Enterprise provides upbeat 2022 profit outlook, raises longer-term revenue growth view

...

Shares of Hewlett Packard Enterprise Co. rose 1.0% in afternoon trading Thursday, after the information technology company provided an upbeat earnings outlook for next year, and raised its longer-term revenue growth outlook.

The company said it expects 2022 adjusted earnings per share of $1.96 to $2.10, compared with the FactSet EPS consensus of $1.97. The company also said it expects to buy back at least $500 million worth of its stock in 2022, and pay out about $625 million in dividends.

Chief Executive Antonio Neri said at the company's virtual securities analyst meeting that there are three distinct trends that have gained traction as the world recovers from the COVID-19 pandemic:

1) explosion of data at the edge which requires secure connectivity;

2) the mandate for a cloud-everywhere experience; and

3) the need to quickly extract value from data to generate insights and build new business models.

The company raised its compound annual growth rate for revenue, for 2022 through 2024, to 2% to 4% from 1% to 3%.

...

https://www.marketwatch.com/story/hewlett-packard-enterprise…

Hewlett Packard Enterprise provides upbeat 2022 profit outlook, raises longer-term revenue growth view

...

Shares of Hewlett Packard Enterprise Co. rose 1.0% in afternoon trading Thursday, after the information technology company provided an upbeat earnings outlook for next year, and raised its longer-term revenue growth outlook.

The company said it expects 2022 adjusted earnings per share of $1.96 to $2.10, compared with the FactSet EPS consensus of $1.97. The company also said it expects to buy back at least $500 million worth of its stock in 2022, and pay out about $625 million in dividends.

Chief Executive Antonio Neri said at the company's virtual securities analyst meeting that there are three distinct trends that have gained traction as the world recovers from the COVID-19 pandemic:

1) explosion of data at the edge which requires secure connectivity;

2) the mandate for a cloud-everywhere experience; and

3) the need to quickly extract value from data to generate insights and build new business models.

The company raised its compound annual growth rate for revenue, for 2022 through 2024, to 2% to 4% from 1% to 3%.

...

https://www.marketwatch.com/story/hewlett-packard-enterprise…

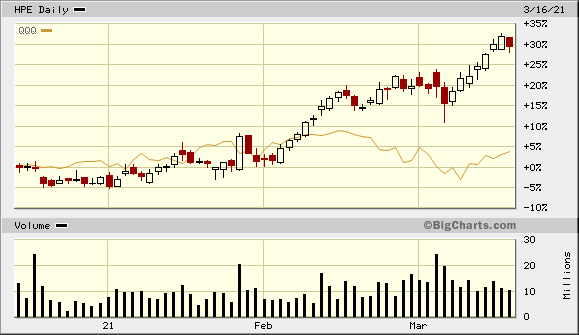

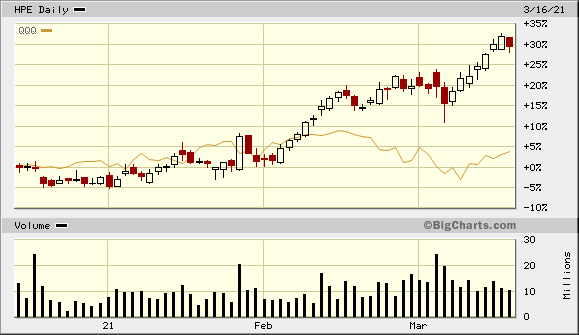

Antwort auf Beitrag Nr.: 67.486.817 von faultcode am 17.03.21 00:50:2226.7.

HP Enterprise Stock Is Rallying. It’s a Tech Bargain, Analyst Says.

https://www.marketwatch.com/articles/hp-enterprise-stock-tec…

...

Hewlett Packard Enterprise shares are getting a boost Monday from Evercore ISI analyst Amit Daryanani, who raised his rating on the stock to Outperform from In Line, while boosting his target price to $20 from $16. The new target price represents a potential gain of more than 40% from Friday’s close at $14.10.

...

But as information-technology spending picks up, and the company’s networking business in particular gains traction, the stock offers “multiple ways to win,” as the analyst writes in a research report.

...

Top-line growth is muted—Daryanani sees revenue growth of just under 2% this year, to $27.6 billion, with a similar increase next year to $28.1 billion. But he sees profits jumping to $1.88 a share this year from $1.54 last year, reaching $2 a share in 2022.

And Daryanani thinks there is a path to reach profits of $2.90 a share, with more than $2 billion in annual free cash flow. If he’s right, the stock trades for less than 5 times projected peak earnings—which makes it one of the cheapest tech stocks on the planet.

“We think HPE via a combination of organic tailwinds and self-help levers should see a path towards mid-teens [earnings and free cash flow] growth over next few years,” he writes, asserting that the company is laying the groundwork for a stock price above $20. And Daryanani adds that a sum-of-the-parts calculation yields an upside scenario north of $30 a share.

The Evercore analyst says that the growth of HPE’s $3 billion “intelligent edge” networking business in particular remains underappreciated, given double-digit growth and high teens operating margins—he thinks that the business can drive sustained multiple expansion.

...

HP Enterprise Stock Is Rallying. It’s a Tech Bargain, Analyst Says.

https://www.marketwatch.com/articles/hp-enterprise-stock-tec…

...

Hewlett Packard Enterprise shares are getting a boost Monday from Evercore ISI analyst Amit Daryanani, who raised his rating on the stock to Outperform from In Line, while boosting his target price to $20 from $16. The new target price represents a potential gain of more than 40% from Friday’s close at $14.10.

...

But as information-technology spending picks up, and the company’s networking business in particular gains traction, the stock offers “multiple ways to win,” as the analyst writes in a research report.

...

Top-line growth is muted—Daryanani sees revenue growth of just under 2% this year, to $27.6 billion, with a similar increase next year to $28.1 billion. But he sees profits jumping to $1.88 a share this year from $1.54 last year, reaching $2 a share in 2022.

And Daryanani thinks there is a path to reach profits of $2.90 a share, with more than $2 billion in annual free cash flow. If he’s right, the stock trades for less than 5 times projected peak earnings—which makes it one of the cheapest tech stocks on the planet.

“We think HPE via a combination of organic tailwinds and self-help levers should see a path towards mid-teens [earnings and free cash flow] growth over next few years,” he writes, asserting that the company is laying the groundwork for a stock price above $20. And Daryanani adds that a sum-of-the-parts calculation yields an upside scenario north of $30 a share.

The Evercore analyst says that the growth of HPE’s $3 billion “intelligent edge” networking business in particular remains underappreciated, given double-digit growth and high teens operating margins—he thinks that the business can drive sustained multiple expansion.

...

es ist nicht mehr zu übersehen - hier und auch woanders (Cisco, Intel, HPQ) - "old Tech" hat ein Comeback:

Antwort auf Beitrag Nr.: 67.294.818 von faultcode am 03.03.21 23:33:03HPE macht nun 68% seines Umsatzes außerhalb der USA (FY2018: 67%).

Antwort auf Beitrag Nr.: 65.413.983 von faultcode am 16.10.20 22:17:40gefällige 2020-Zahlen und 2021e-Ausblick:

Fiscal 2021 outlook:

Hewlett Packard Enterprise raises GAAP diluted net EPS outlook to $0.48 to $0.66 from $0.38 to $0.56 and non-GAAP diluted net EPS outlook to $1.70 to $1.88 from $1.60 to $1.78. Fiscal 2021 non-GAAP diluted net EPS estimates exclude after-tax adjustments of approximately $1.22 per diluted share, primarily related to transformation costs, stock-based compensation expense and the amortization of intangible assets. Raises free cash flow1 guidance range to $1.1 to $1.4 billion from $0.9 to $1.1 billion.

https://www.wallstreet-online.de/nachricht/13579728-hpe-repo…

Fiscal 2021 outlook:

Hewlett Packard Enterprise raises GAAP diluted net EPS outlook to $0.48 to $0.66 from $0.38 to $0.56 and non-GAAP diluted net EPS outlook to $1.70 to $1.88 from $1.60 to $1.78. Fiscal 2021 non-GAAP diluted net EPS estimates exclude after-tax adjustments of approximately $1.22 per diluted share, primarily related to transformation costs, stock-based compensation expense and the amortization of intangible assets. Raises free cash flow1 guidance range to $1.1 to $1.4 billion from $0.9 to $1.1 billion.

https://www.wallstreet-online.de/nachricht/13579728-hpe-repo…

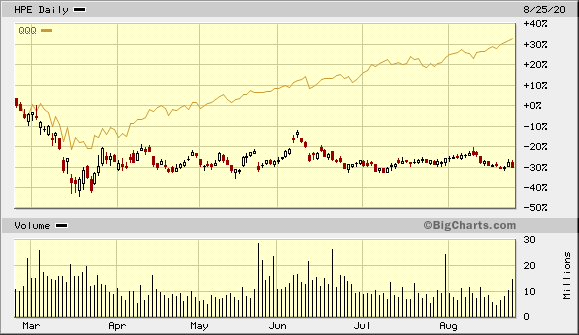

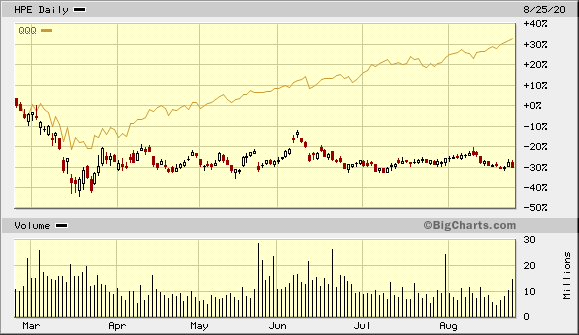

Antwort auf Beitrag Nr.: 64.881.695 von faultcode am 25.08.20 23:38:40HPE könnte im Vergleich zu HPQ auch langsam mal den Hintern hochbekommen (mMn  ):

):

15.10.

Hewlett Packard Enterprise Accelerates Pivot to Drive Long-Term Sustainable, Profitable Growth and Announces FY21 Outlook

https://www.wallstreet-online.de/nachricht/13038474-hewlett-…

...

FY21 Outlook

HPE expects its non-GAAP operating profit growth to be approximately 15-20% year-over-year, excluding costs of approximately $2.0 billion primarily related to transformation costs, stock compensation expense and amortization of intangible assets.

The company expects non-GAAP Other Income & Expense of approximately $150 million of an expense, excluding approximately $35 million net expense impact from the amortization of the basis difference in relation to the H3C divestiture, tax indemnification adjustments, and non-service net periodic benefit credits.

The company expects a non-GAAP tax rate of 14%. HPE expects non-GAAP diluted net EPS of $1.56 to $1.76, up 10% year-over-year at the mid-point when adjusted for stock-based compensation expense. The company expects GAAP diluted net EPS to be approximately $0.34 to $0.54, up $0.77 year-over-year at the mid-point and includes after-tax costs of approximately $1.22 per share related primarily to transformation costs, stock-based compensation expense and amortization of intangible assets.

Free cash flow is expected to be $0.9 billion to $1.1 billion, up 65% year-over-year at the mid-point.

...

):

):

15.10.

Hewlett Packard Enterprise Accelerates Pivot to Drive Long-Term Sustainable, Profitable Growth and Announces FY21 Outlook

https://www.wallstreet-online.de/nachricht/13038474-hewlett-…

...

FY21 Outlook

HPE expects its non-GAAP operating profit growth to be approximately 15-20% year-over-year, excluding costs of approximately $2.0 billion primarily related to transformation costs, stock compensation expense and amortization of intangible assets.

The company expects non-GAAP Other Income & Expense of approximately $150 million of an expense, excluding approximately $35 million net expense impact from the amortization of the basis difference in relation to the H3C divestiture, tax indemnification adjustments, and non-service net periodic benefit credits.

The company expects a non-GAAP tax rate of 14%. HPE expects non-GAAP diluted net EPS of $1.56 to $1.76, up 10% year-over-year at the mid-point when adjusted for stock-based compensation expense. The company expects GAAP diluted net EPS to be approximately $0.34 to $0.54, up $0.77 year-over-year at the mid-point and includes after-tax costs of approximately $1.22 per share related primarily to transformation costs, stock-based compensation expense and amortization of intangible assets.

Free cash flow is expected to be $0.9 billion to $1.1 billion, up 65% year-over-year at the mid-point.

...

Antwort auf Beitrag Nr.: 63.766.249 von faultcode am 21.05.20 22:51:3025.8.

HPE shares jump 8% on revenue, earnings beat

https://www.marketwatch.com/story/hpe-shares-jump-7-on-reven…

Hewlett Packard Enterprise Co. shares surged 8% in after-hours trading Tuesday after the enterprise software and services provider reported fiscal third-quarter results that soundly beat Wall Street estimates.

HPE reported non-GAAP earnings of 32 cents a share, compared with non-GAAP earnings of 45 cents a share in the year-ago quarter. Revenue declined 5% to $6.82 billion from $7.2 billion a year ago.

Analysts surveyed by FactSet had expected adjusted earnings of 23 cents a share on revenue of $6.06 billion.

“We significantly improved operational and supply-chain execution and advanced our innovation agenda with the introduction of HPE GreenLake cloud-services solutions, our new HPE Ezmeral software portfolio, and our planned acquisition of SD-WAN leader Silver Peak,” HPE Chief Executive Antonio Neri said in a statement.

“We were very pleased with the performance, especially in reducing our backlog $500 million,” HPE Chief Financial Officer Tarek Robbiati told MarketWatch in a phone interview after the results were announced. In a sign of the company’s confidence, it issued earnings guidance for its current fourth-quarter of non-GAAP EPS of between 32 cents and 36 cents a share — squarely above FactSet estimates of 31 cents a share.

HPE expects to be “back operating in a much more stable position” the next few quarters, Robbiati added. He pointed to revenue for high-end computing systems, which improved 3% to $649 million.

...

--> ich kann mir vorstellen, daß HPE nach dem Platzen der NASDAQ100-Blase den ein oder anderen Software-Anbieter übernehmen wird. Aber bitte keine Autonomy wieder

HPE shares jump 8% on revenue, earnings beat

https://www.marketwatch.com/story/hpe-shares-jump-7-on-reven…

Hewlett Packard Enterprise Co. shares surged 8% in after-hours trading Tuesday after the enterprise software and services provider reported fiscal third-quarter results that soundly beat Wall Street estimates.

HPE reported non-GAAP earnings of 32 cents a share, compared with non-GAAP earnings of 45 cents a share in the year-ago quarter. Revenue declined 5% to $6.82 billion from $7.2 billion a year ago.

Analysts surveyed by FactSet had expected adjusted earnings of 23 cents a share on revenue of $6.06 billion.

“We significantly improved operational and supply-chain execution and advanced our innovation agenda with the introduction of HPE GreenLake cloud-services solutions, our new HPE Ezmeral software portfolio, and our planned acquisition of SD-WAN leader Silver Peak,” HPE Chief Executive Antonio Neri said in a statement.

“We were very pleased with the performance, especially in reducing our backlog $500 million,” HPE Chief Financial Officer Tarek Robbiati told MarketWatch in a phone interview after the results were announced. In a sign of the company’s confidence, it issued earnings guidance for its current fourth-quarter of non-GAAP EPS of between 32 cents and 36 cents a share — squarely above FactSet estimates of 31 cents a share.

HPE expects to be “back operating in a much more stable position” the next few quarters, Robbiati added. He pointed to revenue for high-end computing systems, which improved 3% to $649 million.

...

--> ich kann mir vorstellen, daß HPE nach dem Platzen der NASDAQ100-Blase den ein oder anderen Software-Anbieter übernehmen wird. Aber bitte keine Autonomy wieder

21.5.

HPE loses more than $800 million as sales slump, CEO blames coronavirus 'economic lockdowns'

Stock falls 5% in after-hours trading, Neri introduces three-year plan to cut $1 billion in costs

https://www.marketwatch.com/story/hpe-loses-more-than-800-mi…

...

HPE loses more than $800 million as sales slump, CEO blames coronavirus 'economic lockdowns'

Stock falls 5% in after-hours trading, Neri introduces three-year plan to cut $1 billion in costs

https://www.marketwatch.com/story/hpe-loses-more-than-800-mi…

...

Hallo zusammen, bin leider kurz nach Beginn der Krise hier eingestiegen und mache mir nun Gedanken, wie sich das Geschäft für HPE wohl entwickelt.

Sollten die gestiegenen Datenströme aufgrund des verbreiteten home office nicht für einen Anstieg der Servernachfrage sorgen? Dann ist natürlich noch abzuschätzen, wo HPE produziert und ob die Produktion weiterläuft. Für 5G interessiert sich wahrscheinlich gerade kaum jemand.

Gibt es weitere Meinungen?

Sollten die gestiegenen Datenströme aufgrund des verbreiteten home office nicht für einen Anstieg der Servernachfrage sorgen? Dann ist natürlich noch abzuschätzen, wo HPE produziert und ob die Produktion weiterläuft. Für 5G interessiert sich wahrscheinlich gerade kaum jemand.

Gibt es weitere Meinungen?

Antwort auf Beitrag Nr.: 61.355.776 von faultcode am 27.08.19 23:40:403.3.

HPE shares drop on revenue miss, warning it no longer expects revenue to grow in fiscal 2020

https://www.marketwatch.com/story/hpe-earnings-shares-drop-o…

Hewlett Packard Enterprise Co. shares fell more than 6% in after-hours trading Tuesday after the technology giant reported first-quarter revenue that did not meet Wall Street estimates and warned it no longer expects revenue to grow in fiscal 2020.

In a phone interview shortly after the results were released, HPE Chief Financial Officer Tarek Robbiati highlighted gains in intelligent-edge computing (up 2% year-over-year to $720 million) and operating profit margin for its storage business (up to 18%). But he blamed a 16% year-over-year decline in compute revenue ($3 billion) and 9% decline in total revenue on “microenvironment” issues such as supply-chain disruption, and coronavirus.

“There are too many unknowns at this time to predict the impact on the second quarter,” Robbiati said.

...

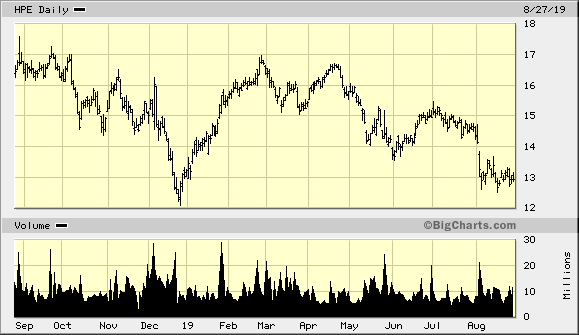

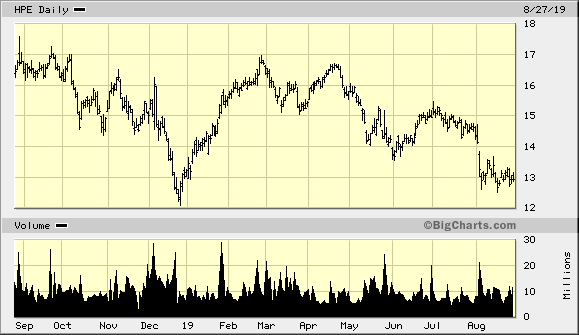

2018-2020

HPE shares drop on revenue miss, warning it no longer expects revenue to grow in fiscal 2020

https://www.marketwatch.com/story/hpe-earnings-shares-drop-o…

Hewlett Packard Enterprise Co. shares fell more than 6% in after-hours trading Tuesday after the technology giant reported first-quarter revenue that did not meet Wall Street estimates and warned it no longer expects revenue to grow in fiscal 2020.

In a phone interview shortly after the results were released, HPE Chief Financial Officer Tarek Robbiati highlighted gains in intelligent-edge computing (up 2% year-over-year to $720 million) and operating profit margin for its storage business (up to 18%). But he blamed a 16% year-over-year decline in compute revenue ($3 billion) and 9% decline in total revenue on “microenvironment” issues such as supply-chain disruption, and coronavirus.

“There are too many unknowns at this time to predict the impact on the second quarter,” Robbiati said.

...

2018-2020

Antwort auf Beitrag Nr.: 60.765.543 von faultcode am 08.06.19 13:37:14

=>

Hewlett Packard Enterprise Co.’s stock rose as much as 8% in after-hours trading Tuesday after it reported earnings that beat Wall Street estimates, but the company warned of softness in compute and storage markets in the third quarter.

The San Jose, Calif.-based company reported non-GAAP earnings of 45 cents a share. But its revenue slid 7% year-over-year to $7.22 billion. Analysts polled by FactSet expected earnings of 40 cents a share and revenue of $7.275 billion.

Hybrid IT revenue led the way for HPE, at $5.5 billion, as it continues its transition to become a software-as-a-service company by 2022. HPE’s Nimble Storage improved 21% year-over-year when adjusted for currency.

“We are transitioning the [product] portfolio to higher-margin offerings,” HPE CEO Antonio Neri told analysts in a conference call after the results were released.

Trade tensions, however, have contributed to uneven demand in enterprise IT sales, HPE Chief Financial Officer Tarek Robbiati added during the conference call...

+4% AH -- 2019Q2

https://www.marketwatch.com/story/hpe-earnings-beat-sends-sh…=>

Hewlett Packard Enterprise Co.’s stock rose as much as 8% in after-hours trading Tuesday after it reported earnings that beat Wall Street estimates, but the company warned of softness in compute and storage markets in the third quarter.

The San Jose, Calif.-based company reported non-GAAP earnings of 45 cents a share. But its revenue slid 7% year-over-year to $7.22 billion. Analysts polled by FactSet expected earnings of 40 cents a share and revenue of $7.275 billion.

Hybrid IT revenue led the way for HPE, at $5.5 billion, as it continues its transition to become a software-as-a-service company by 2022. HPE’s Nimble Storage improved 21% year-over-year when adjusted for currency.

“We are transitioning the [product] portfolio to higher-margin offerings,” HPE CEO Antonio Neri told analysts in a conference call after the results were released.

Trade tensions, however, have contributed to uneven demand in enterprise IT sales, HPE Chief Financial Officer Tarek Robbiati added during the conference call...

Aufkauf von BlueData

https://www.zdnet.de/88362105/hpe-ergaenzt-analytik-portfoli…Mit BlueData und dessen Analytikplattform EPIC ergänzt Hewlett Packard Enterprise (HPE) sein Portfolio in diesem zukunftsträchtigen Bereich. Die Plattform soll die Arbeit von Datenanalysten vereinfachen und dadurch beschleunigen.

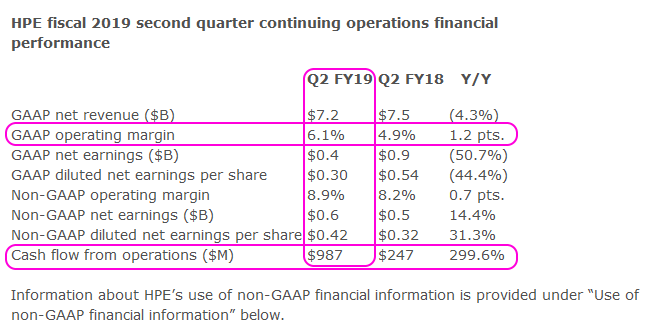

HPE Delivers Q2 Results & Raises FY19 EPS Outlook

23.05.2019, 22:05https://www.wallstreet-online.de/nachricht/11480068-hpe-deli…

=>

Hewlett Packard Enterprise (NYSE: HPE) today announced financial results for its fiscal 2019 second quarter, ended April 30, 2019. “In Q2 we demonstrated traction in critical areas for our customers that delivered strong margin improvement, EPS above our outlook and solid cash flow,” said Antonio Neri, President and CEO of HPE.

“We continue to make important strategic moves that further enhance our competitive position and ability to better serve our customers in a hybrid world. I remain confident that our edge-to-core strategy backed by the important investments we’ve been making will generate positive shareholder returns in the near and longer term.”....

...

...

Antwort auf Beitrag Nr.: 59.380.826 von faultcode am 06.12.18 16:39:15

Cutting costs and diversifying

As Reuters has reported, corporate server buyers are seeking cheaper options, thereby creating headwinds for branded server vendors such as HPE.

In response to this challenging environment, HPE has shifted its focus to cutting costs and diversifying outside the server market. In terms of cost-cutting, HPE is aiming to eliminate $1.5 billion in expenses in the next three years.

As for diversification, HPE is increasing its investment in emerging technology areas such as AI and the Internet of Things, which it collectively calls Intelligent Edge technology.

HPE’s CEO, Antonio Neri, told Bloomberg last month that the company’s Intelligent Edge business was growing at a double-digit rate...

https://marketrealist.com/2018/12/what-are-hpes-plans-as-the…

What Are HPE’s Plans as the Server Market Gets Tough?

...Cutting costs and diversifying

As Reuters has reported, corporate server buyers are seeking cheaper options, thereby creating headwinds for branded server vendors such as HPE.

In response to this challenging environment, HPE has shifted its focus to cutting costs and diversifying outside the server market. In terms of cost-cutting, HPE is aiming to eliminate $1.5 billion in expenses in the next three years.

As for diversification, HPE is increasing its investment in emerging technology areas such as AI and the Internet of Things, which it collectively calls Intelligent Edge technology.

HPE’s CEO, Antonio Neri, told Bloomberg last month that the company’s Intelligent Edge business was growing at a double-digit rate...

https://marketrealist.com/2018/12/what-are-hpes-plans-as-the…

Antwort auf Beitrag Nr.: 59.380.706 von faultcode am 06.12.18 16:22:53z.Z. SP500 leader - kommt auch nicht oft vor

Antwort auf Beitrag Nr.: 58.562.522 von faultcode am 29.08.18 17:08:46

aus: https://marketrealist.com/2018/12/hewlett-packard-enterprise…

=>

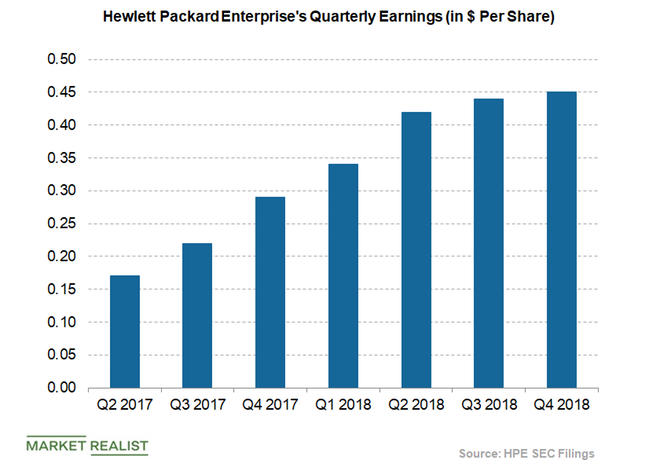

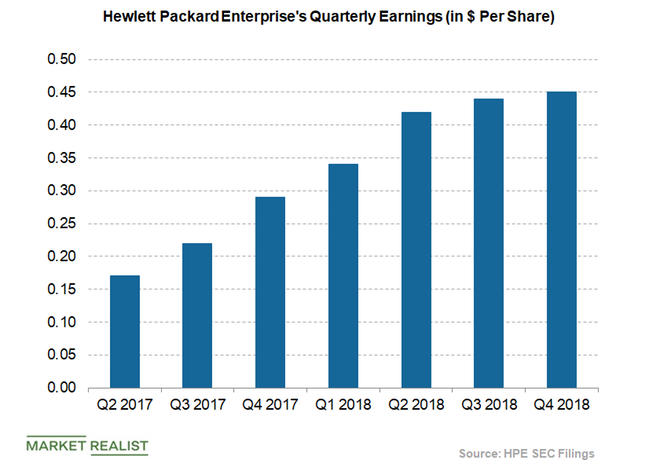

...Hewlett Packard Enterprise’s (HPE) earnings have improved sequentially for the past six quarters, and have beaten analysts’ estimates in the past five quarters.

• Its non-GAAP EPS of $0.45 in the fourth quarter of fiscal 2018 beat analysts’ consensus estimate of $0.43.

• Its EPS of $0.44 in the third quarter beat analysts’ estimate of $0.37.

• Its EPS of $0.34 in the second quarter beat analysts’ estimate of $0.31.

• Its EPS of $0.34 in the first quarter beat analysts’ estimate of $0.22.

• Its EPS of $0.31 in the fourth quarter of fiscal 2017 beat analysts’ estimate of $0.28.

...

aus: https://marketrealist.com/2018/12/hewlett-packard-enterprise…

=>

...Hewlett Packard Enterprise’s (HPE) earnings have improved sequentially for the past six quarters, and have beaten analysts’ estimates in the past five quarters.

• Its non-GAAP EPS of $0.45 in the fourth quarter of fiscal 2018 beat analysts’ consensus estimate of $0.43.

• Its EPS of $0.44 in the third quarter beat analysts’ estimate of $0.37.

• Its EPS of $0.34 in the second quarter beat analysts’ estimate of $0.31.

• Its EPS of $0.34 in the first quarter beat analysts’ estimate of $0.22.

• Its EPS of $0.31 in the fourth quarter of fiscal 2017 beat analysts’ estimate of $0.28.

...

Hewlett Packard Enterprises