China Crash

eröffnet am 26.10.18 15:59:51 von

neuester Beitrag 08.02.24 12:18:20 von

neuester Beitrag 08.02.24 12:18:20 von

Beiträge: 314

ID: 1.291.324

ID: 1.291.324

Aufrufe heute: 2

Gesamt: 40.196

Gesamt: 40.196

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 25.04.24, 13:40 | 2430 | |

| vor 39 Minuten | 1713 | |

| vor 24 Minuten | 1425 | |

| vor 1 Stunde | 1295 | |

| vor 31 Minuten | 586 | |

| gestern 18:36 | 504 | |

| gestern 23:57 | 423 | |

| vor 49 Minuten | 381 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.939,75 | +0,22 | 166 | |||

| 2. | 2. | 169,58 | -1,28 | 83 | |||

| 3. | 4. | 3,9000 | +5,41 | 62 | |||

| 4. | 3. | 8,4000 | +1,33 | 58 | |||

| 5. | 5. | 0,1865 | -3,62 | 41 | |||

| 6. | 6. | 6,6460 | -0,51 | 31 | |||

| 7. | 11. | 2.314,46 | +1,26 | 27 | |||

| 8. | 8. | 57.677,70 | +0,40 | 26 |

Beitrag zu dieser Diskussion schreiben

8.2.

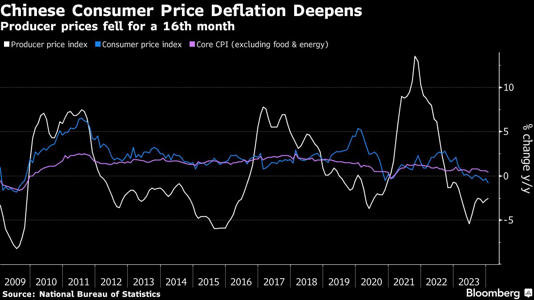

China's Economy Under Pressure as Inflation Drops at Fastest Pace in 14 Years

https://www.msn.com/en-us/money/markets/china-s-economy-unde…

...

7.2.

China Replaces Top Markets Regulator as Xi Tries to End Rout

https://finance.yahoo.com/news/china-replaces-head-securitie…

...

China Replaces Top Markets Regulator as Xi Tries to End Rout

https://finance.yahoo.com/news/china-replaces-head-securitie…

...

6.2.

Xi to Discuss China Stocks With Regulators as Rescue Bets Build

https://finance.yahoo.com/news/xi-set-discuss-china-stock-04…

...

Anticipation is mounting for more forceful Chinese government efforts to end the nation’s stock rout, with regulators planning to brief President Xi Jinping on the market as soon as Tuesday.

Chinese stocks extended their rebound after Bloomberg reported regulators led by the China Securities Regulatory Commission plan to update the top leadership on market conditions and the latest policy initiatives, according to people with knowledge of the matter. The CSI 300 benchmark closed 3.5% higher in its best day since late 2022. Small-cap equities that have so far borne the brunt of the rout also jumped, with the CSI 1000 gauge up 7%, the most since 2008.

While it’s unclear whether any new support measures will come out of the Xi meeting, traders are hoping this time will be different. Some $7 trillion of value has been wiped off Hong Kong and China equities since their peaks in 2021 and piecemeal approaches to support the economy and stabilize markets have so far failed to lift sentiment. For policymakers, it’s important to stabilize the stock market to avoid further hurting consumer confidence as China enters the weeklong Lunar New Year holiday.

...

Xi to Discuss China Stocks With Regulators as Rescue Bets Build

https://finance.yahoo.com/news/xi-set-discuss-china-stock-04…

...

Anticipation is mounting for more forceful Chinese government efforts to end the nation’s stock rout, with regulators planning to brief President Xi Jinping on the market as soon as Tuesday.

Chinese stocks extended their rebound after Bloomberg reported regulators led by the China Securities Regulatory Commission plan to update the top leadership on market conditions and the latest policy initiatives, according to people with knowledge of the matter. The CSI 300 benchmark closed 3.5% higher in its best day since late 2022. Small-cap equities that have so far borne the brunt of the rout also jumped, with the CSI 1000 gauge up 7%, the most since 2008.

While it’s unclear whether any new support measures will come out of the Xi meeting, traders are hoping this time will be different. Some $7 trillion of value has been wiped off Hong Kong and China equities since their peaks in 2021 and piecemeal approaches to support the economy and stabilize markets have so far failed to lift sentiment. For policymakers, it’s important to stabilize the stock market to avoid further hurting consumer confidence as China enters the weeklong Lunar New Year holiday.

...

5.2.

China Tightens Some Trading Restrictions for Domestic and Offshore Investors

https://finance.yahoo.com/news/china-widens-stock-trading-cu…

...

Officials this week imposed caps on some brokerages’ cross-border total return swaps with clients, limiting a channel that can be used by China-based investors to short Hong Kong stocks, said the people, asking not to be identified discussing a private matter.

At the same time, some Chinese brokers that use the channel to buy mainland shares for their offshore units were told not to reduce their positions, the people said.

Some quantitative hedge funds meanwhile were banned from placing sell orders completely starting Monday, while others were barred from cutting stock positions in their leveraged market-neutral funds. These bets, known as a Direct Market Access strategy, are believed to have amplified the recent sell-off in small-cap stocks, the people added.

...

China Tightens Some Trading Restrictions for Domestic and Offshore Investors

https://finance.yahoo.com/news/china-widens-stock-trading-cu…

...

Officials this week imposed caps on some brokerages’ cross-border total return swaps with clients, limiting a channel that can be used by China-based investors to short Hong Kong stocks, said the people, asking not to be identified discussing a private matter.

At the same time, some Chinese brokers that use the channel to buy mainland shares for their offshore units were told not to reduce their positions, the people said.

Some quantitative hedge funds meanwhile were banned from placing sell orders completely starting Monday, while others were barred from cutting stock positions in their leveraged market-neutral funds. These bets, known as a Direct Market Access strategy, are believed to have amplified the recent sell-off in small-cap stocks, the people added.

...

...

“I think the worst two years are behind us,” Guttieres said in a phone interview from Miami. “Not just in Asia, but globally, there is going to be a ramp up in the equity capital markets business in the next two years.

...

Viridian will likely focus on the Japanese, Indian and South Korean markets in the first two or three years, before the eventual rebound in share sales in Hong Kong and China, Guttieres said. Stocks in India and Japan been rallying, in part as investors pull out of China, with a gauge of Hong Kong-listed Chinese stocks entering its fifth straight year of loss.”

...

2.2.

Ex-UBS Banker’s New Hedge Fund to Bet on Share Sale Rebound

https://finance.yahoo.com/news/ex-ubs-banker-start-hedge-034…

“I think the worst two years are behind us,” Guttieres said in a phone interview from Miami. “Not just in Asia, but globally, there is going to be a ramp up in the equity capital markets business in the next two years.

...

Viridian will likely focus on the Japanese, Indian and South Korean markets in the first two or three years, before the eventual rebound in share sales in Hong Kong and China, Guttieres said. Stocks in India and Japan been rallying, in part as investors pull out of China, with a gauge of Hong Kong-listed Chinese stocks entering its fifth straight year of loss.”

...

2.2.

Ex-UBS Banker’s New Hedge Fund to Bet on Share Sale Rebound

https://finance.yahoo.com/news/ex-ubs-banker-start-hedge-034…

das China-Plunge Protection Team (+) soll's nun richten:

23.1.

China Weighs Stock Market Rescue Package Backed by $278 Billion

https://finance.yahoo.com/news/china-weighs-stock-market-res…

...

Policymakers are seeking to mobilize about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link, said the people, asking not to be identified discussing a private matter. They have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd., the people said.

The deliberations underscore the elevated sense of urgency among Chinese authorities to stem a selloff that sent the benchmark CSI 300 Index to a five-year low this week. Calming the nation’s retail investors, many of whom have been bruised by the protracted property downturn, is also seen as key to maintaining social stability.

...

(+) https://de.wikipedia.org/wiki/Plunge_Protection_Team

23.1.

China Weighs Stock Market Rescue Package Backed by $278 Billion

https://finance.yahoo.com/news/china-weighs-stock-market-res…

...

Policymakers are seeking to mobilize about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link, said the people, asking not to be identified discussing a private matter. They have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd., the people said.

The deliberations underscore the elevated sense of urgency among Chinese authorities to stem a selloff that sent the benchmark CSI 300 Index to a five-year low this week. Calming the nation’s retail investors, many of whom have been bruised by the protracted property downturn, is also seen as key to maintaining social stability.

...

(+) https://de.wikipedia.org/wiki/Plunge_Protection_Team

23.1.

India overtakes Hong Kong as world’s fourth-largest stock market

https://economictimes.indiatimes.com/markets/stocks/news/ind…

...

Equities in India have been booming, thanks to a rapidly growing retail investor base and strong corporate earnings.

The world’s most populous country has positioned itself as an alternative to China, attracting fresh capital from global investors and companies alike, thanks to its stable political setup and a consumption-driven economy that remains among the fastest-growing of major nations.

...

India overtakes Hong Kong as world’s fourth-largest stock market

https://economictimes.indiatimes.com/markets/stocks/news/ind…

...

Equities in India have been booming, thanks to a rapidly growing retail investor base and strong corporate earnings.

The world’s most populous country has positioned itself as an alternative to China, attracting fresh capital from global investors and companies alike, thanks to its stable political setup and a consumption-driven economy that remains among the fastest-growing of major nations.

...

22.1.

Gloom Over China Assets Is Spreading Beyond Battered Stocks

https://finance.yahoo.com/news/gloom-over-china-assets-sprea…

...

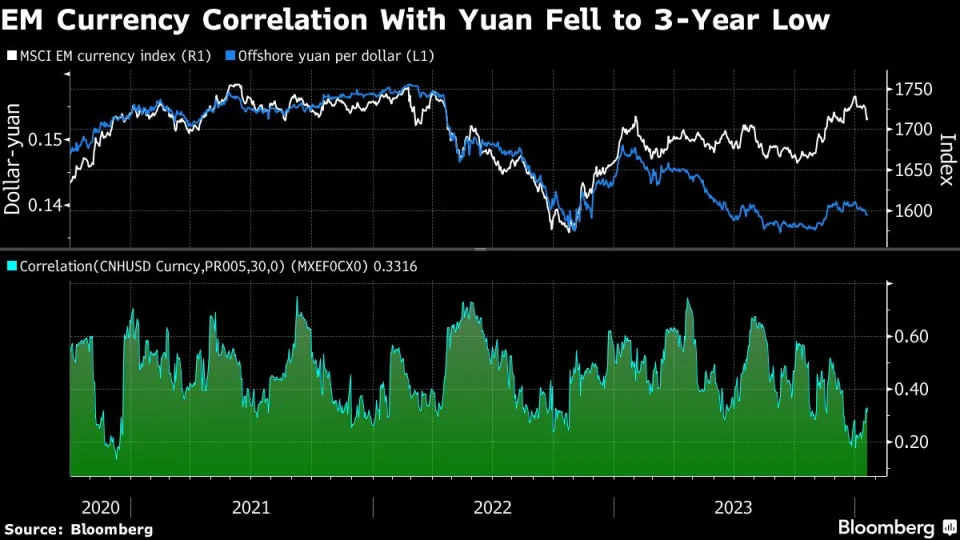

Skepticism over Chinese assets is spreading beyond stocks, with investors expecting the yuan and government bonds to underperform in a year when the Federal Reserve’s dovish pivot is set to buoy emerging markets.

...

“We expect the yuan to remain under pressure in the near term given the bearish expectations for China growth this year,” said Ken Cheung, chief Asian currency strategist at Mizuho Bank Ltd. in Hong Kong. “Bonds will remain supported as the PBOC will maintain an easing bias. However, renewed yuan depreciation pressure and narrow net interest margin among Chinese banks will limit the room for rate cuts.”

...

13.1.

Flucht vor Pekings Politik: Reiche Chinesen schmuggeln ihr Geld ins Ausland

https://www.n-tv.de/wirtschaft/Reiche-Chinesen-schmuggeln-ih…

...

Weil Chinas Wirtschaft bröckelt, schmuggeln reiche Chinesen ihr Geld aus dem Land. Legal ist das kaum möglich - deshalb nutzen sie dafür ein seit vielen Jahren bewährtes Netzwerk. Wer bei den illegalen Aktionen erwischt wird, dem drohen empfindliche Strafen.

...

Wohlstand ist in China ohnehin eher verpönt. In Peking sind Luxus-Werbetafeln schon seit 2011 verboten. Das soziale Netzwerk Douyin löscht Videos und Konten, die mit Reichtum protzen.

Präsident Xi Jinping kämpft gegen die Ungleichheit im Land und will Vermögen regulieren. Er hat den "gemeinsamen Wohlstand" für alle ausgerufen. Die Superreichen sind alarmiert, wollen ihr Geld im Ausland in Sicherheit bringen.

Immer mehr wandern zudem aus: 2022 haben 10.800 Millionäre das Land verlassen, 2023 gab es in China dann den weltweit größten Exodus mit prognostizierten 13.500 reichen Auswanderern, geht aus einer Studie von Henley & Partners hervor. Die Ziele der reichen Auswanderer sind vor allem Australien, die Vereinigten Arabischen Emirate, Singapur und die USA.

...

Legal von China aus Geld ins Ausland zu schicken, ist allerdings kaum möglich. Chinesen dürfen pro Jahr nur eine begrenzte Summe außer Landes überweisen: 50.000 Dollar. Wer auswandert, darf nur einmal Geld transferieren.

Viele Reiche nutzen daher heimlich ein informelles System, um ihr Geld vor dem Auswandern in die neue Heimat zu transferieren: Hawala heißt das, berichtet Bloomberg. Das Hawala-Banking hat seine Wurzeln im Orient. Auf Arabisch heißt Hawala "Wechsel", "Scheck" oder "Zahlungsanweisung". Anders als eine Bank wird es nicht reguliert oder kontrolliert. Es ist es eher eine Art Netzwerk, das auf Vertrauen basiert.

...

Damit kann Geld anonym und in Echtzeit transferiert werden. Eine Buchhaltung gibt es nicht - das macht einen Nachweis schwierig.

...

In China vermitteln oft etablierte Finanzfachleute den Kontakt zu den Überweisungsagenturen. Die Nachfrage nach dem Hawala-Banking ist bei wohlhabenden Familien laut Bloomberg gestiegen. Insbesondere seitdem die internationalen Grenzen nach der Pandemie wieder offen sind.

Vergangenes Jahr sind bis zu 150 Milliarden Dollar von China aus ins Ausland geflossen, schätzt ein Ökonom der französischen Investmentbank Natixis laut dem Bericht. Der Wohlstand in China hat in den vergangenen Jahrzehnten zugenommen. Dort leben nach den USA die meisten Millionäre der Welt mit einem Vermögen von zwei Billionen US-Dollar. Allerdings machen sie einen deutlich geringeren Anteil der Bevölkerung aus.

...

Flucht vor Pekings Politik: Reiche Chinesen schmuggeln ihr Geld ins Ausland

https://www.n-tv.de/wirtschaft/Reiche-Chinesen-schmuggeln-ih…

...

Weil Chinas Wirtschaft bröckelt, schmuggeln reiche Chinesen ihr Geld aus dem Land. Legal ist das kaum möglich - deshalb nutzen sie dafür ein seit vielen Jahren bewährtes Netzwerk. Wer bei den illegalen Aktionen erwischt wird, dem drohen empfindliche Strafen.

...

Wohlstand ist in China ohnehin eher verpönt. In Peking sind Luxus-Werbetafeln schon seit 2011 verboten. Das soziale Netzwerk Douyin löscht Videos und Konten, die mit Reichtum protzen.

Präsident Xi Jinping kämpft gegen die Ungleichheit im Land und will Vermögen regulieren. Er hat den "gemeinsamen Wohlstand" für alle ausgerufen. Die Superreichen sind alarmiert, wollen ihr Geld im Ausland in Sicherheit bringen.

Immer mehr wandern zudem aus: 2022 haben 10.800 Millionäre das Land verlassen, 2023 gab es in China dann den weltweit größten Exodus mit prognostizierten 13.500 reichen Auswanderern, geht aus einer Studie von Henley & Partners hervor. Die Ziele der reichen Auswanderer sind vor allem Australien, die Vereinigten Arabischen Emirate, Singapur und die USA.

...

Legal von China aus Geld ins Ausland zu schicken, ist allerdings kaum möglich. Chinesen dürfen pro Jahr nur eine begrenzte Summe außer Landes überweisen: 50.000 Dollar. Wer auswandert, darf nur einmal Geld transferieren.

Viele Reiche nutzen daher heimlich ein informelles System, um ihr Geld vor dem Auswandern in die neue Heimat zu transferieren: Hawala heißt das, berichtet Bloomberg. Das Hawala-Banking hat seine Wurzeln im Orient. Auf Arabisch heißt Hawala "Wechsel", "Scheck" oder "Zahlungsanweisung". Anders als eine Bank wird es nicht reguliert oder kontrolliert. Es ist es eher eine Art Netzwerk, das auf Vertrauen basiert.

...

Damit kann Geld anonym und in Echtzeit transferiert werden. Eine Buchhaltung gibt es nicht - das macht einen Nachweis schwierig.

...

In China vermitteln oft etablierte Finanzfachleute den Kontakt zu den Überweisungsagenturen. Die Nachfrage nach dem Hawala-Banking ist bei wohlhabenden Familien laut Bloomberg gestiegen. Insbesondere seitdem die internationalen Grenzen nach der Pandemie wieder offen sind.

Vergangenes Jahr sind bis zu 150 Milliarden Dollar von China aus ins Ausland geflossen, schätzt ein Ökonom der französischen Investmentbank Natixis laut dem Bericht. Der Wohlstand in China hat in den vergangenen Jahrzehnten zugenommen. Dort leben nach den USA die meisten Millionäre der Welt mit einem Vermögen von zwei Billionen US-Dollar. Allerdings machen sie einen deutlich geringeren Anteil der Bevölkerung aus.

...

22.12.

Chinese stocks set for record third year of losses as post-Covid recovery sputters, foreign funds flee

--- The CSI 300 Index has dropped 14 per cent year to date, adding to a 22 per cent plunge in 2022 and a 5.2 per cent decline in 2021

-- The worst for Chinese stocks is likely over and they are due for a rebound, according to global investment banks

https://www.scmp.com/business/china-business/article/3245424…

...

While China’s growth outlook may not improve significantly in 2024, the worst for stocks may have already been priced in and they are due for a comeback, according to global investment banks.

UBS predicts a 15 per cent gain in the MSCI China Index of both onshore and offshore stocks next year, which will be driven by cheap valuations, low investor positioning, more policy support and an improvement in corporate earnings.

...

Chinese stocks set for record third year of losses as post-Covid recovery sputters, foreign funds flee

--- The CSI 300 Index has dropped 14 per cent year to date, adding to a 22 per cent plunge in 2022 and a 5.2 per cent decline in 2021

-- The worst for Chinese stocks is likely over and they are due for a rebound, according to global investment banks

https://www.scmp.com/business/china-business/article/3245424…

...

While China’s growth outlook may not improve significantly in 2024, the worst for stocks may have already been priced in and they are due for a comeback, according to global investment banks.

UBS predicts a 15 per cent gain in the MSCI China Index of both onshore and offshore stocks next year, which will be driven by cheap valuations, low investor positioning, more policy support and an improvement in corporate earnings.

...