Ascent Solar Technologies, Inc. (ASTI) - 500 Beiträge pro Seite

eröffnet am 18.01.07 15:35:08 von

neuester Beitrag 20.01.17 12:26:52 von

neuester Beitrag 20.01.17 12:26:52 von

Beiträge: 1.600

ID: 1.105.975

ID: 1.105.975

Aufrufe heute: 0

Gesamt: 155.437

Gesamt: 155.437

Aktive User: 0

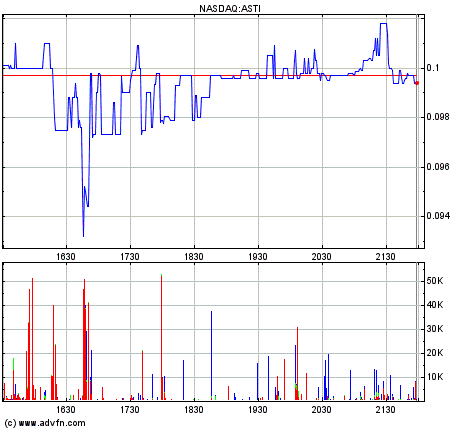

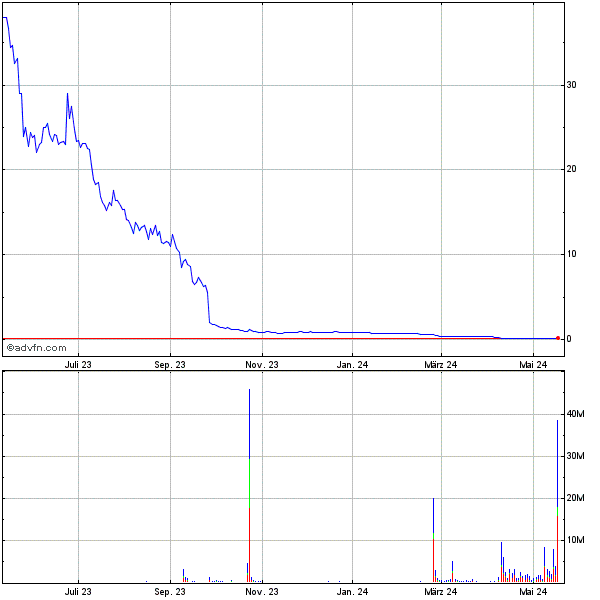

ISIN: US0436355079 · WKN: A2NB3Q

0,0040

USD

+5,26 %

+0,0002 USD

Letzter Kurs 29.01.22 Nasdaq OTC

Profile:Ascent Solar Technologies, Inc. commercializes copper-indium-gallium-diSelenide photovoltaic (PV) technology for the space and near-space markets. PV devices convert sunlight into the electricity needed to power instruments and communications systems. The company’s target customers include traditional aerospace companies, companies in the defense and communications industries, and domestic and foreign government entities. Ascent Solar Technologies was founded in 2005 and is based in Littleton, Colorado.

http://www.ascentsolartech.com/

http://www.ascentsolartech.com/

Ascent Solar Receives Transfer of Contracts

Thursday January 18, 6:00 am ET

LITTLETON, Colo.--(BUSINESS WIRE)--Ascent Solar Technologies, Inc. ("Ascent Solar") (NASDAQ:ASTI - News; BSE:AKC - News) announced today that it has successfully completed the novation, or transfer, of approximately $3.5 million in government funded research and development (R&D) contracts from ITN Energy Systems Inc. ("ITN"). The various contracts are being performed for U.S. government customers that include the Air Force Research Laboratory, and the National Aeronautics and Space Administration. In addition to approximately $1.6 million in remaining firm revenues to be provided under the transferred contracts, the key scientists, engineers, and process technicians responsible for performing the contracts have also been transferred from ITN to become full-time Ascent Solar employees. Ascent Solar also amended its sublease agreement with ITN to include an additional 4,331 sq. feet at their existing location to accommodate this activity. The monthly rent expense was increased by $5,214 per month for the additional space. As before, Ascent Solar is responsible for payment of pass-through expenses such as property taxes, insurance, water and utilities.

Ascent Solar was formed in October 2005 by ITN to commercialize certain thin film photovoltaic technology for space, near-space, and terrestrial applications. In January 2006, ITN transferred its CIGS photovoltaic intellectual property to Ascent Solar and in July of last year, Ascent Solar completed a $16.5 million initial public offering to establish an initial production plant at its facilities in Littleton, Colorado. Novating the ongoing research and development programs to Ascent Solar required additional time to facilitate the necessary approvals from the Defense Contractor Management Agency which oversees the programs, defense contractor accounting systems and contractor business operations related to government funded activities.

Ascent Solar Chief Technical Officer Dr. Joseph Armstrong stated "Transitioning this group of key individuals and novating the contracts to AST are consistent with our previously-stated business goals. While at ITN, our team consistently succeeded at winning and performing on government and other externally funded programs that have totaled over $60M since 1995. The government funded research and development contracts enable us to significantly leverage external funding sources to pioneer leading edge technology developments that have direct application to our commercial markets. Bringing this world-class talent together again within Ascent Solar, in conjunction with our existing R&D and prototype roll-to-roll manufacturing capabilities, as well as the establishment of our initial manufacturing plant later this year, provides us a unique competitive advantage over other thin film companies pursuing next generation flexible CIGS photovoltaics. We have already demonstrated device, cell level and monolithically integrated module prototypes and roll-to-roll manufacturing capabilities for our planned thin film products on plastic substrates. The novated contracts represent advanced processing technologies that will augment our initial product manufacturing, as well as provide the seeds for several generations of products yet to come with the potential of reaching 20% efficiencies or more. In addition, these activities complement our in-house activities that offer the promise of lowering manufacturing cost to less than one dollar per watt at the module level for terrestrial applications. "

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

Contact:

PR Financial Marketing LLC

Jim Blackman, 713-256-0369 (Investor Relations)

jimblackman@prfinancialmarketing.com

or

Media Contact:

Brand Fortified Public Relations

Kelly Brandner, 303-289-4303

kellybrandner@msn.com

--------------------------------------------------------------------------------

Source: Ascent Solar Technologies, Inc.

Thursday January 18, 6:00 am ET

LITTLETON, Colo.--(BUSINESS WIRE)--Ascent Solar Technologies, Inc. ("Ascent Solar") (NASDAQ:ASTI - News; BSE:AKC - News) announced today that it has successfully completed the novation, or transfer, of approximately $3.5 million in government funded research and development (R&D) contracts from ITN Energy Systems Inc. ("ITN"). The various contracts are being performed for U.S. government customers that include the Air Force Research Laboratory, and the National Aeronautics and Space Administration. In addition to approximately $1.6 million in remaining firm revenues to be provided under the transferred contracts, the key scientists, engineers, and process technicians responsible for performing the contracts have also been transferred from ITN to become full-time Ascent Solar employees. Ascent Solar also amended its sublease agreement with ITN to include an additional 4,331 sq. feet at their existing location to accommodate this activity. The monthly rent expense was increased by $5,214 per month for the additional space. As before, Ascent Solar is responsible for payment of pass-through expenses such as property taxes, insurance, water and utilities.

Ascent Solar was formed in October 2005 by ITN to commercialize certain thin film photovoltaic technology for space, near-space, and terrestrial applications. In January 2006, ITN transferred its CIGS photovoltaic intellectual property to Ascent Solar and in July of last year, Ascent Solar completed a $16.5 million initial public offering to establish an initial production plant at its facilities in Littleton, Colorado. Novating the ongoing research and development programs to Ascent Solar required additional time to facilitate the necessary approvals from the Defense Contractor Management Agency which oversees the programs, defense contractor accounting systems and contractor business operations related to government funded activities.

Ascent Solar Chief Technical Officer Dr. Joseph Armstrong stated "Transitioning this group of key individuals and novating the contracts to AST are consistent with our previously-stated business goals. While at ITN, our team consistently succeeded at winning and performing on government and other externally funded programs that have totaled over $60M since 1995. The government funded research and development contracts enable us to significantly leverage external funding sources to pioneer leading edge technology developments that have direct application to our commercial markets. Bringing this world-class talent together again within Ascent Solar, in conjunction with our existing R&D and prototype roll-to-roll manufacturing capabilities, as well as the establishment of our initial manufacturing plant later this year, provides us a unique competitive advantage over other thin film companies pursuing next generation flexible CIGS photovoltaics. We have already demonstrated device, cell level and monolithically integrated module prototypes and roll-to-roll manufacturing capabilities for our planned thin film products on plastic substrates. The novated contracts represent advanced processing technologies that will augment our initial product manufacturing, as well as provide the seeds for several generations of products yet to come with the potential of reaching 20% efficiencies or more. In addition, these activities complement our in-house activities that offer the promise of lowering manufacturing cost to less than one dollar per watt at the module level for terrestrial applications. "

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

Contact:

PR Financial Marketing LLC

Jim Blackman, 713-256-0369 (Investor Relations)

jimblackman@prfinancialmarketing.com

or

Media Contact:

Brand Fortified Public Relations

Kelly Brandner, 303-289-4303

kellybrandner@msn.com

--------------------------------------------------------------------------------

Source: Ascent Solar Technologies, Inc.

TSL

Ascent Solar tendiert gegen den schwachen Markt nach oben. Und das unter hohem Volumen. Der Wert geht auf die Watchlist.

Tja , zu lange "gewatched":

"Die ebenfalls an dieser Stelle bereits angesprochene Ascent Solar (ASTI) wartete gestern nachbörslich mit sensationellen News auf: Norsk Hydro (WKN 851 908), mit einer Marktkapitalisierung von fast 29 Mrd. Euro einer der größten Energie- und Aluminium-Produzenten Europas, investierte über 9 Millionen Euro in Ascent Solar. Der Hammer dabei: Norsk erwarb auf einen Schlag 23 Prozent aller ausstehenden Aktien und bezahlte dafür einen Preis von 5,77 US-Dollar je Aktie, also einen Aufschlag von 25 Prozent auf den Schlusskurs vom Montag. Das ist der Ritterschlag für ASTI. Vorbörslich notiert die Aktie bereits jenseits der 6 US-Dollar. Ich gehe davon aus, dass wir hier bald zweistellige Kurse sehen. Nun wird auch klar, warum ASTI zuletzt bei steigenden Kursen immer ein wesentlich höheres Handelsvolumen ausgewiesen hat, als bei fallenden Kursen."

"Die ebenfalls an dieser Stelle bereits angesprochene Ascent Solar (ASTI) wartete gestern nachbörslich mit sensationellen News auf: Norsk Hydro (WKN 851 908), mit einer Marktkapitalisierung von fast 29 Mrd. Euro einer der größten Energie- und Aluminium-Produzenten Europas, investierte über 9 Millionen Euro in Ascent Solar. Der Hammer dabei: Norsk erwarb auf einen Schlag 23 Prozent aller ausstehenden Aktien und bezahlte dafür einen Preis von 5,77 US-Dollar je Aktie, also einen Aufschlag von 25 Prozent auf den Schlusskurs vom Montag. Das ist der Ritterschlag für ASTI. Vorbörslich notiert die Aktie bereits jenseits der 6 US-Dollar. Ich gehe davon aus, dass wir hier bald zweistellige Kurse sehen. Nun wird auch klar, warum ASTI zuletzt bei steigenden Kursen immer ein wesentlich höheres Handelsvolumen ausgewiesen hat, als bei fallenden Kursen."

Und der Wert legt aktuell an der Nyse rund 17% zu...

Antwort auf Beitrag Nr.: 28.438.071 von Robse6969 am 22.03.07 18:36:47Gut das ich schon rechtzeitig rein bin ... genauso wie bei worldwater ... beide laufen heute hervorragend!

Gruss aus Köln,

ZYREX

Gruss aus Köln,

ZYREX

17:18 Uhr - Astec Solar (ASTI) vorhin mit neuem Allzeithoch bei 9,61 US-Dollar

Thema: AllgemeinIm Blog vorgestellt bei gut 6 US-Dollar. Kursziel 10 US-Dollar damit fast erreicht. Auch Konkurrent Daystar Technologies (DSTI) stark heute:

Auch First Solar heute mit Ausbruchsversuch:

Posted in Allgemein | Edit | Kommentar schreiben »

Thema: AllgemeinIm Blog vorgestellt bei gut 6 US-Dollar. Kursziel 10 US-Dollar damit fast erreicht. Auch Konkurrent Daystar Technologies (DSTI) stark heute:

Auch First Solar heute mit Ausbruchsversuch:

Posted in Allgemein | Edit | Kommentar schreiben »

Quelle: www.mastertraders.de/us-trading

Antwort auf Beitrag Nr.: 28.440.249 von Braggo2 am 22.03.07 20:17:3110 US Dollar geknackt!

ASCENT SOLAR TECH INC

Resource News: In- Depth Research on Ascent Solar Technologies Inc

3/22/2007

Mar 22, 2007 (M2 PRESSWIRE via COMTEX News Network) --

In- Depth Research on Ascent Solar Technologies Inc (NASDAQ:ASTI)

Ascent Solar Technologies, Inc. commercializes copper-indium-gallium-diSelenide photovoltaic (PV) technology for the space and near-space markets. PV devices convert sunlight into the electricity needed to power instruments and communications systems. The company's target customers include traditional aerospace companies, companies in the defense and communications industries, and domestic and foreign government entities. Ascent Solar Technologies was founded in 2005 and is based in Littleton, Colorado.

Shares were up 17% on a recent investment by Norwegian energy giant Norsk Hydro.

BellwetherReport.com is a leading online research firm for international investors looking to get an edge over their portfolio. Investors seeking the most up to date information on Ascent Solar Technologies Inc are invited to sign up for a free complimentary subscription to www.bellwetherreport.com. No credit card needed!

First Solar has a technological edge over its Chinese peers by employing thin-film panels, which not only frees it from the burden of rising silicon prices but also makes for more efficient panels.

There are other U.S. solar stocks that have done even better, such as Ascent Solar Technologies which is up 175% on a recent investment by Norwegian energy giant Norsk Hydro. But most have tiny market caps, such as Ascent's $43 million value.

More information on Ascent Solar Technologies Inc available in the members section of www.BellwetherReport.com.

To review research on Ascent Solar Technologies Inc as well as many more exciting articles we encourage you to visit www.bellwetherreport.com. You can find these reports under the "Today's Articles" section. No credit Card Needed!!

The Bellwether Report will continue to research the small cap markets to bring you exciting opportunities!! If you are interested in receiving more information on these small cap opportunities and other features of our site, feel free to sign up for a complimentary subscription to the #1 online investment tool www.bellwetherreport.com.

Companies looking to advertise with Bellwether Report should email jlee@bellwetherreport.com with the subject line (Advertising).

Information has been gathered from sources such as www.Hoovers.com, www.yahoo.com, www.associatedpress.com, www.marketwire.com, www.businesswire.com and other public resources.

All material herein was prepared by the Bellwetherreport.com, (Bellwether) based upon information believed to be reliable. The information contained herein is not guaranteed by Bellwether to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Bellwether is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. Bellwether may receive compensation in cash or shares from independent third parties or from the companies mentioned.

Bellwether's affiliates, officers, directors and employees may also have bought or may buy the shares discussed in this opinion and may profit in the event those shares rise in value.

Bellwether will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and Bellwether undertakes no obligation to update such statements.

M2 Communications Ltd disclaims all liability for information provided within M2 PressWIRE. Data supplied by named party/parties. Further information on M2 PressWIRE can be obtained at http://www.presswire.net on the world wide web. Inquiries to info@m2.com.

(C)1994-2007 M2 COMMUNICATIONS LTD

ASCENT SOLAR TECH INC

Resource News: In- Depth Research on Ascent Solar Technologies Inc

3/22/2007

Mar 22, 2007 (M2 PRESSWIRE via COMTEX News Network) --

In- Depth Research on Ascent Solar Technologies Inc (NASDAQ:ASTI)

Ascent Solar Technologies, Inc. commercializes copper-indium-gallium-diSelenide photovoltaic (PV) technology for the space and near-space markets. PV devices convert sunlight into the electricity needed to power instruments and communications systems. The company's target customers include traditional aerospace companies, companies in the defense and communications industries, and domestic and foreign government entities. Ascent Solar Technologies was founded in 2005 and is based in Littleton, Colorado.

Shares were up 17% on a recent investment by Norwegian energy giant Norsk Hydro.

BellwetherReport.com is a leading online research firm for international investors looking to get an edge over their portfolio. Investors seeking the most up to date information on Ascent Solar Technologies Inc are invited to sign up for a free complimentary subscription to www.bellwetherreport.com. No credit card needed!

First Solar has a technological edge over its Chinese peers by employing thin-film panels, which not only frees it from the burden of rising silicon prices but also makes for more efficient panels.

There are other U.S. solar stocks that have done even better, such as Ascent Solar Technologies which is up 175% on a recent investment by Norwegian energy giant Norsk Hydro. But most have tiny market caps, such as Ascent's $43 million value.

More information on Ascent Solar Technologies Inc available in the members section of www.BellwetherReport.com.

To review research on Ascent Solar Technologies Inc as well as many more exciting articles we encourage you to visit www.bellwetherreport.com. You can find these reports under the "Today's Articles" section. No credit Card Needed!!

The Bellwether Report will continue to research the small cap markets to bring you exciting opportunities!! If you are interested in receiving more information on these small cap opportunities and other features of our site, feel free to sign up for a complimentary subscription to the #1 online investment tool www.bellwetherreport.com.

Companies looking to advertise with Bellwether Report should email jlee@bellwetherreport.com with the subject line (Advertising).

Information has been gathered from sources such as www.Hoovers.com, www.yahoo.com, www.associatedpress.com, www.marketwire.com, www.businesswire.com and other public resources.

All material herein was prepared by the Bellwetherreport.com, (Bellwether) based upon information believed to be reliable. The information contained herein is not guaranteed by Bellwether to be accurate, and should not be considered to be all-inclusive. The companies that are discussed in this opinion have not approved the statements made in this opinion. This opinion contains forward-looking statements that involve risks and uncertainties. This material is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Bellwether is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst or underwriter. Please consult a broker before purchasing or selling any securities viewed on or mentioned herein. Bellwether may receive compensation in cash or shares from independent third parties or from the companies mentioned.

Bellwether's affiliates, officers, directors and employees may also have bought or may buy the shares discussed in this opinion and may profit in the event those shares rise in value.

Bellwether will not advise as to when it decides to sell and does not and will not offer any opinion as to when others should sell; each investor must make that decision based on his or her judgment of the market.

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a companies' annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and Bellwether undertakes no obligation to update such statements.

M2 Communications Ltd disclaims all liability for information provided within M2 PressWIRE. Data supplied by named party/parties. Further information on M2 PressWIRE can be obtained at http://www.presswire.net on the world wide web. Inquiries to info@m2.com.

(C)1994-2007 M2 COMMUNICATIONS LTD

14.04.2007 - 10:10

Top Pick: Sonnenkraft aus Colorado

Im "Cool Cat Report" konzentriert sich Kevin Kennedy auf kleinere Wachstumsunternehmen vornehmlich aus den USA. Sein aktueller Tipp ist Ascent Solar (ISIN: US0436351011).Kevin Kennedy erklärt: Ascent Solar Technologies entwickelt die gerade stark aufkommende Dünnschicht Solartechnik und ist in Littleton, Colorado beheimatet. Das Unternehmen ist noch keine zwei Jahre alt und ist aus einem Forschungsprojekt in der Solartechnik hervorgegangen.

Der Aktienkurs ist am 14. März um fast 90% explodiert. Dazu trugen zwei Ereignisse bei: Erstens ist Ascent Solar mit neuen Forschungsgeldern ausgerüstet, um eine weitere Generation von Photovoltaikzellen zu entwickeln. Zweitens hat der norwegische Konzern Norsk Hydro sich am kleinen Solarunternehmen mit 1,6 Millionen Aktien beteiligt. Das sind nach aktuellem Stand rund 23% aller ausstehenden Aktien.

Gerade der Markt für die Dünnschicht-Technologie ist äußerst aussichtsreich. Während es der gesamte Solarbereich in den vergangenen Jahren auf ein Wachstum von 40% gebracht hat, wuchs der Markt für Dünnschicht-Technologie im vergangenen Jahr um fast 70%.

Nach den positiven Meldungen erzielte die Aktie am 23. März ein Hoch bei 10,44 Dollar. Danach kam es zu einer Korrektur bis 7,80 Dollar bevor es wieder bis auf 9 Dollar nach oben ging. Unsere Strategie ist es nun, die Aktie mit einem Limit von 9 Dollar zu kaufen und mit einem Stop-Loss bei 7,79 Dollar zu versehen. (HB)

Top Pick: Sonnenkraft aus Colorado

Im "Cool Cat Report" konzentriert sich Kevin Kennedy auf kleinere Wachstumsunternehmen vornehmlich aus den USA. Sein aktueller Tipp ist Ascent Solar (ISIN: US0436351011).Kevin Kennedy erklärt: Ascent Solar Technologies entwickelt die gerade stark aufkommende Dünnschicht Solartechnik und ist in Littleton, Colorado beheimatet. Das Unternehmen ist noch keine zwei Jahre alt und ist aus einem Forschungsprojekt in der Solartechnik hervorgegangen.

Der Aktienkurs ist am 14. März um fast 90% explodiert. Dazu trugen zwei Ereignisse bei: Erstens ist Ascent Solar mit neuen Forschungsgeldern ausgerüstet, um eine weitere Generation von Photovoltaikzellen zu entwickeln. Zweitens hat der norwegische Konzern Norsk Hydro sich am kleinen Solarunternehmen mit 1,6 Millionen Aktien beteiligt. Das sind nach aktuellem Stand rund 23% aller ausstehenden Aktien.

Gerade der Markt für die Dünnschicht-Technologie ist äußerst aussichtsreich. Während es der gesamte Solarbereich in den vergangenen Jahren auf ein Wachstum von 40% gebracht hat, wuchs der Markt für Dünnschicht-Technologie im vergangenen Jahr um fast 70%.

Nach den positiven Meldungen erzielte die Aktie am 23. März ein Hoch bei 10,44 Dollar. Danach kam es zu einer Korrektur bis 7,80 Dollar bevor es wieder bis auf 9 Dollar nach oben ging. Unsere Strategie ist es nun, die Aktie mit einem Limit von 9 Dollar zu kaufen und mit einem Stop-Loss bei 7,79 Dollar zu versehen. (HB)

Antwort auf Beitrag Nr.: 28.829.435 von Buddah am 15.04.07 22:21:55quelle:

http://www.boerse-go.de/news/news.php?ida=597155&idc=2

http://www.boerse-go.de/news/news.php?ida=597155&idc=2

oh...so langsam sind also ein paar mehr mit an board?

hab's in meinen trading thread schon geposted...und grad gesehen das es anscheinend noch ein paar investierte bei W gibt...na...dann will ich euch diese aktuelle investoren-präsentation vom CEO nicht vorenthalten.

gibt...na...dann will ich euch diese aktuelle investoren-präsentation vom CEO nicht vorenthalten.

http://www.ascentsolar.com/pdf/Ascent_Solar_Investor_Present…

bin seit knapp über 4$ dabei...werd aber eher in zukunft weitere shares einsammeln...als das ich vorhabe welche zu geben!denke wir haben noch deutliche kurszuwächse vor uns in den nächsten monaten!

hab's in meinen trading thread schon geposted...und grad gesehen das es anscheinend noch ein paar investierte bei W

gibt...na...dann will ich euch diese aktuelle investoren-präsentation vom CEO nicht vorenthalten.

gibt...na...dann will ich euch diese aktuelle investoren-präsentation vom CEO nicht vorenthalten. http://www.ascentsolar.com/pdf/Ascent_Solar_Investor_Present…

bin seit knapp über 4$ dabei...werd aber eher in zukunft weitere shares einsammeln...als das ich vorhabe welche zu geben!denke wir haben noch deutliche kurszuwächse vor uns in den nächsten monaten!

wann wird in Frankfurt gehandelt??

Weiß jemand?

Weiß jemand?

Hallo!

Schaut mal:

Ascent Solar Technologies, Inc. ASTI (BSX:AKC) today announced that it has been selected by the U.S. Air Force to develop an innovative flexible thin film tandem solar cell with the goal of demonstrating thin film photovoltaic efficiencies of 20%.

Tandem solar cells are a combination of two cells stacked atop one another, with the top and bottom cells gathering energy from separate parts of the solar spectrum. Tandem cells require two solar cells that not only have the desired electrical and optical properties, but must also share compatible manufacturing processes. The program will be performed under a phase one Small Business Innovative Research contract.

Ascent Solar Vice President and Chief Technology Officer Dr. Joseph Armstrong stated, "This important Air Force program builds upon significant work already performed by Ascent Solar personnel in the area of wide bandgap thin-film photovoltaic technology. In particular, this program will demonstrate the ability to make solar cells using a new material system that has the potential to serve as the top cell of a new and innovative tandem solar cell configuration on which Ascent Solar has been working. It's like putting two efficient technologies in a hybrid car, each with its own strengths, but performing better together than either one individually. We are delighted that the U.S. Air Force selected Ascent Solar to work with it in this exciting and promising technology area."

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Hört sich doch gut an, oder?

Ginny.

Schaut mal:

Ascent Solar Technologies, Inc. ASTI (BSX:AKC) today announced that it has been selected by the U.S. Air Force to develop an innovative flexible thin film tandem solar cell with the goal of demonstrating thin film photovoltaic efficiencies of 20%.

Tandem solar cells are a combination of two cells stacked atop one another, with the top and bottom cells gathering energy from separate parts of the solar spectrum. Tandem cells require two solar cells that not only have the desired electrical and optical properties, but must also share compatible manufacturing processes. The program will be performed under a phase one Small Business Innovative Research contract.

Ascent Solar Vice President and Chief Technology Officer Dr. Joseph Armstrong stated, "This important Air Force program builds upon significant work already performed by Ascent Solar personnel in the area of wide bandgap thin-film photovoltaic technology. In particular, this program will demonstrate the ability to make solar cells using a new material system that has the potential to serve as the top cell of a new and innovative tandem solar cell configuration on which Ascent Solar has been working. It's like putting two efficient technologies in a hybrid car, each with its own strengths, but performing better together than either one individually. We are delighted that the U.S. Air Force selected Ascent Solar to work with it in this exciting and promising technology area."

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Hört sich doch gut an, oder?

Ginny.

heute in Frankfurt

Und noch einer:

Ascent Solar Wins Another U.S. Air Force Research Program

Ascent Solar Technologies, Inc. ASTI (BSX:AKC) today announced that it has been selected by the U.S. Air Force to develop a new transparent conductive oxide (TCO) material to serve as the top electrical contact for flexible monolithically integrated thin-film, copper-indium-gallium-selenium (CIGS) solar cells.

The Ascent Solar innovation involves developing a new material system that will be deposited using a novel roll-to-roll process. The new process offers the potential for a higher-quality, lower-cost alternative to the TCO materials and deposition methods presently used. The program will be performed under a Small Business Innovative Research contract.

Ascent Solar Vice President and Chief Technology Officer Dr. Joseph Armstrong stated, "This program provides us with a unique opportunity to improve the top layer of our flexible thin-film photovoltaic product. We believe that the new film material and innovative manufacturing method offers the potential for significantly lower-cost and better-performing products in the future."

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Ascent Solar Wins Another U.S. Air Force Research Program

Ascent Solar Technologies, Inc. ASTI (BSX:AKC) today announced that it has been selected by the U.S. Air Force to develop a new transparent conductive oxide (TCO) material to serve as the top electrical contact for flexible monolithically integrated thin-film, copper-indium-gallium-selenium (CIGS) solar cells.

The Ascent Solar innovation involves developing a new material system that will be deposited using a novel roll-to-roll process. The new process offers the potential for a higher-quality, lower-cost alternative to the TCO materials and deposition methods presently used. The program will be performed under a Small Business Innovative Research contract.

Ascent Solar Vice President and Chief Technology Officer Dr. Joseph Armstrong stated, "This program provides us with a unique opportunity to improve the top layer of our flexible thin-film photovoltaic product. We believe that the new film material and innovative manufacturing method offers the potential for significantly lower-cost and better-performing products in the future."

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Tut sich ja nicht so richtig viel hier in dem Träät ...

Ginny.

Ginny.

Antwort auf Beitrag Nr.: 29.421.644 von Ginny am 22.05.07 17:24:47das macht nix...die aktie würde ich trotzdem halten. der nächste run kommt.

Hier kommt mal wieder eine Neuigkeit:

Ascent Solar Technologies Announces Redemption of Class A Public Warrants

Ascent Solar Technologies, Inc. ASTI (BSX:ASTI) today announced plans to redeem its outstanding Class A public warrants ASTIW (BSX:ASTIW). Today, a notice of redemption has been mailed to all the warrant holders of record as of May 17, 2007. The redemption date is Monday, June 25, 2007, and any outstanding Class A public warrant that has not been exercised before that date will expire and will be redeemable by Ascent Solar for $0.25 per warrant.

Until the redemption date, the Class A public warrants are convertible into common stock at an exercise price of $6.60 per share. A total of 3,290,894 Class A public warrants were issued in connection with Ascent Solar's initial public offering and to certain bridge investors. To date, approximately 640,400 of these warrants have been exercised, yielding $4,226,600 in gross proceeds to the company. Conversion of all of the outstanding Class A public warrants would generate additional proceeds to the company of approximately $17,493,300, which the Company would use to accelerate the planning, engineering and development of a 100 megawatt (MW) manufacturing plant and for general corporate purposes.

Ascent Solar President and CEO Matthew Foster stated "the Company's exceptional performance in the past year and our recently announced partnership with Norsk Hydro NHY have enabled us to achieve this significant milestone ahead of plan. The additional capital received from Class A public warrants already exercised has enabled us to accelerate development of the key production tools that will support our planned 100 MW manufacturing plant. Exercise of the remaining Class A public warrants will help support construction of the first of four 25 MW scale production lines, the first of which is planned for completion in 2009. Our pathway to the market with large volume production will be greatly enhanced should all of the remaining Class A public warrants be exercised."

The Class A public warrants became eligible for redemption on April 16, 2007, when the last closing price of Ascent Solar's common stock had equaled or exceeded $9.35 for five consecutive trading days. On May 23, 2007, the closing price of Ascent Solar's common stock as reported by Nasdaq was $7.97, and the closing price of Ascent Solar's Class A public warrants was $2.03.

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Ascent Solar Technologies Announces Redemption of Class A Public Warrants

Ascent Solar Technologies, Inc. ASTI (BSX:ASTI) today announced plans to redeem its outstanding Class A public warrants ASTIW (BSX:ASTIW). Today, a notice of redemption has been mailed to all the warrant holders of record as of May 17, 2007. The redemption date is Monday, June 25, 2007, and any outstanding Class A public warrant that has not been exercised before that date will expire and will be redeemable by Ascent Solar for $0.25 per warrant.

Until the redemption date, the Class A public warrants are convertible into common stock at an exercise price of $6.60 per share. A total of 3,290,894 Class A public warrants were issued in connection with Ascent Solar's initial public offering and to certain bridge investors. To date, approximately 640,400 of these warrants have been exercised, yielding $4,226,600 in gross proceeds to the company. Conversion of all of the outstanding Class A public warrants would generate additional proceeds to the company of approximately $17,493,300, which the Company would use to accelerate the planning, engineering and development of a 100 megawatt (MW) manufacturing plant and for general corporate purposes.

Ascent Solar President and CEO Matthew Foster stated "the Company's exceptional performance in the past year and our recently announced partnership with Norsk Hydro NHY have enabled us to achieve this significant milestone ahead of plan. The additional capital received from Class A public warrants already exercised has enabled us to accelerate development of the key production tools that will support our planned 100 MW manufacturing plant. Exercise of the remaining Class A public warrants will help support construction of the first of four 25 MW scale production lines, the first of which is planned for completion in 2009. Our pathway to the market with large volume production will be greatly enhanced should all of the remaining Class A public warrants be exercised."

The Class A public warrants became eligible for redemption on April 16, 2007, when the last closing price of Ascent Solar's common stock had equaled or exceeded $9.35 for five consecutive trading days. On May 23, 2007, the closing price of Ascent Solar's common stock as reported by Nasdaq was $7.97, and the closing price of Ascent Solar's Class A public warrants was $2.03.

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Das hört sich doch ganz gut an:

Ascent Solar Shareholders Approve Increasing Norsk Hydro Equity Stake

Ascent Solar Technologies, Inc. ASTI (BSX:ASTI) announced today that its shareholders have overwhelmingly approved the options Ascent Solar granted to Norsk Hydro NHY which will enable Hydro to increase its equity stake in Ascent Solar from its current 23% to up to 35%. The shareholders' vote also will enable Hydro to purchase a corresponding percentage of outstanding warrants.

The approval, obtained at the June 15, 2007 annual shareholders meeting, enables Hydro to immediately purchase up to 23% of Ascent Solar's outstanding Class A and Class B public warrants. Last month, Ascent Solar announced that it would redeem its outstanding Class A public warrants beginning June 25, 2007. All outstanding Class A public warrants that are not exercised before that date will be subject to redemption. If Hydro exercises its option on or after June 25, 2007, it will be entitled to purchase shares of common stock in lieu of the Class A warrants it would have obtained in the absence of the redemption. Beginning in December 2007, Hydro may increase its equity stake to up to 35% by exercising an option to purchase additional shares of common stock and Class B warrants.

With approximately 33,000 employees in nearly 40 countries, Hydro is one of the world's leading suppliers of energy, and its building systems and aluminum divisions are among the largest in the world.

"This vote by Ascent Solar's shareholders is motivating for us. We intend to develop a strong strategic partnership with Ascent Solar, and this vote of confidence by Ascent Solar's shareholders is a critical step in that process. We believe that Ascent Solar's unique thin film products have the potential to serve as a key component in Hydro's solar and building systems lines of businesses," says Einar Glomnes, head of Hydro's solar division.

Ascent Solar President and CEO Matthew Foster stated at the meeting, "I would like to personally thank all of our shareholders and in particular those who attended the annual meeting on Friday June 15, 2007." Mr. Foster also stated, "The Hydro Building Systems product brands are world-class and provide a perfect match for integrating our thin film PV. We are pleased to announce that Hydro and Ascent Solar have already initiated the joint development of a new building integrated PV (BIPV) product line, and we look forward to additional opportunities as our strategic relationship matures."

At the annual meeting, the shareholders also re-elected Richard Swanson, Stanley Gallery, and Dr. T.W. Fraser Russell to the Board of Directors, and approved proposed amendments to Ascent Solar's 2005 stock option plan.

About Hydro:

Headquartered in Oslo, Norway, Hydro is a leading offshore producer of oil and gas and is the third-largest integrated aluminum supplier in the world. Hydro Building Systems is second largest in the world and markets product under three main brand names DOMAL, TECHNAL, and WICONA. Please visit Hydro's website for additional information at www.hydro.com.

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Ascent Solar Shareholders Approve Increasing Norsk Hydro Equity Stake

Ascent Solar Technologies, Inc. ASTI (BSX:ASTI) announced today that its shareholders have overwhelmingly approved the options Ascent Solar granted to Norsk Hydro NHY which will enable Hydro to increase its equity stake in Ascent Solar from its current 23% to up to 35%. The shareholders' vote also will enable Hydro to purchase a corresponding percentage of outstanding warrants.

The approval, obtained at the June 15, 2007 annual shareholders meeting, enables Hydro to immediately purchase up to 23% of Ascent Solar's outstanding Class A and Class B public warrants. Last month, Ascent Solar announced that it would redeem its outstanding Class A public warrants beginning June 25, 2007. All outstanding Class A public warrants that are not exercised before that date will be subject to redemption. If Hydro exercises its option on or after June 25, 2007, it will be entitled to purchase shares of common stock in lieu of the Class A warrants it would have obtained in the absence of the redemption. Beginning in December 2007, Hydro may increase its equity stake to up to 35% by exercising an option to purchase additional shares of common stock and Class B warrants.

With approximately 33,000 employees in nearly 40 countries, Hydro is one of the world's leading suppliers of energy, and its building systems and aluminum divisions are among the largest in the world.

"This vote by Ascent Solar's shareholders is motivating for us. We intend to develop a strong strategic partnership with Ascent Solar, and this vote of confidence by Ascent Solar's shareholders is a critical step in that process. We believe that Ascent Solar's unique thin film products have the potential to serve as a key component in Hydro's solar and building systems lines of businesses," says Einar Glomnes, head of Hydro's solar division.

Ascent Solar President and CEO Matthew Foster stated at the meeting, "I would like to personally thank all of our shareholders and in particular those who attended the annual meeting on Friday June 15, 2007." Mr. Foster also stated, "The Hydro Building Systems product brands are world-class and provide a perfect match for integrating our thin film PV. We are pleased to announce that Hydro and Ascent Solar have already initiated the joint development of a new building integrated PV (BIPV) product line, and we look forward to additional opportunities as our strategic relationship matures."

At the annual meeting, the shareholders also re-elected Richard Swanson, Stanley Gallery, and Dr. T.W. Fraser Russell to the Board of Directors, and approved proposed amendments to Ascent Solar's 2005 stock option plan.

About Hydro:

Headquartered in Oslo, Norway, Hydro is a leading offshore producer of oil and gas and is the third-largest integrated aluminum supplier in the world. Hydro Building Systems is second largest in the world and markets product under three main brand names DOMAL, TECHNAL, and WICONA. Please visit Hydro's website for additional information at www.hydro.com.

Quelle:

http://news.moneycentral.msn.com/ticker/article.aspx?Feed=BW…

Aber ich glaub', so richtig interessieren tut sich hier keiner für das Teil, oooooooooder ?????????????????

Antwort auf Beitrag Nr.: 29.998.341 von Ginny am 18.06.07 15:24:34Abwarten, die stehen erst am Anfang!

Guten Morgen, möchte mich hier kurz auch als neuer Aktionär vorstellen.

Antwort auf Beitrag Nr.: 30.013.198 von Hoerschwelle am 19.06.07 09:29:42

Hi!

Dann haben wir ja schon zwei Baustellen miteinander - ESLR und ASTI ...

Mal schau'n, wann die so auf die Füße kommen.

Schönen Gruß,

Ginny.

Hi!

Dann haben wir ja schon zwei Baustellen miteinander - ESLR und ASTI ...

Mal schau'n, wann die so auf die Füße kommen.

Schönen Gruß,

Ginny.

Antwort auf Beitrag Nr.: 30.024.966 von Ginny am 19.06.07 19:25:06Jo, wird wohl noch dauern, ist eine Investition in die Zukunft. Den Einstieg von Norsk Hydro bewerte ich als ultrapositiv!! Der Kurs hat das zwar schon eskomptiert, aber eben nur das! Bei weiteren Entwickliungsschritten sollte der Kurs weiter steigen. Das Potenzial bei Komerzialisierung ist extremst! Siehe FSLR.

Ascent Solar plans to move its state-of-the-art, thin-film photovoltaic (PV) materials and modules from development into production beginning in early 2008 when the company completes its new manufacturing facility. Unique advantages over earlier product generations and other technologies in the marketplace include:

...

...

The product will be manufactured in large roll formats at the module level using a proprietary monolithic laser-patterned cell integration process that enables individual cells to be interconnected during production. This innovation eliminates the time-intensive cell to cell connections and assembly operations required with other technologies to build up modules.

Modules are produced on durable, light weight plastic in contrast to first generation products on metal foils that were developed over 12 years ago. The plastic substrate materials result in extremely high specific power levels, compactness and flexibility that enable the products to be configured into a wide variety of rolls, foldable packs, or traditional module formats.

The large roll formats allow for direct integration into roofing membranes and other building materials and the large sizes significantly reduces the number of modules required for a typical application.

Ascent Solar and its parent company, ITN Energy Systems, are early developers and manufacturers of multi-megawatt, roll-to-roll production equipment for CIGS photovoltaics on flexible substrates. Ascent Solar plans to be the first solar technology company to take monolithically integrated PV on plastic into full production. Production tools are now at the fourth generation level – fully incorporating proprietary intelligent processing and sensor based controls that have demonstrated exceptional yield and uniformity in manufacturing on first generation products.

http://www.ascentsolar.com/x.php?page=17

Sehr interessant finde ich, das die Kontakte, die auf den kristallinenModulen "mehr oder weniger von Hand" aufgebracht werden müssen, in der Produktion schon mit aufgedruckt weerden!! Ebendso die Rollen herstellung was einen "Endlosproduktionsprozess" ermöglichen sollte. Anfang 2008 ist es so weit!!! Ich bin gespannt!

weiter heisst es ...

Ascent Solar’s state-of-the-art, thin film PV systems will make solar power an affordable energy alternative for industries such as commercial and residential building markets, as well as space and near-space applications. The new suite of PV products and systems, targeting the growing terrestrial market, aims to deliver PV systems that offer significant performance and cost advantages over existing silicon-based solutions.

...

...

The AST 5000 Series Module with FASTTRACKS™ is Ascent Solar’s new “plug-and-play” PV module that is in development and envisioned for use in the commercial and residential rooftop markets. With the use of proprietary integration techniques (co-developed by PermaCity Solar), the AST 5000 Series Module with FASTTRACKS™ has inherent cost and system integration advantages over small, fragile, bulky and rigid silicon modules in use today.

FASTTRACKS™ ─ a “plug-and-play” design with fast, efficient and easy to install connectors. In combination with the planned AST 5000 series modules, entire systems are ready-made-to-order to produce power at the desired system voltage right out of the factory. Ascent Solar anticipates a reduction of installation time from weeks to days for a typical large commercial rooftop PV system.

The Ascent Solar AST 5000 Series Module with FASTTRACKS is being designed to generate between 100 Watts and 5,000 Watts of power per module. These new modules are predicted to significantly reduce the cost of electricity generated with today’s silicon-based PV systems. This new design can be three to four feet wide and nearly half a football field in length and should provide roughly 10 times the power of the largest silicon module available in the market today. Ascent Solar anticipates that this new PV system based upon the AST 5000 series modules would produce electricity at cost levels comparable to today’s fossil fuel power plants.

Case studies have shown that a typical large scale system of up to 600kW could result in as much as a 20 fold reduction in the number of discrete modules by using the planned AST 5000 series modules.

http://www.ascentsolar.com/x.php?page=34

Hammer, woll, die Aufzeit soll sich von Wochen auf Tage verringern und die Größe ... Hammer! Nicht zu sprechen von den Vergleichen mit der Energiegewinnung durch fossile Brennstoffe

...

...

The product will be manufactured in large roll formats at the module level using a proprietary monolithic laser-patterned cell integration process that enables individual cells to be interconnected during production. This innovation eliminates the time-intensive cell to cell connections and assembly operations required with other technologies to build up modules.

Modules are produced on durable, light weight plastic in contrast to first generation products on metal foils that were developed over 12 years ago. The plastic substrate materials result in extremely high specific power levels, compactness and flexibility that enable the products to be configured into a wide variety of rolls, foldable packs, or traditional module formats.

The large roll formats allow for direct integration into roofing membranes and other building materials and the large sizes significantly reduces the number of modules required for a typical application.

Ascent Solar and its parent company, ITN Energy Systems, are early developers and manufacturers of multi-megawatt, roll-to-roll production equipment for CIGS photovoltaics on flexible substrates. Ascent Solar plans to be the first solar technology company to take monolithically integrated PV on plastic into full production. Production tools are now at the fourth generation level – fully incorporating proprietary intelligent processing and sensor based controls that have demonstrated exceptional yield and uniformity in manufacturing on first generation products.

http://www.ascentsolar.com/x.php?page=17

Sehr interessant finde ich, das die Kontakte, die auf den kristallinenModulen "mehr oder weniger von Hand" aufgebracht werden müssen, in der Produktion schon mit aufgedruckt weerden!! Ebendso die Rollen herstellung was einen "Endlosproduktionsprozess" ermöglichen sollte. Anfang 2008 ist es so weit!!! Ich bin gespannt!

weiter heisst es ...

Ascent Solar’s state-of-the-art, thin film PV systems will make solar power an affordable energy alternative for industries such as commercial and residential building markets, as well as space and near-space applications. The new suite of PV products and systems, targeting the growing terrestrial market, aims to deliver PV systems that offer significant performance and cost advantages over existing silicon-based solutions.

...

...

The AST 5000 Series Module with FASTTRACKS™ is Ascent Solar’s new “plug-and-play” PV module that is in development and envisioned for use in the commercial and residential rooftop markets. With the use of proprietary integration techniques (co-developed by PermaCity Solar), the AST 5000 Series Module with FASTTRACKS™ has inherent cost and system integration advantages over small, fragile, bulky and rigid silicon modules in use today.

FASTTRACKS™ ─ a “plug-and-play” design with fast, efficient and easy to install connectors. In combination with the planned AST 5000 series modules, entire systems are ready-made-to-order to produce power at the desired system voltage right out of the factory. Ascent Solar anticipates a reduction of installation time from weeks to days for a typical large commercial rooftop PV system.

The Ascent Solar AST 5000 Series Module with FASTTRACKS is being designed to generate between 100 Watts and 5,000 Watts of power per module. These new modules are predicted to significantly reduce the cost of electricity generated with today’s silicon-based PV systems. This new design can be three to four feet wide and nearly half a football field in length and should provide roughly 10 times the power of the largest silicon module available in the market today. Ascent Solar anticipates that this new PV system based upon the AST 5000 series modules would produce electricity at cost levels comparable to today’s fossil fuel power plants.

Case studies have shown that a typical large scale system of up to 600kW could result in as much as a 20 fold reduction in the number of discrete modules by using the planned AST 5000 series modules.

http://www.ascentsolar.com/x.php?page=34

Hammer, woll, die Aufzeit soll sich von Wochen auf Tage verringern und die Größe ... Hammer! Nicht zu sprechen von den Vergleichen mit der Energiegewinnung durch fossile Brennstoffe

21.06.2007 12:04

Ascent Solar Appoints Two Key Members to Board of Directors

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI) (BSE:ASTI) today announced that it is expanding the current board of directors to seven members pursuant to an agreement signed with Norsk Hydro (NYSE:NHY) and approved by Ascent Solar's shareholders. Ascent Solar has appointed Dr. Amit Kumar and Mr. Einar Glomnes as new directors. Mr. Glomnes is head of Hydro's solar division and will represent Hydro on the Ascent Solar Board. Hydro also will select a non-voting individual to attend meetings of the Board of Directors.

Dr. Kumar is currently serving as President&CEO of Combimatrix Corporation (NASDAQ: CBMX) He has held this position since September 2001. Previously, Dr. Kumar was Vice President of Life Sciences of Acacia Research Corp (NASDAQ: ACRI). From January 1999 to February 2000, Dr. Kumar was the founding President and Chief Executive Officer of Signature BioSciences, Inc., a life science company developing technology for advanced research in genomics, proteomics and drug discovery. From January 1998 to December 1999, Dr. Kumar was an Entrepreneur in Residence with Oak Investment Partners, a venture capital firm. From October 1996 to January 1998, Dr. Kumar was a Senior Manager at IDEXX Laboratories, Inc., a biotechnology company. From October 1993 to September 1996, Dr. Kumar was Head of Research& Development for Idetek Corporation, which was later acquired by IDEXX Laboratories, Inc. Dr. Kumar received his B.S. degree in chemistry from Occidental College. After joint studies at Stanford University and the California Institute of Technology, he received his Ph.D. in Chemistry from Caltech in 1991. He also completed a post-doctoral fellowship at Harvard University in 1993.

Ascent Solar CEO and President Matthew Foster stated, “Ascent Solar is pleased to welcome Dr. Kumar and Mr. Glomnes to our Board of Directors. Having Mr. Glomnes represent our partner, Hydro, on our Board will greatly facilitate the development of our joint vision and growth strategies for Ascent Solar and Hydro Solar. As a small company, we are quick to action, and Hydro has been most impressive to us in demonstrating the ability to be equally responsive. Mr. Glomnes' participation on our Board will enhance our direct communication channels even further.“�

“Dr. Kumar brings invaluable expertise from his years of service as President&CEO of a public company and also serving on the boards of other technology companies. I look forward to Dr. Kumar's contributions as we continue to implement our growth strategies.“�

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

Ascent Solar Appoints Two Key Members to Board of Directors

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI) (BSE:ASTI) today announced that it is expanding the current board of directors to seven members pursuant to an agreement signed with Norsk Hydro (NYSE:NHY) and approved by Ascent Solar's shareholders. Ascent Solar has appointed Dr. Amit Kumar and Mr. Einar Glomnes as new directors. Mr. Glomnes is head of Hydro's solar division and will represent Hydro on the Ascent Solar Board. Hydro also will select a non-voting individual to attend meetings of the Board of Directors.

Dr. Kumar is currently serving as President&CEO of Combimatrix Corporation (NASDAQ: CBMX) He has held this position since September 2001. Previously, Dr. Kumar was Vice President of Life Sciences of Acacia Research Corp (NASDAQ: ACRI). From January 1999 to February 2000, Dr. Kumar was the founding President and Chief Executive Officer of Signature BioSciences, Inc., a life science company developing technology for advanced research in genomics, proteomics and drug discovery. From January 1998 to December 1999, Dr. Kumar was an Entrepreneur in Residence with Oak Investment Partners, a venture capital firm. From October 1996 to January 1998, Dr. Kumar was a Senior Manager at IDEXX Laboratories, Inc., a biotechnology company. From October 1993 to September 1996, Dr. Kumar was Head of Research& Development for Idetek Corporation, which was later acquired by IDEXX Laboratories, Inc. Dr. Kumar received his B.S. degree in chemistry from Occidental College. After joint studies at Stanford University and the California Institute of Technology, he received his Ph.D. in Chemistry from Caltech in 1991. He also completed a post-doctoral fellowship at Harvard University in 1993.

Ascent Solar CEO and President Matthew Foster stated, “Ascent Solar is pleased to welcome Dr. Kumar and Mr. Glomnes to our Board of Directors. Having Mr. Glomnes represent our partner, Hydro, on our Board will greatly facilitate the development of our joint vision and growth strategies for Ascent Solar and Hydro Solar. As a small company, we are quick to action, and Hydro has been most impressive to us in demonstrating the ability to be equally responsive. Mr. Glomnes' participation on our Board will enhance our direct communication channels even further.“�

“Dr. Kumar brings invaluable expertise from his years of service as President&CEO of a public company and also serving on the boards of other technology companies. I look forward to Dr. Kumar's contributions as we continue to implement our growth strategies.“�

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

22.06.2007 12:04

Deadline to Exercise Ascent Solar Technologies Class A Public Warrants

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI) (BSX:ASTI) today reminds holders that all outstanding Class A public warrants (ASTIW) not exercised by 1:00 PM EDT, today, June 22, 2007, will be subject to redemption by Ascent Solar. Any Class A public warrant that has not been exercised by today's 1:00 PM deadline will expire and be redeemable by Ascent Solar for $0.25. Class A public warrants are convertible into common stock at an exercise price of $6.60 per share.

Please direct any questions regarding either the exercise or redemption process to Mr. Brian Blackman, Investor Relations at 832-515-0928. You may also contact Ascent Solar Technologies' Transfer Agent directly for today's warrant conversions; Computershare Inc.-Corporate Actions-303-262-0775.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/watchlist/index.asp

Deadline to Exercise Ascent Solar Technologies Class A Public Warrants

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI) (BSX:ASTI) today reminds holders that all outstanding Class A public warrants (ASTIW) not exercised by 1:00 PM EDT, today, June 22, 2007, will be subject to redemption by Ascent Solar. Any Class A public warrant that has not been exercised by today's 1:00 PM deadline will expire and be redeemable by Ascent Solar for $0.25. Class A public warrants are convertible into common stock at an exercise price of $6.60 per share.

Please direct any questions regarding either the exercise or redemption process to Mr. Brian Blackman, Investor Relations at 832-515-0928. You may also contact Ascent Solar Technologies' Transfer Agent directly for today's warrant conversions; Computershare Inc.-Corporate Actions-303-262-0775.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expressed or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/watchlist/index.asp

Ultrageil ist ja die Verdrahtung der Module im Video! Alles auch einem Guß

http://www.ascentsolar.com/x.php?page=16

http://www.ascentsolar.com/x.php?page=16

Glücklicherweise hat das bald ein Ende

A0KEZT = ASTI

ASTIZ = Equity Options Class A

vgl. http://quotes.nasdaq.com/quote.dll?page=multi&mode=stock&sym…

A0KEZT = ASTI

ASTIZ = Equity Options Class A

vgl. http://quotes.nasdaq.com/quote.dll?page=multi&mode=stock&sym…

ASTI und ASTIZ gibt es dann noch und ASTIW gehen ab 25.6, unter

Möge einer die Amifinanzierungen verstehen

Möge einer die Amifinanzierungen verstehen

25.06.2007 12:04

Ascent Solar Reports Over 99% of Class A Public Warrants Exercised

Ascent Solar Technologies, (Nachrichten) Inc. today announced that its securities transfer agent, Computershare Trust Company, Inc., had reported to the company on June 22, 2007 that a total of 3,278,299 or 99.6% of the outstanding Class A public warrants had been presented for conversion into one share of the company's common stock over the course of the warrant exercise period. The company anticipates a total receipt of approximately $ 21.6 million in proceeds from those warrant holders who elected to exercise their Class A pubic warrants.

On May 24, 2007 Ascent Solar announced its notice of redemption of all outstanding Class A public warrants. Each Class A public warrant was convertible into a single share of the company's common stock for a price of $6.60. Any outstanding Class A public warrants that were not exercised by June 22, 2007 will now be redeemed by the company for a price of $ 0.25 each.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

Ascent Solar Reports Over 99% of Class A Public Warrants Exercised

Ascent Solar Technologies, (Nachrichten) Inc. today announced that its securities transfer agent, Computershare Trust Company, Inc., had reported to the company on June 22, 2007 that a total of 3,278,299 or 99.6% of the outstanding Class A public warrants had been presented for conversion into one share of the company's common stock over the course of the warrant exercise period. The company anticipates a total receipt of approximately $ 21.6 million in proceeds from those warrant holders who elected to exercise their Class A pubic warrants.

On May 24, 2007 Ascent Solar announced its notice of redemption of all outstanding Class A public warrants. Each Class A public warrant was convertible into a single share of the company's common stock for a price of $6.60. Any outstanding Class A public warrants that were not exercised by June 22, 2007 will now be redeemed by the company for a price of $ 0.25 each.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic modules and is located in Littleton, Colorado. Please visit our website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause the Company's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in the Company's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

26.06.2007 12:01

Ascent Solar Technologies to Present at C.E. Unterberg Emerging Growth Opportunities Conference

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI)(BSX:ASTI), a developer of state-of-the-art, thin-film photovoltaic modules, today announced that it has been invited to present and participate at the C.E. Unterberg Annual Emerging Growth Opportunities Conference. CEO Matthew Foster will discuss the company's business strategies and provide solar industry perspectives on flexible thin film markets during a 20 minute presentation scheduled on Tuesday, July 10, 2007 at 3:30 PM (EST). The conference will also include a schedule of one-on-one meetings. The conference will be held at the Mandarin Oriental Hotel, 80 Columbus Circle, New York, NY.

For additional information or to schedule a one-on-one meeting with Ascent Solar Technologies, Inc. at this conference, please contact Brian Blackman at 832-515-0928 or brian@prfmonline.com.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit Ascent Solar's website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause Ascent Solar's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in Ascent Solar's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

Ascent Solar Technologies to Present at C.E. Unterberg Emerging Growth Opportunities Conference

Ascent Solar Technologies, (Nachrichten) Inc. (NASDAQ:ASTI)(BSX:ASTI), a developer of state-of-the-art, thin-film photovoltaic modules, today announced that it has been invited to present and participate at the C.E. Unterberg Annual Emerging Growth Opportunities Conference. CEO Matthew Foster will discuss the company's business strategies and provide solar industry perspectives on flexible thin film markets during a 20 minute presentation scheduled on Tuesday, July 10, 2007 at 3:30 PM (EST). The conference will also include a schedule of one-on-one meetings. The conference will be held at the Mandarin Oriental Hotel, 80 Columbus Circle, New York, NY.

For additional information or to schedule a one-on-one meeting with Ascent Solar Technologies, Inc. at this conference, please contact Brian Blackman at 832-515-0928 or brian@prfmonline.com.

About Ascent Solar Technologies:

Ascent Solar Technologies, Inc. is a developer of state-of-the-art, thin-film photovoltaic materials and modules and is located in Littleton, Colorado. Please visit Ascent Solar's website for additional information at www.ascentsolar.com.

Statements in this press release that are not statements of historical or current fact constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other unknown factors that could cause Ascent Solar's actual operating results to be materially different from any historical results or from any future results expresses or implied by such forward-looking statements. In addition to statements that explicitly describe these risks and uncertainties, readers are urged to consider statements that contain terms such as "believes," "belief," "expects," "expect," "intends," "intend," "anticipate," "anticipates," "plans," "plan," to be uncertain and forward-looking. The forward-looking statements contained herein are also subject generally to other risks and uncertainties that are described from time to time in Ascent Solar's filings with Securities and Exchange Commission.

http://www.finanznachrichten.de/nachrichten-2007-06/artikel-…

über 15 % plus und sehr hohes volume. sieht gut aus. next wave is in the making.