ALLOS THerapeutics zu USD 7.61 - ein Schnäppchen? - 500 Beiträge pro Seite

eröffnet am 21.06.09 19:47:36 von

neuester Beitrag 13.10.09 23:26:29 von

neuester Beitrag 13.10.09 23:26:29 von

Beiträge: 38

ID: 1.151.267

ID: 1.151.267

Aufrufe heute: 0

Gesamt: 3.945

Gesamt: 3.945

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 10.11.14, 14:54 | 132 | |

| gestern 20:43 | 130 | |

| 14.10.18, 17:11 | 120 | |

| 03.04.08, 18:47 | 88 | |

| gestern 22:44 | 87 | |

| 22.05.09, 19:14 | 73 | |

| 06.09.06, 11:36 | 71 | |

| 02.01.05, 21:23 | 64 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.722,00 | -0,22 | 160 | |||

| 2. | 2. | 10,550 | +2,23 | 86 | |||

| 3. | 3. | 171,86 | +1,51 | 79 | |||

| 4. | 4. | 5,1900 | +78,35 | 70 | |||

| 5. | 5. | 0,1960 | -9,68 | 66 | |||

| 6. | 6. | 12,800 | +38,38 | 54 | |||

| 7. | 8. | 0,1500 | -28,57 | 45 | |||

| 8. | 7. | 30,45 | +74,40 | 45 |

Die FDA hat bis zum 24.9.09 den Zulassungsantrag von Pralatrexate zur Behandlung von PTCL (peripheral T-cell lymphoma) zu entscheiden. Die Chancen stehen gut, zumal bisher für PTCL keine Therapiemöglichkeit zur Verfügung steht.

Eine Position zu USD 7.62 erscheint mir sehr viel versprechend.

http://ir.allos.com/phoenix.zhtml?c=125475&p=irol-newsArticl…

Eine Position zu USD 7.62 erscheint mir sehr viel versprechend.

http://ir.allos.com/phoenix.zhtml?c=125475&p=irol-newsArticl…

Antwort auf Beitrag Nr.: 37.436.546 von Cyberhexe am 21.06.09 19:47:36Gut gesehen, Cyberhexe! Ich glaub, im AKTIONÄR war die Aktie auch neulich drin. Denke, die Zulassung dürfte klappen.  Zweistellige Kurse sollten dann drin sein.

Zweistellige Kurse sollten dann drin sein.

VG blb

Zweistellige Kurse sollten dann drin sein.

Zweistellige Kurse sollten dann drin sein.VG blb

Antwort auf Beitrag Nr.: 37.436.919 von blb am 21.06.09 21:21:56im AKTIONÄR war die Aktie auch neulich drin

...das stimmt mich aber äusserst nachdenklich, da sich der AKTIONÄR in der Vergangenheit mehrfach als prima Kontraindikator entpuppt hat. In Anbetracht der sehr oberflächlichen Recherchen würde ich diese Lektüre als Basis für eine Anlageentscheidung nicht empfehlen.

...das stimmt mich aber äusserst nachdenklich, da sich der AKTIONÄR in der Vergangenheit mehrfach als prima Kontraindikator entpuppt hat. In Anbetracht der sehr oberflächlichen Recherchen würde ich diese Lektüre als Basis für eine Anlageentscheidung nicht empfehlen.

http://www.thestreet.com/_yahoo/story/10507220/1/allos-15-mo…

Allos: 15-Month Median Survival in PTCL Study

05/30/09 - 07:59 AM EDT

ALTH , LLY , OSIP Adam Feuerstein

Allos Therapeutics(ALTH Quote) reported Saturday median overall survival of almost 15 months for patients with a rare but aggressive form of blood cancer treated with the company's experimental drug pralatrexate.

More from Adam Feuerstein Biotech Stock Mailbag: Oculus in FocusHemispherx's CFS Drug Is a Long ShotBiotalk: Getting ready for ASCOSmall-Cap Biotechs Pop Before ConferenceMAP's Migraine Drug Provides Big Pain ReliefJ&J Just Made Medivation's DayBiotech Stock Mailbag: Gilead Still Got It?Tiny Biotechs Dancing in the Bull PenDendreon's Gold: What's Next for ProvengeBest in Class: Biogen Idec Clinging to Its Crown Market Activity Eli Lilly & Company| LLY UPOSI Pharmaceuticals Inc.| OSIP DOWNThe updated results come from a pivotal phase II study of pralatrexate presented at the American Society of Clinical Oncology (ACSO) annual meeting being held this weekend in Orlando. The U.S. Food and Drug Administration is already reviewing pralatrexate, with an approval decision expected by Sept. 24.

Allos is seeking permission to market the drug as a treatment for peripheral T-cell lymphoma (PTCL), a fast-growing cancer that affects white blood cells known as T-cells. There are no approved drugs to treat the disease.

The phase II study enrolled 115 patients with PTCL, 109 of whom were evaluable for response. All patients were previously treated with a variety of chemotherapy drugs but their cancer continued to grow.

After treatment with pralatrexate, 30 patients, or 28%, saw their tumors shrink, including 10 patients, or 9%, who went into complete remission. The median duration of response to pralatrexate was 9.4 months. These results are slightly improved from previous presentations of the data last year.

Newly disclosed information Saturday on pralatrexate was the median overall survival of 14.7 months, with 57% of the responders surviving for a year or more.

Allos was able to submit pralatrexate for FDA approval based on this small phase II study because PTCL is diagnosed in only about 5,000 U.S. patients each year. The FDA didn't require Allos to compare the response rate of pralatrexate to another drug in the study because all the enrolled patients were previously treated, most multiple times, without success.

< Previous 1 2 Next > EmailPrintRssYahoo! BuzzCLOSE deliciousfacebooknewsvinestumbleuponmyspacefavoritesreddittwitter

Biotech Author ToolsView Bio

RealMoney

Biotech Select

More Articles by This Author

RSS | Email

Allos: 15-Month Median Survival in PTCL Study

05/30/09 - 07:59 AM EDT

ALTH , LLY , OSIP Adam Feuerstein

Pralatrexate, or PDX, is a chemotherapy drug known as an "antifolate" that works by interfering with the ability of cancer cells to divide, resulting in cell death. Allos designed pralatrexate to be more potent than other antifolates, including the widely used drug methotrexate. Eli Lilly's(LLY Quote) cancer drug Alimta is another antifolate, approved for the treatment of lung cancer.

More from Adam Feuerstein Biotech Stock Mailbag: Oculus in FocusHemispherx's CFS Drug Is a Long ShotBiotalk: Getting ready for ASCOSmall-Cap Biotechs Pop Before ConferenceMAP's Migraine Drug Provides Big Pain ReliefJ&J Just Made Medivation's DayBiotech Stock Mailbag: Gilead Still Got It?Tiny Biotechs Dancing in the Bull PenDendreon's Gold: What's Next for ProvengeBest in Class: Biogen Idec Clinging to Its Crown Market Activity Eli Lilly & Company| LLY UPOSI Pharmaceuticals Inc.| OSIP DOWNAllos is also testing pralatrexate in other forms of non-Hodgkin's lymphoma and lung cancer. One of the lung cancer studies under way pits pralatrexate against Tarceva, a lung cancer drug marketed by OSI Pharmaceuticals(OSIP Quote) and Genentech. Allos shares closed Friday up 6.6% at $7.28.

Allos: 15-Month Median Survival in PTCL Study

05/30/09 - 07:59 AM EDT

ALTH , LLY , OSIP Adam Feuerstein

Allos Therapeutics(ALTH Quote) reported Saturday median overall survival of almost 15 months for patients with a rare but aggressive form of blood cancer treated with the company's experimental drug pralatrexate.

More from Adam Feuerstein Biotech Stock Mailbag: Oculus in FocusHemispherx's CFS Drug Is a Long ShotBiotalk: Getting ready for ASCOSmall-Cap Biotechs Pop Before ConferenceMAP's Migraine Drug Provides Big Pain ReliefJ&J Just Made Medivation's DayBiotech Stock Mailbag: Gilead Still Got It?Tiny Biotechs Dancing in the Bull PenDendreon's Gold: What's Next for ProvengeBest in Class: Biogen Idec Clinging to Its Crown Market Activity Eli Lilly & Company| LLY UPOSI Pharmaceuticals Inc.| OSIP DOWNThe updated results come from a pivotal phase II study of pralatrexate presented at the American Society of Clinical Oncology (ACSO) annual meeting being held this weekend in Orlando. The U.S. Food and Drug Administration is already reviewing pralatrexate, with an approval decision expected by Sept. 24.

Allos is seeking permission to market the drug as a treatment for peripheral T-cell lymphoma (PTCL), a fast-growing cancer that affects white blood cells known as T-cells. There are no approved drugs to treat the disease.

The phase II study enrolled 115 patients with PTCL, 109 of whom were evaluable for response. All patients were previously treated with a variety of chemotherapy drugs but their cancer continued to grow.

After treatment with pralatrexate, 30 patients, or 28%, saw their tumors shrink, including 10 patients, or 9%, who went into complete remission. The median duration of response to pralatrexate was 9.4 months. These results are slightly improved from previous presentations of the data last year.

Newly disclosed information Saturday on pralatrexate was the median overall survival of 14.7 months, with 57% of the responders surviving for a year or more.

Allos was able to submit pralatrexate for FDA approval based on this small phase II study because PTCL is diagnosed in only about 5,000 U.S. patients each year. The FDA didn't require Allos to compare the response rate of pralatrexate to another drug in the study because all the enrolled patients were previously treated, most multiple times, without success.

< Previous 1 2 Next > EmailPrintRssYahoo! BuzzCLOSE deliciousfacebooknewsvinestumbleuponmyspacefavoritesreddittwitter

Biotech Author ToolsView Bio

RealMoney

Biotech Select

More Articles by This Author

RSS | Email

Allos: 15-Month Median Survival in PTCL Study

05/30/09 - 07:59 AM EDT

ALTH , LLY , OSIP Adam Feuerstein

Pralatrexate, or PDX, is a chemotherapy drug known as an "antifolate" that works by interfering with the ability of cancer cells to divide, resulting in cell death. Allos designed pralatrexate to be more potent than other antifolates, including the widely used drug methotrexate. Eli Lilly's(LLY Quote) cancer drug Alimta is another antifolate, approved for the treatment of lung cancer.

More from Adam Feuerstein Biotech Stock Mailbag: Oculus in FocusHemispherx's CFS Drug Is a Long ShotBiotalk: Getting ready for ASCOSmall-Cap Biotechs Pop Before ConferenceMAP's Migraine Drug Provides Big Pain ReliefJ&J Just Made Medivation's DayBiotech Stock Mailbag: Gilead Still Got It?Tiny Biotechs Dancing in the Bull PenDendreon's Gold: What's Next for ProvengeBest in Class: Biogen Idec Clinging to Its Crown Market Activity Eli Lilly & Company| LLY UPOSI Pharmaceuticals Inc.| OSIP DOWNAllos is also testing pralatrexate in other forms of non-Hodgkin's lymphoma and lung cancer. One of the lung cancer studies under way pits pralatrexate against Tarceva, a lung cancer drug marketed by OSI Pharmaceuticals(OSIP Quote) and Genentech. Allos shares closed Friday up 6.6% at $7.28.

http://ir.allos.com/phoenix.zhtml?c=125475&p=irol-newsArticl…

The NDA is based on the results from the Company’s pivotal Phase 2 trial known as PROPEL (Pralatrexate in patients with Relapsed Or refractory PEripheral T-cell Lymphoma).

Gab es in der Vergangenheit vergleichbare Fälle, in denen die FDA ein Krebsmedikament für eine geringe Patientenpopulation schon aufgrund der Phase 2 Ergebnisse zugelassen hat?

Bei Dendreon Bspw. war der FDA ja in 2006 selbst die erste Auswertung des Phase III Trials nicht statistisch signifikant genug, um Provenge direkt zuzulassen...

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9M…

Submitted NDA to FDA for pralatrexate for the treatment of

patients with relapsed or refractory PTCL; FDA accepted the

application for filing under Priority Review and assigned a

PDUFA date of September 24, 2009

Tritt das Komitee also am 24. September zusammen, um an diesem Datum eine Entscheidung zu treffen - oder gibt es potentiell bereits früher stattfindende Meetings, bei denen die FDA das Medikament zulassen oder ablehnen kann?

danke und gruß

gulliver

The NDA is based on the results from the Company’s pivotal Phase 2 trial known as PROPEL (Pralatrexate in patients with Relapsed Or refractory PEripheral T-cell Lymphoma).

Gab es in der Vergangenheit vergleichbare Fälle, in denen die FDA ein Krebsmedikament für eine geringe Patientenpopulation schon aufgrund der Phase 2 Ergebnisse zugelassen hat?

Bei Dendreon Bspw. war der FDA ja in 2006 selbst die erste Auswertung des Phase III Trials nicht statistisch signifikant genug, um Provenge direkt zuzulassen...

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9M…

Submitted NDA to FDA for pralatrexate for the treatment of

patients with relapsed or refractory PTCL; FDA accepted the

application for filing under Priority Review and assigned a

PDUFA date of September 24, 2009

Tritt das Komitee also am 24. September zusammen, um an diesem Datum eine Entscheidung zu treffen - oder gibt es potentiell bereits früher stattfindende Meetings, bei denen die FDA das Medikament zulassen oder ablehnen kann?

danke und gruß

gulliver

hm,

gibt es dafür einen anhaltspunkt, dass der PDUFA-Termin nicht gehalten werden kann...?!

Allos Therapeutics, Inc. (1) (ALTH - $7.60, $619M market cap): ODAC panel uncertainty creates buying opportunity in front of regulatory news and lung cancer data, reiterating Market Outperform rating and $20 price target.

In this report, we address recent pressure that ALTH shares have experienced and may come under during coming weeks as a result of investors becoming wary that an announcement of an advisory panel for pralatrexate (PDX) in peripheral T-cell lymphoma (PTCL) will result in a delayed approval decision relative to the upcoming September 24th PDUFA date. We carried out a scenario analysis to assess the impact of a delay on our valuation of ALTH shares that demonstrated that even with an unlikely six month delay, we believe that there is more than 100% upside to the current valuation. The second purpose of the note is to benchmark the potential efficacy signal that could be demonstrated by PDX in the ongoing Phase IIb trial in non-small cell lung cancer (NSCLC) patients following the announcement last week that the trial is now fully enrolled. Our $20 price target is based on 30x our FY12 EPS estimate of $0.93, discounted at 20%.

gibt es dafür einen anhaltspunkt, dass der PDUFA-Termin nicht gehalten werden kann...?!

Allos Therapeutics, Inc. (1) (ALTH - $7.60, $619M market cap): ODAC panel uncertainty creates buying opportunity in front of regulatory news and lung cancer data, reiterating Market Outperform rating and $20 price target.

In this report, we address recent pressure that ALTH shares have experienced and may come under during coming weeks as a result of investors becoming wary that an announcement of an advisory panel for pralatrexate (PDX) in peripheral T-cell lymphoma (PTCL) will result in a delayed approval decision relative to the upcoming September 24th PDUFA date. We carried out a scenario analysis to assess the impact of a delay on our valuation of ALTH shares that demonstrated that even with an unlikely six month delay, we believe that there is more than 100% upside to the current valuation. The second purpose of the note is to benchmark the potential efficacy signal that could be demonstrated by PDX in the ongoing Phase IIb trial in non-small cell lung cancer (NSCLC) patients following the announcement last week that the trial is now fully enrolled. Our $20 price target is based on 30x our FY12 EPS estimate of $0.93, discounted at 20%.

mit dem heutigen Tag wird wohl die Fantasie beginnen....

http://finance.yahoo.com/news/Allos-says-FDA-panel-will-apf-…

Allos says FDA panel will review drug on Sept. 2

http://finance.yahoo.com/news/Allos-says-FDA-panel-will-apf-…

Allos says FDA panel will review drug on Sept. 2

Allos hat bei der FDA den Zulassungsantrag für Pralatrexate eingereicht und zwar zur Behandlung von PTCL (=peripheres T-Zellen Lymphom), zu deren Therapie bisher keine Medikamente zugelassen sind --> http://www.gloucesterpharma.com/Cancer/PTCL.htm

Obschon die Inzidenz in den USA sehr gering ist --> \"There are approximately 7,500 newly diagnosed cases of PTCL each year in the United States1\"

ergibt sich ein fast konkurrenzloses Potential bei Zulassung, zumal sowohl FDA als auch EMEA schon bereits für verschiedene Indikationen Orphan Drug Status zugesichert haben:

http://www.rockyradar.com/2008/11/24/allos-pralatrexate-rece…

http://www.reuters.com/article/pressRelease/idUS105731+17-Ma…

http://www.emea.europa.eu/pdfs/human/comp/opinion/10755807en…

Auf 2.September wurde von der FDA ein Advisory Committee angesetzt, welches eine Empfehlung über die Zulassung von Pralatrexate auszusprechen hat. Der Zulassungsentscheid sollte spätestens bis zum 24.9.09 veröffentlicht sein:

http://www.fda.gov/AdvisoryCommittees/CommitteesMeetingMater…

Nebst vielen anderen Analysten hat sich auch Adam Feuerstein von thestreet.com sehr zuversichtlich geäussert, dass Pralatrexate zugelassen wird:

Terrence B. writes, \"You said you were positive on Allos Therapeutics(ALTH Quote) going into the Sept. 1 panel meeting, but the company only has phase II data. Doesn\'t this make approval unlikely?\"

Seeking approval solely on phase II data is usually foolish except when the FDA says it\'s OK, which is what the agency told Allos.

The phase II study of Allos\' cancer drug pralatrexate, dubbed \"PROPEL,\" was conducted under a Special Protocol Assessment (SPA) with the FDA. An SPA is essentially an agreement between a drug company and the FDA stating that a clinical trial\'s design, including the size of the trial, the clinical endpoints used and the data analysis plan, are strong enough to form the basis of a drug\'s approval.

An SPA in no way guarantees a drug approval, however. In this case, the response rate, duration of response and safety profile of pralatrexate needed for approval were not set by the SPA covering the PROPEL trial. All those things are subject to FDA review and will be discussed at the Sept. 1 advisory panel meeting. I happen to think the pralatrexate efficacy data, as we\'ve seen it, is strong enough for approval.

Allos was able to convince the FDA to allow a single-arm phase II study to form the basis of pralatrexate\'s approval application because the targeted disease, peripheral T-cell lymphoma, affects fewer than 10,000 patients in the U.S.

http://www.thestreet.com/story/10585179/6/biotech-mailbag-bi…

weitere Analysten:

ALTH Leerink Initiates with an Outperform and $11 target. Jul 13th report. Opp to buy dip on shelf offering filing dip today.....

INITIATION

OUTPERFORM

Target $11

ALLOS THERAPEUTICS, INC.

PDX: A Precious Hematology Commodity; Initiating on ALTH with

an Outperform

• Bottom Line: We are initiating coverage on ALTH with an Outperform rating and an $11/share valuation based on our view that PDX is likely to gain FDA approval, garner an attractive Orphan Drug price, and penetrate effectively into the niche peripheral T-cell lymphoma (pTCL) market to achieve $300M in sales in the U.S. PDX is an antifolate drug that has completed the pivotal PROPEL study in pTCL and is awaiting FDA approval with a September 24, 2009, PDUFA date. pTCL is a rare subtype of Non-Hodgkin\'s Lymphoma (NHL), and we estimate it accounts for over 6% of new lymphomas in the U.S. based on data from large SEER registries. With approximately 75K new lymphomas annually in the U.S., this translates into 4,500+ new patients eligible for therapy each year. Additionally, there is the potential for a much larger OUS market given the higher prevalence of pTCL in Asian territories.

JMP \"All eyes on PTCL Sept 24 PDUFUA date. Reiterate Outperform and $20 Price Target.\"

JMP SECURITIES

Allos Therapeutics, Inc.

Commercial Ops Phasing-In with ODAC Panel Not Yet Announced but Expected

INVESTMENT HIGHLIGHTS

· Good 2Q09, but focus remains on near-term approval of pralatrexate; reiterate Market Outperform rating and $20 price target on Allos. Allos reported financial results for 2Q09 and provided regulatory and clinical updates for pralatrexate. All eyes remain on the September 24th PDUFA date for pralatrexate in peripheral T-cell lymphoma (PTCL). The FDA has not yet posted an advisory panel to the Federal Register, but Allos is making preparations in anticipation that one will be announced. Our view continues to be that a panel should be assumed and even if the timing does result in a delay to pralatrexate’s approval it will likely be weeks rather than months, preserving our expectations for a 4Q09 launch. We continue to expect approval of pralatrexate on or shortly after the PDUFA date and would remain buyers of ALTH shares before this event. Our $20 price target is based on 30x our FY12 EPS estimate of $0.90, discounted at 20%.

· Phasing-in commercial operations toward launch. Allos is continuing to scale up commercial and manufacturing operations for pralatrexate and is building a specialty sales force and hiring medical liaisons to target centers at which PTCL patients are treated. Initially, the pralatrexate sales force will consist of between 25 and 30 representatives with an aim of growing this up to 50 to 80 specialist reps. As part of the initial steps of commercialization, we are looking forward to what we view as a very exciting American Society of Hematology (ASH) meeting for Allos in December. The company is sponsoring two symposia at this year’s meeting, which we believe will set the stage to introduce physicians to a new and much needed treatment option.

· Pralatrexate development progressing beyond PTCL. During 2Q08, enrollment was completed in the Phase IIb trial comparing pralatrexate to Tarceva in patients with previously treated nonsmall cell lung cancer. The trial exceeded its enrollment target of 160 patients and recruited 201 patients who were either former or current smokers. The open label trial will assess smoking status (current vs. former and light vs. heavy) as well as histology and is intended to inform the design of a pivotal Phase III trial. Results from this trial are expected to be available in 1H10. Additionally, patient enrollment is continuing in the Phase II single arm, open label trial assessing pralatrexate in patients with advanced or metastatic relapsed transitional cell carcinoma (TCC) of the bladder.

Patients are continuing to be enrolled in the Phase I trial for pralatrexate in cutaneous T-cell lymphoma with an enrollment target of 56 patients. Finally, the Phase IIa portion of the open label trial for pralatrexate in combination with gemcitabine in relapsed or refractory non-Hodgkin’s lymphoma is ongoing, and results from the Phase I portion of the trial are expected to be presented at ASH.

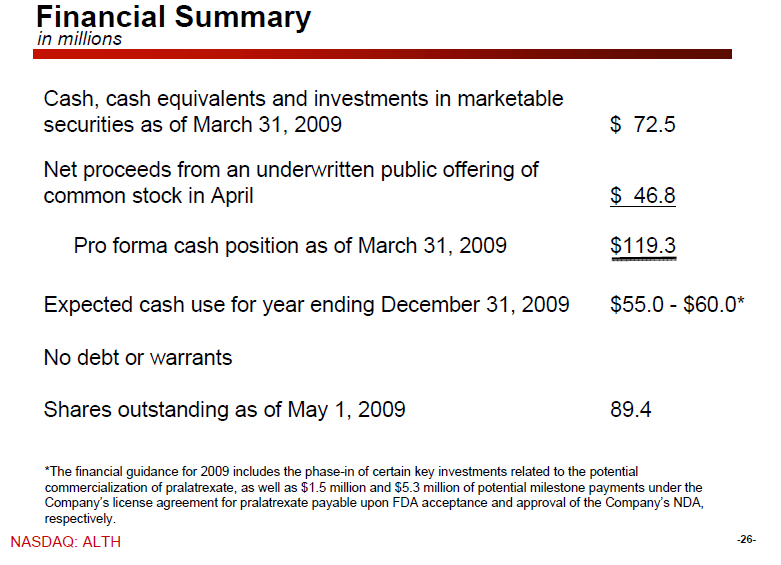

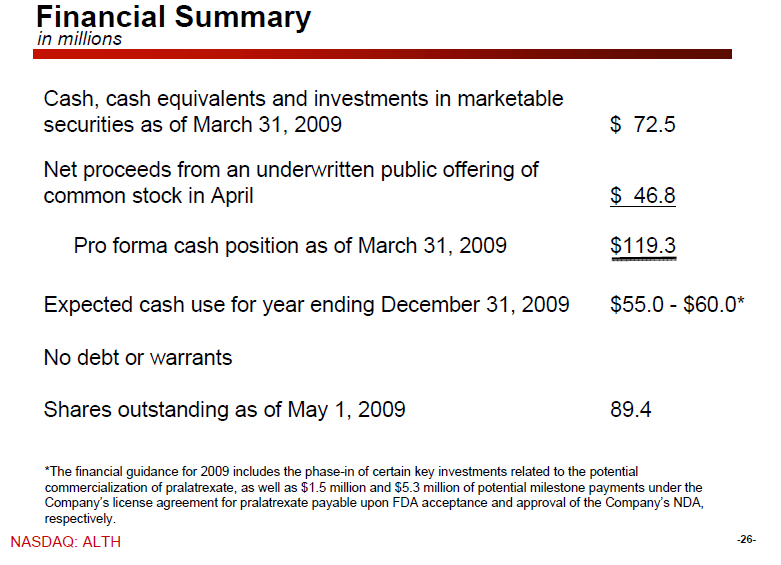

· 2Q09 financial update. Allos reported a 2Q09 EPS loss of ($0.19) slightly below our estimate and the Street consensus of ($0.17). Net loss was greater than our expectation of $15.3MM at $16.7MM due to higher than expected operating expenses. R&D expenses were $7.2MM, above our estimate of $5.9MM, G&A expenses were $8.0MM compared to our estimate of $6.8MM while clinical manufacturing spending was below our estimate of $2.7MM at $1.6MM. Allos ended the quarter with cash and equivalents of $105MM following a financing during the quarter that raised

net proceeds of $47MM. Management updated financial guidance for FY09, increasing its expectations for operating cash burn from a range of $55-60MM to a range of $65-70MM. With $105MM in cash and equivalents at the end of 2Q09, this implies that the company will exit FY09 with approximately $65MM, sufficient to fund our currently projected cash needs in FY10, especially if an ex-US commercial partnership is signed in 1H10 as we anticipate. A summary of actual results for 2Q09 compared to our estimates and changes to our model for FY09 are shown in Figure 1.

CITI \"PDUFA is Approaching. Reiterate Buy and $15 target\"

Allos Therapeutics (ALTH)

BUY

Target: $15

2Q09 Results; No Panel Scheduled Yet & PDUFA is Approaching

What is New — ALTH reported 2Q09 EPS of ($0.19) compared to our and consensus estimate of ($0.17) and ($0.17), respectively. Variance was

attributed to higher R&D and SG&A expenses.

PDX NDA Update — The PDUFA for PDX in peripheral T-cell lymphoma (PTCL) remains for 9/24/09. Though ALTH has not received notification of a potential FDA panel, the company has prepared for one.

Raised 2009 Burn — Net cash use for operating activities is expected to come higher at $65-70M, from $55-60M, due to increased costs in anticipation of PDX launch (inclusive of $5.8M of milestone payables upon NDA approval).

Upcoming Catalysts— Top-line results from the Phase IIb trial of PDX +Tarceva in NSCLC is expected in 1H10. The Phase II trial of PDX in TCC of urinary bladder continues to enroll patients.

Changes to the Model — We have fine tuned our model to reflect 2Q09 results and management\'s guidance. We have increased our 2009-10 operating expenses to $76M and $97M, respectively, from $68M and $89M. Our 2009- 10 EPS decreases to ($0.80) and ($0.25), respectively, from ($0.74) and ($0.16).

Conclusions — We maintain our Buy rating and 12 mo. TP of $15. We believe the major catalyst and value-creating event for ALTH is FDA decision of PDX in PTCL, as well as results from the Phase IIb trial NSCLC (data in 1H10).

Needham \"Awaiting News on FDA Review of Pralatrexate NDA in PTCL and Looking Forward to Data in Other Indications; Reiterating BUY and $12 target\"

Needham & Company, LLC

Oncology / Biotechnology & Life Sciences

Allos Therapeutics, Inc. (ALTH) – Buy

ALTH: 2Q09 and Early 3Q09 Review – Awaiting News on FDA Review of Pralatrexate NDA in PTCL and Looking Forward to Data in Other Indications; Reiterating BUY and $12 Target

Last night, Allos reviewed results for 2Q09 and expected progress for the remainder of 2009. Highlights included: (1) the NDA for pralatrexate (PDX) in PTCL has received priority review with a PDUFA date of September 24; (2) market research has outlined the current unmet need for new therapies for refractory PTCL patients; (3) guidance was given towards an increased cash burn of $65-70MM (was $55- 60MM) for 2009, as the Company is increasing its sales and marketing teams in preparation for a 4Q09 launch of PDX; and (4) completion of enrollment ahead of schedule for the 201-patient NSCLC Phase 2b trial of PDX vs. Tarceva, with data expected in 1H10.

We are positively inclined towards FDA approval for PDX based on the PROPEL trial data, which we believe are clinically meaningful: 27% response rate and 9.4 months median duration of response in a sick and refractory PTCL population

Obschon die Inzidenz in den USA sehr gering ist --> \"There are approximately 7,500 newly diagnosed cases of PTCL each year in the United States1\"

ergibt sich ein fast konkurrenzloses Potential bei Zulassung, zumal sowohl FDA als auch EMEA schon bereits für verschiedene Indikationen Orphan Drug Status zugesichert haben:

http://www.rockyradar.com/2008/11/24/allos-pralatrexate-rece…

http://www.reuters.com/article/pressRelease/idUS105731+17-Ma…

http://www.emea.europa.eu/pdfs/human/comp/opinion/10755807en…

Auf 2.September wurde von der FDA ein Advisory Committee angesetzt, welches eine Empfehlung über die Zulassung von Pralatrexate auszusprechen hat. Der Zulassungsentscheid sollte spätestens bis zum 24.9.09 veröffentlicht sein:

http://www.fda.gov/AdvisoryCommittees/CommitteesMeetingMater…

Nebst vielen anderen Analysten hat sich auch Adam Feuerstein von thestreet.com sehr zuversichtlich geäussert, dass Pralatrexate zugelassen wird:

Terrence B. writes, \"You said you were positive on Allos Therapeutics(ALTH Quote) going into the Sept. 1 panel meeting, but the company only has phase II data. Doesn\'t this make approval unlikely?\"

Seeking approval solely on phase II data is usually foolish except when the FDA says it\'s OK, which is what the agency told Allos.

The phase II study of Allos\' cancer drug pralatrexate, dubbed \"PROPEL,\" was conducted under a Special Protocol Assessment (SPA) with the FDA. An SPA is essentially an agreement between a drug company and the FDA stating that a clinical trial\'s design, including the size of the trial, the clinical endpoints used and the data analysis plan, are strong enough to form the basis of a drug\'s approval.

An SPA in no way guarantees a drug approval, however. In this case, the response rate, duration of response and safety profile of pralatrexate needed for approval were not set by the SPA covering the PROPEL trial. All those things are subject to FDA review and will be discussed at the Sept. 1 advisory panel meeting. I happen to think the pralatrexate efficacy data, as we\'ve seen it, is strong enough for approval.

Allos was able to convince the FDA to allow a single-arm phase II study to form the basis of pralatrexate\'s approval application because the targeted disease, peripheral T-cell lymphoma, affects fewer than 10,000 patients in the U.S.

http://www.thestreet.com/story/10585179/6/biotech-mailbag-bi…

weitere Analysten:

ALTH Leerink Initiates with an Outperform and $11 target. Jul 13th report. Opp to buy dip on shelf offering filing dip today.....

INITIATION

OUTPERFORM

Target $11

ALLOS THERAPEUTICS, INC.

PDX: A Precious Hematology Commodity; Initiating on ALTH with

an Outperform

• Bottom Line: We are initiating coverage on ALTH with an Outperform rating and an $11/share valuation based on our view that PDX is likely to gain FDA approval, garner an attractive Orphan Drug price, and penetrate effectively into the niche peripheral T-cell lymphoma (pTCL) market to achieve $300M in sales in the U.S. PDX is an antifolate drug that has completed the pivotal PROPEL study in pTCL and is awaiting FDA approval with a September 24, 2009, PDUFA date. pTCL is a rare subtype of Non-Hodgkin\'s Lymphoma (NHL), and we estimate it accounts for over 6% of new lymphomas in the U.S. based on data from large SEER registries. With approximately 75K new lymphomas annually in the U.S., this translates into 4,500+ new patients eligible for therapy each year. Additionally, there is the potential for a much larger OUS market given the higher prevalence of pTCL in Asian territories.

JMP \"All eyes on PTCL Sept 24 PDUFUA date. Reiterate Outperform and $20 Price Target.\"

JMP SECURITIES

Allos Therapeutics, Inc.

Commercial Ops Phasing-In with ODAC Panel Not Yet Announced but Expected

INVESTMENT HIGHLIGHTS

· Good 2Q09, but focus remains on near-term approval of pralatrexate; reiterate Market Outperform rating and $20 price target on Allos. Allos reported financial results for 2Q09 and provided regulatory and clinical updates for pralatrexate. All eyes remain on the September 24th PDUFA date for pralatrexate in peripheral T-cell lymphoma (PTCL). The FDA has not yet posted an advisory panel to the Federal Register, but Allos is making preparations in anticipation that one will be announced. Our view continues to be that a panel should be assumed and even if the timing does result in a delay to pralatrexate’s approval it will likely be weeks rather than months, preserving our expectations for a 4Q09 launch. We continue to expect approval of pralatrexate on or shortly after the PDUFA date and would remain buyers of ALTH shares before this event. Our $20 price target is based on 30x our FY12 EPS estimate of $0.90, discounted at 20%.

· Phasing-in commercial operations toward launch. Allos is continuing to scale up commercial and manufacturing operations for pralatrexate and is building a specialty sales force and hiring medical liaisons to target centers at which PTCL patients are treated. Initially, the pralatrexate sales force will consist of between 25 and 30 representatives with an aim of growing this up to 50 to 80 specialist reps. As part of the initial steps of commercialization, we are looking forward to what we view as a very exciting American Society of Hematology (ASH) meeting for Allos in December. The company is sponsoring two symposia at this year’s meeting, which we believe will set the stage to introduce physicians to a new and much needed treatment option.

· Pralatrexate development progressing beyond PTCL. During 2Q08, enrollment was completed in the Phase IIb trial comparing pralatrexate to Tarceva in patients with previously treated nonsmall cell lung cancer. The trial exceeded its enrollment target of 160 patients and recruited 201 patients who were either former or current smokers. The open label trial will assess smoking status (current vs. former and light vs. heavy) as well as histology and is intended to inform the design of a pivotal Phase III trial. Results from this trial are expected to be available in 1H10. Additionally, patient enrollment is continuing in the Phase II single arm, open label trial assessing pralatrexate in patients with advanced or metastatic relapsed transitional cell carcinoma (TCC) of the bladder.

Patients are continuing to be enrolled in the Phase I trial for pralatrexate in cutaneous T-cell lymphoma with an enrollment target of 56 patients. Finally, the Phase IIa portion of the open label trial for pralatrexate in combination with gemcitabine in relapsed or refractory non-Hodgkin’s lymphoma is ongoing, and results from the Phase I portion of the trial are expected to be presented at ASH.

· 2Q09 financial update. Allos reported a 2Q09 EPS loss of ($0.19) slightly below our estimate and the Street consensus of ($0.17). Net loss was greater than our expectation of $15.3MM at $16.7MM due to higher than expected operating expenses. R&D expenses were $7.2MM, above our estimate of $5.9MM, G&A expenses were $8.0MM compared to our estimate of $6.8MM while clinical manufacturing spending was below our estimate of $2.7MM at $1.6MM. Allos ended the quarter with cash and equivalents of $105MM following a financing during the quarter that raised

net proceeds of $47MM. Management updated financial guidance for FY09, increasing its expectations for operating cash burn from a range of $55-60MM to a range of $65-70MM. With $105MM in cash and equivalents at the end of 2Q09, this implies that the company will exit FY09 with approximately $65MM, sufficient to fund our currently projected cash needs in FY10, especially if an ex-US commercial partnership is signed in 1H10 as we anticipate. A summary of actual results for 2Q09 compared to our estimates and changes to our model for FY09 are shown in Figure 1.

CITI \"PDUFA is Approaching. Reiterate Buy and $15 target\"

Allos Therapeutics (ALTH)

BUY

Target: $15

2Q09 Results; No Panel Scheduled Yet & PDUFA is Approaching

What is New — ALTH reported 2Q09 EPS of ($0.19) compared to our and consensus estimate of ($0.17) and ($0.17), respectively. Variance was

attributed to higher R&D and SG&A expenses.

PDX NDA Update — The PDUFA for PDX in peripheral T-cell lymphoma (PTCL) remains for 9/24/09. Though ALTH has not received notification of a potential FDA panel, the company has prepared for one.

Raised 2009 Burn — Net cash use for operating activities is expected to come higher at $65-70M, from $55-60M, due to increased costs in anticipation of PDX launch (inclusive of $5.8M of milestone payables upon NDA approval).

Upcoming Catalysts— Top-line results from the Phase IIb trial of PDX +Tarceva in NSCLC is expected in 1H10. The Phase II trial of PDX in TCC of urinary bladder continues to enroll patients.

Changes to the Model — We have fine tuned our model to reflect 2Q09 results and management\'s guidance. We have increased our 2009-10 operating expenses to $76M and $97M, respectively, from $68M and $89M. Our 2009- 10 EPS decreases to ($0.80) and ($0.25), respectively, from ($0.74) and ($0.16).

Conclusions — We maintain our Buy rating and 12 mo. TP of $15. We believe the major catalyst and value-creating event for ALTH is FDA decision of PDX in PTCL, as well as results from the Phase IIb trial NSCLC (data in 1H10).

Needham \"Awaiting News on FDA Review of Pralatrexate NDA in PTCL and Looking Forward to Data in Other Indications; Reiterating BUY and $12 target\"

Needham & Company, LLC

Oncology / Biotechnology & Life Sciences

Allos Therapeutics, Inc. (ALTH) – Buy

ALTH: 2Q09 and Early 3Q09 Review – Awaiting News on FDA Review of Pralatrexate NDA in PTCL and Looking Forward to Data in Other Indications; Reiterating BUY and $12 Target

Last night, Allos reviewed results for 2Q09 and expected progress for the remainder of 2009. Highlights included: (1) the NDA for pralatrexate (PDX) in PTCL has received priority review with a PDUFA date of September 24; (2) market research has outlined the current unmet need for new therapies for refractory PTCL patients; (3) guidance was given towards an increased cash burn of $65-70MM (was $55- 60MM) for 2009, as the Company is increasing its sales and marketing teams in preparation for a 4Q09 launch of PDX; and (4) completion of enrollment ahead of schedule for the 201-patient NSCLC Phase 2b trial of PDX vs. Tarceva, with data expected in 1H10.

We are positively inclined towards FDA approval for PDX based on the PROPEL trial data, which we believe are clinically meaningful: 27% response rate and 9.4 months median duration of response in a sick and refractory PTCL population

http://www.reuters.com/article/marketsNews/idINN283650842009…

UPDATE 2-US FDA staff question Allos lymphoma drug data

* FDA advisory panel to review drug Wednesday

* Company says drug offers meaningful benefit

* Shares fall over 6 percent (Recasts; adds FDA, analyst comment; updates shares)

By Lisa Richwine

WASHINGTON, Aug 28 (Reuters) - U.S. drug reviewers questioned findings from biotech company Allos Therapeutics Inc (ALTH.O) on the effectiveness of its proposed drug for an aggressive type of lymphoma, documents released on Friday showed.

Allos shares fell 6.2 percent to $7.29 in afternoon trading on Nasdaq. The company is counting on the product, Folotyn, to be its first drug to reach the market.

Food and Drug Administration reviewers, in a summary prepared for an advisory panel, said their two issues with Allos' application were "the clinical significance of tumor response and duration of response" as well as "whether the benefit:risk ratio is favorable" for Folotyn.

Allos is seeking approval to sell the drug for previously treated patients with peripheral T-cell lymphoma (PTCL). There are no approved therapies for the disease.

The FDA reviewers said they would ask an advisory panel that meets on Wednesday for input on those issues.

Wells Fargo analyst Aaron Reames, in a research note, said he "remained positive" on the prospects for a favorable panel vote based on previous support for a cancer drug with similar data, a "robust response rate in a highly desperate patient population" and other factors.

He said it was "a significant positive sign" that there was "no language suggesting a concern with ... Folotyn's safety profile" in the FDA staff summary.

Allos, in a separate summary, said PTCL patients who have failed to respond to other therapies were "in desperate need of better treatment options." Folotyn "offers these patients a therapy demonstrated to induce clinically meaningful responses," the company said.

Allos reported that 29 patients, or 27 percent, responded to treatment with Folotyn. FDA reviewers, however, said the agency "cannot verify these responses and their duration in these 13 responders except that these responses lasted (less than) 14 weeks."

The input from the advisory panel will be key as the agency usually follows panel recommendations. A final decision on whether to approve the drug is due by Sept. 24, although the agency has missed several such deadlines in recent months.

The drug's generic name is pralatrexate.

The FDA and Allos documents were posted here. (Reporting by Lisa Richwine, editing by Gerald E. McCormick and Tim Dobbyn)

UPDATE 2-US FDA staff question Allos lymphoma drug data

* FDA advisory panel to review drug Wednesday

* Company says drug offers meaningful benefit

* Shares fall over 6 percent (Recasts; adds FDA, analyst comment; updates shares)

By Lisa Richwine

WASHINGTON, Aug 28 (Reuters) - U.S. drug reviewers questioned findings from biotech company Allos Therapeutics Inc (ALTH.O) on the effectiveness of its proposed drug for an aggressive type of lymphoma, documents released on Friday showed.

Allos shares fell 6.2 percent to $7.29 in afternoon trading on Nasdaq. The company is counting on the product, Folotyn, to be its first drug to reach the market.

Food and Drug Administration reviewers, in a summary prepared for an advisory panel, said their two issues with Allos' application were "the clinical significance of tumor response and duration of response" as well as "whether the benefit:risk ratio is favorable" for Folotyn.

Allos is seeking approval to sell the drug for previously treated patients with peripheral T-cell lymphoma (PTCL). There are no approved therapies for the disease.

The FDA reviewers said they would ask an advisory panel that meets on Wednesday for input on those issues.

Wells Fargo analyst Aaron Reames, in a research note, said he "remained positive" on the prospects for a favorable panel vote based on previous support for a cancer drug with similar data, a "robust response rate in a highly desperate patient population" and other factors.

He said it was "a significant positive sign" that there was "no language suggesting a concern with ... Folotyn's safety profile" in the FDA staff summary.

Allos, in a separate summary, said PTCL patients who have failed to respond to other therapies were "in desperate need of better treatment options." Folotyn "offers these patients a therapy demonstrated to induce clinically meaningful responses," the company said.

Allos reported that 29 patients, or 27 percent, responded to treatment with Folotyn. FDA reviewers, however, said the agency "cannot verify these responses and their duration in these 13 responders except that these responses lasted (less than) 14 weeks."

The input from the advisory panel will be key as the agency usually follows panel recommendations. A final decision on whether to approve the drug is due by Sept. 24, although the agency has missed several such deadlines in recent months.

The drug's generic name is pralatrexate.

The FDA and Allos documents were posted here. (Reporting by Lisa Richwine, editing by Gerald E. McCormick and Tim Dobbyn)

Hier die Dokumente, die für diie Verunsicherung gesorgt haben...

http://www.fda.gov/AdvisoryCommittees/CommitteesMeetingMater…

http://www.fda.gov/AdvisoryCommittees/CommitteesMeetingMater…

10 yes

4 no

Schaun ma mal wies weitergeht...

4 no

Schaun ma mal wies weitergeht...

anbei die Mitschrift vom Advisory Committees, welches am 2. September von der FDA abgehalten wurde und welches mit einem 10 zu 4 Votum die Zulassung von Pralatrexate befürwortete:

http://www.fda.gov/downloads/AdvisoryCommittees/CommitteesMe…

Die Abstimmungsbegründungen der wohl beiden wichtigsten Fürsprecher sind im IV eingestellt:

Michael Link, M.D. Stanford University

http://www.investorvillage.com/smbd.asp?mb=568&mn=319&pt=msg…

Wyndham Wilson, M.D. Chief, Lymphoma Therapeutics Section:

http://www.investorvillage.com/smbd.asp?mb=568&mn=320&pt=msg…

http://www.fda.gov/downloads/AdvisoryCommittees/CommitteesMe…

Die Abstimmungsbegründungen der wohl beiden wichtigsten Fürsprecher sind im IV eingestellt:

Michael Link, M.D. Stanford University

http://www.investorvillage.com/smbd.asp?mb=568&mn=319&pt=msg…

Wyndham Wilson, M.D. Chief, Lymphoma Therapeutics Section:

http://www.investorvillage.com/smbd.asp?mb=568&mn=320&pt=msg…

weiß jemand wann die entscheidung von der fda zu erwarten ist?

Antwort auf Beitrag Nr.: 38.046.057 von lazkopat85 am 24.09.09 10:03:53ja, ich

Antwort auf Beitrag Nr.: 38.048.216 von dottore am 24.09.09 14:15:35dann verrate es mal

Der grösster Kritiker einer Zulassung von Palatrexate während des AC war der Biostatistiker Thomas Fleming. Werden sich seine Argumente gegen eine Zulassung bei den Entscheidungsträgern der FDA durchsetzen ?

Thomas Fleming, Ph.D.

Professor

Department of Biostatistics

University of Washington, Seattle

DR. FLEMING: Thomas Fleming. I voted no. This is surely a setting of significant unmet need. As I had mentioned earlier though, the fact that there’s unmet need doesn’t mean that an agent that is being studied is in fact going to address that unmet need.

The FDA has, I thought, I felt, had done a very thorough job of really exploring the nature of the response data. About three-quarters of the responses are PRs and there’s a great deal of uncertainty as to whether the achievement of the PRs is really translating into benefit. We had discussion about the five people who responded that in fact hadn’t previously responded to other therapies.

There’s no evidence that I can see from those data that there has been benefit mediated through their receiving pralatrexate. The objective response rate is similar. Maybe it’s as good as what you’re seeing with other single agents that are being studied in this setting that haven’t been approved.

The overall survival is 14 months. The PFS is 3.5 months. The issue is, is this reasonably likely to predict clinical benefit, meaning that we are truly providing survival benefit, we’re truly providing such strong effects on PFS that it would translate to survival benefit? Hard to answer that without a control arm, but it’s also hard from all the data that I’ve seen to believe that a 3.5-month PFS

158

and a 14.5-month overall survival is outside the realm of what is already achievable for patients without this agent.

The transplant issue, if we’re truly bridging people to transplant, and if transplant truly does meaningfully add to the overall survival, that’s -– that is an important benefit. You have three patients that have had CRs that went on to transplant. The dozen people that had responses greater than a year, this is a heterogeneous disease population. There are a lot of folks, a lot of your -– a substantial fraction of people do have very long term courses here and how do I know that they’re not -– that what we’re seeing are just those people that fall into that category?

And the safety risks. This is a relatively safe product if you’re improving survival, but there are safety risks, including one death that seems to be related. And so ultimately, it comes down to, is this reasonably likely to predict clinical benefit? As I’ve said, I don’t see the basis for justifying that and saying when in doubt, approve because you’re going to advance the field and give more options.

I have really serious concerns about that, because overuse of accelerated approval not only provides the risk that these patients are going to be now treated under a marketing setting, and it’s going to be years before we have

159

the validation trial done, and that validation trial now will probably take a lot longer to finish. It does in fact not only create safety risks for the patients that are being provided this intervention if it isn’t truly providing benefit, but it does in fact slow the development of other interventions that are desperately needed as well in this setting.

Thomas Fleming, Ph.D.

Professor

Department of Biostatistics

University of Washington, Seattle

DR. FLEMING: Thomas Fleming. I voted no. This is surely a setting of significant unmet need. As I had mentioned earlier though, the fact that there’s unmet need doesn’t mean that an agent that is being studied is in fact going to address that unmet need.

The FDA has, I thought, I felt, had done a very thorough job of really exploring the nature of the response data. About three-quarters of the responses are PRs and there’s a great deal of uncertainty as to whether the achievement of the PRs is really translating into benefit. We had discussion about the five people who responded that in fact hadn’t previously responded to other therapies.

There’s no evidence that I can see from those data that there has been benefit mediated through their receiving pralatrexate. The objective response rate is similar. Maybe it’s as good as what you’re seeing with other single agents that are being studied in this setting that haven’t been approved.

The overall survival is 14 months. The PFS is 3.5 months. The issue is, is this reasonably likely to predict clinical benefit, meaning that we are truly providing survival benefit, we’re truly providing such strong effects on PFS that it would translate to survival benefit? Hard to answer that without a control arm, but it’s also hard from all the data that I’ve seen to believe that a 3.5-month PFS

158

and a 14.5-month overall survival is outside the realm of what is already achievable for patients without this agent.

The transplant issue, if we’re truly bridging people to transplant, and if transplant truly does meaningfully add to the overall survival, that’s -– that is an important benefit. You have three patients that have had CRs that went on to transplant. The dozen people that had responses greater than a year, this is a heterogeneous disease population. There are a lot of folks, a lot of your -– a substantial fraction of people do have very long term courses here and how do I know that they’re not -– that what we’re seeing are just those people that fall into that category?

And the safety risks. This is a relatively safe product if you’re improving survival, but there are safety risks, including one death that seems to be related. And so ultimately, it comes down to, is this reasonably likely to predict clinical benefit? As I’ve said, I don’t see the basis for justifying that and saying when in doubt, approve because you’re going to advance the field and give more options.

I have really serious concerns about that, because overuse of accelerated approval not only provides the risk that these patients are going to be now treated under a marketing setting, and it’s going to be years before we have

159

the validation trial done, and that validation trial now will probably take a lot longer to finish. It does in fact not only create safety risks for the patients that are being provided this intervention if it isn’t truly providing benefit, but it does in fact slow the development of other interventions that are desperately needed as well in this setting.

Antwort auf Beitrag Nr.: 38.051.610 von Cyberhexe am 24.09.09 19:20:13Der grösster Kritiker einer Zulassung von Palatrexate während des AC war der Biostatistiker Thomas Fleming. ...

Den haben wir doch in unangenehmer Erinnerung...!!!

Den haben wir doch in unangenehmer Erinnerung...!!!

Antwort auf Beitrag Nr.: 38.052.096 von NoSelters am 24.09.09 20:15:50Den haben wir doch in unangenehmer Erinnerung...!!!

Beim AC zu Provenge am 29.03.2007 waren die Biostatistiker Rich Chapell von der Uni Wiscconsin sowie der FDA-Biostatistiker Bo Zhen.

Woher kennen wir Thomas Fleming? Hilf mir auf die Sprünge!

good hunting

ch

Beim AC zu Provenge am 29.03.2007 waren die Biostatistiker Rich Chapell von der Uni Wiscconsin sowie der FDA-Biostatistiker Bo Zhen.

Woher kennen wir Thomas Fleming? Hilf mir auf die Sprünge!

good hunting

ch

Antwort auf Beitrag Nr.: 38.052.252 von Cyberhexe am 24.09.09 20:36:21Einer der Briefeschreiber aus 2007...

http://www.psa-rising.com/blog/2007/05/third-negative-letter…

Gruss.

http://www.psa-rising.com/blog/2007/05/third-negative-letter…

Gruss.

Antwort auf Beitrag Nr.: 38.052.307 von NoSelters am 24.09.09 20:45:03Ein Grund zum Aussteigen...???

Antwort auf Beitrag Nr.: 38.052.307 von NoSelters am 24.09.09 20:45:03Einer der Briefeschreiber aus 2007...

Chapeau NS, daran hatte ich gar nicht mehr gedacht.

Aber zumindest ist er konsequent und scheint alles zu verteufeln, das von der Statistik her nicht wirklich eindeutig und daher anzweifelbar ist. Es bleibt spannend.

gruss zurück

Chapeau NS, daran hatte ich gar nicht mehr gedacht.

Aber zumindest ist er konsequent und scheint alles zu verteufeln, das von der Statistik her nicht wirklich eindeutig und daher anzweifelbar ist. Es bleibt spannend.

gruss zurück

gibt es schon etwas neuen bezügl. de zulassung? ich konnte nichts finden

Antwort auf Beitrag Nr.: 38.054.296 von lazkopat85 am 25.09.09 09:10:18gibt es schon etwas neuen bezügl. de zulassung?

...bisher nicht, ich rechne jedoch mit einer Mitteilung vor Börsenstart.

...bisher nicht, ich rechne jedoch mit einer Mitteilung vor Börsenstart.

endlich news  kurs ausgesetzt

kurs ausgesetzt

kurs ausgesetzt

kurs ausgesetzt

Antwort auf Beitrag Nr.: 38.056.570 von lazkopat85 am 25.09.09 13:21:03$ 8,75 Pre-Market.

Frage: Was bedeutet das wenn eine Aktie vom Handel ausgesetzt wird??

Antwort auf Beitrag Nr.: 38.057.131 von Der_Kapitalist2009 am 25.09.09 14:29:56Genauer formuliert: Warum wurde Allos aus dem Xetra genommen?

UND: Zu welchem Kurs ist es ratsam zu verkaufen? Ist ein Kursanstieg auf 10€/Aktie realistisch?

UND: Zu welchem Kurs ist es ratsam zu verkaufen? Ist ein Kursanstieg auf 10€/Aktie realistisch?

Antwort auf Beitrag Nr.: 38.057.131 von Der_Kapitalist2009 am 25.09.09 14:29:56http://de.wikipedia.org/wiki/Aussetzung_des_Handels

Ist aber schon vorbei .War nur für 30 Min. ausgesetzt.

Ist aber schon vorbei .War nur für 30 Min. ausgesetzt.

Antwort auf Beitrag Nr.: 38.057.180 von Der_Kapitalist2009 am 25.09.09 14:34:07Die Wetten gingen von ca. 11-20 USD.

habe ich vielleicht etwas verpasst? Die zulassung ist da und das für ein medikament das keine konkurrenz hat. Der große hype bleibt wohl aus?

die amis mit ihren gaps, endlich gap geschlossen geht auch schon wieder los

...viel versprechende Vorversuche haben die Zytotoxizität von Pralatrexate in verschiedenenen Zellinien belegt, so dass die Ergebnisse der klinischen Studien mit Spannung erwartet werden:

http://www.clinicaltrials.gov/ct2/results?term=pralatrexate

Allos Therapeutics' Pralatrexate Demonstrates Anticancer Activity in Multiple Cancer Cell Lines.

Publication: Business Wire

Date: Sunday, April 19 2009

, Inc. (Nasdaq:ALTH) today announced new data demonstrating the anticancer activity of its investigational drug, pralatrexate, in colon, ovarian, lung, prostate, and head and neck cancer cell lines. The preclinical research further showed that the antiproliferative effects against these cancer lines were achieved at drug concentrations that are attainable in humans. These data were presented today at the American Association for Cancer Research (AACR) Annual Meeting in Denver, CO.

The results, outlined in a poster titled "Cytotoxicity of Pralatrexate, a Novel Synthetic Antifolate, in Human Cancer Cell Lines (abstract #1686)," demonstrate anticancer activity of pralatrexate in nine of 15 human cell lines tested. Importantly, it appears from analyses of exposure time that the effect of pralatrexate is reached rapidly, within 24-72 hours. During this window, cancer cells susceptible to pralatrexate undergo apoptosis, or cell death.

"The broad anticancer activity demonstrated by pralatrexate in this in vitro study, combined with the results from prior exploratory non-small cell lung cancer clinical trials, support our view that the therapeutic potential of pralatrexate extends beyond hematological malignancies and merits further study in various types of solid tumors," said Pablo J. Cagnoni, M.D., chief medical officer of Allos Therapeutics. "We are currently evaluating pralatrexate in solid tumor indications, including non-small cell lung cancer and bladder cancer."

Further analysis of the data demonstrated a potential correlation between the sensitivity to pralatrexate and the expression level of folyl-polyglutamate synthetase (FPGS), an enzyme that catalyzes the addition of polyglutamate tails to folate derivatives such as pralatrexate. It is believed that the polyglutamation of pralatrexate by FPGS prevents cancer cells from excreting pralatrexate from the cell. The ability of cancer cells to excrete drugs through efflux pumps is a common drug resistance mechanism and has been a challenge in the development of antifolates. By remaining in the cancer cell for a longer period of time pralatraxate has an opportunity to increase tumor cell kill.

Further study is required, but FPGS may prove to be an important biomarker to predict cancer patients' sensitivities to pralatrexate.

About Pralatrexate

Pralatrexate is a novel targeted antifolate designed to accumulate preferentially in cancer cells. Based on preclinical studies, the Company believes that pralatrexate selectively enters cells expressing RFC-1, a protein that is over expressed on cancer cells compared to normal cells. Once inside cancer cells, pralatrexate is efficiently polyglutamylated, which leads to high intracellular drug retention. Polyglutamylated pralatrexate essentially becomes "trapped" inside cancer cells, making it less susceptible to efflux-based drug resistance. Acting on the folate pathway, pralatrexate interferes with DNA synthesis and triggers cancer cell death. The Company believes pralatrexate has the potential to be delivered as a single agent or in combination therapy regimens.

http://www.clinicaltrials.gov/ct2/results?term=pralatrexate

Allos Therapeutics' Pralatrexate Demonstrates Anticancer Activity in Multiple Cancer Cell Lines.

Publication: Business Wire

Date: Sunday, April 19 2009

, Inc. (Nasdaq:ALTH) today announced new data demonstrating the anticancer activity of its investigational drug, pralatrexate, in colon, ovarian, lung, prostate, and head and neck cancer cell lines. The preclinical research further showed that the antiproliferative effects against these cancer lines were achieved at drug concentrations that are attainable in humans. These data were presented today at the American Association for Cancer Research (AACR) Annual Meeting in Denver, CO.

The results, outlined in a poster titled "Cytotoxicity of Pralatrexate, a Novel Synthetic Antifolate, in Human Cancer Cell Lines (abstract #1686)," demonstrate anticancer activity of pralatrexate in nine of 15 human cell lines tested. Importantly, it appears from analyses of exposure time that the effect of pralatrexate is reached rapidly, within 24-72 hours. During this window, cancer cells susceptible to pralatrexate undergo apoptosis, or cell death.

"The broad anticancer activity demonstrated by pralatrexate in this in vitro study, combined with the results from prior exploratory non-small cell lung cancer clinical trials, support our view that the therapeutic potential of pralatrexate extends beyond hematological malignancies and merits further study in various types of solid tumors," said Pablo J. Cagnoni, M.D., chief medical officer of Allos Therapeutics. "We are currently evaluating pralatrexate in solid tumor indications, including non-small cell lung cancer and bladder cancer."

Further analysis of the data demonstrated a potential correlation between the sensitivity to pralatrexate and the expression level of folyl-polyglutamate synthetase (FPGS), an enzyme that catalyzes the addition of polyglutamate tails to folate derivatives such as pralatrexate. It is believed that the polyglutamation of pralatrexate by FPGS prevents cancer cells from excreting pralatrexate from the cell. The ability of cancer cells to excrete drugs through efflux pumps is a common drug resistance mechanism and has been a challenge in the development of antifolates. By remaining in the cancer cell for a longer period of time pralatraxate has an opportunity to increase tumor cell kill.

Further study is required, but FPGS may prove to be an important biomarker to predict cancer patients' sensitivities to pralatrexate.

About Pralatrexate

Pralatrexate is a novel targeted antifolate designed to accumulate preferentially in cancer cells. Based on preclinical studies, the Company believes that pralatrexate selectively enters cells expressing RFC-1, a protein that is over expressed on cancer cells compared to normal cells. Once inside cancer cells, pralatrexate is efficiently polyglutamylated, which leads to high intracellular drug retention. Polyglutamylated pralatrexate essentially becomes "trapped" inside cancer cells, making it less susceptible to efflux-based drug resistance. Acting on the folate pathway, pralatrexate interferes with DNA synthesis and triggers cancer cell death. The Company believes pralatrexate has the potential to be delivered as a single agent or in combination therapy regimens.

...ohohoh...Folotyn wird richtig teuer!

Schlecht für die Versicherer, gut für den Umsatz.

Citi "Folotyn Pricing at High End of Management Guidance. Upside to our ests. Anticipate a solid launch -current valuation doesnt reflect comm'l value. BUY! $15 target."...

Flash: ALTH: Folotyn Pricing at High End of Management Guidance

What is new — ALTH announced commercial availability of Folotyn for the treatment of patients with relapsed or refractory peripheral T-cell lymphoma (PTCL). Folotyn pricing is at the high end of prior management guidance of $75k-145K.

Folotyn Pricing — Average wholesale price for the 20 mg and 40 mg doses are $3,125 and $6,250, respectively. Given that the recommended dose is 30mg/m2/wk for 6 weeks, in 7 week cycles, and assuming that the average patients' (70 kg, 170 cm) surface body area is 1.8 m2, this translates to 54 mg/dose/patient/wk (~3 vials) or a weekly cost of therapy of $9,375. Therefore, Folotyn costs ~$56,250 per cycle (6 weeks on, 1 week off).

Folotyn pricing represents upside to our estimates — We are assuming 3.7 months of average treatment at $24,000 per month. ALTH pricing is ~ $32,000 per month.

Commercial efforts — ALTH expects to detail Folotyn with a 25 person specialty sales force initially, and to double the number of sales reps by January 2010. ALTH has also established a patient assistance program (called ASAP) to provide support for drug reimbursement.

Conclusion(s) — While we anticipate a solid launch and believe the current valuation does not fully reflect the commercial potential of PTCL, we see the data from Phase 2 study of Folotyn in NSCLC (1H10) as the next near-term stock catalyst, which could be viewed as a free option on ALTH at these levels.

Investment strategy

We recommend Allos Therapeutics (ALTH) with a Buy/Speculative (1S) rating and a 12-month target price of $15 per share. Its lead drug product, Folotyn (PDX/pralatrexate), an antifolate agent for the treatment of refractory or relapsed Peripheral T Cell Lymphoma (PTCL) patients, received FDA approval September 24, 2009. Folotyn is the first FDA approved drug for the treatment of relapsed/refactory PTCL patients. We have conservatively modeled only Folotyn revenue contributions for PTCL. ALTH is also developing Folotyn in additional indications, such as CTCL, NSCLC, NHL and B cell lymphoma, which may provide upside to our estimates. We have not included revenue contribution from these potential additional indications as well as RH1 for solid

tumors/NHL in our model.

Valuation

Our 12-month target price of $15 is derived from using a 35x P/E multiple on Allos’ 2012 fully-taxed EPS estimate of $0.85 discounted back at 25% per year. We believe using the current median P/E multiple of a range of profitable biotech companies (including large-, mid- and small-cap names) is the most direct and appropriate method, because in our experience all emerging biopharmaceutical companies are valued based on the assumption that they will join the ranks of profitable companies. We are using the current median P/E multiple of this group of profitable companies to minimize uncertainties around earnings visibility.

Schlecht für die Versicherer, gut für den Umsatz.

Citi "Folotyn Pricing at High End of Management Guidance. Upside to our ests. Anticipate a solid launch -current valuation doesnt reflect comm'l value. BUY! $15 target."...

Flash: ALTH: Folotyn Pricing at High End of Management Guidance

What is new — ALTH announced commercial availability of Folotyn for the treatment of patients with relapsed or refractory peripheral T-cell lymphoma (PTCL). Folotyn pricing is at the high end of prior management guidance of $75k-145K.

Folotyn Pricing — Average wholesale price for the 20 mg and 40 mg doses are $3,125 and $6,250, respectively. Given that the recommended dose is 30mg/m2/wk for 6 weeks, in 7 week cycles, and assuming that the average patients' (70 kg, 170 cm) surface body area is 1.8 m2, this translates to 54 mg/dose/patient/wk (~3 vials) or a weekly cost of therapy of $9,375. Therefore, Folotyn costs ~$56,250 per cycle (6 weeks on, 1 week off).

Folotyn pricing represents upside to our estimates — We are assuming 3.7 months of average treatment at $24,000 per month. ALTH pricing is ~ $32,000 per month.

Commercial efforts — ALTH expects to detail Folotyn with a 25 person specialty sales force initially, and to double the number of sales reps by January 2010. ALTH has also established a patient assistance program (called ASAP) to provide support for drug reimbursement.

Conclusion(s) — While we anticipate a solid launch and believe the current valuation does not fully reflect the commercial potential of PTCL, we see the data from Phase 2 study of Folotyn in NSCLC (1H10) as the next near-term stock catalyst, which could be viewed as a free option on ALTH at these levels.

Investment strategy

We recommend Allos Therapeutics (ALTH) with a Buy/Speculative (1S) rating and a 12-month target price of $15 per share. Its lead drug product, Folotyn (PDX/pralatrexate), an antifolate agent for the treatment of refractory or relapsed Peripheral T Cell Lymphoma (PTCL) patients, received FDA approval September 24, 2009. Folotyn is the first FDA approved drug for the treatment of relapsed/refactory PTCL patients. We have conservatively modeled only Folotyn revenue contributions for PTCL. ALTH is also developing Folotyn in additional indications, such as CTCL, NSCLC, NHL and B cell lymphoma, which may provide upside to our estimates. We have not included revenue contribution from these potential additional indications as well as RH1 for solid

tumors/NHL in our model.

Valuation

Our 12-month target price of $15 is derived from using a 35x P/E multiple on Allos’ 2012 fully-taxed EPS estimate of $0.85 discounted back at 25% per year. We believe using the current median P/E multiple of a range of profitable biotech companies (including large-, mid- and small-cap names) is the most direct and appropriate method, because in our experience all emerging biopharmaceutical companies are valued based on the assumption that they will join the ranks of profitable companies. We are using the current median P/E multiple of this group of profitable companies to minimize uncertainties around earnings visibility.

Antwort auf Beitrag Nr.: 38.117.200 von Cyberhexe am 05.10.09 18:02:54...nun wird die Kursmanipulation mehr als deutlich: Nicht einmal ein derart hoher und in dieser Höhe sicherlich unerwarteter Preis für Folotyn hat eine positive Kursreaktion zur Folge. Das Gute daran ist, dass der Kurs früher oder später diese positive Nachrichten aufnehmen wird und derzeit noch wirklich günstige Schnäppchen möglich sind.

Ich habe Heute deswegen noch einmal zugekauft!

Ich habe Heute deswegen noch einmal zugekauft!

.. ..kieler... zorro... alias.... and_1 ....alias.....? ich werde am ball bleiben...heute wieder voll in den keller...die diluten was das zeug hält...kann jeden nur warnen .

..kieler... zorro... alias.... and_1 ....alias.....? ich werde am ball bleiben...heute wieder voll in den keller...die diluten was das zeug hält...kann jeden nur warnen . ..

..

..kieler... zorro... alias.... and_1 ....alias.....? ich werde am ball bleiben...heute wieder voll in den keller...die diluten was das zeug hält...kann jeden nur warnen .

..kieler... zorro... alias.... and_1 ....alias.....? ich werde am ball bleiben...heute wieder voll in den keller...die diluten was das zeug hält...kann jeden nur warnen . ..

..

...allos therapeutic..threads ....wo sind sie ..?.. kann jeden nur warnen...!!!!

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 160 | ||

| 86 | ||

| 81 | ||

| 69 | ||

| 66 | ||

| 54 | ||

| 44 | ||

| 43 | ||

| 36 | ||

| 34 |

| Wertpapier | Beiträge | |

|---|---|---|

| 32 | ||

| 25 | ||

| 22 | ||

| 20 | ||

| 20 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 18 |