Western Lithium Corporation - Aussichtsreiches Projekt mit kompetentem Management - 500 Beiträge pro Seite

eröffnet am 13.08.09 15:30:42 von

neuester Beitrag 26.02.14 20:17:46 von

neuester Beitrag 26.02.14 20:17:46 von

Beiträge: 177

ID: 1.152.388

ID: 1.152.388

Aufrufe heute: 0

Gesamt: 22.582

Gesamt: 22.582

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 26.04.24, 14:53 | 654 | |

| gestern 23:32 | 161 | |

| gestern 22:06 | 105 | |

| gestern 23:33 | 85 | |

| vor 1 Stunde | 84 | |

| vor 1 Stunde | 84 | |

| gestern 18:36 | 83 | |

| gestern 20:02 | 68 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.159,50 | -0,16 | 207 | |||

| 2. | 2. | 193,75 | +15,13 | 119 | |||

| 3. | 3. | 2.333,58 | -0,05 | 60 | |||

| 4. | 4. | 65,95 | -2,66 | 50 | |||

| 5. | 5. | 7,9000 | +7,48 | 46 | |||

| 6. | 6. | 0,8300 | -29,66 | 38 | |||

| 7. | 7. | 15,116 | -5,73 | 38 | |||

| 8. | 9. | 2,4050 | +25,82 | 31 |

Western Lithium is developing its Nevada lithium deposit to support the new generation of hybrid/electric vehicles.

With one of the world's largest known deposits of lithium, the company is ideally positioned to enter the market as a major long term supplier of high quality lithium carbonate.

Western Lithium is developing its Kings Valley, Nevada lithium resource into potentially one of the world’s largest strategic, scalable and reliable sources of battery grade lithium carbonate.

The Kings Valley property has a National Instrument 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes(1) of lithium carbonate equivalent (LCE). From this U.S.-based resource the company intends to produce approximately 25,000 tonnes per year of LCE starting in 2013, coinciding with the expected increase in the use of mobile electronics and the rise in production of lithium-ion batteries for hybrid/electric vehicles.

The project is located in Northern Nevada, which has a long history in the metals and industrial mineral mining industry and a well developed local infrastructure. The project is located close to paved roads, rail and power lines and within easy reach of west coast shipping ports.

The company was spun out from Western Uranium Corporation (TSX-V: WUC) in July 2008 and Western Uranium retains an approximate 29.3% interest in the company.

Project: Kings Valley, Nevada

Quick Facts:

http://www.westernlithium.com/project/

Board of Directors:

http://www.westernlithium.com/company/team

News:

http://www.westernlithium.com/news

RT...cad 1,00

..scheint mir akt. abissl heiß gelaufen zu sein - mal schaun, ob

sies über ONE schafft

Antwort auf Beitrag Nr.: 37.774.488 von hbg55 am 13.08.09 16:40:37wow

Lithium scheint nun nach Kohle der nächste renner zu werden

Lithium scheint nun nach Kohle der nächste renner zu werden

Antwort auf Beitrag Nr.: 37.774.629 von brocklesnar am 13.08.09 16:52:00....lith. schätz ICH akt. sogar noch HÖHER ein !!!!

habs schon mal in nem andren thr. einkopiert - HIER auch nochmal:

Wirtschaft

Mittwoch, 05. August 2009

Investitionen von 2,4 Mrd. Dollar

Obama setzt auf Elektroautos aufmerksam aufmerksam

Mit einer großen offensive will US-Präsident Obama die USA zu einem führenden Standort zum Bau von Elektroautos machen. Sein Land habe viel zu lange diesen Bereich vernachlässigt. Nun sollen 2,4 Milliarden Dollar investiert werden.

US-Präsident Barack Obama will rund 2,4 Milliarden Dollar (1,7 Milliarden Euro) in die Entwicklung von Elektroautos investieren. Mit dieser Maßnahme sollten zehntausende Arbeitsplätze geschaffen werden, sagte Obama in einer Fabrik in Wakarusa im US-Bundesstaat Indiana im Norden des Landes. Die USA seien viel zu lange "außerstande" gewesen, in diesen Bereich innovativer Jobs zu investieren, sagte der US-Präsident. Länder wie China und Japan seien da sehr viel weiter.

Die Investition sei die "größte dieser Art" in der US-Geschichte in diesem Technologiebereich, sagte Obama in Indiana, das von der Wirtschaftskrise hart getroffen wurde.

Der Großteil der geplanten Investition soll demnach in die industrielle Forschung zu Komponenten und Akkus sowie in das Recycling fließen.

http://www.n-tv.de/wirtschaft/Obama-setzt-auf-Elektroautos-a…

habs schon mal in nem andren thr. einkopiert - HIER auch nochmal:

Wirtschaft

Mittwoch, 05. August 2009

Investitionen von 2,4 Mrd. Dollar

Obama setzt auf Elektroautos aufmerksam aufmerksam

Mit einer großen offensive will US-Präsident Obama die USA zu einem führenden Standort zum Bau von Elektroautos machen. Sein Land habe viel zu lange diesen Bereich vernachlässigt. Nun sollen 2,4 Milliarden Dollar investiert werden.

US-Präsident Barack Obama will rund 2,4 Milliarden Dollar (1,7 Milliarden Euro) in die Entwicklung von Elektroautos investieren. Mit dieser Maßnahme sollten zehntausende Arbeitsplätze geschaffen werden, sagte Obama in einer Fabrik in Wakarusa im US-Bundesstaat Indiana im Norden des Landes. Die USA seien viel zu lange "außerstande" gewesen, in diesen Bereich innovativer Jobs zu investieren, sagte der US-Präsident. Länder wie China und Japan seien da sehr viel weiter.

Die Investition sei die "größte dieser Art" in der US-Geschichte in diesem Technologiebereich, sagte Obama in Indiana, das von der Wirtschaftskrise hart getroffen wurde.

Der Großteil der geplanten Investition soll demnach in die industrielle Forschung zu Komponenten und Akkus sowie in das Recycling fließen.

http://www.n-tv.de/wirtschaft/Obama-setzt-auf-Elektroautos-a…

Antwort auf Beitrag Nr.: 37.774.745 von hbg55 am 13.08.09 17:00:53scheint so und keiner merkts

mensch der Kurs ist gut gelaufen würde gerne einsteigen denke aber es kommt so hoffe ich doch nochmal ein Rücksetzer

was habt ihr beide ihr für KZ?

mensch der Kurs ist gut gelaufen würde gerne einsteigen denke aber es kommt so hoffe ich doch nochmal ein Rücksetzer

was habt ihr beide ihr für KZ?

Electric Vehicles Face Bright Future in U.S.

Date Published: 11 Aug 2009

By Matt Scruggs, Research Analyst, Frost & Sullivan's Automotive Practice and Veerender Kaul, Research Director, Frost & Sullivan's Automotive Practice

President Obama's announcement of a $2.4 billion government grant will open up the electric vehicle frontier on a larger scale than initially predicted. This will prove to be an important measure in reducing the initial cost of electric vehicles and opening the market to consumers. Additionally, electric vehicle development can provide a healthy boost to a stagnant economy with the creation of manufacturing jobs, a great number of which were lost due to the U.S. automotive industry decline. These benefits apply not only to purely-electric vehicles, but also to hybrid vehicles and extended-range electric vehicles (aka plug-in hybrids).

Of the $2.4 billion allocated in the program, approximately $1.5 billion is allocated to companies that manufacture batteries and battery components, as well as companies that recycle batteries once spent. $500 million goes to companies that manufacture electric drive systems or components, and the remaining $400 million is to be used for the creation of electric vehicle education and training, the creation of charging infrastructure, and the purchase of hybrid and electric vehicles for testing and evaluation. Based on Frost & Sullivan's analysis, this allocation of funding is poised to offer the maximum benefit to the future of electric vehicles.

The battery is the single-most expensive component of an electric vehicle, ranging from $8,000 to $15,000 on most vehicles in volume quantities. Automakers are working closely with battery suppliers and recyclers to develop several sales scenarios designed to reduce the initial battery cost to a point within reach of the average consumer. This may entail the consumer paying for a portion of the battery cost along with the price of the vehicle and leasing the rest of the cost over the life of the vehicle. Consumers are expected to be receptive to this, since they would not need to purchase gasoline, and electric recharge costs are expected to range from $0.70 to $2.50 per charge, depending on peak usage rates for each area. Companies that recycle batteries can also subsidize the cost, based on the end-of-life value of the battery pack.

The problem with these scenarios is still the initial cost, which lies not in the materials, but rather the labor and creation of manufacturing facilities for the batteries. The grant provides battery manufacturers with much-needed start-up funds to overcome the initial hurdle, since manufacturers have few options other than either burdening the consumer with excessive costs or absorbing the high prices and losing money on each battery. Once production reaches a significant level, prices will drop, and the cost will stabilize profitably, with price declines potentially reaching 50% by 2015.

The manufacture of electric drive components is expected to present only mild difficulty for the industry, as the technology is proven. The problem of scale, however, must be addressed, though the funds allocated for this are expected to be sufficient. The recipients of these funds are OEMs, 1st-Tier suppliers, or current manufacturers of electric vehicle drive components, suggesting that a straightforward expansion of manufacturing capacity will be the principle strategy.

Electric vehicles, while currently faced with challenges as viable modes of transportation, will continue to evolve to suit the changing face of the American market. Urban sprawl has separated working areas of a city from living areas, leading to an increase in average driving distance over the past few years. This trend is expected to continue, and is the largest single challenge to electric vehicle battery development. Initially, extended-range electric vehicles will offer an all-electric range of around 40 miles, which would be sufficient to meet the needs of the average driver. However, battery development is expected to progress quickly, with range being the first priority.

Aiding and abetting this is the expected creation of recharging infrastructure. Funds granted in this area are the lowest of the categories, though this is not expected to be problematic, as challenges here are largely those of business development. Opportunities are rampant in the infrastructure market, but will not be widely commercially viable until electric vehicles achieve significant market adoption, most likely around 2012.

For more information, please contact David Escalante, Corporate Communications, at 210.477.8427 or david.escalante@frost.com.

http://www.frost.com/prod/servlet/market-insight-top.pag?Src…

Date Published: 11 Aug 2009

By Matt Scruggs, Research Analyst, Frost & Sullivan's Automotive Practice and Veerender Kaul, Research Director, Frost & Sullivan's Automotive Practice

President Obama's announcement of a $2.4 billion government grant will open up the electric vehicle frontier on a larger scale than initially predicted. This will prove to be an important measure in reducing the initial cost of electric vehicles and opening the market to consumers. Additionally, electric vehicle development can provide a healthy boost to a stagnant economy with the creation of manufacturing jobs, a great number of which were lost due to the U.S. automotive industry decline. These benefits apply not only to purely-electric vehicles, but also to hybrid vehicles and extended-range electric vehicles (aka plug-in hybrids).

Of the $2.4 billion allocated in the program, approximately $1.5 billion is allocated to companies that manufacture batteries and battery components, as well as companies that recycle batteries once spent. $500 million goes to companies that manufacture electric drive systems or components, and the remaining $400 million is to be used for the creation of electric vehicle education and training, the creation of charging infrastructure, and the purchase of hybrid and electric vehicles for testing and evaluation. Based on Frost & Sullivan's analysis, this allocation of funding is poised to offer the maximum benefit to the future of electric vehicles.

The battery is the single-most expensive component of an electric vehicle, ranging from $8,000 to $15,000 on most vehicles in volume quantities. Automakers are working closely with battery suppliers and recyclers to develop several sales scenarios designed to reduce the initial battery cost to a point within reach of the average consumer. This may entail the consumer paying for a portion of the battery cost along with the price of the vehicle and leasing the rest of the cost over the life of the vehicle. Consumers are expected to be receptive to this, since they would not need to purchase gasoline, and electric recharge costs are expected to range from $0.70 to $2.50 per charge, depending on peak usage rates for each area. Companies that recycle batteries can also subsidize the cost, based on the end-of-life value of the battery pack.

The problem with these scenarios is still the initial cost, which lies not in the materials, but rather the labor and creation of manufacturing facilities for the batteries. The grant provides battery manufacturers with much-needed start-up funds to overcome the initial hurdle, since manufacturers have few options other than either burdening the consumer with excessive costs or absorbing the high prices and losing money on each battery. Once production reaches a significant level, prices will drop, and the cost will stabilize profitably, with price declines potentially reaching 50% by 2015.

The manufacture of electric drive components is expected to present only mild difficulty for the industry, as the technology is proven. The problem of scale, however, must be addressed, though the funds allocated for this are expected to be sufficient. The recipients of these funds are OEMs, 1st-Tier suppliers, or current manufacturers of electric vehicle drive components, suggesting that a straightforward expansion of manufacturing capacity will be the principle strategy.

Electric vehicles, while currently faced with challenges as viable modes of transportation, will continue to evolve to suit the changing face of the American market. Urban sprawl has separated working areas of a city from living areas, leading to an increase in average driving distance over the past few years. This trend is expected to continue, and is the largest single challenge to electric vehicle battery development. Initially, extended-range electric vehicles will offer an all-electric range of around 40 miles, which would be sufficient to meet the needs of the average driver. However, battery development is expected to progress quickly, with range being the first priority.

Aiding and abetting this is the expected creation of recharging infrastructure. Funds granted in this area are the lowest of the categories, though this is not expected to be problematic, as challenges here are largely those of business development. Opportunities are rampant in the infrastructure market, but will not be widely commercially viable until electric vehicles achieve significant market adoption, most likely around 2012.

For more information, please contact David Escalante, Corporate Communications, at 210.477.8427 or david.escalante@frost.com.

http://www.frost.com/prod/servlet/market-insight-top.pag?Src…

Antwort auf Beitrag Nr.: 37.774.488 von hbg55 am 13.08.09 16:40:37

beeindruckender tag gestern mit nem TOP- vol. von 1,1mios gelingt

der sprung über die ONE- barriere - DIESE auch noch bis zum handelsende behaupten zu können zeigt das große interesse am wert.......selbst auf NEUEM level..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:42 V 1.05 +0.23 2,000 1 Anonymous 1 Anonymous K

15:59:42 V 1.05 +0.23 6,500 1 Anonymous 62 Haywood K

15:59:42 V 1.04 +0.22 1,500 1 Anonymous 33 Canaccord K

15:58:09 V 1.04 +0.22 1,500 7 TD Sec 33 Canaccord K

15:58:09 V 1.04 +0.22 1,500 7 TD Sec 80 National Bank K

15:56:12 V 1.04 +0.22 1,000 88 Scotia iTRADE 80 National Bank K

15:56:01 V 1.04 +0.22 1,000 88 Scotia iTRADE 80 National Bank K

15:46:53 V 1.00 +0.18 1,000 88 Scotia iTRADE 1 Anonymous K

15:46:53 V 1.01 +0.19 500 7 TD Sec 1 Anonymous K

15:43:23 V 1.04 +0.22 1,000 36 Latimer 88 Scotia iTRADE K

...nun richtet sich augenmerk darauf, wie dieser kraftakt HEUTE

verarbeitet wird

beeindruckender tag gestern mit nem TOP- vol. von 1,1mios gelingt

der sprung über die ONE- barriere - DIESE auch noch bis zum handelsende behaupten zu können zeigt das große interesse am wert.......selbst auf NEUEM level..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:42 V 1.05 +0.23 2,000 1 Anonymous 1 Anonymous K

15:59:42 V 1.05 +0.23 6,500 1 Anonymous 62 Haywood K

15:59:42 V 1.04 +0.22 1,500 1 Anonymous 33 Canaccord K

15:58:09 V 1.04 +0.22 1,500 7 TD Sec 33 Canaccord K

15:58:09 V 1.04 +0.22 1,500 7 TD Sec 80 National Bank K

15:56:12 V 1.04 +0.22 1,000 88 Scotia iTRADE 80 National Bank K

15:56:01 V 1.04 +0.22 1,000 88 Scotia iTRADE 80 National Bank K

15:46:53 V 1.00 +0.18 1,000 88 Scotia iTRADE 1 Anonymous K

15:46:53 V 1.01 +0.19 500 7 TD Sec 1 Anonymous K

15:43:23 V 1.04 +0.22 1,000 36 Latimer 88 Scotia iTRADE K

...nun richtet sich augenmerk darauf, wie dieser kraftakt HEUTE

verarbeitet wird

Batteries: The New Oil?

CNBC

Airtime: Thurs. Aug. 13 2009 | 09 20 00 ET

Discussing whether the United States can make enough play in the battery industry to become independent, with Charles Gassenheimer, Ener1 chairman & CEO; Jon Hykawy, Byron Capital Markets analyst; and CNBC's Phil LeBeau.

http://www.cnbc.com/id/15840232?video=1214209086&play=1

CNBC

Airtime: Thurs. Aug. 13 2009 | 09 20 00 ET

Discussing whether the United States can make enough play in the battery industry to become independent, with Charles Gassenheimer, Ener1 chairman & CEO; Jon Hykawy, Byron Capital Markets analyst; and CNBC's Phil LeBeau.

http://www.cnbc.com/id/15840232?video=1214209086&play=1

Antwort auf Beitrag Nr.: 37.774.488 von hbg55 am 13.08.09 16:40:37

...auch HEUTE hat sie noch genug dynamik, um weiter gen norden

zu ziehen..........mit akt. HIGH von cad 1,20

Time Ex Price Change Volume Buyer Seller Markers

11:15:20 V 1.18 +0.15 99 95 Wolverton 92 Pollitt E

11:15:00 V 1.20 +0.15 1,000 7 TD Sec 88 Scotia iTRADE K

11:15:00 V 1.20 +0.15 4,000 7 TD Sec 7 TD Sec K

11:14:52 V 1.20 +0.15 1,000 79 CIBC 7 TD Sec K

11:14:00 V 1.20 +0.15 2,000 33 Canaccord 80 National Bank K

11:13:37 V 1.20 +0.15 1,000 33 Canaccord 80 National Bank K

11:13:27 V 1.19 +0.14 3,000 24 Clarus 80 National Bank K

11:13:27 V 1.19 +0.14 5,100 24 Clarus 1 Anonymous K

11:13:27 V 1.19 +0.14 1,000 24 Clarus 7 TD Sec K

11:13:27 V 1.19 +0.14 1,000 24 Clarus 2 RBC K

...auch HEUTE hat sie noch genug dynamik, um weiter gen norden

zu ziehen..........mit akt. HIGH von cad 1,20

Time Ex Price Change Volume Buyer Seller Markers

11:15:20 V 1.18 +0.15 99 95 Wolverton 92 Pollitt E

11:15:00 V 1.20 +0.15 1,000 7 TD Sec 88 Scotia iTRADE K

11:15:00 V 1.20 +0.15 4,000 7 TD Sec 7 TD Sec K

11:14:52 V 1.20 +0.15 1,000 79 CIBC 7 TD Sec K

11:14:00 V 1.20 +0.15 2,000 33 Canaccord 80 National Bank K

11:13:37 V 1.20 +0.15 1,000 33 Canaccord 80 National Bank K

11:13:27 V 1.19 +0.14 3,000 24 Clarus 80 National Bank K

11:13:27 V 1.19 +0.14 5,100 24 Clarus 1 Anonymous K

11:13:27 V 1.19 +0.14 1,000 24 Clarus 7 TD Sec K

11:13:27 V 1.19 +0.14 1,000 24 Clarus 2 RBC K

Investors pile into lithium producers

Double-digit rise

Peter Koven, Financial Post

Published: Friday, August 14, 2009

Little-known lithium has emerged as the hot commodity of the moment as investors look for a way to cash in on the anticipated flood of electric cars to the market.

The lithium mania yesterday swept up a number of Bay Street institutions, which were buying anything for clients that happened to have the magic L-word in its name.

By the end of the day, explorers and developers of lithium properties -- Canada Lithium Corp., Western Lithium Corp. and First Lithium Resources Inc. -- were up 41%, 28% and 67%, respectively, on massive volumes.

"I just think people are realizing there are going to be an awful lot of lithium batteries used in electric vehicles over the next while," said Jon Hykawy, an analyst at Byron Capital Markets.

He said if a couple of million electric cars are sold in the next five years, that alone would equate to about 10% to 15% of current lithium demand.

The market for lithium, a very light silver-white metal, has grown steadily over the past decade thanks to rising demand for batteries in such consumer electronics as cellphones and laptop computers.

But it is the pending release of the Chevy Volt, the Nissan Leaf, and other electric vehicles that is getting investors most excited.

Some auto companies are already speculating that pure-electric cars could make up 10% of vehicle purchases by 2020, which could put major strain on lithium supplies if it happens.

"The real inflection point is that an automobile needs about 3,000 times as much lithium as a cellphone. This is where we've got a very large potential supply requirement," said Jay Chmelauskas, president of Western Lithium.

The fact that the electric car build-out is getting billions of dollars of subsidies and strong political support, particularly in the United States and China, only adds to the excitement for lithium. In the United States, the support comes as no surprise given the government controls General Motors. But China has also emerged as a leader in electrification. It is the world's largest car market, and experts said that almost every company producing lithium-ion batteries for cars has a plant in China.

The lithium industry is small, with annual production of only about 120,000 tonnes of lithium carbonate. There are also very few ways for investors to get involved in the sector, as it is dominated by four companies: SQM SA of Chile, Rockwood Holdings Inc., FMC Corp., and Talison Minerals Pty Ltd., a private Australian company. "And then you've got a wackload of juniors that are doing anything from the sublime to the ridiculous to come up with lithium," Mr. Hykawy said.

He said that the price of lithium, which is not widely published, reached about US$6,600 a tonne this month. That compares with about US$2,500 a tonne at the beginning of the decade.

The biggest source of lithium is Chile; Argentina and Australia are major producers as well. Bolivia is described by some as the Saudi Arabia of lithium, but experts said that a lot of the deposits there are contaminated with magnesium and are too costly to mine. Political risk has also kept many companies out.

http://www.nationalpost.com/story.html?id=1891696

Double-digit rise

Peter Koven, Financial Post

Published: Friday, August 14, 2009

Little-known lithium has emerged as the hot commodity of the moment as investors look for a way to cash in on the anticipated flood of electric cars to the market.

The lithium mania yesterday swept up a number of Bay Street institutions, which were buying anything for clients that happened to have the magic L-word in its name.

By the end of the day, explorers and developers of lithium properties -- Canada Lithium Corp., Western Lithium Corp. and First Lithium Resources Inc. -- were up 41%, 28% and 67%, respectively, on massive volumes.

"I just think people are realizing there are going to be an awful lot of lithium batteries used in electric vehicles over the next while," said Jon Hykawy, an analyst at Byron Capital Markets.

He said if a couple of million electric cars are sold in the next five years, that alone would equate to about 10% to 15% of current lithium demand.

The market for lithium, a very light silver-white metal, has grown steadily over the past decade thanks to rising demand for batteries in such consumer electronics as cellphones and laptop computers.

But it is the pending release of the Chevy Volt, the Nissan Leaf, and other electric vehicles that is getting investors most excited.

Some auto companies are already speculating that pure-electric cars could make up 10% of vehicle purchases by 2020, which could put major strain on lithium supplies if it happens.

"The real inflection point is that an automobile needs about 3,000 times as much lithium as a cellphone. This is where we've got a very large potential supply requirement," said Jay Chmelauskas, president of Western Lithium.

The fact that the electric car build-out is getting billions of dollars of subsidies and strong political support, particularly in the United States and China, only adds to the excitement for lithium. In the United States, the support comes as no surprise given the government controls General Motors. But China has also emerged as a leader in electrification. It is the world's largest car market, and experts said that almost every company producing lithium-ion batteries for cars has a plant in China.

The lithium industry is small, with annual production of only about 120,000 tonnes of lithium carbonate. There are also very few ways for investors to get involved in the sector, as it is dominated by four companies: SQM SA of Chile, Rockwood Holdings Inc., FMC Corp., and Talison Minerals Pty Ltd., a private Australian company. "And then you've got a wackload of juniors that are doing anything from the sublime to the ridiculous to come up with lithium," Mr. Hykawy said.

He said that the price of lithium, which is not widely published, reached about US$6,600 a tonne this month. That compares with about US$2,500 a tonne at the beginning of the decade.

The biggest source of lithium is Chile; Argentina and Australia are major producers as well. Bolivia is described by some as the Saudi Arabia of lithium, but experts said that a lot of the deposits there are contaminated with magnesium and are too costly to mine. Political risk has also kept many companies out.

http://www.nationalpost.com/story.html?id=1891696

Sollte WLC nicht eine deutlich höhere Bewertung zustehen im momentanen Li-hype anhand der verhältnismässig grossen nachgewiesenen Vorkommen?

"Western Lithium to Profit from Electric Car Stimulus"

http://www.altenergystocks.com/archives/2009/08/western_lith…

"Western Lithium to Profit from Electric Car Stimulus"

http://www.altenergystocks.com/archives/2009/08/western_lith…

Als ich das Folgende las, konnte ich damals nicht widerstehen. Bereut habe ich es nicht.

Sept. 11, 2008

Western Lithium Provides Chairman's Update

Vancouver, British Columbia: Western Lithium Canada Corporation (“the “Company” or “Western Lithium”) (TSXV: WLC) provides the Chairman’s message to the shareholders of the Company.

“As Chairman of Western Lithium Canada Corporation (“Western Lithium”), I would like to provide you with an update of our current activities, plans for the future, and welcome you as we develop the company into a supplier of lithium and associated metals for the emerging hybrid and electric automobile industry. The future for the development of radically new technologies to wean the world from its hydrocarbon addiction is almost unlimited. The resources we control in our company are of the same magnitude. Times are tough. Our company has been born into a turbulent market populated by nervous investors. We share their concerns and intend to manage our capital in a prudent manner with the goal of maximizing our shareholder’s value.

The equity markets today are as difficult as I can remember, especially for junior resource companies. The lack of credit and liquidity has forced many investors to pull back from the market and this in turn has put some of the institutional funds who invested in Western Lithium in a situation where they have significant redemptions. Some of these funds might be forced sellers; some might be taking advantage of liquidity. Regardless of the reason, this scenario has expressed itself in a lower share price. I, for one, am not overly concerned with the situation as the fundamentals of the company speak for themselves.

Western Lithium is not an exploration company seeking to discover something of value. We control the largest known lithium deposit in North America. According to Chevron reports, their drilling program in the late 1980’s identified approximately 24 billion pounds of lithium carbonate in a series of distinct mineralized zones within the McDermitt Caldera volcanic feature. :lick Note: This figure is not considered NI 43-101 compliant and should not be relied upon.) Subsequent work by Western Lithium is supportive of this estimate.

Note: This figure is not considered NI 43-101 compliant and should not be relied upon.) Subsequent work by Western Lithium is supportive of this estimate.

Chevron’s report was completed long before technology realized the value of lithium carbonate and in particular the lithium-ion battery. Today the market for mass produced plug-in hybrid cars and electric cars powered by lithium-ion batteries looks extremely promising. The Japanese government recently announced that they were installing quick charge stations in the larger Japanese cities to facilitate the use of electric vehicles. If you watched the Olympics, you might have noticed ads for Chevy’s new lithium-ion battery powered electric car, the Volt, now scheduled for mass production in 2010. Both Porsche and Mercedes have announced that they will be producing a hybrid vehicle powered by lithium-ion batteries. Today there are cars, motor scooters, boats and any number of electronic devices powered by lithium-ion batteries. The lithium-ion battery is clearly the choice for energy storage, both today and for the future.

The most difficult thing about change is predicting the rate at which it will occur. Three years ago, when we became aware of the Chevron data, the idea of mass produced electric cars or plug-in hybrids was almost science fiction. However, one thing that is certain is that markets for our product will grow and we have identified a resource base large enough to satisfy any possible future demand.

If, for instance, the lead-acid battery that is used in the vast majority of cars today were superseded by a more environmentally and technologically superior lithium-ion battery, your company would be worth multiples of our current value.

Today, Western Lithium has $5 million in the bank. This is sufficient to take the company well into next year based upon its current budget. The Company also benefits from available credit facilities from its sister company Western Uranium Corporation (Western Uranium Corporation currently has over $50 million in cash and is the owner of 30% of the outstanding shares of Western Lithium).

Western Lithium is currently hard at work developing a state-of-the-art processing concept and associated mining operation. In developing a process flow sheet, incorporating those results into a scoping study and moving rapidly to a feasibility study, the company is seeking to optimize the value of its asset as quickly and efficiently as possible. Our current project timeline envisions completion of a scoping study in mid-2009 in parallel with resource delineation and final metallurgical test work. This will lead to pre-feasibility and preliminary engineering design in late 2009. A bankable feasibility study, permitting and subsequent construction could lead to production in 2011. This time frame coincides with projections of growing demand for lithium-ion batteries in the auto industry. In conjunction with this technical work, Western Lithium has also begun canvassing a number of potential lithium-ion battery makers to develop marketing and off-take agreements. Its US address is also proving to be advantageous over foreign producers in respect to securing long term supply contracts.

As results are generated and progress is made, the value of Western Lithium’s shares will increase. With a huge identified asset, a growing market, and a highly experienced Board and Management team, our future could not look brighter, nor our shareholder value more secure. Western Lithium can afford to be patient and ride out this current market malaise. We are excited about the future and what it holds for our Company. We appreciate your continued support and believe the future is bright for the lithium battery market which in turn will reward our share holders over the longer term.”

On behalf of the Board of

Western Lithium Canada Corporation

“R. Edward Flood”

R. Edward Flood

Sept. 11, 2008

Western Lithium Provides Chairman's Update

Vancouver, British Columbia: Western Lithium Canada Corporation (“the “Company” or “Western Lithium”) (TSXV: WLC) provides the Chairman’s message to the shareholders of the Company.

“As Chairman of Western Lithium Canada Corporation (“Western Lithium”), I would like to provide you with an update of our current activities, plans for the future, and welcome you as we develop the company into a supplier of lithium and associated metals for the emerging hybrid and electric automobile industry. The future for the development of radically new technologies to wean the world from its hydrocarbon addiction is almost unlimited. The resources we control in our company are of the same magnitude. Times are tough. Our company has been born into a turbulent market populated by nervous investors. We share their concerns and intend to manage our capital in a prudent manner with the goal of maximizing our shareholder’s value.

The equity markets today are as difficult as I can remember, especially for junior resource companies. The lack of credit and liquidity has forced many investors to pull back from the market and this in turn has put some of the institutional funds who invested in Western Lithium in a situation where they have significant redemptions. Some of these funds might be forced sellers; some might be taking advantage of liquidity. Regardless of the reason, this scenario has expressed itself in a lower share price. I, for one, am not overly concerned with the situation as the fundamentals of the company speak for themselves.

Western Lithium is not an exploration company seeking to discover something of value. We control the largest known lithium deposit in North America. According to Chevron reports, their drilling program in the late 1980’s identified approximately 24 billion pounds of lithium carbonate in a series of distinct mineralized zones within the McDermitt Caldera volcanic feature. :lick

Note: This figure is not considered NI 43-101 compliant and should not be relied upon.) Subsequent work by Western Lithium is supportive of this estimate.

Note: This figure is not considered NI 43-101 compliant and should not be relied upon.) Subsequent work by Western Lithium is supportive of this estimate.Chevron’s report was completed long before technology realized the value of lithium carbonate and in particular the lithium-ion battery. Today the market for mass produced plug-in hybrid cars and electric cars powered by lithium-ion batteries looks extremely promising. The Japanese government recently announced that they were installing quick charge stations in the larger Japanese cities to facilitate the use of electric vehicles. If you watched the Olympics, you might have noticed ads for Chevy’s new lithium-ion battery powered electric car, the Volt, now scheduled for mass production in 2010. Both Porsche and Mercedes have announced that they will be producing a hybrid vehicle powered by lithium-ion batteries. Today there are cars, motor scooters, boats and any number of electronic devices powered by lithium-ion batteries. The lithium-ion battery is clearly the choice for energy storage, both today and for the future.

The most difficult thing about change is predicting the rate at which it will occur. Three years ago, when we became aware of the Chevron data, the idea of mass produced electric cars or plug-in hybrids was almost science fiction. However, one thing that is certain is that markets for our product will grow and we have identified a resource base large enough to satisfy any possible future demand.

If, for instance, the lead-acid battery that is used in the vast majority of cars today were superseded by a more environmentally and technologically superior lithium-ion battery, your company would be worth multiples of our current value.

Today, Western Lithium has $5 million in the bank. This is sufficient to take the company well into next year based upon its current budget. The Company also benefits from available credit facilities from its sister company Western Uranium Corporation (Western Uranium Corporation currently has over $50 million in cash and is the owner of 30% of the outstanding shares of Western Lithium).

Western Lithium is currently hard at work developing a state-of-the-art processing concept and associated mining operation. In developing a process flow sheet, incorporating those results into a scoping study and moving rapidly to a feasibility study, the company is seeking to optimize the value of its asset as quickly and efficiently as possible. Our current project timeline envisions completion of a scoping study in mid-2009 in parallel with resource delineation and final metallurgical test work. This will lead to pre-feasibility and preliminary engineering design in late 2009. A bankable feasibility study, permitting and subsequent construction could lead to production in 2011. This time frame coincides with projections of growing demand for lithium-ion batteries in the auto industry. In conjunction with this technical work, Western Lithium has also begun canvassing a number of potential lithium-ion battery makers to develop marketing and off-take agreements. Its US address is also proving to be advantageous over foreign producers in respect to securing long term supply contracts.

As results are generated and progress is made, the value of Western Lithium’s shares will increase. With a huge identified asset, a growing market, and a highly experienced Board and Management team, our future could not look brighter, nor our shareholder value more secure. Western Lithium can afford to be patient and ride out this current market malaise. We are excited about the future and what it holds for our Company. We appreciate your continued support and believe the future is bright for the lithium battery market which in turn will reward our share holders over the longer term.”

On behalf of the Board of

Western Lithium Canada Corporation

“R. Edward Flood”

R. Edward Flood

Antwort auf Beitrag Nr.: 37.791.584 von nettinvestor am 16.08.09 22:12:00Und ich habe nicht vor jetzt zu verkaufen, die Entwicklung des Projekts braucht noch seine Zeit. Wenn nichts Negatives passiert, bleibe ich bis zum Produktionsbeginn / Übernahme dabei.

Standard & Poor's Initiates Factual Stock Report Coverage on Western Lithium Corporation

By: Business Wire | 19 Aug 2009 | 08:00 AM ET

NEW YORK, Aug 19, 2009 (BUSINESS WIRE) -- Standard & Poor's announced today that it has commenced Factual Stock Report coverage on Western Lithium Canada Corporation.

Western Lithium Canada Corporation (TSX-V:WLC), in the exploration stage, is developing the Kings Valley lithium deposit in northwestern Nevada and intends to produce lithium carbonate.

The company seeks to position itself as a major supplier to support the rising global demand for lithium carbonate that is expected from the increased use of mobile electronics and hybrid/electric vehicles. Lithium is currently used in lithium-ion batteries for cell phones, laptop computers and other electronic devices that require maximum storage capacity with minimum weight.

Western Lithium has engaged URS Corporation, an engineering firm, to complete an economic scoping study at the company's Kings Valley lithium deposit in Nevada.

The study is for a Stage I development plan with proposed production of 25,000 tonnes per year of high-quality, low-impurity lithium carbonate beginning in 2013. Results of the scoping study are targeted for early in the fourth quarter of 2009.

...

http://www.cnbc.com/id/32473588

By: Business Wire | 19 Aug 2009 | 08:00 AM ET

NEW YORK, Aug 19, 2009 (BUSINESS WIRE) -- Standard & Poor's announced today that it has commenced Factual Stock Report coverage on Western Lithium Canada Corporation.

Western Lithium Canada Corporation (TSX-V:WLC), in the exploration stage, is developing the Kings Valley lithium deposit in northwestern Nevada and intends to produce lithium carbonate.

The company seeks to position itself as a major supplier to support the rising global demand for lithium carbonate that is expected from the increased use of mobile electronics and hybrid/electric vehicles. Lithium is currently used in lithium-ion batteries for cell phones, laptop computers and other electronic devices that require maximum storage capacity with minimum weight.

Western Lithium has engaged URS Corporation, an engineering firm, to complete an economic scoping study at the company's Kings Valley lithium deposit in Nevada.

The study is for a Stage I development plan with proposed production of 25,000 tonnes per year of high-quality, low-impurity lithium carbonate beginning in 2013. Results of the scoping study are targeted for early in the fourth quarter of 2009.

...

http://www.cnbc.com/id/32473588

Western Lithium Stands to Profit from Electric Car Stimulus

by: Jason Hamlin August 16, 2009

The lithium market is buzzing as GM, Nissan (NSANY) and other car manufacturers get set to roll out a new series of electric cars that will greatly increase demand for the obscure silver-white alkai metal. GM has announced plans to construct a $43 million plant in Michigan to build lithium-ion batteries for its Chevrolet Volt electric-powered car, which captured headlines with its claim of 230 miles per gallon.

Adding to the lithium mania is Washington’s support in the form of $2 Billion in stimulus funding:

"New plug-in hybrids roll off our assembly lines, but they will run on batteries made in Korea. Well I do not accept a future where the jobs and industries of tomorrow take root beyond our borders –and I know you don’t either. It is time for America to lead again."

- President Obama

For those with concerns that fuel efficiency alone is not enough to entice America’s automobile consumer, consider the company Tesla Motors. While their roadster is the first production automobile to use lithium-ion battery cells and travel more than 200 miles per charge, it is also capable of doing 0-60 in under 4 seconds. Not only will the Tesla Roadster leave most sports cars in its dust, the car recently set a distance record in April 2009 when it completed the 241-mile Rallye Monte Carlo d’Energies Alternatives with 36 miles left on the charge. While the Roadster’s price tag may be out of reach for the average consumer at just over $100,000, Tesla has taken more than 1,000 reservations for the car and expects to begin production of an all-electric and more affordable sedan starting in late 2011. While Tesla remains a private company whose stock you are unlikely to get your hands on, their success bodes well for the future of lithium battery-powered cars.

Lithium prices have nearly tripled over the past decade with 22% compound annual growth since 2000 for use in laptops, cell phones and other electronics. While this demand is expected to continue rising, the recent lithium mania has been ignited by the fact that electric cars require about 3,000 times the lithium needed for an average cell phone or 100 times the lithium used in a computer battery. This huge spike in demand should propel lithium prices much higher over the next few years. Investors are eager to get ahead of the curve and are scrambling to find the companies that stand to benefit most from this new demand.

While most investors turn to the world’s largest lithium producer, Sociedad Quimica y Minera de Chile (ADR) (NYSE:SQM), only a small percentage of their revenue is derived from lithium sales. SQM generates the bulk of their sales from iodine and specialty fertilizers for the agriculture sector.

My preferred way to profit from the coming lithium boom is through the company Western Lithium (CVE: WLC or WLCDF.PK), which owns the largest known lithium deposit in North America. The near surface lithium clay deposit is located in Nevada, USA and was initially discovered by the US Geological Survey and Chevron (CVX) USA in the 1970s. Engineering work completed by Chevron, and later by the US Bureau of Mines in the 1980s, is now being advanced by Western Lithium.

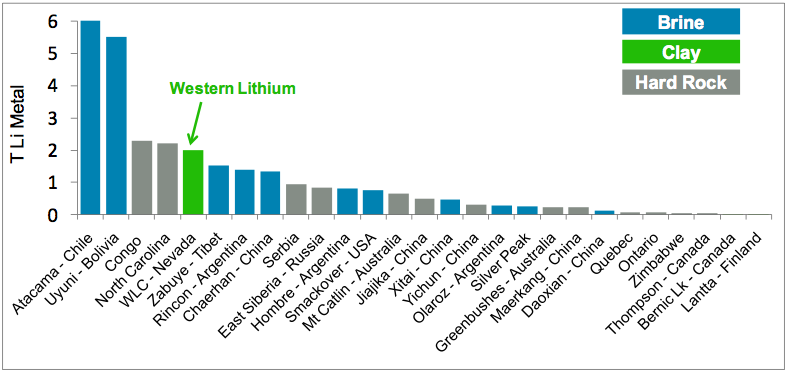

The company’s flagship Kings Valley property has a National Instrument 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes of lithium carbonate equivalent (LCE). The project has a well developed local infrastructure and Nevada has a long history in the metals and industrial mineral mining industry. The company plans a scoping study during Q3 of 2009, a pre-feasibility study with results from additional drilling during 2010 and projected production by 2013. A chart with the world’s largest lithium deposits is below.

Western Lithium is well-funded and debt free with CDN$7.3 million cash on the books. They recently completed a $5.5 million private placement in May of this year and have a market cap of CDN$70 million. As you can see below, the stock has broken out recently on heavy volume. While some might view the stock as overbought, I believe lithium mania is only getting started and that Western Lithium will outperform its peers both in the short and long term. Despite the recent spike in price, shares are selling at a premium of just 20% to their highs which were put in well before the recent flurry of bullish news. The last time the stock made a move like the current one, it continued to produce a gain in excess of 800%!

We might not know for sure “Who Killed the Electric Car?,” but it appears to be making an impressive resurrection.

http://seekingalpha.com/article/156238-western-lithium-stand…

by: Jason Hamlin August 16, 2009

The lithium market is buzzing as GM, Nissan (NSANY) and other car manufacturers get set to roll out a new series of electric cars that will greatly increase demand for the obscure silver-white alkai metal. GM has announced plans to construct a $43 million plant in Michigan to build lithium-ion batteries for its Chevrolet Volt electric-powered car, which captured headlines with its claim of 230 miles per gallon.

Adding to the lithium mania is Washington’s support in the form of $2 Billion in stimulus funding:

"New plug-in hybrids roll off our assembly lines, but they will run on batteries made in Korea. Well I do not accept a future where the jobs and industries of tomorrow take root beyond our borders –and I know you don’t either. It is time for America to lead again."

- President Obama

For those with concerns that fuel efficiency alone is not enough to entice America’s automobile consumer, consider the company Tesla Motors. While their roadster is the first production automobile to use lithium-ion battery cells and travel more than 200 miles per charge, it is also capable of doing 0-60 in under 4 seconds. Not only will the Tesla Roadster leave most sports cars in its dust, the car recently set a distance record in April 2009 when it completed the 241-mile Rallye Monte Carlo d’Energies Alternatives with 36 miles left on the charge. While the Roadster’s price tag may be out of reach for the average consumer at just over $100,000, Tesla has taken more than 1,000 reservations for the car and expects to begin production of an all-electric and more affordable sedan starting in late 2011. While Tesla remains a private company whose stock you are unlikely to get your hands on, their success bodes well for the future of lithium battery-powered cars.

Lithium prices have nearly tripled over the past decade with 22% compound annual growth since 2000 for use in laptops, cell phones and other electronics. While this demand is expected to continue rising, the recent lithium mania has been ignited by the fact that electric cars require about 3,000 times the lithium needed for an average cell phone or 100 times the lithium used in a computer battery. This huge spike in demand should propel lithium prices much higher over the next few years. Investors are eager to get ahead of the curve and are scrambling to find the companies that stand to benefit most from this new demand.

While most investors turn to the world’s largest lithium producer, Sociedad Quimica y Minera de Chile (ADR) (NYSE:SQM), only a small percentage of their revenue is derived from lithium sales. SQM generates the bulk of their sales from iodine and specialty fertilizers for the agriculture sector.

My preferred way to profit from the coming lithium boom is through the company Western Lithium (CVE: WLC or WLCDF.PK), which owns the largest known lithium deposit in North America. The near surface lithium clay deposit is located in Nevada, USA and was initially discovered by the US Geological Survey and Chevron (CVX) USA in the 1970s. Engineering work completed by Chevron, and later by the US Bureau of Mines in the 1980s, is now being advanced by Western Lithium.

The company’s flagship Kings Valley property has a National Instrument 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes of lithium carbonate equivalent (LCE). The project has a well developed local infrastructure and Nevada has a long history in the metals and industrial mineral mining industry. The company plans a scoping study during Q3 of 2009, a pre-feasibility study with results from additional drilling during 2010 and projected production by 2013. A chart with the world’s largest lithium deposits is below.

Western Lithium is well-funded and debt free with CDN$7.3 million cash on the books. They recently completed a $5.5 million private placement in May of this year and have a market cap of CDN$70 million. As you can see below, the stock has broken out recently on heavy volume. While some might view the stock as overbought, I believe lithium mania is only getting started and that Western Lithium will outperform its peers both in the short and long term. Despite the recent spike in price, shares are selling at a premium of just 20% to their highs which were put in well before the recent flurry of bullish news. The last time the stock made a move like the current one, it continued to produce a gain in excess of 800%!

We might not know for sure “Who Killed the Electric Car?,” but it appears to be making an impressive resurrection.

http://seekingalpha.com/article/156238-western-lithium-stand…

Antwort auf Beitrag Nr.: 37.814.199 von Videomart am 19.08.09 22:46:34AHa..hier treibst du Dich herum...

Antwort auf Beitrag Nr.: 37.826.428 von Expertchen007 am 21.08.09 14:55:21Ab und zu auch bei TCM und CLQ - Canada Lithium dem neuesten Baby von Ian McDonald und Kerry J; Knoll

Nissan and Showa Shell: Quick Charging Using Solar Panels and Li-Ion-Batteries

22 Aug 2009

Nissan and Showa Shell announced they will start studies on joint development of a quick charging system for electric vehicles (EV) using Showa Shell's next-generation CIS solar panels and Nissan's lithium ion batteries for automotive use.

This joint development will take place as part of a commissioned project for EV diffusion launched by the Ministry of Economy, Trade and Industry.

A quick charging system of which both companies will consider joint development aims to have following characteristics.

Maximizing the use of solar power which is renewable energy, the system will contribute to diffusion of EV as a ultimate zero emission vehicle which emits no exhaust gas like CO2 not only in driving but also in generating electricity. With lithium-ion batteries, power will be able to be supplied in case of power outage at the time of disaster. Reducing influence to grid power (load leveling), the system will enable to install quick charging facilities with lower electric power capacity.

In addition, a quick charging system using the next-generation CIS solar panels and lithium ion batteries is expected to be utilized in houses and large-scale solar power plants (mega solar plants).

http://www.wattgehtab.com/index.php/content/view/2541/24/

22 Aug 2009

Nissan and Showa Shell announced they will start studies on joint development of a quick charging system for electric vehicles (EV) using Showa Shell's next-generation CIS solar panels and Nissan's lithium ion batteries for automotive use.

This joint development will take place as part of a commissioned project for EV diffusion launched by the Ministry of Economy, Trade and Industry.

A quick charging system of which both companies will consider joint development aims to have following characteristics.

Maximizing the use of solar power which is renewable energy, the system will contribute to diffusion of EV as a ultimate zero emission vehicle which emits no exhaust gas like CO2 not only in driving but also in generating electricity. With lithium-ion batteries, power will be able to be supplied in case of power outage at the time of disaster. Reducing influence to grid power (load leveling), the system will enable to install quick charging facilities with lower electric power capacity.

In addition, a quick charging system using the next-generation CIS solar panels and lithium ion batteries is expected to be utilized in houses and large-scale solar power plants (mega solar plants).

http://www.wattgehtab.com/index.php/content/view/2541/24/

Nissan and GM to go head to head with electric vehicles

LONDON (Metal-Pages) 24-Aug-09.

Nissan and GM are set to go head to head next year with their electric vehicles for the masses. In 2010 GM will release its much talked about 2011 Chevy Volt, while Nissan will launch its lesser known 2011 Leaf EV that it only announced at the beginning...

http://www.metal-pages.com/news/story/41617/

LONDON (Metal-Pages) 24-Aug-09.

Nissan and GM are set to go head to head next year with their electric vehicles for the masses. In 2010 GM will release its much talked about 2011 Chevy Volt, while Nissan will launch its lesser known 2011 Leaf EV that it only announced at the beginning...

http://www.metal-pages.com/news/story/41617/

Antwort auf Beitrag Nr.: 37.842.184 von Videomart am 24.08.09 22:57:40Hi Videomart,

über den link kommt man nicht zum Artikel, da Anmeldung nötig. Wird WLC darin erwähnt und gibt es eine spezielle news über WLC drin?

Grüsse

über den link kommt man nicht zum Artikel, da Anmeldung nötig. Wird WLC darin erwähnt und gibt es eine spezielle news über WLC drin?

Grüsse

Investoren gesucht...

Aug 25, 2009 07:00 ET

Western Lithium Appoints Investor Relations Officer

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Aug. 25, 2009) - Western Lithium Corporation ("Western Lithium" or the "Company") (TSX VENTURE:WLC) is pleased to announce the appointment of Cindy Burnett as Vice President of Investor Relations, effective August 17, 2009.

Ms. Burnett has been actively associated with Western Lithium for the past six months as a consultant, initiating investor relations activities. She will be responsible for the ongoing development of external investor and communications programs for the Company.

Ms. Burnett is an experienced investor relations professional and has worked in both the chemical and mining industries. She was most recently Vice President of Investor Relations at Skye Resources Inc. (which merged with HudBay Minerals Inc.) and prior to that was Vice President of Investor Relations at Ivanhoe Energy Inc. Ms. Burnett previously spent over 25 years with NOVA Chemicals and the Alberta Gas Trunk Line Company in both Canada and the U.S. in a number of corporate roles, including investor relations. She is a past President of the Pittsburgh Chapter of the National Investor Relations Institute and previously a Director of the B.C. Chapter of the Canadian Investor Relations Institute. Ms. Burnett was previously granted options to acquire 200,000 common shares of the Company at a price of C$0.54 per share, which vest over a period of 18 months in accordance with the minimum vesting requirements of the Company's stock option plan.

Western Lithium is developing the Kings Valley, Nevada lithium deposit into potentially one of the world's largest(1) strategic, scalable and reliable sources of high quality lithium carbonate. The Company is positioning itself as a major U.S.-based supplier to support the rising global demand for lithium carbonate that is expected from the increased use of mobile electronics and hybrid/electric vehicles.

Aug 25, 2009 07:00 ET

Western Lithium Appoints Investor Relations Officer

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Aug. 25, 2009) - Western Lithium Corporation ("Western Lithium" or the "Company") (TSX VENTURE:WLC) is pleased to announce the appointment of Cindy Burnett as Vice President of Investor Relations, effective August 17, 2009.

Ms. Burnett has been actively associated with Western Lithium for the past six months as a consultant, initiating investor relations activities. She will be responsible for the ongoing development of external investor and communications programs for the Company.

Ms. Burnett is an experienced investor relations professional and has worked in both the chemical and mining industries. She was most recently Vice President of Investor Relations at Skye Resources Inc. (which merged with HudBay Minerals Inc.) and prior to that was Vice President of Investor Relations at Ivanhoe Energy Inc. Ms. Burnett previously spent over 25 years with NOVA Chemicals and the Alberta Gas Trunk Line Company in both Canada and the U.S. in a number of corporate roles, including investor relations. She is a past President of the Pittsburgh Chapter of the National Investor Relations Institute and previously a Director of the B.C. Chapter of the Canadian Investor Relations Institute. Ms. Burnett was previously granted options to acquire 200,000 common shares of the Company at a price of C$0.54 per share, which vest over a period of 18 months in accordance with the minimum vesting requirements of the Company's stock option plan.

Western Lithium is developing the Kings Valley, Nevada lithium deposit into potentially one of the world's largest(1) strategic, scalable and reliable sources of high quality lithium carbonate. The Company is positioning itself as a major U.S.-based supplier to support the rising global demand for lithium carbonate that is expected from the increased use of mobile electronics and hybrid/electric vehicles.

Antwort auf Beitrag Nr.: 37.842.778 von MaloneBS am 25.08.09 08:24:26Hi MaloneBS!

Nein, über WLC steht nichts in dem Artikel.

Es ging mir auch in erster Linie um die Überschrift, zur Verdeutlichung der Anstrengungen, die die Autofirmen bezüglich des elektrischen Antriebes aktuell unternehmen.

Ein weiterer Artikel zum Thema ist auch der folgende:

http://www.businessweek.com/bwdaily/dnflash/content/aug2009/…

Lithium-Companies werden in solchen Berichten meistens nur dann erwähnt, wenn sie bereits produzieren, wie etwa SQM.

Wen die Situation aus der Sicht eines Produzenten interessiert, kann sich unter folgendem Link informieren:

http://seekingalpha.com/article/156053-a-long-look-at-lithiu…

Ein Blick darauf kann nicht schaden

(Wahrscheinlich aber kennst Du den Artikel schon... )

)

Gruß

Vm

Nein, über WLC steht nichts in dem Artikel.

Es ging mir auch in erster Linie um die Überschrift, zur Verdeutlichung der Anstrengungen, die die Autofirmen bezüglich des elektrischen Antriebes aktuell unternehmen.

Ein weiterer Artikel zum Thema ist auch der folgende:

http://www.businessweek.com/bwdaily/dnflash/content/aug2009/…

Lithium-Companies werden in solchen Berichten meistens nur dann erwähnt, wenn sie bereits produzieren, wie etwa SQM.

Wen die Situation aus der Sicht eines Produzenten interessiert, kann sich unter folgendem Link informieren:

http://seekingalpha.com/article/156053-a-long-look-at-lithiu…

Ein Blick darauf kann nicht schaden

(Wahrscheinlich aber kennst Du den Artikel schon...

)

)Gruß

Vm

Gestern gehörten Canaccord Capital übrigens zu den Hauptverkäufern bei CLQ,

heute tauchen sie als auffällige Käufer bei WLC auf.

Vielleicht nur Zufall, aber ganz interessant...

heute tauchen sie als auffällige Käufer bei WLC auf.

Vielleicht nur Zufall, aber ganz interessant...

Antwort auf Beitrag Nr.: 37.849.101 von Videomart am 25.08.09 19:03:50Danke für die Antwort, und gleich noch ne Frage: wo hast Du denn die Info über Canaccord Capital her?

Uebrigens, hier mal ein etwas negativer Blickwinkel der die momentane Zurückhaltung bei so manchem Li Titel erklärt.

http://www.moneyweek.com/investments/commodities/investing-i…

Allerdings halte ich WLC im Moment für einen Kandidaten mit anhaltendem Potential.

Uebrigens, hier mal ein etwas negativer Blickwinkel der die momentane Zurückhaltung bei so manchem Li Titel erklärt.

http://www.moneyweek.com/investments/commodities/investing-i…

Allerdings halte ich WLC im Moment für einen Kandidaten mit anhaltendem Potential.

Hi Malone!

Folgende Seite zeigt den Handelsverlauf:

http://www.otcbb.com/asp/quote_module.asp?qm_page=31662&symb…

"Depth/LII" anklicken, falls die Trades nicht sofort erscheinen.

Verzögerung: 15 Minuten (es sind jeweils nur die letzten 30 Trades zu sehen)

Gruß

Vm

Folgende Seite zeigt den Handelsverlauf:

http://www.otcbb.com/asp/quote_module.asp?qm_page=31662&symb…

"Depth/LII" anklicken, falls die Trades nicht sofort erscheinen.

Verzögerung: 15 Minuten (es sind jeweils nur die letzten 30 Trades zu sehen)

Gruß

Vm

Byron Capital Markets, bekanntermassen "bullish" für Lithium, haben heute viele Shares eingesammelt:

Allein in den letzten zwei Handelsstunden waren es über 60k...

Allein in den letzten zwei Handelsstunden waren es über 60k...

Western Lithium Stock

The Best Way To Profit from the Lithium Boom

By Brian Hicks

Wednesday, August 26th, 2009

Warren Buffett stunned the market back in September 2008 when he announced that he was investing $250 million in a Chinese electric car company.

I say stunned because Warren Buffett seemed to violate one of his own rules of investing: Invest in companies you understand.

He admitted that he doesn't know a thing about electric cars.

So why did he invest?

Because maybe, just maybe, he knows that electric cars are a guaranteed winner.

I'm not recommending GM, Nissan, or any other automobile stock that's developing electric cars. . .

Instead, I'm going to recommend the commodity that is vital to the battery technology that'll be used in electric cars: lithium.

My play is a tiny mining outfit called Western Lithium (WLC.V: WLCDF). The stock currently trades for about $1.08 a share.

If you're skeptical or concerned that fuel efficiency alone is not enough to entice Americans to buy electric cars, consider the Silicon Valley company Tesla Motors (pictured above). While their roadster is the first production automobile to use lithium-ion battery cells and travel more than 200 miles per charge, it is also capable of going from 0-60mph in under four seconds.

Not only will the Roadster leave most sports cars in the dust, the car recently set a distance record in April 2009 when it completed the 241-mile Rallye Monte Carlo d'Energies Alternatives with 36 miles left on the charge.

Even though the Roadster is probably too pricey for the average consumer at just over $100,000, Tesla has taken more than 1,000 reservations for the car and expects to begin production of an all-electric and more affordable sedan starting in late 2011.

But just remember, the Tesla — as well as every other electric car — needs lithium. And demand for lithium is skyrocketing.

Lithium prices have nearly tripled over the past decade with 22% compound annual growth since 2000 for use in laptops, cell phones, and other electronics.

Demand is expected to continue rising, the recent lithium mania has been ignited by the fact that electric cars require about 3,000 times the lithium needed for an average cell phone, or 100 times the lithium used in a computer battery.

This huge spike in demand should propel lithium prices much higher over the next few years.

The best way to profit from the lithium boom is Western Lithium, which owns the largest known lithium deposit in North America. Take a look. . .

According to a recent investment report:

The near surface lithium clay deposit is located in Nevada, USA and was initially discovered by the US Geological Survey and Chevron USA in the 1970's. Engineering work completed by Chevron, and later by the US Bureau of Mines in the 1980's, is now being advanced by Western Lithium.

The company's flagship Kings Valley property has a National Instrument 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes of lithium carbonate equivalent (LCE). The project has a well developed local infrastructure and Nevada has a long history in the metals and industrial mineral mining industry. The company plans a scoping study during Q3 of 2009, a pre-feasibility study with results from additional drilling during 2010 and projected production by 2013. A chart with the world's largest lithium deposits is below.

While brine is usually the cheapest to mine and process, followed by clay and then pegamite (hard rock), it really depends on the quality of the material and presence of contaminants. It can be cheaper to develop a good rock or clay than a low-quality brine. Access to roads and infrastructure also play important roles in a project's economic feasibility. Western Lithium has a clear advantage to competition in this regard as their clay deposit is touted as high-quality (99% commercial quality) and the project already has all of the necessary road access and infrastructure needed to begin construction and production.

Western Lithium is well-funded and debt free, with $7.3 million cash on the books. They recently completed a $5.5 million private placement in May of this year and have a market cap of 70 million.

Yes, the stock is up a lot this past year. . . but I believe the lithium bull market is just getting started.

I think we'll witness something similar to a uranium-style bull market that lasted several years.

I personally own Western Lithium around $1 per share. I will continue to add to my position on dips.

Profitably yours,

Brian

http://www.wealthdaily.com/articles/western-lithium-stock/19…

The Best Way To Profit from the Lithium Boom

By Brian Hicks

Wednesday, August 26th, 2009

Warren Buffett stunned the market back in September 2008 when he announced that he was investing $250 million in a Chinese electric car company.

I say stunned because Warren Buffett seemed to violate one of his own rules of investing: Invest in companies you understand.

He admitted that he doesn't know a thing about electric cars.

So why did he invest?

Because maybe, just maybe, he knows that electric cars are a guaranteed winner.

I'm not recommending GM, Nissan, or any other automobile stock that's developing electric cars. . .

Instead, I'm going to recommend the commodity that is vital to the battery technology that'll be used in electric cars: lithium.

My play is a tiny mining outfit called Western Lithium (WLC.V: WLCDF). The stock currently trades for about $1.08 a share.

If you're skeptical or concerned that fuel efficiency alone is not enough to entice Americans to buy electric cars, consider the Silicon Valley company Tesla Motors (pictured above). While their roadster is the first production automobile to use lithium-ion battery cells and travel more than 200 miles per charge, it is also capable of going from 0-60mph in under four seconds.

Not only will the Roadster leave most sports cars in the dust, the car recently set a distance record in April 2009 when it completed the 241-mile Rallye Monte Carlo d'Energies Alternatives with 36 miles left on the charge.

Even though the Roadster is probably too pricey for the average consumer at just over $100,000, Tesla has taken more than 1,000 reservations for the car and expects to begin production of an all-electric and more affordable sedan starting in late 2011.

But just remember, the Tesla — as well as every other electric car — needs lithium. And demand for lithium is skyrocketing.

Lithium prices have nearly tripled over the past decade with 22% compound annual growth since 2000 for use in laptops, cell phones, and other electronics.

Demand is expected to continue rising, the recent lithium mania has been ignited by the fact that electric cars require about 3,000 times the lithium needed for an average cell phone, or 100 times the lithium used in a computer battery.

This huge spike in demand should propel lithium prices much higher over the next few years.

The best way to profit from the lithium boom is Western Lithium, which owns the largest known lithium deposit in North America. Take a look. . .

According to a recent investment report:

The near surface lithium clay deposit is located in Nevada, USA and was initially discovered by the US Geological Survey and Chevron USA in the 1970's. Engineering work completed by Chevron, and later by the US Bureau of Mines in the 1980's, is now being advanced by Western Lithium.

The company's flagship Kings Valley property has a National Instrument 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes of lithium carbonate equivalent (LCE). The project has a well developed local infrastructure and Nevada has a long history in the metals and industrial mineral mining industry. The company plans a scoping study during Q3 of 2009, a pre-feasibility study with results from additional drilling during 2010 and projected production by 2013. A chart with the world's largest lithium deposits is below.

While brine is usually the cheapest to mine and process, followed by clay and then pegamite (hard rock), it really depends on the quality of the material and presence of contaminants. It can be cheaper to develop a good rock or clay than a low-quality brine. Access to roads and infrastructure also play important roles in a project's economic feasibility. Western Lithium has a clear advantage to competition in this regard as their clay deposit is touted as high-quality (99% commercial quality) and the project already has all of the necessary road access and infrastructure needed to begin construction and production.

Western Lithium is well-funded and debt free, with $7.3 million cash on the books. They recently completed a $5.5 million private placement in May of this year and have a market cap of 70 million.

Yes, the stock is up a lot this past year. . . but I believe the lithium bull market is just getting started.

I think we'll witness something similar to a uranium-style bull market that lasted several years.

I personally own Western Lithium around $1 per share. I will continue to add to my position on dips.

Profitably yours,

Brian

http://www.wealthdaily.com/articles/western-lithium-stock/19…

Lithium and Obama’s Electrification of America

Commodities / Metals & Mining

Aug 13, 2009 - 02:50 PM

By: Richard_Mills

http://www.marketoracle.co.uk/Article12722.html

Commodities / Metals & Mining

Aug 13, 2009 - 02:50 PM

By: Richard_Mills

http://www.marketoracle.co.uk/Article12722.html

HIGH TECH METAL

The rush for lithium is just beginning

With the anticipated huge growth in hybrid electric vehicles among others demand for lithium is expected to skyrocket.

Author: John Chadwick

Posted: Wednesday , 26 Aug 2009

LONDON -

Dan Gleeson writes in International Mining's September Leader on the growing importance of and interest in lithium, and, by association, Bolivia. In his latest newsletter, A Buck or Two, Tjalling (TJ) de Jong also reports on the different lithium plays. TJ writes, "A small number of countries produce lithium from either brines or concentrates, Chile being the largest producer. Argentina, Chile and Australia together accounted for about 82% of the total lithium production in 2008. Supply of lithium is dominated by production of lithium from brines SQM FMC lithium and Chemetall and the sole mineral producer Talison Minerals of Australia. China has been ramping up production since 2000 but as of 2008 supplies 8% to the lithium market." In just the past week alone we have heard from five lithium explorers.

The majority of known resources are in the Bolivian Altiplano which is thought to host around 50% of global lithium resources; yet the country is unwilling to give up this land without ensuring that it profits from it. President Evo Morales has already nationalised the country's oil and natural gas sectors and is being very protective over this valuable lithium resource - see: Bolivian Govt aims to become global kingpin of lithium

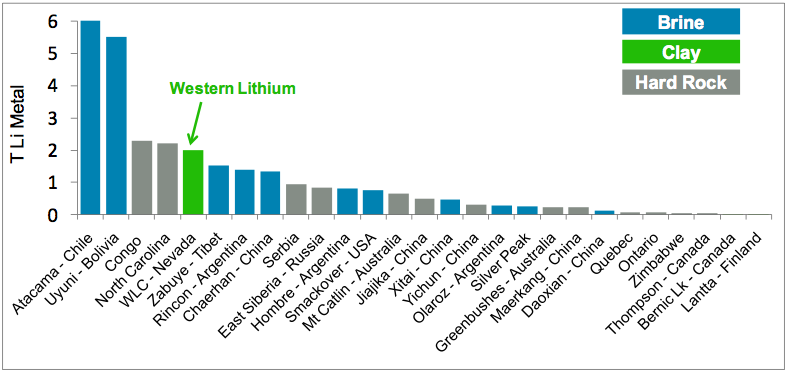

The main uses for lithium have been batteries, ceramics and lubricating greases. Demand is expected to grow significantly as auto makers begin to produce hybrid electric vehicles (HEV) and electric vehicles (EV). TJ says "Lithium Ion Batteries are the preferred method for electrifying these vehicles. World production has come from 13,000 t to about 22,800 t lithium in 2008." Japan, Korea and China already have national Lithium Ion Battery technology development programs. When David Pescod of Canaccord Capital touched base with TJ, and asked for some stock picks, he said he prefers the plays that are based on brine because of their huge cost advantage.

Galaxy Resources has signed agreements for financing of its lithium project with China's Creat Group, raising at least A$26 million for the company. In addition, Creat will provide Galaxy with 100% debt finance of around A$130 million for the purpose of developing both the Mt Cattlin spodumene (lithium/tantalum) and Jiangsu lithium carbonate projects.

Managing Director, Iggy Tan said "this deal provides us with a bedrock Chinese shareholder and enables us to move ahead with the development of both the Mt Cattlin spodumene and Jiangsu lithium carbonate projects."

Galaxy has completed a definitive feasibility study that suggests Mt Cattlin (Ravensthorpe, Western Australia) is commercially viable based on a processing rate of 1 Mt/y over a 15 year mine life. The company is planning to commence the development of the mine and the construction of the mineral processing plant in Q3, 2009 with first concentrate production scheduled for Q3, 2010.

The company has also commenced a prefeasibility study into the value adding downstream production of lithium carbonate (Li2CO3). Galaxy plans to establish a 17,000 t/y lithium carbonate plant in China due to lower associated capital and operating costs, as well as being close to the strategic growing battery markets in Asia.

Linear Metals is reactivating exploration on its road accessible, 100% owned, Seymour Lake lithium/tantalum/beryllium property located to the north of Lake Nipigon, near Armstrong, in north-western Ontario, Canada. Linear says "the project is being reactivated in response to rising prices for elements such as lithium and tantalum. Brian MacEachen, President & CEO: "Historic exploration on the large Seymour Lake property has returned some very exciting lithium grades. Incredibly, lithium has never been the primary focus or target of an exploration program and as such the true potential has yet to be tested. We are taking immediate steps to initiate a drill program that will specifically target lithium mineralisation at Seymour Lake."

Lithium One has announced the first results from its Phase 2 diamond drill program at the James Bay lithium project in Quebec, Canada. Consolidated Abaddon is in the process of staking high potential lithium prospects in North America. It is also "evaluating existing lithium prospects for possible joint venture or acquisition."

Ashburton Resources has signed an agreement to acquire a 100% interest in 37 mineral claims with known occurrences of lithium bearing springs and clays in Churchill and Pershing Counties, Nevada, USA. The claim block has historically showed total lithium contents ranging from 86 to 1,480 ppm from rock and soil samples in auger holes. Ashburton says "Chemetall-Foote Corp.'s Silver Peak operation, located in Clayton Valley [320 km] south of the property, is the only lithium brine producer in North America and has been in production since 1966."

Also in Nevada is Canada's Western Lithium where its flagship Kings Valley property has a NI 43-101 resource estimate for the initial stage of development and in total hosts a historically estimated 11 million tonnes of lithium carbonate equivalent (LCE). Stage 1 of what could be a huge project boasts an indicated resource of 48.1 million tonnes grading 0.27% lithium with a lithium carbonate equivalent (LCE) - 688,000 tonnes and 42.3 million tonnes grading 0.27% lithium (LCE - 606,000 tonnes) inferred. A scoping study is planned for completion during the current quarter and if all goes well the company is aiming for first production in 2013.