!!! GOLD - PREIS !!! Informationen und Gerüchte !!! - 500 Beiträge pro Seite (Seite 14)

eröffnet am 04.04.02 08:32:53 von

neuester Beitrag 19.06.06 19:53:59 von

neuester Beitrag 19.06.06 19:53:59 von

Beiträge: 9.079

ID: 573.644

ID: 573.644

Aufrufe heute: 2

Gesamt: 494.301

Gesamt: 494.301

Aktive User: 0

ISIN: XD0002747026 · WKN: CG3AB0 · Symbol: GLDUZ

2.389,26

USD

-0,05 %

-1,10 USD

Letzter Kurs 17.04.24 Citigroup

Neuigkeiten

| TitelBeiträge |

|---|

14:00 Uhr · wallstreetONLINE Redaktion |

17:12 Uhr · Christoph Geyer |

13:28 Uhr · Clickout Media Anzeige |

11:00 Uhr · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 74,01 | +99.999,00 | |

| 1,0000 | +53,85 | |

| 794,35 | +12,21 | |

| 0,5500 | +10,00 | |

| 232,30 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,7500 | -6,78 | |

| 52,80 | -6,99 | |

| 25,56 | -7,96 | |

| 2,3900 | -8,08 | |

| 0,6300 | -16,56 |

Der Goldpreis scheint sich heute wieder etwas zu erholen!

Noch mal in Euro... GD100 weiterhin markant.

Ja, Thailand ist billig und fundamental untermauert, sehe ich auch so, im Gegensatz zur USA sowieso, was sie bei einer Korrektur der Leitindizes relative Stärke zeigen lassen wird.

http://www.sharelynx.net/Charts/THAILANDlog.gif

Bis zur Bubble ist noch Platz.

Unter 1000 werde ich nicht verkaufen, aber das dauert noch

http://www.sharelynx.net/Charts/THAILANDlog.gif

Bis zur Bubble ist noch Platz.

Unter 1000 werde ich nicht verkaufen, aber das dauert noch

July 16 - Gold $342.90 up $1.10 - Silver $4.64 unchanged

The Bond Debacle

" target="_blank" rel="nofollow ugc noopener">"--- Thy princes have become companion of thieves.’ They hang thieves who have stolen a gulden or a half gulden, but trade with those who rob the whole world ---"

Martin Luther

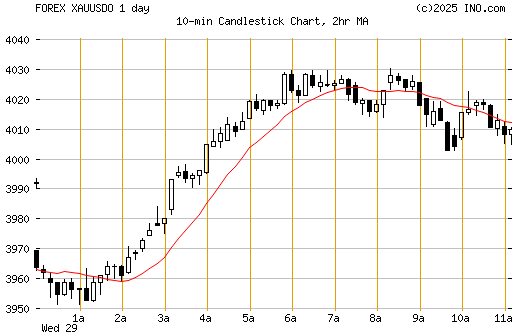

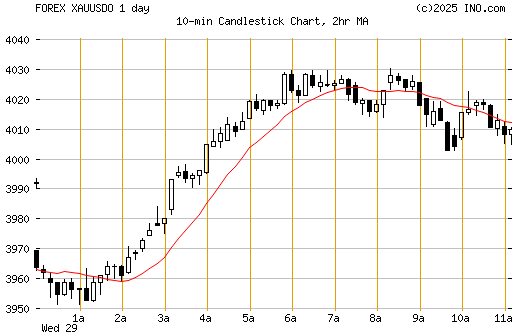

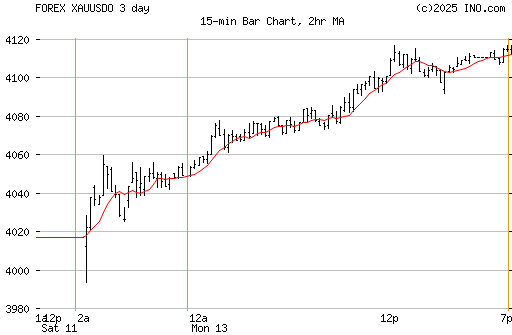

Gold held its 200-day moving average yesterday, cleaned out some stops below that average this morning, and then turned up for the rest of the session.

Gold’s tested bullish megaphone formation remains intact:

http://futures.tradingcharts.com/chart/GD/83

There was modest spec liquidation in gold and silver on the sell-off. Gold dropped 2861 contracts to 186,983. Silver fell 2153 contracts to 87,872.

Yesterday silver was trashed along with gold. We note once again that is often the case when gold is blasted. Conversely, silver is rarely allowed to soar when gold moves sharply higher. It’s sickening.

Something to keep an eye on:

Bill,

Dont know if you saw this on FNM..1.9 Billion loss on DERIVATIVES. Their loss on derivatives was bigger than their profit...an unexpected single day rise in bond rates of 0.25% must not be a great tonic for this toxic portfolio!

Cheers

Adrian

Fannie Mae Net Falls 25 Percent

http://biz.yahoo.com/rb/030715/financial_fanniemae_12.html

NEW YORK (Reuters) - Fannie Mae (NYSE:FNM - News), the largest U.S. mortgage financier, said on Tuesday its quarterly earnings fell 25 percent because derivatives it uses to hedge against interest rate swings lost $1.9 billion in market value…

-END-

GATA’s contention for years has been that one of the main reasons the gold price was rigged was to influence interest rates lower than they normally would be if gold was freely traded. Remember what former Treasury Secretary Lawrence Summers wrote in 1988 in his paper, Gibson’s Paradox and The Gold Standard:

" target="_blank" rel="nofollow ugc noopener">"gold prices in a free market should move inversely to real interest rates."

By manipulating the gold price and keeping it artificially low, the US government was able to keep interest rates lower and more stable than they should have been. In addition, fortunes were made by the various banks in on the gold/interest rate rig. It is GATA’s contention the gold rigging operations are directly linked to the astronomical build-up of interest rate derivatives at JP Morgan Chase. They are over $20 trillion, which is double the GNP of the US.

Besides long-term rates rising sharply, volatility has gone through the roof as rates have risen so quickly. Both of those conditions are anathema to many financial institutions and will create havoc. That havoc will be reflected in the financial markets in the months to come. The bond vigilantes have thrown a monkey wrench into the Fed/Treasury’s efforts to keep long term interest rates down.

Bottom line for gold as financial market turmoil kicks in the US: EXTREMELY BULLLISH! Can’t see the price staying down at these levels for much longer.

Most gold market commentary is off the mark. An example:

CBS MarketWatch.com

July 15, 2003

WASHINGTON (CBS.MW) -- Gold futures fell more than $5 an ounce Tuesday, with gold stocks faring even worse as many traders took Federal Reserve Chairman Alan Greenspan`s upbeat economic comments on Capitol Hill as a signal to sell.

The central banker, testifying about the state of the U.S. economy, said little to indicate he expects a return of inflation anytime soon, undercutting gold`s attractiveness as an inflation hedge.

The decline in gold coincided almost exactly with the release of Greenspan`s prepared testimony before the House Financial Services Committee…-END-

At least the reporter had the orchestrated selling of gold to begin Greenspan’s speech right.

www.lemetropolecafe.com

The John Brimelow Report

Wednesday, July 16, 2003

Lots of physical needed

Sorry for break in comments, due to Reuters problems.

Indian ex-duty premiums: AM $ 6.41, PM $6.53: with world gold at $342.10 and $342.80. High: ample for legal imports. The Indian news channels have a number of stories expressing satisfaction with the Monsoon and the local consumer spending boom: confidence seems high.

On Monday, the Istanbul weekly gold report spoke of heavy imports and surging activity last week: yesterday’s action guarantees the same thing this week.

TOCOM withstood an attempt to break gold down further, recovering from just below $341 in the late morning session. The attempt was serious: volume jumped 127% from Tuesday to the equivalent of 64,674 Comex lots. Ultimately world gold went out unchanged from NY at $341.10; the active contract fell 18 yen and open interest rose the equivalent of 535 Comex contracts. (NY yesterday traded 61,946 contracts; open interest fell 2,861 lots to 186,983 contracts: TOCOM open interest is the equivalent of 130,851 Comex lots.)

Viewed from the perspective of the South Carolina coast, there appears to have been yet another effort to break gold down by US-centric interests who do not follow the physical market closely. (It should be remembered that the Euro is not a good indicator for this, although many observers assume it is: the key buying markets lie outside the EU.) Based on the premiums, it will fail.

JB

www.lemetropolecafe.com

CARTEL CAPITULATION WATCH

At press time, a meager bond rally failed and they are trading lower again, even as the stock market sells off. Bonds were last at 111 28/32. The euro is slightly lower on the day.

GATA’s Mike Bolser:

Hi Bill:

The Fed added $6Billion to the repo pool but with a $9 Billion expiration the total funding available for futures buying fell to $26.25 Billion.

We now see the mid-phase of the DOW`s topping activity as shown buy the DOW`s 30-day moving average.

I wish to again point out the clear reduction in Fed repos which has preceded the DOW`s topping condition. If one were only looking at the DOW as is the practice of Elliot wave and Prechter followers, you could not have known about the principal driving forces of the Federal Reserve`s open market activities.

A great deal of thought and planning has gone into masking the true intent of the Fed with respect to their open market tactics and strategies. That strategy is coming into very clear focus this week. They want the DOW to fall. Today the DOW will finish down perhaps even by 85-90. That trend will continue through to Labor Day or until the DOW gets back to the 7,500 level.

Mike

More:

Below is a decent review of today`s Greenspan comments.

It should be noted that the prime reason for rigging the gold market in the first instance has been since 1994 the control and "safe" lowering of interest rates in order to construct the several bubbles.

Now that interest rates have broken sharply upwards the Fed`s real threat has risen from the dead. Continued hammering of the gold price as interest rates soar should, at some point, be judged as superfluous.

The real damage will come from 8% and up 30-year rates with the Fed Funds at 1%...perhaps by Labor Day [Using today`s upslope]. The very essence of a derivatives neutron explosion.

Mike

++++++++++++++++++++++++++++++++

Will Winter Come Early This Year ?

(SeattleSun) Jul 15, 22:21

The biggest economic news for the day was not a report but a speech by Greenspan to Congress. The event was not without controversy and a major amount of grandstanding. Greenspan touted the numerous ways he felt the economy was poised to recover and the panel pointed out the numerous things he had done wrong and why the plan would fail. It was not your regular "praise meeting" full of "we have the utmost respect for you" comments.Panel members continually pounded him with verbal assaults so severe that other members publicly apologized for their behavior. Yes, it is an election year and Alan was forced to be the fall guy for the reelection crowd.

Alan said the FOMC was prepared to make substantial additional rate cuts to keep the economy on track and to use other weapons at their disposal for a long time to come. Unfortunately nobody believed him. With the Fed funds rate at 1.00% he admitted that any additional rate cuts could hurt interest rate sensitive businesses like money market funds as well as destroy retirement investments for millions of people who depend on CDs and short term interest bearing accounts for income. Alan did not win any friends there and the bond junkies laughed behind his back at what they considered an obvious bluff.

He also shot himself in the foot on the threat to use other weapons after he closed the speech with "However, given the now highly stimulative stance of monetary and fiscal policy and well-anchored inflation expectations, the Committee concluded that economic fundamentals are such that situations requiring special policy actions are most unlikely to arise." If the situation is most unlikely to arise then the bond market promptly ignored it and rushed to sell their bonds. The Ten year sold off a full two points and the 30-year a full three points. Yields on the 30-year nearly hit 5% and the ten year hit 3.968%. The interest sensitive stocks got killed with home builders selling off substantially along with utilities. It was a rout as bonds hit three-month lows and gave no indications that anything was going to change. Suddenly the Fed`s carefully crafted plan to keep interest rates low simply disintegrated before their eyes. With refinancing applications falling -22% last week and rates soaring this week there could be an even bigger drop off ahead. The refi consumer as the pillar of the recovering economy has died. It is now time for the business community to step up to the table or the winter may begin early.

-END-

Chuck checks in last night:

Bill:

I have been looking through the day`s material and opinions that are on the net, and believe that today will mark the beginning of something huge. The most important event will be the rise in interest rates, for that will immediately attack and threaten the economic structure that has built up so much cheap lending to less than credit worthy customers. I still think that it is possible for a financial panic somewhere along the way of the massive sell off just ahead.

The world markets keep gapping up on a daily occurrence, but recently the Japanese market has been reversing most of the time which is a very ominous gesture. Soon, I would expect the rest of the markets to turn down. We are so technically weak here, it won`t take much to pull the proverbial plug on this nonsense.

I was looking at the gold decline from last year at this very time to see if we are possibly repeating that action. Since this is a once in history event, anything can happen over the short-term. The most logical action should be for gold to break under $340 here and finish off the selling by the, most likely, same people who panicked last year. But if the rates keep rising without a let up, then who knows. I hope we can enjoy this and not worry about the very short term moves in gold. An explosion is going to come out of this mess with the shorts adding the fuel to the break out.

Today was Chairman Al`s last taste of glory. From here on he will be greatly villified. Talk to you tomorrow. Relax. Chuck

The next day:

Bill:

I just read Bob Hoye`s blurb on the bond market. His belief is that we have ended the current decline in bond prices which would coincide with the dollar`s strength, from what I can tell. That might also explain the panic in the golds. Notice that they never even had a bounce. I still am amazed by this.

Chuck

The gold shares were mostly lower across the board with follow-through selling appearing after yesterday`s bashing. It was expected.

I am out of here for a few days. Off to San Diego to visit with family. Since I will be at the beach, at amusement parks with kids, etc, the MIDAS commentary will be brief. Will put it out when I can.

MIDAS

Appendix

Hi Bill,

Don`t know if you are aware that the Bank of Canada lowered the prime lending rate Tuesday by 1/4 of a percent when the recent employment figures were improving. The Bank of Canada move surprised analysts.

Greenspan talks up the U.S. economy and the Bank of Canada forces down the Canadian dollar on the same day. Even the brain dead can see that the central banks who are immune from criminal charges work in concert upsetting natural market equilibriums. It is not worthwhile for businesses and individuals to study the markets anymore with the aim of trying to make intelligent economic decisions for they cannot read the minds of the immune manipulators.

Through this insanity of market manipulations by central banks and governments those in the know (large institutions and a few individuals) profit vastly from advanced information of the manipulations. The

profitability of the trading rooms of these institutions bears the proof. These institutions profit vastly in another way too. The unpredictability of the timing of the manipulations forces companies and individuals to purchase expensive insurance against these bizarre movements and so they buy derivatives and engage in fancy and costly swaps which enrich financial institutions. This is just one more way the unproductive in society extract wealth from the productive.

Bill, we are witnessing first hand the dwindling spiral of a decaying empire played out over and over and over again throughout history, and it is always the SAME people who are destroying these once glorious societies - the SUPPRESSIVE FEW. Bill, the suppressive few are psychotic in the truest sense of the word. They must be restrained by

the decent human impulses of society or else we will lose this current society too. The decent human impulses build society up. The suppressive few tear society down. These two forces are always in conflict and the destructive forces of the suppressive few have always won out to date. For the first time in man`s long history the suppressive few are being challenged on a grand scale. For the first

time in man`s long history there is a chance for a dwindling spiral of destruction to be broken. But we are VERY far along that path of destruction and it will require many heroes to restrain the suppressive few and terminate the decline, then build up a civilization here on

earth...for the first time.

Bill, you and Chris Powell and Reg Howe and a few others earned your decent human impulse stripes long ago. Unfortunately, we still ask for your continued leadership.

Many are with you.

Regards,

Ron Lutka

www.lemetropolecafe.com

Wäre ich Goldbulle, dann würde ich genau jetzt Gold kaufen.

Ich bin ja keiner , hab mit aber mal mit Spielgeld die 237408 geholt.

, hab mit aber mal mit Spielgeld die 237408 geholt.

Ich bin ja keiner

, hab mit aber mal mit Spielgeld die 237408 geholt.

, hab mit aber mal mit Spielgeld die 237408 geholt.

http://www.phlx.com/news/XAU071503.pdf

MEMORANDUM

To: All Option Members, Member Organizations & ROPs

From: Regulatory Services Department

Subject: PHLX Gold & Silver SectorSM (XAU)SM

Date: July 15, 2003

The Philadelphia Stock Exchange, Inc. (PHLX) has determined to make the following changes to th

PHLX Gold & Silver SectorSM(XAU)SM, before the open of business on Monday, August 18, 2003

Additions Stock Symbols

Kinross Gold Corp. KGC

Durban Roodepoort Deep Ltd. DROOY

Deletions

Apex Silver Mines Limited SIL

As a result, the PHLX Gold & Silver SectorSM(XAU)SM will include the following 12 stocks effective Monday, August 18, 2003.

Agnico Eagle Mines Ltd AEM

Anglogold Ltd AU

Barrick Gold Corp. ABX

Durban Roodepoort Deep Ltd. DROOY

Freeport McMoran Copper Gold FCX

Gold Fields Ltd. GFI

Goldcorp, Inc. GG

Harmony Gold Mining Co. Ltd HMY

Kinross Gold Corp. KGC

Meridian Gold, Inc MDG

Newmont Mining Corporation NEM

Placer Dome, Inc. PDG

The new (XAU)SM Divisor will be announced on a separate release prior to the open of business on Monday, August 18, 2003.

Questions concerning this release should be directed to the Regulatory Serices Department

1-800-THE-PHLX, choice 2, or, (215) 496-6775.

MEMORANDUM

To: All Option Members, Member Organizations & ROPs

From: Regulatory Services Department

Subject: PHLX Gold & Silver SectorSM (XAU)SM

Date: July 15, 2003

The Philadelphia Stock Exchange, Inc. (PHLX) has determined to make the following changes to th

PHLX Gold & Silver SectorSM(XAU)SM, before the open of business on Monday, August 18, 2003

Additions Stock Symbols

Kinross Gold Corp. KGC

Durban Roodepoort Deep Ltd. DROOY

Deletions

Apex Silver Mines Limited SIL

As a result, the PHLX Gold & Silver SectorSM(XAU)SM will include the following 12 stocks effective Monday, August 18, 2003.

Agnico Eagle Mines Ltd AEM

Anglogold Ltd AU

Barrick Gold Corp. ABX

Durban Roodepoort Deep Ltd. DROOY

Freeport McMoran Copper Gold FCX

Gold Fields Ltd. GFI

Goldcorp, Inc. GG

Harmony Gold Mining Co. Ltd HMY

Kinross Gold Corp. KGC

Meridian Gold, Inc MDG

Newmont Mining Corporation NEM

Placer Dome, Inc. PDG

The new (XAU)SM Divisor will be announced on a separate release prior to the open of business on Monday, August 18, 2003.

Questions concerning this release should be directed to the Regulatory Serices Department

1-800-THE-PHLX, choice 2, or, (215) 496-6775.

@silverpwd

Keine schlechte Idee, aber vielleicht ein bisschen zu früh...

macvin

Keine schlechte Idee, aber vielleicht ein bisschen zu früh...

macvin

Mal schauen ob zu früh.

Dollar fällt, während Gold nicht mehr runter will.

Da ist ein Hauch von relative Stärke zu erkennen.

Dollar fällt, während Gold nicht mehr runter will.

Da ist ein Hauch von relative Stärke zu erkennen.

http://www.usagold.com

The Afternoon Gold Report...

by Jon Warner

July 17, 2003 (usagold.com)

NEW YORK:

New York spot gold settled higher at $344.20 an ounce, up $1.30 an ounce from yesterday’s close. In a late development South African gold miners set a strike deadline for July 27th. What effect this may have had on today’s gold market is unclear. Gold gained late in the session as Funds sold off early in the session only to have buyers appear. Some short covering emerged as well to buoy the price of gold even as the U.S. dollar rose against major currencies while bond and global equities markets dipped lower. Early in the session gold slipped lower on weak but “better than expected” economic data. "The funds came right out of the box as major sellers in gold, but the trade bought it all," said Leonard Kaplan, president of Prospector Asset Management. "We created a double-bottom and then rallied about $4 from there. The trade buying was strong and excellent all day." Kaplan said he pinpointed next chart resistance in August gold at $346 an ounce, followed by $350 and $352, with technical support lurking down at $340.60.

"Gold is reacting to the dollar right now -- stronger dollar, weaker gold," said Ian MacDonald, manager of precious metals trading at Commerzbank in New York. "Gold is bouncing right on the 200-day moving average, so I think the market, particularly funds, will be watching very closely to see if we will break (below that) today," MacDonald said. By mid-session traders regained their composure and gold traded higher. ``When the euro turned higher on the day, the gold market rallied,`` said Frank McGhee, head gold trader at Alliance Financial LLC in Chicago. ``When you see stocks falling, that adds to the support,`` he said. ``We bounced off the euro rally today,`` said Robert Gottlieb, head of precious-metals trading in New York for HSBC Holdings Plc. "Gold prices still have plenty of reasons for long-term support," said Todd Hultman, president of Dailyfutures.com, a commodity information provider. The Federal Reserve`s "low interest rate (weak dollar) policy has been and still is the No. 1 driver for higher gold prices," he said. The White House forecasts a $455 billion deficit this year and a $475 billion deficit next year and that`s also supportive for gold, he said. As a result, spot gold has good support at $340 per ounce with potential to trade above $400 by the end of 2004, Hultman said.

EUROPE:

London gold was fixed this afternoon at $342.50 an ounce, down from $344.60 an ounce at the morning fixing. Some analysts have kept a broadly positive outlook for gold further out with the market expected to see further gains related to a resumption of dollar weakness. They still maintain that optimism over economic recovery for the second half of this year is overblown. "We`ve seen the euro trying to push its way back convincingly through $1.12 this morning – it seems to be suffering a lack of steam because of the European stock markets being a little bit lower and that`s stalling gold before the $345.00 level," said Rory McVeigh of Mitsubishi. "I think there are a few people out there that want to push gold into more positive ground. Following on from Greenspan`s comments yesterday -- he was a bit of a doom and gloom merchant -- if people are going to run with that sentiment, then gold could move up this afternoon," he added. "Continued support between $338.00 and the 200-day moving average at $340.90 while resistance should be found around $346.00 (100-day moving average)," wrote James Moore of the BullionDesk.com.

"Gold really has all the hallmarks of a market trying to figure out where to go from here. I think it`s range trading -- we`re at the lower end of that," said Peter Hillyard, head of European metals sales at ANZ bank. "Broadly speaking between $338.00 and $342.00 you are in a good support area, while between 348.00 and 350.00 you are in good resistance - there`s just not a lot going on," he added. "I think a lack of physical or fundamental buying has allowed the market to go into retreat," said analyst Rhona O`Connell at the World Gold Council. "We saw a heavily traded period earlier this week and I think that has left the market `licking its wounds` today," she said. However, she said prices remain well supported for the moment, "holding just a touch above technical support levels," citing the 200 day moving average currently standing at 341.07 usd/oz.

The U.S. dollar was mixed against major currencies weakening against the Yen in spite of Bank of Japan currency market intervention and slightly lower against the Euro. "People are starting to take notice that the BoJ is not going away. Some were caught by surprise two nights ago and they are reluctant to get caught again," said Lee Ferridge, head of global currency strategy at Rabobank in London. "We`ve had comments from the U.S. commander in Iraq that the war is still going on and so it`s a dollar unfriendly picture in the morning," said Peter Fontaine, currency strategist at KBC in Brussels.

ASIA:

Earlier spot gold rose $2.40 in Hong Kong to $345.05. Traders said news that South Korea had exchanged machinegun fire with communist North Korea in the Demilitarised Zone -- the first such shooting since November 2001 -- failed to spark interest in safe-haven gold. Instead, the market focused on the dollar, which slipped from a two-month peak against the euro in the morning before recovering somewhat in range-bound trade. "I think maybe people still think there may be more long liquidation in the market," said William Leung, a dealer at Standard Bank London in Hong Kong. "They still feel it`s a little bit bearish, but yesterday it seemed to hold up quite well below $342, so at this level it`s very quiet. They`re still waiting to see what will happen."

" target="_blank" rel="nofollow ugc noopener">SOUTH AFRICAN GOLD MINER STRIKE SET:

South African mineworkers threatened the first nationwide strike in 16 years on Thursday after wage talks with gold and coal companies hit deadlock. Three of the world`s major bullion firms would be hit by the planned stoppage by more than 160,000 workers on July 27 in the world`s biggest gold producing country. Goldfields, the world`s fourth biggest gold miner, Harmony and South Deep would be affected, but global number two AngloGold would be exempted because their pay offers were "significant", a statement from the National Union of Mineworkers (NUM) said. The employers` umbrella organisation, the Chamber of Mines, said talks would continue and there was hope a strike could be averted.

GEOPOLITICAL NEWS:

The head of U.S. forces in Iraq said on Wednesday troops faced a classic guerrilla war as a grenade attack killed a U.S. soldier and attackers fired a surface-to-air missile at a military plane. The latest U.S. combat death brought the total to 147, equaling the toll in the 1991 Gulf War, and increased pressure on President Bush, who is under political fire over the spiraling cost of the war and accusations that he misled Americans into the war.

Hong Kong plunged deeper into crisis on Thursday after the resignation of two top ministers added fuel to demands for democratic change and put further pressure on leader Tung Chee-hwa. Markets were on edge after the resignations of deeply unpopular Security Secretary Regina Ip and Financial Secretary Antony Leung at a time of growing uncertainty over the government`s ability to revive the city`s ailing economy. Tung gave little explanation for the departures on Wednesday and did not name their successors. He flies to Beijing on Saturday where he is expected to report to his political masters on the city`s biggest political crisis in years, offer names of possible new cabinet members and outline plans on running the city despite massive protests.

Liberia`s capital Monrovia braced for the threat of a third rebel attack in two months on Thursday as calls mounted for the rapid deployment of peacekeepers to stave off more bloodshed. Rebels and government soldiers traded gunfire north of Monrovia Wednesday, eroding a shaky truce and underscoring the risk of more of the kinds of clashes in which hundreds were killed in the coastal city last month.

South Korea exchanged machinegun fire with communist North Korea on Thursday in the Demilitarized Zone, the divided peninsula`s heavily fortified frontier, the South`s Joint Chiefs of Staff said. The rare shooting -- the last was in November 2001 -- took place as the United States and China searched for a way to coax North Korea to enter talks on Pyongyang`s nuclear weapons aims. A U.S. official said the North may be ready to restart talks.

ECONOMIC NEWS:

The number of Americans filing new jobless claims fell a seasonally adjusted 29,000 last week, the government said on Thursday in a surprisingly upbeat report which nevertheless showed the U.S. jobs market was still soft. New claims for state unemployment insurance benefits for the July 12 week dropped to 412,000 from an upwardly revised 441,000 in the prior week, the Labor Department said. Analysts were expecting 425,000 new claims. Initial claims have been unable to punch below the critical 400,000 mark for 22 weeks, the longest run in more than a decade. Some analysts were not impressed with the data and said that while the jobless figure was positive, the level has been above 400,000 every week since Feb. 7. Overall, firms are still in a job-shedding rather than hiring mode, said Commerzbank in a research note, adding that unemployment, if it remains unchecked, would act as a real drag on current and future growth.

The Commerce Department said housing starts leaped 3.7 percent to a seasonally adjusted 1.803 million annual rate in June as home buyers scurried to take advantage of extremely low mortgage interest rates. The pace was the strongest since January`s 1.828 million rate. The housing report surprised analysts by its strength. Permits for new home construction rose to a 1.817 million annual rate, the fastest since December 2002. Permits for single-family dwellings posted a record annual pace of 1.421 million. However, mortgage rates have begun creeping back up from their June lows, a trend that should eventually begin to put a damper on the market.

The Federal Reserve Bank of Philadelphia said its index of factory business conditions rose to 8.3 in July from 4.0 in June, the second month of expansion and above economists` forecasts of a rise to 7.0. A reading above zero shows growth. New orders jumped to 10.4 from -0.5 and even employment showed marked improvement, climbing to plus 0.8 from -12.9. It was the first positive reading in 8 months and the highest since May 2002, suggesting a more positive reading on manufacturing jobs in the July payrolls report after two years of job losses in the sector.

Federal Reserve policymakers` forecasts for U.S. economic growth next year are way above the market consensus and the strongest since 1984, suggesting they are confident recent stimulus will light a fire under the moribund recovery. But economists caution the central bank has been over-optimistic in its forecasts throughout the entire downturn and pallid recovery, and as yet there are scant signs of the long-anticipated return to solid growth. The Fed`s central tendency forecast for 2004, compiled from estimates by the members of the policy-setting Federal Open Market Committee, put growth at 3.75 to 4.75 percent. "It looks to me like a stretch, really," said 4Cast chief economist Alan Ruskin, who thought the Fed would predict growth about 1.0 percent lower.

Comment:

The day after U.S. Federal Reserve chairman Alan Greenspan testified before Congress, bond prices plunged resulting in rapidly rising interest rates and increased borrowing costs that also carried over into the stock markets in the last three trading sessions. The equities markets continued to sink today in spite of a mixed bag of economic data, some that should be considered as positive news, however, digging deeper into the data there are still reasons for investors to be cautious. First time unemployment claims fell lower but remain well above the recessionary 400,000 level. Many are quick to point out that the “government inspired” number is statistically massaged and heavily skewed this week by a seasonality adjustment filter designed to account for the usually summer plant closures in the auto industry for maintenance and retooling. That did not occur as expected and therefore the first time claims number is actually higher. Not to mention that the previous week’s unemployment data was revised upward as always the case. Permits for housing construction soared as expected due to rising interest rates coming off of the lowest rates in decades. This may be a short-term event as many home buyers are quick to lock in low rates and make purchases now on fears that they “might miss out”.

In a late developing story South African gold miners set a deadline of July 27th for a strike at most of the country’s gold mines over wages. This may have some impact in the price of gold but the story appears to have broke after the New York trading session. Gold traded higher today after Funds sold off position only to be met by traders and speculators who covered short positions while investors digested the latest round of mixed economic data. The price of gold fell lower early in the New York session but finished the day higher supported by Fund buying, short covering by some speculators, strong physical demand, mixed economic data, a generally weak U.S. dollar, weaker bond and equities markets. Strong physical buying emerged out of the Middle East and India over the last several days. As the U.S. dollar strengthened foreign buyers came out to restock on gold supply as the price of gold pulled back.

With the likelihood of higher gold prices as physical demand heats up toward the end of summer, some retailers and fabricators are making purchases now in preparation for Asian festival and western holiday demand. Then there are the persistent rumors of continued physical gold and silver purchases by “deep pocketed” investors and Asian central banks who may be quietly accumulating and diversifying their holdings. Few of the “deep pockets” are talking openly though not long ago billionaire George Soros mentioned that he was buying gold as it was evident to him that the U.S. administration has abandoned the “strong dollar policy”. Asian central banks are known to be grossly overweight in U.S. dollars. Exchanging some of those dollars to diversify reserves into other currencies and precious metals as in the past would be a reasonable assumption and a common sense strategy.

- Jon H. Warner -

E-Mail the current report to a friend or to yourself.

__________________________

Jon Warner is a professional geologist with nearly 24 years in exploration and project development in both mining and petroleum. Mr. Warner brings to the table an impressive industry contact list, thorough knowledge of the precious metals and energy markets as well as a practical understanding of gold`s role in the private investment portfolio. His strong knowledge in these fields has been demonstrated at the USAGOLD Discussion Forum where he posts on a regular basis as Black Blade.

--------------------------------------------------------------------------------

We invite you to stay tuned to the gold market through our DISCUSSION FORUM

featuring round the clock gold news & commentary from the public.

--------------------------------------------------------------------------------

http://quote.bloomberg.com/apps/news?pid=10000081&sid=a2tpad…

Australia & New Zealand

Australian, N.Z. Currencies Tumble as Investors Buy Swiss Franc.

July 18 (Bloomberg) -- The Australian and New Zealand dollars tumbled as investors sold the currencies to buy the Swiss franc, traders said. The Swiss franc had the biggest gain of 16 major currencies against the dollar in New York yesterday.

The Australian dollar bought 64.62 U.S. cents at 8.40 a.m. Sydney time, compared with 65.64 cents yesterday. The New Zealand dollar bought 57.26 cents versus 58.39 cents late yesterday.

Last Updated: July 17, 2003 18:45 EDT

Gold $344.20 up $1.30 - Silver $4.66 up 2 cents

Morgan Stanley and Goldman Sachs Fail To Break Gold

The two most powerful warriors are patience and time.

- Leo Nikolaevich Tolstoy, 1828 – 1910

Back from San Diego’s Balboa Park to the relative solitude of the markets after spending the day with 4 youngsters ages 4 to 7. What a workout!

Was out of the loop today, but was told Morgan Stanley and Goldman Sachs tried to break down gold early, but when it held they both turned buyers with a vengeance. A surging physical market and strong technical support around the 200-day moving average proved too much for these stalwart Gold Cartel members.

Support for gold in the low $340’s is proving to be very formidable. The cabal took gold down to a low of $340.20 before sounding retreat.

With a retreating stock market and a bond market that refuses to rally much, even in an oversold condition, The Gold Cartel seems desperate to trash gold in order to calm down market observers concerning there is real trouble brewing behind the scenes. It is hard for me to visualize them succeeding, not with the gold fundamentals a “10+.”

This would be a real blow to the sorrowful crooks holding down the gold price:

“Mineweb headlines that 160,000 miners will strike. Says it has the story to be posted soon.”

Could not agree more on this one:

Bill,

This note on George Ure`s Urban Survival page caught my eye.....

" target="_blank" rel="nofollow ugc noopener">The ESF manipulations are increasingly ineffective in gold -- large quantities were leased July 7th (and bumped up rates) and failed to break gold into the 330`s. It is easy to see ESF foot prints in the market -- they drive up lease rates and try to bust the spot price shortly thereafter with their borrowing. The frequency of "capping" is increasing and the duration of effect is shortening. This is approaching the end of the gold pool game.

Best, Ron

Regards

Keith Whitehouse

www.lemetropolecafe.com

Auf dem Kitco Leasing Chart, sieht man schön den oben im Beitrag beschriebenen Anstieg der Gold Leasing Raten am 7. July für 1, 2, und 3 Monate.

Wozu das Gold Cabal dieses "ausgeliehene" Gold ab dem 7. July 2003 benutzt haben dürfte, das überlasse ich ganz Eurer eigenen Konbinationsgabe!

Gruss

ThaiGuru

Wenn man sich den Anstieg der Gold Leasing Rate, am 18. Juni 2003 im Kitco Chart ansieht, und mit dem Gold Preis "Verhalten" an diesem Tag vergleicht, sollte dem geneigten Leser eigentlich auch etwas bemerkenswertes auffallen.

Einen Tag vorher, am 17. Juni 2003 war der Gold Preis bis 365.- Dollar pro Unze gestiegen, und der Trend, auch Charttechnisch, zeigte wieder eine starke Tendenz weiter nach oben auszubrechen.

Der 26. Juni 2003, der Tag an dem die Lease Raten für Gold ebenfalls einen Spike anzeigen, lässt ebenfalls einiges erkennen, wenn man das Goldpreis "Verhalten" mit dem untenstehenden Gold Chart an diesem Tag vergleicht.

Ein Schelm, wer sich nichts böses dabei denkt!

Gruss

ThaiGuru

Einen Tag vorher, am 17. Juni 2003 war der Gold Preis bis 365.- Dollar pro Unze gestiegen, und der Trend, auch Charttechnisch, zeigte wieder eine starke Tendenz weiter nach oben auszubrechen.

Der 26. Juni 2003, der Tag an dem die Lease Raten für Gold ebenfalls einen Spike anzeigen, lässt ebenfalls einiges erkennen, wenn man das Goldpreis "Verhalten" mit dem untenstehenden Gold Chart an diesem Tag vergleicht.

Ein Schelm, wer sich nichts böses dabei denkt!

Gruss

ThaiGuru

@Thaiguru - A P P L A U S !

Es ist wie immer, alles nur eine Frage des Zeithorizonts.

Gruss Mic

Gruss Mic

Schau an, der Goldpreis soll mal wieder gewaltig fallen!

Hoffentlich!! Mit Nachkäufen hab ich keinerlei Probleme! Und wenn der mal wieder die berühmten 42 Dollar sieht (Zu diesem Mindestpreis ist die Fed verpflichtet Gold wieder vom Markt zu nehmen), miete ich mir halt einen Stapler und fahr damit zur Bank!!!!

...........................................

Was wird aus dem Washingtoner Goldabkommen ? – Von Herbst 2004 an kann eine physische Verkaufswelle drohen

(18.07.2003)

Am Goldmarkt wird es langsam für jene interessant, die längerfristig disponieren müssen oder wollen. Es geht um die Frage, ob und, wenn ja, wie das im September 1999 geschlossene Washingtoner Goldabkommen verlängert wird, wenn es im September 2004 ausläuft. Die Ortsbezeichnung Washington führt in die Irre. Auf das Abkommen haben sich 15 europäische Zentralbanken mit Rückendeckung ihrer jeweiligen Länder verständigt. Dass es in Washington geschlossen und bekanntgegeben wurde, war eher ein Zufall.

Sinn dieses Abkommens war und ist, die Goldabgaben der verkaufswilligen europäischen Zentralbanken zu begrenzen und zu koordinieren, um den seinerzeit vom niedrigen Goldpreis hart bedrängten Produzentenländern Luft zu verschaffen.

Hinter den Kulissen wird schon seit längerem darüber diskutiert, wie das Abkommen verlängert werden könnte. Dabei spielt der Umstand eine bedeutende Rolle, dass vor einiger Zeit auch die Deutsche Bundesbank, die bisher praktisch nichts aus ihren Reserven abgab, Verkaufsabsichten geäußert hat.

Wegen der misslichen Haushaltslage und der Verletzungen der Maastricht-Kriterien suchen mehr und mehr Regierungen in Europa nach Möglichkeiten, ihre Kassen zu füllen. Nicht alle von ihnen können ohne weiteres auf die Goldreserven ihrer Notenbanken zurückgreifen. Dafür wären, wie vor allem in Deutschland, Gesetzesänderungen erforderlich.

Der Bundesbank geht es nach Aussagen ihres Präsidenten Welteke nur darum, einen Teil ihrer "toten" Goldreserven in Erträge abwerfende Investments umzuwandeln. Der Staat bekäme im Falle von Verkäufen nach dem gegenwärtigen Gesetzesstand nichts.

Es kann sehr gut sein, dass politische Interessen und Einwirkungen eine Verlängerung oder eine Neuauflage des Washingtoner Goldabkommens verhindern. Dann allerdings würden wohl Dämme brechen, weil jede Zentralbank wieder nach eigenem Gusto Gold verkaufen und/oder ausleihen könnte.

Zusammen mit den bis zum Herbst 2004 gewiss stark nachlassenden Käufen der Goldproduzenten, mit denen sie ihre Sicherungs- und Vorausverkäufe (Hedge Books) abbauen, könnte sich daraus eine fundamentale Konstellation ergeben, die den Goldpreis massiv unter Druck setzen würde.

Dies ist und bleibt aber nur ein, wenn auch gewichtiger Aspekt für den Goldmarkt. Daher sollte er bei allen mittel- bis längerfristigen Überlegungen nicht vergessen werden.

Arnd Hildebrandt

Herausgeber

--------------------------------------------------------------------------------

Copyright 2003 Tauros GmbH - www.taurosweb.de

Hoffentlich!! Mit Nachkäufen hab ich keinerlei Probleme! Und wenn der mal wieder die berühmten 42 Dollar sieht (Zu diesem Mindestpreis ist die Fed verpflichtet Gold wieder vom Markt zu nehmen), miete ich mir halt einen Stapler und fahr damit zur Bank!!!!

...........................................

Was wird aus dem Washingtoner Goldabkommen ? – Von Herbst 2004 an kann eine physische Verkaufswelle drohen

(18.07.2003)

Am Goldmarkt wird es langsam für jene interessant, die längerfristig disponieren müssen oder wollen. Es geht um die Frage, ob und, wenn ja, wie das im September 1999 geschlossene Washingtoner Goldabkommen verlängert wird, wenn es im September 2004 ausläuft. Die Ortsbezeichnung Washington führt in die Irre. Auf das Abkommen haben sich 15 europäische Zentralbanken mit Rückendeckung ihrer jeweiligen Länder verständigt. Dass es in Washington geschlossen und bekanntgegeben wurde, war eher ein Zufall.

Sinn dieses Abkommens war und ist, die Goldabgaben der verkaufswilligen europäischen Zentralbanken zu begrenzen und zu koordinieren, um den seinerzeit vom niedrigen Goldpreis hart bedrängten Produzentenländern Luft zu verschaffen.

Hinter den Kulissen wird schon seit längerem darüber diskutiert, wie das Abkommen verlängert werden könnte. Dabei spielt der Umstand eine bedeutende Rolle, dass vor einiger Zeit auch die Deutsche Bundesbank, die bisher praktisch nichts aus ihren Reserven abgab, Verkaufsabsichten geäußert hat.

Wegen der misslichen Haushaltslage und der Verletzungen der Maastricht-Kriterien suchen mehr und mehr Regierungen in Europa nach Möglichkeiten, ihre Kassen zu füllen. Nicht alle von ihnen können ohne weiteres auf die Goldreserven ihrer Notenbanken zurückgreifen. Dafür wären, wie vor allem in Deutschland, Gesetzesänderungen erforderlich.

Der Bundesbank geht es nach Aussagen ihres Präsidenten Welteke nur darum, einen Teil ihrer "toten" Goldreserven in Erträge abwerfende Investments umzuwandeln. Der Staat bekäme im Falle von Verkäufen nach dem gegenwärtigen Gesetzesstand nichts.

Es kann sehr gut sein, dass politische Interessen und Einwirkungen eine Verlängerung oder eine Neuauflage des Washingtoner Goldabkommens verhindern. Dann allerdings würden wohl Dämme brechen, weil jede Zentralbank wieder nach eigenem Gusto Gold verkaufen und/oder ausleihen könnte.

Zusammen mit den bis zum Herbst 2004 gewiss stark nachlassenden Käufen der Goldproduzenten, mit denen sie ihre Sicherungs- und Vorausverkäufe (Hedge Books) abbauen, könnte sich daraus eine fundamentale Konstellation ergeben, die den Goldpreis massiv unter Druck setzen würde.

Dies ist und bleibt aber nur ein, wenn auch gewichtiger Aspekt für den Goldmarkt. Daher sollte er bei allen mittel- bis längerfristigen Überlegungen nicht vergessen werden.

Arnd Hildebrandt

Herausgeber

--------------------------------------------------------------------------------

Copyright 2003 Tauros GmbH - www.taurosweb.de

Einen überdurchschnittlichen Leasingrates Spike zeigt der Chart!

Wenn man die vorangegangenen Spikes, und das jeweils darauffolgende Goldpreis "Verhalten" als Kriterium verwendet, wird`s mir etwas flau in der Magengegend.

Entweder kommt das Gold Cabal an die benötigten "ausleih" Goldmengen nur sehr schwierig ran, oder sie haben soviel Gold ausgeliehen, um zu versuchen die Goldpreise nochmals unter die 330.- Dollar zu drücken.

Es könnte aber diesmal auch noch ein dritter, für uns Gold Bugs, sehr erfreulicher Grund sein, der die Gold Leasing (Miete) Rates heute regelrecht explodieren lässt.

Der drohende Generalstrike in Südafrika ab dem 27. July 2003!

Falls das Gold Cabal sich aus Sicherheitsgründen, wegen dem eventuell bevorstehenden Streik von 160000 Goldminen Arbeiter in Südafrika, sich mit physischem Gold eindecken muss, um ihre Lieferverpflichtungen im Falle eines Generalstreikes, und der damit sicherlich einhergehenden massiven Verknappung des physischen Goldes, zu überstehen.

Gold stieg ja wenigstens gerade auch wieder um 4.- Dollar pro Unze an.

Wenn man die vorangegangenen Spikes, und das jeweils darauffolgende Goldpreis "Verhalten" als Kriterium verwendet, wird`s mir etwas flau in der Magengegend.

Entweder kommt das Gold Cabal an die benötigten "ausleih" Goldmengen nur sehr schwierig ran, oder sie haben soviel Gold ausgeliehen, um zu versuchen die Goldpreise nochmals unter die 330.- Dollar zu drücken.

Es könnte aber diesmal auch noch ein dritter, für uns Gold Bugs, sehr erfreulicher Grund sein, der die Gold Leasing (Miete) Rates heute regelrecht explodieren lässt.

Der drohende Generalstrike in Südafrika ab dem 27. July 2003!

Falls das Gold Cabal sich aus Sicherheitsgründen, wegen dem eventuell bevorstehenden Streik von 160000 Goldminen Arbeiter in Südafrika, sich mit physischem Gold eindecken muss, um ihre Lieferverpflichtungen im Falle eines Generalstreikes, und der damit sicherlich einhergehenden massiven Verknappung des physischen Goldes, zu überstehen.

Gold stieg ja wenigstens gerade auch wieder um 4.- Dollar pro Unze an.

http://news.goldseek.com/Zealllc/1058550841.php

The NASDAQ Echo Bubble

By: Adam Hamilton, Zeal Research

Was wird aus dem Washingtoner Goldabkommen ? – Von Herbst 2004 an kann eine physische Verkaufswelle drohen

(18.07.2003)

Am Goldmarkt wird es langsam für jene interessant, die längerfristig disponieren müssen oder wollen. Es geht um die Frage, ob und, wenn ja, wie das im September 1999 geschlossene Washingtoner Goldabkommen verlängert wird, wenn es im September 2004 ausläuft. Die Ortsbezeichnung Washington führt in die Irre. Auf das Abkommen haben sich 15 europäische Zentralbanken mit Rückendeckung ihrer jeweiligen Länder verständigt. Dass es in Washington geschlossen und bekanntgegeben wurde, war eher ein Zufall.

Sinn dieses Abkommens war und ist, die Goldabgaben der verkaufswilligen europäischen Zentralbanken zu begrenzen und zu koordinieren, um den seinerzeit vom niedrigen Goldpreis hart bedrängten Produzentenländern Luft zu verschaffen.

Hinter den Kulissen wird schon seit längerem darüber diskutiert, wie das Abkommen verlängert werden könnte. Dabei spielt der Umstand eine bedeutende Rolle, dass vor einiger Zeit auch die Deutsche Bundesbank, die bisher praktisch nichts aus ihren Reserven abgab, Verkaufsabsichten geäußert hat.

Wegen der misslichen Haushaltslage und der Verletzungen der Maastricht-Kriterien suchen mehr und mehr Regierungen in Europa nach Möglichkeiten, ihre Kassen zu füllen. Nicht alle von ihnen können ohne weiteres auf die Goldreserven ihrer Notenbanken zurückgreifen. Dafür wären, wie vor allem in Deutschland, Gesetzesänderungen erforderlich.

Der Bundesbank geht es nach Aussagen ihres Präsidenten Welteke nur darum, einen Teil ihrer "toten" Goldreserven in Erträge abwerfende Investments umzuwandeln. Der Staat bekäme im Falle von Verkäufen nach dem gegenwärtigen Gesetzesstand nichts.

Es kann sehr gut sein, dass politische Interessen und Einwirkungen eine Verlängerung oder eine Neuauflage des Washingtoner Goldabkommens verhindern. Dann allerdings würden wohl Dämme brechen, weil jede Zentralbank wieder nach eigenem Gusto Gold verkaufen und/oder ausleihen könnte.

Zusammen mit den bis zum Herbst 2004 gewiss stark nachlassenden Käufen der Goldproduzenten, mit denen sie ihre Sicherungs- und Vorausverkäufe (Hedge Books) abbauen, könnte sich daraus eine fundamentale Konstellation ergeben, die den Goldpreis massiv unter Druck setzen würde.

Dies ist und bleibt aber nur ein, wenn auch gewichtiger Aspekt für den Goldmarkt. Daher sollte er bei allen mittel- bis längerfristigen Überlegungen nicht vergessen werden.

Arnd Hildebrandt

Herausgeber

(18.07.2003)

Am Goldmarkt wird es langsam für jene interessant, die längerfristig disponieren müssen oder wollen. Es geht um die Frage, ob und, wenn ja, wie das im September 1999 geschlossene Washingtoner Goldabkommen verlängert wird, wenn es im September 2004 ausläuft. Die Ortsbezeichnung Washington führt in die Irre. Auf das Abkommen haben sich 15 europäische Zentralbanken mit Rückendeckung ihrer jeweiligen Länder verständigt. Dass es in Washington geschlossen und bekanntgegeben wurde, war eher ein Zufall.

Sinn dieses Abkommens war und ist, die Goldabgaben der verkaufswilligen europäischen Zentralbanken zu begrenzen und zu koordinieren, um den seinerzeit vom niedrigen Goldpreis hart bedrängten Produzentenländern Luft zu verschaffen.

Hinter den Kulissen wird schon seit längerem darüber diskutiert, wie das Abkommen verlängert werden könnte. Dabei spielt der Umstand eine bedeutende Rolle, dass vor einiger Zeit auch die Deutsche Bundesbank, die bisher praktisch nichts aus ihren Reserven abgab, Verkaufsabsichten geäußert hat.

Wegen der misslichen Haushaltslage und der Verletzungen der Maastricht-Kriterien suchen mehr und mehr Regierungen in Europa nach Möglichkeiten, ihre Kassen zu füllen. Nicht alle von ihnen können ohne weiteres auf die Goldreserven ihrer Notenbanken zurückgreifen. Dafür wären, wie vor allem in Deutschland, Gesetzesänderungen erforderlich.

Der Bundesbank geht es nach Aussagen ihres Präsidenten Welteke nur darum, einen Teil ihrer "toten" Goldreserven in Erträge abwerfende Investments umzuwandeln. Der Staat bekäme im Falle von Verkäufen nach dem gegenwärtigen Gesetzesstand nichts.

Es kann sehr gut sein, dass politische Interessen und Einwirkungen eine Verlängerung oder eine Neuauflage des Washingtoner Goldabkommens verhindern. Dann allerdings würden wohl Dämme brechen, weil jede Zentralbank wieder nach eigenem Gusto Gold verkaufen und/oder ausleihen könnte.

Zusammen mit den bis zum Herbst 2004 gewiss stark nachlassenden Käufen der Goldproduzenten, mit denen sie ihre Sicherungs- und Vorausverkäufe (Hedge Books) abbauen, könnte sich daraus eine fundamentale Konstellation ergeben, die den Goldpreis massiv unter Druck setzen würde.

Dies ist und bleibt aber nur ein, wenn auch gewichtiger Aspekt für den Goldmarkt. Daher sollte er bei allen mittel- bis längerfristigen Überlegungen nicht vergessen werden.

Arnd Hildebrandt

Herausgeber

Aus dem Kitco Board von heute

Gold.........

is up in.......

Euro`s

Yen

Pounds

Swiss Francs

Dollars

Rands

Canadian Dollars

All of that fiat Schitt above is dropping

That Must mean Gold is Now MONEY

Gold.........

is up in.......

Euro`s

Yen

Pounds

Swiss Francs

Dollars

Rands

Canadian Dollars

All of that fiat Schitt above is dropping

That Must mean Gold is Now MONEY

Der Dollar macht wieder das, was er am besten kann!

Er fällt !!!

Er fällt !!!

http://www.usagold.com

The Afternoon Gold Report...

by Jon Warner

July 18, 2003 (usagold.com)

NEW YORK:

New York spot gold settled higher at $347.05 an ounce, up $2.85 an ounce from yesterday’s close. Fund buying and short covering came in at the close to boost gold higher ahead of the weekend as the U.S. dollar weakened slightly. Gold traded near unchanged Friday morning as dealers tracked choppy currency markets, market sources said. Gold mainly keyed off the U.S. dollar, which bounced up and down against the euro, without stronger recovery evidence from U.S. earnings and economic data, said one floor source. "August gold is flat. We`re teetering at key technical levels, and so long as the dollar stays firm, you probably stand a better than fair chance of testing that $341-$340 area," said AG Edwards commodities commentator James Quinn at the COMEX floor. "It`s a good day for the gold. It seems to be almost all euro-driven action today," said Tom Boustead, an analyst at Refco LLC in New York. "I think the ring was a bit short early on, but traders said a decent-sized order came in and helped pop it at the $345 level," he said. "It is a positive close because it is above the 100-day moving average" at $346.70, said Boustead. Pioneer Futures analyst Scott Meyers said most of the buying was by locals as summer conditions were thin. "It`s all dollar-driven, but it`s still stuck between $340 and $350."

Gold prices have settled into a trading range between $341 and $345 per ounce and "seem to be trading opposite of the U.S. dollar," said Robert Fuhrmann, an analyst at Myfuturesonline.com in Chicago. "We may be seeing some `investment` type buying of gold around the current price levels," he said. Still, "strength in the dollar, as well as a generally upbeat economic assessment by (Federal Reserve Chairman Alan) Greenspan is not making a very forceful case for traders to bid the price up yet," said Grady Garrett, chief trading strategist at EnergyTrendAlert.com, a commodity information provider.

EUROPE:

London gold was fixed this afternoon at $344.35 an ounce, up from $344.00 an ounce at the morning fixing. "Gold continues to trade unimaginatively between the 100-day and 200-day moving averages, and moves in between are still largely driven by the currencies," said analyst Rhona O`Connell at the World Gold Council. Analyst James Moore at TheBullionDesk.com said: "Support around the 338-41 usd/oz level continues to prove solid for now and the swings in the equity market and currency markets are likely to encourage fresh investor interest in gold`s safe haven qualities. "Scaled up selling ahead of the 100-day moving average at 345.80 (usd/oz) will offer strong resistance for now but the continued bargain hunter and physical buying are likely to push the yellow metal back towards the 360 usd (level) over the coming weeks," he added. "Swings in the equity market and currency markets are likely to encourage fresh investor interest in gold`s safe haven qualities," said Moore.

Some felt that gold`s failure this week to decisively fall through a key support level -- the 200-day moving average at $341 an ounce -- could see the market try to test higher levels in day`s ahead. Others were less convinced. "Funds have been known to bulldoze through such barriers before and with great effect," Standard Bank London said in a daily report. John Reade, metals analyst with UBS Investment Bank, said in his daily comment that although he was looking for higher gold prices in the second half of the year based on UBS`s expectations for further weakening in the dollar, short term weakness could not be ruled out. "We still favour a test of the downside in the near term as we expect that the metal can come under further selling pressure should the dollar remain perky," he wrote.

Analysts said the market has not reacted to a national strike threat by South Africa`s National Union of Mineworkers. The threat provides "only limited support" to prices, according to Barclays Capital analyst Ingrid Sternby. Analyst John Reade of UBS Investment Bank said there could be some impact if the strike really takes place and lasts longer than one or two weeks. Only three gold miners, Gold Fields, Harmony Gold Mining and South Deep are affected, and the strike will begin July 27, according to the union.

ASIA:

Earlier spot gold fell 80 cents in Hong Kong to $344.25. Gold traded in a narrow range supported by some short covering by Japanese investors ahead of a public holiday Monday. A day after an exchange of gunfire in the demilitarised zone between North and South Korea, traders said investors may also have been reminded of gold`s role as a safe haven in uncertain times, although most played down the dangers. "There`s been tension in Korea, so I think the Japanese don`t want to be too short over the weekend," said Greg Fan, a senior dealer at NM Rothschild in Hong Kong. "I think the North Koreans are just playing games. When they had that little fight yesterday, the market didn`t really react at all," he said.

The U.S. dollar gained ground by selling in yen against other currencies, including the euro and Swiss franc, as well as dollar demand in the run-up to commercial fixing. "I`ve heard that foreign players had placed huge buy orders in euro/yen yesterday and so the yen is keeping a bearish tone due to that," said Gen Kawabe, manager of the treasury department at Chuo Mitsui Trust and Banking. Another dealer said aggressive buying in the Swiss franc was seen as investors continued to unwind Swiss carry positions and shift out of high-yielding currencies. Traders remained wary of selling dollars on continued fears of BoJ currency intervention.

GEOPOLITICAL NEWS:

The number of U.S. soldiers killed in combat in Iraq surpassed the toll for the 1991 Gulf War on Friday when a serviceman was killed in a blast in the restive town of Falluja. His death was the 148th in combat since the war was launched nearly four months ago. A U.S. military spokeswoman said the soldier`s Humvee drove over an explosive device in the town 50 km (32 miles) west of Baghdad. There were 147 American fatalities in the 1991 war. The soldier was the latest victim in what U.S. officials say is a "guerrilla-style" war waged by supporters of Saddam Hussein who was toppled on April 9 in the U.S.-led war.

The Defense Department is considering calling up thousands of additional National Guard and Reserve troops in the coming months for service in Iraq, U.S. defense officials said on Thursday. The Pentagon said a total of about 201,000 National Guard and Reserve troops already are on active duty. The officials, speaking on condition of anonymity, said the use of additional National Guard and Reserve troops is in the mix of options now being weighed as the Pentagon devises a plan to bring long-serving troops home from Iraq and replace them with fresh ones while maintaining adequate troops levels. Officials said elements of Army divisions in Texas and Hawaii, Marine Corps troops, and reservists are being considered for service in Iraq in the coming months.

The United States faces a rapidly closing window of opportunity to create law and order in Iraq or face a possible descent into chaos, experts sent by the Pentagon to assess postwar reconstruction efforts said on Thursday. The team of five independent policy experts issued a report urging the Bush administration to secure greater international involvement in the reconstruction process and calling the U.S. civil administration leading the efforts "badly handicapped" by a business-as-usual approach during an urgent situation. The report said "the next three months are crucial to turning around the security situation, which is volatile in key parts of the country," but added that the United States needs to be prepared "to stay the course in Iraq for several years."

The head of the U.N. nuclear watchdog said Friday the biggest nuclear weapons threat at the moment was North Korea, though he said he was encouraged by China`s attempts to re-open talks with Pyongyang. International Atomic Energy Agency (IAEA) chief Mohamed ElBaradei also expressed concern over recent reports that North Korea had reprocessed all its 8,000 spent fuel rods to extract weapons-grade plutonium. "In my view, the situation in the DPRK (North Korea) is currently the most immediate and most serious threat to the nuclear non-proliferation regime," ElBaradei said in comments he made to a board of governors session on the IAEA`s budget. Also on Friday, U.N. inspectors found enriched uranium in environmental samples taken in Iran, which could mean Tehran has been enriching uranium without informing the U.N. nuclear watchdog. The diplomats said initial analysis showed enrichment levels possibly consistent with an attempt to make weapons-grade material and high enough to cause concern at the International Atomic Energy Agency (IAEA).

Eight Afghan government soldiers were killed on Friday in an attack by suspected members of the ousted Taliban regime in the southeastern province of Khost, a military official said. The soldiers were traveling in a four-wheel-drive vehicle near a market about 25 km (15 miles) east of Khost town when they came under attack. The soldiers were recruits to Afghanistan`s fledgling national army and served along the border with Pakistan. They had been shopping at the market.

ECONOMIC NEWS:

The Economic Cycle Research Institute, a private forecasting group, said its weekly leading index rose to 126.8 in the week ended of July 11, from a revised 124.9 the prior week. The index`s growth rate, an annualized rate for the four-week moving average that evens out weekly fluctuations, rose to 9.7 percent, its fastest growth rate since May 1987, from a revised 8.5 percent the previous week. An increase in money supply, including assets in mutual funds, and high levels of applications for mortgages to buy homes are the main forces behind the index`s increase, said Anirvan Banerji, director of research at ECRI in New York.

The pace of home mortgage refinancings, a crutch for the wobbly U.S. economy in recent years, likely will drop because of higher borrowing costs. Interest rates have trended higher in recent weeks on views the economy was improving. Remarks by Federal Reserve Chief Alan Greenspan on Tuesday predicting a hearty economic recovery briefly propelled 10-year Treasury note rates above 4 percent. The ensuing jump in rates has taken away the ability of many home owners to cut monthly mortgage payments and draw equity out of a home by refinancing. The Federal Reserve and the current and previous administrations have closely watched the rate of refinancings because this source of cash has been so important for the overall economy.

The University of Michigan`s preliminary consumer sentiment index, a widely followed measure of consumers` mood, rose to 90.3 in July from a final reading of 89.7 in June, market sources said. That was a touch higher than economists` forecasts for a reading of 90.0. The survey`s preliminary current conditions index, which tracks consumers` views about their present financial situation, jumped to 102.8 in July from 94.7 in June, market sources said. "All of the increase was due to a sharp rise in the current conditions index which probably occurred due to the implementation of the recent tax cut law," said Patrick Fearon, economist at A.G. Edwards & Sons in St. Louis, Missouri. "The Fed rate cut (in late June) probably was a help as well." A slip in the expectations index -- which measures attitudes about the 12 months ahead -- to 82.7 in July from 86.4 in June, may have been due to the rise in the June unemployment rate to 6.4 percent, reported on July 3. "Even people who are not laid off now could be getting concerned that they might be laid off down the road," Fearon said.

Comment:

Gold gained on some Fund buying and short-covering and at the close a fairly large buy order came into the market to send gold near the highs of the trading session. Though the name of the game is still the U.S. dollar as the key driver of the gold trade, investors appear to be looking toward the equities markets and economic data with more frequency. Over the last couple of days gold occasionally traded inline with the stronger U.S. dollar as the equities markets dipped on weak to mixed economic data. At some point investors will actually pay attention to economic data and the health of the economy as a driver for gold. Longer term the U.S. dollar will have to give way under the mounting pressure of soaring record setting current account, trade, and budget deficits. The combined soaring debt and weakness in the economy will make gold attractive for its “safe haven” qualities. Near term investors may want to keep an eye on developments in South Africa’s mining sector. The National Union of Mineworkers have set a strike deadline for July 27 that will effect operations at Gold Fields, Harmony Gold Mining and South Deep. Should the strike actually occur gold prices could find additional support in a market where physical metal demand outstrips actual physical metal supply.

Consumer spending is said to be two thirds of the economy and corporate expenditures have fallen off sharply in recent years. Even as consumers fret over rising unemployment and having suffered heavy losses in investments after the stock market mania imploded they kept spending by drawing equity out of their homes. The pace of home mortgage refinancings may fall off soon now that interest rates are rising. The bond market is coming under pressure on Wall Street sentiment that the economy is improving fueled by this week’s Humphrey-Hawkins testimony before Congress by Federal Reserve Chairman Alan Greenspan predicting an economic recovery. Shortly afterward the10-year Treasury note rate rose above 4 percent. The rise in interest rates have taken away the ability of home owners to cut monthly mortgage payments and draw equity out of a home by refinancing. As interest rates continue to rise fewer consumers will have the ability to keep spending and float the economy by increasing their debt. This source of cash has been very important for the overall economy. Rising interest rates will also likely put an end to the rush to buy real estate and could lead to a collapse of the housing market and ultimately lowering the value of real estate. Those who have adjustable mortgage interest rates will be hard pressed to keep spending as they struggle to keep the family home.

Meanwhile the U.S. dollar decline stalled and continues to hold up against major currencies despite a wide spread between European and U.S. interest rates, soaring deficits (current account, trade, and budget), and massive infusions of cash courtesy of the Federal Reserve. The U.S. dollar remains in a long-term decline though temporarily supported by currency market intervention (most notably under direction of Japanese monetary authorities at the Ministry of Finance).

The current “dollar strength” is unsustainable of course regardless of the recent U.S. administration’s public statements supporting the “strong dollar policy”. Billionaire hedge fund master George Soros recently explained that his interest in foreign currencies “and some gold” was due to the obvious fact that the “strong dollar policy” is unsupportable.

I agree. Should the Federal Reserve prove successful creating inflation in this “slow growth” economic environment the dollar must weaken and investors will do well to have hard assets such as precious metals in their investment portfolio.

- Jon H. Warner -

E-Mail the current report to a friend or to yourself.

__________________________

Jon Warner is a professional geologist with nearly 24 years in exploration and project development in both mining and petroleum. Mr. Warner brings to the table an impressive industry contact list, thorough knowledge of the precious metals and energy markets as well as a practical understanding of gold`s role in the private investment portfolio. His strong knowledge in these fields has been demonstrated at the USAGOLD Discussion Forum where he posts on a regular basis as Black Blade.

--------------------------------------------------------------------------------

We invite you to stay tuned to the gold market through our DISCUSSION FORUM

featuring round the clock gold news & commentary from the public.

--------------------------------------------------------------------------------

Die Engländer scheinen auch ihre grossen Probleme mit ihrem Altersvorsorge System zu haben!

Die Uhr tickt, nicht nur in den USA, und Deutschland!

Allen ein schönes Wochenende

wünscht

ThaiGuru

http://www.telegraph.co.uk/money/main.jhtml%3B$sessionid$HF3…

How big a pot of gold do you need?

(Filed: 19/07/2003)

With a pension crisis looming, you can avoid poverty in old age, but at a hefty price, says Ian Cowie

"How much is enough?" may sound like a question from a philosophy exam but the answer has practical applications for millions of people saving to fund retirement.

Members of money purchase company pensions have been able to see the impact on their funds of falling share prices and increased taxation for several years. Now members of final salary schemes have been warned the crisis is likely to affect them, too.

Aon Consulting, Britain`s biggest insurance broker, forecast this week:

" target="_blank" rel="nofollow ugc noopener">"Several million employees in final salary pension schemes may need to increase their contributions by a total of £1 billion a year."

One in five of the company schemes surveyed had already increased employee contributions from five per cent of salary to seven per cent, said Simon Martin of Aon, who added: "This is hard evidence that employees face a choice if they are to retire on an adequate pension; either they will need to work longer - or start paying more into their pensions now."

The good news is that Standard Life`s figures are not quite as daunting as they seem. For the sake of simplicity, the insurer assumes no other savings - but pensions are not the only way to save for retirement; indeed, property has been a better bet in recent years.

Another consideration is that the contributions expressed as a percentage of current earnings, calculated by Standard Life, do not include any employer`s contributions - and many firms still make substantial payments into occupational schemes.

That is important because the Inland Revenue maximum limits - which are lower than Standard Life`s recommendations in several instances - do not include employer`s contributions. "Net relevant earnings" for pension contribution purposes include all pay the typical employee receives - including overtime and benefits in kind, such as company cars and medical insurance - but exclude dividend income and redundancy pay.

Fortunately, there are some simple rules of thumb to guide you through the complexities. Adrian Boulding, of Legal & General, said: "Take the age at which you start saving for a pension, divide that by two, and the result is the percentage of your salary that you should save throughout your working life in a pension plan. This will produce a pension which, when added to your state pension entitlement, will replace about two thirds of your pre-retirement salary."

Similarly, if you wonder how much of your savings should be in shares - as opposed to bonds or deposits - you could do worse than be guided by Charles Kindleberger, the American economist who died earlier this month. He advised: "Subtract your age from 100 and that is the percentage you should have in equities."

William Sallitt, of Advisory & Brokerage Services, a London-based independent financial adviser, added: "The answer to the question: `how much should I save?` is as much as you can afford without making yourself miserable in the meantime.

" target="_blank" rel="nofollow ugc noopener">"Best of all, speak to someone in retirement and ask what they would have done, had they had their time again."

Pension forecasts specific to your age and when you hope to retire can be obtained online from the Financial Services Authority and the Association of British Insurers at www.pensioncalculator.org.uk

Die Uhr tickt, nicht nur in den USA, und Deutschland!

Allen ein schönes Wochenende

wünscht

ThaiGuru

http://www.telegraph.co.uk/money/main.jhtml%3B$sessionid$HF3…

How big a pot of gold do you need?

(Filed: 19/07/2003)

With a pension crisis looming, you can avoid poverty in old age, but at a hefty price, says Ian Cowie

"How much is enough?" may sound like a question from a philosophy exam but the answer has practical applications for millions of people saving to fund retirement.

Members of money purchase company pensions have been able to see the impact on their funds of falling share prices and increased taxation for several years. Now members of final salary schemes have been warned the crisis is likely to affect them, too.

Aon Consulting, Britain`s biggest insurance broker, forecast this week:

" target="_blank" rel="nofollow ugc noopener">"Several million employees in final salary pension schemes may need to increase their contributions by a total of £1 billion a year."

One in five of the company schemes surveyed had already increased employee contributions from five per cent of salary to seven per cent, said Simon Martin of Aon, who added: "This is hard evidence that employees face a choice if they are to retire on an adequate pension; either they will need to work longer - or start paying more into their pensions now."

The good news is that Standard Life`s figures are not quite as daunting as they seem. For the sake of simplicity, the insurer assumes no other savings - but pensions are not the only way to save for retirement; indeed, property has been a better bet in recent years.

Another consideration is that the contributions expressed as a percentage of current earnings, calculated by Standard Life, do not include any employer`s contributions - and many firms still make substantial payments into occupational schemes.

That is important because the Inland Revenue maximum limits - which are lower than Standard Life`s recommendations in several instances - do not include employer`s contributions. "Net relevant earnings" for pension contribution purposes include all pay the typical employee receives - including overtime and benefits in kind, such as company cars and medical insurance - but exclude dividend income and redundancy pay.

Fortunately, there are some simple rules of thumb to guide you through the complexities. Adrian Boulding, of Legal & General, said: "Take the age at which you start saving for a pension, divide that by two, and the result is the percentage of your salary that you should save throughout your working life in a pension plan. This will produce a pension which, when added to your state pension entitlement, will replace about two thirds of your pre-retirement salary."

Similarly, if you wonder how much of your savings should be in shares - as opposed to bonds or deposits - you could do worse than be guided by Charles Kindleberger, the American economist who died earlier this month. He advised: "Subtract your age from 100 and that is the percentage you should have in equities."

William Sallitt, of Advisory & Brokerage Services, a London-based independent financial adviser, added: "The answer to the question: `how much should I save?` is as much as you can afford without making yourself miserable in the meantime.

" target="_blank" rel="nofollow ugc noopener">"Best of all, speak to someone in retirement and ask what they would have done, had they had their time again."

Pension forecasts specific to your age and when you hope to retire can be obtained online from the Financial Services Authority and the Association of British Insurers at www.pensioncalculator.org.uk

Hi ,

wie seht ihr das in Posting #6475 beschriebene Szenario,

daß wenn das Washingtoner Abkommen nicht verlängert wird,

es zu massiven Verkäufen seitens der Zentralbanken kommt,

die den Goldpreis implodieren lasssen?

Wie wahrscheinlich ist es,daß das Abkommen nicht verlängert wird?

Gruss

wie seht ihr das in Posting #6475 beschriebene Szenario,

daß wenn das Washingtoner Abkommen nicht verlängert wird,

es zu massiven Verkäufen seitens der Zentralbanken kommt,

die den Goldpreis implodieren lasssen?

Wie wahrscheinlich ist es,daß das Abkommen nicht verlängert wird?

Gruss

Hat sich eigentlich schon mal jemand Gedanken gemacht, was Schulden eigentlich bedeuten?

- Zinsbelastung

- Rating

- Bankkrott

Ist das alles?

Auf Kredit konsumieren bedeutet ein in der Zukunft möglicher Konsum wird heute realisiert hab ich mal gelernt.

Für den Einzelnen sicher kein Problem, für kurze Zeit sicher auch nicht.

Aber wenn ganze Volkswirtschaften über Jahrzehnte hinweg auf Kredit konsumieren, haben sie quasi Ihre Zukunft verbraucht!