starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 10)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 2

Gesamt: 279.139

Gesamt: 279.139

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 52 Minuten | 3249 | |

| vor 57 Minuten | 2424 | |

| vor 1 Stunde | 2266 | |

| vor 58 Minuten | 2081 | |

| vor 1 Stunde | 1158 | |

| vor 1 Stunde | 903 | |

| gestern 20:51 | 760 | |

| vor 53 Minuten | 724 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.801,48 | +0,44 | 211 | |||

| 2. | 3. | 0,2260 | +7,62 | 108 | |||

| 3. | 2. | 0,3120 | +0,65 | 95 | |||

| 4. | 4. | 161,00 | +0,52 | 78 | |||

| 5. | 5. | 2,5630 | -0,10 | 61 | |||

| 6. | 7. | 6,8100 | +2,53 | 43 | |||

| 7. | 10. | 2.376,47 | +1,29 | 43 | |||

| 8. | 6. | 0,1651 | -0,60 | 39 |

Antwort auf Beitrag Nr.: 58.161.725 von Popeye82 am 07.07.18 20:11:12Lithium Americas

http://lithiumamericas.com/wp-content/uploads/2018/07/LAC-Th…

- Lithium Americas Corp.

Am 03.07.2018 veröffentlicht

A project update on the construction activity at the Cauchari-Olaroz lithium brine project in Jujuy, Argentina. Cauchari-Olaroz is owned by Minera Exar, a 50/50 joint venture between Lithium Americas and SQM. -

http://lithiumamericas.com/wp-content/uploads/2018/07/LAC-Th…

- Lithium Americas Corp.

Am 03.07.2018 veröffentlicht

A project update on the construction activity at the Cauchari-Olaroz lithium brine project in Jujuy, Argentina. Cauchari-Olaroz is owned by Minera Exar, a 50/50 joint venture between Lithium Americas and SQM. -

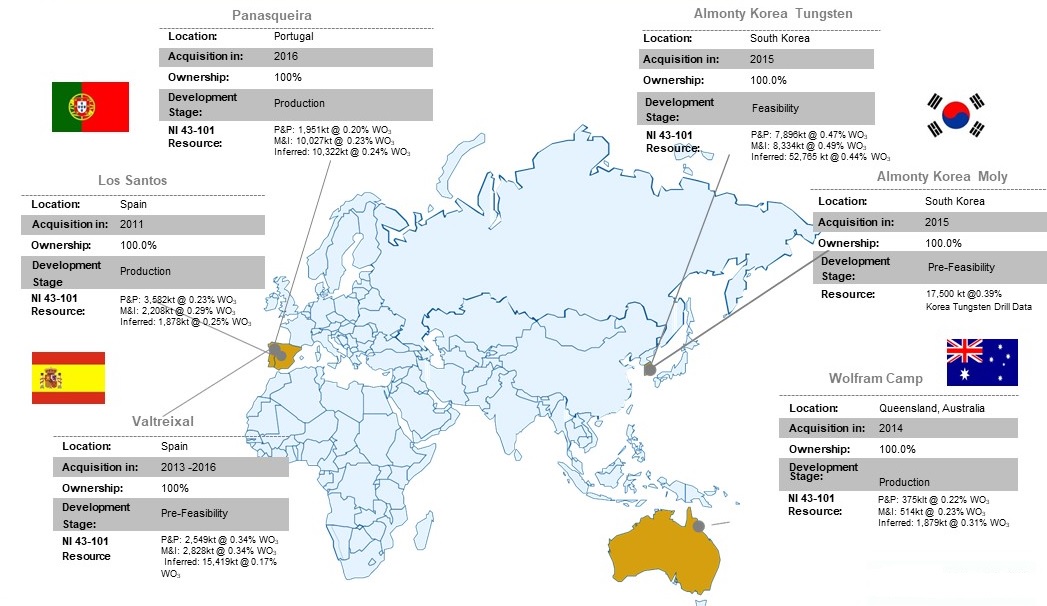

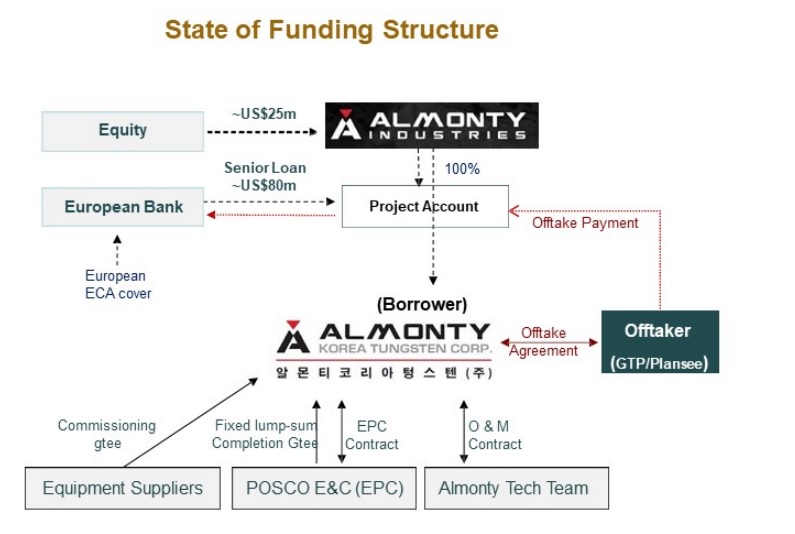

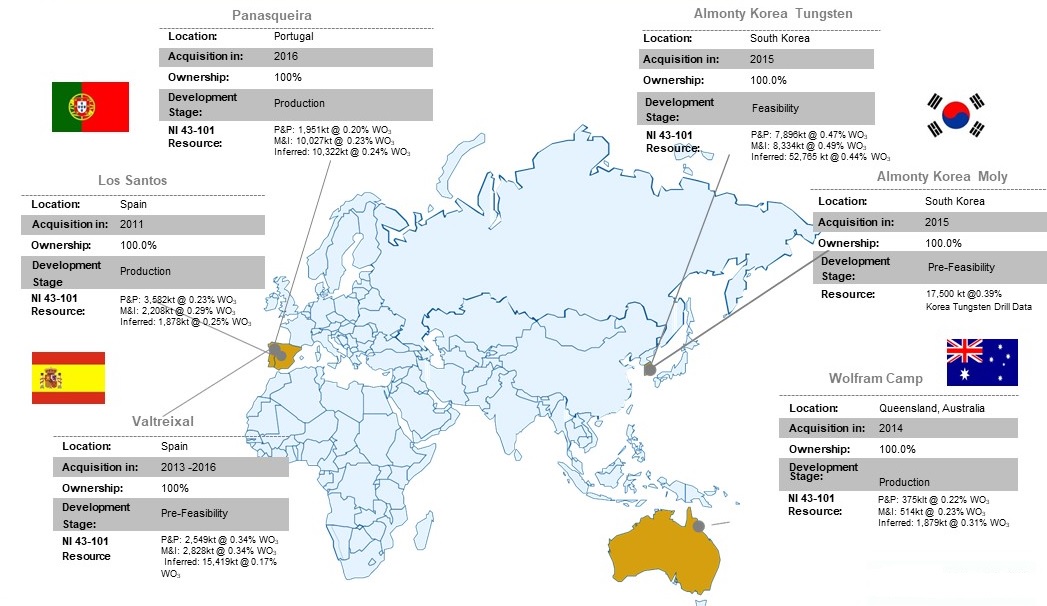

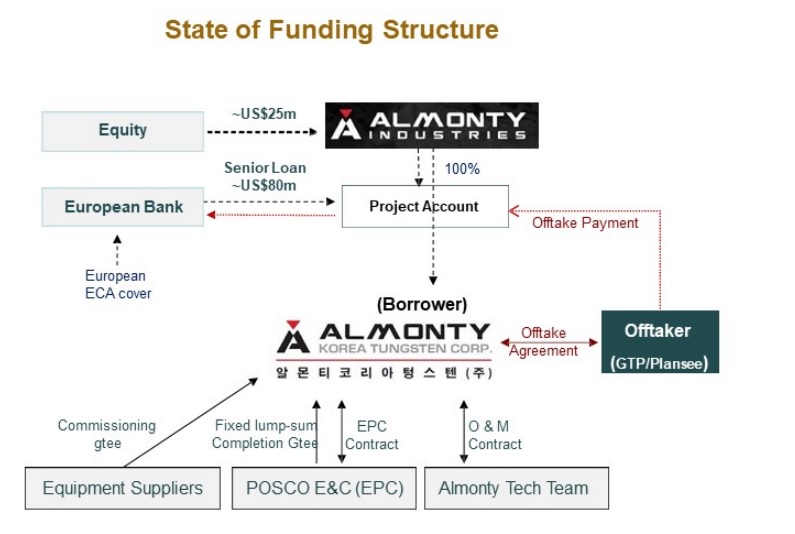

Antwort auf Beitrag Nr.: 58.159.070 von Popeye82 am 07.07.18 01:44:26Almonty Industries

http://www.caesarsreport.com/blog/almonty-industries-lists-o…

http://www.caesarsreport.com/blog/almonty-industries-lists-o…

Antwort auf Beitrag Nr.: 58.012.741 von Popeye82 am 18.06.18 21:53:42SRG Graphite

- Production of 50,200 tons of graphite concentrate per year over a 16-year mine life

- Capital costs of $105 million (“M’) including contingency of $15M

- Operational costs of $372/tonne (“t”) of concentrate and $130/t of transport

- Pre-tax NPV(8%) of $204M (post-tax NPV(8%) of $121M) at an average sales price of $1,328/t

- Finished grade of over 94% and up to 98% over all size fractions

- Strip ratio of 0.39

http://srggraphite.com/news/srg-positive-preliminary-economi…

http://www.met-chem.com/en/

http://www.draglobal.com/

http://srggraphite.com/news/srg-graphite-inc-announces-under…

"SRG: Positive Preliminary Economic Assessment and Resource Additions at Lola. Pre-tax IRR of 35% over a 16-year mine life

Montreal, Quebec, July 10, 2018 – SRG Graphite Inc. (TSXV: SRG) (“SRG” or the “Company”) is pleased to announce results of a Preliminary Economic Assessment study (“PEA”) for the development of its Lola graphite project in the Republic of Guinea, West Africa. The PEA was prepared by Montréal-based Met-Chem, a division of DRA Americas Inc. (“Met-Chem/DRA”). All dollar figures are in United States dollars.

Highlights of the Lola graphite PEA:

Production of 50,200 tons of graphite concentrate per year over a 16-year mine life

Capital costs of $105 million (“M’) including contingency of $15M

Operational costs of $372/tonne (“t”) of concentrate and $130/t of transport

Pre-tax NPV(8%) of $204M (post-tax NPV(8%) of $121M) at an average sales price of $1,328/t

Finished grade of over 94% and up to 98% over all size fractions

Strip ratio of 0.39

“These results highlight the value of the Lola graphite asset for the company” said Ugo Landry-Tolszczuk, President and Chief Operating Officer of SRG, “that said, the team will continue to work on improving the design and economics of the project. During our trade-off assessment work, we have found several key points of improvement to incorporate in the feasibility study. Early works which will contribute to the next stage in the development of the project is underway and we are dedicated to meeting our objectives for the year.”

The PEA follows the Mineral Resource Estimate published on June 18, 2018. A technical report detailing the PEA, and completed in accordance with National Instrument (NI) 43–101 guidelines, will be filed and available on SEDAR within 45 days from June 18, 2018, the release date of the mineral resource update published by the Company. Effective date of the estimate is June 14, 2018.

COMMERCIAL SALES, REVENUES & PROJECT ECONOMIC SENSITIVITIES

The Lola mine will produce an average of 50,200 tonnes of saleable graphite annually. At an average sale price of $1,328 per tonne, this represents $66.6M annual revenue. Given the volatility of graphite prices in recent years and the bilateral nature of sales contracts a sensitivity analysis of the project economics is presented below in Table 1.

Table 1 Project economics sensitivity analysis (pre-tax)

1 Base case

2 Does not include year 16 as it is not a full year

MINERAL RESOURCES UPDATE

The PEA was prepared using data from the Mineral Resource Estimate published on June 18, 2018, and including the latest drill campaign. To maximize the life of mine of the project, the PEA uses the resource at a cut-off grade of 1.64% graphitic carbon (“Cg”), which includes measured resources of 2.1 million tonnes (“Mt”) grading 4.31% Cg, indicated resources of 17.0Mt grading 4.39% Cg and inferred resources of 2.1Mt grading 4.79% Cg The resource has been pit-constrained at $1,300/t. Figure 1 depicts the resource locations on the deposit and represents approximately 30% of the deposit outline.

Figure 1 Map of the Deposit With Resource Classification

The mineral resources update was estimated as at June 14, 2018, in accordance with the definitions adopted by the Canadian Institute of Mining Metallurgy and Petroleum and incorporated into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Mineral resources estimate update for the Lola graphite project was carried out by Dr. Marc-Antoine Audet, P.Geo., Lead Geologist and SRG’s Qualified Person.

MINING

The Lola deposit is characterised by its saprolite surface mineralisation, which continues at depth into the fresh rock bed. For the PEA, mining operations were exclusively focused on the weathered zone, ensuring operation efficiency and competitive cost of operations. The first 30 metres of the deposit represent the weathered material. Constraining mining to the weathered portion of the deposit ensures minimal utilisation of blasting, and results in a strip ratio of only 0.39.

The average grade fed to the processing plant over the 16-year mine life is 4.43% Cg, and the total material mined per year is 1.8Mt (mineralised material and waste). Mining costs were established at 2.13$/t, considering preliminary pit design and access roads. Table 2 provides a summary of results.

Table 2 Mining highlights

Mining costs ($/t material mined) 2.13

Average graphite grade (% Cg) 4.43%

Stripping ratio (waste/mineralised) 0.39

Average graphite bearing material mined per year (t/y) 1,294,763

Average waste mined per year (t/y) 510 178

Mine of Life (years) 16 years

PROCESS

The processing plant and waste dump are located on a plateau, west of the main pit, where the land is already conveniently flat and barren of trees. It is currently less than one kilometre from the visual mineralisation. This proximity will ensure short cycle times and contribute to the control of production costs.

Efforts were made to keep a simple flowsheet with limited polishing and flotation stages. Concentrate grade higher than 94% Cg is expected, with a recovery of 79%. Reagents used for processing are diesel as a collector and methyl isobutyl carbinol (“MIBC”) as a frother, both commonly available and routinely used reagents in the graphite sector. The processing costs are $9.24/t of processed material resulting in $248/t of graphite concentrate produced. Table 3 provides a summary of results.

Table 3 Process highlights

Processing costs ($/t plant feed) 9.24

Processing costs ($/t concentrate) 248

Average concentrate grade (%Cg) >94%

Graphite plant recovery 79%

Average material fed to the plant (t/year) 1,294,763

Process description:

Mineralised material handling, crushing, scrubbing, grinding and de-sliming circuits were designed considering the saprolitic properties of the deposit. The relatively low competency of the material allows the design to use two mineral sizers at the front end instead of a jaw crusher or cone crusher. These processing units are known for their low operational cost and reliability compared with conventional jaw and cone crushers.

The crushed material is fed into a scrubber which promotes flake preservation and consumes less energy compared with conventional milling methods. The scrubber discharge is screened, where the coarse fraction is fed to a closed-circuit ball mill, before being recombined with the screen fines. The combined slurry is then fed through a de-sliming stage, where ultra-fines, including slime, clay and organic material are removed. This leads to an upgraded and cleaner material feeding the flotation circuit, resulting in an overall simpler flowsheet.

After de-sliming, the material is fed to the rougher flotation bank producing a rougher concentrate. A first polishing stage further liberate the graphite flakes. The polished rougher concentrate goes through a first cleaning stag and is then fed into a splitting screen, dividing the fine from the coarse graphite, in order to apply the relevant specific polishing energy to each stream. After their respective polishing and cleaning stages, the two streams are recombined, thickened, filtered and dried. The dried concentrate is then screened into four different size fractions before being bagged, and finally stored and shipped to clients. Figure 2 depicts the process flowsheet.

Figure 2 Process flowsheet

Quality Control and Assurance

Silvia Del Carpio, P.Eng., MBA Met-Chem/DRA., independent Qualified Person as defined by National Instrument 43-101, for the purposes of the PEA has reviewed the technical content of this press release. Raphaël Beaudoin P. Eng., Director of Operations and a Qualified Person for SRG has read and approved this press release.

Cautionary Note

The PEA completed for the Company is preliminary in nature and includes inferred mineral resources, considered too speculative in nature to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the resources development, production, and economic forecasts on which this PEA is based will be realized.

About Met-Chem/DRA

Met-Chem, a division of DRA Americas Inc., was originally established in 1969 as a consulting engineering company, headquartered in Montreal, and provides a wide range of technical and engineering services. Met-Chem is well recognized for its capabilities in mining, geology and mineral processing and has a talented team of engineering, technical and project management personnel with experience in North America, Latin America, Europe, West Africa and India. DRA is a multidisciplinary global engineering group that originated in South Africa and delivers mining, mineral processing, energy, water treatment and infrastructure services from concept to commissioning, as well as comprehensive operations and maintenance services for the mineral resources, water, agriculture and energy sectors. DRA has offices in Africa, Australia, Canada, China, India and the United States.

ABOUT SRG

SRG is a Canadian-based company focused on developing the Lola graphite deposit and the Gogota nickel-cobalt-scandium deposit, both located in the Republic of Guinea, West Africa. SRG is committed to operating in a socially, environmentally and ethically responsible manner.

For additional information, please visit SRG’s website at www.srggraphite.com.

For more information contact:

Ugo Landry-Tolszczuk

Tel: +1 (514) 679-4196

Email: ultolszczuk@srggraphite.com Benoit La Salle, FCPA FCA

Tel: +1 (514) 951-4411

Email: benoit.lasalle@srggraphite.com"

- Production of 50,200 tons of graphite concentrate per year over a 16-year mine life

- Capital costs of $105 million (“M’) including contingency of $15M

- Operational costs of $372/tonne (“t”) of concentrate and $130/t of transport

- Pre-tax NPV(8%) of $204M (post-tax NPV(8%) of $121M) at an average sales price of $1,328/t

- Finished grade of over 94% and up to 98% over all size fractions

- Strip ratio of 0.39

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://srggraphite.com/wp-content/uploads/2018/07/table1_2018-07-10-1024x488.jpg

[/url]http://srggraphite.com/news/srg-positive-preliminary-economi…

http://www.met-chem.com/en/

http://www.draglobal.com/

http://srggraphite.com/news/srg-graphite-inc-announces-under…

"SRG: Positive Preliminary Economic Assessment and Resource Additions at Lola. Pre-tax IRR of 35% over a 16-year mine life

Montreal, Quebec, July 10, 2018 – SRG Graphite Inc. (TSXV: SRG) (“SRG” or the “Company”) is pleased to announce results of a Preliminary Economic Assessment study (“PEA”) for the development of its Lola graphite project in the Republic of Guinea, West Africa. The PEA was prepared by Montréal-based Met-Chem, a division of DRA Americas Inc. (“Met-Chem/DRA”). All dollar figures are in United States dollars.

Highlights of the Lola graphite PEA:

Production of 50,200 tons of graphite concentrate per year over a 16-year mine life

Capital costs of $105 million (“M’) including contingency of $15M

Operational costs of $372/tonne (“t”) of concentrate and $130/t of transport

Pre-tax NPV(8%) of $204M (post-tax NPV(8%) of $121M) at an average sales price of $1,328/t

Finished grade of over 94% and up to 98% over all size fractions

Strip ratio of 0.39

“These results highlight the value of the Lola graphite asset for the company” said Ugo Landry-Tolszczuk, President and Chief Operating Officer of SRG, “that said, the team will continue to work on improving the design and economics of the project. During our trade-off assessment work, we have found several key points of improvement to incorporate in the feasibility study. Early works which will contribute to the next stage in the development of the project is underway and we are dedicated to meeting our objectives for the year.”

The PEA follows the Mineral Resource Estimate published on June 18, 2018. A technical report detailing the PEA, and completed in accordance with National Instrument (NI) 43–101 guidelines, will be filed and available on SEDAR within 45 days from June 18, 2018, the release date of the mineral resource update published by the Company. Effective date of the estimate is June 14, 2018.

COMMERCIAL SALES, REVENUES & PROJECT ECONOMIC SENSITIVITIES

The Lola mine will produce an average of 50,200 tonnes of saleable graphite annually. At an average sale price of $1,328 per tonne, this represents $66.6M annual revenue. Given the volatility of graphite prices in recent years and the bilateral nature of sales contracts a sensitivity analysis of the project economics is presented below in Table 1.

Table 1 Project economics sensitivity analysis (pre-tax)

1 Base case

2 Does not include year 16 as it is not a full year

MINERAL RESOURCES UPDATE

The PEA was prepared using data from the Mineral Resource Estimate published on June 18, 2018, and including the latest drill campaign. To maximize the life of mine of the project, the PEA uses the resource at a cut-off grade of 1.64% graphitic carbon (“Cg”), which includes measured resources of 2.1 million tonnes (“Mt”) grading 4.31% Cg, indicated resources of 17.0Mt grading 4.39% Cg and inferred resources of 2.1Mt grading 4.79% Cg The resource has been pit-constrained at $1,300/t. Figure 1 depicts the resource locations on the deposit and represents approximately 30% of the deposit outline.

Figure 1 Map of the Deposit With Resource Classification

The mineral resources update was estimated as at June 14, 2018, in accordance with the definitions adopted by the Canadian Institute of Mining Metallurgy and Petroleum and incorporated into National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Mineral resources estimate update for the Lola graphite project was carried out by Dr. Marc-Antoine Audet, P.Geo., Lead Geologist and SRG’s Qualified Person.

MINING

The Lola deposit is characterised by its saprolite surface mineralisation, which continues at depth into the fresh rock bed. For the PEA, mining operations were exclusively focused on the weathered zone, ensuring operation efficiency and competitive cost of operations. The first 30 metres of the deposit represent the weathered material. Constraining mining to the weathered portion of the deposit ensures minimal utilisation of blasting, and results in a strip ratio of only 0.39.

The average grade fed to the processing plant over the 16-year mine life is 4.43% Cg, and the total material mined per year is 1.8Mt (mineralised material and waste). Mining costs were established at 2.13$/t, considering preliminary pit design and access roads. Table 2 provides a summary of results.

Table 2 Mining highlights

Mining costs ($/t material mined) 2.13

Average graphite grade (% Cg) 4.43%

Stripping ratio (waste/mineralised) 0.39

Average graphite bearing material mined per year (t/y) 1,294,763

Average waste mined per year (t/y) 510 178

Mine of Life (years) 16 years

PROCESS

The processing plant and waste dump are located on a plateau, west of the main pit, where the land is already conveniently flat and barren of trees. It is currently less than one kilometre from the visual mineralisation. This proximity will ensure short cycle times and contribute to the control of production costs.

Efforts were made to keep a simple flowsheet with limited polishing and flotation stages. Concentrate grade higher than 94% Cg is expected, with a recovery of 79%. Reagents used for processing are diesel as a collector and methyl isobutyl carbinol (“MIBC”) as a frother, both commonly available and routinely used reagents in the graphite sector. The processing costs are $9.24/t of processed material resulting in $248/t of graphite concentrate produced. Table 3 provides a summary of results.

Table 3 Process highlights

Processing costs ($/t plant feed) 9.24

Processing costs ($/t concentrate) 248

Average concentrate grade (%Cg) >94%

Graphite plant recovery 79%

Average material fed to the plant (t/year) 1,294,763

Process description:

Mineralised material handling, crushing, scrubbing, grinding and de-sliming circuits were designed considering the saprolitic properties of the deposit. The relatively low competency of the material allows the design to use two mineral sizers at the front end instead of a jaw crusher or cone crusher. These processing units are known for their low operational cost and reliability compared with conventional jaw and cone crushers.

The crushed material is fed into a scrubber which promotes flake preservation and consumes less energy compared with conventional milling methods. The scrubber discharge is screened, where the coarse fraction is fed to a closed-circuit ball mill, before being recombined with the screen fines. The combined slurry is then fed through a de-sliming stage, where ultra-fines, including slime, clay and organic material are removed. This leads to an upgraded and cleaner material feeding the flotation circuit, resulting in an overall simpler flowsheet.

After de-sliming, the material is fed to the rougher flotation bank producing a rougher concentrate. A first polishing stage further liberate the graphite flakes. The polished rougher concentrate goes through a first cleaning stag and is then fed into a splitting screen, dividing the fine from the coarse graphite, in order to apply the relevant specific polishing energy to each stream. After their respective polishing and cleaning stages, the two streams are recombined, thickened, filtered and dried. The dried concentrate is then screened into four different size fractions before being bagged, and finally stored and shipped to clients. Figure 2 depicts the process flowsheet.

Figure 2 Process flowsheet

Quality Control and Assurance

Silvia Del Carpio, P.Eng., MBA Met-Chem/DRA., independent Qualified Person as defined by National Instrument 43-101, for the purposes of the PEA has reviewed the technical content of this press release. Raphaël Beaudoin P. Eng., Director of Operations and a Qualified Person for SRG has read and approved this press release.

Cautionary Note

The PEA completed for the Company is preliminary in nature and includes inferred mineral resources, considered too speculative in nature to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the resources development, production, and economic forecasts on which this PEA is based will be realized.

About Met-Chem/DRA

Met-Chem, a division of DRA Americas Inc., was originally established in 1969 as a consulting engineering company, headquartered in Montreal, and provides a wide range of technical and engineering services. Met-Chem is well recognized for its capabilities in mining, geology and mineral processing and has a talented team of engineering, technical and project management personnel with experience in North America, Latin America, Europe, West Africa and India. DRA is a multidisciplinary global engineering group that originated in South Africa and delivers mining, mineral processing, energy, water treatment and infrastructure services from concept to commissioning, as well as comprehensive operations and maintenance services for the mineral resources, water, agriculture and energy sectors. DRA has offices in Africa, Australia, Canada, China, India and the United States.

ABOUT SRG

SRG is a Canadian-based company focused on developing the Lola graphite deposit and the Gogota nickel-cobalt-scandium deposit, both located in the Republic of Guinea, West Africa. SRG is committed to operating in a socially, environmentally and ethically responsible manner.

For additional information, please visit SRG’s website at www.srggraphite.com.

For more information contact:

Ugo Landry-Tolszczuk

Tel: +1 (514) 679-4196

Email: ultolszczuk@srggraphite.com Benoit La Salle, FCPA FCA

Tel: +1 (514) 951-4411

Email: benoit.lasalle@srggraphite.com"

Antwort auf Beitrag Nr.: 58.215.809 von Popeye82 am 14.07.18 23:08:30SRG Graphite

https://deref-web-02.de/mail/client/J6I4k_lwJeQ/dereferrer/?…

https://deref-web-02.de/mail/client/J6I4k_lwJeQ/dereferrer/?…

Antwort auf Beitrag Nr.: 57.671.298 von Popeye82 am 01.05.18 18:49:19Reward Minerals

http://www.asx.com.au/asxpdf/20180713/pdf/43whgsw9fwsqmj.pdf

http://www.asx.com.au/asxpdf/20180713/pdf/43whgsw9fwsqmj.pdf

Antwort auf Beitrag Nr.: 56.524.040 von Popeye82 am 22.12.17 05:11:11Platina Resources

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.lachlan.nsw.gov.au/

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.outotec.com/

http://www.sgs.com.au/en-gb/mining

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.ausenco.com/

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.lachlan.nsw.gov.au/

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.outotec.com/

http://www.sgs.com.au/en-gb/mining

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

http://www.ausenco.com/

http://www.platinaresources.com.au/wp-content/uploads/2018/0…

Antwort auf Beitrag Nr.: 57.751.051 von Popeye82 am 14.05.18 01:14:22Vendetta Mining

http://vendettaminingcorp.com/wp-content/uploads/2018/07/201…

http://amcconsultants.com/

https://elysium.company/en/about

https://ca.linkedin.com/in/david-j-baker-mba-bec-ca-aus-8026…

http://www.gres.com.au/

http://www.klohn.com/

http://www.aarc.net.au/

http://vendettaminingcorp.com/wp-content/uploads/2018/07/201…

http://amcconsultants.com/

https://elysium.company/en/about

https://ca.linkedin.com/in/david-j-baker-mba-bec-ca-aus-8026…

http://www.gres.com.au/

http://www.klohn.com/

http://www.aarc.net.au/

Antwort auf Beitrag Nr.: 57.811.553 von Popeye82 am 23.05.18 03:38:06Aura Energy

https://stockhead.com.au/columnists/barry-fitzgerald-aura-mo…

http://www.auraenergy.com.au/investor/ASX%20Announcements/20…

https://stockhead.com.au/columnists/barry-fitzgerald-aura-mo…

http://www.auraenergy.com.au/investor/ASX%20Announcements/20…

Antwort auf Beitrag Nr.: 58.211.393 von Popeye82 am 13.07.18 21:48:33MGX Minerals/ZincNyx Energy Solutions

http://www.theglobeandmail.com/amp/business/commentary/artic…

http://www.zincnyx.com/

http://salientenergy.ca/

http://www.theglobeandmail.com/amp/business/commentary/artic…

http://www.zincnyx.com/

http://salientenergy.ca/

Antwort auf Beitrag Nr.: 58.068.529 von Popeye82 am 26.06.18 12:09:07Mayur Resources

http://www.investi.com.au/api/announcements/mrl/acb69002-c79…

https://geographic.org/geographic_names/name.php?uni=-304168…

http://www.mra.gov.pg/

http://www.nswports.com.au/ports-and-facilities/port-botany/

http://www.investi.com.au/api/announcements/mrl/acb69002-c79…

https://geographic.org/geographic_names/name.php?uni=-304168…

http://www.mra.gov.pg/

http://www.nswports.com.au/ports-and-facilities/port-botany/

Antwort auf Beitrag Nr.: 58.093.867 von Popeye82 am 29.06.18 06:14:51Orion Minerals NL

http://www.asx.com.au/asxpdf/20180716/pdf/43wjypwh8v30c0.pdf

http://www.asx.com.au/asxpdf/20180716/pdf/43wjypwh8v30c0.pdf

Antwort auf Beitrag Nr.: 58.165.904 von Popeye82 am 09.07.18 03:46:13MOD Resources

http://www.modresources.com.au/sites/default/files/asx-annou…

http://www.csaglobal.com/

http://www.modresources.com.au/sites/default/files/research_…

http://www.modresources.com.au/sites/default/files/asx-annou…

http://www.csaglobal.com/

http://www.modresources.com.au/sites/default/files/research_…

Antwort auf Beitrag Nr.: 58.182.818 von Popeye82 am 11.07.18 04:39:45Prospect Resources

http://www.prospectresources.com.au/sites/default/files/asx-…

http://www.prospectresources.com.au/sites/default/files/asx-…

Antwort auf Beitrag Nr.: 58.196.546 von Popeye82 am 12.07.18 13:03:34TNG

http://clients2.weblink.com.au/news/pdf_1%5C01999723.pdf

http://clients2.weblink.com.au/news/pdf_1%5C01999723.pdf

Antwort auf Beitrag Nr.: 58.022.326 von Popeye82 am 20.06.18 03:37:21Highfield Resources

http://www.highfieldresources.com.au/wp-content/uploads/site…

http://www.mapama.gob.es/en/

http://www.highfieldresources.com.au/wp-content/uploads/site…

http://www.mapama.gob.es/en/

Antwort auf Beitrag Nr.: 58.151.894 von Popeye82 am 06.07.18 10:38:07Condor Gold Plc

http://www.condorgold.com/sites/default/files/news/Condor%20…

http://wikiedit.org/Nicaragua/La-Cruz-De-La-India/2454741/

www.marena.gob.ni/

http://www.funides.com/

http://www.condorgold.com/sites/default/files/news/Condor%20…

http://wikiedit.org/Nicaragua/La-Cruz-De-La-India/2454741/

www.marena.gob.ni/

http://www.funides.com/

Antwort auf Beitrag Nr.: 57.688.611 von Popeye82 am 03.05.18 18:31:24Egan Street Resources

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.pcfcapital.com.au/

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.pcfcapital.com.au/

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

Antwort auf Beitrag Nr.: 58.200.410 von Popeye82 am 12.07.18 19:57:39Desert Lion Energy

http://desertlionenergy.com/desert-lion-energy-confirms-firs…

http://www.mining-journal.com/tag/jiangxi-jinhui-lithium/

http://desertlionenergy.com/desert-lion-energy-confirms-firs…

http://www.mining-journal.com/tag/jiangxi-jinhui-lithium/

Antwort auf Beitrag Nr.: 58.209.863 von Popeye82 am 13.07.18 18:06:08Kutcho Copper

https://caesarsreport.com/freereports/CaesarsReport_2018-07-…

https://caesarsreport.com/freereports/CaesarsReport_2018-07-…

Antwort auf Beitrag Nr.: 58.004.881 von Popeye82 am 17.06.18 19:37:20Trilogy Metals

https://trilogymetals.com/news/2018/trilogy-metals-reports-s…

https://trilogymetals.com/news/2018/trilogy-metals-reports-s…

Antwort auf Beitrag Nr.: 58.112.069 von Popeye82 am 02.07.18 06:01:17Cardinal Resources

http://www.cardinalresources.com.au/wp-content/uploads/2018/…

http://www.cardinalresources.com.au/wp-content/uploads/2018/…

Antwort auf Beitrag Nr.: 58.234.542 von Popeye82 am 17.07.18 17:32:09Kutcho ist schon ganz nett... für 19 Mios CAD.

CAPEX nicht ganz wenig, aber geht

CAPEX nicht ganz wenig, aber geht

Antwort auf Beitrag Nr.: 58.144.742 von Popeye82 am 05.07.18 14:35:13Piedmont Lithium

https://d1io3yog0oux5.cloudfront.net/_c568f5bccb5070fc50b2bc…

https://mrl.ies.ncsu.edu/

https://steinertglobal.com/

https://d1io3yog0oux5.cloudfront.net/_c568f5bccb5070fc50b2bc…

https://mrl.ies.ncsu.edu/

https://steinertglobal.com/

Antwort auf Beitrag Nr.: 58.158.416 von Popeye82 am 06.07.18 22:33:04Black Rock Mining

http://www.asx.com.au/asxpdf/20180717/pdf/43wlb6zq5dwdrg.pdf

http://www.indmin.com/Article/3818408/Graphite/China-opens-u…

http://www.miningreview.com/tanzania-wagging-dog-mining-act/

http://www.miningreview.com/srk-consulting-sa-mineral-explor…

http://www.proactiveinvestors.com.au/companies/news/200086/b…

http://www.asx.com.au/asxpdf/20180717/pdf/43wlb6zq5dwdrg.pdf

http://www.indmin.com/Article/3818408/Graphite/China-opens-u…

http://www.miningreview.com/tanzania-wagging-dog-mining-act/

http://www.miningreview.com/srk-consulting-sa-mineral-explor…

http://www.proactiveinvestors.com.au/companies/news/200086/b…

Antwort auf Beitrag Nr.: 58.184.795 von Popeye82 am 11.07.18 10:26:49Prophecy Development

http://www.prophecydev.com/prophecy-proposes-to-spin-off-van…

https://onlinexperiences.com/scripts/Server.nxp?LASCmd=AI:4;…

http://www.stockhouse.com/news/newswire/2018/07/10/the-solar…

"Prophecy Proposes to Spin Off Vanadium Royalty Co, to Finance Construction of Gibellini Vanadium Project

Vancouver, British Columbia, July 9, 2018 – Prophecy Development Corp. (“Prophecy” or “the Company”) (TSX:PCY, OTCQX:PRPCF, Frankfurt:1P2N) announces that it is engaged in discussions with advisors regarding spinning off a vanadium royalty and streaming company (“VRC”). It would be a means to provide investors with direct participation in vanadium mining royalties, streaming, and physical vanadium.

Under the proposed structure, Prophecy would incorporate VRC as a wholly owned subsidiary—subject to regulatory, shareholder, and other necessary approvals. VCR would receive a minority portion of the vanadium production by the Company’s Gibellini project in Nevada, USA. That project would have the target of starting production in 2021.

For each pound of vanadium pentoxide (“V2O5”) that Prophecy produces and delivers to VRC, VRC would pay Prophecy at a substantially discounted price. That price would be based on the European vanadium pentoxide price published by Metal Bulletin—or any alternative reference price agreed to by Prophecy and VRC.

In exchange for the discounted vanadium purchase price, VRC would make a cash prepayment to Prophecy. This would cover the capital cost of constructing the Gibellini project, prior to the Company’s receiving all the permits required to start the Gibellini mine construction. As announced in the Company’s May 29, 2018 news release, the Company estimates Gibellini’s capital cost to be approximately $116.8M, with a 25% contingency margin.

An equity financing is planned in conjunction with the proposed spinoff transaction whereby VRC shares would be distributed to Prophecy shareholders.

The above transaction and proposed terms would be contingent upon the securities of VRC being listed for trading on a Canadian public stock exchange.

Below is a summary of the preliminary economic assessment study (“PEA”) for the Gibellini project prepared by Amec Foster Wheeler E&C Services Inc. (“AMEC”), as announced in the May 29, 2018 press release:

Highlights of the PEA (after tax):

Internal rate of return 50.8%

Net present value (NPV) $338.3 million at 7% discount rate

Payback period 1.72 years

Average annual production 9.65 million lbs V2O5

Average V2O5 selling price $12.73 per lb

Operating cash cost $4.77 per lb V2O5

Initial capital cost including 25% contingency $116.76 million

Life of mine 13.5 years

The PEA is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The PEA was prepared under the direction of Kirk Hanson, P.E., Technical Director, Open Pit Mining for AMEC. Mr. Hanson is a “Qualified Person” for the purposes of National Instrument 43-101, and he is independent of Prophecy.

Sensitivity Analysis

After-tax NPV is over $568 million (7% discount) and after-tax IRR is 69% at the current vanadium price of $16.9/lb.

V2O5 price

change V2O5

price $/lb After-tax

IRR After-tax NPV

$M @ 7% After-tax

cashflow

$M

30% 16.55 69% 568.0 996.0

20% 15.28 63% 491.3 864.4

10% 14.00 57% 415.2 733.2

Base price 12.73 51% 338.3 600.4

-10% 11.46 44% 261.0 467.2

-20% 10.18 36% 183.1 333.2

-30% 8.91 26% 103.9 196.9

Having already filed its Management’s Plan of Operations with baseline studies, Prophecy’s targets are for Gibellini construction to start by mid 2020 and first vanadium delivery to occur by the end of 2021.

John Lee, Prophecy’s Executive Chairman, states:

“The price of vanadium pentoxide has risen from a low of $2.5/lb in 2016 (through $4.2/lb in 2017) to a 9-year high of $16.9/lb today. And we expect it to trade materially higher for the remainder of 2018 and well into 2019.

Due to a decade of underinvestment in vanadium mining, there will be no vanadium mines coming on stream in the next 3 years. And China, which accounts for 55% of the world’s vanadium production, is curtailing its vanadium export as domestic consumption for steel rebar, aerospace/defense, and vanadium batteries all are growing at high rates. There is no meaningful aboveground inventory. Chinese suppliers are reporting months-long back orders and so are not accepting new customers.

We are creating VRC for investors who want the opportunity to profit from the rising price of vanadium through owning an interest in near-term vanadium streaming and physical vanadium.

The Gibellini vanadium project is the most advanced stage vanadium project in North America. It has a 2021 target for first vanadium product delivery. A Gibellini vanadium streaming package tailored to VRC could offer returns superior to other, recently announced cobalt streaming transactions. Concurrently, Prophecy is shopping for physical vanadium from its established contacts who have confirmed availability.

Vanadium streaming has the potential of giving investors a cash flow upside when there are increases in mine production, vanadium price, and future mine reserves. And it caps the downside to a fixed, discounted purchase price throughout the life of the project.

Prophecy expects to benefit from this proposed spinoff transaction as VRC takes care of Gibelliini’s pre-production capital expenditure, while Prophecy maintains significant vanadium exposure through holding a majority portion of the future Gibellini production which is unhedged.

VRC will keep a lean corporate structure and look to being the leader in the vanadium streaming and physical vanadium space. It will do this by enlisting strategic equity investors, closing Gibellini streaming deals, and making its first purchase in physical vanadium.”

The Company expects to announce material updates on the proposed VRC spinoff transaction later this month.

All dollar amounts (“$”) are United States dollars.

QUALIFIED Person

The technical contents of this news release have been prepared under the supervision of Danniel Oosterman, VP, Exploration. Mr. Oosterman is not independent of the Company in that he is employed as a consultant to the Company and most of his income is derived from the Company. Mr. Oosterman is a Qualified Person as defined in NI 43-101.

About Prophecy

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Its main objective is to develop the Gibellini primary vanadium mining project in the Battle Mountain region in northeastern Nevada to production. Further information about Prophecy can be found at www.prophecydev.com.

PROPHECY DEVELOPMENT CORP.

ON BEHALF OF THE BOARD

“JOHN LEE”

Executive Chairman

For more information about Prophecy, please contact Investor Relations:

+1.888.513.6286

ir@prophecydev.com

www.prophecydev.com"

http://www.prophecydev.com/prophecy-proposes-to-spin-off-van…

https://onlinexperiences.com/scripts/Server.nxp?LASCmd=AI:4;…

http://www.stockhouse.com/news/newswire/2018/07/10/the-solar…

"Prophecy Proposes to Spin Off Vanadium Royalty Co, to Finance Construction of Gibellini Vanadium Project

Vancouver, British Columbia, July 9, 2018 – Prophecy Development Corp. (“Prophecy” or “the Company”) (TSX:PCY, OTCQX:PRPCF, Frankfurt:1P2N) announces that it is engaged in discussions with advisors regarding spinning off a vanadium royalty and streaming company (“VRC”). It would be a means to provide investors with direct participation in vanadium mining royalties, streaming, and physical vanadium.

Under the proposed structure, Prophecy would incorporate VRC as a wholly owned subsidiary—subject to regulatory, shareholder, and other necessary approvals. VCR would receive a minority portion of the vanadium production by the Company’s Gibellini project in Nevada, USA. That project would have the target of starting production in 2021.

For each pound of vanadium pentoxide (“V2O5”) that Prophecy produces and delivers to VRC, VRC would pay Prophecy at a substantially discounted price. That price would be based on the European vanadium pentoxide price published by Metal Bulletin—or any alternative reference price agreed to by Prophecy and VRC.

In exchange for the discounted vanadium purchase price, VRC would make a cash prepayment to Prophecy. This would cover the capital cost of constructing the Gibellini project, prior to the Company’s receiving all the permits required to start the Gibellini mine construction. As announced in the Company’s May 29, 2018 news release, the Company estimates Gibellini’s capital cost to be approximately $116.8M, with a 25% contingency margin.

An equity financing is planned in conjunction with the proposed spinoff transaction whereby VRC shares would be distributed to Prophecy shareholders.

The above transaction and proposed terms would be contingent upon the securities of VRC being listed for trading on a Canadian public stock exchange.

Below is a summary of the preliminary economic assessment study (“PEA”) for the Gibellini project prepared by Amec Foster Wheeler E&C Services Inc. (“AMEC”), as announced in the May 29, 2018 press release:

Highlights of the PEA (after tax):

Internal rate of return 50.8%

Net present value (NPV) $338.3 million at 7% discount rate

Payback period 1.72 years

Average annual production 9.65 million lbs V2O5

Average V2O5 selling price $12.73 per lb

Operating cash cost $4.77 per lb V2O5

Initial capital cost including 25% contingency $116.76 million

Life of mine 13.5 years

The PEA is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

The PEA was prepared under the direction of Kirk Hanson, P.E., Technical Director, Open Pit Mining for AMEC. Mr. Hanson is a “Qualified Person” for the purposes of National Instrument 43-101, and he is independent of Prophecy.

Sensitivity Analysis

After-tax NPV is over $568 million (7% discount) and after-tax IRR is 69% at the current vanadium price of $16.9/lb.

V2O5 price

change V2O5

price $/lb After-tax

IRR After-tax NPV

$M @ 7% After-tax

cashflow

$M

30% 16.55 69% 568.0 996.0

20% 15.28 63% 491.3 864.4

10% 14.00 57% 415.2 733.2

Base price 12.73 51% 338.3 600.4

-10% 11.46 44% 261.0 467.2

-20% 10.18 36% 183.1 333.2

-30% 8.91 26% 103.9 196.9

Having already filed its Management’s Plan of Operations with baseline studies, Prophecy’s targets are for Gibellini construction to start by mid 2020 and first vanadium delivery to occur by the end of 2021.

John Lee, Prophecy’s Executive Chairman, states:

“The price of vanadium pentoxide has risen from a low of $2.5/lb in 2016 (through $4.2/lb in 2017) to a 9-year high of $16.9/lb today. And we expect it to trade materially higher for the remainder of 2018 and well into 2019.

Due to a decade of underinvestment in vanadium mining, there will be no vanadium mines coming on stream in the next 3 years. And China, which accounts for 55% of the world’s vanadium production, is curtailing its vanadium export as domestic consumption for steel rebar, aerospace/defense, and vanadium batteries all are growing at high rates. There is no meaningful aboveground inventory. Chinese suppliers are reporting months-long back orders and so are not accepting new customers.

We are creating VRC for investors who want the opportunity to profit from the rising price of vanadium through owning an interest in near-term vanadium streaming and physical vanadium.

The Gibellini vanadium project is the most advanced stage vanadium project in North America. It has a 2021 target for first vanadium product delivery. A Gibellini vanadium streaming package tailored to VRC could offer returns superior to other, recently announced cobalt streaming transactions. Concurrently, Prophecy is shopping for physical vanadium from its established contacts who have confirmed availability.

Vanadium streaming has the potential of giving investors a cash flow upside when there are increases in mine production, vanadium price, and future mine reserves. And it caps the downside to a fixed, discounted purchase price throughout the life of the project.

Prophecy expects to benefit from this proposed spinoff transaction as VRC takes care of Gibelliini’s pre-production capital expenditure, while Prophecy maintains significant vanadium exposure through holding a majority portion of the future Gibellini production which is unhedged.

VRC will keep a lean corporate structure and look to being the leader in the vanadium streaming and physical vanadium space. It will do this by enlisting strategic equity investors, closing Gibellini streaming deals, and making its first purchase in physical vanadium.”

The Company expects to announce material updates on the proposed VRC spinoff transaction later this month.

All dollar amounts (“$”) are United States dollars.

QUALIFIED Person

The technical contents of this news release have been prepared under the supervision of Danniel Oosterman, VP, Exploration. Mr. Oosterman is not independent of the Company in that he is employed as a consultant to the Company and most of his income is derived from the Company. Mr. Oosterman is a Qualified Person as defined in NI 43-101.

About Prophecy

Prophecy Development Corp. is a Canadian public company listed on the Toronto Stock Exchange. Its main objective is to develop the Gibellini primary vanadium mining project in the Battle Mountain region in northeastern Nevada to production. Further information about Prophecy can be found at www.prophecydev.com.

PROPHECY DEVELOPMENT CORP.

ON BEHALF OF THE BOARD

“JOHN LEE”

Executive Chairman

For more information about Prophecy, please contact Investor Relations:

+1.888.513.6286

ir@prophecydev.com

www.prophecydev.com"

Antwort auf Beitrag Nr.: 57.662.013 von Popeye82 am 30.04.18 13:41:39ONE of the best exploration packages, on the planet

Vimy Resources

http://clients3.weblink.com.au/pdf/VMY/01999970.pdf

http://clients3.weblink.com.au/pdf/VMY/01989847.pdf

http://clients3.weblink.com.au/pdf/VMY/01988268.pdf

http://www.vimyresources.com.au/index.php/investor-relations…

Vimy Resources

http://clients3.weblink.com.au/pdf/VMY/01999970.pdf

http://clients3.weblink.com.au/pdf/VMY/01989847.pdf

http://clients3.weblink.com.au/pdf/VMY/01988268.pdf

http://www.vimyresources.com.au/index.php/investor-relations…

Antwort auf Beitrag Nr.: 57.740.710 von Popeye82 am 11.05.18 13:58:24Dome Gold Mines

http://clients2.weblink.com.au/news/pdf_2%5C01990794.pdf

http://clients2.weblink.com.au/news/pdf_2%5C01990794.pdf

Antwort auf Beitrag Nr.: 58.220.028 von Popeye82 am 16.07.18 04:05:50MOD Resources

http://www.modresources.com.au/sites/default/files/asx-annou…

http://www.metaltigerplc.com/

http://www.modresources.com.au/sites/default/files/asx-annou…

http://www.metaltigerplc.com/

Antwort auf Beitrag Nr.: 58.220.034 von Popeye82 am 16.07.18 04:18:49Prospect Resources

https://stockhead.com.au/resources/these-asx-explorers-are-c…

https://stockhead.com.au/resources/these-asx-explorers-are-c…

Antwort auf Beitrag Nr.: 58.173.161 von Popeye82 am 09.07.18 22:01:40Savannah Resources Plc

http://www.savannahresources.com/cms/wp-content/uploads/2018…

http://www.savannahresources.com/cms/wp-content/uploads/2018…

Antwort auf Beitrag Nr.: 58.142.924 von Popeye82 am 05.07.18 11:33:35Birimian

http://birimian.com/pdfs/2018PFSRoadshowPresentation18Jul18.…

http://birimian.com/pdfs/2018PFSRoadshowPresentation18Jul18.…

Antwort auf Beitrag Nr.: 58.031.125 von Popeye82 am 21.06.18 03:40:44Celsius Resources

https://twitter.com/BrendanBorg/status/1019465801823182849?r…

https://twitter.com/BrendanBorg/status/1019465801823182849?r…

Antwort auf Beitrag Nr.: 58.143.767 von Popeye82 am 05.07.18 13:01:57Tando Resources

http://www.tandoresources.com.au/sites/default/files/asx-ann…

http://www.tandoresources.com.au/sites/default/files/asx-ann…

Antwort auf Beitrag Nr.: 58.220.067 von Popeye82 am 16.07.18 05:12:12MGX Minerals

http://www.mgxminerals.com/investors/news/2018/379-mgx-miner…

http://www.hatch.com/

http://akfmining.com/

http://www.zoominfo.com/p/Allan-Reeves/1443497220

http://www.samuelengineering.com/

http://www.mgxminerals.com/investors/news/2018/379-mgx-miner…

http://www.hatch.com/

http://akfmining.com/

http://www.zoominfo.com/p/Allan-Reeves/1443497220

http://www.samuelengineering.com/

Antwort auf Beitrag Nr.: 58.162.112 von Popeye82 am 07.07.18 22:42:51Advantage Lithium

http://www.advantagelithium.com/news-and-media/company-news/…

https://seekingalpha.com/article/4178401-advantage-lithium-d…

http://www.advantagelithium.com/news-and-media/company-news/…

https://seekingalpha.com/article/4178401-advantage-lithium-d…

Antwort auf Beitrag Nr.: 58.170.548 von Popeye82 am 09.07.18 16:54:33Victoria Gold

http://www.vitgoldcorp.com/news/2018/victoria-golds-2018-exp…

http://www.vitgoldcorp.com/news/2018/victoria-golds-2018-exp…

Antwort auf Beitrag Nr.: 58.213.979 von Popeye82 am 14.07.18 12:57:00SolGold

http://www.rns-pdf.londonstockexchange.com/rns/9963U_1-2018-…

http://www.rns-pdf.londonstockexchange.com/rns/9963U_1-2018-…

Antwort auf Beitrag Nr.: 58.158.776 von Popeye82 am 06.07.18 23:40:59for a BETTER Tomorrow ...........................today

NEXT Bumsbude.

nicht ganz uninteressant,

iMo,

weil Die, neben Talga, Eine Der ganz, ganz Wenigen Firmen,

bis dato,

im (potenziell/wahrscheinlich Machbaren, m.E.) Graphenebereich sein dürften.

ich vermuuuuute mal Das dürfte wahrscheinlich "neben Talga Einer der, Wenigen, early Player werden".

Informationsinteressierte vor Allem Link2 mal ansehen.

NanoXplore

- Pre-tax NPV at 8% discount of $476 million, pre-tax IRR of 75%

- Project life of 25 years with modular design, enabling further expansion with simple replication of production modules

- Total plant construction cost estimated at $40.1 million including the sustaining capex with 25 months pre-tax payback period

- Average Graphene selling price of $10,000 per metric ton and average operating cost of $4,042 per metric ton

http://www.nanoxplore.ca/nanoxplore-announces-positive-feasi…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

http://www.nanoxplore.ca/

"NanoXplore Announces Positive Feasibility Study, For Its 10,000 Metric ton/year Graphene Production Plant

(*To download the document, please click here.)

NanoXplore Inc. (“NanoXplore” or “Corporation”) (TSX-V: GRA) is pleased to announce the summary results of an independent Feasibility Study (the “FS”) for its upcoming 10,000 metric tons/year graphene production plant. All reported figures are in Canadian dollars and are on a 100% project basis unless otherwise stated.

Pre-Tax NPV at 8% discount of $476M, pre-tax IRR of 75%, Total CAPEX of $40.1M, Payback period of 25 months, Significant improvement comparing to the released preliminary economic assessment (“PEA”)

FEASIBILITY STUDY HIGHLIGHTS

Pre-tax NPV at 8% discount of $476 million, pre-tax IRR of 75%

Project life of 25 years with modular design, enabling further expansion with simple replication of production modules

Total plant construction cost estimated at $40.1 million including the sustaining capex with 25 months pre-tax payback period

Average Graphene selling price of $10,000 per metric ton and average operating cost of $4,042 per metric ton

DESIGN CRITERIA AND EXECUTION STRATEGY

The FS envisions a modular graphene production plant consisting of 5 graphene production lines, each with a capacity of 2,000 metric ton/year. Each line consists of 4 graphene production modules, each with a capacity of 500 metric ton/year and each module is designed based upon existing and producing graphene production module in the Corporation. The Corporation’s proprietary graphene production technique is a batch process and modular design of the plant provides the flexibility to adjust the production output with customer requirements.

NanoXplore has already signed a lease and an option to expand and purchase agreement for a 70,000 sq.ft building bearing civic address 4500 Thimens Boulevard, in Montréal (Borough of Saint-Laurent), along with two vacant lands, attached to the building. Following the expansion, total building area reaches to more than 134,000 sq.ft.

The project will be executed on an EPCM basis which initially one graphene production line would be constructed and commissioned by January 2020 followed by the construction and commission of four remaining lines by January 2021. The FS envisions a production output of 2,000 metric tons during 2020 civil year with an average operating cost of $5,500 per metric ton, 5,000 metric tons during 2021 civil year with an average operating cost of $4,300 per metric ton and 10,000 metric tons during 2022 civil year and after with an average operating cost of $4,040 per metric ton.

COMPARING THE FS WITH PEA ON A 100% PROJECT BASIS

Dr. Soroush Nazarpour, President and CEO of NanoXplore commented: “This is a significant achievement for NanoXplore and a significant milestone for graphene market. This upcoming 10,000 metric ton/year graphene production plant would be the largest of its kind in the world and would position NanoXplore as a leader in graphene market. Offering graphene with a price of $10,000 per metric ton has been repeatedly asked by our partners and clients and such pricing will meaningfully help the global growth of graphene market. I am very pleased that we are taking this initiative with project metrics that make sense for our customers, existing shareholders and future investors”.

About NanoXplore Inc.

NanoXplore is a graphene corporation, a manufacturer and supplier of high-volume graphene powder for use in industrial markets, as well as standard and custom graphene enhanced plastic and composite products. NanoXplore has recently announced the acquisition of Sigma Industries. Upon completion, NanoXplore will employ near 400 people with production plants in Canada, US, and Switzerland."

NEXT Bumsbude.

nicht ganz uninteressant,

iMo,

weil Die, neben Talga, Eine Der ganz, ganz Wenigen Firmen,

bis dato,

im (potenziell/wahrscheinlich Machbaren, m.E.) Graphenebereich sein dürften.

ich vermuuuuute mal Das dürfte wahrscheinlich "neben Talga Einer der, Wenigen, early Player werden".

Informationsinteressierte vor Allem Link2 mal ansehen.

NanoXplore

- Pre-tax NPV at 8% discount of $476 million, pre-tax IRR of 75%

- Project life of 25 years with modular design, enabling further expansion with simple replication of production modules

- Total plant construction cost estimated at $40.1 million including the sustaining capex with 25 months pre-tax payback period

- Average Graphene selling price of $10,000 per metric ton and average operating cost of $4,042 per metric ton

http://www.nanoxplore.ca/nanoxplore-announces-positive-feasi…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

http://www.nanoxplore.ca/

"NanoXplore Announces Positive Feasibility Study, For Its 10,000 Metric ton/year Graphene Production Plant

(*To download the document, please click here.)

NanoXplore Inc. (“NanoXplore” or “Corporation”) (TSX-V: GRA) is pleased to announce the summary results of an independent Feasibility Study (the “FS”) for its upcoming 10,000 metric tons/year graphene production plant. All reported figures are in Canadian dollars and are on a 100% project basis unless otherwise stated.

Pre-Tax NPV at 8% discount of $476M, pre-tax IRR of 75%, Total CAPEX of $40.1M, Payback period of 25 months, Significant improvement comparing to the released preliminary economic assessment (“PEA”)

FEASIBILITY STUDY HIGHLIGHTS

Pre-tax NPV at 8% discount of $476 million, pre-tax IRR of 75%

Project life of 25 years with modular design, enabling further expansion with simple replication of production modules

Total plant construction cost estimated at $40.1 million including the sustaining capex with 25 months pre-tax payback period

Average Graphene selling price of $10,000 per metric ton and average operating cost of $4,042 per metric ton

DESIGN CRITERIA AND EXECUTION STRATEGY

The FS envisions a modular graphene production plant consisting of 5 graphene production lines, each with a capacity of 2,000 metric ton/year. Each line consists of 4 graphene production modules, each with a capacity of 500 metric ton/year and each module is designed based upon existing and producing graphene production module in the Corporation. The Corporation’s proprietary graphene production technique is a batch process and modular design of the plant provides the flexibility to adjust the production output with customer requirements.

NanoXplore has already signed a lease and an option to expand and purchase agreement for a 70,000 sq.ft building bearing civic address 4500 Thimens Boulevard, in Montréal (Borough of Saint-Laurent), along with two vacant lands, attached to the building. Following the expansion, total building area reaches to more than 134,000 sq.ft.

The project will be executed on an EPCM basis which initially one graphene production line would be constructed and commissioned by January 2020 followed by the construction and commission of four remaining lines by January 2021. The FS envisions a production output of 2,000 metric tons during 2020 civil year with an average operating cost of $5,500 per metric ton, 5,000 metric tons during 2021 civil year with an average operating cost of $4,300 per metric ton and 10,000 metric tons during 2022 civil year and after with an average operating cost of $4,040 per metric ton.

COMPARING THE FS WITH PEA ON A 100% PROJECT BASIS

Dr. Soroush Nazarpour, President and CEO of NanoXplore commented: “This is a significant achievement for NanoXplore and a significant milestone for graphene market. This upcoming 10,000 metric ton/year graphene production plant would be the largest of its kind in the world and would position NanoXplore as a leader in graphene market. Offering graphene with a price of $10,000 per metric ton has been repeatedly asked by our partners and clients and such pricing will meaningfully help the global growth of graphene market. I am very pleased that we are taking this initiative with project metrics that make sense for our customers, existing shareholders and future investors”.

About NanoXplore Inc.

NanoXplore is a graphene corporation, a manufacturer and supplier of high-volume graphene powder for use in industrial markets, as well as standard and custom graphene enhanced plastic and composite products. NanoXplore has recently announced the acquisition of Sigma Industries. Upon completion, NanoXplore will employ near 400 people with production plants in Canada, US, and Switzerland."

Antwort auf Beitrag Nr.: 58.172.555 von Popeye82 am 09.07.18 20:51:52Tharisa Plc

http://www.overend.co.za/download/sens_salene_chrome_zimbabw…

http://www.overend.co.za/download/sens_salene_chrome_zimbabw…

Antwort auf Beitrag Nr.: 58.238.595 von Popeye82 am 18.07.18 03:42:50Savannah Resources Plc

http://www.savannahresources.com/cms/wp-content/uploads/2018…

http://www.aldeiairmao.pt/

http://www.proactiveinvestors.co.uk/companies/stocktube/9888…

http://www.savannahresources.com/cms/wp-content/uploads/2018…

http://www.aldeiairmao.pt/

http://www.proactiveinvestors.co.uk/companies/stocktube/9888…

Antwort auf Beitrag Nr.: 58.181.426 von Popeye82 am 10.07.18 20:56:29Cornerstone Metals

http://www.canadianminingjournal.com/news/technology-metals-…

http://www.canadianminingjournal.com/news/technology-metals-…

Antwort auf Beitrag Nr.: 58.168.166 von Popeye82 am 09.07.18 11:39:36Pilbara Minerals

https://thelithiumspot.com/2018/07/16/pilbaras-waking-up/

https://thelithiumspot.com/2018/07/16/pilbaras-waking-up/

Antwort auf Beitrag Nr.: 58.244.139 von Popeye82 am 18.07.18 16:09:50MGX Minerals

http://www.stockhouse.com/news/newswire/2018/07/18/this-jv-c…

http://www.belmontresources.com/src/documents/SpartanMTSurve…

http://www.stockhouse.com/news/newswire/2018/07/18/this-jv-c…

http://www.belmontresources.com/src/documents/SpartanMTSurve…

Antwort auf Beitrag Nr.: 58.242.468 von Popeye82 am 18.07.18 13:37:43Celsius Resources

https://wcsecure.weblink.com.au/pdf/CLA/02000718.pdf

https://wcsecure.weblink.com.au/pdf/CLA/02000718.pdf

Antwort auf Beitrag Nr.: 58.220.121 von Popeye82 am 16.07.18 06:22:45TNG

http://tngltd.com.au/investor_centre/media_articles.phtml

http://tngltd.com.au/investor_centre/media_articles.phtml

Antwort auf Beitrag Nr.: 57.971.538 von Popeye82 am 13.06.18 00:21:12REDUNDANT internationale PennyStockVerbrecherKartelle

XVVIIIIIIIIIIXVIII

XVVIIIIIIIIIIXVIII

Soverein Metals

99,9995% PURITY GRAPHITE CONFIRMS SUITABILITY FOR MULTIPLE DOWNSTREAM APPLICATIONS

- Ultra-high purity “5-Nines” 99.9995

weight % C graphite (by LOI analysis) produced via non-acid leach technique.

weight % C graphite (by LOI analysis) produced via non-acid leach technique.

- Test work undertaken using proprietary thermal purification process conducted at reduced temperature, requiring lower energy input and therefore having a significantly reduced CO2 footprint compared to other thermal technologies.

- Extremely low content of total impurities of less than 5 ppm against generally accepted maximum of 490 ppm for most advanced battery applications.

- Thermal purification is far more environmentally friendly than the incumbent commercial method which uses hydrofluoric acid.

http://www.investi.com.au/api/announcements/svm/dc1bc3c5-b0d…

XVVIIIIIIIIIIXVIII

XVVIIIIIIIIIIXVIIISoverein Metals

99,9995% PURITY GRAPHITE CONFIRMS SUITABILITY FOR MULTIPLE DOWNSTREAM APPLICATIONS

- Ultra-high purity “5-Nines” 99.9995

weight % C graphite (by LOI analysis) produced via non-acid leach technique.

weight % C graphite (by LOI analysis) produced via non-acid leach technique.- Test work undertaken using proprietary thermal purification process conducted at reduced temperature, requiring lower energy input and therefore having a significantly reduced CO2 footprint compared to other thermal technologies.

- Extremely low content of total impurities of less than 5 ppm against generally accepted maximum of 490 ppm for most advanced battery applications.

- Thermal purification is far more environmentally friendly than the incumbent commercial method which uses hydrofluoric acid.

http://www.investi.com.au/api/announcements/svm/dc1bc3c5-b0d…

Antwort auf Beitrag Nr.: 57.951.438 von Popeye82 am 10.06.18 10:33:21Para Resources

http://pararesourcesinc.com/para-announces-us-16-6-million-l…

http://pandionmetals.co/

http://pararesourcesinc.com/para-announces-restructuring-sha…

http://www.bloomberg.com/research/stocks/private/snapshot.as…

http://conterraconstruction.com/

http://pararesourcesinc.com/para-announces-closing-3729800-p…

http://pararesourcesinc.com/para-releases-request-proposals-…

http://www.rmpglobalevents.com/

http://pararesourcesinc.com/para-announces-us-16-6-million-l…

http://pandionmetals.co/

http://pararesourcesinc.com/para-announces-restructuring-sha…

http://www.bloomberg.com/research/stocks/private/snapshot.as…

http://conterraconstruction.com/

http://pararesourcesinc.com/para-announces-closing-3729800-p…

http://pararesourcesinc.com/para-releases-request-proposals-…

http://www.rmpglobalevents.com/

Antwort auf Beitrag Nr.: 58.236.384 von Popeye82 am 17.07.18 20:22:09Piedmont Lithium

- Integrated project to produce 22,700 tonnes per year of lithium hydroxide

- Initial 13-year mine life, with 2 years of concentrate sales and 11 years of integrated operation

- Staged development, to minimise up-front capital requirements and equity dilution

.1) Stage 1 initial capex of US$91mm, for the Mine/Concentrator(excluding contingency)

.2) Stage 2 capex for Chemical Plant funded largely by internal cash flow

- Estimated 1st quartile lithium hydroxide operating costs, of US$3,960/t

- Conventional technology selection in all project aspects

- Steady state EBITDA of US$220mm, annually, with steady-state after-tax cash flow of US$170-180mm

- Estimated after-tax IRR of 56%, and NPV8% of US$777mm, with ~2-year payback

- Upside opportunities include project life extension and by-product monetisation

https://d1io3yog0oux5.cloudfront.net/_815ed12df62152cc813133…

- Integrated project to produce 22,700 tonnes per year of lithium hydroxide

- Initial 13-year mine life, with 2 years of concentrate sales and 11 years of integrated operation

- Staged development, to minimise up-front capital requirements and equity dilution

.1) Stage 1 initial capex of US$91mm, for the Mine/Concentrator(excluding contingency)

.2) Stage 2 capex for Chemical Plant funded largely by internal cash flow

- Estimated 1st quartile lithium hydroxide operating costs, of US$3,960/t

- Conventional technology selection in all project aspects

- Steady state EBITDA of US$220mm, annually, with steady-state after-tax cash flow of US$170-180mm

- Estimated after-tax IRR of 56%, and NPV8% of US$777mm, with ~2-year payback

- Upside opportunities include project life extension and by-product monetisation

https://d1io3yog0oux5.cloudfront.net/_815ed12df62152cc813133…

Antwort auf Beitrag Nr.: 58.198.127 von Popeye82 am 12.07.18 16:08:32Bluestone Resources

https://gallery.mailchimp.com/135b47d9a5a04ba3a508b7b7e/file…

https://gallery.mailchimp.com/135b47d9a5a04ba3a508b7b7e/file…

Antwort auf Beitrag Nr.: 58.162.364 von Popeye82 am 08.07.18 01:17:50Neo Lithium

- Resource upgrade confirms the 3Q Project as one of the largest and highest-grade lithium brine deposits in the world

- Significant high-grade resource estimate at 400 mg/L Lithium cut-off:

.1) Measured and indicated (M&I) resource estimate of 4,005,000 tonnes of lithium carbonate equivalent at an average grade of 614 mg/L Lithium

.2) High grade zone in the northern portion of the project with a M&I resource estimate of 1.106 million tonnes of lithium carbonate equivalent at an average grade of 1,106 mg/L Lithium

.3) Inferred resource estimate of 2,917,000 tonnes of lithium carbonate equivalent at an average grade of 584 mg/L Lithium

- Average combined impurities for Magnesium/Lithium and Sulphate/Lithium continue to be very low

- Potential for resource expansion still exists at depth

http://www.neolithium.ca/news/press-releases-and-news/press-…

- Resource upgrade confirms the 3Q Project as one of the largest and highest-grade lithium brine deposits in the world

- Significant high-grade resource estimate at 400 mg/L Lithium cut-off:

.1) Measured and indicated (M&I) resource estimate of 4,005,000 tonnes of lithium carbonate equivalent at an average grade of 614 mg/L Lithium

.2) High grade zone in the northern portion of the project with a M&I resource estimate of 1.106 million tonnes of lithium carbonate equivalent at an average grade of 1,106 mg/L Lithium

.3) Inferred resource estimate of 2,917,000 tonnes of lithium carbonate equivalent at an average grade of 584 mg/L Lithium

- Average combined impurities for Magnesium/Lithium and Sulphate/Lithium continue to be very low

- Potential for resource expansion still exists at depth

http://www.neolithium.ca/news/press-releases-and-news/press-…

Antwort auf Beitrag Nr.: 58.248.762 von Popeye82 am 19.07.18 02:18:20MGX Minerals

http://www.mgxminerals.com/investors/news/2018/380-mgx-miner…

http://www.alsglobal.com/

http://www.anzaplan.com/

https://de.wikipedia.org/wiki/Teck_Resources

http://www.zincnyx.com/

http://www.mgxminerals.com/investors/news/2018/380-mgx-miner…

http://www.alsglobal.com/

http://www.anzaplan.com/

https://de.wikipedia.org/wiki/Teck_Resources

http://www.zincnyx.com/

Antwort auf Beitrag Nr.: 57.442.988 von Popeye82 am 02.04.18 14:41:07Peregrine Diamonds

http://www.pdiam.com/news/news-releases/peregrine-diamonds-l…

http://www.mining-journal.com/m-amp-a/news/1342831/de-beers-…

http://www.pdiam.com/news/news-releases/new-chidliak-prelimi…

http://www.debeers.com/

http://www.pdiam.com/news/news-releases/peregrine-diamonds-l…

http://www.mining-journal.com/m-amp-a/news/1342831/de-beers-…

http://www.pdiam.com/news/news-releases/new-chidliak-prelimi…

http://www.debeers.com/

Antwort auf Beitrag Nr.: 58.215.833 von Popeye82 am 14.07.18 23:20:02SRG Graphite

http://srggraphite.com/news/srg-engages-snc-lavalin-and-als-…

http://www.snclavalin.com/en/

http://www.alsglobal.com/locations/asia-pacific/pacific/aust…

http://srggraphite.com/news/srg-engages-snc-lavalin-and-als-…

http://www.snclavalin.com/en/

http://www.alsglobal.com/locations/asia-pacific/pacific/aust…

Antwort auf Beitrag Nr.: 58.238.418 von Popeye82 am 18.07.18 00:16:10Sirius Minerals Plc

http://www.sharesmagazine.co.uk/article/crunch-time-for-siri…

http://www.crugroup.com/knowledge-and-insights/spotlights/20…

http://www.sharesmagazine.co.uk/article/crunch-time-for-siri…

http://www.crugroup.com/knowledge-and-insights/spotlights/20…

Antwort auf Beitrag Nr.: 58.258.757 von Popeye82 am 20.07.18 09:18:34Neo Lithium

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

Antwort auf Beitrag Nr.: 58.247.850 von Popeye82 am 18.07.18 22:11:55NanoXplore

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

Antwort auf Beitrag Nr.: 58.202.552 von Popeye82 am 13.07.18 02:55:35Niocorp Developments

http://www.niocorp.com/index.php/press-releases/388-niocorp-…

http://www.energy.senate.gov/public/

http://www.energy.senate.gov/public/index.cfm/hearings-and-b…

http://www.energy.senate.gov/public/index.cfm/files/serve?Fi…

http://www.niocorp.com/index.php/press-releases/388-niocorp-…

http://www.energy.senate.gov/public/

http://www.energy.senate.gov/public/index.cfm/hearings-and-b…

http://www.energy.senate.gov/public/index.cfm/files/serve?Fi…

Antwort auf Beitrag Nr.: 58.235.289 von Popeye82 am 17.07.18 18:40:29Trilogy Metals

http://www.stockhouse.com/news/press-releases/2018/07/20/tri…

https://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerN…

http://www.stockhouse.com/news/press-releases/2018/07/20/tri…

https://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerN…

Antwort auf Beitrag Nr.: 57.532.538 von Popeye82 am 13.04.18 04:11:55Kerr Mines

https://kerrmines.com/kerr-mines-announces-us27-6-million-pr…

http://pandionmetals.co/

http://www.mkspamp.com/

http://www.ospraie.com/

https://kerrmines.com/kerr-mines-strengthens-executive-team-…

http://media.stockhouse.com/media/companies/funres/Kerr-Mine…

https://kerrmines.com/kerr-mines-announces-us27-6-million-pr…

http://pandionmetals.co/

http://www.mkspamp.com/

http://www.ospraie.com/

https://kerrmines.com/kerr-mines-strengthens-executive-team-…

http://media.stockhouse.com/media/companies/funres/Kerr-Mine…

Antwort auf Beitrag Nr.: 57.710.551 von Popeye82 am 07.05.18 17:13:32AgriMin

http://www.lucapa.com.au/sites/default/files/Resources%20Qua…

http://www.abc.net.au/news/2018-06-24/lake-mackay-potash-pla…

https://agrimin.com.au/wp-content/uploads/Capital-Raising-of…

https://agrimin.com.au/wp-content/uploads/20180713-Quarterly…

http://www.lucapa.com.au/sites/default/files/Resources%20Qua…

http://www.abc.net.au/news/2018-06-24/lake-mackay-potash-pla…

https://agrimin.com.au/wp-content/uploads/Capital-Raising-of…

https://agrimin.com.au/wp-content/uploads/20180713-Quarterly…

Antwort auf Beitrag Nr.: 58.220.595 von Popeye82 am 16.07.18 08:25:27Heron Resources

http://www.lucapa.com.au/sites/default/files/Resources%20Qua…

http://www.lucapa.com.au/sites/default/files/Best%20Buys%20J…

http://www.lucapa.com.au/sites/default/files/Resources%20Qua…

http://www.lucapa.com.au/sites/default/files/Best%20Buys%20J…

Antwort auf Beitrag Nr.: 58.078.861 von Popeye82 am 27.06.18 14:13:12American Pacific Borate + Lithium

http://www.miningnews.net/resourcestocks/resourcestocks/1342…

http://www.miningnews.net/resourcestocks/resourcestocks/1342…

Antwort auf Beitrag Nr.: 58.182.434 von Popeye82 am 10.07.18 23:23:46FireWeed Zinc

http://www.proactiveinvestors.com/companies/news/201081

http://www.proactiveinvestors.com/companies/news/201081

Antwort auf Beitrag Nr.: 58.149.539 von Popeye82 am 06.07.18 00:28:16Plateau Energy Metals

http://plateauenergymetals.com/2018/07/18/plu-announces-fina…

http://www.ansto.gov.au/BusinessServices/ANSTOMinerals/index…

http://plateauenergymetals.com/wp-content/uploads/2018/07/Fi…

http://plateauenergymetals.com/wp-content/uploads/2018/07/Fi…

"Plateau Energy Metals announces final results from its preliminary test work program at ANSTO Minerals laboratories, Australia. Battery Grade Lithium Carbonate produced as final product from PLU’s Falchani Li feed material. PLU now plans to progress into a PEA

TORONTO, ONTARIO -- (GlobeNewswire – July 18, 2018) – Plateau Energy Metals Inc. (“Plateau” “PLU” or the "Company")(TSX VENTURE:PLU)(FRANKFURT:QG1)(OTCQB:PLUUF), a lithium and uranium exploration and development company, is pleased to provide final results from the initial metallurgical test work program undertaken by ANSTO Minerals (a division of the Australian Nuclear Science and Technology Organisation) processing laboratories in Sydney, Australia. The test work was completed on representative lithium-rich tuff samples collected from outcrop trenches at the Falchani discovery on the Company’s Macusani Plateau lithium/uranium project in southeastern Peru.

The test work forms part of the Company's continuing efforts to unlock value from the Falchani high-grade lithium discovery and demonstrates successful ‘proof of concept’ precipitation of battery grade lithium carbonate product employing an approach which involves simple atmospheric acid leaching of the lithium-rich tuff feed material followed by conventional lithium processing steps.

Figure 1 - Image of PLU Li2CO3 Product (Photo from ANSTO Minerals

ANSTO Minerals Test Work Results

- ANSTO Minerals has successfully completed a scoping study taking a sample of lithium-rich tuff, provided by PLU from the Falchani deposit in Peru, through to a battery grade lithium carbonate product. (Link to Figure 1 – Image of PLU Li2CO3 Product)

Lithium Carbonate purity was reported at 99.73% from Primary LC precipitation before final refining

- Primary Lithium Carbonate product compares favourably with Industry Specifications (Link to Table 1 – PLU Primary Lithium Carbonate (LC) Analysis and LC Specifications). Final Refining expected to remove any elements that are ‘near-spec’ limits (ex. Ca, K, Na, S)

- Starting with an atmospheric sulfuric acid leach, then after 12 hours in the bulk leach, downstream processing and purification was completed as per the flowsheet previously recommended by ANSTO Minerals.

- The approach successfully employed conventional lithium processing steps to produce battery grade product at the primary lithium carbonate precipitation step without any additional refining steps.

(Link to Figure 2– Preliminary Acid Leach Lithium Carbonate (LC) Flow Sheet for Falchani)

- This demonstrates the “proof of concept” required for the production of lithium carbonate from the Falchani deposit.

- The next step is to further develop the flowsheet and associated economic parameters for Li production to the requirements of a PEA level study.

Ian Stalker, the Interim CEO of Plateau Energy Metals, commented: “These are excellent results for Plateau Energy Metals. This preliminary metallurgical investigation work, completed at the well-known and highly respected laboratories at ANSTO Minerals, confirms that battery grade quality Lithium Carbonate can be produced from our Falchani ‘high-grade’ lithium feed material. It is important to note that these first pass test results did not highlight any major concerns in the delivery of a quality, final product. The process flow sheet ANSTO followed used the simple sulfuric acid leach approach and employed conventional lithium processing steps.

The next step for PLU is commencing a Preliminary Economic Assessment Study (PEA) to better understand the economic background behind this preliminary result. We intend to commence this ‘Study’ this quarter.

PLU is also busy completing our NI 43-101 Mineral Resource Estimate for our Falchani discovery and expect to release this shortly. The Resource Estimate will include a Maiden Resource for our high-grade Falchani Lithium discovery and also a separate resource estimate for the uranium mineralization discovered during this recent drill program.

↓ ↓ News Release Continues Below ↓ ↓

Recent Coverage

Catch up with our story on our website.

11-July-2018 | Video Interview with Interim CEO, Ian Stalker (5 min)