starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 6)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 3

Gesamt: 279.140

Gesamt: 279.140

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 3703 | |

| vor 59 Minuten | 2787 | |

| heute 11:14 | 2633 | |

| vor 1 Stunde | 2466 | |

| vor 1 Stunde | 1396 | |

| vor 49 Minuten | 1053 | |

| vor 51 Minuten | 1012 | |

| vor 56 Minuten | 867 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.789,62 | +0,37 | 207 | |||

| 2. | 3. | 0,2250 | +7,14 | 104 | |||

| 3. | 2. | 0,2920 | -5,81 | 89 | |||

| 4. | 4. | 160,92 | +0,47 | 80 | |||

| 5. | 5. | 2,5700 | +0,18 | 61 | |||

| 6. | Neu! | 9,3990 | +123,87 | 47 | |||

| 7. | 10. | 2.374,14 | +1,19 | 45 | |||

| 8. | 7. | 6,8040 | +2,44 | 42 |

Antwort auf Beitrag Nr.: 56.510.696 von Popeye82 am 20.12.17 22:32:29an Der Firma Interessierte sollten LESEN:

Jangada Mines (plc)

https://polaris.brighterir.com/public/jangada_mines/news/rns…

" Audited 2017 Final Results

Jangada Mines plc, a natural resources company developing South America's largest and most advanced platinum group metals ('PGM') project (the 'Project'), is pleased to announce its audited annual financial results for the year ended 30 June 2017. The Company will shortly be posting the annual report & accounts to Shareholders, together with a notice convening the annual general meeting.

Overview:

· Multiple development milestones achieved at Pedra Branca since admission to trading on AIM in June 2017 , quantifying the upside potential of unique polymetallic deposit

· Major mineral resource upgrade with Measured and Indicated categories increased by 35% and 74% respectively

· Independent re-evaluation, modelling and restatement of JORC resource to 23Mt at 1.3 g/t (PGMs) containing ~1Moz PGM + Au mineralisation from surface - 77% of the Project now in measured and indicated resource categories

· Polymetallic nature confirmed with resource including highly significant nickel, copper, cobalt and chrome credits, critical technology metals in high demand

· Scoping Study completed with exceptional results - IRR of 80% and payback period of 1.3 years - confirmed multi-commodity ore suite, mined at an average grade of 1.22 g/t PGM + Au with additional credits from nickel, copper, chrome and cobalt - NPV of US$158.4m at a 10% discount rate

· Additional credits of cobalt, nickel and copper provide significant impact on the economics of Pedra Branca and underpins its potential to be a 'free platinum' operation

· High-grade vanadium-titanium-iron mineralisation identified adding further exploration upside

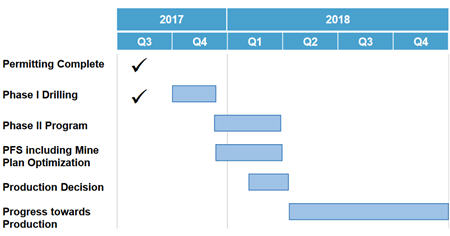

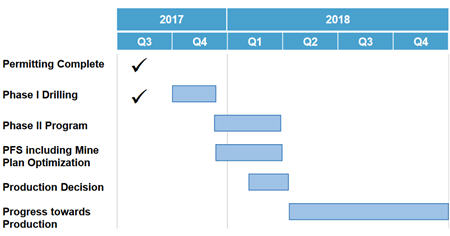

· Authorisation received for pilot scale production - application for trial mining licence to be submitted Q1 2018

· Pre-feasibility study initiated with results due Q1 2018

· Development goals continue to be hit - increasing resource and proving significant polymetallic credits including copper, cobalt, nickel and chrome

· Project continues to offer huge exploration upside in terms of commodity and scale both laterally and at depth

Brian McMaster, Executive Chairman of Jangada said, "We have made amazing progress since listing in June this year and have initiated multiple studies that continue to emphasise the genuinely exciting potential of this polymetallic project, which is rapidly approaching production. In the last six months, we have completed metallurgical test results, increased our JORC Resource, underlined the contribution available from nickel, copper, cobalt and chrome and discovered the potential for vanadium, titanium iron ore deposit. Furthermore, we announced the results of the Scoping Study, which yielded an estimated IRR of 80% and a payback period of 1.3 years, clearly demonstrating the outstanding potential of the Project as a low, cost, shallow pit PGM operation with excellent financial returns. With the demand for technology metals increasing, the additional credits of cobalt, nickel and copper will have a significant impact on the economics and underpins our belief that Pedra Branca has the potential to be a 'free platinum' operation."

"We believe we have created a huge amount of value since listing that unfortunately has not been recognised by the market. 2018 is looking to be just as busy, commencing with the results of the Pre-feasibility Study in Q1; we therefore look forward to the New Year, further advancement of the Project and the recognition of the quality of Pedra Branca."

Director's Statement

This is my inaugural Chairman's Statement since the Company successfully listed on AIM on 29 June of this year (the 'Admission'). At that time and as part of the Admission process, the Company raised £2.25 million, before expenses, through an oversubscribed placing. These funds were raised to advance an aggressive development programme at the Company's 'Pedra Branca Platinum Group Metals Project' (the 'Project') in Brazil. The programme involved reserve drilling, a bulk metallurgy test study, and a scoping study to determine operation parameters and likely financial model. The team has worked overtime to tick these boxes and is now focused on the next stage as we look to move towards trial mining.

The Project is the largest and most advanced Platinum Group Metals ("PGM") project in South America. Located 280 km from the port city of Fortaleza in the northeast of Brazil, the Project consists of three mining licenses and 44 exploration licenses over an area of 55,000 hectares. Shortly after Admission, we announced an updated JORC (2012) compliant resource estimate, significantly increasing the in-situ value of the currently declared 1 million ounces of PGM+Au resources at the Project. The estimate now includes 23.138 Mt of ore in the 'Measured', 'Indicated' and 'Inferred' categories, containing 109 million pounds of nickel and 23 million pounds of copper grading at 0.214% Ni and 0.045% Cu. The significance of the additional nickel and copper credit within the Pedra Branca ore zone is that the incremental value of these elements will off-set the costs of producing PGM and will accrue material profitability upside at limited additional cost.

Just weeks after the updated JORC resource estimate, high-grade vanadium-titanium-iron mineralisation was confirmed from samples across five locations. Strong market dynamics for vanadium pentoxide, which incidentally has risen circa 500% since January 2016, once again bolstered our confidence that we have a highly valuable polymetallic asset.

The next box to tick was the Scoping Study, which was announced at the end of October 2017 and confirmed the Project's potential to become a robust shallow open pit mine with low capital and operation expenditure, ultimately lending itself to yield attractive financial returns in a short payback period. It suggested an internal rate of return of 80% and a payback period of 1.3 years, clearly demonstrating the potential of the polymetallic mine. The addition of the by-product credits was once again mentioned as having a significant positive impact on the economics, underpinning our belief that the Project has the potential to be a 'free platinum' operation, where by-product credits cover the costs of PGM production.

Looking ahead, we expect to announce a pre-feasibility study in the near future and follow this up with trial mining in H1 2018. In anticipation of this, we started the application process for a trial mining permit and environmental permit.

In summary, we set out with a clear strategy to develop this high-value, multi-commodity resource and have hit key value triggers in a timely manner, confirming the historical work totalling circa US$35 million undertaken by previous operators, including Anglo American Platinum. With the work conducted since listing, we have created a huge amount of value that unfortunately has not been recognised by the market. I am confident that as we receive our environmental permit, publish our production flow sheets and pre-feasibility study, all scheduled for early next year, and as we hit more targets, the true value will be more accurately understood.

Finally, I would like to thank shareholders for their support and our dedicated team for their commitment to the development of the Project.

B K McMaster

Director

Group Strategic Report for the Period Ended 30 June 2017

The directors present the strategic report for the year ended 30 June 2017.

INTRODUCTION

Jangada Mines Plc (the "Company") was incorporated as an acquisition vehicle for the purposes of acquiring mining concerns in Brazil. The first acquisition was made on 30 April 2016 when the Company acquired the Pedra Branca project. The Company acts as a holding company for its subsidiary undertaking (together, the "Group").

The financial statements are presented in thousands of US Dollars ($'000). The financial statements have been prepared in accordance with the requirements of the International Financial Reporting Standards adopted by the European Union ("IFRS").

REVIEW OF THE BUSINESS

The Company was incorporated and commenced trading on 30 June 2015. Through a series of transactions, dating between 30 April 2016 and 16 February 2017, the Company has acquired 99.99 per cent. of the shares in Pedra Branca, with 0.01 per cent. of the shares held by FFA Holding & Mineracao Ltda (a vehicle 99.99 per cent. owned by Mr Azevedo) for the benefit of the Company (in accordance with Brazilian laws which require two quota holders for limited liability companies).

On 29 June 2017 the Company was admitted to trading on the AIM market of the London Stock Exchange and placed 45 million ordinary shares at 5p per share in its initial public offering ("IPO") in order to fund further exploratory analysis and drilling activities at Pedra Branca do Brasil Mineracao S/A's ("Pedra Branca") advanced stage Platinum Group Metals (" PGM ") exploration project in the northeast of Brazil.

Much of the IPO and integration expenditure has been charged to the profit and loss account. Accordingly, the results show a substantial loss in the period, though this is in accordance with management expectations.

PRINCIPAL RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties, which could have a material impact on the long-term performance of the Group and could cause actual results to differ materially from expected results.

Management considers the following to be the principal risk and uncertainties relating to the Group:

Foreign exchange risk

The Group holds significant cash funds in British Pounds Sterling and operates and reports in US Dollars. As a result the Company and Group are exposed to foreign exchange risk on the movement between the two currencies. The Group manages this risk by monitoring exchange rate movements and assessing their likely impact on the Group's operations.

Liquidity risk

The Group seeks to manage financial risk by ensuring sufficient liquidity is available to meet foreseeable needs and to invest cash assets safely and profitably.

External funding facilities are managed to ensure that both short-term and longer-term funding is available to provide short-term flexibility whilst providing sufficient funding to the working capital requirements of its subsidiary.

Regulatory decisions and changes in the regulatory environment

The Group must comply with an extensive range of requirements that regulate and supervise the licensing and operation of its mining operations in different jurisdictions. In particular, there are agencies which monitor and enforce regulation and competition laws which apply to the mining industry.

Decisions by regulators regarding the granting, amendment or renewal of licenses to the Group or to third parties could adversely affect future operations in these geographic areas.

The Group mitigates this risk by monitoring changes to the regulatory landscape and ensuring the Group complies with all necessary requirements.

Emerging market footprint may present exposure to unpredictable economic, political, regulatory, tax and legal risks

Political, regulatory, economic and legal systems in emerging markets may be less predictable than in countries with more stable institutional structures. Since the Group operates in and is exposed to emerging markets, the value of investments in these markets may be adversely affected by political, regulatory, economic, tax and legal developments which are beyond the Group's control and anticipated benefits resulting from acquisitions and other investments made in these markets may not be achieved in the time expected, or at all.

The Group mitigates the risk associated with operating in emerging markets by closely monitoring economic and currency situations and developing business continuity plans to allow the Directors to respond effectively to a country economic crisis.

KEY PERFORMANCE INDICATORS

The key financial performance indicator for the Group is the overall performance of its investment in its subsidiary undertaking.

During the year the Group made a consolidated loss attributable to the shareholders of the Company of $1.3m. This was in line with business plans and the directors' expectations whilst the Group invests significantly in the Pedra Branca PGM Project.

The Group also reviews budgets and monitors pre-production timing targets as non-financial performance indicators.

DIRECTORS' EQUITY INTEREST IN THE COMPANY

The interests (all of which are beneficial unless otherwise stated) of the directors and their immediate families and the persons connected with them (within the meaning of section 252 of the Companies Act 2006, the "2006 Act")) in the issued share capital of the Company or the existence of which could, with reasonable diligence, be ascertained by any director are as follows:

No. of ordinary shares held

% of share capital

No. of ordinary shares over which options are granted

Directors' interests:

Brian McMaster (1)

46,177,800

23.4%

3,000,000

Luis Azevedo (2)

45,000,000

22.8%

2,000,000

Nicholas von Schirnding

-

-

1,000,000

Louis Castro

-

-

1,000,000

(1) Includes those ordinary Shares held through Mr McMaster's wholly-owned vehicle, Gemstar Investments Limited, and half of the Garrison Fee Shares issued on Admission.

(2) Held through a corporate vehicle, Flagstaff International Investments Ltd, on Mr Azevedo's behalf.

STRATEGY AND FUTURE DEVELOPMENTS

The Group's key strategic goal is to exploit the opportunities available to it through its ownership of the Project. Wherever possible, the Group will collaborate with experienced contractors to reduce capital expenditure and utilise existing infrastructure to maximise shareholder value.

This report was approved by the directors on 20 December 2017.

B K McMaster

Director

Director's Report for the Year Ended 30 June 2017

The directors present their report and the audited financial statements for the year ended 30 June 2017.

DIRECTORS' RESPONSIBILITIES STATEMENT

The directors are responsible for preparing the Group strategic report, the directors' report and the financial statements in accordance with applicable law and regulations.

The 2006 Act requires the directors to prepare financial statements for each financial period. The directors have elected to prepare the financial statements in accordance with International Financial Reporting Standards adopted by the EU ("IFRS"). Under the 2006 Act the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Company and the Group and of the profit or loss of the Group for that period. In preparing these financial statements, the directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgments and accounting estimates that are reasonable and prudent; and

· prepare the financial statements on a going concern basis unless it is inappropriate to presume that the Group will continue in business.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company's transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements comply with the 2006 Act. They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

PRINCIPAL ACTIVITIES

The Company acts as a holding company. The principal activity of the Group is the operation of businesses engaged in the exploration and development of PGM mining assets in Brazil, the initial such business being that of its subsidiary, Pedra Branca.

RESULTS AND DIVIDENDS

The loss for the period, after taxation, amounted to $1.3 million (2016: $41,000).

The directors do not recommend payment of a dividend.

GOING CONCERN

The Group will require further funding to finance its pre-production programme in Brazil. The Directors are confident that the Group will be able to raise funds for such requirements from investors as required although no binding funding agreement is in place at the date of this report. These conditions indicate the existence of material uncertainty which may cast significant doubt about the Group and Company's ability to continue as a going concern.

The financial statements do not include the adjustment that would result if the Group and Company were unable to continue as a going concern.

DIRECTORS

The directors who served during the period were:

L E Castro (appointed 5 May 2017)

L M F De Azevedo (appointed 5 May 2017)

B K McMaster (appointed 30 June 2015)

N K Von Schrinding (appointed 5 May 2017)

M G W Wood (resigned 1 May 2017)

FINANCIAL INSTRUMENTS

Details of the Company's financial instruments are given in Note 11.

MATTERS COVERED IN THE STRATEGIC REPORT

As required by section 414C (11) of the 2006 Act, the strategic report contains a fair review of the business; the principal risks and uncertainties faced by the business; and the key financial and non-financial performance indicators as considered by the directors. This information is therefore excluded from the directors' report.

AUDIT COMMITTEE

The board operates an Audit Committee, chaired by Louis Castro. This Committee carries out duties as set out in its AIM Admission Document, supervising the financial and reporting arrangements of the Group. During the period, no issues arose that the directors consider appropriate to disclose in their report.

REMUNERATION COMMITTEE

The board has delegated to its Remuneration Committee, chaired by Nicholas von Schirnding, certain responsibilities in respect of the remuneration of senior executives. During the period, none of the senior executives' salaries or benefits changed and no issues arose that the directors consider appropriate to disclose in their report.

NOMINATION COMMITTEE

The board has delegated to its Nomination Committee, chaired by Nicholas von Schirnding, certain responsibilities in respect of the appointment of senior executives. During the period, no additional appointments have been made to disclose in this report.

INDEPENDENT AUDITORS

Crowe Clark Whitehill LLP has indicated its willingness to be reappointed as independent auditors and a proposal for their reappointment will be made at the annual general meeting.

STATEMENT OF DISCLOSURE OF INFORMATION TO AUDITORS

Each person who was a director at the date of approval of this report confirms that:

· so far as the director is aware, there is no relevant audit information of which the Company's auditor is unaware; and

· the director has taken all the steps that he ought to have taken as a director in order to make himself aware of any relevant audit information and to establish that the Company's auditor is aware of that information.

This report was approved by the directors on 20 December 2017.

B K McMaster

Director

Independent Auditor's Report to the Members of Jangada Mines PLC

OPINION

We have audited the financial statements of Jangada Mines Plc (the "Parent Company") and its subsidiary (the "Group") for the year ended 30 June 2017, which comprise:

· the Group Statement of Comprehensive Income for the year ended 30 June 2017;

· the Group and Parent Company Balance Sheets as at 30 June 2017;

· the Group and Parent Company Cash Flow Statements for the year then ended;

· the Group and Parent Company Statements of Changes In Equity for the year then ended; and

· the notes to the financial statements, which include a summary of significant accounting policies and other explanatory information.

The financial reporting framework that has been applied in the preparation of the Group and Parent Company financial statements is applicable law and International Financial Reporting Standards as adopted by the European Union (IFRSs).

In our opinion:

· the financial statements give a true and fair view of the state of the Group's and of the Parent Company's affairs as at 30 June 2017 and of the Group's loss for the year then ended;

· the Group's financial statements have been properly prepared in accordance with IFRS;

· the Parent Company's financial statements have been properly prepared in accordance with IFRS as applied in accordance with the requirements of the Companies Act 2006; and

· the financial statements have been prepared in accordance with the requirements of the Companies Act 2006.

BASIS FOR OPINION

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the 'Auditor's responsibilities for the audit of the financial statements' section of our report. We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC's Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

We draw attention to Notes 2 and 3 of the financial statements which indicate further funding will be required to finance the Group's and Company's pre-production programme in Brazil. The Directors are confident that the Company will be able to raise these funds however there is no binding agreement in place at the date of this report.

These conditions indicate the existence of a material uncertainty and may cash doubt on the ability of the Group and Company to continue as a going concern. Our opinion is not modified in respect of this matter. The financial statements do not include the adjustments that would result if the Group and Company were unable to continue as a going concern. ............................."

Jangada Mines (plc)

https://polaris.brighterir.com/public/jangada_mines/news/rns…

" Audited 2017 Final Results

Jangada Mines plc, a natural resources company developing South America's largest and most advanced platinum group metals ('PGM') project (the 'Project'), is pleased to announce its audited annual financial results for the year ended 30 June 2017. The Company will shortly be posting the annual report & accounts to Shareholders, together with a notice convening the annual general meeting.

Overview:

· Multiple development milestones achieved at Pedra Branca since admission to trading on AIM in June 2017 , quantifying the upside potential of unique polymetallic deposit

· Major mineral resource upgrade with Measured and Indicated categories increased by 35% and 74% respectively

· Independent re-evaluation, modelling and restatement of JORC resource to 23Mt at 1.3 g/t (PGMs) containing ~1Moz PGM + Au mineralisation from surface - 77% of the Project now in measured and indicated resource categories

· Polymetallic nature confirmed with resource including highly significant nickel, copper, cobalt and chrome credits, critical technology metals in high demand

· Scoping Study completed with exceptional results - IRR of 80% and payback period of 1.3 years - confirmed multi-commodity ore suite, mined at an average grade of 1.22 g/t PGM + Au with additional credits from nickel, copper, chrome and cobalt - NPV of US$158.4m at a 10% discount rate

· Additional credits of cobalt, nickel and copper provide significant impact on the economics of Pedra Branca and underpins its potential to be a 'free platinum' operation

· High-grade vanadium-titanium-iron mineralisation identified adding further exploration upside

· Authorisation received for pilot scale production - application for trial mining licence to be submitted Q1 2018

· Pre-feasibility study initiated with results due Q1 2018

· Development goals continue to be hit - increasing resource and proving significant polymetallic credits including copper, cobalt, nickel and chrome

· Project continues to offer huge exploration upside in terms of commodity and scale both laterally and at depth

Brian McMaster, Executive Chairman of Jangada said, "We have made amazing progress since listing in June this year and have initiated multiple studies that continue to emphasise the genuinely exciting potential of this polymetallic project, which is rapidly approaching production. In the last six months, we have completed metallurgical test results, increased our JORC Resource, underlined the contribution available from nickel, copper, cobalt and chrome and discovered the potential for vanadium, titanium iron ore deposit. Furthermore, we announced the results of the Scoping Study, which yielded an estimated IRR of 80% and a payback period of 1.3 years, clearly demonstrating the outstanding potential of the Project as a low, cost, shallow pit PGM operation with excellent financial returns. With the demand for technology metals increasing, the additional credits of cobalt, nickel and copper will have a significant impact on the economics and underpins our belief that Pedra Branca has the potential to be a 'free platinum' operation."

"We believe we have created a huge amount of value since listing that unfortunately has not been recognised by the market. 2018 is looking to be just as busy, commencing with the results of the Pre-feasibility Study in Q1; we therefore look forward to the New Year, further advancement of the Project and the recognition of the quality of Pedra Branca."

Director's Statement

This is my inaugural Chairman's Statement since the Company successfully listed on AIM on 29 June of this year (the 'Admission'). At that time and as part of the Admission process, the Company raised £2.25 million, before expenses, through an oversubscribed placing. These funds were raised to advance an aggressive development programme at the Company's 'Pedra Branca Platinum Group Metals Project' (the 'Project') in Brazil. The programme involved reserve drilling, a bulk metallurgy test study, and a scoping study to determine operation parameters and likely financial model. The team has worked overtime to tick these boxes and is now focused on the next stage as we look to move towards trial mining.

The Project is the largest and most advanced Platinum Group Metals ("PGM") project in South America. Located 280 km from the port city of Fortaleza in the northeast of Brazil, the Project consists of three mining licenses and 44 exploration licenses over an area of 55,000 hectares. Shortly after Admission, we announced an updated JORC (2012) compliant resource estimate, significantly increasing the in-situ value of the currently declared 1 million ounces of PGM+Au resources at the Project. The estimate now includes 23.138 Mt of ore in the 'Measured', 'Indicated' and 'Inferred' categories, containing 109 million pounds of nickel and 23 million pounds of copper grading at 0.214% Ni and 0.045% Cu. The significance of the additional nickel and copper credit within the Pedra Branca ore zone is that the incremental value of these elements will off-set the costs of producing PGM and will accrue material profitability upside at limited additional cost.

Just weeks after the updated JORC resource estimate, high-grade vanadium-titanium-iron mineralisation was confirmed from samples across five locations. Strong market dynamics for vanadium pentoxide, which incidentally has risen circa 500% since January 2016, once again bolstered our confidence that we have a highly valuable polymetallic asset.

The next box to tick was the Scoping Study, which was announced at the end of October 2017 and confirmed the Project's potential to become a robust shallow open pit mine with low capital and operation expenditure, ultimately lending itself to yield attractive financial returns in a short payback period. It suggested an internal rate of return of 80% and a payback period of 1.3 years, clearly demonstrating the potential of the polymetallic mine. The addition of the by-product credits was once again mentioned as having a significant positive impact on the economics, underpinning our belief that the Project has the potential to be a 'free platinum' operation, where by-product credits cover the costs of PGM production.

Looking ahead, we expect to announce a pre-feasibility study in the near future and follow this up with trial mining in H1 2018. In anticipation of this, we started the application process for a trial mining permit and environmental permit.

In summary, we set out with a clear strategy to develop this high-value, multi-commodity resource and have hit key value triggers in a timely manner, confirming the historical work totalling circa US$35 million undertaken by previous operators, including Anglo American Platinum. With the work conducted since listing, we have created a huge amount of value that unfortunately has not been recognised by the market. I am confident that as we receive our environmental permit, publish our production flow sheets and pre-feasibility study, all scheduled for early next year, and as we hit more targets, the true value will be more accurately understood.

Finally, I would like to thank shareholders for their support and our dedicated team for their commitment to the development of the Project.

B K McMaster

Director

Group Strategic Report for the Period Ended 30 June 2017

The directors present the strategic report for the year ended 30 June 2017.

INTRODUCTION

Jangada Mines Plc (the "Company") was incorporated as an acquisition vehicle for the purposes of acquiring mining concerns in Brazil. The first acquisition was made on 30 April 2016 when the Company acquired the Pedra Branca project. The Company acts as a holding company for its subsidiary undertaking (together, the "Group").

The financial statements are presented in thousands of US Dollars ($'000). The financial statements have been prepared in accordance with the requirements of the International Financial Reporting Standards adopted by the European Union ("IFRS").

REVIEW OF THE BUSINESS

The Company was incorporated and commenced trading on 30 June 2015. Through a series of transactions, dating between 30 April 2016 and 16 February 2017, the Company has acquired 99.99 per cent. of the shares in Pedra Branca, with 0.01 per cent. of the shares held by FFA Holding & Mineracao Ltda (a vehicle 99.99 per cent. owned by Mr Azevedo) for the benefit of the Company (in accordance with Brazilian laws which require two quota holders for limited liability companies).

On 29 June 2017 the Company was admitted to trading on the AIM market of the London Stock Exchange and placed 45 million ordinary shares at 5p per share in its initial public offering ("IPO") in order to fund further exploratory analysis and drilling activities at Pedra Branca do Brasil Mineracao S/A's ("Pedra Branca") advanced stage Platinum Group Metals (" PGM ") exploration project in the northeast of Brazil.

Much of the IPO and integration expenditure has been charged to the profit and loss account. Accordingly, the results show a substantial loss in the period, though this is in accordance with management expectations.

PRINCIPAL RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties, which could have a material impact on the long-term performance of the Group and could cause actual results to differ materially from expected results.

Management considers the following to be the principal risk and uncertainties relating to the Group:

Foreign exchange risk

The Group holds significant cash funds in British Pounds Sterling and operates and reports in US Dollars. As a result the Company and Group are exposed to foreign exchange risk on the movement between the two currencies. The Group manages this risk by monitoring exchange rate movements and assessing their likely impact on the Group's operations.

Liquidity risk

The Group seeks to manage financial risk by ensuring sufficient liquidity is available to meet foreseeable needs and to invest cash assets safely and profitably.

External funding facilities are managed to ensure that both short-term and longer-term funding is available to provide short-term flexibility whilst providing sufficient funding to the working capital requirements of its subsidiary.

Regulatory decisions and changes in the regulatory environment

The Group must comply with an extensive range of requirements that regulate and supervise the licensing and operation of its mining operations in different jurisdictions. In particular, there are agencies which monitor and enforce regulation and competition laws which apply to the mining industry.

Decisions by regulators regarding the granting, amendment or renewal of licenses to the Group or to third parties could adversely affect future operations in these geographic areas.

The Group mitigates this risk by monitoring changes to the regulatory landscape and ensuring the Group complies with all necessary requirements.

Emerging market footprint may present exposure to unpredictable economic, political, regulatory, tax and legal risks

Political, regulatory, economic and legal systems in emerging markets may be less predictable than in countries with more stable institutional structures. Since the Group operates in and is exposed to emerging markets, the value of investments in these markets may be adversely affected by political, regulatory, economic, tax and legal developments which are beyond the Group's control and anticipated benefits resulting from acquisitions and other investments made in these markets may not be achieved in the time expected, or at all.

The Group mitigates the risk associated with operating in emerging markets by closely monitoring economic and currency situations and developing business continuity plans to allow the Directors to respond effectively to a country economic crisis.

KEY PERFORMANCE INDICATORS

The key financial performance indicator for the Group is the overall performance of its investment in its subsidiary undertaking.

During the year the Group made a consolidated loss attributable to the shareholders of the Company of $1.3m. This was in line with business plans and the directors' expectations whilst the Group invests significantly in the Pedra Branca PGM Project.

The Group also reviews budgets and monitors pre-production timing targets as non-financial performance indicators.

DIRECTORS' EQUITY INTEREST IN THE COMPANY

The interests (all of which are beneficial unless otherwise stated) of the directors and their immediate families and the persons connected with them (within the meaning of section 252 of the Companies Act 2006, the "2006 Act")) in the issued share capital of the Company or the existence of which could, with reasonable diligence, be ascertained by any director are as follows:

No. of ordinary shares held

% of share capital

No. of ordinary shares over which options are granted

Directors' interests:

Brian McMaster (1)

46,177,800

23.4%

3,000,000

Luis Azevedo (2)

45,000,000

22.8%

2,000,000

Nicholas von Schirnding

-

-

1,000,000

Louis Castro

-

-

1,000,000

(1) Includes those ordinary Shares held through Mr McMaster's wholly-owned vehicle, Gemstar Investments Limited, and half of the Garrison Fee Shares issued on Admission.

(2) Held through a corporate vehicle, Flagstaff International Investments Ltd, on Mr Azevedo's behalf.

STRATEGY AND FUTURE DEVELOPMENTS

The Group's key strategic goal is to exploit the opportunities available to it through its ownership of the Project. Wherever possible, the Group will collaborate with experienced contractors to reduce capital expenditure and utilise existing infrastructure to maximise shareholder value.

This report was approved by the directors on 20 December 2017.

B K McMaster

Director

Director's Report for the Year Ended 30 June 2017

The directors present their report and the audited financial statements for the year ended 30 June 2017.

DIRECTORS' RESPONSIBILITIES STATEMENT

The directors are responsible for preparing the Group strategic report, the directors' report and the financial statements in accordance with applicable law and regulations.

The 2006 Act requires the directors to prepare financial statements for each financial period. The directors have elected to prepare the financial statements in accordance with International Financial Reporting Standards adopted by the EU ("IFRS"). Under the 2006 Act the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Company and the Group and of the profit or loss of the Group for that period. In preparing these financial statements, the directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgments and accounting estimates that are reasonable and prudent; and

· prepare the financial statements on a going concern basis unless it is inappropriate to presume that the Group will continue in business.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company's transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements comply with the 2006 Act. They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

PRINCIPAL ACTIVITIES

The Company acts as a holding company. The principal activity of the Group is the operation of businesses engaged in the exploration and development of PGM mining assets in Brazil, the initial such business being that of its subsidiary, Pedra Branca.

RESULTS AND DIVIDENDS

The loss for the period, after taxation, amounted to $1.3 million (2016: $41,000).

The directors do not recommend payment of a dividend.

GOING CONCERN

The Group will require further funding to finance its pre-production programme in Brazil. The Directors are confident that the Group will be able to raise funds for such requirements from investors as required although no binding funding agreement is in place at the date of this report. These conditions indicate the existence of material uncertainty which may cast significant doubt about the Group and Company's ability to continue as a going concern.

The financial statements do not include the adjustment that would result if the Group and Company were unable to continue as a going concern.

DIRECTORS

The directors who served during the period were:

L E Castro (appointed 5 May 2017)

L M F De Azevedo (appointed 5 May 2017)

B K McMaster (appointed 30 June 2015)

N K Von Schrinding (appointed 5 May 2017)

M G W Wood (resigned 1 May 2017)

FINANCIAL INSTRUMENTS

Details of the Company's financial instruments are given in Note 11.

MATTERS COVERED IN THE STRATEGIC REPORT

As required by section 414C (11) of the 2006 Act, the strategic report contains a fair review of the business; the principal risks and uncertainties faced by the business; and the key financial and non-financial performance indicators as considered by the directors. This information is therefore excluded from the directors' report.

AUDIT COMMITTEE

The board operates an Audit Committee, chaired by Louis Castro. This Committee carries out duties as set out in its AIM Admission Document, supervising the financial and reporting arrangements of the Group. During the period, no issues arose that the directors consider appropriate to disclose in their report.

REMUNERATION COMMITTEE

The board has delegated to its Remuneration Committee, chaired by Nicholas von Schirnding, certain responsibilities in respect of the remuneration of senior executives. During the period, none of the senior executives' salaries or benefits changed and no issues arose that the directors consider appropriate to disclose in their report.

NOMINATION COMMITTEE

The board has delegated to its Nomination Committee, chaired by Nicholas von Schirnding, certain responsibilities in respect of the appointment of senior executives. During the period, no additional appointments have been made to disclose in this report.

INDEPENDENT AUDITORS

Crowe Clark Whitehill LLP has indicated its willingness to be reappointed as independent auditors and a proposal for their reappointment will be made at the annual general meeting.

STATEMENT OF DISCLOSURE OF INFORMATION TO AUDITORS

Each person who was a director at the date of approval of this report confirms that:

· so far as the director is aware, there is no relevant audit information of which the Company's auditor is unaware; and

· the director has taken all the steps that he ought to have taken as a director in order to make himself aware of any relevant audit information and to establish that the Company's auditor is aware of that information.

This report was approved by the directors on 20 December 2017.

B K McMaster

Director

Independent Auditor's Report to the Members of Jangada Mines PLC

OPINION

We have audited the financial statements of Jangada Mines Plc (the "Parent Company") and its subsidiary (the "Group") for the year ended 30 June 2017, which comprise:

· the Group Statement of Comprehensive Income for the year ended 30 June 2017;

· the Group and Parent Company Balance Sheets as at 30 June 2017;

· the Group and Parent Company Cash Flow Statements for the year then ended;

· the Group and Parent Company Statements of Changes In Equity for the year then ended; and

· the notes to the financial statements, which include a summary of significant accounting policies and other explanatory information.

The financial reporting framework that has been applied in the preparation of the Group and Parent Company financial statements is applicable law and International Financial Reporting Standards as adopted by the European Union (IFRSs).

In our opinion:

· the financial statements give a true and fair view of the state of the Group's and of the Parent Company's affairs as at 30 June 2017 and of the Group's loss for the year then ended;

· the Group's financial statements have been properly prepared in accordance with IFRS;

· the Parent Company's financial statements have been properly prepared in accordance with IFRS as applied in accordance with the requirements of the Companies Act 2006; and

· the financial statements have been prepared in accordance with the requirements of the Companies Act 2006.

BASIS FOR OPINION

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the 'Auditor's responsibilities for the audit of the financial statements' section of our report. We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC's Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

We draw attention to Notes 2 and 3 of the financial statements which indicate further funding will be required to finance the Group's and Company's pre-production programme in Brazil. The Directors are confident that the Company will be able to raise these funds however there is no binding agreement in place at the date of this report.

These conditions indicate the existence of a material uncertainty and may cash doubt on the ability of the Group and Company to continue as a going concern. Our opinion is not modified in respect of this matter. The financial statements do not include the adjustments that would result if the Group and Company were unable to continue as a going concern. ............................."

Antwort auf Beitrag Nr.: 55.492.737 von Popeye82 am 09.08.17 21:53:32END of the road for Mannheim(?)(------> https://de.wikipedia.org/wiki/Mannheim )

Afrikapottascheinteressierte sollten sich-Mindestens- Link DREI durchLESEN:

Danakali

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/hannam-partners-research-not…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/arlington-group-updated-rese…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/hartley-s-update-note-copy

http://www.danakali.com.au/item/bell-potter-initiation-note

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/the-colluli-project

http://www.danakali.com.au/the-colluli-project/colluli-posit…

Afrikapottascheinteressierte sollten sich-Mindestens- Link DREI durchLESEN:

Danakali

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/hannam-partners-research-not…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/arlington-group-updated-rese…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/item/hartley-s-update-note-copy

http://www.danakali.com.au/item/bell-potter-initiation-note

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.danakali.com.au/the-colluli-project

http://www.danakali.com.au/the-colluli-project/colluli-posit…

Antwort auf Beitrag Nr.: 56.534.846 von Popeye82 am 23.12.17 00:32:32eine Meiner Aktien.

SolGold

http://www.mining.com/solgold-shares-surge-on-latest-drillin…

SolGold

http://www.mining.com/solgold-shares-surge-on-latest-drillin…

Antwort auf Beitrag Nr.: 56.540.839 von Popeye82 am 24.12.17 17:16:57SolGold

http://www.mining.com/ecuador-expects-488-million-revenue-in…

http://www.mining.com/ecuador-mining-industry-to-grown-eight…

http://www.mining.com/ecuador-anticipates-4-billion-in-minin…

http://www.mining.com/ecuador-expects-488-million-revenue-in…

http://www.mining.com/ecuador-mining-industry-to-grown-eight…

http://www.mining.com/ecuador-anticipates-4-billion-in-minin…

Antwort auf Beitrag Nr.: 56.543.077 von Popeye82 am 25.12.17 21:48:06"In addition to this deal, the Lenin Moreno government expects to increase its cash flow thanks to the agreement it has reached with IVN Minerales Ecuador, a subsidiary of Canadian INV Metals (TSE:INV), for the exploitation of the Loma Larga project. This project is located in the southern Azuay province and has an anticipated annual gold production of approximately 150,000 ounces over a 12-year mine life"

INV hab ich ja ne weile im depot schon...

Bewertung 64 Mios CAD auch nicht gerade üppig für das hier:

https://www.invmetals.com/projects/loma-larga/

Solgold wäre evtl. leckerer...

immer die frage des hebels wenn´s läuft

INV hab ich ja ne weile im depot schon...

Bewertung 64 Mios CAD auch nicht gerade üppig für das hier:

https://www.invmetals.com/projects/loma-larga/

Solgold wäre evtl. leckerer...

immer die frage des hebels wenn´s läuft

Antwort auf Beitrag Nr.: 56.543.119 von Boersiback am 25.12.17 22:05:49jooo, ist richtig.

bei Exploration muss man sehr "szenativ" denken.

bei Exploration muss man sehr "szenativ" denken.

Antwort auf Beitrag Nr.: 56.544.178 von Popeye82 am 26.12.17 12:22:13Naaabend popeye, bist du bei jangada so richtig im Bilde?

Blick die noch nicht recht. Kenn mich mit dem Platin- Palladiumkramm noch nicht so aus.

Blick die noch nicht recht. Kenn mich mit dem Platin- Palladiumkramm noch nicht so aus.

Antwort auf Beitrag Nr.: 56.546.128 von sir_krisowaritschko am 26.12.17 22:50:00ich bin mir bis Jetzt über die Knackpunkte nicht richtig im Klaren.

2,3,4dinge habe ich, aber machen Wir Es doch mal ANDERSrum:

was haben Sie denn bis Jetzt gesichtet,

sehen Sie, bzw. Welche KNACKpunkte??

bissi Info Hier:

http://www.beaufortsecurities.com/shp/research.php?vid=415

2,3,4dinge habe ich, aber machen Wir Es doch mal ANDERSrum:

was haben Sie denn bis Jetzt gesichtet,

sehen Sie, bzw. Welche KNACKpunkte??

bissi Info Hier:

http://www.beaufortsecurities.com/shp/research.php?vid=415

Antwort auf Beitrag Nr.: 56.513.393 von Popeye82 am 21.12.17 09:42:40TNG

http://www.nracapital.com/research/sgxresearchreport/171184s…

http://www.nracapital.com/research/sgxresearchreport/171184s…

Antwort auf Beitrag Nr.: 55.759.056 von Popeye82 am 16.09.17 16:23:52damit wird die Firma Demnächst den BIGGEST loser zugeführt.

ich Danke für Ihre Teilnahme, es kann nicht Jeder gewinnen.

Hummingbird Resources

http://www.beaufortsecurities.com/shp/research.php?vid=494

http://hummingbirdresources.co.uk/_downloads/Gold_Pour_21.12…

http://hummingbirdresources.co.uk/_downloads/Ore_Commissioni…

ich Danke für Ihre Teilnahme, es kann nicht Jeder gewinnen.

Hummingbird Resources

http://www.beaufortsecurities.com/shp/research.php?vid=494

http://hummingbirdresources.co.uk/_downloads/Gold_Pour_21.12…

http://hummingbirdresources.co.uk/_downloads/Ore_Commissioni…

Antwort auf Beitrag Nr.: 56.546.128 von sir_krisowaritschko am 26.12.17 22:50:00ich erwarte WOHLgemut Ihre Fleissarbeit,

danach folgt Meine.

danach folgt Meine.

Antwort auf Beitrag Nr.: 56.550.469 von Popeye82 am 27.12.17 15:06:58Nur weil sie nun produzieren ein Biggest loser? Muss doch nicht sein. Ich fand den Kurs zwar auch ziemlich ausgereizt, aber immerhin sind sie nun im Produzentenspiel. Im Gegensatz leider zu AGG, die deren Kobada nicht mit HUM verpartnern durften.

Antwort auf Beitrag Nr.: 56.553.979 von Popeye82 am 27.12.17 21:04:27Ist a bisl tricky da relatives Neuland für mich. Muss da erstmal eine Basis schaffen anhand ich die Kennzahlen dannn einordnen kann.

Antwort auf Beitrag Nr.: 56.550.469 von Popeye82 am 27.12.17 15:06:58das ist auch wieder so ein beispiel warum ich so viele aktien halte.

nette company. prodstart... man weiss nie wie´s läuft. ganz nett im gewinn.

also mal 40% vom bestand reduziert vor einigen wochen.

aber ganz weg... warum auch. bisher sind sie gut in zeit und budget und zudem ist das liberia-projekt auch nicht uninteressant.

aber letztlich hast halt oft dutzende werte in einem sektor wo sich ähneln.

viele parameter sind ein wenig anders gelagert aber in sume bei der bewertung dann auch ähnlich zu betrachten.

nette company. prodstart... man weiss nie wie´s läuft. ganz nett im gewinn.

also mal 40% vom bestand reduziert vor einigen wochen.

aber ganz weg... warum auch. bisher sind sie gut in zeit und budget und zudem ist das liberia-projekt auch nicht uninteressant.

aber letztlich hast halt oft dutzende werte in einem sektor wo sich ähneln.

viele parameter sind ein wenig anders gelagert aber in sume bei der bewertung dann auch ähnlich zu betrachten.

Antwort auf Beitrag Nr.: 56.554.822 von sir_krisowaritschko am 27.12.17 23:23:43KEIN problem.

ich habe Zeit.

ich habe Zeit.

Antwort auf Beitrag Nr.: 56.381.980 von Popeye82 am 06.12.17 20:42:00Aguia Resources

http://aguiaresources.com.au/2017/12/28/brazil-agriculture-s…

https://gallery.mailchimp.com/1db4eba6be477803bfa22bb54/file…

http://aguiaresources.com.au/2017/12/28/brazil-agriculture-s…

https://gallery.mailchimp.com/1db4eba6be477803bfa22bb54/file…

Antwort auf Beitrag Nr.: 56.523.914 von Popeye82 am 22.12.17 01:19:05Niocorp Developments

http://www.niocorp.com/index.php/press-releases/377-ibc-and-…

http://www.ibcadvancedalloys.com/

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://www.niocorp.com/images/Supply-Demand_Forecast_for_Sc2O3_to_2028_550px.fw.png

[/url]http://www.niocorp.com/index.php/press-releases/377-ibc-and-…

http://www.ibcadvancedalloys.com/

Antwort auf Beitrag Nr.: 55.381.524 von Popeye82 am 24.07.17 02:13:26Trilogy Metals

https://trilogymetals.com/news/2017/trilogy-metals-announces…

https://trilogymetals.com/news/2017/trilogy-metals-announces…

https://www.south32.net/

https://trilogymetals.com/news/2017/trilogy-metals-appoints-…

https://trilogymetals.com/news/2017/trilogy-metals-reports-a…

https://trilogymetals.com/news/2017/trilogy-metals-files-new…

https://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerN…

https://trilogymetals.com/news/2017/trilogy-metals-reports-i…

https://trilogymetals.com/news/2017/trilogy-metals-announces…

https://trilogymetals.com/news/2017/trilogy-metals-announces…

https://www.south32.net/

https://trilogymetals.com/news/2017/trilogy-metals-appoints-…

https://trilogymetals.com/news/2017/trilogy-metals-reports-a…

https://trilogymetals.com/news/2017/trilogy-metals-files-new…

https://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerN…

https://trilogymetals.com/news/2017/trilogy-metals-reports-i…

Antwort auf Beitrag Nr.: 56.483.939 von Popeye82 am 18.12.17 20:51:27Celsius Resources

http://clients3.weblink.com.au/pdf/CLA/01937998.pdf

http://clients3.weblink.com.au/pdf/CLA/01937998.pdf

Antwort auf Beitrag Nr.: 56.543.077 von Popeye82 am 25.12.17 21:48:06SolGold

http://www.mining-journal.com/resourcestocks/resourcestocks/…

http://www.mining-journal.com/events-coverage/news/1309073/n…

http://www.mining-journal.com/resourcestocks/resourcestocks/…

http://www.mining-journal.com/events-coverage/news/1309073/n…

Antwort auf Beitrag Nr.: 56.570.035 von Popeye82 am 29.12.17 18:45:03SolGold

http://www.solgold.com.au/solgold-blog-1

https://twitter.com/jpmorgan/status/946504802388688896/video…

https://twitter.com/i/web/status/946716229854748672

http://www.solgold.com.au/solgold-blog-1

https://twitter.com/jpmorgan/status/946504802388688896/video…

https://twitter.com/i/web/status/946716229854748672

Antwort auf Beitrag Nr.: 56.570.035 von Popeye82 am 29.12.17 18:45:03Hab mir ein paar Cornerstone reingelegt - halten ja 15% an Cascabel und ~10% der Shares von SolGold. Namenswechsel und Auslagerung der eigenen Explorationsgebiete in eine neue Gesellschaft sind geplant...

Antwort auf Beitrag Nr.: 56.517.911 von Popeye82 am 21.12.17 15:19:58NEXT US open, pit Gold Producer

Northern Vertex Mining

http://www.northernvertex.com/news-releases/2017/northern-ve…

Northern Vertex Mining

http://www.northernvertex.com/news-releases/2017/northern-ve…

Antwort auf Beitrag Nr.: 56.427.779 von Popeye82 am 12.12.17 02:54:17spannende Firma.

____________

scopping study.

American Pacific Borate +Lithium

http://americanpacificborate.com/wp-content/uploads/ABRCompl…

____________

scopping study.

American Pacific Borate +Lithium

http://americanpacificborate.com/wp-content/uploads/ABRCompl…

Antwort auf Beitrag Nr.: 56.539.004 von Popeye82 am 24.12.17 01:13:04Jangada Mines (plc)

https://investingnews.com/daily/resource-investing/precious-…

http://www.mining.com/palladium-touches-17-year-high-1069-50…

https://investingnews.com/daily/resource-investing/precious-…

http://www.mining.com/palladium-touches-17-year-high-1069-50…

Antwort auf Beitrag Nr.: 56.292.365 von Popeye82 am 28.11.17 01:39:29Millennial Lithium

http://millenniallithium.com/2017/12/27/millennial-lithium-a…

http://millenniallithium.com/2017/12/21/millennial-and-remsa…

www.remsa.gob.ar

www.remsa.gob.ar/files/REMSA_PDAC_2017.pptx

http://millenniallithium.com/2017/12/27/millennial-lithium-a…

http://millenniallithium.com/2017/12/21/millennial-and-remsa…

www.remsa.gob.ar

www.remsa.gob.ar/files/REMSA_PDAC_2017.pptx

Antwort auf Beitrag Nr.: 56.571.859 von Popeye82 am 29.12.17 23:06:03wenn ichs grad richtig im kopf hab bei denen

39% Palladium

31% Platin

sollte platin mal wieder kommen und palladium unter den platinpreis fallen machts auch nicht so viel aus. in der Studie hatte man platin recht hoch angesetzt und palladium sehr tief (was in summe dann auch wieder passt)

39% Palladium

31% Platin

sollte platin mal wieder kommen und palladium unter den platinpreis fallen machts auch nicht so viel aus. in der Studie hatte man platin recht hoch angesetzt und palladium sehr tief (was in summe dann auch wieder passt)

Antwort auf Beitrag Nr.: 56.454.467 von Popeye82 am 14.12.17 23:20:29eine Meiner Aktien.

Black Rock Mining

http://www.mining-journal.com/resourcestocks-company-profile…

Black Rock Mining

http://www.mining-journal.com/resourcestocks-company-profile…

Antwort auf Beitrag Nr.: 56.570.956 von rolleg am 29.12.17 20:40:30bei SOLG habe ich auch lange überlegt.

SolGold/Cornerstone/Keine/oder Beide.

haben Beide Vor- und Nachteile Wie ich Das sehe.

aber der "Brainbug" hat mir dann doch besser gefallen.

SolGold/Cornerstone/Keine/oder Beide.

haben Beide Vor- und Nachteile Wie ich Das sehe.

aber der "Brainbug" hat mir dann doch besser gefallen.

Antwort auf Beitrag Nr.: 55.117.156 von Popeye82 am 10.06.17 14:39:25Arianne Phosphate (Incorporation)

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

he touched a LOT of people

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

he touched a LOT of people

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

Antwort auf Beitrag Nr.: 56.538.422 von Popeye82 am 23.12.17 21:43:18Pretium Resources

http://www.stockhouse.com/opinion/independent-reports/2017/1…

http://www.stockhouse.com/opinion/independent-reports/2017/1…

Antwort auf Beitrag Nr.: 56.453.501 von Popeye82 am 14.12.17 21:14:59Anson Resources

http://www.proactiveinvestors.co.uk/companies/news/189329/an…

http://www.ansonresources.com/wp-content/uploads/2017/12/17.…

https://www.bloomberg.com/profiles/companies/0480761D:CH-zho…

http://www.ansonresources.com/wp-content/uploads/2017/12/17.…

http://www.proactiveinvestors.co.uk/companies/news/189329/an…

http://www.ansonresources.com/wp-content/uploads/2017/12/17.…

https://www.bloomberg.com/profiles/companies/0480761D:CH-zho…

http://www.ansonresources.com/wp-content/uploads/2017/12/17.…

Antwort auf Beitrag Nr.: 56.481.143 von Popeye82 am 18.12.17 16:44:05Bacanora Minerals

http://ir.euroinvestor.com/Tools/newsArticleHTML.aspx?soluti…

http://ir.euroinvestor.com/Tools/newsArticleHTML.aspx?soluti…

Antwort auf Beitrag Nr.: 56.026.422 von Popeye82 am 25.10.17 19:40:29Carbine Resources

http://www.asx.com.au/asxpdf/20171031/pdf/43ntvxc5dvj48j.pdf

http://carbineresources.com.au/wp-content/uploads/2017/12/17…

http://www.asx.com.au/asxpdf/20171031/pdf/43ntvxc5dvj48j.pdf

http://carbineresources.com.au/wp-content/uploads/2017/12/17…

Antwort auf Beitrag Nr.: 56.384.011 von Popeye82 am 07.12.17 04:43:15Capricorn Metals

http://capmetals.com.au/wp-content/uploads/2017/11/171130-CM…

http://capmetals.com.au/wp-content/uploads/2017/10/171005-Ta…

http://capmetals.com.au/wp-content/uploads/2017/11/171130-CM…

http://capmetals.com.au/wp-content/uploads/2017/10/171005-Ta…

Antwort auf Beitrag Nr.: 56.215.038 von Popeye82 am 18.11.17 12:26:05Mkango Resources

http://www.mkango.ca/s/news.asp?ReportID=808811

http://www.hallgartenco.com/file.php?path=Mining&filename=Mk…

http://www.mkango.ca/s/news.asp?ReportID=808811

http://www.hallgartenco.com/file.php?path=Mining&filename=Mk…

Antwort auf Beitrag Nr.: 56.201.475 von Popeye82 am 16.11.17 18:01:40Asiamet Resources

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.proactiveinvestors.co.uk/companies/news/176233/in…

http://www.asiametresources.com/i/pdf/2017-12-05-CP.pdf

http://www.asiametresources.com/s/Copper.asp

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.proactiveinvestors.co.uk/companies/news/176233/in…

http://www.asiametresources.com/i/pdf/2017-12-05-CP.pdf

http://www.asiametresources.com/s/Copper.asp

Antwort auf Beitrag Nr.: 56.484.491 von Popeye82 am 18.12.17 21:48:54MGX Minerals

https://www.mgxminerals.com/investors/news/2018/306-mgx-mine…

https://oilgas.ogm.utah.gov/oilgasweb/statistics/oil-prod-by…

https://pubs.usgs.gov/fs/2012/3031/FS12-3031.pdf

https://www.mgxminerals.com/investors/news/2018/306-mgx-mine…

https://oilgas.ogm.utah.gov/oilgasweb/statistics/oil-prod-by…

https://pubs.usgs.gov/fs/2012/3031/FS12-3031.pdf

Antwort auf Beitrag Nr.: 56.572.288 von Popeye82 am 30.12.17 01:00:45Millennial Lithium

https://www.sedar.com/CheckCode.do

https://www.sedar.com/CheckCode.do

Antwort auf Beitrag Nr.: 56.571.301 von Popeye82 am 29.12.17 21:41:23NEW US Open winner

Northern Vertex Mining

http://www.northernvertex.com/news-releases/2018/northern-ve…

Northern Vertex Mining

http://www.northernvertex.com/news-releases/2018/northern-ve…

Antwort auf Beitrag Nr.: 56.432.171 von Popeye82 am 12.12.17 15:52:18Ironbark Zinc

RESOURCEStocks Q&A: Ironbark's Jonathan Downes; Standout zinc project developer Ironbark Zinc (ASX: IBG) is seeking finance for one of the world’s major new proposed zinc projects, in Greenland. The project could be transformative for the sparsely populated country – and certainly the under-valued junior. Managing director Jonathan Downes talks us through the next phase for Citronen

http://www.mining-journal.com/resourcestocks/resourcestocks/…

"RESOURCEStocks: Your recent revised feasibility study reinforced the long-term earning potential/credentials, and asset value, of Citronen. What do you see as the most compelling aspects from a peer-comparison valuation perspective?

Jonathan Downes: I think that generally peer to peer is always hard from a valuation perspective because every project typically has distinctions. Nevertheless I consider that Ironbark has been overlooked due to the significant time spent securing the 30-year mining permit. The project is fully drilled out, engineered, permitted and located in a low sovereign risk jurisdiction with a large 100% owned resource.

RS: What are the standout points of difference in your value proposition at this stage?

JD: The scale of the project is probably one of the key defining points and the resource to date is limited only by the current extent of drilling. In production it would be one of the largest zinc mines in the world with over 5.2 million tonnes of defined zinc metal in resources.

RS: Presumably, valuation upside is another of the real distinctions. I'm struggling to see a bigger disconnect between a (revised) project NPV, and the value the market is putting on the company/asset. What do you put that disconnect down to, and what is going to turn it around?

JD: I am also surprised at the market disconnect - it is simply absurd. Some feedback I have received has been that the market needs to see more clarity and get more comfort around the financing of the project. The resource and study work has all been done by independent and credible engineering and construction groups, Greenland is a great jurisdiction to develop a project, and the zinc price is strong and forecast to remain so. We are making some solid headway into the financing and I believe it is going to be one of the situations when just one investor "stepping up" is required and then the vision will be realised, followed by the rest of the financing and a major revaluation of the company.

RS: What is the zinc-price ‘sweet spot' for this project?

JD: The zinc sweet spot once operational is anything over the total projected costs of US$0.66/lb plus something to return to our investors. I am confident that we will see a healthy margin above this going forward.

RS: Where is there scope to further improve the economics of Citronen/what will be the focus of work to be done over the next 3-6 months?

JD: The level of engineering work and optimising has been substantial and we are confident that we already have a workable, industry proven and cost effective plan. To optimise this further may involve some further metallurgical testwork, which is currently ongoing, and some potential opportunities regarding reduced shipping costs. We are pleased that the project is currently robust. Work now is really focused on the project financing package.

RS: What were the main things to come out of the recent site visit you made with senior Greenland Government, and NFC, officials?

JD: The recent site visit was helpful in introducing the senior Greenland Government officials to the senior China Nonferrous (NFC) officials and building a relationship of trust. The main objective however was to provide site access to the NFC engineers to the project to finalise their feasibility study. This included core library inspections, visiting the proposed equipment sites, decline site and proposed tailings sites.

RS: What comments would you make about the outlook for next year, in terms of the impact continuing strength in zinc prices, and clarity on what's in the supply pipeline, might have on Ironbark's plans and valuation going forward?

JD: Going forward I am seeing a lot of credible research suggesting strong zinc prices so with our project at such an advanced stage I am confident we can achieve development in a rapid time frame. One of the more interesting aspects of the zinc market is just how little material is available to the industry in the reported zinc stockpiles and the war between smelters as the Chinese treatment charge rates fall to attract zinc concentrate from around the world.

It is a fascinating time in the zinc space."

RESOURCEStocks Q&A: Ironbark's Jonathan Downes; Standout zinc project developer Ironbark Zinc (ASX: IBG) is seeking finance for one of the world’s major new proposed zinc projects, in Greenland. The project could be transformative for the sparsely populated country – and certainly the under-valued junior. Managing director Jonathan Downes talks us through the next phase for Citronen

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://www.mining-journal.com/w-images/24c9c2ac-dcfa-4c16-8b65-65eb862af818/3/IronbarkSiteVisit-1131x553.jpg

[/url]http://www.mining-journal.com/resourcestocks/resourcestocks/…

"RESOURCEStocks: Your recent revised feasibility study reinforced the long-term earning potential/credentials, and asset value, of Citronen. What do you see as the most compelling aspects from a peer-comparison valuation perspective?

Jonathan Downes: I think that generally peer to peer is always hard from a valuation perspective because every project typically has distinctions. Nevertheless I consider that Ironbark has been overlooked due to the significant time spent securing the 30-year mining permit. The project is fully drilled out, engineered, permitted and located in a low sovereign risk jurisdiction with a large 100% owned resource.

RS: What are the standout points of difference in your value proposition at this stage?

JD: The scale of the project is probably one of the key defining points and the resource to date is limited only by the current extent of drilling. In production it would be one of the largest zinc mines in the world with over 5.2 million tonnes of defined zinc metal in resources.

RS: Presumably, valuation upside is another of the real distinctions. I'm struggling to see a bigger disconnect between a (revised) project NPV, and the value the market is putting on the company/asset. What do you put that disconnect down to, and what is going to turn it around?

JD: I am also surprised at the market disconnect - it is simply absurd. Some feedback I have received has been that the market needs to see more clarity and get more comfort around the financing of the project. The resource and study work has all been done by independent and credible engineering and construction groups, Greenland is a great jurisdiction to develop a project, and the zinc price is strong and forecast to remain so. We are making some solid headway into the financing and I believe it is going to be one of the situations when just one investor "stepping up" is required and then the vision will be realised, followed by the rest of the financing and a major revaluation of the company.

RS: What is the zinc-price ‘sweet spot' for this project?

JD: The zinc sweet spot once operational is anything over the total projected costs of US$0.66/lb plus something to return to our investors. I am confident that we will see a healthy margin above this going forward.

RS: Where is there scope to further improve the economics of Citronen/what will be the focus of work to be done over the next 3-6 months?

JD: The level of engineering work and optimising has been substantial and we are confident that we already have a workable, industry proven and cost effective plan. To optimise this further may involve some further metallurgical testwork, which is currently ongoing, and some potential opportunities regarding reduced shipping costs. We are pleased that the project is currently robust. Work now is really focused on the project financing package.

RS: What were the main things to come out of the recent site visit you made with senior Greenland Government, and NFC, officials?

JD: The recent site visit was helpful in introducing the senior Greenland Government officials to the senior China Nonferrous (NFC) officials and building a relationship of trust. The main objective however was to provide site access to the NFC engineers to the project to finalise their feasibility study. This included core library inspections, visiting the proposed equipment sites, decline site and proposed tailings sites.

RS: What comments would you make about the outlook for next year, in terms of the impact continuing strength in zinc prices, and clarity on what's in the supply pipeline, might have on Ironbark's plans and valuation going forward?

JD: Going forward I am seeing a lot of credible research suggesting strong zinc prices so with our project at such an advanced stage I am confident we can achieve development in a rapid time frame. One of the more interesting aspects of the zinc market is just how little material is available to the industry in the reported zinc stockpiles and the war between smelters as the Chinese treatment charge rates fall to attract zinc concentrate from around the world.

It is a fascinating time in the zinc space."

Antwort auf Beitrag Nr.: 56.424.077 von Popeye82 am 11.12.17 15:53:09Plateau Uranium

http://markets.businessinsider.com/news/stocks/Plateau-Urani…

http://markets.businessinsider.com/news/stocks/Plateau-Urani…

Antwort auf Beitrag Nr.: 55.556.415 von Popeye82 am 18.08.17 21:41:09Fission Uranium

https://fissionuranium.com/news/index.php?content_id=622

https://fissionuranium.com/news/index.php?content_id=613

https://fissionuranium.com/news/index.php?content_id=608

https://fissionuranium.com/news/index.php?content_id=607

https://fissionuranium.com/news/index.php?content_id=622

https://fissionuranium.com/news/index.php?content_id=613

https://fissionuranium.com/news/index.php?content_id=608

https://fissionuranium.com/news/index.php?content_id=607

(Erste)"PEA" avisiert H1 2018.

Callinex Mines

https://callinex.ca/callinex-issues-letter-shareholders/

https://callinex.ca/wp-content/uploads/2017/09/CNX-Investor-…

Callinex Mines

https://callinex.ca/callinex-issues-letter-shareholders/

https://callinex.ca/wp-content/uploads/2017/09/CNX-Investor-…

Antwort auf Beitrag Nr.: 56.522.105 von Popeye82 am 21.12.17 20:36:57Bluestone Resources

http://www.bluestoneresources.ca/_resources/news/20180102.pd…

http://www.bluestoneresources.ca/_resources/news/20180102.pd…

Antwort auf Beitrag Nr.: 56.106.968 von Popeye82 am 06.11.17 07:44:02Primary Gold

http://www.primarygold.com.au/final-approval-paves-way-start…

http://www.dmirs.wa.gov.au/

http://www.primarygold.com.au/wp-content/uploads/2017/11/171…

http://www.westgold.com.au/

http://www.primarygold.com.au/category/company-news/

http://www.primarygold.com.au/final-approval-paves-way-start…

http://www.dmirs.wa.gov.au/

http://www.primarygold.com.au/wp-content/uploads/2017/11/171…

http://www.westgold.com.au/

http://www.primarygold.com.au/category/company-news/

Antwort auf Beitrag Nr.: 56.408.593 von Popeye82 am 08.12.17 19:39:33voraussichtlich EIner Der NEXT loser.

interessant zu lesen.

Alphamin Resources

http://www.alphaminresources.com/wp-content/uploads/2017/12/…

http://www.lockheedmartin.com/

http://www.alphaminresources.com/alphamins-reluctant-ceo/

interessant zu lesen.

Alphamin Resources

http://www.alphaminresources.com/wp-content/uploads/2017/12/…

http://www.lockheedmartin.com/

http://www.alphaminresources.com/alphamins-reluctant-ceo/

Antwort auf Beitrag Nr.: 56.570.413 von Popeye82 am 29.12.17 19:34:05Jetzt ist Sie da.

Ecuador(resources) oder SolGold-Interessierte SOLLTEN es lesen.

SolGold

http://ir.euroinvestor.com/Tools/newsArticleHTML.aspx?soluti…

https://www.rns-pdf.londonstockexchange.com/rns/7768A_1-2018…

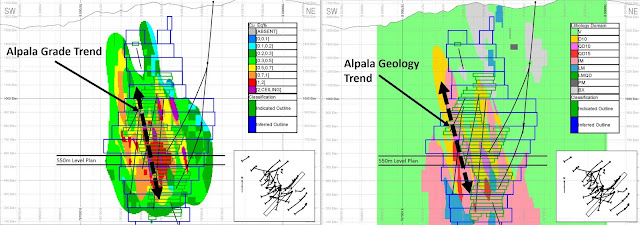

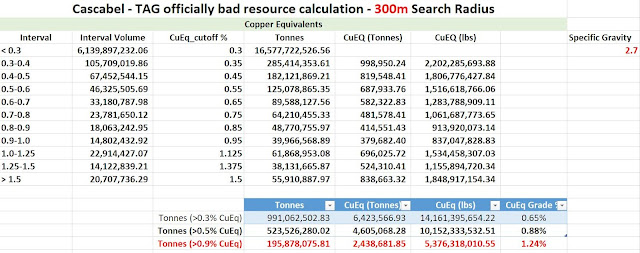

"Alpala Maiden Mineral Resource Estimate

120 Mt High Grade Core @1.8% CuEq (60% Indicated) within

1.08 Bt @ 0.68% CuEq (5.2 Mt Cu, 12.3 Moz Au, 40% Indicated)

The Board of SolGold (LSE and TSX code: SOLG) is pleased to announce the results of the Alpala Maiden Mineral Resource Estimate (MRE) at the Cascabel Project, the Company's 85% owned copper-gold porphyry project in Ecuador (refer Further Information below). The MRE has been reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014).

HIGHLIGHTS:

Ø Alpala Maiden Mineral Resource Estimate across both Indicated and Inferred classifications totals a current 1.08 Bt @ 0.68% CuEq (7.4 Mt CuEq) at 0.3% CuEq cut off, some 40% of which is in the Indicated category (by tonnage).

Ø Contained metal content totals a current 5.2 Mt Cu and 12.3 Moz Au, some 45% of which is within the Indicated category (by contained metal).

Ø Higher grade core has a current 120 Mt @ 1.8% CuEq (2.0 Mt CuEq) at a 1.1% CuEq cut off, some 60% of which is in the Indicated category (by tonnage);

Ø A further 100 Mt @ 1.0% CuEq (1.0 Mt CuEq) is added to the high grade core if a 0.9% CuEq cut off is used, some 50% of which is in the Indicated category (by tonnage).

Ø Estimate completed from 53,616m of drilling, approximately 84% of 63,500m metres drilled to date.

Ø Assay results still pending for a further 9,844m of drill core (16%) of the total to 21 December 2017.