Rohstoffe, Angebot/Nachfrage - 500 Beiträge pro Seite (Seite 2)

eröffnet am 11.09.14 08:32:17 von

neuester Beitrag 02.11.19 22:08:46 von

neuester Beitrag 02.11.19 22:08:46 von

Beiträge: 2.052

ID: 1.198.959

ID: 1.198.959

Aufrufe heute: 0

Gesamt: 67.810

Gesamt: 67.810

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 19 Minuten | 1496 | |

| vor 31 Minuten | 954 | |

| vor 15 Minuten | 874 | |

| gestern 18:31 | 840 | |

| heute 10:47 | 753 | |

| vor 37 Minuten | 675 | |

| heute 09:07 | 666 | |

| vor 12 Minuten | 620 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.161,01 | +1,36 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3500 | +1,14 | 60 | |||

| 5. | 4. | 157,24 | -0,91 | 50 | |||

| 6. | Neu! | 0,3044 | +4,32 | 36 | |||

| 7. | Neu! | 4,7950 | +6,91 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 31 |

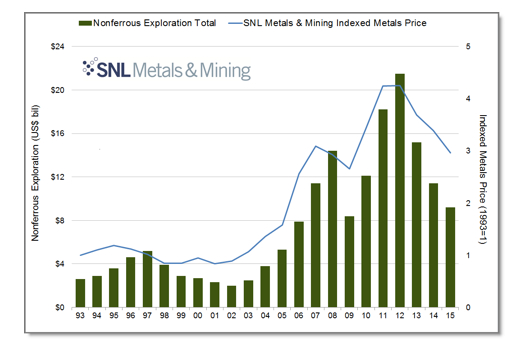

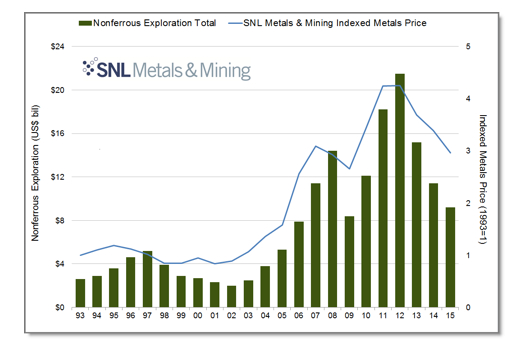

Global mining exploration down, 19%, in 2015

www.mining.com/web/global-mining-exploration-down-19-in-2015…

http://go.snl.com/SNL-Metals-Mining-World-Exploration-Trends…

www.mining.com/web/global-mining-exploration-down-19-in-2015…

http://go.snl.com/SNL-Metals-Mining-World-Exploration-Trends…

More than Oil: Iran Has Big Plans for Downstream +Mining, after Sanctions End, Iran plans to diversify its industry, after the end of the international sanctions +embargos, with bigs investments in mining, mid- and downstream projects. These plans however, are based on optimistic growth assumptions of an annual double digit growth, within the next decade; Iran's target is to increase the mining’s current GDP share from <1% to >2%, +relevant downstream industries from 5% to 20% within next ten years(2015-'25), market analysts +industry experts agree. These plans would require mining +relevant industries to grow @10-12%, per year

www.process-worldwide.com/more-than-oil-iran-has-big-plans-f…

www.process-worldwide.com/more-than-oil-iran-has-big-plans-f…

www.australianmining.com.au/news/forrest-reignites-call-for-…

“I believe it is in the national interest to fully investigate why certain industry players repeatedly made forward looking statements about oversupplying the market and how those statements contributed to the collapse in the price of iron ore,” Forrest said

http://piercepoints.com/mining-investment-exploration-gold-b…

"Last week, I talked about big changes afoot in the world’s top gold-consuming nation, India. With the government there imposing a surprise sales tax on gold, in an apparent attempt to further curb demand.

And the last few days, things got a lot more serious for the gold market in this critical locale.

One of the immediate effects of the 1% sales tax announced on February 29 was a massive outcry from India’s jewellers. Who launched a full-scale strike on March 2 to protest the levy.

That work action has reportedly brought gold sales in the country to a standstill. With one professional in the Indian refining industry telling Platts on Tuesday that there is “no buying anywhere” across the nation.

But reports emerged the last couple days suggesting that jewellers were ready to make a compromise with the government in order to get back to work. And late Tuesday, such a strategy was indeed confirmed by the head of India’s Gems and Jewellery Trade Federation.

And it could be the biggest news to hit the gold market in decades.

The Jewellery Federation director Ashok Minawalla told local press that India’s jewellers have offered to stop selling gold bullion directly to consumers. A practice that up until now has been common — with gold buyers often picking up gold bars from jewellers as investment holdings.

The following is a direct quote from India’s Hindustan Times on what a halt to bullion sales could mean for the gold market:

“The move will likely affect almost a quarter of [jewellers’] overall sales, while also reducing gold imports, which had earlier been driven due to a surge in purchases.

More than 250 to 300 tonnes of the total 900 tonnes of gold annually imported by jewellers, is bought into the country in the form of bullion bars of 100 gm each.”

This suggests that the decision from the jewellery federation could cut demand by up to 300 tonnes, or 9.65 million ounces, annually. A figure that would equate to 7.1% of total global demand from 2015.

The effect this could have on the gold price is difficult to overstate. In short, this could be one of the biggest threats the gold market has seen in years. Watch for more announcements on whether India’s jewellers will indeed implement this unprecedented policy.

Here’s to getting ready,

Dave Forest "

BHP's $14,000,000,000 Jansen potash becomes latest victim of commodities rout, BHP has cut $130,000,000 from this year's planned $330,000,000 capital expenditure to develop +study the feasibility of the project

www.mining.com/bhps-14-billion-jansen-potash-becomes-latest-…

www.bloomberg.com/news/articles/2016-03-10/bhp-scales-back-c…

"After months of speculation, BHP Billiton’s (ASX:BHP) massive potash project in Canada has finally begun feeling the impact of a sustained rout in commodity prices, as the world’s biggest miner has confirmed it is reducing spending on the Saskatchewan-based asset this year.

Speaking to Bloomberg, the president of BHP’s Canadian unit Giles Hellyer said the company has cut $130 million from the planned $330 million capital expenditure to develop and study the feasibility of the Jansen project in the current financial.

“We’re doing more with less,” Hellyer told Bloomberg. “The intent is to be a lot more effective and efficient in what we’re doing and complete the work over a slightly longer time horizon.”

The crop nutrient began its decline four years ago as weak crop prices and currency declines pinched demand. Prices also suffered from increased competition following the breakup in 2013 of a Russian-Belarusian marketing cartel that previously helped limit supply.

In recent months, potash collapse has picked up speed, with some prices falling by a quarter since last spring. That has put a lot of more pressure on producers, whose profits have been hit by falling prices, largely due to weak currencies in countries such as Brazil and low grain prices.

BHP is in the midst of a $2.6-billion investment to build production shafts at its Jansen project in Saskatchewan. Jansen would be a game-changer in the industry, as the company expects to generate eight million tonnes of potash a year, which would amount to nearly 15% of global supply.

By comparison, the Mosaic Company’s (NYSE:MOS) Esterhazy mine will produce about 6.3 million tonnes per year once its latest expansion is complete, while most Saskatchewan operations churn out between three and four million tonnes per year.

So far BHP has invested about $3.8 billion in Jansen, $2.6 billion of which was earmarked for surface construction and the sinking of shafts in August 2013. And while the company does not release capital cost estimates, analysts have predicted it will cost about $14 billion to bring the mine into production.

BHP has not committed to a completion date, nor received board approval. "

www.mining.com/bhps-14-billion-jansen-potash-becomes-latest-…

www.bloomberg.com/news/articles/2016-03-10/bhp-scales-back-c…

"After months of speculation, BHP Billiton’s (ASX:BHP) massive potash project in Canada has finally begun feeling the impact of a sustained rout in commodity prices, as the world’s biggest miner has confirmed it is reducing spending on the Saskatchewan-based asset this year.

Speaking to Bloomberg, the president of BHP’s Canadian unit Giles Hellyer said the company has cut $130 million from the planned $330 million capital expenditure to develop and study the feasibility of the Jansen project in the current financial.

“We’re doing more with less,” Hellyer told Bloomberg. “The intent is to be a lot more effective and efficient in what we’re doing and complete the work over a slightly longer time horizon.”

The crop nutrient began its decline four years ago as weak crop prices and currency declines pinched demand. Prices also suffered from increased competition following the breakup in 2013 of a Russian-Belarusian marketing cartel that previously helped limit supply.

In recent months, potash collapse has picked up speed, with some prices falling by a quarter since last spring. That has put a lot of more pressure on producers, whose profits have been hit by falling prices, largely due to weak currencies in countries such as Brazil and low grain prices.

BHP is in the midst of a $2.6-billion investment to build production shafts at its Jansen project in Saskatchewan. Jansen would be a game-changer in the industry, as the company expects to generate eight million tonnes of potash a year, which would amount to nearly 15% of global supply.

By comparison, the Mosaic Company’s (NYSE:MOS) Esterhazy mine will produce about 6.3 million tonnes per year once its latest expansion is complete, while most Saskatchewan operations churn out between three and four million tonnes per year.

So far BHP has invested about $3.8 billion in Jansen, $2.6 billion of which was earmarked for surface construction and the sinking of shafts in August 2013. And while the company does not release capital cost estimates, analysts have predicted it will cost about $14 billion to bring the mine into production.

BHP has not committed to a completion date, nor received board approval. "

http://piercepoints.com/energy-investment-exploration-oil-na…

www.law360.com/articles/769100/sabine-contract-ruling-may-sp…

"Oil and gas data experts Evaluate Energy showed yesterday that U.S. E&Ps took a huge hit in 2015. With the value of total proved reserves in the sector declining by an astounding $515 billion dollars.

The chart below shows just how great the damage is, compared to reserves valuations the last few years.

Factors like that have caused an increasing number of high-profile E&Ps to file for bankruptcy in America. And a critical court decision this week could mean even more coming.

That ruling came Tuesday in the bankruptcy proceedings of Sabine Oil & Gas, detailed by Energy Law360. Where a New York judge ruled that bankruptcy allows Sabine to cancel contracts it holds with midstream firms on the company's petroleum licenses in Texas.

Here's why this is a sea change for oil and gas law.

Sabine held three separate contracts with pipeline firms in Texas, for the transport and sale of oil and gas that the company produced. These contracts came with clauses like "deliver or pay" features -- where Sabine was obligated to send minimum volumes of production through the pipeline, or pay financial penalties to the pipeline operators.

Such contracts could have been a stumbling block in bankruptcy -- requiring the company to deliver production or cash at a time when its operations have slowed or stopped. And so Sabine had challenged in bankruptcy court to have the agreements nixed.

And the judge in the case agreed. Ruling that the midstream contracts are not "running with the land" -- in essence, saying that the contracts are not inextricably tied to the land assets that underlie Sabine.

The decision opens the door for Sabine to sever the contracts as it restructures in bankruptcy. A strategy that other E&Ps immediately jumped on -- with bankrupt producer Magnum Hunter Resources yesterday striking a deal to cancel four midstream contracts as it restructures.

With the case giving producers a greater financial incentive to declare bankruptcy, we could see such filings increase. Obviously posing a risk for equity holders -- and also for midstream companies, which could see a rising amount of contract business disappear in the bankruptcy courts.

Watch for more cases of canceled contracts emerging. And possible writedowns and loss of income at midstream firms as a result.

Here's to running with it,

Dave Forest "

Antwort auf Beitrag Nr.: 51.986.891 von Popeye82 am 15.03.16 20:11:10

http://piercepoints.com/energy-investment-mining-coal-china-…

http://piercepoints.com/energy-investment-mining-coal-china-…

Antwort auf Beitrag Nr.: 51.987.608 von Popeye82 am 15.03.16 22:03:16

How the global nuclear power industry is transforming, INTERACTIVE: Nuclear electricity output set to grow @fastest clip in >20 years increasing annual uranium supply needs by >100,000,000 pound

https://mlms.infomine.com/ga/MINING.com%20Mining%20News%20Di…

www.mining.com/how-the-global-nuclear-power-industry-is-tran…

www.world-nuclear.org/our-association/publications/publicati…

How the global nuclear power industry is transforming, INTERACTIVE: Nuclear electricity output set to grow @fastest clip in >20 years increasing annual uranium supply needs by >100,000,000 pound

https://mlms.infomine.com/ga/MINING.com%20Mining%20News%20Di…

www.mining.com/how-the-global-nuclear-power-industry-is-tran…

www.world-nuclear.org/our-association/publications/publicati…

Antwort auf Beitrag Nr.: 51.988.217 von Popeye82 am 16.03.16 03:15:57

European Commission to Recommend 450,000,000,000 to 500,000,000,000 Euro Investments in Nuclear Power, by 2050

www.u3o8.biz/s/MarketCommentary.asp?ReportID=742785&_Type=Ma…

"German business and financial publication Handelsblatt reported on Tuesday that the European Commission is planning to call on European utility companies to make major investments in nuclear energy.

The commission is set to release a report on the state of the nuclear industry in coming weeks, and Handelsblatt was able to see the document in advance of its publication.

"[T]he Commission estimated that to secure energy supply across the 28-nation bloc, investments of between €450 billion and €500 billion are needed in nuclear power by 2050," the publication stated. Of that, between 45 and 50 billion euros would go towards maintaining existing power stations. The remainder would be invested in building new plants.

Rob Chang, managing director and head of metals and mining and Cantor Fitzgerald, was certainly positive on the news. "This will be very positive for uranium equities across the board and among producers," he said in an emailed statement. Specifically, he cited Cameco (TSX:CCO) Ur-Energy (TSX:URE) and Uranium Energy Corp (NYSEMKT:UEC) as examples, "among others."

Chang also mentioned that the news would be positive for uranium investment firm Uranium Participation Corp. (TSX:U).

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article. "

European Commission to Recommend 450,000,000,000 to 500,000,000,000 Euro Investments in Nuclear Power, by 2050

www.u3o8.biz/s/MarketCommentary.asp?ReportID=742785&_Type=Ma…

"German business and financial publication Handelsblatt reported on Tuesday that the European Commission is planning to call on European utility companies to make major investments in nuclear energy.

The commission is set to release a report on the state of the nuclear industry in coming weeks, and Handelsblatt was able to see the document in advance of its publication.

"[T]he Commission estimated that to secure energy supply across the 28-nation bloc, investments of between €450 billion and €500 billion are needed in nuclear power by 2050," the publication stated. Of that, between 45 and 50 billion euros would go towards maintaining existing power stations. The remainder would be invested in building new plants.

Rob Chang, managing director and head of metals and mining and Cantor Fitzgerald, was certainly positive on the news. "This will be very positive for uranium equities across the board and among producers," he said in an emailed statement. Specifically, he cited Cameco (TSX:CCO) Ur-Energy (TSX:URE) and Uranium Energy Corp (NYSEMKT:UEC) as examples, "among others."

Chang also mentioned that the news would be positive for uranium investment firm Uranium Participation Corp. (TSX:U).

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article. "

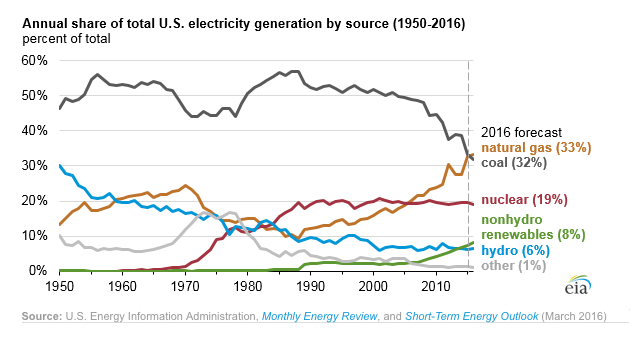

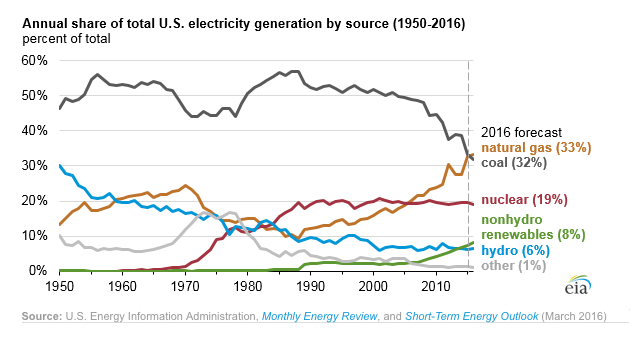

9(!!)% der US Elektrizität 2014 geht auf Peabody zurück

Bankruptcy looms for world's largest private coal miner, "Substantial doubts" St-Louis-based Peabody Energy with history traced back to 1883 can continue as going concern, after missing payment on $6,000,000,000 debt

www.mining.com/worlds-largest-private-coal-company-likely-go…

www.sec.gov/Archives/edgar/data/1064728/000106472816000157/b…

Bankruptcy looms for world's largest private coal miner, "Substantial doubts" St-Louis-based Peabody Energy with history traced back to 1883 can continue as going concern, after missing payment on $6,000,000,000 debt

www.mining.com/worlds-largest-private-coal-company-likely-go…

www.sec.gov/Archives/edgar/data/1064728/000106472816000157/b…

Antwort auf Beitrag Nr.: 51.988.217 von Popeye82 am 16.03.16 03:15:57

http://piercepoints.com/mining-investment-exploration-kazakh…

"Short but ominous note from the world’s largest uranium-producing nation this week. Suggesting that some unpleasant surprises could be coming for the mining sector here.

The place is Kazakhstan. Where the country’s president said the government may be about to take some drastic action against foreign operators in the uranium industry.

Speaking at a meeting with national uranium miner Kazatomprom, President Nursultan Nazarbayev said that Kazakhstan may soon look to “reclaim” some assets from mining companies. With the president saying that the action is necessary because firms are “not meeting their obligations” when it comes to mine development.

As Nazarbayev put it, “In this regard it is necessary to either ensure that they meet their obligations or look into reclaiming those assets in the interests of our state.”

That’s a serious warning from the government. Especially given that Kazakhstan’s uranium sector has attracted considerable foreign investment over the last several years — including from Areva, Cameco, and Sumitomo, as well as Russian and Chinese developers.

The government didn’t elaborate as to which of these project holders are not pulling their weight. But the warning suggests all of these companies could see their ventures come under scrutiny, if they’re seen to be advancing too slowly.

There was also little detail as to what exact issues the government has taken with project developments. Which makes the situation all the more concerning, raising the possibility that any number of nitpickings could be used to justify stripping projects.

It’s even possible that this whole argument could simply be a pretext for re-enforcing greater state control of the mining sector. Or a means of clawing back choice assets in order to award them to more politically-palatable partners.

Of course, it’s also possible this is just sabre-rattling to spur miners into greater productivity. But the tough words make this an issue all observers in the uranium space need to be paying attention to. Watch for more announcements from the Kazakhs.

Here’s to a grey area in yellowcake,

"

"

http://piercepoints.com/mining-investment-exploration-kazakh…

"Short but ominous note from the world’s largest uranium-producing nation this week. Suggesting that some unpleasant surprises could be coming for the mining sector here.

The place is Kazakhstan. Where the country’s president said the government may be about to take some drastic action against foreign operators in the uranium industry.

Speaking at a meeting with national uranium miner Kazatomprom, President Nursultan Nazarbayev said that Kazakhstan may soon look to “reclaim” some assets from mining companies. With the president saying that the action is necessary because firms are “not meeting their obligations” when it comes to mine development.

As Nazarbayev put it, “In this regard it is necessary to either ensure that they meet their obligations or look into reclaiming those assets in the interests of our state.”

That’s a serious warning from the government. Especially given that Kazakhstan’s uranium sector has attracted considerable foreign investment over the last several years — including from Areva, Cameco, and Sumitomo, as well as Russian and Chinese developers.

The government didn’t elaborate as to which of these project holders are not pulling their weight. But the warning suggests all of these companies could see their ventures come under scrutiny, if they’re seen to be advancing too slowly.

There was also little detail as to what exact issues the government has taken with project developments. Which makes the situation all the more concerning, raising the possibility that any number of nitpickings could be used to justify stripping projects.

It’s even possible that this whole argument could simply be a pretext for re-enforcing greater state control of the mining sector. Or a means of clawing back choice assets in order to award them to more politically-palatable partners.

Of course, it’s also possible this is just sabre-rattling to spur miners into greater productivity. But the tough words make this an issue all observers in the uranium space need to be paying attention to. Watch for more announcements from the Kazakhs.

Here’s to a grey area in yellowcake,

"

"

Antwort auf Beitrag Nr.: 51.956.607 von Popeye82 am 11.03.16 08:51:32

www.mining-technology.com/news/newssirius-minerals-plans-min…

www.mining-technology.com/news/newssirius-minerals-plans-min…

CAT sales show mining slump only getting worse, Industry bellwether Caterpillar's global mining equipment sales drop 42%, as Asia-Pacific and Latin America orders fall off a cliff, Overall sales have been falling for 39 months straight

www.mining.com/cat-sales-show-mining-slump-only-getting-wors…

www.sec.gov/Archives/edgar/data/18230/000001823016000473/feb…

www.mining.com/cat-sales-show-mining-slump-only-getting-wors…

www.sec.gov/Archives/edgar/data/18230/000001823016000473/feb…

Natural gas about to overtake coal for power generation in the US, 2016 would be the 1st year the fossil fuel loses out to natural gas as preferred fuel for electricity generation in the US

www.mining.com/natural-gas-about-to-overtake-coal-for-power-…

www.mining.com/natural-gas-about-to-overtake-coal-for-power-…

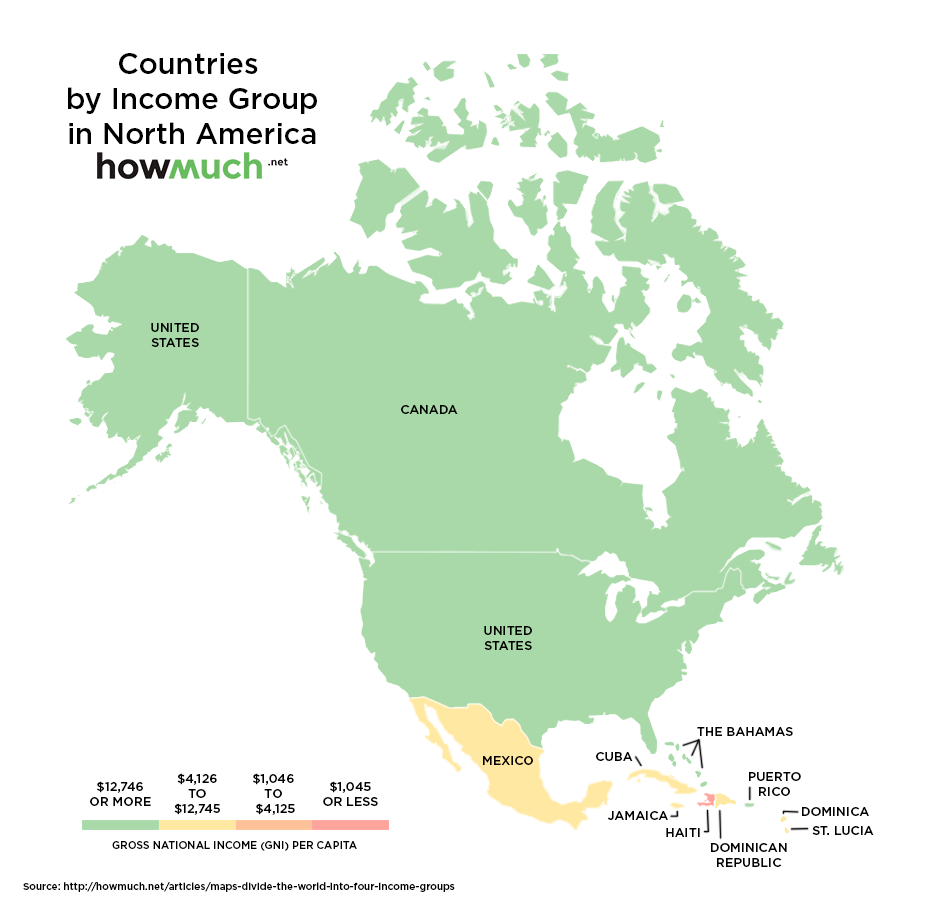

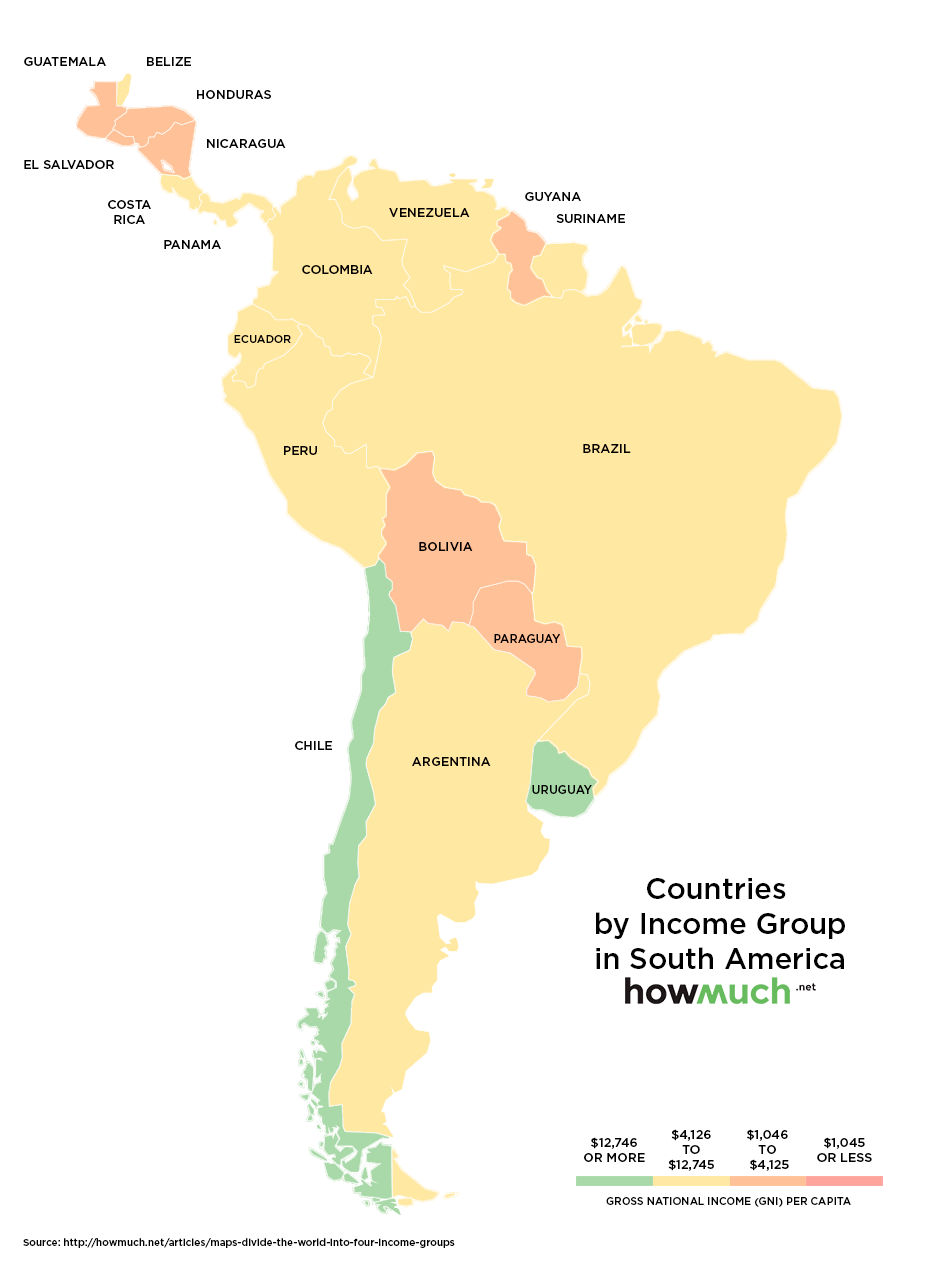

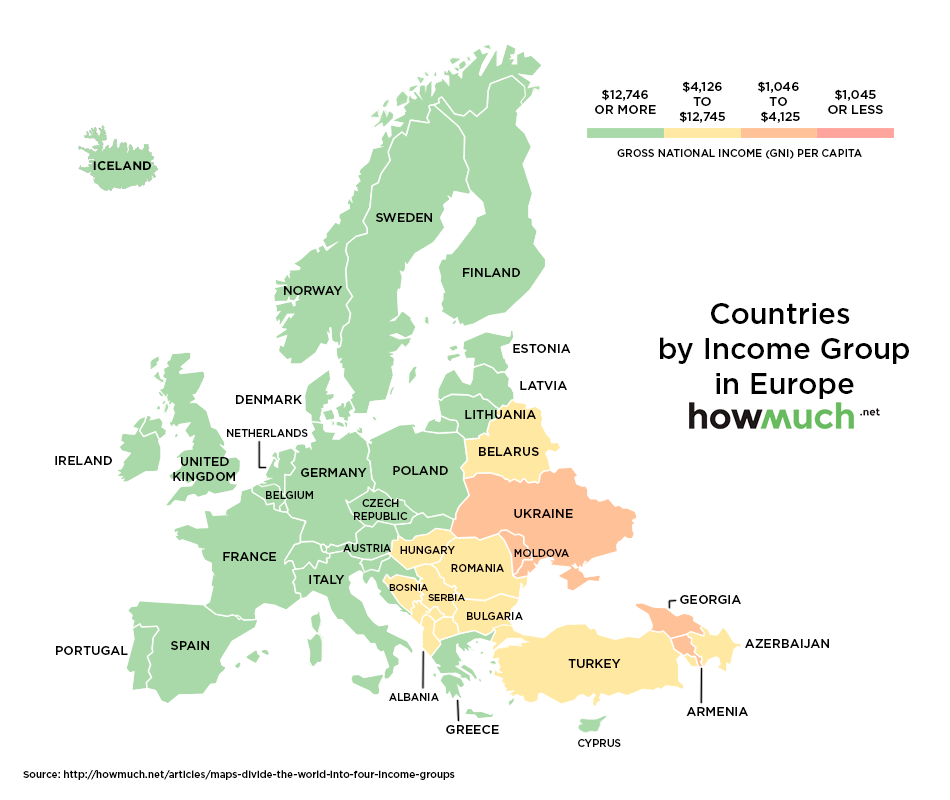

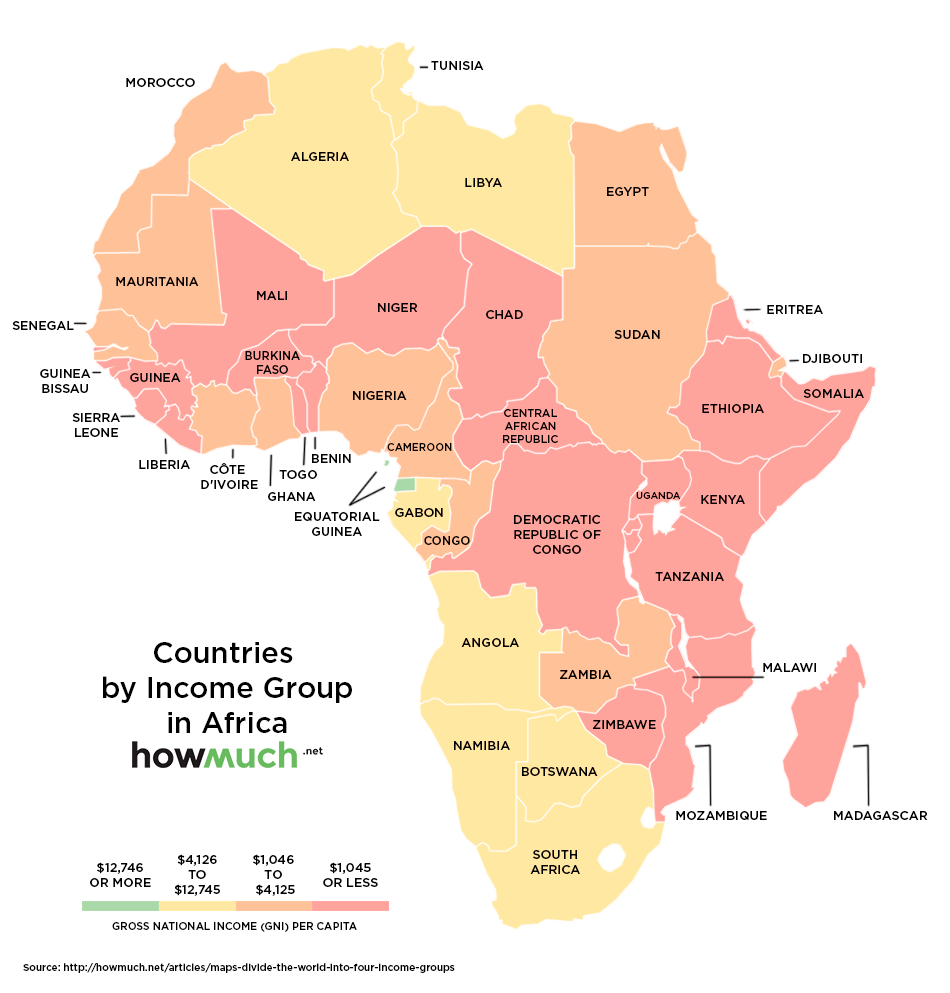

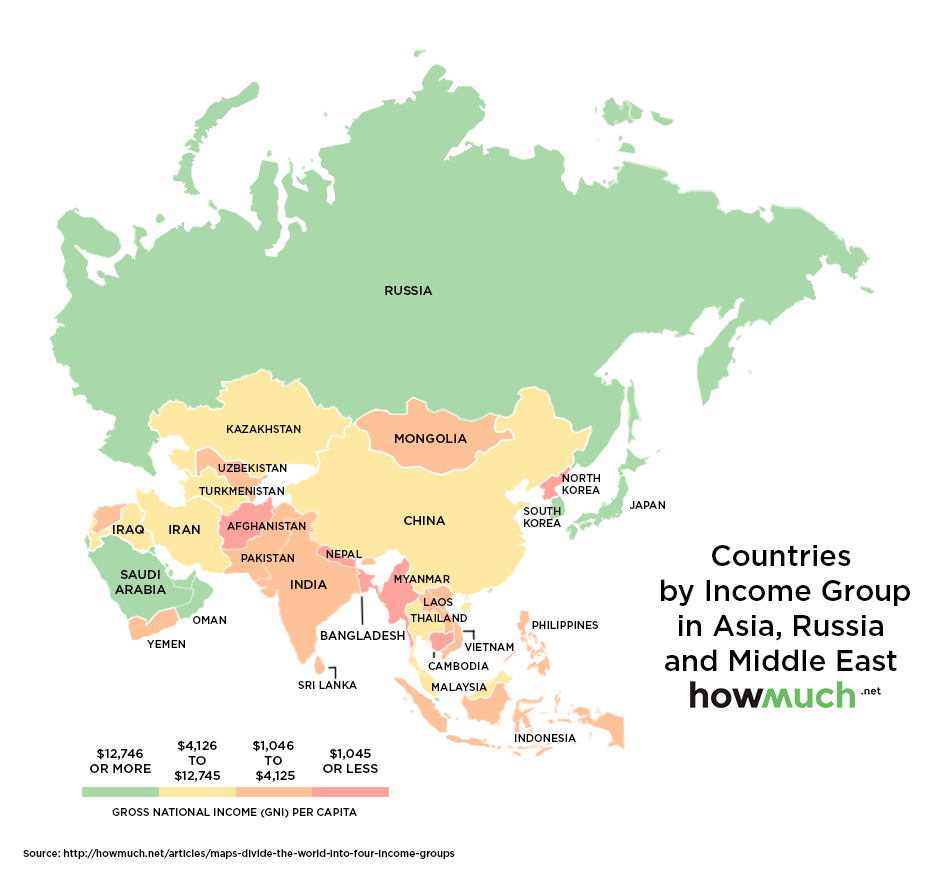

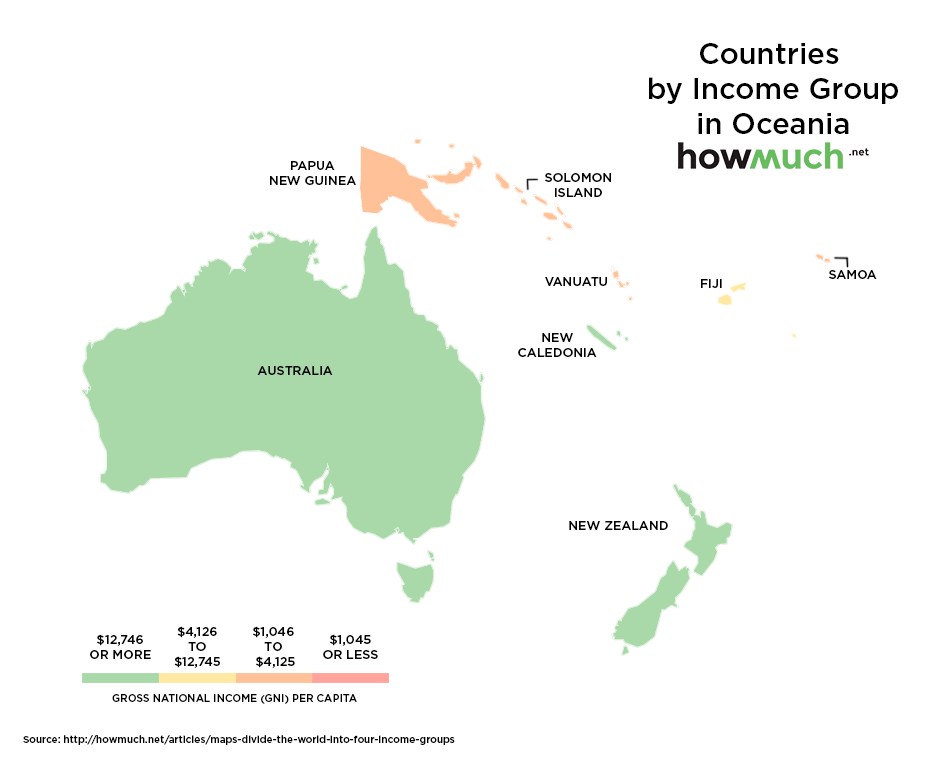

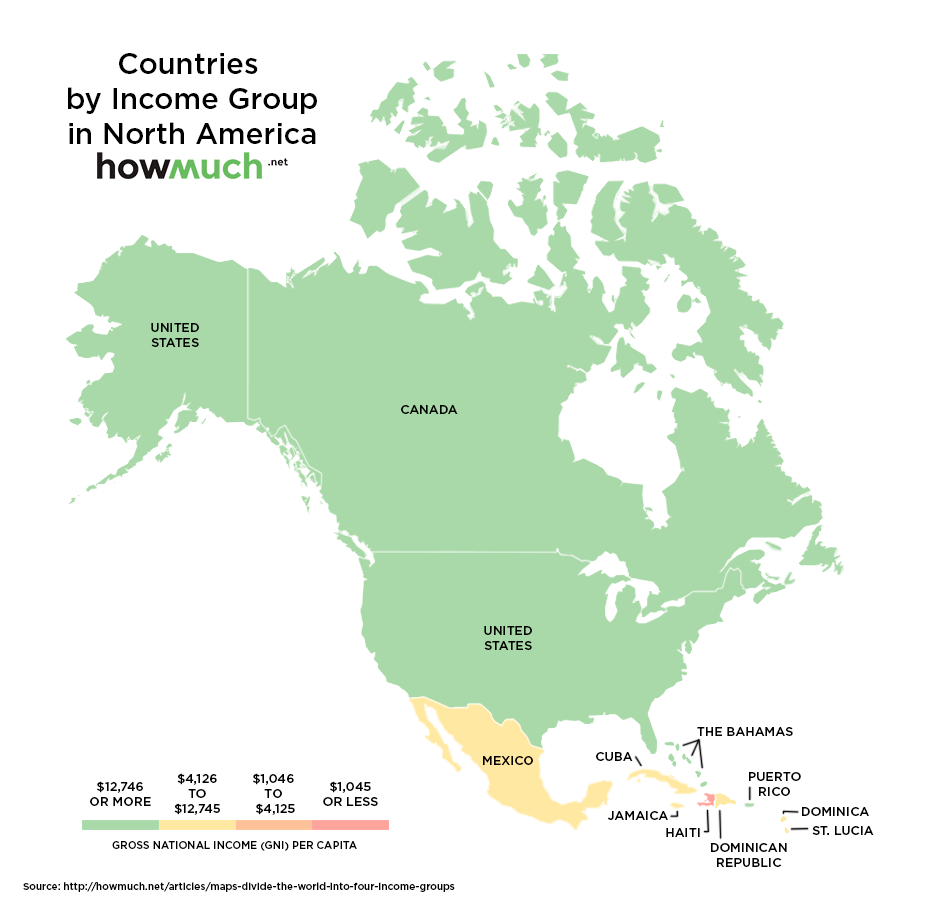

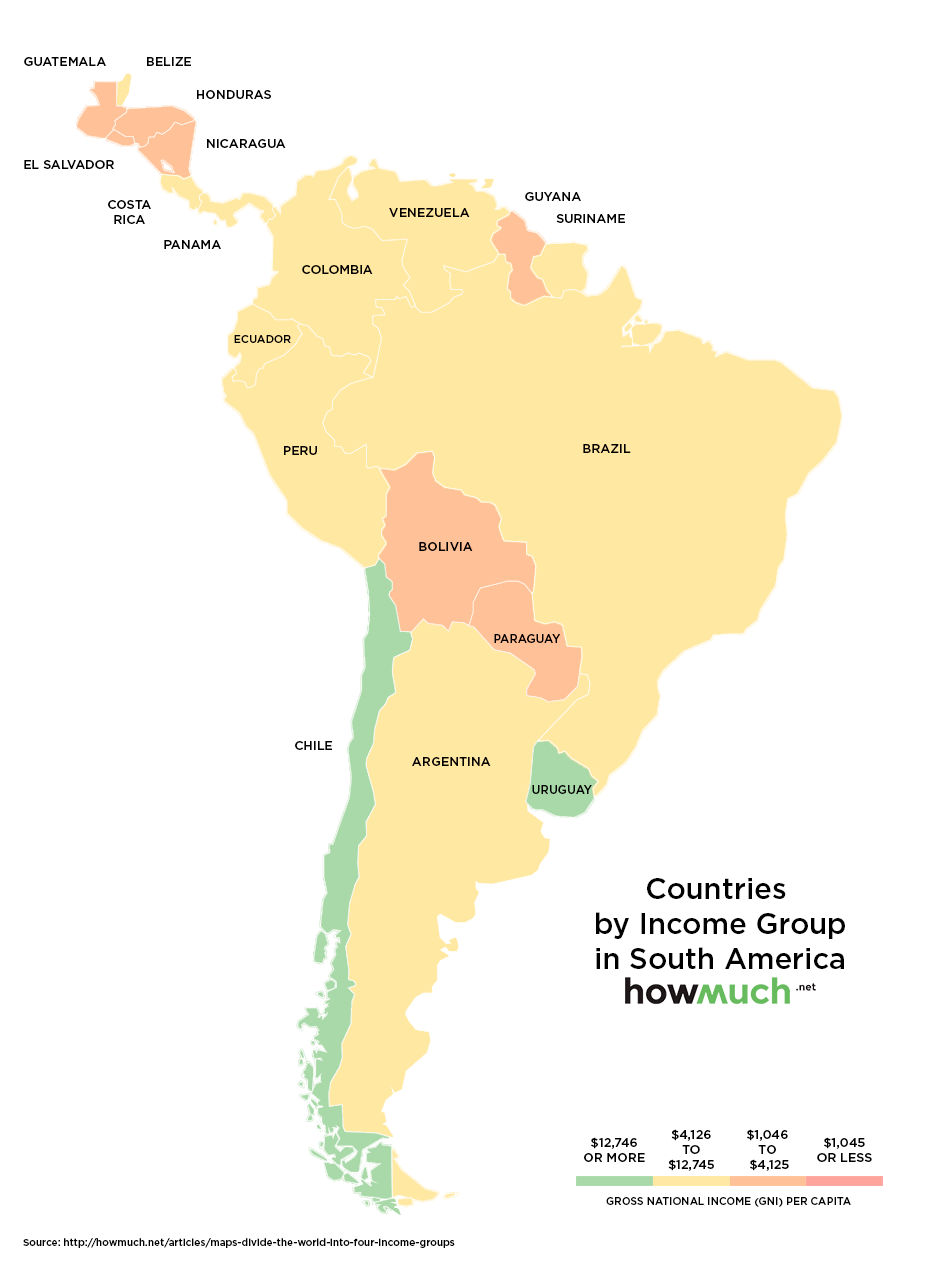

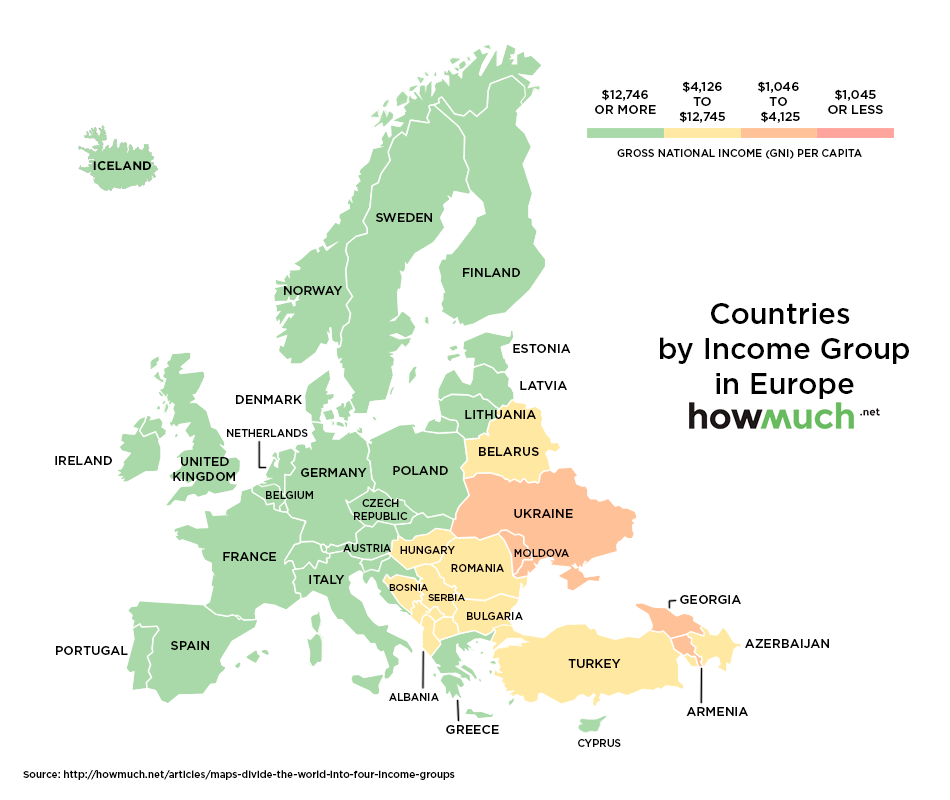

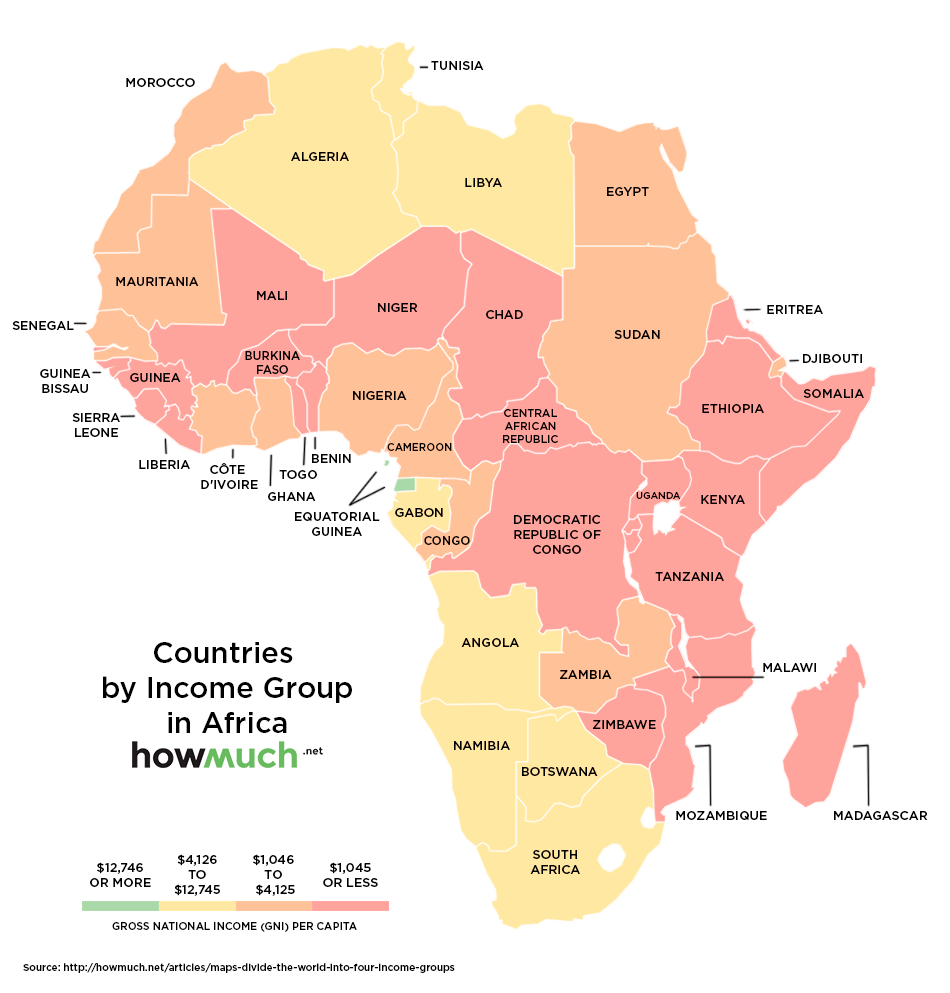

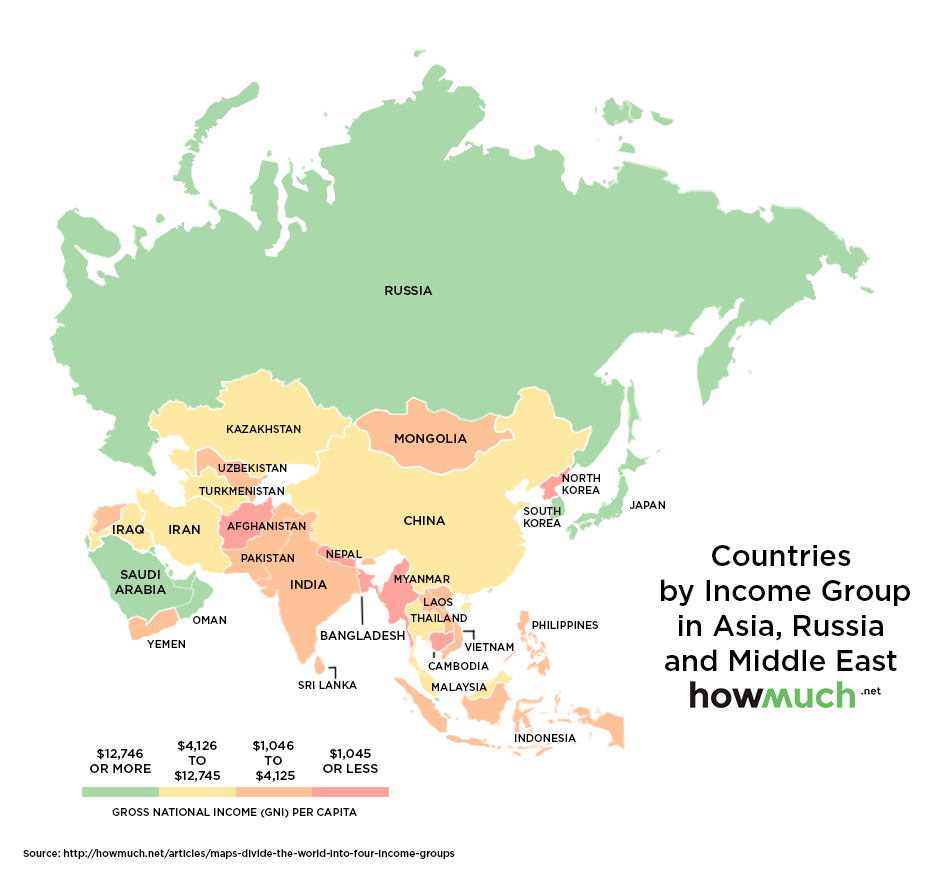

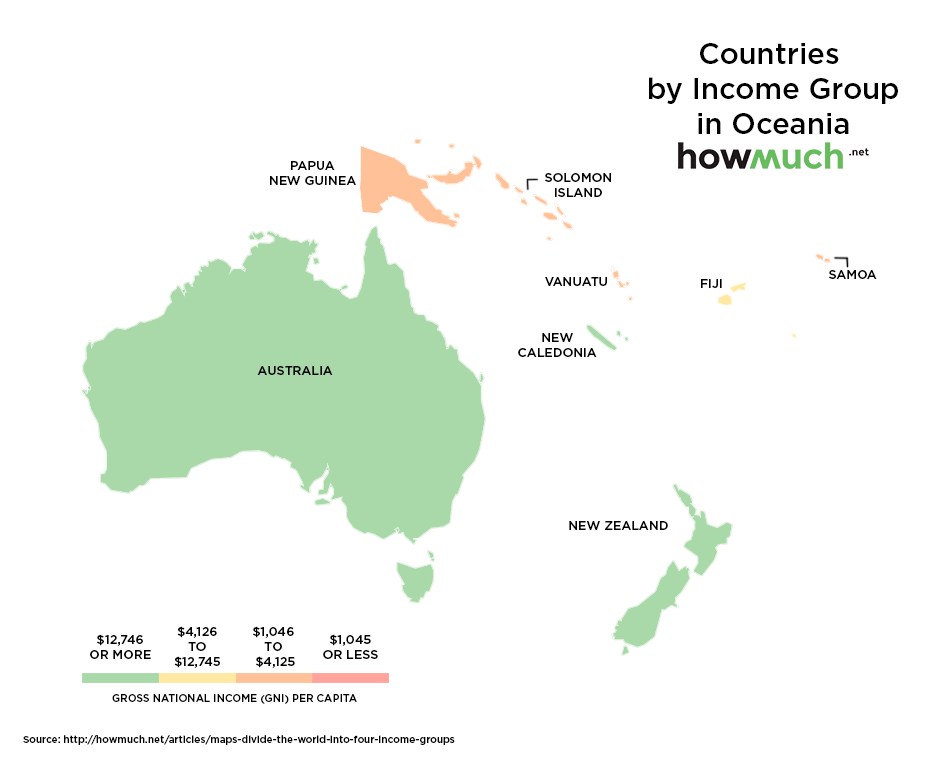

The richest +poorest countries in the world, the world economy is complex, but today’s series of maps will allow you to simplify your understanding of the relative wealth of people around the globe

www.gfmag.com/global-data/economic-data/pagfgt-countries-by-…

www.mining.com/web/the-richest-and-poorest-countries-in-the-…

www.gfmag.com/global-data/economic-data/pagfgt-countries-by-…

www.mining.com/web/the-richest-and-poorest-countries-in-the-…

These bacteria can help, you, find rich platinum deposits

www.mining.com/these-bacteria-can-help-you-find-rich-platinu…

www.adelaide.edu.au/news/news83742.html

www.nature.com/ngeo/journal/vaop/ncurrent/full/ngeo2679.html

www.mining.com/these-bacteria-can-help-you-find-rich-platinu…

www.adelaide.edu.au/news/news83742.html

www.nature.com/ngeo/journal/vaop/ncurrent/full/ngeo2679.html

interessannater Punkt

sollte sich das Rohstoffumfeld in absehbarer Zeit nicht deutlich(st) aufhellen(was ich nicht glaube(EM vielleicht ausgenommen)) sehe ich das im Prinzip ganz genauso

es wird eine REfokussierung -abgesehen davon dass sie schon eingesetzt hat-geben

ballast abwerfen

dann klappts auch wieder mit dem schwimmen

vielleicht

bei Interesse in dem Feld würde ich mir ruhig ma (ganz)durchlesen

The end of the global diversified miner?, New report predicts narrower focus for mining's majors

www.mining.com/the-end-of-the-global-diversified-miner/?utm_…

sollte sich das Rohstoffumfeld in absehbarer Zeit nicht deutlich(st) aufhellen(was ich nicht glaube(EM vielleicht ausgenommen)) sehe ich das im Prinzip ganz genauso

es wird eine REfokussierung -abgesehen davon dass sie schon eingesetzt hat-geben

ballast abwerfen

dann klappts auch wieder mit dem schwimmen

vielleicht

bei Interesse in dem Feld würde ich mir ruhig ma (ganz)durchlesen

The end of the global diversified miner?, New report predicts narrower focus for mining's majors

www.mining.com/the-end-of-the-global-diversified-miner/?utm_…

Antwort auf Beitrag Nr.: 52.049.522 von Popeye82 am 24.03.16 07:58:07

- Offered for sale from an Asian private collection, ‘De Beers Millennium Jewel 4’, a rare and superb Oval-shaped Internally Flawless Fancy Vivid Blue Diamond weighing 10.10 carats (Est. HK$235 – 280 million / US$30 – 35 million), is one of twelve rare diamonds - eleven blue and one colourless – that form the world-renowned De Beers Millennium Jewels collection unveiled in 2000 in celebration of the millennium. At 10.10 carats, it is the largest oval-shaped fancy vivid blue diamond ever to appear at auction. -

- Offered for sale from an Asian private collection, ‘De Beers Millennium Jewel 4’, a rare and superb Oval-shaped Internally Flawless Fancy Vivid Blue Diamond weighing 10.10 carats (Est. HK$235 – 280 million / US$30 – 35 million), is one of twelve rare diamonds - eleven blue and one colourless – that form the world-renowned De Beers Millennium Jewels collection unveiled in 2000 in celebration of the millennium. At 10.10 carats, it is the largest oval-shaped fancy vivid blue diamond ever to appear at auction. -

Antwort auf Beitrag Nr.: 52.051.793 von Popeye82 am 24.03.16 10:59:20

die meisten sagen wir "sind durch"

(, neuer bull markt)

für den gesamtrohstoffmarkt sehe sehe ich es eher nicht so,

denke eher dass sind Die -Anleger-die sich schön, wieder, die Finger abfackeln

die meisten sagen wir "sind durch"

(, neuer bull markt)

für den gesamtrohstoffmarkt sehe sehe ich es eher nicht so,

denke eher dass sind Die -Anleger-die sich schön, wieder, die Finger abfackeln

This country just ended its coal power production, Scotland has stopped generating electricity from coa,l for the first time in >100 years

www.mining.com/this-country-just-ended-its-coal-power-produc…

www.mining.com/this-country-just-ended-its-coal-power-produc…

World’s No.1 copper miner Codelco posts historic loss, of $1,400,000,000 in 2015, for every penny copper prices drop, Codelco loses $36,000,000 +Chile, the world's largest producing country, $50,000,000

www.mining.com/worlds-no-1-copper-miner-codelco-posts-histor…

www.mining.com/worlds-no-1-copper-miner-codelco-posts-histor…

World’s largest coal producer keeps adding to global supply glut, Coal India just posted its highest ouput in almost three decades

www.mining.com/worlds-largest-coal-producer-keeps-adding-to-…

www.mining.com/worlds-largest-coal-producer-keeps-adding-to-…

Antwort auf Beitrag Nr.: 52.107.200 von Popeye82 am 02.04.16 22:14:18

China’s coal companies are SOOOOO desperate, they’ve started farming, to keep employees busy

www.mining.com/web/chinas-coal-companies-are-so-desperate-th…

China’s coal companies are SOOOOO desperate, they’ve started farming, to keep employees busy

www.mining.com/web/chinas-coal-companies-are-so-desperate-th…

Antwort auf Beitrag Nr.: 52.107.200 von Popeye82 am 02.04.16 22:14:18

www.mining.com/queensland-approves-australias-largest-coal-m…

www.mining.com/queensland-approves-australias-largest-coal-m…

Nuclear power under threat, In New York, Cut greenhouse gas emissions in New York by 40 percent by 2050. A commendable goal. But two of the four nuclear power stations in the state may close down by 2017

www.mining.com/web/nuclear-power-under-threat-in-new-york/?u…

"Cut greenhouse gas emissions in New York by 40 percent by 2050. A commendable goal. But two of the four nuclear power stations in the state may close down by 2017.

One is already on life support, collecting a surcharge from upstate customers to keep it open ostensibly because closure might cause shortages in the area. And the governor wants to close down a third plant, downstate (Indian Point) because it is too close to New York City.

None of that helps the plan to cut the greenhouse gas emissions. On top of that, the governor wants to encourage more economic activity upstate. Closing down those nuclear power stations with their hundreds of jobs and big tax payments to local governments would not endear him to upstaters, but closing down the power station in Westchester County, just north of New York City, would endear him to the locals there, who haven’t figured out how they would evacuate in case of emergency, due to crowded roads on one side and the Hudson River on the other.

The state’s top regulator characterized the problem this way: “We want to make certain that we don’t lose nuclear plants unnecessarily because we have a market situation that doesn’t support them in the wholesale markets…”

New York’s regulators commissioned their staff to write a white paper to look at the problem. The authors said that they looked at the best practices throughout the United States before fashioning a solution, which was an interesting comment in that the British had to deal with the same issue in their attempt to revive nuclear power, and settled on something that they had used before in various ways, the contract for differences.

That is, on a simplified basis, they set a strike price for nuclear power and force all buyers to sign a cer-tain number of those contracts with the generator.

Here is how it works. The generator sells power to the wholesale market. When that price exceeds the strike price, it pays the excess back to the buyer. When market price falls below strike price, the buyer pays the difference to the generator.

Considering all the contracts for differences out there, it looks more and more as if the UK’s competitive generation market will be crowded out by all the facilities getting preferential treatment through contracts for differences mandated by the government. New York proposes that buyers of wholesale electricity purchase zero emission credits from the nuclear plants, which the buyers will pass on to customers. Sounds similar.

The current market turmoil has created a once in a generation opportunity for savvy energy investors.

Whilst the mainstream media prints scare stories of oil prices falling through the floor smart investors are setting up their next winning oil plays.

As for the downstate nuclear plant, the regulatory agency has decided to exclude plants without licenses extending through 2029 and as Indian Point’s license, having expired, is awaiting relicensing from the Nuclear Regulatory Commission, it does not make the cut. How convenient.

The New York effort brings up three questions, though. The first is: don’t we ever examine what other people do and what happens when they do it? The rest of the world has tried stuff for years that we are finally thinking about. Well, that is a rhetorical question, isn’t it?

Second, why isn’t Indian Point’s contribution to carbon emission reductions as good as any other plant’s? If Indian Point is unsafe, why not close it and if it is deemed safe, why is the regulator denying it the same credits as other similar facilities? That question may go to court.

Third, if the market’s design cannot keep needed facilities in service, then maybe the regulator should change the market design rather than bolt on fixes that will reduce the size of the competitive market as more and more of it is reserved for generators that the market does not support.

Maybe the best way to look at New York’s nuclear protection measure is as another indicator that the current electricity market, as designed, can’t handle the fundamental issues facing it, but rather than making basic changes, the powers that be will simply encrust it with complicated modifications, barna-cles so to speak, that will allow them to maintain the competitive facade but limit the competitive sub-stance.

By Leonard S. Hyman and William I. Tilles for Oilprice.com "

www.mining.com/web/nuclear-power-under-threat-in-new-york/?u…

"Cut greenhouse gas emissions in New York by 40 percent by 2050. A commendable goal. But two of the four nuclear power stations in the state may close down by 2017.

One is already on life support, collecting a surcharge from upstate customers to keep it open ostensibly because closure might cause shortages in the area. And the governor wants to close down a third plant, downstate (Indian Point) because it is too close to New York City.

None of that helps the plan to cut the greenhouse gas emissions. On top of that, the governor wants to encourage more economic activity upstate. Closing down those nuclear power stations with their hundreds of jobs and big tax payments to local governments would not endear him to upstaters, but closing down the power station in Westchester County, just north of New York City, would endear him to the locals there, who haven’t figured out how they would evacuate in case of emergency, due to crowded roads on one side and the Hudson River on the other.

The state’s top regulator characterized the problem this way: “We want to make certain that we don’t lose nuclear plants unnecessarily because we have a market situation that doesn’t support them in the wholesale markets…”

New York’s regulators commissioned their staff to write a white paper to look at the problem. The authors said that they looked at the best practices throughout the United States before fashioning a solution, which was an interesting comment in that the British had to deal with the same issue in their attempt to revive nuclear power, and settled on something that they had used before in various ways, the contract for differences.

That is, on a simplified basis, they set a strike price for nuclear power and force all buyers to sign a cer-tain number of those contracts with the generator.

Here is how it works. The generator sells power to the wholesale market. When that price exceeds the strike price, it pays the excess back to the buyer. When market price falls below strike price, the buyer pays the difference to the generator.

Considering all the contracts for differences out there, it looks more and more as if the UK’s competitive generation market will be crowded out by all the facilities getting preferential treatment through contracts for differences mandated by the government. New York proposes that buyers of wholesale electricity purchase zero emission credits from the nuclear plants, which the buyers will pass on to customers. Sounds similar.

The current market turmoil has created a once in a generation opportunity for savvy energy investors.

Whilst the mainstream media prints scare stories of oil prices falling through the floor smart investors are setting up their next winning oil plays.

As for the downstate nuclear plant, the regulatory agency has decided to exclude plants without licenses extending through 2029 and as Indian Point’s license, having expired, is awaiting relicensing from the Nuclear Regulatory Commission, it does not make the cut. How convenient.

The New York effort brings up three questions, though. The first is: don’t we ever examine what other people do and what happens when they do it? The rest of the world has tried stuff for years that we are finally thinking about. Well, that is a rhetorical question, isn’t it?

Second, why isn’t Indian Point’s contribution to carbon emission reductions as good as any other plant’s? If Indian Point is unsafe, why not close it and if it is deemed safe, why is the regulator denying it the same credits as other similar facilities? That question may go to court.

Third, if the market’s design cannot keep needed facilities in service, then maybe the regulator should change the market design rather than bolt on fixes that will reduce the size of the competitive market as more and more of it is reserved for generators that the market does not support.

Maybe the best way to look at New York’s nuclear protection measure is as another indicator that the current electricity market, as designed, can’t handle the fundamental issues facing it, but rather than making basic changes, the powers that be will simply encrust it with complicated modifications, barna-cles so to speak, that will allow them to maintain the competitive facade but limit the competitive sub-stance.

By Leonard S. Hyman and William I. Tilles for Oilprice.com "

Antwort auf Beitrag Nr.: 52.039.817 von Popeye82 am 23.03.16 04:57:31

REinvestieren, Lösegeld

www.wallstreet-online.de/nachricht/8492790-osama-laden-gold-…

www.wallstreet-online.de/nachricht/8492790-osama-laden-gold-…

China's coming, for your copper project; faced with declining domestic production, China's top copper company says the "only solution is going overseas"

www.mining.com/chinas-coming-for-your-copper-project/?utm_so…

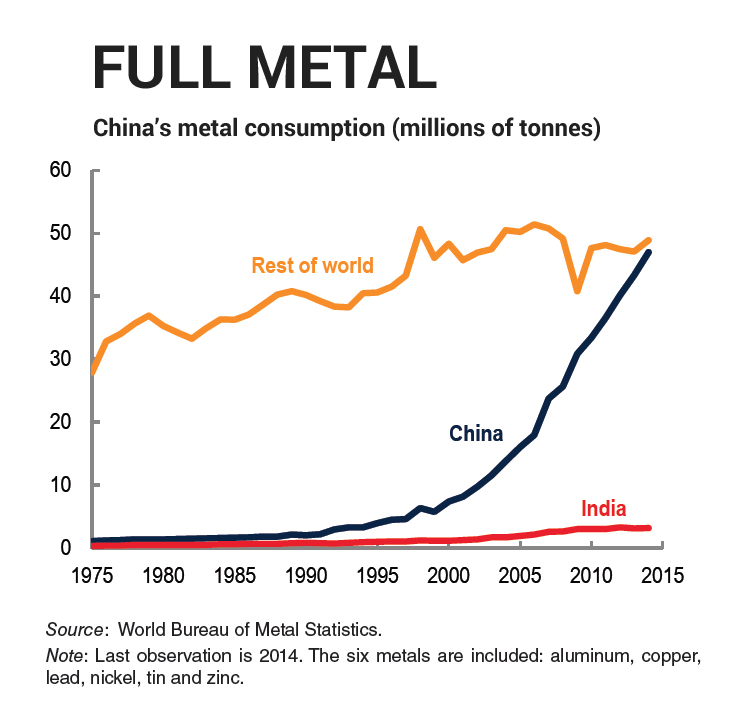

"While global copper production was up 3.5% in 2015, Chinese output declined.

At 1.66 million tonnes, China's mine production accounts for 8.7% of global supply of just over 19 million tonnes last year. That contrasts with Chinese demand for the metal which is expected to grow to 46% of worldwide copper consumption by 2018.

China is the world's number two producer but is likely to be overtaken by Peru in the near future after the South American country's output surged 28% last year.

Peru's production is set to jump again this year and next as projects come on stream led by the giant Las Bambas mine which made its first shipment in January.

Las Bambas, a project started over a decade ago by Xstrata, is majority owned by China's Minmetals with two other Chinese conglomerates holding the remaining 37%.

""We all know there are not many Las Bambas out there, it’s not easy to develop a huge mine""

Chinese authorities carefully engineered the 2014 acquisition of Las Bambas over a period of two years, by making its approval of the Glencore-Xstrata merger dependent on the Swiss-based company's disposal of the project.

Las Bambas was likely just the curtain raiser for many future Chinese forays outside the country in search of copper sources. Chinalco's 75,000 tpa Toromocho expansion also in Peru, Guangdong Rising's new 50,000 tpa Inca de Oro (Chile) and 125,000tpa Frieda River (PNG) projects are others.

“We all know there are not many Las Bambas out there, it’s not easy to develop a huge mine,” Jerry Jiao, vice-president of China Minmetals, told the World Copper Conference in Santiago reports the FT:

“China is very short of copper resources. The only way to have a stable supply of copper resources … going overseas is the only solution.”

How Beijing landed copper's flagship project

Glencore and Xstrata first announced a merger February 2012 and after much shareholder wrangling and jumping through regulatory hoops China was the last country to approve the deal – a full 14 months later.

There was one, pretty specific, proviso.

Glencore must give up Las Bambas. Or something of equivalent significance for future global copper supply (nothing springs to mind).

The Swiss-based firm had already lavished $4 billion on the Peruvian mine and China took its sweet time to ink a deal.

While negotiations of the sale dragged on for another year Las Bambas was being thoroughly de-risked (compared to the likes of a Conga or Oyu Tolgoi, it appears to have been smooth-sailing) and readied for production by one of the more experienced teams in the global copper mining game.

At the same time the copper price was sliding to a near four-year low, strengthening China's hand in the final month of talks before the consortium led by Minmetals finally came to a $6 billion agreement.

Both sides walked away satisfied, at least according to Glencore CEO Ivan Glasenberg.

Las Bambas, which is operated by Melbourne-based MMG, is set to become the world's third largest copper mine boasting peak capacity of 400,000 tonnes of copper (and not insubstantial quantities of molybdenum, gold and silver). "

www.mining.com/chinas-coming-for-your-copper-project/?utm_so…

"While global copper production was up 3.5% in 2015, Chinese output declined.

At 1.66 million tonnes, China's mine production accounts for 8.7% of global supply of just over 19 million tonnes last year. That contrasts with Chinese demand for the metal which is expected to grow to 46% of worldwide copper consumption by 2018.

China is the world's number two producer but is likely to be overtaken by Peru in the near future after the South American country's output surged 28% last year.

Peru's production is set to jump again this year and next as projects come on stream led by the giant Las Bambas mine which made its first shipment in January.

Las Bambas, a project started over a decade ago by Xstrata, is majority owned by China's Minmetals with two other Chinese conglomerates holding the remaining 37%.

""We all know there are not many Las Bambas out there, it’s not easy to develop a huge mine""

Chinese authorities carefully engineered the 2014 acquisition of Las Bambas over a period of two years, by making its approval of the Glencore-Xstrata merger dependent on the Swiss-based company's disposal of the project.

Las Bambas was likely just the curtain raiser for many future Chinese forays outside the country in search of copper sources. Chinalco's 75,000 tpa Toromocho expansion also in Peru, Guangdong Rising's new 50,000 tpa Inca de Oro (Chile) and 125,000tpa Frieda River (PNG) projects are others.

“We all know there are not many Las Bambas out there, it’s not easy to develop a huge mine,” Jerry Jiao, vice-president of China Minmetals, told the World Copper Conference in Santiago reports the FT:

“China is very short of copper resources. The only way to have a stable supply of copper resources … going overseas is the only solution.”

How Beijing landed copper's flagship project

Glencore and Xstrata first announced a merger February 2012 and after much shareholder wrangling and jumping through regulatory hoops China was the last country to approve the deal – a full 14 months later.

There was one, pretty specific, proviso.

Glencore must give up Las Bambas. Or something of equivalent significance for future global copper supply (nothing springs to mind).

The Swiss-based firm had already lavished $4 billion on the Peruvian mine and China took its sweet time to ink a deal.

While negotiations of the sale dragged on for another year Las Bambas was being thoroughly de-risked (compared to the likes of a Conga or Oyu Tolgoi, it appears to have been smooth-sailing) and readied for production by one of the more experienced teams in the global copper mining game.

At the same time the copper price was sliding to a near four-year low, strengthening China's hand in the final month of talks before the consortium led by Minmetals finally came to a $6 billion agreement.

Both sides walked away satisfied, at least according to Glencore CEO Ivan Glasenberg.

Las Bambas, which is operated by Melbourne-based MMG, is set to become the world's third largest copper mine boasting peak capacity of 400,000 tonnes of copper (and not insubstantial quantities of molybdenum, gold and silver). "

Norway's sovereign wealth fund TO DROP 52 COAL-RElATED COMPANIES FROM PORTFOLIO

- Impacts companies with more than 30% activity, sales in coal

- Says further exclusions due to coal exposure to follow in 2016 ...

www.bloomberg.com/news/articles/2016-04-14/norway-s-860-bill…

"Norway’s $860 billion sovereign wealth fund unveiled the first list of miners and power producers to be excluded from its portfolio following a ban on coal investments.

The 52 companies being barred include American Electric Power Co. Inc., China Shenhua Energy Co. Ltd., Whitehaven Coal Ltd., Tata Power Co. and Peabody Energy Corp., according to a statement from Norges Bank Investment Management, the unit of Norway’s central bank that manages the world’s biggest wealth fund. The exclusions are based on new criteria introduced by the government in February impacting companies that base at least 30 percent of their activities or revenues on coal.

“We’re reviewing all relevant companies by the end of 2016, and there will be further exclusions,” NBIM spokeswoman Marthe Skaar said by phone.

Already Sold

The fund has already divested stocks and bonds from the 52 companies, Skaar said. Based on current valuations and allocations in line with the fund’s benchmark index, the securities would represent about 19 billion kroner ($2.3 billion), she said. Most of the companies were out of the portfolio by the end of 2015 because 28 of them overlap with a list of so-called risk-based divestments, which the fund initiated as early as 2013, before it was clear there would be a new exclusion criterion based on coal, she said.

Norges Bank has estimated that the ban on coal investments, which was agreed in Parliament last year against the initial reluctance of Norway’s minority, Conservative-led government, would force the fund to sell holdings valued at about 55 billion kroner in 120 companies. The central bank said in a letter to the Finance Ministry last year that most of the companies will have been evaluated by the end of 2016, and that some could remain in the investment portfolio while the fund continued a dialog on their future use of coal.

“We look at the companies’ plans for the future in a one- to three-year perspective, and that can affect whether the companies are excluded or not,” Skaar said. “If a company plans to go below 30 percent, we can stay invested.”

Disappointing Response

The analysis process based on the new criterion is “comprehensive and demanding,” and the fund is struggling to obtain sufficiently detailed information from the companies, meaning it also relies on other sources, Skaar said.

“Before we make anything public, we will contact the relevant companies to seek information,” she said. “This time we sent 50 letters, and got only five replies. That’s a bit disappointing.” "

- Impacts companies with more than 30% activity, sales in coal

- Says further exclusions due to coal exposure to follow in 2016 ...

www.bloomberg.com/news/articles/2016-04-14/norway-s-860-bill…

"Norway’s $860 billion sovereign wealth fund unveiled the first list of miners and power producers to be excluded from its portfolio following a ban on coal investments.

The 52 companies being barred include American Electric Power Co. Inc., China Shenhua Energy Co. Ltd., Whitehaven Coal Ltd., Tata Power Co. and Peabody Energy Corp., according to a statement from Norges Bank Investment Management, the unit of Norway’s central bank that manages the world’s biggest wealth fund. The exclusions are based on new criteria introduced by the government in February impacting companies that base at least 30 percent of their activities or revenues on coal.

“We’re reviewing all relevant companies by the end of 2016, and there will be further exclusions,” NBIM spokeswoman Marthe Skaar said by phone.

Already Sold

The fund has already divested stocks and bonds from the 52 companies, Skaar said. Based on current valuations and allocations in line with the fund’s benchmark index, the securities would represent about 19 billion kroner ($2.3 billion), she said. Most of the companies were out of the portfolio by the end of 2015 because 28 of them overlap with a list of so-called risk-based divestments, which the fund initiated as early as 2013, before it was clear there would be a new exclusion criterion based on coal, she said.

Norges Bank has estimated that the ban on coal investments, which was agreed in Parliament last year against the initial reluctance of Norway’s minority, Conservative-led government, would force the fund to sell holdings valued at about 55 billion kroner in 120 companies. The central bank said in a letter to the Finance Ministry last year that most of the companies will have been evaluated by the end of 2016, and that some could remain in the investment portfolio while the fund continued a dialog on their future use of coal.

“We look at the companies’ plans for the future in a one- to three-year perspective, and that can affect whether the companies are excluded or not,” Skaar said. “If a company plans to go below 30 percent, we can stay invested.”

Disappointing Response

The analysis process based on the new criterion is “comprehensive and demanding,” and the fund is struggling to obtain sufficiently detailed information from the companies, meaning it also relies on other sources, Skaar said.

“Before we make anything public, we will contact the relevant companies to seek information,” she said. “This time we sent 50 letters, and got only five replies. That’s a bit disappointing.” "

Podcast unten, höre Ihn grade

How to Analyze the Junior Mining Sector with Brent Cook, Exploration Insights

For this episode of the Planet MicroCap Podcast, I spoke with Brent Cook from Exploration Insights. One of the first conferences I went to since joining the business was a mining and resources conference back in 2011 and 2012 during the natural resources bull market. During that time, I was meeting a lot of experts in the field, and the one person I gravitated towards most was my guest on today’s show, Brent Cook. Geology is not an exact science, and picking the right company that has a promising resource can be difficult. It helps learning from geologists who analyze and look at these rocks on a daily basis. Brent has been in the business for a long time and has seen a lot of rocks.

The goal for this episode is to get a general understanding of the mining and junior mining sector, the business itself, opportunities when investing in junior mining companies, his criteria, tips to analyzing mining results and PEA’s, and more.

The Planet MicroCap Podcast is brought to you by SNN Incorporated, publishers of StockNewsNow.com, The Official MicroCap News Source, and the MicroCap Review Magazine, the leading magazine in the MicroCap market - check out the latest issue here: MicroCap Review Winter/Spring 2016

In this episode, Brent and I discuss the following topics:

- His background and how he got into the mining and junior mining space

- Overview of the junior mining sector. Why is space important and why he is so focused here?

- How the business of mining, natural resources work. Brief history on the significance of metals as both a currency and industrial good

- Cyclical nature of resources industry

- His advice for those who don’t have that geology background

- Describes the opportunities when investing in junior mining companies. Different stages for these companies

- His criteria when looking at a potential investment in a junior mining microcap company

- Tips to analyzing mining results and PEA’s

- Characteristics should beginning investors look out for in mining management - both positive and negative

- What investing experience he learned from the most

- Resources that helps him when doing research and due diligence

- Advice for new MicroCap investors looking at mining and junior mining industry

Brent Cook's website: www.ExplorationInsights.com

You can follow the Planet MicroCap Podcast on Twitter @BobbyKKraft, and you can also listen to this interview on StockNewsNow.com

http://planetmicrocap.podbean.com/e/episode-17-how-to-analyz…

How to Analyze the Junior Mining Sector with Brent Cook, Exploration Insights

For this episode of the Planet MicroCap Podcast, I spoke with Brent Cook from Exploration Insights. One of the first conferences I went to since joining the business was a mining and resources conference back in 2011 and 2012 during the natural resources bull market. During that time, I was meeting a lot of experts in the field, and the one person I gravitated towards most was my guest on today’s show, Brent Cook. Geology is not an exact science, and picking the right company that has a promising resource can be difficult. It helps learning from geologists who analyze and look at these rocks on a daily basis. Brent has been in the business for a long time and has seen a lot of rocks.

The goal for this episode is to get a general understanding of the mining and junior mining sector, the business itself, opportunities when investing in junior mining companies, his criteria, tips to analyzing mining results and PEA’s, and more.

The Planet MicroCap Podcast is brought to you by SNN Incorporated, publishers of StockNewsNow.com, The Official MicroCap News Source, and the MicroCap Review Magazine, the leading magazine in the MicroCap market - check out the latest issue here: MicroCap Review Winter/Spring 2016

In this episode, Brent and I discuss the following topics:

- His background and how he got into the mining and junior mining space

- Overview of the junior mining sector. Why is space important and why he is so focused here?

- How the business of mining, natural resources work. Brief history on the significance of metals as both a currency and industrial good

- Cyclical nature of resources industry

- His advice for those who don’t have that geology background

- Describes the opportunities when investing in junior mining companies. Different stages for these companies

- His criteria when looking at a potential investment in a junior mining microcap company

- Tips to analyzing mining results and PEA’s

- Characteristics should beginning investors look out for in mining management - both positive and negative

- What investing experience he learned from the most

- Resources that helps him when doing research and due diligence

- Advice for new MicroCap investors looking at mining and junior mining industry

Brent Cook's website: www.ExplorationInsights.com

You can follow the Planet MicroCap Podcast on Twitter @BobbyKKraft, and you can also listen to this interview on StockNewsNow.com

http://planetmicrocap.podbean.com/e/episode-17-how-to-analyz…

Antwort auf Beitrag Nr.: 52.219.336 von Popeye82 am 19.04.16 07:57:36

www.mining.com/hedge-funds-have-never-been-this-bullish-on-s…

www.mining.com/hedge-funds-have-never-been-this-bullish-on-s…

für südafrikanische rohstofffirmen wichtig

http://piercepoints.com/mining-investment-exploration-south-…

"The mining sector in one of the world’s most important platinum, gold and coal nations is in an uproar this week. After the government surprised the industry with some controversial changes Friday.

The place is South Africa. Where the national government published a draft of a new Mining Charter for the country’s industry late last week — containing some unexpected proposed measures.

One of the biggest surprises was new rules for Black Economic Empowerment (BEE) requirements. With the government making a decisive declaration on the so-called “once empowered, always empowered” issue.

Here’s the crux. Mining enterprises in South Africa are currently required to sell 26% of ownership to local BEE groups. But there’s been a lot of confusion about what happens after that.

For example, what if the black empowerment group then turns around and sells its share of the mining business to a non-BEE shareholder? Is it the responsibility of the mining company to go out and sell additional percentages to new BEE groups, in order to get back above the 26% threshold?

Miners have argued no — saying that if they met the 26% requirement, things are out of their hands if the BEE partner sells. One empowered, always empowered.

But the proposed new mining charter disagrees. Here’s what the new text prescribes:

“Where a BEE partner or partners have exited, BEE contract has lapsed or the previous BEE partner has transferred shares to a non-BEE company, the mining right holder must within the three years transitional period from the date of publication of the charter review its empowerment credentials consistent with the amended 2016 mining charter.”

Such a rule would put miners on the treadmill — having to constantly replace BEE shareholders if old ones exit. And that’s not the only change the new rules are proposing.

The draft charter also makes new stipulations on where the 26% BEE ownership must go. With the new rules specifying that 5% overall ownership must go to mine workers (through a trust), while another 5% must be owned by a local community trust.

The new rules also increase targets for black representation in management to between 60% and 88%, from a former 40%. And raise requirements for sourcing capital goods from local black interests.

South African mining leaders such as Sibanye Gold immediately said that elements in the new proposal are “unacceptable”. With the country’s Chamber of Mines saying it will engage with the government during the 30-day comment period for the draft rules, to see what can be changed.

Watch for more developments on the acceptance or rejection of this critical document, in one of the world’s most important mining centers.

Here’s to BEEing prudent,

Dave Forest"

http://piercepoints.com/mining-investment-exploration-south-…

"The mining sector in one of the world’s most important platinum, gold and coal nations is in an uproar this week. After the government surprised the industry with some controversial changes Friday.

The place is South Africa. Where the national government published a draft of a new Mining Charter for the country’s industry late last week — containing some unexpected proposed measures.

One of the biggest surprises was new rules for Black Economic Empowerment (BEE) requirements. With the government making a decisive declaration on the so-called “once empowered, always empowered” issue.

Here’s the crux. Mining enterprises in South Africa are currently required to sell 26% of ownership to local BEE groups. But there’s been a lot of confusion about what happens after that.

For example, what if the black empowerment group then turns around and sells its share of the mining business to a non-BEE shareholder? Is it the responsibility of the mining company to go out and sell additional percentages to new BEE groups, in order to get back above the 26% threshold?

Miners have argued no — saying that if they met the 26% requirement, things are out of their hands if the BEE partner sells. One empowered, always empowered.

But the proposed new mining charter disagrees. Here’s what the new text prescribes:

“Where a BEE partner or partners have exited, BEE contract has lapsed or the previous BEE partner has transferred shares to a non-BEE company, the mining right holder must within the three years transitional period from the date of publication of the charter review its empowerment credentials consistent with the amended 2016 mining charter.”

Such a rule would put miners on the treadmill — having to constantly replace BEE shareholders if old ones exit. And that’s not the only change the new rules are proposing.

The draft charter also makes new stipulations on where the 26% BEE ownership must go. With the new rules specifying that 5% overall ownership must go to mine workers (through a trust), while another 5% must be owned by a local community trust.

The new rules also increase targets for black representation in management to between 60% and 88%, from a former 40%. And raise requirements for sourcing capital goods from local black interests.

South African mining leaders such as Sibanye Gold immediately said that elements in the new proposal are “unacceptable”. With the country’s Chamber of Mines saying it will engage with the government during the 30-day comment period for the draft rules, to see what can be changed.

Watch for more developments on the acceptance or rejection of this critical document, in one of the world’s most important mining centers.

Here’s to BEEing prudent,

Dave Forest"

- Every plant needs three basic elements to grow nitrogen, phosphorus, and potassium. Potassium (K) is important to plants because it acts as a regulator. It helps plants efficiently use water, transfer food, and protect against structural stress. So where do we get the K in fertilizer that provides all these great benefits? This short video shows the process of creating potash fertilizer, complete with unique footage of potash mines, evaporation ponds, and depictions of ancient evaporated inland oceans. Also, check out our new Potassium Cycle Poster available free through our website. -

Antwort auf Beitrag Nr.: 52.229.770 von Popeye82 am 20.04.16 00:31:40

Potash miners hit by increased competition, supply, amid low prices, Analysts, companies expect prices to stay below 2015 levels for @least the next two years

www.mining.com/potash-miners-hit-by-increased-competition-su…

www.uralkali.com/upload/iblock/a64/2015_IFRS.pdf

Potash miners hit by increased competition, supply, amid low prices, Analysts, companies expect prices to stay below 2015 levels for @least the next two years

www.mining.com/potash-miners-hit-by-increased-competition-su…

www.uralkali.com/upload/iblock/a64/2015_IFRS.pdf

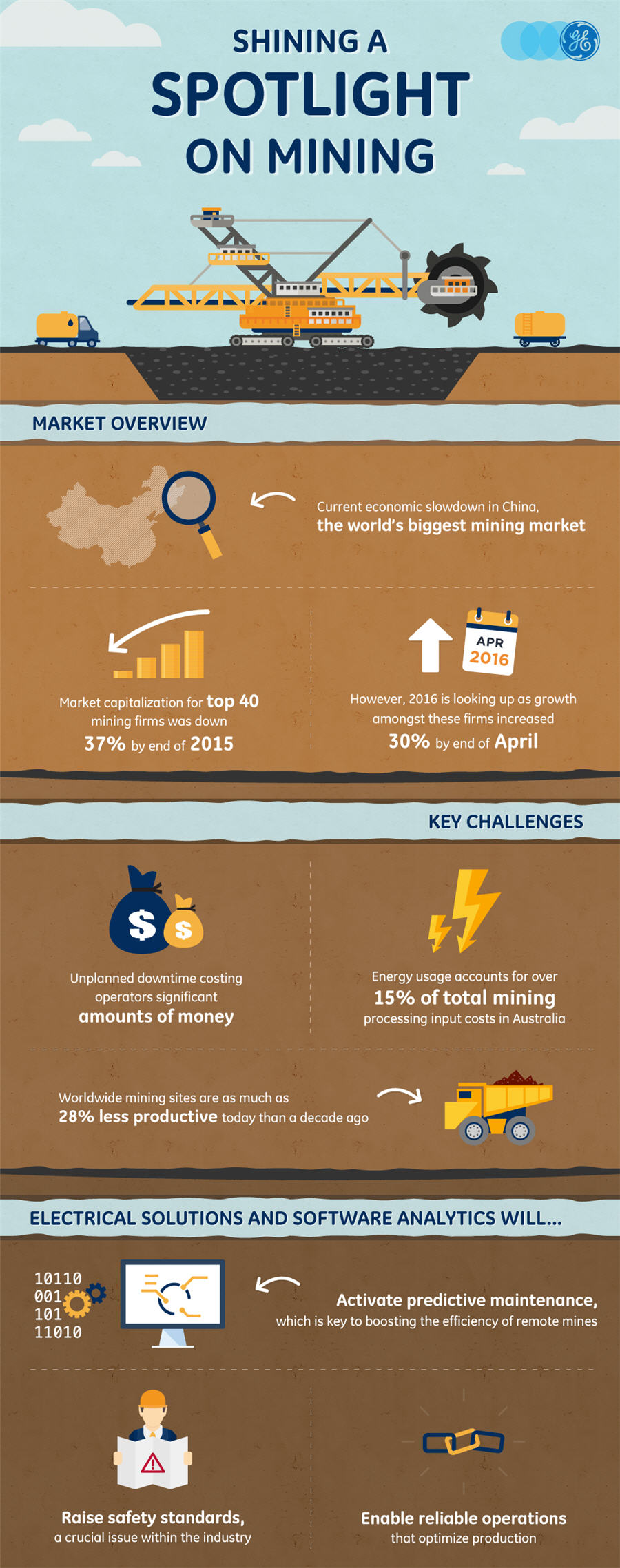

today's mining challenges, solutions

interessantin einigen Ländern(Indonesien, z.B.) gibts "schon" soweit ich weiss so kinda "plant(gold/rohstoff) finder"

denke auf jeden Fall von diesem "BioMining Sh*t" wird noch Diverses mehr kommen

Da gibts glaub ich ganzen Strauss interessante "Projekte"

This insect’s guts could be key for mining remediation, The new method would allow for specialized plants, which are critical for biodiversity, to be re-established faster around old iron ore mines

- The team is looking at looking at how canga microorganisms dissolve and reform iron oxides which are chemical compounds composed of iron and oxygen. (Image via Wikipedia) -

www.mining.com/insects-guts-key-mining-remediation/?utm_sour…

www.uq.edu.au/news/article/2016/04/tiny-microbes-could-help-…

"Researchers from the University of Queensland, in collaboration with mining giant Vale (NYSE:VALE), have found that the use of termite guts could contribute to mining site rehabilitation and pay big dividends for the planet.

The team of experts focused their studies on the method to promote formation of a type of iron cement crust — known as canga — that naturally forms a protective layer over the top of iron ores.

University of Queensland School of Earth Sciences researcher Dr. Emma Gagen explained that, during the mining process, canga is broken up and moved away to access the underlying ore. She said the project she is leading is looking at ways to speed-up its reformation after mining.

- Researchers inside a canga cave. (Image courtesy of The University of Queensland) -

“This would allow for specialized indigenous plants which grow on canga and are critical for biodiversity to be re-established faster,” Gage said in a statement. “We are pursuing a number of lines of inquiry into microbe-mineral interactions, but one line investigates the gut of termites that build nests in and over canga.”

According to Professor Gordon Southam, one of the project’s leaders, the university-industry collaboration would produce economic benefits for the world's iron mining industry through advanced training in mining-related research, and through the completion of the mining life cycle by site remediation.

“This will enhance Australia's position as a global leader in providing innovative solutions to today's mining challenges,” he said.

As a next step, the team plans to set a field trial in Brazil where they will develop a bio-remediation strategy for iron ores by re-establishing canga. "

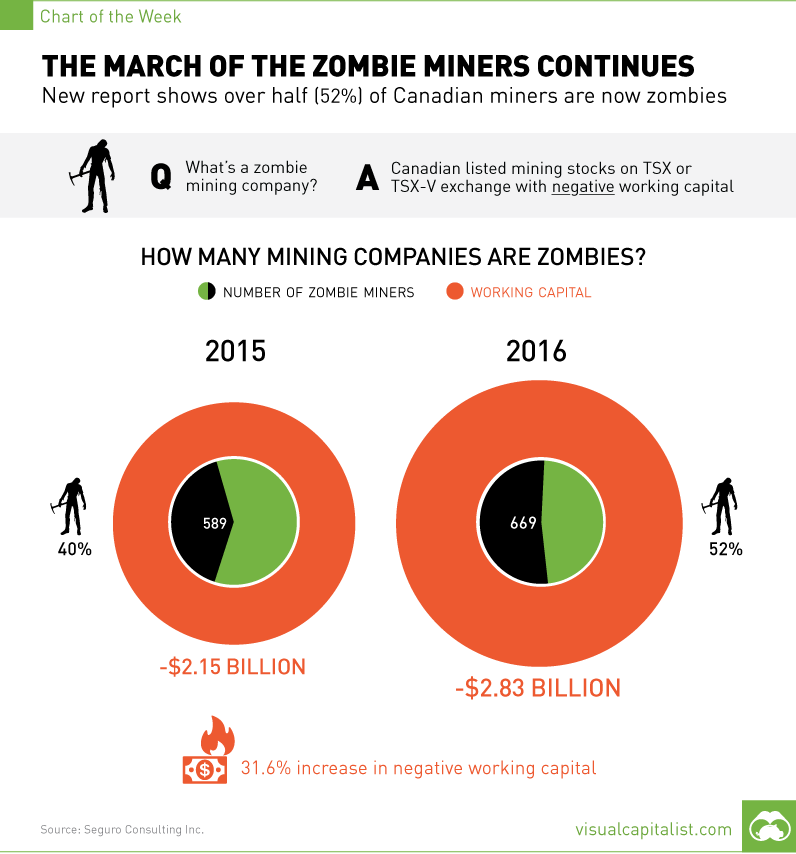

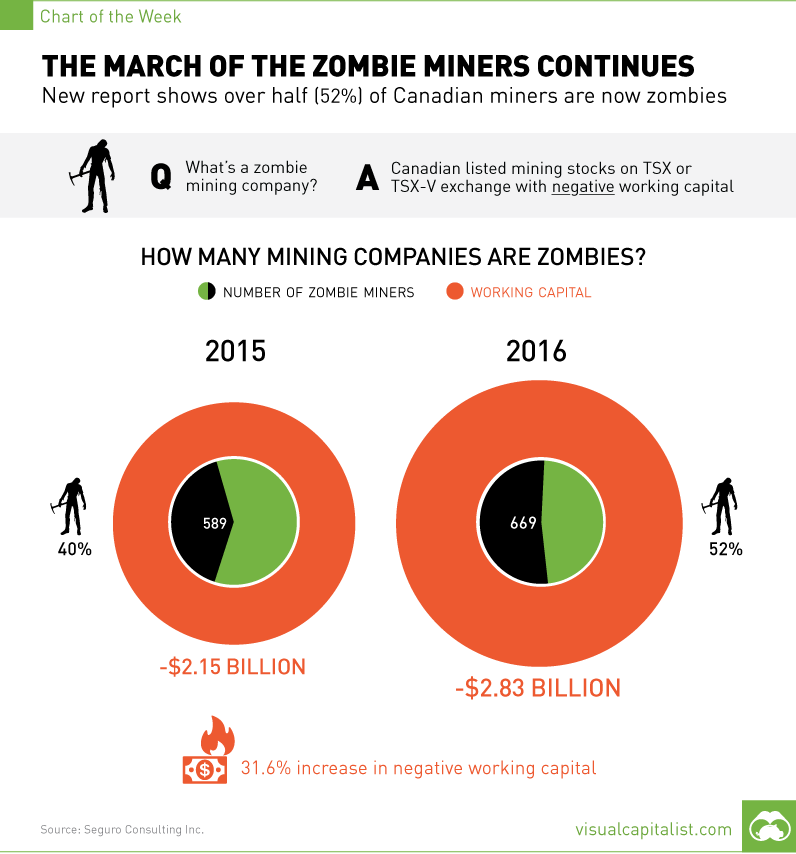

march of the zombie miners CONTINUES, NEW REPORT SHOWS THAT >HALF(52%) OF ALL CANADIAN-LISTED MINING COMPANIES ARE ZOMBIES

www.mining.com/web/chart-the-march-of-the-zombie-miners-cont…

www.mining.com/web/chart-the-march-of-the-zombie-miners-cont…

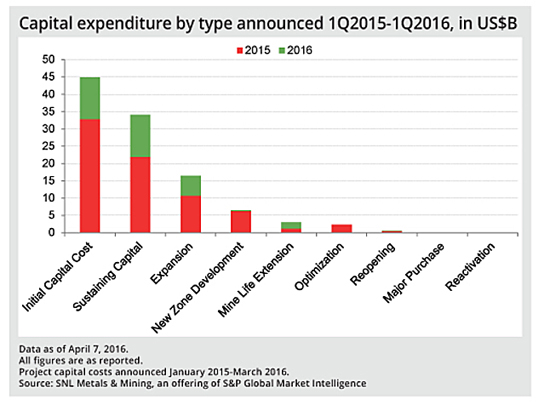

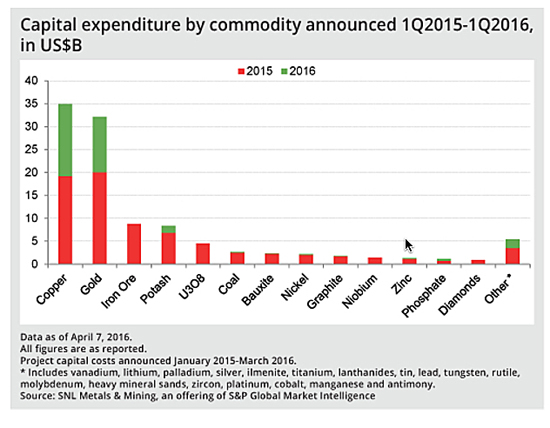

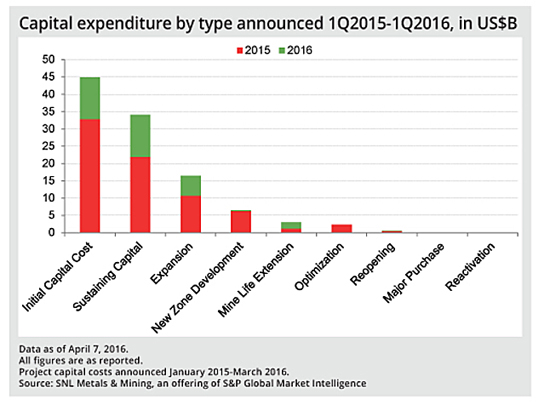

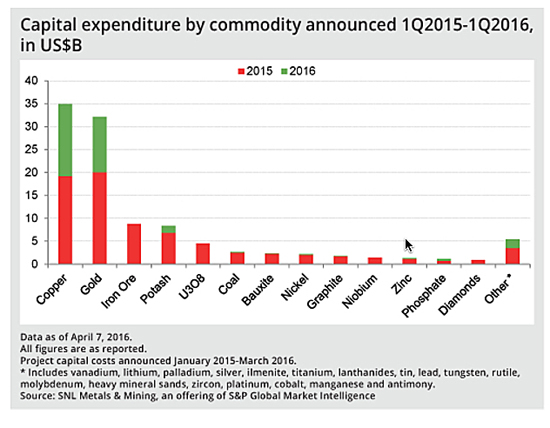

Miners spending again: $50,000,000,000 capex in five months, Confidence returns to mining sector, as announced capital outlays surge to $108,000,000,000 –greenfield project spending up 3-fold in 1st quarter

www.mining.com/planned-mining-capex-jumps-50-billion-over-5-…

www.mining.com/planned-mining-capex-jumps-50-billion-over-5-…

Ich täte diesem eeeeeher eine vorsichtigen Stance gegenüber einnehmen

Sagt (glaub ich) (a8ch) Mr. Klopppppa

www.mining.com/iron-ore-soars-past-70-to-a-16-month-high/?ut…

Sagt (glaub ich) (a8ch) Mr. Klopppppa

www.mining.com/iron-ore-soars-past-70-to-a-16-month-high/?ut…

New mineral discovered, a new mineral has been discovered at Kalgoorlie’s Super Pit, dubbed ‘kalgoorlieite’

https://australianmining.com.au/news/new-mineral-unearthed-i…

https://australianmining.com.au/news/new-mineral-unearthed-i…

Study discovers new uses for coal, a new study has shown the potential for coal’s future usage in high tech devices

- “When you look at coal as a material, and not just as something to burn, the chemistry is extremely rich,” says Jeffrey Grossman. In this photo, a sample of pulverized coal (right) is shown with several test devices made from coal by the MIT researchers.

Photo courtesy of the researchers -

https://australianmining.com.au/news/study-unveils-new-futur…

http://news.mit.edu/2016/making-electronics-out-coal-0419

http://pubs.acs.org/doi/abs/10.1021/acs.nanolett.5b04735

"A new study has shown the potential for coal’s future usage in high tech devices.

Researchers at MIT have uncovered a way to harness coal in new ways, using thin films of the material for electronic devices.

“Disordered carbon materials, both amorphous and with long-range order, have been used in a variety of applications, from conductive additives and contact materials to transistors and photovoltaics,” researchers Brent D. Keller, Nicola Ferralis, and Jeffrey C. Grossman explain in their paper in Nano Letters.

“We show a flexible solution-based method of preparing thin films with tunable electrical properties from suspensions of ball-milled coals following centrifugation.”

Grossman went on to explain, “When you look at coal as a material, and not just as something to burn, the chemistry is extremely rich.”

He asked: “Could we leverage the wealth of chemistry in things like coal to make devices that have useful functionality?”

In their research, they found that different types of coal – without the refining processes typically needed for electrical components such as silicon – have ranges of electrical conductivities that span more than seven orders of magnitude.

“The measured hopping energies demonstrate electronic properties similar to amorphous carbon materials and reduced graphene oxide,” their paper states.

Keller told MIT News coal has never been studied in terms of its potential use in electronic devices.

“The material has never been approached this way before, to find out what the properties are, what unique features there might be,” he said.

The method of processing the material involves crushing the coal to a powder, putting it into a solution, and then spreading it as a thin, uniform film on a substrate – a step used in creating many different electronic devices such as transistors or photovoltaics.

The researchers found simply by adjusting the temperature at which they processed the coal the material’s optical and electrical properties could be fine-tuned.

Grossman went on to state that the low cost of the material, combined with these low fabrication costs, provide a potential new avenue for coal, and unlike grapheme or silica, does not require high levels of purity in its processing.

The study was supported through a Bose Fellows program and oil and gas company ExxonMobil through the MIT Energy Initiative and the ExxonMobil Fellow program. "

- “When you look at coal as a material, and not just as something to burn, the chemistry is extremely rich,” says Jeffrey Grossman. In this photo, a sample of pulverized coal (right) is shown with several test devices made from coal by the MIT researchers.

Photo courtesy of the researchers -

https://australianmining.com.au/news/study-unveils-new-futur…

http://news.mit.edu/2016/making-electronics-out-coal-0419

http://pubs.acs.org/doi/abs/10.1021/acs.nanolett.5b04735

"A new study has shown the potential for coal’s future usage in high tech devices.

Researchers at MIT have uncovered a way to harness coal in new ways, using thin films of the material for electronic devices.

“Disordered carbon materials, both amorphous and with long-range order, have been used in a variety of applications, from conductive additives and contact materials to transistors and photovoltaics,” researchers Brent D. Keller, Nicola Ferralis, and Jeffrey C. Grossman explain in their paper in Nano Letters.

“We show a flexible solution-based method of preparing thin films with tunable electrical properties from suspensions of ball-milled coals following centrifugation.”

Grossman went on to explain, “When you look at coal as a material, and not just as something to burn, the chemistry is extremely rich.”

He asked: “Could we leverage the wealth of chemistry in things like coal to make devices that have useful functionality?”

In their research, they found that different types of coal – without the refining processes typically needed for electrical components such as silicon – have ranges of electrical conductivities that span more than seven orders of magnitude.

“The measured hopping energies demonstrate electronic properties similar to amorphous carbon materials and reduced graphene oxide,” their paper states.

Keller told MIT News coal has never been studied in terms of its potential use in electronic devices.

“The material has never been approached this way before, to find out what the properties are, what unique features there might be,” he said.

The method of processing the material involves crushing the coal to a powder, putting it into a solution, and then spreading it as a thin, uniform film on a substrate – a step used in creating many different electronic devices such as transistors or photovoltaics.

The researchers found simply by adjusting the temperature at which they processed the coal the material’s optical and electrical properties could be fine-tuned.

Grossman went on to state that the low cost of the material, combined with these low fabrication costs, provide a potential new avenue for coal, and unlike grapheme or silica, does not require high levels of purity in its processing.

The study was supported through a Bose Fellows program and oil and gas company ExxonMobil through the MIT Energy Initiative and the ExxonMobil Fellow program. "

Base Metals Mining In Brazil, To 2020

www.mining-technology.com/news/newsreport-copper-nickel-prod…www.timetricreports.com/report/mmbm0022mr--base-metals-minin…

Shale Debt Crisis Is Hitting Record Levels

http://piercepoints.com/energy-investment-exploration-shale-…

Vale READIES for iron ore price war

"prepared to operate @ANY

price level"

price level"

www.mining.com/vale-readies-iron-ore-price-war/?utm_source=d…

Reach Subsea signs contract with NTNU, for marine mining project in Norway

www.mining-technology.com/news/newsreach-subsea-secures-cont…

Brazilian prosecutors file $43,000,000,000 lawsuit, against Samarco, Vale +BHP, over dam failure

www.mining-technology.com/news/newsbrazilian-prosecutors-fil…

"XXX, ...

ExxonMobil's allies on the House Science Committee are holding to a deadline of next WEDNESDAY for UCS staff to hand over years of correspondence about our investigation into Exxon's deception.

We won't let this harassment detract from our critical work—but we need you with us as we face down this spurious attack on UCS and on climate science itself.

Read our email below, and please renew your support now to help UCS defend science, unbowed and unafraid.

John Mace, Membership Director

Union of Concerned Scientists

The deadline for Representative Smith's demand for our scientists' correspondence is in just a few days.

We need you with us as we face down this unprecedented attack on UCS.

Renew your support for the Union of Concerned Scientists to stand up to congressional bullies and keep holding big polluters accountable.

RENEW TODAY

Dear Petrus,

You helped UCS catch ExxonMobil's hand in the cookie jar. Now they're lashing out.

Last Thursday we notified you that allies of ExxonMobil in Congress have targeted UCS, requesting that we provide them with years' worth of communications with state officials, other non-profits, and climate science researchers, all in an effort to cow us into silence. They claim that we are threatening ExxonMobil's freedom of speech. Their deadline for us to respond is in less than a week.

They're trying to bully us all into silence.

Don't stand for it. Join more than 1,000 UCS supporters who have pitched in since Thursday to keep our work to expose big polluters going strong—no matter what they throw our way. Renew your support for the Union of Concerned Scientists now.

ExxonMobil might not be acknowledging its efforts to mislead the public—yet—but the fact that they and their political allies are responding so aggressively means we're pushing all the right buttons.

In just the last few months, more than 90,000 UCS supporters have sent letters to ExxonMobil demanding that executives come clean on suppressing vital research and stop funding climate-denying front groups like the American Legislative Exchange Council (ALEC). The company's annual shareholder meeting is today—and we have staff and activists on the ground to tell investors about the changes ExxonMobil needs to make.

We've also urged government leaders to hold ExxonMobil accountable for possibly defrauding investors and the public. I'm proud to say that in the wake of hard-hitting research by UCS and others, 17 state attorneys general have come together to cooperate on probes into whether fossil fuel companies misled investors on climate change risk. New York, California, Massachusetts, and the U.S. Virgin Islands have officially launched their own investigations into ExxonMobil. And all this pressure is exactly why the House Science Committee is coming after UCS.

But ExxonMobil has vast resources, and they're mounting an aggressive effort to quash the investigations and walk away scot-free. Exxon and its allies have hired two law firms that defended tobacco companies for years.¹

We can't let that happen. Renew your support today.

A donation to UCS is a solid investment. We've pushed major companies to stop funding climate denial, shifted whole industries towards more sustainable supply chain practices, secured strong renewable energy standards in state and federal energy policies, and more.

With unimpeachable science, cold, hard facts, and grassroots power, we've shown time and again that we can make corporate and political leaders act in our planet's best interest. But we're only as strong as the support we get from our members.

I hope you'll contribute during this critical moment for our campaign, Petrus, and thank you for your support.

Sincerely,

Ken Kimmell

President

Union of Concerned Scientists

1. http://insideclimatenews.org/news/21042016/exxon-competitive…

Science for a healthy planet and safer world "

https://secure3.convio.net/ucs/site/Donation2;jsessionid=F13…

ExxonMobil's allies on the House Science Committee are holding to a deadline of next WEDNESDAY for UCS staff to hand over years of correspondence about our investigation into Exxon's deception.

We won't let this harassment detract from our critical work—but we need you with us as we face down this spurious attack on UCS and on climate science itself.

Read our email below, and please renew your support now to help UCS defend science, unbowed and unafraid.

John Mace, Membership Director

Union of Concerned Scientists

The deadline for Representative Smith's demand for our scientists' correspondence is in just a few days.

We need you with us as we face down this unprecedented attack on UCS.

Renew your support for the Union of Concerned Scientists to stand up to congressional bullies and keep holding big polluters accountable.

RENEW TODAY

Dear Petrus,

You helped UCS catch ExxonMobil's hand in the cookie jar. Now they're lashing out.

Last Thursday we notified you that allies of ExxonMobil in Congress have targeted UCS, requesting that we provide them with years' worth of communications with state officials, other non-profits, and climate science researchers, all in an effort to cow us into silence. They claim that we are threatening ExxonMobil's freedom of speech. Their deadline for us to respond is in less than a week.

They're trying to bully us all into silence.

Don't stand for it. Join more than 1,000 UCS supporters who have pitched in since Thursday to keep our work to expose big polluters going strong—no matter what they throw our way. Renew your support for the Union of Concerned Scientists now.

ExxonMobil might not be acknowledging its efforts to mislead the public—yet—but the fact that they and their political allies are responding so aggressively means we're pushing all the right buttons.