McEwen Mining - 500 Beiträge pro Seite (Seite 3)

eröffnet am 29.01.12 19:26:51 von

neuester Beitrag 17.04.24 18:58:02 von

neuester Beitrag 17.04.24 18:58:02 von

Beiträge: 1.903

ID: 1.172.023

ID: 1.172.023

Aufrufe heute: 23

Gesamt: 235.628

Gesamt: 235.628

Aktive User: 0

ISIN: US58039P3055 · WKN: A3DMEX

11,400

EUR

+1,33 %

+0,150 EUR

Letzter Kurs 22:27:33 Lang & Schwarz

Neuigkeiten

18.03.24 · Stephan Bogner Anzeige |

14.12.23 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 4,7000 | +22,40 | |

| 5,1500 | +21,75 | |

| 14,850 | +21,22 | |

| 1,7850 | +20,20 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6050 | -6,20 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 46,88 | -97,99 |

Antwort auf Beitrag Nr.: 53.244.633 von boersentrader02 am 09.09.16 13:55:47ansonsten auch immer wieder mal hier gucken  :

:

http://www.siliconinvestor.com/subject.aspx?subjectid=58536

z.B.:

http://www.siliconinvestor.com/readmsg.aspx?msgid=30744387

SEPT. 14

MINING - CALINGASTA

Macri received CEO of McEwen Mining Project Los Azules

Mauricio Macri, with Rob McEwen

...

..

.

:

:http://www.siliconinvestor.com/subject.aspx?subjectid=58536

z.B.:

http://www.siliconinvestor.com/readmsg.aspx?msgid=30744387

SEPT. 14

MINING - CALINGASTA

Macri received CEO of McEwen Mining Project Los Azules

Mauricio Macri, with Rob McEwen

...

..

.

Silber 2,5% im Plus , Gold im Plus aber McEwen im Minus. Hab heute noch mal aufgestockt, mal sehen wie ich aus der Sache rauskomme. Silberproduktion macht schließlich einen bedeutenden Anteil an McEwens Einkünften aus.

Für Rob ist es egal wer in den USA die Wahl gewinnen wird, beide werden dafür . . .

. . . Sorge tragen, dass die Edelmetalle noch in diesem Jahr steigen werden. Ich gönn es ihm denn ich profitiere dann ja auch.

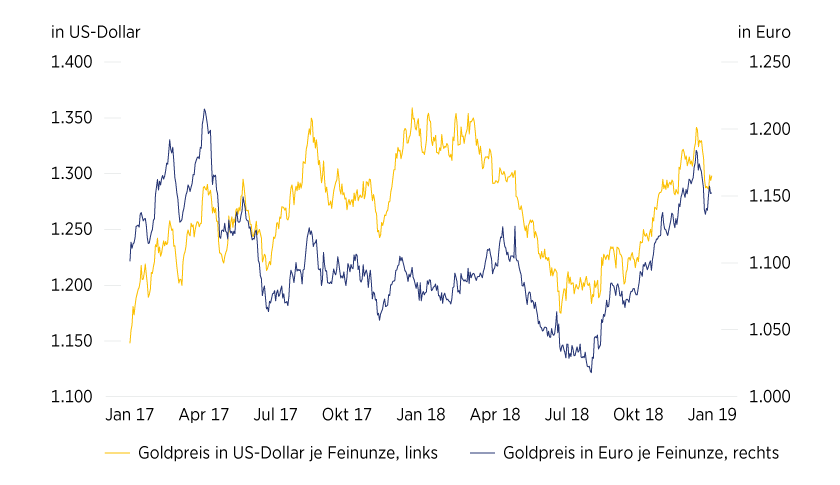

Gold Bull McEwen Sees Prices as High as $1,900 by End of Year

Bullion ‘is a currency that doesn’t have a liability attached’

Either Trump or Clinton victory is positive for gold: McEwen

Robert McEwen, one of the gold’s industry’s most unabashed bulls, is predicting prices could surge as much as 44 percent by the end of the year as confidence in the economy buckles.

The metal could trade in a range of $1,700 an ounce to $1,900 by the end of 2016 as uncertainty builds around the stability of global currencies and sovereign debt, said McEwen, who’s so enamored by bullion that he’s founded two producers: McEwen Mining Inc. and Goldcorp Inc. Record-low global interest rates will cause a “huge amount of anxiety” for investors, who will turn to gold as a store of value and an alternative asset, he said.

Gold “is a currency that doesn’t have a liability attached to it,” McEwen said Tuesday in an interview at a gold conference in Colorado Springs. “A store of value that has gone for millennia. And the big argument against gold used to be it costs you money to store it. Right now, it’s costing you money to store your cash.”

In New York, gold futures for December delivery settled little changed at $1,318.20 on the Comex. Prices have climbed 24 percent so far this year, this biggest gain for this point in the calendar since 2011.

Vielleicht gelingt es ihm ja, das MUX es im nächsten Jahr schafft, in den S&P 500 aufgenommen zu werden.

http://www.bnn.ca/video/robert-mcewen-why-my-dream-is-gettin…" target="_blank" rel="nofollow ugc noopener">http://www.bnn.ca/video/robert-mcewen-why-my-dream-is-gettin…Robert McEwen: Why my dream is getting into S&P 500

The gold tycoon updates us on his projects and reminds us why he's so keen on seeing McEwen Mining included in America's stock benchmark.

MsEwen Mining hat anläßlich der Denver Show, am 19. Sept. 016 eine neue Präsentation ins Netz gestellt.

http://s1.q4cdn.com/807296388/files/doc_presentations/201609…" target="_blank" rel="nofollow ugc noopener">http://s1.q4cdn.com/807296388/files/doc_presentations/201609…

DENVER GOLD SHOW SEPTEMBER 19, 2016

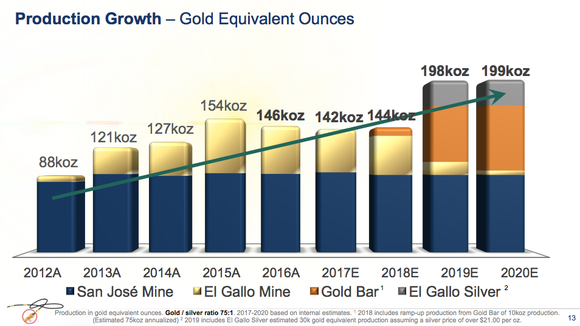

Wenn auch in diesem Jahr die Edelmetall-Produktion rückläufig ist und im nächsten Jahr stagniert, hier kann man dann sehen, das es in den ab 2018-er Jahren wieder nach oben gehen wird. Gönnen wir MUX die Zeit die es für diesen Sektorensprung benötigt.

S&P wir kommen.

http://s1.q4cdn.com/807296388/files/doc_presentations/201609…" target="_blank" rel="nofollow ugc noopener">http://s1.q4cdn.com/807296388/files/doc_presentations/201609…

DENVER GOLD SHOW SEPTEMBER 19, 2016

Wenn auch in diesem Jahr die Edelmetall-Produktion rückläufig ist und im nächsten Jahr stagniert, hier kann man dann sehen, das es in den ab 2018-er Jahren wieder nach oben gehen wird. Gönnen wir MUX die Zeit die es für diesen Sektorensprung benötigt.

S&P wir kommen.

Antwort auf Beitrag Nr.: 53.317.941 von boersentrader02 am 21.09.16 12:01:26korrekter Link zur (pdf) Präsentation ( 14 MB, 34 Seiten):

s1.q4cdn.com/807296388/files/doc_presentations/20160918_denv…

s1.q4cdn.com/807296388/files/doc_presentations/20160918_denv…

Danke, für die Einstellung des richtigen Links.

Wer es bisher noch nicht gemacht hat, soll sich einfach die Situation . . . .

. . . . zur Zeit ansehen und auf Edelmetalle setzen. Allerdings ist das nur m.M. Es ist kein Aufruf von mir Edelmetalle zu kaufen, aber schaut es euch einfach nur an, was jetzt in der Welt alles passiert.

Hoffen wir das Beste und bereiten uns auf das Schlimmste vor - 09.10.2016

Sehr geehrte Damen und Herren,

Lassen Sie mich zunächst auf die Bedrohung des Bargeldes eingehen, bevor ich auf weitere mich beunruhigende Entwicklungen sowie die aktuelle Lage bei Gold und Silber nach der von uns erwarteten Korrektur zu sprechen komme. Vorausschicken will ich, dass ich mich sehr freue, auf der kommenden Edelmetallmesse am 3. November um 17:10 Uhr in München sprechen zu dürfen.

Jetzt das Bargeld und bald das Gold

Viele fragen mich, warum ich derzeit so viel Zeit in die Arbeit als Vorsitzender des gemeinnützigen Vereins Pro Bargeld - Pro Freiheit e.V. stecke. Insgesamt an 9 Tagen werden wir immerhin wie erstmals am 4. Mai 2016 an der Konstabler Wache für die große Kundgebung am Samstag, den 22. Oktober 2016, ab 14 Uhr auf der Hauptwache in Frankfurt werben. Wir werden auch drei Geldtransporter dank der Unterstützung der drei größten Werttransportunternehmen auffahren. Ich freue mich besonders, dass wir neben Prof. Joachim Starbatty den ehemaligen Partner der Börsenlegende Andre Kostolany, den Kapitalmarktexperten Gottfried Heller, gewinnen konnten.

Mehr dazu unter:

http://www.pro-bargeld.com/probargeld-profreiheit_kundgebung…" target="_blank" rel="nofollow ugc noopener">http://www.pro-bargeld.com/probargeld-profreiheit_kundgebung…

Der neueste Newsletter wurde gestern, am 9.10.2016, veröffentlicht. H

http://www.pro-bargeld.com/images/kundgebung_titel.jpg

Naja, etwas mehr hätte es schon sein können.

Das es diesmal weniger werden würde, hat man ja schon kommuniziert, aber über 5k weniger überrascht mich schon. Das 4. Quartal soll ja wieder besser werden. Erst bei besseren Zahlen wird auch der Kurs wieder nach Norden gehen, aber erst dann. Rob braucht halt seine Zeit um die Förderung nach oben zu bringen.

McEwen Mining produces 36,496 oz AuEq in Q3 2016

2016-10-13 06:42 ET - News Release

Ms. Christina McCarthy reports

MCEWEN MINING REPORTS Q3 PRODUCTION, MEXICO EXPLORATION DRILL RESULTS

McEwen Mining Inc.'s total production for the third quarter was 36,496 gold-equivalent ounces using a gold-to-silver ratio of 75 to 1, or 24,281 gold ounces and 916,168 silver ounces. Production is on target to achieve our 2016 guidance of 144,000 gold equivalent ounces, or 99,500 gold ounces and 3,337,000 silver ounces.

2016 Consolidated Production Summary

Guidance YTD Q1 Q2 Q3

Gold ounces 99,500 81,145 28,975 27,888 24,281

Silver ounces 3,337,000 2,464,941 673,767 875,006 916,168

Gold Eq. ounces 144,000 114,009 37,958 39,555 36,496

San Jose Mine, Argentina (49%) (1)

The San Jose Mine produced 12,527 gold ounces and 909,017 silver ounces attributable to us in Q3, for a total of 24,647 gold equivalent ounces. Year-to-date the San Jose Mine produced 33,839 gold ounces and 2,443,527 silver ounces attributable to us, for a total of 66,419 gold equivalent ounces. Full year production guidance for San Jose in 2016 is 45,000 gold ounces and 3.3 million silver ounces, for a total of 89,000 gold equivalent ounces attributable to us.

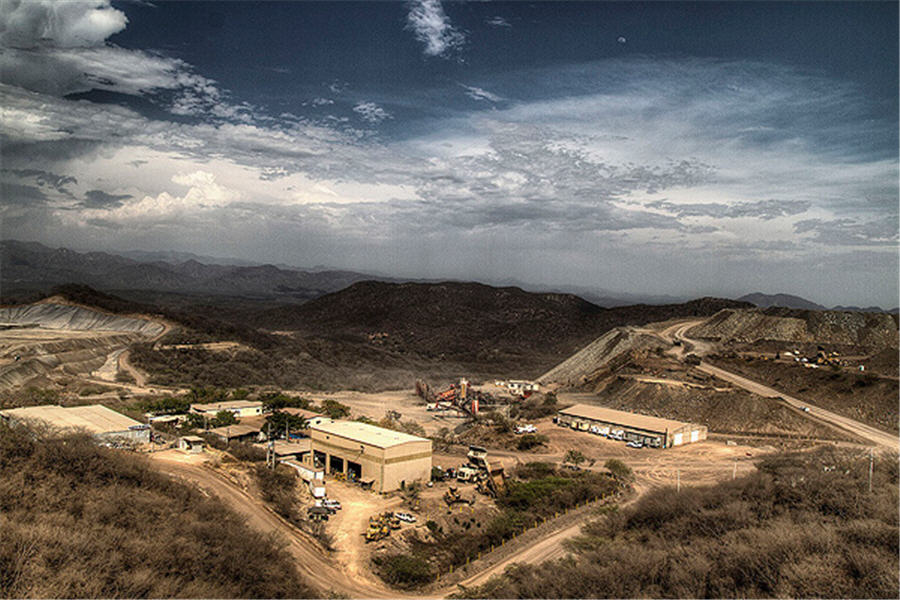

El Gallo Mine, Mexico (100%)

The El Gallo Mine performed as expected in Q3, producing 11,849 gold equivalent ounces. Production in Q3 was lower than the prior quarter due to lower ore grades, as we previously forecast (1.4 gpt in Q3 2016 vs. 2.3 gpt in Q2 2016). Year-to-date the El Gallo Mine produced 47,590 gold equivalent ounces. Full year guidance for El Gallo is 55,000 gold equivalent ounces.

Mexico Exploration Update

The 2016 exploration budget for Mexico is $4 million. Exploration drilling in the district around our El Gallo Mine has been concentrated primarily on three prospective areas; one area called Encuentro South has returned particularly encouraging results at shallow depths. Highlights are summarized below:

Hole ID Gold Grade (gpt) Intercept Width (m)

Den Rest der News findet ihr hier:

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:MUX-2412495

Antwort auf Beitrag Nr.: 53.559.735 von meichel am 26.10.16 18:59:36Für mich ein ganz gewichtiger Grund wieso ich hier investiert bin!

In conclusion, Mr. McEwen said, “I have invested a lot of personal money, $127 million, in this company with the objective of significantly increasing its value to our share owners and myself. I do not take a salary, nor do I receive a bonus so I will only make money the same way my fellow share owners do with an increasing share price.

http://www.metalsnews.com/spotlight.aspx?ArticleID=1085447

In conclusion, Mr. McEwen said, “I have invested a lot of personal money, $127 million, in this company with the objective of significantly increasing its value to our share owners and myself. I do not take a salary, nor do I receive a bonus so I will only make money the same way my fellow share owners do with an increasing share price.

http://www.metalsnews.com/spotlight.aspx?ArticleID=1085447

Denver Goldforum hier die Presentation von Rob MC Ewen hoffe link klappt

http://www.denvergoldforum.org/dgf16/company-webcast/MUX:US/

http://www.denvergoldforum.org/dgf16/company-webcast/MUX:US/

http://factsreporter.com/2016/11/01/past-3-quarter-analysis-…

Past 3 Quarter Analysis for McEwen Mining Inc. (NYSE:MUX)

By Troy Mann - November 1, 201643

McEwen Mining Inc. (NYSE:MUX) moved up 4.17% and closed its last trading session at $3.25. This Basic Materials Sector stock currently has the Market Capitalization of 926.87 Million. The Average Volume for the stock is measured as 4.18 Million. The Stock has a 52-Week High of $4.92 and 52-Week Low of $0.79 following the dates, it touched its 52-Week High on Jul 11, 2016 and 52-Week Low on Nov 6, 2015. Currently, the Return on Assets value for the trailing twelve months is 1.8% with the Return on Equity and Return on Investment of 2.1% and -5.9% respectively. This firm currently has YTD (year to date) performance of 208.19 Percent which is awesome. The Short Ratio for the stock is 7.38.

McEwen Mining Inc. (NYSE:MUX) Price to Earnings (P/E) ratio is 108.33. EPS or Earning per Share stands at $0.03. The TTM operating margin is -12.4 percent.

McEwen Mining Inc. (NYSE:MUX) reports its Earnings on Thu 3 Nov (In 2 Days). The estimated EPS for the current quarter is said to be $. Following Earnings result, share price were UP 8 times out of last 16 Qtrs. The stock has reduced about -30.5% since it reported its last earnings. The Closing price of McEwen Mining Inc. (NYSE:MUX) at Last Earnings was $4.49 as compared to the previous closing price of $3.08. The Predicted Move on the 7th day after McEwen Mining Inc. (NYSE:MUX) will release its earnings at about 8%.

By Looking at Earnings History, Out of 12 Quarters when the Earnings were reported, McEwen Mining Inc. (NYSE:MUX) beats earnings by 0%, The Stock Missed Earnings 0 times and has met earnings 0 times.

Earnings History:

We will discuss the past Quarters Earnings below:

McEwen Mining Inc. (NYSE:MUX) reported its previous quarter on 08/03/2016. The Closing price before the company posted its earnings was $4.49. The Stock declined on the very next day of earnings and maintained its stock price at $4.39 by showing a % change of -2.23 percent from its previous closing price. The Next Day Volume after Earnings was reported as 2.48 Million. On the 7th day After Earnings Report, the stock hit its share price as $4.34 by showing -3.34% decrease from the Stock price Before Earnings were reported.

Company Profile:

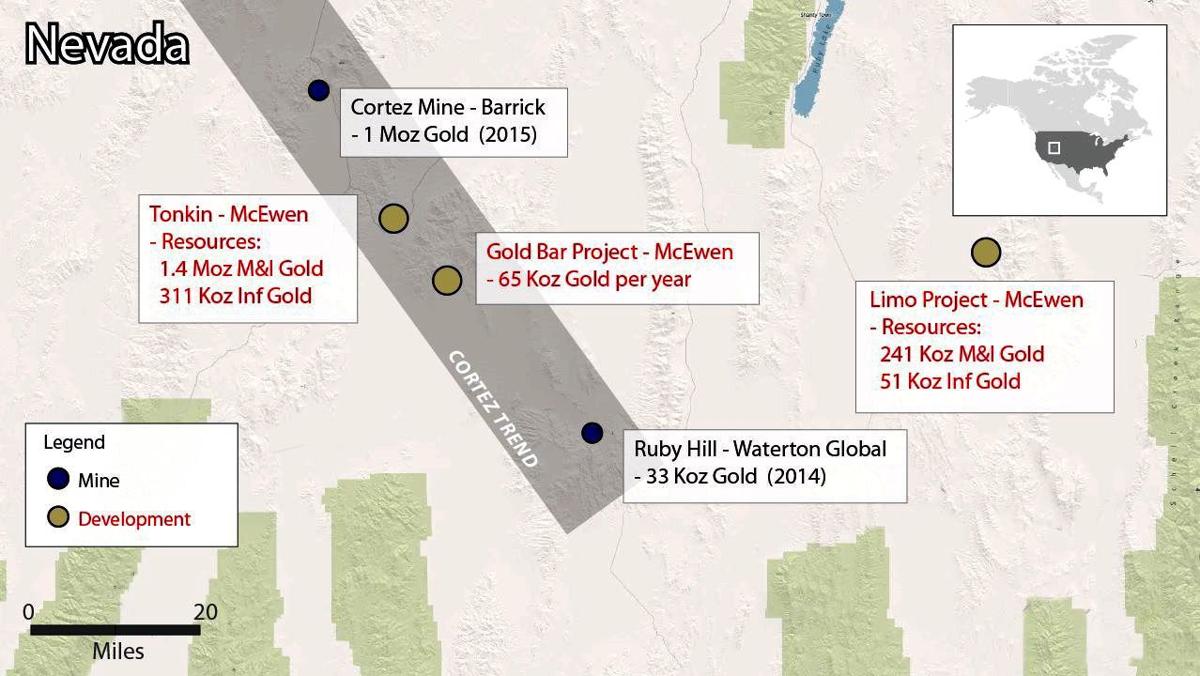

McEwen Mining Inc. explores for, develops, produces, and sells precious and base metals in Argentina, Mexico, and the United States. It primarily explores for gold, silver, and copper. The companys principal assets consist of a 49% interest in the San José Mine in Santa Cruz, Argentina; the El Gallo 1 mine and El Gallo 2 project in Sinaloa, Mexico; the Gold Bar project in Nevada, the United States; and the Los Azules copper project in San Juan, Argentina. It covers an area of approximately 730 square miles and comprises 146 mining concessions consisting of 71 approved mining claims; 54 claims that are in the application process for mining claim status; and 21 claims, principally that are for exploration only. The company was formerly known as US Gold Corporation and changed its name to McEwen Mining Inc. in January 2012. McEwen Mining Inc. was founded in 1979 and is headquartered in Toronto, Canada.

Past 3 Quarter Analysis for McEwen Mining Inc. (NYSE:MUX)

By Troy Mann - November 1, 201643

McEwen Mining Inc. (NYSE:MUX) moved up 4.17% and closed its last trading session at $3.25. This Basic Materials Sector stock currently has the Market Capitalization of 926.87 Million. The Average Volume for the stock is measured as 4.18 Million. The Stock has a 52-Week High of $4.92 and 52-Week Low of $0.79 following the dates, it touched its 52-Week High on Jul 11, 2016 and 52-Week Low on Nov 6, 2015. Currently, the Return on Assets value for the trailing twelve months is 1.8% with the Return on Equity and Return on Investment of 2.1% and -5.9% respectively. This firm currently has YTD (year to date) performance of 208.19 Percent which is awesome. The Short Ratio for the stock is 7.38.

McEwen Mining Inc. (NYSE:MUX) Price to Earnings (P/E) ratio is 108.33. EPS or Earning per Share stands at $0.03. The TTM operating margin is -12.4 percent.

McEwen Mining Inc. (NYSE:MUX) reports its Earnings on Thu 3 Nov (In 2 Days). The estimated EPS for the current quarter is said to be $. Following Earnings result, share price were UP 8 times out of last 16 Qtrs. The stock has reduced about -30.5% since it reported its last earnings. The Closing price of McEwen Mining Inc. (NYSE:MUX) at Last Earnings was $4.49 as compared to the previous closing price of $3.08. The Predicted Move on the 7th day after McEwen Mining Inc. (NYSE:MUX) will release its earnings at about 8%.

By Looking at Earnings History, Out of 12 Quarters when the Earnings were reported, McEwen Mining Inc. (NYSE:MUX) beats earnings by 0%, The Stock Missed Earnings 0 times and has met earnings 0 times.

Earnings History:

We will discuss the past Quarters Earnings below:

McEwen Mining Inc. (NYSE:MUX) reported its previous quarter on 08/03/2016. The Closing price before the company posted its earnings was $4.49. The Stock declined on the very next day of earnings and maintained its stock price at $4.39 by showing a % change of -2.23 percent from its previous closing price. The Next Day Volume after Earnings was reported as 2.48 Million. On the 7th day After Earnings Report, the stock hit its share price as $4.34 by showing -3.34% decrease from the Stock price Before Earnings were reported.

Company Profile:

McEwen Mining Inc. explores for, develops, produces, and sells precious and base metals in Argentina, Mexico, and the United States. It primarily explores for gold, silver, and copper. The companys principal assets consist of a 49% interest in the San José Mine in Santa Cruz, Argentina; the El Gallo 1 mine and El Gallo 2 project in Sinaloa, Mexico; the Gold Bar project in Nevada, the United States; and the Los Azules copper project in San Juan, Argentina. It covers an area of approximately 730 square miles and comprises 146 mining concessions consisting of 71 approved mining claims; 54 claims that are in the application process for mining claim status; and 21 claims, principally that are for exploration only. The company was formerly known as US Gold Corporation and changed its name to McEwen Mining Inc. in January 2012. McEwen Mining Inc. was founded in 1979 and is headquartered in Toronto, Canada.

http://globenewswire.com/news-release/2016/11/03/886191/0/en…" target="_blank" rel="nofollow ugc noopener">http://globenewswire.com/news-release/2016/11/03/886191/0/en…

TORONTO, Nov. 03, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce consolidated quarterly production of 36,496 gold equivalent ounces(1), comprised of 24,281 ounces gold and 916,168 ounces silver. For the three and nine months ended September 30, 2016, the Company reported net income of $4.2 million(2) or $0.01 per share and $25.5 million or $0.09 per share, respectively. Earnings from mining operations(3) were $18.9 million and $57.7 million over the same periods. Net income for the three months ended September 30, 2015 was $2.6 million or $0.01 per share and net loss for the nine months ended September 30, 2015 was $5.5 million, or $0.02 per share.

For the three and nine months ended September 30, 2016, the Company generated $4.9 million and $24.4 million of net cash flow from operations, respectively. We ended the third quarter of 2016 with liquid assets(3) of $62.5 million composed of cash of $38.8 million, precious metals of $16.6 million and marketable securities of $7.1 million. The Company has no debt, and has not done any financings, sold any metal streams, royalties, or hedges against precious metals. As at October 31, 2016 we had liquid assets of $60.3 million.

Our 2016 production guidance remains 99,500 gold ounces and 3.3 million silver ounces, or approximately 144,000 gold equivalent ounces. However, we are reducing our original guidance for total cash costs and all-in sustaining costs (“AISC”) from $780 and $935 per gold equivalent ounce, respectively, to $700 and $860. This is attributable to the reduced cost levels at the El Gallo Mine in the first nine months, which we expect to continue for the rest of this year.

In addition, the Company announces the promotion of Xavier Ochoa from Chief Operating Officer to President and Chief Operating Officer, effective immediately. Simultaneously, the Company announces the departure of its former President, Colin Sutherland.

The tables below provide selected operating and financial results for Q3, comparative results for Q3 2015, and our production and cost guidance for full year 2016. For our SEC Form 10-Q Financial Statements and MD&A please refer to:

...

..

.

TORONTO, Nov. 03, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce consolidated quarterly production of 36,496 gold equivalent ounces(1), comprised of 24,281 ounces gold and 916,168 ounces silver. For the three and nine months ended September 30, 2016, the Company reported net income of $4.2 million(2) or $0.01 per share and $25.5 million or $0.09 per share, respectively. Earnings from mining operations(3) were $18.9 million and $57.7 million over the same periods. Net income for the three months ended September 30, 2015 was $2.6 million or $0.01 per share and net loss for the nine months ended September 30, 2015 was $5.5 million, or $0.02 per share.

For the three and nine months ended September 30, 2016, the Company generated $4.9 million and $24.4 million of net cash flow from operations, respectively. We ended the third quarter of 2016 with liquid assets(3) of $62.5 million composed of cash of $38.8 million, precious metals of $16.6 million and marketable securities of $7.1 million. The Company has no debt, and has not done any financings, sold any metal streams, royalties, or hedges against precious metals. As at October 31, 2016 we had liquid assets of $60.3 million.

Our 2016 production guidance remains 99,500 gold ounces and 3.3 million silver ounces, or approximately 144,000 gold equivalent ounces. However, we are reducing our original guidance for total cash costs and all-in sustaining costs (“AISC”) from $780 and $935 per gold equivalent ounce, respectively, to $700 and $860. This is attributable to the reduced cost levels at the El Gallo Mine in the first nine months, which we expect to continue for the rest of this year.

In addition, the Company announces the promotion of Xavier Ochoa from Chief Operating Officer to President and Chief Operating Officer, effective immediately. Simultaneously, the Company announces the departure of its former President, Colin Sutherland.

The tables below provide selected operating and financial results for Q3, comparative results for Q3 2015, and our production and cost guidance for full year 2016. For our SEC Form 10-Q Financial Statements and MD&A please refer to:

...

..

.

Antwort auf Beitrag Nr.: 53.619.621 von meichel am 04.11.16 11:12:19

Ein Goldindustrie-Insider sieht den Goldpreis bis Ende des Jahres bei 1.900 US-Dollar

(Quelle: Ein Goldindustrie-Insider sieht den Goldpreis bis Ende des J…

Ein Goldindustrie-Insider sieht den Goldpreis bis Ende des Jahres bei 1.900 US-Dollar

(Quelle: Ein Goldindustrie-Insider sieht den Goldpreis bis Ende des J…

McEwen Mining appoints Ochoa president

2016-11-04 07:49 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING APPOINTS XAVIER OCHOA AS PRESIDENT AND COO

McEwen Mining Inc. has appointed Xavier Ochoa as president and chief operating officer. Mr. Ochoa joined the company this past September, 2016, as McEwen Mining's COO (see news release dated Sept. 9, 2016).

The change in management represents a significant step toward reaching the company's operational goals and further advancing its portfolio of projects. Mr. Ochoa brings over 25 years of international experience in the mining industry, including senior management positions, where he was instrumental for leading project and operational teams, both underground and open pit.

In Mexico, the company has an extensive land package with numerous small-scale historic areas of mine production throughout the property package. A new geological interpretation making use of advanced geophysics and information collected from exploration work has been developed for the El Gallo property which confirms the geological potential. Recent work has demonstrated encouraging results at the El Encuentro-La Revancha zone (see news release dated Oct. 13, 2016). The company has recently begun to demonstrate the prospective nature and potential longevity of mining within the El Gallo district. Under Xavier's direction, the company will continue to implement this program with the goal of extending the mine life at the El Gallo complex.

At the El Gallo silver project, the company is revisiting the project and conducting new studies to improve the project economics in light of current silver prices and its continuing exploration program on the El Gallo district.

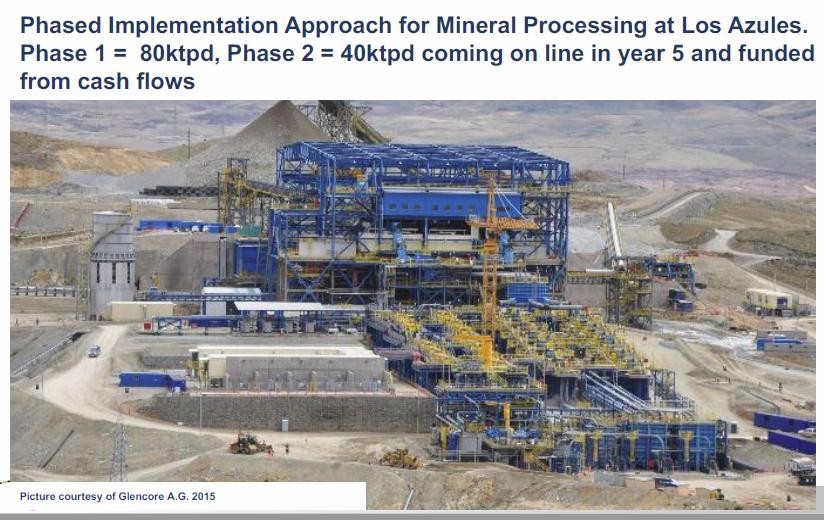

Mr. Ochoa will continue to oversee the advancement of the permits required for a speedy construction decision of the company's Gold Bar project in Nevada while implementing the continuing work program to improve the economics of the large Los Azules copper project in Argentina.

"At McEwen Mining, we believe in constant innovation and a vision of aggressively growing shareowner value. Xavier is a mining engineer with a strong record of enhancing production, reducing operating costs and creatively improving capital efficiency. Having worked for several large companies in the past such as Xtrata, Goldcorp, Barrick and Glencore, I believe Xavier has the skill set and meets the needs to be very effective in his new role," commented Rob McEwen, chief owner.

About McEwen Mining

McEwen Mining's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the El Gallo mine and El Gallo silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, United States, and the Los Azules copper project in San Juan, Argentina. Mr. McEwen owns 25 per cent of the company.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-11-04 07:49 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING APPOINTS XAVIER OCHOA AS PRESIDENT AND COO

McEwen Mining Inc. has appointed Xavier Ochoa as president and chief operating officer. Mr. Ochoa joined the company this past September, 2016, as McEwen Mining's COO (see news release dated Sept. 9, 2016).

The change in management represents a significant step toward reaching the company's operational goals and further advancing its portfolio of projects. Mr. Ochoa brings over 25 years of international experience in the mining industry, including senior management positions, where he was instrumental for leading project and operational teams, both underground and open pit.

In Mexico, the company has an extensive land package with numerous small-scale historic areas of mine production throughout the property package. A new geological interpretation making use of advanced geophysics and information collected from exploration work has been developed for the El Gallo property which confirms the geological potential. Recent work has demonstrated encouraging results at the El Encuentro-La Revancha zone (see news release dated Oct. 13, 2016). The company has recently begun to demonstrate the prospective nature and potential longevity of mining within the El Gallo district. Under Xavier's direction, the company will continue to implement this program with the goal of extending the mine life at the El Gallo complex.

At the El Gallo silver project, the company is revisiting the project and conducting new studies to improve the project economics in light of current silver prices and its continuing exploration program on the El Gallo district.

Mr. Ochoa will continue to oversee the advancement of the permits required for a speedy construction decision of the company's Gold Bar project in Nevada while implementing the continuing work program to improve the economics of the large Los Azules copper project in Argentina.

"At McEwen Mining, we believe in constant innovation and a vision of aggressively growing shareowner value. Xavier is a mining engineer with a strong record of enhancing production, reducing operating costs and creatively improving capital efficiency. Having worked for several large companies in the past such as Xtrata, Goldcorp, Barrick and Glencore, I believe Xavier has the skill set and meets the needs to be very effective in his new role," commented Rob McEwen, chief owner.

About McEwen Mining

McEwen Mining's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the El Gallo mine and El Gallo silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, United States, and the Los Azules copper project in San Juan, Argentina. Mr. McEwen owns 25 per cent of the company.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Alles was Rang und Namen bei Mc Ewen Mining hat, war anläßlich der Telefon-Konferenz da . . ..

. . . und gab Auskunft über das Unternehmen. Die Telefon-Konferenz fand am 3.11. 2016 statt und hier ist das vollständige Frage- und Antwortspiel der leitenden Herren nachzuvollziehen.

Das Ergebnis des 3.Quaertals wurde ja, wie alle wissen, bereits veröffentlicht. Aber die weiteren und tiefergehenden Infos gibt es hier.

Die Veröffentlichung dieser Infos gab es erst heute und wie zu sehen ist, hat der Kurs von MUX danach wieder gedreht. Ob diese News das veranlasst hat ?

McEwen Mining's (MUX) CEO Rob McEwen on Q3 2016 Results - Earnings Call Transcript

Nov. 7, 2016 1:13 PM ET|

About: McEwen Mining Inc. (MUX)

Q3 2016 Earnings Summary

News

EPS of $0.01 | Revenue of $13.43M (- 40.3% Y/Y)

McEwen Mining Inc. (NYSE:MUX)

Q3 2016 Earnings Conference Call

November 3, 2016 11:00 ET

Executives

Rob McEwen - Chief Owner

Andrew Elinesky - CFO

Xavier Ochoa - President & COO

Analysts

Operator

Good morning, ladies and gentlemen and welcome to the McEwen Mining Third Quarter 2016 Financial Results Conference Call. I would now like to turn the meeting over to Mr. Rob McEwen, Chief Owner. Please go ahead, Mr. McEwen.

Rob McEwen

Thank you, operator. Good morning, fellow shareholders and investors. Welcome to our third quarter 2016 conference call. We've produced another solid quarter, positive net cash flow, positive earnings, and we continue advancing our development projects: Gold Bar in Nevada, and El Gallo Silver in Mexico. I'm pleased to highlight that our balance sheet is clean and our treasury remains strong.

With me today to discuss our performance are Andrew Elinesky, our Chief Financial Officer, who will be discussing our financial performance along with Xavier Ochoa who joined us at the beginning of September as our Chief Operating Officer, and I'm pleased to say yesterday he was promoted to President and Chief Operating Officer of the Company. Xavier is a mining engineer with more than 25 years of experience in open pit and underground mine. He has held senior executive positions with Xstrata, Glencore, Barrick and Goldcorp. His outstanding record of delivering growth in operational excellence positions us well, as we prepare to leap forward with our development projects. Xavier will discuss our operational performance.

I'll now turn the conference call over to Andrew.

http://seekingalpha.com/article/4020592-mcewen-minings-mux-c…

Geht es in der angegebenen Zeit für MUX um die Aufnahme in den S&P 500 ?

Es wäre für alle Noch-Aktionäre, bestimmt sind einige durch den derzeitigen, auch nicht zu erwartenden, Kursverfall der Aktie bereits ausgestiegen, ein kleines Schmankel wenn es das sein sollte.

MUX in den S&P 500.

Ist der heutige Kursanstieg der MUX-Aktie bereits die Folge, dieser eventuellen Spekulation ?

MCEWEN MINING INC

2,75 Euro +0,17 +6,59 -.-.-.-.-. 18:36 21.11.2016 | 18:21

(2 Leser)

Newsfile·Mehr Nachrichten von Newsfile

McEwen Mining, Gold, Silver and Copper in the Americas, CEO Clip Video

McEwen Mining is being featured on CBC's Documentary Channel, Nov 28-Dec 11, Monday through Friday, throughout the day and evenings.

McEwen Mining (TSX: MUX):

McEwen Mining's goal is to qualify for inclusion in the S&P 500 Index by creating a high growth, profitable gold and silver producer focused in the Americas and Europe. McEwen Mining's principal assets consist of the San José Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina. http://www.mcewenmining.com/

About CEO Clips:

CEO Clips is the largest library of publicly traded company CEO videos in the US and Canada. These 90 second video profiles broadcast on national TV and are distributed online on top financial portals including: Thomson Reuters, BNN.ca, and Stockhouse.com. They are also disseminated via a video news release to several financial portals including Globe Investor, OTC Markets, TMX Money MoneyThe National Post.

BTV - Business Television/CEO Clip Contact: Trina Schlingmann (604) 664-7401 x 5 trina@b-tv.com

http://www.finanznachrichten.de/nachrichten-2016-11/39248408…

MUX-US: Earnings Analysis: Q3, 2016

McEwen Mining, Inc. :MUX-US: Earnings Analysis: Q3, 2016 By the Numbers : November 18, 2016November 18, 2016 by CapitalCube

McEwen Mining, Inc. reports financial results for the quarter ended September 30, 2016.

We analyze the earnings along side the following peers of McEwen Mining, Inc. – Yamana Gold Inc., Alamos Gold Inc., First Majestic Silver Corp. and Pilot Gold Inc. (AUY-US, AGI-US, AG-US and PLGTF-US) that have also reported for this period.

Highlights

Summary numbers: Revenues of USD 13.42 million, Net Earnings of USD 4.21 million.

Gross margins narrowed from 40.80% to 32.86% compared to the same period last year, operating (EBITDA) margins now -3.80% from 23.82%.

Year-on-year change in operating cash flow of -54.47% is about the same as the change in earnings, likely no significant movement in accruals or reserves.

Earnings growth due to contribution of one-time items.

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

...

..

.

http://www.capitalcube.com/blog/index.php/mcewen-mining-inc-…

Rob spricht hier über das Jahr 2017 und wie es mit den RÈdelmetallen weiter gehen wird.

Rob McEwens Erwartungen für 201708:41 Uhr | Redaktion

Rob McEwen, Gründer und ehemaliger CEO von Goldcorp Inc. und aktuell CEO of McEwen Mining, sprach Ende 2016 mit Daniela Cambone von Kitco News über seine Erwartungen bezüglich der Entwicklung des Goldmarktes im Jahr 2017.

Demnach glaubt der Bergbauexperte, dass Donald Trump die US-Wirtschaft positiv beeinflussen wird. Daher rechnet er damit, dass Gold besonders in den USA zu kämpfen haben wird. In den ersten Monaten der Präsidentschaft Trumps sollte es zu keinen großen Preisbewegungen kommen. In anderen Ländern könnte der Preis des gelben Metalls allerdings steigen, da sie Währungen an Wert verlieren.

http://www.goldseiten.de/artikel/313772--Rob-McEwens-Erwartu…

McEwen Mining produces 145,530 oz AuEq in 2016

2017-01-16 07:50 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING REPORTS 2016 FULL YEAR AND Q4 PRODUCTION RESULTS

McEwen Mining Inc.'s annual consolidated production in 2016 was 145,530 gold-equivalent ounces (1) using a gold-to-silver ratio of 75:1, or 101,482 gold ounces and 3,303,709 silver ounces.

2016 Consolidated Production Summary

Guidance 2016 Q1 Q2 Q3 Q4

Gold ounces 99,500 101,482 28,975 27,888 24,281 20,337

Silver ounces 3,337,000 3,303,709 673,767 875,006 916,168 838,768

Gold Eq. ounces 144,000 145,530 37,958 39,555 36,496 31,521

Highlights

Achieved gold and silver production in-line with guidance from our two producing mines.

Doubled liquid assets during the year to $64 million(2) in cash, cash equivalents and precious metals, and no debt.

3rd semi-annual return of capital of one-half cent per common share will be paid on February 14th, 2017 to shareholders of record as of the close of business on February 3rd, 2017.

El Gallo Mine, Mexico

Production in 2016 was 55,266 gold equivalent ounces, compared to 63,366 gold equivalent ounces in 2015. Our production guidance for the year was slightly exceeded and the mine performed well despite lower ore grades mined and processed relative to 2015.

In Q4, the mine produced 7,676 gold equivalent ounces, compared to 11,092 gold equivalent ounces during same period in 2015. Production in Q4 was lower as a result of mining and processing lower ore grades during the quarter.

San Jose Mine, Argentina (49% (3) )

Our attributable production from San Jose in 2016 was 46,553 gold ounces and 3,278,373 silver ounces, for a total of 90,264 gold equivalent ounces. Compared to 2015, silver production levels were maintained and gold production was down 2%.

In Q4, attributable production was 12,714 gold ounces and 834,846 silver ounces, for a total of 23,845 gold equivalent ounces.

Return of Capital

Our third semi-annual return of capital of one-half cent per share will be paid on February 14th, 2017 to shareholders of record as of the close of business on February 3rd, 2017. It will be paid to common shareholders of McEwen Mining Inc. from additional paid-in capital. For shareholders in the US and Canada, return of capital is generally not taxed, however we advise you to obtain advice from a tax professional familiar with your specific situation.

Financial Results

Operating costs for the quarter ended December 31, 2016 will be released with our 10-K Annual Financial Statements in late February 2017. As at December 31, 2016 we have no debt and liquid assets of $64 million composed of $36 million in cash, $21 million in precious metals, and $7 million in marketable securities. We have not issued equity to finance our operations since completing a rights issue in 2013, and we have preserved our leverage to higher gold and silver prices by not encumbering our assets with royalties, metal streams or hedges.

Footnotes:

'Gold Equivalent Ounces' are calculated based on a 75:1 gold to silver ratio.

Figures updated as of December 31, 2016.

The San Jose Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc.

ABOUT MCEWEN MINING

McEwen Mining has an ambitious goal of qualifying for inclusion in the S&P 500 Index by creating a high growth gold and silver producer focused in the Americas. McEwen Mining's principal assets consist of the San Jose Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina.

TECHNICAL INFORMATION

The technical contents of this news release has been reviewed and approved by Nathan M. Stubina, Ph.D., P.Eng., FCIM, Managing Director and a Qualified Person as defined by Canadian Securities Administrator National Instrument 43-101 "Standards of Disclosure for Mineral Projects".

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

2017-01-16 07:50 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING REPORTS 2016 FULL YEAR AND Q4 PRODUCTION RESULTS

McEwen Mining Inc.'s annual consolidated production in 2016 was 145,530 gold-equivalent ounces (1) using a gold-to-silver ratio of 75:1, or 101,482 gold ounces and 3,303,709 silver ounces.

2016 Consolidated Production Summary

Guidance 2016 Q1 Q2 Q3 Q4

Gold ounces 99,500 101,482 28,975 27,888 24,281 20,337

Silver ounces 3,337,000 3,303,709 673,767 875,006 916,168 838,768

Gold Eq. ounces 144,000 145,530 37,958 39,555 36,496 31,521

Highlights

Achieved gold and silver production in-line with guidance from our two producing mines.

Doubled liquid assets during the year to $64 million(2) in cash, cash equivalents and precious metals, and no debt.

3rd semi-annual return of capital of one-half cent per common share will be paid on February 14th, 2017 to shareholders of record as of the close of business on February 3rd, 2017.

El Gallo Mine, Mexico

Production in 2016 was 55,266 gold equivalent ounces, compared to 63,366 gold equivalent ounces in 2015. Our production guidance for the year was slightly exceeded and the mine performed well despite lower ore grades mined and processed relative to 2015.

In Q4, the mine produced 7,676 gold equivalent ounces, compared to 11,092 gold equivalent ounces during same period in 2015. Production in Q4 was lower as a result of mining and processing lower ore grades during the quarter.

San Jose Mine, Argentina (49% (3) )

Our attributable production from San Jose in 2016 was 46,553 gold ounces and 3,278,373 silver ounces, for a total of 90,264 gold equivalent ounces. Compared to 2015, silver production levels were maintained and gold production was down 2%.

In Q4, attributable production was 12,714 gold ounces and 834,846 silver ounces, for a total of 23,845 gold equivalent ounces.

Return of Capital

Our third semi-annual return of capital of one-half cent per share will be paid on February 14th, 2017 to shareholders of record as of the close of business on February 3rd, 2017. It will be paid to common shareholders of McEwen Mining Inc. from additional paid-in capital. For shareholders in the US and Canada, return of capital is generally not taxed, however we advise you to obtain advice from a tax professional familiar with your specific situation.

Financial Results

Operating costs for the quarter ended December 31, 2016 will be released with our 10-K Annual Financial Statements in late February 2017. As at December 31, 2016 we have no debt and liquid assets of $64 million composed of $36 million in cash, $21 million in precious metals, and $7 million in marketable securities. We have not issued equity to finance our operations since completing a rights issue in 2013, and we have preserved our leverage to higher gold and silver prices by not encumbering our assets with royalties, metal streams or hedges.

Footnotes:

'Gold Equivalent Ounces' are calculated based on a 75:1 gold to silver ratio.

Figures updated as of December 31, 2016.

The San Jose Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc.

ABOUT MCEWEN MINING

McEwen Mining has an ambitious goal of qualifying for inclusion in the S&P 500 Index by creating a high growth gold and silver producer focused in the Americas. McEwen Mining's principal assets consist of the San Jose Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina.

TECHNICAL INFORMATION

The technical contents of this news release has been reviewed and approved by Nathan M. Stubina, Ph.D., P.Eng., FCIM, Managing Director and a Qualified Person as defined by Canadian Securities Administrator National Instrument 43-101 "Standards of Disclosure for Mineral Projects".

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

Am 14. Februar 2017 wird die Dividende von MUX gezahlt an alle Aktionäre die am 3.2.17

noch in diesem Wert invesziert waren. McEwen Mining Inc. Declares Semiannual Dividend of $0.01 (MUX)

Posted by Renata Jones on Jan 20th, 2017 // No Comments

McEwen Mining logoMcEwen Mining Inc. (NYSE:MUX) (TSE:MUX) announced a semiannual dividend on Thursday, January 19th. Stockholders of record on Friday, February 3rd will be paid a dividend of 0.005 per share on Tuesday, February 14th. This represents a dividend yield of 0.26%. The ex-dividend date is Wednesday, February 1st.

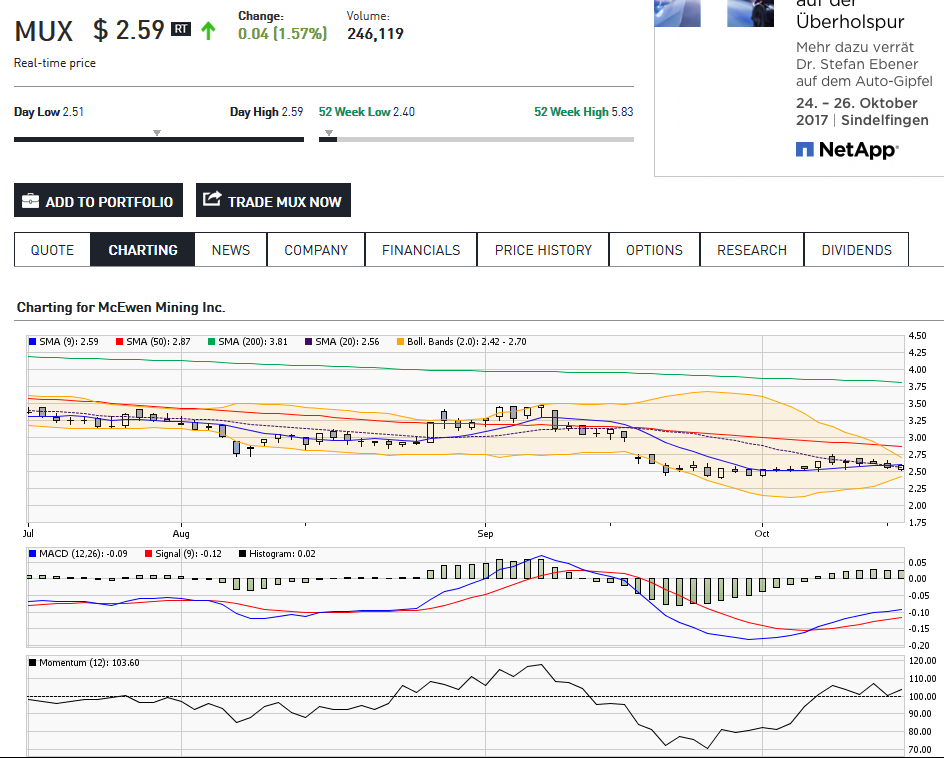

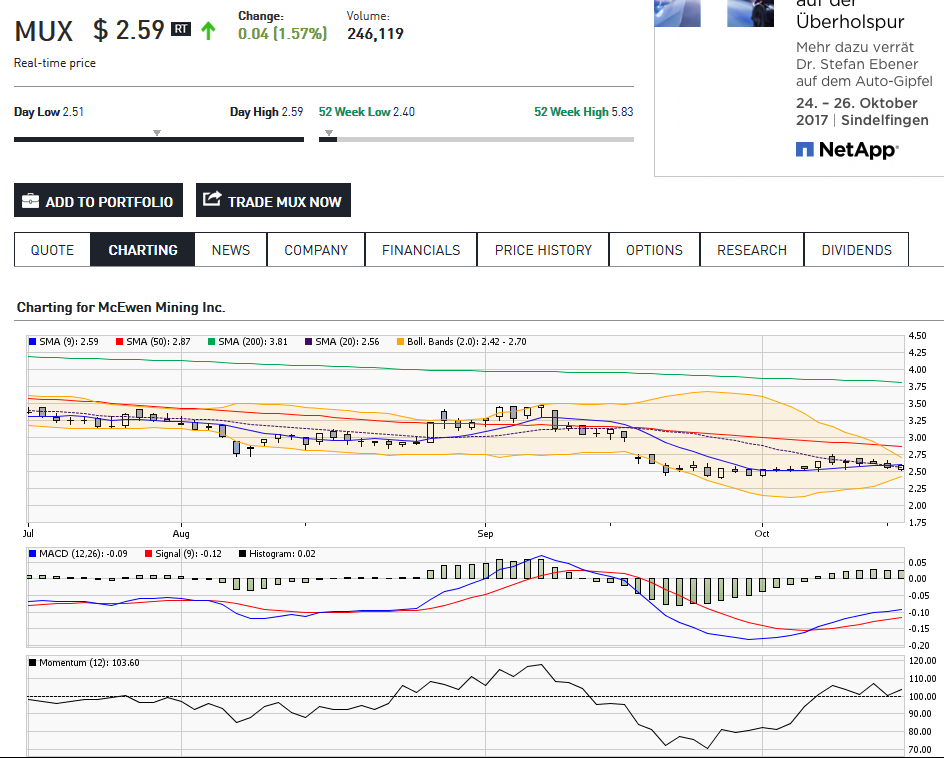

Shares of McEwen Mining (NYSE:MUX) opened at 3.78 on Friday. The stock’s 50 day moving average price is $3.20 and its 200-day moving average price is $3.61. McEwen Mining has a 52 week low of $0.98 and a 52 week high of $4.92. The company has a market cap of $1.13 billion and a PE ratio of 108.00.

McEwen Mining (NYSE:MUX) last posted its quarterly earnings data on Thursday, November 3rd. The company reported $0.01 earnings per share for the quarter. McEwen Mining had a net margin of 17.41% and a return on equity of 3.36%. Analysts expect that McEwen Mining will post $0.10 EPS for the current year.

https://sportsperspectives.com/2017/01/20/mcewen-mining-inc-…

Nur mal so zur Erinnerung und Erheiterung, was "Experten" so an "Prognosen" und einfach Unsinn von sich geben:

http://www.wallstreet-online.de/nachricht/9135012-mcewen-min…

McEwen Mining ist der Liebling der SPEKULANTEN!

Gastautor: Robert Sasse

30.11.2016

Liebe Leser, wer extreme Kursbewegungen liebt, der findet bei McEwen genau die richtige Aktie. Das Papier konnte sich in der Vergangenheit schon innerhalb von Monaten um 600 Prozent im Wert steigern. Dass derart heftige Gewinne kein Garant für die langfristige Entwicklung sind, zeigen aber Korrekturen, die sich auf einem ähnlichen Niveau abspielen. Momentan befindet sich McEwen in einer eher ruhigen Phase, doch der nächste Paukenschlag dürfte nur eine Frage der Zeit sein. In welche Richtung geht es mit der Aktie jetzt? Weiter im Abwärtskanal! Aktuell befindet sich McEwen Mining noch immer in einer Phase der Korrektur, die jetzt schon seit Monaten anhält. In den letzten 12 Wochen belaufen die Kursverluste sich auf satte 25 Prozent. Mit sinkenden Rohstoffpreisen ist nicht davon auszugehen, dass sich an dieser Lage allzu schnell etwas ändert. Erst heute fällt der Goldpreis unter die Marke von 1.180 USD, was alles andere als gute Signale an Anleger von Rohstoffaktien sendet. Es ist deshalb nur zu empfehlen, sich von McEwen Mining festzuhalten, wenn man nicht gerade ein hochspekulativer Anleger ist, der über starke Nerven verfügt und sich im Zweifel über hohe Verluste nicht allzu sehr ärgert.

...

"Es ist deshalb nur zu empfehlen, sich von McEwen Mining festzuhalten, ...

da hat er sich wohl auch noch in der Eile seines Dahingeschmieres verschrieben:

"sich von McEwen Mining festzuhalten"

soll wohl heißen "sich .. zu trennen"

geschrieben am 30.11.2016, da stand der Aktienkurs bei :

2,83 us$

jetzt bei:

3,95 us$

= + 1,12 us$

= ca. + 40%!

http://www.wallstreet-online.de/nachricht/9135012-mcewen-min…

McEwen Mining ist der Liebling der SPEKULANTEN!

Gastautor: Robert Sasse

30.11.2016

Liebe Leser, wer extreme Kursbewegungen liebt, der findet bei McEwen genau die richtige Aktie. Das Papier konnte sich in der Vergangenheit schon innerhalb von Monaten um 600 Prozent im Wert steigern. Dass derart heftige Gewinne kein Garant für die langfristige Entwicklung sind, zeigen aber Korrekturen, die sich auf einem ähnlichen Niveau abspielen. Momentan befindet sich McEwen in einer eher ruhigen Phase, doch der nächste Paukenschlag dürfte nur eine Frage der Zeit sein. In welche Richtung geht es mit der Aktie jetzt? Weiter im Abwärtskanal! Aktuell befindet sich McEwen Mining noch immer in einer Phase der Korrektur, die jetzt schon seit Monaten anhält. In den letzten 12 Wochen belaufen die Kursverluste sich auf satte 25 Prozent. Mit sinkenden Rohstoffpreisen ist nicht davon auszugehen, dass sich an dieser Lage allzu schnell etwas ändert. Erst heute fällt der Goldpreis unter die Marke von 1.180 USD, was alles andere als gute Signale an Anleger von Rohstoffaktien sendet. Es ist deshalb nur zu empfehlen, sich von McEwen Mining festzuhalten, wenn man nicht gerade ein hochspekulativer Anleger ist, der über starke Nerven verfügt und sich im Zweifel über hohe Verluste nicht allzu sehr ärgert.

...

"Es ist deshalb nur zu empfehlen, sich von McEwen Mining festzuhalten, ...

da hat er sich wohl auch noch in der Eile seines Dahingeschmieres verschrieben:

"sich von McEwen Mining festzuhalten"

soll wohl heißen "sich .. zu trennen"

geschrieben am 30.11.2016, da stand der Aktienkurs bei :

2,83 us$

jetzt bei:

3,95 us$

= + 1,12 us$

= ca. + 40%!

Antwort auf Beitrag Nr.: 54.159.863 von Antarius am 25.01.17 10:45:53fernzuhalten

Antwort auf Beitrag Nr.: 54.164.285 von orofino1 am 25.01.17 17:13:09

... wer sich etwas eingehender mit dieser Firma befasst stellt bald fest das hier nichts von "fernhalten " zu reden ist, genau das Gegenteil ist doch der Fall. Die Firma steht sehr gut da und wächst, gehört zu den Topinvestments im Gold/Silbersektor. Aber entscheiden soll ja jeder wie er meint...

... wer sich etwas eingehender mit dieser Firma befasst stellt bald fest das hier nichts von "fernhalten " zu reden ist, genau das Gegenteil ist doch der Fall. Die Firma steht sehr gut da und wächst, gehört zu den Topinvestments im Gold/Silbersektor. Aber entscheiden soll ja jeder wie er meint...

Jetzt hat Rob es geschafft, er wird in Canada unvergesslich sein und werden durch die Aufstellung in die

. . . Canadian Mining Hall of Fame. Rob McEwen ist eine Legende in Canada und ich wünsche ihm, das es ihn nochmal gelingen wird, ein ähnliches Unternehen zu bauen.

Warum sollte es nicht gelingen, ich gehe davon aus, das wir alle gemeinsam auf einen guten Weg sind.

Rob McEwen inducted into Canadian Mining Hall of Fame

Andrew Topf | a day ago | 775 | 0

"“He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents”: Michael Wekerle, chairman and co-founder of Difference Capital, on Rob McEwen"

"“He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents”: Michael Wekerle, chairman and co-founder of Difference Capital, on Rob McEwen"Legendary mine developer Rob McEwen has been recognized for his accomplishments in Canadian mining through an induction into the hallowed corridors of the Canadian Mining Hall of Fame.

The Goldcorp (NYSE:GG, TSX:G) founder was recognized at a gala dinner this past month in Toronto – an annual event that celebrates men and women whose contributions to the country's mining industry have been particularly impactful.

“Rob is a man of rare talents, he is a natural innovator with a keen business mind,” Michael Wekerle, chairman and co-founder of Difference Capital, was quoted saying in TimminsToday – where Goldcorp continues to be one of the mining town's largest employers. “He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents.”

In a video, McEwen said his father Donald was his life's inspiration. Told by doctors that he would never walk again after returning from the Second World War in an iron lung, Donald McEwen refused to accept their diagnosis and regained the use of his legs.

“Today, I look at challenges and obstacles I face and say this seems to pale compared to what my dad faced,” McEwen said in the video honouring his induction into the Hall of Fame. His father also inspired his son to become an avid investor, with Rob buying his first stock at the tender age of 12.

McEwen's story is well known to those who follow mining, but for those wanting a refresher, here it is again, reprised by the Canadian Mining Hall of Fame:

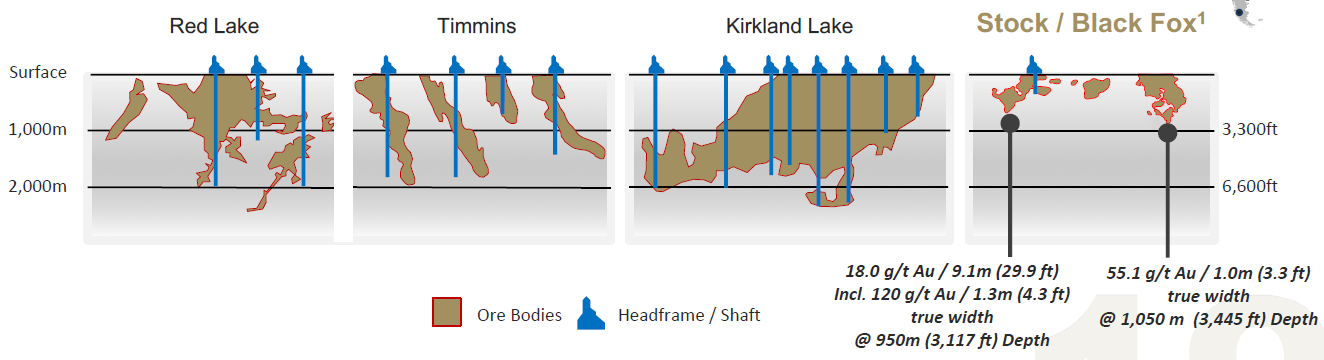

He is best known for transforming Goldcorp Inc. from a holding company into a global gold-mining powerhouse and revitalizing Ontario’s Red Lake gold mine through the discovery of new high-grade resources at depth. His famous “Goldcorp Challenge” in 2000, which provided open access to 50 years of proprietary geological data from Red Lake and offered prizes to anyone who could find the next six million ounces of gold, created an estimated $6 billion of value from subsequent discoveries.

McEwen is also an astute investor and corporate strategist, as demonstrated by Goldcorp’s friendly merger with Wheaton River Minerals in 2005. Goldcorp shares tripled in the next 14 months as it grew through a series of mergers into one of the world’s largest gold producers. He went on to build a new flagship, McEwen Mining, while supporting many worthy causes through donations totalling more than $50 million to date.

Born and raised in Toronto, McEwen worked at his father’s investment firm after earning a B.A. from the University of Western Ontario in 1973, followed by an MBA from York University in 1978. In the 1980s, he took the reins of Goldcorp, then a gold fund, and managed its investment portfolio. In 1989, he led Goldcorp’s acquisition of Dickinson Mines and its aging and capital-starved gold mine in the famous Red Lake camp, and began building an operating company.

His faith in the mine’s untapped potential was rewarded after a $10-million exploration led to a high-grade discovery in the mid-1990s. In a brilliant move, he created the “Goldcorp Challenge” and placed the mine’s geological data since 1948 on the internet and offered $575,000 in prizes for the best exploration concepts. More than 1,000 participants from 80 countries took part, resulting in more than 50 new targets, 80% of which yielded total gold resources valued at $6 billion. The Red Lake mine was transformed from a 50,000-ounce producer in 1997 to a 500,000-ounce producer in 2001, while cash costs fell from $360 per ounce to $60 per ounce over this period.

Goldcorp went on to become a star performer, with its share price appreciating at a compound annual rate of 31% between 1993 and 2004. McEwen stepped down from Goldcorp after its high-profile $2.4-billion merger with Wheaton River to focus on junior mining. After acquiring U.S. Gold and expanding its assets, he merged the junior with Minera Andes to create McEwen Mining, a gold, silver and copper producer with projects in Nevada, Mexico and Argentina.

As a philanthropist, McEwen has donated more than $50 million to encourage excellence, innovation and leadership in healthcare and education. He also contributed to the Red Lake Margaret Cochenour Memorial Hospital, the Red Lake Regional Heritage Centre, St. Andrews College Leadership Program, Rumie Initiative and most recently the McEwen School of Architecture at Laurentian University. In addition to an honorary degree from York University, McEwen has received many accolades for his achievements, including Developer of the Year for 2001, Mining Man of the Year for 2002, Most Innovative CEO in 2006, and the Order of Canada in 2007.

http://www.mining.com/rob-mcewen-inducted-into-canadian-mini…" target="_blank" rel="nofollow ugc noopener">

http://www.mining.com/rob-mcewen-inducted-into-canadian-mini…

Es gibt eine Menge von Leuten die in der letzten Zeit Aktien von McEwen Mining gekauft haben.

Sollen die alle falsch liegen ? McEwen Mining Inc. (MUX) Given Average Rating of “Strong Buy” by Brokerages

Posted by Brent Sawyer on Jan 31st, 2017 // No Comments

McEwen Mining logo Shares of McEwen Mining Inc. (NYSE:MUX) (TSE:MUX) have been assigned an average broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One equities research analyst has rated the stock with a strong buy recommendation.

Brokers have set a one year consensus price target of $5.00 for the company, according to Zacks. Zacks has also given McEwen Mining an industry rank of 36 out of 265 based on the ratings given to its competitors.

Separately, Zacks Investment Research lowered McEwen Mining from a “buy” rating to a “hold” rating in a report on Thursday, January 5th.

McEwen Mining (NYSE:MUX) opened at 3.85 on Thursday. The firm has a market capitalization of $1.15 billion and a price-to-earnings ratio of 110.00. McEwen Mining has a 1-year low of $1.30 and a 1-year high of $4.92. The firm’s 50-day moving average price is $3.38 and its 200 day moving average price is $3.57.

McEwen Mining (NYSE:MUX) last posted its earnings results on Thursday, November 3rd. The company reported $0.01 earnings per share for the quarter. McEwen Mining had a return on equity of 3.36% and a net margin of 17.41%. On average, analysts predict that McEwen Mining will post $0.10 EPS for the current year.

The firm also recently announced a semiannual dividend, which will be paid on Tuesday, February 14th. Investors of record on Friday, February 3rd will be issued a dividend of $0.005 per share. This represents a dividend yield of 0.26%. The ex-dividend date of this dividend is Wednesday, February 1st. McEwen Mining’s payout ratio is presently 33.34%.

Hedge funds and other institutional investors have recently bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. increased its stake in McEwen Mining by 4.9% in the third quarter.

Connor Clark & Lunn Investment Management Ltd. now owns 62,075 shares of the company’s stock valued at $228,000 after buying an additional 2,900 shares during the period.

Jane Street Group LLC increased its stake in McEwen Mining by 34.5% in the third quarter. Jane Street Group LLC now owns 1,184,713 shares of the company’s stock valued at $4,348,000 after buying an additional 303,941 shares during the period.

OLD Mission Capital LLC purchased a new stake in McEwen Mining during the third quarter valued at about $331,000.

Morgan Stanley increased its stake in McEwen Mining by 254.1% in the third quarter. Morgan Stanley now owns 283,217 shares of the company’s stock valued at $1,040,000 after buying an additional 203,244 shares during the period.

Finally, Suntrust Banks Inc. purchased a new stake in McEwen Mining during the third quarter valued at about $124,000. 33.68% of the stock is currently owned by institutional investors and hedge funds.

https://sportsperspectives.com/2017/01/31/mcewen-mining-inc-…

McEwen Mining Shines Bright

Feb. 1, 2017 8:58 AM ET|

5 comments|

Summary

CEO knows how to make money for shareholders.

Currencies are being devalued across the globe.

San Jose mine spins off $13 million in dividends.

Rob McEwen is not your typical CEO. After a highly successful tenure as founder of Goldcorp (NYSE:GG), he launched McEwen mining (NYSE:MUX) and is banking on a robust stock price move, since he commands a paltry salary of only $1 per year.

Mr. McEwen wants his management decisions to align with his stockholders as he owns a substantial 25% of McEwen stock. With 300 million shares outstanding and the stock trading just shy of $4.00 per share, this is a $1.23 billion company.

Argentina has dramatically improved the financial fortunes of the company's 49% owned San Jose mine, by cutting onerous taxes that had driven miners out of their country. 51% owner Hochschild mining has delivered $13 million in dividends to McEwen Mining- through the first 3 quarters of 2016, with expectations of more to come. Hochschild has been cutting mining costs and the lifting of capital controls by Argentina President Macri has allowed the free market to properly devalue the peso currency. Mining costs have plunged alongside the weaker peso and new investment and exploration should lead to an expansion of gold and silver production.

The great Fidelity Magellan Fund Manager Peter Lynch stated that small company stocks make big price moves and large companies tend to make smaller moves. This fact is very applicable to the mining industry for those small companies that have strong balance sheets. McEwen Mining holds $62 million in cash, precious metals, and liquid securities and 0 debt through September 2016.

The 100% owned El Gallo mine in Mexico is also seeing a sharp decline of all in cash costs to $680 per ounce of gold equivalent (gold and silver converted to gold). The Mexican peso has devalued sharply and mining production costs have fallen accordingly. Gold price is hovering around $1,200 per ounce, but McEwen sees a potential high price of $5,000 in the next few years. Silver price has risen from an average of $14.86 in early 2016 to $17.50 per ounce amid continued reports of strong physical demand from both investors and industry.

McEwen is looking to propel the company into the S&P 500 stock index, through additional acquisitions or mergers. The deal has to be "good" for his stockholders as he is the largest one. One of the requirements of the S&P 500 is that the company must be based in the United States, and McEwen Mining was incorporated in Colorado. There is only one miner currently listed in the index, so the next miner to join-will experience some heavy share purchases and the stock price will jump higher.

Fiat paper money currency continues to be devalued as the central banks seem to believe that printing more paper currency will remedy weak economic conditions. There are huge debt problems in the United States and China, and paper currency inflation is only creating havoc across economic markets everywhere. India has confiscated paper money and China continues to attempt to control capital outflow. Venezuela is experiencing crippling inflation of 122% in 2015 and 546% in 2016 (CIA report) and the United States is vastly understating inflation when it excludes the crushing rise in healthcare costs from the failed Affordable Care Act. As citizens experience loss of paper currency purchasing power, they will continue to purchase hard assets, including silver and gold. China and Russia central banks continue to purchase gold, possibly as a prelude to backing a more stable currency. Noted silver metal analyst Ted Butler reports that JP Morgan has accumulated 80 million ounces of silver in their COMEX warehouse.

The reported manipulation of silver prices by Deutsche Bank among many others has set up a bullish scenario for miners who maintained their fiscal discipline during the period of price suppression. The suppressed price has shut down mining production because its arbitrary price was pushed below the cost of producing the precious metal. The stronger surviving miners such as McEwen, are now in a position to capitalize on these rebounding gold and silver prices. New miners will try to move in to production mode, but it takes time to do so. Rising demand and limited supply creates rising profits.

McEwen mining has not hedged any of its gold, silver, nor copper production and therefore will make large moves in the direction of precious metal prices. The company is funding capital expenditures from cash flow and those huge dividends from San Jose mine do not show in the quarterly earnings figure. This accounting method seems to vastly understate the rising value of this miner. $13 million dividend is a large figure that cannot be ignored. There are more of these dividends that will arrive in 2017 if gold and silver prices continue to move higher.

Disclosure: I am/we are long MUX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://seekingalpha.com/article/4041408-mcewen-mining-shines…

Feb. 1, 2017 8:58 AM ET|

5 comments|

Summary

CEO knows how to make money for shareholders.

Currencies are being devalued across the globe.

San Jose mine spins off $13 million in dividends.

Rob McEwen is not your typical CEO. After a highly successful tenure as founder of Goldcorp (NYSE:GG), he launched McEwen mining (NYSE:MUX) and is banking on a robust stock price move, since he commands a paltry salary of only $1 per year.

Mr. McEwen wants his management decisions to align with his stockholders as he owns a substantial 25% of McEwen stock. With 300 million shares outstanding and the stock trading just shy of $4.00 per share, this is a $1.23 billion company.

Argentina has dramatically improved the financial fortunes of the company's 49% owned San Jose mine, by cutting onerous taxes that had driven miners out of their country. 51% owner Hochschild mining has delivered $13 million in dividends to McEwen Mining- through the first 3 quarters of 2016, with expectations of more to come. Hochschild has been cutting mining costs and the lifting of capital controls by Argentina President Macri has allowed the free market to properly devalue the peso currency. Mining costs have plunged alongside the weaker peso and new investment and exploration should lead to an expansion of gold and silver production.

The great Fidelity Magellan Fund Manager Peter Lynch stated that small company stocks make big price moves and large companies tend to make smaller moves. This fact is very applicable to the mining industry for those small companies that have strong balance sheets. McEwen Mining holds $62 million in cash, precious metals, and liquid securities and 0 debt through September 2016.

The 100% owned El Gallo mine in Mexico is also seeing a sharp decline of all in cash costs to $680 per ounce of gold equivalent (gold and silver converted to gold). The Mexican peso has devalued sharply and mining production costs have fallen accordingly. Gold price is hovering around $1,200 per ounce, but McEwen sees a potential high price of $5,000 in the next few years. Silver price has risen from an average of $14.86 in early 2016 to $17.50 per ounce amid continued reports of strong physical demand from both investors and industry.

McEwen is looking to propel the company into the S&P 500 stock index, through additional acquisitions or mergers. The deal has to be "good" for his stockholders as he is the largest one. One of the requirements of the S&P 500 is that the company must be based in the United States, and McEwen Mining was incorporated in Colorado. There is only one miner currently listed in the index, so the next miner to join-will experience some heavy share purchases and the stock price will jump higher.

Fiat paper money currency continues to be devalued as the central banks seem to believe that printing more paper currency will remedy weak economic conditions. There are huge debt problems in the United States and China, and paper currency inflation is only creating havoc across economic markets everywhere. India has confiscated paper money and China continues to attempt to control capital outflow. Venezuela is experiencing crippling inflation of 122% in 2015 and 546% in 2016 (CIA report) and the United States is vastly understating inflation when it excludes the crushing rise in healthcare costs from the failed Affordable Care Act. As citizens experience loss of paper currency purchasing power, they will continue to purchase hard assets, including silver and gold. China and Russia central banks continue to purchase gold, possibly as a prelude to backing a more stable currency. Noted silver metal analyst Ted Butler reports that JP Morgan has accumulated 80 million ounces of silver in their COMEX warehouse.

The reported manipulation of silver prices by Deutsche Bank among many others has set up a bullish scenario for miners who maintained their fiscal discipline during the period of price suppression. The suppressed price has shut down mining production because its arbitrary price was pushed below the cost of producing the precious metal. The stronger surviving miners such as McEwen, are now in a position to capitalize on these rebounding gold and silver prices. New miners will try to move in to production mode, but it takes time to do so. Rising demand and limited supply creates rising profits.

McEwen mining has not hedged any of its gold, silver, nor copper production and therefore will make large moves in the direction of precious metal prices. The company is funding capital expenditures from cash flow and those huge dividends from San Jose mine do not show in the quarterly earnings figure. This accounting method seems to vastly understate the rising value of this miner. $13 million dividend is a large figure that cannot be ignored. There are more of these dividends that will arrive in 2017 if gold and silver prices continue to move higher.

Disclosure: I am/we are long MUX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://seekingalpha.com/article/4041408-mcewen-mining-shines…

Hier ist ein Überblick über die Investoren die sich in den letzten Monaten 2016 an McEwen Mining . . .

. . . . teilweise richtig "dick" eingekauft haben. Das bedeuted für mich McEwen Mining ist zu diesen Preisen immer noch ein Schnäppchen.

The McEwen Mining Inc. (MUX) Position Boosted by Oppenheimer & Close LLC

February 2, 2017 Jamie Williams

The McEwen Mining Inc. (MUX) Position Boosted by Oppenheimer & Close LLC

Oppenheimer & Close LLC increased its stake in McEwen Mining Inc. (NYSE:MUX) (TSE:MUX) by 0.9% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 533,500 shares of the company’s stock after buying an additional 5,000 shares during the period. McEwen Mining comprises 1.9% of Oppenheimer & Close LLC’s holdings, making the stock its 14th largest position. Oppenheimer & Close LLC’s holdings in McEwen Mining were worth $1,957,000 as of its most recent filing with the SEC.

Other institutional investors also recently added to or reduced their stakes in the company. Bank of Montreal Can raised its position in McEwen Mining by 18.5% in the third quarter. Bank of Montreal Can now owns 1,477,015 shares of the company’s stock valued at $5,421,000 after buying an additional 230,246 shares during the period. Alps Advisors Inc. bought a new position in McEwen Mining during the third quarter valued at approximately $4,629,000. Teacher Retirement System of Texas raised its position in McEwen Mining by 16.4% in the second quarter.

Teacher Retirement System of Texas now owns 31,850 shares of the company’s stock valued at $123,000 after buying an additional 4,483 shares during the period. Sprott Inc. bought a new position in McEwen Mining during the third quarter valued at approximately $2,576,000. Finally, Spot Trading L.L.C raised its position in McEwen Mining by 104.3% in the second quarter. Spot Trading L.L.C now owns 35,552 shares of the company’s stock valued at $137,000 after buying an additional 18,152 shares during the period. 33.68% of the stock is currently owned by hedge funds and other institutional investors.

McEwen Mining Inc. (NYSE:MUX) opened at 3.85 on Tuesday. The firm has a market capitalization of $1.15 billion and a price-to-earnings ratio of 110.00. The firm has a 50 day moving average price of $3.38 and a 200-day moving average price of $3.57. McEwen Mining Inc. has a 12 month low of $1.30 and a 12 month high of $4.92.

McEwen Mining (NYSE:MUX) last announced its quarterly earnings data on Thursday, November 3rd. The company reported $0.01 earnings per share (EPS) for the quarter. McEwen Mining had a return on equity of 3.36% and a net margin of 17.41%. On average, equities analysts forecast that McEwen Mining Inc. will post $0.10 EPS for the current year.

The firm also recently disclosed a semiannual dividend, which will be paid on Tuesday, February 14th. Investors of record on Friday, February 3rd will be paid a $0.005 dividend. This represents a yield of 0.26%. The ex-dividend date of this dividend is Wednesday, February 1st. McEwen Mining’s dividend payout ratio is currently 33.34%.

Separately, Zacks Investment Research lowered McEwen Mining from a “buy” rating to a “hold” rating in a research report on Thursday, October 6th.

http://dailyquint.com/2017-02-02-mcewen-mining-inc-mux-posit…

Why McEwen Mining Inc. Stock Rallied 21% in January

Why McEwen Mining Inc. Stock Rallied 21% in JanuaryGold and silver miner McEwen Mining benefited from a precious-metals rally and solid production results in January

Reuben Gregg Brewer

(TMFReubenGBrewer)

Feb 7, 2017 at 9:05AM

What happened

Shares of McEwen Mining Inc. (NYSE:MUX) moved 21% higher last month. That follows a gain of nearly 175% in 2016. However, January's gain represents something of a performance reversal. Indeed, investors watched McEwen stock rally more than 325% by mid-2016 only to see those gains fall away through the second half. With one month down in 2017, commodity prices are again pushing the stock higher.

So what

Gold prices rose around 5% last month, with silver advancing a bit more, at nearly 8%. That was a clear positive for McEwen's stock price. Although precious-metals prices are likely to have an outsize impact on the miner's share price, there was more going on than just a silver and gold move last month.

For example, on Jan. 16, McEwen announced that it produced roughly 145,500 gold equivalent ounces in 2016. That metric puts gold and silver production on equal footing, and it also beat the company's internal production forecast of 144,000 ounces. So the company was able to exceed a key guidance target, which is a clear positive.

However, that release also noted that during the year, McEwen doubled its liquid assets -- made up of cash, marketable securities, and precious metals -- to $64 million. And it continues to have no debt on the balance sheet. In other words, it's in pristine financial health, with cash to invest back into two development projects it's working on -- Gold Bar and El Gallo Silver.

[

Now what

McEwen is a small precious-metals miner, but it's financially solid and successfully meeting the public goals it sets for itself. More important, it's benefiting from rising precious-metals prices at a point when it's working on the key growth projects that will underpin its future. There's a lot to like about McEwen from a fundamental point of view. Still, gold and silver prices will continue have an outsize impact on performance. Just don't let that distract you from the work being done to build a foundation for the future.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

----------------

McEwen: Freundliche Übernahme von Lexam VG Gold

McEwen Mining Inc. und Lexam VG Gold Inc. meldeten soeben eine Vereinbarung, wonach McEwen sämtliche ausgegebenen und ausstehenden Wertpapiere von Lexam übernehmen wird. Lexam würde bei Zustandekommen der Transaktion zu einem zu 100% eigenen Tochterunternehmen von McEwen werden. Gemäß Vereinbarung würden die Aktionäre von Lexam, sofern sie der Übernahme zustimmen, pro Lexam-Stammaktie 0,056 einer McEwen-Aktie erhalten.

MinenPortal

Antwort auf Beitrag Nr.: 54.306.980 von cervical am 13.02.17 14:20:00Man beachte das Logo von Lexam Gold

http://www.lexamvggold.com/index.php

Chairman von Lexam ist niemand geringerer als Rob McEwen der nicht weniger als 27% des Unternehmens hält... Habe ich da was verpasst???

Auf jedenfall wird so der Deal zu einem für beide Seiten fairen Preis abgewickelt, so hoffe ich. Der Preis kommt rechnerisch auf rund CAD 0.31 was unter dem letzten Hoch von Lexam liegt.

Ohne tiefer zu graben würde ich vom Schiff aus sagen: Daumen hoch (nur meine Meinung).

http://www.lexamvggold.com/index.php

Chairman von Lexam ist niemand geringerer als Rob McEwen der nicht weniger als 27% des Unternehmens hält... Habe ich da was verpasst???

Auf jedenfall wird so der Deal zu einem für beide Seiten fairen Preis abgewickelt, so hoffe ich. Der Preis kommt rechnerisch auf rund CAD 0.31 was unter dem letzten Hoch von Lexam liegt.

Ohne tiefer zu graben würde ich vom Schiff aus sagen: Daumen hoch (nur meine Meinung).

Der Kurs gibt nicht nach. Das ist sehr positiv zu werten. Sonst wurde der Übernehmende erstmal abgestraft.

Zacks estimated an EPS of $1 for McEwen Mining Inc. (NYSE:MUX)

By Koko Saunders -

February 13, 2017 38

Unten habe ich einen Auszug aus der heutigen News von der Newspaper: topchronicle.com zur Info eingestellt.

Danach hat der Direktor von Lexam, Richard W. Brissenden - Director

Mr. Brissenden is a Chartered Professional Accountant (Ontario) (Diesen Texthabe ich von der Management-Seite bei Lexam genommen und hier eingestellt) bereits im Dezember 2016 Aktien von McEwen Mining gekauft.

https://topchronicle.com/zacks-estimated-an-eps-of-1-for-mce…

The latest Insider trade was made on 14 Dec 2016 where Brissenden (Richard William) Director did a transaction type “Sell” in which 5000 shares were traded at a price of $2.75. Another insider trade includes Director Brissenden (Richard William) who also initiated a transaction in which 25000 shares were traded on 13 Dec 2016 as “Buy”.

By Koko Saunders -

February 13, 2017 38

Unten habe ich einen Auszug aus der heutigen News von der Newspaper: topchronicle.com zur Info eingestellt.

Danach hat der Direktor von Lexam, Richard W. Brissenden - Director

Mr. Brissenden is a Chartered Professional Accountant (Ontario) (Diesen Texthabe ich von der Management-Seite bei Lexam genommen und hier eingestellt) bereits im Dezember 2016 Aktien von McEwen Mining gekauft.

https://topchronicle.com/zacks-estimated-an-eps-of-1-for-mce…

The latest Insider trade was made on 14 Dec 2016 where Brissenden (Richard William) Director did a transaction type “Sell” in which 5000 shares were traded at a price of $2.75. Another insider trade includes Director Brissenden (Richard William) who also initiated a transaction in which 25000 shares were traded on 13 Dec 2016 as “Buy”.

Ob Rob Mc Ewen vielleicht auch ein Auge auf West Red Lake Gold Mines (WKN A1J0MZ / CSE RLG) werfen könnte ?

Erst einmal muss McEwen Mining die Company LEXAM VG, die ja ebenfalls in dem Timmins Gebiet zu Hause, ins eigene Unternehmen integrieren. Aber das wird wohl nicht schwer werden, zumal hier Rob Mc Ewen, mit einem über 25 %-igen Anteil, der größte Aktionär von LEXAM VG ist.

Wenn er sich dann weiter in diesem edelmetallträchtigen Gebiet umschauen wird, könnte er eventuell ein Auge auf West Red Lake Gold Mines werfen und Interesse daran finden, auch dieses Unternehmen unter seine Fittiche zu nehmen, natürlich nur vielleicht ?

West Red Lake Gold Mines besitzt im West Red Lake Project 3100 hectarelocated in the prolific Red Lake Gold District, Northwestern Ontario, Canada and is planned to begin during the last week of January 2017 with the exploration drilling. West Red Lake Gold Mines wird in den nächsten Wochen die neuen Bohrergebnisse veröffentlichen und sollten die entsprechend ausfallen könnte es schon vielleicht dazu kommen, vielleicht ?

Dann könnte es zu einem Käuferwettbewerb mit Goldcorp kommen, die bereits mit ca. 40 % an West Red Lake Gold Mines beteiligt sind.

Warten wir auf die Ergebnisse, die ja wohl bald von WRLG veröffentlicht werden.

Klar, es wird noch etwas mehr an Zeit brauchen bis es soweit kommen sollte. Erst einmal muss McEwen Mining die gerade übernommen Company LEXAM VG, die ebenfalls in diesem Gebiet zu Hause sind, ins eigene Unternehmen integrieren.