starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 17)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 0

Gesamt: 279.093

Gesamt: 279.093

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 58 Minuten | 1662 | |

| heute 13:20 | 1030 | |

| vor 1 Stunde | 991 | |

| vor 1 Stunde | 884 | |

| gestern 18:31 | 879 | |

| heute 10:47 | 762 | |

| vor 1 Stunde | 718 | |

| heute 09:07 | 709 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.161,01 | +1,36 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3500 | +1,14 | 60 | |||

| 5. | 4. | 157,24 | -0,91 | 50 | |||

| 6. | Neu! | 0,3044 | +4,32 | 36 | |||

| 7. | Neu! | 4,7950 | +6,91 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 31 |

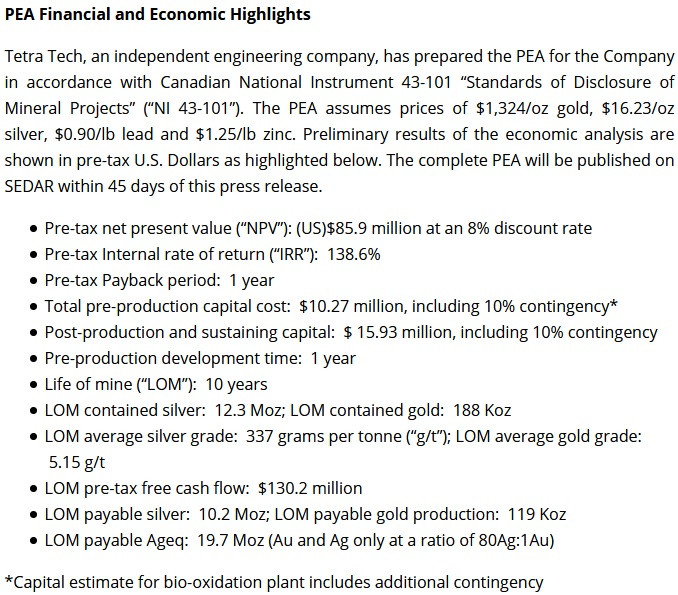

Antwort auf Beitrag Nr.: 61.777.526 von Boersiback am 27.10.19 22:24:40Pacifico Minerals

http://finfeed.com/small-caps/mining/pacifico-upgrades-miner…

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/en/projects/sorby-hills

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/images/2019_Announcements…

http://finfeed.com/small-caps/mining/pacifico-upgrades-miner…

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/en/projects/sorby-hills

http://www.pacificominerals.com.au/images/2019_Announcements…

http://www.pacificominerals.com.au/images/2019_Announcements…

Nova Minerals, i.A. popeye

https://youtu.be/nPTzmBbGDuQ

Antwort auf Beitrag Nr.: 61.793.929 von Boersiback am 29.10.19 23:34:49

https://www.asx.com.au/asxpdf/20191029/pdf/449zxc2rb4xq18.pd…

Zitat von Boersiback: https://www.asx.com.au/asxpdf/20191028/pdf/449z3t77kbs2p1.pd…

https://www.asx.com.au/asxpdf/20191029/pdf/449zxc2rb4xq18.pd…

Nova Min.

Antwort auf Beitrag Nr.: 61.758.260 von tgfn am 24.10.19 17:01:24Report: Integra Resources – The PEA-box has been ticked, fast forward to the (pre-)feasibility study

https://www.caesarsreport.com/reports/report-integra-resourc…

Integra Resources Announces the Appointment of Timothy Arnold as Chief Operating Officer and Repayment of the Kinross C$4.5 Million Promissory Note

https://www.integraresources.com/news/2019/integra-resources…

https://www.caesarsreport.com/reports/report-integra-resourc…

Integra Resources Announces the Appointment of Timothy Arnold as Chief Operating Officer and Repayment of the Kinross C$4.5 Million Promissory Note

https://www.integraresources.com/news/2019/integra-resources…

Lukara Diamonds

https://www.juniorminingnetwork.com/junior-miner-news/press-…LOM production of 7.8 million carats out to 2040; resource remains open to depth

$5.25 billion in Gross Revenue

Pre-production capital costs of $514 million for the underground project

After-tax undiscounted net cash flow of $1,220 million, no real diamond price escalation

After-tax NPV(5%) of $718 million

Payback Period of 2.8 years extending the mine life 15 years (including stockpiles)

Average LOM operation costs of $28.43 per tonne of ore processed

Lucara Diamond, i.A.popeye

https://www.juniorminingnetwork.com/junior-miner-news/press-… Beer Creek, i.A. popeye

2019 Corani Feasibility Study Improves Project Economics2019 Corani Feasibility Study Improves Project Economics

Antwort auf Beitrag Nr.: 61.845.459 von Boersiback am 05.11.19 21:08:42hihihi, hohoho, auch gerade heimgekommen?

CGS2019 to feature Colombia-Ecuador project updates, i.A.popeye

https://www.mining-journal.com/gold-and-silver-news/news/137… EmiAfrica commences environmental and social impact studies at Manono Lithium and Tin Projec, i.A. popeye

https://mailchi.mp/372127b34a00/emiafrica-commences-environm… Australian Potash, i.A. popeye

https://mailchi.mp/91d1bdd5d7bc/australian-potash-limited-jo…

A propos potash: Was halten die Experten hier

vom (in meinen Augen hochinteressanten) Konzept DIESER Firma?

https://gensourcepotash.ca/

Bitte gründlich studieren & einarbeiten - ist ein disruptiver Ansatz ... thanx for feedback!

vom (in meinen Augen hochinteressanten) Konzept DIESER Firma?

https://gensourcepotash.ca/

Bitte gründlich studieren & einarbeiten - ist ein disruptiver Ansatz ... thanx for feedback!

noch mehr Galena Mining, i.A. popeye

https://www.mining-journal.com/resourcestocks/resourcestocks… Orion Minerals, Positive Progress Achieved From BFS Optimisation Work, i.A. popeye

https://orionminerals.com.au/download/29/market-news-2019/39…

Antwort auf Beitrag Nr.: 60.346.027 von Popeye82 am 13.04.19 01:13:17Xanadu Mines: Significant increase in Exploration Target at Kharmagtai

http://www.xanadumines.com/irm/PDF/3256_0/Significantincreas…

http://www.xanadumines.com/irm/PDF/3256_0/Significantincreas…

Antwort auf Beitrag Nr.: 59.527.948 von Popeye82 am 30.12.18 03:51:28Independence Group makes opportune play for Panoramic Resources as nickel LME levels continue eroding

https://smallcaps.com.au/independence-group-makes-opportune-…

https://smallcaps.com.au/independence-group-makes-opportune-…

Sovereign Metals: Outstanding Drill Results Confirm High Grade Rutile

http://www.investi.com.au/api/announcements/svm/e8165e4d-b69…

http://www.investi.com.au/api/announcements/svm/e8165e4d-b69…

Antwort auf Beitrag Nr.: 61.777.451 von Boersiback am 27.10.19 21:59:38Hawkstone Mining - Big Sandy Lithium Project Exploration Target Update

HIGHLIGHTS

• Exploration has resultedin a 23% increase in the Exploration Target within Blocks C and D in the Northern Mineralised Zone (NMZ), of the Big Sandy lithium Project, located in Arizona USA.

• This represents an overall increase of 5% to the total Exploration Target for the Big Sandy Project.

• Further exploration has resulted in a higher level of confidence in Block C, in addition to an increase in tonnage in Block D within the NMZ

https://gallery.mailchimp.com/b7d461903737dcf961676c2ea/file…

HIGHLIGHTS

• Exploration has resultedin a 23% increase in the Exploration Target within Blocks C and D in the Northern Mineralised Zone (NMZ), of the Big Sandy lithium Project, located in Arizona USA.

• This represents an overall increase of 5% to the total Exploration Target for the Big Sandy Project.

• Further exploration has resulted in a higher level of confidence in Block C, in addition to an increase in tonnage in Block D within the NMZ

https://gallery.mailchimp.com/b7d461903737dcf961676c2ea/file…

Antwort auf Beitrag Nr.: 60.768.979 von Popeye82 am 09.06.19 16:36:16Base Resources - Toliara Project Government of Madagascar statement

https://wcsecure.weblink.com.au/pdf/BSE/02170509.pdf

https://wcsecure.weblink.com.au/pdf/BSE/02170509.pdf

Antwort auf Beitrag Nr.: 60.969.472 von Popeye82 am 06.07.19 23:48:06Kogi Iron: October Shareholder Newsletter

https://www.kogiiron.com/sites/default/files/KFE-KCM%20Newsl…

https://www.kogiiron.com/sites/default/files/KFE-KCM%20Newsl…

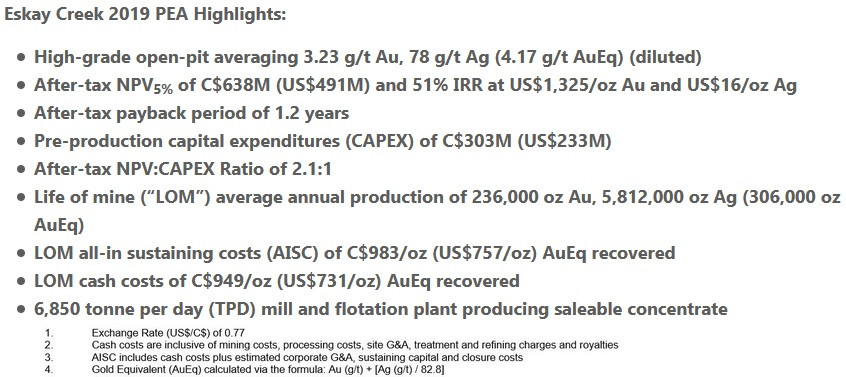

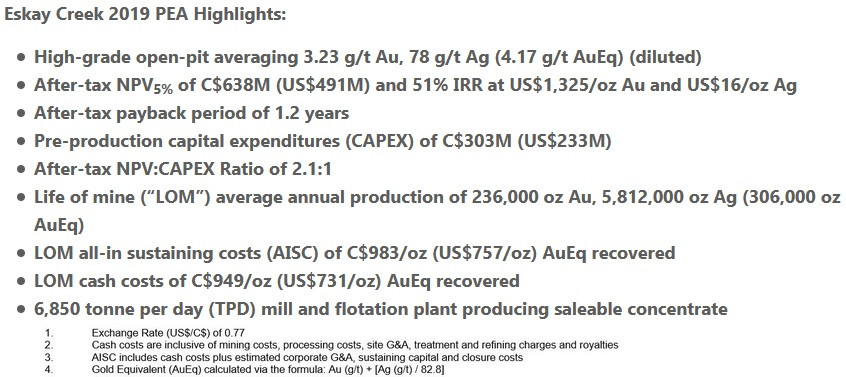

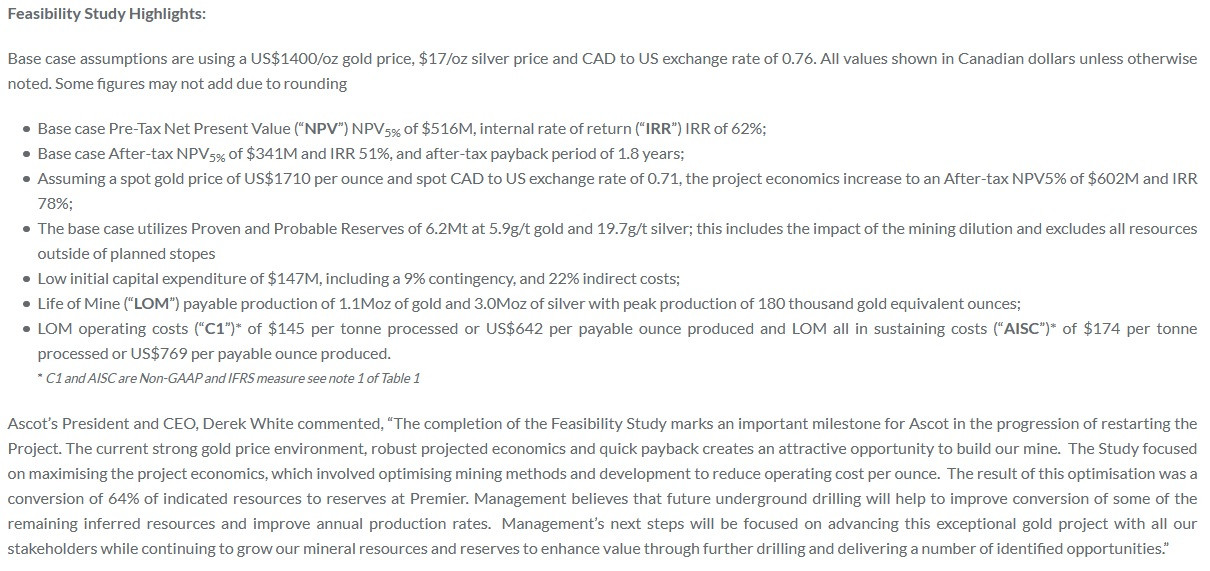

Antwort auf Beitrag Nr.: 61.121.768 von Popeye82 am 28.07.19 16:42:09Skeena Delivers Robust Project Economics for Eskay Creek: After-Tax NPV5% of C$638M, 51% IRR and 1.2 Year Payback

https://www.skeenaresources.com/news/skeena-delivers-robust-…

https://www.skeenaresources.com/news/skeena-delivers-robust-…

Antwort auf Beitrag Nr.: 61.817.269 von tgfn am 01.11.19 18:06:20

Exceptional Silver Grades in Grab Samples at the Silver Hill Prospect and New Gold Zone at Premier Portal

http://www.globenewswire.com/news-release/2019/11/07/1943036…

Exceptional Silver Grades in Grab Samples at the Silver Hill Prospect and New Gold Zone at Premier Portal

http://www.globenewswire.com/news-release/2019/11/07/1943036…

IAMGOLD Announces Positive Results from the Essakane Carbon-in-Leach and Heap Leach Project Feasibility Study; Reflecting Increased Cash Flows and Extended Mine Life

https://www.iamgold.com/English/investors/news-releases/news…

https://www.iamgold.com/English/investors/news-releases/news…

Lumina Gold, i.A. popeye

Lumina Gold Dramatically Increases the Cangrejos Resource: 10.4 Moz Gold in Indicated Mineral Resource and 6.3 Moz Gold in Inferred Mineral Resourcehttps://www.juniorminingnetwork.com/junior-miner-news/press-…

Kefi Minerals, i.A.popye

https://www.kefi-minerals.com/files/announcements/kefi-ethio… Nova Minerals i.A. popeye

https://mailchi.mp/a16ea478b26b/thompson-brothers-lithium-pr…

Antwort auf Beitrag Nr.: 61.799.179 von Reiners am 30.10.19 15:07:58GRAPHEX MINING: Road upgrades to support development of Chilalo

https://www.asx.com.au/asxpdf/20191107/pdf/44bbrc2y6sf8wx.pd…

https://www.asx.com.au/asxpdf/20191107/pdf/44bbrc2y6sf8wx.pd…

Mag Silver Q3 Financials, i.A. popeye

VANCOUVER, British Columbia, Nov. 08, 2019 (GLOBE NEWSWIRE) -- MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG” or the “Company”) announces the Company’s unaudited financial results for the three and nine months ended September 30, 2019. For details of the unaudited condensed interim consolidated financial statements and Management's Discussion and Analysis for the three and nine months ended September 30, 2019, please see the Company’s filings on SEDAR (www.sedar.com[http://www.sedar.com]) or on EDGAR (www.sec.gov[http://www.sec.gov]). > All amounts herein are reported in $000s of United States dollars (“US$”) unless otherwise specified.

> HIGHLIGHTS – SEPTEMBER 30, 2019

>

> Joint formal Juanicipio Project mine development approval by Fresnillo and MAG was announced in the second quarter of 2019 (see Press Release dated April 11, 2019), and an Engineering, Procurement and Construction Management (“EPCM”) contract finalized to oversee the mine development.

> During the quarter ended September 30, 2019 further progress was made in detailed engineering, and subsequent to the quarter end in October, earthmoving and foundation preparation commenced for the construction of the 4,000 tonnes per day (“tpd”) beneficiation plant.

> Mill fabrication is progressing on schedule, and both the SAG and ball mills are expected to be shipped to site early 2020. Flotation cells, processing tanks and minor process equipment pieces are starting to arrive on site. Thickener tanks and drive and rakes fabrication are well advanced.

> Underground development is ongoing at Juanicipio and has now reached approximately 23 kilometres of development (or 14.3 miles). The focus areas for underground development are the three sub-vertical ramps that descend alongside the mineralization and the conveyor ramp to surface.

> Construction is on track for late 2020 commissioning according to the operator Fresnillo.

> Estimated pre-operative initial capital is $395,000 (100% basis) as of January 1, 2018, less development expenditures incurred since then to September 30, 2019 of approximately $107,600 (Company therefore estimates approximately $287,400 of remaining initial capital on a 100% basis as at September 30, 2019).

> MAG is well funded with cash and cash equivalents as at September 30, 2019 of $94,599 while Minera Juanicipio had working capital on a 100% basis of $24,486 as at September 30, 2019.

> A 25,000 metre 2019 Juanicipio exploration program was completed in late October, with all assays pending.

> “This year we've launched the final stages of development of the Juanicipio mine.” said George Paspalas, President and CEO. “We're opening up more areas underground, including production cross-cuts through the vein, surface construction has commenced in earnest and every day sees more mill components arriving to site.”

> JUANICIPIO PROJECT UPDATES

> MINE DEVELOPMENT APPROVAL

> On April 11, 2019, Fresnillo and MAG as shareholders of Minera Juanicipio, jointly announced formal approval of the Juanicipio mine development plan. The partners also finalized an EPCM agreement as part of the approval process which defines the specific terms by which Fresnillo will oversee the continued project development and the construction of the process plant and associated surface infrastructure. Pre-operative initial capital is estimated on a 100% basis as $395,000 as of January 1, 2018, of which over the past 21 months approximately $107,600 has been expended to September 30, 2019, leaving an estimated $287,400 of remaining initial capital (MAG’s 44% remaining share estimated $126,456 as at September 30, 2019).

> The Operator Services agreement was also finalized by the partners in the project approval process which will become effective on commencement of commercial production. As well, both lead and zinc off-take agreements have been agreed to by the partners whereby both concentrates will be treated at market terms by Met-Mex Peñoles, S.A. De C.V., in Torreón, Mexico.

> SURFACE CONSTRUCTION AND SITE PREPARATION

> Upon project approval, construction plans for the 4,000 tpd processing plant commenced immediately. Basic engineering is substantially complete and detailed engineering is well advanced. Development of surface infrastructure facilities (power lines, access roads, auxiliary buildings, etc.) had already previously begun and continues. During the quarter ended September 30, 2019, further progress was made in detailed engineering, and subsequent to the quarter end in October, earthmoving and foundation preparation commenced for the construction of the beneficiation plant.

> Orders had already been placed and the manufacturing of the long lead items for the process plant is well advanced. Mill fabrication is progressing on schedule, and both the SAG and ball mills are expected to be shipped to site early 2020. Flotation cells, processing tanks and minor process equipment pieces are starting to arrive on site. Thickener tanks and drive and rakes fabrication are well advanced.

> According to the operator, Fresnillo, permitting for the tailings impoundments should be completed in the fourth quarter of this year and mill construction is on track for commissioning by late 2020.

> UNDERGROUND DEVELOPMENT

> Access to the mine will be via the completed twin underground declines that now have reached the top of mineralization in the Valdecañas Vein. From there, the upper footwall haulage/access drift has been driven the length of the vein from which three internal spiral footwall production ramps will extend to depth. Twinning of the original access decline was required to provide expanded capacity for hauling additional mineralized rock and waste stemming from the planned increase in processing capacity to 4,000 tpd. The twin ramps and second entry portal allow for streamlined underground traffic flow and increased safety through the mine having a second egress. The three spiral ramps into the mineralized envelope are designed to provide access to stopes within the mineralized material and were also required to facilitate the increase in planned mining rate to 4,000 tpd. The first cross-cuts through the vein have been made from the easternmost footwall ramp, exposing well-mineralized vein.

> Mineralized material from throughout the vein will be crushed underground and the crushed material conveyed directly from the underground crushing station (already excavated) to the process plant area via a third ramp which is being driven both from the surface and from the crushing chamber. This ramp will also provide access to the entire Valdecañas underground mining infrastructure and serve as a fresh air entry for the ventilation system.

> With total underground development having now reached approximately 23 kilometres to date, an additional contractor has been appointed to further accelerate development rates. Concurrent with the ongoing underground development, detailed engineering continues for the internal shaft, other mine infrastructure, and the final process plant configuration.

> A photo gallery of current progress on the Juanicipio development is available at http://www.magsilver.com/s/PhotoGallery.asp[http://www.magsi…

> The Juanicipio development is expected to create approximately 2,750 jobs during construction and 1,720 jobs once at full production, with potential to scale-up operations in the future beyond 4,000 tpd.

> EXPLORATION

> Exploration drilling continued in the quarter ended September 30, 2019. To date in 2019, 29 drill holes have been completed, 21 being infill holes and 8 exploration holes as part of a 25,000 metre 2019 exploration program which was completed subsequent to the September 30, 2019 quarter end (all assays pending). The 2019 drilling has primarily been directed at infilling the few remaining gaps in the Indicated Resources in the Bonanza Zone, converting Inferred Resources included in the Deep Zone into Indicated Resources, and further tracing the Deep Zone laterally and to depth. Five holes were also directed at the recently discovered Venadas Vein, and additional prospective targets are expected to be drilled in 2020.

> Assays from 48 previously completed holes (46,060 metres) were reported in the first quarter of 2019 (see Press Release dated March 4, 2019).

> FINANCIAL RESULTS – THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2019

> As at September 30, 2019, the Company had working capital of $94,895 (September 30, 2018: $141,865) including cash and cash equivalents of $94,599 (September 30, 2018: $141,776). Other than an office lease obligation under IFRS 16, the Company currently has no debt and believes it has sufficient working capital to maintain all of its properties and currently planned programs well into next year (2020). The Company makes capital contributions through cash advances to Minera Juanicipio as ‘cash called’ by operator Fresnillo, based on approved joint venture budgets. In the three and nine months ended September 30, 2019, the Company funded advances to Minera Juanicipio, which combined with MAG’s Juanicipio expenditures on its own account, totaled $17,915 and $33,371 respectively (September 30, 2018: $8,542 and $14,387 respectively).

> The Company’s net loss for the three and nine months ended September 30, 2019 amounted to $2,005 and $3,408 respectively (September 30, 2018: $597 net income and $1,973 net loss respectively) or $(0.02)/share and $(0.04)/share respectively (September 30, 2018: $0.01/share and $(0.02)/share respectively).

> Share based payment expense, a non-cash item, recorded in the three and nine months ended September 30, 2019 amounted to $507 and $2,015 respectively (September 30, 2018: $406 and $1,217 respectively), and is determined based on the fair value of equity incentives granted and vesting in the period. In the three and nine months ended September 30, 2019, the Company earned interest income on its cash and cash equivalents of $589 and $2,215 respectively (September 30, 2018: $812 and $2,277 respectively). The Company also recorded its 44% equity loss pick up of $266 and equity income pick up of $496 respectively for the three and nine months ended September 30, 2019 (September 30, 2018: $665 equity income pick up and $75 equity loss pick up respectively) from Minera Juanicipio related primarily to exchange rate changes and deferred taxes.

Ioneer, i.A. popeye

Chairmans Addresshttps://www.ioneer.com/track/click/99/1137%5DAnnual

Quality of Rhyolite Ridge Lithium Carbonate Confirmed

[urlhttps://www.ioneer.com/files/announcement/files/191108-quality-lithium-carbonate-confirmed.pdf][/url]

Filo Mining, Q3, i.A. popeye

https://www.filo-mining.com/news/2019/filo-mining-reports-q3… Liontown, Maiden Resource Estimate, i.A. popeye

https://www.asx.com.au/asxpdf/20191108/pdf/44bd0xmtgqm4qv.pd… Emmerson, i.A. popeye

https://mailchi.mp/100815f126d6/shard-capital-emmersons-debt… Trilogy, Drillresults, i.A. popeye

https://us14.campaign-archive.com/?e=9665898174&u=8e5abc1950… Talon,advancing-the-tamarack-project, i.A. popeye

https://mailchi.mp/talonmetals/advancing-the-tamarack-projec…

Armadale Capital Plc

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Arm…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Arm…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://polaris.brighterir.com/public/armadale_capital/news/r…

http://polaris.brighterir.com/public/armadale_capital/news/r…

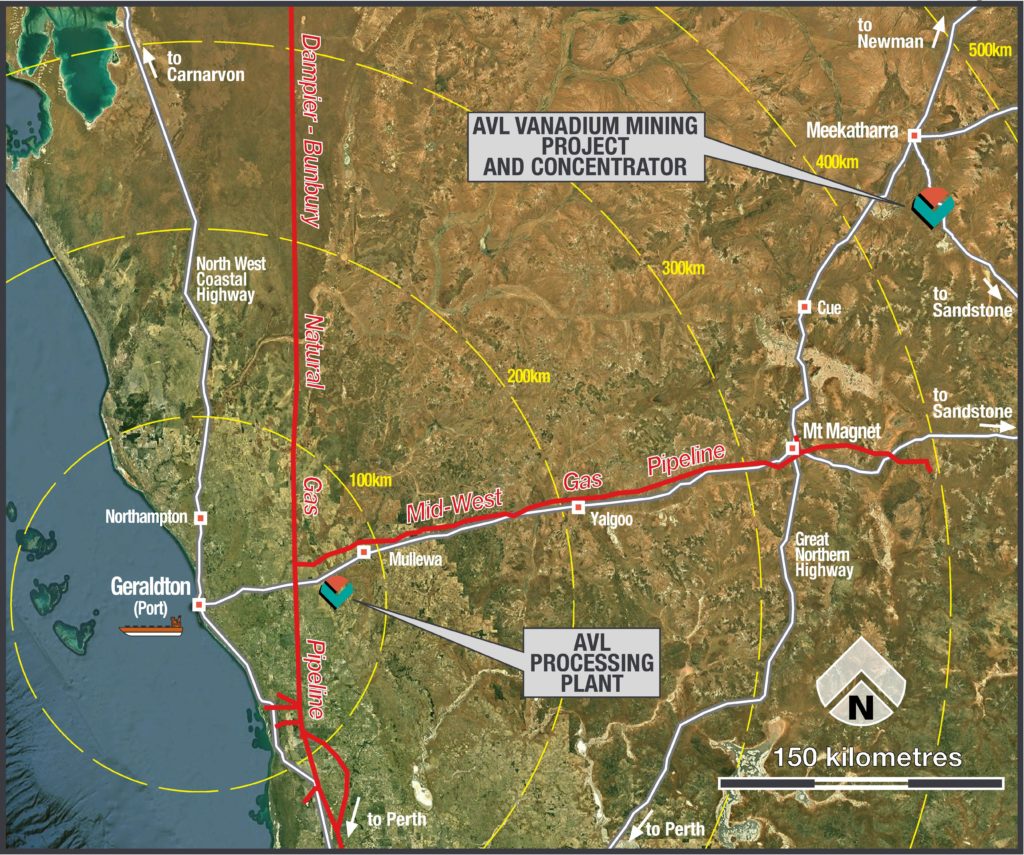

Vanadium Resources, Ex Tando Resources, i.A. popeye

https://vr8.global/sites/default/files/asx-announcements/695…http://vr8.global/sites/default/files/asx-announcements/6945…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

Vanadium Resources/(Ex) Tando Resources

https://vr8.global/sites/default/files/asx-announcements/695…

http://vr8.global/sites/default/files/asx-announcements/6945…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/695…

http://vr8.global/sites/default/files/asx-announcements/6945…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

https://vr8.global/sites/default/files/asx-announcements/694…

@boersi: Sorry, aber das zu metallic ist uralt .. da gibt's leider nix neues?!

ich mach nur kopierdienst für pop

Ivanhoe Mines, i.A. popeye

Schichtwechselhttp://www.ivanhoemines.com/news/2019/ivanhoe-mines-issues-t…

http://www.ivanhoemines.com/news/2019/fec-chamber-of-mines-m…

[urlhttp://www.ivanhoemines.com/news/2019/ivanhoe-mines-and-ivanhoe-capital-address-information-shortcomings-in-financial-times-article-focused-on-the-kamoa-kakula/][/url]

http://www.ivanhoemines.com/news/2019/palladium-prices-hit-a…

Aurania

1 November 2019

Chaarat Gold Holdings Limited

("Chaarat" or the "Company")

Kapan Mine Revised Mine Plan and Reserves Update

Chaarat (AIM:CGH), an AIM-listed gold mining company (the Company) with assets in Armenia and the Kyrgyz Republic, is pleased to announce an update for their Kapan polymetallic mine (the Mine) located in the Republic of Armenia. This is the first Ore Reserve statement from Chaarat since acquiring the Mine in February 2019.

The mineral resources and ore reserves, detailed in this press release, have been reported following the guidelines and requirements of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ('the JORC Code'), 2012 (JORC 2012).

In July 2019 (see press release dated 29 July 2019), the Company provided an update to the Kapan Mineral Resource Estimate.

The Mineral Resources have since been updated to account for depletion as well as new assay and geological data derived from 627 meters of underground drilling completed since the July update, included within the 24,321 meters of underground drilling completed to date in 2019 (of a budget of 48,000 meters for 2019). This updated Mineral Resource Estimate forms the basis for the revised Ore Reserves and mine plan presented here.

Highlights:

· The Life of Mine Plan (LOMP) has a life of 7 years, with AuEq production averaging 60 koz per annum.

· The overall contained gold equivalent ounces (AuEq oz) in the Measured and Indicated Resource ("M&I") is 1,663k AuEq oz indicating that near-mine exploration continues to replace the mined tonnes.

· The average grade of the Kapan M&I resource has decreased from 6.20 grammes per tonne (g/t) gold equivalent (AuEq) (July 19), to 5.89 g/t AuEq, due to an update in the gold equivalence formula in order to reflect revised pricing and estimation parameters that match mill results through reconciliation exercises.

· The LOMP delivers an EBITDA averaging $20 million.

· Updated Ore Reserves comprise of 4.5 Mt of Proven and Probable ore at grades of 1.69g/t Au, 31.72g/t Ag, 0.35% Cu and 1.34% Zn at a cut off of 2.5g/t AuEq.

· The LOMP's average Operating Cash Cost and All in Sustaining Cost ("AISC") are US$817/AuEq oz produced and US$1,032/AuEq oz produced respectively.

· Sustaining Capex guidance for the LMP is approximately $4 million per annum. This will be primarily focused on mining fleet replacement.

· Pre-tax cash flow for the LOMP averages $ 16 million per annum.

· Pre-tax NPV for the LOM is $102 million at a discount rate of 5%.

· Historical upgrade of Inferred Resource to M&I Resource that can be converted to reserves suggests that the life of mine can be further extended from the anticipated upgrading of a portion of the current Inferred Resource. Ongoing exploration is expected to continue adding to this inventory.

· We are confident that significant upside potential remains on the property through the conversion of Mineral Resources to Ore Reserves that are not currently included in the 2019 LOMP.

Summary information on the LOMP can be found in appendix 1.

Significant production potential remains through the conversion of resources currently outside the LOMP. As a result, the actual mine life is expected to be longer than 7 years. There is good potential to add reserves from upgrading and conversion of these resources. Historically Kapan reserve depletion has been replenished through ongoing exploration and development. This is expected to continue.

In addition, there are known exploration targets within the existing license area and others further away but still close to the current mine infrastructure. Exploration and development of these areas over the next few years should allow Kapan to open up new operating areas with the potential to debottleneck mine production and allow further expansion of the mill. Capacity for up to 1.2Mt of ore is already installed in the mill and can be put into service with minimal capital cost.

Artem Volynets, the Company's CEO, commented:

"We are very pleased with this update for Kapan. The resource and reserve update show that depletion continues to be replaced with new reserves through our well-developed and successful exploration program. In addition, the work this year has allowed us to improve mine life while at the same time maintaining our target of $20 million run-rate EBITDA from the operation. This ongoing replacement of resource through exploration continues to give us the confidence that this mine should have many years of ongoing operation well beyond the current LOMP. Indeed, the fact that we bought the Kapan Mine in early 2019 with a 5-year LOM and now, net of depletion, we have a 7-year LOM, supports this confidence.

"We are also encouraged by the fact that there is still significant exploration potential in the broader area, including the existing flank areas to the main workings. These are areas of potential we will look to further scope over the next year or two as we look to continue to develop the Kapan mine."

Chaarat Gold Holdings Limited

("Chaarat" or the "Company")

Kapan Mine Revised Mine Plan and Reserves Update

Chaarat (AIM:CGH), an AIM-listed gold mining company (the Company) with assets in Armenia and the Kyrgyz Republic, is pleased to announce an update for their Kapan polymetallic mine (the Mine) located in the Republic of Armenia. This is the first Ore Reserve statement from Chaarat since acquiring the Mine in February 2019.

The mineral resources and ore reserves, detailed in this press release, have been reported following the guidelines and requirements of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ('the JORC Code'), 2012 (JORC 2012).

In July 2019 (see press release dated 29 July 2019), the Company provided an update to the Kapan Mineral Resource Estimate.

The Mineral Resources have since been updated to account for depletion as well as new assay and geological data derived from 627 meters of underground drilling completed since the July update, included within the 24,321 meters of underground drilling completed to date in 2019 (of a budget of 48,000 meters for 2019). This updated Mineral Resource Estimate forms the basis for the revised Ore Reserves and mine plan presented here.

Highlights:

· The Life of Mine Plan (LOMP) has a life of 7 years, with AuEq production averaging 60 koz per annum.

· The overall contained gold equivalent ounces (AuEq oz) in the Measured and Indicated Resource ("M&I") is 1,663k AuEq oz indicating that near-mine exploration continues to replace the mined tonnes.

· The average grade of the Kapan M&I resource has decreased from 6.20 grammes per tonne (g/t) gold equivalent (AuEq) (July 19), to 5.89 g/t AuEq, due to an update in the gold equivalence formula in order to reflect revised pricing and estimation parameters that match mill results through reconciliation exercises.

· The LOMP delivers an EBITDA averaging $20 million.

· Updated Ore Reserves comprise of 4.5 Mt of Proven and Probable ore at grades of 1.69g/t Au, 31.72g/t Ag, 0.35% Cu and 1.34% Zn at a cut off of 2.5g/t AuEq.

· The LOMP's average Operating Cash Cost and All in Sustaining Cost ("AISC") are US$817/AuEq oz produced and US$1,032/AuEq oz produced respectively.

· Sustaining Capex guidance for the LMP is approximately $4 million per annum. This will be primarily focused on mining fleet replacement.

· Pre-tax cash flow for the LOMP averages $ 16 million per annum.

· Pre-tax NPV for the LOM is $102 million at a discount rate of 5%.

· Historical upgrade of Inferred Resource to M&I Resource that can be converted to reserves suggests that the life of mine can be further extended from the anticipated upgrading of a portion of the current Inferred Resource. Ongoing exploration is expected to continue adding to this inventory.

· We are confident that significant upside potential remains on the property through the conversion of Mineral Resources to Ore Reserves that are not currently included in the 2019 LOMP.

Summary information on the LOMP can be found in appendix 1.

Significant production potential remains through the conversion of resources currently outside the LOMP. As a result, the actual mine life is expected to be longer than 7 years. There is good potential to add reserves from upgrading and conversion of these resources. Historically Kapan reserve depletion has been replenished through ongoing exploration and development. This is expected to continue.

In addition, there are known exploration targets within the existing license area and others further away but still close to the current mine infrastructure. Exploration and development of these areas over the next few years should allow Kapan to open up new operating areas with the potential to debottleneck mine production and allow further expansion of the mill. Capacity for up to 1.2Mt of ore is already installed in the mill and can be put into service with minimal capital cost.

Artem Volynets, the Company's CEO, commented:

"We are very pleased with this update for Kapan. The resource and reserve update show that depletion continues to be replaced with new reserves through our well-developed and successful exploration program. In addition, the work this year has allowed us to improve mine life while at the same time maintaining our target of $20 million run-rate EBITDA from the operation. This ongoing replacement of resource through exploration continues to give us the confidence that this mine should have many years of ongoing operation well beyond the current LOMP. Indeed, the fact that we bought the Kapan Mine in early 2019 with a 5-year LOM and now, net of depletion, we have a 7-year LOM, supports this confidence.

"We are also encouraged by the fact that there is still significant exploration potential in the broader area, including the existing flank areas to the main workings. These are areas of potential we will look to further scope over the next year or two as we look to continue to develop the Kapan mine."

i.A. Popeye:

Critical Minerals Mining Means New High-Tech Jobs

------------------------------------------------------------

By Mark A. Smith, P.E., Esq.

CEO and Executive Chairman, NioCorp Devlepments Ltd.

November 11, 2019

Critical minerals and materials are defined by the U.S. Government as critical because they (1) are essential to the economic and national security of the United States, (2) have supply chains that are vulnerable to disruption, and (3) serve an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.

In short, critical minerals are things we really, really need and can't always get.

From the perspective of the U.S., and western nations in general, the more we mine and manufacture our own critical minerals and materials, the more secure our collective economic and national security will be. But there is another compelling driver behind the resurgence of interest in critical minerals mining and manufacturing: high-tech jobs and economic growth for states and localities.

NioCorp’s Elk Creek Project is an excellent case in point.

* This Project is projected to create approximately 436 new, full-time jobs, including approximately 182 mining jobs and 224 jobs associated with the Project’s primary metal manufacturing operations.

* It also will support nearly 1,200 construction/contract jobs at the height of the Project’s expected 3+ year construction period.

* A model developed by the U.S. Department of Commerce’s Bureau of Economic Analysis (“BEA”) projects the creation of approximately 1,000 additional jobs throughout the economy as a result of the increased economic activity generated by the Project. For every new job created by metal mining projects in the U.S, the BEA’s model projects that an average of 2.3 additional jobs will be created.^1

That’s not all. Many of these new, full-time jobs will be training workers in a host of new, high-tech skills that are part and parcel of modern mining and critical materials manufacture.

https://www.niocorp.com/critical-minerals-mining-means-new-h…

These include operating underground mobile equipment remotely, computerized development and production drilling and operating plant production equipment through a computer interface.

The economic benefits of critical minerals and materials manufacturing go well beyond the creation of new high-tech jobs. The Elk Creek Project, for example, will operate as a very powerful economic engine for Nebraska and the U.S. in terms of economic stimulus and increased revenue to state and local government in Nebraska.

Estimated Economic Benefits and New Tax Revenue Generated by the Elk Creek Project^2

Direct Full-Time, Permanent Jobs Created 436

Indirect Jobs Created 1,000

Peak Construction-Related Jobs 1,200

Total Investment over 36-Year Project Life: $7.76 billion

Cumulative Operating Expenses over Project Life: $6.618 billion

Employee Payroll over Project Life (included in cumulative operating expenses above): $882 million

New Tax Revenue to State and Local Government over Project Life: $742.4 million

Royalties Paid to Nebraska Landowners over Project Life: $279 million

With economic benefits of this magnitude, it is no wonder that States such as Nebraska are actively encouraging investment in critical minerals and materials manufacturing by offering targeted tax incentives to companies who launch such manufacturing operations in the state. As the Elk Creek Project's projections clearly show, the return on such investments can be very large.

[1] Derived from analyses conducted as part of NioCorp’s April 2019 Elk Creek Project FS (https://www.niocorp.com/niocorp_releases_2019_update_to-elk_… .

[2] The economic data and projections cited in this table are contained in NioCorp’s April 2019 Elk Creek FS (https://www.niocorp.com/niocorp_releases_2019_update_to-elk_… or are derived from analyses conducted as part of the FS, which was prepared in accordance with National Instrument 43-101 (“NI 43-101“) and is available for download at sedar.com

Critical Minerals Mining Means New High-Tech Jobs

------------------------------------------------------------

By Mark A. Smith, P.E., Esq.

CEO and Executive Chairman, NioCorp Devlepments Ltd.

November 11, 2019

Critical minerals and materials are defined by the U.S. Government as critical because they (1) are essential to the economic and national security of the United States, (2) have supply chains that are vulnerable to disruption, and (3) serve an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economy or national security.

In short, critical minerals are things we really, really need and can't always get.

From the perspective of the U.S., and western nations in general, the more we mine and manufacture our own critical minerals and materials, the more secure our collective economic and national security will be. But there is another compelling driver behind the resurgence of interest in critical minerals mining and manufacturing: high-tech jobs and economic growth for states and localities.

NioCorp’s Elk Creek Project is an excellent case in point.

* This Project is projected to create approximately 436 new, full-time jobs, including approximately 182 mining jobs and 224 jobs associated with the Project’s primary metal manufacturing operations.

* It also will support nearly 1,200 construction/contract jobs at the height of the Project’s expected 3+ year construction period.

* A model developed by the U.S. Department of Commerce’s Bureau of Economic Analysis (“BEA”) projects the creation of approximately 1,000 additional jobs throughout the economy as a result of the increased economic activity generated by the Project. For every new job created by metal mining projects in the U.S, the BEA’s model projects that an average of 2.3 additional jobs will be created.^1

That’s not all. Many of these new, full-time jobs will be training workers in a host of new, high-tech skills that are part and parcel of modern mining and critical materials manufacture.

https://www.niocorp.com/critical-minerals-mining-means-new-h…

These include operating underground mobile equipment remotely, computerized development and production drilling and operating plant production equipment through a computer interface.

The economic benefits of critical minerals and materials manufacturing go well beyond the creation of new high-tech jobs. The Elk Creek Project, for example, will operate as a very powerful economic engine for Nebraska and the U.S. in terms of economic stimulus and increased revenue to state and local government in Nebraska.

Estimated Economic Benefits and New Tax Revenue Generated by the Elk Creek Project^2

Direct Full-Time, Permanent Jobs Created 436

Indirect Jobs Created 1,000

Peak Construction-Related Jobs 1,200

Total Investment over 36-Year Project Life: $7.76 billion

Cumulative Operating Expenses over Project Life: $6.618 billion

Employee Payroll over Project Life (included in cumulative operating expenses above): $882 million

New Tax Revenue to State and Local Government over Project Life: $742.4 million

Royalties Paid to Nebraska Landowners over Project Life: $279 million

With economic benefits of this magnitude, it is no wonder that States such as Nebraska are actively encouraging investment in critical minerals and materials manufacturing by offering targeted tax incentives to companies who launch such manufacturing operations in the state. As the Elk Creek Project's projections clearly show, the return on such investments can be very large.

[1] Derived from analyses conducted as part of NioCorp’s April 2019 Elk Creek Project FS (https://www.niocorp.com/niocorp_releases_2019_update_to-elk_… .

[2] The economic data and projections cited in this table are contained in NioCorp’s April 2019 Elk Creek FS (https://www.niocorp.com/niocorp_releases_2019_update_to-elk_… or are derived from analyses conducted as part of the FS, which was prepared in accordance with National Instrument 43-101 (“NI 43-101“) and is available for download at sedar.com

Gold Standard Discovers High-Grade Oxide Gold Mineralization at the LT Target i.A. popeye

http://www.globenewswire.com/News/ViewBB/2202117?f=44&ai=194… Lithium Americas Reports Third Quarter 2019 Results, i.A. popeye

November 12, 2019>

> Vancouver, Canada: Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) ("Lithium Americas" or the "Company") has announced its financial and operating results for the three months ended September 30, 2019. All amounts are in U.S. dollars unless otherwise indicated.

>

> This news release should be read in conjunction with Lithium Americas’ unaudited condensed consolidated interim financial statements and management's discussion and analysis ("MD&A") for the nine months ended September 30, 2019, which are available on the Company’s website and SEDAR.

>

> Lithium Americas is also pleased to announce that it has filed the previously announced Updated Feasibility Study and Mineral Reserve Estimation to Support 40,000 tpa Lithium Carbonate Production at the Cauchari-Olaroz Salars, Jujuy Province, Argentina, with an effective date of August 19, 2019, on SEDAR.

>

> Highlights

>

> Cauchari-Olaroz lithium project (“Cauchari-Olaroz”):

> * Construction activities are on schedule to support the start of production by early 2021.

> * Overall the project is 25% complete with 42% of construction capital costs committed including 24% spent.

> * 13 of the 40 production wells are complete with a further seven under execution.

> * Earthworks for the ponds is 70% complete with five ponds lined, three more in progress and four filled with brine.

> * Erection of a warehouse and a soda ash storage building is well advanced.

> * Process plant construction continues on schedule to support mechanical completion by the end of 2020.

> * Currently 730 people are working on Cauchari-Olaroz, including 265 employees and 465 contractors.

> * In August, Ganfeng Lithium Co. Ltd. completed a $160.0 million investment (“Project Investment”) in Cauchari-Olaroz increasing its interest to 50% from 37.5% and reducing the Company’s interest from 62.5% to 50%.

> * Lithium Americas’ 50% share of Cauchari-Olaroz’s construction costs is expected to be fully-funded with $221.0 million still available under the Company’s credit and loan facilities.

> * Completed and filed on SEDAR a definitive feasibility study for production capacity of 40,000 tonnes per annum of battery-quality lithium carbonate.

>

> Thacker Pass lithium project (“Thacker Pass”):

> * Plan of Operation deemed complete by Bureau of Land Management with major permits for Phase 1 expected to be received by the end of 2020.

> * Partnered with Sawtooth Mining LLC, a subsidiary of NACCO Industries, Inc. (NYSE: NC) and The North American Coal Corporation, in a long-term mining contract to provide mine engineering, construction, operation and reclamation services as well as certain mining equipment.

> * Produced over 5,000 kg of high-quality lithium sulphate at the process testing facility in Reno, Nevada.

> * Engaged third-party vendors to engineer and design lithium carbonate and lithium hydroxide evaporator and crystallizer as well as provide performance guarantees and product samples.

> * Commenced a definitive feasibility study with a Phase 1 production capacity of 20,000 tonnes per annum lithium carbonate equivalent which is expected to be complete by mid-2020.

> * Entered into a contract with The Industrial Company to complete key aspects of the feasibility study.

> * Project permitting and DFS costs are expected to be funded from available cash on hand.

> * Exploring financing options, including the possibility of a joint venture partner at Thacker Pass.

>

> Corporate:

> * Following the closing of the Project Investment, the Company’s investment in Cauchari-Olaroz is accounted for as a joint operation and the Company now recognizes its share of any assets, liabilities and results of the joint operation rather than equity accounting for the investment.

> * As at September 30, 2019, the Company had $108.1 million in cash and cash equivalents, including $73.7 million representing the Company’s 50% share of Cauchari-Olaroz’s cash and cash equivalents and $34.4 million held by Lithium Americas and subsidiaries.

> * As at September 30, 2019, the Company has total available credit of $221.0 million.

> * The Company has drawn $83.8 million of the $205.0 million senior credit facility available to fund the Company’s share of Cauchari-Olaroz project construction. An additional $100.0 million unsecured, limited recourse, subordinated loan facility, remains undrawn and available for the Company’s general corporate purposes.

> * On October 20, 2019, the Board of Directors appointed Dr. Yuan Gao as an independent director of the Company.

>

> Financial Results:

> Selected consolidated financial information is presented as follows:

>

> In Q3 2019, total assets increased primarily as a result of recognizing the Company’s 50% share of Cauchari-Olaroz’s cash of $73.7 million, property, plant and equipment of $130.6 million and other assets. In Q3 2019, total liabilities increased primarily as a result of recognizing the Company’s share of its joint operation’s borrowings of $28.0 million.

> Net income for the three months ended September 30, 2019 was $69.0 million compared to net loss of $7.4 million for the three months ended September 30, 2018. Net income in Q3 2019 is primarily a result of a gain on closing of the Project Investment of $74.5 million.

> Qualified Person:

> The scientific and technical information in this news release has been reviewed and approved by Dr. Rene LeBlanc, a Qualified Person for purposes of NI 43-101 by virtue of his experience, education and professional association. Mr. LeBlanc is the Chief Technical Officer of the Company. Information on the Company’s data verification and QA / QC procedures is contained in Lithium Americas’ current technical reports for the Cauchari-Olaroz lithium project and the Thacker Pass lithium project, available at www.sedar.com.

> About Lithium Americas:

> Lithium Americas is developing the Caucharí-Olaroz lithium project under construction in Jujuy, Argentina through a 50/50 joint operation with Ganfeng Lithium Co. Ltd. In addition, Lithium Americas is advancing the 100% owned Thacker Pass lithium project located in Nevada and the largest known lithium deposit in the United States. The Company trades on both the Toronto Stock Exchange and on the New York Stock Exchange, under the ticker symbol “LAC”.

First Vanadium Corp: Gold Target Identified on the Carlin Vanadium Project by Prominent Nevada Geologist, i.A. popeye

https://us19.campaign-archive.com/?e=6df93c16a6&u=b15a19c392…

i. A. Popeye

Skeena Resources

Golden Unicorn: Eskay Creek PEA Discussion

Skeena Resources

Golden Unicorn: Eskay Creek PEA Discussion

Hawkstone Mining, i.A. popeye

https://gallery.mailchimp.com/b7d461903737dcf961676c2ea/file… Alphamin Resources, Quarterly update, i.A. popeye

http://www.globenewswire.com/news-release/2019/11/11/1944918… South Star Mining, i.A. popeye

South Star Mining Provides Further Update on its Advanced Testing Program with Urbix Resourceshttps://mailchi.mp/5030a213e45e/south-star-mining-provides-u…

Goldinvest -> Davenport Resources, i.A. popeye

TNG Limited, Research Notei.A. popeye

https://www.tngltd.com.au/wp-content/uploads/2019/11/191104-… Iron Bark Zinc, Research Note, i.A. popeye

https://gallery.mailchimp.com/c108dbc2422b014650e30c936/file… !

Dieser Beitrag wurde von CloudMOD moderiert. Grund: ohne Quellenangabe, Auszüge, Kopie aus fremden Medien- bitte nachlesen unter 9.5. Nutzungsbedingungen: "wie zitiere ich richtig"

Ist popeys Sendungsbewusstsein eigentlich UNERMESSLICH?? Ich frag ja nur ... ;-))))

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Kopie, Inhalt aus fremden Medien, Urheberrechtsverletzung, zudem ohne QuellenangabeSalt Lake Potash, i.A. popeye

https://www.eurekareport.com.au/investment-news/playing-with… Kalium Lakes Limited - WA Government Gives Green Light, i.A. popeye

https://kaliumlakes.us14.list-manage.com/track/click?u=dde2c… TRISTAR GOLD ,i.A. popeye

http://r20.rs6.net/tn.jsp?f=001KVhzYZuek4sHjqsksw3e2USgKfFDf… African Gold Group, i.A. popeye

https://www.juniorminingnetwork.com/junior-miner-news/press-…

Antwort auf Beitrag Nr.: 61.926.692 von Tirolesi am 14.11.19 20:51:50https://stockdaymedia.com/news/mining/troilus-gold-corp-crea…

Tietto Resources, i.A. popeye

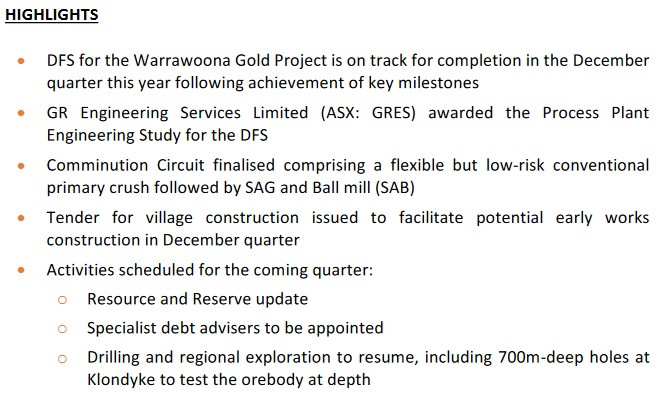

https://smallcaps.com.au/tietto-minerals-posts-substantial-u… Adriatic Metals

Scoping Studiehttps://www.asx.com.au/asxpdf/20191119/pdf/44bpxxb46j4sf9.pd…

auf den ersten Blick "very nice"

(PS: diesmal nicht von pop

)

)...ich hab ein paar shares von der bude...

New Elk Feasibility Study Delivers Outstanding Results

http://newsroom.irmau.com/wf/click?upn=p6OB-2FY1zohH8zo5q0uI… Colonial Coal, open pit PEA

https://www.globenewswire.com/news-release/2019/11/26/195273… Vulcan Energy

http://v-er.com/wp-content/uploads/LargestJORCLithiumResourc…

http://v-er.com/wp-content/uploads/ZeroCarbonLithiumPresenta…" target="_blank" rel="nofollow ugc noopener">https://finfeed.com/small-caps/mining/vulcan-confirmed-as-europes-largest-jorc-lithium-resource/?utm_medium=email&utm_campaign=2019-12-07&utm_content=2019-12-07+CID_8faf1928bb6b8749398f421da0d664be&utm_source=campaignmonitor&utm_term=Vulcan%20confirmed%20as%20Europes%20largest%20JORC%20Lithium%20Res

http://v-er.com/wp-content/uploads/LargestJORCLithiumResourc…

http://v-er.com/wp-content/uploads/ZeroCarbonLithiumPresenta…" target="_blank" rel="nofollow ugc noopener">http://v-er.com/wp-content/uploads/LargestJORCLithiumResourc…

http://v-er.com/wp-content/uploads/ZeroCarbonLithiumPresenta…" target="_blank" rel="nofollow ugc noopener">https://finfeed.com/small-caps/mining/vulcan-confirmed-as-europes-largest-jorc-lithium-resource/?utm_medium=email&utm_campaign=2019-12-07&utm_content=2019-12-07+CID_8faf1928bb6b8749398f421da0d664be&utm_source=campaignmonitor&utm_term=Vulcan%20confirmed%20as%20Europes%20largest%20JORC%20Lithium%20Res

http://v-er.com/wp-content/uploads/LargestJORCLithiumResourc…

http://v-er.com/wp-content/uploads/ZeroCarbonLithiumPresenta…

Base Resources

https://wcsecure.weblink.com.au/pdf/BSE/02184655.pdf

Antwort auf Beitrag Nr.: 61.815.520 von Boersiback am 01.11.19 14:24:50Prospect Resources Updates Arcadia Definitive Financial Study

Prospect Resources Ltd updates its Definitive Feasibility Study (DFS) for the 2.4 Mtpa Base Case development of the 87% owned Arcadia Lithium Project located outside the capital city of Harare in Zimbabwe.

Key outcomes with reference to the updated DFS are:

- US$710M pretax NPV 10

Up 39%. Confirming the value of the project and the opportunity for Prospect Resources

- US$168M average annual EBITDA for the first 5 years of operation

Exceptional profitability and healthy operating margins

- US$162M capital expenditure estimate

Including EPCM contract cost provision, and 14% contingency (including EAA*)

US$3.42B LOM revenue excluding tantalum credits

Up 17%. Demonstrating the value to shareholders

- 15.5 year mine life

Adding 3.5 years. Further increasing Arcadia's exposure to long term EV demand

- Internal rate of return (IRR) of 71% (pretax)

Up from IRR 44%. Substantially improving project returns

https://campaignmonitor.springwebsolutions.com/t/ViewEmail/j…

Prospect Resources Ltd updates its Definitive Feasibility Study (DFS) for the 2.4 Mtpa Base Case development of the 87% owned Arcadia Lithium Project located outside the capital city of Harare in Zimbabwe.

Key outcomes with reference to the updated DFS are:

- US$710M pretax NPV 10

Up 39%. Confirming the value of the project and the opportunity for Prospect Resources

- US$168M average annual EBITDA for the first 5 years of operation

Exceptional profitability and healthy operating margins

- US$162M capital expenditure estimate

Including EPCM contract cost provision, and 14% contingency (including EAA*)

US$3.42B LOM revenue excluding tantalum credits

Up 17%. Demonstrating the value to shareholders

- 15.5 year mine life

Adding 3.5 years. Further increasing Arcadia's exposure to long term EV demand

- Internal rate of return (IRR) of 71% (pretax)

Up from IRR 44%. Substantially improving project returns

https://campaignmonitor.springwebsolutions.com/t/ViewEmail/j…

Antwort auf Beitrag Nr.: 62.153.897 von rolleg am 13.12.19 16:18:45Prospect Resources signs MOU with Uranium One Group

African lithium developer, Prospect Resources Ltd (ASX: PSC, FRA:5E8) (“Prospect” or “the Company”) is pleased to announce that it has entered into a Memorandum of Understanding (“MOU”) with Uranium One Group JSC (“Uranium One") a wholly owned subsidiary of ROSATOM.

The purpose of the MOU is to afford Uranium One with a 90-day exclusivity period (subject to certain exceptions) to:

• complete due diligence on the Company and its Arcadia Lithium Mine; and

subject to satisfactory due diligence, negotiate:

• equity investment terms in Prospect or its subsidiaries; and

• off-take terms for at least 51% of the Company’s future lithium production

https://campaignmonitor.springwebsolutions.com/t/ViewEmail/j…

African lithium developer, Prospect Resources Ltd (ASX: PSC, FRA:5E8) (“Prospect” or “the Company”) is pleased to announce that it has entered into a Memorandum of Understanding (“MOU”) with Uranium One Group JSC (“Uranium One") a wholly owned subsidiary of ROSATOM.

The purpose of the MOU is to afford Uranium One with a 90-day exclusivity period (subject to certain exceptions) to:

• complete due diligence on the Company and its Arcadia Lithium Mine; and

subject to satisfactory due diligence, negotiate:

• equity investment terms in Prospect or its subsidiaries; and

• off-take terms for at least 51% of the Company’s future lithium production

https://campaignmonitor.springwebsolutions.com/t/ViewEmail/j…

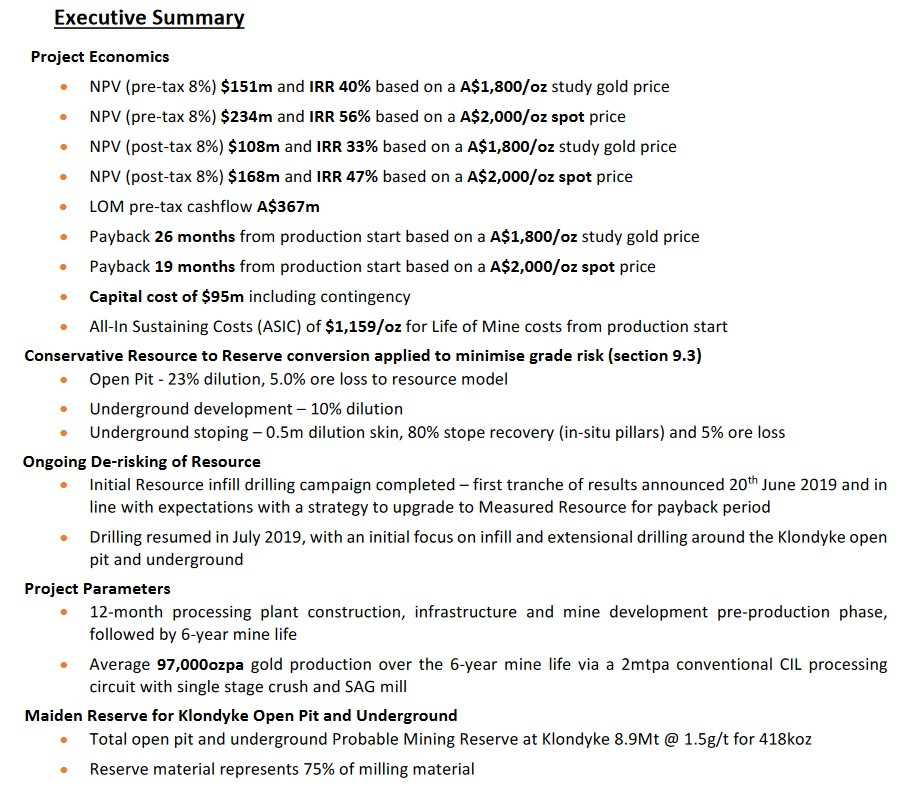

Antwort auf Beitrag Nr.: 60.873.606 von Popeye82 am 24.06.19 03:13:47Liontown Resources

Kathleen Valley Pre-Feasibility Study confirms potential for robust new long-life open pit lithium mine in WA

https://www.ltresources.com.au/sites/default/files/asx-annou…

KATHLEEN VALLEY PRE-FEASIBILITY STUDY AND BEYOND

http://www.ltresources.com.au/sites/default/files/asx-announ…

Kathleen Valley Pre-Feasibility Study confirms potential for robust new long-life open pit lithium mine in WA

https://www.ltresources.com.au/sites/default/files/asx-annou…

KATHLEEN VALLEY PRE-FEASIBILITY STUDY AND BEYOND

http://www.ltresources.com.au/sites/default/files/asx-announ…

Antwort auf Beitrag Nr.: 61.121.483 von Popeye82 am 28.07.19 15:30:13

Canyon Resources

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

Canyon Resources

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

http://static1.squarespace.com/static/5b9cbcb58f5130f854d93d…

Antwort auf Beitrag Nr.: 61.121.348 von Popeye82 am 28.07.19 14:57:57Emmerson Plc

Potential for Government Subsidies to Cover Up to 10% of Total Project Capital Cost

http://polaris.brighterir.com/public/emmerson_plc/news/rns/s…

PEA DemonstratesPotential for Low Capex SOP Production with Outstanding CashflowGeneration

http://www.rns-pdf.londonstockexchange.com/rns/4467U_1-2019-…

Elimination ofPort Infrastructure Capital Cost by usingPort of Casablanca

http://www.rns-pdf.londonstockexchange.com/rns/0512S_1-2019-…

72% Increase in Mineral ResourceEstimate (“MRE”)for Khemisset Potash Projectto 537Million Tonnes

http://www.rns-pdf.londonstockexchange.com/rns/2426R_1-2019-…

Potential for Government Subsidies to Cover Up to 10% of Total Project Capital Cost

http://polaris.brighterir.com/public/emmerson_plc/news/rns/s…

PEA DemonstratesPotential for Low Capex SOP Production with Outstanding CashflowGeneration

http://www.rns-pdf.londonstockexchange.com/rns/4467U_1-2019-…

Elimination ofPort Infrastructure Capital Cost by usingPort of Casablanca

http://www.rns-pdf.londonstockexchange.com/rns/0512S_1-2019-…

72% Increase in Mineral ResourceEstimate (“MRE”)for Khemisset Potash Projectto 537Million Tonnes

http://www.rns-pdf.londonstockexchange.com/rns/2426R_1-2019-…

@rolleg & boersi: Könnt ihr euch bitte untereinander absprechen (bzw. mit popeye),

damit nicht immer mehr Beiträge hier DOPPELT erscheinen?

MERCI ... und happy weekend!

damit nicht immer mehr Beiträge hier DOPPELT erscheinen?

MERCI ... und happy weekend!

Geopacific Resources: Woodlark Construction Commences

https://wcsecure.weblink.com.au/pdf/GPR/02185691.pdf

Kalium Lakes

Extensive Increase in Aquifer Thickness at Lake Sunshine

https://www.asx.com.au/asxpdf/20191217/pdf/44cn354qvg5ysf.pd…

Extensive Increase in Aquifer Thickness at Lake Sunshine

https://www.asx.com.au/asxpdf/20191217/pdf/44cn354qvg5ysf.pd…

ioneer

Binding Boric Acid Offtake Agreement with Dalian JinmaBoron Technology

https://www.asx.com.au/asxpdf/20191218/pdf/44cp9l82x94h18.pd…

Binding Boric Acid Offtake Agreement with Dalian JinmaBoron Technology

https://www.asx.com.au/asxpdf/20191218/pdf/44cp9l82x94h18.pd…

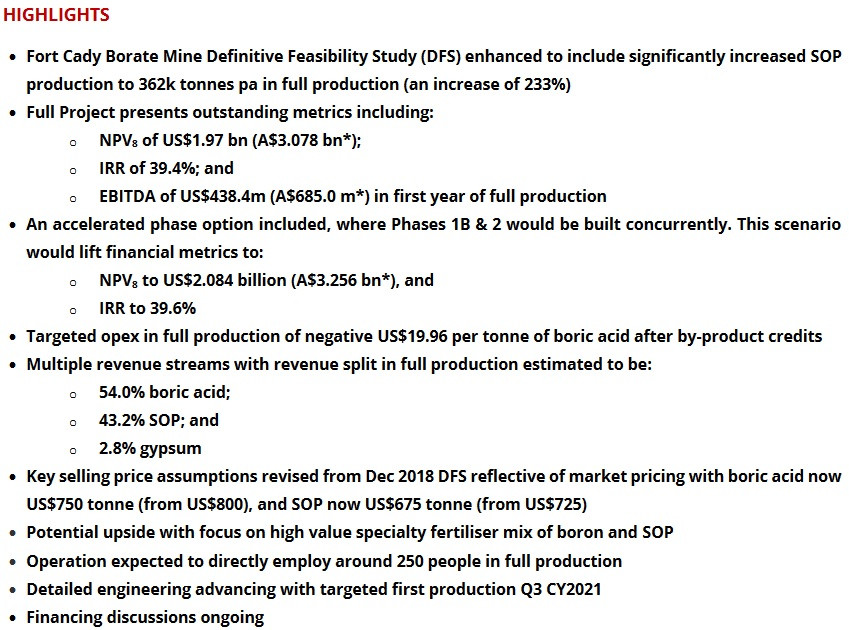

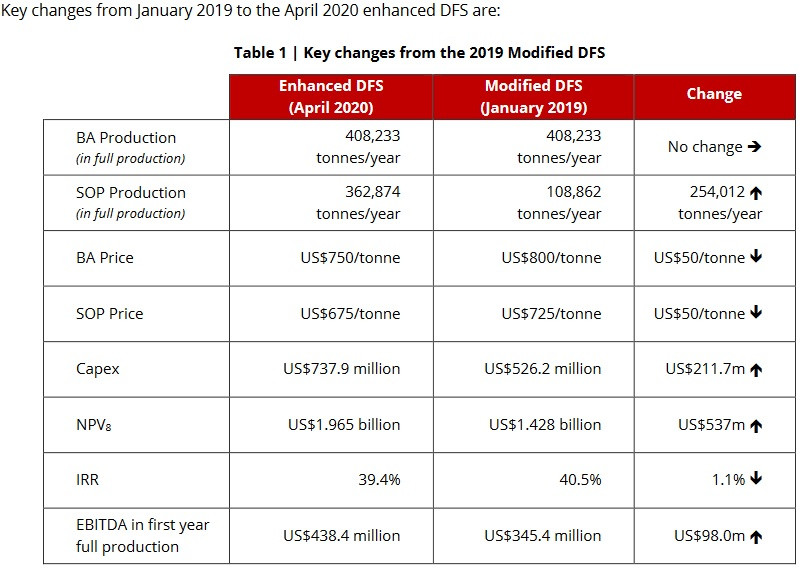

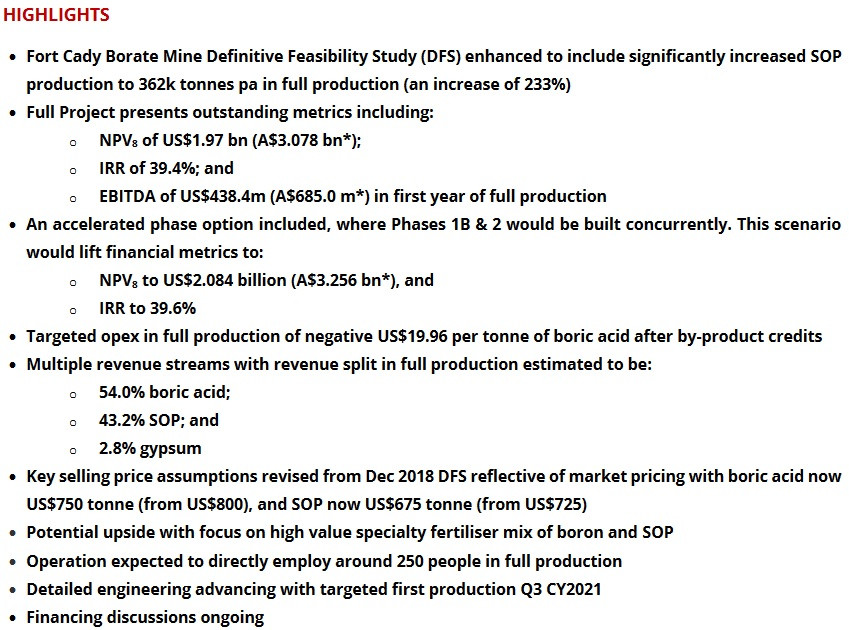

AMERICAN PACIFIC BORATES LIMITED

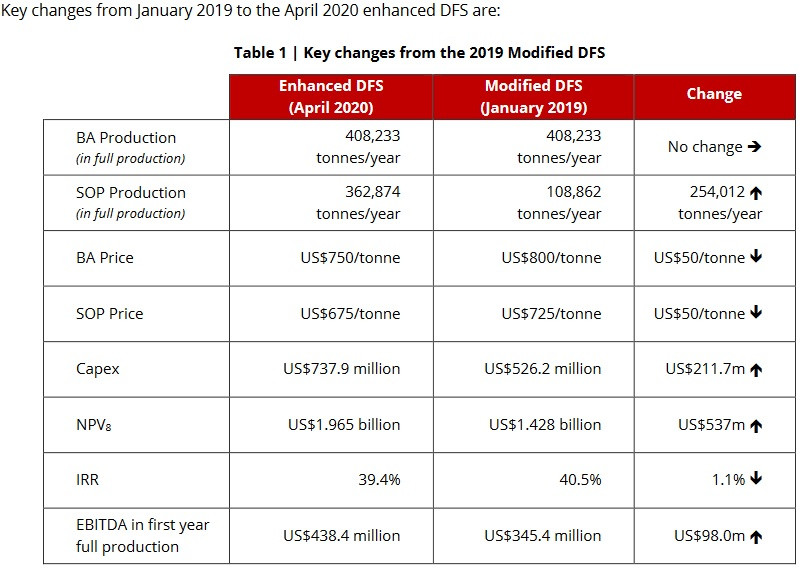

ABR to double SOP production at Fort Cady Mine to target EBITDA of over US$400m in first year of full production

https://www.asx.com.au/asxpdf/20191217/pdf/44cnfw1qp9n4s6.pd…

ABR to double SOP production at Fort Cady Mine to target EBITDA of over US$400m in first year of full production

https://www.asx.com.au/asxpdf/20191217/pdf/44cnfw1qp9n4s6.pd…

Atrum Coal: Expanded Elan Scoping Study for 1Q 2020

https://www.asx.com.au/asxpdf/20191219/pdf/44cqp0fr7czky2.pd… Prospect Resources, Interview

https://vimeo.com/380316735?utm_source=ActiveCampaign&utm_me… Renascor, Broker Report

https://renascor.com.au/wp-content/uploads/2019/12/Renascor_… South32 and Trilogy Metals to Form Upper Kobuk Mineral Projects Joint Venture

https://us14.campaign-archive.com/?e=9665898174&u=8e5abc1950… Titanium Sands, COMPANYUPDATE

https://wcsecure.weblink.com.au/pdf/TSL/02187746.pdf Element 25, Bulk Sampling

https://www.element25.com.au/site/showdownloaddoc.aspx?Annou…

von Popeye Weiterleitung

Die sind noch recht früh, KÖNNTEN da vielleicht aber noch ziemlich spannend werden.

Die Drills sind "teils schon richtig, richtig geil" muss sagen.

http://www.highgoldmining.com/news/2019/highgold-mining-retr…

http://www.highgoldmining.com/site/assets/files/6073/high_in…

https://www.highgoldmining.com/projects/johnson-tract-projec…

Die sind noch recht früh, KÖNNTEN da vielleicht aber noch ziemlich spannend werden.

Die Drills sind "teils schon richtig, richtig geil" muss sagen.

http://www.highgoldmining.com/news/2019/highgold-mining-retr…

http://www.highgoldmining.com/site/assets/files/6073/high_in…

https://www.highgoldmining.com/projects/johnson-tract-projec…

von POP - WEITERLEITUNG

- Nova Minerals - Lithium off-take? Large-scale Gold District. Nooooow Whaaaaaaat???????

5.920 Aufrufe

•23.11.2019

95

1

Teilen

Speichern

CRUX Investor

11.800 Abonnenten

Interview with Christopher Gerteisen, General Manager of Nova Minerals Ltd (ASX:NVA)

Nova Minerals is a minerals explorer and developer, listed on the ASX, focussed on district scale gold and advanced lithium projects in North America. Nova Minerals has 2 core projects: the flagship Estelle Gold Project, Alaska (poised for growth) and the Thompson Brothers Lithium-Cesium-Tantalum Project, Canada (cash flow ready). Lastly, Nova Minerals has a bonus project in the form of the Officer Hill Gold Project in Australia. All projects are in "safe, favourable jurisdictions."

Nova Minerals has had a fairly stagnant share price this year, reflective of poor lithium market performance, and unable to take full advantage of the rise in the gold price since August; Nova Minerals started the year at AUS$0.02, rode the rising gold price to a peak of AUS$0.07 in September, before falling back down to AUS$0.036 today. Nova has a market cap of AUS$33.55M.

Gerteisen states the management intends to take the project all the way, evidenced by the managements teams' large personal investments in the project. They intend to make it the "next world-class operation in Alaska."

Lithium has had poor spot price performance for the last couple of years, but Gerteisen is keen to emphasise Nova's unique position: dealing directly with a Chinese group and employing an offtake agreement helps avoid the unfavourable Western lithium markets in favour of a market where lithium is desperately needed to instigate the EV revolution and clean the incredibly polluted city air.

The Estelle Gold Project was obtained by Nova Minerals after the previous company ran into trouble courtesy of a falling zinc price. Nova Minerals began geophysics at the site in 2018. Based on their ground IP charge-ability results, they identified 4 "very strong anomalies:" Target A, B, C and D. These anomalies are consistent with historic drilling results. In June-August 2018, Nova carried out their own resource drilling programme over Target A and B. Based on these results, they defined their resource at 2.5Moz: 180M tons at 0.44g/t; this is a clear bulk play.

Nova Minerals is trying to avoid diluting as much as possible and are in conversations with potential partners across Australia and beyond. Ideally, Nova would like to obtain a strategic "cornerstone partner" in the form of a "big mining house" such as the giant Kinross Gold Corporation. Nova is confident they can operate year-round at their asset sites once the appropriate infrastructure has been put in place; one such consideration is the potential transportation of gold at the Estelle Gold site via train or truck.

Nova Minerals has a management team with vast experience in finances and construction, but there might be question marks posed regarding their experience at a mining company. However, Gerteisen is insistent Nova Minerals isn't a "lifestyle company." It is instead a "full endeavour" with an active intention to see it through to full success, "every cent" they can "put into the ground, they put into the ground."

Gerteisen concludes with Nova Mineral's USPs: a 20-30 year mine life, a district with a ubiquity of gold-filled mines, a committed management team and incredibly favourable jurisdictions.

What did you make of Christopher Gerteisen? Is Nova an exciting prospect, or is it an unrealistic proposition? Comment below and we may just ask your questions in the near future.

We Discuss:

0:53 - Company Overview

2:01 - Vision for the Business: What are They Trying to Create?

2:49 - Lithium: Overview of the Project, How Much it's Going to Cost and Who Will Fund it? Is This the Means of Funding Their Gold Projects?

14:53 - Estelle Gold Project: What Have They Got There and How are They Funding it?

20:47 - Finding Investors and Possible Partnership Deals

23:06 - The Jurisdiction and Drill Season Considerations

25:43 - Management Decision Making: What Should They be Focused on?

27:34 - Officer Hill Gold Project: Newmont JV, What's Going on and What are Their Plans for it

29:23 - Team Experience and Remuneration

30:42 - Why Should You Invest in Nova Minerals?

Company page: https://novaminerals.com.au/

Make smarter investment decisions, subscribe here: https://www.cruxinvestor.com

For FREE unbiased investment information, follow us on Twitter, LinkedIn and Facebook:

https://twitter.com/cruxinvestor

https://www.linkedin.com/company/crux...

https://www.facebook.com/cruxinvestor

- Nova Minerals - Lithium off-take? Large-scale Gold District. Nooooow Whaaaaaaat???????

5.920 Aufrufe

•23.11.2019

95

1

Teilen

Speichern

CRUX Investor

11.800 Abonnenten

Interview with Christopher Gerteisen, General Manager of Nova Minerals Ltd (ASX:NVA)

Nova Minerals is a minerals explorer and developer, listed on the ASX, focussed on district scale gold and advanced lithium projects in North America. Nova Minerals has 2 core projects: the flagship Estelle Gold Project, Alaska (poised for growth) and the Thompson Brothers Lithium-Cesium-Tantalum Project, Canada (cash flow ready). Lastly, Nova Minerals has a bonus project in the form of the Officer Hill Gold Project in Australia. All projects are in "safe, favourable jurisdictions."

Nova Minerals has had a fairly stagnant share price this year, reflective of poor lithium market performance, and unable to take full advantage of the rise in the gold price since August; Nova Minerals started the year at AUS$0.02, rode the rising gold price to a peak of AUS$0.07 in September, before falling back down to AUS$0.036 today. Nova has a market cap of AUS$33.55M.

Gerteisen states the management intends to take the project all the way, evidenced by the managements teams' large personal investments in the project. They intend to make it the "next world-class operation in Alaska."

Lithium has had poor spot price performance for the last couple of years, but Gerteisen is keen to emphasise Nova's unique position: dealing directly with a Chinese group and employing an offtake agreement helps avoid the unfavourable Western lithium markets in favour of a market where lithium is desperately needed to instigate the EV revolution and clean the incredibly polluted city air.

The Estelle Gold Project was obtained by Nova Minerals after the previous company ran into trouble courtesy of a falling zinc price. Nova Minerals began geophysics at the site in 2018. Based on their ground IP charge-ability results, they identified 4 "very strong anomalies:" Target A, B, C and D. These anomalies are consistent with historic drilling results. In June-August 2018, Nova carried out their own resource drilling programme over Target A and B. Based on these results, they defined their resource at 2.5Moz: 180M tons at 0.44g/t; this is a clear bulk play.

Nova Minerals is trying to avoid diluting as much as possible and are in conversations with potential partners across Australia and beyond. Ideally, Nova would like to obtain a strategic "cornerstone partner" in the form of a "big mining house" such as the giant Kinross Gold Corporation. Nova is confident they can operate year-round at their asset sites once the appropriate infrastructure has been put in place; one such consideration is the potential transportation of gold at the Estelle Gold site via train or truck.

Nova Minerals has a management team with vast experience in finances and construction, but there might be question marks posed regarding their experience at a mining company. However, Gerteisen is insistent Nova Minerals isn't a "lifestyle company." It is instead a "full endeavour" with an active intention to see it through to full success, "every cent" they can "put into the ground, they put into the ground."

Gerteisen concludes with Nova Mineral's USPs: a 20-30 year mine life, a district with a ubiquity of gold-filled mines, a committed management team and incredibly favourable jurisdictions.

What did you make of Christopher Gerteisen? Is Nova an exciting prospect, or is it an unrealistic proposition? Comment below and we may just ask your questions in the near future.

We Discuss:

0:53 - Company Overview

2:01 - Vision for the Business: What are They Trying to Create?

2:49 - Lithium: Overview of the Project, How Much it's Going to Cost and Who Will Fund it? Is This the Means of Funding Their Gold Projects?

14:53 - Estelle Gold Project: What Have They Got There and How are They Funding it?

20:47 - Finding Investors and Possible Partnership Deals

23:06 - The Jurisdiction and Drill Season Considerations

25:43 - Management Decision Making: What Should They be Focused on?

27:34 - Officer Hill Gold Project: Newmont JV, What's Going on and What are Their Plans for it

29:23 - Team Experience and Remuneration

30:42 - Why Should You Invest in Nova Minerals?

Company page: https://novaminerals.com.au/

Make smarter investment decisions, subscribe here: https://www.cruxinvestor.com

For FREE unbiased investment information, follow us on Twitter, LinkedIn and Facebook:

https://twitter.com/cruxinvestor

https://www.linkedin.com/company/crux...

https://www.facebook.com/cruxinvestor

von popeye

(ich mag den wert nicht der erzkörper ist mir zu klein)HighGold Mining

http://www.highgoldmining.com/news/2019/highgold-mining-dril…

http://www.highgoldmining.com/news/2019/highgold-mining-dril…

http://www.highgoldmining.com/news/2019/highgold-mining-retr…

http://www.highgoldmining.com/site/assets/files/6073/high_in…

http://www.gowebcasting.com/events/precious-metals-summit-co…

https://www.highgoldmining.com/projects/johnson-tract-projec…

Danakali

http://www.businesswire.com/news/home/20191216005296/en/AFC-…

http://www.africafc.org/Who-We-Are/An-Overview.aspx

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.draglobal.com/

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.earthmovingworldwide.com/

http://www.danakali.com.au/images/stories/research-report/20…

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.businesswire.com/news/home/20191216005296/en/AFC-…

http://www.africafc.org/Who-We-Are/An-Overview.aspx

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.draglobal.com/

http://www.danakali.com.au/images/stories/axs-announcements/…

http://www.earthmovingworldwide.com/

http://www.danakali.com.au/images/stories/research-report/20…

http://www.danakali.com.au/images/stories/axs-announcements/…

Emerald Resources NL

- Approval of Mineral Investment Agreement by Cambodian Council of Ministers, providing certainty and stability of the fiscal regime for the Okvau Gold Project development and operations

- Uplift in NPV, to US$337M(A$488M) and IRR, to 69%, following an internal evaluation of original key assumptions applied to DFS, demonstrates compelling economics of the Okvau Gold Project

- US$60M Project Facility with Sprott Private Resource Lending II L.P. (“Sprott”) for development of the Okvau Gold Project nearing finalisation

- Emerald is well positioned to capitalise on a unique development opportunity, with reduced fiscal risk and a well-credentialled gold project development team

http://sprott.com/media/2711/191126-emr-scp-fiscal-stability…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

http://www.cdc-crdb.gov.kh/

http://www.sprott.com/what-we-do/resource-financing/resource…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

- Approval of Mineral Investment Agreement by Cambodian Council of Ministers, providing certainty and stability of the fiscal regime for the Okvau Gold Project development and operations

- Uplift in NPV, to US$337M(A$488M) and IRR, to 69%, following an internal evaluation of original key assumptions applied to DFS, demonstrates compelling economics of the Okvau Gold Project

- US$60M Project Facility with Sprott Private Resource Lending II L.P. (“Sprott”) for development of the Okvau Gold Project nearing finalisation

- Emerald is well positioned to capitalise on a unique development opportunity, with reduced fiscal risk and a well-credentialled gold project development team

http://sprott.com/media/2711/191126-emr-scp-fiscal-stability…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

http://www.cdc-crdb.gov.kh/

http://www.sprott.com/what-we-do/resource-financing/resource…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

http://www.emeraldresources.com.au/sites/default/files/asx-a…

Excelsior Mining

http://www.excelsiormining.com/news/news-

2019/Excelsior_Mining_Receives_Approval_to_Start_Mining_Operations" target="_blank" rel="nofollow ugc noopener">http://www.excelsiormining.com/news/news-

2019/Excelsior_Mining_Receives_Approval_to_Start_Mining_Operations

http://www.epa.gov/

http://www.excelsiormining.com/news/news-

2019/Excelsior_Mining_Receives_Approval_to_Start_Mining_Operations" target="_blank" rel="nofollow ugc noopener">http://www.excelsiormining.com/news/news-

2019/Excelsior_Mining_Receives_Approval_to_Start_Mining_Operations

http://www.epa.gov/

Adriatic Metals

http://sprott.com/media/2696/191119-adt-scp-scoping-study.pd…

http://sprott.com/media/2728/191205-adt-scp-drilling-sfr-sha…

http://sprott.com/media/2663/adt-scp-site-visit-191023.pdf

http://www.investi.com.au/api/announcements/adt/2a330d2f-78e…

http://www.investi.com.au/api/announcements/adt/5aeae804-f3d…

http://www.investi.com.au/api/announcements/adt/82ccc90f-8b8…

http://www.investi.com.au/api/announcements/adt/6db25ffe-b5e…

http://sprott.com/media/2696/191119-adt-scp-scoping-study.pd…

http://sprott.com/media/2728/191205-adt-scp-drilling-sfr-sha…

http://sprott.com/media/2663/adt-scp-site-visit-191023.pdf

http://www.investi.com.au/api/announcements/adt/2a330d2f-78e…

http://www.investi.com.au/api/announcements/adt/5aeae804-f3d…

http://www.investi.com.au/api/announcements/adt/82ccc90f-8b8…

http://www.investi.com.au/api/announcements/adt/6db25ffe-b5e…

MRG Metals

http://www.asx.com.au/asxpdf/20190123/pdf/442161rr24rnf4.pdf

http://www.asx.com.au/asxpdf/20191216/pdf/44cm4fkl90zq58.pdf

http://www.asx.com.au/asxpdf/20191220/pdf/44crsb668vv8qq.pdf

http://www.asx.com.au/asxpdf/20191015/pdf/449hn2dt7xrcxz.pdf

http://www.asx.com.au/asxpdf/20190719/pdf/446qnyhmkcclgs.pdf

Die Aktie werde ich wahrscheinlich noch kaufen.

http://www.asx.com.au/asxpdf/20190123/pdf/442161rr24rnf4.pdf

http://www.asx.com.au/asxpdf/20191216/pdf/44cm4fkl90zq58.pdf

http://www.asx.com.au/asxpdf/20191220/pdf/44crsb668vv8qq.pdf

http://www.asx.com.au/asxpdf/20191015/pdf/449hn2dt7xrcxz.pdf

http://www.asx.com.au/asxpdf/20190719/pdf/446qnyhmkcclgs.pdf

Die Aktie werde ich wahrscheinlich noch kaufen.

GTEC Holdings

http://gtec.co/corporate/reports/GTEC_Sprott_Report_052119.p…

http://sprott.com/media/2618/gtec-092619.pdf

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

noch bei Research Reports:

http://www.wallstreet-online.de/diskussion/1233389-3241-3250…

http://gtec.co/corporate/reports/GTEC_Sprott_Report_052119.p…

http://sprott.com/media/2618/gtec-092619.pdf

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

http://www.gtec.co/wp-content/uploads/2019/07/GTEC_Sprott_Re…

noch bei Research Reports:

http://www.wallstreet-online.de/diskussion/1233389-3241-3250…

Kööönnten Sie Dies, ---->HIER<----, auuuuuch noch---->1n<----mal bei Machbarstudien her---->1n<----stellen

?

?

?

?

?

Steppe Gold

http://steppegold.com/steppe-golds-ato-mine-fully-permitted-…

http://steppegold.com/content/uploads/STGO-CorpPresentation.…

?

?

?

?

?

Steppe Gold

http://steppegold.com/steppe-golds-ato-mine-fully-permitted-…

http://steppegold.com/content/uploads/STGO-CorpPresentation.…

Niocorp Developments

https://www.niocorp.com/niocorp-secures-critical-local-permi…

https://johnsoncounty.ne.gov/

https://www.niocorp.com/niocorp-secures-extension-agreements-with-nebraska-landowners-for-the-proposed-elk-creek-superalloy-materials-project/

https://www.niocorp.com/niocorp-secures-critical-local-permi…

https://johnsoncounty.ne.gov/

https://www.niocorp.com/niocorp-secures-extension-agreements-with-nebraska-landowners-for-the-proposed-elk-creek-superalloy-materials-project/

Davenport Resources