starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 12)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 3

Gesamt: 279.140

Gesamt: 279.140

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 17:51 | 6642 | |

| vor 1 Stunde | 5336 | |

| vor 1 Stunde | 5256 | |

| heute 17:54 | 4283 | |

| vor 1 Stunde | 4239 | |

| heute 18:18 | 3049 | |

| vor 1 Stunde | 1986 | |

| heute 15:56 | 1682 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.767,81 | +0,26 | 143 | |||

| 2. | 3. | 0,2120 | +0,95 | 111 | |||

| 3. | Neu! | 8,2990 | +97,67 | 100 | |||

| 4. | 4. | 156,52 | -2,27 | 100 | |||

| 5. | 2. | 0,2660 | -14,19 | 56 | |||

| 6. | 14. | 5,7560 | -2,14 | 53 | |||

| 7. | 5. | 2,3605 | -7,99 | 50 | |||

| 8. | 7. | 6,8180 | +2,65 | 49 |

Antwort auf Beitrag Nr.: 58.832.390 von Popeye82 am 29.09.18 16:32:55CONFIRMS Thunderbird as ONE of the largest (undeveloped) (zircon-rich) HM deposits(globally) (meaning=worldwide), FURTHER enhanced by its location in one of the world’s (meaning=globally) BEST mining jurisdictions, one of the largest AND highest grade mineral sands discoveries in the LAST 30 YEARS, demonstrating GLOBALLY (meaning=worldwide) significance

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3096_0/MineralResource…

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3096_0/MineralResource…

Antwort auf Beitrag Nr.: 58.696.017 von MONSIEURCB am 13.09.18 23:19:18NUS gerade mit (D) Feasibility.

Könnte eng werden würde ich sagen.

Könnte eng werden würde ich sagen.

Antwort auf Beitrag Nr.: 58.654.347 von Popeye82 am 09.09.18 14:25:04High Grade Metals

www.asx.com.au/asxpdf/20181004/pdf/43yyrfn7v6t3pw.pdf

www.asx.com.au/asxpdf/20180927/pdf/43yqr8vv4hvs35.pdf

www.asx.com.au/asxpdf/20181004/pdf/43yyrfn7v6t3pw.pdf

www.asx.com.au/asxpdf/20180927/pdf/43yqr8vv4hvs35.pdf

Antwort auf Beitrag Nr.: 57.800.495 von Tirolesi am 21.05.18 07:55:09Tirolesi

Mal ne Frage: Wie WEIT wohnst Du denn von Leogang und Schellgaden entfernt??

Wenn Du willst, würd schon mal versuchen ob man Dir da 1,2,3 "Mitmach"tage organisieren kann.

Oder kannst Du auch Selber versuchen.

Keine Ahnung ob Das für Dich "passen würde", aber ich denke ist schon mal ziemlich spannend.

Den Dreckwühlern mal auf Die Finger zu gucken.

Und notfalls raufzuhauen.

Mal ne Frage: Wie WEIT wohnst Du denn von Leogang und Schellgaden entfernt??

Wenn Du willst, würd schon mal versuchen ob man Dir da 1,2,3 "Mitmach"tage organisieren kann.

Oder kannst Du auch Selber versuchen.

Keine Ahnung ob Das für Dich "passen würde", aber ich denke ist schon mal ziemlich spannend.

Den Dreckwühlern mal auf Die Finger zu gucken.

Und notfalls raufzuhauen.

Antwort auf Beitrag Nr.: 58.858.089 von Popeye82 am 03.10.18 01:26:58as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3068_0/IsabelNickelProjectUpdat…

https://gunvorgroup.com/en/

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3068_0/IsabelNickelProjectUpdat…

https://gunvorgroup.com/en/

Antwort auf Beitrag Nr.: 58.669.878 von Popeye82 am 11.09.18 13:37:16MOD Resources

www.modresources.com.au/sites/default/files/asx-announcement…

www.modresources.com.au/sites/default/files/asx-announcement…

Antwort auf Beitrag Nr.: 58.865.112 von Popeye82 am 04.10.18 02:44:36war letzte Woche in der Nähe von Leogang...

naja es sind schon ein paar Stunden,

falls sie angefangen haben zu puddeln

habe noch keine weiteren (Erzberge) usw

gesehen...

werde das im Auge behalten (HGM)

(HGM)

naja es sind schon ein paar Stunden,

falls sie angefangen haben zu puddeln

habe noch keine weiteren (Erzberge) usw

gesehen...

werde das im Auge behalten

(HGM)

(HGM)

Antwort auf Beitrag Nr.: 58.865.091 von Popeye82 am 04.10.18 02:08:50High Grade Metals

https://smallcaps.com.au/high-grade-metals-maiden-drilling-l…

https://hotcopper.com.au/threads/ann-drilling-commences-at-l…

https://smallcaps.com.au/high-grade-metals-maiden-drilling-l…

https://hotcopper.com.au/threads/ann-drilling-commences-at-l…

Antwort auf Beitrag Nr.: 58.711.642 von Popeye82 am 16.09.18 14:23:48Aurania Resources

www.aurania.com/2467-2/

www.aurania.com/2467-2/

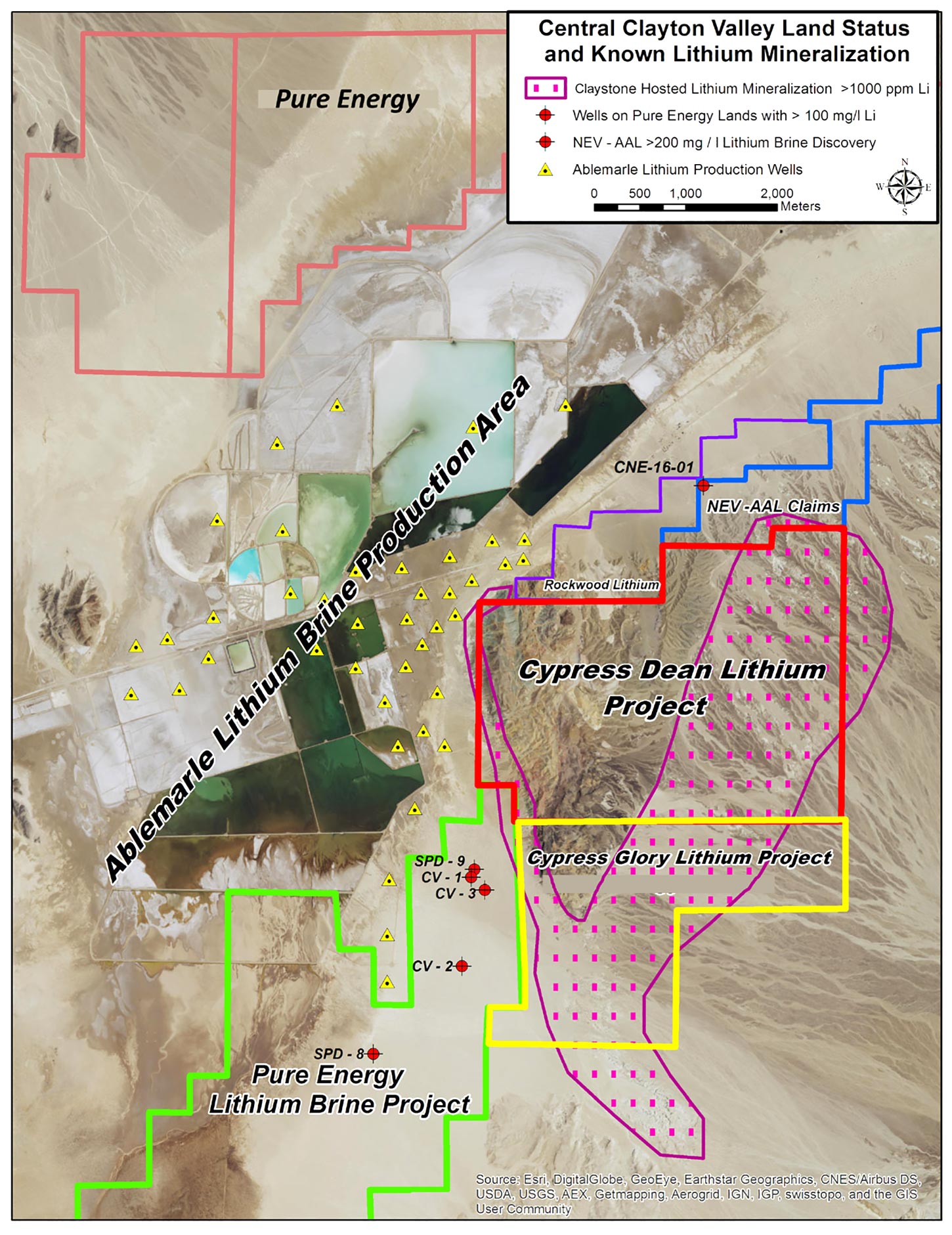

Antwort auf Beitrag Nr.: 58.851.714 von Popeye82 am 02.10.18 13:29:05kann EVT noch spannend werden.

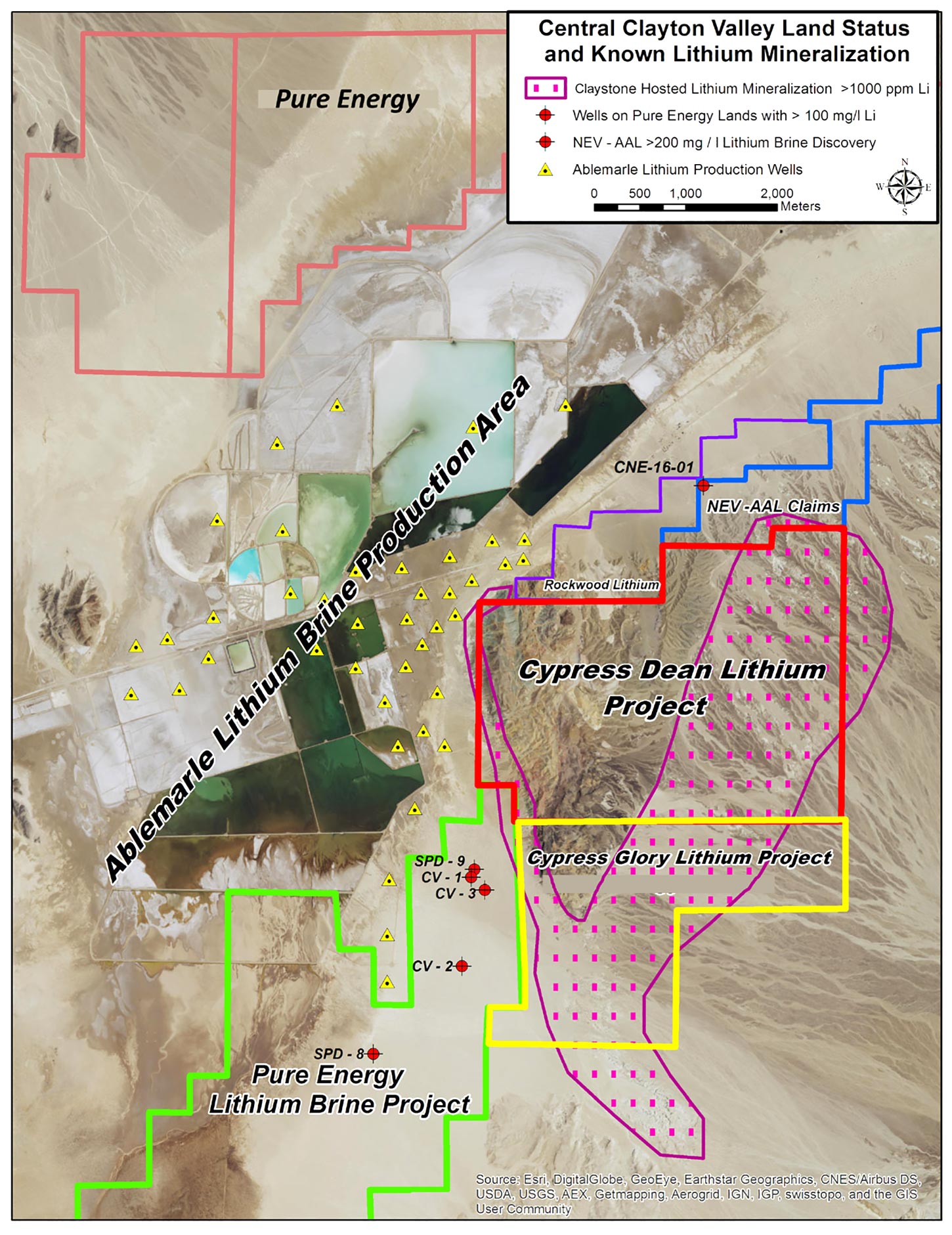

Cypress Development

www.cypressdevelopmentcorp.com/news/2018/cypress-development…

http://dajin.ca/en/home

Cypress Development

www.cypressdevelopmentcorp.com/news/2018/cypress-development…

http://dajin.ca/en/home

Antwort auf Beitrag Nr.: 58.795.235 von Popeye82 am 25.09.18 17:42:03Celsius Resources

http://clients3.weblink.com.au/pdf/CLA/02030789.pdf

http://www.kaibatla.co.za/

http://clients3.weblink.com.au/pdf/CLA/02028882.pdf

http://clients3.weblink.com.au/pdf/CLA/02030789.pdf

http://www.kaibatla.co.za/

http://clients3.weblink.com.au/pdf/CLA/02028882.pdf

Antwort auf Beitrag Nr.: 58.831.991 von Popeye82 am 29.09.18 14:36:31as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Harte Gold

hwww.hartegold.com/wp-content/uploads/2018/10/2018-24-3-Octo…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Harte Gold

hwww.hartegold.com/wp-content/uploads/2018/10/2018-24-3-Octo…

Antwort auf Beitrag Nr.: 58.831.910 von Popeye82 am 29.09.18 14:20:47Nzuri Copper

https://smallcaps.com.au/cobalt-supply-chain-transparency-hu…

https://smallcaps.com.au/cobalt-supply-chain-transparency-hu…

Antwort auf Beitrag Nr.: 58.871.481 von Popeye82 am 04.10.18 18:52:37der junge Mann soll nicht so traurig gucken... der soll sich um meine künftige Dividende kümmern.

Vom gucken wird mein Konto nicht voller...

Das mal ne einstellung tststs

Vom gucken wird mein Konto nicht voller...

Das mal ne einstellung tststs

Antwort auf Beitrag Nr.: 58.871.481 von Popeye82 am 04.10.18 18:52:37Nzuri Copper

www.asx.com.au/asxpdf/20181003/pdf/43yy08ks4998b0.pdf

www.asx.com.au/asxpdf/20181001/pdf/43yv27hkjy6krh.pdf

www.asx.com.au/asxpdf/20181003/pdf/43yy08ks4998b0.pdf

www.asx.com.au/asxpdf/20181001/pdf/43yv27hkjy6krh.pdf

Cobalt ist schon eines der dreckigsten Rohstoffe gelle ..

80% der Förderung ist doch von Kindern .. Wenn nicht mehr . Und jeder nimmt es so hin .

80% der Förderung ist doch von Kindern .. Wenn nicht mehr . Und jeder nimmt es so hin .

Antwort auf Beitrag Nr.: 58.871.586 von Boersiback am 04.10.18 19:03:15Sie scheinen ein Guter Kapitalist geworden zu sein.

Ich versuche Meine Moral nicht "total" über Bord zu werfen,

CNL z.B. halte ich aber trotzdem weiter.

Ich versuche Meine Moral nicht "total" über Bord zu werfen,

CNL z.B. halte ich aber trotzdem weiter.

Antwort auf Beitrag Nr.: 58.833.965 von Popeye82 am 29.09.18 23:21:59Lindian Resources

www.asx.com.au/asxpdf/20181004/pdf/43yystrxnr52hm.pdf

www.asx.com.au/asxpdf/20181004/pdf/43yystrxnr52hm.pdf

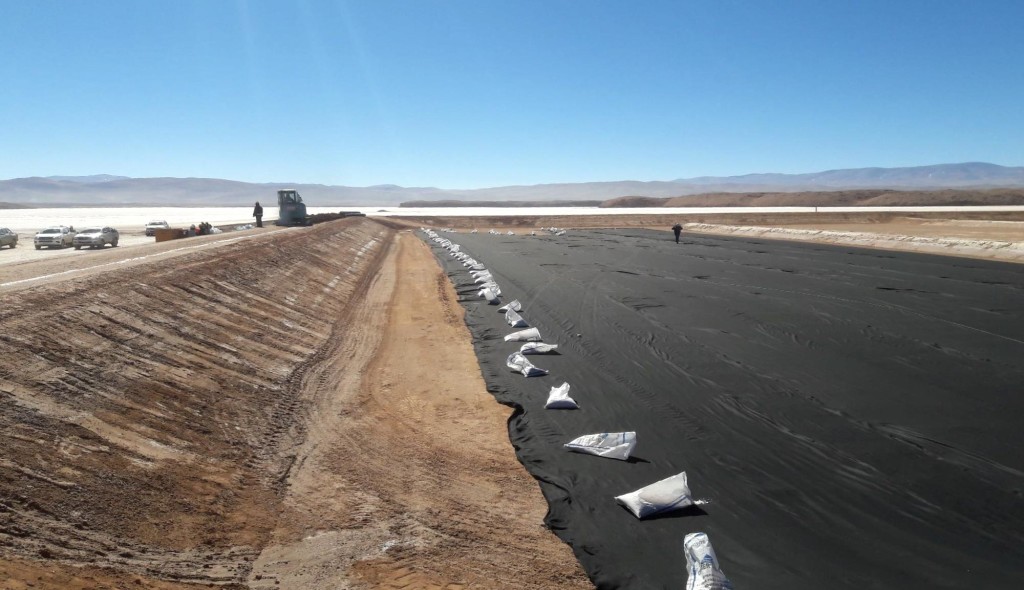

Antwort auf Beitrag Nr.: 58.762.531 von Popeye82 am 21.09.18 15:26:34LSC Lithium

- Allocation of gas capacity to support electricity and steam generation for 20ktpa lithium carbonate operation.

- Fresh water sources identified with quality confirmed for future operations.

- Commencement of geotechnical investigations for ponds and plant infrastructure covering approximately 800 ha in the Pozuelos salar.

- Completion of exploration camp which will be converted and expanded to a future operations camp.

- Application submitted for permit for brine pipeline corridor connecting Pastos Grandes and Pozuelos with approval expected in Q1 2019. This will secure the planned production mix of approximately 35% of brine from Pastos Grandes and 65% from Pozuelos, providing an efficient blend.

www.lsclithium.com/news-and-media/news-releases/press-releas…

- Allocation of gas capacity to support electricity and steam generation for 20ktpa lithium carbonate operation.

- Fresh water sources identified with quality confirmed for future operations.

- Commencement of geotechnical investigations for ponds and plant infrastructure covering approximately 800 ha in the Pozuelos salar.

- Completion of exploration camp which will be converted and expanded to a future operations camp.

- Application submitted for permit for brine pipeline corridor connecting Pastos Grandes and Pozuelos with approval expected in Q1 2019. This will secure the planned production mix of approximately 35% of brine from Pastos Grandes and 65% from Pozuelos, providing an efficient blend.

www.lsclithium.com/news-and-media/news-releases/press-releas…

Antwort auf Beitrag Nr.: 58.768.039 von Popeye82 am 22.09.18 01:17:15Plateau Energy Metals

www.juniorminingnetwork.com/junior-miner-news/press-releases…

www.ansto.gov.au/business/consultancy-and-expertise/minerals

www.juniorminingnetwork.com/junior-miner-news/press-releases…

www.ansto.gov.au/business/consultancy-and-expertise/minerals

Antwort auf Beitrag Nr.: 58.739.182 von Popeye82 am 19.09.18 15:40:02Orca Gold

http://orcagold.com/news/news-releases/2018/orca-gold-announ…

www.infobel.com/en/australia/mpr_geological_consultants_pty_…

www.alsglobal.com/services-and-products/metallurgy

http://orcagold.com/news/news-releases/2018/orca-gold-announ…

www.infobel.com/en/australia/mpr_geological_consultants_pty_…

www.alsglobal.com/services-and-products/metallurgy

Antwort auf Beitrag Nr.: 58.684.374 von Popeye82 am 12.09.18 19:16:38BlueJay Mining

www.eng.geus.dk/media/19979/nr40_p001-239.pdf

www.eng.geus.dk/products-services-facilities/publications/ge…

www.eng.geus.dk/media/19979/nr40_p001-239.pdf

www.eng.geus.dk/products-services-facilities/publications/ge…

Antwort auf Beitrag Nr.: 58.873.710 von Popeye82 am 04.10.18 23:06:51Ernsthafte Frage:

nach dem Kursrückgang nun...

Darf ich die jetzt kaufen ??

Wollte schon immer mal, hatte aber kursangst da oben.

sie haben nur 17% getestet soweit ich weiss vom ganzen kuchen.

zudem gäbs noch ein interessantes Ni-Cu-projekt.

(ist halt grönland aber nicht so fies im norden wie ironbark)

nach dem Kursrückgang nun...

Darf ich die jetzt kaufen ??

Wollte schon immer mal, hatte aber kursangst da oben.

sie haben nur 17% getestet soweit ich weiss vom ganzen kuchen.

zudem gäbs noch ein interessantes Ni-Cu-projekt.

(ist halt grönland aber nicht so fies im norden wie ironbark)

Antwort auf Beitrag Nr.: 58.873.710 von Popeye82 am 04.10.18 23:06:51

Bluejay Mining delays its PFS for a more encompassing report

Antwort auf Beitrag Nr.: 58.873.782 von Boersiback am 04.10.18 23:23:39solche nachrichten liebe ich wenn ich dann 60% tiefer zum zug komme

Antwort auf Beitrag Nr.: 58.857.588 von Popeye82 am 02.10.18 23:08:01Pilbara Minerals

Battery prices are plunging and that could drive an electric car industry in Australia; The cost of lithium batteries could drop up to 95 per cent

in the next decade, leading to a dramatic

in the next decade, leading to a dramatic expansion in opportunities

expansion in opportunities

related to electric cars, says the boss of one of Australia’s newest electric vehicle companies

related to electric cars, says the boss of one of Australia’s newest electric vehicle companies

https://stockhead.com.au/tech/battery-prices-are-plunging-an…

" Battery prices are plunging and that could drive an electric car industry in Australia

Tech

37 minutes ago | Rachel Williamson

The cost of lithium batteries could drop up to 95 per cent in the next decade, leading to a dramatic expansion in opportunities related to electric cars, says the boss of one of Australia’s newest electric vehicle companies.

Right now batteries are among the most expensive components in electric cars. That’s been a major drag on sales — and has limited the market for batteries and related materials.

But that’s about to change says Tony Fairweather, managing director of Melbourne electric vehicle (EV) retrofitter SEA Electric.

SEA Electric retrofits commercial trucks and vans to electric power.

Smaller, cheaper and more energy-dense batteries mean Mr Fairweather’s business can retrofit an increasing variety of vehicles.

The energy density of batteries has improved by a third in the last year — and that’s a key reason why new EV businesses like SEA are taking off says Mr Fairweather.

“This is going to turn the commercial vehicle manufacturing space on its head,” he said at this week’s All Energy conference in Melbourne.

“[Manufacturers] are actively scrambling to find a position in the EV space.”

A truck retrofitted with an electric drive train by SEA Electric. Pic: Stockhead

SEA is one type of EV company that a new government committee focusing on the technology reckons might be Australia’s way into the sector, as the country plays catch-up in the battery race.

South Australia Senator Tim Storer, who chairs the committee, says he’s hoping to have a report by December that can guide Australia’s transition to EVs and support the industries behind that.

There’s no consideration of a return to large-scale car manufacturing in Australia — but there are opportunities throughout the EV supply chain, he says.

That includes niche products like Precision Buses’ electric buses in South Australia, Queensland fast-charger maker Tritium, battery factories like Magnis Resources (ASX:MNS) which wants to build a Queensland plant, and even WA’s proposed ‘Lithium Valley’ which will develop Australia’s raw materials into batteries.

Already the latter process is happening: Lithium Australia and Lepidico are trying to produce battery grade lithium from mine waste.

Another example is Olivers Food (ASX:OLI) – a roadside retailer that is building Tesla EV chargers in its car parks.

EVs are bigger in Australia than you think

While most EV-related activity in the ASX-listed sector is limited to upstream exploration for battery commodities, a lot is happening elsewhere to advance the Australian market.

Fast charger network installers like Everty, EV products seller GelCo, and EV bus seller Carbridge as well as backers like the NRMA are all working to ensure that Australia is prepared for EVs as battery prices fall and cheaper EV models arrive.

Mr Fairweather says there are three areas of opportunity for EVs: passenger vehicles, high-end cars, and commercial vehicles.

Commercial is where the fastest uptake is — as businesses begin to convert their fleets to electric, he says.

A rubbish truck retrofitted with an electric drivetrain by SEA Electric. Pic: Stockhead

One of the biggest factors in EV prices — and therefore uptake — is public policy.

The federal government will consider how to manage a fall in excise tax on petrol and what to replace it with, how to best support EV purchases, and how to manage the fact that by 2040 11 per cent of Australia’s total energy consumption is expected to be from EVs, says Senator Storer.

EV prices should start to come down significantly — in part because of policy efforts — from 2020, he believes.

Can Australia become a battery producer?

While countries like China, Japan, the US and South Korea have already stolen a march on battery development and production, an impending battery shortage means new gigafactories are still needed.

There are some 45 gigfactories around the world – plants that make lithium ion batteries – driving demand for lithium, nickel and graphite.

Australia has potential to “move up the value chain” to start refining lithium for global markets, according to the Australian Office of the Chief Economist’s September Quarterly Report.

“More than $3 billion is committed to the development of facilities that will supply lithium hydroxide to the electric vehicle market, and the number of full-time workers on lithium projects in Western Australia has increased from 399 in December 2014 to more than 2600, with thousands more to come,” the report said.

“Australia’s prospects for entry into this market are mixed. Australia would likely need to be strongly established at all previous stages of the supply chain in order to position itself for battery.”

A new port in Kwinana, the fact that Australia has all 35 minerals used in lithium batteries, and research in West Australia into cathodes are advantageous, but it needs to be back by government policy supporting the whole supply chain."

Battery prices are plunging and that could drive an electric car industry in Australia; The cost of lithium batteries could drop up to 95 per cent

in the next decade, leading to a dramatic

in the next decade, leading to a dramatic expansion in opportunities

expansion in opportunities

related to electric cars, says the boss of one of Australia’s newest electric vehicle companies

related to electric cars, says the boss of one of Australia’s newest electric vehicle companies

https://stockhead.com.au/tech/battery-prices-are-plunging-an…

" Battery prices are plunging and that could drive an electric car industry in Australia

Tech

37 minutes ago | Rachel Williamson

The cost of lithium batteries could drop up to 95 per cent in the next decade, leading to a dramatic expansion in opportunities related to electric cars, says the boss of one of Australia’s newest electric vehicle companies.

Right now batteries are among the most expensive components in electric cars. That’s been a major drag on sales — and has limited the market for batteries and related materials.

But that’s about to change says Tony Fairweather, managing director of Melbourne electric vehicle (EV) retrofitter SEA Electric.

SEA Electric retrofits commercial trucks and vans to electric power.

Smaller, cheaper and more energy-dense batteries mean Mr Fairweather’s business can retrofit an increasing variety of vehicles.

The energy density of batteries has improved by a third in the last year — and that’s a key reason why new EV businesses like SEA are taking off says Mr Fairweather.

“This is going to turn the commercial vehicle manufacturing space on its head,” he said at this week’s All Energy conference in Melbourne.

“[Manufacturers] are actively scrambling to find a position in the EV space.”

A truck retrofitted with an electric drive train by SEA Electric. Pic: Stockhead

SEA is one type of EV company that a new government committee focusing on the technology reckons might be Australia’s way into the sector, as the country plays catch-up in the battery race.

South Australia Senator Tim Storer, who chairs the committee, says he’s hoping to have a report by December that can guide Australia’s transition to EVs and support the industries behind that.

There’s no consideration of a return to large-scale car manufacturing in Australia — but there are opportunities throughout the EV supply chain, he says.

That includes niche products like Precision Buses’ electric buses in South Australia, Queensland fast-charger maker Tritium, battery factories like Magnis Resources (ASX:MNS) which wants to build a Queensland plant, and even WA’s proposed ‘Lithium Valley’ which will develop Australia’s raw materials into batteries.

Already the latter process is happening: Lithium Australia and Lepidico are trying to produce battery grade lithium from mine waste.

Another example is Olivers Food (ASX:OLI) – a roadside retailer that is building Tesla EV chargers in its car parks.

EVs are bigger in Australia than you think

While most EV-related activity in the ASX-listed sector is limited to upstream exploration for battery commodities, a lot is happening elsewhere to advance the Australian market.

Fast charger network installers like Everty, EV products seller GelCo, and EV bus seller Carbridge as well as backers like the NRMA are all working to ensure that Australia is prepared for EVs as battery prices fall and cheaper EV models arrive.

Mr Fairweather says there are three areas of opportunity for EVs: passenger vehicles, high-end cars, and commercial vehicles.

Commercial is where the fastest uptake is — as businesses begin to convert their fleets to electric, he says.

A rubbish truck retrofitted with an electric drivetrain by SEA Electric. Pic: Stockhead

One of the biggest factors in EV prices — and therefore uptake — is public policy.

The federal government will consider how to manage a fall in excise tax on petrol and what to replace it with, how to best support EV purchases, and how to manage the fact that by 2040 11 per cent of Australia’s total energy consumption is expected to be from EVs, says Senator Storer.

EV prices should start to come down significantly — in part because of policy efforts — from 2020, he believes.

Can Australia become a battery producer?

While countries like China, Japan, the US and South Korea have already stolen a march on battery development and production, an impending battery shortage means new gigafactories are still needed.

There are some 45 gigfactories around the world – plants that make lithium ion batteries – driving demand for lithium, nickel and graphite.

Australia has potential to “move up the value chain” to start refining lithium for global markets, according to the Australian Office of the Chief Economist’s September Quarterly Report.

“More than $3 billion is committed to the development of facilities that will supply lithium hydroxide to the electric vehicle market, and the number of full-time workers on lithium projects in Western Australia has increased from 399 in December 2014 to more than 2600, with thousands more to come,” the report said.

“Australia’s prospects for entry into this market are mixed. Australia would likely need to be strongly established at all previous stages of the supply chain in order to position itself for battery.”

A new port in Kwinana, the fact that Australia has all 35 minerals used in lithium batteries, and research in West Australia into cathodes are advantageous, but it needs to be back by government policy supporting the whole supply chain."

Antwort auf Beitrag Nr.: 58.873.752 von Boersiback am 04.10.18 23:17:37Ernsthafte Frage:

nach dem Kursrückgang nun...

Darf ich die jetzt kaufen ??

Wollte schon immer mal, hatte aber kursangst da oben.

sie haben nur 17% getestet soweit ich weiss vom ganzen kuchen.

zudem gäbs noch ein interessantes Ni-Cu-projekt.

(ist halt grönland aber nicht so fies im norden wie ironbark)

_________________________________________

Gute Frage, ich versuche es mal mit Einer Antwort.

Wird aber 2 Schluck dauern.

P.S.

Kannst ruhig öfter mal ernsthafte Fragen stellen.

Ist ungewohnt, aber steht Dir gut zu Gesicht.

BEM und FYI hast Du schon??

nach dem Kursrückgang nun...

Darf ich die jetzt kaufen ??

Wollte schon immer mal, hatte aber kursangst da oben.

sie haben nur 17% getestet soweit ich weiss vom ganzen kuchen.

zudem gäbs noch ein interessantes Ni-Cu-projekt.

(ist halt grönland aber nicht so fies im norden wie ironbark)

_________________________________________

Gute Frage, ich versuche es mal mit Einer Antwort.

Wird aber 2 Schluck dauern.

P.S.

Kannst ruhig öfter mal ernsthafte Fragen stellen.

Ist ungewohnt, aber steht Dir gut zu Gesicht.

BEM und FYI hast Du schon??

Antwort auf Beitrag Nr.: 58.873.986 von Popeye82 am 05.10.18 00:27:44FYI ja, BEM nicht, und Black Rock Mining auch noch nicht wieder

beide im geiste dabei und mit absichten. walkabout hab ich auch nicht wieder gekauft.

geht so die richtung 2 aus 3 und ist gegrübel derzeit

hab im sektor nur Graphex, Sovereign, First Graphene (die halbe portion) und Talga

BlueJay steht mal die order bei geigen 11 GBp...

die verzögerung und das drumrum ist schon ein bischen schluckauf aber im wesentlichen kein grund für diesen extremabschlag... das ist dann doch sehr sehr verlockend da reinzuhuschen und den moment zu nutzen

beide im geiste dabei und mit absichten. walkabout hab ich auch nicht wieder gekauft.

geht so die richtung 2 aus 3 und ist gegrübel derzeit

hab im sektor nur Graphex, Sovereign, First Graphene (die halbe portion) und Talga

BlueJay steht mal die order bei geigen 11 GBp...

die verzögerung und das drumrum ist schon ein bischen schluckauf aber im wesentlichen kein grund für diesen extremabschlag... das ist dann doch sehr sehr verlockend da reinzuhuschen und den moment zu nutzen

Antwort auf Beitrag Nr.: 58.566.449 von Popeye82 am 30.08.18 00:36:24as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Alphamin Resources

www.alphaminresources.com/alphamin-receives-approval-for-dra…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Alphamin Resources

www.alphaminresources.com/alphamin-receives-approval-for-dra…

Antwort auf Beitrag Nr.: 58.777.592 von Popeye82 am 23.09.18 23:48:38Technology Metals Australia

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

www.proactiveinvestors.com.au/companies/news/205926/technolo…

www.miningnews.net/project-finance/news/1347560/tmt-raises-u…

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

www.proactiveinvestors.com.au/companies/news/205926/technolo…

www.miningnews.net/project-finance/news/1347560/tmt-raises-u…

www.tmtlimited.com.au/sites/default/files/asx-announcements/…

Antwort auf Beitrag Nr.: 58.491.840 von Popeye82 am 20.08.18 20:27:14as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

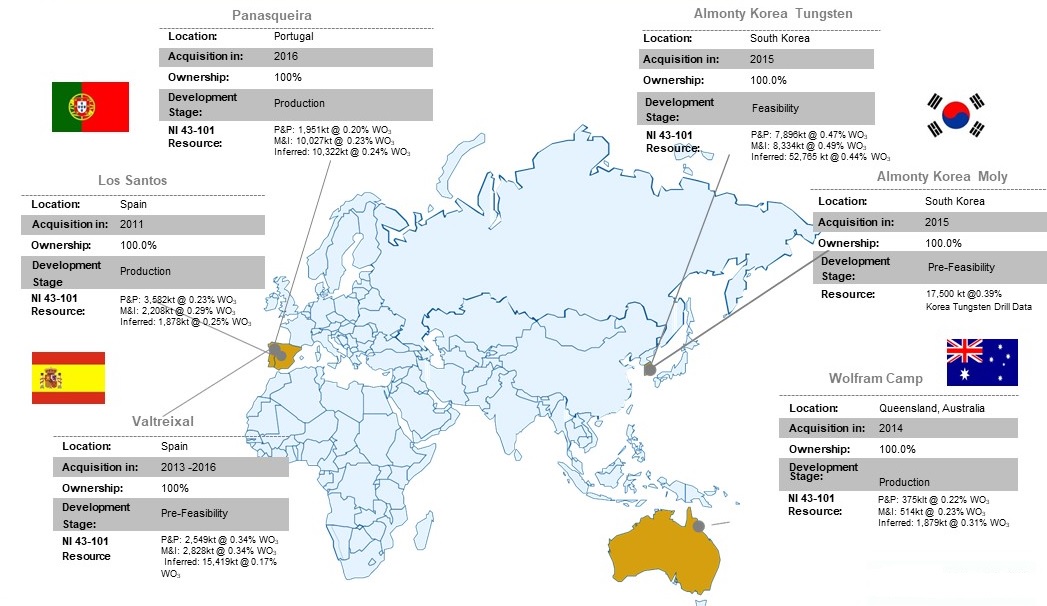

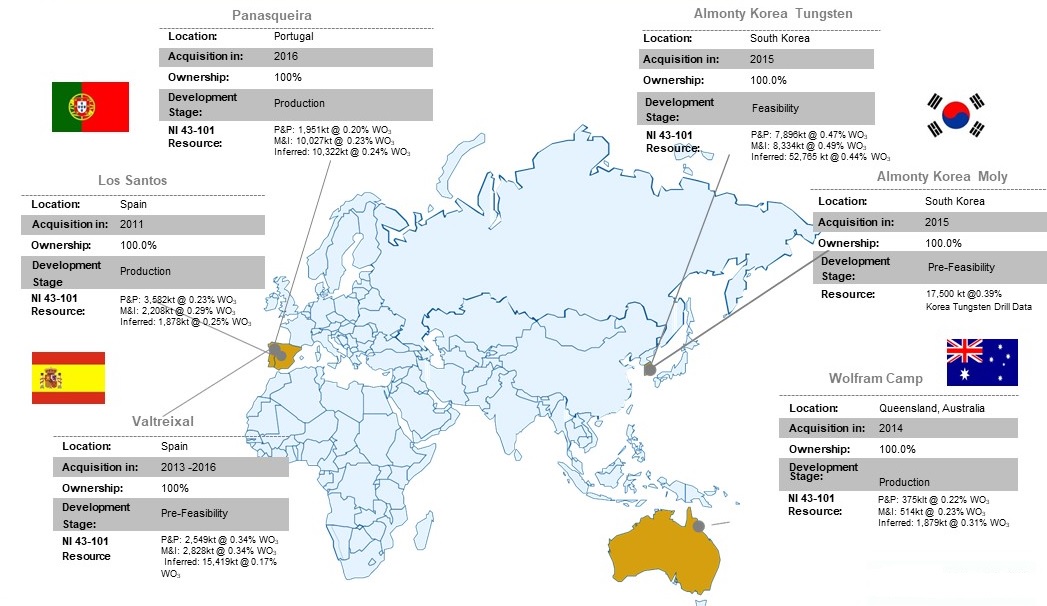

Almonty Industries

www.almonty.com/_resources/AII_NR181004.pdf

http://www.kfw-ipex-bank.de/Internationale-Finanzierung/KfW-…

http://www.oekb.at/

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Almonty Industries

www.almonty.com/_resources/AII_NR181004.pdf

http://www.kfw-ipex-bank.de/Internationale-Finanzierung/KfW-…

http://www.oekb.at/

Antwort auf Beitrag Nr.: 58.838.313 von Popeye82 am 01.10.18 02:45:57as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

New Century Resources

https://wcsecure.weblink.com.au/pdf/NCZ/02031132.pdf

http://www.portsnorth.com.au/karumba/

http://www.seatransport.com/transhipment-vessels/

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

New Century Resources

https://wcsecure.weblink.com.au/pdf/NCZ/02031132.pdf

http://www.portsnorth.com.au/karumba/

http://www.seatransport.com/transhipment-vessels/

Antwort auf Beitrag Nr.: 58.874.004 von Boersiback am 05.10.18 00:32:24

mal ne persönliche frage, falls gestattet!?

sind sie die selbe person oder haben sie ihren account verkauft?

falls der selbe, können sie sich noch an ihr versprechen errinnern, die nächsten jahre dem rohstoffsektor den rücken zu kehren? können sie ihr hin und her mal kurz rational beleuchten?

Zitat von Boersiback: FYI ja, BEM nicht, und Black Rock Mining auch noch nicht wieder

beide im geiste dabei und mit absichten. walkabout hab ich auch nicht wieder gekauft.

geht so die richtung 2 aus 3 und ist gegrübel derzeit

hab im sektor nur Graphex, Sovereign, First Graphene (die halbe portion) und Talga

BlueJay steht mal die order bei geigen 11 GBp...

die verzögerung und das drumrum ist schon ein bischen schluckauf aber im wesentlichen kein grund für diesen extremabschlag... das ist dann doch sehr sehr verlockend da reinzuhuschen und den moment zu nutzen

mal ne persönliche frage, falls gestattet!?

sind sie die selbe person oder haben sie ihren account verkauft?

falls der selbe, können sie sich noch an ihr versprechen errinnern, die nächsten jahre dem rohstoffsektor den rücken zu kehren? können sie ihr hin und her mal kurz rational beleuchten?

Antwort auf Beitrag Nr.: 58.346.412 von Popeye82 am 01.08.18 03:35:47Salt Lake Potash

www.investi.com.au/api/announcements/so4/3f1df56b-f01.pdf

http://www.australianpotash.com.au/

www.investi.com.au/api/announcements/so4/3f1df56b-f01.pdf

http://www.australianpotash.com.au/

Antwort auf Beitrag Nr.: 58.876.671 von sir_krisowaritschko am 05.10.18 11:38:16

die Welt dreht sich schnelllllllll.

die Welt dreht sich schnelllllllll.

Antwort auf Beitrag Nr.: 58.613.595 von Popeye82 am 04.09.18 18:28:04Ironbark Zinc

http://files.clickdimensions.com/pslcomau-avndp/files/ibg181…

http://files.clickdimensions.com/pslcomau-avndp/files/ibg181…

Antwort auf Beitrag Nr.: 58.876.671 von sir_krisowaritschko am 05.10.18 11:38:16

ja, ich bin derselbe, oder auch nicht

Aufmerksam zuhören.... es geht um das Ding von Jung....

Zitat von sir_krisowaritschko:Zitat von Boersiback: FYI ja, BEM nicht, und Black Rock Mining auch noch nicht wieder

beide im geiste dabei und mit absichten. walkabout hab ich auch nicht wieder gekauft.

geht so die richtung 2 aus 3 und ist gegrübel derzeit

hab im sektor nur Graphex, Sovereign, First Graphene (die halbe portion) und Talga

BlueJay steht mal die order bei geigen 11 GBp...

die verzögerung und das drumrum ist schon ein bischen schluckauf aber im wesentlichen kein grund für diesen extremabschlag... das ist dann doch sehr sehr verlockend da reinzuhuschen und den moment zu nutzen

mal ne persönliche frage, falls gestattet!?

sind sie die selbe person oder haben sie ihren account verkauft?

falls der selbe, können sie sich noch an ihr versprechen errinnern, die nächsten jahre dem rohstoffsektor den rücken zu kehren? können sie ihr hin und her mal kurz rational beleuchten?

ja, ich bin derselbe, oder auch nicht

Aufmerksam zuhören.... es geht um das Ding von Jung....

Antwort auf Beitrag Nr.: 58.877.517 von Popeye82 am 05.10.18 12:53:19Salt Lake Potash

www.investi.com.au/api/announcements/so4/4d9e0b23-647.pdf

http://www.sinofert.com/en/5589.html

www.investi.com.au/api/announcements/so4/00b56c4a-d74.pdf

www.investi.com.au/api/announcements/so4/4d9e0b23-647.pdf

http://www.sinofert.com/en/5589.html

www.investi.com.au/api/announcements/so4/00b56c4a-d74.pdf

Antwort auf Beitrag Nr.: 58.880.358 von Boersiback am 05.10.18 17:40:04ja, ich bin derselbe, oder auch nicht

Aufmerksam zuhören.... es geht um das Ding von Jung....

_________________________________________________

Nur nochmal zum Verständnis:

Also Sie sind der BISEXUELLE PEACETERMINATOR????????????????????????????????????

(Der den "Inneren Amerikaner"(ist Das jetzt wieder Eine Sextechnik, oder Irgendwas Anderes?) aus Allen rausholen will)

Aufmerksam zuhören.... es geht um das Ding von Jung....

_________________________________________________

Nur nochmal zum Verständnis:

Also Sie sind der BISEXUELLE PEACETERMINATOR????????????????????????????????????

(Der den "Inneren Amerikaner"(ist Das jetzt wieder Eine Sextechnik, oder Irgendwas Anderes?) aus Allen rausholen will)

Antwort auf Beitrag Nr.: 58.881.738 von Popeye82 am 05.10.18 19:58:53

also das mit dem Amerikaner kann ich auch nachvollziehen...

aus mir kommt jeden Tag einer raus...

also das mit dem Amerikaner kann ich auch nachvollziehen...

aus mir kommt jeden Tag einer raus...

Antwort auf Beitrag Nr.: 58.576.787 von Popeye82 am 30.08.18 22:01:38Trilogy Metals

https://trilogymetals.com/news/2018/trilogy-metals-reports-t…

https://trilogymetals.com/news/2018/trilogy-metals-reports-t…

Antwort auf Beitrag Nr.: 58.838.067 von Popeye82 am 30.09.18 22:58:23Sirius Minerals Plc

www.proactiveinvestors.co.uk/companies/market_reports/206467…

www.proactiveinvestors.co.uk/companies/market_reports/206467…

Antwort auf Beitrag Nr.: 58.882.260 von Boersiback am 05.10.18 20:58:01Was haben SIE denn Heute gegessen

Antwort auf Beitrag Nr.: 58.883.244 von Popeye82 am 05.10.18 22:39:15An Der Firma Interessierte GUT lesen.

Sirius Minerals

Sirius Minerals project and funding timelines put under City microscope; The UK mine developer should have sufficient funds to bring its project through the second quarter of 2019, meanwhile, stage two financing efforts are underway 11:20 28 Sep 2018

www.proactiveinvestors.co.uk/companies/news/205876/sirius-mi…

"Sirius is seeking £2.6-£2.7bn

The clock is ticking for Sirius Minerals PLC (LON:SXX) so far as the second phase of financing for the giant Woodsmith potash mine is concerned, based on analysis carried out by Shore Capital.

The interim results statement revealed the company was sitting on just over £323mln as at June 30, having spent £148mln on the North Yorkshire project in the first six months of 2018.

That was augmented with £190mln-worth of royalty financing.

This is sufficient to get Sirius into the second-quarter of 2019 based on the current work schedule, according to Shore.

“At this point, proceeds from the stage-2 senior debt financing would be required,” the broker explained.

“Alternatively, curtailing of discretionary expenditure from the first quarter of 2019 would enable Sirius to operate into late 2019 or early 2020 without any Stage 2 financing proceeds.”

Sirius is currently seeking a further £2.6-£2.7bn (US$3.4-US$3.6bn) from lenders for the Woodsmith project, which has been revised up by £300-£460mln.

“A number of financing alternatives to fund the increased capital requirement are under active consideration,” the company said.

The expenditure involved makes Woodsmith, which is being dug to a depth of over a mile and which will include a 23-mile tunnel to an export terminal on the River Tees, one of the most ambitious civil engineering projects undertaken by the private sector in the UK in recent years.

Work to date has involved diaphragm walling on the service, the shaft has been completed, while the excavation of the service shaft foreshaft is now underway and is expected to be completed in the fourth quarter.

Broker Liberum said the “key drivers” going forward would be a European off-take, expected before the end of October, and the finalising of that stage-2 financing package.

It rates the stock a ‘buy’, up 50p a share. Currently, the stock is changing hands for around 30p, valuing the business at £1.37bn."

Sirius Minerals

Sirius Minerals project and funding timelines put under City microscope; The UK mine developer should have sufficient funds to bring its project through the second quarter of 2019, meanwhile, stage two financing efforts are underway 11:20 28 Sep 2018

www.proactiveinvestors.co.uk/companies/news/205876/sirius-mi…

"Sirius is seeking £2.6-£2.7bn

The clock is ticking for Sirius Minerals PLC (LON:SXX) so far as the second phase of financing for the giant Woodsmith potash mine is concerned, based on analysis carried out by Shore Capital.

The interim results statement revealed the company was sitting on just over £323mln as at June 30, having spent £148mln on the North Yorkshire project in the first six months of 2018.

That was augmented with £190mln-worth of royalty financing.

This is sufficient to get Sirius into the second-quarter of 2019 based on the current work schedule, according to Shore.

“At this point, proceeds from the stage-2 senior debt financing would be required,” the broker explained.

“Alternatively, curtailing of discretionary expenditure from the first quarter of 2019 would enable Sirius to operate into late 2019 or early 2020 without any Stage 2 financing proceeds.”

Sirius is currently seeking a further £2.6-£2.7bn (US$3.4-US$3.6bn) from lenders for the Woodsmith project, which has been revised up by £300-£460mln.

“A number of financing alternatives to fund the increased capital requirement are under active consideration,” the company said.

The expenditure involved makes Woodsmith, which is being dug to a depth of over a mile and which will include a 23-mile tunnel to an export terminal on the River Tees, one of the most ambitious civil engineering projects undertaken by the private sector in the UK in recent years.

Work to date has involved diaphragm walling on the service, the shaft has been completed, while the excavation of the service shaft foreshaft is now underway and is expected to be completed in the fourth quarter.

Broker Liberum said the “key drivers” going forward would be a European off-take, expected before the end of October, and the finalising of that stage-2 financing package.

It rates the stock a ‘buy’, up 50p a share. Currently, the stock is changing hands for around 30p, valuing the business at £1.37bn."

Antwort auf Beitrag Nr.: 58.883.598 von Popeye82 am 06.10.18 00:37:56ONE of the most ambitious civil engineering projects undertaken, by the private sector in the UK in recent years

Sirius Minerals

www.proactiveinvestors.co.uk/companies/news/205831/sirius-mi…

"Sirius Minerals says a number of financing alternatives are on the table as mine build continues; £148mln was spent in the first-half developing the giant potash project

13:37 27 Sep 2018

Sirius Minerals says a number of financing alternatives are on the table as mine build continues

Sirius spending - Construction is now well underway at the Woodsmith Mine

Sirius Minerals PLC (LON:SXX) is burning through over £800,000 a day as it develops the giant Woodsmith potash mine in North Yorkshire with the cash spent on the project in the six months to June 30 totalling £148mln.

It left the company with £323mln in cash and equivalents at the period-end. Recently Sirius tied up royalty funding of a further £190mln (US$250mln), which provides it with breathing space to find the second, debt-funded round of investment.

Sirius is now seeking £2.6-£2.7bn (US$3.4-US$3.6bn) from lenders, which has been revised up £300-£460mln.

“A number of financing alternatives to fund the increased capital requirement are under active consideration,” the company said.

The expenditure involved makes Woodsmith, which is being dug to a depth of over a mile and which will include a 23-mile tunnel to an export terminal on the River Tees, one of the most ambitious civil engineering projects undertaken by the private sector in the UK in recent years.

To date diaphragm walling on the service, the shaft has been completed, while the excavation of the service shaft foreshaft is now underway and is expected to be completed in the fourth quarter.

Still on track

The plans is to ship the first POLY4 fertiliser in 2021.

The product has required a significant marketing effort to generate orders to ensure Woodsmith is financially viable.

Recently Sirius signed its largest supply agreement to date – for 2.5mln tonnes per year – for key markets in South America.

This has taken total contract volumes to 8.2mln tonnes a year.

"The announcement of our largest supply agreement to date with Cibra, Brazil's sixth largest fertilizer distributor, has enabled us to exceed the target peak aggregate POLY4 take-or-pay volumes intended to support stage-two financing and further agreements are expected to be completed soon,” said managing director Chris Fraser."

Sirius Minerals

www.proactiveinvestors.co.uk/companies/news/205831/sirius-mi…

"Sirius Minerals says a number of financing alternatives are on the table as mine build continues; £148mln was spent in the first-half developing the giant potash project

13:37 27 Sep 2018

Sirius Minerals says a number of financing alternatives are on the table as mine build continues

Sirius spending - Construction is now well underway at the Woodsmith Mine

Sirius Minerals PLC (LON:SXX) is burning through over £800,000 a day as it develops the giant Woodsmith potash mine in North Yorkshire with the cash spent on the project in the six months to June 30 totalling £148mln.

It left the company with £323mln in cash and equivalents at the period-end. Recently Sirius tied up royalty funding of a further £190mln (US$250mln), which provides it with breathing space to find the second, debt-funded round of investment.

Sirius is now seeking £2.6-£2.7bn (US$3.4-US$3.6bn) from lenders, which has been revised up £300-£460mln.

“A number of financing alternatives to fund the increased capital requirement are under active consideration,” the company said.

The expenditure involved makes Woodsmith, which is being dug to a depth of over a mile and which will include a 23-mile tunnel to an export terminal on the River Tees, one of the most ambitious civil engineering projects undertaken by the private sector in the UK in recent years.

To date diaphragm walling on the service, the shaft has been completed, while the excavation of the service shaft foreshaft is now underway and is expected to be completed in the fourth quarter.

Still on track

The plans is to ship the first POLY4 fertiliser in 2021.

The product has required a significant marketing effort to generate orders to ensure Woodsmith is financially viable.

Recently Sirius signed its largest supply agreement to date – for 2.5mln tonnes per year – for key markets in South America.

This has taken total contract volumes to 8.2mln tonnes a year.

"The announcement of our largest supply agreement to date with Cibra, Brazil's sixth largest fertilizer distributor, has enabled us to exceed the target peak aggregate POLY4 take-or-pay volumes intended to support stage-two financing and further agreements are expected to be completed soon,” said managing director Chris Fraser."

Antwort auf Beitrag Nr.: 58.676.097 von Popeye82 am 12.09.18 04:26:46Australian Potash

www.australianpotash.com.au/site/PDF/1635_0/LogisticsUpgrade

http://www.laverton.wa.gov.au/

http://transportinfrastructurecouncil.gov.au/publications/fi…

http://www.esperanceport.com.au/

www.australianpotash.com.au/site/PDF/1635_0/LogisticsUpgrade

http://www.laverton.wa.gov.au/

http://transportinfrastructurecouncil.gov.au/publications/fi…

http://www.esperanceport.com.au/

Antwort auf Beitrag Nr.: 58.882.260 von Boersiback am 05.10.18 20:58:01BBack

Pass mal auf.

Du hast ja Hin und Wieder geschrieben Was Deine "Normal"happen sind.

Was wär denn für Dich uuuuungefähr eine Maximalpositionsgröße??

Geht auch per BM, Prozent von Gesamtanlagesumme, Alles, wie auch immer.

Aber der Vergleich von "Normal" zu Max wäre mal gut, wenn Es geht.

Pass mal auf.

Du hast ja Hin und Wieder geschrieben Was Deine "Normal"happen sind.

Was wär denn für Dich uuuuungefähr eine Maximalpositionsgröße??

Geht auch per BM, Prozent von Gesamtanlagesumme, Alles, wie auch immer.

Aber der Vergleich von "Normal" zu Max wäre mal gut, wenn Es geht.

Antwort auf Beitrag Nr.: 58.850.361 von Popeye82 am 02.10.18 11:25:46Ventnor Resources

www.statista.com/statistics/301564/us-silicon-price-by-type/

www.statista.com/statistics/301564/us-silicon-price-by-type/

Antwort auf Beitrag Nr.: 58.883.802 von Popeye82 am 06.10.18 05:47:35Ventnor Resources

www.proactiveinvestors.com.au/companies/news/206143

https://investorinsight.com.au/home/ventnor-resources-arrows…

https://hotcopper.com.au/threads/arrowsmith-north-maiden-res…

www.proactiveinvestors.com.au/companies/news/206143

https://investorinsight.com.au/home/ventnor-resources-arrows…

https://hotcopper.com.au/threads/arrowsmith-north-maiden-res…

Antwort auf Beitrag Nr.: 58.883.814 von Popeye82 am 06.10.18 06:01:16Ventnor Resources

http://austsilicaquartz.com.au/PRODUCTS

http://austsilicaquartz.com.au/PRODUCTS

Antwort auf Beitrag Nr.: 58.705.782 von Popeye82 am 15.09.18 04:24:12as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Excelsior Mining

www.excelsiormining.com/news/news-2018/excelsior-mining-conf…

http://www.epa.wa.gov.au/

https://legacy.azdeq.gov/environ/water/permits/app.html

https://yosemite.epa.gov/oa/EAB_Web_Docket.nsf

"Excelsior Mining Confirms Agreement to Dismiss UIC Permit Appeal

Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQX: EXMGF) ("Excelsior" or the “Company”) is pleased to announce that a Settlement Agreement (the “Agreement”) has been concluded that will result in the dismissal of the appeal (the “Appeal”) filed with respect to the Company’s Class III Underground Injection Control Area Permit (the “UIC Permit”) for the Gunnison Copper Project.

On June 22, the Environmental Protection Agency (the “EPA”) issued Excelsior the UIC Permit with an effective date of August 1, 2018. An appeal of the UIC permit was subsequently filed by a coalition of non-governmental organizations (the “Petitioners”) (See Excelsior Mining news release dated August 6, 2018 – “Excelsior Provides Permitting Update”). All appeals are reviewed by the Environmental Appeals Board (the “EAB”). As per the terms of the Agreement, Excelsior, the EPA, and the Petitioners have submitted to the EAB a joint stipulated motion to dismiss the Appeal. It is anticipated that the EAB will accept the joint motion to dismiss the Appeal which, subject to notice by the EAB, will prompt the EPA to lift the stay, thereby resulting in the UIC Permit becoming effective with permanence.

The Agreement provides for additional monitoring wells and certain other matters. The Agreement does not take the place of the extensive protective measures, monitoring and reporting requirements of the Federal EPA UIC Permit and the State ADEQ Aquifer Protection Permit. However, it does provide for additional items that are a benefit to local stakeholders.

With all key permits in place and effective, Excelsior will be in position to commence construction upon the completion of its project financing plan. Excelsior’s Gunnison Copper project remains poised to be the next new copper producer in the United States.

About Excelsior Mining

Excelsior Mining “The Copper Solution Company” is a mineral exploration and development company that is advancing the Gunnison Copper Project in Cochise County, Arizona. The project is an advanced staged, low cost, environmentally friendly in-situ recovery copper extraction project. The Feasibility Study projected an after-tax NPV of US$ 807 million and an IRR of 40% using a US$ 2.75 per pound copper price and a 7.5% discount rate.

Excelsior’s technical work on the Gunnison Copper Project is supervised by Stephen Twyerould, Fellow of AUSIMM, President & CEO of Excelsior and a Qualified Person as defined by National Instrument 43-101. Mr. Twyerould has reviewed and approved the technical information contained in this news release.

Additional information about the Gunnison Copper Project can be found in the technical report filed on SEDAR at www.sedar.com entitled: “Gunnison Copper Project, NI 43-101 Technical Report, Feasibility Study” dated effective December 17, 2016. For more information on Excelsior, please visit our website at www.excelsiormining.com.

ON BEHALF OF THE EXCELSIOR BOARD

"Stephen Twyerould"

President & CEO

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

JJ Jennex, Vice President, Corporate Affairs

T: 604-681-8030 x240

E: info@excelsiormining.com

www.excelsiormining.com"

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Excelsior Mining

www.excelsiormining.com/news/news-2018/excelsior-mining-conf…

http://www.epa.wa.gov.au/

https://legacy.azdeq.gov/environ/water/permits/app.html

https://yosemite.epa.gov/oa/EAB_Web_Docket.nsf

"Excelsior Mining Confirms Agreement to Dismiss UIC Permit Appeal

Excelsior Mining Corp. (TSX: MIN) (FSE: 3XS) (OTCQX: EXMGF) ("Excelsior" or the “Company”) is pleased to announce that a Settlement Agreement (the “Agreement”) has been concluded that will result in the dismissal of the appeal (the “Appeal”) filed with respect to the Company’s Class III Underground Injection Control Area Permit (the “UIC Permit”) for the Gunnison Copper Project.

On June 22, the Environmental Protection Agency (the “EPA”) issued Excelsior the UIC Permit with an effective date of August 1, 2018. An appeal of the UIC permit was subsequently filed by a coalition of non-governmental organizations (the “Petitioners”) (See Excelsior Mining news release dated August 6, 2018 – “Excelsior Provides Permitting Update”). All appeals are reviewed by the Environmental Appeals Board (the “EAB”). As per the terms of the Agreement, Excelsior, the EPA, and the Petitioners have submitted to the EAB a joint stipulated motion to dismiss the Appeal. It is anticipated that the EAB will accept the joint motion to dismiss the Appeal which, subject to notice by the EAB, will prompt the EPA to lift the stay, thereby resulting in the UIC Permit becoming effective with permanence.

The Agreement provides for additional monitoring wells and certain other matters. The Agreement does not take the place of the extensive protective measures, monitoring and reporting requirements of the Federal EPA UIC Permit and the State ADEQ Aquifer Protection Permit. However, it does provide for additional items that are a benefit to local stakeholders.

With all key permits in place and effective, Excelsior will be in position to commence construction upon the completion of its project financing plan. Excelsior’s Gunnison Copper project remains poised to be the next new copper producer in the United States.

About Excelsior Mining

Excelsior Mining “The Copper Solution Company” is a mineral exploration and development company that is advancing the Gunnison Copper Project in Cochise County, Arizona. The project is an advanced staged, low cost, environmentally friendly in-situ recovery copper extraction project. The Feasibility Study projected an after-tax NPV of US$ 807 million and an IRR of 40% using a US$ 2.75 per pound copper price and a 7.5% discount rate.

Excelsior’s technical work on the Gunnison Copper Project is supervised by Stephen Twyerould, Fellow of AUSIMM, President & CEO of Excelsior and a Qualified Person as defined by National Instrument 43-101. Mr. Twyerould has reviewed and approved the technical information contained in this news release.

Additional information about the Gunnison Copper Project can be found in the technical report filed on SEDAR at www.sedar.com entitled: “Gunnison Copper Project, NI 43-101 Technical Report, Feasibility Study” dated effective December 17, 2016. For more information on Excelsior, please visit our website at www.excelsiormining.com.

ON BEHALF OF THE EXCELSIOR BOARD

"Stephen Twyerould"

President & CEO

For further information regarding this press release, please contact:

Excelsior Mining Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018.

JJ Jennex, Vice President, Corporate Affairs

T: 604-681-8030 x240

E: info@excelsiormining.com

www.excelsiormining.com"

Antwort auf Beitrag Nr.: 58.819.679 von Popeye82 am 28.09.18 07:45:00Birimian

http://birimian.com/pdfs/HighlyExperiencedLithiumExpertAppoi…

http://birimian.com/pdfs/HighlyExperiencedLithiumExpertAppoi…

Antwort auf Beitrag Nr.: 58.833.476 von Popeye82 am 29.09.18 20:55:07MAJOR significance, to Cameroon

Canyon Resources

http://www.asx.com.au/asxpdf/20181002/pdf/43ywcf93l88gr1.pdf

http://www.minmidt.cm/en/home/

http://minmidt-gov.net/en/index.html

http://minmidtcm.com/

Canyon Resources

http://www.asx.com.au/asxpdf/20181002/pdf/43ywcf93l88gr1.pdf

http://www.minmidt.cm/en/home/

http://minmidt-gov.net/en/index.html

http://minmidtcm.com/

Antwort auf Beitrag Nr.: 58.738.969 von Popeye82 am 19.09.18 15:25:25Bluestone Resources

http://www.wallstreet-online.de/nachricht/10910562-wirtschaf…

http://www.wallstreet-online.de/nachricht/10910562-wirtschaf…

Antwort auf Beitrag Nr.: 58.882.260 von Boersiback am 05.10.18 20:58:01Hast Du BM schon gelesen??

Oder immernoch mit Dem epischem Bidet fight("End"gegner) zu tun?

Oder immernoch mit Dem epischem Bidet fight("End"gegner) zu tun?

Antwort auf Beitrag Nr.: 58.890.093 von Popeye82 am 07.10.18 19:29:50ja, hab ich... wundert mich nichtmal so sehr...

ich denke da könnte einiges gehen.

ist eine meiner aktien wo ich bis auf weiteres unter "unverkäuflich" stehen hab

ich denke da könnte einiges gehen.

ist eine meiner aktien wo ich bis auf weiteres unter "unverkäuflich" stehen hab

Antwort auf Beitrag Nr.: 58.224.591 von Popeye82 am 16.07.18 15:45:34Egan Street Resources

www.eganstreetresources.com.au/wp-content/uploads/2018/10/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/09/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/07/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/07/43…

http://www.pcfcapital.com.au/

http://www.cubeconsulting.com/

http://symbiosisenvironmental.ca/

https://au.linkedin.com/in/miketurner3

http://entechmining.com.au/

www.ib.com.au/resources/registered-companies/companydetails/…

http://www.cpcengineering.com.au/

http://www.knightpiesold.com/en/

http://www.rockwater.com.au/

http://www.macsaustralia.com.au/

www.eganstreetresources.com.au/wp-content/uploads/2018/09/EG…

www.eganstreetresources.com.au/wp-content/uploads/2018/10/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/09/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/07/43…

www.eganstreetresources.com.au/wp-content/uploads/2018/07/43…

http://www.pcfcapital.com.au/

http://www.cubeconsulting.com/

http://symbiosisenvironmental.ca/

https://au.linkedin.com/in/miketurner3

http://entechmining.com.au/

www.ib.com.au/resources/registered-companies/companydetails/…

http://www.cpcengineering.com.au/

http://www.knightpiesold.com/en/

http://www.rockwater.com.au/

http://www.macsaustralia.com.au/

www.eganstreetresources.com.au/wp-content/uploads/2018/09/EG…

Antwort auf Beitrag Nr.: 58.657.230 von Popeye82 am 10.09.18 04:02:56Rating: Exploration to watch.

Könnte noch sehr interessant werden.

Und Das programm wird Es.

programm wird Es.

Pensana Metals/Rift Valley Resources

www.asx.com.au/asxpdf/20181001/pdf/43yvgvlvbgbt30.pdf

Könnte noch sehr interessant werden.

Und Das

Pensana Metals/Rift Valley Resources

www.asx.com.au/asxpdf/20181001/pdf/43yvgvlvbgbt30.pdf

Antwort auf Beitrag Nr.: 58.883.880 von Popeye82 am 06.10.18 07:03:02Ventnor Resources

https://hotcopper.com.au/threads/arrowsmith-north-maiden-res…

https://hotcopper.com.au/threads/arrowsmith-north-maiden-res…

Antwort auf Beitrag Nr.: 58.708.227 von Popeye82 am 15.09.18 17:29:55as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

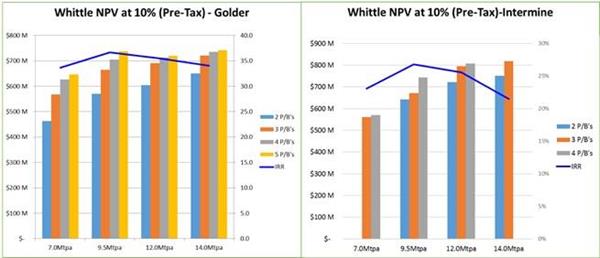

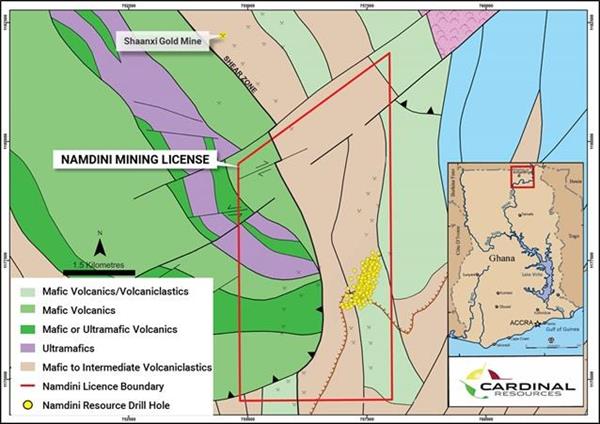

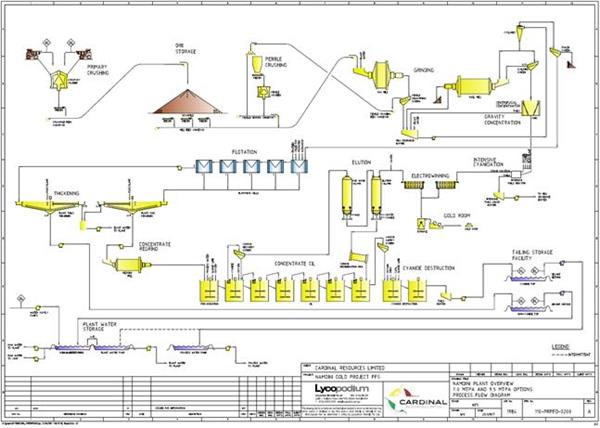

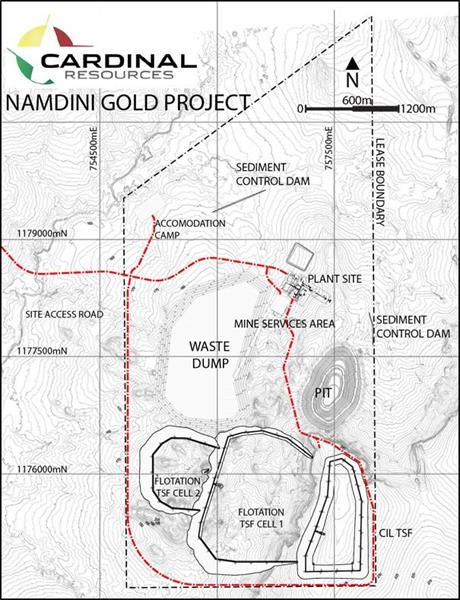

Cardinal Resources

- 4.76 million ounces from 129.6 Mt @ 1.14 g/t Au at 0.5 g/t cut-off Maiden Probable Ore Reserve estimate

- US$ 1,105/oz gold price used to provide a Life of Mine (LOM) optimised pit converting 73% of the 6.5Moz Indicated Mineral Resource to Probable Ore Reserves

- US$ 1,250 gold price financial model generated a 38% Post-Tax Internal Rate of Return (IRR)

- US$ 599/oz all-in sustaining costs (AISC) for the first 2.5 years inclusive of 1.8-year payback period

- US$ 414M (down from US$ 426M) Capital development cost for the 9.5 Mtpa throughput plant

- 1.06 Moz at 1.31 g/t Au and strip ratio of 0.5 to 1 (waste to ore) for first 2.5 years of production (Starter Pit)

- 86% Metallurgical recovery for Starter Pit and 84% for LOM with ongoing optimisation testwork

www.cardinalresources.com.au/wp-content/uploads/2018/09/1845…

www.cardinalresources.com.au/wp-content/uploads/2018/09/1850…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Cardinal Resources

- 4.76 million ounces from 129.6 Mt @ 1.14 g/t Au at 0.5 g/t cut-off Maiden Probable Ore Reserve estimate

- US$ 1,105/oz gold price used to provide a Life of Mine (LOM) optimised pit converting 73% of the 6.5Moz Indicated Mineral Resource to Probable Ore Reserves

- US$ 1,250 gold price financial model generated a 38% Post-Tax Internal Rate of Return (IRR)

- US$ 599/oz all-in sustaining costs (AISC) for the first 2.5 years inclusive of 1.8-year payback period

- US$ 414M (down from US$ 426M) Capital development cost for the 9.5 Mtpa throughput plant

- 1.06 Moz at 1.31 g/t Au and strip ratio of 0.5 to 1 (waste to ore) for first 2.5 years of production (Starter Pit)

- 86% Metallurgical recovery for Starter Pit and 84% for LOM with ongoing optimisation testwork

www.cardinalresources.com.au/wp-content/uploads/2018/09/1845…

www.cardinalresources.com.au/wp-content/uploads/2018/09/1850…

Antwort auf Beitrag Nr.: 58.890.966 von Popeye82 am 07.10.18 23:14:17Resources Resources

https://hotcopper.com.au/threads/silica-research-points-to-a…

https://hotcopper.com.au/threads/silica-research-points-to-a…

Antwort auf Beitrag Nr.: 58.616.832 von Popeye82 am 04.09.18 23:49:21Dome Gold Mines

www.asx.com.au/asxpdf/20181002/pdf/43ywtsqbqrmg73.pdf

www.asx.com.au/asxpdf/20181002/pdf/43ywtsqbqrmg73.pdf

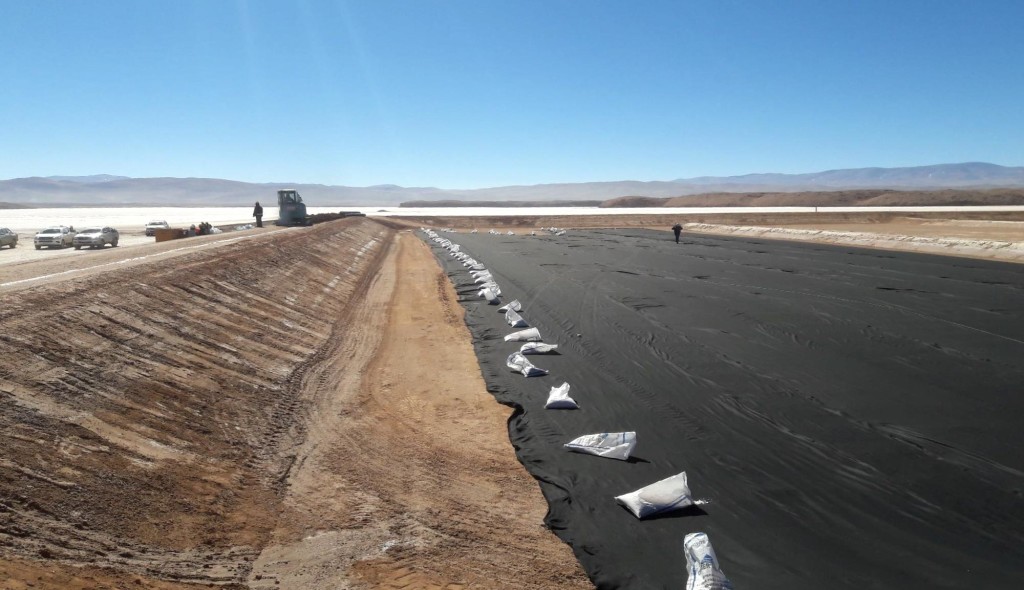

Antwort auf Beitrag Nr.: 58.881.615 von Popeye82 am 05.10.18 19:47:41FIRST operational scale SOP evaporation ponds built on a salt lake in Australia; MOST sustainable, +rewarding, fertiliser project, in the world

Salt Lake Potash

www.investi.com.au/api/announcements/so4/ffc6d934-eb5.pdf

http://www.dmirs.wa.gov.au/

http://blackhamresources.com.au/

Salt Lake Potash

www.investi.com.au/api/announcements/so4/ffc6d934-eb5.pdf

http://www.dmirs.wa.gov.au/

http://blackhamresources.com.au/

Antwort auf Beitrag Nr.: 58.874.214 von Popeye82 am 05.10.18 03:34:30Almonty Industries

www.caesarsreport.com/blog/almonty-industries-does-what-it-p…

www.caesarsreport.com/blog/almonty-industries-does-what-it-p…

Antwort auf Beitrag Nr.: 58.873.590 von Popeye82 am 04.10.18 22:39:51Pilbara Minerals

https://hotcopper.com.au/threads/article-next-year-will-be-h…

https://stockhead.com.au/resources/next-year-will-be-huge-fo…

https://hotcopper.com.au/threads/article-next-year-will-be-h…

https://stockhead.com.au/resources/next-year-will-be-huge-fo…

Antwort auf Beitrag Nr.: 58.869.435 von Popeye82 am 04.10.18 15:25:52High Grade Metals

www.asx.com.au/asxpdf/20181008/pdf/43z1r4sx84mggy.pdf

www.asx.com.au/asxpdf/20181008/pdf/43z1r4sx84mggy.pdf

Antwort auf Beitrag Nr.: 58.597.188 von Popeye82 am 02.09.18 21:14:36Niocorp Developments

www.stockhouse.com/news/press-releases/2018/10/08/niocorp-an…

https://ibcadvancedalloys.com/

http://www.energy.gov/

http://www.ameslab.gov/

www.stockhouse.com/news/press-releases/2018/10/08/niocorp-an…

https://ibcadvancedalloys.com/

http://www.energy.gov/

http://www.ameslab.gov/

Antwort auf Beitrag Nr.: 58.858.224 von Popeye82 am 03.10.18 04:36:14as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Strandline Resources

www.miningreview.com/strandline-resources-fungoni-project-st…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________

Strandline Resources

www.miningreview.com/strandline-resources-fungoni-project-st…

Antwort auf Beitrag Nr.: 58.890.828 von Popeye82 am 07.10.18 22:27:58Pensana Metals

http://riftvalleyresources.com.au/wp-content/uploads/2018/10…

http://riftvalleyresources.com.au/wp-content/uploads/2018/10…

Antwort auf Beitrag Nr.: 58.858.338 von Popeye82 am 03.10.18 07:21:19Sheffield Resources

www.sheffieldresources.com.au/irm/showdownloaddoc.aspx?Annou…

www.sheffieldresources.com.au/irm/showdownloaddoc.aspx?Annou…

Antwort auf Beitrag Nr.: 58.788.230 von Popeye82 am 25.09.18 02:26:58American Pacific Borate+Lithium

http://americanpacificborate.com/wp-content/uploads/Magnetot…

http://americanpacificborate.com/wp-content/uploads/Magnetot…

Antwort auf Beitrag Nr.: 58.884.432 von Popeye82 am 06.10.18 09:44:33Excelsior Mining

www.mining-journal.com/copper-news/news/1348296/excelsior-ap…

www.mining-journal.com/copper-news/news/1348296/excelsior-ap…

Antwort auf Beitrag Nr.: 58.673.901 von Popeye82 am 11.09.18 19:55:41as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Altura Mining

https://alturamining.com/wp-content/uploads/2018/10/1854443.…

http://www.porthedland.wa.gov.au/

http://www.marinetraffic.com/en/ais/details/ships/shipid:370…

https://alturamining.com/wp-content/uploads/2018/10/1853026.…

https://alturamining.com/wp-content/uploads/2018/09/1844461.…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Altura Mining

https://alturamining.com/wp-content/uploads/2018/10/1854443.…

http://www.porthedland.wa.gov.au/

http://www.marinetraffic.com/en/ais/details/ships/shipid:370…

https://alturamining.com/wp-content/uploads/2018/10/1853026.…

https://alturamining.com/wp-content/uploads/2018/09/1844461.…

Antwort auf Beitrag Nr.: 58.855.584 von Popeye82 am 02.10.18 19:01:26Giyani Metals

http://giyanimetals.com/wp-content/uploads/2018/10/Giyani_Oc…

http://giyanimetals.com/wp-content/uploads/2018/10/Giyani_Oc…

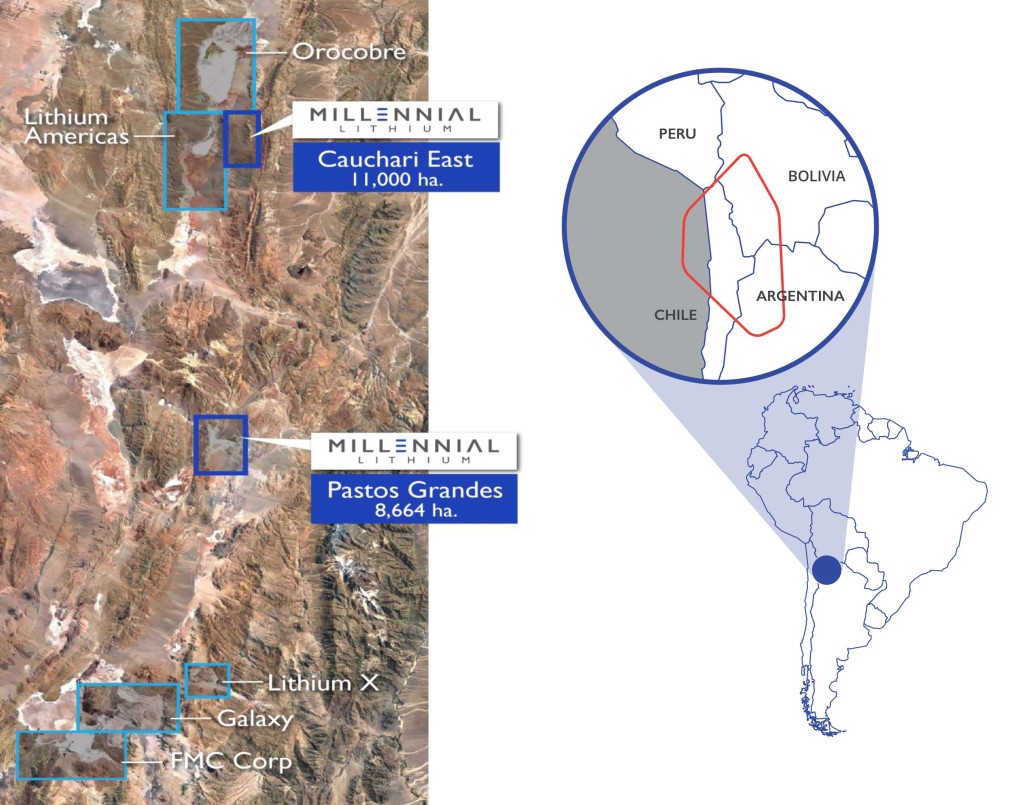

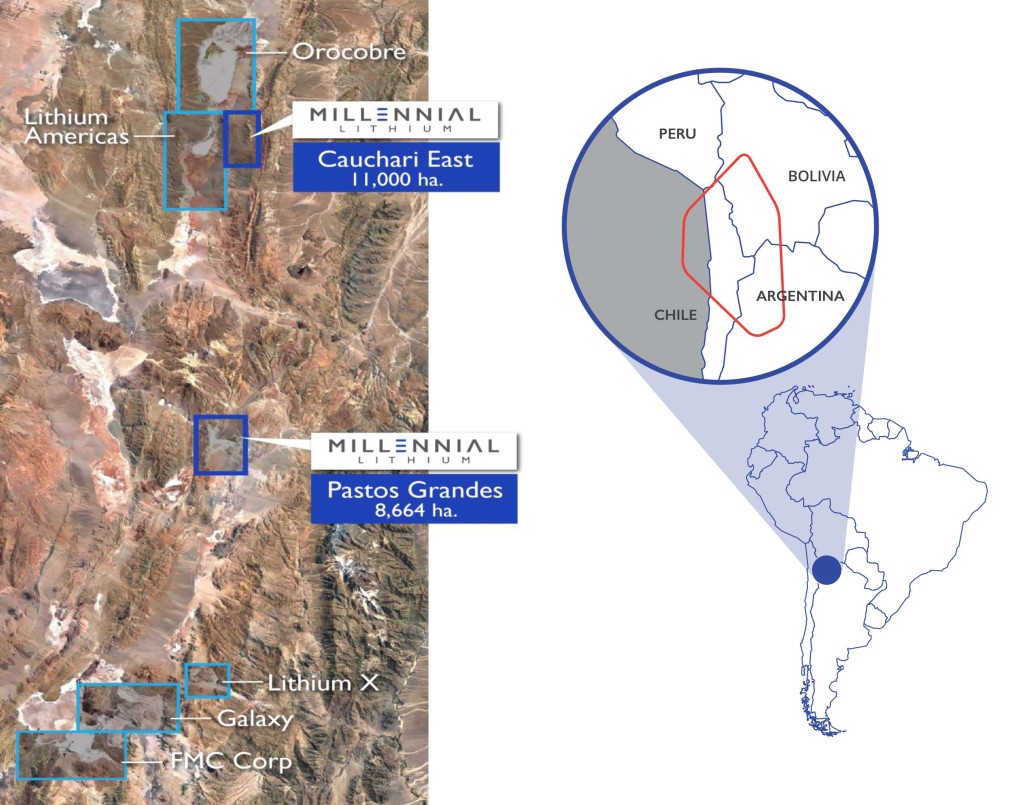

Antwort auf Beitrag Nr.: 58.788.143 von Popeye82 am 25.09.18 00:56:06Millennial Lithium

https://caesarsreport.com/freereports/CaesarsReport_2018-10-…

https://caesarsreport.com/freereports/CaesarsReport_2018-10-…

Antwort auf Beitrag Nr.: 58.873.752 von Boersiback am 04.10.18 23:17:37EL TeddyImperatore

("geistiger "Jung" Schüler")

BlueJay.

Also in Einem "100"%igem Sinne, "wird Was/Wird Nichts", Das geht NICHT.

Aber man kann, und sollte, sich Einige Dinge mal ansehen, und bewusst machen.

Das ist m.M. "schon bisschen Andere Kiste".

Zu Diesen Sachen schreibe ich Ihnen wahrscheinlich noch paar Zeilen.

("geistiger "Jung" Schüler")

BlueJay.

Also in Einem "100"%igem Sinne, "wird Was/Wird Nichts", Das geht NICHT.

Aber man kann, und sollte, sich Einige Dinge mal ansehen, und bewusst machen.

Das ist m.M. "schon bisschen Andere Kiste".

Zu Diesen Sachen schreibe ich Ihnen wahrscheinlich noch paar Zeilen.

Antwort auf Beitrag Nr.: 58.741.843 von Popeye82 am 19.09.18 19:33:59Wealth Minerals

https://wealthminerals.com/news/wealth-hires-from-albemarle-…

https://wealthminerals.com/news/wealth-hires-from-albemarle-…

Antwort auf Beitrag Nr.: 58.335.933 von Popeye82 am 30.07.18 19:49:26Ardea Resources

https://ardearesources.com.au/downloads/announcements/arl_20…

https://ardearesources.com.au/downloads/announcements/arl_20…

Antwort auf Beitrag Nr.: 58.872.780 von Popeye82 am 04.10.18 20:58:38Interessierte: GUT lesen.

Lindian Resources

www.asx.com.au/asxpdf/20181008/pdf/43z1n217d72qrv.pdf

Lindian Resources

www.asx.com.au/asxpdf/20181008/pdf/43z1n217d72qrv.pdf

Antwort auf Beitrag Nr.: 58.882.926 von Popeye82 am 05.10.18 22:05:18Trilogy Metals

https://trilogymetals.com/news/2018/trilogy-metals-reports-d…

https://trilogymetals.com/news/2018/trilogy-metals-reports-d…

Antwort auf Beitrag Nr.: 58.865.157 von Popeye82 am 04.10.18 04:12:55as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3124_0/Capitalraisingtransactio…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

________________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3124_0/Capitalraisingtransactio…

Antwort auf Beitrag Nr.: 58.775.021 von Popeye82 am 23.09.18 15:59:36Tharisa (Plc)

www.overend.co.za/download/q4productionreport08102018.pdf

www.overend.co.za/download/q4productionreport08102018.pdf

Antwort auf Beitrag Nr.: 58.477.747 von Popeye82 am 18.08.18 04:50:19Para Resources

http://pararesourcesinc.com/para-provides-corporate-update/

http://pararesourcesinc.com/para-provides-corporate-update/

Antwort auf Beitrag Nr.: 58.869.648 von Popeye82 am 04.10.18 15:51:05Aurania Resources

- Aurania's President Dr. Richard Spencer and Vice President of Geology Jean-Paul Pallier introduce our new "Target Series" of videos to help investors gain a better understanding of the logic behind the exploration process for each target we've located in The Lost Cities - Cutucu Project area in Ecuador. -

- Aurania's President Dr. Richard Spencer and Vice President of Geology Jean-Paul Pallier introduce our new "Target Series" of videos to help investors gain a better understanding of the logic behind the exploration process for each target we've located in The Lost Cities - Cutucu Project area in Ecuador. -

Antwort auf Beitrag Nr.: 58.873.590 von Popeye82 am 04.10.18 22:39:51Plateau Energy Metals

- 65 m of 3,374 ppm Li (0.73% Li2O) from 9-74 m in Li-rich tuff unit within broader interval of 172 m of 2,908 ppm Li (0.63% Li2O) from 7-179 m (End of Hole – EOH) (PLAT14-V Vertical Hole)

- 93 m of 2,839 ppm Li (0.61% Li2O) from 42-135 m in lithium tuff unit, within 104 m of 2,728 ppm Li (0.59% Li2O) from 39 to 143 m (EOH) in lithium tuff and upper and lower breccia units (PLAT13-V Vertical Hole)

- Both drill holes terminated in lithium bearing lower breccia unit, which remain open at depth

- Falchani West target area is a relatively new zone identified through ground mapping and sampling where highly anomalous lithium values now cover a footprint of >1.5 km E-W by approximately 1.7km N-S

- Three rigs are currently active at Falchani West with the strong results from the first two vertical holes confirming broad intervals of lithium-rich mineralization, drilling will continue West and North through to the end of 2018

- Falchani West is across a shallow, incised valley cutting down into, and floored by Li-rich tuff mineralization, located to the west of the existing Falchani “East” lithium deposit resources

- The lithium tuff and upper and lower breccia units outcrop on the Eastern slope at Falchani West and are interpreted as a continuation of the Falchani East lithium zones

- Falchani West will be a focus of drilling until the end of 2018 as this near surface target extends over a significant footprint and will be part of a resource update in late Q1 2019

http://plateauenergymetals.com/2018/10/09/plateau-confirms-w…

- 65 m of 3,374 ppm Li (0.73% Li2O) from 9-74 m in Li-rich tuff unit within broader interval of 172 m of 2,908 ppm Li (0.63% Li2O) from 7-179 m (End of Hole – EOH) (PLAT14-V Vertical Hole)

- 93 m of 2,839 ppm Li (0.61% Li2O) from 42-135 m in lithium tuff unit, within 104 m of 2,728 ppm Li (0.59% Li2O) from 39 to 143 m (EOH) in lithium tuff and upper and lower breccia units (PLAT13-V Vertical Hole)

- Both drill holes terminated in lithium bearing lower breccia unit, which remain open at depth

- Falchani West target area is a relatively new zone identified through ground mapping and sampling where highly anomalous lithium values now cover a footprint of >1.5 km E-W by approximately 1.7km N-S

- Three rigs are currently active at Falchani West with the strong results from the first two vertical holes confirming broad intervals of lithium-rich mineralization, drilling will continue West and North through to the end of 2018

- Falchani West is across a shallow, incised valley cutting down into, and floored by Li-rich tuff mineralization, located to the west of the existing Falchani “East” lithium deposit resources

- The lithium tuff and upper and lower breccia units outcrop on the Eastern slope at Falchani West and are interpreted as a continuation of the Falchani East lithium zones

- Falchani West will be a focus of drilling until the end of 2018 as this near surface target extends over a significant footprint and will be part of a resource update in late Q1 2019

http://plateauenergymetals.com/2018/10/09/plateau-confirms-w…

Antwort auf Beitrag Nr.: 58.832.825 von Popeye82 am 29.09.18 18:49:30SolGold

http://angrygeologist.blogspot.com/2018/09/alpala-resource-u…

http://angrygeologist.blogspot.com/2018/09/alpala-resource-u…

Antwort auf Beitrag Nr.: 58.798.931 von Popeye82 am 26.09.18 01:10:21ONE of the highest-grade zinc projects(in the world)

______________________________________________

demonstrates Superior Lake Project is ONE of the leading zinc development assets, today(globally)

Superior Lake Resources

– Superior Lake Project Restart Study confirms robust forecast economics

– Project mine life of 6.5 years, producing high-value, high-grade zinc and copper concentrates, based on greater than 95% indicated resource

– Restart Study shows potential for Superior Lake Project to be in lowest-cost quartile of zinc producers(globally)

– Low initial estimated capital cost – leverage historical mine development and infrastructure

– Fully funded Definitive Feasibility Study commenced, expected to be completed by mid-2019

– Tribeca Investment Partners Pty Ltd, a cornerstone investor in the Company’s recent $5 million placement, has been appointed to arrange up to US$60 million in Project Financing

https://superiorlake.com.au/sup/wp-content/uploads/austocks/…

http://tribecaip.com/

http://www.mining-plus.com/

______________________________________________

demonstrates Superior Lake Project is ONE of the leading zinc development assets, today(globally)

Superior Lake Resources

– Superior Lake Project Restart Study confirms robust forecast economics

– Project mine life of 6.5 years, producing high-value, high-grade zinc and copper concentrates, based on greater than 95% indicated resource

– Restart Study shows potential for Superior Lake Project to be in lowest-cost quartile of zinc producers(globally)

– Low initial estimated capital cost – leverage historical mine development and infrastructure

– Fully funded Definitive Feasibility Study commenced, expected to be completed by mid-2019

– Tribeca Investment Partners Pty Ltd, a cornerstone investor in the Company’s recent $5 million placement, has been appointed to arrange up to US$60 million in Project Financing

https://superiorlake.com.au/sup/wp-content/uploads/austocks/…

http://tribecaip.com/

http://www.mining-plus.com/

Antwort auf Beitrag Nr.: 58.883.724 von Popeye82 am 06.10.18 02:42:42Australian Potash

www.australianpotash.com.au/site/PDF/1640_0/GOLDJOINTVENTURE…

https://stbarbara.com.au/

- Australian Potash Ltd (ASX:APC) executive chairman Matt Shackleton speaks to Proactive Investors about the company's formative and flagship Lake Wells Potash Project, located near Laverton in Western Australia, for which mining leases have recently been granted. A Definitive Feasibility Study (DFS) on the project is well underway, with samples of Sulphate of Potash (SOP) due to be produced before the end of the year. In addition to signing a Memorandum of Understanding (MOU) with neighbouring Salt Lake Potash Limited (ASX:SO4) (AIM:SO4) to study the benefits of cost sharing to develop the area, Australian Potash is set to benefit from A$35 million of Federal and State funding for the upgrade of a 100 kilometre section of the Great Central Road between Lake Wells and Laverton. -

www.australianpotash.com.au/site/PDF/1640_0/GOLDJOINTVENTURE…

https://stbarbara.com.au/

- Australian Potash Ltd (ASX:APC) executive chairman Matt Shackleton speaks to Proactive Investors about the company's formative and flagship Lake Wells Potash Project, located near Laverton in Western Australia, for which mining leases have recently been granted. A Definitive Feasibility Study (DFS) on the project is well underway, with samples of Sulphate of Potash (SOP) due to be produced before the end of the year. In addition to signing a Memorandum of Understanding (MOU) with neighbouring Salt Lake Potash Limited (ASX:SO4) (AIM:SO4) to study the benefits of cost sharing to develop the area, Australian Potash is set to benefit from A$35 million of Federal and State funding for the upgrade of a 100 kilometre section of the Great Central Road between Lake Wells and Laverton. -

Antwort auf Beitrag Nr.: 58.891.224 von Popeye82 am 08.10.18 04:55:01Pilbara Minerals

www.pilbaraminerals.com.au/site/PDF/2243_0/FirstConcentrateS…

www.marinetraffic.com/de/ais/details/ships/shipid:755730/imo…

http://www.sgs.ca/en/mining

http://www.australiasnorthwest.com/destination/port-hedland

www.pilbaraminerals.com.au/site/PDF/2243_0/FirstConcentrateS…

www.marinetraffic.com/de/ais/details/ships/shipid:755730/imo…

http://www.sgs.ca/en/mining

http://www.australiasnorthwest.com/destination/port-hedland

Antwort auf Beitrag Nr.: 58.911.522 von Popeye82 am 10.10.18 01:29:40Pilbara Minerals

www.pilbaraminerals.com.au/site/PDF/2246_0/2018AnnualReport

www.pilbaraminerals.com.au/site/PDF/2246_0/2018AnnualReport

Antwort auf Beitrag Nr.: 58.857.198 von Popeye82 am 02.10.18 22:09:36Jangada Mines (Plc)

www.mining-journal.com/pgms/news/1348284/palladium-could-bec…

www.mining-journal.com/pgms/news/1346179/platinum-to-move-in…

www.mining-journal.com/pgms/news/1348284/palladium-could-bec…

www.mining-journal.com/pgms/news/1346179/platinum-to-move-in…

Antwort auf Beitrag Nr.: 58.911.612 von Popeye82 am 10.10.18 03:12:40

Zitat von Popeye82: Jangada Mines (Plc)

![]()

![]()

![]()

![]()

![]()

![]()

www.mining-journal.com/pgms/news/1348284/palladium-could-bec…

![]()

www.mining-journal.com/pgms/news/1346179/platinum-to-move-in…

Venturex Resources

- Project Revenue: A$2,625 million

- Free Cash-Flow (pre-tax real): A$818 million

- Pre-Production Processing Plant and Infrastructure Capital: A$146 million

- Pre-Tax NPV8%: A$472 million

- Internal Rate of Return(pre-tax): 51%

- Average Annual Pre-tax Cashflow: ~A$80M

- Average annual production of approximately 65ktpa of ~25% Copper concentrate (~15ktpa Cu payable metal) and 75Ktpa of ~50% Zinc concentrate(~35ktpa Zn payable metal)

- Life-of-mine payable metal of 146kt of Copper and 348kt of Zinc

- Increased Ore Reserve of 8.5Mt @ 1.4% Cu and 3.1% Zn (up from 7.3Mt @ 1.2% Cu and 3.5% Zn), representing a 42% increase in contained Cu metal

- Life-of-mine mine inventory of 12.6Mt @ 1.4% Cu and 3.6% Zn (inclusive of Reserves and Inferred Resources)

- Mine life of 10.3 years(post construction), averaging ~A$80M per year of free cash-flow

- Upfront Capital requirement of A$169M, including:

1) A$146M for a 1.25Mtpa processing plant and other site infrastructure (which represents a significant capital cost decrease, from the Feb 2017 Value Engineering Study(“VES”

), of A$167M for a 1Mtpa processing plant, and related infrastructure)

), of A$167M for a 1Mtpa processing plant, and related infrastructure)

2) A$23M for other pre-production costs, including site access and pre-strip mining