Baidu.com - NASDAQ: BIDU crashed - dieses Jahr noch unter 30 US Dollar? (Seite 165)

eröffnet am 10.03.06 10:23:51 von

neuester Beitrag 26.03.24 10:24:03 von

neuester Beitrag 26.03.24 10:24:03 von

Beiträge: 1.961

ID: 1.046.404

ID: 1.046.404

Aufrufe heute: 3

Gesamt: 230.792

Gesamt: 230.792

Aktive User: 0

ISIN: US0567521085 · WKN: A0F5DE · Symbol: BIDU

111,75

USD

+7,12 %

+7,43 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

30.04.24 · wallstreetONLINE Redaktion |

30.04.24 · wallstreetONLINE Redaktion |

29.04.24 · Markus Weingran |

29.04.24 · Der Aktionär TV |

29.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,8250 | +297,52 | |

| 116,50 | +33,77 | |

| 3,9801 | +29,64 | |

| 0,8000 | +28,00 | |

| 58,64 | +16,05 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,320 | -6,18 | |

| 0,7010 | -7,76 | |

| 1,8300 | -9,25 | |

| 114,31 | -10,32 | |

| 59,24 | -15,06 |

Beitrag zu dieser Diskussion schreiben

Sagenhaft, wie wenig hier zu diesem excellenten Wachstumstitel gepostet wird. Auch wenn ich mir die Umsätze an der Nasdaq ansehe, zeige sie derzeit nur 1/5 dessen, was vor der Finanzkrise umging. Kaum zu glauben, aber so ist es.

Suchmaschinenbetreiber Baidu bietet drahtlose Suchanfragen mit China Unicoms 3G Diensten an

Der chinesische Suchmaschinenbetreiber Baidu teilte mit, dass er eine Partnerschaft mit China Unicom eingegangen sei, um drahtlose Suchanfragen auf 3G-fähigen Mobiltelefonen anzubieten. Damit will das Unternehmen Googles steigender Präsenz im weltweit größten Mobilfunkmarkt die Stirn bieten.

Baidu wird seine Dienste auf China Unicom Handys vorinstallieren. Dazu gehören dem Abkommen zufolge Text, Bild, MP3 und Nachrichtensuche. Baidu wird außerdem das mobile Internetangebot von China Unicom um Suchdienste erweitern. Der Mobilfunkanbieter will sein iPhone noch im Oktober in China auf den Markt bringen.

"Wir hoffen, dass Baidus Zusammenarbeit mit führenden Telekommunikationsanbietern in China die Entwicklung von 3G Diensten beschleunigen wird und wir somit einer rasch wachsenden Zahl von Nutzern mobiler Suchdienste einen besseren Zugang zu Informationen bieten können", sagte Ren Xuyang, stellvertretender Präsident Baidus, gestern in einer Stellungnahme.

Das Abkommen mit Baidu sei nicht exklusiv gewesen, sagte ein Sprecher von China Unicom. Die von Google im iPhone vorinstallierten Dienste seien davon nicht betroffen.

Mit der Markteinführung von 3G Diensten in China, die Handynutzern das Surfen im Internet ermöglichen, ist die mobile Suche ein viel versprechender Markt für Suchmaschinenanbieter geworden, die außerhalb von Computern neue Märkte erschließen wollen.

In den vergangenen Jahren hatte Google verstärkt versucht, mobile Suchdienste wie Google Maps chinesischen Handynutzern anzubieten. Im Jahr 2007 kündigte das Unternehmen eine Partnerschaft mit China Mobile an, um für diesen einen mobilen Suchdienst anzubieten. Google teilte vergangene Woche mit, dass es in den nächsten Wochen einen chinesischen Sprachsuchdienst für chinesische Smart-Phone Nutzer auf den Markt bringen wolle.

Nach Angaben des Marktforschungsunternehmens Analysys International hinkt Google immer noch hinter Marktführer Baidu hinterher, der 60 Prozent des Suchmaschinenmarktes einnimmt. Doch in Chinas mobilem Suchmaschinenmarkt erreichte Google einen Marktanteil von 26,6 Prozent im zweiten Quartal 2009, während Baidu nur 26 Prozent erzielte.

Im Mai habe Baidu ein Abkommen mit China Telecom für einen Suchdienst auf dessen Dienstplattform getroffen. Im November werde Baidu außerdem mobile Suchdienste für den höher entwickelten japanischen 3G Markt anbieten, teilte das Unternehmen mit.

Verglichen mit seinem Abkommen mit China Telecom, das nur 41,73 Millionen Handynutzer im Juli hatte, scheint Baidus Partnerschaft mit China Unicom dem Unternehmen bessere Chancen für die Erschließung des 3G Marktes zu bieten.

China Unicom ist mit 141 Millionen Mitgliedern im Juli 2009 Chinas zweitgrößter Mobilfunkanbieter. Obwohl die Mitgliederzahl nicht mit den 450 Millionen Handynutzern von China Mobile vergleichbar ist, scheint China Unicom von großen Handyherstellern größere Unterstützung zu erfahren, unter anderem von Nokia, das Chinas Handymarkt mit 35 Prozent Marktanteil anführt.

Zhou Liqian, ein Analyst von Everbright Securities, prognostizierte, dass China Unicom im Jahr 2011 die Hälfte von Chinas 3G Markt besetze.

Laut Angaben des China Internet Network Information Center gab es in China Ende Juli 338 Millionen Internetnutzer. Die Zahl der Nutzer von mobilen Internetdiensten hatte sich im Vergleich zum Vorjahr um 32,1 Prozent auf 155 Millionen erhöht.

Quelle: China Daily

Suchmaschinenbetreiber Baidu bietet drahtlose Suchanfragen mit China Unicoms 3G Diensten an

Der chinesische Suchmaschinenbetreiber Baidu teilte mit, dass er eine Partnerschaft mit China Unicom eingegangen sei, um drahtlose Suchanfragen auf 3G-fähigen Mobiltelefonen anzubieten. Damit will das Unternehmen Googles steigender Präsenz im weltweit größten Mobilfunkmarkt die Stirn bieten.

Baidu wird seine Dienste auf China Unicom Handys vorinstallieren. Dazu gehören dem Abkommen zufolge Text, Bild, MP3 und Nachrichtensuche. Baidu wird außerdem das mobile Internetangebot von China Unicom um Suchdienste erweitern. Der Mobilfunkanbieter will sein iPhone noch im Oktober in China auf den Markt bringen.

"Wir hoffen, dass Baidus Zusammenarbeit mit führenden Telekommunikationsanbietern in China die Entwicklung von 3G Diensten beschleunigen wird und wir somit einer rasch wachsenden Zahl von Nutzern mobiler Suchdienste einen besseren Zugang zu Informationen bieten können", sagte Ren Xuyang, stellvertretender Präsident Baidus, gestern in einer Stellungnahme.

Das Abkommen mit Baidu sei nicht exklusiv gewesen, sagte ein Sprecher von China Unicom. Die von Google im iPhone vorinstallierten Dienste seien davon nicht betroffen.

Mit der Markteinführung von 3G Diensten in China, die Handynutzern das Surfen im Internet ermöglichen, ist die mobile Suche ein viel versprechender Markt für Suchmaschinenanbieter geworden, die außerhalb von Computern neue Märkte erschließen wollen.

In den vergangenen Jahren hatte Google verstärkt versucht, mobile Suchdienste wie Google Maps chinesischen Handynutzern anzubieten. Im Jahr 2007 kündigte das Unternehmen eine Partnerschaft mit China Mobile an, um für diesen einen mobilen Suchdienst anzubieten. Google teilte vergangene Woche mit, dass es in den nächsten Wochen einen chinesischen Sprachsuchdienst für chinesische Smart-Phone Nutzer auf den Markt bringen wolle.

Nach Angaben des Marktforschungsunternehmens Analysys International hinkt Google immer noch hinter Marktführer Baidu hinterher, der 60 Prozent des Suchmaschinenmarktes einnimmt. Doch in Chinas mobilem Suchmaschinenmarkt erreichte Google einen Marktanteil von 26,6 Prozent im zweiten Quartal 2009, während Baidu nur 26 Prozent erzielte.

Im Mai habe Baidu ein Abkommen mit China Telecom für einen Suchdienst auf dessen Dienstplattform getroffen. Im November werde Baidu außerdem mobile Suchdienste für den höher entwickelten japanischen 3G Markt anbieten, teilte das Unternehmen mit.

Verglichen mit seinem Abkommen mit China Telecom, das nur 41,73 Millionen Handynutzer im Juli hatte, scheint Baidus Partnerschaft mit China Unicom dem Unternehmen bessere Chancen für die Erschließung des 3G Marktes zu bieten.

China Unicom ist mit 141 Millionen Mitgliedern im Juli 2009 Chinas zweitgrößter Mobilfunkanbieter. Obwohl die Mitgliederzahl nicht mit den 450 Millionen Handynutzern von China Mobile vergleichbar ist, scheint China Unicom von großen Handyherstellern größere Unterstützung zu erfahren, unter anderem von Nokia, das Chinas Handymarkt mit 35 Prozent Marktanteil anführt.

Zhou Liqian, ein Analyst von Everbright Securities, prognostizierte, dass China Unicom im Jahr 2011 die Hälfte von Chinas 3G Markt besetze.

Laut Angaben des China Internet Network Information Center gab es in China Ende Juli 338 Millionen Internetnutzer. Die Zahl der Nutzer von mobilen Internetdiensten hatte sich im Vergleich zum Vorjahr um 32,1 Prozent auf 155 Millionen erhöht.

Quelle: China Daily

Neue Kursziele.......

09.10.2009 21:57

Baidu: Broker sehen rasantes Wachstum und Kurse weit über bisherigem All-Time-Hoch

Beijing (BoerseGo.de) - Der Aktienkurs von Baidu, Chinas Marktführer bei den Suchmaschinen, stieg in den vergangenen Monaten so rasant, dass die Analysten kaum noch mit ihren Kurszielen nachkommen. Heute nahmen zwei Branchenvertreter jeweils einen Versuch.

Die Citigroup schraubte ihr Kursziel von $385 auf $480 hoch und bekräftigte das Buy-Rating. Obwohl sich der Aktienkurs in diesem Jahr mehr als verdreifacht hat, sieht Citigroup-Analystin Catherine Leung noch Spielraum. Bei den kommenden Quartalszahlen seien Überraschungen möglich, die zeigen, dass sich das Wachstum in den kommenden 12 Monaten weiter beschleunigt, schrieb Leung in einer Notiz an ihre Klienten.

Der Broker CLSA Asia-Pacific Markets hob das Kursziel von $430 auf $480 und bestätigte ebenfalls das Buy-Rating. Das Wachstum in China sollten die Anzeigenaufträge steigern.

Baidu steigt 3,6% auf $ 427,61

Das All-Time -Hoch von Baidu betrug $ 429.19 und wurde im Oktober 2007 erreicht.

(© BörseGo AG 2007 - http://www.boerse-go.de, Autor: Maier Gerhard, Redakteur)

© 2009 BörseGo

09.10.2009 21:57

Baidu: Broker sehen rasantes Wachstum und Kurse weit über bisherigem All-Time-Hoch

Beijing (BoerseGo.de) - Der Aktienkurs von Baidu, Chinas Marktführer bei den Suchmaschinen, stieg in den vergangenen Monaten so rasant, dass die Analysten kaum noch mit ihren Kurszielen nachkommen. Heute nahmen zwei Branchenvertreter jeweils einen Versuch.

Die Citigroup schraubte ihr Kursziel von $385 auf $480 hoch und bekräftigte das Buy-Rating. Obwohl sich der Aktienkurs in diesem Jahr mehr als verdreifacht hat, sieht Citigroup-Analystin Catherine Leung noch Spielraum. Bei den kommenden Quartalszahlen seien Überraschungen möglich, die zeigen, dass sich das Wachstum in den kommenden 12 Monaten weiter beschleunigt, schrieb Leung in einer Notiz an ihre Klienten.

Der Broker CLSA Asia-Pacific Markets hob das Kursziel von $430 auf $480 und bestätigte ebenfalls das Buy-Rating. Das Wachstum in China sollten die Anzeigenaufträge steigern.

Baidu steigt 3,6% auf $ 427,61

Das All-Time -Hoch von Baidu betrug $ 429.19 und wurde im Oktober 2007 erreicht.

(© BörseGo AG 2007 - http://www.boerse-go.de, Autor: Maier Gerhard, Redakteur)

© 2009 BörseGo

Antwort auf Beitrag Nr.: 37.926.173 von Karlll am 05.09.09 18:40:25Seit Bekanntgabe der Aufnahme in in BRIC 50 dem 3.9. ging es von 329 auf 379 US-Dollar.

Jetzt neues Kursziel von Goldman Sachs.

GS reiterates conviction buy, raises PT to $455

Highest on the street. Firm believes Baidu's coverage

ratios will rise to match Google and Yahoo at around

50 to 60%. Currently it is at around 20%, and GS

believes Phoenix Nest will help improve the ratio.

Paid search in China is expected to rise to 0.07% of

GDP by 2013, with Baidu maintaining its market

share.

Und die dürften wir doch wohl bis 31.12.09 erreichen.

Karlll

Jetzt neues Kursziel von Goldman Sachs.

GS reiterates conviction buy, raises PT to $455

Highest on the street. Firm believes Baidu's coverage

ratios will rise to match Google and Yahoo at around

50 to 60%. Currently it is at around 20%, and GS

believes Phoenix Nest will help improve the ratio.

Paid search in China is expected to rise to 0.07% of

GDP by 2013, with Baidu maintaining its market

share.

Und die dürften wir doch wohl bis 31.12.09 erreichen.

Karlll

Baidu unfazed by Google's China inroads -CTO

Thu Sep 10, 2009 12:15pm IST

* Baidu likely to maintain lead over Google in China

* Google, portals more assertive in China search market

* E-commerce and box computing to spur growth

* Google lags Baidu in China sales and marketing - analysts

By Melanie Lee

SHANGHAI, Sept 10 (Reuters) - China Internet search giant Baidu Inc (BIDU.O: Quote, Profile, Research) is likely to maintain its search lead over rival Google (GOOG.O: Quote, Profile, Research) in China in the near term, given the firm's aggressive expansion plans, a top Baidu executive said.

Baidu, which leads Google in the world's largest Internet search market by volume, rolled out a slew of new products this year aimed at maintaining its dominant position. But the firm faces stiff competition from web portals such as Sina.com (SINA.O: Quote, Profile, Research) and NetEase (NTES.O: Quote, Profile, Research) as well as an increasingly localised and assertive Google.

"It's not just at this moment that we are competing. We have a lot of new innovations to help us to maintain our dominant position," Li Yinan, chief technology officer of Baidu, told Reuters in an interview on Thursday.

Among their new products is a search platform called Box Computing unveiled in August, which allows users to input a question and retrieve an answer without having to click a link.

Li said he is banking on the intuitiveness of the search platform to enhance Baidu's market share which stands at 61.6 percent in terms of revenue while Google has 29 percent, according to Analysys International.

UBS analyst Li Wenlin said in a note that Baidu's new search solution is better than Google's, given that online information of Chinese websites is not well organised and the Chinese language requires a more sophisticated algorithm than English.

Baidu's Li said box computing was already in effect on its website but more features would be rolled out in time, declining to give a firm time frame. Baidu is also looking at expanding its e-commerce platform Youa to tap into China's fast growing B2C market. "E-commerce will be a focus of ours over the next 5 years," Li said.

GOOGLE VS BAIDU

Google, who was a tiny player in China's market in 2003 with only a 2 percent market share has steadily grown into Baidu's formidable foe with innovative offers for the Chinese Internet surfer such as free music downloads.

However, the search titan also faced tighter scrutiny from Beijing censors who this year railed against Google for its "pornographic" content and asked the Mountain View, California firm to audit its searches.

But where Google has lagged Baidu, says analysts, is not in technology but in its sales and marketing effort.

According to the UBS report issued late last month, Google has no direct sales force in China whereas Baidu has close to 3,600.

"We do not believe Google could gain more share at a fast pace as before," said UBS analyst Li in the report.

"Most likely scenario could be a stable competitive landscape, or Google slowly taking share from Baidu if the company could launch attractive products and maintain the localisation pace," Li said.

Google's former head of China operations, Lee Kai-Fu resigned last week to start his own venture firm to help start-ups. Google said John Liu, its sales and marketing head of China, will take over Lee's business and operational responsibilities.

Baidu will not be fazed by Google's incursions into its market space, Li said.

"Both of us (Google and Baidu) continue to enhance our quality and I don't see that we will lose to them by a lot in any area," Baidu's Li said.

"We are pushing ahead dramatically and aggressively and we are moving faster than our competitors," he added.

In the second-quarter, Baidu rolled out a new advertising keyword bidding system Phoenix Nest similar to Google's AdWords.

For the third-quarter, Baidu projected sales of $184 million to $189 million, compared with the analysts' average estimates of $178.9 million.

Analysts expect Phoenix Nest to be a key growth driver for Baidu in the upcoming quarters as China's search market continues to expand at a rapid pace.

Baidu shares are trading about 180 percent higher this year, about 56.6 times its December 2009 earnings.

(Reporting by Melanie Lee; Editing by Valerie Lee)

((melanie.lee@thomsonreuters.com; +86 21 6104 1778; Reuters Messaging: melanie.lee.reuters.com@reuters.net))

((If you have a query or comment on this story, send an email to news.feedback.asia@thomsonreuters.com)) Keywords: BAIDU/

(C) Reuters 2009. All rights reserved. Republication or redistribution ofReuters content, including by caching, framing or similar means, is expresslyprohibited without the prior written consent of Reuters. Reuters and the Reuterssphere logo are registered trademarks and trademarks of the Reuters group ofcompanies around the world.nSHA284052

Thu Sep 10, 2009 12:15pm IST

* Baidu likely to maintain lead over Google in China

* Google, portals more assertive in China search market

* E-commerce and box computing to spur growth

* Google lags Baidu in China sales and marketing - analysts

By Melanie Lee

SHANGHAI, Sept 10 (Reuters) - China Internet search giant Baidu Inc (BIDU.O: Quote, Profile, Research) is likely to maintain its search lead over rival Google (GOOG.O: Quote, Profile, Research) in China in the near term, given the firm's aggressive expansion plans, a top Baidu executive said.

Baidu, which leads Google in the world's largest Internet search market by volume, rolled out a slew of new products this year aimed at maintaining its dominant position. But the firm faces stiff competition from web portals such as Sina.com (SINA.O: Quote, Profile, Research) and NetEase (NTES.O: Quote, Profile, Research) as well as an increasingly localised and assertive Google.

"It's not just at this moment that we are competing. We have a lot of new innovations to help us to maintain our dominant position," Li Yinan, chief technology officer of Baidu, told Reuters in an interview on Thursday.

Among their new products is a search platform called Box Computing unveiled in August, which allows users to input a question and retrieve an answer without having to click a link.

Li said he is banking on the intuitiveness of the search platform to enhance Baidu's market share which stands at 61.6 percent in terms of revenue while Google has 29 percent, according to Analysys International.

UBS analyst Li Wenlin said in a note that Baidu's new search solution is better than Google's, given that online information of Chinese websites is not well organised and the Chinese language requires a more sophisticated algorithm than English.

Baidu's Li said box computing was already in effect on its website but more features would be rolled out in time, declining to give a firm time frame. Baidu is also looking at expanding its e-commerce platform Youa to tap into China's fast growing B2C market. "E-commerce will be a focus of ours over the next 5 years," Li said.

GOOGLE VS BAIDU

Google, who was a tiny player in China's market in 2003 with only a 2 percent market share has steadily grown into Baidu's formidable foe with innovative offers for the Chinese Internet surfer such as free music downloads.

However, the search titan also faced tighter scrutiny from Beijing censors who this year railed against Google for its "pornographic" content and asked the Mountain View, California firm to audit its searches.

But where Google has lagged Baidu, says analysts, is not in technology but in its sales and marketing effort.

According to the UBS report issued late last month, Google has no direct sales force in China whereas Baidu has close to 3,600.

"We do not believe Google could gain more share at a fast pace as before," said UBS analyst Li in the report.

"Most likely scenario could be a stable competitive landscape, or Google slowly taking share from Baidu if the company could launch attractive products and maintain the localisation pace," Li said.

Google's former head of China operations, Lee Kai-Fu resigned last week to start his own venture firm to help start-ups. Google said John Liu, its sales and marketing head of China, will take over Lee's business and operational responsibilities.

Baidu will not be fazed by Google's incursions into its market space, Li said.

"Both of us (Google and Baidu) continue to enhance our quality and I don't see that we will lose to them by a lot in any area," Baidu's Li said.

"We are pushing ahead dramatically and aggressively and we are moving faster than our competitors," he added.

In the second-quarter, Baidu rolled out a new advertising keyword bidding system Phoenix Nest similar to Google's AdWords.

For the third-quarter, Baidu projected sales of $184 million to $189 million, compared with the analysts' average estimates of $178.9 million.

Analysts expect Phoenix Nest to be a key growth driver for Baidu in the upcoming quarters as China's search market continues to expand at a rapid pace.

Baidu shares are trading about 180 percent higher this year, about 56.6 times its December 2009 earnings.

(Reporting by Melanie Lee; Editing by Valerie Lee)

((melanie.lee@thomsonreuters.com; +86 21 6104 1778; Reuters Messaging: melanie.lee.reuters.com@reuters.net))

((If you have a query or comment on this story, send an email to news.feedback.asia@thomsonreuters.com)) Keywords: BAIDU/

(C) Reuters 2009. All rights reserved. Republication or redistribution ofReuters content, including by caching, framing or similar means, is expresslyprohibited without the prior written consent of Reuters. Reuters and the Reuterssphere logo are registered trademarks and trademarks of the Reuters group ofcompanies around the world.nSHA284052

Aha, daher seit 2 Tagen wieder anziehende Kurse!!!

Source: Dow Jones Indexes

Component Changes Made to Dow Jones BRIC 50 Index

Changes Are the Result of the Regular Annual Review

NEW YORK, Sept. 3, 2009 (GLOBE NEWSWIRE) -- Dow Jones Indexes, a leading global index provider, today announced the results of the regular annual review of the Dow Jones BRIC 50 Index.

The following three components will be added to the Dow Jones BRIC 50 Index: OGX Petroleo e Gas Participacoes S/A Ord (Brazil, Oil & Gas, OGXP3.BR), Jindal Steel & Power Limited (India, Basic Resources, 532286.BY) and Baidu Inc. ADS (China, Technology, BIDU).

Companies exiting the index: Companhia Energetica de Sao Paulo Pref B (Brazil, Utilities, CESP5.BR), Cairn India Limited (India, Oil & Gas, 532792.BY) and Focus Media Holding Limited ADS (China, Media, FMCN).

The float-adjusted market capitalization of the reconstituted Dow Jones BRIC 50 Index increased to US$794 billion from US$760 billion, as of September 2, 2009.

The changes will be effective after the close of trading on Friday, September 18, 2009.

The Dow Jones BRIC 50 Index is an investable, blue-chip index that measures the performance of the 50 largest and most liquid companies in Brazil, Russia, India and China Offshore. The number of components in the Dow Jones BRIC 50 Index is fixed at 15 each for Brazil, India and China and five components for Russia to reflect the size of each market in the index. The Dow Jones BRIC 50 Index is calculated in USD and Euro.

Further information on the Dow Jones BRIC 50 Index can be found on www.djindexes.com.

Company additions to and deletions from the Dow Jones BRIC 50 Index do not in any way reflect an opinion on the investment merits of the company.

Journalists may e-mail questions regarding this press release to PR-Indexes@dowjones.com.

About Dow Jones Indexes

A full-service index provider, Dow Jones Indexes develops, maintains and licenses indexes for use as benchmarks and as the basis of investment products. Best known for the Dow Jones Industrial Average, Dow Jones Indexes also is co-owner of the Dow Jones STOXX indexes, the world's leading pan-European indexes that are an integrated segment of the Dow Jones Global Index series. Additionally, Dow Jones Indexes maintains its benchmark index series, the Dow Jones Total Stock Market Indexes, which is anchored by the Dow Jones U.S. Total Stock Market Index and covers more than 12,000 securities in 65 markets. Beyond equity indexes, Dow Jones Indexes maintains a number of alternative indexes, including measures of the hedge fund and commodity markets. Dow Jones indexes are maintained according to clear, unbiased and systematic methodologies that are fully integrated within index families. www.djindexes.com

Dow Jones & Company (www.dowjones.com) is a News Corporation company (Nasdaq:NWS) (Nasdaq:NWSA) (ASX:NWS) (ASX:NWSLV) (www.newscorp.com). Dow Jones is a leading provider of global business news and information services. Its Consumer Media Group publishes The Wall Street Journal, Barron's, MarketWatch and the Far Eastern Economic Review. Its Enterprise Media Group includes Dow Jones Newswires, Dow Jones Factiva, Dow Jones Client Solutions, Dow Jones Indexes and Dow Jones Financial Information Services. Its Local Media Group operates community-based information franchises. Dow Jones owns 50% of SmartMoney and 33% of STOXX Ltd. and provides news content to radio stations in the U.S.

Source: Dow Jones Indexes

Component Changes Made to Dow Jones BRIC 50 Index

Changes Are the Result of the Regular Annual Review

NEW YORK, Sept. 3, 2009 (GLOBE NEWSWIRE) -- Dow Jones Indexes, a leading global index provider, today announced the results of the regular annual review of the Dow Jones BRIC 50 Index.

The following three components will be added to the Dow Jones BRIC 50 Index: OGX Petroleo e Gas Participacoes S/A Ord (Brazil, Oil & Gas, OGXP3.BR), Jindal Steel & Power Limited (India, Basic Resources, 532286.BY) and Baidu Inc. ADS (China, Technology, BIDU).

Companies exiting the index: Companhia Energetica de Sao Paulo Pref B (Brazil, Utilities, CESP5.BR), Cairn India Limited (India, Oil & Gas, 532792.BY) and Focus Media Holding Limited ADS (China, Media, FMCN).

The float-adjusted market capitalization of the reconstituted Dow Jones BRIC 50 Index increased to US$794 billion from US$760 billion, as of September 2, 2009.

The changes will be effective after the close of trading on Friday, September 18, 2009.

The Dow Jones BRIC 50 Index is an investable, blue-chip index that measures the performance of the 50 largest and most liquid companies in Brazil, Russia, India and China Offshore. The number of components in the Dow Jones BRIC 50 Index is fixed at 15 each for Brazil, India and China and five components for Russia to reflect the size of each market in the index. The Dow Jones BRIC 50 Index is calculated in USD and Euro.

Further information on the Dow Jones BRIC 50 Index can be found on www.djindexes.com.

Company additions to and deletions from the Dow Jones BRIC 50 Index do not in any way reflect an opinion on the investment merits of the company.

Journalists may e-mail questions regarding this press release to PR-Indexes@dowjones.com.

About Dow Jones Indexes

A full-service index provider, Dow Jones Indexes develops, maintains and licenses indexes for use as benchmarks and as the basis of investment products. Best known for the Dow Jones Industrial Average, Dow Jones Indexes also is co-owner of the Dow Jones STOXX indexes, the world's leading pan-European indexes that are an integrated segment of the Dow Jones Global Index series. Additionally, Dow Jones Indexes maintains its benchmark index series, the Dow Jones Total Stock Market Indexes, which is anchored by the Dow Jones U.S. Total Stock Market Index and covers more than 12,000 securities in 65 markets. Beyond equity indexes, Dow Jones Indexes maintains a number of alternative indexes, including measures of the hedge fund and commodity markets. Dow Jones indexes are maintained according to clear, unbiased and systematic methodologies that are fully integrated within index families. www.djindexes.com

Dow Jones & Company (www.dowjones.com) is a News Corporation company (Nasdaq:NWS) (Nasdaq:NWSA) (ASX:NWS) (ASX:NWSLV) (www.newscorp.com). Dow Jones is a leading provider of global business news and information services. Its Consumer Media Group publishes The Wall Street Journal, Barron's, MarketWatch and the Far Eastern Economic Review. Its Enterprise Media Group includes Dow Jones Newswires, Dow Jones Factiva, Dow Jones Client Solutions, Dow Jones Indexes and Dow Jones Financial Information Services. Its Local Media Group operates community-based information franchises. Dow Jones owns 50% of SmartMoney and 33% of STOXX Ltd. and provides news content to radio stations in the U.S.

Baidu on Track to Beat Q3 Guidance 1

by: Xiaofan Zhang September 03, 2009 | about: BIDU

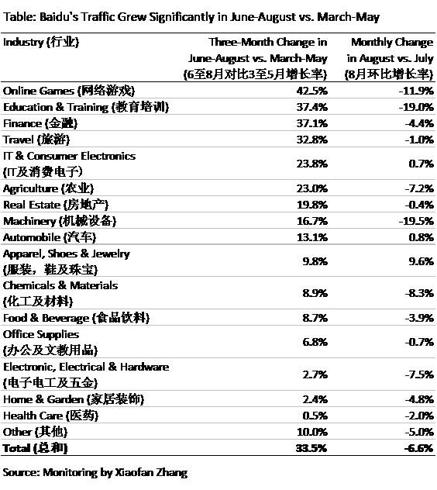

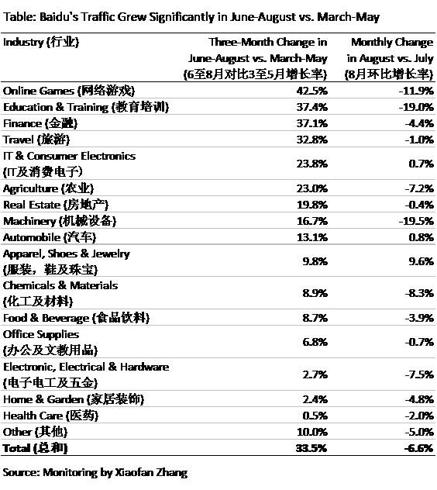

This data point supports my opinion that Baidu is on track to outperform its guidance of 15%-18% Q/Q revenue growth in 3Q09. Baidu's strong traffic this summer was mainly driven by search queries in five categories/industries: Online Games, Education & Training, Finance, Travel, IT & Consumer Electronics. Below is my analysis on each category:

Online Games category enjoyed a 42.5% Q/Q increase in search volume mainly due to strong seasonality in the summer, when students are in holidays and have more time to play throughout the day. The biggest winners in this category included Perfect World's (PWRD) Fantasy Zhu Xian (+2408% Q/Q), Tencent's (TCEHF.PK) Hero Island (+1689% Q/Q), and Kingsoft's JX III (+342% Q/Q).

Education & Training category saw search queries grow 37.4% Q/Q mainly due to students and parents anxiously searching for information on the annual National College Entrance Examination (Gao Kao). Searches related to scores and admissions surged 3593% and 1459% Q/Q, respectively.

Finance category enjoyed a 37.1% Q/Q growth in search volume, as Chinese investors eagerly searched for solutions to the large fluctuations in the A-share market: Shanghai Composite Index surged 30% in June and July, and then plunged 22% in August. Top traffic gainers included Everbright (Guangda) Securities (+154% Q/Q), mutual funds (+144% Q/Q), and Huaxia Fund Management Co. (+120% Q/Q).

Travel category saw search volume grow 32.8% Q/Q mainly driven by strong seasonality during the summer. Another factor is the cancellation of May 1st long holiday since 2008, which has caused people to shift some travel activities to the summer. Top gainers in this category included "Dalian Travel" (+183% Q/Q), "Air Ticket Booking" (+155% Q/Q), and "Qingdao Hotels" (+100% Q/Q).

IT & Consumer Electronics category enjoyed a 23.8% Q/Q increase in search queries, thanks to the annual busy season in the summer and aggressive promotions launched by manufacturers and stores. Top winners in this category included "Cell Phone Price Quotes" (+177% Q/Q), "Nokia Cell Phones" (+82% Q/Q), and "Lenovo Notebooks" (+63% Q/Q).

Disclosure: No positions

Karlll

by: Xiaofan Zhang September 03, 2009 | about: BIDU

This data point supports my opinion that Baidu is on track to outperform its guidance of 15%-18% Q/Q revenue growth in 3Q09. Baidu's strong traffic this summer was mainly driven by search queries in five categories/industries: Online Games, Education & Training, Finance, Travel, IT & Consumer Electronics. Below is my analysis on each category:

Online Games category enjoyed a 42.5% Q/Q increase in search volume mainly due to strong seasonality in the summer, when students are in holidays and have more time to play throughout the day. The biggest winners in this category included Perfect World's (PWRD) Fantasy Zhu Xian (+2408% Q/Q), Tencent's (TCEHF.PK) Hero Island (+1689% Q/Q), and Kingsoft's JX III (+342% Q/Q).

Education & Training category saw search queries grow 37.4% Q/Q mainly due to students and parents anxiously searching for information on the annual National College Entrance Examination (Gao Kao). Searches related to scores and admissions surged 3593% and 1459% Q/Q, respectively.

Finance category enjoyed a 37.1% Q/Q growth in search volume, as Chinese investors eagerly searched for solutions to the large fluctuations in the A-share market: Shanghai Composite Index surged 30% in June and July, and then plunged 22% in August. Top traffic gainers included Everbright (Guangda) Securities (+154% Q/Q), mutual funds (+144% Q/Q), and Huaxia Fund Management Co. (+120% Q/Q).

Travel category saw search volume grow 32.8% Q/Q mainly driven by strong seasonality during the summer. Another factor is the cancellation of May 1st long holiday since 2008, which has caused people to shift some travel activities to the summer. Top gainers in this category included "Dalian Travel" (+183% Q/Q), "Air Ticket Booking" (+155% Q/Q), and "Qingdao Hotels" (+100% Q/Q).

IT & Consumer Electronics category enjoyed a 23.8% Q/Q increase in search queries, thanks to the annual busy season in the summer and aggressive promotions launched by manufacturers and stores. Top winners in this category included "Cell Phone Price Quotes" (+177% Q/Q), "Nokia Cell Phones" (+82% Q/Q), and "Lenovo Notebooks" (+63% Q/Q).

Disclosure: No positions

Karlll

Baidu announces new e-commerce strategy based on x2c

Tuesday, August 18, 2009; Posted: 05:15 AM

Baidu.com (BIDU.NASDAQ), Tuesday announced its new e-commerce strategy as well as a series of plans for its online C2C e-commerce platform, known as Youa.

Li Mingyuan, general manager of Baidu's E-commerce Department, announced the strategy on the sideline of the 2009 Baidu Technology Innovation Forum held in Beijing.

Li explained that the "2c" in x2c stands for the core part of Baidu's e-commerce while the "x" refers to cooperation with partners based on Baidu's information searching, marketing and promotion, coordination and other subjects.

Of the innovative plans, Baidu said that an "Ark Plan" is aimed at building a comprehensive online shopping service and a "Bretton Woods Plan" will help improve the credit rating mechanism of Youa.

Moreover, Baidu would launch the "Fengming Plan" to introduce a batch of independent and quality online shopkeepers, jointly improving Youa's competitiveness.

Li added that the "Fengming Plan," created to help Youa advance into the e-commerce consumption business, would serve a crucial role in Baidu's x2c business, and that the company will further develop the plan.

Tuesday, August 18, 2009; Posted: 05:15 AM

Baidu.com (BIDU.NASDAQ), Tuesday announced its new e-commerce strategy as well as a series of plans for its online C2C e-commerce platform, known as Youa.

Li Mingyuan, general manager of Baidu's E-commerce Department, announced the strategy on the sideline of the 2009 Baidu Technology Innovation Forum held in Beijing.

Li explained that the "2c" in x2c stands for the core part of Baidu's e-commerce while the "x" refers to cooperation with partners based on Baidu's information searching, marketing and promotion, coordination and other subjects.

Of the innovative plans, Baidu said that an "Ark Plan" is aimed at building a comprehensive online shopping service and a "Bretton Woods Plan" will help improve the credit rating mechanism of Youa.

Moreover, Baidu would launch the "Fengming Plan" to introduce a batch of independent and quality online shopkeepers, jointly improving Youa's competitiveness.

Li added that the "Fengming Plan," created to help Youa advance into the e-commerce consumption business, would serve a crucial role in Baidu's x2c business, and that the company will further develop the plan.

Baidu Platform Rumored, "Knows" Adds Maps

Posted on Aug 14, 2009 | 18:08

"Reliable sources" say Baidu (Nasdaq:BIDU) Chairman and CEO Robin Li plans to announce a new statistics platform at the Baidu Technology Innovation Conference, to be held in Beijing from August 18, reports National Business Daily. Baidu plans to display a new ad solution support system, named "Si Nan" during the conference, Sohu reports. ("Si nan" refers to a kind of compass used in ancient China's Spring and Autumn Period.)

Baidu has added a new function that allows users to insert maps when answering questions in its interactive Q&A channel "Baidu Knows," reports KissBaidu. The channel added an "insert picture" function in January, the report said.

Karlll

Posted on Aug 14, 2009 | 18:08

"Reliable sources" say Baidu (Nasdaq:BIDU) Chairman and CEO Robin Li plans to announce a new statistics platform at the Baidu Technology Innovation Conference, to be held in Beijing from August 18, reports National Business Daily. Baidu plans to display a new ad solution support system, named "Si Nan" during the conference, Sohu reports. ("Si nan" refers to a kind of compass used in ancient China's Spring and Autumn Period.)

Baidu has added a new function that allows users to insert maps when answering questions in its interactive Q&A channel "Baidu Knows," reports KissBaidu. The channel added an "insert picture" function in January, the report said.

Karlll

Baidu Phoenix Nest Lures 100,000 Customers

As of 12:00 AM ET 8/12/09

Baidu Inc. (NASDAQ: BIDU) announces on August 13, 2009 that its newest advertising system Phoenix Nest has lured more than 100,000 users, accounting for 60% of its corporate customers.

After Baidu was accused last November of questionable paid search listing services on its general online search engine, the CEO Robin Li announced that his company would launch Phoenix Nest to solve the problems in its search engine marketing business, according to earlier reports.

At that time, Baidu expected that its old paid search listing system and Phoenix Nest would work simultaneously for a certain period. Upon Shen Haoyu, Baidu's vice president for operations, Phoenix Nest will take over all Baidu's advertising slots after the company's exiting customers move to the new system.

As the three-month-old Phoenix Nest has been widely accepted by Baidu customers, analysts pointed out that the simultaneous operation of the two advertising systems would cause the waste of both human and material resources.

Source: www.163.com (August 13, 2009)

As of 12:00 AM ET 8/12/09

Baidu Inc. (NASDAQ: BIDU) announces on August 13, 2009 that its newest advertising system Phoenix Nest has lured more than 100,000 users, accounting for 60% of its corporate customers.

After Baidu was accused last November of questionable paid search listing services on its general online search engine, the CEO Robin Li announced that his company would launch Phoenix Nest to solve the problems in its search engine marketing business, according to earlier reports.

At that time, Baidu expected that its old paid search listing system and Phoenix Nest would work simultaneously for a certain period. Upon Shen Haoyu, Baidu's vice president for operations, Phoenix Nest will take over all Baidu's advertising slots after the company's exiting customers move to the new system.

As the three-month-old Phoenix Nest has been widely accepted by Baidu customers, analysts pointed out that the simultaneous operation of the two advertising systems would cause the waste of both human and material resources.

Source: www.163.com (August 13, 2009)

Analyst Call on Baidu: Why Most Calls Are Useless

http://seekingalpha.com/article/154873-analyst-call-on-baidu…

http://seekingalpha.com/article/154873-analyst-call-on-baidu…

Baidu.com - NASDAQ: BIDU crashed - dieses Jahr noch unter 30 US Dollar?