Monarch Gold Corporation - 500 Beiträge pro Seite

eröffnet am 29.04.20 18:49:59 von

neuester Beitrag 04.02.21 11:36:07 von

neuester Beitrag 04.02.21 11:36:07 von

Beiträge: 85

ID: 1.324.061

ID: 1.324.061

Aufrufe heute: 0

Gesamt: 4.194

Gesamt: 4.194

Aktive User: 0

ISIN: CA60918T1012 · WKN: A14MVD

0,3400

EUR

+1,19 %

+0,0040 EUR

Letzter Kurs 26.01.21 Stuttgart

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 42,93 | +19,98 | |

| 247,15 | +16,31 | |

| 3.200,00 | +15,90 | |

| 3,0470 | +11,82 | |

| 12,040 | +11,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 53,54 | -6,97 | |

| 0,6280 | -7,10 | |

| 0,5510 | -8,17 | |

| 38,52 | -9,22 | |

| 4,6500 | -10,23 |

Monarch Gold hat einen Thread verdient mit korrektem Namen. Deshalb habe ich einen neuen angelegt.

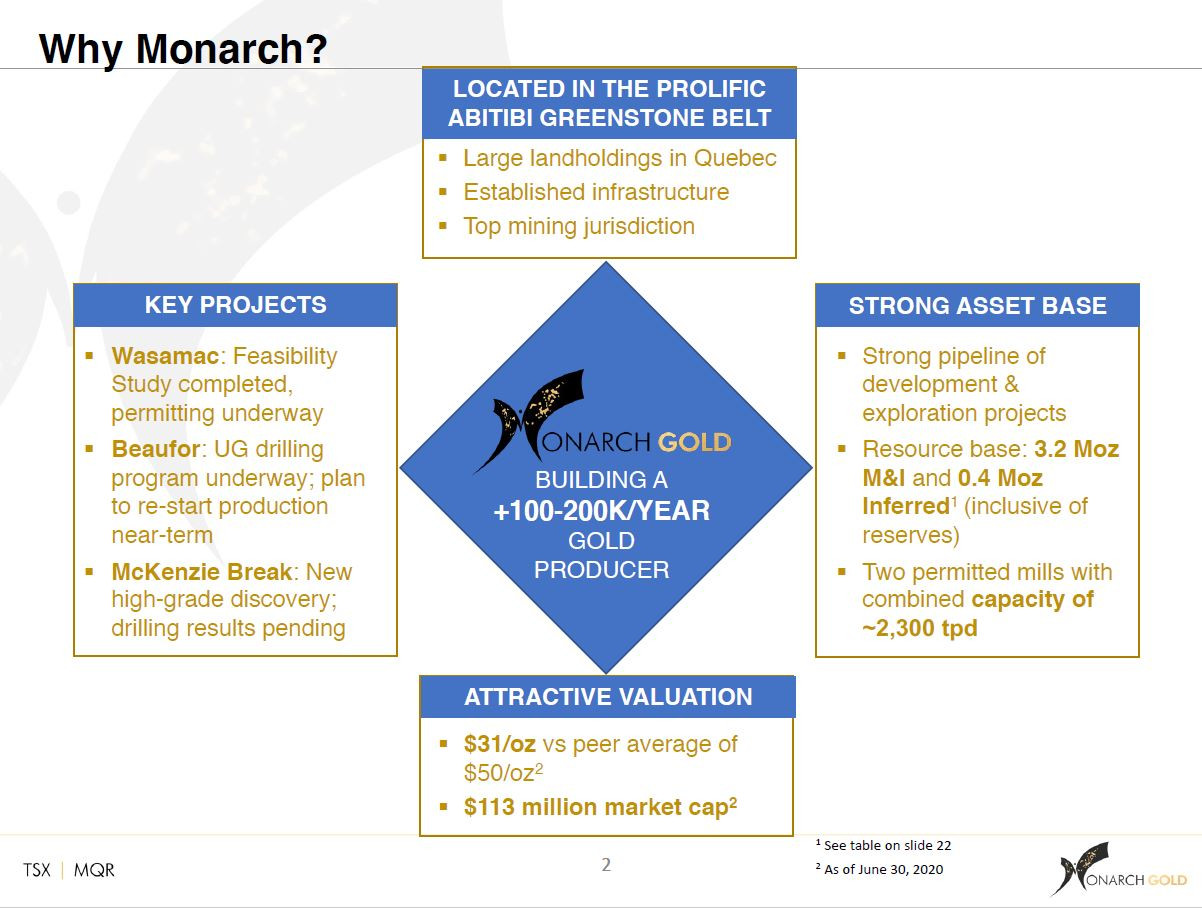

Corporate Profile

Monarch Gold Corporation (TSX: MQR) is an emerging Canadian gold mining company that aims to be a 100,000-200,000-ounce per year gold producer through the development of its portfolio of high-quality projects covering over 320 km² in the Abitibi mining camp in Quebec, Canada.

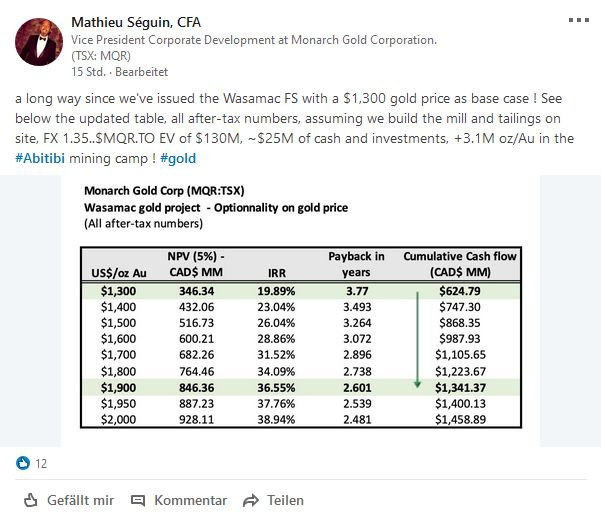

The December 2018 feasibility study on the Corporation’s flagship Wasamac 2.6 million-ounce gold project forecasts average annual production of 142,000 ounces of gold for 11 years at a cash cost of US$550 per ounce. Based on a US$1,300 gold price, the project has a pre-tax net present value of $522 million and a 23.6% pre-tax internal rate of return. The deposit remains open at depth and along strike.

Monarch is also a fully integrated mining company that owns five other advanced projects, namely the Beaufor, Croinor Gold, Fayolle, McKenzie Break and Swanson projects, all located near Monarch’s wholly owned, fully functional, fully permitted Camflo (1,600 tpd) and Beacon (750 tpd) mills and a potential source of feed for the mills.

Corporate Presentation

http://monarquesgoldfiles.com/documents/files/Corporate-Pres…

Corporate Profile

Monarch Gold Corporation (TSX: MQR) is an emerging Canadian gold mining company that aims to be a 100,000-200,000-ounce per year gold producer through the development of its portfolio of high-quality projects covering over 320 km² in the Abitibi mining camp in Quebec, Canada.

The December 2018 feasibility study on the Corporation’s flagship Wasamac 2.6 million-ounce gold project forecasts average annual production of 142,000 ounces of gold for 11 years at a cash cost of US$550 per ounce. Based on a US$1,300 gold price, the project has a pre-tax net present value of $522 million and a 23.6% pre-tax internal rate of return. The deposit remains open at depth and along strike.

Monarch is also a fully integrated mining company that owns five other advanced projects, namely the Beaufor, Croinor Gold, Fayolle, McKenzie Break and Swanson projects, all located near Monarch’s wholly owned, fully functional, fully permitted Camflo (1,600 tpd) and Beacon (750 tpd) mills and a potential source of feed for the mills.

Corporate Presentation

http://monarquesgoldfiles.com/documents/files/Corporate-Pres…

Monarch Gold gehört nach meiner Meinung zu einem der interessantesten Werte im Goldsektor. Monarch verfügt über 2 Mills (2.300 tpd) mit einem Wert von über 50 Millionen Can-Dollar. Die aktuelle Marktkapitalisierung von Monarch beträgt ~ 58 Millionen Can-Dollar.

Mit dem aktuellen Goldpreis von 1650 USD hat Monarchs Flagship Projekt Wasamac einen pre-tax NPV von 1 Mrd. USD. Monarch begann im Dezember 2019 mit einem zweijährigen Genehmigungsverfahren. Wasamac hat 142.000 Unzen pro Jahr mit mine life von 11 Jahren. AISC sind 630 USD / Unze. CAPEX ist 464 Millionen US-Dollar, die möglicherweise um 230 Millionen US-Dollar für mill and tailings facility reduziert werden können, wenn sie sich für custom milling entscheiden, da sich Wasamac direkt neben einer Eisenbahnstrecke befindet. Wasamac hat Explorationspotential in alle Richtungen.

Near term production Möglichkeiten sind insbesondere die Beaufor Mine und Fayolle:

• Die Beaufor-Mine hat noch ein Jahr mine life (Measured Resources 16,100 ounces). Die Mine ist derzeit on care and maintenance. Monarch strebt derzeit eine Partnerschaft an, um die Reserven zu erhöhen und die Mine innerhalb eines Zeitraums von 12 bis 18 Monaten neu zu starten. Nach früheren Mitteilungen des Unternehmens besteht das Potenzial für ~ 714.000 neue Unzen mit einem Bohrprogramm von 4 bis 6 Mio. USD.

• Fayolle ist ein potenzieller kurzfristiger Cash-Windfall. 6 Gramm open pitable 75.000 ounces und Monarchs Mill direkt daneben. Nach früheren Mitteilungen des Unternehmens könnte Fayolle mit anderthalb Jahren mine life leicht einen Gewinn von 50 bis 60 Millionen US-Dollar bringen. Der Start des Genehmigungsverfahrens wird im Frühjahr erwartet mit erwarteter Genehmigung im Jahr 2021. Eine prefeasibility study ist für Q2 2020 geplant.

Zum 31. Dezember 2019 verfügte das Unternehmen über Barmittel in Höhe von 5,1 Mio. USD, kurzfristige Investitionen in Höhe von 3,6 Mio. USD und Lagerbestände in Höhe von 500 Unzen Gold.

Mit dem aktuellen Goldpreis von 1650 USD hat Monarchs Flagship Projekt Wasamac einen pre-tax NPV von 1 Mrd. USD. Monarch begann im Dezember 2019 mit einem zweijährigen Genehmigungsverfahren. Wasamac hat 142.000 Unzen pro Jahr mit mine life von 11 Jahren. AISC sind 630 USD / Unze. CAPEX ist 464 Millionen US-Dollar, die möglicherweise um 230 Millionen US-Dollar für mill and tailings facility reduziert werden können, wenn sie sich für custom milling entscheiden, da sich Wasamac direkt neben einer Eisenbahnstrecke befindet. Wasamac hat Explorationspotential in alle Richtungen.

Near term production Möglichkeiten sind insbesondere die Beaufor Mine und Fayolle:

• Die Beaufor-Mine hat noch ein Jahr mine life (Measured Resources 16,100 ounces). Die Mine ist derzeit on care and maintenance. Monarch strebt derzeit eine Partnerschaft an, um die Reserven zu erhöhen und die Mine innerhalb eines Zeitraums von 12 bis 18 Monaten neu zu starten. Nach früheren Mitteilungen des Unternehmens besteht das Potenzial für ~ 714.000 neue Unzen mit einem Bohrprogramm von 4 bis 6 Mio. USD.

• Fayolle ist ein potenzieller kurzfristiger Cash-Windfall. 6 Gramm open pitable 75.000 ounces und Monarchs Mill direkt daneben. Nach früheren Mitteilungen des Unternehmens könnte Fayolle mit anderthalb Jahren mine life leicht einen Gewinn von 50 bis 60 Millionen US-Dollar bringen. Der Start des Genehmigungsverfahrens wird im Frühjahr erwartet mit erwarteter Genehmigung im Jahr 2021. Eine prefeasibility study ist für Q2 2020 geplant.

Zum 31. Dezember 2019 verfügte das Unternehmen über Barmittel in Höhe von 5,1 Mio. USD, kurzfristige Investitionen in Höhe von 3,6 Mio. USD und Lagerbestände in Höhe von 500 Unzen Gold.

Ergebnisse von Bohrloch 1 von 7 bei Fayolle wurde heute veröffentlicht...

Monarch Gold Intersects 3.33 G/T Au Over 109 Metres (358 Ft) At Its Fayolle Gold Project

April 30, 2020

- Hole FA-19-121 (first of seven holes) returned 3.33 g/t Au over 109.0 metres (358 ft), including 10.27 g/t Au over 7.0 metres, 9.14 g/t Au over 6.0 metres, 7.68 g/t Au over 5.0 metres, 7.50 g/t Au over 8.0 metres, and 6.80 g/t Au over 4.9 metres.

- The lower portion of the interval assayed 3.33 g/t Au over 32.9 metres immediately below the current planned constrained pit outline and could potentially increase the in-pit gold resource.

https://www.monarquesgold.com/news-releases/monarch-gold-int…

Monarch Gold Intersects 3.33 G/T Au Over 109 Metres (358 Ft) At Its Fayolle Gold Project

April 30, 2020

- Hole FA-19-121 (first of seven holes) returned 3.33 g/t Au over 109.0 metres (358 ft), including 10.27 g/t Au over 7.0 metres, 9.14 g/t Au over 6.0 metres, 7.68 g/t Au over 5.0 metres, 7.50 g/t Au over 8.0 metres, and 6.80 g/t Au over 4.9 metres.

- The lower portion of the interval assayed 3.33 g/t Au over 32.9 metres immediately below the current planned constrained pit outline and could potentially increase the in-pit gold resource.

https://www.monarquesgold.com/news-releases/monarch-gold-int…

Die gestrige News bezüglich eines möglichen pit extension bei Fayolle ist sehr positiv nach meiner Meinung. Ergebnisse von 6 der 7 Bohrlöcher stehen noch aus. Fayolle ist ein möglicher near term cash windfall. Monarch führt derzeit die Feasibility Study für Fayolle durch. Die Fertigstellung wird für das zweite Quartal 2020 erwartet. Die PEA 2013 hatte einen Netto-Cashflow von 38,5 Mio. CAD bei einem Goldpreis von 1.518 CAD / Unze angegeben, wobei der IRR nach Steuern 110% beträgt. Der heutige Goldpreis beträgt 2.400 CAD / Unze. Das Capex für Fayolle ist mit anfänglichen Kosten von 5,9 Mio. CAD recht überschaubar. Die Gesamtproduktion beträgt 74.813 Unzen bei cash operating costs von 721 US-Dollar pro Unze.

Hoffen wir, dass die noch ausstehenden Bohrlochergebnisse die Erwartungen ebenfalls übertreffen.

Monarch ist meiner Meinung nach immer noch stark unterbewertet. Monarch hat mehrere aussichtsreiche Projekte im Portfolio in einer erstklassigen Gerichtsbarkeit.

Hoffen wir, dass die noch ausstehenden Bohrlochergebnisse die Erwartungen ebenfalls übertreffen.

Monarch ist meiner Meinung nach immer noch stark unterbewertet. Monarch hat mehrere aussichtsreiche Projekte im Portfolio in einer erstklassigen Gerichtsbarkeit.

Eine gute Zeit um sich nochmal das Interview mit David Erfle, Herausgeber des Junior Miner Junky Newsletters vom Oktober vergangenen Jahres anzuhören. Laut Erfle könnte Monarch ein 10-Bagger sein (Interview gegen 18:40 Uhr) unter der Annahme, dass der Goldpreis über $1.500 bleibt.

Schön zu sehen, dass Monarch etwas mehr im Fokus steht. Dies ist erst der Anfang. Multibagger Potential nach meiner Ansicht...

4 Hot Gold Penny Stocks to Buy in May 2020

https://microsmallcap.com/4-hot-gold-penny-stocks-buy-05-01-…

Monarch Gold Corp. had a particularly exciting day in the markets Thursday after reporting high-grade gold intercepts at its Fayolle gold project in Quebec.

According to Monarch Gold CEO Jean-Marc Lacoste, the first diamond drill hole has confirmed the block model and wireframe output and surpassed the company’s expectations in terms of gold grade and continuity of the mineralization.

“Hitting significant economic gold values below the planned constrained pit will likely add to the tonnage and ounces of the Fayolle deposit,” he added.

Monarch is focused on producing 100,000 to 200,000 ounces of gold per year through its large portfolio of projects in the prolific Abitibi mining district. The company currently owns over 370 square kilometers of gold properties, including the Wasamac deposit, which has a measured and indicated resource of 2.6 million ounces of gold, the Beaufor, Croinor Gold, Fayolle, McKenzie Break, and Swanson projects.

On Thursday, MQR stock increased by 13.64% to C$0.25 on the TSX and was up 18% to $0.18 on the OTC. The company’s share price has been on an upward trajectory for the last couple weeks after hitting a 52-week low of C$0.11 in March.

The company has been busy making new discoveries, selling off certain assets, raising funds, and working to restart mining operations that are on care and maintenance.

If Monarch Gold manages to restart operations at its Beaufor underground gold mine in the next 18 months, as well as expand the mine’s resource, it might not remain a gold penny stock for long.

Monarch Gold has a market cap of C$59.3 million, with 269,621,119 shares issued. It is currently selling for C$0.25 on the TSX and for $0.17 on the OTC.

4 Hot Gold Penny Stocks to Buy in May 2020

https://microsmallcap.com/4-hot-gold-penny-stocks-buy-05-01-…

Monarch Gold Corp. had a particularly exciting day in the markets Thursday after reporting high-grade gold intercepts at its Fayolle gold project in Quebec.

According to Monarch Gold CEO Jean-Marc Lacoste, the first diamond drill hole has confirmed the block model and wireframe output and surpassed the company’s expectations in terms of gold grade and continuity of the mineralization.

“Hitting significant economic gold values below the planned constrained pit will likely add to the tonnage and ounces of the Fayolle deposit,” he added.

Monarch is focused on producing 100,000 to 200,000 ounces of gold per year through its large portfolio of projects in the prolific Abitibi mining district. The company currently owns over 370 square kilometers of gold properties, including the Wasamac deposit, which has a measured and indicated resource of 2.6 million ounces of gold, the Beaufor, Croinor Gold, Fayolle, McKenzie Break, and Swanson projects.

On Thursday, MQR stock increased by 13.64% to C$0.25 on the TSX and was up 18% to $0.18 on the OTC. The company’s share price has been on an upward trajectory for the last couple weeks after hitting a 52-week low of C$0.11 in March.

The company has been busy making new discoveries, selling off certain assets, raising funds, and working to restart mining operations that are on care and maintenance.

If Monarch Gold manages to restart operations at its Beaufor underground gold mine in the next 18 months, as well as expand the mine’s resource, it might not remain a gold penny stock for long.

Monarch Gold has a market cap of C$59.3 million, with 269,621,119 shares issued. It is currently selling for C$0.25 on the TSX and for $0.17 on the OTC.

👍

CDPQ Invests $5 Million in Monarch Gold to Support the Potential Re-Opening of the Beaufor Mine

May 7, 2020

- The Corporation will undertake an extensive 42,500-metre drilling program on Beaufor.

- Monarch will incorporate artificial intelligence technologies to optimize target selection for its next drilling program using advanced analytics.

- The ultimate goal is to restart gold production at the Beaufor mine within 12 to 18 months to take advantage of the bullish gold market.

MONTRÉAL, May 7, 2020 /PRNewswire/ - MONARCH GOLD CORPORATION ("Monarch" or the "Corporation") (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) announces that it has signed an agreement with Caisse de dépôt et placement du Québec ("CDPQ") to sell a 3% net smelter return royalty on gold production at the Beaufor mine (the "NSR") for $5 million.

https://www.monarquesgold.com/news-releases/cdpq-invests-5-m…

CDPQ Invests $5 Million in Monarch Gold to Support the Potential Re-Opening of the Beaufor Mine

May 7, 2020

- The Corporation will undertake an extensive 42,500-metre drilling program on Beaufor.

- Monarch will incorporate artificial intelligence technologies to optimize target selection for its next drilling program using advanced analytics.

- The ultimate goal is to restart gold production at the Beaufor mine within 12 to 18 months to take advantage of the bullish gold market.

MONTRÉAL, May 7, 2020 /PRNewswire/ - MONARCH GOLD CORPORATION ("Monarch" or the "Corporation") (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) announces that it has signed an agreement with Caisse de dépôt et placement du Québec ("CDPQ") to sell a 3% net smelter return royalty on gold production at the Beaufor mine (the "NSR") for $5 million.

https://www.monarquesgold.com/news-releases/cdpq-invests-5-m…

Mir gefällt der deal mit CDPQ - Caisse de dépôt et placement du Québec. Finanzierung ohne Dilution. Laut CEO Präsentationen besteht Potential for ~714,000 new ounces with a $4M to $6M drilling program at the Beaufor Mine.

Market Cap von Monarch ist ein Witz...

Market Cap von Monarch ist ein Witz...

GoldSpot Discoveries Signs Agreement with Monarch Gold

Newsfile Corp.

May 8, 2020

https://finance.yahoo.com/news/goldspot-discoveries-signs-ag…

The planned exploration program will be one of the largest exploration programs ever undertaken on the Beaufor Mine, consisting of approximately 270 drill holes for a total of 42,500 metres.

Newsfile Corp.

May 8, 2020

https://finance.yahoo.com/news/goldspot-discoveries-signs-ag…

The planned exploration program will be one of the largest exploration programs ever undertaken on the Beaufor Mine, consisting of approximately 270 drill holes for a total of 42,500 metres.

Im folgenden ein Link zur Beaufor Presentation (May 2020).

http://monarquesgoldfiles.com/documents/files/Beaufor/MQR-Be…

- Concluded $5 million financing with La Caisse de dépôt et placement du Québec (CDPQ) to fund exploration program with the goal of restarting the mine

- Timeline to production <18 months

- No permits required to re-start

- Year ended June 30, 2018: 14,856 oz of gold produced

http://monarquesgoldfiles.com/documents/files/Beaufor/MQR-Be…

- Concluded $5 million financing with La Caisse de dépôt et placement du Québec (CDPQ) to fund exploration program with the goal of restarting the mine

- Timeline to production <18 months

- No permits required to re-start

- Year ended June 30, 2018: 14,856 oz of gold produced

Abhängig von der weiteren Kursentwicklung dieser drei Unternehmen kann Monarch ggf. das Capex bei Fayolle (5,9 Mio. CAD laut PEA 2013) mit ihren short-term investments finanzieren. Dann hoffe ich mal, dass diese Unternehmen in naher Zukunft einige Explorationserfolge erzielen werden...

Unigold (TSXV: UGD): 6.5 million shares at a price of $0.115 per Share (current price $ 0.225)

O3 Mining (TSXV: OIII): 435,000 common shares and 435,000 warrants. Each warrant entitles Monarch to subscribe for one additional common share of O3 Mining at a price of $4.20 for a period of three years following the closing of the transaction. Current price of OIII is $ 1.99

Probe Metals (TSXV: PRB): 1,275,510 common shares. Current price of PRB is $ 1.19

Unigold (TSXV: UGD): 6.5 million shares at a price of $0.115 per Share (current price $ 0.225)

O3 Mining (TSXV: OIII): 435,000 common shares and 435,000 warrants. Each warrant entitles Monarch to subscribe for one additional common share of O3 Mining at a price of $4.20 for a period of three years following the closing of the transaction. Current price of OIII is $ 1.99

Probe Metals (TSXV: PRB): 1,275,510 common shares. Current price of PRB is $ 1.19

Monarch Gold Starts Drilling On Wholly Owned Mckenzie Break, Swanson And Beacon Properties

May 13, 2020

News Release

- The follow-up program on McKenzie Break will target lateral and depth extensions of hole MK19250, which returned 10.50 g/t Au over 11 metres, including 156.00 g/t Au over 0.6 metres, and the eastern extension of hole MK-19-249, which returned 5.28 g/t Au over 13.70 metres, including 58.17 g/t Au over 0.6 metres.

- Best results from the 2018 and 2019 drilling programs on McKenzie Break, by metal factor:

MK-18-205Ext: 32.30 g/t Au over 7.1 metres (realized in 2019)

MK-18-196: 61.20 g/t Au over 2.6 metres

MK-19-250: 10.50 g/t Au over 11.0 metres

MK-19-249: 5.28 g/t Au over 13.7 metres

MK-19-241: 26.78 g/t Au over 2.1 metres

- The program on the Swanson and Beacon properties will test new high-potential targets.

Montreal, Quebec, Canada, May 13, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) is pleased to announce that it has started diamond drill programs on three of its wholly-owned gold properties, namely McKenzie Break, Swanson and Beacon. Drilling started on the McKenzie Break property, and will subsequently move to the Swanson and the Beacon properties, respectively.

https://www.monarquesgold.com/news-releases/monarch-gold-sta…

May 13, 2020

News Release

- The follow-up program on McKenzie Break will target lateral and depth extensions of hole MK19250, which returned 10.50 g/t Au over 11 metres, including 156.00 g/t Au over 0.6 metres, and the eastern extension of hole MK-19-249, which returned 5.28 g/t Au over 13.70 metres, including 58.17 g/t Au over 0.6 metres.

- Best results from the 2018 and 2019 drilling programs on McKenzie Break, by metal factor:

MK-18-205Ext: 32.30 g/t Au over 7.1 metres (realized in 2019)

MK-18-196: 61.20 g/t Au over 2.6 metres

MK-19-250: 10.50 g/t Au over 11.0 metres

MK-19-249: 5.28 g/t Au over 13.7 metres

MK-19-241: 26.78 g/t Au over 2.1 metres

- The program on the Swanson and Beacon properties will test new high-potential targets.

Montreal, Quebec, Canada, May 13, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) is pleased to announce that it has started diamond drill programs on three of its wholly-owned gold properties, namely McKenzie Break, Swanson and Beacon. Drilling started on the McKenzie Break property, and will subsequently move to the Swanson and the Beacon properties, respectively.

https://www.monarquesgold.com/news-releases/monarch-gold-sta…

Monarch Gold Reports Its Third Quarter Results For Fiscal 2020

May 13, 2020

Montreal, Quebec, Canada, May 13, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) reported its results today for the third quarter ended March 31, 2020. Amounts are in Canadian dollars unless otherwise indicated.

“COVID-19 may have put a temporary halt on our exploration activities but we are still extremely busy preparing for the post-COVID period and a rising gold market,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “In fact, we recently announced a $5 million financing with the Caisse de dépôt et placement du Québec for the Beaufor mine (see press release dated May 7, 2020), excellent results for the Fayolle deposit (see press release dated April 30, 2020) and the McKenzie Break deposit (see press release dated February 26, 2020) and strengthening of our management team with the appointment of Guylaine Daigle to our Board of Directors. The coming period should be equally interesting as we continue to work on the development of our flagship Wasamac deposit, which is currently attracting renewed interest from the mining and financial community, as well as our other substantial mining assets, including the Croinor Gold and Swanson deposits and the Camflo and Beacon ore processing plants.”

https://www.monarquesgold.com/news-releases/monarch-gold-rep…

May 13, 2020

Montreal, Quebec, Canada, May 13, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) reported its results today for the third quarter ended March 31, 2020. Amounts are in Canadian dollars unless otherwise indicated.

“COVID-19 may have put a temporary halt on our exploration activities but we are still extremely busy preparing for the post-COVID period and a rising gold market,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “In fact, we recently announced a $5 million financing with the Caisse de dépôt et placement du Québec for the Beaufor mine (see press release dated May 7, 2020), excellent results for the Fayolle deposit (see press release dated April 30, 2020) and the McKenzie Break deposit (see press release dated February 26, 2020) and strengthening of our management team with the appointment of Guylaine Daigle to our Board of Directors. The coming period should be equally interesting as we continue to work on the development of our flagship Wasamac deposit, which is currently attracting renewed interest from the mining and financial community, as well as our other substantial mining assets, including the Croinor Gold and Swanson deposits and the Camflo and Beacon ore processing plants.”

https://www.monarquesgold.com/news-releases/monarch-gold-rep…

Geht weiter vorwärts beim Flagship project Wasamac 👍

Monarch Gold Signs MOU With Glencore Canada Regarding The Potential Use Of The Kidd Concentrator For Its Wasamac Gold Project

May 14, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-sig…

Monarch Gold Signs MOU With Glencore Canada Regarding The Potential Use Of The Kidd Concentrator For Its Wasamac Gold Project

May 14, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-sig…

Gestern war ein guter Zeitpunkt einzusteigen. Nemaska musste wohl verkaufen...

Nemaska Lithium Sells Its 15,849,455 Common Shares of Monarques

May 15, 2020 06:30 ET | Source: Nemaska Lithium Inc

https://www.globenewswire.com/news-release/2020/05/15/203410…

Nemaska Lithium Sells Its 15,849,455 Common Shares of Monarques

May 15, 2020 06:30 ET | Source: Nemaska Lithium Inc

https://www.globenewswire.com/news-release/2020/05/15/203410…

Hier noch die offizielle Press Release von Monarch wegen dem hohen Handelsvolumen. Market cap von Monarch ist immer noch viel zu niedrig. Monarch hat mehrere aussichtsreiche Projekte im Portfolio in einer erstklassigen Gerichtsbarkeit.

Monarch Gold Announces The Sale By Nemaska Lithium Of 15,849,455 Monarch Gold Shares

May 15, 2020

Montreal, Quebec, Canada, May 15, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) explains yesterday’s record volume due to the sale of the 15,849,455 shares held by Nemaska Lithium in connection with its ongoing restructuring process under the Companies’ Creditors Arrangement Act (CCAA) (see press release). Nemaska no longer holds any Monarch shares.

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

Monarch Gold Announces The Sale By Nemaska Lithium Of 15,849,455 Monarch Gold Shares

May 15, 2020

Montreal, Quebec, Canada, May 15, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) explains yesterday’s record volume due to the sale of the 15,849,455 shares held by Nemaska Lithium in connection with its ongoing restructuring process under the Companies’ Creditors Arrangement Act (CCAA) (see press release). Nemaska no longer holds any Monarch shares.

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

Monarch Gold Receives Excellent Results From New Tailings Study On The Wasamac Gold Project

May 20, 2020

- Study clearly shows that the Wasamac tailings are non-potentially acid generating (non-PAG).

- Wasamac tailings could also lower the acidity at tailings sites of neighbouring mills (see the map).

- Combined effect could improve the project’s economic parameters and support the lower-CAPEX custom milling scenario.

https://www.monarquesgold.com/news-releases/monarch-gold-rec…

“This study is of great interest to us, as it indicates that the Wasamac tailings will be significantly less harmful to the environment than if they were acid-generating,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “In addition, the potential to neutralize acid on existing tailings facilities from Wasamac tailings suggests that Wasamac could be an obvious economic choice for several mills (see the map).”

May 20, 2020

- Study clearly shows that the Wasamac tailings are non-potentially acid generating (non-PAG).

- Wasamac tailings could also lower the acidity at tailings sites of neighbouring mills (see the map).

- Combined effect could improve the project’s economic parameters and support the lower-CAPEX custom milling scenario.

https://www.monarquesgold.com/news-releases/monarch-gold-rec…

“This study is of great interest to us, as it indicates that the Wasamac tailings will be significantly less harmful to the environment than if they were acid-generating,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “In addition, the potential to neutralize acid on existing tailings facilities from Wasamac tailings suggests that Wasamac could be an obvious economic choice for several mills (see the map).”

Glencore ist nach meiner Ansicht ein ausgezeichneter Partner für das Wasamac Project (NPV of ~ C$1 Billion mit dem derzeitigen Goldpreis. 142,000 ounces/year über 11 Jahre. US$630/oz all-in-sustaining costs). Monarchs Market Cap ist weiterhin viel zu niedrig...

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 90 commodities. The Group's operations comprise around 150 mining and metallurgical sites, oil production assets and agricultural facilities.

With a strong footprint in both established and emerging regions for natural resources, Glencore's industrial and marketing activities are supported by a global network of more than 90 offices located in over 50 countries.

Glencore's customers are industrial consumers, such as those in the automotive, steel, power generation, oil and food processing sectors. We also provide financing, logistics and other services to producers and consumers of commodities. Glencore's companies employ around 158,000 people, including contractors.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. We are an active participant in the Extractive Industries Transparency Initiative.

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 90 commodities. The Group's operations comprise around 150 mining and metallurgical sites, oil production assets and agricultural facilities.

With a strong footprint in both established and emerging regions for natural resources, Glencore's industrial and marketing activities are supported by a global network of more than 90 offices located in over 50 countries.

Glencore's customers are industrial consumers, such as those in the automotive, steel, power generation, oil and food processing sectors. We also provide financing, logistics and other services to producers and consumers of commodities. Glencore's companies employ around 158,000 people, including contractors.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. We are an active participant in the Extractive Industries Transparency Initiative.

Laut der Unternehmenspräsentation wird die Feasibilty Study für Fayolle im zweiten Quartal 2020 fertig sein. Dies ist eine enorme cash windfall Chance für Monarch. Es wird nicht viel Zeit benötigt, um dieses Projekt in Produktion zu bringen. Permits werden innerhalb eines Jahres nach Feasibilty Study erwartet. Höchstwahrscheinlich werden sich die folgenden Zahlen unter Berücksichtigung der jüngsten Bohrergebnisse sogar verbessern.

Fayolle (PEA 2013)

Capex initial costs of C$ 5.9 Million

Total Production is 74,813 oz at cash operating costs of $721 US/oz

Minelife of 3 years.

After-Tax IRR 110%

Fayolle (PEA 2013)

Capex initial costs of C$ 5.9 Million

Total Production is 74,813 oz at cash operating costs of $721 US/oz

Minelife of 3 years.

After-Tax IRR 110%

Monarch Gold Sells Fayolle To IAMGOLD For $11.5 Million

June 1, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-sel…

“This is a profitable short-term transaction for Monarch, allowing us to significantly strengthen our financial position without dilution and with the potential for appreciation if the share value of IAMGOLD increases, especially in the current gold bull market,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “While Fayolle has potential, the fact remains that Wasamac is our priority project and the recent signing of the MOU with Glencore Canada (see press release dated May 14, 2020) has raised the outlook of our 2.6-million-ounce gold flagship project, which includes 1.8 million ounces of reserves. The funds from this transaction will allow us to advance the Wasamac project at a faster pace, while simultaneously pursuing exploration programs on our Beaufor and McKenzie Break properties.”

June 1, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-sel…

“This is a profitable short-term transaction for Monarch, allowing us to significantly strengthen our financial position without dilution and with the potential for appreciation if the share value of IAMGOLD increases, especially in the current gold bull market,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “While Fayolle has potential, the fact remains that Wasamac is our priority project and the recent signing of the MOU with Glencore Canada (see press release dated May 14, 2020) has raised the outlook of our 2.6-million-ounce gold flagship project, which includes 1.8 million ounces of reserves. The funds from this transaction will allow us to advance the Wasamac project at a faster pace, while simultaneously pursuing exploration programs on our Beaufor and McKenzie Break properties.”

Hallo!

Kaum verständlich, warum die Aktie in Toronto für umgerechnet 0,163 € gehandelt wird und in Deutschland bei L + S für 0,143 zum Verkauf steht!?!?

Kaum verständlich, warum die Aktie in Toronto für umgerechnet 0,163 € gehandelt wird und in Deutschland bei L + S für 0,143 zum Verkauf steht!?!?

Neben dem re-start der Beaufor Mine ist der klare Fokus nun auf dem Flagship Project Wasamac.

Wasamac

- 142.000 Unzen pro Jahr mit mine life von 11 Jahren

- pre-tax NPV von 1 Mrd. USD (unter Berücksichtigung des derzeitigen Goldpreises)

- AISC von 630 USD / Unze

- CAPEX von 464 Millionen US-Dollar

- Wasamac hat Explorationspotential in alle Richtungen

- Monarch begann im Dezember 2019 mit einem zweijährigen Genehmigungsverfahren

CAPEX kann möglicherweise um 230 Millionen US-Dollar für mill and tailings facility reduziert werden, sofern man sich für custom milling entscheidet (wonach es derzeit auch stark aussieht). Wasamac befindet sich direkt neben einer Eisenbahnstrecke.

Memorandum Of Understanding mit Glencore Canada Corporation hinsichtlich "the potential use of Glencore’s Kidd concentrator (the “Concentrator”) in Timmins, Ontario for the treatment of ore to be mined from Monarch’s Wasamac gold property located in the Province of Québec".

Wasamac

- 142.000 Unzen pro Jahr mit mine life von 11 Jahren

- pre-tax NPV von 1 Mrd. USD (unter Berücksichtigung des derzeitigen Goldpreises)

- AISC von 630 USD / Unze

- CAPEX von 464 Millionen US-Dollar

- Wasamac hat Explorationspotential in alle Richtungen

- Monarch begann im Dezember 2019 mit einem zweijährigen Genehmigungsverfahren

CAPEX kann möglicherweise um 230 Millionen US-Dollar für mill and tailings facility reduziert werden, sofern man sich für custom milling entscheidet (wonach es derzeit auch stark aussieht). Wasamac befindet sich direkt neben einer Eisenbahnstrecke.

Memorandum Of Understanding mit Glencore Canada Corporation hinsichtlich "the potential use of Glencore’s Kidd concentrator (the “Concentrator”) in Timmins, Ontario for the treatment of ore to be mined from Monarch’s Wasamac gold property located in the Province of Québec".

Die derzeitige Marktkapitalisierung von Monarch ~ $70 Mio ist immer noch ein Witz nach meiner Ansicht. Die beiden Mills im Besitz von Monarch haben einen Wert von ~ $50 Mio. Cash und short-term investments belaufen sich auf ca. $20 Mio (einschließlich des $11,5 Mio Aktiendeals mit IAMGOLD). Hinzu kommt die Investition von CDPG (Caisse de Dépôt et Placement du Québec) in Höhe von $5 Mio, um die Beaufor-Mine von Monarch wieder in Betrieb zu nehmen.

Pre-tax NPV vom flagship Wasamac project ist $1 Mrd mit dem derzeitigen Goldpreis.

Die Beaufor Mine produzierte zuletzt 14.856 Unzen Gold im Jahr. Mit dem von CDPG bezahlten Bohrprogramm besteht das Potenzial für ~ 714.000 neue Unzen laut früheren Präsentationen vom CEO. Ziel ist es, die Goldproduktion der Beaufor Mine innerhalb von 12 bis 18 Monaten wieder aufzunehmen.

Weiterhin Multibagger Potential nach meiner Meinung...

Pre-tax NPV vom flagship Wasamac project ist $1 Mrd mit dem derzeitigen Goldpreis.

Die Beaufor Mine produzierte zuletzt 14.856 Unzen Gold im Jahr. Mit dem von CDPG bezahlten Bohrprogramm besteht das Potenzial für ~ 714.000 neue Unzen laut früheren Präsentationen vom CEO. Ziel ist es, die Goldproduktion der Beaufor Mine innerhalb von 12 bis 18 Monaten wieder aufzunehmen.

Weiterhin Multibagger Potential nach meiner Meinung...

Monarch Gold Announces The Closing Of The Sale Of The Fayolle Property To IAMGOLD

June 8, 2020

Montreal, Quebec, Canada, June 8, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) is pleased to announce the closing of the sale of the Fayolle property to IAMGOLD Corporation (“IAMGOLD”) (TSX: IMG) (NYSE: IAG) for a total consideration of $11.5 million.

IAMGOLD issued 1,851,145 common shares to Monarch at a price of $5.24 per share for a total value of $9.7 million and will pay an additional $0.3 million in cash upon transfer of ownership of a parcel of land to IAMGOLD and an additional $1.5 million in cash 90 days after the initial transport of ore from the Fayolle deposit.

Following this transaction, Monarch now has approximately $20 million in cash and short-term investments.

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

June 8, 2020

Montreal, Quebec, Canada, June 8, 2020 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) is pleased to announce the closing of the sale of the Fayolle property to IAMGOLD Corporation (“IAMGOLD”) (TSX: IMG) (NYSE: IAG) for a total consideration of $11.5 million.

IAMGOLD issued 1,851,145 common shares to Monarch at a price of $5.24 per share for a total value of $9.7 million and will pay an additional $0.3 million in cash upon transfer of ownership of a parcel of land to IAMGOLD and an additional $1.5 million in cash 90 days after the initial transport of ore from the Fayolle deposit.

Following this transaction, Monarch now has approximately $20 million in cash and short-term investments.

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

Interessanter Beitrag aus stockhouse (Zitat):

If production for Beaufor Mine can be around 20K ounces per year, doing some back of the napkin math, Monarch could achieve around $15M profit a year. After a year or two and with some sort of financing, Croinor can be put into production since it has mine permit already. Croinor requires around $35M to start up and has potential for way more ounces than Beaufor. Probably be generating $30-$40M profit a year with Beaufor and Croinor combined. By this time, Wasamac will have progressed to being close to starting and once production begins, Monarch could see profits over $100M per year. Based on this, it would make Monarch at least a 10 bagger based on current share price as gold price will go up.

If production for Beaufor Mine can be around 20K ounces per year, doing some back of the napkin math, Monarch could achieve around $15M profit a year. After a year or two and with some sort of financing, Croinor can be put into production since it has mine permit already. Croinor requires around $35M to start up and has potential for way more ounces than Beaufor. Probably be generating $30-$40M profit a year with Beaufor and Croinor combined. By this time, Wasamac will have progressed to being close to starting and once production begins, Monarch could see profits over $100M per year. Based on this, it would make Monarch at least a 10 bagger based on current share price as gold price will go up.

Yamana Gold Invests In Monarch Gold

June 11, 2020

- Closing of a $5,419,800 private placement with Yamana Gold ($4.2 million), Alamos Gold ($720,000) and other investors ($499,800).

- Yamana Gold will be entitled to participate in future financings to maintain its interest in the Corporation and will be represented on the Board of Directors of Monarch.

https://www.monarquesgold.com/news-releases/yamana-gold-inve…

June 11, 2020

- Closing of a $5,419,800 private placement with Yamana Gold ($4.2 million), Alamos Gold ($720,000) and other investors ($499,800).

- Yamana Gold will be entitled to participate in future financings to maintain its interest in the Corporation and will be represented on the Board of Directors of Monarch.

https://www.monarquesgold.com/news-releases/yamana-gold-inve…

Zu den Aktionären zählen jetzt Alamos Gold, Hecla Mining, Yamana, Rob McEwen und Agnico. Ziemlich beeindruckende Liste von Namen.

Die derzeitige Marktkapitalisierung on a fully diluted basis beträgt C$ 88 Mio. Cash und short-term investments betragen ~ 25 Mio. CAD. Die beiden Mills im Besitz von Monarch haben einen Wert von ~ C$ 50 Mio.

Allein Wasamac hat einen NPV after tax von rund C$ 650 Mio. CAD. Monarch hat bereits eine Vereinbarung mit Glencore im Zusammenhang mit der möglichen Verwendung des Kidd-Konzentrators von Glencore in Timmins, Ontario, zur Behandlung von Erz aus Wasamac.

Die Beaufor-Mine wird in 12 bis 18 Monaten wiedereröffnet. Die Mine produzierte in 2018 14.856 Unzen Gold. Nach früheren Präsentationen des CEO besteht das Potenzial für ~ 714.000 neue Unzen mit dem C$ 5 Millionen Bohrprogramm bezahlt von Caisse de Dépôt et Placement du Québec.

Alle anderen Goldprojekte von Monarch (Croinor, McKenzie Break, Swanson und Beacon) haben ebenfalls hervorragendes Potenzial.

An dieser Aktie werde ich noch viel Freude haben sagt mir mein Gefühl. Mal abwarten...

Die derzeitige Marktkapitalisierung on a fully diluted basis beträgt C$ 88 Mio. Cash und short-term investments betragen ~ 25 Mio. CAD. Die beiden Mills im Besitz von Monarch haben einen Wert von ~ C$ 50 Mio.

Allein Wasamac hat einen NPV after tax von rund C$ 650 Mio. CAD. Monarch hat bereits eine Vereinbarung mit Glencore im Zusammenhang mit der möglichen Verwendung des Kidd-Konzentrators von Glencore in Timmins, Ontario, zur Behandlung von Erz aus Wasamac.

Die Beaufor-Mine wird in 12 bis 18 Monaten wiedereröffnet. Die Mine produzierte in 2018 14.856 Unzen Gold. Nach früheren Präsentationen des CEO besteht das Potenzial für ~ 714.000 neue Unzen mit dem C$ 5 Millionen Bohrprogramm bezahlt von Caisse de Dépôt et Placement du Québec.

Alle anderen Goldprojekte von Monarch (Croinor, McKenzie Break, Swanson und Beacon) haben ebenfalls hervorragendes Potenzial.

An dieser Aktie werde ich noch viel Freude haben sagt mir mein Gefühl. Mal abwarten...

Monarch Gold Appoints Yohann Bouchard To Its Board Of Directors

June 16, 2020

Mr. Bouchard is currently Senior Vice President, Operations of Yamana Gold Inc. He joined Yamana in October 2014. Mr. Bouchard has obtained progressively more technical and operating experience over a 24-year career in mining with a particular focus on underground and open pit operations. Prior to joining Yamana, Mr. Bouchard occupied key operating and technical positions with Primero Mining Corporation, IAMGOLD Corporation, Breakwater Resources Ltd. and Cambior Inc. Mr. Bouchard oversaw precious and base metal operations in both the Americas and in Africa. Mr. Bouchard holds a Bachelor of Mining Engineering degree from École Polytechnique of Montréal. He is registered as a professional engineer with Professional Engineers Ontario.

https://www.monarquesgold.com/news-releases/monarch-gold-app…

June 16, 2020

Mr. Bouchard is currently Senior Vice President, Operations of Yamana Gold Inc. He joined Yamana in October 2014. Mr. Bouchard has obtained progressively more technical and operating experience over a 24-year career in mining with a particular focus on underground and open pit operations. Prior to joining Yamana, Mr. Bouchard occupied key operating and technical positions with Primero Mining Corporation, IAMGOLD Corporation, Breakwater Resources Ltd. and Cambior Inc. Mr. Bouchard oversaw precious and base metal operations in both the Americas and in Africa. Mr. Bouchard holds a Bachelor of Mining Engineering degree from École Polytechnique of Montréal. He is registered as a professional engineer with Professional Engineers Ontario.

https://www.monarquesgold.com/news-releases/monarch-gold-app…

Morgen um 19:00 Uhr unserer Zeit...

Thurs #askMQR Monarch Gold CEO, Jean-Marc Lacoste

https://twitter.com/soarfinancial/status/1272313807390380035

Thurs #askMQR Monarch Gold CEO, Jean-Marc Lacoste

https://twitter.com/soarfinancial/status/1272313807390380035

Monarch Gold Begins Vast Data Compilation Program At Its Camflo Gold Property, Barrick Gold’s Original Asset

June 18, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-beg…

June 18, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-beg…

Sehr überzeugendes Interview von gestern mit President & CEO Jean-Marc Lacoste. Dürfte stetig weiter aufwärts gehen mit Monarch

https://twitter.com/soarfinancial/status/1273660816080826369

https://twitter.com/soarfinancial/status/1273660816080826369

Monarch Gold Awards Contract To Ausenco For Wasamac

June 22, 2020

- Ausenco to conduct an upgrading study on the Kidd concentrator in connection with the Wasamac gold project

- Study constitutes Phase 1 of MOU between Monarch and Glencore Canada (see press release dated May 14, 2020)

- Study results expected by October 2020

https://www.monarquesgold.com/news-releases/monarch-gold-awa…

June 22, 2020

- Ausenco to conduct an upgrading study on the Kidd concentrator in connection with the Wasamac gold project

- Study constitutes Phase 1 of MOU between Monarch and Glencore Canada (see press release dated May 14, 2020)

- Study results expected by October 2020

https://www.monarquesgold.com/news-releases/monarch-gold-awa…

Ein lohnenswertes anzuhörendes Interview. Monarch war ein möglicher 10-bagger von Erfle in einem Interview vor einem halben Jahr.

Still Only Early Days of Junior Gold Bull But Generalist Investors Are Returning says David Erfle

Posted on June 30th, 2020

https://www.miningstockeducation.com/2020/06/still-only-earl…

Still Only Early Days of Junior Gold Bull But Generalist Investors Are Returning says David Erfle

Posted on June 30th, 2020

https://www.miningstockeducation.com/2020/06/still-only-earl…

Für die kommenden Monate wird das die Strategie hinsichtlich meines Investments in Monarch sein:

“be right and sit tight”

Still Only Early Days of Junior Gold Bull But Generalist Investors Are Returning says David Erfle

30.06.2020

“be right and sit tight”

Still Only Early Days of Junior Gold Bull But Generalist Investors Are Returning says David Erfle

30.06.2020

JV Article: Monarch Gold focused on producing 100-200,000 ounces of gold annually

July 7, 2020

https://www.northernminer.com/joint-venture-article/jv-artic…

July 7, 2020

https://www.northernminer.com/joint-venture-article/jv-artic…

Geht weiter voran beim flagship project Wasamac...

Monarch Gold Signs MOU With Ontario Northland For Wasamac

July 9, 2020

- The agreement will allow negotiation of a favourable rate for the transportation of ore from the Wasamac gold project to the Kidd concentrator under the MOU with Glencore Canada.

- The Ontario Northland Railway serves northern Ontario and northern Quebec, running directly past Wasamac to end its route at Rouyn-Noranda, after which the line becomes CN property east of Rouyn-Noranda.

https://www.monarquesgold.com/news-releases/monarch-gold-sig…

Monarch Gold Signs MOU With Ontario Northland For Wasamac

July 9, 2020

- The agreement will allow negotiation of a favourable rate for the transportation of ore from the Wasamac gold project to the Kidd concentrator under the MOU with Glencore Canada.

- The Ontario Northland Railway serves northern Ontario and northern Quebec, running directly past Wasamac to end its route at Rouyn-Noranda, after which the line becomes CN property east of Rouyn-Noranda.

https://www.monarquesgold.com/news-releases/monarch-gold-sig…

@iknowthew: Bist nicht mehr allein hier .. bin eben (zum zweiten Mal in den letzten Jahren) wieder neu eingestigen ... und wünsche uns fette Beute! ;-) Gruß - Chris

Antwort auf Beitrag Nr.: 64.364.309 von MONSIEURCB am 10.07.20 15:58:36Meiner Ansicht nach eine gute Entscheidung. Mein Anlagehorizont hier ist längerfristig. Bin mir ziemlich sicher, dass in 2-3 Jahren die Market Cap von Monarch über 1 Milliarde liegen wird...

Zudem ist der CEO ganz nach meinem Geschmack. Der macht wirklich gute deals ohne viel shareholder dilution.

Zudem ist der CEO ganz nach meinem Geschmack. Der macht wirklich gute deals ohne viel shareholder dilution.

Wenn man bedenkt, dass die 2 Mills im Besitz von Monarch ungefähr ~$50 million Wert sind und der Cash + short-term investments Bestand bei ungefähr ~$25 million liegt, so finde ich die derzeitige Market Cap von $110 million weiterhin verdammt niedrig.

Das Flagship project Wasamac ist meiner Ansicht nach viel mehr wert:

- 142,000 ounces/year over 11 years.

- US$630/oz all-in-sustaining costs.

- CAPEX of C$464 million which can potentially be reduced by C$230 million

Hier eine Slide aus der July Company Presentation. Der Newsflow in den kommenden Monaten wird sehr positiv sein...

Das Flagship project Wasamac ist meiner Ansicht nach viel mehr wert:

- 142,000 ounces/year over 11 years.

- US$630/oz all-in-sustaining costs.

- CAPEX of C$464 million which can potentially be reduced by C$230 million

Hier eine Slide aus der July Company Presentation. Der Newsflow in den kommenden Monaten wird sehr positiv sein...

👍

Wasamac dans le top 4 mondial des projets aurifères les plus prometteurs

Le navire amiral de Monarques devance plus de 3500 projets à travers la planète

17 juillet 2020

https://www.lecitoyenrouynlasarre.com/article/2020/07/17/was…

Übersetzung (Google)

Wasamac gehört zu den vier vielversprechendsten Goldprojekten der Welt

Monarques Flaggschiff vor mehr als 3.500 Projekten auf der ganzen Welt

Wasamac, das Goldminenprojekt, das die Monarques Gold Corporation in Rouyn-Noranda auf halbem Weg zwischen den Stadtteilen Évain und Arntfield entwickelt, gilt als eines der vielversprechendsten Goldprojekte der Welt.

Dies geht aus einer kürzlich durchgeführten Analyse von Integra Resources hervor, einem in Vancouver ansässigen Junior-Unternehmen, das den Wert untersuchen wollte, den seine drei Vermögenswerte, alle in Idaho, für Investoren darstellen würden.

Zu diesem Zweck hat das Unternehmen alle Bergbauprojekte, die auf der Produktion von Edelmetallen basieren, mit einer Schätzung der Bodenschätze sukzessive aus einer Zusammenstellung gestrichen. Diese Liste enthielt weltweit genau 3.517 Assets. Anschließend wurden alle Projekte entfernt, die in den letzten fünf Jahren nicht Gegenstand einer gültigen Wirtschaftsstudie waren, und die Liste wurde auf nur 338 Vermögenswerte reduziert.

Durch die Eliminierung von Projekten mit einer erwarteten Produktion über die Lebensdauer der Mine von weniger als 100.000 Unzen Gold pro Jahr beschränkte Integra Resources die Stichprobe anschließend auf 77 Vermögenswerte und senkte sie dann. auf 53 Elemente durch Löschen von Projekten mit einer Lebensdauer von weniger als 10 Jahren.

Um der politischen und wirtschaftlichen Stabilität Rechnung zu tragen, wurden alle Projekte außerhalb Kanadas, der USA, Westeuropas, Australiens und Neuseelands entfernt. Reduziert die Liste auf nur 17 Elemente. Integra Resources beseitigte auch Projekte, die bereits einem Goldproduzenten mit anderen operativen Minen gehörten, was zu einer Liste von nur 8 Projekten führte.

Im letzten Schritt der Übung wurden schließlich alle Projekte abgelehnt, für die eine Anfangsinvestition von mehr als 500 Millionen US-Dollar erforderlich war. Es waren also nur noch 4 Projekte übrig: DeLamar (Idaho) von Integra Resources, Valentine Lake (Labrador) von Toronto Gold Marathon, Back River (Nunavut) von Sabina Gold & Silver aus Vancouver und Wasamac von Monarques.

Wasamac dans le top 4 mondial des projets aurifères les plus prometteurs

Le navire amiral de Monarques devance plus de 3500 projets à travers la planète

17 juillet 2020

https://www.lecitoyenrouynlasarre.com/article/2020/07/17/was…

Übersetzung (Google)

Wasamac gehört zu den vier vielversprechendsten Goldprojekten der Welt

Monarques Flaggschiff vor mehr als 3.500 Projekten auf der ganzen Welt

Wasamac, das Goldminenprojekt, das die Monarques Gold Corporation in Rouyn-Noranda auf halbem Weg zwischen den Stadtteilen Évain und Arntfield entwickelt, gilt als eines der vielversprechendsten Goldprojekte der Welt.

Dies geht aus einer kürzlich durchgeführten Analyse von Integra Resources hervor, einem in Vancouver ansässigen Junior-Unternehmen, das den Wert untersuchen wollte, den seine drei Vermögenswerte, alle in Idaho, für Investoren darstellen würden.

Zu diesem Zweck hat das Unternehmen alle Bergbauprojekte, die auf der Produktion von Edelmetallen basieren, mit einer Schätzung der Bodenschätze sukzessive aus einer Zusammenstellung gestrichen. Diese Liste enthielt weltweit genau 3.517 Assets. Anschließend wurden alle Projekte entfernt, die in den letzten fünf Jahren nicht Gegenstand einer gültigen Wirtschaftsstudie waren, und die Liste wurde auf nur 338 Vermögenswerte reduziert.

Durch die Eliminierung von Projekten mit einer erwarteten Produktion über die Lebensdauer der Mine von weniger als 100.000 Unzen Gold pro Jahr beschränkte Integra Resources die Stichprobe anschließend auf 77 Vermögenswerte und senkte sie dann. auf 53 Elemente durch Löschen von Projekten mit einer Lebensdauer von weniger als 10 Jahren.

Um der politischen und wirtschaftlichen Stabilität Rechnung zu tragen, wurden alle Projekte außerhalb Kanadas, der USA, Westeuropas, Australiens und Neuseelands entfernt. Reduziert die Liste auf nur 17 Elemente. Integra Resources beseitigte auch Projekte, die bereits einem Goldproduzenten mit anderen operativen Minen gehörten, was zu einer Liste von nur 8 Projekten führte.

Im letzten Schritt der Übung wurden schließlich alle Projekte abgelehnt, für die eine Anfangsinvestition von mehr als 500 Millionen US-Dollar erforderlich war. Es waren also nur noch 4 Projekte übrig: DeLamar (Idaho) von Integra Resources, Valentine Lake (Labrador) von Toronto Gold Marathon, Back River (Nunavut) von Sabina Gold & Silver aus Vancouver und Wasamac von Monarques.

Man hätte bei den Kriterien für die vielversprechendsten Goldprojekte der Welt das Capex um die Hälfte auf unter $250 Millionen reduzieren können. Wasamac wäre dann noch dabei

Zudem sind bei Wasamac all zones open at depth.

Und weiter:

Wasamac was selected as a pilot project by the Government of Quebec to be supported throughout the permitting process by the interdepartmental table announced by Minister Julien on November 19, 2019.

Zudem sind bei Wasamac all zones open at depth.

Und weiter:

Wasamac was selected as a pilot project by the Government of Quebec to be supported throughout the permitting process by the interdepartmental table announced by Minister Julien on November 19, 2019.

Guter Artikel über Monarch:

https://ceo.ca/@leni/monarch-gold-compelling-value-in-the-ab…

Aus den dort genannten Gründen bleibe ich weiter investiert...

https://ceo.ca/@leni/monarch-gold-compelling-value-in-the-ab…

Aus den dort genannten Gründen bleibe ich weiter investiert...

Monarch Gold Intersects 13.95 G/T Au Over 14.35 Metres (47.1 Feet) At Mckenzie Break

July 23, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-int…

- Highest single assay result on the McKenzie Break property: Bonanza grade of 311 g/t Au over 0.5 metres. More than 115 grains of visible gold throughout the 14.35 m intersection.

- Impressive results over a large section in hole MK-20-255 confirm the continuity of the mineralized zone below and to the south of the current resource.

Dazu auch dieser Artikel aus dem NORTHERN MINER:

https://www.northernminer.com/news/monarch-gold-hits-new-hig…

https://www.northernminer.com/news/monarch-gold-hits-new-hig…

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: unnötige Provokation, persönliche Angriffe bitte unterlassen!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: themenfremder Inhalt

Das wird noch richtig fein hier 😎

Flagship project Wasamac geht zügig voran. McKenzie Break drill results vielverprechend. Weitere Bohrungen geplant.

Ich hoffe es weiss jetzt jeder was nun kommt: Erste Bohrergebnisse Beaufor Mine

Laut CEO kann "at the push of a button" die Produktion starten. Je nach Gold grade ist mit einer annual production zwischen 20-40 Tausend Ounces zu rechnen.

Welches Unternehmen hat schon so ein starkes Portfolio. Market Cap von ~ C140 Million ist im Vergleich zu anderen Unternehmen weiterhin ziemlich niederig nach meiner Ansicht. Sollten die ersten Bohrergebnisse von Beaufor überzeugen, so sind schnell weitere 100% drinn vom derzeitigen Kursniveau...

Flagship project Wasamac geht zügig voran. McKenzie Break drill results vielverprechend. Weitere Bohrungen geplant.

Ich hoffe es weiss jetzt jeder was nun kommt: Erste Bohrergebnisse Beaufor Mine

Laut CEO kann "at the push of a button" die Produktion starten. Je nach Gold grade ist mit einer annual production zwischen 20-40 Tausend Ounces zu rechnen.

Welches Unternehmen hat schon so ein starkes Portfolio. Market Cap von ~ C140 Million ist im Vergleich zu anderen Unternehmen weiterhin ziemlich niederig nach meiner Ansicht. Sollten die ersten Bohrergebnisse von Beaufor überzeugen, so sind schnell weitere 100% drinn vom derzeitigen Kursniveau...

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Diskussionen zu Moderationentscheidungen gehören nicht in den Thread. Kontaktieren Sie ggf den Moderator oder den CommunitySupport.

Antwort auf Beitrag Nr.: 64.539.855 von iknowtheway am 24.07.20 22:51:04Zurück zum Wesentlichen würde ich sagen: Multibagger Potential 💰🤠

Zitat von iknowtheway: Das wird noch richtig fein hier.

Flagship project Wasamac geht zügig voran. McKenzie Break drill results vielverprechend. Weitere Bohrungen geplant.

Ich hoffe es weiss jetzt jeder was nun kommt: Erste Bohrergebnisse Beaufor Mine

Laut CEO kann "at the push of a button" die Produktion starten. Je nach Gold grade ist mit einer annual production zwischen 20-40 Tausend Ounces zu rechnen.

Welches Unternehmen hat schon so ein starkes Portfolio. Market Cap von ~ C140 Million ist im Vergleich zu anderen Unternehmen weiterhin ziemlich niederig nach meiner Ansicht. Sollten die ersten Bohrergebnisse von Beaufor überzeugen, so sind schnell weitere 100% drinn vom derzeitigen Kursniveau...

Monarch Gold Provides Update on Wasamac Gold Project, Acquisition Criteria and Value Catalysts

28.07.2020

SNNLive

28.07.2020

SNNLive

The Abitibi Greenstone Belt: One of the World’s Richest Gold Regions

July 25, 2020 8:30

https://thedeepdive.ca/the-abitibi-greenstone-belt-one-of-th…

July 25, 2020 8:30

https://thedeepdive.ca/the-abitibi-greenstone-belt-one-of-th…

Monarch Resources (MQR CN) Initiating with BUY rating and C$1.65/sh PT

17 August 2020

https://sprott.com/media/3230/200817-sector-scp-valdor.pdf

Monarch: potential bidding war for 2Moz, stock is just too cheap

We think Monarch is too cheap. There could be a two-way (or more) bidding war for Wasamac’s 2Moz, 25-30koz pa from Beauforwhilebonanza grades at McKenzie Break potentially underpin the entire market cap in cash. In neighbouring camps we count >$1.5bn market cap from a few juniors with no mineable gold. As enthusiasm wanes, we expect a re-rate forthe‘real’ assets of Monarch. Our valuation is based on 0.5xNAV for Wasamac’sC$948m NPV, 0.7xNAV C$40mforBeaufor and C$36m for other assets, with the stock trading at just 0.14xNAV.

17 August 2020

https://sprott.com/media/3230/200817-sector-scp-valdor.pdf

Monarch: potential bidding war for 2Moz, stock is just too cheap

We think Monarch is too cheap. There could be a two-way (or more) bidding war for Wasamac’s 2Moz, 25-30koz pa from Beauforwhilebonanza grades at McKenzie Break potentially underpin the entire market cap in cash. In neighbouring camps we count >$1.5bn market cap from a few juniors with no mineable gold. As enthusiasm wanes, we expect a re-rate forthe‘real’ assets of Monarch. Our valuation is based on 0.5xNAV for Wasamac’sC$948m NPV, 0.7xNAV C$40mforBeaufor and C$36m for other assets, with the stock trading at just 0.14xNAV.

Monarch Gold Corporation Announces C$7 Million Bought Deal Private Placement of Flow-Through Units

https://www.newswire.ca/news-releases/monarch-gold-corporati…

https://www.newswire.ca/news-releases/monarch-gold-corporati…

Antwort auf Beitrag Nr.: 64.877.021 von homooec am 25.08.20 16:32:49Nice  Ein möglicher bidding-war um Wasamac und zwar ggf. innerhalb des nächsten halben Jahres...

Ein möglicher bidding-war um Wasamac und zwar ggf. innerhalb des nächsten halben Jahres...

Ein möglicher bidding-war um Wasamac und zwar ggf. innerhalb des nächsten halben Jahres...

Ein möglicher bidding-war um Wasamac und zwar ggf. innerhalb des nächsten halben Jahres...

.. und noch mal ein satter Nachschlag:

https://www.goldseiten.de/artikel/462538--Monarch-Gold-Corpo…

https://www.goldseiten.de/artikel/462538--Monarch-Gold-Corpo…

Register for the LIVE Webinar with Monarch Gold President/CEO @jeanmarclacoste along with John Tumazos Very Independent Research, LLC on Thursday September 10, 2020 1:15 PM EDT at:

https://register.gotowebinar.com/register/151695372121297972…

https://register.gotowebinar.com/register/151695372121297972…

Monarch Gold To Assess Wasamac Property Silver Potential

September 10, 2020

Significant silver mineralization was identified in the Wasamac gold property shear zone during the 2012 drilling and resampling programs.

Silver mineralization is associated with the gold-rich sections. The best silver values included 7.01 g/t Ag over 75.9 metres and 10.72 g/t Ag over 10.2 metres (see Figure).

The economic analysis (Wasamac Gold 2018 Feasibility Study) did not account for silver credits as silver was not included in either the gold mineral resources or the mining plan.

A strong silver market could increase the economic value of the currently outlined gold deposit.

https://www.monarquesgold.com/news-releases/monarch-gold-to-…

September 10, 2020

Significant silver mineralization was identified in the Wasamac gold property shear zone during the 2012 drilling and resampling programs.

Silver mineralization is associated with the gold-rich sections. The best silver values included 7.01 g/t Ag over 75.9 metres and 10.72 g/t Ag over 10.2 metres (see Figure).

The economic analysis (Wasamac Gold 2018 Feasibility Study) did not account for silver credits as silver was not included in either the gold mineral resources or the mining plan.

A strong silver market could increase the economic value of the currently outlined gold deposit.

https://www.monarquesgold.com/news-releases/monarch-gold-to-…

Laut CEO beim Webcast gestern wird eine Entscheidung fallen innerhalb der nächsten 4-6 Monate wo das Material von Wasamac verarbeitet wird.

Höchstwahrscheinlich wird Monarch von einem Big Player in der Region gekauft, da mehrere von denen Feedstock brauchen.

Laut CEO ist der Wiederherstellungswert der 2 Mills im Besitz von Monarch $50-75 Mio. Bei einem Übernahmeangebot wird es nach meiner Ansicht einen satten Aufschlag geben zur derzeitigen Market Cap von $133 Mio...

Höchstwahrscheinlich wird Monarch von einem Big Player in der Region gekauft, da mehrere von denen Feedstock brauchen.

Laut CEO ist der Wiederherstellungswert der 2 Mills im Besitz von Monarch $50-75 Mio. Bei einem Übernahmeangebot wird es nach meiner Ansicht einen satten Aufschlag geben zur derzeitigen Market Cap von $133 Mio...

👍

Monarch Gold ab 22:10 min

Gold Stock Investing Roundtable with Pros David Erfle and Brian Leni

22.09.2020

Monarch Gold ab 22:10 min

Gold Stock Investing Roundtable with Pros David Erfle and Brian Leni

22.09.2020

Building one of the biggest portfolios of gold real estate in Abitibi

Sep 22, 2020

https://www.b-tv.com/monarch-gold-in-abitibi-company-feature…

Video (4:19)

https://videos-fms.jwpsrv.com/0_5f6ceb5f_0xd18f7a6967f8b2160…

Sep 22, 2020

https://www.b-tv.com/monarch-gold-in-abitibi-company-feature…

Video (4:19)

https://videos-fms.jwpsrv.com/0_5f6ceb5f_0xd18f7a6967f8b2160…

Insiders Are Buying These Gold Mining Stocks

Sep. 29, 2020 7:35 AM ET

https://seekingalpha.com/article/4376786-insiders-are-buying…

3. Monarch Gold Corp.

Monarch shares also trade at an attractive valuation compared to some of its peers, as they trades at approximately $40 per ounce of gold, much lower than Marathon Gold (MGDPF) ($118/oz), Probe Mines (PROBF) ($72/oz) and Bonterra (BONXF) ($62/oz), according to the company's corporate presentation (slide 20).

Sep. 29, 2020 7:35 AM ET

https://seekingalpha.com/article/4376786-insiders-are-buying…

3. Monarch Gold Corp.

Monarch shares also trade at an attractive valuation compared to some of its peers, as they trades at approximately $40 per ounce of gold, much lower than Marathon Gold (MGDPF) ($118/oz), Probe Mines (PROBF) ($72/oz) and Bonterra (BONXF) ($62/oz), according to the company's corporate presentation (slide 20).

Vielversprechend, aber dies sind erst die ersten Löcher...

Monarch Gold Intersects 783 G/T Au Over 0.2 Metres And 293 G/T Au Over 0.5 Metres At The Beaufor Property

October 1, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-int…

Monarch Gold Intersects 783 G/T Au Over 0.2 Metres And 293 G/T Au Over 0.5 Metres At The Beaufor Property

October 1, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-int…

Eine Einschätzung zum Deal mit Yamana...

Yamana Gold to Acquire Monarch Gold’s Flagship Asset: Good or Bad Deal? (Brian Leni Commentary)

02.11.2020

Yamana Gold to Acquire Monarch Gold’s Flagship Asset: Good or Bad Deal? (Brian Leni Commentary)

02.11.2020

Amid gold price whipsaw, M&A heats up in the mining space

David Erfle

Friday November 13

https://www.kitco.com/commentaries/2020-11-13/Amid-gold-pric…

Meanwhile, M&A began to heat up in the sector last week, as Yamana Gold Inc. (AUY) and Monarch Gold Corp. (MQR.TO) announced that they had entered into a definitive agreement in which Yamana will purchase all of Monarch’s shares that it does not already own for C$152 million.

Under the agreement, Monarch will first spin out some of its assets and liabilities into a new company, and Yamana will acquire the remaining properties, including the Wasamac gold project in Quebec’s Abitibi region and the Camflo property near Val-d’Or, Quebec. The takeover is expected to be completed by January 2021.

According to the Monarch Gold press release announcing this proposed deal, boards of both companies and certain larger shareholders of Monarch have entered into support agreements. The agreed parties together, along with shares already owned or held by Yamana, equal approximately 28% of Monarch’s issued and outstanding stock.

But the acquisition will need regulatory, court and stock exchange approvals, along with a two-thirds majority approval by Monarch stakeholders and other closing conditions.

This proposed offer by Yamana equals just $40 an ounce for the 2.88 million-ounce Wasamac gold resource. The industry average is twice that at $80 per ounce when comparing similar past acquisition deals in the gold space.

Yamana rival Alamos Gold (AGI), who also has operations near the Wasamac Gold Project, controls 16% of Monarch stock. Both Hecla Mining (HL) and Agnico Eagle Mines (AEM) also hold positions of 4% and 3%, respectively.

Being a Monarch Gold shareholder, I am hoping for a bidding war to take place for this quality asset that is being offered at a significant discount to previous sector deals, while located in a Tier 1 jurisdiction.

David Erfle

Friday November 13

https://www.kitco.com/commentaries/2020-11-13/Amid-gold-pric…

Meanwhile, M&A began to heat up in the sector last week, as Yamana Gold Inc. (AUY) and Monarch Gold Corp. (MQR.TO) announced that they had entered into a definitive agreement in which Yamana will purchase all of Monarch’s shares that it does not already own for C$152 million.

Under the agreement, Monarch will first spin out some of its assets and liabilities into a new company, and Yamana will acquire the remaining properties, including the Wasamac gold project in Quebec’s Abitibi region and the Camflo property near Val-d’Or, Quebec. The takeover is expected to be completed by January 2021.

According to the Monarch Gold press release announcing this proposed deal, boards of both companies and certain larger shareholders of Monarch have entered into support agreements. The agreed parties together, along with shares already owned or held by Yamana, equal approximately 28% of Monarch’s issued and outstanding stock.

But the acquisition will need regulatory, court and stock exchange approvals, along with a two-thirds majority approval by Monarch stakeholders and other closing conditions.

This proposed offer by Yamana equals just $40 an ounce for the 2.88 million-ounce Wasamac gold resource. The industry average is twice that at $80 per ounce when comparing similar past acquisition deals in the gold space.

Yamana rival Alamos Gold (AGI), who also has operations near the Wasamac Gold Project, controls 16% of Monarch stock. Both Hecla Mining (HL) and Agnico Eagle Mines (AEM) also hold positions of 4% and 3%, respectively.

Being a Monarch Gold shareholder, I am hoping for a bidding war to take place for this quality asset that is being offered at a significant discount to previous sector deals, while located in a Tier 1 jurisdiction.

Interessantes Interview. Marrone geht auch darauf ein, wie es mit Wasamac weitergehen soll. Vielleicht gibt es aber doch noch ein weiteres Angebot. Mal sehen...

Yamana Gold - Executive Chairman Peter Marrone

49:52 Is your intent to use Monarch Gold as a source of ore or as a stand-alone mine?

51:30 Do you plan on using the Camflo tailings dam (part of Monarch Gold) for Malartic?

Yamana Gold - Executive Chairman Peter Marrone

49:52 Is your intent to use Monarch Gold as a source of ore or as a stand-alone mine?

51:30 Do you plan on using the Camflo tailings dam (part of Monarch Gold) for Malartic?

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Kopie aus fremden Medien- bitte nachlesen unter 9.5. Nutzungsbedingungen: "Wie zitiere ich richtig"

Auf sedar verfügbar

Management information circular - English

https://www.sedar.com/GetFile.do?lang=EN&docClass=10&issuerN…

NOTICE OF MEETING AND MANAGEMENT INFORMATION CIRCULAR RELATING TO THE ANNUAL AND SPECIAL MEETING OF SECURITYHOLDERS OF MONARCH GOLD CORPORATION TO BE HELD ON DECEMBER 30, 2020 Dated as of November 30, 2020

Management information circular - English

https://www.sedar.com/GetFile.do?lang=EN&docClass=10&issuerN…

NOTICE OF MEETING AND MANAGEMENT INFORMATION CIRCULAR RELATING TO THE ANNUAL AND SPECIAL MEETING OF SECURITYHOLDERS OF MONARCH GOLD CORPORATION TO BE HELD ON DECEMBER 30, 2020 Dated as of November 30, 2020

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: Kopie aus fremden Medien- bitte nachlesen unter 9.5. Nutzungsbedingungen: "Wie zitiere ich richtig"

Der deal ist dann wohl durch...

Monarch Gold Announces Securityholder Approval Of The Arrangement With Yamana Gold

December 30, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

Monarch Gold Announces Securityholder Approval Of The Arrangement With Yamana Gold

December 30, 2020

https://www.monarquesgold.com/news-releases/monarch-gold-ann…

Monarch Gold Intersects 35.87 g/t Au Over 9.8 Metres (32 Feet) From Exploration Holes At the Beaufor Mine

News provided by

Monarch Gold Corporation

Jan 19, 2021, 07:01 ET

First 21 surface exploration holes have been drilled, totalling 4,787 metres of a 42,500-metre drilling program.

Ten drill holes intersected significant gold mineralization. Assay results are still pending for 4 of the 21 holes.

High-grade assay results received to date include 35.87 g/t Au over 9.8 metres and 11.02 g/t Au over 5.55 metres from shallow surface exploration holes.

Four underground drill rigs continue testing "near-mine" exploration targets.

An additional 5,000 m of drilling is planned to follow up on the recent near-surface results.

https://www.prnewswire.com/news-releases/monarch-gold-inters…

News provided by

Monarch Gold Corporation

Jan 19, 2021, 07:01 ET

First 21 surface exploration holes have been drilled, totalling 4,787 metres of a 42,500-metre drilling program.

Ten drill holes intersected significant gold mineralization. Assay results are still pending for 4 of the 21 holes.

High-grade assay results received to date include 35.87 g/t Au over 9.8 metres and 11.02 g/t Au over 5.55 metres from shallow surface exploration holes.

Four underground drill rigs continue testing "near-mine" exploration targets.

An additional 5,000 m of drilling is planned to follow up on the recent near-surface results.

https://www.prnewswire.com/news-releases/monarch-gold-inters…

Monarch Gold Receives Final Court Approval for the Plan of Arrangement With Yamana Gold

Jan 20, 2021

https://www.newswire.ca/news-releases/monarch-gold-receives-…

Monarch will shortly close the transaction with Yamana and the common shares of new Monarch Mining Corporation will begin trading on the Toronto Stock Exchange under the symbol GBAR in the coming days.

Jan 20, 2021

https://www.newswire.ca/news-releases/monarch-gold-receives-…

Monarch will shortly close the transaction with Yamana and the common shares of new Monarch Mining Corporation will begin trading on the Toronto Stock Exchange under the symbol GBAR in the coming days.

So, dann war es das wohl. Monarch war auf jeden Fall ein lohnendes Investment mit feiner Rendite. Ich denke die neue GBAR wird ebenfalls erfolgreich werden. Genug cash ist vorhanden um die Produktion zu starten bei Beaufor Mine in 2021. GBAR dürfte dann mit wenig dilution auskommen...

Monarch Mining Announces Completion of the Arrangement with Yamana Gold

Monarch Mining Corporation

Jan 21, 2021

https://www.prnewswire.com/news-releases/monarch-mining-anno…

However, Monarch is confident that the common shares will commence trading at the opening of business on or about January 26, 2021 under the symbol GBAR.

Monarch Mining Announces Completion of the Arrangement with Yamana Gold

Monarch Mining Corporation

Jan 21, 2021

https://www.prnewswire.com/news-releases/monarch-mining-anno…

However, Monarch is confident that the common shares will commence trading at the opening of business on or about January 26, 2021 under the symbol GBAR.

Hallo!

Habt ihr schon den Umtausch bei eurem Broker verbucht bekommen?

CortalConsors hat sich da noch nicht bewegt...

Habt ihr schon den Umtausch bei eurem Broker verbucht bekommen?

CortalConsors hat sich da noch nicht bewegt...

Antwort auf Beitrag Nr.: 66.749.344 von homooec am 01.02.21 16:12:11Bei Flatex hat sich auch noch nichts getan...

Neues aus der Depotwelt:

Yamana wurde eingebucht

Monarch Gold steht noch im Depot (kann aber natürlich nicht mehr verkauft/gehandelt werden)

Sonst hat sich (Baranteil sowie neue Anteile an Monarch Mining (GABR.TO)) noch nix in Punkto Einbuchung getan.

LG

Yamana wurde eingebucht

Monarch Gold steht noch im Depot (kann aber natürlich nicht mehr verkauft/gehandelt werden)

Sonst hat sich (Baranteil sowie neue Anteile an Monarch Mining (GABR.TO)) noch nix in Punkto Einbuchung getan.

LG

Neues aus der Depotwelt II:

Yamana wird nun bei mir mit einem Einstandskurs von ca. 0,62 € ausgewiesen, wodurch natürlich beim aktuellen Kurs von Yamana ein riesiger Batzen an Steuern bei einem Verkauf fällig wäre.

Damals hatte ich Monarch zu ca. 0,147 € pro Aktie erworben.

Nun habe ich mal bei Consors nachgefragt, wie dieser Einstandskurs zustande kommt. Ich kann es mir nicht erklären!

Yamana wird nun bei mir mit einem Einstandskurs von ca. 0,62 € ausgewiesen, wodurch natürlich beim aktuellen Kurs von Yamana ein riesiger Batzen an Steuern bei einem Verkauf fällig wäre.

Damals hatte ich Monarch zu ca. 0,147 € pro Aktie erworben.

Nun habe ich mal bei Consors nachgefragt, wie dieser Einstandskurs zustande kommt. Ich kann es mir nicht erklären!

Antwort auf Beitrag Nr.: 66.795.832 von homooec am 03.02.21 13:18:21Da ist es bei dir ja schon ziemlich weit fortgeschritten. Bei mir sind weiterhin nur die alten Monarch Aktien im Depot...

Bei mir sind jetzt die neuen Monarch Mining drin, Yamana und cash fehlt noch. Kaufkurs von GBAR C$ 0.19

Bei mir ist jetzt alles eingebucht, Monarch Mining, Yamana, Cash.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,20 | |

| +4,31 | |

| +2,81 | |

| +5,49 | |

| +2,22 | |

| +1,80 | |

| 0,00 | |

| +2,44 | |

| +2,22 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 262 | ||

| 80 | ||

| 70 | ||