Sylvamo Corp, International Paper spin-off Papier

eröffnet am 21.10.21 15:18:57 von

neuester Beitrag 16.02.24 00:05:04 von

neuester Beitrag 16.02.24 00:05:04 von

Beiträge: 18

ID: 1.353.726

ID: 1.353.726

Aufrufe heute: 0

Gesamt: 2.762

Gesamt: 2.762

Aktive User: 0

ISIN: US8713321029 · WKN: A3CY7Z · Symbol: SLVM

62,98

USD

+0,77 %

+0,48 USD

Letzter Kurs 01:00:00 NYSE

Neuigkeiten

10.04.24 · Business Wire (engl.) |

21.02.24 · Business Wire (engl.) |

20.02.24 · Business Wire (engl.) |

15.02.24 · Business Wire (engl.) |

Werte aus der Branche Holzindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 83,57 | +11,77 | |

| 0,5400 | +5,88 | |

| 2,7900 | +5,28 | |

| 26,46 | +5,00 | |

| 4,3000 | +4,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 670,00 | -4,96 | |

| 7,0400 | -4,99 | |

| 1,1300 | -5,04 | |

| 10,850 | -11,57 | |

| 24,590 | -17,59 |

Beitrag zu dieser Diskussion schreiben

25% sind heftig, aber auch nachhaltig?

15.2.

Sylvamo Stock Jumps 25% on Surging Value of Brazilian Forestlands

https://www.marketwatch.com/story/sylvamo-stock-jumps-25-on-…

...

Shares of Sylvamo surged after the paper company said a third-party appraisal of its Brazilian forestland showed the value of the land has more than doubled since 2021.

...

The company, based in Memphis, Tenn., on Thursday reported a fourth-quarter profit of $1.16 a share, down from $2.13 a share a year earlier. Revenue rose to $964 million from $927 million.

Chief Executive Jean-Michel Ribiéras said the company's forestlands in Brazil have surged in value, adding that they have been undervalued by the market. In December, a third-party appraisal of the land valued the assets at about $1 billion, up from roughly $400 million from a 2021 appraisal done by the same firm.

He said the company's eucalyptus plantations in Brazil are a competitive cost advantage, and that the company is able to source most of the wood it needs from its owned forest lands.

=>

Sylvamo Stock Jumps 25% on Surging Value of Brazilian Forestlands

https://www.marketwatch.com/story/sylvamo-stock-jumps-25-on-…

...

Shares of Sylvamo surged after the paper company said a third-party appraisal of its Brazilian forestland showed the value of the land has more than doubled since 2021.

...

The company, based in Memphis, Tenn., on Thursday reported a fourth-quarter profit of $1.16 a share, down from $2.13 a share a year earlier. Revenue rose to $964 million from $927 million.

Chief Executive Jean-Michel Ribiéras said the company's forestlands in Brazil have surged in value, adding that they have been undervalued by the market. In December, a third-party appraisal of the land valued the assets at about $1 billion, up from roughly $400 million from a 2021 appraisal done by the same firm.

He said the company's eucalyptus plantations in Brazil are a competitive cost advantage, and that the company is able to source most of the wood it needs from its owned forest lands.

=>

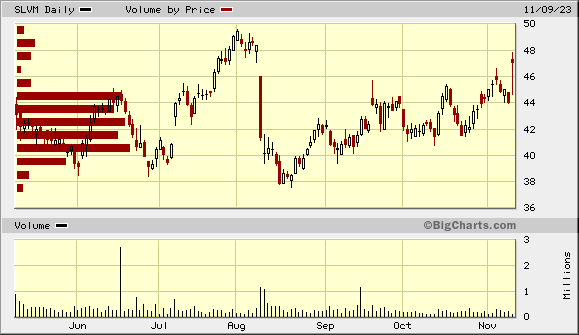

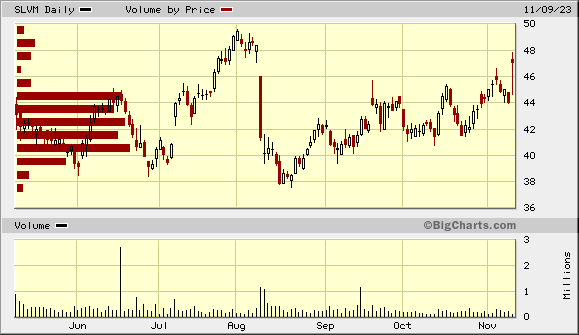

Antwort auf Beitrag Nr.: 74.776.016 von faultcode am 09.11.23 16:59:16nach meinem Eindruck sind viele Small cap materials in den USA dieses Jahr operativ überraschend gut gelaufen. Nicht nur Sylvamo.

Offenbar war auch vielfach das Management davon überrascht, siehe eben oben: "Third quarter earnings were higher than our outlook."

Offenbar war auch vielfach das Management davon überrascht, siehe eben oben: "Third quarter earnings were higher than our outlook."

Q3: https://www.wallstreet-online.de/nachricht/17526920-sylvamo-…

...

• Net income from continuing operations of $58 million ($1.37 per diluted share) vs. $49 million ($1.14 per diluted share)

• Adjusted operating earnings1 (non-GAAP) of $72 million ($1.70 per diluted share) vs. $49 million ($1.14 per diluted share)

• Adjusted EBITDA2 (non-GAAP) of $158 million (18% margin) vs. $124 million (14% margin)

• Cash provided by operating activities from continuing operations of $197 million vs. $77 million

• Free cash flow3 (non-GAAP) of $155 million vs. $33 million

"Cost Reductions" =>

Management Summary from Chairman and Chief Executive Officer Jean-Michel Ribiéras

Third quarter earnings were higher than our outlook. We took measures to maximize free cash flow, including selling and administrative cost reductions, shrinking working capital and adjusting the timing of capital spending. We now expect free cash flow for the year to be more than $270 million.

By the end of the third quarter, we returned $85 million to shareowners this year. In the third quarter, we also deposited $60 million in escrow to remove cash return limits in our credit agreement. As of Nov. 9, we have returned $110 million this year and plan to return a total of $125 million in 2023.

Our board of directors increased our regular dividend by 20%, declaring a fourth quarter $0.30 per share dividend and a special $0.30 per share dividend. We paid both, totaling $25 million, Oct. 17. The board also authorized an incremental $150 million share repurchase program. At the end of the third quarter, the May 2022 and September 2023 authorizations collectively had $167 million remaining. We will continue to look for opportunities to repurchase shares at attractive prices.

Sylvamo competes as a low-cost producer of commodity products sold in mature-demand, cyclical markets. In the spirit of continuous improvement, we initiated a cost reduction program called Project Horizon. The project will streamline our organization and cost structures and make us a leaner, stronger company.

Before inflation, we are targeting run rate savings of at least $110 million by the end of 2024. Approximately two-thirds of the target will come from operational improvements in our mills and supply chains. The balance will consist of selling and administrative cost reductions, including the elimination of approximately 150 positions, or nearly 7% of our global salaried workforce.

...

• Net income from continuing operations of $58 million ($1.37 per diluted share) vs. $49 million ($1.14 per diluted share)

• Adjusted operating earnings1 (non-GAAP) of $72 million ($1.70 per diluted share) vs. $49 million ($1.14 per diluted share)

• Adjusted EBITDA2 (non-GAAP) of $158 million (18% margin) vs. $124 million (14% margin)

• Cash provided by operating activities from continuing operations of $197 million vs. $77 million

• Free cash flow3 (non-GAAP) of $155 million vs. $33 million

"Cost Reductions" =>

Management Summary from Chairman and Chief Executive Officer Jean-Michel Ribiéras

Third quarter earnings were higher than our outlook. We took measures to maximize free cash flow, including selling and administrative cost reductions, shrinking working capital and adjusting the timing of capital spending. We now expect free cash flow for the year to be more than $270 million.

By the end of the third quarter, we returned $85 million to shareowners this year. In the third quarter, we also deposited $60 million in escrow to remove cash return limits in our credit agreement. As of Nov. 9, we have returned $110 million this year and plan to return a total of $125 million in 2023.

Our board of directors increased our regular dividend by 20%, declaring a fourth quarter $0.30 per share dividend and a special $0.30 per share dividend. We paid both, totaling $25 million, Oct. 17. The board also authorized an incremental $150 million share repurchase program. At the end of the third quarter, the May 2022 and September 2023 authorizations collectively had $167 million remaining. We will continue to look for opportunities to repurchase shares at attractive prices.

Sylvamo competes as a low-cost producer of commodity products sold in mature-demand, cyclical markets. In the spirit of continuous improvement, we initiated a cost reduction program called Project Horizon. The project will streamline our organization and cost structures and make us a leaner, stronger company.

Before inflation, we are targeting run rate savings of at least $110 million by the end of 2024. Approximately two-thirds of the target will come from operational improvements in our mills and supply chains. The balance will consist of selling and administrative cost reductions, including the elimination of approximately 150 positions, or nearly 7% of our global salaried workforce.

Die Paper-Rezession ist nun auch hier angekommen: "Slower Demand Recovery Drives Revised Annual Outlook, Company Remains Committed to $125 Million in Cash Returns"

https://investors.sylvamo.com/news/news-details/2023/Sylvamo…

...

With respect to paper demand, we believe that our customers have completed the majority of their inventory corrections. We are now seeing very early indications that global advertising may be starting to rebound and we would expect demand in Europe and North America to begin to improve.

...

=>

https://investors.sylvamo.com/news/news-details/2023/Sylvamo…

...

With respect to paper demand, we believe that our customers have completed the majority of their inventory corrections. We are now seeing very early indications that global advertising may be starting to rebound and we would expect demand in Europe and North America to begin to improve.

...

=>

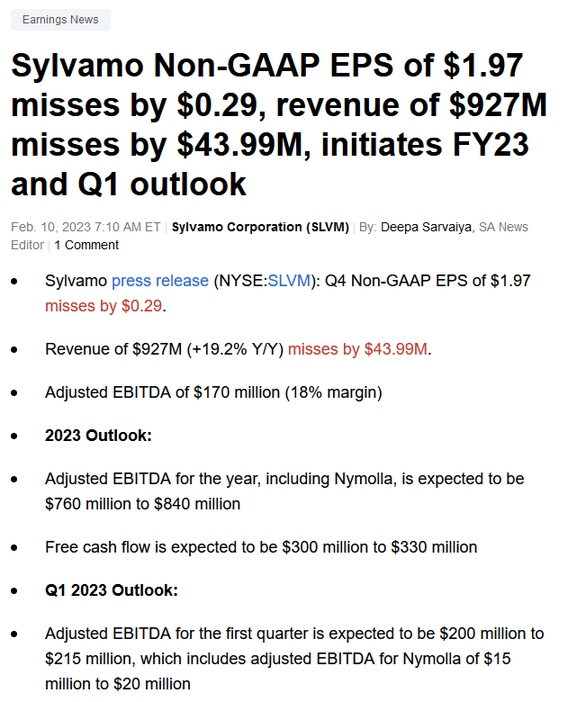

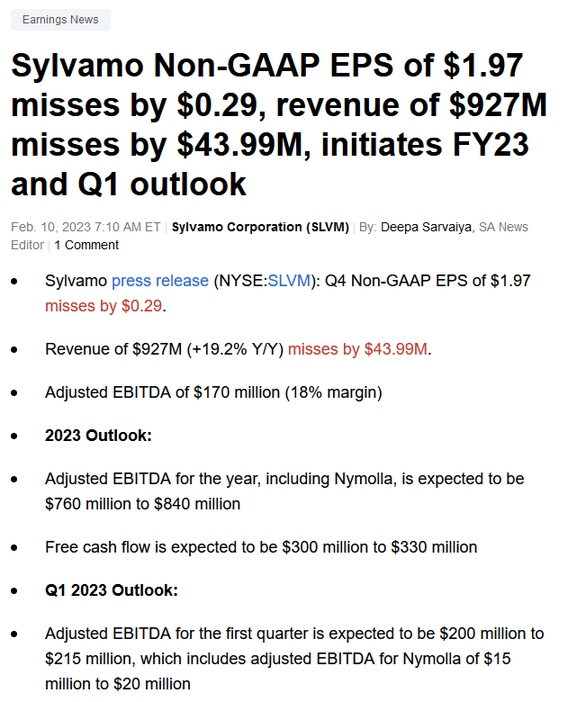

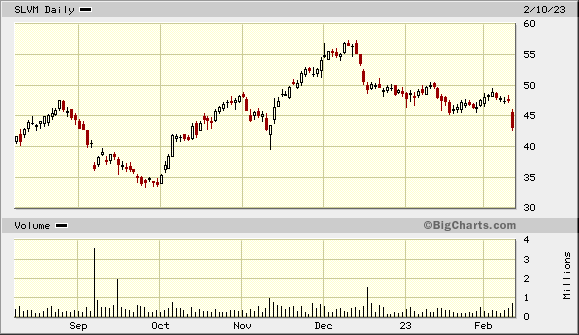

Antwort auf Beitrag Nr.: 72.846.038 von faultcode am 01.12.22 16:47:19doch nun ein Miss:

...

https://seekingalpha.com/news/3934725-sylvamo-non-gaap-eps-o…

=>

...

https://seekingalpha.com/news/3934725-sylvamo-non-gaap-eps-o…

=>

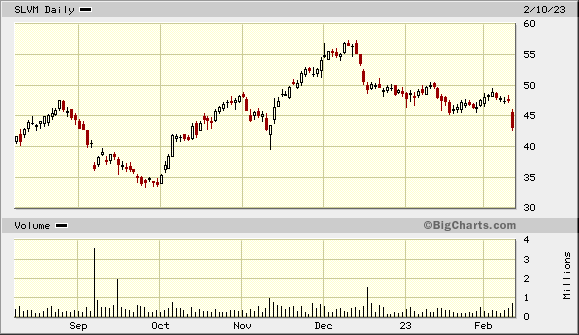

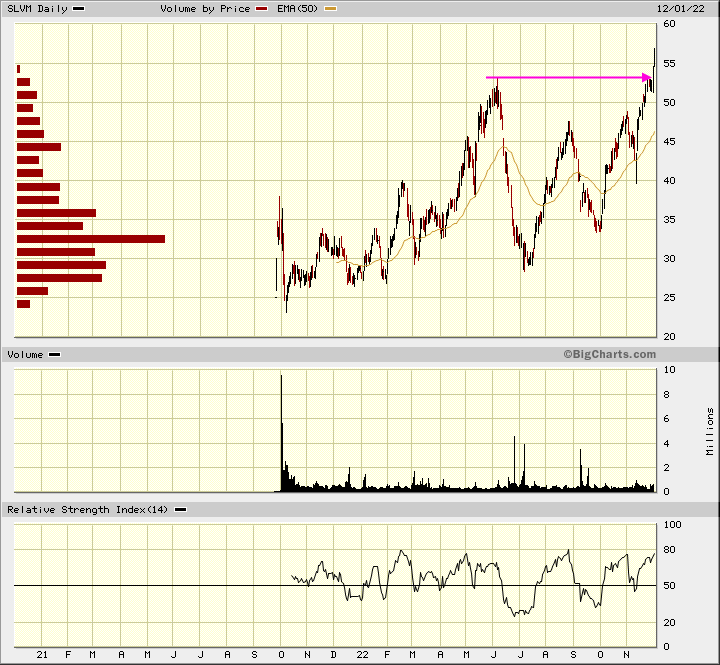

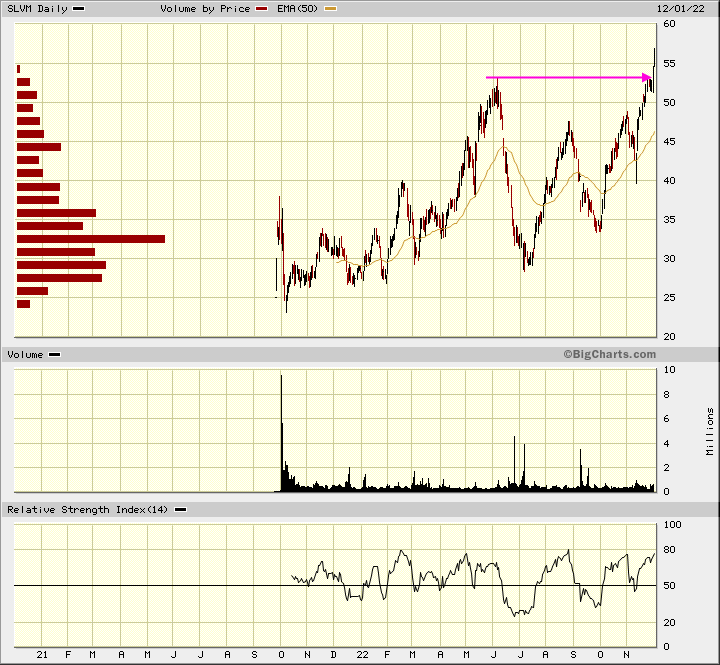

Antwort auf Beitrag Nr.: 72.486.441 von faultcode am 28.09.22 17:31:18Relentless:

10.11.

Sylvamo Delivers Strong Results, Fortifies Financial Position and Increases Quarterly Dividend

https://www.wallstreet-online.de/nachricht/16184402-sylvamo-…

...

10.11.

Sylvamo Delivers Strong Results, Fortifies Financial Position and Increases Quarterly Dividend

https://www.wallstreet-online.de/nachricht/16184402-sylvamo-…

...

Sylvamo schlägt mMn günstig in Europa zu:

15.9.

Sylvamo acquires Stora Enso Nymölla fine paper mill

https://www.euwid-paper.com/news/companies/sylvamo-acquires-…

...

Woodfree uncoated paper manufacturer Sylvamo has agreed to acquire Stora Enso’s fine paper mill in Nymölla, Sweden, for €150m. "The agreement includes the mill, the strong brands it produces and the people who make it happen, " Sylvamo announced.

The deal between Stora Enso and Sylvamo is part of Stora Enso's plan to divest four of its five fine and publication paper mills and focus on packaging solutions and renewable materials business.

...

15.9.

Sylvamo acquires Stora Enso Nymölla fine paper mill

https://www.euwid-paper.com/news/companies/sylvamo-acquires-…

...

Woodfree uncoated paper manufacturer Sylvamo has agreed to acquire Stora Enso’s fine paper mill in Nymölla, Sweden, for €150m. "The agreement includes the mill, the strong brands it produces and the people who make it happen, " Sylvamo announced.

The deal between Stora Enso and Sylvamo is part of Stora Enso's plan to divest four of its five fine and publication paper mills and focus on packaging solutions and renewable materials business.

...

11.8.

Sylvamo Second Quarter Results Show Increased Earnings and Operating Margins, Annual Guidance Raised

https://finance.yahoo.com/news/sylvamo-second-quarter-result…

...

Message from the Chairman and Chief Executive Officer

• "We saw increasing earnings and operating margins in the second quarter after a successful first quarter. We are also raising our adjusted EBITDA and free cash flow full-year guidance based on our first half of the year performance and our second half outlook," said Jean-Michel Ribiéras. "We remain committed to reducing debt, investing in high-return projects and returning cash to shareowners as we continue delivering on our investment thesis."

Russian Operations

• In May, we announced the decision to sell our Russian operations

• Management has committed to a plan for the sale, and the business is now classified as discontinued operations in our financial statements; all amounts reported in this news release for current and prior periods, as well as our outlook for the third quarter and full year, exclude our Russian operations unless otherwise noted

Second Quarter Highlights

• Net income from continuing operations of $84 million ($1.89 per diluted share) compared with $55 million ($1.25 per diluted share) in the first quarter of 2022

• Adjusted operating earnings1 (non-GAAP) of $90 million ($2.02 per diluted share) compared with $59 million ($1.34 per diluted share) in the first quarter of 2022, which was $0.12 per diluted share above the high end of the company’s guidance range

• Adjusted EBITDA2 (non-GAAP) of $189 million (20.7% margin) compared with $146 million (17.8% margin) in the first quarter of 2022, which was $9 million above the high end of the company’s guidance range

• Free cash flow3 (non-GAAP) of $39 million compared with $32 million in the first quarter of 2022

• Repaid $48 million of debt, achieving a gross debt-to-adjusted EBITDA ratio of 2.2x

...

Sylvamo Second Quarter Results Show Increased Earnings and Operating Margins, Annual Guidance Raised

https://finance.yahoo.com/news/sylvamo-second-quarter-result…

...

Message from the Chairman and Chief Executive Officer

• "We saw increasing earnings and operating margins in the second quarter after a successful first quarter. We are also raising our adjusted EBITDA and free cash flow full-year guidance based on our first half of the year performance and our second half outlook," said Jean-Michel Ribiéras. "We remain committed to reducing debt, investing in high-return projects and returning cash to shareowners as we continue delivering on our investment thesis."

Russian Operations

• In May, we announced the decision to sell our Russian operations

• Management has committed to a plan for the sale, and the business is now classified as discontinued operations in our financial statements; all amounts reported in this news release for current and prior periods, as well as our outlook for the third quarter and full year, exclude our Russian operations unless otherwise noted

Second Quarter Highlights

• Net income from continuing operations of $84 million ($1.89 per diluted share) compared with $55 million ($1.25 per diluted share) in the first quarter of 2022

• Adjusted operating earnings1 (non-GAAP) of $90 million ($2.02 per diluted share) compared with $59 million ($1.34 per diluted share) in the first quarter of 2022, which was $0.12 per diluted share above the high end of the company’s guidance range

• Adjusted EBITDA2 (non-GAAP) of $189 million (20.7% margin) compared with $146 million (17.8% margin) in the first quarter of 2022, which was $9 million above the high end of the company’s guidance range

• Free cash flow3 (non-GAAP) of $39 million compared with $32 million in the first quarter of 2022

• Repaid $48 million of debt, achieving a gross debt-to-adjusted EBITDA ratio of 2.2x

...

Antwort auf Beitrag Nr.: 69.904.406 von Calvet am 12.11.21 19:02:59

Sehr schön, schon sind wir über den 50$!

Zitat von Calvet: Sehr schön angesprungen. Das wird erst der Anfang sein nehme ich an. 50$ sollten es mMn schon werden

Sehr schön, schon sind wir über den 50$!