Eurobank Ergasias (Seite 4)

eröffnet am 08.07.13 10:13:54 von

neuester Beitrag 25.04.24 13:55:38 von

neuester Beitrag 25.04.24 13:55:38 von

Beiträge: 1.026

ID: 1.183.619

ID: 1.183.619

Aufrufe heute: 3

Gesamt: 255.235

Gesamt: 255.235

Aktive User: 0

ISIN: GRS323003012 · WKN: A2ABD1 · Symbol: EFGD

1,9985

EUR

-2,56 %

-0,0525 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

31.01.24 · wO Chartvergleich |

21.06.23 · wO Chartvergleich |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 32,00 | +27,95 | |

| 0,5800 | +23,40 | |

| 6,1100 | +18,64 | |

| 5,9000 | +15,69 | |

| 0,8600 | +14,67 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2200 | -11,59 | |

| 14,750 | -14,14 | |

| 1,8775 | -14,17 | |

| 1,2600 | -16,00 | |

| 1.138,25 | -16,86 |

Beitrag zu dieser Diskussion schreiben

21.1.

Greek Banks May Pay Dividend if Conditions Met, ECB’s Enria Says

https://www.bloomberg.com/news/articles/2023-01-21/greek-ban…

...

If the banks “are able to remain above all our supervisory tripwires, let’s say, requirements and buffers, including a payment of some distributions, we would not, in general, object” to a dividend, Enria said in an interview with Kathimerini newspaper conducted on Thursday and posted Saturday on central bank’s web page.

The ECB needs to be assured that the banks can be “sufficiently profitable to generate a sufficient amount of resources in the coming years to remunerate the shareholders and to maintain the capital trajectory on a safe path,” Enria said following a visit to Athens for meetings with bankers and policy makers.

...

Greek Banks May Pay Dividend if Conditions Met, ECB’s Enria Says

https://www.bloomberg.com/news/articles/2023-01-21/greek-ban…

...

If the banks “are able to remain above all our supervisory tripwires, let’s say, requirements and buffers, including a payment of some distributions, we would not, in general, object” to a dividend, Enria said in an interview with Kathimerini newspaper conducted on Thursday and posted Saturday on central bank’s web page.

The ECB needs to be assured that the banks can be “sufficiently profitable to generate a sufficient amount of resources in the coming years to remunerate the shareholders and to maintain the capital trajectory on a safe path,” Enria said following a visit to Athens for meetings with bankers and policy makers.

...

solider Wert, weit ab von den ganzen gehypten Werten, bleibe long!

Antwort auf Beitrag Nr.: 70.453.400 von faultcode am 10.01.22 11:51:27Scheint nicht so, als würde der Euro heute geknackt.

Antwort auf Beitrag Nr.: 61.501.655 von faultcode am 17.09.19 13:28:25

=> Eurobank Ergasias bleibt daher mein "Favorit":

Hier eine super-lange Analyse: https://www.moodys.com/research/Moodys-upgrades-the-four-lar…

Rating Action: Moody's upgrades the four largest Greek banks with positive outlook

Limassol, September 20, 2021 -- Moody's Investors Service (Moody's) has today upgraded the long-term deposit ratings of

• National Bank of Greece S.A.,

• Eurobank S.A. and

• Alpha Bank S.A. to B2 from Caa1, and

• Piraeus Bank S.A.'s long-term deposit rating to B3 from Caa2.

The outlook on the deposit ratings for all four banks is positive.

The rating agency has also upgraded the long-term Counterparty Risk Assessments (CRA) of National Bank of Greece S.A., Eurobank S.A. and Alpha Bank S.A. to Ba3(cr) from B1(cr) and for Piraeus Bank S.A. to B1(cr) from B2(cr).

The long-term Counterparty Risk Ratings (CRR) of National Bank of Greece S.A., Eurobank S.A. and Alpha Bank S.A. were also upgraded to Ba3 from B2 and for Piraeus Bank S.A. to B1 from B3.

The short-term ratings for all banks were affirmed at Not-Prime (NP) and their short-term CRA at NP(cr). Concurrently, Moody's has upgraded the Baseline Credit Assessment (BCA) of National Bank of Greece S.A., Alpha Bank S.A. and Eurobank S.A. to b3 from caa1, and the BCA of Piraeus Bank S.A.'s to caa1 from caa2.

Today's rating action on the four largest Greek banks was primarily driven by their improving asset quality and solvency and good prospects for further enhancing their recurring profitability, factors that are exerting upward pressure on their BCAs. In addition, the upgrade to the banks' deposit ratings also reflects their recent and upcoming MREL (minimum requirement for own funds and eligible liabilities) eligible debt issuances until the end of 2025, which will change the banks' liability structure and enhance the buffers available to protect depositors.

The positive outlooks reflect Moody's expectation that the four banks will continue to improve their credit profiles, and be in a good position to manage any new problem loan formation as a consequence of the coronavirus pandemic.

The ratings could be upgraded in the coming quarters if the banks maintain their sound capital and liquidity, while fully implementing their transformation plans by further reducing their problem loans and leveraging the economic and credit growth potential of the Greek economy, which will benefit significantly from the EU's recovery and resilience facility (RRF).

Greece's real GDP surged by 16.2% year-on-year in the second quarter of 2021, and will likely grow by around 5% on average during 2021 and 2022, providing good opportunities for banks to grow their loan books and support their revenues.

Nonetheless, Greek banks' BCAs are still constrained by the quality of their capital, with sizeable deferred tax credits (DTCs) in the capital structure, and also by the challenge to further reduce their problem loans and cost of risk, as well as improve their core profitability by containing expenses and booking new business.

...

Eurobank S.A.'s BCA upgrade also considers Eurobank Ergasias Services and Holdings S.A.'s ( the holding company of Eurobank S.A.) satisfactory financial results in the first half 2021 with net profits at €190 million, which provides a very good proxy for the operating bank's performance. This was supported by a favourable 16% year-on-year increase in its net commission income and despite a 2.8% year-on-year decrease in its net interest income on the back of some net interest margin (NIM) pressure (decreased to 1.92% in June 2021 from 2.10% in June 2020). The group was able to achieve a satisfactory 7.7% annualised return on tangible book value as of June 2021, from 6% in June 2020.

...

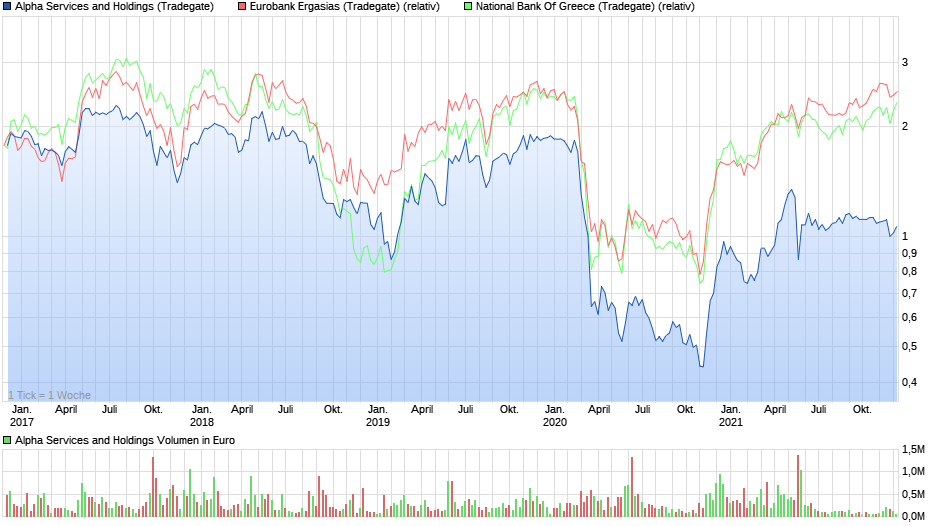

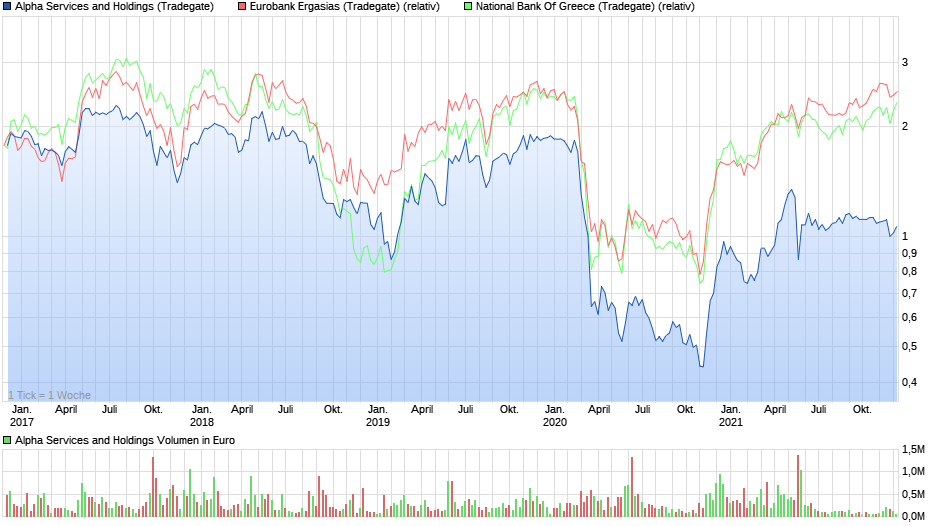

Zitat von faultcode: Eurobank Ergasias und National Bank of Greece führen in diesem "Rennen"; Eurobank Ergasias ist allerdings stabiler (*).

...

(*) Beta 5Y Monthly (Yahoo Finance):

• Eurobank Ergasias: 2.28

• National Bank of Greece: 2.54

=> Eurobank Ergasias bleibt daher mein "Favorit":

Hier eine super-lange Analyse: https://www.moodys.com/research/Moodys-upgrades-the-four-lar…

Rating Action: Moody's upgrades the four largest Greek banks with positive outlook

Limassol, September 20, 2021 -- Moody's Investors Service (Moody's) has today upgraded the long-term deposit ratings of

• National Bank of Greece S.A.,

• Eurobank S.A. and

• Alpha Bank S.A. to B2 from Caa1, and

• Piraeus Bank S.A.'s long-term deposit rating to B3 from Caa2.

The outlook on the deposit ratings for all four banks is positive.

The rating agency has also upgraded the long-term Counterparty Risk Assessments (CRA) of National Bank of Greece S.A., Eurobank S.A. and Alpha Bank S.A. to Ba3(cr) from B1(cr) and for Piraeus Bank S.A. to B1(cr) from B2(cr).

The long-term Counterparty Risk Ratings (CRR) of National Bank of Greece S.A., Eurobank S.A. and Alpha Bank S.A. were also upgraded to Ba3 from B2 and for Piraeus Bank S.A. to B1 from B3.

The short-term ratings for all banks were affirmed at Not-Prime (NP) and their short-term CRA at NP(cr). Concurrently, Moody's has upgraded the Baseline Credit Assessment (BCA) of National Bank of Greece S.A., Alpha Bank S.A. and Eurobank S.A. to b3 from caa1, and the BCA of Piraeus Bank S.A.'s to caa1 from caa2.

Today's rating action on the four largest Greek banks was primarily driven by their improving asset quality and solvency and good prospects for further enhancing their recurring profitability, factors that are exerting upward pressure on their BCAs. In addition, the upgrade to the banks' deposit ratings also reflects their recent and upcoming MREL (minimum requirement for own funds and eligible liabilities) eligible debt issuances until the end of 2025, which will change the banks' liability structure and enhance the buffers available to protect depositors.

The positive outlooks reflect Moody's expectation that the four banks will continue to improve their credit profiles, and be in a good position to manage any new problem loan formation as a consequence of the coronavirus pandemic.

The ratings could be upgraded in the coming quarters if the banks maintain their sound capital and liquidity, while fully implementing their transformation plans by further reducing their problem loans and leveraging the economic and credit growth potential of the Greek economy, which will benefit significantly from the EU's recovery and resilience facility (RRF).

Greece's real GDP surged by 16.2% year-on-year in the second quarter of 2021, and will likely grow by around 5% on average during 2021 and 2022, providing good opportunities for banks to grow their loan books and support their revenues.

Nonetheless, Greek banks' BCAs are still constrained by the quality of their capital, with sizeable deferred tax credits (DTCs) in the capital structure, and also by the challenge to further reduce their problem loans and cost of risk, as well as improve their core profitability by containing expenses and booking new business.

...

Eurobank S.A.'s BCA upgrade also considers Eurobank Ergasias Services and Holdings S.A.'s ( the holding company of Eurobank S.A.) satisfactory financial results in the first half 2021 with net profits at €190 million, which provides a very good proxy for the operating bank's performance. This was supported by a favourable 16% year-on-year increase in its net commission income and despite a 2.8% year-on-year decrease in its net interest income on the back of some net interest margin (NIM) pressure (decreased to 1.92% in June 2021 from 2.10% in June 2020). The group was able to achieve a satisfactory 7.7% annualised return on tangible book value as of June 2021, from 6% in June 2020.

...

By George Georgiopoulos

ATHENS, April 1 (Reuters) - Credit rating agency Moody's on Thursday upgraded its outlook on Greek banks to "positive" from "stable", reflecting its view that the economy will recover from its coronavirus-induced slowdown, boosting credit growth and bank profits.

Though capital strength of the country's banks is expected to deteriorate moderately, Moody's expects it to remain above regulatory requirements and the agency is projecting stable funding and liquidity conditions.

"Government measures to support the economy, together with the ongoing disposal of problem loans through securitisations will improve loan quality and reduce loan-loss provisioning," Moody's said.

The agency expects the Greek economy to recover this year and next after an 8.2% slump in 2020, brought on by coronavirus lockdowns.

Domestic demand and consumption will also help the economy to grow at an estimated 3.6% clip this year, picking up to 5.7% in 2022, with improving business conditions for banks, it said.

"The gradual rollout of vaccines and progressive lifting of travel restrictions will benefit the tourism sector in particular, which is one of the main pillars of the country's economy," Moody's said.

On asset quality, Moody's said that Greek banks plan a significant reduction in legacy non-performing exposures (NPEs) through securitisations in 2021-22 that will more than offset a potential pandemic-driven increase in bad loans.

"We anticipate that Greek banks will proceed with large-scale NPE sales of about 17 billion euros ($19.96 billion), mainly through the state-backed asset protection scheme, Hercules," it said.

Moody's expects Greek banks' regulatory capital to remain above minimum requirements, though losses on NPE securitisations and loan disposals will exert "some pressure on core capital in 2021-22".

"We expect Greek banks' profitability to improve in 2021-22 from a low base as increased lending and a focus on core operations enhance recurring revenues, both in the form of net interest income and fees and commissions," Moody's said. ($1 = 0.8518 euros)

(Reporting by George Georgiopoulos Editing by David Goodman)

((george.georgiopoulos@thomsonreuters.com; +30210 337 6437; Reuters Messaging: george.georgiopoulos.thomsonreuters.com@reuters.net))

Keywords: GREECE BANKS/MOODY'S

ATHENS, April 1 (Reuters) - Credit rating agency Moody's on Thursday upgraded its outlook on Greek banks to "positive" from "stable", reflecting its view that the economy will recover from its coronavirus-induced slowdown, boosting credit growth and bank profits.

Though capital strength of the country's banks is expected to deteriorate moderately, Moody's expects it to remain above regulatory requirements and the agency is projecting stable funding and liquidity conditions.

"Government measures to support the economy, together with the ongoing disposal of problem loans through securitisations will improve loan quality and reduce loan-loss provisioning," Moody's said.

The agency expects the Greek economy to recover this year and next after an 8.2% slump in 2020, brought on by coronavirus lockdowns.

Domestic demand and consumption will also help the economy to grow at an estimated 3.6% clip this year, picking up to 5.7% in 2022, with improving business conditions for banks, it said.

"The gradual rollout of vaccines and progressive lifting of travel restrictions will benefit the tourism sector in particular, which is one of the main pillars of the country's economy," Moody's said.

On asset quality, Moody's said that Greek banks plan a significant reduction in legacy non-performing exposures (NPEs) through securitisations in 2021-22 that will more than offset a potential pandemic-driven increase in bad loans.

"We anticipate that Greek banks will proceed with large-scale NPE sales of about 17 billion euros ($19.96 billion), mainly through the state-backed asset protection scheme, Hercules," it said.

Moody's expects Greek banks' regulatory capital to remain above minimum requirements, though losses on NPE securitisations and loan disposals will exert "some pressure on core capital in 2021-22".

"We expect Greek banks' profitability to improve in 2021-22 from a low base as increased lending and a focus on core operations enhance recurring revenues, both in the form of net interest income and fees and commissions," Moody's said. ($1 = 0.8518 euros)

(Reporting by George Georgiopoulos Editing by David Goodman)

((george.georgiopoulos@thomsonreuters.com; +30210 337 6437; Reuters Messaging: george.georgiopoulos.thomsonreuters.com@reuters.net))

Keywords: GREECE BANKS/MOODY'S

Sorry für die Sprache. Man könnte meinen, ich hätte keinen Bürojob 🙈

Bin auch sehr erfreut, insbesondere weil gerade Wasserstoffwerte im gleichen Zeitraum so stark korrigiert. Dann macht der Blick ins Depot wenigstens noch Freude

Bin auch gespannt wann Cairo Mezz den Sprung über 0,14€ und wohin die Reise geht

Bin auch gespannt wann Cairo Mezz den Sprung über 0,14€ und wohin die Reise geht

Eurobank Ergasias