Arcadia Biosciences Names New Chief Executive Officer - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 22.05.16 10:51:15 von

neuester Beitrag 29.04.21 09:58:01 von

neuester Beitrag 29.04.21 09:58:01 von

Beiträge: 28

ID: 1.232.163

ID: 1.232.163

Aufrufe heute: 0

Gesamt: 1.777

Gesamt: 1.777

Aktive User: 0

ISIN: US0390143032 · WKN: A3D7B0 · Symbol: 17D

1,8100

EUR

-3,72 %

-0,0700 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

25.04.24 · Business Wire (engl.) |

28.03.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

20.02.24 · Business Wire (engl.) |

09.11.23 · Business Wire (engl.) |

Werte aus der Branche Biotechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0100 | +21,57 | |

| 1,2000 | +21,21 | |

| 1,4920 | +20,23 | |

| 0,8232 | +17,25 | |

| 1,0900 | +15,96 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5000 | -26,24 | |

| 0,6700 | -26,58 | |

| 2,1300 | -34,41 | |

| 3,1600 | -38,64 | |

| 125,00 | -95,83 |

Arcadia Biosciences, Inc. (Nasdaq: RKDA), an agricultural technology company that creates value for farmers while benefitting the environment and enhancing human health, announced today that Raj Ketkar will join the company as …

Lesen Sie den ganzen Artikel: Arcadia Biosciences Names New Chief Executive Officer

Lesen Sie den ganzen Artikel: Arcadia Biosciences Names New Chief Executive Officer

to be watched

Holy Fuckin Moly! 330% in a single shot!

Pump and Dump

Nach einem hemmungslosen "pump" ist es jetzt mal genug mit "dump" nach einem Private placement in Höhe von 10 Millionen $. Der Laden ist Schuldenfrei und hat 23 Millionen $ cash. Die Verbrennen 3-4 Millionen $ pro QT, damit kann ich für die Nahe Zukunft kein Insolvenzrisiko erkennen. Die Marke "GoodWheat" hat das Potential das nächste "Nutrasweet" zu werden (ist auch der selbe "Erfinder"). Das ganze bei einer Marktkapitalisierung von 28 Millionen $...ich denke, auf dem Niveau kann man mal einen kleinen Zock riskieren...

Nach einem hemmungslosen "pump" ist es jetzt mal genug mit "dump" nach einem Private placement in Höhe von 10 Millionen $. Der Laden ist Schuldenfrei und hat 23 Millionen $ cash. Die Verbrennen 3-4 Millionen $ pro QT, damit kann ich für die Nahe Zukunft kein Insolvenzrisiko erkennen. Die Marke "GoodWheat" hat das Potential das nächste "Nutrasweet" zu werden (ist auch der selbe "Erfinder"). Das ganze bei einer Marktkapitalisierung von 28 Millionen $...ich denke, auf dem Niveau kann man mal einen kleinen Zock riskieren...

Arcadia Biosciences: A Micro-Cap Opportunity In Agriculture

May.16.18 | About: Arcadia Biosciences (RKDA)

Summary

RKDA is an underfollowed pure play agricultural biotechnology stock.

A compelling growth story is emerging as commercialization of its reduced-gluten wheat begins.

Recent balance sheet improvements and a diverse pipeline of desirable plant traits for major crops mitigate the risk inherent in the micro-cap space.

Editor's note: Seeking Alpha is proud to welcome Wellspring as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

Arcadia Biosciences (RKDA) may be a micro-cap stock with a market capitalization of just $26 million, but its mature pipeline of plant traits and recently shored up balance sheet could make this a compelling multiyear play.

The agricultural biotechnology sector has been dominated by a few titans, and that playing field continues to get smaller as Monsanto and Bayer close on their proposed merger. While nearly 100 mid-cap and smaller pharmaceutical companies are listed on U.S. exchanges, there has been considerably less capital formation dedicated to agricultural biotechnology.

Company Background

Arcadia Biosciences (RKDA) was founded in 2002 and listed on the Nasdaq in 2015 at an IPO price of $164 (accounting for the 1-for-20 reverse split completed this year) raising a total of $68 million at an IPO valuation of $532 million. Significant private equity investments were also made into Arcadia prior to the IPO, notably by Mandala Capital and Moral Compass Corporation, which together owned 73% of Arcadia at the end of 2017.

The company has recently made a significant change in business direction from a focus on the research and development of plant traits to the commercialization of those traits. These traits include:

• High gamma-linolenic acid (GLA) safflower under the brand Sonova as an omega-6 fatty acid supplement for humans and pets.

• Reduced-wheat gluten under the brand GoodWheat.

• Traits that improve nitrogen- and water-use efficiency as well as salinity tolerance, particularly in rice and soybeans.

Sonova GLA commercialization has already begun with sales for human and dog supplementation contributing to 2017 and 2018 revenues. Sonova is the only FDA approved GLA additive for dog food and approval for use in cat food is expected shortly.

GoodWheat samples are currently being sent to prospective companies to be incorporated in their products, which Arcadia plans to commercialize over the next 12-36 months.

A commercialization timeline for the suite of nitrogen, water-use, and abiotic stress tolerance traits is not apparent, but outcomes from these traits continue to be promising. Of note is the announcement this month that these stacked traits can lead to up to as much as a 50% improvement in rice yield under certain field conditions.

The Long Thesis

Arcadia is a bet on the successful commercialization of its portfolio of plant traits or a buyout for its portfolio by a larger agrisciences company. Despite the appeal of a quick profit through a buyout, Arcadia has given no indication of seeking alternatives such as being bought and its two major shareholders likely have the patience to wait out short-term price fluctuations. Both Mandala and Moral Compass have provided capital to Arcadia at much higher valuations and would be resistant to exit Arcadia at even a low multiple of its current share price. Therefore, we will focus on Arcadia as a long-term investment based on the merits of its trait portfolio.

While Sonova GLA is the only product currently commercialized, it is unclear if it will be a long-term source of significant revenues. While the level of GLA in safflower is the highest available (40% or greater by weight) and a marked improvement over conventional sources, the pet and human supplement market is highly competitive. Insufficient evidence exists for the cost competitiveness of Arcadia's GLA versus other sources of omega-6 fatty acids. Despite Arcadia GLA being sold in GNC (GNC) products in the past, currently no GLA product on their website is sourced from safflower. Although borage has lower % content of GLA than Sonova safflower, it may still be more cost efficient at this time.

Much more promising as a potential game changer is the reduced-gluten wheat under the brand GoodWheat was recently rolled out by Arcadia. While this focus may simply appear to be an appeal to the consumer trend of reducing dietary gluten, the brand actually encompasses a much wider array of desirable crop traits. GoodWheat products can also lead provide longer shelf life and higher fiber content. Wheat contributes ~25% of dietary calories in the U.S. and is planted on more acres than any other crop at the global scale.

The global wheat market is expected to be ~$270 billion in 2022 and the global baked good market is predicted to be ~156 in 2020. The commercialization of GoodWheat at this time could be a breakthrough product for Arcadia as the reduction of dietary gluten is increasingly seen as healthy. For example, despite that only 1% of people have a gluten allergy, about 7% of consumers in the U.K. actively reduce gluten intake. Further, CEO Raj Ketkar has emphasized the possibility of incorporating CRISPR-Cas9 technology into future gene editing for plant traits, which they recently licensed from MIT's Broad Institute.

Some of the greatest promise of Arcadia is the improvements in yield of major crops using less fertilizer and under agricultural conditions that are becoming increasingly common globally such as drought. Nitrogen fertilizer used in agriculture can contribute to significant environmental externalities such as eutrophication, harmful algal blooms, and climate change. The necessity of agriculture has left it relatively insulated from environmental legislation but the value of reducing nitrogen fertilization could be significant. A patent by Arcadia even outlines the potential use of enhanced nitrogen-use efficiency plants in the carbon credit market.

Arcadia has recently made significant progress on improving its balance sheet and preparing for the commercialization of its GoodWheat reduced-gluten and other products. In March it secured $10 million in a private placement and currently has over $20 million in cash on hand. A recent mixed-shelf offering for $50 million was also filed, increasing the ease at which Arcadia can meet capital needs. At operating expenses of about $18 million a year, Arcadia has about a year at 2017 run rates to make progress on commercialization without accessing this additional capital.

Downside Risks

Despite the potential appeal of Arcadia and its plant trait portfolio, we must also emphasize the risks inherent in investing in a small company that has products that may not succeed in being commercialized. Major competitors such as Monsanto (MON) and DowDuPont (DWDP) pursue similar plant trait research, particularly for the optimization of harvest yields. Both of these companies possess similar non-exclusive CRISPR-Cas9 licensing to Arcadia. In the startup space Yield10 Bioscience (YTEN) also develops traits for crop yield enhancement, which competes specifically in the soybean trait space.

Arcadia's 52-week high is $66 while it is currently trading under $10. Large fluctuations in price should be expected since just 10% of the company's float is freely traded due to the high insider and institutional ownership. Significant selling also occurred last year due to the removal of Arcadia from the Wilshire U.S. Micro-Cap Index due to temporarily not meeting Nasdaq listing requirements. These issues were addressed in a timely manner by Arcadia management and may lead to future inclusion in micro-cap indices. Despite the low float, Arcadia does meet the 5% float minimum required by Wilshire.

Given that Arcadia trades at a market capitalization of less than $100 million, special caution must be given due to its inherent low liquidity. Daily trading volumes are currently in the $8 million range, meaning that an investment in Arcadia may not be suitable for large amounts. Arcadia often has about a 3% spread between its bid and ask price, and trying to exit a position may result in significant slippage. Furthermore, an investment in Arcadia has led to significant losses since its IPO and has been in violation of Nasdaq listing requirements within the past year. An investment in Arcadia is inherently speculative since they have minimal current revenue that cannot cover G&A expenses and the company may remain unprofitable even if it succeeds in commercializing its plant trait pipeline.

Conclusion

Arcadia Biosciences (RKDA) is a micro-cap agricultural biotechnology company in an uncrowded field. The inherent demand of increased crop yields, particularly in the face of increasingly adverse growing conditions, could make Arcadia a timely bet on the future of agriculture. The low-risk balance sheet, mature plant trait product pipeline, and clear vision for commercialization add to the bull case.

Quelle: Seeking Alpha

May.16.18 | About: Arcadia Biosciences (RKDA)

Summary

RKDA is an underfollowed pure play agricultural biotechnology stock.

A compelling growth story is emerging as commercialization of its reduced-gluten wheat begins.

Recent balance sheet improvements and a diverse pipeline of desirable plant traits for major crops mitigate the risk inherent in the micro-cap space.

Editor's note: Seeking Alpha is proud to welcome Wellspring as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

Arcadia Biosciences (RKDA) may be a micro-cap stock with a market capitalization of just $26 million, but its mature pipeline of plant traits and recently shored up balance sheet could make this a compelling multiyear play.

The agricultural biotechnology sector has been dominated by a few titans, and that playing field continues to get smaller as Monsanto and Bayer close on their proposed merger. While nearly 100 mid-cap and smaller pharmaceutical companies are listed on U.S. exchanges, there has been considerably less capital formation dedicated to agricultural biotechnology.

Company Background

Arcadia Biosciences (RKDA) was founded in 2002 and listed on the Nasdaq in 2015 at an IPO price of $164 (accounting for the 1-for-20 reverse split completed this year) raising a total of $68 million at an IPO valuation of $532 million. Significant private equity investments were also made into Arcadia prior to the IPO, notably by Mandala Capital and Moral Compass Corporation, which together owned 73% of Arcadia at the end of 2017.

The company has recently made a significant change in business direction from a focus on the research and development of plant traits to the commercialization of those traits. These traits include:

• High gamma-linolenic acid (GLA) safflower under the brand Sonova as an omega-6 fatty acid supplement for humans and pets.

• Reduced-wheat gluten under the brand GoodWheat.

• Traits that improve nitrogen- and water-use efficiency as well as salinity tolerance, particularly in rice and soybeans.

Sonova GLA commercialization has already begun with sales for human and dog supplementation contributing to 2017 and 2018 revenues. Sonova is the only FDA approved GLA additive for dog food and approval for use in cat food is expected shortly.

GoodWheat samples are currently being sent to prospective companies to be incorporated in their products, which Arcadia plans to commercialize over the next 12-36 months.

A commercialization timeline for the suite of nitrogen, water-use, and abiotic stress tolerance traits is not apparent, but outcomes from these traits continue to be promising. Of note is the announcement this month that these stacked traits can lead to up to as much as a 50% improvement in rice yield under certain field conditions.

The Long Thesis

Arcadia is a bet on the successful commercialization of its portfolio of plant traits or a buyout for its portfolio by a larger agrisciences company. Despite the appeal of a quick profit through a buyout, Arcadia has given no indication of seeking alternatives such as being bought and its two major shareholders likely have the patience to wait out short-term price fluctuations. Both Mandala and Moral Compass have provided capital to Arcadia at much higher valuations and would be resistant to exit Arcadia at even a low multiple of its current share price. Therefore, we will focus on Arcadia as a long-term investment based on the merits of its trait portfolio.

While Sonova GLA is the only product currently commercialized, it is unclear if it will be a long-term source of significant revenues. While the level of GLA in safflower is the highest available (40% or greater by weight) and a marked improvement over conventional sources, the pet and human supplement market is highly competitive. Insufficient evidence exists for the cost competitiveness of Arcadia's GLA versus other sources of omega-6 fatty acids. Despite Arcadia GLA being sold in GNC (GNC) products in the past, currently no GLA product on their website is sourced from safflower. Although borage has lower % content of GLA than Sonova safflower, it may still be more cost efficient at this time.

Much more promising as a potential game changer is the reduced-gluten wheat under the brand GoodWheat was recently rolled out by Arcadia. While this focus may simply appear to be an appeal to the consumer trend of reducing dietary gluten, the brand actually encompasses a much wider array of desirable crop traits. GoodWheat products can also lead provide longer shelf life and higher fiber content. Wheat contributes ~25% of dietary calories in the U.S. and is planted on more acres than any other crop at the global scale.

The global wheat market is expected to be ~$270 billion in 2022 and the global baked good market is predicted to be ~156 in 2020. The commercialization of GoodWheat at this time could be a breakthrough product for Arcadia as the reduction of dietary gluten is increasingly seen as healthy. For example, despite that only 1% of people have a gluten allergy, about 7% of consumers in the U.K. actively reduce gluten intake. Further, CEO Raj Ketkar has emphasized the possibility of incorporating CRISPR-Cas9 technology into future gene editing for plant traits, which they recently licensed from MIT's Broad Institute.

Some of the greatest promise of Arcadia is the improvements in yield of major crops using less fertilizer and under agricultural conditions that are becoming increasingly common globally such as drought. Nitrogen fertilizer used in agriculture can contribute to significant environmental externalities such as eutrophication, harmful algal blooms, and climate change. The necessity of agriculture has left it relatively insulated from environmental legislation but the value of reducing nitrogen fertilization could be significant. A patent by Arcadia even outlines the potential use of enhanced nitrogen-use efficiency plants in the carbon credit market.

Arcadia has recently made significant progress on improving its balance sheet and preparing for the commercialization of its GoodWheat reduced-gluten and other products. In March it secured $10 million in a private placement and currently has over $20 million in cash on hand. A recent mixed-shelf offering for $50 million was also filed, increasing the ease at which Arcadia can meet capital needs. At operating expenses of about $18 million a year, Arcadia has about a year at 2017 run rates to make progress on commercialization without accessing this additional capital.

Downside Risks

Despite the potential appeal of Arcadia and its plant trait portfolio, we must also emphasize the risks inherent in investing in a small company that has products that may not succeed in being commercialized. Major competitors such as Monsanto (MON) and DowDuPont (DWDP) pursue similar plant trait research, particularly for the optimization of harvest yields. Both of these companies possess similar non-exclusive CRISPR-Cas9 licensing to Arcadia. In the startup space Yield10 Bioscience (YTEN) also develops traits for crop yield enhancement, which competes specifically in the soybean trait space.

Arcadia's 52-week high is $66 while it is currently trading under $10. Large fluctuations in price should be expected since just 10% of the company's float is freely traded due to the high insider and institutional ownership. Significant selling also occurred last year due to the removal of Arcadia from the Wilshire U.S. Micro-Cap Index due to temporarily not meeting Nasdaq listing requirements. These issues were addressed in a timely manner by Arcadia management and may lead to future inclusion in micro-cap indices. Despite the low float, Arcadia does meet the 5% float minimum required by Wilshire.

Given that Arcadia trades at a market capitalization of less than $100 million, special caution must be given due to its inherent low liquidity. Daily trading volumes are currently in the $8 million range, meaning that an investment in Arcadia may not be suitable for large amounts. Arcadia often has about a 3% spread between its bid and ask price, and trying to exit a position may result in significant slippage. Furthermore, an investment in Arcadia has led to significant losses since its IPO and has been in violation of Nasdaq listing requirements within the past year. An investment in Arcadia is inherently speculative since they have minimal current revenue that cannot cover G&A expenses and the company may remain unprofitable even if it succeeds in commercializing its plant trait pipeline.

Conclusion

Arcadia Biosciences (RKDA) is a micro-cap agricultural biotechnology company in an uncrowded field. The inherent demand of increased crop yields, particularly in the face of increasingly adverse growing conditions, could make Arcadia a timely bet on the future of agriculture. The low-risk balance sheet, mature plant trait product pipeline, and clear vision for commercialization add to the bull case.

Quelle: Seeking Alpha

Antwort auf Beitrag Nr.: 57.775.903 von DomRuinart am 16.05.18 20:06:21Sind das nun alles gute Nachrichten? Oder gibt es auch was zu bemängeln!

Antwort auf Beitrag Nr.: 57.780.412 von herku am 17.05.18 12:35:17Unter "Downside Risks" listet der Artikel die Risiken auf:

- kleiner Laden

- starke Wettbewerber mit Monsanto und DuPont

- starke Kursschwankungen, da nur 10% der Aktien im free float, der Rest liegt bei Insidern und Institutionellen (kann man aber durchaus auch positiv sehen)

- geringe Liquidität

- hoher spread erschwert den Einstieg

- hohe Kursverluste seit IPO

- sehr spekulativ, da noch lange nicht profitabel

Man kauft hier die "Story", aber die könnte mit dem Start von "GoodWheat" extrem spannend werden...

- kleiner Laden

- starke Wettbewerber mit Monsanto und DuPont

- starke Kursschwankungen, da nur 10% der Aktien im free float, der Rest liegt bei Insidern und Institutionellen (kann man aber durchaus auch positiv sehen)

- geringe Liquidität

- hoher spread erschwert den Einstieg

- hohe Kursverluste seit IPO

- sehr spekulativ, da noch lange nicht profitabel

Man kauft hier die "Story", aber die könnte mit dem Start von "GoodWheat" extrem spannend werden...

Antwort auf Beitrag Nr.: 57.783.862 von DomRuinart am 17.05.18 18:59:03Danke,ja Kursschwankungen bis zu 3$ täglich sind hier jederzeit möglich. Ein Anstieg auf 20$ kann schnell kommen.Bin jetzt mit dabei!

Antwort auf Beitrag Nr.: 57.784.369 von herku am 17.05.18 19:57:57Immer noch Kampf um die 12$, dann könnte es viel höher gehen!

Antwort auf Beitrag Nr.: 57.880.680 von herku am 31.05.18 19:45:10

Naja $12 sind noch weit weg, aber zumindest wird um die 100 Tage-Linie gekämpft - als die das letzte Mal genommen wurde, ging die Post ab - dranbleiben, kann spannend werden

Zitat von herku: Immer noch Kampf um die 12$, dann könnte es viel höher gehen!

Naja $12 sind noch weit weg, aber zumindest wird um die 100 Tage-Linie gekämpft - als die das letzte Mal genommen wurde, ging die Post ab - dranbleiben, kann spannend werden

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 59.857.420 von soulist am 12.02.19 21:39:43Sieht sehr gut aus,war leider zu sehr mit Sears beschäftigt.

Antwort auf Beitrag Nr.: 59.864.668 von herku am 13.02.19 17:00:24

Leider?

Zitat von herku: Sieht sehr gut aus,war leider zu sehr mit Sears beschäftigt.

Leider?

Antwort auf Beitrag Nr.: 59.864.737 von soulist am 13.02.19 17:06:38Das Ding will wohl hoch,10$ die Woche noch?

Antwort auf Beitrag Nr.: 59.865.430 von herku am 13.02.19 18:05:05

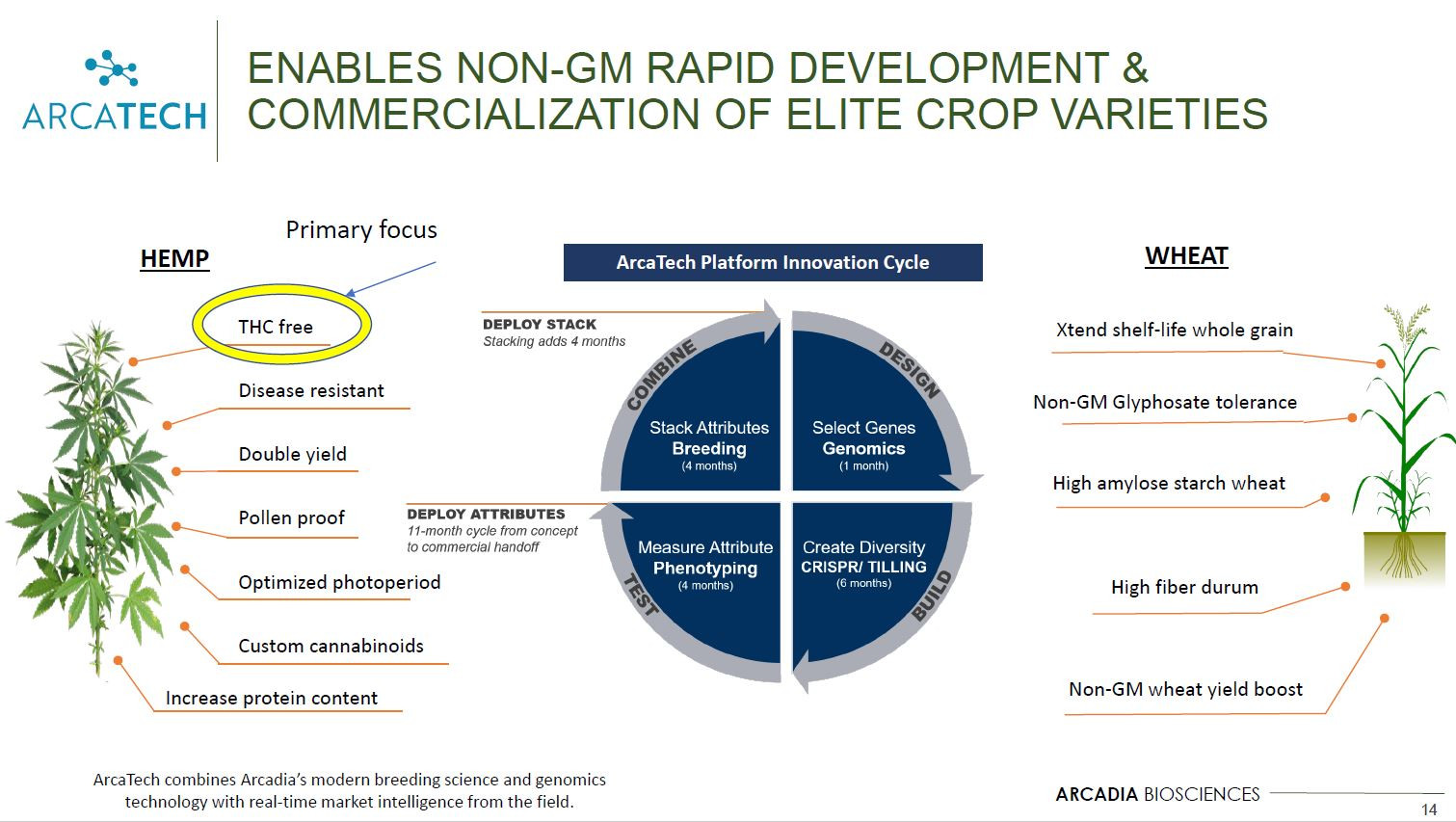

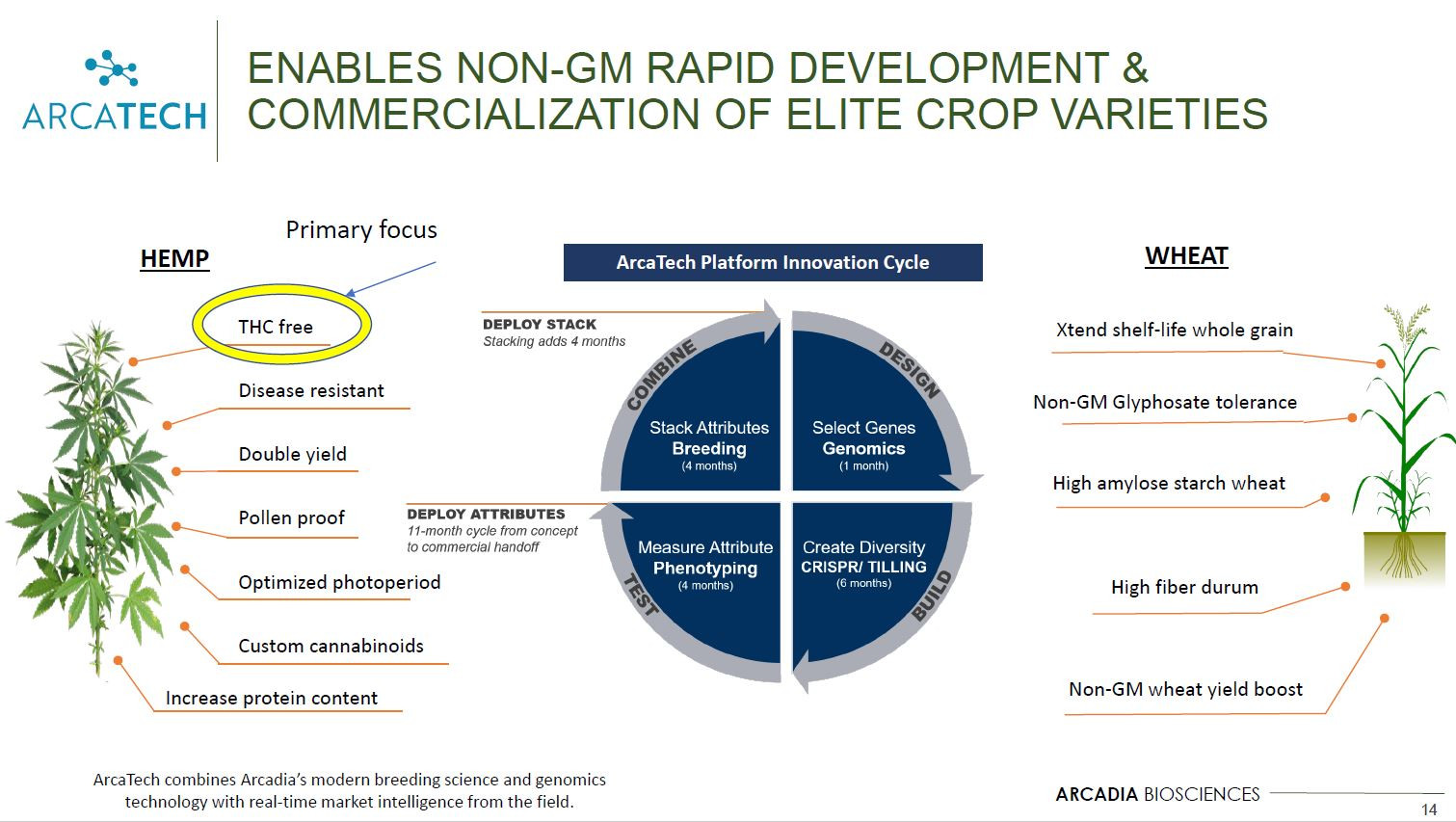

Neuer Geschäftsbereich Cannabis.

QUELLE:

https://www.stockwatch.com/News/Item.aspx?bid=U-b005321-U:RK…

Wiederholt sich ein Ausbruch ähnlich dem letzten Jahr ?

News: Arcadia startet in die Cannabis-Welt

Arcadia Biosciences, a Leader in Advanced Agricultural Breeding and Gene Optimization, Announces New Business Unit Dedicated to CannabisNeuer Geschäftsbereich Cannabis.

QUELLE:

https://www.stockwatch.com/News/Item.aspx?bid=U-b005321-U:RK…

Wiederholt sich ein Ausbruch ähnlich dem letzten Jahr ?

Antwort auf Beitrag Nr.: 59.984.746 von tbhomy am 28.02.19 11:22:50

Mal schauen, wohin das führt...

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Mal schauen, wohin das führt...

8€ war schon gut heute!

Antwort auf Beitrag Nr.: 59.985.523 von tbhomy am 28.02.19 12:37:03Puh, Nasdaq-Trading. Das ist nicht meine Welt, auch wenn es sich lohnt.

9€ jetzt alles super!!!

Es gibt weniger als 5 Mio. Aktien ? Dann wurde der gesamte Freefloat heute mehrmals umgedreht.

Nur wer behält seine Aktien dann im Säckl ?

Nur wer behält seine Aktien dann im Säckl ?

Jackpot. FDA Approval für Sonova

https://www.wallstreet-online.de/nachricht/11312650-arcadia-…Damit hat nicht einmal mein Bauchgefühl gerechnet

Arcadia Biosciences – Consensus Indicates Potential 118.7% Upside

https://www.directorstalkinterviews.com/arcadia-biosciences-…

Die Saga geht weiter.

https://www.directorstalkinterviews.com/arcadia-biosciences-…

Die Saga geht weiter.

Tilray2 ?

Antwort auf Beitrag Nr.: 66.934.295 von check2020 am 10.02.21 17:47:34

läuft wirklich gut 👍

Zitat von check2020: Tilray2 ?

läuft wirklich gut 👍

Habe heute hier eine erste Position aufgebaut. Cash plus Anteil in Biox ist ungefähr gleich der derzeitigen Market Cap.

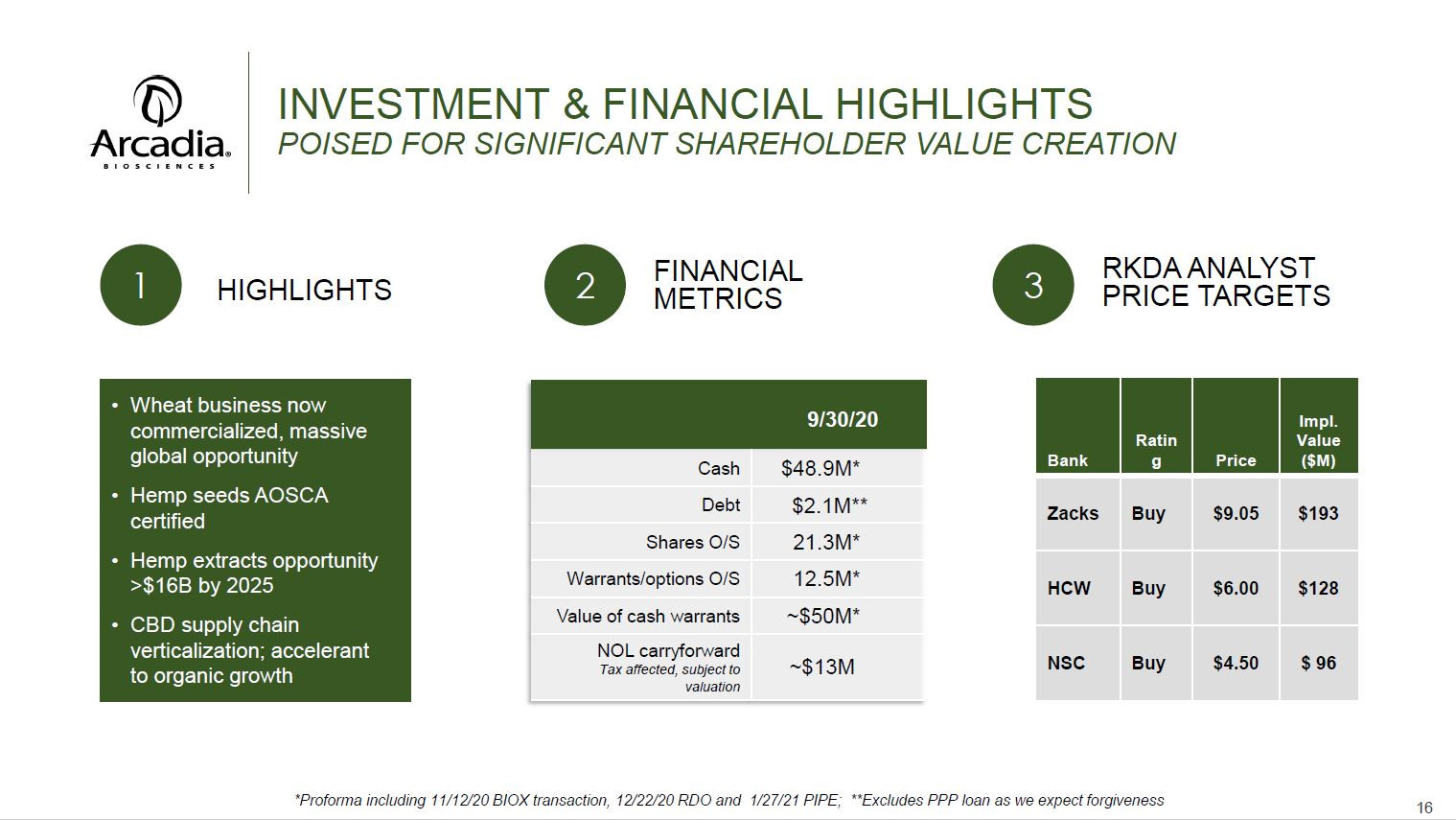

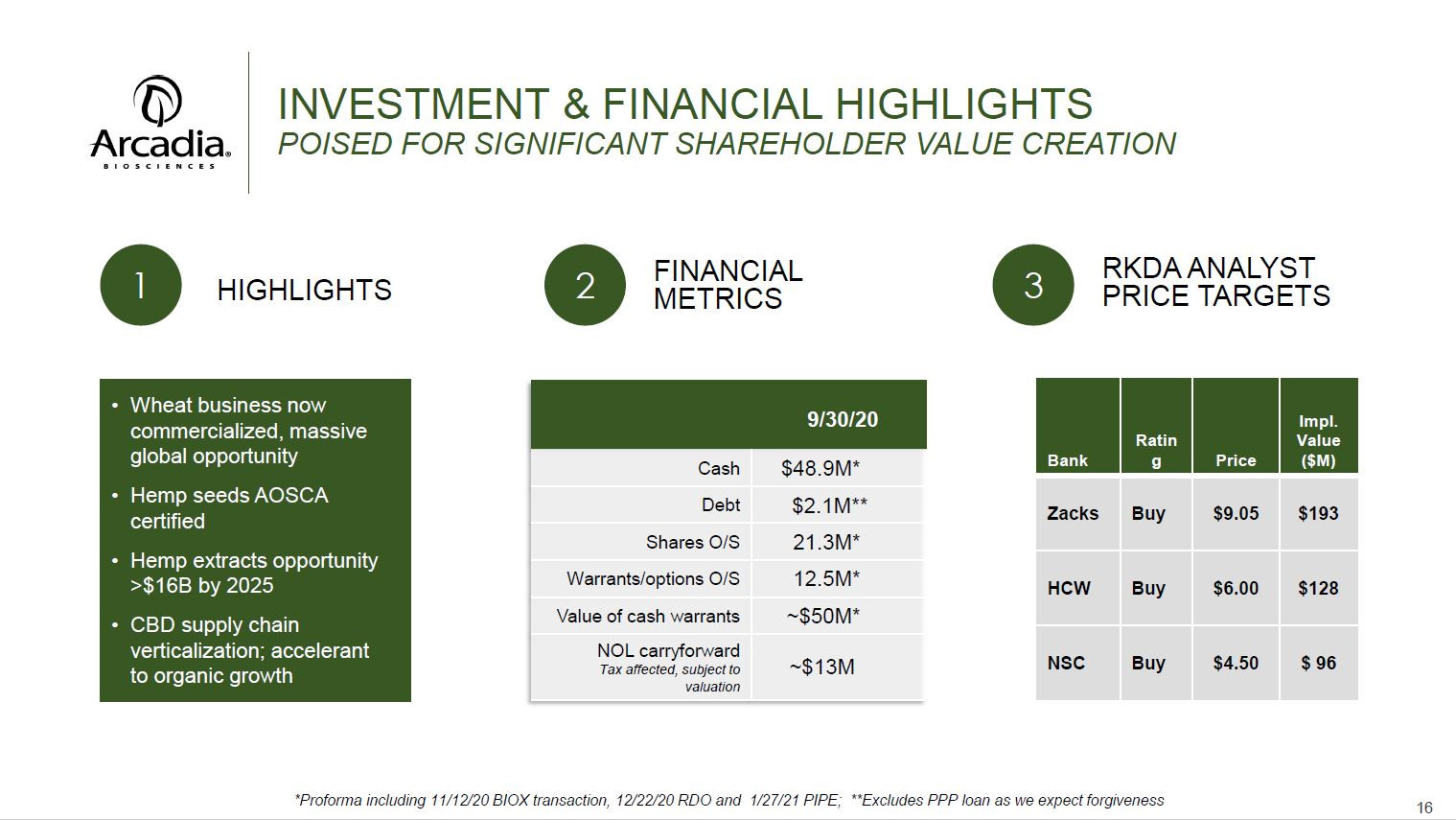

H.C. Wainwright Global Life Sciences Presentation March 2021

https://ir.arcadiabio.com/

H.C. Wainwright Global Life Sciences Presentation March 2021

https://ir.arcadiabio.com/

Die Analysten halten Arcadia Biosciences Inc für unterbewertet:

Arcadia Biosciences – Consensus Indicates Potential 270.2% Upside

Arcadia Biosciences found using ticker (RKDA) now have 3 analysts covering the stock with the consensus suggesting a rating of ‘Strong_Buy’. The target price ranges between 10 and 8 with the average target price sitting at 9.33. With the stocks previous close at 2.52 this is indicating there is a potential upside of 270.2%.

https://www.directorstalkinterviews.com/arcadia-biosciences-…

Kurzporträt:

Arcadia Biosciences, Inc. ist ein Unternehmen für landwirtschaftliche Biotechnologie. Das Unternehmen entwickelt ein Portfolio von Erträgen und Eigenschaften für mehrere Nutzpflanzen, die die globalen Lebensmittel- und Futtermittelmärkte beliefern. Es verfügt über eine Pipeline von Produkten, die sich in der Entwicklung befinden und ihre Eigenschaften berücksichtigen, einschließlich Produkte, die sich in fortgeschrittenen Entwicklungsstadien oder auf dem Markt befinden.

https://ch.marketscreener.com/kurs/aktie/ARCADIA-BIOSCIENCES…

Chart:

💡

Arcadia Biosciences Announces Fourth-Quarter and Full-Year 2020 Financial Results and Business Highlights

– Record revenues, up six-fold over prior year –

– Strong balance sheet entering 2021 –

– Expanded product offerings –

DAVIS, Calif. (March 30, 2021)

https://arcadiabio.com/arcadia-biosciences-announces-fourth-…

– Record revenues, up six-fold over prior year –

– Strong balance sheet entering 2021 –

– Expanded product offerings –

DAVIS, Calif. (March 30, 2021)

https://arcadiabio.com/arcadia-biosciences-announces-fourth-…

Hier denke ich auch der Tiefststand von $ 2,26 ist erreicht und ich habe mir langsam eine gute Position aufgebaut

Nachläufe ziwschen $ 2,26 und 2,50 stehen

Nachläufe ziwschen $ 2,26 und 2,50 stehen

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,79 | |

| -10,00 | |

| +50,00 | |

| +900,00 | |

| -1,26 | |

| 0,00 | |

| +0,81 | |

| +2,39 | |

| +3,90 | |

| -5,78 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 244 | ||

| 79 | ||

| 79 | ||

| 66 | ||

| 35 | ||

| 33 | ||

| 26 | ||

| 23 | ||

| 22 | ||

| 20 |