Digihost Technologies: Unentdeckter Krypto-Miner mit Wachstumspotenzial - 500 Beiträge pro Seite (Seite 3)

eröffnet am 06.11.18 18:27:10 von

neuester Beitrag 12.11.21 07:16:52 von

neuester Beitrag 12.11.21 07:16:52 von

Beiträge: 1.185

ID: 1.292.040

ID: 1.292.040

Aufrufe heute: 0

Gesamt: 86.380

Gesamt: 86.380

Aktive User: 0

ISIN: CA25381D1078 · WKN: A2P0D9

2,0400

CAD

+0,49 %

+0,0100 CAD

Letzter Kurs 27.10.21 TSX Venture

Der Kurssturz bei den Crpytos resultiert aus möglicherweise bevorstehenden Anklagen wegen Geldwäsche gegen Finanzinstitute.

https://www.godmode-trader.de/artikel/bitcoin-bricht-zeitwei…

https://www.godmode-trader.de/artikel/bitcoin-bricht-zeitwei…

Den Xinjiang Blackout halte ich nicht für die Ursache des Kurssturzes und auch nicht für sonderlich bedeutend, denn das ist bereits ein paar Tage bekannt (war mir bekannt seit Donnerstag (?)). Der Blackout soll maximal eine Woche anhalten, letztlich sollten die Auswirkungen deshalb begrenzt sein.

Antwort auf Beitrag Nr.: 67.862.462 von Subvers am 18.04.21 13:38:49

Popular crypto market analyst, Willy Woo, has attributed the violent April 18 cryptocurrency crash to a sudden drop in hash rate resulting from a power outage in the Chinese region of Xinjiang.

grüßle

MOIN

https://cointelegraph.com/news/did-a-massive-chinese-power-o…Popular crypto market analyst, Willy Woo, has attributed the violent April 18 cryptocurrency crash to a sudden drop in hash rate resulting from a power outage in the Chinese region of Xinjiang.

grüßle

Antwort auf Beitrag Nr.: 67.861.796 von extremrelaxer am 18.04.21 11:39:20

jetzt lass die mal machen, ich würde deine emails garnicht beantworten an seiner stelle ... dafür gibt es ja eine IR !

grüßle

MOIN

mich wundert es, dass er dir überhaupt so viel zeit gewidmet hat, das ist schon sehr unüblich.jetzt lass die mal machen, ich würde deine emails garnicht beantworten an seiner stelle ... dafür gibt es ja eine IR !

grüßle

Antwort auf Beitrag Nr.: 67.862.346 von extremrelaxer am 18.04.21 13:04:46@ ER

Winter is coming ?

Starke Einbrüche/Korrekturen - je nachdem wie weit der Hype in der Spitze führen mag, ok, aber an so einen richtig harten Krypto-Winter, mit jahrelang niedrigen Kursen glaube ich derzeit nicht unbedingt.

Auf einen Zeitpunkt für das letzte ATH vor der nächsten größeren Korrektur mag ich mich auch nicht festlegen, denke aber, dass wir es vor der sehcsstelligen Schallmauer nicht sehen werden...

Ich denke auch , dass in den nächsten Jahren immer mehr Anleger in BTC investieren und bereits investierte Großanleger aufstocken. Mit dem Anstieg der Massen sollte die heute übliche Vola etwas nachlassen - aber natürlich gilt wie immer: Wer weiß das schon im Voraus...

DIGI nimmt alte Miner vom Netz

Stimmt, mit dem Halfing steigen jedesmal die Produktionskosten der Miner und in der Regel in der Folge auch der BTC-Kurs, der aber im August noch nicht so angesprungen war wie dies ab Dezember geschehen ist. Bei den heutigen Kursen würden auch die weniger effizienten Miner Profit erwirtschaften - siehe Bitfarms, die jüngst für kleines Geld ($5 jet TH) ihre Altgeräte überholt und repariert haben und damit 80 PH/s zusätzlich ins Netz bringen.

MARA

Wie bereits geschrieben, ergibt sich deren Gross-Margin aus dem allgemein zugänglichen Jahresbericht... aber ich verstehe jetzt, wie du zu diesen Differenzen kommst:

Wenn du die Gesamtkosten eines Miners hernimmst, so wie sie in den Abschlüssen aufgeführt werden und diese ins Verhältnis setzt zu den ebenfalls dort aufgeführten Umsatzerlösen, dann werden zwei Miner allerdings nur dann vergleichbar sein, wenn beide den gleichen Anteil der geschürften Coins veräußert haben - denn nur die veräußerten geminten Coins gelangen in die Umsätzzahlen.

MARA hat z.B. zuletzt im Oktober selbstgeminte BTC veräußert. Alles was danach geschürft wurde haben sie behalten und lassen es an der Preisentwicklung teilnehemn. DIGI hat vermutlich öfters mal Geld gebraucht und geschürfte Coins verkauft, sodass die Umsätze auch in der Bilanz auftauchen. Die Gross-Margin ist unabhängig vom Verkauf oder vom Halten der geschürften Coins und damit zur Beurteilung, wie effizient das Schürfen erfolgt deutlich besser geeignet - und sie enthält natürlich nicht nur die Stromkosten 😉

Winter is coming ?

Starke Einbrüche/Korrekturen - je nachdem wie weit der Hype in der Spitze führen mag, ok, aber an so einen richtig harten Krypto-Winter, mit jahrelang niedrigen Kursen glaube ich derzeit nicht unbedingt.

Auf einen Zeitpunkt für das letzte ATH vor der nächsten größeren Korrektur mag ich mich auch nicht festlegen, denke aber, dass wir es vor der sehcsstelligen Schallmauer nicht sehen werden...

Ich denke auch , dass in den nächsten Jahren immer mehr Anleger in BTC investieren und bereits investierte Großanleger aufstocken. Mit dem Anstieg der Massen sollte die heute übliche Vola etwas nachlassen - aber natürlich gilt wie immer: Wer weiß das schon im Voraus...

DIGI nimmt alte Miner vom Netz

Stimmt, mit dem Halfing steigen jedesmal die Produktionskosten der Miner und in der Regel in der Folge auch der BTC-Kurs, der aber im August noch nicht so angesprungen war wie dies ab Dezember geschehen ist. Bei den heutigen Kursen würden auch die weniger effizienten Miner Profit erwirtschaften - siehe Bitfarms, die jüngst für kleines Geld ($5 jet TH) ihre Altgeräte überholt und repariert haben und damit 80 PH/s zusätzlich ins Netz bringen.

MARA

Wie bereits geschrieben, ergibt sich deren Gross-Margin aus dem allgemein zugänglichen Jahresbericht... aber ich verstehe jetzt, wie du zu diesen Differenzen kommst:

Wenn du die Gesamtkosten eines Miners hernimmst, so wie sie in den Abschlüssen aufgeführt werden und diese ins Verhältnis setzt zu den ebenfalls dort aufgeführten Umsatzerlösen, dann werden zwei Miner allerdings nur dann vergleichbar sein, wenn beide den gleichen Anteil der geschürften Coins veräußert haben - denn nur die veräußerten geminten Coins gelangen in die Umsätzzahlen.

MARA hat z.B. zuletzt im Oktober selbstgeminte BTC veräußert. Alles was danach geschürft wurde haben sie behalten und lassen es an der Preisentwicklung teilnehemn. DIGI hat vermutlich öfters mal Geld gebraucht und geschürfte Coins verkauft, sodass die Umsätze auch in der Bilanz auftauchen. Die Gross-Margin ist unabhängig vom Verkauf oder vom Halten der geschürften Coins und damit zur Beurteilung, wie effizient das Schürfen erfolgt deutlich besser geeignet - und sie enthält natürlich nicht nur die Stromkosten 😉

erstmal kommt noch der sommer

cool bleiben ....

grüßle

cool bleiben ....

grüßle

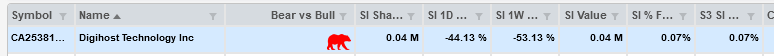

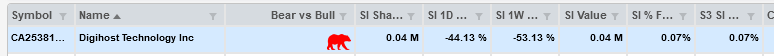

Meine Shortdaten (S3 Partners) sagen mir, dass bei Digi die Shorter auf dem Rückzug sind. Hatte sich bereits letzte Woche angedeutet. -9,42% im Vergleich zu Freitag und auf Wochensicht -2,89%.

Allerdings Niveau insgesamt noch sehr hoch.

Riot und DMG sind derzeit die Top-Targets, dort wird sogar noch ausgebaut.

Allerdings Niveau insgesamt noch sehr hoch.

Riot und DMG sind derzeit die Top-Targets, dort wird sogar noch ausgebaut.

Antwort auf Beitrag Nr.: 67.871.682 von LuyiWang am 19.04.21 17:03:01Muss jeder selber wissen was er macht.

Ich werde halten. Im Chart sieht es so aus, als könnte das Tief bereits gewesen sein.

Falls BTC allerdings nun deutlich runter geht, kann man den Digi-Chart vermutlich in die Tonne kloppen.

Ich werde halten. Im Chart sieht es so aus, als könnte das Tief bereits gewesen sein.

Falls BTC allerdings nun deutlich runter geht, kann man den Digi-Chart vermutlich in die Tonne kloppen.

Hält sich heute erstaunlich gut!!

205 % zum ATH

Antwort auf Beitrag Nr.: 67.895.150 von Seven0706 am 21.04.21 12:03:11So langsam könnt es aber aufwärts gehen, irgendwann fangen auch mal die Nerven an blank zu liegen. Man weiss genau dass das Unternehmen unterbewertet ist aber es tut sich nicht ausser rot gen Süden.

Jeder Blick ins Depot lässt die Augen tränen.

Wie fühlt ihr euch ? Wie geht man am besten mit so einer Situation um? Bin 60% im Minus.

LG

Jeder Blick ins Depot lässt die Augen tränen.

Wie fühlt ihr euch ? Wie geht man am besten mit so einer Situation um? Bin 60% im Minus.

LG

hab da 0 Gefühle...das Fiat was ich rein schiebe ist für mich physisch nicht vorhanden...meine Frau sieht das aber auch anders

Antwort auf Beitrag Nr.: 67.900.331 von kalle00021 am 21.04.21 17:16:51

If you are in trouble, double!

Ich mache das tatsächlich mit verbilligen.

Mein Depot ist gegenwärtig blutrot. Man muss halt schauen, dass man trotzdem nachts gut schlafen kann. Ob es das nun war oder Digi nochmal deutlich abschmiert, keine Ahnung.

Zitat von kalle00021: Wie fühlt ihr euch ? Wie geht man am besten mit so einer Situation um? Bin 60% im Minus.

If you are in trouble, double!

Ich mache das tatsächlich mit verbilligen.

Mein Depot ist gegenwärtig blutrot. Man muss halt schauen, dass man trotzdem nachts gut schlafen kann. Ob es das nun war oder Digi nochmal deutlich abschmiert, keine Ahnung.

Antwort auf Beitrag Nr.: 67.902.164 von Subvers am 21.04.21 19:09:08@Kalle, verbilligen wäre die schlechteste Entscheidung die du treffen könntest...

Das macht einer entweder aus Verzweiflung, oder weil er in eine Aktie verliebt ist.

Im schlimmsten Fall verbrennst du dadurch nur noch mehr von deinem hart verdienten Geld.

Ein lahmer Gaul wird auch nicht schneller, nur weil du ihm einen neuen Sattel draufmachst...😛

Nur wenn du von Digi überzeugt bist, warte eine Bodenbildung ab. Auch wenn du dann möglicherweise den ersten Hype verpasst, gibt es genug Möglichkeiten wieder einzusteigen. Ansonsten heißt es Reissleine ziehen.

@subvers, wie oft hast du schon bei Digi in den letzten Wochen verbilligt, in der Hoffnung das es wieder hoch geht ???

Das wäre doch mal ein guter Indikator. 😛

Das macht einer entweder aus Verzweiflung, oder weil er in eine Aktie verliebt ist.

Im schlimmsten Fall verbrennst du dadurch nur noch mehr von deinem hart verdienten Geld.

Ein lahmer Gaul wird auch nicht schneller, nur weil du ihm einen neuen Sattel draufmachst...😛

Nur wenn du von Digi überzeugt bist, warte eine Bodenbildung ab. Auch wenn du dann möglicherweise den ersten Hype verpasst, gibt es genug Möglichkeiten wieder einzusteigen. Ansonsten heißt es Reissleine ziehen.

@subvers, wie oft hast du schon bei Digi in den letzten Wochen verbilligt, in der Hoffnung das es wieder hoch geht ???

Das wäre doch mal ein guter Indikator. 😛

Wer Aktien aufgrund Hoffnung kauft, aus Verzweiflung oder weil er in eine Aktie verliebt ist, dem ist sowieso nicht zu helfen. Muss ja jeder selber wissen was er macht, wie hoch sein Budget ist, was seine Lebensplanung ist und ob er sichs leisten kann Geld im Kamin zu verbrennen. Mein EK ist 2,35 CAD, auch aufgrund Nachkäufe. Dort liegt praktischerweise auch ein offenes Gap und Gaps werden fast immer geschlossen. Ich habe Zeit. Sollte es wider Erwarten nicht passieren oder aus welchem Grund auch immer gar ein Totalverlust resultieren, dann wäre es eben so. Passiert zwar äußerst selten, aber die Fälle gibts natürlich.

Allgemein gilt, dass man nicht verpflichtet ist mit der gleichen Aktie mit der man Verluste eingefahren hat, diese wieder auszugleichen.

Allgemein gilt, dass man nicht verpflichtet ist mit der gleichen Aktie mit der man Verluste eingefahren hat, diese wieder auszugleichen.

Vielleicht haben Sie ja bis dahin die neue Präsentation fertig...😉

bitte Verkaufsorder nicht vergessen...danke

Na das wird hier heute bestimmt auf -20 % rauslaufen :-((((

Antwort auf Beitrag Nr.: 67.924.970 von kalle00021 am 23.04.21 11:31:54Ja und?

Einfach cool bleiben und hodln.

Zur Motivation: So true! https://youtu.be/anf22ZQLIcg

Einfach cool bleiben und hodln.

Zur Motivation: So true! https://youtu.be/anf22ZQLIcg

Hallo zusammen,

nachdem hier im Thread sowie im Handel bei Digihost Ruhe eingekehrt ist scheint es mir ein interessanter Zeitpunkt zu sein, nochmals ein Auge auf Digihost zu werfen.

Ich habe von Digihost weiterhin die "editierte" Version des Interviews nicht zurück bekommen. Des Weiteren hat CEO Michel Amar seine Versprechungen bezüglich einer Aktualisierung der Homepage und dem Einstellen der aktuellen Firmenpräsentation nicht gehalten, wobei mir die Mitarbeiterin Manish Z. Kshatriya zuletzt ja folgende Antwort auf meine Fragen gegeben hatte:

1. We are currently in the process of redesigning and relaunching our website, and hope to have it finalized by the end of this month.

2. The Company presentation will be available on the newly launched website

3. The interview is being reviewed and edited and we will advise as soon as that process is complete.

Nun bin ich ja nicht mehr gewillt, den Aussagen seitens Digihost blind zu glauben. Dennoch sehe ich eine gute Chance, dass wir diese Woche noch die Aktualisierung der Homepage mit eingestellter neuer Firmenpräsentation sehen könnten.

Für heute steht ja folgendes Ereignis an:

Digihost Announces Participation at the H.C. WAINWRIGHT Cryptocurrency, Blockchain & Fintech Conference on April 27, 2021 https://finance.yahoo.com/news/digihost-announces-participat…

In der Meldung heißt es:

"Michel Amar, CEO of Digihost, will provide an overview of the Company’s journey to develop its highly efficient Bitcoin mining operations, as well as the Company’s plans to innovate, improve and grow its mining infrastructure as the Company turns towards the next milestones in its strategic growth."

Das heißt, dass der CEO seinen Fahrplan offiziell bekanntgeben / erläutern will. Sinnvoll wäre eine solche Erläuterung, wenn zeitgleich sozusagen als "Handout" auch eine entsprechende schriftliche Firmenpräsentation verfügbar ist.

Daher könnte ich mir vorstellen, dass wir hier heute noch News sehen könnten.

Charttechnisch hätte die Aktie nach Ausbruch aus dem absteigenden Dreieck und abgeschlossener Bodenbildung im Bereich zwischen 1,70-1,75 CAD jetzt beste Möglichkeiten, einen erneuten Anlauf nach oben zu wagen. Der Rückenwind seitens des Bitcoins wäre ja wieder vorhanden (anhaltend???). Entsprechend wäre der Markt jetzt auch wieder bereit positive Nachrichten entsprechend zu würdigen.

Was meint ihr?

LG, ER

nachdem hier im Thread sowie im Handel bei Digihost Ruhe eingekehrt ist scheint es mir ein interessanter Zeitpunkt zu sein, nochmals ein Auge auf Digihost zu werfen.

Ich habe von Digihost weiterhin die "editierte" Version des Interviews nicht zurück bekommen. Des Weiteren hat CEO Michel Amar seine Versprechungen bezüglich einer Aktualisierung der Homepage und dem Einstellen der aktuellen Firmenpräsentation nicht gehalten, wobei mir die Mitarbeiterin Manish Z. Kshatriya zuletzt ja folgende Antwort auf meine Fragen gegeben hatte:

1. We are currently in the process of redesigning and relaunching our website, and hope to have it finalized by the end of this month.

2. The Company presentation will be available on the newly launched website

3. The interview is being reviewed and edited and we will advise as soon as that process is complete.

Nun bin ich ja nicht mehr gewillt, den Aussagen seitens Digihost blind zu glauben. Dennoch sehe ich eine gute Chance, dass wir diese Woche noch die Aktualisierung der Homepage mit eingestellter neuer Firmenpräsentation sehen könnten.

Für heute steht ja folgendes Ereignis an:

Digihost Announces Participation at the H.C. WAINWRIGHT Cryptocurrency, Blockchain & Fintech Conference on April 27, 2021 https://finance.yahoo.com/news/digihost-announces-participat…

In der Meldung heißt es:

"Michel Amar, CEO of Digihost, will provide an overview of the Company’s journey to develop its highly efficient Bitcoin mining operations, as well as the Company’s plans to innovate, improve and grow its mining infrastructure as the Company turns towards the next milestones in its strategic growth."

Das heißt, dass der CEO seinen Fahrplan offiziell bekanntgeben / erläutern will. Sinnvoll wäre eine solche Erläuterung, wenn zeitgleich sozusagen als "Handout" auch eine entsprechende schriftliche Firmenpräsentation verfügbar ist.

Daher könnte ich mir vorstellen, dass wir hier heute noch News sehen könnten.

Charttechnisch hätte die Aktie nach Ausbruch aus dem absteigenden Dreieck und abgeschlossener Bodenbildung im Bereich zwischen 1,70-1,75 CAD jetzt beste Möglichkeiten, einen erneuten Anlauf nach oben zu wagen. Der Rückenwind seitens des Bitcoins wäre ja wieder vorhanden (anhaltend???). Entsprechend wäre der Markt jetzt auch wieder bereit positive Nachrichten entsprechend zu würdigen.

Was meint ihr?

LG, ER

Mein Standpunkt ist der, dass ich bezweifle, dass sie Mit dem Kapital miner kaufen können, bitfarms schafft dies durch Partnerschaften, daher bin ich aktuell sehr vorsichtig was digi angeht. Ich setze auf Firmen mit einer bereits erhöhten hashrate

Zumal digi noch einige kes machen wird denke ich, bis sie die 2/EH erreichen

Zumal digi noch einige kes machen wird denke ich, bis sie die 2/EH erreichen

Antwort auf Beitrag Nr.: 67.957.715 von johnki am 27.04.21 08:17:35

Klar wird Digi zum Erreichen von 2 EH/s noch weitere Kapitalerhöhungen durchziehen müssen. Aktuell steht aber ja wohl hoffentlich keine an, nachdem Digi ja durch die 2 letzten KEs eine prall gefüllte Kriegskasse hat.

Dass Bitfarms bessere Partnerschaften bessere Chancen beim Kauf von Minern hat halte ich für eine schwer überprüfbare Hypothese, schließlich hat Bitfarms zuletzt 120 $ pro TH/s und Digihost 80 $ pro TH/s gezahlt. Bitfarms musste also gleich 50% mehr hinblättern, als Digihost.

Ich denke da sitzen alle in einem Boot. Der Preis wird da eher durch Angebot und Nachfrage bestimmt, sofern keine entsprechenden Verträge vorab fixiert wurden.

Was mich beschäftigt ist die Frage, ob wir heute News sehen. Zumindest würde ich meinerseits an keiner solchen Veranstaltung teilnehmen, ohne eine aktuelle Firmenpräsentation in der Hand zu haben!

VG, ER

Zitat von johnki: Mein Standpunkt ist der, dass ich bezweifle, dass sie Mit dem Kapital miner kaufen können, bitfarms schafft dies durch Partnerschaften, daher bin ich aktuell sehr vorsichtig was digi angeht. Ich setze auf Firmen mit einer bereits erhöhten hashrate

Zumal digi noch einige kes machen wird denke ich, bis sie die 2/EH erreichen

Klar wird Digi zum Erreichen von 2 EH/s noch weitere Kapitalerhöhungen durchziehen müssen. Aktuell steht aber ja wohl hoffentlich keine an, nachdem Digi ja durch die 2 letzten KEs eine prall gefüllte Kriegskasse hat.

Dass Bitfarms bessere Partnerschaften bessere Chancen beim Kauf von Minern hat halte ich für eine schwer überprüfbare Hypothese, schließlich hat Bitfarms zuletzt 120 $ pro TH/s und Digihost 80 $ pro TH/s gezahlt. Bitfarms musste also gleich 50% mehr hinblättern, als Digihost.

Ich denke da sitzen alle in einem Boot. Der Preis wird da eher durch Angebot und Nachfrage bestimmt, sofern keine entsprechenden Verträge vorab fixiert wurden.

Was mich beschäftigt ist die Frage, ob wir heute News sehen. Zumindest würde ich meinerseits an keiner solchen Veranstaltung teilnehmen, ohne eine aktuelle Firmenpräsentation in der Hand zu haben!

VG, ER

Wenn Digi schlau ist, dann stecken sie alles verfügbare Geld in Miner und zwar jetzt und nehmen was sie kriegen können. Dass es im akutellen Zyklus bei einem steigenden BTC nochmal wesentlich billiger wird, glaube ich nicht. Eher steigen die Equipment-Preise noch weiter an. Und im nächsten Krypto-Winter braucht es dann auch kein Equipment mehr.

Digi für mich immer mehr reine Zock-Aktie. Langfristig sehe ich massive Schwierigkeiten, denn in dem Sektor reicht es nicht einfach seine Hashrate zu halten, wer nicht mindestens im Gleichschritt mit der Konkurrenz läuft, wird abgehängt und in Konsequenz dauerhaft zurückbleiben. Und dafür braucht es Geld. Und um Geld zu bekommen, einen möglichst hohen Aktienkurs.

Ich hoffe dass sie endlich paar gute Meldungen raushauen und ihre Homepage aktualisieren. Jetzt mit dem Wainright-Event wäre tatsächlich ein guter Zeitpunkt dafür.

Digi für mich immer mehr reine Zock-Aktie. Langfristig sehe ich massive Schwierigkeiten, denn in dem Sektor reicht es nicht einfach seine Hashrate zu halten, wer nicht mindestens im Gleichschritt mit der Konkurrenz läuft, wird abgehängt und in Konsequenz dauerhaft zurückbleiben. Und dafür braucht es Geld. Und um Geld zu bekommen, einen möglichst hohen Aktienkurs.

Ich hoffe dass sie endlich paar gute Meldungen raushauen und ihre Homepage aktualisieren. Jetzt mit dem Wainright-Event wäre tatsächlich ein guter Zeitpunkt dafür.

Habe heute einen Teil geschmissen und werde schauen den Rest auch noch loszuwerden.

Neuer Chief Financial Officer (CFO) ist Paul Ciullo. Praktischerweise war der bereits früher CFO beim Digi-Vorgänger und weil der Job anscheinend nicht besonders anspruchsvoll ist, ist er gleichzeitig auch noch CFO bei diversen anderen Firmen.

Man hat also erst den Abschlussprüfer gewechselt und jetzt den CFO.

https://finance.yahoo.com/news/digihost-announces-appointmen…

Ich traue Digi irgendwann 10 CAD zu, aber sicher nicht, weil das Management irgendwie kompetent ist, sondern weil Bitcoin hoffentlich zieht.

Neuer Chief Financial Officer (CFO) ist Paul Ciullo. Praktischerweise war der bereits früher CFO beim Digi-Vorgänger und weil der Job anscheinend nicht besonders anspruchsvoll ist, ist er gleichzeitig auch noch CFO bei diversen anderen Firmen.

Man hat also erst den Abschlussprüfer gewechselt und jetzt den CFO.

https://finance.yahoo.com/news/digihost-announces-appointmen…

Ich traue Digi irgendwann 10 CAD zu, aber sicher nicht, weil das Management irgendwie kompetent ist, sondern weil Bitcoin hoffentlich zieht.

Leute, es investiert doch keiner mal einfach so 75 Mio. in DMG.

In Digohost, sorry.!!!

Was ist mit Digihost denn los?

Hab zwar nur´ne kleine Possition, dennoch letzten Freitag war BTC ordentlich im Plus,

und was hat Digihostkurs gemacht? Hat`s nicht sonderlich interessiert.

Nun, nach dem Motto „steig ab, wenn das Pferd bereits tot ist“?

Oder steckt im Digihost „Nebel“ dann doch noch eine Überraschung?

Wie steht Ihr zu Digihost jetzt?

Hab zwar nur´ne kleine Possition, dennoch letzten Freitag war BTC ordentlich im Plus,

und was hat Digihostkurs gemacht? Hat`s nicht sonderlich interessiert.

Nun, nach dem Motto „steig ab, wenn das Pferd bereits tot ist“?

Oder steckt im Digihost „Nebel“ dann doch noch eine Überraschung?

Wie steht Ihr zu Digihost jetzt?

Extremrelaxer wollte sich ja melden wenn er Neuigkeiten vom CEO Amar hat, aber anscheinend bekommt er leider keine.

Es wurde ein Kraftwerk gekauft, zuvor wurden ja 70 Mio über ein Privat Placement eingesammelt.

Was hat DIGI noch gekauft? Wie viele Minergeräte waren es??

Danke

Es wurde ein Kraftwerk gekauft, zuvor wurden ja 70 Mio über ein Privat Placement eingesammelt.

Was hat DIGI noch gekauft? Wie viele Minergeräte waren es??

Danke

Wahnsinn! Wenn die von Digihost auf sedar.com veröffentlichten Zahlen stimmen, dann liegt die Hashrate weit über dem, was allgemein und auch von mir erwartet wurde!

Im einzelnen:

DIGIHOST TECHNOLOGY INC. (formerly HashChain Technology Inc.) Management’s Discussion & Analysis For the Year Ended December 31, 2020 Discussion dated: April 30, 2021

MD&A vom 30.04.2021

Seite 7 und 8/28

The recent acquisition of the Bitmain S17+ miners that were delivered in early April 2021, combined with the current price of Bitcoin and the level of mining difficulty, the Company expects to increase the Company’s monthly mined BTC by approximately 9 BTC, which would translate to an additional $400,000 of operating profit per month. A portion of the new miners are already installed at the Company’s existing mining facility in Upstate New York with the remainder to be installed in Q2 2021. The Company intends to aggressively pursue every new opportunity that aligns with its goal to expand operations through the strategic acquisition of Bitcoin miners and low-cost sources of clean energy.

January 2021 33,07

February 2021 35,02

March 2021 36,54

At the end of April 2021, Digihost held 309 Bitcoin in its inventory from mining, which at the approximate Bitcoin price of $57,000 per Bitcoin values the Bitcoin at approximately $17,600,000.

https://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo…

Zur Erinnerung:

News release vom 06.04.2021:

Digihost Announces 105.26 Bitcoins Mined in the First Quarter of 2021 and Provides Operations Update TORONTO, April 06, 2021 (GLOBE NEWSWIRE) -- Digihost Technology Inc. (“Digihost” or the “Company”) (TSXV: DGHI; OTCQB: HSSHF) is pleased to announce that the Company has increased its mined Bitcoin (“BTC”) holdings during the month of March 2021 by 36.54 BTC, bringing the Company’s total BTC balance to 256.26. Based on an approximate current BTC price of US$59,000, the total value of BTC in the Company’s possession is approximately US$15,119,000. During the first quarter of 2021, Digihost mined a total of 105.26 BTC

https://www.sedar.com/GetFile.do?lang=EN&docClass=8&issuerNo…

Von Ende März 2021 bis Ende April hat Digihost also 52,74 BTC gefördert und somit seine Bitcoinförderung im Vergleich zu März 2021 (36,54 BTC) um 44,33% gesteigert (obwohl März ja 31 und April nur 30 Tage hat).

So wie ich das auf Seite 7 /29 des MD&A lese hat Digihost die zusätzlichen 50 PH/s schon Anfang April geliefert bekommen und somit seine Hashrate bereits von 190 auf 240 PH/s steigern können. Das alleine würde jedoch nur eine Steigerung der Bitcoinförderung um 26,31% erklären. Digihost scheint also ebenfalls wie schon Bitfarms zusätzlich altes Miningequipment reaktiviert zu haben (sofern die auf sedar.com veröffentlichten Zahlen korrekt sind).

52,74 BTC pro Monat wären auf 1 Jahr hochgerechnet (vorsicht, hierbei wird die Steigerung der globalen Hashrate nicht berücksichtigt): 632,88 BTC pro Jahr. Bei einem Bitcoinkurs von 57.000/BTC würde das einem Rohertrag von 36,1 Mio USD bzw, 45,1 Mio CAD entsprechen.

Ach ja und zu den Zahlen 2020:

For the three months ended December 31, 2020, the Company’s net loss was $1,472,103.

Das war so zu erwarten. 2020 konnten ja auch die Konkurrenten keine Gewinne mit dem Bitcoin-Mining erzielen. Da ist der Verlust von Digihost ja im Vergleich zum Glück noch verkraftbar.

Leider habe ich inzwischen einen Großteil meiner Digihostaktien verkauft gehabt, nachdem CEO Amar seine Versprechen mir gegenüber bzgl. Firmenpräsentation, Intervieweditierung und Homepageerneuerung nicht eingelöst hat. Wenn das Management von Digihost vertrauenswürdiger wäre, dann würde ich hier wahrscheinlich wieder den Großteil meines Kapitals auf 1 Karte setzen, schließlich ist der Wert der Assets, der gehaltenen Bitcoins und des gehaltenen Kapitals inzwischen ca auf dem Level der Marktkapitalisierung des gesamten Unternehmens. Aber dieser CEO hält mich davon ab: Er ist der größte Aktionär und arbeitet 2021 für nur 1 USD. Somit ist er wie kein anderer von einer positiven Kursentwicklung abhängig und macht dennoch die schlechteste PR, die man sich vorstellen kann!

Ob Ihr dem CEO und dem Unternehmen Vertrauen schenkt müsst Ihr selbst entscheiden. Das Versprechend bzgl. neuer Homepage mit neuer Firmenpräsentation blieb bisher unerfüllt. Andererseits gibt es weit und breit keinen billigeren Laden.

Vielleicht ergibt sich ja doch noch die Chance, ein paar Stücke einzusammeln!

VG, ER

Im einzelnen:

DIGIHOST TECHNOLOGY INC. (formerly HashChain Technology Inc.) Management’s Discussion & Analysis For the Year Ended December 31, 2020 Discussion dated: April 30, 2021

MD&A vom 30.04.2021

Seite 7 und 8/28

The recent acquisition of the Bitmain S17+ miners that were delivered in early April 2021, combined with the current price of Bitcoin and the level of mining difficulty, the Company expects to increase the Company’s monthly mined BTC by approximately 9 BTC, which would translate to an additional $400,000 of operating profit per month. A portion of the new miners are already installed at the Company’s existing mining facility in Upstate New York with the remainder to be installed in Q2 2021. The Company intends to aggressively pursue every new opportunity that aligns with its goal to expand operations through the strategic acquisition of Bitcoin miners and low-cost sources of clean energy.

January 2021 33,07

February 2021 35,02

March 2021 36,54

At the end of April 2021, Digihost held 309 Bitcoin in its inventory from mining, which at the approximate Bitcoin price of $57,000 per Bitcoin values the Bitcoin at approximately $17,600,000.

https://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo…

Zur Erinnerung:

News release vom 06.04.2021:

Digihost Announces 105.26 Bitcoins Mined in the First Quarter of 2021 and Provides Operations Update TORONTO, April 06, 2021 (GLOBE NEWSWIRE) -- Digihost Technology Inc. (“Digihost” or the “Company”) (TSXV: DGHI; OTCQB: HSSHF) is pleased to announce that the Company has increased its mined Bitcoin (“BTC”) holdings during the month of March 2021 by 36.54 BTC, bringing the Company’s total BTC balance to 256.26. Based on an approximate current BTC price of US$59,000, the total value of BTC in the Company’s possession is approximately US$15,119,000. During the first quarter of 2021, Digihost mined a total of 105.26 BTC

https://www.sedar.com/GetFile.do?lang=EN&docClass=8&issuerNo…

Von Ende März 2021 bis Ende April hat Digihost also 52,74 BTC gefördert und somit seine Bitcoinförderung im Vergleich zu März 2021 (36,54 BTC) um 44,33% gesteigert (obwohl März ja 31 und April nur 30 Tage hat).

So wie ich das auf Seite 7 /29 des MD&A lese hat Digihost die zusätzlichen 50 PH/s schon Anfang April geliefert bekommen und somit seine Hashrate bereits von 190 auf 240 PH/s steigern können. Das alleine würde jedoch nur eine Steigerung der Bitcoinförderung um 26,31% erklären. Digihost scheint also ebenfalls wie schon Bitfarms zusätzlich altes Miningequipment reaktiviert zu haben (sofern die auf sedar.com veröffentlichten Zahlen korrekt sind).

52,74 BTC pro Monat wären auf 1 Jahr hochgerechnet (vorsicht, hierbei wird die Steigerung der globalen Hashrate nicht berücksichtigt): 632,88 BTC pro Jahr. Bei einem Bitcoinkurs von 57.000/BTC würde das einem Rohertrag von 36,1 Mio USD bzw, 45,1 Mio CAD entsprechen.

Ach ja und zu den Zahlen 2020:

For the three months ended December 31, 2020, the Company’s net loss was $1,472,103.

Das war so zu erwarten. 2020 konnten ja auch die Konkurrenten keine Gewinne mit dem Bitcoin-Mining erzielen. Da ist der Verlust von Digihost ja im Vergleich zum Glück noch verkraftbar.

Leider habe ich inzwischen einen Großteil meiner Digihostaktien verkauft gehabt, nachdem CEO Amar seine Versprechen mir gegenüber bzgl. Firmenpräsentation, Intervieweditierung und Homepageerneuerung nicht eingelöst hat. Wenn das Management von Digihost vertrauenswürdiger wäre, dann würde ich hier wahrscheinlich wieder den Großteil meines Kapitals auf 1 Karte setzen, schließlich ist der Wert der Assets, der gehaltenen Bitcoins und des gehaltenen Kapitals inzwischen ca auf dem Level der Marktkapitalisierung des gesamten Unternehmens. Aber dieser CEO hält mich davon ab: Er ist der größte Aktionär und arbeitet 2021 für nur 1 USD. Somit ist er wie kein anderer von einer positiven Kursentwicklung abhängig und macht dennoch die schlechteste PR, die man sich vorstellen kann!

Ob Ihr dem CEO und dem Unternehmen Vertrauen schenkt müsst Ihr selbst entscheiden. Das Versprechend bzgl. neuer Homepage mit neuer Firmenpräsentation blieb bisher unerfüllt. Andererseits gibt es weit und breit keinen billigeren Laden.

Vielleicht ergibt sich ja doch noch die Chance, ein paar Stücke einzusammeln!

VG, ER

Antwort auf Beitrag Nr.: 68.021.888 von michii1983 am 02.05.21 19:54:20

Hallo Michi,

steht alles in der "MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE YEAR ENDED DECEMBER 31, 2020", welche Freitag wohl nachbörslich auf sedar.com erschienen ist.

Von Herrn Amar habe ich keine neuen Informationen erhalten. Ich habe ihn aber auch nicht erneut kontaktiert, nachdem er seine bisher mir gegenüber getätigten Aussagen ja nicht eingehalten hat.

Ich bewerte Digihost für mich nur noch nach dem Wert der Assets. Und auf dem aktuellen Niveau wird Digihost auch vom Markt ziemlich genau so bewertet. Rechnet man Cash, Bitcoins, Kraftwerk, Miningequipment / Hashrate, Infrastruktur und Hostingbetrieb etc. zusammen, dann dürfte der verbleibende Goodwill negativ sein!

VG, ER

Zitat von michii1983: Extremrelaxer wollte sich ja melden wenn er Neuigkeiten vom CEO Amar hat, aber anscheinend bekommt er leider keine.

Es wurde ein Kraftwerk gekauft, zuvor wurden ja 70 Mio über ein Privat Placement eingesammelt.

Was hat DIGI noch gekauft? Wie viele Minergeräte waren es??

Danke

Hallo Michi,

steht alles in der "MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE YEAR ENDED DECEMBER 31, 2020", welche Freitag wohl nachbörslich auf sedar.com erschienen ist.

Von Herrn Amar habe ich keine neuen Informationen erhalten. Ich habe ihn aber auch nicht erneut kontaktiert, nachdem er seine bisher mir gegenüber getätigten Aussagen ja nicht eingehalten hat.

Ich bewerte Digihost für mich nur noch nach dem Wert der Assets. Und auf dem aktuellen Niveau wird Digihost auch vom Markt ziemlich genau so bewertet. Rechnet man Cash, Bitcoins, Kraftwerk, Miningequipment / Hashrate, Infrastruktur und Hostingbetrieb etc. zusammen, dann dürfte der verbleibende Goodwill negativ sein!

VG, ER

Digi hat in Q1 nach eigenen Angaben 105.26 BTC gemint und die verteilen sich auf Januar-März auch eher gleich (33,7 - 36,5 BTC im Monat).

Sie sprechen davon durch die neuen Miner etwa 9 BTC mehr im Monat zu generieren, das wären somit ungefähr 42,7-45,6 BTC im Monat. Davon würde ich ausgehen. In Q2 (also jetzt) erwarten sie die Inbetriebnahme weiterer Miner aus der Lieferung, es ist (für mich) nicht klar, ob die 9 BTC mehr bereits erreicht sind oder erst im Laufe Q2 erreicht werden. Vom Wortlaut könnte man ersteres vermuten, aber ich finde die Passage nicht eindeutig.

Sie sprechen davon durch die neuen Miner etwa 9 BTC mehr im Monat zu generieren, das wären somit ungefähr 42,7-45,6 BTC im Monat. Davon würde ich ausgehen. In Q2 (also jetzt) erwarten sie die Inbetriebnahme weiterer Miner aus der Lieferung, es ist (für mich) nicht klar, ob die 9 BTC mehr bereits erreicht sind oder erst im Laufe Q2 erreicht werden. Vom Wortlaut könnte man ersteres vermuten, aber ich finde die Passage nicht eindeutig.

Antwort auf Beitrag Nr.: 68.021.888 von michii1983 am 02.05.21 19:54:20Hallo Michi1983 und Extremrelaxer, danke für Feedback!

ich glaube, mehr Vertrauensbemühungen von Digihost zu PR + KE, abgesehen von möglichen Leerverkäufern, hätte der Digihostkurs besser gedient.

Ich behalte Digihostposten, vorerst. Also, vorerst keine Umschichtung. Größere Posten Bitfarms und Hut 8 habe ich bereits + einige DMG Bl.

Viel gutes Gelingen mit Digihostaktien uns allen!

ich glaube, mehr Vertrauensbemühungen von Digihost zu PR + KE, abgesehen von möglichen Leerverkäufern, hätte der Digihostkurs besser gedient.

Ich behalte Digihostposten, vorerst. Also, vorerst keine Umschichtung. Größere Posten Bitfarms und Hut 8 habe ich bereits + einige DMG Bl.

Viel gutes Gelingen mit Digihostaktien uns allen!

Die Zahlen lesen sich tatsächlich nicht schlecht, sofern man an die Glaubwürdigkeit nicht den Ma0stab anlegt, der sich offensichtlich für die letzten Äußerungen als zutreffend herausgestellt hat.

Würde mich nicht wundern, wenn sie nur deshalb so positiv klingen, weil sie die nächste KE einläuten sollen.

Trotzalledem ist DIGI extrem niedrig bewertet und wird wohl bei steigenden BTC-Kursen Richtung 75K ebenfalls (überproportional) stark ansteigen - ich gedenke daher meine Verlustposition in DIGI durchaus weiter zu halten.

Würde mich nicht wundern, wenn sie nur deshalb so positiv klingen, weil sie die nächste KE einläuten sollen.

Trotzalledem ist DIGI extrem niedrig bewertet und wird wohl bei steigenden BTC-Kursen Richtung 75K ebenfalls (überproportional) stark ansteigen - ich gedenke daher meine Verlustposition in DIGI durchaus weiter zu halten.

Antwort auf Beitrag Nr.: 68.028.722 von johnplayer1 am 03.05.21 14:02:03https://www.globenewswire.com/news-release/2021/05/03/222122…

Was sagt ihr zu den Zahlen welche von kalle00021 eingestellt wurden?

Ich würde sagen es geht stetig Bergauf und wir sind sowas von unterbewertet...

Ich würde sagen es geht stetig Bergauf und wir sind sowas von unterbewertet...

Ich glaube die wollen noch es unter den Euro drücken

Extremrelaxer hat es doch gestern auf den Punkt gebracht... Die Zahlen welche auf Sédar veröffentlicht wurden sind noch besser als er gedacht hatte bzw. mit welchen er damals gerechnet hatte, als was soll dieser Kurs???

Ich denke eines der Probleme hier ist, dass die nächste KE nicht mehr lange auf sich warten lassen dürfte und die umso größer ausfällt, je länger Digi noch wartet. Weil es jeder weiß und bis dahin der Kurs gedrückt werden kann und je tiefer der ist, desto mehr neue Aktien müssen emittiert werden.

Digi braucht einfach mit allem viel zulange, so kommt es mir jedenfalls vor.

Digi braucht einfach mit allem viel zulange, so kommt es mir jedenfalls vor.

Antwort auf Beitrag Nr.: 68.022.959 von extremrelaxer am 02.05.21 22:30:47Heute ergeben sich viele Chancen

Antwort auf Beitrag Nr.: 68.051.030 von wallander08 am 04.05.21 17:55:42Wir sind jetzt wieder ein Pennystock

Bin mal gespannt, wie es weitergeht!? Habe mir ein kleine Position zugelegt.

Antwort auf Beitrag Nr.: 68.082.320 von mediacool am 06.05.21 13:38:09Unten 1CAD sehr wahrscheinlich !

Bin nur noch genervt wenn ich hier bei Digihost täglich reinschaue.

Antwort auf Beitrag Nr.: 68.091.167 von LuyiWang am 06.05.21 20:21:28Das Problem ist die Umsätze haben überhaupt keine Aussagekraft. Es stimmt in bestimmten Phasen kann der Umsatz ohne Problem m 30% fallen. Andererseits sind 100% nach oben auch kein Problem.

Die Bewertung ist schon etwas hilfreicher zur Orientierung.

Die Bewertung ist schon etwas hilfreicher zur Orientierung.

Antwort auf Beitrag Nr.: 68.109.860 von mediacool am 07.05.21 21:32:04Meiner Meinung nach: BTC korrigiert im Moment, könnte bis 48000 USD dollar😢😢😢? Mining Hype ist vorbei.

Antwort auf Beitrag Nr.: 68.124.850 von LuyiWang am 10.05.21 08:51:20

Oh ja, der Bitcoin hat gerade von 59.000$ auf 58.900$ korrigiert. 😂😂😂

Zitat von LuyiWang: Meiner Meinung nach: BTC korrigiert im Moment, könnte bis 48000 USD dollar😢😢😢? Mining Hype ist vorbei.

Oh ja, der Bitcoin hat gerade von 59.000$ auf 58.900$ korrigiert. 😂😂😂

NEWS: DIGIGOST GOES NASDAQ

Digihost Announces Status of NASDAQ Listing Application and Expansion of Cryptocurrency Business Model

https://finance.yahoo.com/news/digihost-announces-status-nas…

Ich hoffe, wir werden bald entschädigt für unsere Geduld!

Digihost Announces Status of NASDAQ Listing Application and Expansion of Cryptocurrency Business Model

https://finance.yahoo.com/news/digihost-announces-status-nas…

Ich hoffe, wir werden bald entschädigt für unsere Geduld!

Na das hört sich doch mal gut an

Für meinen Geschmack verdächtig viele Meldungen die Digi derzeit raushaut. Da sie gleichzeitig weitestgehend inhaltlslos sind, denke ich, die nächste KE ist maximal eine Woche entfernt.

Ich persönlich kann mir auch nicht vorstellen, dass Digi auf absehbare Zeit an das Nasdaq landet. Alleine schon wegen den Voraussetzungen sollte eher schwierig werden. Gerne lasse ich mich jedoch eines Besseren belehren.

Ich persönlich kann mir auch nicht vorstellen, dass Digi auf absehbare Zeit an das Nasdaq landet. Alleine schon wegen den Voraussetzungen sollte eher schwierig werden. Gerne lasse ich mich jedoch eines Besseren belehren.

Antwort auf Beitrag Nr.: 68.130.004 von Subvers am 10.05.21 14:52:45

Wozu? Cash ist ja genug da! Als nächste Meldung erwarte ich eher den Kauf von Miningequipment und da am ehesten Equipment für das ETH-Mining!

Aber Digihost ist und bleibt undurchsichtig, daher ja auch die bescheidene Börsenbewertung. Mich wird das Unternehmen nur noch positiv überraschen können, da alles Negative hier schon eingepreist ist.

Ich werde versuchen, noch ein paar Aktien in Kanada abzustauben. 1,09 Euro ist schon deutlich über Schlusskursniveau!

Zitat von Subvers: Für meinen Geschmack verdächtig viele Meldungen die Digi derzeit raushaut. Da sie gleichzeitig weitestgehend inhaltlslos sind, denke ich, die nächste KE ist maximal eine Woche entfernt.

Ich persönlich kann mir auch nicht vorstellen, dass Digi auf absehbare Zeit an das Nasdaq landet. Alleine schon wegen den Voraussetzungen sollte eher schwierig werden. Gerne lasse ich mich jedoch eines Besseren belehren.

Wozu? Cash ist ja genug da! Als nächste Meldung erwarte ich eher den Kauf von Miningequipment und da am ehesten Equipment für das ETH-Mining!

Aber Digihost ist und bleibt undurchsichtig, daher ja auch die bescheidene Börsenbewertung. Mich wird das Unternehmen nur noch positiv überraschen können, da alles Negative hier schon eingepreist ist.

Ich werde versuchen, noch ein paar Aktien in Kanada abzustauben. 1,09 Euro ist schon deutlich über Schlusskursniveau!

Wenn ich mir die Umsätze vor allem auch an der heimatbörse anschaue, dann gibt das wenig Aussagekraft und viel Raum für böse Spiele. Auch das gebashe hier ist ein Glaubenfrage. Wer an digihost glaubt, der kauft und wird sehen was in einigen Wochen der Fall ist. Im Prinzip kann es auch in den Keller gehen. Aber von dieser stimmungsmache würde ich mich nicht anstecken lassen. Ist halt eine Glaubensfrage. Im positiven wie negativen. Ich wünsche jeden dafür Glück. Das nur ein Teil Gewinner ist, istwohl klar

Gut heute hier nicht reingegangen zu sein,irgendwas stimmt hier ganz und garnicht

Antwort auf Beitrag Nr.: 68.132.641 von sharp2008 am 10.05.21 17:26:48https://legislation.nysenate.gov/pdf/bills/2021/S6486

Antwort auf Beitrag Nr.: 68.133.760 von BWSound am 10.05.21 18:45:10BTC-ECHO Logo

Bitcoin kaufen

Social Token: Der nächste große Hype steht bevor

Klimasünder

New York bringt Mining-Verbot auf den Weg

Von Moritz Draht

5. Mai 2021

Lesezeit: 3 Minuten

Mining-Anlage

Quelle: Shutterstock

Telegram Logo

The Crypto App Logo

Im Bundesstaat New York wird ein dreijähriges Verbot für Mining-Betriebe vorbereitet. Der Senat muss den Gesetzentwurf noch durchwinken.

Krypto-Mining könnte in New York bald erst mal der Vergangenheit angehören. Dem Senat liegt ein Gesetzentwurf “zur Einrichtung eines Moratoriums für den Betrieb von Krypto-Mining-Zentren” vor. Der Entwurf sieht eine dreijährige Sperre für Mining-Betriebe vor, die Umwelt-Auflagen nicht erfüllen.

Anzeige

Deutsches Krypto-Startup startet Crowdinvest für Handelsplattform

Bisher zählt der Markt nur wenige deutsche Handelsplattformen für Bitcoin & Co. - eine Lücke, die das deutsche Krypto-Startup BinnoEx schließen will. Ein Investment ist bereits ab 100€ möglich und erlaubt eine Teilhabe an Gewinnen und der Unternehmensbewertung.

Mehr zum Investment >> >>

Mining auf dem Abstellgleis

Auslöser für den Entwurf ist der immense Energieverbrauch von Mining-Anlagen, der die Klimaziele des Bundestaates gefährdet. Das 2019 in Kraft getretene “Gesetz zur Förderung des Klimaschutzes und zum Schutz der Gemeinschaft” (Climate Leadership and Community Protection Act) schreibt eine Reduktion der Treibhausgasemissionen von 85 Prozent bis zum Jahr 2050 im Bundesstaat vor. Aufgabe der Politik sei es demnach, die “natürlichen Ressourcen und die Umwelt zu erhalten, zu verbessern und zu schützen”.

Der Energiebedarf von Mining-Betrieben, die sich häufig “in stillgelegten oder umgewandelten Kraftwerken für fossile Brennstoffe befinden”, stünde folglich im Gegensatz zu den erklärten Klimazielen. Der Betrieb von Mining-Zentren würde schließlich den “Energieverbrauch im Staat New York stark erhöhen” und die Einhaltung des Klimaschutzgesetzes “irreparabel schädigen”, heißt es in dem Entwurf.

Anzeige

Deutsches Krypto-Startup startet Crowdinvest für Handelsplattform

Bisher zählt der Markt nur wenige deutsche Handelsplattformen für Bitcoin & Co. - eine Lücke, die das deutsche Krypto-Startup BinnoEx schließen will. Ein Investment ist bereits ab 100€ möglich und erlaubt eine Teilhabe an Gewinnen und der Unternehmensbewertung.

Mehr zum Investment >> >>

Eine einzige Kryptowährungstransaktion verbraucht die gleiche Menge an Energie, die ein durchschnittlicher amerikanischer Haushalt in einem Monat verbraucht, mit einem geschätzten Niveau des globalen Energieverbrauchs, das dem des Landes Schweden entspricht.

Der Entwurf fordert daher ein dreijähriges Moratorium für Mining-Anlagen. Betreiber dürfen ihre Anlagen nur am Netz halten, wenn sie eine “allgemeine Umweltverträglichkeitsprüfung” bestehen. Dieses Verfahren bewertet Anlagen anhand ihrer Treibhausgasemissionen und der damit verbundenen “Auswirkungen auf die Wasserqualität, die Luftqualität oder die Tierwelt”. Zentren, die die Auflagen nicht erfüllen, dürfen weder gebaut noch weiter in Betrieb genommen werden. Nach Ablauf der drei Jahre verfallen die Auflagen wieder. Der Senat muss dem Entwurf noch nach einer öffentlichen Anhörung zustimmen.

Problemfall Stromverbrauch

Tritt das Gesetz in Kraft, könnte es weitreichende Folgen für die heimische Mining-Industrie haben. Schwergewichte wie Riot Blockchain und Greenidge haben ihre Hardware-Ressourcen in den letzten Monaten aggressiv aufgestockt – beide betreiben ihre Anlagen in New York. Erfüllen sie die Kriterien nicht, könnten sie gezwungen sein, ihre Betriebe auszulagern.

Auch in China weckt der Stromverbrauch von Mining-Anlagen allmählich Argwohn. Wie Reuters berichtet, wurden in Peking vor wenigen Tagen Inspektionen von Mining-Rechenzentren durchgeführt, die diese auf ihren Stromverbrauch prüften. Die Untersuchungen sollen Aufschluss über den tatsächlichen Verbrauch der Anlagen geben. Betreiber müssen zudem die Menge des Stroms, den sie beim Mining verbrauchen, der Stadt künftig melden. Erst wenige Wochen zuvor beschloss die Regierung der Inneren Mongolei, einer der Hash-Rate-Knotenpunkte im Reich der Mitte, ein gänzliches Mining-Verbot in der Region.

Mining

New York

Kryptokompass Cover

1. Ausgabe GRATIS testen

Bitcoin & Blockchain Magazin

Zum Magazin

Anzeige

ÄHNLICHE ARTIKEL

Internet der Dinge

Helium Network (HNT) – wie man vom IoT-Boom profitieren kann

Das schnellste Pferd

Goldman Sachs: Aktien mit Bitcoin-Bezug performen überdurchschnittlich

Hashrate Upgrade

In Nord- und Südamerika: Bitcoin-Miner auf Expansionskurs

NEUSTE ARTIKEL

Gesamtmarktanalyse

Bitcoin-Kurs rangiert unter 60.000 USD – Altcoin-Rallye in vollem Gange

Phönix aus der Asche

Lisk kehrt auf die Krypto-Bühne zurück

Marktupdate

Dogecoin: Elon Musk will DOGE nach SNL-Debakel zum Mond schießen

Regulierungs-ECHO

Klimakiller oder Schlüsseltechnologie: Blockchain und die Angst der Behörden

Das Meinungs-ECHO

Bitcoin: Realized Cap zeichnet bullishes Bild

Leere Versprechen

NFT-Blase: Warum der Token-Hype zur Nullnummer werden könnte

Impressum

Datenschutzerklärung

Widerruf

AGB

Advertising | Press Release

All Rights Reserved

Desktop Version anzeigen

Bitcoin kaufen

Social Token: Der nächste große Hype steht bevor

Klimasünder

New York bringt Mining-Verbot auf den Weg

Von Moritz Draht

5. Mai 2021

Lesezeit: 3 Minuten

Mining-Anlage

Quelle: Shutterstock

Telegram Logo

The Crypto App Logo

Im Bundesstaat New York wird ein dreijähriges Verbot für Mining-Betriebe vorbereitet. Der Senat muss den Gesetzentwurf noch durchwinken.

Krypto-Mining könnte in New York bald erst mal der Vergangenheit angehören. Dem Senat liegt ein Gesetzentwurf “zur Einrichtung eines Moratoriums für den Betrieb von Krypto-Mining-Zentren” vor. Der Entwurf sieht eine dreijährige Sperre für Mining-Betriebe vor, die Umwelt-Auflagen nicht erfüllen.

Anzeige

Deutsches Krypto-Startup startet Crowdinvest für Handelsplattform

Bisher zählt der Markt nur wenige deutsche Handelsplattformen für Bitcoin & Co. - eine Lücke, die das deutsche Krypto-Startup BinnoEx schließen will. Ein Investment ist bereits ab 100€ möglich und erlaubt eine Teilhabe an Gewinnen und der Unternehmensbewertung.

Mehr zum Investment >> >>

Mining auf dem Abstellgleis

Auslöser für den Entwurf ist der immense Energieverbrauch von Mining-Anlagen, der die Klimaziele des Bundestaates gefährdet. Das 2019 in Kraft getretene “Gesetz zur Förderung des Klimaschutzes und zum Schutz der Gemeinschaft” (Climate Leadership and Community Protection Act) schreibt eine Reduktion der Treibhausgasemissionen von 85 Prozent bis zum Jahr 2050 im Bundesstaat vor. Aufgabe der Politik sei es demnach, die “natürlichen Ressourcen und die Umwelt zu erhalten, zu verbessern und zu schützen”.

Der Energiebedarf von Mining-Betrieben, die sich häufig “in stillgelegten oder umgewandelten Kraftwerken für fossile Brennstoffe befinden”, stünde folglich im Gegensatz zu den erklärten Klimazielen. Der Betrieb von Mining-Zentren würde schließlich den “Energieverbrauch im Staat New York stark erhöhen” und die Einhaltung des Klimaschutzgesetzes “irreparabel schädigen”, heißt es in dem Entwurf.

Anzeige

Deutsches Krypto-Startup startet Crowdinvest für Handelsplattform

Bisher zählt der Markt nur wenige deutsche Handelsplattformen für Bitcoin & Co. - eine Lücke, die das deutsche Krypto-Startup BinnoEx schließen will. Ein Investment ist bereits ab 100€ möglich und erlaubt eine Teilhabe an Gewinnen und der Unternehmensbewertung.

Mehr zum Investment >> >>

Eine einzige Kryptowährungstransaktion verbraucht die gleiche Menge an Energie, die ein durchschnittlicher amerikanischer Haushalt in einem Monat verbraucht, mit einem geschätzten Niveau des globalen Energieverbrauchs, das dem des Landes Schweden entspricht.

Der Entwurf fordert daher ein dreijähriges Moratorium für Mining-Anlagen. Betreiber dürfen ihre Anlagen nur am Netz halten, wenn sie eine “allgemeine Umweltverträglichkeitsprüfung” bestehen. Dieses Verfahren bewertet Anlagen anhand ihrer Treibhausgasemissionen und der damit verbundenen “Auswirkungen auf die Wasserqualität, die Luftqualität oder die Tierwelt”. Zentren, die die Auflagen nicht erfüllen, dürfen weder gebaut noch weiter in Betrieb genommen werden. Nach Ablauf der drei Jahre verfallen die Auflagen wieder. Der Senat muss dem Entwurf noch nach einer öffentlichen Anhörung zustimmen.

Problemfall Stromverbrauch

Tritt das Gesetz in Kraft, könnte es weitreichende Folgen für die heimische Mining-Industrie haben. Schwergewichte wie Riot Blockchain und Greenidge haben ihre Hardware-Ressourcen in den letzten Monaten aggressiv aufgestockt – beide betreiben ihre Anlagen in New York. Erfüllen sie die Kriterien nicht, könnten sie gezwungen sein, ihre Betriebe auszulagern.

Auch in China weckt der Stromverbrauch von Mining-Anlagen allmählich Argwohn. Wie Reuters berichtet, wurden in Peking vor wenigen Tagen Inspektionen von Mining-Rechenzentren durchgeführt, die diese auf ihren Stromverbrauch prüften. Die Untersuchungen sollen Aufschluss über den tatsächlichen Verbrauch der Anlagen geben. Betreiber müssen zudem die Menge des Stroms, den sie beim Mining verbrauchen, der Stadt künftig melden. Erst wenige Wochen zuvor beschloss die Regierung der Inneren Mongolei, einer der Hash-Rate-Knotenpunkte im Reich der Mitte, ein gänzliches Mining-Verbot in der Region.

Mining

New York

Kryptokompass Cover

1. Ausgabe GRATIS testen

Bitcoin & Blockchain Magazin

Zum Magazin

Anzeige

ÄHNLICHE ARTIKEL

Internet der Dinge

Helium Network (HNT) – wie man vom IoT-Boom profitieren kann

Das schnellste Pferd

Goldman Sachs: Aktien mit Bitcoin-Bezug performen überdurchschnittlich

Hashrate Upgrade

In Nord- und Südamerika: Bitcoin-Miner auf Expansionskurs

NEUSTE ARTIKEL

Gesamtmarktanalyse

Bitcoin-Kurs rangiert unter 60.000 USD – Altcoin-Rallye in vollem Gange

Phönix aus der Asche

Lisk kehrt auf die Krypto-Bühne zurück

Marktupdate

Dogecoin: Elon Musk will DOGE nach SNL-Debakel zum Mond schießen

Regulierungs-ECHO

Klimakiller oder Schlüsseltechnologie: Blockchain und die Angst der Behörden

Das Meinungs-ECHO

Bitcoin: Realized Cap zeichnet bullishes Bild

Leere Versprechen

NFT-Blase: Warum der Token-Hype zur Nullnummer werden könnte

Impressum

Datenschutzerklärung

Widerruf

AGB

Advertising | Press Release

All Rights Reserved

Desktop Version anzeigen

Antwort auf Beitrag Nr.: 68.133.832 von BWSound am 10.05.21 18:49:55Deshalb wohl ein eigenes Kraftwerk!?

Antwort auf Beitrag Nr.: 68.133.832 von BWSound am 10.05.21 18:49:55Und der Kursverfall?

Fest steht der Druck auf die Miner nimmt zu . Egal wo in der Welt, da eine hoher Resourcenverbrauch vorhanden ist. Auf der anderen Seite müßte man dann auch Goldminen verbieten. Hoher Resourcenverbrauch in oft schwierigen Ländern für ein genauso nutzloser Gut. Im Prinzip braucht man so gut wie kein Gold und dieser ganze HokusPokus für Cryptos wäre auch völlig überflüssig.

Aber dazu wird es nicht kommen. Ich hatte noch eine Meldung in Erinnerung, wo ein Miner nach Argentinien gehen möchte (Erinnerung, Richtig?)

Da dachte ich an Goldminen. Die gehen wegen des Vorkommen in solche Länder und steigt der Preis, dann steigt die illegale Förderung mit schlimmsten Umweltschäden.

Ein sehr schwieriges Thema.

So sind wir aktuell alle Pro EV, aber in einigen Jahren wird das Entsorgungsthema mit Bewertung eine deutlich größere Rolle einnehmen.

Jetzt wieder zu den Minern. Der Druck nimmt zu, aber ein Verbot in New York hat leider überhaupt keine Bedeutung, sondern wird nur Schwerpunkte verschieben. Einzelne Betroffene werden dies verständlicherweise anders sehen.

Am Schluss wird Russland das Thema übernehmen, was ja heute bereits der Fall ist

Aber dazu wird es nicht kommen. Ich hatte noch eine Meldung in Erinnerung, wo ein Miner nach Argentinien gehen möchte (Erinnerung, Richtig?)

Da dachte ich an Goldminen. Die gehen wegen des Vorkommen in solche Länder und steigt der Preis, dann steigt die illegale Förderung mit schlimmsten Umweltschäden.

Ein sehr schwieriges Thema.

So sind wir aktuell alle Pro EV, aber in einigen Jahren wird das Entsorgungsthema mit Bewertung eine deutlich größere Rolle einnehmen.

Jetzt wieder zu den Minern. Der Druck nimmt zu, aber ein Verbot in New York hat leider überhaupt keine Bedeutung, sondern wird nur Schwerpunkte verschieben. Einzelne Betroffene werden dies verständlicherweise anders sehen.

Am Schluss wird Russland das Thema übernehmen, was ja heute bereits der Fall ist

Bin bei 3€ hier mit einer Riesen Summe rein... echt traurig hätte ich nicht gedacht😥

So geht es mir auch. Bin gestern mit 50% der Anteile raus und habe in Bitfarms investiert, hier steht man unmittelbar vor einem Listing an der NASDAQ.

ob das ein guter deal war ...

Antwort auf Beitrag Nr.: 68.144.353 von Seven0706 am 11.05.21 12:59:16Ich habe mir hier gerade mal wieder einen Überblick zu meinem DIGI-Investement verschafft.

Oh Mann, die haben ja wahrlich keine Glücksträhne...

Nach vorläufigen Zahlen zur Hashrate sind sie das ganze Jahr 2020 so gut wie nicht gewachsen, obwohl sie immer angekündigt haben neue Miner zu kaufen und wohl auch tatsächlich gekauft haben Aber scheinbar haben sie stets im selben Umfang Altgeräte ausmustern müssen...

Kaufen im März ein ganzes Kraftwerk in NewYork, um dort künftig günstiger minen zu können und dann dauert es nur ein paar Wochen und NewYork untersagt den Stromverbrauch zum Mining für die nächsten 3 Jahre...

Mitten im Jahresabschluss trennen sie sich vom Abschlussprüfer und kaum wird der Neue tätig, springt auch der CFO über die Klinge.

Testierter Abschluss 2020 liegt immer noch nicht vor.

Weiß jemand, ob denen dann die Aussetzung vom Handel drohen könnte, wie es ja auch bei NetCents aus eben diesem Grund passiert ist?

Und dann hat dieses schwer angeschlagene Börsenschiffchen auch noch einen Kapitän, der sich uns Anlegern gegenüber als äußerst unzuverlässig und unglaubwürdig erweist und damit einen extrem fragwürdigen Eindruck hinterlässt.

BTC steht heut etwa fünf- bis sechs mal so hoch wie letztes Jahr und man kann wohl kaum schwierigen Gewässern sprechen, durch die er uns in den letzten 12 Monaten steuern musste und trotzdem saufen wir hier fast ab...

Eigentlich kann es ja nur noch besser werden, wenn alles denkbar schlechte (außer BTC-Absturz) bereits eingetroffen und eingepreist ist...

Oh Mann, die haben ja wahrlich keine Glücksträhne...

Nach vorläufigen Zahlen zur Hashrate sind sie das ganze Jahr 2020 so gut wie nicht gewachsen, obwohl sie immer angekündigt haben neue Miner zu kaufen und wohl auch tatsächlich gekauft haben Aber scheinbar haben sie stets im selben Umfang Altgeräte ausmustern müssen...

Kaufen im März ein ganzes Kraftwerk in NewYork, um dort künftig günstiger minen zu können und dann dauert es nur ein paar Wochen und NewYork untersagt den Stromverbrauch zum Mining für die nächsten 3 Jahre...

Mitten im Jahresabschluss trennen sie sich vom Abschlussprüfer und kaum wird der Neue tätig, springt auch der CFO über die Klinge.

Testierter Abschluss 2020 liegt immer noch nicht vor.

Weiß jemand, ob denen dann die Aussetzung vom Handel drohen könnte, wie es ja auch bei NetCents aus eben diesem Grund passiert ist?

Und dann hat dieses schwer angeschlagene Börsenschiffchen auch noch einen Kapitän, der sich uns Anlegern gegenüber als äußerst unzuverlässig und unglaubwürdig erweist und damit einen extrem fragwürdigen Eindruck hinterlässt.

BTC steht heut etwa fünf- bis sechs mal so hoch wie letztes Jahr und man kann wohl kaum schwierigen Gewässern sprechen, durch die er uns in den letzten 12 Monaten steuern musste und trotzdem saufen wir hier fast ab...

Eigentlich kann es ja nur noch besser werden, wenn alles denkbar schlechte (außer BTC-Absturz) bereits eingetroffen und eingepreist ist...

Shortseller ziehen sich zurück minus 44% 1 day change

Antwort auf Beitrag Nr.: 68.145.520 von johnplayer1 am 11.05.21 13:59:29eigentlich kann es nur besser werden...

und es wird besser:

MEGA-DEAL MIT NORTHERN-DATA

Kauf von 10.000 Bitcoinminern

+ 925 PH/s Hashrate

https://finance.yahoo.com/news/digihost-announces-deal-north…

Darauf habe wir lange warten müssen! Ich hoffe, ein paar von Euch haben die Geduld gehabt oder nutzen die aktuell noch niedrigen Einstiegskurse!

VG, ER

und es wird besser:

MEGA-DEAL MIT NORTHERN-DATA

Kauf von 10.000 Bitcoinminern

+ 925 PH/s Hashrate

https://finance.yahoo.com/news/digihost-announces-deal-north…

Darauf habe wir lange warten müssen! Ich hoffe, ein paar von Euch haben die Geduld gehabt oder nutzen die aktuell noch niedrigen Einstiegskurse!

VG, ER

Mit dem Deal im Rücken dürfte der Digihost-Kurs meiner Einschätzung nach kurzfristig auf das Niveau einer der beiden Kapitalerhöhungen (je 25 Mio $ bei 2,14 $ und 2,67 $) steigen.

Ich sehe kurzfristig eine Kurschance von um die 100%

Nur meine persönliche Meinung und keine Aufforderung zum Handel...

VG, ER

Ich sehe kurzfristig eine Kurschance von um die 100%

Nur meine persönliche Meinung und keine Aufforderung zum Handel...

VG, ER

Antwort auf Beitrag Nr.: 68.156.779 von extremrelaxer am 12.05.21 08:41:30Nicht schlecht, und was wird bezahlt für den Deal,er wird ja nicht kostenlos sein,sieht nirgends wo drin was bezahlt wird

Kurzer zackiger Anstieg heute morgen, wer gestern im Tief eingestiegen ist hat jetzt schon 50% gemacht!Herzlichen Glückwunsch an alle!Werde heute Nachmittag in Kanada einsteigen da mir die Kurse hier schon 20% über Kanadakurs stehen

Antwort auf Beitrag Nr.: 68.157.037 von sharp2008 am 12.05.21 08:54:05Der Kurs gestern in Kanada wurde im Abschluß ordentlich nach unten korrigiert bei minimalen Umsätzen.

Will damit sagen, dass dies nicht zwingend der richtige Ansatz sein muss. Könnt passieren dass wir deutlich höher in Kanada einsteigen. Nur ein freundlicher Hinweis!

Will damit sagen, dass dies nicht zwingend der richtige Ansatz sein muss. Könnt passieren dass wir deutlich höher in Kanada einsteigen. Nur ein freundlicher Hinweis!

Digi teilt die Einnahmen mit northern data somit wird nur die Hälfte verdient...

Antwort auf Beitrag Nr.: 68.157.037 von sharp2008 am 12.05.21 08:54:05

Der Kurs wurde in letzter Sekunde von 1,35 CAD auf 1,26 CAD runter getaxt. Rechnet man mit 1,35 CAD dann wäre pari 0,92 Euro.

Die Meldung wird drüben einschlagen wie eine Bombe. Digihost wurde (zurecht) massiv dafür kritisiert, gleich 2 x eine KE um je 25 Mio $ durchgeführt zu haben ohne zugleich die Kohle in Miningequipment zu investieren. Jetzt wird allerdings "ein Schuh draus". Mit dem Deal werden sie ihre bisher doch eher als vollmundig oder unrealistisch erscheinenden Ziele wirklich verwirklichen können und damit zu den großen kanadischen Minern aufschließen können.

Ich befürchte, dass wir heute nachmittags hier nicht nochmals so günstig reinkommen. Digihost wird 15.30 Uhr bereits auf einem ganz anderen Levele starten und dann eine Neubewertung bekommen.

VG, ER

Zitat von sharp2008: Kurzer zackiger Anstieg heute morgen, wer gestern im Tief eingestiegen ist hat jetzt schon 50% gemacht!Herzlichen Glückwunsch an alle!Werde heute Nachmittag in Kanada einsteigen da mir die Kurse hier schon 20% über Kanadakurs stehen

Der Kurs wurde in letzter Sekunde von 1,35 CAD auf 1,26 CAD runter getaxt. Rechnet man mit 1,35 CAD dann wäre pari 0,92 Euro.

Die Meldung wird drüben einschlagen wie eine Bombe. Digihost wurde (zurecht) massiv dafür kritisiert, gleich 2 x eine KE um je 25 Mio $ durchgeführt zu haben ohne zugleich die Kohle in Miningequipment zu investieren. Jetzt wird allerdings "ein Schuh draus". Mit dem Deal werden sie ihre bisher doch eher als vollmundig oder unrealistisch erscheinenden Ziele wirklich verwirklichen können und damit zu den großen kanadischen Minern aufschließen können.

Ich befürchte, dass wir heute nachmittags hier nicht nochmals so günstig reinkommen. Digihost wird 15.30 Uhr bereits auf einem ganz anderen Levele starten und dann eine Neubewertung bekommen.

VG, ER

Antwort auf Beitrag Nr.: 68.157.175 von mediacool am 12.05.21 09:01:21Bin mir da nicht so sicher das wir mit einem Eröffnungsgap von 20% eröffnen, dafür gibt es noch soviel Unannehmlichkeiten bei dem Deal wie zb.Kosten, noch eine Finanzierungrunde und ganz wichtig das mangeldende Vertrauen in den letzten Wochen, da wurde viel Vertrauen verspielt, aber ich denke 10% sollten schon drin sein zur Eröffnung, aber ich rede hier nur von der Eröffnung, danach wenn alles eingehalten wird gibt es für mich keine Grenzen nach oben, möchte nur einigen Anlegern warnen hier nicht jeden Preis zu bezahlen wenn man doch günstiger heute Nachmittag ran kommt

Antwort auf Beitrag Nr.: 68.157.196 von johnki am 12.05.21 09:02:31

Wo hast Du gelesen, dass es nur die "Hälfte" ist?

Zitat von johnki: Digi teilt die Einnahmen mit northern data somit wird nur die Hälfte verdient...

Wo hast Du gelesen, dass es nur die "Hälfte" ist?

Antwort auf Beitrag Nr.: 68.157.196 von johnki am 12.05.21 09:02:31Okay wo steht das das die Einnahmen geteilt werden?

Ich verstehe den Deal mit northern data so, dass man einen umfassenden Service Contract eingeht. Wer da was verdient ist immer schwer zu beurteilen.

Die Nettoeinnahmen aus dem BTC-Bergbaubetrieb werden nach Zahlung einer sehr wettbewerbsfähigen Stromrate an Digihost nach einer festen Verteilungsformel zwischen Digihost und Northern Data aufgeteilt

Die Nettoeinnahmen aus dem BTC-Bergbaubetrieb werden nach Zahlung einer sehr wettbewerbsfähigen Stromrate an Digihost nach einer festen Verteilungsformel zwischen Digihost und Northern Data aufgeteilt

https://www.marketscreener.com/quote/stock/DIGIHOST-TECHNOLO…

https://www.marketscreener.com/quote/stock/DIGIHOST-TECHNOLO…

"The net revenue generated from the BTC mining operation, after paying Digihost a very competitive power rate, will be allocated between Digihost and Northern Data according to a fixed distribution formula."

Das heißt doch nicht 50-50!

Didihost akquiriert das Miningequipment. Northern Data ist nach Lieferung und Installation nur noch Serviceprovider. Üblich sind für soclche Hosting-Dienstleistungen 2% vom Umsatz.

Aber wie kommt man da auf die "Hälfte"?

Das heißt doch nicht 50-50!

Didihost akquiriert das Miningequipment. Northern Data ist nach Lieferung und Installation nur noch Serviceprovider. Üblich sind für soclche Hosting-Dienstleistungen 2% vom Umsatz.

Aber wie kommt man da auf die "Hälfte"?

Antwort auf Beitrag Nr.: 68.157.196 von johnki am 12.05.21 09:02:31

Ja er hat recht, in der Unternehmensmeldung von Northern Data steht das sie am Gewinn beteiligt sind, aber steht nix von der Hälfte, trotzdem blöd das Digihost nichts davon schreibt oder habe ich was übersehen?

Zitat von johnki: Digi teilt die Einnahmen mit northern data somit wird nur die Hälfte verdient...

Ja er hat recht, in der Unternehmensmeldung von Northern Data steht das sie am Gewinn beteiligt sind, aber steht nix von der Hälfte, trotzdem blöd das Digihost nichts davon schreibt oder habe ich was übersehen?

Antwort auf Beitrag Nr.: 68.157.559 von sharp2008 am 12.05.21 09:19:26Soll wohl im mittleren einstelligen Millionenbereich sein

Northern Data wird proprietäre, vorgefertigte, leistungsoptimierte und mobile Rechenzentren des Unternehmens, die mit erneuerbarem Erdgas betrieben werden, in den firmeneigenen Einrichtungen von Digihost nutzen, um die Installation und das Hosting der Miner für Digihost zu betreiben. Die Unternehmen befinden sich bereits in Gesprächen über eine Aufstockung des Vertrages auf mindestens 2,5 Exahash für das Jahr 2022. Im Rahmen der Hosting-Vereinbarung und basierend auf dem aktuellen BTC-Kurs wird Northern Data mit einer Gewinnbeteiligung im mittleren einstelligen Millionen-Euro-Bereich pro Monat am operativen Gewinn partizipieren.

also nicht die Hälfte, sorry. hab da was falsch verstanden. naja aber trotzdem pro monat mittlerer Millionen Betrag

also nicht die Hälfte, sorry. hab da was falsch verstanden. naja aber trotzdem pro monat mittlerer Millionen Betrag

Antwort auf Beitrag Nr.: 68.157.742 von johnki am 12.05.21 09:29:08Sind dann auch 60 bis 90 Millionen im Jahr Gewinnbeteiligung und nächstes Jahr dann das 3fache,auch kein schlechter Deal für Northern Data

Das digihost so Seine Probleme hat, dürfte ja allgemein bekannt sein. Von daher ist es nur konsequent einen Servicepartner mit Erfahrung dazu zu nehmen. Ich frage mich nur, was das für pappenheimer sind bei digihost. Dafür ist der Kurs ja auch mittlerweile extrem eingebrochen.

Ist allerdings nicht das erste mal, dass ich so etwas erlebe. Die Branche ist halt jung und unerfahren.

Ist allerdings nicht das erste mal, dass ich so etwas erlebe. Die Branche ist halt jung und unerfahren.

Antwort auf Beitrag Nr.: 68.157.253 von extremrelaxer am 12.05.21 09:05:18

Hoffen wir es mal für alle investierten...

Zitat von extremrelaxer:Zitat von sharp2008: Kurzer zackiger Anstieg heute morgen, wer gestern im Tief eingestiegen ist hat jetzt schon 50% gemacht!Herzlichen Glückwunsch an alle!Werde heute Nachmittag in Kanada einsteigen da mir die Kurse hier schon 20% über Kanadakurs stehen

Der Kurs wurde in letzter Sekunde von 1,35 CAD auf 1,26 CAD runter getaxt. Rechnet man mit 1,35 CAD dann wäre pari 0,92 Euro.

Die Meldung wird drüben einschlagen wie eine Bombe. Digihost wurde (zurecht) massiv dafür kritisiert, gleich 2 x eine KE um je 25 Mio $ durchgeführt zu haben ohne zugleich die Kohle in Miningequipment zu investieren. Jetzt wird allerdings "ein Schuh draus". Mit dem Deal werden sie ihre bisher doch eher als vollmundig oder unrealistisch erscheinenden Ziele wirklich verwirklichen können und damit zu den großen kanadischen Minern aufschließen können.

Ich befürchte, dass wir heute nachmittags hier nicht nochmals so günstig reinkommen. Digihost wird 15.30 Uhr bereits auf einem ganz anderen Levele starten und dann eine Neubewertung bekommen.

VG, ER

Hoffen wir es mal für alle investierten...

das Asset BTC liegt bei 309Stück ca. 17Mio ist das richtig ?

Also wenn man das ganze ausrechnet, so denke ich ist es nicht so weit weg von der Hälfte, die northern data kassiert oder?

8 btc pro Tag in etwa ergibt im monat Einnahmen von in etwa 13.000.000

Bei einem mittleren Millionen Betrag, sind wir bei der Hälfte

8 btc pro Tag in etwa ergibt im monat Einnahmen von in etwa 13.000.000

Bei einem mittleren Millionen Betrag, sind wir bei der Hälfte

Also egal was da wie wo läuft, ich hätte Digi schon mal keine Partnerschaft mit NORTHERN DATA AG zugetraut... haben wir eigentlich dann immer noch 30Mio Fiat rumliegen...was machen die damit?

oder wer hätte das Gedacht das die kleine Digi fähig ist einen solchen Deal einzutüten...

Digi kennt eigentlich niemand

https://trends.google.de/trends/explore?date=today%201-m&q=N…

https://stocktwits.com/symbol/HSSHF

Digi kennt eigentlich niemand

https://trends.google.de/trends/explore?date=today%201-m&q=N…

https://stocktwits.com/symbol/HSSHF

also aktuell 1,45 zum Verkauf schon mal ganz net

https://www.neo.inc/en/live/security-activity/DGHI#!/market-…

https://www.neo.inc/en/live/security-activity/DGHI#!/market-…

so denke ne 2 CAD wäre für den Anfang mal nicht schlecht

Antwort auf Beitrag Nr.: 68.164.153 von Seven0706 am 12.05.21 15:32:40

Schön zu wissen, wo die Reise hingehen soll. Danke für´s einstellen!

Zitat von Seven0706:

Schön zu wissen, wo die Reise hingehen soll. Danke für´s einstellen!

Käufer fehlen ;(

Antwort auf Beitrag Nr.: 68.165.929 von Seven0706 am 12.05.21 17:21:00Käufer kommen spätestens dann, wenn diese Vereibarung Früchte trägt, die offiziell verbucht werden können...

kommen so langsam https://www.neo.inc/en/live/security-activity/DGHI#!/market-…

Warum schiesst das so hoch hier??

Mit 514 K Umsatz in 3 Minuten??

1,2 Millionen jetzt schon, was ist denn da los

mich hat ja eher gewundert, dass sie so billig waren!

Hab das Gefühl die Amis haben die aktie entdeckt von 300 auf 1000 follower bei stockwits😂

Antwort auf Beitrag Nr.: 68.179.171 von johnki am 13.05.21 16:27:02Ne, das dachte ich erst auch. Das sind zwei unterschiedliche Boards. Kanada und USA

sehr schön

Ich denke fast die haben ihr Stromproblem im Griff  Das wäre top

Das wäre top

Das wäre top

Das wäre top

morgen dann 2 CAD und am Wochenende einen schönen anstieg im BTC dann kann es hier richtig los gehen

45% Plus ohne News

Das ist genau das, was ich an Digihost hasse!

Vielleicht hat der CEO wieder irgendwas gelabert, was keine Substanz hat und der Kursgewinn wird wieder komplett abverkauft. Man weiß es nicht, da Digihost kein seriöses Management hat.

Ich habe mal die Chance genutzt und einen Teil verkauft.

Das ist genau das, was ich an Digihost hasse!

Vielleicht hat der CEO wieder irgendwas gelabert, was keine Substanz hat und der Kursgewinn wird wieder komplett abverkauft. Man weiß es nicht, da Digihost kein seriöses Management hat.

Ich habe mal die Chance genutzt und einen Teil verkauft.

Antwort auf Beitrag Nr.: 68.179.741 von extremrelaxer am 13.05.21 17:15:29Vor 2,7 Euro geht bei mir nichts raus!

Das Wasserkraftwerk wird jetzt das seine tun. Sauberes Mining. Geile Aktion. Jetzt geht's ab!

Antwort auf Beitrag Nr.: 68.182.933 von floriam am 13.05.21 21:09:56

Welches Wasserkraftwerk?

Was für eine geile Aktion?

???

Zitat von floriam: Das Wasserkraftwerk wird jetzt das seine tun. Sauberes Mining. Geile Aktion. Jetzt geht's ab!

Welches Wasserkraftwerk?

Was für eine geile Aktion?

???

Eher Gas...ähh jetzt Biogas

Eher Gas...ähh jetzt Biogas

Wenn ich mir diverse Foren ansehe, auch im Ausland, dann scheint absolut niemand zu wissen, weshalb die Aktie steigt.

eher Gas...ähh jetzt Biogas...damit die Beamten aus Übersee n Stempel auf die Mininganlage drücken

@Subvers

Wäre es möglich, dass Digi vielleicht eigene Aktien zurückkauft??

Wäre es möglich, dass Digi vielleicht eigene Aktien zurückkauft??

Antwort auf Beitrag Nr.: 68.183.026 von Subvers am 13.05.21 21:18:46 wohl die Ursache für den Anstieg!

Antwort auf Beitrag Nr.: 68.182.972 von extremrelaxer am 13.05.21 21:14:09Haben die nicht vor ein paar Monaten ein Wasserkraftwerk gekauft? 🤷🏽♂️

Antwort auf Beitrag Nr.: 68.182.972 von extremrelaxer am 13.05.21 21:14:09Sorry! Da gab ich wohl was verwechselt. Warum schließe ich bei Kraftwerken automatisch immer auf Wasserkraftwerke? Könnte wohl daran liegen dass wir hier in Österreich in den Alpen viele von denen haben und ich unweit von der höchsten Staumauer Österreichs wohne.

Die News waren schon super, aber gab es doch schon gestern Mittag:

https://finance.yahoo.com/news/digihost-announces-deal-north…

Gestern kaum Reaktion und ausgerechnet nach dem kleinen Bitcoin-Crash dann heute plötzlich der Anstieg aus dem nichts, verstehe mal jemand die Börse.

Bleibt aber natürlich dennoch die momentan eher ungünstige Location New York.

https://finance.yahoo.com/news/digihost-announces-deal-north…

Gestern kaum Reaktion und ausgerechnet nach dem kleinen Bitcoin-Crash dann heute plötzlich der Anstieg aus dem nichts, verstehe mal jemand die Börse.

Bleibt aber natürlich dennoch die momentan eher ungünstige Location New York.

Alter Falter 😄

Gibt es irgendwas neues, das begründet warum der Kurs so steil geht?

es geht selbst jetzt noch als weiter  das kommt irgendwas die Tage

das kommt irgendwas die Tage

https://www.neo.inc/en/live/security-activity/DGHI#!/market-…

das kommt irgendwas die Tage

das kommt irgendwas die Tagehttps://www.neo.inc/en/live/security-activity/DGHI#!/market-…

Vielleicht aber auch die nächste KE

Antwort auf Beitrag Nr.: 68.194.273 von Matze8886 am 14.05.21 19:04:25Ich bin inzwischen aus Digihost ausgestiegen und habe die Kohle in DMG investiert.

Keine Ahnung, warum der Kurs so schnell angestiegen ist. Evtl. nur im Rahmen eines Pushs, evtl. auch weil Zocker von den hohen Kurssteigerungen angezogen wurden und dann weiter den Preis hochgetrieben haben. Grundsätzlich könnte das ja auch noch weiter gehen, allerdings steigt das Korrekturrisiko und da scheinen mir Alternativen wie DMG oder auch HUT8 die bessere Wahl zu sein.

Wenn man sich die Meldung vom 12.05. genauer anschaut, dann trägt das die Handschrift von CEO Amar. Die Ausdrucksweise ist die alt bekannte entsprechend dem Motto "equal or better than RIOT or MARA":

"Acquiring 10,000 Bitcoin Miners", dafür muss man dann aber Hostinggebühren im mittleren Millionenbereich monatlich zahlen. Wenn man von Akquisition spricht, dann kauft man doch das Equipment und mietet es nicht (zumindest nach meinem Verständnis). Über die genaue Formel, nach welcher Gewinne und Verluste zwischen Digihost und Northern Data aufgeteilt werden bleiben wir im Ungewissen. Das ist für mich kein Investmentcase. Wir müssen hier erneut die Katze im Sack kaufen ohne die Kenntnis darüber, ob wir überhaupt eine gute Beteiligung an den Gewinnen erzielen können.

So wie ich CEO Amar kenne hätte er es aber laut heraus posaunt, wenn der Deal für Digihost wirklich so positiv wäre. Das macht er sonst ja auch gerne und legt dabei immer noch eine Schippe drauf, auch wenn er seine Aussagen so nicht einhalten kann (wie bei dem ursprünglichen Ziel von 3 EH/s zum Jahreswechsel, welches schon wieder einkassiert wurde oder in Bezug auf die Größe des Kraftwerks oder die 240 PH/s im April oder...)

Ne, da bin ich doch erleichtert, dass es noch andere Unternehmen gibt, in welche man sein Geld sinnvoller investieren kann. Für die Möglichkeit des Ausstiegs mit einem blauen Auge bin ich entsprechend dankbar.

VG, ER

Keine Ahnung, warum der Kurs so schnell angestiegen ist. Evtl. nur im Rahmen eines Pushs, evtl. auch weil Zocker von den hohen Kurssteigerungen angezogen wurden und dann weiter den Preis hochgetrieben haben. Grundsätzlich könnte das ja auch noch weiter gehen, allerdings steigt das Korrekturrisiko und da scheinen mir Alternativen wie DMG oder auch HUT8 die bessere Wahl zu sein.

Wenn man sich die Meldung vom 12.05. genauer anschaut, dann trägt das die Handschrift von CEO Amar. Die Ausdrucksweise ist die alt bekannte entsprechend dem Motto "equal or better than RIOT or MARA":

"Acquiring 10,000 Bitcoin Miners", dafür muss man dann aber Hostinggebühren im mittleren Millionenbereich monatlich zahlen. Wenn man von Akquisition spricht, dann kauft man doch das Equipment und mietet es nicht (zumindest nach meinem Verständnis). Über die genaue Formel, nach welcher Gewinne und Verluste zwischen Digihost und Northern Data aufgeteilt werden bleiben wir im Ungewissen. Das ist für mich kein Investmentcase. Wir müssen hier erneut die Katze im Sack kaufen ohne die Kenntnis darüber, ob wir überhaupt eine gute Beteiligung an den Gewinnen erzielen können.

So wie ich CEO Amar kenne hätte er es aber laut heraus posaunt, wenn der Deal für Digihost wirklich so positiv wäre. Das macht er sonst ja auch gerne und legt dabei immer noch eine Schippe drauf, auch wenn er seine Aussagen so nicht einhalten kann (wie bei dem ursprünglichen Ziel von 3 EH/s zum Jahreswechsel, welches schon wieder einkassiert wurde oder in Bezug auf die Größe des Kraftwerks oder die 240 PH/s im April oder...)