Dacian Gold (Seite 4)

eröffnet am 17.09.19 15:38:17 von

neuester Beitrag 16.10.23 13:21:20 von

neuester Beitrag 16.10.23 13:21:20 von

Beiträge: 38

ID: 1.311.992

ID: 1.311.992

Aufrufe heute: 0

Gesamt: 1.674

Gesamt: 1.674

Aktive User: 0

ISIN: AU000000DCN6 · WKN: A1J69Z

0,1640

EUR

0,00 %

0,0000 EUR

Letzter Kurs 09.11.23 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9900 | +130,23 | |

| 10,850 | +18,45 | |

| 1,0500 | +17,32 | |

| 3.200,00 | +15,90 | |

| 0,5650 | +14,14 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5.900,00 | -9,23 | |

| 9,9900 | -9,59 | |

| 67,15 | -10,76 | |

| 9,0100 | -13,37 | |

| 1,0000 | -53,27 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 63.334.237 von faultcode am 15.04.20 13:23:10schau mal unter :

goldfund.com.au/company-reports

dort ist soeben ein neuer report zu dacian eingestellt worden.

aktuell wird kurs als fair bewertet., sicherlich auch im hinblick auf

die verdoppelung der shareanzahl. auch wenn´s ´en aussi titel ist,

mit mehr als 550m shares (ohne evtl. warrants - so auf die schnelle)

ist man schon recht hoch - auch für einen produzenten.

kurze frage : bei wem holst du dir nen ordentlichen chart mit MA´s etc.

danke im voraus.

elsolivars

goldfund.com.au/company-reports

dort ist soeben ein neuer report zu dacian eingestellt worden.

aktuell wird kurs als fair bewertet., sicherlich auch im hinblick auf

die verdoppelung der shareanzahl. auch wenn´s ´en aussi titel ist,

mit mehr als 550m shares (ohne evtl. warrants - so auf die schnelle)

ist man schon recht hoch - auch für einen produzenten.

kurze frage : bei wem holst du dir nen ordentlichen chart mit MA´s etc.

danke im voraus.

elsolivars

Antwort auf Beitrag Nr.: 62.759.617 von faultcode am 23.02.20 00:24:2927.2.

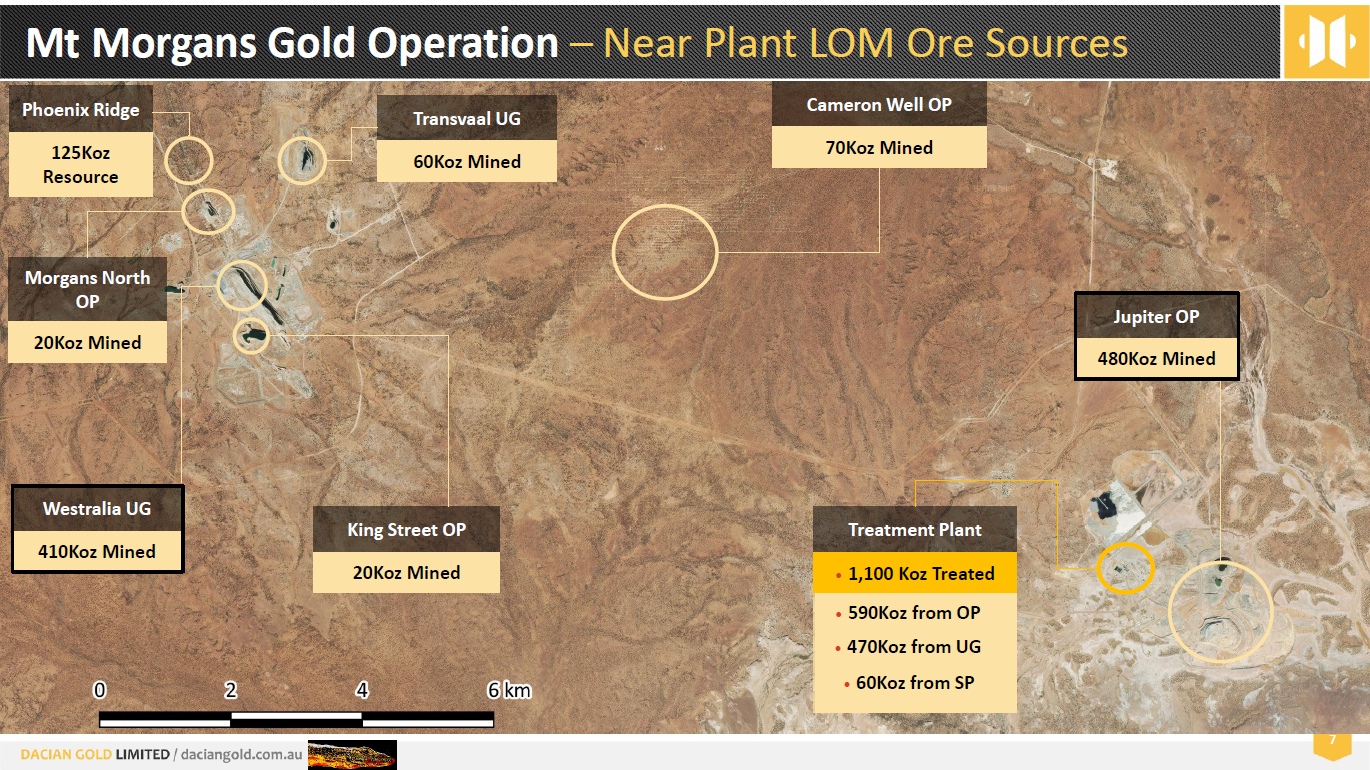

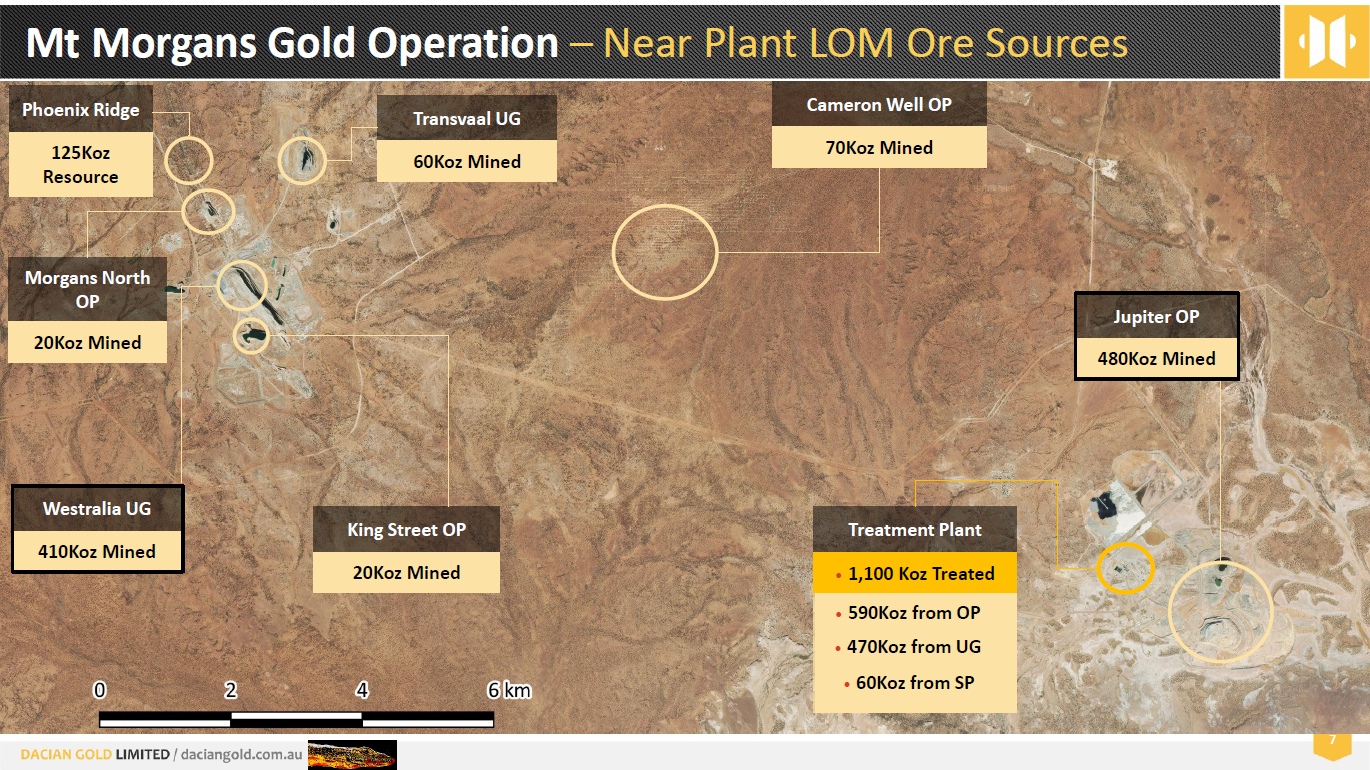

2019 MINERAL RESOURCE AND ORE RESERVE UPDATE

• Mt Morgans Gold Operation total Mineral Resource of 2.1Moz

• Total Ore Reserves of 754,000oz underpinned by Jupiter open pit material

• Westralia underground mine to undergo optimisation studies throughout CY2020

https://www.daciangold.com.au/site/investor-centre/ASX-Annou…

...

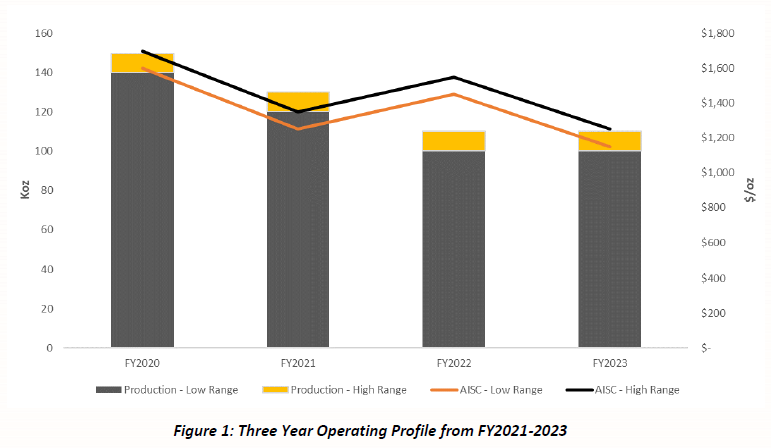

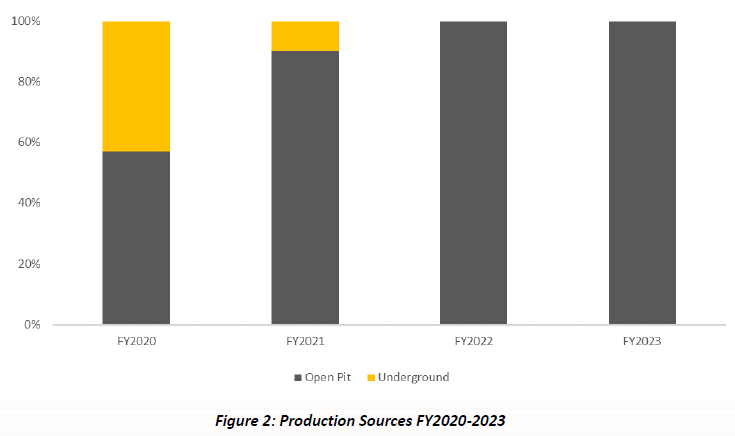

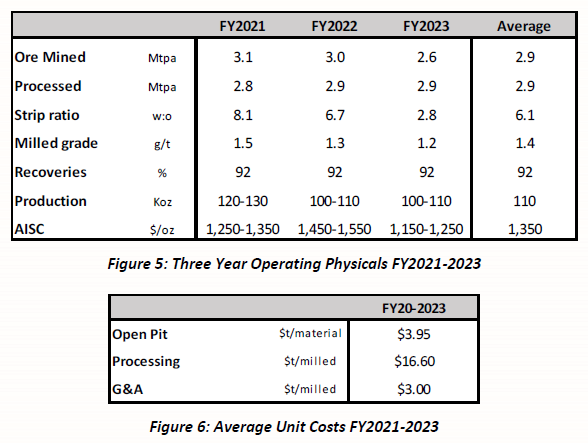

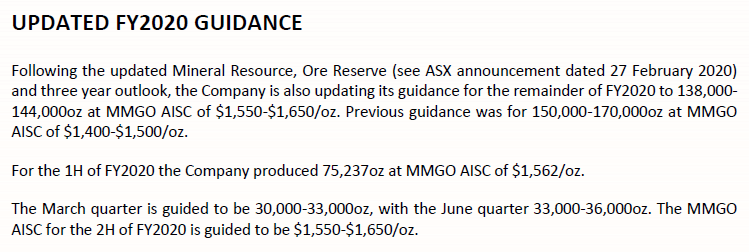

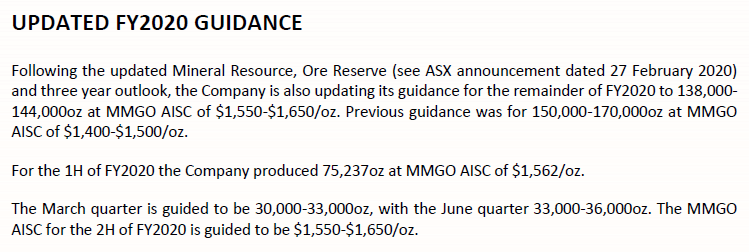

As a result of the updated Mineral Resources and Ore Reserves (see separate announcement released today) and three year outlook, the Company remains in ongoing discussions regarding the proposed recapitalisation of the Company.

Accordingly, trading in the Company’s shares will remain in suspension pending the finalisation of that recapitalisation proposal, which is anticipated to occur by the end of March 2020.

2019 MINERAL RESOURCE AND ORE RESERVE UPDATE

• Mt Morgans Gold Operation total Mineral Resource of 2.1Moz

• Total Ore Reserves of 754,000oz underpinned by Jupiter open pit material

• Westralia underground mine to undergo optimisation studies throughout CY2020

https://www.daciangold.com.au/site/investor-centre/ASX-Annou…

...

As a result of the updated Mineral Resources and Ore Reserves (see separate announcement released today) and three year outlook, the Company remains in ongoing discussions regarding the proposed recapitalisation of the Company.

Accordingly, trading in the Company’s shares will remain in suspension pending the finalisation of that recapitalisation proposal, which is anticipated to occur by the end of March 2020.

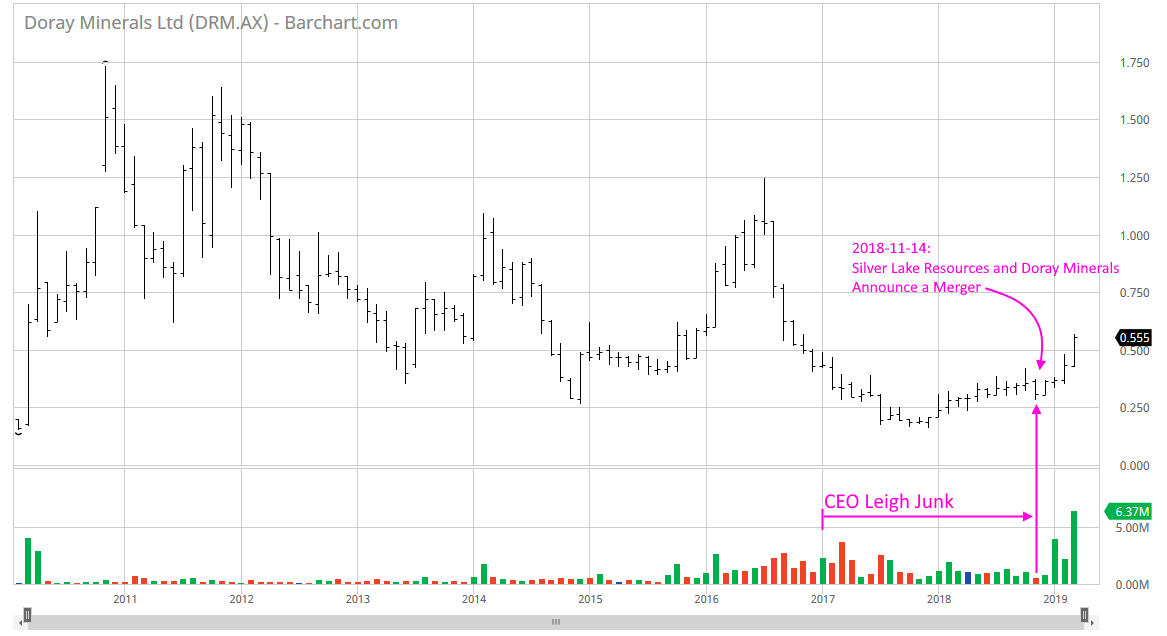

Antwort auf Beitrag Nr.: 62.759.572 von faultcode am 22.02.20 23:49:06Leigh Junk hat mMn Doray Minerals stabilisiert, und dann Doray Minerals schließlich von Silver Lake Resources - in Wahrheit - übernehmen lassen:

--> mittelfristig kann ich mir auch so ein Szenario für Dacian Gold vorstellen. Ich gehe halt auch davon aus, oder besser gesagt hoffe es, daß Dacian Gold auch erst einmal stabilisert werden kann

--> mittelfristig kann ich mir auch so ein Szenario für Dacian Gold vorstellen. Ich gehe halt auch davon aus, oder besser gesagt hoffe es, daß Dacian Gold auch erst einmal stabilisert werden kann

Antwort auf Beitrag Nr.: 62.759.569 von faultcode am 22.02.20 23:41:24

20 DECEMBER 2019

BOARD AND MANAGEMENT SUCCESSION

Dacian Gold Ltd (Dacian Gold or the Company) (ASX : DCN) announces the following Board and Management changes.

Executive Chairman and CEO Mr Rohan Williams will retire from the Board and will resign as Chief Executive Officer, effective 6 January, 2020.

The Board has appointed Mr Leigh Junk as the Company’s new Managing Director and Chief Executive Officer, effective 6 January, 2020.

Mr Junk is a highly experienced mining executive with over 25 years of operations and corporate experience. He was most recently Managing Director and Chief Executive Officer of Doray Minerals Limited until its merger with Silver Lake Resources Ltd in April 2019. A summary of Mr Junk’s background and experience is attached as Appendix A.

Mr Williams will be available to assist with the handover to Mr Junk and to consult to the Company as required. He will remain a significant shareholder in Dacian Gold and continue to be a strong supporter of the Company.

Mr Ian Cochrane, presently a Non-Executive Director of Dacian Gold, is to be appointed Non-Executive Chairman, also from 6 January 2020.

Mr Williams is the founder of Dacian Gold and led the Company from its pre-IPO in January 2012 through to its current position as a mid-tier ASX gold producer.

Mr Williams said: “After eight years during which we established the Company and built the Mt Morgans Gold Operation, I believe that the time is the right to refresh the CEO and Chairman roles.

...

07.07.17

neuer CEO Leigh Junk -- der Gründer geht

das war auch noch:20 DECEMBER 2019

BOARD AND MANAGEMENT SUCCESSION

Dacian Gold Ltd (Dacian Gold or the Company) (ASX : DCN) announces the following Board and Management changes.

Executive Chairman and CEO Mr Rohan Williams will retire from the Board and will resign as Chief Executive Officer, effective 6 January, 2020.

The Board has appointed Mr Leigh Junk as the Company’s new Managing Director and Chief Executive Officer, effective 6 January, 2020.

Mr Junk is a highly experienced mining executive with over 25 years of operations and corporate experience. He was most recently Managing Director and Chief Executive Officer of Doray Minerals Limited until its merger with Silver Lake Resources Ltd in April 2019. A summary of Mr Junk’s background and experience is attached as Appendix A.

Mr Williams will be available to assist with the handover to Mr Junk and to consult to the Company as required. He will remain a significant shareholder in Dacian Gold and continue to be a strong supporter of the Company.

Mr Ian Cochrane, presently a Non-Executive Director of Dacian Gold, is to be appointed Non-Executive Chairman, also from 6 January 2020.

Mr Williams is the founder of Dacian Gold and led the Company from its pre-IPO in January 2012 through to its current position as a mid-tier ASX gold producer.

Mr Williams said: “After eight years during which we established the Company and built the Mt Morgans Gold Operation, I believe that the time is the right to refresh the CEO and Chairman roles.

...

07.07.17

Zitat von faultcode: ...Zunächst einmal muss ich sagen, dass ich Vertrauen habe ins neue Management, also:

- neuer CEO Leigh Junk seit 2017-01 und..

- neuer Chairman 2017-02 (non-exec.)

Die Grausamkeiten muss man eben (relativ) am Anfang machen. Nachdem Schulden zu bedienen sind, und das nicht zu knapp, ist es einfach das Beste hier den Stecker vorerst zu ziehen...

Antwort auf Beitrag Nr.: 62.241.860 von faultcode am 28.12.19 21:10:06

--> so einfach ist es nicht

--> seit 3.2. im Trading Halt:

3.2.

Dacian Gold (ASX : DCN) investors brace for a tight quarter as debt repayments loom

https://themarketherald.com.au/dacian-gold-asxdcn-investors-…

...

Up-and-coming gold producer Dacian Gold (DCN) is meeting production guidance for the year but perhaps leaving breathing room a little tight.

In its latest quarterly report for the three months leading up to the end of December, Dacian told shareholders it produced roughly 33,000 ounces of gold.

While this is down on the previous quarter's 42,000 ounces, the total 75,000 still falls in the upper range of Dacian's guidance for the first half of the 2020 financial year.

The company blamed a lower average mill feed grade for the decreased production compared to the September quarter.

Though Dacian processed a record 776,000 tonnes of ore in December, the average feed grade was 1.5 grams per tonne of gold for roughly 36,000 contained ounces.

Further, all-in-sustaining-costs (AISC) for Dacian's Mount Morgans Gold Operation were $1737 per ounce. Costs were higher than September quarter's $1423 per ounce AISC, but the average for the half-year once again fell within the company's expectations.

However, the annual cost guidance for the 2020 financial year is between $1400 and $1500, meaning Dacian will have to work at cutting AISC over the next six months to meet expectations.

Taking a look at the company's financials, Dacian burned over $10 million cash over the December quarter. While the company remains cash-flow positive for the 2020 financial year so far, Dacian's $59.9 million in customer receipts over the quarter was outweighed by its $70.3 million in operating costs.

For the half-year, Dacian is up $9.9 million in operating cash flow. The company had $43 million cash on hand at the end of the December quarter.

However, Dacian made no debt repayments over the quarter. With the company owing $94.7 million to debtors, investors may be worried the company is leaving little margin for error over the coming quarters.

Dacian has a hefty $24.7 million debt repayment due in March going hand-in-hand with some higher operating costs, bringing expected cash outflows for the next quarter to over $100 million.

The company's cash reserves combined with its expected earnings should be enough to meet these costs without the help of another capital raise, but any unexpected costs or hindrances to operations could leave Dacian in trouble.

Of course, provided the next two quarters track along without a hitch, it will leave the company in a strong position for the next financial year.

However, Dacian entered a voluntary trading halt before shares got a chance to move this morning, so it's not yet sure how the market will react to today's quarterly report.

Dacian shares closed on Friday at $1.40 each. The company has a $319.8 million market cap.

Zitat von faultcode: ...Ich glaube, man muss kein Genie sein, um anzunehmen, daß in 2020 auch das Abriss-Niveau von ~AUD1.5 genommen werden wird...

--> so einfach ist es nicht

--> seit 3.2. im Trading Halt:

3.2.

Dacian Gold (ASX : DCN) investors brace for a tight quarter as debt repayments loom

https://themarketherald.com.au/dacian-gold-asxdcn-investors-…

...

Up-and-coming gold producer Dacian Gold (DCN) is meeting production guidance for the year but perhaps leaving breathing room a little tight.

In its latest quarterly report for the three months leading up to the end of December, Dacian told shareholders it produced roughly 33,000 ounces of gold.

While this is down on the previous quarter's 42,000 ounces, the total 75,000 still falls in the upper range of Dacian's guidance for the first half of the 2020 financial year.

The company blamed a lower average mill feed grade for the decreased production compared to the September quarter.

Though Dacian processed a record 776,000 tonnes of ore in December, the average feed grade was 1.5 grams per tonne of gold for roughly 36,000 contained ounces.

Further, all-in-sustaining-costs (AISC) for Dacian's Mount Morgans Gold Operation were $1737 per ounce. Costs were higher than September quarter's $1423 per ounce AISC, but the average for the half-year once again fell within the company's expectations.

However, the annual cost guidance for the 2020 financial year is between $1400 and $1500, meaning Dacian will have to work at cutting AISC over the next six months to meet expectations.

Taking a look at the company's financials, Dacian burned over $10 million cash over the December quarter. While the company remains cash-flow positive for the 2020 financial year so far, Dacian's $59.9 million in customer receipts over the quarter was outweighed by its $70.3 million in operating costs.

For the half-year, Dacian is up $9.9 million in operating cash flow. The company had $43 million cash on hand at the end of the December quarter.

However, Dacian made no debt repayments over the quarter. With the company owing $94.7 million to debtors, investors may be worried the company is leaving little margin for error over the coming quarters.

Dacian has a hefty $24.7 million debt repayment due in March going hand-in-hand with some higher operating costs, bringing expected cash outflows for the next quarter to over $100 million.

The company's cash reserves combined with its expected earnings should be enough to meet these costs without the help of another capital raise, but any unexpected costs or hindrances to operations could leave Dacian in trouble.

Of course, provided the next two quarters track along without a hitch, it will leave the company in a strong position for the next financial year.

However, Dacian entered a voluntary trading halt before shares got a chance to move this morning, so it's not yet sure how the market will react to today's quarterly report.

Dacian shares closed on Friday at $1.40 each. The company has a $319.8 million market cap.

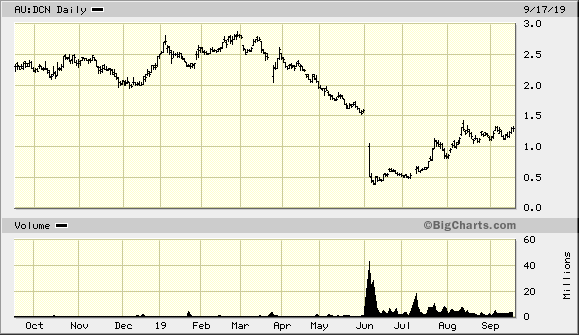

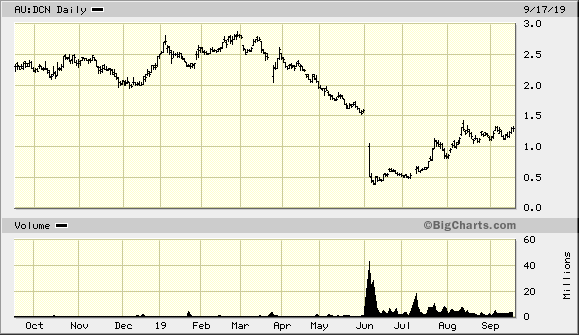

Antwort auf Beitrag Nr.: 61.502.759 von faultcode am 17.09.19 15:38:17<MMGO = Mt Morgans Gold Operation>

mittlerweile aufgestockt.

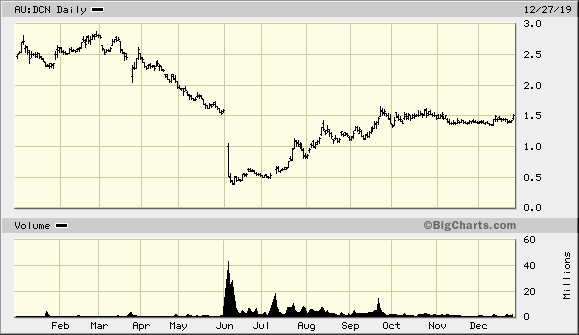

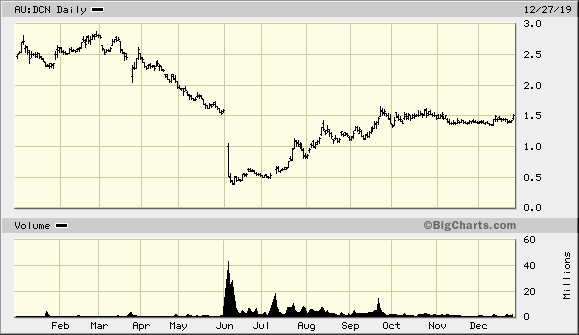

Ich glaube, man muss kein Genie sein, um anzunehmen, daß in 2020 auch das Abriss-Niveau von ~AUD1.5 genommen werden wird:

...

We believe the changes we have made in the last few months have made significant inroads into being able to better predict production levels, and it is pleasing to be able to re-affirm again today our FY2020 guidance of 150,000-170,000 ounces of production at a Mt Morgans All-in-Cost (inclusive of all capital) of A$1,400-1,500/oz.

...

Since the beginning of FY2019, we have paid back $55.3 million to our lenders.

...

At Phoenix Ridge, we have discovered a new high-grade and near-surface deposit which has returned some of our best-ever exploration intercepts including 23.1m @ 30.2g/t Au, 31m @ 6.3g/t Au, 14.3m @ 12.7g/t Au, 1.7m @ 127g/t Au, 2.4m @ 47.5g/t Au and 19.1m @ 5.1g/t Au. We still have a lot of work to do but we are highly encouraged that Phoenix Ridge has the potential to become a new near-term, high-grade production source at Mt Morgans.

...

aus: 27 NOVEMBER 2019, CHAIRMAN’S ADDRESS TO AGM

AGM-Präsentation:

mittlerweile aufgestockt.

Ich glaube, man muss kein Genie sein, um anzunehmen, daß in 2020 auch das Abriss-Niveau von ~AUD1.5 genommen werden wird:

...

We believe the changes we have made in the last few months have made significant inroads into being able to better predict production levels, and it is pleasing to be able to re-affirm again today our FY2020 guidance of 150,000-170,000 ounces of production at a Mt Morgans All-in-Cost (inclusive of all capital) of A$1,400-1,500/oz.

...

Since the beginning of FY2019, we have paid back $55.3 million to our lenders.

...

At Phoenix Ridge, we have discovered a new high-grade and near-surface deposit which has returned some of our best-ever exploration intercepts including 23.1m @ 30.2g/t Au, 31m @ 6.3g/t Au, 14.3m @ 12.7g/t Au, 1.7m @ 127g/t Au, 2.4m @ 47.5g/t Au and 19.1m @ 5.1g/t Au. We still have a lot of work to do but we are highly encouraged that Phoenix Ridge has the potential to become a new near-term, high-grade production source at Mt Morgans.

...

aus: 27 NOVEMBER 2019, CHAIRMAN’S ADDRESS TO AGM

AGM-Präsentation:

www.daciangold.com.au

moderate Erst-Position

--> der Kursabschlag seinerzeit im Juni erscheint mir übertrieben (*). Die Aktie ist auch schon gut zurückgekommen, und nun habe ich sie eben "spät" entdeckt:

(*) Grund:

5.6.

Dacian Gold Crashes After Cutting Production Guidance

https://investingnews.com/daily/resource-investing/precious-…

=>

...The company revealed that production guidance at Westralia, an area of Mount Morgans, has been dropped to a range of 36,000 ounces to 38,000 ounces of gold, down from the original guidance of 50,000 ounces to 55,000 ounces.

The miner blamed the revision on underground contractor performance issues that caused lower productivity than Dacian had anticipated, as well as a decline in grade performance.

Additionally, the company noted that costs will increase from between AU$1,050 and AU$1,150 per ounce to an all-in sustaining cost (AISC) of between AU$1,500 and AU$1,600 per ounce.

Despite the production downgrade and increased costs, the miner believes Dacian is in a good position to improve. “Whilst the downgraded June quarter production guidance is disappointing, the company notes improvements in both equipment availability and mine development advance at Westralia are clearly evident and heading in the right direction,” Rohan Williams, executive chairman, stated.

“Many of the issues with fleet availability have already been resolved and a focus on capital development in the short term will open up more work areas, thus improving production going forward.”

Looking ahead, Dacian estimates that production for the 2020 financial year will be in the range of 150,000 to 170,000 ounces of gold at an AISC of AU$1,350 to AU$1,450 per ounce.

The miner said it will release an updated five year mine plan at the end of this month, with its preliminary review pointing to average production of 160,000 to 180,000 ounces per year...

moderate Erst-Position

--> der Kursabschlag seinerzeit im Juni erscheint mir übertrieben (*). Die Aktie ist auch schon gut zurückgekommen, und nun habe ich sie eben "spät" entdeckt:

(*) Grund:

5.6.

Dacian Gold Crashes After Cutting Production Guidance

https://investingnews.com/daily/resource-investing/precious-…

=>

...The company revealed that production guidance at Westralia, an area of Mount Morgans, has been dropped to a range of 36,000 ounces to 38,000 ounces of gold, down from the original guidance of 50,000 ounces to 55,000 ounces.

The miner blamed the revision on underground contractor performance issues that caused lower productivity than Dacian had anticipated, as well as a decline in grade performance.

Additionally, the company noted that costs will increase from between AU$1,050 and AU$1,150 per ounce to an all-in sustaining cost (AISC) of between AU$1,500 and AU$1,600 per ounce.

Despite the production downgrade and increased costs, the miner believes Dacian is in a good position to improve. “Whilst the downgraded June quarter production guidance is disappointing, the company notes improvements in both equipment availability and mine development advance at Westralia are clearly evident and heading in the right direction,” Rohan Williams, executive chairman, stated.

“Many of the issues with fleet availability have already been resolved and a focus on capital development in the short term will open up more work areas, thus improving production going forward.”

Looking ahead, Dacian estimates that production for the 2020 financial year will be in the range of 150,000 to 170,000 ounces of gold at an AISC of AU$1,350 to AU$1,450 per ounce.

The miner said it will release an updated five year mine plan at the end of this month, with its preliminary review pointing to average production of 160,000 to 180,000 ounces per year...