RESOLUTE MINING -- aus Aschenputtel wird Goldmarie (Seite 107)

eröffnet am 15.10.09 12:52:37 von

neuester Beitrag 04.03.24 00:37:42 von

neuester Beitrag 04.03.24 00:37:42 von

Beiträge: 1.425

ID: 1.153.697

ID: 1.153.697

Aufrufe heute: 0

Gesamt: 127.566

Gesamt: 127.566

Aktive User: 0

ISIN: AU000000RSG6 · WKN: 794836

0,2664

EUR

+2,38 %

+0,0062 EUR

Letzter Kurs 02.05.24 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1200 | +17,78 | |

| 9,8360 | +17,66 | |

| 85.089,50 | +16,19 | |

| 2,5900 | +13,85 | |

| 0,5340 | +12,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6865 | -6,92 | |

| 19,480 | -9,69 | |

| 183,20 | -19,30 | |

| 12,000 | -25,00 | |

| 46,60 | -97,97 |

Beitrag zu dieser Diskussion schreiben

23 March 2017

Outstanding drilling results from Bibiani

Highlights

• Initial assay results from the current second phase surface and underground diamond drilling program at Resolute Mining Limited’s Bibiani Gold Mine in Ghana include a number of excellent broad high grade intercepts from both infill and extensional drilling.

• Significant results include:

o BSDD040 30m @ 8.9g/t from 498m

o BUDD072 48m @ 3.6g/t from 171m; and

6m @ 16.5g/t from 227m

o BUDD074 47m @ 2.3g/t from 130m

o BUDD077 51m @ 4.3g/t from 117m

o BUDD078 37m @ 3.9g/t from 152m

• The initial drilling has intersected mineralisation better than predicted by the current inferred resource estimate.

• It is expected the high grade intersections from the Central Lode will lead to resource and reserve increases.

• The current drilling program, which commenced in December 2016, is designed to upgrade the 591,000 ounces (4.5 million tonnes at 4.1 grams per tonne) of inferred resources within the current total resource of 1.7 million ounces (15.6 million tonnes at 3.5 grams per tonne) and increase the current ore reserve of 640,000 ounces (5.4 million tonnes at 3.7 grams per tonne).

• The drilling program is also targeting new areas of mineralisation outside of the existing resource.

Resolute Mining Limited (Resolute or the Company) (ASX:RSG) is pleased to announce initial results from current drilling at the Company’s Bibiani Gold Mine in Ghana (Bibiani). The program represents Resolute’s second phase of drilling at Bibiani since assuming ownership in 2014. The Company’s first phase of drilling commenced in 2015 and allowed Resolute to complete a positive feasibility study (see ASX Announcement dated 23 June 2016) which highlighted an economically viable project at current gold prices. The current drilling program is designed to upgrade existing inferred mineral resources as well as identify new mineralisation. The program aims to significantly increase the ore reserve, improve project economics, and confirm a decision to mine.

Managing Director and CEO John Welborn was encouraged by the initial results of the current drilling program: “Bibiani is one of the largest gold deposits in Ghana, with historical production of approximately 4 million ounces and current resources of 1.7 million ounces. We believe there is tremendous exploration potential along the Bibiani shear to upgrade existing resources and delineate new high grade mineralisation. These results represent a significant step in realising that potential.”

“The feasibility study completed in June 2016 identified a viable pathway to a low-cost operation capable of producing in excess of 100,000 ounces of gold per year. We are looking at further enhancements and have been re-energised

2

by the growth opportunity at Bibiani. Resolute has a clear vison to recommission Bibiani as a long life, low cost gold mine.”

“The drilling program is continuing and we are now targeting new zones of mineralisation along strike and at depth where there has been limited historic drilling. These new zones have the potential to reveal new high grade orebodies. The Bibiani second phase drilling program forms part of an increased investment in exploration at all of Resolute’s assets focused on creating long term value for our shareholders.”

Resolute’s feasibility study for Bibiani was based on an underground mine requiring low start-up capital of US$72M and a short lead time to production of only nine months. The feasibility study proposed a successful underground mine that would produce in excess of 100,000 ounces (oz) of gold per annum at a Life of Mine All-In Sustaining Cost of US$851/oz. The current drilling program is focused on increasing the size, grade, and confidence in the current resource, improving project economics, and extending the mine life beyond five years.

Bibiani Infill and Extensional Drilling Program

Resolute commenced the current second phase of resource drilling in December 2016. The drilling program is expected to comprise of at least 3,500m of underground and 17,500m of surface diamond drilling. Drilling is expected to take approximately six months at which time an updated resource will be compiled. The updated resource will underpin further project studies and ultimately, a future decision to mine.

The current drilling program comprises two surface rigs and two underground rigs on double shifts. The program is approximately halfway to completion with eight surface holes and 12 underground holes completed to date.

Assay Results

Results received from completed holes are very encouraging with particularly impressive results from the Central Lode drilling from underground positions. Excellent high grade results in the southern Central Lode between 5150N and 5600N suggests the mineralisation in this area is better than predicted by the inferred resource estimate.

Better than 50 gram x metre intersections include:

• BSDD035 - 14m @ 4.36 grams per tonne (g/t) from 454m;

• BSDD040 - 30.3m @ 8.92g/t from 499m;

• BSDD042 - 23.7m @ 3.15g/t from 426m;

• BUDD071 - 34m @ 1.6g/t from 139m;

• BUDD072 - 48m @ 3.58g/t from 171m;

• BUDD072 - 5.9m @ 16.51g/t from 227m;

• BUDD074 - 47m @ 2.26g/t from 130m;

• BUDD074 - 17m @ 3.53g/t from 182m;

• BUDD077 - 51m @ 4.3g/t from 117m;

• BUDD078 - 37m @ 3.86g/t from 152m; and

• BUDD080 - 20m @ 2.71g/t from 68m.

The high-grade intersections in all the reported underground holes (BUDD prefix) and two surface holes BSDD040 and BSDD042 are all located within the down dip extensions of the Central Lode. These down dip extensions are likely to add resources and increase the ore reserve within this underground mining panel.

The exceptional intercept in BSDD040 of 30.3m @ 8.92g/t from 498.7m, shown in Figure 2 below, is from the southern end of the Central Lode and is approximately 100m down dip of the Phase 1 intercept of 20m @ 4.71g/t from 138m in hole BUDD064 (see ASX Announcement dated 1 April 2015). The intercept included an approximately 3m wide zone of stylolitic quartz veining, with numerous <1mm specks of visible Au, which returned 3m @ 56.7g/t Au from

3

524m. The result in BSDD040 is indicative of the width and tenor of the deposit in those areas which have not been mined previously.

Figure 1: Bibiani Phase 2 drilling results long section

Future Exploration

The Bibiani feasibility study defined a viable development pathway based on the initial ore reserve and highlighted a strong potential economic benefit from upgrading the higher grade portions of the inferred resource. A large portion of the existing inferred resource will be upgraded to an indicated resource as a result of the current drilling program. Most of the current inferred resource occurs close to the ore reserve and consequently the planned development infrastructure could be utilised to extract this material at minimal additional cost. The original workings at Bibiani extend to around 800m below surface. The current resource of 1.7Moz only considers the area between the base of the pit at around 200m below surface, and the limit of Resolute’s drilling, at around 450m below surface. Substantial potential for discovery of additional mineralisation remains below the current reserves and along strike to the north. The length of the main historic underground mining zone extends to 1,800m while the total strike length of the Bibiani mineralised trend is around 4,000m.

The remainder of the program will concentrate on exploring for new zones of mineralisation along strike to the north and also targeting parallel shear structures to the west of the current lenses. Results will be released when received.

For further information, contact:

John Welborn | Managing Director and CEO Telephone: +61 8 9261 6100 Email: contact@rml.com.au

Outstanding drilling results from Bibiani

Highlights

• Initial assay results from the current second phase surface and underground diamond drilling program at Resolute Mining Limited’s Bibiani Gold Mine in Ghana include a number of excellent broad high grade intercepts from both infill and extensional drilling.

• Significant results include:

o BSDD040 30m @ 8.9g/t from 498m

o BUDD072 48m @ 3.6g/t from 171m; and

6m @ 16.5g/t from 227m

o BUDD074 47m @ 2.3g/t from 130m

o BUDD077 51m @ 4.3g/t from 117m

o BUDD078 37m @ 3.9g/t from 152m

• The initial drilling has intersected mineralisation better than predicted by the current inferred resource estimate.

• It is expected the high grade intersections from the Central Lode will lead to resource and reserve increases.

• The current drilling program, which commenced in December 2016, is designed to upgrade the 591,000 ounces (4.5 million tonnes at 4.1 grams per tonne) of inferred resources within the current total resource of 1.7 million ounces (15.6 million tonnes at 3.5 grams per tonne) and increase the current ore reserve of 640,000 ounces (5.4 million tonnes at 3.7 grams per tonne).

• The drilling program is also targeting new areas of mineralisation outside of the existing resource.

Resolute Mining Limited (Resolute or the Company) (ASX:RSG) is pleased to announce initial results from current drilling at the Company’s Bibiani Gold Mine in Ghana (Bibiani). The program represents Resolute’s second phase of drilling at Bibiani since assuming ownership in 2014. The Company’s first phase of drilling commenced in 2015 and allowed Resolute to complete a positive feasibility study (see ASX Announcement dated 23 June 2016) which highlighted an economically viable project at current gold prices. The current drilling program is designed to upgrade existing inferred mineral resources as well as identify new mineralisation. The program aims to significantly increase the ore reserve, improve project economics, and confirm a decision to mine.

Managing Director and CEO John Welborn was encouraged by the initial results of the current drilling program: “Bibiani is one of the largest gold deposits in Ghana, with historical production of approximately 4 million ounces and current resources of 1.7 million ounces. We believe there is tremendous exploration potential along the Bibiani shear to upgrade existing resources and delineate new high grade mineralisation. These results represent a significant step in realising that potential.”

“The feasibility study completed in June 2016 identified a viable pathway to a low-cost operation capable of producing in excess of 100,000 ounces of gold per year. We are looking at further enhancements and have been re-energised

2

by the growth opportunity at Bibiani. Resolute has a clear vison to recommission Bibiani as a long life, low cost gold mine.”

“The drilling program is continuing and we are now targeting new zones of mineralisation along strike and at depth where there has been limited historic drilling. These new zones have the potential to reveal new high grade orebodies. The Bibiani second phase drilling program forms part of an increased investment in exploration at all of Resolute’s assets focused on creating long term value for our shareholders.”

Resolute’s feasibility study for Bibiani was based on an underground mine requiring low start-up capital of US$72M and a short lead time to production of only nine months. The feasibility study proposed a successful underground mine that would produce in excess of 100,000 ounces (oz) of gold per annum at a Life of Mine All-In Sustaining Cost of US$851/oz. The current drilling program is focused on increasing the size, grade, and confidence in the current resource, improving project economics, and extending the mine life beyond five years.

Bibiani Infill and Extensional Drilling Program

Resolute commenced the current second phase of resource drilling in December 2016. The drilling program is expected to comprise of at least 3,500m of underground and 17,500m of surface diamond drilling. Drilling is expected to take approximately six months at which time an updated resource will be compiled. The updated resource will underpin further project studies and ultimately, a future decision to mine.

The current drilling program comprises two surface rigs and two underground rigs on double shifts. The program is approximately halfway to completion with eight surface holes and 12 underground holes completed to date.

Assay Results

Results received from completed holes are very encouraging with particularly impressive results from the Central Lode drilling from underground positions. Excellent high grade results in the southern Central Lode between 5150N and 5600N suggests the mineralisation in this area is better than predicted by the inferred resource estimate.

Better than 50 gram x metre intersections include:

• BSDD035 - 14m @ 4.36 grams per tonne (g/t) from 454m;

• BSDD040 - 30.3m @ 8.92g/t from 499m;

• BSDD042 - 23.7m @ 3.15g/t from 426m;

• BUDD071 - 34m @ 1.6g/t from 139m;

• BUDD072 - 48m @ 3.58g/t from 171m;

• BUDD072 - 5.9m @ 16.51g/t from 227m;

• BUDD074 - 47m @ 2.26g/t from 130m;

• BUDD074 - 17m @ 3.53g/t from 182m;

• BUDD077 - 51m @ 4.3g/t from 117m;

• BUDD078 - 37m @ 3.86g/t from 152m; and

• BUDD080 - 20m @ 2.71g/t from 68m.

The high-grade intersections in all the reported underground holes (BUDD prefix) and two surface holes BSDD040 and BSDD042 are all located within the down dip extensions of the Central Lode. These down dip extensions are likely to add resources and increase the ore reserve within this underground mining panel.

The exceptional intercept in BSDD040 of 30.3m @ 8.92g/t from 498.7m, shown in Figure 2 below, is from the southern end of the Central Lode and is approximately 100m down dip of the Phase 1 intercept of 20m @ 4.71g/t from 138m in hole BUDD064 (see ASX Announcement dated 1 April 2015). The intercept included an approximately 3m wide zone of stylolitic quartz veining, with numerous <1mm specks of visible Au, which returned 3m @ 56.7g/t Au from

3

524m. The result in BSDD040 is indicative of the width and tenor of the deposit in those areas which have not been mined previously.

Figure 1: Bibiani Phase 2 drilling results long section

Future Exploration

The Bibiani feasibility study defined a viable development pathway based on the initial ore reserve and highlighted a strong potential economic benefit from upgrading the higher grade portions of the inferred resource. A large portion of the existing inferred resource will be upgraded to an indicated resource as a result of the current drilling program. Most of the current inferred resource occurs close to the ore reserve and consequently the planned development infrastructure could be utilised to extract this material at minimal additional cost. The original workings at Bibiani extend to around 800m below surface. The current resource of 1.7Moz only considers the area between the base of the pit at around 200m below surface, and the limit of Resolute’s drilling, at around 450m below surface. Substantial potential for discovery of additional mineralisation remains below the current reserves and along strike to the north. The length of the main historic underground mining zone extends to 1,800m while the total strike length of the Bibiani mineralised trend is around 4,000m.

The remainder of the program will concentrate on exploring for new zones of mineralisation along strike to the north and also targeting parallel shear structures to the west of the current lenses. Results will be released when received.

For further information, contact:

John Welborn | Managing Director and CEO Telephone: +61 8 9261 6100 Email: contact@rml.com.au

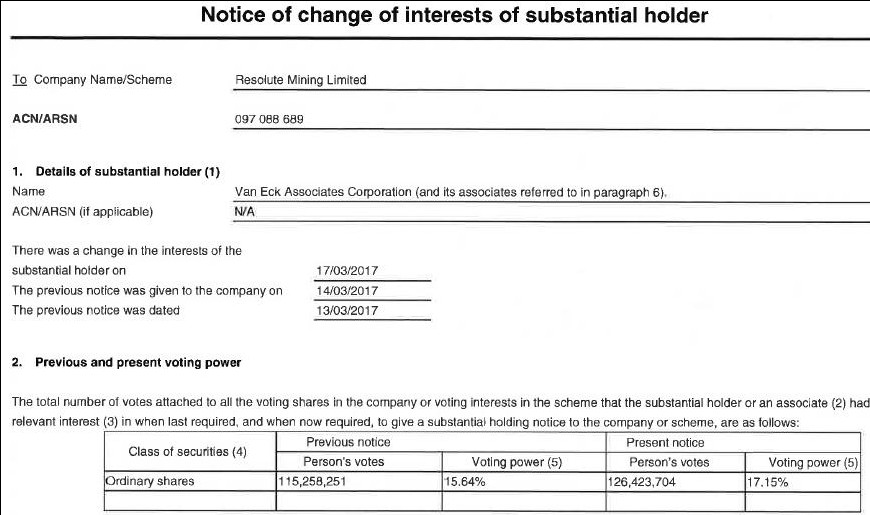

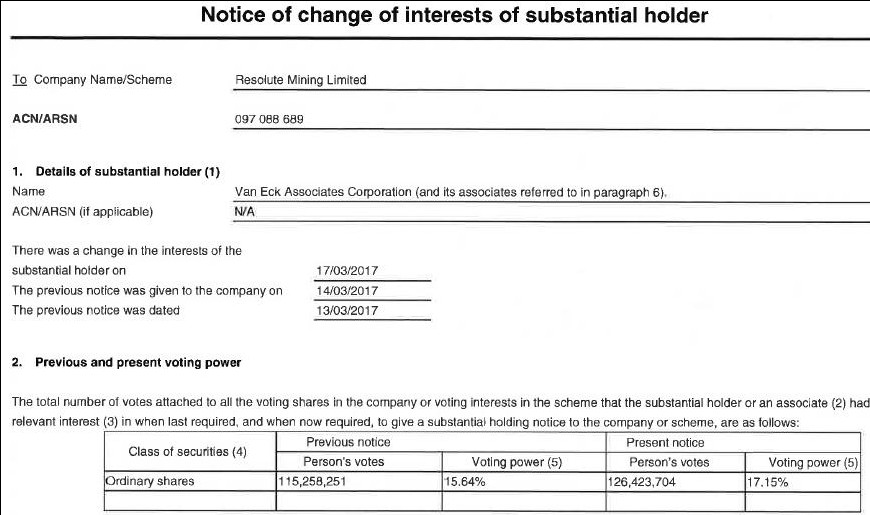

Van Eck hat um 11 Mio Stk aufgestockt. Ansich gut, aber wenn es wieder eine Goldabverkauf gibt, steigt Van Eck erfahrungsgemäß schnell wieder aus und der Kurs rasselt nach unten. Aber das gilt für alle Minen

Prognose vom 25.01.17

Produktion 300 koz

AISC 934 USD je oz

bin dadurch darauf gekommen sorry

Produktion 300 koz

AISC 934 USD je oz

bin dadurch darauf gekommen sorry

625 USD im 4. Quartal 2016 zu 889 USD im 3. Quartal  http://www.goldseiten.de/artikel/316564--Resolute-Mining-Ltd…

http://www.goldseiten.de/artikel/316564--Resolute-Mining-Ltd…

http://www.goldseiten.de/artikel/316564--Resolute-Mining-Ltd…

http://www.goldseiten.de/artikel/316564--Resolute-Mining-Ltd…

@Freddy wie kommst du auf 934 USD AISC, nach Goldseiten.de liegen die bei etwas über 600USD!?

Antwort auf Beitrag Nr.: 54.521.225 von Global-Player83 am 12.03.17 17:40:40Zwischen der Wiederholung von H1 in H2 und der momentanen Prognose (damit sehr schwaches H2). Tiefer habe ich das auch noch nicht analysiert - würde wohl mal Zeit.

Muss mal eine Frage stellen bei Kosten von AISC 934 USD bleibt eigentlich bei Resolute Recources keine hohe Gewinnmarge hängen gibt es noch möglichkeiten die Gewinnmarge zu erhöhen?

Hat jemand hier im Forum schon Erfahrung damit sich seine Dividende in Gold auszuzahlen?

Hat jemand hier im Forum schon Erfahrung damit sich seine Dividende in Gold auszuzahlen?

Wie sieht denn deine Prognose für das 2. Halbjahr bzw. Gesamtjahr aus? Überlege gerade zu 1,26 AUD einzusteigen...bin mir noch unschlüssig

Antwort auf Beitrag Nr.: 54.516.963 von Global-Player83 am 11.03.17 12:12:07Ich und viele Analysten und zumindest bis zuletzt viele Anleger setzten auf eine baldige Prognoseanhebung. Darin besteht beim abgestürzten Kurs nun wieder eine Chance - ich hätte trotzdem lieber bei 1,80 verkauft und heute wieder gekauft. So habe ich bei ca. 1,40 nur etwas reduziert, aber viel zu viele Buchgewinne weggeschenkt.

Antwort auf Beitrag Nr.: 54.444.156 von startvestor am 01.03.17 21:42:48oper. Zahlen für das Dezember Halbjahr 2016

Produktion 170,5 koz Au

AISC 753 USD je oz

----

Prognose vom 25.01.17

Produktion 300 koz

AISC 934 USD je oz

Retrograd gerechnet dürfte das Juni-Halbjahr dann dementsprechend schwach werden, Produktion ca. 130 koz Gold und AISC wohl vierstellig in USD (ca. 1168 USD)

Produktion 170,5 koz Au

AISC 753 USD je oz

----

Prognose vom 25.01.17

Produktion 300 koz

AISC 934 USD je oz

Retrograd gerechnet dürfte das Juni-Halbjahr dann dementsprechend schwach werden, Produktion ca. 130 koz Gold und AISC wohl vierstellig in USD (ca. 1168 USD)