PANCONTINENTAL OIL - Projekte in Australien, Kenya, Malta, Marocco und Namibia

eröffnet am 23.01.10 01:07:33 von

neuester Beitrag 09.05.24 12:20:58 von

neuester Beitrag 09.05.24 12:20:58 von

Beiträge: 3.844

ID: 1.155.508

ID: 1.155.508

Aufrufe heute: 254

Gesamt: 420.908

Gesamt: 420.908

Aktive User: 0

ISIN: AU000000PCL4 · WKN: A0CAFF

0,0145

EUR

+3,57 %

+0,0005 EUR

Letzter Kurs 23:00:16 Lang & Schwarz

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 07:04 Uhr | ||

| 09:20 Uhr | ||

| 11:59 Uhr | ||

| 12:20 Uhr |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 07:04 Uhr | ||

| 09:20 Uhr | ||

| 04.05.24 | ||

| 12:20 Uhr | ||

| 05.05.24 |

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 07:04 Uhr | ||

| 09:20 Uhr | ||

| 12.04.24 | ||

| 26.04.24 | ||

| 11:59 Uhr |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2760 | +37,95 | |

| 1,1500 | +27,78 | |

| 1,0400 | +18,18 | |

| 8,2500 | +16,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,4000 | -9,43 | |

| 2,0500 | -9,69 | |

| 850,20 | -12,51 | |

| 11,800 | -12,59 | |

| 1,5450 | -19,32 |

Beitrag zu dieser Diskussion schreiben

Hallo Tex, wenn das zutrifft weiß ich wie man sich als Millionär fühlt😜

ABER HIER KOMMT DAS ALLERBESTE

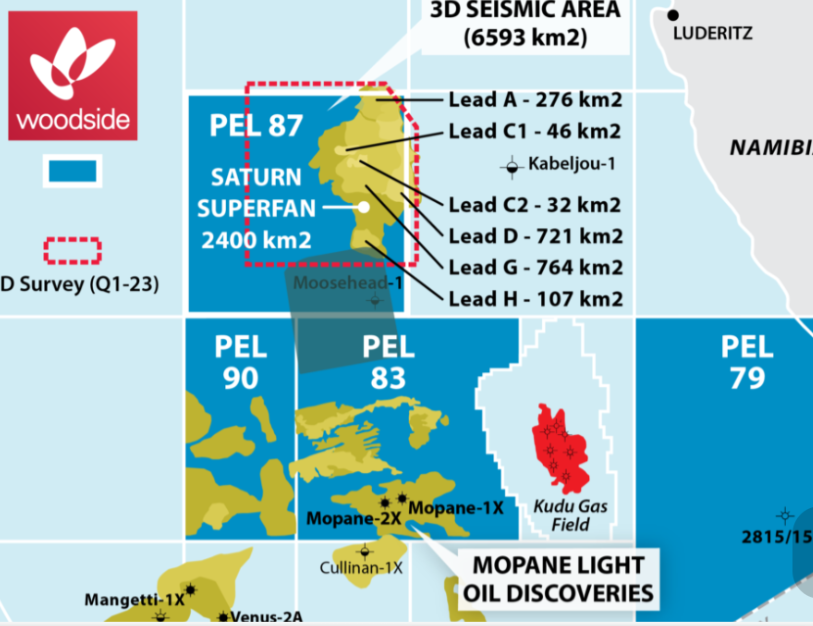

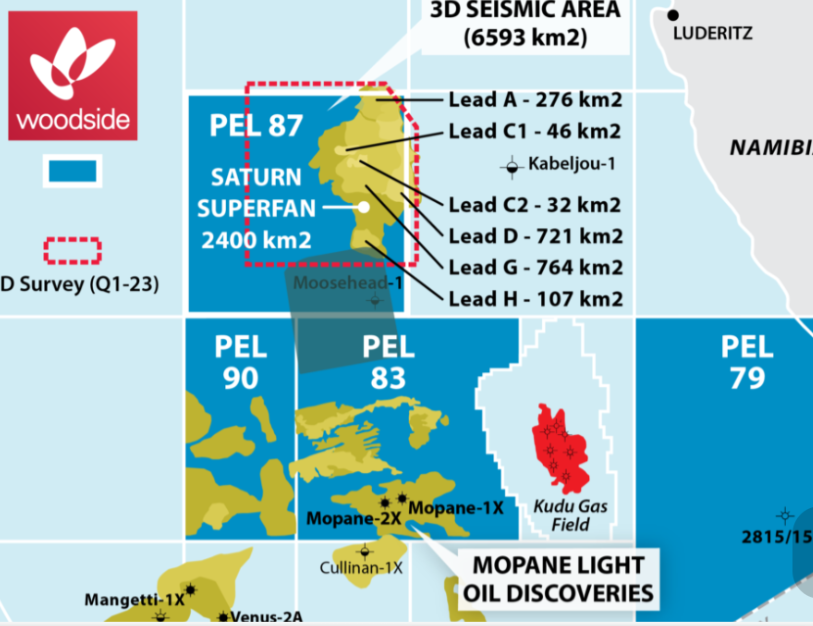

IN DEM YOUTUBE VIDEO BEI 07:26 BRABBELT DER PANCONTINENTAL ETWAS VON 40 MILLIARDEN BARREL OIL IN PLACE DIE SO EIN SATURN TURBIDITE BEINHALTEN KÖNNTE WENN ER BIS ZUM SPILL VOLL MIT ÖL IST

keine Ahnung wie ich die Wartezeit von einem Jahr bis zur Bohrung überleben werden. Bei solchen Zahlen könnte man schon nervös werden...

IN DEM YOUTUBE VIDEO BEI 07:26 BRABBELT DER PANCONTINENTAL ETWAS VON 40 MILLIARDEN BARREL OIL IN PLACE DIE SO EIN SATURN TURBIDITE BEINHALTEN KÖNNTE WENN ER BIS ZUM SPILL VOLL MIT ÖL IST

keine Ahnung wie ich die Wartezeit von einem Jahr bis zur Bohrung überleben werden. Bei solchen Zahlen könnte man schon nervös werden...

ich denke der PCL Kurs kann konsolidieren oder weiter ansteigen wenn in den Galp/Sintana sowie Chevron/Sintana Nachbarblöcken weitere erfolgreiche Bohrungen abgeteuft werden und wenn die Pancontinental/Woodside/Sintana-Seismik fertig interpretiert ist für die Auswahl der Lokation für die Explorationsbohrung in dem riesengrossen Saturn Turbidite System. Dann kommt in einem Jahr (für mich eine gefühlte Ewigkeit) die Stunde der Wahrheit mit der ersten Saturn-Bohrung im Pancontinental/Sintan/Woodside Block. Es ist eine gefühlte Ewigkeit weil für diese erste Saturn-Bohrung für die jetzigen PCL Aktionäre (und auch Sintana Aktionäre) auf Grund der Größe des Prospekts ein game and life changer Potential besteht.

Für die Namibier ist auf Grund der bisherigen sensationellen Explorationserfolge im Oranje Basin die Tür für changing their life bereits aufgestossen.

Für die Namibier ist auf Grund der bisherigen sensationellen Explorationserfolge im Oranje Basin die Tür für changing their life bereits aufgestossen.

Why Namibia's Orange Basin is an oil haven for Pancontinental Energy

hier noch eine sehr gute Zusammenfassung über Namibia Offshore

https://zerogcos.substack.com/p/field-notes-introduction-to-…

https://zerogcos.substack.com/p/field-notes-introduction-to-…

danke Texas für dein unermüdlichen Informationsfluss. Ich hoffe es kommen bald Ergebnisse. Es nervt langsam.

bildlicher Flächenvergleich Mopane mit Saturn

BP and Eni strike deal to barrel into Namibia’s prolific Orange basin

https://www.upstreamonline.com/exploration/bp-and-eni-strike…

"BP and Eni have struck a deal to take an operating stake in a highly prospective exploration licence in Namibia's Orange basin close to Galp Energia's huge Mopane discovery and next door to acreage where Shell has made five discoveries. This move means that ExxonMobil is now the only supermajor absent from this exploration party that is happening in the prolific southern African hydrocarbon play.

Azule Energy, the 50:50 joint venture between BP and Eni which brings together their Angolan assets, has struck an agreement with privately owned Rhino Resources to enter Petroleum Exploration Licence 85 which covers Block 2914A. Once completed, the deal will see Azule take a 42.5% interest in the asset where the first of two high-impact exploration wells is set to spud this November. The transaction marks Azule’s first international deal. Azule chief executive Ardriano Mongini said: “Our entry into Namibia represents a significant milestone for Azule. This venture aligns with (our) visions of becoming a regional leader in energy exploration.”

Travis Smithard, Rhino’s chief executive added that the deal — the terms of which were not revealed — “sets the foundations for a new strategic partnership” between the two companies. He said the partnership aims to “accelerate exploration on the block, with the goal of developing the hydrocarbon potential in the shortest time frame possible”. Rhino currently holds an 85% stake in PEL 85 which will halve on completion of the farm-out deal. State-owned Namcor will retain a 10% interest, with local company Korres Investments on 5%.

The African Energy Chamber (AEC) — an energy advocacy group based in Johannesburg — said the deal gives Azule the option of becoming operator of PEL 85. NJ Ayuk, AEC’s executive chairman, said: ”This farm-in further confirms Namibia as one of the world’s most prospective, under-explored hot spots, with billions of barrels of oil yet to be found. “We still believe that there will be many more similar farm-in deals by companies holding exploration assets in this emerging country,” he added."

https://www.upstreamonline.com/exploration/bp-and-eni-strike…

"BP and Eni have struck a deal to take an operating stake in a highly prospective exploration licence in Namibia's Orange basin close to Galp Energia's huge Mopane discovery and next door to acreage where Shell has made five discoveries. This move means that ExxonMobil is now the only supermajor absent from this exploration party that is happening in the prolific southern African hydrocarbon play.

Azule Energy, the 50:50 joint venture between BP and Eni which brings together their Angolan assets, has struck an agreement with privately owned Rhino Resources to enter Petroleum Exploration Licence 85 which covers Block 2914A. Once completed, the deal will see Azule take a 42.5% interest in the asset where the first of two high-impact exploration wells is set to spud this November. The transaction marks Azule’s first international deal. Azule chief executive Ardriano Mongini said: “Our entry into Namibia represents a significant milestone for Azule. This venture aligns with (our) visions of becoming a regional leader in energy exploration.”

Travis Smithard, Rhino’s chief executive added that the deal — the terms of which were not revealed — “sets the foundations for a new strategic partnership” between the two companies. He said the partnership aims to “accelerate exploration on the block, with the goal of developing the hydrocarbon potential in the shortest time frame possible”. Rhino currently holds an 85% stake in PEL 85 which will halve on completion of the farm-out deal. State-owned Namcor will retain a 10% interest, with local company Korres Investments on 5%.

The African Energy Chamber (AEC) — an energy advocacy group based in Johannesburg — said the deal gives Azule the option of becoming operator of PEL 85. NJ Ayuk, AEC’s executive chairman, said: ”This farm-in further confirms Namibia as one of the world’s most prospective, under-explored hot spots, with billions of barrels of oil yet to be found. “We still believe that there will be many more similar farm-in deals by companies holding exploration assets in this emerging country,” he added."

Antwort auf Beitrag Nr.: 75.714.543 von Xulix am 01.05.24 17:01:10

die Infos auf dieser Seite sind falsch. PCL hat noch kein Öl gefunden weil sie noch nicht gebohrt haben. Erst einmal warten wir auf die Ergebnisse aus der 3 D Seismik Interpretation, die eigentlich schon überfällig sind. Und dann erst wird wahrscheinlich veröffentlicht wann in 2025 und wo PCL mit Woodside und Sintana im Saturn 1, 2 .. Bohrungen abteufen wird. Also noch ein wenig Geduld hier.

Zitat von Xulix: https://www.tipranks.com/news/company-announcements/pancontinental-energy-strikes-oil-in-namibia

die Infos auf dieser Seite sind falsch. PCL hat noch kein Öl gefunden weil sie noch nicht gebohrt haben. Erst einmal warten wir auf die Ergebnisse aus der 3 D Seismik Interpretation, die eigentlich schon überfällig sind. Und dann erst wird wahrscheinlich veröffentlicht wann in 2025 und wo PCL mit Woodside und Sintana im Saturn 1, 2 .. Bohrungen abteufen wird. Also noch ein wenig Geduld hier.