Hudson Resources bald Rare Earth Star? - 500 Beiträge pro Seite

eröffnet am 03.10.10 22:03:31 von

neuester Beitrag 12.05.12 19:53:45 von

neuester Beitrag 12.05.12 19:53:45 von

Beiträge: 37

ID: 1.160.266

ID: 1.160.266

Aufrufe heute: 0

Gesamt: 2.567

Gesamt: 2.567

Aktive User: 0

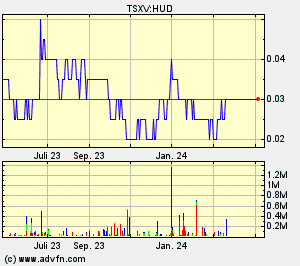

ISIN: CA03634T1049 · WKN: A4045G

0,0225

EUR

0,00 %

0,0000 EUR

Letzter Kurs 22:57:10 Lang & Schwarz

Neuigkeiten

19.03.24 · globenewswire |

01.06.23 · globenewswire |

Werte aus der Branche Sonstige Technologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 76,25 | +40,29 | |

| 10,420 | +14,63 | |

| 2,9600 | +12,55 | |

| 4,7700 | +11,71 | |

| 13,890 | +10,24 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,6000 | -7,02 | |

| 2,1101 | -7,45 | |

| 0,5060 | -8,33 | |

| 21,800 | -8,40 | |

| 0,8975 | -10,70 |

Hudson Resources

Website: http://www.hudsonresources.ca/home.asp

Firmenprofil http://www.hudsonresources.ca/files/HUD_SEPT_2010.pdf

SARFARTOQ RARE EARTH PROJECT

The Sarfartoq Carbonatite Complex is exposed over a large area, with approximate dimensions of 11 by 9 km. It is located near tidewater and adjacent to excellent potential hydroelectric sites.

Hudson has identified three high grade prospects, known as ST40, ST1 and ST19, all lying within the outer ring structure of the Sarfartoq Carbonatite. The outer ring structure is approximately 35km in circumference and remains largely unexplored.

Assay highlights of the 163 rock samples, taken from outcrop and sub-crop, include the following:

* Prospect ST40 assays averaged 3.6% TREO, including 1.8% neodymium oxide (Nd2O3) and 417ppm europium oxide (Eu2O3)

* Prospect ST19 assays averaged 2.5% TREO over the core of the anomaly

* 25% of all samples assayed between 1.0% and 8.9% TREO (5 samples assayed between 5.0% and 8.9% TREO)

* 50% of all samples returned anomalous REE assays (above 0.25% TREO)

A summary of the three primary target areas is as follows:

ST40 - is a well-defined radiometric anomaly measuring approximately 1000m by 250m. At the heart of the anomaly, nine sub-crop rock samples were collected within an area measuring 125m by 100m. Seven of the samples produced assays ranging from 2.5% to 5.3% TREO. The seven samples averaged 1.8% Nd2O3 (neodymium oxide) and 417ppm Eu2O3, (europium oxide), which are atypically high amounts for REE projects. The REE distribution of lanthanides for the seven sub-crop samples are: neodymium 46% > cerium 20% > praseodymium 8% > lanthanum 5%. The neodymium levels are highly elevated compared with typical levels of 10% to 15% found in other deposits.

Two rock samples located 1000m and 1400m west of ST40 (roughly half way between ST40 and ST1) averaged 0.9% TREO. These samples are intriguing because they also contain an average of 1.4% niobium oxide (Nb2O5). This area is predominantly under cover but warrants further exploration to determine potential continuity of mineralization between the two prospects. Niobium oxide currently trades for approximately US$25/kg.

ST1 - is a 1000m by 500m radiometric anomaly located 3km west of ST40. Both anomalies appear to be related and four samples taken between the two prospects yielded highly anomalous assays from 0.5% to 2.0% TREO. Within the ST1 anomaly, 49 individual widely spaced samples were collected. The TREO averaged 0.6%. Within a 250m by 150m sub-area, 15 samples averaged 1.0% TREO. The REE distribution is as follows: cerium 45% > neodymium 25% > lanthanum 15% > praseodymium 6%. The neodymium oxide proportion is twice the typical REE concentration, which is important since it is a more valuable REE mineral than either cerium or lanthanum.

A further six samples collected from abundant float in a creek bed at the centre of radiometric anomaly ST1 contained significant REE content with sample 16962 reporting the highest REE assay to date at 9.8% TREO.

ST19 - is located on the southern extension of the outer ring structure approximately 10km south of ST1 and ST40. It lies within a large radiometric anomaly approximately 2500m by 500m along a valley with excellent rock exposure. A 450m by 125m sub-area produced some of the highest REE assays of the program. The fifteen outcrop samples collected within this sub-area averaged 2.5% TREO. The best 6 samples averaged 5.4% TREO, including an average of 173ppm Eu2O3. The two highest samples from the program were found here. Located 110m apart, these samples contained 8.9% and 8.5% TREO. The REE distribution is as follows: cerium 47% > lanthanum 27% > neodymium 15% > praseodymium 5%.

About Neodymium:

One of the main uses of neodymium is in the production of neodymium-iron-boron super magnets, which are used in electric motors. As such, Neodymium is one of the more valuable rare earths, as it is a key component in motors for wind turbines, hybrid cars, and other green technologies. Neodymium oxide currently trades for approximately US$15/kg. Similarly, europium is amongst the least abundant of the rare-earth elements and is a critical component in flat panel display technology. Europium oxide currently trades for around US$500/kg.

Demand for neodymium has risen sharply with the growth in hybrid car production and power generation including wind turbines. Hybrid cars such as the Prius require 20 kilograms of REE. China recently announced a target of 100 gigawatts (100,000 megawatts) of wind power capacity by 2020. The most efficient turbines require approximately 1,000 kg of neodymium for each megawatt. China currently has about 12 gigawatt of capacity. This suggests substantial neodymium supplies will be required to meet ChinaÕs targets, let alone the rest of the world. Currently, over 95% of the global supply of REEs currently comes from China where exports are decreasing due to internal demand. As a result, end users are looking for alternative sources outside of China of which there are few.

Sarfartoq Project Historical Niobium Work

The Sarfartoq Project was initially explored by previous license holders for niobium. The niobium and tantalum pentoxides, are typically associated with the mineral pyrochlore. Historical reports filed with the Government of Greenland (all non NI43-101 compliant) include a trench grading 14.4% Nb2O5 over 200m and a diamond drill hole averaging 12.13% Nb2O5 over 20m starting near surface. In 2008, Hudson collected 2 large samples (approx. 15kg) of pyrochlore rich material from the location and recovered and average of 36.0% Nb2O3, 1.1% U3O8, and 0.7% Ta2O5. Uranium is directly associated with the niobium in the pyrochlore and is an effective prospecting tool used to identify other occurrences on the project area.

Hudson acquired all of the previous work on the project carried out by the previous owner, New Millennium Resources NL (ÒNew MillenniumÓ). New Millennium spent in excess of US$5 million evaluating the project and was advancing the niobium deposit to feasibility. Previous work, which only focused on the recovery of niobium from a single pod of pyrochlore mineralization, included advanced studies on mining and processing the niobium deposit. Bench-scale metallurgical test work, completed by Curtin University of Technology, Perth, Australia (2002-2003), demonstrated that recoveries of over 95% for niobium and uranium are achievable utilizing solvent extraction.

Niobium, which is corrosion resistant and has superconducting properties, is primarily used in the production of high-grade structural steel. Adding four dollars worth of niobium (less than half a kilogram) to a car frame will reduce the overall weight by 100 Kg due to its strengthening properties

GARNET LAKE DIAMOND PROJECT

Hudson Resources is the leader in diamond exploration in Greenland. Hudson has discovered an exciting diamond bearing kimberlite dike at Garnet Lake in Western Greenland. The Garnet Lake project is readily accessible and is located close to an international airport and is only 15km from tide-water providing the potential for cost effective, all season access. The site also has exceptional opportunities for hydroelectric power production.

Hudsons' licenses have the right ingredients for finding world class diamond mines including: highly diamondiferous kimberlite; a geotherm which is as cold or colder than that found in the Lac de Gras region (which hosts the Diavik, Ekati and Snap Lake mines); and a superior Kimberlite Indicator Mineral (KIM) data set with high concentrations of G10D and eclogitic garnets suggesting multiple highly diamondiferous sources exist.

In 2007 Hudson constructed a Dense Media Separation (DMS) plant on site at Garnet Lake to allow for the extraction and evaluation of large samples from the Garnet Lake dike and other diamond discoveries in the area.

The Garnet Lake kimberlite dike has produced numerous high quality, large diamonds from a series of bulk samples conducted between 2006-2008. The dike, which averages 2.5m in thickness, has been delineated over a strike length of 1.2 km and down-dip to 2.0 km.

Significant exploration activities were completed in 2008 which including the processing of 560 tonnes of Garnet Lake dike kimberlite through the on-site DMS plant and 4,000 meters of exploration drilling. Results of the bulk sample are expected before the end of the year. The 2008 program also extended the known strike-length of the Garnet Lake dike by 700 meters to over 2,000 meters, further demonstrating the excellent potential for sufficient tonnage to support an economic project. Drilling of targets outside of Garnet Lake successfully intercepted kimberlite in 12 of 15 drill holes.

Hudson is conducting a scaled down diamond program in 2009 to reflect the current health of the diamond market. The company has collected a 350kg sample, which will be sent to Canada for liberation testwork utilizing High Pressure Grinding Rolls (HPGR). Hudson hopes to be back on target to continue with the evaluation of the Garnet Lake dike in 2010, including the potential extraction of a larger bulk sample to allow the project to advance to the prefeasibility stage.

2008 Bulk Sample Program The 2008 bulk sample program processed 499 dry tonnes of kimberlite through the CompanyÕs on-site DMS plant and yielded 78.26 carats. There were 23 diamonds in the 0.25 to 1.0 carat range, including an exceptional 0.95 carat amber coloured diamond. A high proportion of the diamonds recovered were high quality, inclusion free stones. The program was successful in liberating 80% more stones in the 0.10 to 0.25 carat range than in the 2007 sample. To date, over 108 carats have been recovered from the dike. This sample continues to demonstrate a coarse diamond distribution that suggests larger stones are likely to be found with larger sample sizes.

Website: http://www.hudsonresources.ca/home.asp

Firmenprofil http://www.hudsonresources.ca/files/HUD_SEPT_2010.pdf

SARFARTOQ RARE EARTH PROJECT

The Sarfartoq Carbonatite Complex is exposed over a large area, with approximate dimensions of 11 by 9 km. It is located near tidewater and adjacent to excellent potential hydroelectric sites.

Hudson has identified three high grade prospects, known as ST40, ST1 and ST19, all lying within the outer ring structure of the Sarfartoq Carbonatite. The outer ring structure is approximately 35km in circumference and remains largely unexplored.

Assay highlights of the 163 rock samples, taken from outcrop and sub-crop, include the following:

* Prospect ST40 assays averaged 3.6% TREO, including 1.8% neodymium oxide (Nd2O3) and 417ppm europium oxide (Eu2O3)

* Prospect ST19 assays averaged 2.5% TREO over the core of the anomaly

* 25% of all samples assayed between 1.0% and 8.9% TREO (5 samples assayed between 5.0% and 8.9% TREO)

* 50% of all samples returned anomalous REE assays (above 0.25% TREO)

A summary of the three primary target areas is as follows:

ST40 - is a well-defined radiometric anomaly measuring approximately 1000m by 250m. At the heart of the anomaly, nine sub-crop rock samples were collected within an area measuring 125m by 100m. Seven of the samples produced assays ranging from 2.5% to 5.3% TREO. The seven samples averaged 1.8% Nd2O3 (neodymium oxide) and 417ppm Eu2O3, (europium oxide), which are atypically high amounts for REE projects. The REE distribution of lanthanides for the seven sub-crop samples are: neodymium 46% > cerium 20% > praseodymium 8% > lanthanum 5%. The neodymium levels are highly elevated compared with typical levels of 10% to 15% found in other deposits.

Two rock samples located 1000m and 1400m west of ST40 (roughly half way between ST40 and ST1) averaged 0.9% TREO. These samples are intriguing because they also contain an average of 1.4% niobium oxide (Nb2O5). This area is predominantly under cover but warrants further exploration to determine potential continuity of mineralization between the two prospects. Niobium oxide currently trades for approximately US$25/kg.

ST1 - is a 1000m by 500m radiometric anomaly located 3km west of ST40. Both anomalies appear to be related and four samples taken between the two prospects yielded highly anomalous assays from 0.5% to 2.0% TREO. Within the ST1 anomaly, 49 individual widely spaced samples were collected. The TREO averaged 0.6%. Within a 250m by 150m sub-area, 15 samples averaged 1.0% TREO. The REE distribution is as follows: cerium 45% > neodymium 25% > lanthanum 15% > praseodymium 6%. The neodymium oxide proportion is twice the typical REE concentration, which is important since it is a more valuable REE mineral than either cerium or lanthanum.

A further six samples collected from abundant float in a creek bed at the centre of radiometric anomaly ST1 contained significant REE content with sample 16962 reporting the highest REE assay to date at 9.8% TREO.

ST19 - is located on the southern extension of the outer ring structure approximately 10km south of ST1 and ST40. It lies within a large radiometric anomaly approximately 2500m by 500m along a valley with excellent rock exposure. A 450m by 125m sub-area produced some of the highest REE assays of the program. The fifteen outcrop samples collected within this sub-area averaged 2.5% TREO. The best 6 samples averaged 5.4% TREO, including an average of 173ppm Eu2O3. The two highest samples from the program were found here. Located 110m apart, these samples contained 8.9% and 8.5% TREO. The REE distribution is as follows: cerium 47% > lanthanum 27% > neodymium 15% > praseodymium 5%.

About Neodymium:

One of the main uses of neodymium is in the production of neodymium-iron-boron super magnets, which are used in electric motors. As such, Neodymium is one of the more valuable rare earths, as it is a key component in motors for wind turbines, hybrid cars, and other green technologies. Neodymium oxide currently trades for approximately US$15/kg. Similarly, europium is amongst the least abundant of the rare-earth elements and is a critical component in flat panel display technology. Europium oxide currently trades for around US$500/kg.

Demand for neodymium has risen sharply with the growth in hybrid car production and power generation including wind turbines. Hybrid cars such as the Prius require 20 kilograms of REE. China recently announced a target of 100 gigawatts (100,000 megawatts) of wind power capacity by 2020. The most efficient turbines require approximately 1,000 kg of neodymium for each megawatt. China currently has about 12 gigawatt of capacity. This suggests substantial neodymium supplies will be required to meet ChinaÕs targets, let alone the rest of the world. Currently, over 95% of the global supply of REEs currently comes from China where exports are decreasing due to internal demand. As a result, end users are looking for alternative sources outside of China of which there are few.

Sarfartoq Project Historical Niobium Work

The Sarfartoq Project was initially explored by previous license holders for niobium. The niobium and tantalum pentoxides, are typically associated with the mineral pyrochlore. Historical reports filed with the Government of Greenland (all non NI43-101 compliant) include a trench grading 14.4% Nb2O5 over 200m and a diamond drill hole averaging 12.13% Nb2O5 over 20m starting near surface. In 2008, Hudson collected 2 large samples (approx. 15kg) of pyrochlore rich material from the location and recovered and average of 36.0% Nb2O3, 1.1% U3O8, and 0.7% Ta2O5. Uranium is directly associated with the niobium in the pyrochlore and is an effective prospecting tool used to identify other occurrences on the project area.

Hudson acquired all of the previous work on the project carried out by the previous owner, New Millennium Resources NL (ÒNew MillenniumÓ). New Millennium spent in excess of US$5 million evaluating the project and was advancing the niobium deposit to feasibility. Previous work, which only focused on the recovery of niobium from a single pod of pyrochlore mineralization, included advanced studies on mining and processing the niobium deposit. Bench-scale metallurgical test work, completed by Curtin University of Technology, Perth, Australia (2002-2003), demonstrated that recoveries of over 95% for niobium and uranium are achievable utilizing solvent extraction.

Niobium, which is corrosion resistant and has superconducting properties, is primarily used in the production of high-grade structural steel. Adding four dollars worth of niobium (less than half a kilogram) to a car frame will reduce the overall weight by 100 Kg due to its strengthening properties

GARNET LAKE DIAMOND PROJECT

Hudson Resources is the leader in diamond exploration in Greenland. Hudson has discovered an exciting diamond bearing kimberlite dike at Garnet Lake in Western Greenland. The Garnet Lake project is readily accessible and is located close to an international airport and is only 15km from tide-water providing the potential for cost effective, all season access. The site also has exceptional opportunities for hydroelectric power production.

Hudsons' licenses have the right ingredients for finding world class diamond mines including: highly diamondiferous kimberlite; a geotherm which is as cold or colder than that found in the Lac de Gras region (which hosts the Diavik, Ekati and Snap Lake mines); and a superior Kimberlite Indicator Mineral (KIM) data set with high concentrations of G10D and eclogitic garnets suggesting multiple highly diamondiferous sources exist.

In 2007 Hudson constructed a Dense Media Separation (DMS) plant on site at Garnet Lake to allow for the extraction and evaluation of large samples from the Garnet Lake dike and other diamond discoveries in the area.

The Garnet Lake kimberlite dike has produced numerous high quality, large diamonds from a series of bulk samples conducted between 2006-2008. The dike, which averages 2.5m in thickness, has been delineated over a strike length of 1.2 km and down-dip to 2.0 km.

Significant exploration activities were completed in 2008 which including the processing of 560 tonnes of Garnet Lake dike kimberlite through the on-site DMS plant and 4,000 meters of exploration drilling. Results of the bulk sample are expected before the end of the year. The 2008 program also extended the known strike-length of the Garnet Lake dike by 700 meters to over 2,000 meters, further demonstrating the excellent potential for sufficient tonnage to support an economic project. Drilling of targets outside of Garnet Lake successfully intercepted kimberlite in 12 of 15 drill holes.

Hudson is conducting a scaled down diamond program in 2009 to reflect the current health of the diamond market. The company has collected a 350kg sample, which will be sent to Canada for liberation testwork utilizing High Pressure Grinding Rolls (HPGR). Hudson hopes to be back on target to continue with the evaluation of the Garnet Lake dike in 2010, including the potential extraction of a larger bulk sample to allow the project to advance to the prefeasibility stage.

2008 Bulk Sample Program The 2008 bulk sample program processed 499 dry tonnes of kimberlite through the CompanyÕs on-site DMS plant and yielded 78.26 carats. There were 23 diamonds in the 0.25 to 1.0 carat range, including an exceptional 0.95 carat amber coloured diamond. A high proportion of the diamonds recovered were high quality, inclusion free stones. The program was successful in liberating 80% more stones in the 0.10 to 0.25 carat range than in the 2007 sample. To date, over 108 carats have been recovered from the dike. This sample continues to demonstrate a coarse diamond distribution that suggests larger stones are likely to be found with larger sample sizes.

Hallo WissenMacht,

anbei ein Artikel aus Übersee, wo HUD.V auch erwähnt wird:

Rare Earth Stock Poised to Make a Run

September 13, 2010

Matthew B. Smith

The world has finally awoken to the dire situation it faces with the shrinking supply of rare earths with no quick, easy fixes to boost production in the immediate near-term. It is a daunting task indeed for countries such as the United States and its European brethren who figured they would be able to build tomorrow’s devices with yesterday’s low rare earth prices. Ironically, tomorrow’s energy plans for the wind turbines and electric cars to create ‘green energy economies’ could simply turn out to be a pipe dream as China appears more and more reluctant to export their rare earths abroad at any price.

It has always been our view of the world that from time to time certain situations tilt from one extreme to another, generally spending the majority of the time somewhere in between. Over the last decade or two America has exported its idea of free trade and capitalism, creating harsh competition among producers which drove down prices as everything became streamlined. Now China is assuming its rightful place among the world’s leading economies and is doing what all the previous world powers did to assume their massive power, assembling supply of resources to fuel their future growth. In the past, the British used their colonies to supply them with the necessary resources, America was blessed with everything needed within their massive landmass until after the second world war when growth really exploded. Going further back even the Romans imported the resources they needed to expand their economy, using massive road networks and aqueducts to get what they needed.

This brings us to our main point, in the next few years, as rare earths are understood to be the key to future technology and regarded as a necessity to fuel future economic growth as well as build the defense systems needed to protect that economy, economics of projects will matter less and less. It is our opinion that countries will want to have production to build stockpiles, much like the period that existed prior to globalization and free trade created the just-in-time delivery system which enabled most to liquidate their strategic stockpiles. Our guess is that countries will provide cheap financing or grant funding in order to get these resources to their manufacturing sectors, not to mention that a mine is an excellent provider of well paying jobs. Another idea is that we could see European countries along with America and Canada changing laws in order to accommodate these projects for their valuable production, which could be a trend already started.

North America has many companies with promising REE projects, Europe much less so. Obviously Greenland has Greenland Minerals & Energy with their massive rare earths and uranium project and Sweden has Tasman Metals with their Norra Karr project, but after that the project pipeline is pretty thin. The company we view as the most undervalued in the entire European sector, as far as those who actually have drill results confirming mineralization on their properties but no calculated resource yet, is Hudson Resources Ltd. (HUD – Toronto Venture, HUDRF – OTC). The stock has languished due to concerns about the Greenland government not allowing Greenland Minerals and Energy to mine their project due to the radioactive by-product that would be present, uranium. This past week the government of Greenland announced that GGG could proceed with the development of their project through the feasibility phase of the project. The country will make its decisions on a project-by-project basis, but in our opinion Hudson’s Sarfartoq project is less of a risk of getting the ax than was Greenland’s.

Across the rare earth spectrum many of the stocks are now at 52-week highs having either recently set them or run right back up to where they had been. Hudson however has been a languisher. In our opinion Hudson presents the most compelling value play among those currently drilling and trying to prove up an economical resource. The stock is trading 55% off of its 52-week high of C$1.67 set back on December 31, 2009. The Greenland government’s decision sent the shares up 19%, but if one looks around the industry, it would be hard to find a more undervalued company on the same level as Hudson.

The drilling results for Hudson have been quite impressive with the company reporting Quest-like drill intercepts. For the 2010 drilling campaign the company has already finished and reported Phase I, and Phase II started on August 17. Phase II, according to the company, should, “include approximately 2,000m of drilling on existing and new targets.”

The company’s ST1 Zone at this point has the best chance of making Sarfartoq the company maker that we think it is. The area has returned monster intersections with drill holes SAR09-04, SAR09-05, SAR10-08, SAR10-13, SAR10-15, SAR10-16 and SAR10-17 all returning over 100m of 1% TREO or better, with SAR10-08 and SAR10-13 reporting over 300m of those intersection grades. The company reported in its August 12th press release that they have a high distribution of neodymium which averages 20% of TREO in the drill intercepts at the ST1 Zone to date, with additional significant niobium (up to 0.56% Nb205).

This project is huge in scale and the company has drill tested two other sections, ST40 and ST19. The potential exists where mineralization could exist between the ST1 Zone and the ST40 Zone according to one of the company’s consulting geologists.

Metallurgical work will also commence in the last quarter of 2010, and those results should give investors a better idea of what they are working with. Also of interest to investors is that the project is near infrastructure currently in place, or that will be in place within the next few years. This infrastructure would have the potential to significantly drive down the costs of any future production should the company’s continued exploration efforts prove up a large resource.

From our analysis of the company and its prospects we believe from these levels that the company could see an increase in its near-term share price of 50%. Positive drill results or newfound support and/or sponsorship in the investment community could push shares higher than this estimate. With Greenland’s new ruling on atomic by-products Hudson Resources is a company that could catch many investors’ attention in the months ahead.

http://www.theinvestar.com/articles/2010_09_13.htm

Ich bin mal wieder drin, nach einem kleinen Ausflug in MHM

Gruß Charly

anbei ein Artikel aus Übersee, wo HUD.V auch erwähnt wird:

Rare Earth Stock Poised to Make a Run

September 13, 2010

Matthew B. Smith

The world has finally awoken to the dire situation it faces with the shrinking supply of rare earths with no quick, easy fixes to boost production in the immediate near-term. It is a daunting task indeed for countries such as the United States and its European brethren who figured they would be able to build tomorrow’s devices with yesterday’s low rare earth prices. Ironically, tomorrow’s energy plans for the wind turbines and electric cars to create ‘green energy economies’ could simply turn out to be a pipe dream as China appears more and more reluctant to export their rare earths abroad at any price.

It has always been our view of the world that from time to time certain situations tilt from one extreme to another, generally spending the majority of the time somewhere in between. Over the last decade or two America has exported its idea of free trade and capitalism, creating harsh competition among producers which drove down prices as everything became streamlined. Now China is assuming its rightful place among the world’s leading economies and is doing what all the previous world powers did to assume their massive power, assembling supply of resources to fuel their future growth. In the past, the British used their colonies to supply them with the necessary resources, America was blessed with everything needed within their massive landmass until after the second world war when growth really exploded. Going further back even the Romans imported the resources they needed to expand their economy, using massive road networks and aqueducts to get what they needed.

This brings us to our main point, in the next few years, as rare earths are understood to be the key to future technology and regarded as a necessity to fuel future economic growth as well as build the defense systems needed to protect that economy, economics of projects will matter less and less. It is our opinion that countries will want to have production to build stockpiles, much like the period that existed prior to globalization and free trade created the just-in-time delivery system which enabled most to liquidate their strategic stockpiles. Our guess is that countries will provide cheap financing or grant funding in order to get these resources to their manufacturing sectors, not to mention that a mine is an excellent provider of well paying jobs. Another idea is that we could see European countries along with America and Canada changing laws in order to accommodate these projects for their valuable production, which could be a trend already started.

North America has many companies with promising REE projects, Europe much less so. Obviously Greenland has Greenland Minerals & Energy with their massive rare earths and uranium project and Sweden has Tasman Metals with their Norra Karr project, but after that the project pipeline is pretty thin. The company we view as the most undervalued in the entire European sector, as far as those who actually have drill results confirming mineralization on their properties but no calculated resource yet, is Hudson Resources Ltd. (HUD – Toronto Venture, HUDRF – OTC). The stock has languished due to concerns about the Greenland government not allowing Greenland Minerals and Energy to mine their project due to the radioactive by-product that would be present, uranium. This past week the government of Greenland announced that GGG could proceed with the development of their project through the feasibility phase of the project. The country will make its decisions on a project-by-project basis, but in our opinion Hudson’s Sarfartoq project is less of a risk of getting the ax than was Greenland’s.

Across the rare earth spectrum many of the stocks are now at 52-week highs having either recently set them or run right back up to where they had been. Hudson however has been a languisher. In our opinion Hudson presents the most compelling value play among those currently drilling and trying to prove up an economical resource. The stock is trading 55% off of its 52-week high of C$1.67 set back on December 31, 2009. The Greenland government’s decision sent the shares up 19%, but if one looks around the industry, it would be hard to find a more undervalued company on the same level as Hudson.

The drilling results for Hudson have been quite impressive with the company reporting Quest-like drill intercepts. For the 2010 drilling campaign the company has already finished and reported Phase I, and Phase II started on August 17. Phase II, according to the company, should, “include approximately 2,000m of drilling on existing and new targets.”

The company’s ST1 Zone at this point has the best chance of making Sarfartoq the company maker that we think it is. The area has returned monster intersections with drill holes SAR09-04, SAR09-05, SAR10-08, SAR10-13, SAR10-15, SAR10-16 and SAR10-17 all returning over 100m of 1% TREO or better, with SAR10-08 and SAR10-13 reporting over 300m of those intersection grades. The company reported in its August 12th press release that they have a high distribution of neodymium which averages 20% of TREO in the drill intercepts at the ST1 Zone to date, with additional significant niobium (up to 0.56% Nb205).

This project is huge in scale and the company has drill tested two other sections, ST40 and ST19. The potential exists where mineralization could exist between the ST1 Zone and the ST40 Zone according to one of the company’s consulting geologists.

Metallurgical work will also commence in the last quarter of 2010, and those results should give investors a better idea of what they are working with. Also of interest to investors is that the project is near infrastructure currently in place, or that will be in place within the next few years. This infrastructure would have the potential to significantly drive down the costs of any future production should the company’s continued exploration efforts prove up a large resource.

From our analysis of the company and its prospects we believe from these levels that the company could see an increase in its near-term share price of 50%. Positive drill results or newfound support and/or sponsorship in the investment community could push shares higher than this estimate. With Greenland’s new ruling on atomic by-products Hudson Resources is a company that could catch many investors’ attention in the months ahead.

http://www.theinvestar.com/articles/2010_09_13.htm

Ich bin mal wieder drin, nach einem kleinen Ausflug in MHM

Gruß Charly

Auch das Orderbuch macht eine guten Eindruck:

http://www.tmx.com/HttpController?GetPage=DelayedMarketByPri…

Die Bid Seite ist im Verhältnis 2 : 1 zur ASK Seite

Da Wissen ein paar Leute Etwas

http://www.tmx.com/HttpController?GetPage=DelayedMarketByPri…

Die Bid Seite ist im Verhältnis 2 : 1 zur ASK Seite

Da Wissen ein paar Leute Etwas

Antwort auf Beitrag Nr.: 40.256.753 von WissenMacht am 03.10.10 22:03:31Bohrergebnisse kommen Ende Oktober! Kleine Position macht auch vorher schon Sinn.

denke ich auch wir haben da noch ein gap zu schliessen.

Guten Morgen,

nach Betrachtung der "Technik" im Vergleich zu unseren anderen bekannten REE Werten wie

Tsm.V oder Res.V

sind wir ein Wert mit enorm viel Nachholpotential.

Die Beiden oben genannten Werte liegen bei ca. 100 - 120 % über der 200 Tages Linie.

Hud.V wäre im Vergleich zu den beiden Vorgenannten bei ca. 1.50 CAD !! zu gestern 0,81 CAD noch enormes Kurspotenzial.

Sich zu Positionieren ist nicht verkehrt. Zumal in den Hausephasen wenn die bekanntesten Werte "gelaufen" sind sich die Werte in der 2. Reihe angesehen werden.

Gruß Charly

nach Betrachtung der "Technik" im Vergleich zu unseren anderen bekannten REE Werten wie

Tsm.V oder Res.V

sind wir ein Wert mit enorm viel Nachholpotential.

Die Beiden oben genannten Werte liegen bei ca. 100 - 120 % über der 200 Tages Linie.

Hud.V wäre im Vergleich zu den beiden Vorgenannten bei ca. 1.50 CAD !! zu gestern 0,81 CAD noch enormes Kurspotenzial.

Sich zu Positionieren ist nicht verkehrt. Zumal in den Hausephasen wenn die bekanntesten Werte "gelaufen" sind sich die Werte in der 2. Reihe angesehen werden.

Gruß Charly

Antwort auf Beitrag Nr.: 40.263.499 von charly31 am 05.10.10 08:43:53Desweiteren wird bei 0,80 - 0,81 das Orderbuch momentan immer wieder aufgefüllt.

Das Verhältnis Käufer & Verkäufer im Orderbuch liegt 2:1 für die Käuferseite.

Vergleichswerte sehen momentan wesentlich schlechter aus..

Das Verhältnis Käufer & Verkäufer im Orderbuch liegt 2:1 für die Käuferseite.

Vergleichswerte sehen momentan wesentlich schlechter aus..

1,13

+18,95 %

+0,180

+18,95 %

+0,180

1,17

1,43

schöner anstieg

schöner anstieg

1,55

2.000 +0,130

+9,15

2.000 +0,130

+9,15

Nur zur Info: Bin ab heute auch dabei .. interessante Bereicherung für meinen ganz privaten Rare earth-Basket ... ;-)

welcome

Antwort auf Beitrag Nr.: 40.456.357 von MONSIEURCB am 04.11.10 17:55:51glückwunsch gutes timing

1,52

+31,03 %

1,52

+31,03 %

thanks!

Soviel zum Thema gutes Timing ... und schon geht's in CA wieder runter, mit großem Volumen ... ich kann keinen Grund dafür erkennen - außer viell. allgemeine Unsicherheit wegen der Abstimmung in Grönland am 10.11.?

Tja, scheine D O C H einen genialen Einstiegspunkt erwischt zu haben ,,,, ;-)

http://finance.yahoo.com/q?s=HUD.V

...aber langsam krieg ich Muffensausen - bin mit Hudson, Greenland und Ram gleich 3-fach in Grönland investiert .... und übermorgen ist die große, eventuell zukunftsentscheidende Abstimmung ...

http://finance.yahoo.com/q?s=HUD.V

...aber langsam krieg ich Muffensausen - bin mit Hudson, Greenland und Ram gleich 3-fach in Grönland investiert .... und übermorgen ist die große, eventuell zukunftsentscheidende Abstimmung ...

Das dürfte den Kurs WEITER hoch treiben...

http://finance.yahoo.com/news/Hudson-Discovers-New-High-ccn-…

http://finance.yahoo.com/news/Hudson-Discovers-New-High-ccn-…

gute ergebnisse. hudson hat noch einiges an potenzial.

goldpreis war ja auch unter druck.

aber das hat sich wieder gelegt

goldpreis war ja auch unter druck.

aber das hat sich wieder gelegt

hält sich recht gut bei dem marktumfeld.

Hi...

Leute warum so wenig los im Thread

...bin doch bei Euch

....solange es ruhig dahergeht

gönnen wir der Aktie einen guten Lauf.

Intraday

Glück auf,

Metallix

Ps.

Machen wir uns zu 3 Euronen als Kurswert auf in 2011

Leute warum so wenig los im Thread

...bin doch bei Euch

....solange es ruhig dahergeht

gönnen wir der Aktie einen guten Lauf.

Intraday

Glück auf,

Metallix

Ps.

Machen wir uns zu 3 Euronen als Kurswert auf in 2011

ruhig ist immer gut

Antwort auf Beitrag Nr.: 40.781.659 von WissenMacht am 30.12.10 23:45:17Du sagst es.....aber ein bischen mehr Leute könnten es schon sein.

vielleicht werden wir ja noch ein paar mehr wenn wir die 2 Euro erreichen....

Einen Guten Rutsch,

wünscht All ,

Metallix

vielleicht werden wir ja noch ein paar mehr wenn wir die 2 Euro erreichen....

Einen Guten Rutsch,

wünscht All ,

Metallix

Heute in CA still und heimlich +13 % ... news im Anmarsch???

kann sein. denke eher das die unterbewertung langsam vom markt erkannt wird

Investoren Präsentation vom 10.1.11

http://www.abnnewswire.net/media/en/docs/64955-ASX-HRS-62030…

http://www.abnnewswire.net/media/en/docs/64955-ASX-HRS-62030…

oooops?!

Die Company zeiht den Schwanz ein ..

womöglich morgen sell-off in CA?

http://finance.yahoo.com/news/Hudson-Clarifies-Continuous-cc…

Die Company zeiht den Schwanz ein ..

womöglich morgen sell-off in CA?

http://finance.yahoo.com/news/Hudson-Clarifies-Continuous-cc…

Antwort auf Beitrag Nr.: 41.079.608 von MONSIEURCB am 21.02.11 20:06:15mal sehen...

metallix

metallix

Schon lange keine news ... und der Kurs bröckelt zusehends ab .. weiß jemand, was sich im Hintergrund tut? Vermutlich NIX ... ;-<<

ich glaub das ding ist tot. Da mag noch soviel in der Tiefe liegen. Die Förderung ist zu teuer und im Übrigen liegt ganz in der Nähe das Naturschutzgebiet Paradisdalen. Da wird nie etwas wie eine Straße o.ä. durchgehen.

Grönland kann sich ein vielleicht zwei größere Minenprojekte leisten. Mehr qualifiziertes Personal gibt es gar nicht in Grönland. Aus meiner Sicht wird das am ehesten das im Süden gelegene Projekt von ggg sein.

kingreo

Grönland kann sich ein vielleicht zwei größere Minenprojekte leisten. Mehr qualifiziertes Personal gibt es gar nicht in Grönland. Aus meiner Sicht wird das am ehesten das im Süden gelegene Projekt von ggg sein.

kingreo

Hudson 5 Tonne Bulk Metallurgical Surface Sample Grades 2.5% TREO-Sarfartoq Rare Earth Project, Greenland

VANCOUVER, BRITISH COLUMBIA -- (Marketwire) -- 01/10/12 -- HUDSON RESOURCES INC. (the "Company") - (TSX VENTURE:HUD)(OTCQX:HUDRF) is pleased to announce that assays from a five tonne bulk metallurgical sample, collected on surface at the ST1 Zone, graded 2.5% Total Rare Earth Oxides (TREO). Neodymium oxide averaged 20% of total REO's.

James Tuer, Hudson's President, stated, "The extraction of the five tonne metallurgical sample is very exciting for several reasons. Firstly, it confirms the presence of a significant amount of high-grade rare earth material at surface. Secondly, and possibly more importantly, it provides a sufficient quantity of material for us to take the metallurgy through to pilot scale testing. This sample will be incorporated into our updated resource model which we expect to have out in the first quarter of 2012."

"As well, mineralogical studies conducted on the bulk sample have confirmed that the rare earths are hosted within a distinct "red" ankerite mineral in the ST1 body which contains bastnaesite and monazite REEs. Our metallurgical studies are focused on defining a process to extract these common rare earth bearing minerals from the bulk material."

AVERAGE TOTAL RARE EARTH OXIDES (PARTS PER MILLION)

-------------------------------------------------------------------

TREO La2O3 Ce2O3 Pr2O3 Nd2O3 Sm2O3 Eu2O3 Gd2O3

-------------------------------------------------------------------

24,979 5,153 12,585 1,464 5,055 407 82 110

-------------------------------------------------------------------

Tb2O3 Dy2O3 Ho2O3 Er2O3 Tm2O3 Yb203 Lu2O3 Y2O3

-------------------------------------------------------------------

10.4 36.6 3.2 1.3 0.3 0.6 0.2 69.8

-------------------------------------------------------------------

The sample was randomly bagged in the field and approximately 700kg was shipped by air to the GeoAnalytical Laboratories of the Saskatchewan Research Council (SRC) in Saskatoon, Saskatchewan. The balance of the sample was sent by ground and has now been received by the SRC. The initial 700kg sample was crushed and blended by the SRC and four separate samples assayed by lithium meteborate fusion, followed by dissolution in dilute HNO3 and ICP-MS analysis. A portion of the bulk sample material was shipped to Ancaster Ontario for processing at Activation Laboratories Ltd. (Actlabs) using lithium borate fusion, acid dissolution and ICP-MS analysis. Actlabs processed two separate assays. The results presented in this press release represent the average of the results from the two labs.

Metallurgical testwork of the ST1 Zone material is ongoing at Hazen Research in Colorado, and the Saskatchewan Research Council (SRC) in Saskatoon. Both SRC and Hazen are conducting flotation tests. The entire metallurgical program is being directed by Dr. John Goode who has more than 40 years experience in rare earth and resource projects.

Recent metallurgical testwork from SRC has demonstrated successful extraction of rare earths utilizing acid baking and leaching. Test work showed that two hours of baking, at 220 degrees C and approximately one tonne of acid per tonne of mineralized feed (concentrate) recovers 94% of the TREO.

Magnetic testwork and mineralogical studies are ongoing under the direction of Dr. Peter LeCouteur, P.Eng. With respect to the bulk sample, three hand specimens were examined microscopically with the objective of quantifying the rare earth element (REE) minerals present in the material. Samples were examined in polished thin section by light microscope and minerals of interest analyzed on an AMRAY 1810 scanning electron microscope ("SEM") equipped with an EDAX "Genesis" energy dispersive X-ray analyzer ("EDX" analyses). Key findings are as follows:

-- The 2011 Safartoq bulk sample is a slightly oxidized surface sample of

ferrocarbonatite of the "ST1 Zone" and consists mostly of Ca-Mg-Fe

carbonates.

-- The only REE minerals identified in the bulk sample are: REE phosphate

monazite-(Ce), REE fluorocarbonate bastnasite-(Ce), and Ca

fluorocarbonate synchysite-(Ce)

-- The proportion of the three REE minerals varies from sample to sample

but overall it is estimated that about 50-70% of the REE are carried by

monazite, 30-50 % by bastnasite, and less than 5% by synchysite.

-- The hematized "red" ankerite contains +95% of the rare earth minerals

and is distinct in colour from the other minerals present as it is

pigmented with iron oxide.

-- About 90% of REE particles fall in a size range of 10 to 300 microns in

length. All the REE minerals occur as fine-grained single crystals that

range from about 5 microns to 80 microns long and as shapeless

aggregates of such crystals that are generally from 50 to 500 microns

across but occasionally up to 1 mm across.

Sarfartoq Project Background

Hudson recently released the results of a Preliminary Economic Assessment (PEA) completed by Wardrop, A Tetra Tech Company (Tetra Tech). Their Study shows a Net Present Value of $616M and an Internal Rate of Return of 31.2 % with a 2.7 year pay-back period. The Study was based on the Company's 43-101 compliant inferred resource of 14.1Mt at 1.5% TREO at the ST1 Zone. The ST1 Zone represents one of the industry's highest ratios of neodymium and praseodymium to TREO, totaling 25%, based on the inferred resource. It contains over 40 million kilograms of neodymium oxide, which is the key component in permanent magnets and the fastest growth sector of the rare earths industry. A total 16,514m over 71 holes were drilled in 2011 and these results have not yet been incorporated into either the resource estimate or the PEA.

The Sarfartoq REE project is located within 20 km of tidewater and only 60 km from Greenland's international airport. The project is owned 100% by Hudson. The Company is currently well financed with approximately $12.5 million in working capital.

Dr. Michael Druecker is a qualified person as defined by National Instrument 43-101 and reviewed the preparation of the scientific and technical information in this press release.

ON BEHALF OF THE BOARD OF DIRECTORS

James Tuer, President

Forward-Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this news release, including, without limitation, statements regarding plans for the completion of a financing and the intended terms and use of proceeds thereof, and other future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include market prices, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts:

Hudson Resources Inc.

James Tuer

President

604-628-5002 or 604-688-3415

604-688-3452 (FAX)

tuer@hudsonresources.ca

www.hudsonresources.ca

Marketwire

January 10, 2012 - 9:20 AM EST

http://www.stockhouse.com/financialtools/sn_newsreleases.asp…

Seit Tagen sind höhere Umsätze in Canada zu beobachten.Der Markt ist Liquider wie hier in Deutschland. Die Bollinger Bands ziehen sich stark zusammen. Da könnte in den nächsten Tagen doch die Post abgehen.

Keine Kaufempfehlung nur meine Gedanken.

Gruß charly

VANCOUVER, BRITISH COLUMBIA -- (Marketwire) -- 01/10/12 -- HUDSON RESOURCES INC. (the "Company") - (TSX VENTURE:HUD)(OTCQX:HUDRF) is pleased to announce that assays from a five tonne bulk metallurgical sample, collected on surface at the ST1 Zone, graded 2.5% Total Rare Earth Oxides (TREO). Neodymium oxide averaged 20% of total REO's.

James Tuer, Hudson's President, stated, "The extraction of the five tonne metallurgical sample is very exciting for several reasons. Firstly, it confirms the presence of a significant amount of high-grade rare earth material at surface. Secondly, and possibly more importantly, it provides a sufficient quantity of material for us to take the metallurgy through to pilot scale testing. This sample will be incorporated into our updated resource model which we expect to have out in the first quarter of 2012."

"As well, mineralogical studies conducted on the bulk sample have confirmed that the rare earths are hosted within a distinct "red" ankerite mineral in the ST1 body which contains bastnaesite and monazite REEs. Our metallurgical studies are focused on defining a process to extract these common rare earth bearing minerals from the bulk material."

AVERAGE TOTAL RARE EARTH OXIDES (PARTS PER MILLION)

-------------------------------------------------------------------

TREO La2O3 Ce2O3 Pr2O3 Nd2O3 Sm2O3 Eu2O3 Gd2O3

-------------------------------------------------------------------

24,979 5,153 12,585 1,464 5,055 407 82 110

-------------------------------------------------------------------

Tb2O3 Dy2O3 Ho2O3 Er2O3 Tm2O3 Yb203 Lu2O3 Y2O3

-------------------------------------------------------------------

10.4 36.6 3.2 1.3 0.3 0.6 0.2 69.8

-------------------------------------------------------------------

The sample was randomly bagged in the field and approximately 700kg was shipped by air to the GeoAnalytical Laboratories of the Saskatchewan Research Council (SRC) in Saskatoon, Saskatchewan. The balance of the sample was sent by ground and has now been received by the SRC. The initial 700kg sample was crushed and blended by the SRC and four separate samples assayed by lithium meteborate fusion, followed by dissolution in dilute HNO3 and ICP-MS analysis. A portion of the bulk sample material was shipped to Ancaster Ontario for processing at Activation Laboratories Ltd. (Actlabs) using lithium borate fusion, acid dissolution and ICP-MS analysis. Actlabs processed two separate assays. The results presented in this press release represent the average of the results from the two labs.

Metallurgical testwork of the ST1 Zone material is ongoing at Hazen Research in Colorado, and the Saskatchewan Research Council (SRC) in Saskatoon. Both SRC and Hazen are conducting flotation tests. The entire metallurgical program is being directed by Dr. John Goode who has more than 40 years experience in rare earth and resource projects.

Recent metallurgical testwork from SRC has demonstrated successful extraction of rare earths utilizing acid baking and leaching. Test work showed that two hours of baking, at 220 degrees C and approximately one tonne of acid per tonne of mineralized feed (concentrate) recovers 94% of the TREO.

Magnetic testwork and mineralogical studies are ongoing under the direction of Dr. Peter LeCouteur, P.Eng. With respect to the bulk sample, three hand specimens were examined microscopically with the objective of quantifying the rare earth element (REE) minerals present in the material. Samples were examined in polished thin section by light microscope and minerals of interest analyzed on an AMRAY 1810 scanning electron microscope ("SEM") equipped with an EDAX "Genesis" energy dispersive X-ray analyzer ("EDX" analyses). Key findings are as follows:

-- The 2011 Safartoq bulk sample is a slightly oxidized surface sample of

ferrocarbonatite of the "ST1 Zone" and consists mostly of Ca-Mg-Fe

carbonates.

-- The only REE minerals identified in the bulk sample are: REE phosphate

monazite-(Ce), REE fluorocarbonate bastnasite-(Ce), and Ca

fluorocarbonate synchysite-(Ce)

-- The proportion of the three REE minerals varies from sample to sample

but overall it is estimated that about 50-70% of the REE are carried by

monazite, 30-50 % by bastnasite, and less than 5% by synchysite.

-- The hematized "red" ankerite contains +95% of the rare earth minerals

and is distinct in colour from the other minerals present as it is

pigmented with iron oxide.

-- About 90% of REE particles fall in a size range of 10 to 300 microns in

length. All the REE minerals occur as fine-grained single crystals that

range from about 5 microns to 80 microns long and as shapeless

aggregates of such crystals that are generally from 50 to 500 microns

across but occasionally up to 1 mm across.

Sarfartoq Project Background

Hudson recently released the results of a Preliminary Economic Assessment (PEA) completed by Wardrop, A Tetra Tech Company (Tetra Tech). Their Study shows a Net Present Value of $616M and an Internal Rate of Return of 31.2 % with a 2.7 year pay-back period. The Study was based on the Company's 43-101 compliant inferred resource of 14.1Mt at 1.5% TREO at the ST1 Zone. The ST1 Zone represents one of the industry's highest ratios of neodymium and praseodymium to TREO, totaling 25%, based on the inferred resource. It contains over 40 million kilograms of neodymium oxide, which is the key component in permanent magnets and the fastest growth sector of the rare earths industry. A total 16,514m over 71 holes were drilled in 2011 and these results have not yet been incorporated into either the resource estimate or the PEA.

The Sarfartoq REE project is located within 20 km of tidewater and only 60 km from Greenland's international airport. The project is owned 100% by Hudson. The Company is currently well financed with approximately $12.5 million in working capital.

Dr. Michael Druecker is a qualified person as defined by National Instrument 43-101 and reviewed the preparation of the scientific and technical information in this press release.

ON BEHALF OF THE BOARD OF DIRECTORS

James Tuer, President

Forward-Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this news release, including, without limitation, statements regarding plans for the completion of a financing and the intended terms and use of proceeds thereof, and other future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include market prices, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contacts:

Hudson Resources Inc.

James Tuer

President

604-628-5002 or 604-688-3415

604-688-3452 (FAX)

tuer@hudsonresources.ca

www.hudsonresources.ca

Marketwire

January 10, 2012 - 9:20 AM EST

http://www.stockhouse.com/financialtools/sn_newsreleases.asp…

Seit Tagen sind höhere Umsätze in Canada zu beobachten.Der Markt ist Liquider wie hier in Deutschland. Die Bollinger Bands ziehen sich stark zusammen. Da könnte in den nächsten Tagen doch die Post abgehen.

Keine Kaufempfehlung nur meine Gedanken.

Gruß charly

Aus dem Greenland Minerals & Energie Thread ..

Europa, Grönland und Seltene Erden

das könnte was ganz großes werden.

Dänemark war das Mutterland,

die Seltene Erden sind das teure Pfand.

29.02.2012

EU will Abbau von Seltenen Erden in Europa vorantreiben

http://www.suedostschweiz.ch/wirtschaft/eu-will-abbau-von-se…

Europa, Grönland und Seltene Erden

das könnte was ganz großes werden.

Dänemark war das Mutterland,

die Seltene Erden sind das teure Pfand.

29.02.2012

EU will Abbau von Seltenen Erden in Europa vorantreiben

http://www.suedostschweiz.ch/wirtschaft/eu-will-abbau-von-se…

Hudson Resources ( V.HUD )

hat gestern Abend ein Plus von 71.11 % hingelegt.

Es könnte ein Covern von Short Positionen sein, ein Leck von guten News welches genutzt wurde, um sich einzudecken ??

Die Letzte News war am 26.04:

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

HUDSON RESOURCES REPORTS UPDATED MINERAL RESOURCE: SIGNIFICANT GRADE INCREASES AND INDICATED RESOURCES CONFIRMED

Hudson Resources Inc. has released an updated National Instrument 43-101-compliant mineral resource estimate for the 100-per-cent-owned Sarfartoq ST1 zone rare earth element (REE) project in Greenland. The updated resource model includes the 2011 drill program. In total, 50 holes totaling 12,700 meters of drilling has been included in the ST1 resource calculation. This resource estimate includes indicated resources of 5.9M tonnes averaging 1.8% total rare earth oxides (TREO) and inferred resources of 2.5M tonnes averaging 1.6% TREO for the ST1 zone, based on a 1.0% cut-off grade. The resource estimate was prepared by GeoSim Services Inc. of Vancouver. A Technical Report will be filed on SEDAR within 45 days.

Das Inferred wurde größten Teils zu Indicated. !!

Der bisherige Kursverfall / -rückgang war aufgrund von Verkäufen eines Fonds geschuldet:

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=HU…

I talked to management and it looks like a fund is doing some selling out of the US from the financing last March. The company expects to have an updated resource model out shortly and is starting drilling again in early May to extend the resource and drill more targets. Importantly, they have $12M in the bank which means no financing (no dilution) in 2012. Painful stock price but with good assets and money in the bank we should bounce back when this market stabilizes. Neodymium prices are still very strong and the demand for NdFeB magnets will grow at 15% a year (according to Neo) so Hudson is in a good place IMHO

Hudson Resources ( V.HUD )

Ich bin gespannt , wie es weitergeht...

Schönes Wochenende noch

Gruß charly

hat gestern Abend ein Plus von 71.11 % hingelegt.

Es könnte ein Covern von Short Positionen sein, ein Leck von guten News welches genutzt wurde, um sich einzudecken ??

Die Letzte News war am 26.04:

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&…

HUDSON RESOURCES REPORTS UPDATED MINERAL RESOURCE: SIGNIFICANT GRADE INCREASES AND INDICATED RESOURCES CONFIRMED

Hudson Resources Inc. has released an updated National Instrument 43-101-compliant mineral resource estimate for the 100-per-cent-owned Sarfartoq ST1 zone rare earth element (REE) project in Greenland. The updated resource model includes the 2011 drill program. In total, 50 holes totaling 12,700 meters of drilling has been included in the ST1 resource calculation. This resource estimate includes indicated resources of 5.9M tonnes averaging 1.8% total rare earth oxides (TREO) and inferred resources of 2.5M tonnes averaging 1.6% TREO for the ST1 zone, based on a 1.0% cut-off grade. The resource estimate was prepared by GeoSim Services Inc. of Vancouver. A Technical Report will be filed on SEDAR within 45 days.

Das Inferred wurde größten Teils zu Indicated. !!

Der bisherige Kursverfall / -rückgang war aufgrund von Verkäufen eines Fonds geschuldet:

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=HU…

I talked to management and it looks like a fund is doing some selling out of the US from the financing last March. The company expects to have an updated resource model out shortly and is starting drilling again in early May to extend the resource and drill more targets. Importantly, they have $12M in the bank which means no financing (no dilution) in 2012. Painful stock price but with good assets and money in the bank we should bounce back when this market stabilizes. Neodymium prices are still very strong and the demand for NdFeB magnets will grow at 15% a year (according to Neo) so Hudson is in a good place IMHO

Hudson Resources ( V.HUD )

Ich bin gespannt , wie es weitergeht...

Schönes Wochenende noch

Gruß charly

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +1,62 | |

| +6,83 | |

| -0,35 | |

| +3,30 | |

| +0,55 | |

| +2,47 | |

| +6,51 | |

| -8,33 | |

| +9.900,00 | |

| +0,72 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 255 | ||

| 79 | ||

| 72 | ||

| 66 | ||

| 36 | ||

| 34 | ||

| 26 | ||

| 23 | ||

| 22 | ||

| 22 |