Midway Gold - eine 10 mio Unzen Chance? - 500 Beiträge pro Seite

eröffnet am 04.03.11 19:10:21 von

neuester Beitrag 11.07.15 18:51:15 von

neuester Beitrag 11.07.15 18:51:15 von

Beiträge: 109

ID: 1.164.329

ID: 1.164.329

Aufrufe heute: 0

Gesamt: 8.610

Gesamt: 8.610

Aktive User: 0

ISIN: CA5981531042 · WKN: 260730

0,0001

USD

+9.900,00 %

+0,0001 USD

Letzter Kurs 07.12.17 Nasdaq OTC

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7875 | +17,54 | |

| 0,8000 | +11,11 | |

| 10,770 | +9,50 | |

| 5,1400 | +8,44 | |

| 200,00 | +8,11 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9860 | -12,74 | |

| 0,6000 | -18,37 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 | |

| 46,67 | -97,98 |

Wer meine Beiträge aufmerksam verfolgt, hat sicher an der einen oder anderen Stelle einen Hinweis auf Midway Gold (MDW) gelesen, bei denen ich letzten April bei 67 Cent eingestiegen bin.

Midway hat lange Mikado gespielt und sich nicht bewegt, kein Geld gehabt, aber ich glaube, dies lässt sich heute retrospektiv gut erklären.

Der Schlüssel ist diese News:

http://www.midwaygold.com/s/NewsReleases.asp?ReportID=432456

December 08, 2010

Midway Expands Land Position at Spring Valley Gold Project, Nevada

Denver, Colorado -- Midway Gold Corp. is pleased to report that 1.2 square miles of additional land have been added to the Company's Spring Valley project, near Lovelock Nevada with two recent acquisitions. These strategic new properties will allow expanded exploration in an area contiguous with the existing Inferred Resource*.

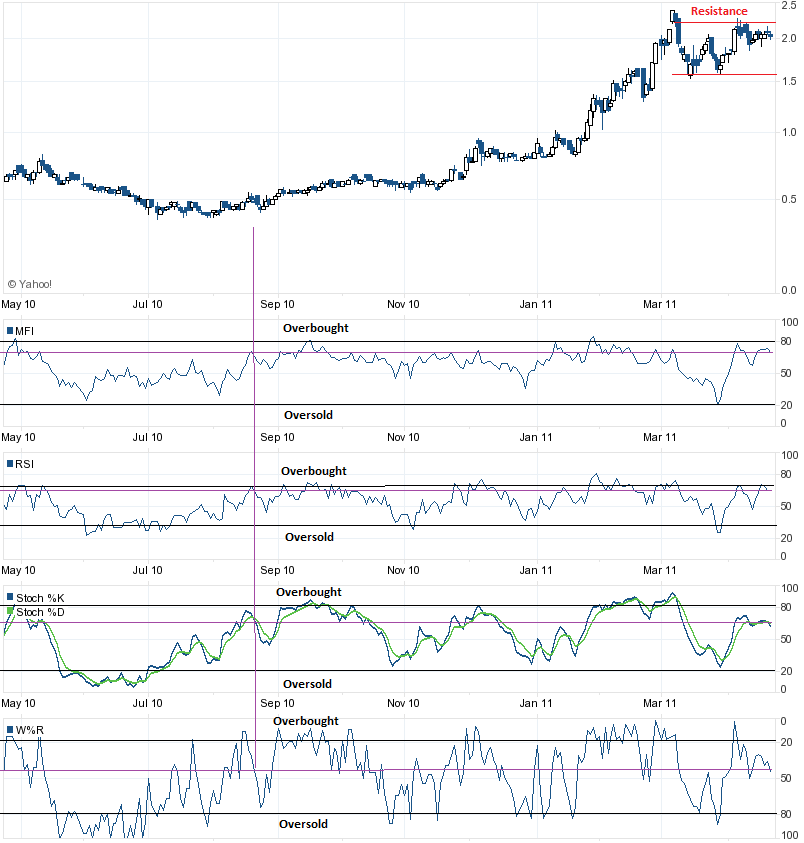

Exakt nach dieser News begann der Kurs zu rennen:

Jetzt haben sie dieses Land und haben ein neues Loch gebohrt:

Damit erzählt sich die Geschichte selbst. Wenn dieses Step Out Loch keine neue Entdeckung ist, sondern eine Verlängerung der bekannten Zone, dann ist Spring Valley ein 10 Mio Unzen Gebiet.

Die Ernsthaftigkeit dieser Überlegung zeigt sich auch darin, dass Barrick Gold dieses Gebiet im Rahmen eines JV exploriert - und die wollen sicher nicht ein 2 mio Unzen low grade Pit in Nevada. Die letzten Jahre haben alle die Füsse still gehalten, um günstig an die Parzelle zu kommen, jetzt geht der Kurs durch die Decke.

Nicht einmal diese News konnte den Kurs nennenswert aufhalten:

http://www.midwaygold.com/s/NewsReleases.asp?ReportID=443410

Hoffentlich gelingt es Midway, diese Ungereimtheiten schnell und vollständig aus dem Weg zu räumen.

Spring Valley ist nicht das einzige Pferdchen im Stall:

http://www.midwaygold.com/s/ResourceEstimates.asp

Midway hat lange Mikado gespielt und sich nicht bewegt, kein Geld gehabt, aber ich glaube, dies lässt sich heute retrospektiv gut erklären.

Der Schlüssel ist diese News:

http://www.midwaygold.com/s/NewsReleases.asp?ReportID=432456

December 08, 2010

Midway Expands Land Position at Spring Valley Gold Project, Nevada

Denver, Colorado -- Midway Gold Corp. is pleased to report that 1.2 square miles of additional land have been added to the Company's Spring Valley project, near Lovelock Nevada with two recent acquisitions. These strategic new properties will allow expanded exploration in an area contiguous with the existing Inferred Resource*.

Exakt nach dieser News begann der Kurs zu rennen:

Jetzt haben sie dieses Land und haben ein neues Loch gebohrt:

Damit erzählt sich die Geschichte selbst. Wenn dieses Step Out Loch keine neue Entdeckung ist, sondern eine Verlängerung der bekannten Zone, dann ist Spring Valley ein 10 Mio Unzen Gebiet.

Die Ernsthaftigkeit dieser Überlegung zeigt sich auch darin, dass Barrick Gold dieses Gebiet im Rahmen eines JV exploriert - und die wollen sicher nicht ein 2 mio Unzen low grade Pit in Nevada. Die letzten Jahre haben alle die Füsse still gehalten, um günstig an die Parzelle zu kommen, jetzt geht der Kurs durch die Decke.

Nicht einmal diese News konnte den Kurs nennenswert aufhalten:

http://www.midwaygold.com/s/NewsReleases.asp?ReportID=443410

Hoffentlich gelingt es Midway, diese Ungereimtheiten schnell und vollständig aus dem Weg zu räumen.

Spring Valley ist nicht das einzige Pferdchen im Stall:

http://www.midwaygold.com/s/ResourceEstimates.asp

Man beachte auch die Rekordvolumina in diesem Wert, aktuell schiesst der Kurs über die 2,10 $

http://de.advfn.com/p.php?pid=staticchart&s=A%5EMDW&p=0&t=39

der Chart sieht sehr verlockend aus

packe ich mir mal auf die Watchlist

packe ich mir mal auf die Watchlist

March 18, 2011, 8:20 p.m. EDT

Midway Gold -- CFO change

DENVER, Mar 18, 2011 (BUSINESS WIRE) -- Midway Gold Corp. (the "Company") reports that the Company has hired Fritz K. Schaudies as its Chief Financial Officer replacing Doris Meyer in that role. The Company sincerely thanks Ms. Meyer for her dedication and support to the Company during its growth years. As the Company now prepares itself to become a gold production company it needs a full time Chief Financial Officer to work in Denver with the rest of the management team.

Mr. Schaudies has over 35 years of progressive financial leadership experience in the mining and real estate development industries. Mr. Schaudies brings extensive senior management expertise in the fields of financial accounting, acquisition analysis, financial and project forecasting, budgeting, and planning. For the past four years Mr. Schaudies was a consultant to an emerging mining company's start-up and operation of a gold mine in the State of Sonora, Mexico. Prior to that Mr. Schaudies held various positions with Newmont, Echo Bay Mines, Arch Mineral, Morrison Knudsen, and the Consolidation Coal Company (now Consol Energy). Mr. Schaudies is a registered CPA in Colorado, holds an MBA from Boise State University, completed extensive work towards a M.S. in Accounting at the University of Colorado, holds an undergraduate degree in accounting from Wheeling College and an undergraduate degree in Botany from the Ohio University.

ON BEHALF OF THE BOARD "Dan Wolfus" Dan Wolfus, Director, Chairman and CEO

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate mines in a manner accountable to all stakeholders while producing an acceptable return to its shareholders. For more information about Midway, please visit our website at www.midwaygold.com or contact R.J. Smith, Manager of Corporate Administration, at (877) 475-3642 (toll-free).

http://www.marketwatch.com/story/midway-gold-cfo-change-2011…

Das hört sich so an, als hätten sie einiges vor.

Midway Gold -- CFO change

DENVER, Mar 18, 2011 (BUSINESS WIRE) -- Midway Gold Corp. (the "Company") reports that the Company has hired Fritz K. Schaudies as its Chief Financial Officer replacing Doris Meyer in that role. The Company sincerely thanks Ms. Meyer for her dedication and support to the Company during its growth years. As the Company now prepares itself to become a gold production company it needs a full time Chief Financial Officer to work in Denver with the rest of the management team.

Mr. Schaudies has over 35 years of progressive financial leadership experience in the mining and real estate development industries. Mr. Schaudies brings extensive senior management expertise in the fields of financial accounting, acquisition analysis, financial and project forecasting, budgeting, and planning. For the past four years Mr. Schaudies was a consultant to an emerging mining company's start-up and operation of a gold mine in the State of Sonora, Mexico. Prior to that Mr. Schaudies held various positions with Newmont, Echo Bay Mines, Arch Mineral, Morrison Knudsen, and the Consolidation Coal Company (now Consol Energy). Mr. Schaudies is a registered CPA in Colorado, holds an MBA from Boise State University, completed extensive work towards a M.S. in Accounting at the University of Colorado, holds an undergraduate degree in accounting from Wheeling College and an undergraduate degree in Botany from the Ohio University.

ON BEHALF OF THE BOARD "Dan Wolfus" Dan Wolfus, Director, Chairman and CEO

About Midway Gold Corp.

Midway Gold Corp. is a precious metals company with a vision to explore, design, build and operate mines in a manner accountable to all stakeholders while producing an acceptable return to its shareholders. For more information about Midway, please visit our website at www.midwaygold.com or contact R.J. Smith, Manager of Corporate Administration, at (877) 475-3642 (toll-free).

http://www.marketwatch.com/story/midway-gold-cfo-change-2011…

Das hört sich so an, als hätten sie einiges vor.

Midway Gold Announces Positive Prefeasibility Study for Pan Gold Project, Nevada

DENVER, Apr 04, 2011 (BUSINESS WIRE) -- Midway Gold Corp. announces the results of a positive Prefeasibility Study of its Pan gold project located in White Pine County, Nevada. The accompanying National Instrument (NI) 43-101 technical report will be filed on SEDAR within 45 days. This NI 43-101 report was independently prepared by Gustavson Associates, LLC ("Gustavson") of Lakewood, Colorado, and concludes that the Pan Project is economically viable and amenable to heap leach mining operations, as summarized below.

Highlights of the Prefeasibility Study (Base Case at $1,050/oz gold)

-- Resource growth over the July 2010 Preliminary Economic Assessment -- 848,700 contained ounces in Measured and Indicated Resource categories at a grade of 0.016 oz gold per short ton at a 0.008 oz/ton cutoff grade

-- Proven and Probable Reserves of 716,900 contained ounces grading 0.017 oz/ton gold

-- Robust project economics -- Capital costs of US$79.25 million including 15% contingency

-- Total cash operating costs (including taxes) projected to be $431 per oz

-- Total cash costs (including royalties) projected to be $473 per oz

-- Fully loaded production cost (cash costs and capital) is expected to be $666 per oz

-- At $1,050 per oz gold, after-tax net present value (NPV) at 5% discount of US$91.1 million and internal rate of return (IRR) of 32.5% using a 0.008 oz/ton cutoff grade

-- At $1,250 per oz gold, the NPV increases to approximately $142 million (55% higher)

-- At $1,450 per oz gold, the NPV increases to approximately $192 million (111% higher)

-- Project lifespan in excess of 9 years with heap leach stacking of 17,000 tons per day (tpd) -- Average of 77,000 ounces per year produced over 8.5 years of operation

-- Average estimated recovery of 80% gold for the South Pit and 70% gold for the North Pit

-- Life of mine (LOM) strip ratio of 1.40:1

-- Expansion potential includes -- Inferred resources in the $1,050 pit

-- Open mineralization at depth and along strike at North and South Pan

Pan Mineral Reserves and Resources

The open pit mineral reserves and resources were completed by Gustavson, with Ms. Terre A. Lane and Mr. Donald E. Hulse acting as the Qualified Persons (QP). The Prefeasibility Study demonstrates the project is economically viable therefore the Measured and Indicated Mineral Resources within the designed pits are considered Proven and Probable Reserves. Only the two main ore bodies (North Pan and South Pan) are included in the mine design. A 0.008 oz/ton cutoff grade resulted in the highest NPV for the project and is the selected Base Case. Mineral Reserves were based upon a design pit using Lerchs Grossmann generated pit surfaces that maximize revenue based on a $1,050 per ounce three-year trailing average price of gold.

The resource estimation includes all data collected through February 28, 2011, including 15 core holes drilled in 2010 by Midway as well as new lithology and alteration models for breccia controlled mineralization. Ordinary Kriging was used to estimate gold grades in a block model with blocks 20 feet wide, 20 feet long and 20 feet high. Measured and Indicated resource estimates are limited to drill intervals with fire assay results. Inferred resource estimates include all available assay data.

The mineral resources and reserves are summarized in Table 1 and Table 2 below. Mineral resources are inclusive of mineral reserves.

Expansion Potential

Additional mineralization not included in the Prefeasibility Study includes Inferred resources in the $1,050 pit, open mineralization at depth and along strike at North and South Pan. Mineralization at North Pan has not been closed off at depth, particularly along the Pilot Shale-Devil's Gate Limestone contact, or to the north where it trends under Tertiary volcanic rocks. At the South Pan deposit, mineralization is open to the east and to the south where the deposit also trends under Tertiary volcanic rocks.

Mining and Production

Midway plans to use conventional open pit mining methods, using front end loaders and in-pit crush and convey with mobile jaw crushers and mobile conveyors conveying waste to the waste dump. The majority of the material from the mine will be drilled and blasted prior to loading. The initial mining fleet consists of two loaders, two jaw crushers, and two 100-ton trucks, with various support equipment. The mine plan produces 6.1 million tons of ore per year for delivery to the heap leach (17,000 tpd). Peak ore and waste production is estimated to be 52,000 tpd. The pit design is based on inter-ramp slope angles of 50 degrees for South Pan, 45 degrees for North Pan. The face slope angles are 70 degrees for South Pan and 63 degrees for North Pan.

Metallurgy and Processing

Material from the North and South Pan pits will be processed using conventional heap leaching methods. Ore from both pits will be crushed by the primary in-pit mobile jaw crusher and secondary and tertiary cone crushers to a nominal 0.5 inches prior to leaching. The fines will be agglomerated. Crush size and leach kinetics are based on current metallurgical testing. Additional testing for optimization is underway.

Barren solution will be distributed on the leach pad with drip tube emitters. Pregnant solution and storm water storage ponds are integral to the leach pad system. Pregnant solutions will be treated in an adsorption/desorption refining (ADR) plant using conventional unit processes.

Opportunities and Recommendations

Gustavson has recommended the following work plans as part of Midway's ongoing project development effort to further refine costs, recoveries, engineering, and mine designs in order to produce a Feasibility Study:

-- Proceed with the NEPA / EIS (environmental) permitting process.

-- Expand the mineral resource and mineral reserve to determine the total mineral resource potential at depth and along strike at North and South Pan.

-- Complete a statistical review of the RC/core twin holes completed on the property.

-- Complete metallurgical testing of 29 composite diamond core samples.

-- Selective core drilling to determine if historic RC assays are under-reporting gold grades. Limited data suggests that core assays average 30.5 percent higher grade than corresponding RC assays.

-- Selectively re-drill areas with older mine lab solution assays, which average 14.7 percent lower gold grades than twin holes with fire assays.

http://www.marketwatch.com/story/midway-gold-announces-posit…

DENVER, Apr 04, 2011 (BUSINESS WIRE) -- Midway Gold Corp. announces the results of a positive Prefeasibility Study of its Pan gold project located in White Pine County, Nevada. The accompanying National Instrument (NI) 43-101 technical report will be filed on SEDAR within 45 days. This NI 43-101 report was independently prepared by Gustavson Associates, LLC ("Gustavson") of Lakewood, Colorado, and concludes that the Pan Project is economically viable and amenable to heap leach mining operations, as summarized below.

Highlights of the Prefeasibility Study (Base Case at $1,050/oz gold)

-- Resource growth over the July 2010 Preliminary Economic Assessment -- 848,700 contained ounces in Measured and Indicated Resource categories at a grade of 0.016 oz gold per short ton at a 0.008 oz/ton cutoff grade

-- Proven and Probable Reserves of 716,900 contained ounces grading 0.017 oz/ton gold

-- Robust project economics -- Capital costs of US$79.25 million including 15% contingency

-- Total cash operating costs (including taxes) projected to be $431 per oz

-- Total cash costs (including royalties) projected to be $473 per oz

-- Fully loaded production cost (cash costs and capital) is expected to be $666 per oz

-- At $1,050 per oz gold, after-tax net present value (NPV) at 5% discount of US$91.1 million and internal rate of return (IRR) of 32.5% using a 0.008 oz/ton cutoff grade

-- At $1,250 per oz gold, the NPV increases to approximately $142 million (55% higher)

-- At $1,450 per oz gold, the NPV increases to approximately $192 million (111% higher)

-- Project lifespan in excess of 9 years with heap leach stacking of 17,000 tons per day (tpd) -- Average of 77,000 ounces per year produced over 8.5 years of operation

-- Average estimated recovery of 80% gold for the South Pit and 70% gold for the North Pit

-- Life of mine (LOM) strip ratio of 1.40:1

-- Expansion potential includes -- Inferred resources in the $1,050 pit

-- Open mineralization at depth and along strike at North and South Pan

Pan Mineral Reserves and Resources

The open pit mineral reserves and resources were completed by Gustavson, with Ms. Terre A. Lane and Mr. Donald E. Hulse acting as the Qualified Persons (QP). The Prefeasibility Study demonstrates the project is economically viable therefore the Measured and Indicated Mineral Resources within the designed pits are considered Proven and Probable Reserves. Only the two main ore bodies (North Pan and South Pan) are included in the mine design. A 0.008 oz/ton cutoff grade resulted in the highest NPV for the project and is the selected Base Case. Mineral Reserves were based upon a design pit using Lerchs Grossmann generated pit surfaces that maximize revenue based on a $1,050 per ounce three-year trailing average price of gold.

The resource estimation includes all data collected through February 28, 2011, including 15 core holes drilled in 2010 by Midway as well as new lithology and alteration models for breccia controlled mineralization. Ordinary Kriging was used to estimate gold grades in a block model with blocks 20 feet wide, 20 feet long and 20 feet high. Measured and Indicated resource estimates are limited to drill intervals with fire assay results. Inferred resource estimates include all available assay data.

The mineral resources and reserves are summarized in Table 1 and Table 2 below. Mineral resources are inclusive of mineral reserves.

Table 1: Gustavson Total Pan Mineral Resource, March 2011

Cutoff Grade Short Tons Gold Grade Ounces

(gold oz/ton) (x 1000) (gold oz/ton) (x 1000)

------------- ---------- ------------- --------

Measured

---------------------------------------------------------

0.01 21,996 0.019 426.9

------------- ---------- ------------- --------

0.008 25,025 0.018 453.7

------------- ---------- ------------- --------

0.006 28,110 0.017 474.5

------------- ---------- ------------- --------

0.004 30,685 0.016 487.9

------------- ---------- ------------- --------

Indicated

---------------------------------------------------------

0.01 21,273 0.016 346.2

------------- ---------- ------------- --------

0.008 26,814 0.015 394.8

------------- ---------- ------------- --------

0.006 32,162 0.013 432.2

------------- ---------- ------------- --------

0.004 36,629 0.013 456.1

------------- ---------- ------------- --------

Measured plus Indicated

---------------------------------------------------------

0.01 43,269 0.018 770.7

------------- ---------- ------------- --------

0.008 51,839 0.016 848.7

------------- ---------- ------------- --------

0.006 60,272 0.015 909.8

------------- ---------- ------------- --------

0.004 67,314 0.014 946.2

------------- ---------- ------------- --------

Inferred

---------------------------------------------------------

0.01 4,977 0.016 80.5

------------- ---------- ------------- --------

0.008 7,164 0.014 100.2

------------- ---------- ------------- --------

0.006 10,834 0.012 125.1

------------- ---------- ------------- --------

0.004 14,690 0.010 144.7

------------- ---------- ------------- --------

Table 2: Gustavson Total Pan Mineral Reserve, March 2011

Cutoff Grade Short Tons Gold Grade Ounces

(gold oz/ton) (x 1000) (gold oz/ton) (x 1000)

------------- ---------- ------------- --------

Proven

---------------------------------------------------------

0.01 20,481 0.020 402.5

------------- ---------- ------------- --------

0.008 23,012 0.018 425.4

------------- ---------- ------------- --------

0.006 25,289 0.017 441.3

------------- ---------- ------------- --------

0.004 27,047 0.017 450.2

------------- ---------- ------------- --------

Probable

---------------------------------------------------------

0.01 15,656 0.017 265.1

------------- ---------- ------------- --------

0.008 18,540 0.016 291.1

------------- ---------- ------------- --------

0.006 20,944 0.015 308.0

------------- ---------- ------------- --------

0.004 23,775 0.016 374.2

------------- ---------- ------------- --------

Proven plus Probable

---------------------------------------------------------

0.01 36,137 0.018 667.6

------------- ---------- ------------- --------

0.008 41,553 0.017 716.5

------------- ---------- ------------- --------

0.006 46,233 0.016 749.3

------------- ---------- ------------- --------

0.004 50,822 0.016 824.4

------------- ---------- ------------- --------

Inferred within $1,050 Pit Design

---------------------------------------------------------

0.01 530 0.015 8.1

------------- ---------- ------------- --------

0.008 774 0.013 10.3

------------- ---------- ------------- --------

0.006 1,110 0.011 12.6

------------- ---------- ------------- --------

0.004 1,542 0.010 14.8

------------- ---------- ------------- --------

Expansion Potential

Additional mineralization not included in the Prefeasibility Study includes Inferred resources in the $1,050 pit, open mineralization at depth and along strike at North and South Pan. Mineralization at North Pan has not been closed off at depth, particularly along the Pilot Shale-Devil's Gate Limestone contact, or to the north where it trends under Tertiary volcanic rocks. At the South Pan deposit, mineralization is open to the east and to the south where the deposit also trends under Tertiary volcanic rocks.

Mining and Production

Midway plans to use conventional open pit mining methods, using front end loaders and in-pit crush and convey with mobile jaw crushers and mobile conveyors conveying waste to the waste dump. The majority of the material from the mine will be drilled and blasted prior to loading. The initial mining fleet consists of two loaders, two jaw crushers, and two 100-ton trucks, with various support equipment. The mine plan produces 6.1 million tons of ore per year for delivery to the heap leach (17,000 tpd). Peak ore and waste production is estimated to be 52,000 tpd. The pit design is based on inter-ramp slope angles of 50 degrees for South Pan, 45 degrees for North Pan. The face slope angles are 70 degrees for South Pan and 63 degrees for North Pan.

Table 3: Operating Costs

Description US$ US$

Per ton of ore Per oz of gold

-------------------- -------------- --------------

Mining 1.76 136.92

-------------------- -------------- --------------

Processing 2.46 191.02

-------------------- -------------- --------------

G&A 0.33 25.88

-------------------- -------------- --------------

Production Taxes 0.50 38.44

-------------------- -------------- --------------

Contingency - 10% 0.51 39.23

-------------------- -------------- --------------

Total Operating Cost $5.56 $431.48

-------------------- -------------- --------------

Table 4: Initial Capital Costs

Description US$

----------------------------- --------------

Construction capital 58.11 million

----------------------------- --------------

Owner's capital 4.42 million

----------------------------- --------------

Contingency (15%) 9.45 million

----------------------------- --------------

Working capital and inventory 7.26 million

----------------------------- --------------

Total $79.25 million

----------------------------- --------------

Metallurgy and Processing

Material from the North and South Pan pits will be processed using conventional heap leaching methods. Ore from both pits will be crushed by the primary in-pit mobile jaw crusher and secondary and tertiary cone crushers to a nominal 0.5 inches prior to leaching. The fines will be agglomerated. Crush size and leach kinetics are based on current metallurgical testing. Additional testing for optimization is underway.

Barren solution will be distributed on the leach pad with drip tube emitters. Pregnant solution and storm water storage ponds are integral to the leach pad system. Pregnant solutions will be treated in an adsorption/desorption refining (ADR) plant using conventional unit processes.

Opportunities and Recommendations

Gustavson has recommended the following work plans as part of Midway's ongoing project development effort to further refine costs, recoveries, engineering, and mine designs in order to produce a Feasibility Study:

-- Proceed with the NEPA / EIS (environmental) permitting process.

-- Expand the mineral resource and mineral reserve to determine the total mineral resource potential at depth and along strike at North and South Pan.

-- Complete a statistical review of the RC/core twin holes completed on the property.

-- Complete metallurgical testing of 29 composite diamond core samples.

-- Selective core drilling to determine if historic RC assays are under-reporting gold grades. Limited data suggests that core assays average 30.5 percent higher grade than corresponding RC assays.

-- Selectively re-drill areas with older mine lab solution assays, which average 14.7 percent lower gold grades than twin holes with fire assays.

http://www.marketwatch.com/story/midway-gold-announces-posit…

Sehr schön, die 2$ wurden wieder überschritten heute.

Nachtrag

http://www.marketwatch.com/story/midway-gold-announces-initi…

Midway Gold Announces Initial Underground Resource for Midway Project, Nevada

DENVER, Apr 01, 2011 (BUSINESS WIRE) -- Midway Gold Corp. (tsx.v and nyse amex:MDW) (the "Company") announces the results of an initial underground resource evaluation of the Midway project located in Nye County, Nevada. The accompanying National Instrument (NI) 43-101 technical report to be filed on SEDAR within 45 days contains a technical and scientific review of information regarding the project and makes certain recommendations for future work programs. A summary of the conclusions in the technical report is provided below. The NI 43-101 report was independently prepared by Gustavson Associates, LLC ("Gustavson") of Lakewood, Colorado.

A resource estimate prepared by Mine Development Associates in 2005 using an open pit mining scenario calculated an inferred low grade resource of 5.5 million short tons containing 215,500 ounces of gold at an average grade of 0.039 oz/ton gold. While the Company considers the 2005 estimate valid, it believes preferred and optimal development at the Midway project may be through underground mining focused on the structurally controlled gold zones. Underground mining also recognizes certain site sensitivities involving archaeology and groundwater considerations that partially formed the basis for a recent cooperative agreement with the Town of Tonopah (see press release dated February 17, 2011). Core drilling designed to further define additional veins is in progress and is anticipated to continue throughout the year. The Company has also undertaken a program to implement the recommendations of Gustavson as noted below. Management will assess the results of these efforts and will commission further independent analysis as and when required.

Therefore, the current NI 43-101 compliant resource estimate was commissioned to evaluate a limited number of vein-like structures primarily in the Discovery Zone. Gustavson modeled mineralization using an Indicator Kriging method to analyze zones of potential high grade mineralization that may or may not correspond to modeled veins but which may represent veins that have not yet been modeled. This indicator model was calibrated by comparison with the modeled vein cross sections, and appears to have identified higher grade areas with continuous gold mineralization that could possibly be mined by underground methods.

Midway Project Initial Inferred Underground Resource

Recommendations

Gustavson recommends the following work plan, which the Company has commenced:

-- Twin a select number of reverse circulation drill holes in the various mineralized zones by diamond drill core to compare methodologies and resulting assay results.

-- Compile, analyze and document QA/QC data generated by Midway and Chemex for all assays completed since 2004.

-- As part of an ongoing QA/QC program with drill samples, submit blank samples at the rate of 2%.

-- Compile, analyze and document the metallic screen assay results as compared with the original fire assays and/or with duplicate analyses run on the same samples.

-- Conduct future definition drilling with diamond drill core and restrict reverse circulation drilling to exploration activities.

Nachtrag

http://www.marketwatch.com/story/midway-gold-announces-initi…

Midway Gold Announces Initial Underground Resource for Midway Project, Nevada

DENVER, Apr 01, 2011 (BUSINESS WIRE) -- Midway Gold Corp. (tsx.v and nyse amex:MDW) (the "Company") announces the results of an initial underground resource evaluation of the Midway project located in Nye County, Nevada. The accompanying National Instrument (NI) 43-101 technical report to be filed on SEDAR within 45 days contains a technical and scientific review of information regarding the project and makes certain recommendations for future work programs. A summary of the conclusions in the technical report is provided below. The NI 43-101 report was independently prepared by Gustavson Associates, LLC ("Gustavson") of Lakewood, Colorado.

A resource estimate prepared by Mine Development Associates in 2005 using an open pit mining scenario calculated an inferred low grade resource of 5.5 million short tons containing 215,500 ounces of gold at an average grade of 0.039 oz/ton gold. While the Company considers the 2005 estimate valid, it believes preferred and optimal development at the Midway project may be through underground mining focused on the structurally controlled gold zones. Underground mining also recognizes certain site sensitivities involving archaeology and groundwater considerations that partially formed the basis for a recent cooperative agreement with the Town of Tonopah (see press release dated February 17, 2011). Core drilling designed to further define additional veins is in progress and is anticipated to continue throughout the year. The Company has also undertaken a program to implement the recommendations of Gustavson as noted below. Management will assess the results of these efforts and will commission further independent analysis as and when required.

Therefore, the current NI 43-101 compliant resource estimate was commissioned to evaluate a limited number of vein-like structures primarily in the Discovery Zone. Gustavson modeled mineralization using an Indicator Kriging method to analyze zones of potential high grade mineralization that may or may not correspond to modeled veins but which may represent veins that have not yet been modeled. This indicator model was calibrated by comparison with the modeled vein cross sections, and appears to have identified higher grade areas with continuous gold mineralization that could possibly be mined by underground methods.

Midway Project Initial Inferred Underground Resource

Cutoff Grade Short Tons Grade Ounces

(oz/ton) (thousands) (oz/ton)

------------ ----------- -------- ------

0.1000 114.0 0.3017 34,394

------------ ----------- -------- ------

0.0750 127.0 0.2813 35,725

------------ ----------- -------- ------

0.0500 130.0 0.2758 35,854

------------ ----------- -------- ------

0.0200 131.0 0.2742 35,920

------------ ----------- -------- ------

Recommendations

Gustavson recommends the following work plan, which the Company has commenced:

-- Twin a select number of reverse circulation drill holes in the various mineralized zones by diamond drill core to compare methodologies and resulting assay results.

-- Compile, analyze and document QA/QC data generated by Midway and Chemex for all assays completed since 2004.

-- As part of an ongoing QA/QC program with drill samples, submit blank samples at the rate of 2%.

-- Compile, analyze and document the metallic screen assay results as compared with the original fire assays and/or with duplicate analyses run on the same samples.

-- Conduct future definition drilling with diamond drill core and restrict reverse circulation drilling to exploration activities.

Midway gestern die 4. stärkste Aktie an der AMEX, after hours auf 2,17$

http://pennystockdd.com/stock-news/amex-exchange-gainers-tod…

http://pennystockdd.com/stock-news/amex-exchange-gainers-tod…

Midway Gold Builds Operations Team for Nevada Gold Projects

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Historical Stock Chart

1 Monat : March 2011 bis April 2011

Midway Gold Corp. (TSX.V and NYSE Amex: MDW) (“Midway” or the “Company”) is pleased to announce the appointment of Roger G. Gross to the position of Vice President of Nevada Operations for its U.S. operating subsidiary.

“Midway is excited and pleased to add Roger to our team as he is a respected and experienced operator in the gold industry, and will bring immediate value to our Nevada projects and future growth of the Company,” said Ken Brunk, President and COO of Midway. “Roger’s level of technical expertise in operating mines will be valuable and important to our shareholders. He will be based locally at our regional office in Ely, Nevada, and will lead our development and construction team in executing the anticipated feasibility study and mine plan for the Pan project.”

Mr. Gross holds B.S. and M.S. degrees in Mining Engineering from the School of Mines and Engineering at Montana Tech in Butte, Montana and throughout his 29 year career has managed mining operations in the Western U.S. and around the world. Most recently, he was responsible for management of all business unit activities for American Colloid Company’s mining operations in South Dakota and Nevada. Previously, he spent 15 years with Newmont Gold Company, where his range of activities included posts as mine manager of the Batu Hijau operation through the establishment of the Closure and Reclamation business unit in Nevada. Prior to Newmont, he served in positions as mine engineer, foreman and superintendent for a number of precious metals companies, including Freeport McMoran Copper and Gold, Bond International Gold, Western Energy Company, and the Energy Development Company. Mr. Gross has extensive experience in financial evaluation, feasibility, permitting, engineering, construction, and mine operations management, including through the reclamation phase of operations.

Mr. Gross reports to Midway’s Vice President of Project Development, Richard Moritz, and will be responsible for overseeing the development, construction and operation of the Company’s projects in Nevada, principally Pan and Gold Rock in White Pine County and the Midway Project in Nye County.

At Pan, a reverse circulation drilling program is currently underway to follow up on results of last year’s diamond core drilling program, to potentially upgrade inferred resources to higher categories and to explore for open mineralization at depth and along strike at North and South Pan. At the Midway Project, a diamond core drilling program is also in progress to further define additional vein-like structures identified from earlier drilling.

Midway’s Nevada operations are based from its regional office located in Ely, Nevada.

http://de.advfn.com/nachrichten/Midway-Gold-Builds-Operation…

---

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Historical Stock Chart

1 Monat : March 2011 bis April 2011

Midway Gold Corp. (TSX.V and NYSE Amex: MDW) (“Midway” or the “Company”) is pleased to announce the appointment of Roger G. Gross to the position of Vice President of Nevada Operations for its U.S. operating subsidiary.

“Midway is excited and pleased to add Roger to our team as he is a respected and experienced operator in the gold industry, and will bring immediate value to our Nevada projects and future growth of the Company,” said Ken Brunk, President and COO of Midway. “Roger’s level of technical expertise in operating mines will be valuable and important to our shareholders. He will be based locally at our regional office in Ely, Nevada, and will lead our development and construction team in executing the anticipated feasibility study and mine plan for the Pan project.”

Mr. Gross holds B.S. and M.S. degrees in Mining Engineering from the School of Mines and Engineering at Montana Tech in Butte, Montana and throughout his 29 year career has managed mining operations in the Western U.S. and around the world. Most recently, he was responsible for management of all business unit activities for American Colloid Company’s mining operations in South Dakota and Nevada. Previously, he spent 15 years with Newmont Gold Company, where his range of activities included posts as mine manager of the Batu Hijau operation through the establishment of the Closure and Reclamation business unit in Nevada. Prior to Newmont, he served in positions as mine engineer, foreman and superintendent for a number of precious metals companies, including Freeport McMoran Copper and Gold, Bond International Gold, Western Energy Company, and the Energy Development Company. Mr. Gross has extensive experience in financial evaluation, feasibility, permitting, engineering, construction, and mine operations management, including through the reclamation phase of operations.

Mr. Gross reports to Midway’s Vice President of Project Development, Richard Moritz, and will be responsible for overseeing the development, construction and operation of the Company’s projects in Nevada, principally Pan and Gold Rock in White Pine County and the Midway Project in Nye County.

At Pan, a reverse circulation drilling program is currently underway to follow up on results of last year’s diamond core drilling program, to potentially upgrade inferred resources to higher categories and to explore for open mineralization at depth and along strike at North and South Pan. At the Midway Project, a diamond core drilling program is also in progress to further define additional vein-like structures identified from earlier drilling.

Midway’s Nevada operations are based from its regional office located in Ely, Nevada.

http://de.advfn.com/nachrichten/Midway-Gold-Builds-Operation…

---

Neues Kaufsignal in Sichtweite

Mitte März berichteten wir bei Kursen um 1,60 USD über die außerordentlichen Chancen von Midway Gold (USA: MDW). Heute notiert der angehende Goldproduzent bei 2,13 USD – ein Kursplus von über 30%! Mit einem Börsenwert von etwa 215 Mio. USD ist Midway noch immer recht günstig. Nach einem Ausbruch über das jüngste Hoch bei 2,40 USD dürfte in den kommenden Wochen und Monaten recht schnell die 3-Dollar-Marke in Sicht kommen.

Midway drückt bei der Entwicklung seiner Gold-Projekte im US-Bundesstaat Nevada auf´s Tempo und schickt sich nun ganz offiziell an in die Riege der Produzenten aufzusteigen. Die Amerikaner verstärken augenscheinlich derzeit ihr Arbeitsteam für die Erschließung ihrer Low-Grad-Vorkommen, allen voran von „Pan“. Eine am vergangenen Montag veröffentlichte vorläufige Machbarkeitsstudie für dieses Projekt beziffert die Kosten des geplanten Tagebaus auf knapp 80 Mio. Dollar. Und: Unabhängige Experten sehen erhebliches Explorationspotenzial; ein entsprechendes Bohrprogramm zur Aus- und Aufwertung der Ressource läuft bereits. Aktuell summiert sich die Pan-Gesamtressource in den Kategorien Measured & Indicated auf 848.700 Unzen Gold. Weitere 716.900 Unzen kommen als Reserve hinzu. Unter dem Strich sollen auf Pan über einen Zeitraum von 9 Jahren jährlich 77.000 Unzen Gold zu Kosten von etwa 470 Dollar pro Unze produziert werden. Rechnen wir die Kapitalkosten und weitere Risikoparameter mit ein, könnte Pan nach unserer Schätzung jährlich 40 bis 50 Mio. USD einbringen. Aber: Pan ist nur eines von einem halben Dutzend Gold-Projekten in Nevada.

Bei der Bewertung von Midway Gold gilt unser Hauptaugenmerk nach wie vor dem Spring Valley, welches Midway zusammen mit Barrick Gold (USA: ABX) entwickelt und in Produktion führen möchte. Ob es soweit kommt, steht jedoch auf einem anderen Blatt: Gut möglich das der potente Partner zuvor Midway in einem Happen schluckt oder Spring Valley separat erwirbt. Beide Szenarien würden den Midway-Aktien wohl kaum schaden. Halten Sie deshalb an Ihren Anteilen weiter fest. Den Stop-Loss würden wir nun auf Einstand nachziehen.

http://www.capital-manager.net/aktuelles-detail.php?id=25" target="_blank" rel="nofollow ugc noopener">

http://www.capital-manager.net/aktuelles-detail.php?id=25

Mitte März berichteten wir bei Kursen um 1,60 USD über die außerordentlichen Chancen von Midway Gold (USA: MDW). Heute notiert der angehende Goldproduzent bei 2,13 USD – ein Kursplus von über 30%! Mit einem Börsenwert von etwa 215 Mio. USD ist Midway noch immer recht günstig. Nach einem Ausbruch über das jüngste Hoch bei 2,40 USD dürfte in den kommenden Wochen und Monaten recht schnell die 3-Dollar-Marke in Sicht kommen.

Midway drückt bei der Entwicklung seiner Gold-Projekte im US-Bundesstaat Nevada auf´s Tempo und schickt sich nun ganz offiziell an in die Riege der Produzenten aufzusteigen. Die Amerikaner verstärken augenscheinlich derzeit ihr Arbeitsteam für die Erschließung ihrer Low-Grad-Vorkommen, allen voran von „Pan“. Eine am vergangenen Montag veröffentlichte vorläufige Machbarkeitsstudie für dieses Projekt beziffert die Kosten des geplanten Tagebaus auf knapp 80 Mio. Dollar. Und: Unabhängige Experten sehen erhebliches Explorationspotenzial; ein entsprechendes Bohrprogramm zur Aus- und Aufwertung der Ressource läuft bereits. Aktuell summiert sich die Pan-Gesamtressource in den Kategorien Measured & Indicated auf 848.700 Unzen Gold. Weitere 716.900 Unzen kommen als Reserve hinzu. Unter dem Strich sollen auf Pan über einen Zeitraum von 9 Jahren jährlich 77.000 Unzen Gold zu Kosten von etwa 470 Dollar pro Unze produziert werden. Rechnen wir die Kapitalkosten und weitere Risikoparameter mit ein, könnte Pan nach unserer Schätzung jährlich 40 bis 50 Mio. USD einbringen. Aber: Pan ist nur eines von einem halben Dutzend Gold-Projekten in Nevada.

Bei der Bewertung von Midway Gold gilt unser Hauptaugenmerk nach wie vor dem Spring Valley, welches Midway zusammen mit Barrick Gold (USA: ABX) entwickelt und in Produktion führen möchte. Ob es soweit kommt, steht jedoch auf einem anderen Blatt: Gut möglich das der potente Partner zuvor Midway in einem Happen schluckt oder Spring Valley separat erwirbt. Beide Szenarien würden den Midway-Aktien wohl kaum schaden. Halten Sie deshalb an Ihren Anteilen weiter fest. Den Stop-Loss würden wir nun auf Einstand nachziehen.

http://www.capital-manager.net/aktuelles-detail.php?id=25" target="_blank" rel="nofollow ugc noopener">

http://www.capital-manager.net/aktuelles-detail.php?id=25

Antwort auf Beitrag Nr.: 41.349.997 von Deltaline am 11.04.11 17:43:27Stock Ideas for $5000 Gold

http://seekingalpha.com/article/265447-stock-ideas-for-5000-…

http://seekingalpha.com/article/265447-stock-ideas-for-5000-…

Trading Halt bei Midway Gold!!

http://de.advfn.com/nachrichten/Investment-Industry-Regulato…

Hoffentlich ist das Spiel noch nicht aus. Eine Übernahme mit 30% oder 40% Premium würde mir in Anbetracht des Potentials doch nicht ganz ausreichend erscheinen.

http://de.advfn.com/nachrichten/Investment-Industry-Regulato…

Hoffentlich ist das Spiel noch nicht aus. Eine Übernahme mit 30% oder 40% Premium würde mir in Anbetracht des Potentials doch nicht ganz ausreichend erscheinen.

Midway’s Spring Valley, Nevada Gold Project Experiences Substantial Resource Growth

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Intraday Stock Chart

Heute : Monday 2 May 2011

Midway Gold Corp. (TSX.V and NYSE Amex: MDW) (the “Company”) announces that the total gold identified at its wholly-owned Spring Valley project in Pershing County, Nevada has grown significantly from the previous Inferred resource estimate in 2009. Drilling at Spring Valley in the last two years has resulted in the conversion of 2.16 million ounces of gold to the Measured and Indicated categories, consisting of 0.93 million ounces in the Measured category and 1.23 million ounces in the Indicated category at a cut-off grade of 0.14 grams per tonne (g/t). The new drilling also produced an additional Inferred resource of 1.97 million ounces of gold at the same cut-off grade. Importantly, the greater part of the drilling was limited to the resource area labeled in the following figure. Please click on the following link to view the figure:

http://www.usetdas.com/maps/midway/MidwayFigureMay2-11.pdf

The Measured resource is contained within 59.0 million tonnes grading 0.49 g/t, the Indicated resource is contained within 85.8 million tonnes grading 0.45 g/t and the Inferred resource is contained within 103.9 million tonnes grading 0.59 g/t.

Ken Brunk, President and Chief Operating Officer said, “We believe these new results show that Spring Valley is rapidly becoming a world-class gold system and could see further substantial growth with continued exploration along trend of the resource reported here. We are anxiously awaiting the commencement of drilling and future results from ground acquired late last year.”

The resource remains open at depth, to the south, and to the northwest. Significant untested strike length remains within land recently acquired adjacent to the south end of the resource. Drill hole SV10-499c encountered gold 1,800 meters south-southwest of the 2011 resource area in similar host rocks and alteration along trend of known mineralization (February 24, 2011 press release). Midway considers the untested trend to be highly prospective. The resource is open to the north where hole SV10-511 intercepted 295 meters of 2.5 g/t gold, which included 71.6 meters of 9.0 g/t gold, using the 0.14 g/t cut-off.

Under the terms of a March 9th, 2009 agreement between Midway and Barrick Gold Exploration Inc., Barrick will earn a 60% interest in the project by completing work expenditures totaling US$30 million before December 31, 2013. Barrick has informed Midway that it intends to conduct and fund the minimum required program of US$7 million in 2011 which will result in a cumulative expenditure of US$16 million by December 31, 2011. Drilling in 2011 is expected to focus on expanding the resource and evaluating satellite targets, particularly within the recently acquired land south of the existing resource.

The 2011 resource estimate includes all data provided to Midway by Barrick from its 2009 and 2010 drill campaigns. The estimate has been prepared by Gustavson Associates, LLC of Lakewood, Colorado, under the direction of Ms. Terre A. Lane, an independent Qualified Person. All estimates were prepared utilizing industry standard Software and resource estimation methodology. Further details will be available in a new NI 43-101 technical report, which will be posted on SEDAR (www.sedar.com), no later than 45 days from the date of this release.

(...)

Note: The tonnage and total ounces of gold were determined from the block model. Average grades were calculated from the tonnage and total ounces and then rounded to the significant digits shown. Calculations based on this table may differ due to rounding effects.

Information in this release has been reviewed and approved by Ms. Terre A. Lane, Principal Mining Engineer and Mr. Donald E. Hulse (P.E.), Vice President, Mining and Latin American Development, both of Gustavson, “qualified persons" as that term is defined in NI 43-101. This release has also been reviewed and approved for Midway by Mr. William S. Neal (M.Sc. and CPG), Midway’s Vice President of Geological Services and a "qualified person" as that term is defined in NI 43-101.

ON BEHALF OF THE BOARD

"Kenneth A. Brunk"

http://de.advfn.com/nachrichten/Midway-s-Spring-Valley-Nevad…

Kenneth A. Brunk, Director, President and COO

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Intraday Stock Chart

Heute : Monday 2 May 2011

Midway Gold Corp. (TSX.V and NYSE Amex: MDW) (the “Company”) announces that the total gold identified at its wholly-owned Spring Valley project in Pershing County, Nevada has grown significantly from the previous Inferred resource estimate in 2009. Drilling at Spring Valley in the last two years has resulted in the conversion of 2.16 million ounces of gold to the Measured and Indicated categories, consisting of 0.93 million ounces in the Measured category and 1.23 million ounces in the Indicated category at a cut-off grade of 0.14 grams per tonne (g/t). The new drilling also produced an additional Inferred resource of 1.97 million ounces of gold at the same cut-off grade. Importantly, the greater part of the drilling was limited to the resource area labeled in the following figure. Please click on the following link to view the figure:

http://www.usetdas.com/maps/midway/MidwayFigureMay2-11.pdf

The Measured resource is contained within 59.0 million tonnes grading 0.49 g/t, the Indicated resource is contained within 85.8 million tonnes grading 0.45 g/t and the Inferred resource is contained within 103.9 million tonnes grading 0.59 g/t.

Ken Brunk, President and Chief Operating Officer said, “We believe these new results show that Spring Valley is rapidly becoming a world-class gold system and could see further substantial growth with continued exploration along trend of the resource reported here. We are anxiously awaiting the commencement of drilling and future results from ground acquired late last year.”

The resource remains open at depth, to the south, and to the northwest. Significant untested strike length remains within land recently acquired adjacent to the south end of the resource. Drill hole SV10-499c encountered gold 1,800 meters south-southwest of the 2011 resource area in similar host rocks and alteration along trend of known mineralization (February 24, 2011 press release). Midway considers the untested trend to be highly prospective. The resource is open to the north where hole SV10-511 intercepted 295 meters of 2.5 g/t gold, which included 71.6 meters of 9.0 g/t gold, using the 0.14 g/t cut-off.

Under the terms of a March 9th, 2009 agreement between Midway and Barrick Gold Exploration Inc., Barrick will earn a 60% interest in the project by completing work expenditures totaling US$30 million before December 31, 2013. Barrick has informed Midway that it intends to conduct and fund the minimum required program of US$7 million in 2011 which will result in a cumulative expenditure of US$16 million by December 31, 2011. Drilling in 2011 is expected to focus on expanding the resource and evaluating satellite targets, particularly within the recently acquired land south of the existing resource.

The 2011 resource estimate includes all data provided to Midway by Barrick from its 2009 and 2010 drill campaigns. The estimate has been prepared by Gustavson Associates, LLC of Lakewood, Colorado, under the direction of Ms. Terre A. Lane, an independent Qualified Person. All estimates were prepared utilizing industry standard Software and resource estimation methodology. Further details will be available in a new NI 43-101 technical report, which will be posted on SEDAR (www.sedar.com), no later than 45 days from the date of this release.

(...)

Note: The tonnage and total ounces of gold were determined from the block model. Average grades were calculated from the tonnage and total ounces and then rounded to the significant digits shown. Calculations based on this table may differ due to rounding effects.

Information in this release has been reviewed and approved by Ms. Terre A. Lane, Principal Mining Engineer and Mr. Donald E. Hulse (P.E.), Vice President, Mining and Latin American Development, both of Gustavson, “qualified persons" as that term is defined in NI 43-101. This release has also been reviewed and approved for Midway by Mr. William S. Neal (M.Sc. and CPG), Midway’s Vice President of Geological Services and a "qualified person" as that term is defined in NI 43-101.

ON BEHALF OF THE BOARD

"Kenneth A. Brunk"

http://de.advfn.com/nachrichten/Midway-s-Spring-Valley-Nevad…

Kenneth A. Brunk, Director, President and COO

die beiden livecharts:

usa

Kanada

usa

Kanada

Midway hat eine Finanzierung zu 1,60$ durchgezogen - bemerkenswert daran ist, dass es keine Warrants gibt.

http://www.marketwatch.com/story/midway-announces-us12-milli…

Midway Gold Corp. ("Midway" or the "Company") CA:MDW

+5.37%

MDW

+7.85%

is pleased to announce that it has entered into an agreement with Haywood Securities Inc. (the "Underwriter"), pursuant to which the Underwriter has agreed to purchase, on a bought deal basis, 7,500,000 common shares (the "Common Shares") of the Company at a price of US$1.60 per Common Share (the "Issue Price") for aggregate gross proceeds to the Company of US$12,000,000 (the "Offering"). The Common Shares are to be sold by way of a prospectus supplement to Midway's existing base shelf prospectus dated April 21, 2011 and filed with the securities commissions in the provinces of British Columbia, Alberta and Ontario and in the United States by way of a prospectus supplement to the Company's base shelf prospectus included in the Company's shelf registration statement filed with the U.S. Securities and Exchange Commission (the "SEC") on April 21, 2011.

Midway intends to use the net proceeds of the offering to advance its projects, to fund its general and administrative costs (including property maintenance fees) and for general working capital purposes.

Closing of the Offering is expected to occur on or about June 6, 2011 and is subject to receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange and the NYSE Amex Equities.

Haywood Securities Inc. will receive a cash commission of 5% of the total gross proceeds.

http://www.marketwatch.com/story/midway-announces-us12-milli…

Midway Gold Corp. ("Midway" or the "Company") CA:MDW

+5.37%

MDW

+7.85%

is pleased to announce that it has entered into an agreement with Haywood Securities Inc. (the "Underwriter"), pursuant to which the Underwriter has agreed to purchase, on a bought deal basis, 7,500,000 common shares (the "Common Shares") of the Company at a price of US$1.60 per Common Share (the "Issue Price") for aggregate gross proceeds to the Company of US$12,000,000 (the "Offering"). The Common Shares are to be sold by way of a prospectus supplement to Midway's existing base shelf prospectus dated April 21, 2011 and filed with the securities commissions in the provinces of British Columbia, Alberta and Ontario and in the United States by way of a prospectus supplement to the Company's base shelf prospectus included in the Company's shelf registration statement filed with the U.S. Securities and Exchange Commission (the "SEC") on April 21, 2011.

Midway intends to use the net proceeds of the offering to advance its projects, to fund its general and administrative costs (including property maintenance fees) and for general working capital purposes.

Closing of the Offering is expected to occur on or about June 6, 2011 and is subject to receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange and the NYSE Amex Equities.

Haywood Securities Inc. will receive a cash commission of 5% of the total gross proceeds.

Antwort auf Beitrag Nr.: 41.533.713 von valueinvestor am 20.05.11 17:39:51Die doch angenehm überraschenden Umstände der Kapitalerhöhung führen an der börse zu einem sehr starken Kurszuwachs von über 12%.

Wer es schon einmal miterlebt hat, wie ein Explorer erst einmal 80% in die Knie gehen muss bevor er neues Kapital einsammeln kann, würdigt diese Umstände bestimmt.

Dabei kann Midway angenehmerweise jetzt mehrgleisig fahren.

Barrick kümmert sich um das gewaltige Potential von Spring Valley, an dem midway seinen Anteil hält, die pre feasablity für das Pan Projekt zeigt ein schönes Potential dort auf.

Wer es schon einmal miterlebt hat, wie ein Explorer erst einmal 80% in die Knie gehen muss bevor er neues Kapital einsammeln kann, würdigt diese Umstände bestimmt.

Dabei kann Midway angenehmerweise jetzt mehrgleisig fahren.

Barrick kümmert sich um das gewaltige Potential von Spring Valley, an dem midway seinen Anteil hält, die pre feasablity für das Pan Projekt zeigt ein schönes Potential dort auf.

Zitat von valueinvestor: Die doch angenehm überraschenden Umstände der Kapitalerhöhung führen an der börse zu einem sehr starken Kurszuwachs von über 12%.

Wer es schon einmal miterlebt hat, wie ein Explorer erst einmal 80% in die Knie gehen muss bevor er neues Kapital einsammeln kann, würdigt diese Umstände bestimmt.

Dabei kann Midway angenehmerweise jetzt mehrgleisig fahren.

Barrick kümmert sich um das gewaltige Potential von Spring Valley, an dem midway seinen Anteil hält, die pre feasablity für das Pan Projekt zeigt ein schönes Potential dort auf.

Weise Worte, da ist was dran

"Im Zuge der jüngsten Turbulenzen am Edelmetallmarkt fiel Minco Gold (Kanada: MMM) unter die wichtige 2-CAD-Marke. In dieser Zone hatten wir zu einer Absicherung per Stop-Loss geraten. Nun ist die Aktie vorerst uninteressant und wandert zurück auf unsere Watchlist. Abwärts ging es zuletzt auch mit Midway Gold (USA: MDW): Wer, wie von uns angeraten (siehe Ausgabe vom 09.05.2011), nachfassen wollte hatte dazu in den vergangenen beiden Wochen Gelegenheit. Uns gefällt nun vor allem die Anfang vergangener Woche entstandene Candlestick-Kerze, die das Ende der Konsolidierung signalisieren könnte. Wie zum Wochenschluss bekannt wurde, hat Midway eine Finanzierungsrunde durchgeführt, was die jüngste Kursschwäche erklärt. Die Amerikaner verkauften 7,5 Millionen neue Aktien zu je 1,60 USD, was brutto 12 Mio. USD für die Entwicklung der Goldprojekte in Nevada einbrachte: Unter dem Strich ein sehr guter Schritt des Managements, das nun mit rund 20 Mio.USD arbeiten kann. Bemerkenswert auch: Midway verzichtete bei besagter Privatplatzierung auf die Ausgabe von Warrants. Unser Fazit: Aktuell ist Midway eine gute Halteposition. Behalten Sie aber eine mentale Stop-Loss-Marke zwischen 1,20 und 1,30 USD im Auge. Midway ist und bleibt ein höchst volatiler Wert mit sehr guter Perspektive! "

http://www.capital-manager.net/aktuelles-detail.php?id=31

Pan kommt ganz gut voran:

Midway Drills Best Gold Intercept To-Date at Pan Project, Nevada

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Intraday Stock Chart

Heute : Tuesday 14 June 2011

Midway Gold Corp. ("Midway" or the "Company") (MDW:TSX-V; MDW:NYSE-AMEX) announces drill hole PN11-09 contained the longest and highest grade gold intercept yet encountered at its 100 percent controlled Pan Project, White Pine County, Nevada. This 30 meter intercept of 3.15 grams per tonne (gpt) gold includes a zone of 13.7 meters of 5.79 gpt gold which also includes a 1.5 meter interval of 10.1 gpt gold.

Drill hole PN11-09 is part of a reverse circulation (RC) drill program designed to expand the South Pan resource. Due to the unusually high grade assays and to confirm the initial results, sample rejects for the entire interval were re-assayed along with a new set of standard and blank samples. Results gave excellent reproducibility with the average grade of the interval proving to be identical for both sets of assays. This new intercept is located about 115 meters from drill hole PN10-03c which bottomed in 6.4 meters averaging 1.5 gpt gold (see Midway press release dated November 8, 2010).

Midway currently has one RC rig operating at Pan and to date in 2011, has completed approximately 7,200 meters in 28 RC holes. Gold assays received to date are summarized in the table below. Additional intercepts east of South Pan include 126.5 meters of 0.55 gpt gold in PN11-07 and 100 meters of 0.38 gpt gold in PN11-05. North of South Pan, intercepts include 71 meters of 0.45 gpt gold in PN11-12, 19.8 meters of 0.93 gpt gold in PN11-14, and 59 meters of 0.72 gpt gold in PN11-30. Drill holes PN11-17 to PN11-21 were condemnation holes drilled to test for mineralization beneath proposed mine facilities to depths of 250-450 meters. As expected, these condemnation holes did not find significant gold mineralization, therefore the area is confirmed suitable for locating the leach pad and associated production facilities. Drilling is also scheduled at North Pan this year where the current gold resource appears to remain open in all directions.

“The expansion of mineralization at South Pan from step out drilling to the east and north may have a positive impact on our mine design at Pan,” said Ken Brunk, President and COO of Midway. “Further data evaluation and additional drilling will be needed to quantify the impact. Meanwhile, our team of engineers continue to advance the Feasibility Study currently underway to aggressively move the project toward our planned 2013 production target.”

In addition to on-going geologic activities, several engineering programs are underway to support the Pan Feasibility Study. This includes detailed engineering of the leach pad facilities, final geo-technical design, metallurgical optimization, equipment selection, detailed mine design, design of utilities and ancillary support facilities, detailed man-power planning, and project execution scheduling, including construction methodologies and attendant schedules. The environmental team is completing the final phases of the Plan of Operations which will be submitted to the Bureau of Land Management, the project’s lead agency, in the coming weeks.

Notes:

Assays are 30 gram fire assays conducted by ALS Chemex labs in Sparks, Nevada. Reverse circulation drilling was conducted by O’Keefe Drilling of Butte, Montana. Intercepts reported using a 0.14 gpt cut off. Intercepts are along the length of the hole and may not represent true mineralized widths.

http://de.advfn.com/nachrichten/Midway-Drills-Best-Gold-Inte…

Midway Drills Best Gold Intercept To-Date at Pan Project, Nevada

Midway Gold Corp. Ordinary Shares (Canada) (AMEX:MDW)

Intraday Stock Chart

Heute : Tuesday 14 June 2011

Midway Gold Corp. ("Midway" or the "Company") (MDW:TSX-V; MDW:NYSE-AMEX) announces drill hole PN11-09 contained the longest and highest grade gold intercept yet encountered at its 100 percent controlled Pan Project, White Pine County, Nevada. This 30 meter intercept of 3.15 grams per tonne (gpt) gold includes a zone of 13.7 meters of 5.79 gpt gold which also includes a 1.5 meter interval of 10.1 gpt gold.

Drill hole PN11-09 is part of a reverse circulation (RC) drill program designed to expand the South Pan resource. Due to the unusually high grade assays and to confirm the initial results, sample rejects for the entire interval were re-assayed along with a new set of standard and blank samples. Results gave excellent reproducibility with the average grade of the interval proving to be identical for both sets of assays. This new intercept is located about 115 meters from drill hole PN10-03c which bottomed in 6.4 meters averaging 1.5 gpt gold (see Midway press release dated November 8, 2010).

Midway currently has one RC rig operating at Pan and to date in 2011, has completed approximately 7,200 meters in 28 RC holes. Gold assays received to date are summarized in the table below. Additional intercepts east of South Pan include 126.5 meters of 0.55 gpt gold in PN11-07 and 100 meters of 0.38 gpt gold in PN11-05. North of South Pan, intercepts include 71 meters of 0.45 gpt gold in PN11-12, 19.8 meters of 0.93 gpt gold in PN11-14, and 59 meters of 0.72 gpt gold in PN11-30. Drill holes PN11-17 to PN11-21 were condemnation holes drilled to test for mineralization beneath proposed mine facilities to depths of 250-450 meters. As expected, these condemnation holes did not find significant gold mineralization, therefore the area is confirmed suitable for locating the leach pad and associated production facilities. Drilling is also scheduled at North Pan this year where the current gold resource appears to remain open in all directions.

“The expansion of mineralization at South Pan from step out drilling to the east and north may have a positive impact on our mine design at Pan,” said Ken Brunk, President and COO of Midway. “Further data evaluation and additional drilling will be needed to quantify the impact. Meanwhile, our team of engineers continue to advance the Feasibility Study currently underway to aggressively move the project toward our planned 2013 production target.”

In addition to on-going geologic activities, several engineering programs are underway to support the Pan Feasibility Study. This includes detailed engineering of the leach pad facilities, final geo-technical design, metallurgical optimization, equipment selection, detailed mine design, design of utilities and ancillary support facilities, detailed man-power planning, and project execution scheduling, including construction methodologies and attendant schedules. The environmental team is completing the final phases of the Plan of Operations which will be submitted to the Bureau of Land Management, the project’s lead agency, in the coming weeks.

PAN PROJECT DRILL INTERCEPTS

Drill hole Area Starting

From (m) Length

meters Grade

(gpt) Starting

PN11-01 S Pan 25.9 76.2 1.371

PN11-02 S Pan 0.0 170.7 0.720

PN11-03 S Pan 62.5 30.5 0.55

PN11-04 S Pan 170.7 6.1 0.34

182.9 3.0 0.27

207.3 3.0 0.17 680 10 0.005

PN11-05 S Pan 71.6 21.3 0.14

99.1 100.6 0.38

PN11-06 S Pan 96.0 10.7 0.27

141.7 15.2 0.89

166.1 19.8 0.62

PN11-07 S Pan 54.9 126.5 0.55

PN11-08 S Pan 77.7 79.2 0.65

164.6 12.2 0.31

PN11-09 S Pan 146.3 30.5 3.15

includes 157.0 13.7 5.79

PN11-10 S Pan 112.8 10.7 0.17

184.4 7.6 0.21

199.6 15.2 0.21

PN11-11 S Pan no significant intercept

PN11-12 S Pan 109.7 71.6 0.45

PN11-13 S Pan 157.0 24.4 0.21

PN11-14 S Pan 131.1 19.8 0.93

PN11-15 S Pan 0.0 18.3 0.31

65.5 10.7 0.41

PN11-16 S Pan 120.4 22.9 0.48

PN11-17 Facilities Condemnation hole no significant intercept

PN11-18 Facilities Condemnation hole no significant intercept

PN11-19 Facilities Condemnation hole no significant intercept

PN11-20 Facilities Condemnation hole no significant intercept

PN11-21 Facilities Condemnation hole no significant intercept

Notes:

Assays are 30 gram fire assays conducted by ALS Chemex labs in Sparks, Nevada. Reverse circulation drilling was conducted by O’Keefe Drilling of Butte, Montana. Intercepts reported using a 0.14 gpt cut off. Intercepts are along the length of the hole and may not represent true mineralized widths.

http://de.advfn.com/nachrichten/Midway-Drills-Best-Gold-Inte…

Ds Rekordvolumen am Freitag war der Aufnahme in den Russel 3000 Index geschuldet.

http://www.russell.com/indexes/tools-resources/reconstitutio…

Der Kursanstieg dazu auf über 2 Dollar ist signifikant, ich habe bei anderen Neuaufnahmen gespickelt, dort war das Volumen auch meist rekordhoch, Kurssteigerungen aber keineswegs die Regel.

Eigentlich warten eh alle nur auf die Spring Valley Löcher zwischen Loch 499 und der Pit

und die Frage, ob es bei 4 Mio Unzen (siehe jüngste Resourcenschätzung,

http://www.usetdas.com/maps/midway/MidwayFigureMay2-11.pdf) bleibt oder Richtung 10 Mio geht.

http://www.russell.com/indexes/tools-resources/reconstitutio…

Der Kursanstieg dazu auf über 2 Dollar ist signifikant, ich habe bei anderen Neuaufnahmen gespickelt, dort war das Volumen auch meist rekordhoch, Kurssteigerungen aber keineswegs die Regel.

Eigentlich warten eh alle nur auf die Spring Valley Löcher zwischen Loch 499 und der Pit

und die Frage, ob es bei 4 Mio Unzen (siehe jüngste Resourcenschätzung,

http://www.usetdas.com/maps/midway/MidwayFigureMay2-11.pdf) bleibt oder Richtung 10 Mio geht.

heute eine hochsignifikante Kursbewegung.

Der breite Markt schwächelt nach starkem Start, unter den 63 ganz großen sind nur ganz wenige im Plus:

http://www.kitco.com/stocks/changepercentage_desc.html

da sind die bis jetzt 6,8% heute richtig gut.

Oft beobachte ich, dass sich vor wichtigen Nachrichten der Chart an einer Ausbruchmarke positioniert, das wäre bei MDW sicher das hoch bei 2,39. Und dann bitte 5 Löcher zwischen pit und step out mit der gleichen Mieralisierung!

Der breite Markt schwächelt nach starkem Start, unter den 63 ganz großen sind nur ganz wenige im Plus:

http://www.kitco.com/stocks/changepercentage_desc.html

da sind die bis jetzt 6,8% heute richtig gut.

Oft beobachte ich, dass sich vor wichtigen Nachrichten der Chart an einer Ausbruchmarke positioniert, das wäre bei MDW sicher das hoch bei 2,39. Und dann bitte 5 Löcher zwischen pit und step out mit der gleichen Mieralisierung!

Jetzt ists ein Homerun:

Midway Reports Long Gold Intercepts at Spring Valley Project, Nevada

DENVER, Jul 13, 2011 (BUSINESS WIRE) -- Midway Gold Corp. ("Midway" or the "Company") (mdw:TSX-V)(mdw:NYSE-AMEX) announces results calculated from data provided by Barrick Gold Exploration Inc. ("Barrick"), who is earning into Midway's Spring Valley Project, Nevada. Highlights include metallic screen assays with gold intercepts of 166 meters of 1.48 grams per tonne (gpt) gold, including 23 meters of 2.15 gpt gold in SV10-510, and 218 meters of 2.7 gpt gold including 41 meters of 12.3 gpt in SV10-511c.

2010 Drilling

On the north end of the known resource, metallic screen assays for drill hole SV10-510 report 166 meters of 1.48 gpt gold, which includes 23 meters of 2.15 gpt gold, and hole SV10-511c contains 218 meters of 2.7 gpt gold, which also includes 41 meters of 12.3 gpt gold. This northern zone appears to remain open to the north, and additional infill drilling will be required to include this zone with the currently defined gold resource.

South of the existing resource (see map below), metallic screen assays for drill hole SV10-499 confirm the presence of a 205-meter-thick zone of anomalous mineralization averaging 0.24 gpt gold. This thick anomalous gold zone, only 1,800 meters from the known resource area, suggests that the intervening ground is ideally located for on-going exploration and resource expansion. Additional reverse circulation (RC) and core drilling will test this zone and its continuity with the known gold resource.

Final metallic screen assay results have been received for 12 holes drilled in 2010. Assays are pending for two 2010 core drill holes. Highlights of the first quarter drill results as calculated by Midway are summarized in the table below. These new metallic screen assays include some intervals that Midway considers significantly better than previously reported intercepts based on fire assays (Midway press release dated February 24, 2011). Metallic screen assays analyze a larger quantity of the sample and are more reliable when coarse gold is present.

2011 Drilling

The 2011 drilling program commenced in early April, and two RC rigs and one core rig are currently operating. The 2011 drill plan is focused on expanding the resource and evaluating property acquired near the end of 2010 south of the current resource area. In addition to drilling, cultural and biological surveys, hydrogeologic studies and trace element analyses are underway to support future permit applications.

To view a map of the 2011 Resource Area and 2011 Drill Targets at Spring Valley, please click on the following link: To view a map of the 2011 Resource Area and 2011 Drill Targets at Spring Valley, please click on the following link: http://www.usetdas.com/pr/midwaymap.gif .

Spring Valley is a large, porphyry-hosted gold system. A May, 2011 updated resource estimate reported 2.16 million ounces of gold in the combined Measured and Indicated categories at a cut-off grade of 0.14 gpt. There is an additional Inferred resource of 1.97 million ounces of gold at the same cut-off grade. The Measured resource is 0.93 million ounces contained within 59.0 million tonnes grading 0.49 gpt, the Indicated resource is 1.23 million ounces contained within 85.8 million tonnes grading 0.45 gpt, and the Inferred resource is contained within 103.9 million tonnes grading 0.59 gpt. The estimate was prepared for Midway by Gustavson Associates, LLC of Lakewood, Colorado (Midway press release dated May 2, 2011).

Under the terms of a March 9, 2009 agreement between Midway and Barrick, Barrick will earn a 60% interest in the project by completing work expenditures totaling US$30 million before December 31, 2013. Barrick has informed Midway that it intends to conduct and fund the minimum required program of US$7 million in 2011, resulting in cumulative expenditures of US$16 million by December 31, 2011.

Reverse circulation drilling was conducted by Hard Rock Drilling of Elko, Nevada. Core drilling was conducted by TonaTec Exploration of Mapleton, Utah. Drill hole numbers ending with a "C" indicate core holes. Samples were assayed by ALS-Chemex Labs, in Sparks, Nevada by 30-gram fire assays (FA) or 1000-gram metallic screen assays (MS). Results reported represent thickness along the trace of the drill hole and do not necessarily represent true thickness.

Data provided to Midway by Barrick and disclosed in this press release have been reviewed for Midway by William S. Neal, (M.Sc., CPG), a "Qualified Person" as that term is defined in National Instrument 43-101.

ON BEHALF OF THE BOARD

"Kenneth A. Brunk"

http://www.marketwatch.com/story/midway-reports-long-gold-in…

Midway Reports Long Gold Intercepts at Spring Valley Project, Nevada

DENVER, Jul 13, 2011 (BUSINESS WIRE) -- Midway Gold Corp. ("Midway" or the "Company") (mdw:TSX-V)(mdw:NYSE-AMEX) announces results calculated from data provided by Barrick Gold Exploration Inc. ("Barrick"), who is earning into Midway's Spring Valley Project, Nevada. Highlights include metallic screen assays with gold intercepts of 166 meters of 1.48 grams per tonne (gpt) gold, including 23 meters of 2.15 gpt gold in SV10-510, and 218 meters of 2.7 gpt gold including 41 meters of 12.3 gpt in SV10-511c.

2010 Drilling

On the north end of the known resource, metallic screen assays for drill hole SV10-510 report 166 meters of 1.48 gpt gold, which includes 23 meters of 2.15 gpt gold, and hole SV10-511c contains 218 meters of 2.7 gpt gold, which also includes 41 meters of 12.3 gpt gold. This northern zone appears to remain open to the north, and additional infill drilling will be required to include this zone with the currently defined gold resource.

South of the existing resource (see map below), metallic screen assays for drill hole SV10-499 confirm the presence of a 205-meter-thick zone of anomalous mineralization averaging 0.24 gpt gold. This thick anomalous gold zone, only 1,800 meters from the known resource area, suggests that the intervening ground is ideally located for on-going exploration and resource expansion. Additional reverse circulation (RC) and core drilling will test this zone and its continuity with the known gold resource.

Final metallic screen assay results have been received for 12 holes drilled in 2010. Assays are pending for two 2010 core drill holes. Highlights of the first quarter drill results as calculated by Midway are summarized in the table below. These new metallic screen assays include some intervals that Midway considers significantly better than previously reported intercepts based on fire assays (Midway press release dated February 24, 2011). Metallic screen assays analyze a larger quantity of the sample and are more reliable when coarse gold is present.

2011 Drilling

The 2011 drilling program commenced in early April, and two RC rigs and one core rig are currently operating. The 2011 drill plan is focused on expanding the resource and evaluating property acquired near the end of 2010 south of the current resource area. In addition to drilling, cultural and biological surveys, hydrogeologic studies and trace element analyses are underway to support future permit applications.

To view a map of the 2011 Resource Area and 2011 Drill Targets at Spring Valley, please click on the following link: To view a map of the 2011 Resource Area and 2011 Drill Targets at Spring Valley, please click on the following link: http://www.usetdas.com/pr/midwaymap.gif .