Alacer Gold the new rocket? - 500 Beiträge pro Seite

eröffnet am 06.11.11 12:46:33 von

neuester Beitrag 17.09.20 12:20:31 von

neuester Beitrag 17.09.20 12:20:31 von

Beiträge: 268

ID: 1.170.166

ID: 1.170.166

Aufrufe heute: 0

Gesamt: 22.767

Gesamt: 22.767

Aktive User: 0

ISIN: CA0106791084 · WKN: A1JFG6

6,1260

EUR

+0,39 %

+0,0240 EUR

Letzter Kurs 17.09.20 Tradegate

Neuigkeiten

!

Dieser Beitrag wurde von MODernist moderiert. Grund: Spam, Werbung

http://finance.yahoo.com/echarts?s=ALIAF.PK+Interactive#symb…

Na viel Spass beim Kursnachrennen

MK von 3.3 Milliarden

http://finance.yahoo.com/q?s=ALIAF.PK&ql=1

30 mal höher als mmy!

und p/e über 40!!!!!!!

http://seekingalpha.com/article/298914-3-gold-stocks-that-co…

One of Eldorado’s competitors is Anatolia Minerals Development Ltd. (ALIAF.PK). ALIAF.PK is currently trading around $10 with a market cap of $2.8 billion and a negative price to earnings ratio.

Eldorado is a Canadian gold mining company that operates throughout the world. The company is well established, and has made a profit in each of the last five years. In 2010, the company benefited from the high price of gold and realized a 91.5% increased in its net income. The company increased year-over-year second quarter revenues by 9.9% and net income by 12.4%. In spite of the recent earnings increases, the stock has performed poorly. The stock price is down by 10.7% over the last 52 weeks and 29.2% over the last month. With a price to earnings ratio of 40.37 and a price to book ratio of 3.06, this stock is still expensive for a gold stock. I rate Eldorado as a hold.

Na viel Spass beim Kursnachrennen

MK von 3.3 Milliarden

http://finance.yahoo.com/q?s=ALIAF.PK&ql=1

30 mal höher als mmy!

und p/e über 40!!!!!!!

http://seekingalpha.com/article/298914-3-gold-stocks-that-co…

One of Eldorado’s competitors is Anatolia Minerals Development Ltd. (ALIAF.PK). ALIAF.PK is currently trading around $10 with a market cap of $2.8 billion and a negative price to earnings ratio.

Eldorado is a Canadian gold mining company that operates throughout the world. The company is well established, and has made a profit in each of the last five years. In 2010, the company benefited from the high price of gold and realized a 91.5% increased in its net income. The company increased year-over-year second quarter revenues by 9.9% and net income by 12.4%. In spite of the recent earnings increases, the stock has performed poorly. The stock price is down by 10.7% over the last 52 weeks and 29.2% over the last month. With a price to earnings ratio of 40.37 and a price to book ratio of 3.06, this stock is still expensive for a gold stock. I rate Eldorado as a hold.

Alacer Gold verfügt gleich über mehrere interessante Projekte in Australien und der Türkei.

Obwohl man Alacer Gold mittlerweile bereits zu den mittelgroßen Goldförderern zählen kann, ist die Aktie bei den meisten Anlegern noch weitgehend unbekannt. Dies liegt wohl daran, dass die Geselschaft erst im vergangenen Jahr aus der Fusion zwischen Avoca Gold und Anatolia Minerals hervorging und daher erst seitdem auf dem Kurszettel zu finden ist.

Alacer Gold betreibt derzeit insgesamt vier Minen.

Im vierten Quartal per Ende September meldete die Gesellschaft eine Rekord -Goldproduktion von 112.680 Unzen, nach 101.348 Unzen im Vorquartal.

Im Gesamtjahr 2011 will Alacer Gold eine Förderung von rund 400.000 Unzen zu günstigen Cashkosten von 590 Dollar je Unze erreichen. Darüber hinaus verfügt das Unternehmen über 5,8 Millionen Unzen Gold an Reserven und 15 Millionen Gold an Ressourcen.

Kursziel meiner Meinung nach bei 17€.

Obwohl man Alacer Gold mittlerweile bereits zu den mittelgroßen Goldförderern zählen kann, ist die Aktie bei den meisten Anlegern noch weitgehend unbekannt. Dies liegt wohl daran, dass die Geselschaft erst im vergangenen Jahr aus der Fusion zwischen Avoca Gold und Anatolia Minerals hervorging und daher erst seitdem auf dem Kurszettel zu finden ist.

Alacer Gold betreibt derzeit insgesamt vier Minen.

Im vierten Quartal per Ende September meldete die Gesellschaft eine Rekord -Goldproduktion von 112.680 Unzen, nach 101.348 Unzen im Vorquartal.

Im Gesamtjahr 2011 will Alacer Gold eine Förderung von rund 400.000 Unzen zu günstigen Cashkosten von 590 Dollar je Unze erreichen. Darüber hinaus verfügt das Unternehmen über 5,8 Millionen Unzen Gold an Reserven und 15 Millionen Gold an Ressourcen.

Kursziel meiner Meinung nach bei 17€.

ich denke wir werden hier bald steigende Kurse sehen.

Antwort auf Beitrag Nr.: 42.315.012 von holzfuss12345 am 07.11.11 20:35:12ich denke wir werden hier bald steigende Kurse sehen.

Die sehen wir doch jetzt schon

Die sehen wir doch jetzt schon

Angesichts der starken Produktionszahlen und der hervorragenden Wachstumsperspektiven ist Alacer Gold im Vergleich zu Konkurrenten wie New Gold sehr günstig bewertet. Dies dürfte auch dem ein oder anderen großen Goldproduzenten wie beispielsweise Barrick Gold nicht entgangen sein. Die hervorragenden Fundamentaldaten sowie aufkeimende Übernahmefantasie dürften den Wert in den kommenden Wochen zum Großen Gewinner machen.

jetzt sollte FR noch pari ziehen....morgen!

Antwort auf Beitrag Nr.: 42.321.507 von holzfuss12345 am 08.11.11 20:43:44Und wenn die Übernahme nicht kommt, steige ich dann vielleicht bei 4 USD ein

Antwort auf Beitrag Nr.: 42.332.512 von Simonalex am 10.11.11 17:08:10ich denke eine Übernahme ist nicht ausgeschlossen.

Man sollte mal die Prognosen genauer unter die Lupe nehmen.

In den kommenden Jahren will man das schon gute Zahlenwerk noch deutlich ausbauen. Neben South Kalgoorlie soll insbesondere die türkische Cöpler-Mine für weiteres Wachstum sorgen. So deuten die jüngsten Bohrungen dort auf zusätzliche Ressourcen sowohl in Oxid- aus auch Sulfidzonen hin.

Man sollte mal die Prognosen genauer unter die Lupe nehmen.

In den kommenden Jahren will man das schon gute Zahlenwerk noch deutlich ausbauen. Neben South Kalgoorlie soll insbesondere die türkische Cöpler-Mine für weiteres Wachstum sorgen. So deuten die jüngsten Bohrungen dort auf zusätzliche Ressourcen sowohl in Oxid- aus auch Sulfidzonen hin.

12,48 Kanadische Dollar = 9,01752836 Euro

Das werden wir morgen sehen!

Schade, dass ich diese Perle nicht weiter bewerben kann.

Diese Aktie mach einen reich und keiner weiß es....

Das werden wir morgen sehen!

Schade, dass ich diese Perle nicht weiter bewerben kann.

Diese Aktie mach einen reich und keiner weiß es....

Hier wächst ein Gigant heran. Gefällt mir sehr, wie New Gold. Gibt es was solideres als Goldmining stocks bzw. Gold in 2012?!

Der Goldpreis hat sich in den letzten 2 Tagen von der Entwicklung des EUR/$ Kursen abgekoppelt. Wenn dieser Zustand anhält, könnten Goldminenaktien das Top-Investment in 2012 werden. Mit 410.000 oz in 2011 und 500.000 oz in 2012 ist Alacer Gold als Mid-Tier Produzent meiner Meinung nach, eine sehr gute Wahl (vielleicht auch mit Dividende).

http://watch.bnn.ca/the-street/january-2012/the-street-janua…

800,000 oz/a in 2015!

Edward Dowling, President and CEO:

“Alacer has surpassed 2011 guidance with gold production from our four mines totaling 421,204 ounces for 2011. This great result is largely due to our flagship Çöpler Gold Mine outperforming expectations during its first year of operations.”

800,000 oz/a in 2015!

Edward Dowling, President and CEO:

“Alacer has surpassed 2011 guidance with gold production from our four mines totaling 421,204 ounces for 2011. This great result is largely due to our flagship Çöpler Gold Mine outperforming expectations during its first year of operations.”

Die Aktie wurde leider massiv abgestraft, weil für diese Jahr keine Produktionssteigerung in Aussicht gestellt wurde. Da könnte der Kurs noch länger drunter leiden.

Der Wert lief ja letztes Jahr im Gegensatz zu vielen anderen sehr gut.

Was macht ihr? Drinbleiben oder nach alternativen Werten suchen? Gibt ja derzeit genug, die sehr aussichtsreich sind, u. a. wegen der Charttechnik.

Der Wert lief ja letztes Jahr im Gegensatz zu vielen anderen sehr gut.

Was macht ihr? Drinbleiben oder nach alternativen Werten suchen? Gibt ja derzeit genug, die sehr aussichtsreich sind, u. a. wegen der Charttechnik.

Antwort auf Beitrag Nr.: 42.651.568 von branigan am 26.01.12 14:09:51Alacer Gold (WKN A1JFG6) hat 2011 mit einer Goldproduktion von 421.204 Unzen die eigenen Prognosen übertroffen. Für das laufende Jahr geht man von einem Ausstoß zwischen 420.000 und 440.000 Unzen Gold bei Cashkosten von 688 bis 693 USD pro Unze des gelben Metalls aus

Wie es aus dem Unternehmen zudem hieß, will man 2012 die Exploration aggressiv ausweiten und zu diesem Zweck das Explorationsbudget substanziell auf 50 Mio. Dollar erhöhen.

Also ich bleibe drin!

Wie es aus dem Unternehmen zudem hieß, will man 2012 die Exploration aggressiv ausweiten und zu diesem Zweck das Explorationsbudget substanziell auf 50 Mio. Dollar erhöhen.

Also ich bleibe drin!

Antwort auf Beitrag Nr.: 42.651.568 von branigan am 26.01.12 14:09:51Am 6.11.11 war die MK 3300 Millionen USD

Heute beträgt die MK noch 2650 Million USD

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Verlust 38 Millionen, noch keine Produktion im 2010

Halbjahreszahlen 2011

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Umsatz 189 Millionen

Verlust 30 Millionen (darin enthalten Merger Kosten von 71 Millionen)

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

9 Monate / nur 3.Quartal 2011

Umsatz 373 Millionen / 184 Millionen

Gewinn 10 Millionen / 41 Millionen

Jahrenzahlen noch ausstehend

Ich bleibe hier an der Seitenlinie.

Ist mir immer noch zu teuer.

Zwei Dollar tiefer schaue ich mir die weitere Entwicklung nochmal an.

Heute beträgt die MK noch 2650 Million USD

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Verlust 38 Millionen, noch keine Produktion im 2010

Halbjahreszahlen 2011

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

Umsatz 189 Millionen

Verlust 30 Millionen (darin enthalten Merger Kosten von 71 Millionen)

http://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=…

9 Monate / nur 3.Quartal 2011

Umsatz 373 Millionen / 184 Millionen

Gewinn 10 Millionen / 41 Millionen

Jahrenzahlen noch ausstehend

Ich bleibe hier an der Seitenlinie.

Ist mir immer noch zu teuer.

Zwei Dollar tiefer schaue ich mir die weitere Entwicklung nochmal an.

Man hört so Gerüchte das Alacer versucht die übrigen 51% an der Frog's Leg Mine in Australien aufzukaufen, welche derzeit von La Mancha gehalten werden. Areva will sich nehmlich von seinen Gold Assets trennen. Soweit ich weiß hält Areva mehr als 50% der Aktien von La Mancha. Schauen wir mal...

Alacer Gold Corp

Symbol C : ASR

Shares Issued 279,020,533

Close 2012-02-03 C$ 9.51

Recent Sedar Documents

Alacer's Higginsville at 7.9 Mt of 3.5 g/t Au P+P

2012-02-06 02:15 ET - News Release

Mr. Edward Dowling reports

ALACER GOLD ANNOUNCES 23% INCREASE OF HIGGINSVILLE MINERAL RESERVE ESTIMATE TO 875,000 OUNCES

Alacer Gold Corp. has issued updated mineral resource and reserve estimates for its Higginsville gold operations in Australia. The mineral reserve estimate has increased by 164,000 ounces (net of mining depletion over 18 months) to 7.9 million tonnes at 3.5 grams per tonne gold, containing 875,000 ounces, as detailed in the related table.

MINERAL RESERVE FOR HIGGINSVILLE OPERATIONS AS AT DEC.31, 2011

Proven Probable Total reserves

Tonnes Grade Ounces Tonnes Grade Ounces Tonnes Grade Ounces

(kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s)

Trident underground 595 5.0 96 3,108 4.5 447 3,703 4.6 543

Chalice underground - - - 1,049 4.3 144 1,049 4.3 144

Fairplay underground - - - 139 6.4 29 139 6.4 29

Open pits - - - 2,704 1.7 151 2,704 1.7 151

Stockpiles (*) 282 0.8 7 - - - 282 0.8 7

Total 877 3.7 104 7,000 3.4 771 7,877 3.5 875

Note: Rounding differences will occur. The above estimate is based on a gold price of

$1,350 (U.S.) per ounce.

(*) Includes satellite and Trident low-grade stockpiles.

Edward Dowling, president and chief executive officer of Alacer, stated: "This updated Higginsville reserve is the culmination of extensive drilling and other work since July, 2010. The net increase of 164,000 ounces is quite significant considering that the Higginsville gold operations produced more than 230,000 ounces of gold during the 18 months to December, 2011.

"The increased reserves are largely due to down-plunge extensions of the Trident orebody. The Trident reserve was about 500,000 ounces when mining started four years ago, more than 500,000 ounces have now been produced from Trident, and the Trident reserve remains more than 500,000 ounces.

"It is important to note that the measured and indicated resources for Trident and Chalice total a combined 5.7 million tonnes at 4.9 grams per tonne gold, containing 895,000 ounces. Further drilling should progressively convert more resources to reserves as well as continuing to extend both resources. These efforts take time, but we are excited about the likelihood of additional high-margin ores as demonstrated by the recent high-grade discovery at Corona within the Higginsville line of lode.

"An increasing proportion of Higginsville feed should be high-grade ore from underground mines following the ramp-up of Chalice ore production later this year. This will take Higginsville a long way towards the target of processing 1.5 million tonnes per annum at a head grade of 4.5 grams per tonne gold, thus producing approximately 200,000 ounces per annum."

The primary components of the net reserve increase of 164,000 ounces since the previous (July, 2010) estimate are:

Despite Trident being the predominant ore source for Higginsville, the Trident underground mineral reserve increased by 47,000 ounces largely as a result of additional ounces in the Artemis and Helios lodes, partially offset by mining depleting the Western zone, Apollo and Athena lodes.

The Chalice mineral reserve increased by 26,000 ounces and reflects the identification of the new lodes in the footwall to the main Olympus lode. The grade has decreased slightly due to additional drilling and conversion to reserves of resources up dip of the Olympus lode.

The updated estimate includes a maiden Fairplay underground mineral reserve of 29,000 ounces. This relatively high-grade reserve would potentially be accessed from the floor of the planned Fairplay pit.

Systematic evaluation of existing mineral resources has increased open pit mineral reserves by a total of 79,000 ounces, predominantly from the Pluto, Musket, Mitchell and Vine deposits.

The updated mineral reserve was estimated at a gold price of $1,350 (U.S.) per ounce, compared with $1,200 per ounce for the July, 2010 mineral reserve.

The Higginsville mineral resource was previously stated at July 1, 2011. This previous estimate has been adjusted to reflect mining depletion totalling 61,302 ounces over the six months to Dec. 31, 2011. The updated estimate is in the related table.

MINERAL RESOURCE FOR HIGGINSVILLE OPERATIONS AS AT DEC. 31, 2011

Measured Indicated Measured and indicated Inferred

Project Tonnes Au Grade Au ounces Tonnes Au grade Au ounces Tonnes Au grade Au ounces Tonnes Au grade Au ounces

(kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s)

Trident 1,252 4.6 187 3,159 5.2 525 4,411 5.0 711 625 3.9 79

Chalice - - - 1,250 4.6 184 1,250 4.6 184 336 4.4 48

Fairplay area - - - 2,669 1.9 165 2,669 1.9 165 145 2.1 10

Palaeochannels - - - 1,203 2.1 81 1,203 2.1 81 121 1.8 7

Lake Cowan - - - 1,773 1.6 92 1,773 1.6 92 56 1.1 2

Other 194 0.7 4 434 2.6 36 628 2.0 40 923 1.7 50

Total 1,445 4.1 191 10,489 3.2 1,083 11,934 3.3 1,274 2,205 2.8 196

Note: Rounding differences will occur.

Mineral resources are quoted inclusive of mineral reserves.

Further mineral resource and reserve updates

Alacer intends to provide an updated Copler mineral resource estimate during Q1 2012.

An updated mineral reserve estimate for the South Kalgoorlie operations is expected to be announced following completion of underground mining feasibility studies for the Mt. Marion West and HBJ deposits, and review by the Alacer board of the South Kalgoorlie expansion project.

Current mineral reserve figures are stated as at Dec. 31, 2011, with depletion by production where relevant. A comparison with the previous reserve is in the related table.

HIGGINSVILLE -- MINERAL RESERVES COMPARISON

Previous (*) As at Dec. 31, 2011 Change

Project Tonnes Au Grade Contained Au Tonnes Au grade Contained Au Tonnes Au grade Contained Au

(kt) (g/t (000s ounces) (kt) (g/t) (000s ounces) (kt) (g/t) (000s ounces)

Trident underground 3,219 4.8 496 3,703 4.6 543 484 (0.2) 47

Chalice underground 727 5.1 118 1,049 4.3 144 322 (0.8) 26

Fairplay underground - - - 139 6.4 29 139 6.4 29

Open pits 1,226 2.0 78 2,704 1.7 151 1,478 (0.3) 73

Stockpiles 505 1.2 19 282 0.8 7 (223) (0.4) (12)

Total 5,677 3.9 711 7,877 3.5 875 2,200 (0.4) 164

* The previous mineral reserve is at July 1, 2010, and is detailed in NI 43-101 technical report of the mining

operations and exploration tenements of Avoca Resources Ltd., Western Australia, completed by SRK Consulting

and dated Dec. 15, 2010.

There are no known environmental, permitting, legal, taxation, political or other relevant issues that would materially affect the estimates of the mineral reserves.

Due to rounding of figures small discrepancies may exist.

We seek Safe Harbor.

Symbol C : ASR

Shares Issued 279,020,533

Close 2012-02-03 C$ 9.51

Recent Sedar Documents

Alacer's Higginsville at 7.9 Mt of 3.5 g/t Au P+P

2012-02-06 02:15 ET - News Release

Mr. Edward Dowling reports

ALACER GOLD ANNOUNCES 23% INCREASE OF HIGGINSVILLE MINERAL RESERVE ESTIMATE TO 875,000 OUNCES

Alacer Gold Corp. has issued updated mineral resource and reserve estimates for its Higginsville gold operations in Australia. The mineral reserve estimate has increased by 164,000 ounces (net of mining depletion over 18 months) to 7.9 million tonnes at 3.5 grams per tonne gold, containing 875,000 ounces, as detailed in the related table.

MINERAL RESERVE FOR HIGGINSVILLE OPERATIONS AS AT DEC.31, 2011

Proven Probable Total reserves

Tonnes Grade Ounces Tonnes Grade Ounces Tonnes Grade Ounces

(kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s)

Trident underground 595 5.0 96 3,108 4.5 447 3,703 4.6 543

Chalice underground - - - 1,049 4.3 144 1,049 4.3 144

Fairplay underground - - - 139 6.4 29 139 6.4 29

Open pits - - - 2,704 1.7 151 2,704 1.7 151

Stockpiles (*) 282 0.8 7 - - - 282 0.8 7

Total 877 3.7 104 7,000 3.4 771 7,877 3.5 875

Note: Rounding differences will occur. The above estimate is based on a gold price of

$1,350 (U.S.) per ounce.

(*) Includes satellite and Trident low-grade stockpiles.

Edward Dowling, president and chief executive officer of Alacer, stated: "This updated Higginsville reserve is the culmination of extensive drilling and other work since July, 2010. The net increase of 164,000 ounces is quite significant considering that the Higginsville gold operations produced more than 230,000 ounces of gold during the 18 months to December, 2011.

"The increased reserves are largely due to down-plunge extensions of the Trident orebody. The Trident reserve was about 500,000 ounces when mining started four years ago, more than 500,000 ounces have now been produced from Trident, and the Trident reserve remains more than 500,000 ounces.

"It is important to note that the measured and indicated resources for Trident and Chalice total a combined 5.7 million tonnes at 4.9 grams per tonne gold, containing 895,000 ounces. Further drilling should progressively convert more resources to reserves as well as continuing to extend both resources. These efforts take time, but we are excited about the likelihood of additional high-margin ores as demonstrated by the recent high-grade discovery at Corona within the Higginsville line of lode.

"An increasing proportion of Higginsville feed should be high-grade ore from underground mines following the ramp-up of Chalice ore production later this year. This will take Higginsville a long way towards the target of processing 1.5 million tonnes per annum at a head grade of 4.5 grams per tonne gold, thus producing approximately 200,000 ounces per annum."

The primary components of the net reserve increase of 164,000 ounces since the previous (July, 2010) estimate are:

Despite Trident being the predominant ore source for Higginsville, the Trident underground mineral reserve increased by 47,000 ounces largely as a result of additional ounces in the Artemis and Helios lodes, partially offset by mining depleting the Western zone, Apollo and Athena lodes.

The Chalice mineral reserve increased by 26,000 ounces and reflects the identification of the new lodes in the footwall to the main Olympus lode. The grade has decreased slightly due to additional drilling and conversion to reserves of resources up dip of the Olympus lode.

The updated estimate includes a maiden Fairplay underground mineral reserve of 29,000 ounces. This relatively high-grade reserve would potentially be accessed from the floor of the planned Fairplay pit.

Systematic evaluation of existing mineral resources has increased open pit mineral reserves by a total of 79,000 ounces, predominantly from the Pluto, Musket, Mitchell and Vine deposits.

The updated mineral reserve was estimated at a gold price of $1,350 (U.S.) per ounce, compared with $1,200 per ounce for the July, 2010 mineral reserve.

The Higginsville mineral resource was previously stated at July 1, 2011. This previous estimate has been adjusted to reflect mining depletion totalling 61,302 ounces over the six months to Dec. 31, 2011. The updated estimate is in the related table.

MINERAL RESOURCE FOR HIGGINSVILLE OPERATIONS AS AT DEC. 31, 2011

Measured Indicated Measured and indicated Inferred

Project Tonnes Au Grade Au ounces Tonnes Au grade Au ounces Tonnes Au grade Au ounces Tonnes Au grade Au ounces

(kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s) (kt) (g/t) (000s)

Trident 1,252 4.6 187 3,159 5.2 525 4,411 5.0 711 625 3.9 79

Chalice - - - 1,250 4.6 184 1,250 4.6 184 336 4.4 48

Fairplay area - - - 2,669 1.9 165 2,669 1.9 165 145 2.1 10

Palaeochannels - - - 1,203 2.1 81 1,203 2.1 81 121 1.8 7

Lake Cowan - - - 1,773 1.6 92 1,773 1.6 92 56 1.1 2

Other 194 0.7 4 434 2.6 36 628 2.0 40 923 1.7 50

Total 1,445 4.1 191 10,489 3.2 1,083 11,934 3.3 1,274 2,205 2.8 196

Note: Rounding differences will occur.

Mineral resources are quoted inclusive of mineral reserves.

Further mineral resource and reserve updates

Alacer intends to provide an updated Copler mineral resource estimate during Q1 2012.

An updated mineral reserve estimate for the South Kalgoorlie operations is expected to be announced following completion of underground mining feasibility studies for the Mt. Marion West and HBJ deposits, and review by the Alacer board of the South Kalgoorlie expansion project.

Current mineral reserve figures are stated as at Dec. 31, 2011, with depletion by production where relevant. A comparison with the previous reserve is in the related table.

HIGGINSVILLE -- MINERAL RESERVES COMPARISON

Previous (*) As at Dec. 31, 2011 Change

Project Tonnes Au Grade Contained Au Tonnes Au grade Contained Au Tonnes Au grade Contained Au

(kt) (g/t (000s ounces) (kt) (g/t) (000s ounces) (kt) (g/t) (000s ounces)

Trident underground 3,219 4.8 496 3,703 4.6 543 484 (0.2) 47

Chalice underground 727 5.1 118 1,049 4.3 144 322 (0.8) 26

Fairplay underground - - - 139 6.4 29 139 6.4 29

Open pits 1,226 2.0 78 2,704 1.7 151 1,478 (0.3) 73

Stockpiles 505 1.2 19 282 0.8 7 (223) (0.4) (12)

Total 5,677 3.9 711 7,877 3.5 875 2,200 (0.4) 164

* The previous mineral reserve is at July 1, 2010, and is detailed in NI 43-101 technical report of the mining

operations and exploration tenements of Avoca Resources Ltd., Western Australia, completed by SRK Consulting

and dated Dec. 15, 2010.

There are no known environmental, permitting, legal, taxation, political or other relevant issues that would materially affect the estimates of the mineral reserves.

Due to rounding of figures small discrepancies may exist.

We seek Safe Harbor.

So langsam wird es hier interessanter. Erleben wir eine vorsichtige Bodenbilsung?

Gewinne und Cash-Generierung beginnt hier langsam zu sprudeln.

Gewinne und Cash-Generierung beginnt hier langsam zu sprudeln.

hier schreibt ja keiner mehr...obwohl hier die ausichten in nächster zeit doch gar nicht so schlecht aus sehen

"Gesunkene Gehalte

Alacer Gold meldet Produktionsrückgang von 5%

Der kanadische Goldproduzent Alacer Gold Corp. (WKN A1JFG6) musste im dritten Quartal einen Rückgang der anrechenbaren Produktion von 5% auf nun noch 90.951 Unzen des gelben Metalls hinnehmen. Die Çöpler-Mine des Unternehmens in der Türkei und die Higginsville-Mine in Australien hatten Probleme, die Erzgehalte aufrechtzuerhalten.

Goldbarrenguss

Goldbarrenguss

Wie Alacer erklärte, lag der anrechenbare Ausstoß der zu 80% im Unternehmensbesitz befindlichen Çöpler-Mine im Septemberquartal bei 32.674 Unzen. Das resultierte aus dem neuen Abbauplan, der vorsah, härteres Gestein in den Gruben Manganese und Marbel zu gewinnen. Man habe, so das Unternehmen weiter, im dritten Quartal nun die Erze mit niedrigerem Goldgehalt abgebaut und werde im vierten Quartal wieder Material mit höheren Gehalten verarbeiten können.

Die Goldproduktion der Higginsville-Mine, die zu 100% dem Unternehmen gehört, lag im abgelaufenen Quartal bei 32.357 Unzen und damit leicht unter den Erwartungen. Das war vor allem auf die Entscheidung Alacers zurückzuführen, den Abbau in den Gruben mit niedrigen Gehalten einzustellen. Zudem lagen die Goldgehalte des Erzes, das auf der Untertagemine Trident abgebaut wurde, unter Plan.

Gestiegen ist hingegen die Goldproduktion auf dem South Kalgoorlie-Betrieb, die zu 49% dem Unternehmen gehörende Frog’s Leg-Mine eingerechnet. Hier legte der Ausstoß um 31% auf 25.920 Unzen zu, vor allem auf Grund der höheren Gehalte des in der Tagebaugrube Triumph und des auf Frog’s Leg abgebauten Erzes.

Laut Alacers CEO David Quinlivan sollten Verbesserungen an der Produktionsleistung der australischen Minen und im vierten Quartal wieder höhere Gehalte auf der Çöpler-Mine dazu führen, dass man die Produktionsprognose für 2012 erfüllen kann. Das Unternehmen hatte die Prognose für das laufende Jahr im August von 396.000 bis 410.000 Unzen Gold auf 385.000 bis 403.000 Unzen gesenkt.

Wie Quinlivan weiter ausführte, habe man in Australien zudem eine Reihe von Kostensenkungsmaßnahmen ergriffen. Weitere solche Maßnahmen sollen in den kommenden Monaten folgen.

Details zum Kursverlauf der Aktie und weitere Informationen zum Wertpapier finden Sie bei unserem Partner finanzen100.de: Aktien-Dossier Alacer Gold

Hinweis: Die hier angebotenen Artikel stellen keine Kauf- bzw. Verkaufsempfehlungen dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Die GOLDINVEST Media GmbH und ihre Autoren schließen jede Haftung diesbezüglich aus. Die Artikel und Berichte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar. Zwischen der GOLDINVEST Media GmbH und den Lesern dieser Artikel entsteht keinerlei Vertrags- und/oder Beratungsverhältnis, da sich unsere Artikel lediglich auf das jeweilige Unternehmen, nicht aber auf die Anlageentscheidung, beziehen. Wir weisen darauf hin, dass Partner, Autoren und Mitarbeiter der GOLDINVEST Media GmbH Aktien der jeweils angesprochenen Unternehmen halten oder halten können und somit ein möglicher Interessenkonflikt besteht. Wir können nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen."

http://www.goldinvest.de/index.php/alacer-gold-meldet-produk…

Dafür geht der Kurs 2-stellig runter !!!!

Abstauber !!!

Alacer Gold meldet Produktionsrückgang von 5%

Der kanadische Goldproduzent Alacer Gold Corp. (WKN A1JFG6) musste im dritten Quartal einen Rückgang der anrechenbaren Produktion von 5% auf nun noch 90.951 Unzen des gelben Metalls hinnehmen. Die Çöpler-Mine des Unternehmens in der Türkei und die Higginsville-Mine in Australien hatten Probleme, die Erzgehalte aufrechtzuerhalten.

Goldbarrenguss

Goldbarrenguss

Wie Alacer erklärte, lag der anrechenbare Ausstoß der zu 80% im Unternehmensbesitz befindlichen Çöpler-Mine im Septemberquartal bei 32.674 Unzen. Das resultierte aus dem neuen Abbauplan, der vorsah, härteres Gestein in den Gruben Manganese und Marbel zu gewinnen. Man habe, so das Unternehmen weiter, im dritten Quartal nun die Erze mit niedrigerem Goldgehalt abgebaut und werde im vierten Quartal wieder Material mit höheren Gehalten verarbeiten können.

Die Goldproduktion der Higginsville-Mine, die zu 100% dem Unternehmen gehört, lag im abgelaufenen Quartal bei 32.357 Unzen und damit leicht unter den Erwartungen. Das war vor allem auf die Entscheidung Alacers zurückzuführen, den Abbau in den Gruben mit niedrigen Gehalten einzustellen. Zudem lagen die Goldgehalte des Erzes, das auf der Untertagemine Trident abgebaut wurde, unter Plan.

Gestiegen ist hingegen die Goldproduktion auf dem South Kalgoorlie-Betrieb, die zu 49% dem Unternehmen gehörende Frog’s Leg-Mine eingerechnet. Hier legte der Ausstoß um 31% auf 25.920 Unzen zu, vor allem auf Grund der höheren Gehalte des in der Tagebaugrube Triumph und des auf Frog’s Leg abgebauten Erzes.

Laut Alacers CEO David Quinlivan sollten Verbesserungen an der Produktionsleistung der australischen Minen und im vierten Quartal wieder höhere Gehalte auf der Çöpler-Mine dazu führen, dass man die Produktionsprognose für 2012 erfüllen kann. Das Unternehmen hatte die Prognose für das laufende Jahr im August von 396.000 bis 410.000 Unzen Gold auf 385.000 bis 403.000 Unzen gesenkt.

Wie Quinlivan weiter ausführte, habe man in Australien zudem eine Reihe von Kostensenkungsmaßnahmen ergriffen. Weitere solche Maßnahmen sollen in den kommenden Monaten folgen.

Details zum Kursverlauf der Aktie und weitere Informationen zum Wertpapier finden Sie bei unserem Partner finanzen100.de: Aktien-Dossier Alacer Gold

Hinweis: Die hier angebotenen Artikel stellen keine Kauf- bzw. Verkaufsempfehlungen dar, weder explizit noch implizit sind sie als Zusicherung etwaiger Kursentwicklungen zu verstehen. Die GOLDINVEST Media GmbH und ihre Autoren schließen jede Haftung diesbezüglich aus. Die Artikel und Berichte dienen ausschließlich der Information der Leser und stellen keine wie immer geartete Handlungsaufforderung dar. Zwischen der GOLDINVEST Media GmbH und den Lesern dieser Artikel entsteht keinerlei Vertrags- und/oder Beratungsverhältnis, da sich unsere Artikel lediglich auf das jeweilige Unternehmen, nicht aber auf die Anlageentscheidung, beziehen. Wir weisen darauf hin, dass Partner, Autoren und Mitarbeiter der GOLDINVEST Media GmbH Aktien der jeweils angesprochenen Unternehmen halten oder halten können und somit ein möglicher Interessenkonflikt besteht. Wir können nicht ausschließen, dass andere Börsenbriefe, Medien oder Research-Firmen die von uns empfohlenen Werte im gleichen Zeitraum besprechen. Daher kann es in diesem Zeitraum zur symmetrischen Informations- und Meinungsgenerierung kommen."

http://www.goldinvest.de/index.php/alacer-gold-meldet-produk…

Dafür geht der Kurs 2-stellig runter !!!!

Abstauber !!!

Das sind ja richtige Kaufkurse heute

weiterhin Kaufkurse, dank Moody´s & Co.

http://www.asx.com.au/asx/markets/priceLookup.do?by=asxCodes…

5,10-5,25AUD

http://www.asx.com.au/asx/markets/priceLookup.do?by=asxCodes…

5,10-5,25AUD

Bin mal mit einer ersten Position rein

Alacer ist in den letzten Wochen ziemlich unter Druck kommen. Heute mal wieder ordentlich abgestraft -6-7%. Habe mir gestern mal die Q3-Ergebnisse anhört bzw. mal angeschaut. Natürlich waren die Analysen enttäuscht.

Die Kosten sind derzeit ein Problem, aber die Kostensenkungsmaßnahmen scheinen zu greifen. Desweiteren wird in Q4 höher-gradigeres Material abgebaut, was zu einem höheren Gold-Ausstoß führen wird bei gleichzeitger Kostensenkung.

Ich denke mit einem weiterhin positiven Goldmarkt und derzeitigen SP von unter 5$ ist Alacer meiner Meinung nach wirklich ein Schnäppchen.

Immerhin produzieren die 400.000 oz/a bei moderaten Cashkosten und haben ergeizigen Ziele in den nächsten Jahren.

Ich denke die wahr Richtung des Aktienkursen werden wir erst in Q1/2013 sehen wenn die Vorgaben für 2013 veröffentlich werden.

Die Kosten sind derzeit ein Problem, aber die Kostensenkungsmaßnahmen scheinen zu greifen. Desweiteren wird in Q4 höher-gradigeres Material abgebaut, was zu einem höheren Gold-Ausstoß führen wird bei gleichzeitger Kostensenkung.

Ich denke mit einem weiterhin positiven Goldmarkt und derzeitigen SP von unter 5$ ist Alacer meiner Meinung nach wirklich ein Schnäppchen.

Immerhin produzieren die 400.000 oz/a bei moderaten Cashkosten und haben ergeizigen Ziele in den nächsten Jahren.

Ich denke die wahr Richtung des Aktienkursen werden wir erst in Q1/2013 sehen wenn die Vorgaben für 2013 veröffentlich werden.

Kurse Einzelkurse

Charts

Kurslisten

Trading-Depot

Forum Börse

Hot-Stocks

Talk

Derivate

Fonds

Rohstoffe

Boardmail

Regeln & Hilfe

Newsletter Anmeldung

Verteiler-Konfiguration

Urlaubsschaltung

Ummeldung

Abmeldung

Suche

Anleihen

Fonds

Derivate Futures & Optionen

Optionsscheine

Rohstoffe

Zertifikate

Devisen

..

Alacer Gold-Aktie: "outperform"

15.11.12 16:17

RBC Capital Markets

Toronto (www.aktiencheck.de) - Michael D. Curran, Analyst von RBC Capital Markets, bewertet die Alacer Gold-Aktie weiterhin mit dem Rating "outperform". Das 12-Monats-Kursziel bleibe mit 12,00 CAD (Kanadischer Dollar) unverändert. (Analyse vom 14.11.2012) (15.11.2012/ac/a/a)

http://www.aktiencheck.de/analysen/Artikel-Alacer_Gold_Aktie…

Charts

Kurslisten

Trading-Depot

Forum Börse

Hot-Stocks

Talk

Derivate

Fonds

Rohstoffe

Boardmail

Regeln & Hilfe

Newsletter Anmeldung

Verteiler-Konfiguration

Urlaubsschaltung

Ummeldung

Abmeldung

Suche

Anleihen

Fonds

Derivate Futures & Optionen

Optionsscheine

Rohstoffe

Zertifikate

Devisen

..

Alacer Gold-Aktie: "outperform"

15.11.12 16:17

RBC Capital Markets

Toronto (www.aktiencheck.de) - Michael D. Curran, Analyst von RBC Capital Markets, bewertet die Alacer Gold-Aktie weiterhin mit dem Rating "outperform". Das 12-Monats-Kursziel bleibe mit 12,00 CAD (Kanadischer Dollar) unverändert. (Analyse vom 14.11.2012) (15.11.2012/ac/a/a)

http://www.aktiencheck.de/analysen/Artikel-Alacer_Gold_Aktie…

Interessante Insiderkäufe

Vladimir Iorich bzw. der Mastermind hinter Pala Investments, de Hedge-Fond aus Zug hat in der letzten Woche etwa 1 mio. Shares eingesammelt.

Meines Wissen nach ist das der erste signifikate Kauf überhaupt seit der akquisition der Kinross Anteile im Jahre 2007?!

Nov 16/12

Iorich, Vladimir

10 - Acquisition in the public market

121,400

$4.71

Nov 15/12

Iorich, Vladimir

10 - Acquisition in the public market

861,800

$4.71

Vladimir Iorich bzw. der Mastermind hinter Pala Investments, de Hedge-Fond aus Zug hat in der letzten Woche etwa 1 mio. Shares eingesammelt.

Meines Wissen nach ist das der erste signifikate Kauf überhaupt seit der akquisition der Kinross Anteile im Jahre 2007?!

Nov 16/12

Iorich, Vladimir

10 - Acquisition in the public market

121,400

$4.71

Nov 15/12

Iorich, Vladimir

10 - Acquisition in the public market

861,800

$4.71

Deutsche Bank has maintained its “buy” recommendation on Alacer Gold after the goldminer reported a weaker than expected result for the three months to September 30. Alacer reported net profit of $23.4 million, which was 25 per cent below Deutsche’s expectations, due to higher depreciation and amortisation and high group cash costs. Deutsche has reduced its 12-month price target to $7.10 and is forecasting earnings per share of US43¢ for the year to December 31, 2012, and US82¢ in 2013.

Danke Wellaflex für Deine Arbeit hier im Thread

The president of La Mancha Resources says the gold miner’s new owner, Egyptian billionaire Naguib Sawiris, has issued a challenge to triple production within five years at its Australian operations.

Cairo-based Mr Sawiris, rated by Forbes as worth about $US3.1 billion, recently completed a $C500 million takeover of La Mancha which will produce about 65,000oz this year at the Frog’s Leg underground mine near Coolgardie.

La Mancha president Sebastien de Montessus was in Kalgoorlie-Boulder yesterday to review the operations, as the miner investigates the merits of spending as much as $120 million on its own processing plant. Ore from Frog’s Leg, in which La Mancha holds a controlling 51 per cent interest alongside Alacer Gold, is currently processed at the Greenfields mill near Coolgardie.

“The mandate we have got from our new shareholder is to grow quickly,” Mr de Montessus said. “We think we have the potential to triple the size of production over the next four to five years.

“The market environment is favourable for that.” Paris-based Mr de Montessus predicts the gold price will surpass $2000/oz and remain strong for at least the next three years.

http://au.news.yahoo.com/thewest/regional/goldfields/a/-/new…

Wieder Insiderkaeufe von Pala Investments

Nov 23/12 Nov 21/12 Iorich, Vladimir Indirect Ownership Common Shares 10 - Acquisition in the public market 22,000 $4.75

Nov 23/12 Nov 20/12 Iorich, Vladimir Indirect Ownership Common Shares 10 - Acquisition in the public market 706,000 $4.73

Nov 23/12 Nov 21/12 Iorich, Vladimir Indirect Ownership Common Shares 10 - Acquisition in the public market 22,000 $4.75

Nov 23/12 Nov 20/12 Iorich, Vladimir Indirect Ownership Common Shares 10 - Acquisition in the public market 706,000 $4.73

Insider-Kauf:

Nov 27/12 Nov 27/12 Graff, Richard P. Direct Ownership Common Shares 10 - Acquisition in the public market 6,100

Nov 27/12 Nov 27/12 Graff, Richard P. Direct Ownership Common Shares 10 - Acquisition in the public market 6,100

Es stellt sich die Frage, wann der Tiefpunkt erreicht ist, früher oder später geht das Ding doch wieder ordentlich hoch.

Ich kenne diesen Wert nach aus Anatolia Minerals Zeiten. Der Wert reagiert relative Stark nach Oben bzw. Unten. Trotz allem wurde der Wert in den letzten Wochen ordentlich verprügelt.

Wir befinden uns derzeit in einem Marktumfeld das nicht gerade positiv erscheint für Goldmining stocks.

Dazu kommt noch das einige Analysten wegen den höheren Abbbaukosten den Großteil der Australische Alacer Einheit in Frage stellt!?

Mann kann es kaum Glauben....Sowas nennt man dann Übertriebene Marktreaktionen.

Wir befinden uns derzeit in einem Marktumfeld das nicht gerade positiv erscheint für Goldmining stocks.

Dazu kommt noch das einige Analysten wegen den höheren Abbbaukosten den Großteil der Australische Alacer Einheit in Frage stellt!?

Mann kann es kaum Glauben....Sowas nennt man dann Übertriebene Marktreaktionen.

Alacer Gold has downplayed suggestions the gold miner is poised to close its South Kalgoorlie operations next year.

Deutsche Bank analysts have suggested South Kalgoorlie, which includes the Jubilee processing plant, is in the firing line as Alacer conducts a review of its high-cost Australian assets.

The review is due in the first quarter of 2013. “With a desire to focus the Australian operations on higher margin ounces, we believe South Kalgoorlie will either be closed or restructured,” Deutsche Bank research analyst Brett McKay said.

Shares in Alacer have plummeted from $11.74 last December to close at $4.22 yesterday. Deutsche Bank has set a 12-month target price of $7.10.

The American-based miner this month posted a third quarter profit of $US50.9 million – of which $US49.9m came from its Copler operations in Turkey.

“Many operating scenarios are being considered as part of the review process,” Alacer president David Quinlivan said. “However, we currently have no plans to put South Kalgoorlie on care and maintenance."

http://au.news.yahoo.com/thewest/regional/goldfields/a/-/new…

Deutsche Bank analysts have suggested South Kalgoorlie, which includes the Jubilee processing plant, is in the firing line as Alacer conducts a review of its high-cost Australian assets.

The review is due in the first quarter of 2013. “With a desire to focus the Australian operations on higher margin ounces, we believe South Kalgoorlie will either be closed or restructured,” Deutsche Bank research analyst Brett McKay said.

Shares in Alacer have plummeted from $11.74 last December to close at $4.22 yesterday. Deutsche Bank has set a 12-month target price of $7.10.

The American-based miner this month posted a third quarter profit of $US50.9 million – of which $US49.9m came from its Copler operations in Turkey.

“Many operating scenarios are being considered as part of the review process,” Alacer president David Quinlivan said. “However, we currently have no plans to put South Kalgoorlie on care and maintenance."

http://au.news.yahoo.com/thewest/regional/goldfields/a/-/new…

Nov 28/12 Nov 26/12 Haddon, Timothy John Direct Ownership Common Shares 10 - Acquisition in the public market 500 $4.78

USD

Nov 28/12 Nov 26/12 Haddon, Timothy John Direct Ownership Common Shares 10 - Acquisition in the public market 7,833 $4.78

USD

USD

Nov 28/12 Nov 26/12 Haddon, Timothy John Direct Ownership Common Shares 10 - Acquisition in the public market 7,833 $4.78

USD

So, ich bin auch drin, die geht bald wieder kräftig hoch...

Wieder Insiderkäufe von Pala Invesments

http://canadianinsider.com/node/7?menu_tickersearch=Alacer+G…

Nov 29/12

Nov 28/12

Iorich, Vladimir

Indirect Ownership

Common Shares

10 - Acquisition in the public market

450,000

$4.39

Nov 29/12

Nov 27/12

Iorich, Vladimir

Indirect Ownership

Common Shares

10 - Acquisition in the public market

29,300

$4.55

http://canadianinsider.com/node/7?menu_tickersearch=Alacer+G…

Nov 29/12

Nov 28/12

Iorich, Vladimir

Indirect Ownership

Common Shares

10 - Acquisition in the public market

450,000

$4.39

Nov 29/12

Nov 27/12

Iorich, Vladimir

Indirect Ownership

Common Shares

10 - Acquisition in the public market

29,300

$4.55

Meine Freunde die naechten Wochen und Monaten koennen ziemlich interessant werden !!!

Alacer Offer at 40% Premium Seen Tied to Turkey: Real M&A

http://www.bloomberg.com/news/2012-12-05/alacer-offer-at-40-…

Alacer Offer at 40% Premium Seen Tied to Turkey: Real M&A

http://www.bloomberg.com/news/2012-12-05/alacer-offer-at-40-…

29.11.12 Mining Conference 2012 - Alacer Gold Corp

Webcast:

http://www.newswire.ca/en/webcast/play/1080433/1176821

Präsentation:

http://www.alacergold.com/files/scotiabank_conf_final.pdf

Webcast:

http://www.newswire.ca/en/webcast/play/1080433/1176821

Präsentation:

http://www.alacergold.com/files/scotiabank_conf_final.pdf

"“We believe that Alacer is becoming an increasingly interesting target for a potential takeover, our rationale being an acquirer can pay a reasonable premium to recent share prices, assume zero value for Australian assets and still be in the black for the prize Turkish assets,”

http://blogs.wsj.com/dealjournalaustralia/2012/12/11/alacer-…

http://blogs.wsj.com/dealjournalaustralia/2012/12/11/alacer-…

Na wer sagt's denn, läuft ja bisher ganz gut :-)

Eldorado Gold ist auch in der Türkei tätig. Einige Leute sind der Meinung das diese beiden Unternehmen gut zu einander passen würden. Für ein Buyout währe Alacer evtl. zu groß. Aber vielleicht eine Fusion? Des weiteren hat

Eldorado Gold vor kurzem eine dicke Finanzierung abgeschlossen (600 Mio. $)!

Ist natürlich alles Spekulation aber ich denke das eine Fusion, eine

Spin-out der Australischen Assets wahrscheinlicher währen als ein klassischer Buyout. Zwei Millarden sind nicht gerade wenig. Die Frage ist in wie weit Shareholder wie Pala Investments dazu bereit währen. Diese haben sich in der Vergangeheit als sehr gierig herausgestellt

Eldorado Gold vor kurzem eine dicke Finanzierung abgeschlossen (600 Mio. $)!

Ist natürlich alles Spekulation aber ich denke das eine Fusion, eine

Spin-out der Australischen Assets wahrscheinlicher währen als ein klassischer Buyout. Zwei Millarden sind nicht gerade wenig. Die Frage ist in wie weit Shareholder wie Pala Investments dazu bereit währen. Diese haben sich in der Vergangeheit als sehr gierig herausgestellt

Nun da wir die Fiscal-Klippe ueberlebt haben, denke ich das der Goldpreis weitesehend eine positive Entwicklungen vollziehen wird in 2013. Die einzige ernstzunehmende Gefahr fuer den Goldpreis ist ein schneller Abbau der Arbeitslosigkeit in de USA. Das sollte man immer im Auge behalten wenn man investiert ist in Gold oder Gold Equities. Die FED wuerde in diesem Fall evtl. Ihre Massnahmen einstellen oder was wahrscheinlicher ist zurueck fahren.

Was Alacer betrifft, stehen in diesem Qartal sehr wichtige Entwicklungen vor der Tuer:

Q4 2012 Produktionsergebnisse (Q1)

2013 Produktionsziele (Q1)

Çöpler Sulfid feasibility study (Q1)

Exploration Update Australien bzw. Australien BU update! (Q1)

Exploration Update Tuerkei (Q1)

SART plant (Update) Q1

Falls der Markt die Produktionsziele fuer 2013 positiv aufnimmt und die Kosten weiter gesenkt werden koennen, koennte 2013 ein gutes Jahr werden. Dazu kommen noch moegliche Uebernahme-Phantasien durch verschiedene Peers. Die Errichtung des SART plant und die Nutzung der Nebenprodukte (z.B. Kupfer) werden meiner Meinung nach erst in 2014 einen positiven Einfluss auf die Cashkosts haben. Goldminer nutzen die Erloese aus den Nebenprodukten um Ihre Total cash cost schoen zu rechnen

Was Alacer betrifft, stehen in diesem Qartal sehr wichtige Entwicklungen vor der Tuer:

Q4 2012 Produktionsergebnisse (Q1)

2013 Produktionsziele (Q1)

Çöpler Sulfid feasibility study (Q1)

Exploration Update Australien bzw. Australien BU update! (Q1)

Exploration Update Tuerkei (Q1)

SART plant (Update) Q1

Falls der Markt die Produktionsziele fuer 2013 positiv aufnimmt und die Kosten weiter gesenkt werden koennen, koennte 2013 ein gutes Jahr werden. Dazu kommen noch moegliche Uebernahme-Phantasien durch verschiedene Peers. Die Errichtung des SART plant und die Nutzung der Nebenprodukte (z.B. Kupfer) werden meiner Meinung nach erst in 2014 einen positiven Einfluss auf die Cashkosts haben. Goldminer nutzen die Erloese aus den Nebenprodukten um Ihre Total cash cost schoen zu rechnen

Leute ich bin auch hier komplett raus und habe meine Verluste realisiert. Ich wünsche euch allen weiter viel Erfolg und gute Gewinne, auch wenn ich nicht mehr daran glaube.

Ich sollte erwähnen, das ich früher mal holzfuss123 hieß und diese Diskussion eröffnet habe. Also tschüss....

Ich sollte erwähnen, das ich früher mal holzfuss123 hieß und diese Diskussion eröffnet habe. Also tschüss....

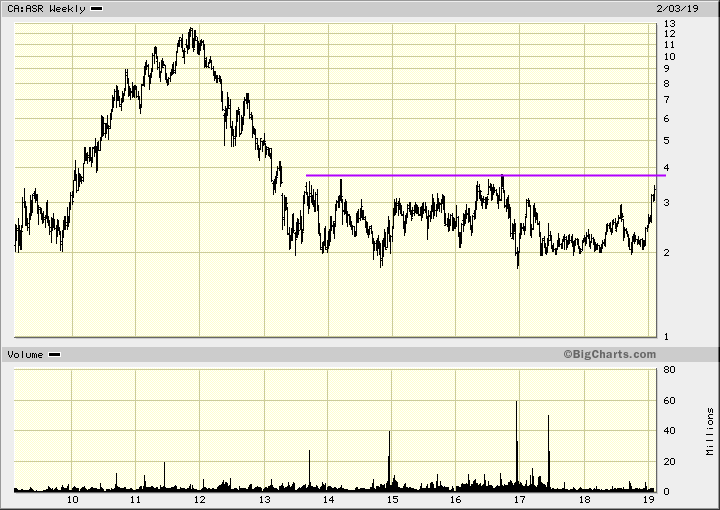

Erst so:

Dann so:

Mein Beileid!

Zitat von holzfuss123: Diese Aktie mach einen reich und keiner weiß es....

Dann so:

Zitat von herrposa: Leute ich bin auch hier komplett raus und habe meine Verluste realisiert. Ich wünsche euch allen weiter viel Erfolg und gute Gewinne, auch wenn ich nicht mehr daran glaube.

Ich sollte erwähnen, das ich früher mal holzfuss123 hieß und diese Diskussion eröffnet habe. Also tschüss....

Mein Beileid!

Globe says move on Inmet an uncommon sight these days

2013-01-10 06:57 ET - In the News

See In the News (C-IMN) Inmet Mining Corp

The Globe and Mail reports in its Thursday, Jan. 10, edition that the attempted takeout of Inmet Mining by First Quantum Minerals has become a rarity, a sign of rising anxiety about the long-term outlook for the commodity supercycle. The Globe's Scott Barlow writes that today's low interest rates provide strong support for M&A in the Canadian mining sector. Despite the fertile deal conditions, takeover activity plunged in 2012. Bloomberg reports that 157 mergers and acquisitions involving Canadian companies in the materials sector were completed in the past 12 months with a total value of $28.9-billion. In comparison, 226 deals were done in 2010 with a combined value of $84.8-billion. The success of an acquisition depends largely on the free cash flow of the company being bought. There are 10 companies in the S&P/TSX materials index with a free cash flow yield above 4 per cent, a level that would make them attractive as acquisitions at current interest rates. The top five by this metric, according to Bloomberg, are Nevsun Resources, Hudbay Minerals, Sherritt International, Methanex and Alacer Gold. Mr. Barlow says each of these companies would appear to be a prime candidate to be acquired.

2013-01-10 06:57 ET - In the News

See In the News (C-IMN) Inmet Mining Corp

The Globe and Mail reports in its Thursday, Jan. 10, edition that the attempted takeout of Inmet Mining by First Quantum Minerals has become a rarity, a sign of rising anxiety about the long-term outlook for the commodity supercycle. The Globe's Scott Barlow writes that today's low interest rates provide strong support for M&A in the Canadian mining sector. Despite the fertile deal conditions, takeover activity plunged in 2012. Bloomberg reports that 157 mergers and acquisitions involving Canadian companies in the materials sector were completed in the past 12 months with a total value of $28.9-billion. In comparison, 226 deals were done in 2010 with a combined value of $84.8-billion. The success of an acquisition depends largely on the free cash flow of the company being bought. There are 10 companies in the S&P/TSX materials index with a free cash flow yield above 4 per cent, a level that would make them attractive as acquisitions at current interest rates. The top five by this metric, according to Bloomberg, are Nevsun Resources, Hudbay Minerals, Sherritt International, Methanex and Alacer Gold. Mr. Barlow says each of these companies would appear to be a prime candidate to be acquired.

Starten jetzt die großen M&A aktivitäten im Mining Sector ???

Erst Imnet und jetzt Alamos...

Alamos makes $780-million takeover offer for Aurizon

Aurizon Mines Ltd

Symbol C : ARZ

Shares Issued 164,562,827

Close 2013-01-11 C$ 3.41

Recent Sedar Documents

View Original Document

Alamos makes $780-million takeover offer for Aurizon

2013-01-14 08:03 ET - News Release

See News Release (C-AGI) Alamos Gold Inc

Mr. John McCluskey of Alamos reports

ALAMOS ANNOUNCES 40% PREMIUM TAKEOVER OFFER FOR AURIZON

Erst Imnet und jetzt Alamos...

Alamos makes $780-million takeover offer for Aurizon

Aurizon Mines Ltd

Symbol C : ARZ

Shares Issued 164,562,827

Close 2013-01-11 C$ 3.41

Recent Sedar Documents

View Original Document

Alamos makes $780-million takeover offer for Aurizon

2013-01-14 08:03 ET - News Release

See News Release (C-AGI) Alamos Gold Inc

Mr. John McCluskey of Alamos reports

ALAMOS ANNOUNCES 40% PREMIUM TAKEOVER OFFER FOR AURIZON

Siehe heute auch

URANIUM ONE ENTERS INTO DEFINITIVE AGREEMENT WITH ARMZ FOR GOING PRIVATE TRANSACTION FOR CDN$2.86 PER SHARE IN CASH; BOARD UNANIMOUSLY RECOMMENDS TRANSACTION

Uranium One signs Atomredmetzoloto going-private deal

2013-01-14 07:05 ET - News Release

URANIUM ONE ENTERS INTO DEFINITIVE AGREEMENT WITH ARMZ FOR GOING PRIVATE TRANSACTION FOR CDN$2.86 PER SHARE IN CASH; BOARD UNANIMOUSLY RECOMMENDS TRANSACTION

Uranium One signs Atomredmetzoloto going-private deal

2013-01-14 07:05 ET - News Release

Alacer Gold produces 419,489 oz Au in 2012

2013-01-17 08:27 ET - News Release

Mr. David Quinlivan reports

ALACER ACHIEVES STRONGEST QUARTERLY PRODUCTION OF THE YEAR OF 103,426 ATTRIBUTABLE OUNCES

Alacer Gold Corp. has provided an update about fourth-quarter 2012 mine production for its operations in Turkey and Australia. All production statistics are on a 100% basis except where otherwise noted. All $'s are US$'s except where otherwise noted. All ounces are troy ounces of gold.Fourth quarter 2012 financial statements and the related management's discussion and analysis are planned to be released on or about March 13, 2013 (North America) and March 14, 2013 (Australia).

Fourth Quarter 2012 Highlights

Mine Q4 2012 Gold Production2012 Gold Production

Copler (100%) (oz) 52,137 188,756

Higginsville (oz) 35,774 136,687

SKO (incl. 49% of Frog's Leg)(oz) 25,942 94,046

Total (oz) 113,853 419,489

Total (Alacer attributable1) (oz) 103,426 381,738

Attributable gold production of 103,426 ounces achieved for the quarter and attributable gold sold totalled 95,986 ounces for the quarter.

Copler gold production increased to 52,137 ounces for the quarter as the revised mining plan delivered more ore tonnes at an improved grade.

Higginsville gold production increased to 35,774 ounces for the quarter as the head grade increased to 3.6g/t gold with the Trident underground mine contributing 243,516 tonnes at 4.2g/t gold.

South Kalgoorlie Operations ("SKO") continued to perform as planned with 25,942 ounces produced during the quarter. The Triumph open pit was completed during the quarter

David Quinlivan, President and CEO of Alacer, stated "Our mines had a strong finish to 2012 with our attributable gold production increasing to 103,426 ounces for Q4 2012, a 12,475 ounces (14%) increase over the previous quarter. Despite a challenging start to the year, the strong fourth quarter enabled the Company to substantially meet full-year production guidance on an aggregate basis."

The Company is in the process of finalizing its gold production and cost guidance for 2013, including its strategic plan for the business. The Company expects to make an announcement concerning these key matters in February 2013, which will include an update regarding the Company's Copler Sulfide Feasibility Study and the possibility of constructing an oxide mill at Copler.

___________________________ 1Attributable gold production reflects Alacer's 80% ownership of Copler.

OperationsCopler Gold Mine

Copler Gold Mine Q1 2012 Q2 2012 Q3 2012 Q4 2012 2012

Ore treated (100%) (tonnes)1,776,5591,618,2281,747,8161,935,1247,077,727

Head grade (g/t) 1.69 1.67 1.55 1.69 1.65

Recovery1 (%) 57.9% 57.3% 61.1% 59.5% 58.9%

Total gold produced (100%) (oz) 44,564 51,212 40,843 52,137 188,756

Alacer ownership (%) 80% 80% 80% 80% 80%

Attributable gold produced (oz) 35,651 40,970 32,674 41,710 151,005

1 Gold recovery rate is indicative of the modelled recovery of ore placed on

the heap-leach pad during the respective period presented.

Attributable Copler gold production increased to 41,710 ounces for the quarter (Q3 attributable: 32,674 ounces) as the revised mining plan delivered more ore tonnes at an improved grade.

Gold production was less than forecast due to limitations on crushing/agglomerating high-grade clayey ore and the mined grade being lower than planned on one level in the Manganese pit.

During the quarter, ore was mined from the Manganese open pit (1,323,058 tonnes), the Marble open pit (485,989 tonnes) and the Main open pits (256,633 tonnes) with total 130,556 tonnes of sulfide ore stockpiled.

A total of 1,329,308 tonnes of ore at 2.0g/t gold were crushed and stacked on the leach pad during the quarter (Q3: 1,110,774 tonnes crushed at 2.0g/t). Ore crushed and stacked during the month of December totaled 455,705 tonnes at 2.6g/t gold.

Run-of-mine ore placed directly on the heap-leach pad totaled 605,815

tonnes at 1.0g/t gold (Q3: 637,042 tonnes at 0.8g/t).

Higginsville Gold Operations (100% owned)

Higginsville Gold OperationsQ1 2012Q2 2012Q3 2012Q4 2012 2012

Ore treated (tonnes) 332,299345,134355,554324,3531,357,340

Head grade (g/t) 3.23 3.26 2.92 3.56 3.23

Recovery (%) 96.5% 97.3% 96.9% 96.4% 97.0%

Gold produced (oz) 33,329 35,227 32,357 35,774 136,687

Gold production from Higginsville Gold Operations increased to 35,774 ounces of gold for the quarter (Q3: 32,357 ounces), due to improved grades mined at the Trident and Chalice underground mines.

Significant rainfall events in late November and early December restricted the haulage of ore from Chalice to the Higginsville processing plant and resulted in tonnes processed during Q4 being less than Q3. Stockpiled ore at December 31, 2012 totalled 46,480 tonnes at 2.9g/t gold, containing 4,348 ounces.

Ore mined from Trident totalled 243,516 tonnes (Q3: 241,214 tonnes) at 4.2g/t gold for the quarter (Q3: 3.5g/t). The increased Trident grade was due to mining higher grade stopes in the Athena and Apollo Lodes as planned.

The Trident decline reached the 615mRL at the end of the quarter, with the first ore from the Helios and Artemis Lodes expected in mid-2013 on the 585mRL and 605mRL, respectively.

Ore mined from Chalice totalled 80,188 tonnes (Q3: 25,288 tonnes) at 2.5g/t gold for the quarter (Q3: 2.1g/t). The increased Chalice grade is associated with the commencement of stoping in the Atlas Lode as planned.

The Chalice decline reached the 1,026mRL at the end of the quarter. The first development ore from the Grampians Lode was mined during the quarter and the first development ore from the Olympus Lode is expected in mid-2013 on the 1,014mRL.

South Kalgoorlie Operations (100% owned except for 49% interest in

Frog's Leg Mine)

SKO (including 49% of Frog's Leg)Q1 2012Q2 2012Q3 2012Q4 2012 2012

Ore treated (tonnes) 325,626333,959327,452324,6291,311,666

Head grade (g/t) 2.36 2.02 2.67 2.69 2.43

Recovery (%) 90.7% 91.0% 92.2% 92.2% 91.6

Gold produced (oz) 22,397 19,787 25,920 25,942 94,046

Gold production from South Kalgoorlie Operations ("SKO") was steady at 25,942 ounces for the quarter (Q3: 25,920 ounces).

Alacer's 49% share of gold production from processing Frog's Leg ore was 14,526 ounces for the quarter (Q3: 14,666 ounces), with lower tonnes processed 82,041 tonnes (Q3: 97,209 tonnes) partially offset by a higher grade of 6.0g/t gold (Q3: 5.1g/t).

Gold production from processing South Kalgoorlie open-pit ore increased slightly to 11,416 gold ounces (Q3: 11,254 ounces), as a result of processing a higher tonnage of 242,588 tonnes (Q3: 230,243 tonnes) at a lower grade of 1.6g/t gold (Q3: 1.7g/t).

Ore mined from the Triumph and Pernatty open pits totalled 168,800 tonnes at 1.6g/t gold (Q3: 228,595 tonnes at 1. 8g/t) during the quarter. The lower tonnage mined during the quarter reflects the completion of the Triumph open pit in early November.

SKO now has only one active open-pit mining fleet at Pernatty. Mining of the Pernatty open pit is planned to be completed in Q1 2013 with mining then moving to SBS28 area.

Fourth Quarter and Full-Year Financial Results

The financial statements and management discussion and analysis for the fourth quarter and full-year are planned to be released on or about March 13 (North America) and March 14 (Australia). Conference call details will be advised in due course.

Fourth Quarter 2012 Production Statistics

SKO

Copler HigginsvilleFrog's Leg (49%) Other South Kalgoorlie Operations Total

Alacer Gold Total

U/G ore mined (tonnes) - 323,704 95,010 - 95,010 418,714

U/G mined grade (g/t) - 3.80 6.98 - 6.98 4.52

U/G mined ounces (ounces) - 39,592 21,316 - 21,316 60,908

O/P ore mined (tonnes)2,065,680 - -168,800 168,800 2,234,480

O/P waste mined (tonnes)5,563,273 - -936,130 936,130 6,499,403

O/P mined grade (g/t) 1.83 - - 1.63 1.63 1.81

O/P ounces mined (ounces) 121,541 - - 8,824 8,824 130,365

Total tonnes mined (tonnes)2,065,680 323,704 95,010168,800 263,810 2,653,194

Total mined grade (g/t) 1.83 3.80 6.98 1.63 3.55 2.24

Total mined ounces (ounces) 121,541 39,592 21,316 8,824 30,140 191,273

Ore treated (tonnes)1,935,124 324,353 82,041242,588 324,629 2,584,106

Head grade (g/t) 1.69 3.56 5.99 1.58 2.69 2.05

Recovery1& 2 (%) 59.5 96.4 91.9 92.6 92.2 N/M

Gold produced 3 (oz) 52,137 35,774 14,526 11,416 25,942 113,853

Gold sold (oz) 52,041 32,029 11,936 10,388 22,324 106,394

Attributable gold produced4 (oz) 41,710 35,774 14,526 11,416 25,942 103,426

Attributable gold sold4 (oz) 41,633 32,029 11,936 10,388 22,324 95,986

1 For Copler, recovery rate is indicative of the modeled recovery of ore placed on the heap leach pad during the respective quarter.

2 "N/M" means not meaningful for consolidated results.

3 Gold produced is ounces poured plus net change of gold-in-circuit for Australian mines. Gold produced is ounces poured only at Copler.

4 Attributable reflects Alacer 80% ownership of Copler.

Full-Year Production Statistics (January to December 2012)

SKO

CoplerHigginsvilleFrog's Leg (49%) Other South Kalgoorlie Operations Total

Alacer Gold Total

U/G ore mined (tonnes) - 1,100,544 331,855 - 331,855 1,432,399

U/G mined grade (g/t) - 3.78 6.00 - 6.00 4.30

U/G mined ounces (ounces) - 133,795 64,006 - 64,006 197,801

O/P ore mined (tonnes) 7,226,245 27,104 - 716,983 716,983 7,970,332

O/P waste mined (tonnes)18,071,316 947,822 -10,335,370 10,335,370 29,354,508

O/P mined grade (g/t) 1.68 3.80 - 1.55 1.55 1.67

O/P ounces mined (ounces) 389,413 3,308 - 35,808 35,808 428,529

Total ore mined (tonnes) 7,226,245 1,127,648 331,855 716,983 1,048,838 9,402,731

Total mined grade (g/t) 1.68 3.78 6.00 1.55 2.96 2.07

Total mined ounces (ounces) 389,413 137,103 64,006 35,808 99,814 626,330

Ore treated (tonnes) 7,077,727 1,357,340 342,354 969,312 1,311,666 9,746,733

Head grade (g/t) 1.65 3.23 5.30 1.42 2.43 1.98

Recovery1& 2 (%) 58.9 97.0 91.9 91.3 91.6 N/M

Gold produced3 (oz) 188,756 136,687 53,640 40,406 94,046 419,489

Gold sold (oz) 202,851 135,604 52,699 40,229 92,928 431,383

Attributable gold produced4 (oz) 151,005 136,687 53,640 40,406 94,046 381,738

Attributable gold sold4 (oz) 162,281 135,604 52,699 40,229 92,928 390,813

1 For Copler, recovery rate is indicative of the modeled recovery of ore placed on the heap leach pad during the year.

2 "N/M" means not meaningful for consolidated results.

3 Gold produced is ounces poured plus net change of gold-in-circuit for Australian mines. Gold produced is ounces poured only at Copler.

4 Attributable reflects Alacer 80% ownership of Copler.

We seek Safe Harbor.

2013-01-17 08:27 ET - News Release

Mr. David Quinlivan reports

ALACER ACHIEVES STRONGEST QUARTERLY PRODUCTION OF THE YEAR OF 103,426 ATTRIBUTABLE OUNCES

Alacer Gold Corp. has provided an update about fourth-quarter 2012 mine production for its operations in Turkey and Australia. All production statistics are on a 100% basis except where otherwise noted. All $'s are US$'s except where otherwise noted. All ounces are troy ounces of gold.Fourth quarter 2012 financial statements and the related management's discussion and analysis are planned to be released on or about March 13, 2013 (North America) and March 14, 2013 (Australia).

Fourth Quarter 2012 Highlights

Mine Q4 2012 Gold Production2012 Gold Production

Copler (100%) (oz) 52,137 188,756

Higginsville (oz) 35,774 136,687

SKO (incl. 49% of Frog's Leg)(oz) 25,942 94,046

Total (oz) 113,853 419,489

Total (Alacer attributable1) (oz) 103,426 381,738

Attributable gold production of 103,426 ounces achieved for the quarter and attributable gold sold totalled 95,986 ounces for the quarter.

Copler gold production increased to 52,137 ounces for the quarter as the revised mining plan delivered more ore tonnes at an improved grade.

Higginsville gold production increased to 35,774 ounces for the quarter as the head grade increased to 3.6g/t gold with the Trident underground mine contributing 243,516 tonnes at 4.2g/t gold.

South Kalgoorlie Operations ("SKO") continued to perform as planned with 25,942 ounces produced during the quarter. The Triumph open pit was completed during the quarter

David Quinlivan, President and CEO of Alacer, stated "Our mines had a strong finish to 2012 with our attributable gold production increasing to 103,426 ounces for Q4 2012, a 12,475 ounces (14%) increase over the previous quarter. Despite a challenging start to the year, the strong fourth quarter enabled the Company to substantially meet full-year production guidance on an aggregate basis."

The Company is in the process of finalizing its gold production and cost guidance for 2013, including its strategic plan for the business. The Company expects to make an announcement concerning these key matters in February 2013, which will include an update regarding the Company's Copler Sulfide Feasibility Study and the possibility of constructing an oxide mill at Copler.

___________________________ 1Attributable gold production reflects Alacer's 80% ownership of Copler.

OperationsCopler Gold Mine

Copler Gold Mine Q1 2012 Q2 2012 Q3 2012 Q4 2012 2012

Ore treated (100%) (tonnes)1,776,5591,618,2281,747,8161,935,1247,077,727

Head grade (g/t) 1.69 1.67 1.55 1.69 1.65

Recovery1 (%) 57.9% 57.3% 61.1% 59.5% 58.9%

Total gold produced (100%) (oz) 44,564 51,212 40,843 52,137 188,756

Alacer ownership (%) 80% 80% 80% 80% 80%

Attributable gold produced (oz) 35,651 40,970 32,674 41,710 151,005

1 Gold recovery rate is indicative of the modelled recovery of ore placed on

the heap-leach pad during the respective period presented.

Attributable Copler gold production increased to 41,710 ounces for the quarter (Q3 attributable: 32,674 ounces) as the revised mining plan delivered more ore tonnes at an improved grade.

Gold production was less than forecast due to limitations on crushing/agglomerating high-grade clayey ore and the mined grade being lower than planned on one level in the Manganese pit.

During the quarter, ore was mined from the Manganese open pit (1,323,058 tonnes), the Marble open pit (485,989 tonnes) and the Main open pits (256,633 tonnes) with total 130,556 tonnes of sulfide ore stockpiled.

A total of 1,329,308 tonnes of ore at 2.0g/t gold were crushed and stacked on the leach pad during the quarter (Q3: 1,110,774 tonnes crushed at 2.0g/t). Ore crushed and stacked during the month of December totaled 455,705 tonnes at 2.6g/t gold.

Run-of-mine ore placed directly on the heap-leach pad totaled 605,815

tonnes at 1.0g/t gold (Q3: 637,042 tonnes at 0.8g/t).

Higginsville Gold Operations (100% owned)

Higginsville Gold OperationsQ1 2012Q2 2012Q3 2012Q4 2012 2012

Ore treated (tonnes) 332,299345,134355,554324,3531,357,340

Head grade (g/t) 3.23 3.26 2.92 3.56 3.23

Recovery (%) 96.5% 97.3% 96.9% 96.4% 97.0%

Gold produced (oz) 33,329 35,227 32,357 35,774 136,687

Gold production from Higginsville Gold Operations increased to 35,774 ounces of gold for the quarter (Q3: 32,357 ounces), due to improved grades mined at the Trident and Chalice underground mines.

Significant rainfall events in late November and early December restricted the haulage of ore from Chalice to the Higginsville processing plant and resulted in tonnes processed during Q4 being less than Q3. Stockpiled ore at December 31, 2012 totalled 46,480 tonnes at 2.9g/t gold, containing 4,348 ounces.

Ore mined from Trident totalled 243,516 tonnes (Q3: 241,214 tonnes) at 4.2g/t gold for the quarter (Q3: 3.5g/t). The increased Trident grade was due to mining higher grade stopes in the Athena and Apollo Lodes as planned.

The Trident decline reached the 615mRL at the end of the quarter, with the first ore from the Helios and Artemis Lodes expected in mid-2013 on the 585mRL and 605mRL, respectively.

Ore mined from Chalice totalled 80,188 tonnes (Q3: 25,288 tonnes) at 2.5g/t gold for the quarter (Q3: 2.1g/t). The increased Chalice grade is associated with the commencement of stoping in the Atlas Lode as planned.

The Chalice decline reached the 1,026mRL at the end of the quarter. The first development ore from the Grampians Lode was mined during the quarter and the first development ore from the Olympus Lode is expected in mid-2013 on the 1,014mRL.

South Kalgoorlie Operations (100% owned except for 49% interest in

Frog's Leg Mine)

SKO (including 49% of Frog's Leg)Q1 2012Q2 2012Q3 2012Q4 2012 2012

Ore treated (tonnes) 325,626333,959327,452324,6291,311,666

Head grade (g/t) 2.36 2.02 2.67 2.69 2.43

Recovery (%) 90.7% 91.0% 92.2% 92.2% 91.6

Gold produced (oz) 22,397 19,787 25,920 25,942 94,046

Gold production from South Kalgoorlie Operations ("SKO") was steady at 25,942 ounces for the quarter (Q3: 25,920 ounces).

Alacer's 49% share of gold production from processing Frog's Leg ore was 14,526 ounces for the quarter (Q3: 14,666 ounces), with lower tonnes processed 82,041 tonnes (Q3: 97,209 tonnes) partially offset by a higher grade of 6.0g/t gold (Q3: 5.1g/t).

Gold production from processing South Kalgoorlie open-pit ore increased slightly to 11,416 gold ounces (Q3: 11,254 ounces), as a result of processing a higher tonnage of 242,588 tonnes (Q3: 230,243 tonnes) at a lower grade of 1.6g/t gold (Q3: 1.7g/t).

Ore mined from the Triumph and Pernatty open pits totalled 168,800 tonnes at 1.6g/t gold (Q3: 228,595 tonnes at 1. 8g/t) during the quarter. The lower tonnage mined during the quarter reflects the completion of the Triumph open pit in early November.

SKO now has only one active open-pit mining fleet at Pernatty. Mining of the Pernatty open pit is planned to be completed in Q1 2013 with mining then moving to SBS28 area.

Fourth Quarter and Full-Year Financial Results

The financial statements and management discussion and analysis for the fourth quarter and full-year are planned to be released on or about March 13 (North America) and March 14 (Australia). Conference call details will be advised in due course.

Fourth Quarter 2012 Production Statistics

SKO

Copler HigginsvilleFrog's Leg (49%) Other South Kalgoorlie Operations Total

Alacer Gold Total

U/G ore mined (tonnes) - 323,704 95,010 - 95,010 418,714

U/G mined grade (g/t) - 3.80 6.98 - 6.98 4.52

U/G mined ounces (ounces) - 39,592 21,316 - 21,316 60,908

O/P ore mined (tonnes)2,065,680 - -168,800 168,800 2,234,480

O/P waste mined (tonnes)5,563,273 - -936,130 936,130 6,499,403

O/P mined grade (g/t) 1.83 - - 1.63 1.63 1.81

O/P ounces mined (ounces) 121,541 - - 8,824 8,824 130,365

Total tonnes mined (tonnes)2,065,680 323,704 95,010168,800 263,810 2,653,194

Total mined grade (g/t) 1.83 3.80 6.98 1.63 3.55 2.24

Total mined ounces (ounces) 121,541 39,592 21,316 8,824 30,140 191,273

Ore treated (tonnes)1,935,124 324,353 82,041242,588 324,629 2,584,106

Head grade (g/t) 1.69 3.56 5.99 1.58 2.69 2.05

Recovery1& 2 (%) 59.5 96.4 91.9 92.6 92.2 N/M

Gold produced 3 (oz) 52,137 35,774 14,526 11,416 25,942 113,853

Gold sold (oz) 52,041 32,029 11,936 10,388 22,324 106,394

Attributable gold produced4 (oz) 41,710 35,774 14,526 11,416 25,942 103,426

Attributable gold sold4 (oz) 41,633 32,029 11,936 10,388 22,324 95,986

1 For Copler, recovery rate is indicative of the modeled recovery of ore placed on the heap leach pad during the respective quarter.

2 "N/M" means not meaningful for consolidated results.

3 Gold produced is ounces poured plus net change of gold-in-circuit for Australian mines. Gold produced is ounces poured only at Copler.

4 Attributable reflects Alacer 80% ownership of Copler.

Full-Year Production Statistics (January to December 2012)

SKO

CoplerHigginsvilleFrog's Leg (49%) Other South Kalgoorlie Operations Total

Alacer Gold Total

U/G ore mined (tonnes) - 1,100,544 331,855 - 331,855 1,432,399

U/G mined grade (g/t) - 3.78 6.00 - 6.00 4.30

U/G mined ounces (ounces) - 133,795 64,006 - 64,006 197,801

O/P ore mined (tonnes) 7,226,245 27,104 - 716,983 716,983 7,970,332

O/P waste mined (tonnes)18,071,316 947,822 -10,335,370 10,335,370 29,354,508

O/P mined grade (g/t) 1.68 3.80 - 1.55 1.55 1.67

O/P ounces mined (ounces) 389,413 3,308 - 35,808 35,808 428,529

Total ore mined (tonnes) 7,226,245 1,127,648 331,855 716,983 1,048,838 9,402,731

Total mined grade (g/t) 1.68 3.78 6.00 1.55 2.96 2.07

Total mined ounces (ounces) 389,413 137,103 64,006 35,808 99,814 626,330

Ore treated (tonnes) 7,077,727 1,357,340 342,354 969,312 1,311,666 9,746,733

Head grade (g/t) 1.65 3.23 5.30 1.42 2.43 1.98

Recovery1& 2 (%) 58.9 97.0 91.9 91.3 91.6 N/M

Gold produced3 (oz) 188,756 136,687 53,640 40,406 94,046 419,489

Gold sold (oz) 202,851 135,604 52,699 40,229 92,928 431,383

Attributable gold produced4 (oz) 151,005 136,687 53,640 40,406 94,046 381,738

Attributable gold sold4 (oz) 162,281 135,604 52,699 40,229 92,928 390,813

1 For Copler, recovery rate is indicative of the modeled recovery of ore placed on the heap leach pad during the year.

2 "N/M" means not meaningful for consolidated results.

3 Gold produced is ounces poured plus net change of gold-in-circuit for Australian mines. Gold produced is ounces poured only at Copler.

4 Attributable reflects Alacer 80% ownership of Copler.

We seek Safe Harbor.

Hallo,

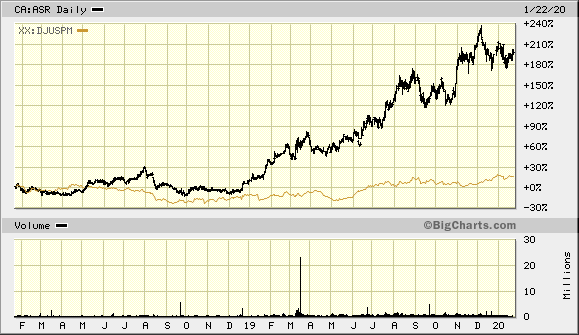

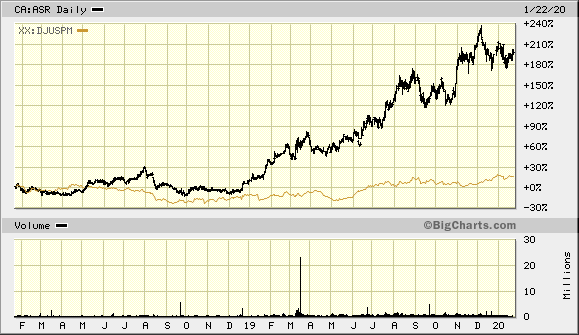

könnte jemand einen RT-Chart aus CAN hier einstellen das wäre super.

danke

gruß brocki

könnte jemand einen RT-Chart aus CAN hier einstellen das wäre super.

danke

gruß brocki

Hallo,

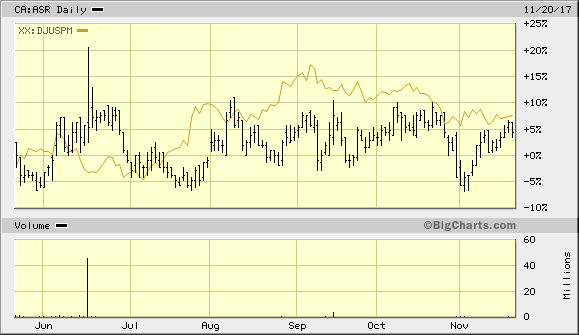

Schaut euch den anliegenden S&P/TSX Global Gold Index Chart an.

Das koennte der anfang einer kleinen Rally bei den Goldminen Aktien sein...

Schaut euch den anliegenden S&P/TSX Global Gold Index Chart an.

Das koennte der anfang einer kleinen Rally bei den Goldminen Aktien sein...

http://www.miningweekly.com/article/alacer-sells-frogs-leg-i…

PERTH (miningweekly.com) - Dual-listed gold miner Alacer Gold on Monday told shareholders it would sell off its 49% shareholding in the Frog’s Leg mine, in Western Australia, as it moved to maximise its portfolio value and contain capital spend.

“2013 will be a back-to-basics year for Alacer from an operational perspective, as we focus on gold production to maximise free cash flow,” said president and CEO David Quinlivan.

The company decided to sell off the Frog’s Leg project, and an 18-month toll treatment agreement for a total transaction value of A$171-million, following a strategic review of its operations.

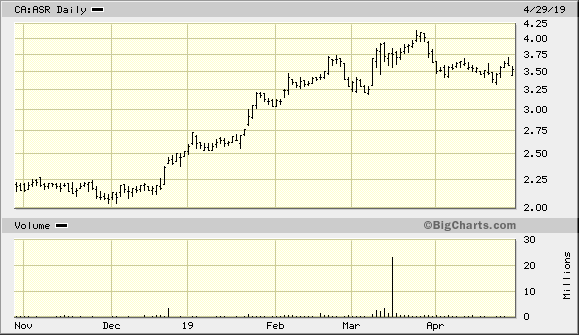

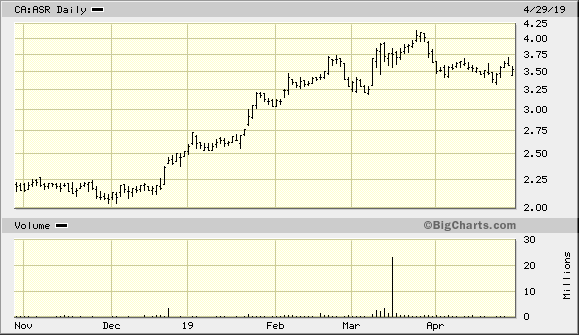

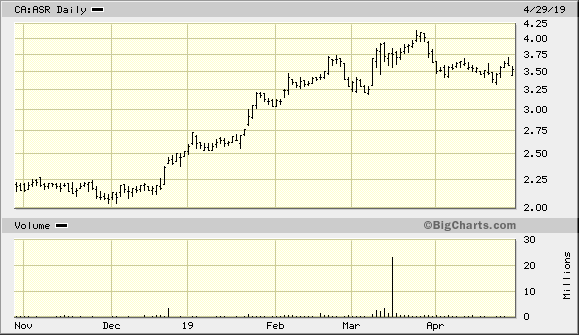

Der Markt reagiert positiv auf die neue Strategie und Produktionsziele fuer 2013. An der ASX ist der wert ist um 7,5% gestiegen. Schauen wir mal wie es heute Nachmittag an der TSX aussehen wird

PERTH (miningweekly.com) - Dual-listed gold miner Alacer Gold on Monday told shareholders it would sell off its 49% shareholding in the Frog’s Leg mine, in Western Australia, as it moved to maximise its portfolio value and contain capital spend.

“2013 will be a back-to-basics year for Alacer from an operational perspective, as we focus on gold production to maximise free cash flow,” said president and CEO David Quinlivan.

The company decided to sell off the Frog’s Leg project, and an 18-month toll treatment agreement for a total transaction value of A$171-million, following a strategic review of its operations.

Der Markt reagiert positiv auf die neue Strategie und Produktionsziele fuer 2013. An der ASX ist der wert ist um 7,5% gestiegen. Schauen wir mal wie es heute Nachmittag an der TSX aussehen wird

bitteschön:

Alacer Gold Corp. (ASR)

Exchange: Toronto Stock Exchange

$4.530

Feb 11, 2013, 10:05 AM EST

Change: 0.130 (2.95%)

Volume: 720,915

Day Low

4.530

Day High

4.690

52 Week Low

4.250

52 Week High

9.940

TSX:

http://tmx.quotemedia.com/quote.php?qm_page=8366&qm_symbol=A…

ASX:

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode…

Meiner Meinung nach könnten bei einer (zeitnahen) Kaufentscheidung "long" außerdem mit Währungsgewinnen zu rechnen sein (CAD/EUR oder besser AUD/EUR)

Auf Basismetal-Seite rechne ich mittelfristig eher weiter mit einer Seitwärtsbewegung.. (mit leicht abfallender Tendenz)

Positive Aussichten die von der GL verbreitet werden, sind immer gut ;-)

Ob diese so auch umgesetzt werden (können) - steht auf einem anderen Blatt.

Der Kursverlauf bzw. das aktuelle Kursniveau verspricht allemal ein gutes Chancen/Risiko-Verhältnis.

>>> alles nur meine Meinung >> andere Meinungen?