RHI Magnesita - 500 Beiträge pro Seite

eröffnet am 02.11.17 09:56:59 von

neuester Beitrag 01.07.19 14:05:28 von

neuester Beitrag 01.07.19 14:05:28 von

Beiträge: 5

ID: 1.266.053

ID: 1.266.053

Aufrufe heute: 0

Gesamt: 1.456

Gesamt: 1.456

Aktive User: 0

ISIN: NL0012650360 · WKN: A2H5W8

42,20

EUR

+1,08 %

+0,45 EUR

Letzter Kurs 30.04.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Baugewerbe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5010 | +33.296,67 | |

| 32.300,00 | +23,28 | |

| 1,0400 | +20,93 | |

| 1,2900 | +18,35 | |

| 12,480 | +16,48 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | -13,79 | |

| 32,96 | -15,55 | |

| 0,6100 | -18,67 | |

| 0,9800 | -19,67 | |

| 2,8600 | -35,15 |

...wurden mir heute eingebucht für meine alten Thread: RHI eine Perle?

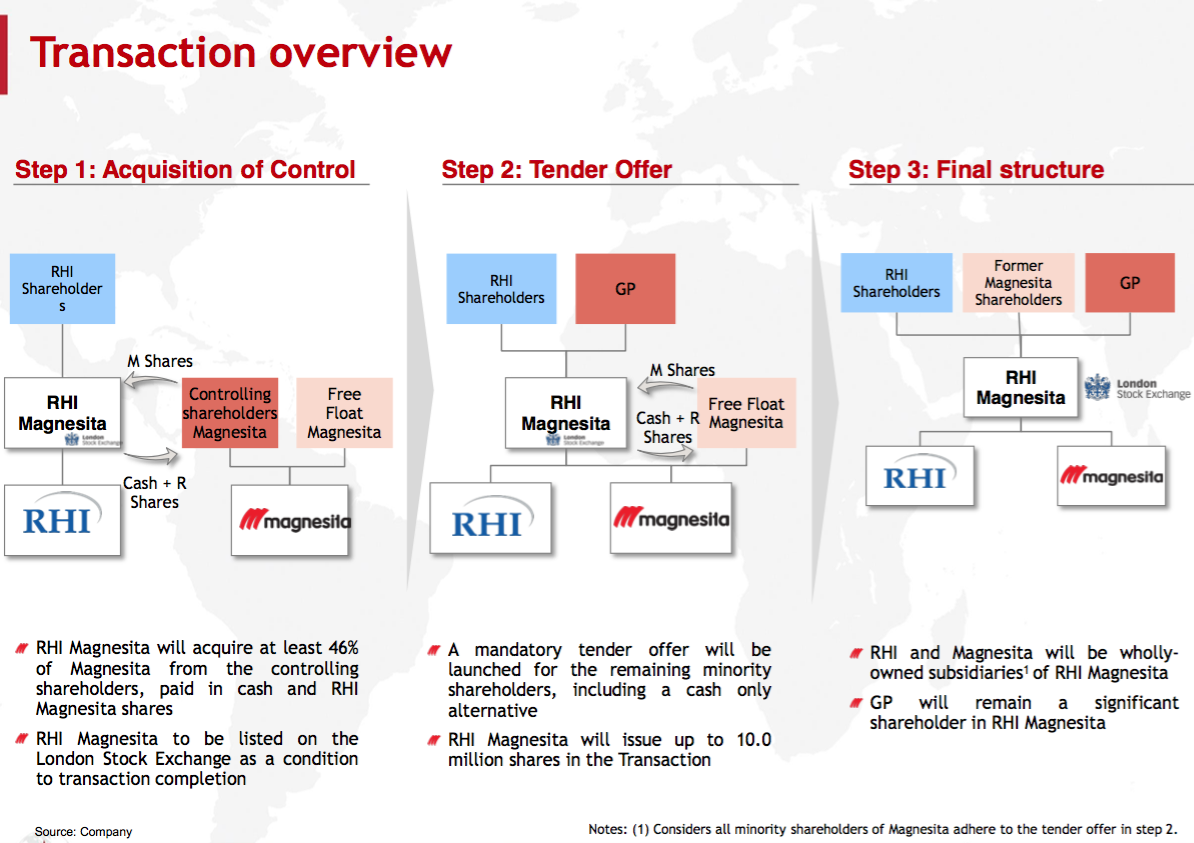

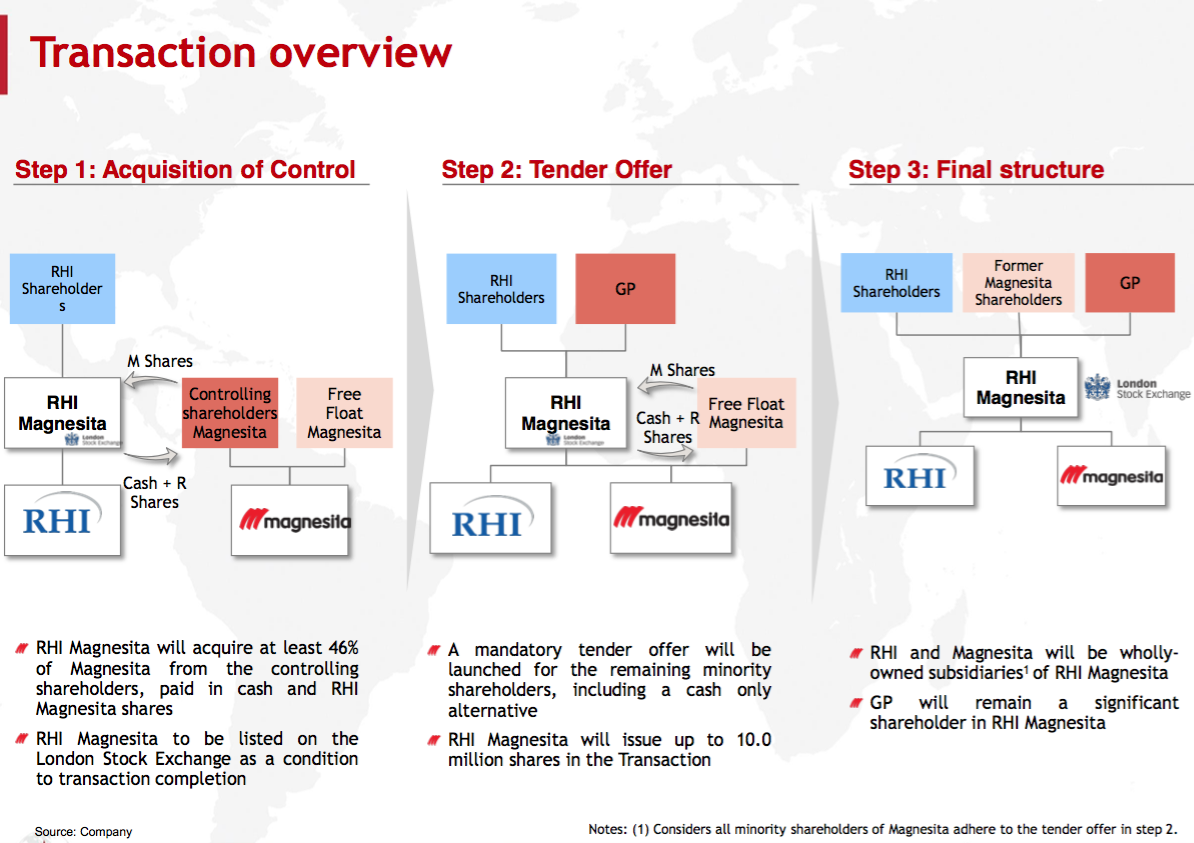

Antwort auf Beitrag Nr.: 56.079.455 von R-BgO am 02.11.17 09:56:59Thread: GP Investments ist einer der Ankeraktionäre:

Antwort auf Beitrag Nr.: 56.079.617 von R-BgO am 02.11.17 10:13:36

RHI Magnesita N.V. (LSE: RHIM), a global leading supplier of refractory products, systems and services, today announces a trading update as a combined group for the nine months to September 2017.

OVERVIEW

RHI Magnesita’s year-to-date trading performance has improved significantly since Q2, as underlying market conditions reflect a recovery of the activity levels seen in the first half. Revenue of the combined group for the nine months to September 2017 was €2,052.3m, 9.3% higher than the comparative period. Operating EBITA was €224.6m, an increase of 23.7% on 9M2016, with a 10.9% Operating EBITA margin.

Although global industrial production has been stable for many years, 2017 has been a year of synchronized growth in basic industries across the globe. Steel production is growing simultaneously in all regions where the Company has a relevant market position. In this context, RHI Magnesita’s revenue for 2017 is expected to grow at high single digits, comfortably above volume growth seen in our customers’ industries.

STEEL DIVISION

Regional steel production trends continue to be strong, with global volumes, as reported by the World Steel Association, 5.2% higher than last year’s comparative period. Steel production growth in Brazil is up 9%, China and India are up 5% and 6%, respectively, with a 4% growth in North America and the European Union. RHI Magnesita’s steel division’s performance reflects these trends with trading activity being above last year’s comparative period.

INDUSTRIAL DIVISION

The Industrial division is performing in line with management expectations. On a business unit level the Cement/Lime segment has been strong, especially in Brazil and Asia Pacific, whilst EEC (Environment, Energy & Chemicals) is below expectations mainly due to lower construction business in North America. We expect revenue for the industrial division to improve in the Q4, and to be in line with management expectations for the full year.

COMBINATION AND INTEGRATION

We continue to successfully implement our planned integration actions and remain very confident in achieving our synergy target of €70.0m p.a. by 2020.

FINANCIAL CONDITION

Our financial position continues to strengthen, with Net Debt/EBITDA below 2.5x upon listing (accounting for the cash consideration disbursements) and significantly below the level anticipated in the combination announcement one year ago. Our focus on working capital management and cash generation remains strong, and we continue to be well financed with high liquidity and a robust balance sheet and deleveraging profile.

In addition to the strong cash flows from the underlying business, we expect by year-end €40m of proceeds from the divestments of Magnesita’s EU Mag-Carbon and RHI’s EU Dolomite businesses and an additional €15m in working capital monetisation.

Trading update

13 November 2017, London – RHI Magnesita N.V. (LSE: RHIM), a global leading supplier of refractory products, systems and services, today announces a trading update as a combined group for the nine months to September 2017.

OVERVIEW

RHI Magnesita’s year-to-date trading performance has improved significantly since Q2, as underlying market conditions reflect a recovery of the activity levels seen in the first half. Revenue of the combined group for the nine months to September 2017 was €2,052.3m, 9.3% higher than the comparative period. Operating EBITA was €224.6m, an increase of 23.7% on 9M2016, with a 10.9% Operating EBITA margin.

Although global industrial production has been stable for many years, 2017 has been a year of synchronized growth in basic industries across the globe. Steel production is growing simultaneously in all regions where the Company has a relevant market position. In this context, RHI Magnesita’s revenue for 2017 is expected to grow at high single digits, comfortably above volume growth seen in our customers’ industries.

STEEL DIVISION

Regional steel production trends continue to be strong, with global volumes, as reported by the World Steel Association, 5.2% higher than last year’s comparative period. Steel production growth in Brazil is up 9%, China and India are up 5% and 6%, respectively, with a 4% growth in North America and the European Union. RHI Magnesita’s steel division’s performance reflects these trends with trading activity being above last year’s comparative period.

INDUSTRIAL DIVISION

The Industrial division is performing in line with management expectations. On a business unit level the Cement/Lime segment has been strong, especially in Brazil and Asia Pacific, whilst EEC (Environment, Energy & Chemicals) is below expectations mainly due to lower construction business in North America. We expect revenue for the industrial division to improve in the Q4, and to be in line with management expectations for the full year.

COMBINATION AND INTEGRATION

We continue to successfully implement our planned integration actions and remain very confident in achieving our synergy target of €70.0m p.a. by 2020.

FINANCIAL CONDITION

Our financial position continues to strengthen, with Net Debt/EBITDA below 2.5x upon listing (accounting for the cash consideration disbursements) and significantly below the level anticipated in the combination announcement one year ago. Our focus on working capital management and cash generation remains strong, and we continue to be well financed with high liquidity and a robust balance sheet and deleveraging profile.

In addition to the strong cash flows from the underlying business, we expect by year-end €40m of proceeds from the divestments of Magnesita’s EU Mag-Carbon and RHI’s EU Dolomite businesses and an additional €15m in working capital monetisation.

super...

nachdem zuerst die divi gemäß niederländischem Recht (neuer Sitz) mit 15% quellenbesteuert wurde,hat Comdirect das nun storniert und mit 27,5% belastet

2018 war solide

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| 0,00 | |

| -0,52 | |

| +1,77 | |

| 0,00 | |

| -1,08 | |

| +1,08 | |

| -3,21 | |

| -1,44 | |

| +0,21 | |

| -1,33 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 228 | ||

| 204 | ||

| 73 | ||

| 71 | ||

| 67 | ||

| 60 | ||

| 28 | ||

| 27 | ||

| 26 | ||

| 24 |