AKTIEN IM FOKUS: Übernahme von Aetna setzen CVS-Health-Aktien unter Druck (Seite 8) | Diskussion im Forum

eröffnet am 05.03.18 21:49:56 von

neuester Beitrag 02.05.24 11:12:45 von

neuester Beitrag 02.05.24 11:12:45 von

Beiträge: 86

ID: 1.275.619

ID: 1.275.619

Aufrufe heute: 324

Gesamt: 8.265

Gesamt: 8.265

Aktive User: 3

ISIN: US1266501006 · WKN: 859034 · Symbol: CVS

53,08

EUR

-16,36 %

-10,38 EUR

Letzter Kurs 12:47:35 Tradegate

Neuigkeiten

01.05.24 · wallstreetONLINE Redaktion |

01.05.24 · dpa-AFX |

23.04.24 · Aktienwelt360 |

16.04.24 · dpa-AFX |

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,2600 | +45,83 | |

| 12,220 | +20,39 | |

| 28,18 | +15,49 | |

| 0,5215 | +14,36 | |

| 3,4800 | +12,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 13,504 | -11,49 | |

| 0,7800 | -12,36 | |

| 53,08 | -16,36 | |

| 0,6420 | -16,51 | |

| 0,7130 | -31,44 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 59.148.543 von faultcode am 06.11.18 13:51:35

=>

...WASHINGTON — A federal judge on Monday sharply questioned the Justice Department’s decision to green-light CVS Health Corp.’s nearly $70 billion acquisition of Aetna Inc. , and said he may order CVS to halt its integration of Aetna’s assets while he considers the merger’s implications.

It is highly unusual for a judge to make such an announcement, since Justice Department antitrust enforcers had approved the deal in October under the condition the companies sell Aetna’s Medicare drug business to preserve competition. The companies sold those assets to WellCare Health Plans Inc.

When the Justice Department identifies concerns with a merger — and reaches an agreement with the merging companies to address them — a federal law called the Tunney Act requires the government to file the proposed settlement for approval by a federal court, which determines whether the deal is in the public interest.

Such settlements are almost universally approved, often without a judge calling a hearing. But U.S. District Judge Richard Leon — who was a central figure in AT&T Inc.’s merger with Time Warner Inc. — made clear he would play an active role.

He said at a terse hearing Monday — in which he sought no input from either the Justice Department or the companies — that he was concerned that the department hadn’t adequately addressed the potential competitive harms raised by the merger.

=> Aktie eigentlich ungerührt

WSJ: Judge questions CVS-Aetna merger, says he may halt asset integration

https://www.marketwatch.com/story/judge-questions-cvs-aetna-…=>

...WASHINGTON — A federal judge on Monday sharply questioned the Justice Department’s decision to green-light CVS Health Corp.’s nearly $70 billion acquisition of Aetna Inc. , and said he may order CVS to halt its integration of Aetna’s assets while he considers the merger’s implications.

It is highly unusual for a judge to make such an announcement, since Justice Department antitrust enforcers had approved the deal in October under the condition the companies sell Aetna’s Medicare drug business to preserve competition. The companies sold those assets to WellCare Health Plans Inc.

When the Justice Department identifies concerns with a merger — and reaches an agreement with the merging companies to address them — a federal law called the Tunney Act requires the government to file the proposed settlement for approval by a federal court, which determines whether the deal is in the public interest.

Such settlements are almost universally approved, often without a judge calling a hearing. But U.S. District Judge Richard Leon — who was a central figure in AT&T Inc.’s merger with Time Warner Inc. — made clear he would play an active role.

He said at a terse hearing Monday — in which he sought no input from either the Justice Department or the companies — that he was concerned that the department hadn’t adequately addressed the potential competitive harms raised by the merger.

=> Aktie eigentlich ungerührt

Antwort auf Beitrag Nr.: 58.918.755 von faultcode am 10.10.18 17:07:02

https://www.marketwatch.com/story/cvs-shares-rise-after-earn…

=>

CVS Health Corp. shares rose 2.6% in Tuesday premarket trading after the pharmacy retailer reported third-quarter earnings and sales that beat consensus.

Net income totaled $1.39 billion, or $1.36 per share, up from $1.29 billion, or $1.26 per share, last year.

Adjusted EPS was $1.73. Revenue totaled $47.3 billion, up from $46.2 billion. And same-store sales rose 6.7% with pharmacy same-store sales up 8.7%.

The FactSet consensus was for EPS of $1.71, revenue of $47.2 billion, and same-store sales growth of 5.4%.

Pharmacy same-store sales were forecast to be up 7.6%.

CVS continues to expect full-year EPS of $1.40 to $1.50 and adjusted EPS of $6.98 to $7.08. The FactSet guidance is for EPS of $7.04....

=> P/E|2018e = ~USD76 / USD7.04 = ~10.8 --> nicht sehr teuer würde ich mal sagen

CVS shares rise after earnings and sales beat consensus

Published: Nov 6, 2018 7:14 a.m. EThttps://www.marketwatch.com/story/cvs-shares-rise-after-earn…

=>

CVS Health Corp. shares rose 2.6% in Tuesday premarket trading after the pharmacy retailer reported third-quarter earnings and sales that beat consensus.

Net income totaled $1.39 billion, or $1.36 per share, up from $1.29 billion, or $1.26 per share, last year.

Adjusted EPS was $1.73. Revenue totaled $47.3 billion, up from $46.2 billion. And same-store sales rose 6.7% with pharmacy same-store sales up 8.7%.

The FactSet consensus was for EPS of $1.71, revenue of $47.2 billion, and same-store sales growth of 5.4%.

Pharmacy same-store sales were forecast to be up 7.6%.

CVS continues to expect full-year EPS of $1.40 to $1.50 and adjusted EPS of $6.98 to $7.08. The FactSet guidance is for EPS of $7.04....

=> P/E|2018e = ~USD76 / USD7.04 = ~10.8 --> nicht sehr teuer würde ich mal sagen

Antwort auf Beitrag Nr.: 58.632.165 von faultcode am 06.09.18 15:13:18--> nun ist es fast geschafft:

10.10.

DOJ approves CVS-Aetna merger as long as prescription drug business sold to WellCare

https://www.marketwatch.com/story/doj-approves-cvs-aetna-mer…

=>...

The Justice Department said Wednesday that CVS Health and Aetna will have to divest Aetna's Medicare Part D prescription drug plan business to proceed with its merger.

The proposed divestiture to WellCare Health Plans, Inc. would fully resolve the Justice Department's competition concerns, the agency said.

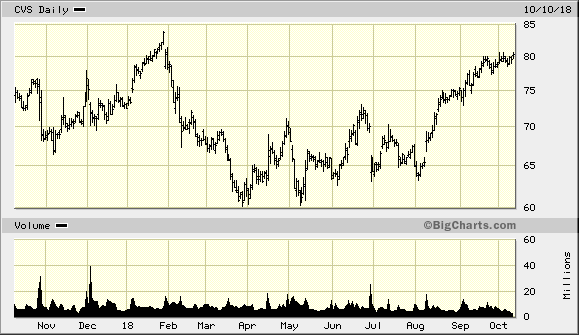

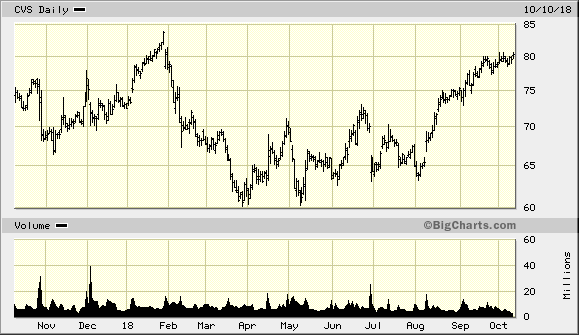

=> CVS zuletzt:

10.10.

DOJ approves CVS-Aetna merger as long as prescription drug business sold to WellCare

https://www.marketwatch.com/story/doj-approves-cvs-aetna-mer…

=>...

The Justice Department said Wednesday that CVS Health and Aetna will have to divest Aetna's Medicare Part D prescription drug plan business to proceed with its merger.

The proposed divestiture to WellCare Health Plans, Inc. would fully resolve the Justice Department's competition concerns, the agency said.

=> CVS zuletzt:

Antwort auf Beitrag Nr.: 58.088.437 von faultcode am 28.06.18 14:58:17

Antitrust approval may come in the coming weeks

https://www.marketwatch.com/story/cvs-aetna-cigna-express-sc…

CVS-Aetna, Cigna-Express Scripts mergers close to Justice Department approval

5.9.Antitrust approval may come in the coming weeks

https://www.marketwatch.com/story/cvs-aetna-cigna-express-sc…

Antwort auf Beitrag Nr.: 58.020.598 von faultcode am 19.06.18 19:40:34

...und nicht nur dieser Wert nach unten.

CVS, Walgreens among pharmacy stocks trading lower after Amazon announces acquisition of online pharmacy PillPack

https://www.marketwatch.com/story/amazon-to-acquire-online-p…

=>

Amazon.com Inc. said Thursday that it has agreed to acquire PillPack, an online pharmacy that pre-sorts medications into different doses and handles both refills and renewals.

PillPack delivers medications to customers and specializes in customers who take multiple prescriptions per day. The deal is expected to close in the second half of the year, and terms weren't disclosed. "PillPack's visionary team has a combination of deep pharmacy experience and a focus on technology," said Jeff Wilke, the chief executive officer of Amazon's Worldwide Consumer segment, in a release.

Shares of pharmacy stocks CVS Health Corp., Walgreens Boots Alliance Inc. and Rite-Aid Corp. are down in premarket trading. Rite-Aid shares turned lower on the news, after they were initially up following earnings results. Insurers UnitedHealth Group Inc. and Aetna Inc. have seen their stocks fall as well.

Shares of Walmart Inc., McKesson Corp. and Express Scripts Holding Co. are also down.

Amazon hat wieder zugeschlagen

premarket: -9%...und nicht nur dieser Wert nach unten.

CVS, Walgreens among pharmacy stocks trading lower after Amazon announces acquisition of online pharmacy PillPack

https://www.marketwatch.com/story/amazon-to-acquire-online-p…

=>

Amazon.com Inc. said Thursday that it has agreed to acquire PillPack, an online pharmacy that pre-sorts medications into different doses and handles both refills and renewals.

PillPack delivers medications to customers and specializes in customers who take multiple prescriptions per day. The deal is expected to close in the second half of the year, and terms weren't disclosed. "PillPack's visionary team has a combination of deep pharmacy experience and a focus on technology," said Jeff Wilke, the chief executive officer of Amazon's Worldwide Consumer segment, in a release.

Shares of pharmacy stocks CVS Health Corp., Walgreens Boots Alliance Inc. and Rite-Aid Corp. are down in premarket trading. Rite-Aid shares turned lower on the news, after they were initially up following earnings results. Insurers UnitedHealth Group Inc. and Aetna Inc. have seen their stocks fall as well.

Shares of Walmart Inc., McKesson Corp. and Express Scripts Holding Co. are also down.

+4.5% (z.Z.)

..an einem wirklich schwachen Börsen-Tag:=> Flucht in "Sicherheit"?

keine neuen News: https://cvshealth.com/newsroom/press-releases#press-release

CVS And Aetna Are Changing The Healthcare Paradigm

https://seekingalpha.com/article/4182317-cvs-aetna-changing-…=>

• CVS & Aetna are changing the healthcare paradigm

• CVS's stock has lost a lot of value from taking on huge amounts of debt, but is now cheap on an absolute and relative basis

• Free cash flow generation is exceptional which alleviates much of my debt concern

• Buy-and-Hold CVS

=>...

With the recent proposed purchase of Aetna (NYSE:AET), CVS (NYSE:CVS) has positioned itself as the only player in the market with such a significant market share in both the pharmacy and healthcare insurance markets.

It seems highly likely the deal will close given neither of these companies control too much of their respective industries to worry about anti-trust issues. In light of this, CVS has detailed some very high-level plans for integration. A team has been developed with execs from both companies to help accomplish 1) $750mm worth of synergy savings in two years and 2) “to create the long-term roadmap for success in growth.”

The latter is rather ambiguous, but I agree all the same that the marriage of CVS and Aetna can deliver long-term returns for investors who are willing hold this stock for a few years.

Demand for health care is only going to increase. With increasing drug costs (+) and an aging American population, CVS will have a steadily growing market in years to come. CEO Larry Merlo cited in an investor relations call that 10,000 baby boomers turn retirement age every day. That creates an irreversible stream of participants coming to market and by combining the two companies, it offers a holistic treatment to each customer that also captures revenue at each point in the process...

(+) hier habe ich Einwände: die Zuwachsraten der Vergangenheit (in den USA) lassen sich nicht mehr so wiederholen.

Grob gesagt, (mMn) sterben die Leute zunehmend eher, bevor sie überhaupt in der Lage sind - als Masse - weitere (eigene) Geldmittel ins US-Gesundheitssystem zu pumpen

--> Medicare-Schwierigkeiten lassen grüssen:

New warnings about cuts to Social Security and Medicare are a reason to worry

https://www.marketwatch.com/story/new-warnings-about-cuts-to…

(Pflichtlektüre mMn)

Antwort auf Beitrag Nr.: 57.558.903 von flying.kangaroo am 17.04.18 01:57:45Besten Dank für die Info!

Antwort auf Beitrag Nr.: 57.557.481 von Performancekiller am 16.04.18 20:50:55Amazon hat seine Pläne für den Verkauf und Vertrieb von pharmazeutischen Produkten auf Eis gelegt.

https://www.cnbc.com/2018/04/16/amazon-business-not-selling-…

https://www.cnbc.com/2018/04/16/amazon-business-not-selling-…

Gibt es Gründe für diesen starken Anstieg?Oder sind das Shorteindeckungen?

01.05.24 · wallstreetONLINE Redaktion · CVS Health |

01.05.24 · dpa-AFX · Advanced Micro Devices |

23.04.24 · Aktienwelt360 · Chevron Corporation |

16.04.24 · dpa-AFX · CVS Health |

03.04.24 · wallstreetONLINE Redaktion · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |

02.04.24 · dpa-AFX · CVS Health |