Etabliertem Rohstoffexplorer steht Wachstum von ~400% bevor?!

eröffnet am 27.03.18 14:39:56 von

neuester Beitrag 21.10.22 12:46:12 von

neuester Beitrag 21.10.22 12:46:12 von

Beiträge: 21

ID: 1.277.183

ID: 1.277.183

Aufrufe heute: 0

Gesamt: 2.071

Gesamt: 2.071

Aktive User: 0

ISIN: AU000000PNR8 · WKN: A0YFVM

0,0550

EUR

+6,80 %

+0,0035 EUR

Letzter Kurs 22:59:55 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7875 | +17,54 | |

| 0,8000 | +11,11 | |

| 0,6300 | +8,62 | |

| 35,60 | +8,50 | |

| 5,1400 | +8,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5850 | -8,24 | |

| 0,6000 | -18,37 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 | |

| 46,67 | -97,98 |

Beitrag zu dieser Diskussion schreiben

zur Erinnerung: bald soll's losgehen:

...

=>

...

=>

Pantoro mit diesem überraschenden Ergebnis ("outstanding platinum group element (PGE) results"):

...

https://www2.asx.com.au/markets/company/PNR

=> +19%

...

https://www2.asx.com.au/markets/company/PNR

=> +19%

Antwort auf Beitrag Nr.: 65.904.522 von faultcode am 01.12.20 13:31:51https://www.pantoro.com.au/investors/asx-announcements/

ASX RELEASE – 10 May 2021

HIGH GRADE MINERALISATION AT SCOTIA MINING CENTRE

Tulla Resources Plc (ASX:TUL) (Tulla) is pleased to advise that the Manager of the unincorporated joint venture of the Norseman Gold Project has reported on the results of the additional drill results from the Scotia Mining Centre.

These results are set out in the attached ASX release by Pantoro Limited (ASX: PNR).

Kevin Maloney commented on the results: “The Scotia Mining Centre is a key focus for the recommencement of gold production and these are encouraging results”.

...

(...The other 50% in the Project is held by ASX listed company Pantoro Limited through its wholly owned subsidiary, Pantoro South Pty Ltd (Pantoro South) via a farm-in and joint venture agreement dated 14 May 2019 (FJVA).)

...

...

Pantoro has focused initial project planning on six initial mining areas containing multiple deposits which are amenable to both open pit and underground mining. A Phase 1 DFS was completed in October 2020 detailing an initial seven year mine plan with a centralised processing facility and combination of open pit and underground mining producing approximately 108,000 ounces per annum. A new one million tonne per annum processing plant is to be constructed by GR Engineering following an extensive tendering process.

Pre-construction works are underway, with first production planned for the first half of 2022. An additional 100,000 metres of drilling is planned to be completed during 2021 with the aim of doubling the current mining inventory.

...

ASX RELEASE – 10 May 2021

HIGH GRADE MINERALISATION AT SCOTIA MINING CENTRE

Tulla Resources Plc (ASX:TUL) (Tulla) is pleased to advise that the Manager of the unincorporated joint venture of the Norseman Gold Project has reported on the results of the additional drill results from the Scotia Mining Centre.

These results are set out in the attached ASX release by Pantoro Limited (ASX: PNR).

Kevin Maloney commented on the results: “The Scotia Mining Centre is a key focus for the recommencement of gold production and these are encouraging results”.

...

(...The other 50% in the Project is held by ASX listed company Pantoro Limited through its wholly owned subsidiary, Pantoro South Pty Ltd (Pantoro South) via a farm-in and joint venture agreement dated 14 May 2019 (FJVA).)

...

...

Pantoro has focused initial project planning on six initial mining areas containing multiple deposits which are amenable to both open pit and underground mining. A Phase 1 DFS was completed in October 2020 detailing an initial seven year mine plan with a centralised processing facility and combination of open pit and underground mining producing approximately 108,000 ounces per annum. A new one million tonne per annum processing plant is to be constructed by GR Engineering following an extensive tendering process.

Pre-construction works are underway, with first production planned for the first half of 2022. An additional 100,000 metres of drilling is planned to be completed during 2021 with the aim of doubling the current mining inventory.

...

kleine Erstposition; habe bislang nur quergelesen (den TR noch nicht)

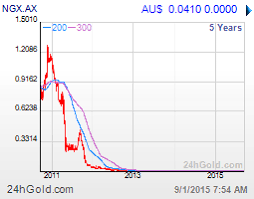

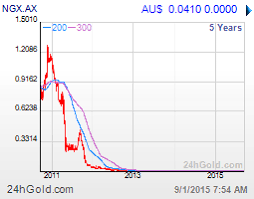

Hier sind (zu 50%) die ehemaligen Croesus Mining bzw. später Norseman Gold Plc (2015 delisted) -Liegenschaften gelandet, was mir am Wochenende auffiel.

Gold war ja hier noch nie das Problem, aber die Kosten

15.05.2010

Nach meinen Croesus-Erfahrungen (heute Norseman, auch sehr günstig and läuft auch ganz ordentlich beim derzeitigen Au-Preis)...

https://www.wallstreet-online.de/diskussion/500-beitraege/11…

Doch danach machte ich den Kardinalfehler mitten in den beginnenden Bärenmarkt nachzukaufen Anfang April 2011:

Nicht nur der Chart war ab 2011 eine Katastrophe, sondern auch das Arbeiten mit unzulänglichen Methoden (und das wahrscheinlich über viele Jahre und mehrere Betreiber hinweg):

20.12.2019

Central Norseman Gold Corporation fights charges it failed to provide safe work environment

https://www.abc.net.au/news/2019-12-20/miner-fights-charges-…

...

--> der Mann hatte viel Glück (was aus der Klage wurde, weiß ich nicht; Beklagter ist Central Norseman Gold, nicht Pantoro)

Pantoro ist ja hier der Betreiber des 50:50-JV's.

Hier sind (zu 50%) die ehemaligen Croesus Mining bzw. später Norseman Gold Plc (2015 delisted) -Liegenschaften gelandet, was mir am Wochenende auffiel.

Gold war ja hier noch nie das Problem, aber die Kosten

15.05.2010

Nach meinen Croesus-Erfahrungen (heute Norseman, auch sehr günstig and läuft auch ganz ordentlich beim derzeitigen Au-Preis)...

https://www.wallstreet-online.de/diskussion/500-beitraege/11…

Doch danach machte ich den Kardinalfehler mitten in den beginnenden Bärenmarkt nachzukaufen Anfang April 2011:

Nicht nur der Chart war ab 2011 eine Katastrophe, sondern auch das Arbeiten mit unzulänglichen Methoden (und das wahrscheinlich über viele Jahre und mehrere Betreiber hinweg):

20.12.2019

Central Norseman Gold Corporation fights charges it failed to provide safe work environment

https://www.abc.net.au/news/2019-12-20/miner-fights-charges-…

...

--> der Mann hatte viel Glück (was aus der Klage wurde, weiß ich nicht; Beklagter ist Central Norseman Gold, nicht Pantoro)

Pantoro ist ja hier der Betreiber des 50:50-JV's.

@lex: nicht kirre machen lassen ... ;-) .. wie gut Pantoro in Wirklichkeit ist,

zeigt gerade das Kaufverhalten der Aussies ... bin auch gut mit dabei .. weiterhin good luck!

zeigt gerade das Kaufverhalten der Aussies ... bin auch gut mit dabei .. weiterhin good luck!

Geht da irgendwann auch mal etwas , oder schmieren die Aktie ab ?

Habe die Aktie im Depot und ist schon fast 50% im Minus.

Ich glaub nicht mehr dran .

Habe die Aktie im Depot und ist schon fast 50% im Minus.

Ich glaub nicht mehr dran .

Pantoro is a low-cost gold producer with plenty of growth opportunities

The company's AISC for the December quarter 2017 was $990 per ounce.

The gold price has already been as high as A$1,750 per ounce in 2018

Pantoro Ltd (ASX:PNR) is producing gold from its 100% owned Nicolsons Gold Mine within the Halls Creek Project in Western Australia.

Notably, the December quarter of 2017 marked Pantoro’s tenth consecutive quarter of increased production from Nicolsons.

Furthermore, the company expects to continue production increases later in 2018 facilitated by improved ore sorting and underground development.

Commenced production in September 2015

Pantoro commenced gold production from Nicolsons in September 2015 following six months of construction which involved commencement of a new underground mine.

The existing processing facility was repaired and refurbished and surface infrastructure including the tailings storage facility was built.

After producing 13,841 ounces in the December 2017 quarter, Pantoro is currently producing gold at levels exceeding its feasibility study targets.

The company has expanded to a production rate of 55,000 ounces per annum and is well on its way to growing its annual production to 80-100,000 ounces per annum.

A competitive advantage of Pantoro relative to other comparable ASX gold producers is its cost of production.

Significantly, the company's all-in sustaining costs (AISC) per ounce fell below the A$1,000 mark to A$990 ($US 780) for the December 2017 quarter.

With the gold price already reaching up to A$1,750 per ounce in 2018, Pantoro has secured its position in the market as a high-margin, debt-free gold producer.

Taking the Wagtail pits underground

While the majority of ore has been mined from the Nicolsons underground mine, open pit mining has also been undertaken at the project.

Mining at the Wagtail open pits was completed in December 2017 as scheduled after which time work to establish underground access points commenced.

Pantoro is finalising approvals documentation and intends to start development and mining immediately after the wet season in April 2018.

Mineral resource modelling is underway at Wagtail, with a new mineral resource and ore reserve expected to be published before underground mining begins.

In March 2018, Pantoro identified deep high-grade gold extensions at the Nicolsons underground mine.

Extensional drilling revealed the deepest intersection received to date in the Anderson Lode at 410 metres below the surface and 130 metres below the current ore reserve.

Best results included 16.9 metres at 7.20 g/t gold, including 8.35 metres at 12.04 g/t; 1 metre at 11.80 g/t; and 3.8 metres at 58.36 g/t, including 2.4 metres at 91.7 g/t.

Mineralisation out-performing ore reserve

Development at Nicolsons continues to identify zones of very high-grade mineralisation which significantly out-perform the ore reserve in a manner similar to results in the northern side of the mine.

Pantoro will continue to explore deeper at Nicolsons with approved drill programs in place to systematically target the ore body to depths greater than 600 metres below surface.

Processing plant expansion underway

After undertaking ore sorting test work Pantoro has purchased a state-of-the-art ore sorter from STEINERT Australia.

The machine is expected to be operational by April 2018.

The ore sorter, as well as other processing upgrades, support Pantoro’s expectations to achieve a production run rate of 80-100,000 ounces per annum by the end of CY2018.

Pantoro became debt-free in April 2018 after making its final repayment under the gold pre-payment facility with the Commonwealth Bank of Australia (ASX:CBA).

Competitively priced hedge contracts in place

During April 2018, the company entered into new hedging contracts with CBA up to October 2019.

The company hedged 2,000 ounces per month to underwrite operating costs while ensuring strong leverage to the gold price.

Notably, Pantoro has already hedged a total of 38,000 ounces to be delivered at a competitive average price of A$1,724 per ounce, which compares favourably with the hedge price of peers.

The greater project region has only been sporadically assessed over a number of years, and is considered to be grossly under-explored.

First pass exploration results from early-2018 at a number of targets has highlighted the potential of the Nicolsons project area which has remained essentially untapped until now.

These new results combined with other recent successes lay the foundations for Pantoro’s continued growth in the Halls Creek region.

The widespread results confirm that extensive gold mineralisation exists throughout the 15-kilometre strike length of the Nicolsons tenement area.

2018 exploration program targeting new resources

Work completed to date has allowed Pantoro to plan its 2018 exploration program.

The initial focus will be on further expansion of the Nicolsons and Wagtail ore reserves.

Resource definition at Grants Creek, Paddock Well and Western Reef exploration prospects will begin following the wet season, with one drill rig to be committed to this work.

http://www.proactiveinvestors.com.au/companies/news/194216/p…

The company's AISC for the December quarter 2017 was $990 per ounce.

The gold price has already been as high as A$1,750 per ounce in 2018

Pantoro Ltd (ASX:PNR) is producing gold from its 100% owned Nicolsons Gold Mine within the Halls Creek Project in Western Australia.

Notably, the December quarter of 2017 marked Pantoro’s tenth consecutive quarter of increased production from Nicolsons.

Furthermore, the company expects to continue production increases later in 2018 facilitated by improved ore sorting and underground development.

Commenced production in September 2015

Pantoro commenced gold production from Nicolsons in September 2015 following six months of construction which involved commencement of a new underground mine.

The existing processing facility was repaired and refurbished and surface infrastructure including the tailings storage facility was built.

After producing 13,841 ounces in the December 2017 quarter, Pantoro is currently producing gold at levels exceeding its feasibility study targets.

The company has expanded to a production rate of 55,000 ounces per annum and is well on its way to growing its annual production to 80-100,000 ounces per annum.

A competitive advantage of Pantoro relative to other comparable ASX gold producers is its cost of production.

Significantly, the company's all-in sustaining costs (AISC) per ounce fell below the A$1,000 mark to A$990 ($US 780) for the December 2017 quarter.

With the gold price already reaching up to A$1,750 per ounce in 2018, Pantoro has secured its position in the market as a high-margin, debt-free gold producer.

Taking the Wagtail pits underground

While the majority of ore has been mined from the Nicolsons underground mine, open pit mining has also been undertaken at the project.

Mining at the Wagtail open pits was completed in December 2017 as scheduled after which time work to establish underground access points commenced.

Pantoro is finalising approvals documentation and intends to start development and mining immediately after the wet season in April 2018.

Mineral resource modelling is underway at Wagtail, with a new mineral resource and ore reserve expected to be published before underground mining begins.

In March 2018, Pantoro identified deep high-grade gold extensions at the Nicolsons underground mine.

Extensional drilling revealed the deepest intersection received to date in the Anderson Lode at 410 metres below the surface and 130 metres below the current ore reserve.

Best results included 16.9 metres at 7.20 g/t gold, including 8.35 metres at 12.04 g/t; 1 metre at 11.80 g/t; and 3.8 metres at 58.36 g/t, including 2.4 metres at 91.7 g/t.

Mineralisation out-performing ore reserve

Development at Nicolsons continues to identify zones of very high-grade mineralisation which significantly out-perform the ore reserve in a manner similar to results in the northern side of the mine.

Pantoro will continue to explore deeper at Nicolsons with approved drill programs in place to systematically target the ore body to depths greater than 600 metres below surface.

Processing plant expansion underway

After undertaking ore sorting test work Pantoro has purchased a state-of-the-art ore sorter from STEINERT Australia.

The machine is expected to be operational by April 2018.

The ore sorter, as well as other processing upgrades, support Pantoro’s expectations to achieve a production run rate of 80-100,000 ounces per annum by the end of CY2018.

Pantoro became debt-free in April 2018 after making its final repayment under the gold pre-payment facility with the Commonwealth Bank of Australia (ASX:CBA).

Competitively priced hedge contracts in place

During April 2018, the company entered into new hedging contracts with CBA up to October 2019.

The company hedged 2,000 ounces per month to underwrite operating costs while ensuring strong leverage to the gold price.

Notably, Pantoro has already hedged a total of 38,000 ounces to be delivered at a competitive average price of A$1,724 per ounce, which compares favourably with the hedge price of peers.

The greater project region has only been sporadically assessed over a number of years, and is considered to be grossly under-explored.

First pass exploration results from early-2018 at a number of targets has highlighted the potential of the Nicolsons project area which has remained essentially untapped until now.

These new results combined with other recent successes lay the foundations for Pantoro’s continued growth in the Halls Creek region.

The widespread results confirm that extensive gold mineralisation exists throughout the 15-kilometre strike length of the Nicolsons tenement area.

2018 exploration program targeting new resources

Work completed to date has allowed Pantoro to plan its 2018 exploration program.

The initial focus will be on further expansion of the Nicolsons and Wagtail ore reserves.

Resource definition at Grants Creek, Paddock Well and Western Reef exploration prospects will begin following the wet season, with one drill rig to be committed to this work.

http://www.proactiveinvestors.com.au/companies/news/194216/p…

Pantoro Ltd (ASX:PNR) is a zero-debt company after making its final repayment under the gold pre-payment facility with the Commonwealth Bank of Australia (ASX:CBA).

The payment was due at the end of April 2018, however the board made the decision to close out the facility repayments early.

READ: Pantoro makes strategic move to expand portfolio in gold producing region

Pantoro managing director Paul Cmrlec said “We are very pleased to have completed repayment of the gold prepayment facility ahead of schedule.

“Pantoro would like to thank CBA for its support during the past three years and looks forward to continuing the relationship through hedging arrangements.”

Additional cashflow to complete processing plant upgrade

The pre-payment facility was utilised to facilitate the construction of the Nicolsons mine within the Halls Creek Project in Western Australia.

Importantly, the closing of the facility will result in an additional free cashflow for Pantoro of about $2.6 million per quarter at the current gold price of A$1,730 per ounce.

This will enable the company to complete the current processing plant upgrade and construction of the new Wagtail underground mine, while continuing existing mining and processing operations at Nicolsons.

READ: Pantoro AISC below A$1000 ($US780) in another record-breaking quarter of production

Pantoro produced a record 13,841 ounces of gold at the Halls Creek Project during the December 2017 quarter, the 10th consecutive quarter of increases.

The company is well positioned to achieve its planned production rate of 80-100,000 ounces per annum later this year.

Productivity and profitability of Nicolsons operation set to rise

The processing plant upgrade, including ore sorting technology is well advanced with the ore sorter and its base in place at site and all required infrastructure ready for installation.

The ore sorter and new tertiary crusher are expected to be operational during April 2018 with commissioning to be completed during the following two weeks.

Cmrlec added “The capital projects currently underway at site will take the Nicolsons operation to a new level of productivity and profitability in the near term, with everything continuing on the planned time line at the present time.”

New contracts to hedge risks in gold price

Pantoro has entered into new hedging contracts with CBA up to October 2019.

The company has hedged 2,000 ounces per month to underwrite operating costs while ensuring strong leverage to the gold price.

Pantoro has already hedged a total of 38,000 ounces to be delivered at an average price of A$1,724 per ounce, which compares favourably with the hedge price of peers.

http://www.proactiveinvestors.com.au/companies/news/194102/p…

The payment was due at the end of April 2018, however the board made the decision to close out the facility repayments early.

READ: Pantoro makes strategic move to expand portfolio in gold producing region

Pantoro managing director Paul Cmrlec said “We are very pleased to have completed repayment of the gold prepayment facility ahead of schedule.

“Pantoro would like to thank CBA for its support during the past three years and looks forward to continuing the relationship through hedging arrangements.”

Additional cashflow to complete processing plant upgrade

The pre-payment facility was utilised to facilitate the construction of the Nicolsons mine within the Halls Creek Project in Western Australia.

Importantly, the closing of the facility will result in an additional free cashflow for Pantoro of about $2.6 million per quarter at the current gold price of A$1,730 per ounce.

This will enable the company to complete the current processing plant upgrade and construction of the new Wagtail underground mine, while continuing existing mining and processing operations at Nicolsons.

READ: Pantoro AISC below A$1000 ($US780) in another record-breaking quarter of production

Pantoro produced a record 13,841 ounces of gold at the Halls Creek Project during the December 2017 quarter, the 10th consecutive quarter of increases.

The company is well positioned to achieve its planned production rate of 80-100,000 ounces per annum later this year.

Productivity and profitability of Nicolsons operation set to rise

The processing plant upgrade, including ore sorting technology is well advanced with the ore sorter and its base in place at site and all required infrastructure ready for installation.

The ore sorter and new tertiary crusher are expected to be operational during April 2018 with commissioning to be completed during the following two weeks.

Cmrlec added “The capital projects currently underway at site will take the Nicolsons operation to a new level of productivity and profitability in the near term, with everything continuing on the planned time line at the present time.”

New contracts to hedge risks in gold price

Pantoro has entered into new hedging contracts with CBA up to October 2019.

The company has hedged 2,000 ounces per month to underwrite operating costs while ensuring strong leverage to the gold price.

Pantoro has already hedged a total of 38,000 ounces to be delivered at an average price of A$1,724 per ounce, which compares favourably with the hedge price of peers.

http://www.proactiveinvestors.com.au/companies/news/194102/p…