Türkiye Garanti Bankasi (Seite 2)

eröffnet am 05.07.19 17:16:01 von

neuester Beitrag 21.12.23 13:34:34 von

neuester Beitrag 21.12.23 13:34:34 von

Beiträge: 39

ID: 1.306.828

ID: 1.306.828

Aufrufe heute: 0

Gesamt: 3.352

Gesamt: 3.352

Aktive User: 0

ISIN: US9001487019 · WKN: 909386

2,4400

EUR

0,00 %

0,0000 EUR

Letzter Kurs 18:28:11 Lang & Schwarz

Neuigkeiten

30.04.24 · EQS Group AG |

30.04.24 · EQS Group AG |

29.04.24 · EQS Group AG |

20.04.24 · EQS Group AG |

17.04.24 · EQS Group AG |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 40,00 | +300,00 | |

| 0,6550 | +43,17 | |

| 1,4600 | +43,14 | |

| 4,5000 | +20,00 | |

| 2,0425 | +15,89 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,85 | -9,93 | |

| 14,750 | -14,14 | |

| 0,7200 | -14,29 | |

| 1.138,25 | -16,86 | |

| 1,0750 | -21,82 |

Beitrag zu dieser Diskussion schreiben

25.8.

Turkish Stock Rally Lures Biggest Foreign Inflows in a Year

https://www.bnnbloomberg.ca/turkish-stock-rally-lures-bigges…

...

Overseas investors ramped up purchases of Turkish stocks at the fastest pace since November, joining a rally fueled by local investors seeking protection from the fastest inflation in a quarter century.

Foreigners poured a net $366 million into Turkish equities in the week ended Aug. 19, according to central bank data. Stocks have climbed 68% in local currency terms so far this year, the most worldwide. In dollar terms, they’re the third-best performer.

A surprise central bank interest-rate cut last week rattled traders and sent the lira close to a record low, adding fresh impetus to the hunt for investments offering protection against price growth. As Turks pile into equities to safeguard their savings, foreign cash is returning too as investors seize the opportunity for higher returns.

Still, the pickup in inflows has yet to offset the foreign exodus since the start of the year. Total year-to-date outflows stand at about $2.9 billion.

...

=>

https://tradingeconomics.com/turkey/stock-market

Turkish Stock Rally Lures Biggest Foreign Inflows in a Year

https://www.bnnbloomberg.ca/turkish-stock-rally-lures-bigges…

...

Overseas investors ramped up purchases of Turkish stocks at the fastest pace since November, joining a rally fueled by local investors seeking protection from the fastest inflation in a quarter century.

Foreigners poured a net $366 million into Turkish equities in the week ended Aug. 19, according to central bank data. Stocks have climbed 68% in local currency terms so far this year, the most worldwide. In dollar terms, they’re the third-best performer.

A surprise central bank interest-rate cut last week rattled traders and sent the lira close to a record low, adding fresh impetus to the hunt for investments offering protection against price growth. As Turks pile into equities to safeguard their savings, foreign cash is returning too as investors seize the opportunity for higher returns.

Still, the pickup in inflows has yet to offset the foreign exodus since the start of the year. Total year-to-date outflows stand at about $2.9 billion.

...

=>

https://tradingeconomics.com/turkey/stock-market

31.5.

Turkish Quest to Hedge Inflation Fuels World-Beating Stocks Boom

https://www.bnnbloomberg.ca/turkish-quest-to-hedge-inflation…

...

Turkish stocks have outpaced every equity market in the world this year in local currency terms as domestic investors clamor for assets that can shield against soaring inflation.

The Borsa Istanbul 30 index of blue-chip firms has surged 39% so far in 2022, just shading out Lebanon’s Blom Index. The Borsa Istanbul 100 Index, Turkey’s benchmark, is up 37%.

A jump in the inflation rate to almost 70%, coupled with a government-led pause to interest-rate hikes, has left Turks with limited choices for where to park their savings. The trend has powered stellar gains for companies such as Turkish Airlines, up 145% since the start of January, or steelmaker Eregli Demir ve Celik Fabrikalari TAS, which has gained almost 40%.

“There’s not much option for where Turkish money can go,” said Burak Cetinceker, a money manager at Istanbul-based Strateji Portfoy, in a phone interview. “It’s impossible for savers to ignore Turkish equities if they want to protect their savings from inflation.”

Gains for Turkish equities are in contrast to the losses seen in global stock markets on concerns over recession risks as surging inflation spurs central banks to ramp up rate hikes. The scale of the advance is such that the country’s BIST 30 index is still up more than 12% in dollar terms, among the top 15 performers worldwide, even after the lira plunged 19% since the start of the year.

...

70%

5.5.

Triple-Digit Factory Inflation Stirs Up Storm for Turkish Prices

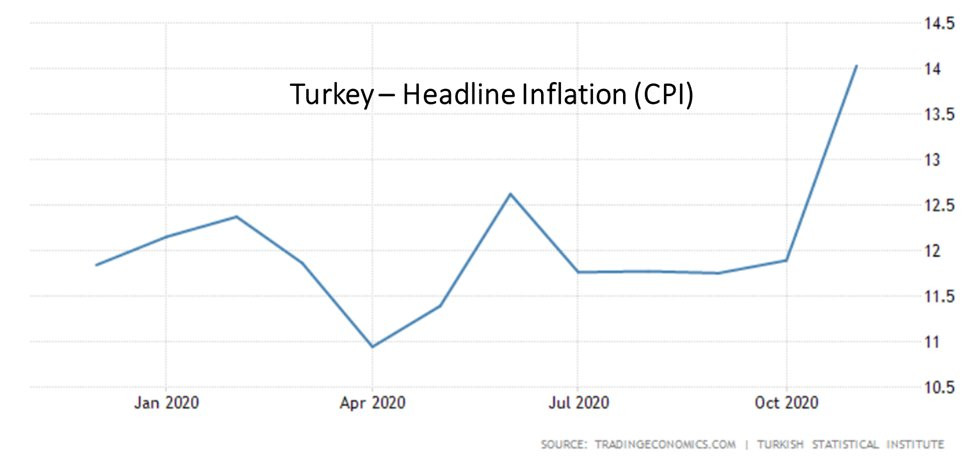

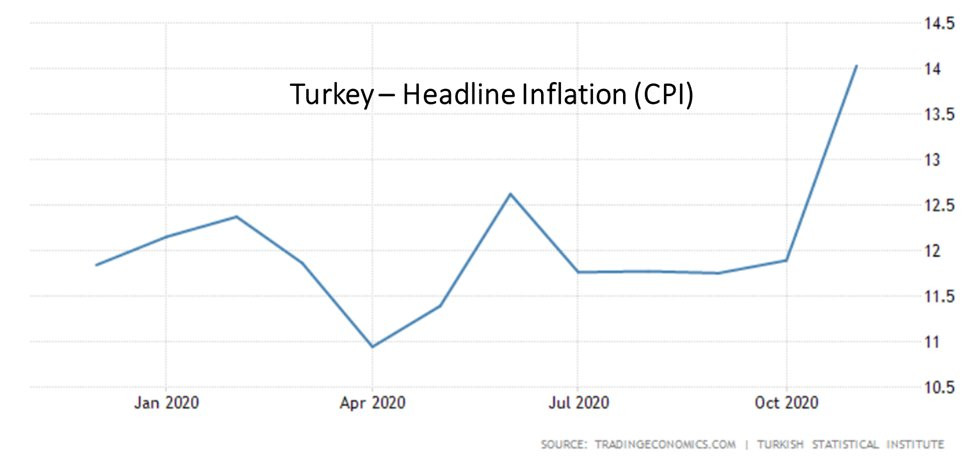

• Consumer inflation reaches 70%, staying at highest since 2002

• Prices fueled by low interest rates, weak lira, food, energy

https://news.yahoo.com/turkish-inflation-accelerates-70-driv…

...

Turkish policy makers have mainly heeded Erdogan’s demands for lower rates since he expanded his powers with 2018 elections. Erdogan sacked three central bank governors for not toeing his line, and installed Kavcioglu, a former lawmaker of the ruling party, in March last year.

With Kavcioglu at the helm, the central bank’s key one-week repo rate of 14% corresponds to the world’s lowest -- at about negative 56 -- when adjusted for prices.

...

5.5.

Triple-Digit Factory Inflation Stirs Up Storm for Turkish Prices

• Consumer inflation reaches 70%, staying at highest since 2002

• Prices fueled by low interest rates, weak lira, food, energy

https://news.yahoo.com/turkish-inflation-accelerates-70-driv…

...

Turkish policy makers have mainly heeded Erdogan’s demands for lower rates since he expanded his powers with 2018 elections. Erdogan sacked three central bank governors for not toeing his line, and installed Kavcioglu, a former lawmaker of the ruling party, in March last year.

With Kavcioglu at the helm, the central bank’s key one-week repo rate of 14% corresponds to the world’s lowest -- at about negative 56 -- when adjusted for prices.

...

BBVA bekommt die Turkiye Garanti Bankasi für 'n Appel und 'n Ei -- und sie sagen das auch noch:

29.11.

https://www.reuters.com/business/finance/ceo-spains-bbva-say…

Sie bezahlen den Kaufpreis in Türkischer Lira

29.11.

https://www.reuters.com/business/finance/ceo-spains-bbva-say…

Sie bezahlen den Kaufpreis in Türkischer Lira

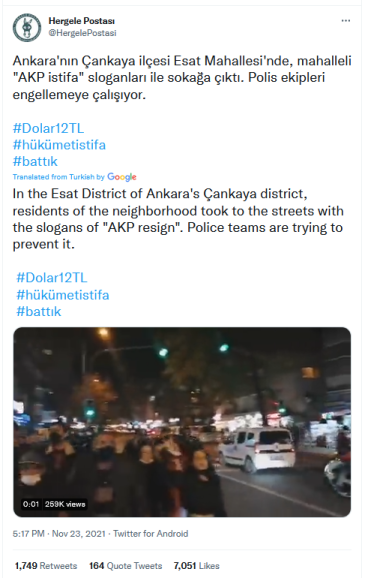

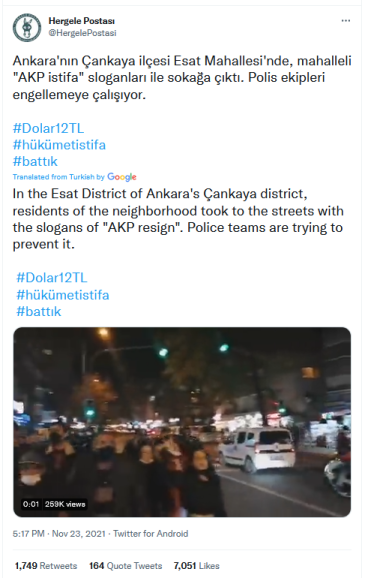

es scheinen sich erste Unruhen in der Türkei auszubreiten:

https://twitter.com/HergelePostasi/status/146317996956422963…

https://twitter.com/HergelePostasi/status/146317996956422963…

15.11.

BBVA Boosts Bet on Turkey in $2.6 Billion Bid for Garanti

https://finance.yahoo.com/news/bbva-seeks-control-turkey-gar…

...

Banco Bilbao Vizcaya Argentaria SA is seeking full control of its Turkish unit in a deal valued at as much as 25.7 billion liras ($2.56 billion), increasing its bet on the country amid a slump in the nation’s currency.

The Spanish lender will offer 12.20 liras per share for the 50.15% it doesn’t own in Turkiye Garanti Bankasi AS, according to a statement from the bank on Monday. That represents a premium of about 15% over Garanti’s closing price on Nov. 12.

BBVA first bought a stake in Garanti about a decade ago and then boosted its position to just under 50% in 2017. Turkey is currently the third-largest market for BBVA in terms of profit contribution and executives have repeatedly defended their focus on the emerging market, even amid increasingly unorthodox monetary policy that’s pushing the lira to record lows.

BBVA Chairman Carlos Torres shrugged off concerns that further exposure to Turkey could be a drag on his bank given the macroeconomic situation.

“We know the asset well, we’ve run it for a decade, we’ve seen how in crisis situations it operates and generates euro returns,” he said, adding that Garanti’s return on capital is “very attractive.”

...

=> TRY12.2 = ~USD1.22

<das reicht für meine Position aus 2018 nicht [Kosten ~USD1.46]. Aber der Deal wird mMn so kommen>

BBVA Boosts Bet on Turkey in $2.6 Billion Bid for Garanti

https://finance.yahoo.com/news/bbva-seeks-control-turkey-gar…

...

Banco Bilbao Vizcaya Argentaria SA is seeking full control of its Turkish unit in a deal valued at as much as 25.7 billion liras ($2.56 billion), increasing its bet on the country amid a slump in the nation’s currency.

The Spanish lender will offer 12.20 liras per share for the 50.15% it doesn’t own in Turkiye Garanti Bankasi AS, according to a statement from the bank on Monday. That represents a premium of about 15% over Garanti’s closing price on Nov. 12.

BBVA first bought a stake in Garanti about a decade ago and then boosted its position to just under 50% in 2017. Turkey is currently the third-largest market for BBVA in terms of profit contribution and executives have repeatedly defended their focus on the emerging market, even amid increasingly unorthodox monetary policy that’s pushing the lira to record lows.

BBVA Chairman Carlos Torres shrugged off concerns that further exposure to Turkey could be a drag on his bank given the macroeconomic situation.

“We know the asset well, we’ve run it for a decade, we’ve seen how in crisis situations it operates and generates euro returns,” he said, adding that Garanti’s return on capital is “very attractive.”

...

=> TRY12.2 = ~USD1.22

<das reicht für meine Position aus 2018 nicht [Kosten ~USD1.46]. Aber der Deal wird mMn so kommen>

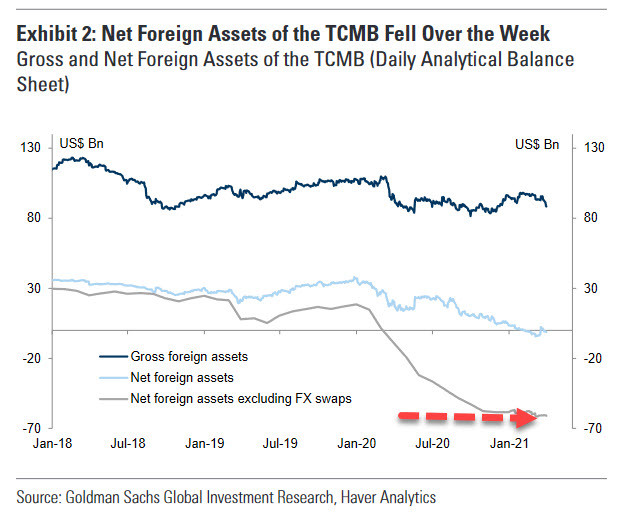

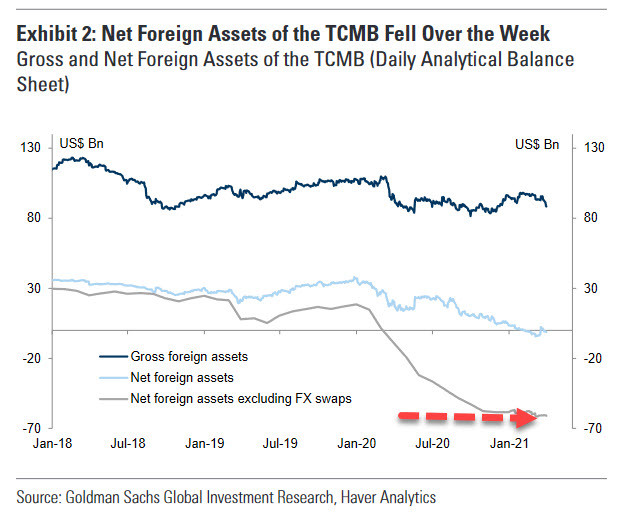

Antwort auf Beitrag Nr.: 67.566.867 von faultcode am 23.03.21 14:18:10so gesehen ist die Türkei spätestens nun bankrott:

Antwort auf Beitrag Nr.: 66.147.211 von faultcode am 21.12.20 13:54:4723.3.

All Hell Breaks Loose In Turkey: Stocks Halted, Overnight Lira Implied Rate Hits 10,000%

https://www.zerohedge.com/markets/all-hell-breaks-loose-turk…

...

...

All Hell Breaks Loose In Turkey: Stocks Halted, Overnight Lira Implied Rate Hits 10,000%

https://www.zerohedge.com/markets/all-hell-breaks-loose-turk…

...

...

21.12.

Top Turkish Equity Fund Bets on Banks to Be Among 2021 Stars

https://ca.finance.yahoo.com/news/top-turkish-equity-fund-be…

...

Turkey’s top-performing equity fund is buying banks and other large industrial companies, anticipating that they will benefit the most from an economic upswing in 2021.

This shift is happening at the cost of the smaller companies so beloved by Turkey’s legion of mom and pop investors and which have helped Tacirler Portfoy’s $80 million equity intensive fund outpace its peers, said General Manager Okan Alpay. The fund has gained 102% in 2020 as of Dec. 18, the most among those focused on domestic stocks, according to the national fund distribution platform, known as Tefas.

Valuations of Turkish lenders have become “meaningfully” cheap compared with regional peers and the broader local market, Alpay said in an interview in Istanbul. The overhaul of the country’s economic management and a return to more conventional central-bank policy, could trigger gains next year, he said.

Until early November, the shares of Turkey’s biggest companies, including its banks, bore the brunt of a foreign selloff as the lira tumbled in the face of investor concerns about monetary policies that prioritized economic growth above all else. That began to change as President Recep Tayyip Erdogan signaled his support for an investor-friendly approach to running the economy.

The replacement of Turkey’s treasury and finance minister and its central bank head have spurred gains. In the past six weeks, the Borsa Istanbul Banks Index is up 23%, while the Borsa Istanbul 30 Index of the most-widely owned and largest companies has gained 17%. That compares with the 7% rise in the MSCI Emerging Markets Index. If the commitment to orthodox policy proves sustained, banks could find a place among the longer-term holdings in the fund, Alpay said.

Tacirler has started to invest in stocks worst-hit by the pandemic, including airlines and tourism on bets that Covid-19 headlines will start to wane.

Turkish stocks have the potential to gain more than 100% in dollar terms over “a few years” as the country’s revised economic policy combines with increased flows toward emerging markets, said Semih Kara, Tacirler Portfoy’s chief portfolio manager. Tacirler has been speaking to potential foreign equity investors, and “there is a good level of interest from them,” he said.

Foreign Investors

That suggestion is backed by some overseas money managers. “Turkish stocks possess the rare combination of high growth prospects and attractive current valuations,” said Change Global Investment Managing Director Thea Jamison, in Camas, Washington. “As long as the authorities stay within their lane, we believe investors will be well rewarded to take on Turkish risk.”

Bank Julius Baer closed most of their short recommendations in Turkish assets in mid-November, said Mathieu Racheter, the bank’s head of equity strategy. “Despite the recent rally, we still see value in Turkish banks stocks relative to other EM banks stocks,” he said.

Top Turkish Equity Fund Bets on Banks to Be Among 2021 Stars

https://ca.finance.yahoo.com/news/top-turkish-equity-fund-be…

...

Turkey’s top-performing equity fund is buying banks and other large industrial companies, anticipating that they will benefit the most from an economic upswing in 2021.

This shift is happening at the cost of the smaller companies so beloved by Turkey’s legion of mom and pop investors and which have helped Tacirler Portfoy’s $80 million equity intensive fund outpace its peers, said General Manager Okan Alpay. The fund has gained 102% in 2020 as of Dec. 18, the most among those focused on domestic stocks, according to the national fund distribution platform, known as Tefas.

Valuations of Turkish lenders have become “meaningfully” cheap compared with regional peers and the broader local market, Alpay said in an interview in Istanbul. The overhaul of the country’s economic management and a return to more conventional central-bank policy, could trigger gains next year, he said.

Until early November, the shares of Turkey’s biggest companies, including its banks, bore the brunt of a foreign selloff as the lira tumbled in the face of investor concerns about monetary policies that prioritized economic growth above all else. That began to change as President Recep Tayyip Erdogan signaled his support for an investor-friendly approach to running the economy.

The replacement of Turkey’s treasury and finance minister and its central bank head have spurred gains. In the past six weeks, the Borsa Istanbul Banks Index is up 23%, while the Borsa Istanbul 30 Index of the most-widely owned and largest companies has gained 17%. That compares with the 7% rise in the MSCI Emerging Markets Index. If the commitment to orthodox policy proves sustained, banks could find a place among the longer-term holdings in the fund, Alpay said.

Tacirler has started to invest in stocks worst-hit by the pandemic, including airlines and tourism on bets that Covid-19 headlines will start to wane.

Turkish stocks have the potential to gain more than 100% in dollar terms over “a few years” as the country’s revised economic policy combines with increased flows toward emerging markets, said Semih Kara, Tacirler Portfoy’s chief portfolio manager. Tacirler has been speaking to potential foreign equity investors, and “there is a good level of interest from them,” he said.

Foreign Investors

That suggestion is backed by some overseas money managers. “Turkish stocks possess the rare combination of high growth prospects and attractive current valuations,” said Change Global Investment Managing Director Thea Jamison, in Camas, Washington. “As long as the authorities stay within their lane, we believe investors will be well rewarded to take on Turkish risk.”

Bank Julius Baer closed most of their short recommendations in Turkish assets in mid-November, said Mathieu Racheter, the bank’s head of equity strategy. “Despite the recent rally, we still see value in Turkish banks stocks relative to other EM banks stocks,” he said.

Antwort auf Beitrag Nr.: 65.768.961 von faultcode am 19.11.20 14:33:58