NORONT RES. (NOT.V): Spektakuläre Funde (Gold,Kupfer,Uran,Metalle) - 500 Beiträge pro Seite

eröffnet am 11.12.06 23:17:19 von

neuester Beitrag 14.04.22 13:52:34 von

neuester Beitrag 14.04.22 13:52:34 von

Beiträge: 3.139

ID: 1.099.646

ID: 1.099.646

Aufrufe heute: 0

Gesamt: 329.901

Gesamt: 329.901

Aktive User: 0

ISIN: CA65626P1018 · WKN: A0CAKK

0,7840

EUR

-1,13 %

-0,0090 EUR

Letzter Kurs 08.04.22 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,5650 | +14,00 | |

| 0,8947 | +11,85 | |

| 1,4400 | +11,20 | |

| 205,00 | +10,81 | |

| 1,5690 | +10,26 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 183,20 | -19,30 | |

| 0,7500 | -21,05 | |

| 1,1367 | -22,67 | |

| 12,000 | -25,00 | |

| 8,3600 | -39,81 |

Noront Resources (NOT.V)

Head Office:

NORONT RESOURCES LTD

Suite 1000, 15 Toronto Street

Toronto ON Canada M5C 2E3

Phone:416 864-1456

Fax:416 367-5444

Website: www.norontresources.com

Other Locations: 100% interest in Windfall exploration-stage gold property in Urban Township, Québec; option to earn up to 100% interest in uranium-gold claims in Atwater and Booth townships of Québec; Double Eagle exploration-stage property in the McFauld's Lake area of northern Ontario (50% under option to Probe Mines Limited); Burnt Hill exploration-stage tungsten property north of Fredericton NB; option to acquire 100% interest in exploration-stage mineral property in Lawson Township of northeastern Ontario; option to acquire Volcan I exploration-stage copper-nickel property near Todos Santos on the Baja Mexico; option to acquire 100% interest in El Verde exploration-stage zinc-copper-silver property in Sinaloa State, Mexico; China One exploration-stage copper-gold property in Inner Mongolia, China (50% under option to Newport Gold Inc.); right to earn 75% interest in mineral exploration permits in the Mid-Matra region of Hungary (all of this interest is under option to Znco Minerals Limited).

Fiscal Year End: Apr 30

Auditor: Moore Stephens Cooper Molyneux LLP

Employee Count (2006/2005): N/A / N/A

NAICS Codes: 2129, Holding and Exploring Mineral Properties For Possible Development

Officers:

Richard E. Nemis, President;

Board Members:

John D. Blanchflower, David G. Graham, Richard E. Nemis, Neil D. Novak, Maurice H. Stekel

Gruß,

Fantomas

Head Office:

NORONT RESOURCES LTD

Suite 1000, 15 Toronto Street

Toronto ON Canada M5C 2E3

Phone:416 864-1456

Fax:416 367-5444

Website: www.norontresources.com

Other Locations: 100% interest in Windfall exploration-stage gold property in Urban Township, Québec; option to earn up to 100% interest in uranium-gold claims in Atwater and Booth townships of Québec; Double Eagle exploration-stage property in the McFauld's Lake area of northern Ontario (50% under option to Probe Mines Limited); Burnt Hill exploration-stage tungsten property north of Fredericton NB; option to acquire 100% interest in exploration-stage mineral property in Lawson Township of northeastern Ontario; option to acquire Volcan I exploration-stage copper-nickel property near Todos Santos on the Baja Mexico; option to acquire 100% interest in El Verde exploration-stage zinc-copper-silver property in Sinaloa State, Mexico; China One exploration-stage copper-gold property in Inner Mongolia, China (50% under option to Newport Gold Inc.); right to earn 75% interest in mineral exploration permits in the Mid-Matra region of Hungary (all of this interest is under option to Znco Minerals Limited).

Fiscal Year End: Apr 30

Auditor: Moore Stephens Cooper Molyneux LLP

Employee Count (2006/2005): N/A / N/A

NAICS Codes: 2129, Holding and Exploring Mineral Properties For Possible Development

Officers:

Richard E. Nemis, President;

Board Members:

John D. Blanchflower, David G. Graham, Richard E. Nemis, Neil D. Novak, Maurice H. Stekel

Gruß,

Fantomas

Eines der besten Bohrergebnisse (wenn nicht sogar das beste) in Kanada.

Gemeldet am 01.12.2006:

NORONT RESOURCES LTD

http://www.stockhouse.com/news/news.asp?newsid=4824580&tick=…

Noront Intersects More Hi-Grade at Windfall Lake

12/1/2006

TORONTO, ONTARIO, Dec 01, 2006 (MARKET WIRE via COMTEX News Network) --

NORONT RESOURCES LTD. (TSX VENTURE: NOT) is pleased to announce the following results from diamond drilling on its wholly owned Windfall Lake property in Urban Township, Quebec.

The fall 2006 drilling program has been completed with 12 drill holes totaling 3297.9 meters. The holes tested the mineralized gold zones previously discovered by Noront and warranting further testing as recommended by Tracy Armstrong (a qualified geologist in the province of Quebec) of P&E Mining Consultants (Brampton, Ontario).

The first three holes (NOT 06-97 to 99) failed to encounter any new significant gold mineralization, however the fourth hole (NOT-06-100) encountered three significant zones of gold mineralization, the best of which covered a total width of 4.80 meters (15.7 feet) consisted of six individual split core samples, two of which contained visible gold. Each of these latter six samples were assayed twice (using two split/separate pulps of the same sample) with the normal fire assay method and a third time (a third split/separate pulp of the same sample) with a metallic screen test.

The assayed, weighted average of the three assay tests for the six individual samples over the 4.80 meters (15.7 feet) were; 1792.9 g/t (52.30 oz/t), 800.1 g/t (23.33 oz/t) from the fire assays and 1327.9 g/t (38.74 oz/t) for the metallic screening assay.

For those interested parties who wish to know more about the methodology used in the assaying process, you may contact Bourlamaque Labs of Val d'Or, Quebec.

The remaining 8 drill holes completed (NOT-06-101 to NOT-06-108) are awaiting assay results which are expected before year-end.

Further work at Windfall Lake in 2007 has not yet been planned and will likely not commence before next spring as road access in the area has been severely curtailed for this coming winter due to a slow-down in the logging industry in the area.

The following table lists the new drill holes giving the hole locations, direction and significant assay intervals. True widths of the gold zones being reported is not known at this time.

SIGNIFICANT GOLDMINERALIZATION

DRILL GRID CORE WIDTH ASSAYSHOLE LOCATION AZIMUTH DIP INTERVAL

(meters) g/ Oz/ METERS FEET tonne ton

NOT-06-97 994W ,150 -60 688N degrees degrees No significant assays

NOT-06-98 1065W,150 -70 665N degrees degrees No significant assays

NOT-06-99 1320W,145 -75 248.00-

690N 249.60 1.60 5.2 F.A. 5.4 .16

NOT-06-100 915W,150 -60 79.40-

550N 80.45 1.05 3.4 F.A. 61.3 1.79

111.50-

114.00 2.50 8.2 F.A. 3.5 .10

119.60-

124.40 4.80 15.7 F.A. 1792.9 52.30

check assay 119.60-

124.40 4.80 15.7 F.A. 800.1 23.33

check assay 119.60-

124.40 4.80 15.7 M.A. 1327.9 38.74

(F.A equals Fire Assayed M.A. - Metallic Assayed)

Assay samples are taken from (NQ) drill core sawed in half with one half sent to Bourlamaque Assay Laboratory located in Val D'Or, Quebec for assaying. The remaining half core is stored in a secure location for future reference or further testing. The gold assay method uses a 30-gram fire assay with gravimetric finish on each sample. Significantly high assay results are checked by the laboratory by re-assaying additional pulps from the same sample using the fire assay and/or the metallic screening method. Additional checks are carried out normally on pulp duplicates and preparation duplicates. The Bourlamaque Assay Lab also complies with industry approved Certified Reference Material.

Gold assay results as reported to the company are in parts per billion (ppb) and reported publicly by the company in grams per tonne (1000 ppb equals 1 gram). Conversion to ounces per ton (oz/ton) on the attached Table employs a factor of 34.285 grams per tonne equaling 1 troy ounce per short ton and core width of significant zones is also give in feet (1.0 meter equals 3.28 feet).

John Harvey, P. Eng., is the company's qualified person for the technical information in this release under National Instrument 43-101 guidelines.

Noront is a tier 2 junior resource company on the TSX Venture Exchange, trading symbol NOT, with 54,567,692 shares issued to date.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contacts: Noront Resources Ltd. Richard Nemis (416) 864-1456 (416) 367-5444 (FAX) Email: info@norontresources.com Website: www.norontresources.com

SOURCE: Noront Resources Ltd.

mailto:info@norontresources.com http://www.norontresources.com

Copyright 2006 Market Wire, All rights reserved.

Gemeldet am 01.12.2006:

NORONT RESOURCES LTD

http://www.stockhouse.com/news/news.asp?newsid=4824580&tick=…

Noront Intersects More Hi-Grade at Windfall Lake

12/1/2006

TORONTO, ONTARIO, Dec 01, 2006 (MARKET WIRE via COMTEX News Network) --

NORONT RESOURCES LTD. (TSX VENTURE: NOT) is pleased to announce the following results from diamond drilling on its wholly owned Windfall Lake property in Urban Township, Quebec.

The fall 2006 drilling program has been completed with 12 drill holes totaling 3297.9 meters. The holes tested the mineralized gold zones previously discovered by Noront and warranting further testing as recommended by Tracy Armstrong (a qualified geologist in the province of Quebec) of P&E Mining Consultants (Brampton, Ontario).

The first three holes (NOT 06-97 to 99) failed to encounter any new significant gold mineralization, however the fourth hole (NOT-06-100) encountered three significant zones of gold mineralization, the best of which covered a total width of 4.80 meters (15.7 feet) consisted of six individual split core samples, two of which contained visible gold. Each of these latter six samples were assayed twice (using two split/separate pulps of the same sample) with the normal fire assay method and a third time (a third split/separate pulp of the same sample) with a metallic screen test.

The assayed, weighted average of the three assay tests for the six individual samples over the 4.80 meters (15.7 feet) were; 1792.9 g/t (52.30 oz/t), 800.1 g/t (23.33 oz/t) from the fire assays and 1327.9 g/t (38.74 oz/t) for the metallic screening assay.

For those interested parties who wish to know more about the methodology used in the assaying process, you may contact Bourlamaque Labs of Val d'Or, Quebec.

The remaining 8 drill holes completed (NOT-06-101 to NOT-06-108) are awaiting assay results which are expected before year-end.

Further work at Windfall Lake in 2007 has not yet been planned and will likely not commence before next spring as road access in the area has been severely curtailed for this coming winter due to a slow-down in the logging industry in the area.

The following table lists the new drill holes giving the hole locations, direction and significant assay intervals. True widths of the gold zones being reported is not known at this time.

SIGNIFICANT GOLDMINERALIZATION

DRILL GRID CORE WIDTH ASSAYSHOLE LOCATION AZIMUTH DIP INTERVAL

(meters) g/ Oz/ METERS FEET tonne ton

NOT-06-97 994W ,150 -60 688N degrees degrees No significant assays

NOT-06-98 1065W,150 -70 665N degrees degrees No significant assays

NOT-06-99 1320W,145 -75 248.00-

690N 249.60 1.60 5.2 F.A. 5.4 .16

NOT-06-100 915W,150 -60 79.40-

550N 80.45 1.05 3.4 F.A. 61.3 1.79

111.50-

114.00 2.50 8.2 F.A. 3.5 .10

119.60-

124.40 4.80 15.7 F.A. 1792.9 52.30

check assay 119.60-

124.40 4.80 15.7 F.A. 800.1 23.33

check assay 119.60-

124.40 4.80 15.7 M.A. 1327.9 38.74

(F.A equals Fire Assayed M.A. - Metallic Assayed)

Assay samples are taken from (NQ) drill core sawed in half with one half sent to Bourlamaque Assay Laboratory located in Val D'Or, Quebec for assaying. The remaining half core is stored in a secure location for future reference or further testing. The gold assay method uses a 30-gram fire assay with gravimetric finish on each sample. Significantly high assay results are checked by the laboratory by re-assaying additional pulps from the same sample using the fire assay and/or the metallic screening method. Additional checks are carried out normally on pulp duplicates and preparation duplicates. The Bourlamaque Assay Lab also complies with industry approved Certified Reference Material.

Gold assay results as reported to the company are in parts per billion (ppb) and reported publicly by the company in grams per tonne (1000 ppb equals 1 gram). Conversion to ounces per ton (oz/ton) on the attached Table employs a factor of 34.285 grams per tonne equaling 1 troy ounce per short ton and core width of significant zones is also give in feet (1.0 meter equals 3.28 feet).

John Harvey, P. Eng., is the company's qualified person for the technical information in this release under National Instrument 43-101 guidelines.

Noront is a tier 2 junior resource company on the TSX Venture Exchange, trading symbol NOT, with 54,567,692 shares issued to date.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contacts: Noront Resources Ltd. Richard Nemis (416) 864-1456 (416) 367-5444 (FAX) Email: info@norontresources.com Website: www.norontresources.com

SOURCE: Noront Resources Ltd.

mailto:info@norontresources.com http://www.norontresources.com

Copyright 2006 Market Wire, All rights reserved.

PROJECT & PROPERTIES

CANADA

Ontario

Mc Faulds Lake - Double Eagle - Base Metals & Diamonds

Ireland Project - Gold

Lawson - Uranium Gold

Kashabowie - Gold

Quebec

Windfall Lake - Gold (aktuelles Bohrergebnis vom 01.12.06)

Hunters Point - Uranium, Gold & Diamonds

New Brunswick

Burnt Hill Deposit - Tungstem Molydbenum, Tin

CHINA

Inner Mongolia China One Project - Copper & Gold

HUNGARY

Mid-Matra Project

MEXICO

Volcan One Project - Copper, Nickle & Cobolt

El Verde Project - Zinc, Copper & Silver

About Us

Noront Resources is a mineral exploration company whose activities, since its incorporation, have focused on the exploration for gold, base metals and has at times during its history, extended its attention to the exploration for diamonds and industrial minerals in Canada. Since its formation in 1983, Noront Resources has been an active resource explorer throughout Ontaria, New Brunswick, Quebec, Inner Monogolia China and Mexico.

--------------------------------------------------------------------------------

About The Directors

RICHARD NEMIS B.A. LLB

PERSONAL

Born in Sudbury, Ontario, Canada 1938

EDUCATION

-St. Charles College, Sudbury, Ontario

-University of Ottawa graduated with BA degree

-Graduated from Osgoode Hall Law School and called to the bar in the Province of Ontario as Barrister and Solicitor in 1968.

Richard E. Nemis, B.A., LL.B. (Legal and Finance), President and CEO Noront Resources Ltd. Mr. Nemis since 1980 has been the President of Noront Resources Ltd. Noront has funded the exploration and discovery of what may be the largest and richest antimony deposit in the world. The mine was put into production but due to poor antimony prices, was put on a care and standby basis by Roycefield Resources. Mr. Nemis was president and CEO of Central Crude Ltd. until its merger to become River Gold Mines Inc. During the period in which Mr. Nemis was its President, Central Crude discovered, developed and financed over $35 million to further develop two deposits. The first gold deposit being the Eagle River Deposit near Mishibishu Lake (south of Hemlo, Ontario) where River Gold is currently in operation and secondly, to delineate the Moss Lake Deposit, Thunder Bay area, Ontario, where reserves were estimated at 92 million tones, grading .0265 Au/ton. “Mr. Nemis was associated with a Mr. V.N. Harbinson and associated with a number of the Harbinson group of companies, Consolidated Durham Mines, Spooner Mines and Oils, Dominion Explorers, Noble Mines and Oils, Onaping Resources to name a few.”Mr. Nemis currently is a senior member and part owner of the largest structural steel firm in northern Ontario, operating since 1946 out of Sudbury

John Douglas Blanchflower

University of British Columbia, B.Sc. Honours Geology, 1971

Registered Professional Geoscientist

Fellow of the Geological Association of Canada

Thirty-nine years of professional experience in economic mineral exploration, including:

- five years of pre-graduate field experience;

- twelve years as a project and district geologist employed by Canadian Superior Exploration Limited and Sulpetro Mines Limited (formerly St. Joseph Explorations Limited and twenty-two years as a geological consultant president of Minorex Consulting Ltd.

Specialization in applied mineral exploration for bulk and lode gold-silver, precious metal-bearing volcanogenic massive sulphide (VMS), porphyry copper-molybdenum and porphyry copper-gold deposits throughout the North American Cordillera.

Neil Novak

Neil has 28 years experience in the mining industry, the last 10 of which have been directly related to the diamond exploration industry. Neil graduated from University of Waterloo in 1977 and immediately became involved as a project geologist for the Canadian operations of Australian based uranium explorer Pancontinental Mining Ltd.

In 1983, Neil left Pancontinental and formed a private consulting company, Nominex Ltd. As managing director of Noninex, Neil became involved in various North American and International exploration assignments. In late 1992, Neil prepared the geological report that supported the initial prospectus for Spider Resources Inc. in his capacity as consultant to the founders of Spider. Spider Resources Inc. became a public company in early 1993. Neil became an active board member and senior officer of Spider in 1995 and remained as such through to early 1999. Neil was re-elected to the Board of Spider in September 1999, and was re-appointed as Vice President in November 1999 and as Secretary for the corporation in January 2000. In June of 2003, Neil was appointed as the Chief Operating Officer of Spider.

In 1995, Neil joined KWG Resources Inc. and Ste Genevieve Resources Inc. as the International Exploration Manager for the group of companies; he remained with Ste Genevieve/KWG until November 1997, then helped both companies in their corporate restructuring through 1998.

In 1997, Neil in his capacity as International Exploration Manager for the Ste. Genevieve Group of Companies was appointed President of Ambrex Mining Corporation, (later changed name to Karmin Exploration).

In January, 2000 Neil through his ownership of Nominex Ltd., teamed up with Norman Brewster to form the consulting company Billiken Management Services Inc. Neil is president of Billiken Management. Billiken entered into a contract with Spider Resources Inc. and joint venture partner KWG Resources Inc. to manage all exploration activities of the KWG/Spider joint venture in the capacity of “appointed manager”.

Neil through his involvement in Billiken provides geological consultation and assists in financing various other resource companies, and as a partial result, in November of 2002, Neil was appointed to the Board of Noront Resources Inc.

Maurice H. Stekel

Maurice H. Stekel became a member of The Institute of Chartered Accountants in 1958. He was honoured to be elected by the Council of The Institute as a “Life Member” in November 2003. He was a founding and senior partner in the firm of Birnbaum, Prenick, Stekel & Co., Chartered Accountants. Founded in 1965, their firm was ranked 23 rd on the “Bottom Line’s Top 30” list in 1991. On June 1, 1993, Mr. Stekel changed his status to “retired partner”. He is continuing his consulting under the auspices of his company Mo-Kar Holdings Inc.

Since 1971 he has been a licensed mortgage broker and is president of BPS Management Limited.

Throughout Mr. Stekel’s career, he has been extremely involved in various aspects of the mining industry. Also, since 1963, he has been appointed to hold directorships in numerous mining companies. In addition he has held and continues to hold directorships in various other corporations.

David Graham

Mr. Graham attended the University of Waterloo and received a Batchelor of Science in 1983.

In 1986 Mr. Graham became President of R. Bruce Graham and Associates Ltd. a mining consulting firm that has served the mineral industry since 1956.

Mr. Graham has over twenty five years of experience in the industry and has served as a director and manager of a number of private and public natural resource and mining concerns. His relevant experience has been in the fields of base and precious metals, uranium and industrial minerals and materials.

Mr. Graham has worked in Canada, the United States, Scandinavia and Africa.

Consultants

Don Cross P.Eng.

1952 - 1956 Port Arthur Collegiate Thunder Bay, Ontario

1956 - 1959 Michigan College Mining Technology

Bsc. Geological Engineering

1959-1986 Noranda Exploration Comp Ltd.

Canada, Zimbabwe, S. Africa, USA, Cypress, Ireland

1986 - present Consultant, Canada, Africa, S. America, Mexico

based in Val-d'Or, Quebec

John Harvey P. Eng

Manager of Noront's Windfall Lake gold project and in house consultant to the Board of Directorsl

Formerly President of Hemlo Gold and Senior Vice President of Explorations for Noranda

Noront Resources is a mineral exploration company whose activities, since its incorporation, have focused on the exploration for gold, base metals and has at times during its history, extended its attention to the exploration for diamonds and industrial minerals in Canada. Since its formation in 1983, Noront Resources has been an active resource explorer throughout Ontaria, New Brunswick, Quebec, Inner Monogolia China and Mexico.

--------------------------------------------------------------------------------

About The Directors

RICHARD NEMIS B.A. LLB

PERSONAL

Born in Sudbury, Ontario, Canada 1938

EDUCATION

-St. Charles College, Sudbury, Ontario

-University of Ottawa graduated with BA degree

-Graduated from Osgoode Hall Law School and called to the bar in the Province of Ontario as Barrister and Solicitor in 1968.

Richard E. Nemis, B.A., LL.B. (Legal and Finance), President and CEO Noront Resources Ltd. Mr. Nemis since 1980 has been the President of Noront Resources Ltd. Noront has funded the exploration and discovery of what may be the largest and richest antimony deposit in the world. The mine was put into production but due to poor antimony prices, was put on a care and standby basis by Roycefield Resources. Mr. Nemis was president and CEO of Central Crude Ltd. until its merger to become River Gold Mines Inc. During the period in which Mr. Nemis was its President, Central Crude discovered, developed and financed over $35 million to further develop two deposits. The first gold deposit being the Eagle River Deposit near Mishibishu Lake (south of Hemlo, Ontario) where River Gold is currently in operation and secondly, to delineate the Moss Lake Deposit, Thunder Bay area, Ontario, where reserves were estimated at 92 million tones, grading .0265 Au/ton. “Mr. Nemis was associated with a Mr. V.N. Harbinson and associated with a number of the Harbinson group of companies, Consolidated Durham Mines, Spooner Mines and Oils, Dominion Explorers, Noble Mines and Oils, Onaping Resources to name a few.”Mr. Nemis currently is a senior member and part owner of the largest structural steel firm in northern Ontario, operating since 1946 out of Sudbury

John Douglas Blanchflower

University of British Columbia, B.Sc. Honours Geology, 1971

Registered Professional Geoscientist

Fellow of the Geological Association of Canada

Thirty-nine years of professional experience in economic mineral exploration, including:

- five years of pre-graduate field experience;

- twelve years as a project and district geologist employed by Canadian Superior Exploration Limited and Sulpetro Mines Limited (formerly St. Joseph Explorations Limited and twenty-two years as a geological consultant president of Minorex Consulting Ltd.

Specialization in applied mineral exploration for bulk and lode gold-silver, precious metal-bearing volcanogenic massive sulphide (VMS), porphyry copper-molybdenum and porphyry copper-gold deposits throughout the North American Cordillera.

Neil Novak

Neil has 28 years experience in the mining industry, the last 10 of which have been directly related to the diamond exploration industry. Neil graduated from University of Waterloo in 1977 and immediately became involved as a project geologist for the Canadian operations of Australian based uranium explorer Pancontinental Mining Ltd.

In 1983, Neil left Pancontinental and formed a private consulting company, Nominex Ltd. As managing director of Noninex, Neil became involved in various North American and International exploration assignments. In late 1992, Neil prepared the geological report that supported the initial prospectus for Spider Resources Inc. in his capacity as consultant to the founders of Spider. Spider Resources Inc. became a public company in early 1993. Neil became an active board member and senior officer of Spider in 1995 and remained as such through to early 1999. Neil was re-elected to the Board of Spider in September 1999, and was re-appointed as Vice President in November 1999 and as Secretary for the corporation in January 2000. In June of 2003, Neil was appointed as the Chief Operating Officer of Spider.

In 1995, Neil joined KWG Resources Inc. and Ste Genevieve Resources Inc. as the International Exploration Manager for the group of companies; he remained with Ste Genevieve/KWG until November 1997, then helped both companies in their corporate restructuring through 1998.

In 1997, Neil in his capacity as International Exploration Manager for the Ste. Genevieve Group of Companies was appointed President of Ambrex Mining Corporation, (later changed name to Karmin Exploration).

In January, 2000 Neil through his ownership of Nominex Ltd., teamed up with Norman Brewster to form the consulting company Billiken Management Services Inc. Neil is president of Billiken Management. Billiken entered into a contract with Spider Resources Inc. and joint venture partner KWG Resources Inc. to manage all exploration activities of the KWG/Spider joint venture in the capacity of “appointed manager”.

Neil through his involvement in Billiken provides geological consultation and assists in financing various other resource companies, and as a partial result, in November of 2002, Neil was appointed to the Board of Noront Resources Inc.

Maurice H. Stekel

Maurice H. Stekel became a member of The Institute of Chartered Accountants in 1958. He was honoured to be elected by the Council of The Institute as a “Life Member” in November 2003. He was a founding and senior partner in the firm of Birnbaum, Prenick, Stekel & Co., Chartered Accountants. Founded in 1965, their firm was ranked 23 rd on the “Bottom Line’s Top 30” list in 1991. On June 1, 1993, Mr. Stekel changed his status to “retired partner”. He is continuing his consulting under the auspices of his company Mo-Kar Holdings Inc.

Since 1971 he has been a licensed mortgage broker and is president of BPS Management Limited.

Throughout Mr. Stekel’s career, he has been extremely involved in various aspects of the mining industry. Also, since 1963, he has been appointed to hold directorships in numerous mining companies. In addition he has held and continues to hold directorships in various other corporations.

David Graham

Mr. Graham attended the University of Waterloo and received a Batchelor of Science in 1983.

In 1986 Mr. Graham became President of R. Bruce Graham and Associates Ltd. a mining consulting firm that has served the mineral industry since 1956.

Mr. Graham has over twenty five years of experience in the industry and has served as a director and manager of a number of private and public natural resource and mining concerns. His relevant experience has been in the fields of base and precious metals, uranium and industrial minerals and materials.

Mr. Graham has worked in Canada, the United States, Scandinavia and Africa.

Consultants

Don Cross P.Eng.

1952 - 1956 Port Arthur Collegiate Thunder Bay, Ontario

1956 - 1959 Michigan College Mining Technology

Bsc. Geological Engineering

1959-1986 Noranda Exploration Comp Ltd.

Canada, Zimbabwe, S. Africa, USA, Cypress, Ireland

1986 - present Consultant, Canada, Africa, S. America, Mexico

based in Val-d'Or, Quebec

John Harvey P. Eng

Manager of Noront's Windfall Lake gold project and in house consultant to the Board of Directorsl

Formerly President of Hemlo Gold and Senior Vice President of Explorations for Noranda

Handelbar in:

Kanada (TSX-V): NOT.V

USA (OTC): NOSOF / Local-Id: 65626P101

D (BER): WKN: A0CAKK / ISIN: CA65626P1018 / Symbol: NQ1

Kanada (TSX-V): NOT.V

USA (OTC): NOSOF / Local-Id: 65626P101

D (BER): WKN: A0CAKK / ISIN: CA65626P1018 / Symbol: NQ1

http://www.norontresources.com/annual/index.htm

NORONT RESOURCES LTD.

___________________________

ANNUAL REPORT 2006

NORONT RESOURCES LTD.

DIRECTORS’ REPORT

To the Shareholders:

On behalf of the Board of Directors I am pleased to present your Company’s Annual Report for the year ended April 30th, 2006.

This past year has been a very busy year as we have completed several new property deals, raised money through private placements and have achieved some great results in the field. The cash position for Noront is excellent and will permit us to complete all our proposed programs.

The following outlines the Company’s mining properties and their status.

In Ontario on the Double Eagle Project at McFaulds Lake in the James Bay Lowlands the Company holds a large land position adjacent to the Spider Resources/KWG joint venture where three significant volcanogenic base metal massive sulphides have been discovered and are currently being drill defined for ore resources. Noront has carried out a series of airborne geophysical surveys, which have identified numerous high priority anomalies, with line cutting and ground geophysics having been completed for the most part over the target areas, which are now ready for further testing by diamond drill.

In December 2005, Noront agreed to option a 50% interest in the Double Eagle project to Probe Mines Limited (“Probe”) to be earned by Probe spending $2 million on exploration by September 1, 2007 ($750,000 by June 30, 2006) and transferring to Noront 300,000 common shares of Probe upon execution of the agreement and another 200,000 shares on the first anniversary of the agreement.

On March 16, 2006 Noront announced that it agreed to assign to Probe its agreement with Freewest to option four claims covering 992 hectares in the McFauld’s Lake area (“Freewest JV”). These claims are contiguous with Noront’s Double Eagle JV, where a first phase drill program is currently under way by Probe, which has the right to earn a 60% interest in the Freewest JV (50% by incurring exploration expenditures of $850,000 by November 11, 2007 and issuing 100,000 common shares of Probe to Noront; and 10% by delivering a feasibility study to Freewest).

On February 22, 2006 Noront announced that its JV partner Probe Mines Ltd. (“Probe”) had begun a drill program at Noront’s Double Eagle project. Probe has since advised the Company that in this winter drill program, ten conductors were tested with 11 holes, totalling 1585m, on the Double Eagle property in joint venture with Noront. Three of the holes intersected sulphide mineralization, containing visible chalcopyrite, hosted b felsic volcanic rocks similar to those in the area of Probe Mines’ and Spider Resources’ discoveries. In addition to the volcanic-hosted sulphides, two zones of intense faulting and hydrothermal alteration in ultramafic rocks were delineated and represent the potential for possible gold mieralization in the area.

Of the ten conductors tested in the winter drill program, three produced new base metal-bearing sulphide zones (DDH E3, E4, E5), all with highly anomalous precious metal contents, including a 0.5m section containing 1.5g/t Au identified in hole E5.

The Company has granted Probe an extension in order for Probe to complete its $750,000 exploration program to December 31, 2006. Probe intends to complete some geophysics and diamond drilling later this year.

In Quebec the Company now owns a 100% interest in the Windfall Lake Project in Urban Township. This project covers two adjacent claim blocks of which Noront holds a 100% interest subject to some minor Net Smelter Royalties (NSRs). The Windfall Lake block consists of 33 claims encompassing 528 hectares (1,320 acres), and the Alcane block of 57 claims comprising 912 hectares (2,280 acres).

Numerous diamond drill holes were completed on this project with a number of significant gold intercepts. A detailed study of all diamond drilling done to date on the Windfall Lake project was completed by the Company’s “qualified person”. As a result of this study, further fieldwork was recommended to assess the economic potential of the high grade gold intersections previously encountered in the most recent drill programs. The focus of the current work at Windfall Lake is to further assess an 800-metre-square block immediately east of the original Alto Showing where the best gold mineralization intersected to date has been encountered. This mineralized block is open in all directions. Since exploration drilling commenced in 1998, some 80 drill holes totalling 16,345 metres have been completed with 27 significant gold intersections being reported down to a maximum vertical depth of 450 metres. Gold intersections reported to date vary considerably in width and grade with wide drill hole sections up to 22.89 grams per ton over 9.4 metres and narrow sections up to 383 grams per ton over a one-metre interval have been reported by previous operators. Results to date warrant continuing exploration to assess the economic potential of the property close to surface by attempting to establish sufficient reserves for narrow, high-grade mining or wide, low-grade reserves for bulk mining. An independent detailed study including all of the adjoining Murgor Resources Ltd. data is being finalized. The study, it is hoped, will assist the company in further exploration.

The Windfall Lake project has advanced beyond a grass-roots development opportunity. John Harvey, P. Eng., formerly President of Noranda Explorations, was appointed Manager of this project. He has recommended that a detailed study be conducted using all drilling and trenching data to help determine the complexity of the deposit and assist in further diamond drilling. The Company has collaborated with Murgor Resources Inc. (MUG: TSX.V) and Freewest Resources Canada Inc. (FWR: TSX.V) who have agreed to provide all of their drilling data on their adjacent project to be included in this detailed study. The study is expected to be completed in the near future.

In New Brunswick on the Burnt Hill tungsten deposit in Stanley Parish, York County, the Company particularly due to escalating tungsten prices, felt it prudent to engage Dr. Ewert, P.Eng. to update all the data and carry out conceptual 3-dimensional modeling of the deposit under National Instrument 43-101 guide lines and give some recommendations for further work. The modeling indicated as presently defined that the reasonable potential target for tungsten mineralization would vary in the range of 1,800,000 to 2,300,000 tons at a postulated grade around 0.45% Tungsten (W03) to 0.55% Tungsten (W03) per ton giving the deposit a contained content of around 19.8 to 20.7 million pounds of W03. Dr. Ewert recommends an in-fill confirmation and exploration drill program to better define the presently known deposit. This program then should focus on deeper tungsten mineralization and the recoverable grades of accessory metals such as tin, molybdenum and bismuth.

On October 19th, 2005, Noront entered into an option agreement with Limerick Mines Limited whereby the latter could (1) earn a 50% interest in the Burnt Hill deposit by spending $1.5 million on exploration over 12 months and the issuance to Noront of 8 million shares of Limerick, and (2) earn a further 15% interest if Limerick spends $1 million on exploration and delivers an additional 5 million shares of Limerick as well as a feasibility study during year 2 of the agreement.

As reported in a news release dated June 22, 2005, it had become increasingly obvious that the theoretical value of the tungsten mineralization at Burnt Hill will be affected by the fact that the price of Tungsten concentrate had significantly increased to a current spot price of approximately US$ 16 per lb of WO3. (www.metalprices.com 08/11/06).

An internal memo to Noront suggested that a reasonable potential target for tungsten mineralization at the Burnt Hill, as presently defined, would vary in the range of 1,800,000 to 2,300,000 tons at a postulated grade around 0.45% WO3 to 0.55% WO3 per ton, giving the deposit a contained tungsten content of approximately 19.8 to 20.7 million lbs of WO3. It must be noted and it cannot be overemphasized, that the above estimates are conceptual in nature and accordingly there is no assurance that any of the mineralization can be economically recovered nor is there any guarantee that any value will ever be realized in whole or in part.

An NI 43-101 compliant Technical Report on the Burnt Hill Property, authored by Mr. Eugene Puritch P. Eng and Dr. Wayne Ewert, P.Geo of P&E Mining Consultants Inc., both Qualified persons as defined by NI 43-101, has been completed. The report contains a statement of historical resources for the Burnt Hill property as prepared by Brewster (1981) and as outlined in the Table below.

1981 Burnt Hill Historical Resource Estimates (Brewster, 1981)

Category Tons Metric Tons %WO3

Open-pit, veins 0 - 8 924,000 838,000 0.125

Underground, veins 0 to 7 1,507,000 1,367,000 0.162

Subtotal 2,431,000 2,205,000 0.148

Crown pillar 390,000 354,000 0.144

TOTAL 2,821,000 2,559,000 0.147

Noront owns a 100% interest in the Tie Jiang Ying Zi herein after referred to as the China One Copper/Gold Project which consists of a mineral rights permit comprising 5.16 square kilometres. The company formed a foreign investment company in Inner Mongolia to carry out mineral exploration and development. BaoTou Noront Mineral Development Co. Ltd. (“BaoTou”) will be able to acquire a 100% interest in the Tie Jiang Yng Zi property and other mineral properties, by purchasing the mineral rights from private Chinese companies or by applying for the mineral rights of new properties from the various Chinese Departments responsible for the Land and Mineral Rights. Since mineral rights belong to the Peoples Republic of China, the process of transferring the rights is quite complex and slow, particularly since Noront is the first foreign enterprise in Inner Mongolia to go through this process.

In 2004, two grab samples were taken from a five-metre-deep pit by Norman Brewster, P.Geo, and Uldis Abolins, P.Eng. and assays were performed by SGS Canada Inc. Mineral Services in Toronto, returning values of 1,715.8 gm/mt Au, 338 gm/mt Ag and over 1% Cu from the bedrock sample, and 11.9 gm/mt Au, 9.2 gm/mt Ag and over 1% Cu from the rubble sample.

On February 8, 2006 Noront announced that its wholly owned China subsidiary BaoTou received an exploration permit covering its China One Copper/Gold project. Noront also agreed in principle with private individuals (“China Group”) to grant them the option to earn a 50% interest in the project for USD$90,000. The China Group intends to transfer their rights to a publicly traded vehicle on a recognized stock exchange in North America (the “Transferee”) within 30 days of the agreement, which also calls for exploration expenditures of USD$750,000 by February 1, 2009 ($250,000 by February 1, 2007, to commence as soon as possible). The China Group will also deliver to Noront 300,000 common shares of the Transferee upon transfer of the option arrangements and 250,000 shares on each of the second and third anniversary of the agreement, subject to all regulatory approvals. Noront continues to grant extensions to The China Group for the transfer of their rights to a publicly trading vehicle which is continuing to secure exchange approval of listing. The China Group have advised that they have commenced an exploration program consisting of geophysics, trenching, sampling and diamond drilling and hope to have a report by the end of September 2006.

Kashabowie Property, Moss Lake Area, Ontario

Noront holds a 100% interest in four claims totalling 64 units (approximately 1,024 hectares, 2,560 acres) located 120 km west of Thunder Bay in the Shebandowan Greenstone Belt of northwest Ontario. The property is located over the northeast extension of the La Rose Shear Zone, where Freewest Reources Canada Inc. (“Freewest”) has intermittently exposed a mineralized corridor over a 3.5 kilometre strike length. Freewest highlighted six gold occurrences in this area with best values of 8.80, 64.87, 372, 10.15, 3.87, 62.93 and 13.39 grams per ton gold in grab samples (according to news published at Stockwatch on August 6, 2004). The Company signed an agreement in October 2004 with Murgor Resources Inc. giving Murgor the right to acquire up to a 60% interest in the property. Murgor advised Noront, after completing the first payment of $5,000 and issuing 200,000 common shares to Noront, that it does not intend to proceed further with this option agreement and the Company now retains a 100% interest.

Ireland Project “Larder Lake”

Noront announced on December 1, 2004 that it entered into an option agreement with a private Ontario resident covering five mining claims comprising 14 units located in the Larder Lake mining division of the Temiskaming area in northern Ontario. Subject to consent of all regulatory authorities, the Company may earn a 100% interest in the claims with: issuance of 25,000 common shares of Noront; payment of an additional $7,500 and issuance an additional 10,000 Noront shares by October 25, 2005; and expenditures of $80,000 for exploration on or before September 1, 2006. The optioner will retain a 2% NSR, of which Noront retains the right to purchase 1% at any time for $1 million or the equivalent in the Company’s common shares. Subsequently, Noront acquired, by staking, an additional 27 units contiguous to the five-claim block.

Lawson Township Project

Noront announced on June 8, 2006 that it had entered into an Option Agreement with a local prospector wherein it had the right to earn 100% interest subject to NSR royalties on a copper prospect consisting of 6 claim units in Lawson Township, northeastern Ontario. Geophysical (I.P.) surveying has indicated sub-surface targets covering the eastern extension of the surface mineralization. Further trenching will be carried out here before diamond drill testing is considered. The option agreement calls for payment in aggregate of $17,070 cash and the issuance in total of 35,000 common shares and completion of $80,000 in exploration on or before September 1st, 2008. The Optionee will maintain a 2% Net Smelter Royalty which the Company can repurchase 1% of at any time for $1million.

The sum of $12,450 and the issue of 25,000 shares will be due upon approvals of all regulatory authorities and at the option of the Company, paying and issuing a further $4,620 and 10,000 shares on or before February 1st, 2007 and completing optional exploration expenditures of $30,000 on or before February 1, 2007 and $50,000 on or before September 1st, 2008.

El Volcan Copper/Nickel Property

In December 2005, Noront entered into an option agreement to acquire a 100% interest in this property of 616 hectares (1522 acres) near Todos Santos in the state of Baja California South on the west coast of Mexico. The agreement calls for Noront to:

• pay USD$10,000 and issue 100,000 common shares of Noront upon execution of the agreement,

• pay USD$10,000 and issue 100,000 common shares on the first anniversary of the agreement,

• pay USD$50,000 and issue 150,000 common shares on the second anniversary of the agreement,

• have the right to purchase back, for USD$1 million, 1% of the 2% net smelter royalty retained by the Optionors.

A detailed ground magnetometer survey was recently completed and several strong anomalies have been located along a north-south trend where previous trenching in 1968 discovered significant copper-nickel sulphide mineralization across widths up to 16 meters in a series of trenches along a 400 meter strike length. In 2005 check chip channel samples were taken from the 50 foot trench averaged 2.95% Copper and 0.355% Nickel across 50 feet. Cobalt assays gave values ranging from 230 parts per million (ppm) to 950 ppm (0.095% Cobalt) while Precious Metals (Au, Pt, Pd) assay results gave values up to 0.504 grams per ton. (See press release dated December 19, 2005). No diamond drilling, to the Company’s knowledge, has ever been completed on the project. Before drill testing of the magnetic anomalies is considered, further trenching including resurrection of the old trenches and sampling will be completed as soon as equipment becomes available and temperatures become more moderate on the Baja.

Hunters Point Project

The Company entered into an Option Agreement with Globex Mining Enterprises Inc. whereby the Company can earn up to 100% interest in Globex’s Hunters Point and area properties located approximately 65km south of Belleterre, Quebec.

Under the agreement, the Company has agreed to pay Globex $200,000 in cash, issue 1.1 million shares in aggregate and perform $2.5 million dollars in exploration over a period of 4 years in order to earn a 75% interest in the 6 projects (763 hectares) that make up the properties. The Company can earn a further 25% interest in the property package by paying Globex an additional $500,000 in cash and issuing a further 500,000 Noront shares, all of which is subject to the receipt of all regulatory and other required approvals. A cash payment of $20,000, together with the issuance of 200,000 common shares of the Company and completion of $200,000 of acquisition exploration expenditures over the first six (6) months of the agreement, is a firm commitment, the balance agreed upon in order to earn the 100% interest over four (4) years payable in stages, is optional.

Globex will maintain a 2% Gross Metal Royalty on all production from the properties as well as on any properties acquired by the Company and Globex within 25 km of the boundaries of the existing cells.

Recent staking within the 25 km boundary of the original cells by Noront and Globex has increased appreciably the size of the property package by 230 cells (approximately 13,500 hectares) and which are now included in the option agreement

The Hunters Point package covers a series of uranium-gold, uranium-silver and uranium-rare earth showings with historical values of up to 7.7% U3O8 and 1.12 oz/ton gold reported in surface grab samples (see Globex Mining Enterprises Inc. Press Release dated February 21, 2005) principally in a sericitic quartzite horizon.

In addition, rare earths and uranium oxide are reported from samples of pegmatite taken by Turner Falls Mining Ventures in the late 1950’s on the Turner Falls property. Historical analysis of radioactive oxides returned values reported to range as follows: U3O8 - 0.13% to 0.35%, ThO2 - 0.85% to 1.44%, Nb2O5 -1.05% to 4.06%.

Individual reported historical rare earth values range as follows: Cerium - 0.2% to 3.0%, Lanthanum - 0.3% to 3.0%, Titanium - 0.5% to 2.0% and Zirconium 0.1% to 1.0%. These historical values have been provided to the Company by Globex’s qualified person and have not been verified to date by the Company.

The Hunters Point project has been initiated based upon one of several possible geological concepts, the most attractive concept being possible similarities between certain characteristics of the project area and the world class gold producing Witwatersrand region of South Africa.

Some of the similarities include the gold-uranium mineral association in Precambrian siliceous sediments (quartz conglomerates at Witwatersrand and quartzite at the Hunters Point area), a large basinal structure at Witwatersrand and a basin or fold structure at Hunters Point, similar mineral assemblages and ore zone characteristics, etc.

The Company intends to initiate work on the land package utilizing both on site and remote detection exploration methods.

The Company has agreed (subject to all regulatory approvals), to pay a finder’s fee to a third party as a result of the introduction and completing of the Option Agreement set out herein. The maximum finders fee payable is $107,500, payable in cash and/or shares of the Company with a cash equivalent value of $107,500. The fee is payable in stages, according to a formula based on a percentage of expenditures made by the Company on the project over the term of the option. The sum of $22,500 will be payable pursuant to the Company’s firm commitment upon the option agreement, the balance of the finder’s fee is optional.

On behalf of the Board of Directors, we thank all of our employees who have brought their best efforts to the Company and wish also to thank all our shareholders for their continued support throughout the year.

ON BEHALF OF THE BOARD

“R.E. Nemis”

Richard Nemis - President

Toronto, Ontario

September 12, 2006

Auch diese Nachbarn sind interessant (s. Thread von Silbereagle):

The Windfall Lake project has advanced beyond a grass-roots development opportunity. John Harvey, P. Eng., formerly President of Noranda Explorations, was appointed Manager of this project. He has recommended that a detailed study be conducted using all drilling and trenching data to help determine the complexity of the deposit and assist in further diamond drilling. The Company has collaborated with Murgor Resources Inc. (MUG: TSX.V) and Freewest Resources Canada Inc. (FWR: TSX.V) who have agreed to provide all of their drilling data on their adjacent project to be included in this detailed study. The study is expected to be completed in the near future.

Gruß,

Fantomas

The Windfall Lake project has advanced beyond a grass-roots development opportunity. John Harvey, P. Eng., formerly President of Noranda Explorations, was appointed Manager of this project. He has recommended that a detailed study be conducted using all drilling and trenching data to help determine the complexity of the deposit and assist in further diamond drilling. The Company has collaborated with Murgor Resources Inc. (MUG: TSX.V) and Freewest Resources Canada Inc. (FWR: TSX.V) who have agreed to provide all of their drilling data on their adjacent project to be included in this detailed study. The study is expected to be completed in the near future.

Gruß,

Fantomas

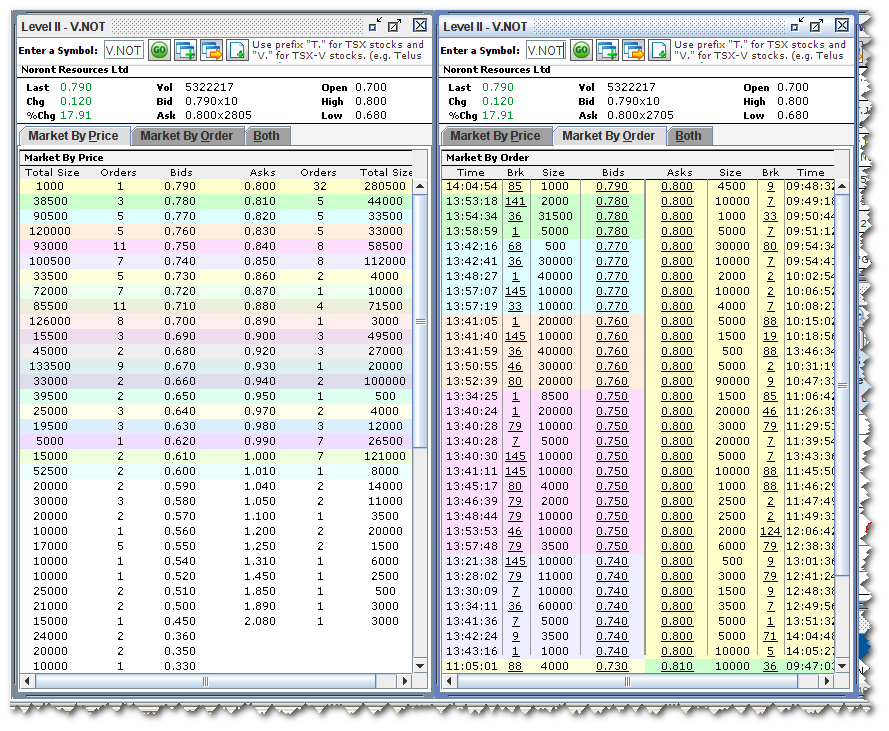

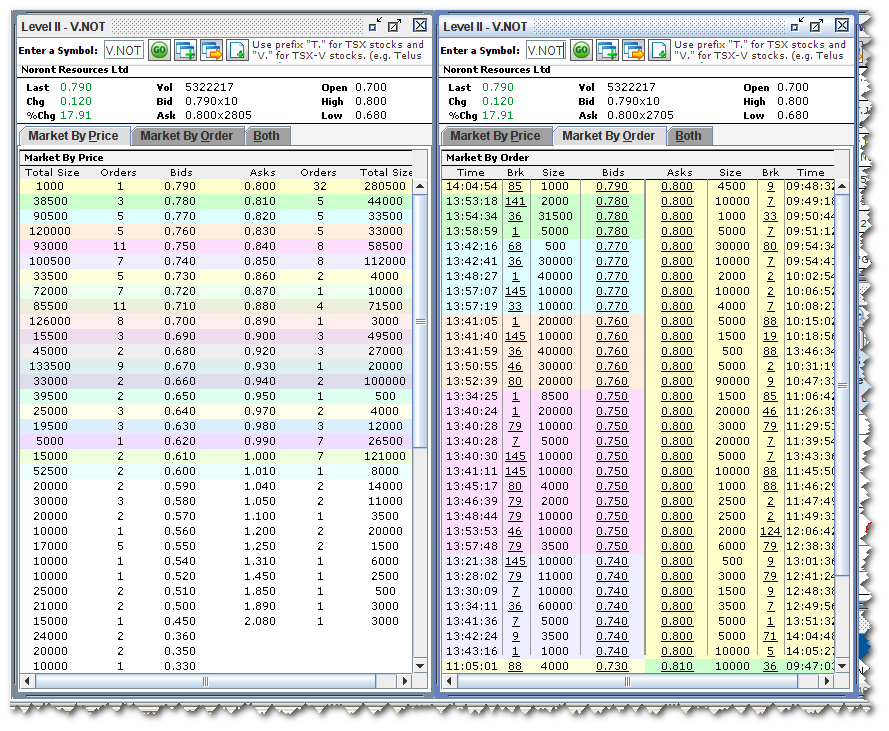

So langsam werden die Day-Trader weniger und wir nähern uns einem guten Einstiegskurs, wenn man hier an weitere gute Bohrergebnisse glaubt.

Gruß,

Fantomas

Gruß,

Fantomas

Ich weiß nicht, ob es noch viel weiter runter geht, aber ich bin heute mit einer ersten Position eingestiegen.

Jetzt heißt es auf neue Meldungen (sollen noch in diesem Jahr kommen) warten.

Gruß,

Fantomas

Jetzt heißt es auf neue Meldungen (sollen noch in diesem Jahr kommen) warten.

Gruß,

Fantomas

Hier mal eine Karte mit dem spektakulären Noront-Fund, die auch die Nähe zu MUG/FWR zeigt:

http://www.freewest.com/maps/dec14discovery.pdf

Das MUG/FWR-JV will Anfang des Jahres weiter auf Windfall bohren (wie NOT auch).

Sollte irgendeiner weiter fündig werden, geht für alle die Post ab.

Gruß,

Fantomas

http://www.freewest.com/maps/dec14discovery.pdf

Das MUG/FWR-JV will Anfang des Jahres weiter auf Windfall bohren (wie NOT auch).

Sollte irgendeiner weiter fündig werden, geht für alle die Post ab.

Gruß,

Fantomas

So, ich bin auch wieder da zur "Weihnachts-Feier" :

hier mal noch die zwei Meldungen der letzten Woche (beide sehr positiv, Noront danach +25%):

1. Noront hat Finanzierungsrunde über $ 15 Mio. abgeschlossen.

http://biz.yahoo.com/ccn/061221/200612210364947001.html?.v=1

Press Release Source: Noront Resources Ltd.

Noront Completes $15 Million Financing

Thursday December 21, 12:06 pm ET

TORONTO, ONTARIO--(CCNMatthews - Dec. 21, 2006) - Noront Resources Ltd. (Noront)(TSX VENTURE:NOT - News) is pleased to announce that it has competed a brokered financing of $15,000,000 through IBK Capital Corp. The financing consists of 10,215,000 flow through units and 19,785,000 hard dollar units. Each flow through unit consists of one common share and one-half of a share purchase warrant and the hard dollar unit consists of one common share and one share purchase warrant. Each full warrant entitles the holder to purchase one additional common share (which share shall not be a flow through share) at a price of $0.75 for a period of two years. See press release dated December 7th, 2006.

ANZEIGE

The Company has currently contracted for two diamond drills for the Company's Windfall Lake gold project Quebec. This new diamond drill program expected to start February 1st, 2007 will better delineate the high grade zones established in preparation for the development of an exploration ramp of approximately 2000 feet. Construction of this exploration ramp will commence as soon as further engineering studies and environmental permitting are completed.

This new exploration ramp is intended to outline, sample and bulk sample the gold zones known to the company at the present time and should be completed in the year 2007.

Tracy Armstrong (a qualified geologist in the Province of Quebec) of P&E Mining Consultants continues to interpret the drilling results to date.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contact:

Richard Nemis

Noront Resources Ltd.

(416) 864-1456

(416) 367-5444 (FAX)

Email: info@norontresources.com

Website: www.norontresources.com

--------------------------------------------------------------------------------

Source: Noront Resources Ltd.

Gruß,

hier mal noch die zwei Meldungen der letzten Woche (beide sehr positiv, Noront danach +25%):

1. Noront hat Finanzierungsrunde über $ 15 Mio. abgeschlossen.

http://biz.yahoo.com/ccn/061221/200612210364947001.html?.v=1

Press Release Source: Noront Resources Ltd.

Noront Completes $15 Million Financing

Thursday December 21, 12:06 pm ET

TORONTO, ONTARIO--(CCNMatthews - Dec. 21, 2006) - Noront Resources Ltd. (Noront)(TSX VENTURE:NOT - News) is pleased to announce that it has competed a brokered financing of $15,000,000 through IBK Capital Corp. The financing consists of 10,215,000 flow through units and 19,785,000 hard dollar units. Each flow through unit consists of one common share and one-half of a share purchase warrant and the hard dollar unit consists of one common share and one share purchase warrant. Each full warrant entitles the holder to purchase one additional common share (which share shall not be a flow through share) at a price of $0.75 for a period of two years. See press release dated December 7th, 2006.

ANZEIGE

The Company has currently contracted for two diamond drills for the Company's Windfall Lake gold project Quebec. This new diamond drill program expected to start February 1st, 2007 will better delineate the high grade zones established in preparation for the development of an exploration ramp of approximately 2000 feet. Construction of this exploration ramp will commence as soon as further engineering studies and environmental permitting are completed.

This new exploration ramp is intended to outline, sample and bulk sample the gold zones known to the company at the present time and should be completed in the year 2007.

Tracy Armstrong (a qualified geologist in the Province of Quebec) of P&E Mining Consultants continues to interpret the drilling results to date.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contact:

Richard Nemis

Noront Resources Ltd.

(416) 864-1456

(416) 367-5444 (FAX)

Email: info@norontresources.com

Website: www.norontresources.com

--------------------------------------------------------------------------------

Source: Noront Resources Ltd.

Gruß,

2. Noront beschließt "Shareholder Rights Plan"

http://biz.yahoo.com/ccn/061222/200612220365278001.html?.v=1

Press Release Source: Noront Resources Ltd.

Noront Adopts a Shareholder Rights Plan

Friday December 22, 3:01 pm ET

TORONTO, ONTARIO--(CCNMatthews - Dec. 22, 2006) - Noront Resources Ltd. (TSX VENTURE:NOT - News) - The Board of Directors (the "Board") of Noront Resources Ltd. ("the Company") has voted to adopt a shareholder rights plan (the "Rights Plan"). The Rights Plan is being adopted in order to reflect developments in Canada with respect to shareholder rights plans and is designed to encourage the fair treatment of shareholders in connection with any take-over bid for the Company.

The Rights Plan will provide the Board and the shareholders with more time to fully consider any unsolicited take-over bid for the Company without undue pressure. Furthermore, the Rights Plan will allow the Board to pursue, if appropriate, other alternatives to maximize shareholder value and to allow additional time for competing bids to emerge.

The Rights Plan is not being proposed in response to, or in anticipation of, any acquisition or takeover offer and is not intended to prevent a take-over bid for the Company. Under the Rights Plan, take-over bids that meet certain requirements intended to protect the interests of all shareholders are deemed to be "Permitted Bids". Permitted Bids must be made by way of a take-over bid circular prepared in compliance with applicable securities laws and, among other conditions, must remain open for sixty days.

The Rights Plan is similar to other shareholder rights plans recently adopted by other Canadian corporations. Until the occurrence of certain specific events, the rights will trade with the common shares of the Company and be represented by the share certificates for such shares. The rights become exercisable only when a person, including any party related to or acting jointly or in concert with such person, acquires or announces its intention to acquire 20% or more of the outstanding common shares common shares of the Company without complying with the "Permitted Bid" provisions of the Rights Plan. Should a non-permitted acquisition occur, each right would entitle each holder of common shares (other than the offeror or certain parties related to it or acting jointly or in concert with it) to purchase additional common shares of the Company at a 50% discount to the market price of the shares at that time.

Although the Rights Plan will take effect immediately in accordance with applicable regulatory requirements, the Company will submit the Rights Plan for confirmation at a special meeting of shareholders to be held within the next six months. Thereafter, the Rights Plan will be subject to reconfirmation at every third annual meeting of shareholders thereafter until its expiry on December 22, 2016. If the shareholders do not confirm the Rights Plan, the Rights Plan will terminate and cease to be effective at that time. The Rights Plan is subject to the approval of the TSX Venture Exchange. A full text of the Rights Plan will be posted on the Company's web site www.norontresources.com. Registered common shareholders will be provided with a synopsis of the Rights Plan, such synopsis to be included in an information circular delivered to each shareholder prior to the special meeting.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contact:

Richard Nemis

Noront Resources Ltd.

(416) 864-1456

(416) 367-5444 (FAX)

Email: info@norontresources.com

Website: www.norontresources.com

--------------------------------------------------------------------------------

Source: Noront Resources Ltd.

Gruß,

Fantomas

http://biz.yahoo.com/ccn/061222/200612220365278001.html?.v=1

Press Release Source: Noront Resources Ltd.

Noront Adopts a Shareholder Rights Plan

Friday December 22, 3:01 pm ET

TORONTO, ONTARIO--(CCNMatthews - Dec. 22, 2006) - Noront Resources Ltd. (TSX VENTURE:NOT - News) - The Board of Directors (the "Board") of Noront Resources Ltd. ("the Company") has voted to adopt a shareholder rights plan (the "Rights Plan"). The Rights Plan is being adopted in order to reflect developments in Canada with respect to shareholder rights plans and is designed to encourage the fair treatment of shareholders in connection with any take-over bid for the Company.

The Rights Plan will provide the Board and the shareholders with more time to fully consider any unsolicited take-over bid for the Company without undue pressure. Furthermore, the Rights Plan will allow the Board to pursue, if appropriate, other alternatives to maximize shareholder value and to allow additional time for competing bids to emerge.

The Rights Plan is not being proposed in response to, or in anticipation of, any acquisition or takeover offer and is not intended to prevent a take-over bid for the Company. Under the Rights Plan, take-over bids that meet certain requirements intended to protect the interests of all shareholders are deemed to be "Permitted Bids". Permitted Bids must be made by way of a take-over bid circular prepared in compliance with applicable securities laws and, among other conditions, must remain open for sixty days.

The Rights Plan is similar to other shareholder rights plans recently adopted by other Canadian corporations. Until the occurrence of certain specific events, the rights will trade with the common shares of the Company and be represented by the share certificates for such shares. The rights become exercisable only when a person, including any party related to or acting jointly or in concert with such person, acquires or announces its intention to acquire 20% or more of the outstanding common shares common shares of the Company without complying with the "Permitted Bid" provisions of the Rights Plan. Should a non-permitted acquisition occur, each right would entitle each holder of common shares (other than the offeror or certain parties related to it or acting jointly or in concert with it) to purchase additional common shares of the Company at a 50% discount to the market price of the shares at that time.

Although the Rights Plan will take effect immediately in accordance with applicable regulatory requirements, the Company will submit the Rights Plan for confirmation at a special meeting of shareholders to be held within the next six months. Thereafter, the Rights Plan will be subject to reconfirmation at every third annual meeting of shareholders thereafter until its expiry on December 22, 2016. If the shareholders do not confirm the Rights Plan, the Rights Plan will terminate and cease to be effective at that time. The Rights Plan is subject to the approval of the TSX Venture Exchange. A full text of the Rights Plan will be posted on the Company's web site www.norontresources.com. Registered common shareholders will be provided with a synopsis of the Rights Plan, such synopsis to be included in an information circular delivered to each shareholder prior to the special meeting.

ON BEHALF OF THE BOARD OF DIRECTORS

"R. Nemis", President and Chief Executive Officer

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Contact:

Richard Nemis

Noront Resources Ltd.

(416) 864-1456

(416) 367-5444 (FAX)

Email: info@norontresources.com

Website: www.norontresources.com

--------------------------------------------------------------------------------

Source: Noront Resources Ltd.

Gruß,

Fantomas

Und die dritte Meldung wäre beinahe durchgerutscht:

Pinetree Capital hat die Beteiligung an Noront weiter aufgestockt und würde bei Ausübung aller Warrants nun 9,797 Mio. Anteile oder ca. 10,8 % aller O/S halten.

http://www.stockhouse.com/news/news.asp?newsid=4859041&tick=…

NORONT RESOURCES LTD

Pinetree Capital Ltd. Acquires Common Shares of Noront Resources Ltd.

12/21/2006

TORONTO, ONTARIO, Dec 21, 2006 (MARKET WIRE via COMTEX News Network) --

Pinetree Capital Ltd. (TSX: PNP), a Canadian investment company, announces that on December 20, 2006, it acquired ownership of 1,500,000 common shares ("Common Shares") of Noront Resources Ltd. ("Noront") and 1,250,000 share purchase warrants (each, a "Warrant") (each Warrant entitling the holder thereof to acquire one additional common share at an exercise price of $0.75 until December 20, 2008). In the event that the Warrants are fully exercised, these holdings represent approximately 3.1% of the total issued and outstanding common shares of Noront as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of Warrants only. As a result of this transaction, Pinetree and its joint actors held, as at December 20, 2006, an aggregate of 6,300,000 common shares of Noront and rights to acquire an aggregate of 3,497,000 common shares of Noront upon exercise of convertible securities, including the Warrants (collectively, the "Convertible Securities"). Of these totals, Pinetree holds 4,700,000 common shares and the 2,375,000 warrants including the Warrants directly. If Pinetree and its joint actors were to exercise all of these Convertible Securities, their combined ownership would represent a total of 9,797,000 common shares of Noront, or approximately 10.8% of such shares outstanding as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of the Convertible Securities only. In the event that only the 2,375,000 warrants are fully exercised, the direct holdings of Pinetree represent approximately 7.9% of all issued and outstanding common shares of Noront as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of the warrants only.

These transactions were made for investment purposes and Pinetree and each of its joint actors could increase or decrease their respective investments in Noront depending on market conditions or any other relevant factor.

About Pinetree

Pinetree Capital Ltd. ("Pinetree" or the "Company") was incorporated under the laws of the Province of Ontario and is publicly traded on the Toronto Stock Exchange ("TSX") under the symbol "PNP". Pinetree develops and manages a portfolio of equity securities of private and public issuers engaged in growth businesses in the following three sectors: (i) Uranium, Mining and Oil & Gas; (ii) Biotechnology; and (iii) Technology and Other. Pinetree's investment focus among these three sectors changes over time, depending on changing investment opportunities. As well, Pinetree takes advantage of special situations and merchant banking opportunities.

For more details about Pinetree and its investments, please visit our website at www.pinetreecapital.com.

This news release contains forward-looking statements within the meaning of the "safe harbour" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties and other factors that may cause Pinetree's results to differ materially from expectations. These include risks relating to market fluctuations, investee performance and other risks. These forward-looking statements speak only as of the date hereof. Pinetree disclaims any intent or obligation to update these forward-looking statements.

Contacts: Investor Relations Contact for Pinetree Capital Ltd.: Larry Goldberg, C.A. Executive Vice President and Chief Financial Officer (416) 941-9600 Email: ir@pinetreecapital.com Website: www.pinetreecapital.com

SOURCE: Pinetree Capital Ltd.

mailto:ir@pinetreecapital.com http://www.pinetreecapital.com

Copyright 2006 Market Wire, All rights reserved.

© 2006 Stockgroup Media Inc.

Gruß,

Fantomas

Pinetree Capital hat die Beteiligung an Noront weiter aufgestockt und würde bei Ausübung aller Warrants nun 9,797 Mio. Anteile oder ca. 10,8 % aller O/S halten.

http://www.stockhouse.com/news/news.asp?newsid=4859041&tick=…

NORONT RESOURCES LTD

Pinetree Capital Ltd. Acquires Common Shares of Noront Resources Ltd.

12/21/2006

TORONTO, ONTARIO, Dec 21, 2006 (MARKET WIRE via COMTEX News Network) --

Pinetree Capital Ltd. (TSX: PNP), a Canadian investment company, announces that on December 20, 2006, it acquired ownership of 1,500,000 common shares ("Common Shares") of Noront Resources Ltd. ("Noront") and 1,250,000 share purchase warrants (each, a "Warrant") (each Warrant entitling the holder thereof to acquire one additional common share at an exercise price of $0.75 until December 20, 2008). In the event that the Warrants are fully exercised, these holdings represent approximately 3.1% of the total issued and outstanding common shares of Noront as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of Warrants only. As a result of this transaction, Pinetree and its joint actors held, as at December 20, 2006, an aggregate of 6,300,000 common shares of Noront and rights to acquire an aggregate of 3,497,000 common shares of Noront upon exercise of convertible securities, including the Warrants (collectively, the "Convertible Securities"). Of these totals, Pinetree holds 4,700,000 common shares and the 2,375,000 warrants including the Warrants directly. If Pinetree and its joint actors were to exercise all of these Convertible Securities, their combined ownership would represent a total of 9,797,000 common shares of Noront, or approximately 10.8% of such shares outstanding as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of the Convertible Securities only. In the event that only the 2,375,000 warrants are fully exercised, the direct holdings of Pinetree represent approximately 7.9% of all issued and outstanding common shares of Noront as of December 20, 2006, calculated on a partially diluted basis assuming the exercise of the warrants only.

These transactions were made for investment purposes and Pinetree and each of its joint actors could increase or decrease their respective investments in Noront depending on market conditions or any other relevant factor.

About Pinetree

Pinetree Capital Ltd. ("Pinetree" or the "Company") was incorporated under the laws of the Province of Ontario and is publicly traded on the Toronto Stock Exchange ("TSX") under the symbol "PNP". Pinetree develops and manages a portfolio of equity securities of private and public issuers engaged in growth businesses in the following three sectors: (i) Uranium, Mining and Oil & Gas; (ii) Biotechnology; and (iii) Technology and Other. Pinetree's investment focus among these three sectors changes over time, depending on changing investment opportunities. As well, Pinetree takes advantage of special situations and merchant banking opportunities.

For more details about Pinetree and its investments, please visit our website at www.pinetreecapital.com.

This news release contains forward-looking statements within the meaning of the "safe harbour" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties and other factors that may cause Pinetree's results to differ materially from expectations. These include risks relating to market fluctuations, investee performance and other risks. These forward-looking statements speak only as of the date hereof. Pinetree disclaims any intent or obligation to update these forward-looking statements.

Contacts: Investor Relations Contact for Pinetree Capital Ltd.: Larry Goldberg, C.A. Executive Vice President and Chief Financial Officer (416) 941-9600 Email: ir@pinetreecapital.com Website: www.pinetreecapital.com

SOURCE: Pinetree Capital Ltd.

mailto:ir@pinetreecapital.com http://www.pinetreecapital.com

Copyright 2006 Market Wire, All rights reserved.

© 2006 Stockgroup Media Inc.

Gruß,

Fantomas

Anhand der News Releases soll hier mal ein Vergleich NORONT / AURELIAN aufgezeigt werden.

Man beachte den fast identischen (nur viel schnelleren) Verlauf bei NORONT:

ARU.V

January 26, 2006: ARU announces drilling for Condor Project

March 22, 2006: ARU announces results (average)

CP-05-46 241.00 298.35(EOH) 57.35 0.29 0.04

---------------------------------------------------------------------

CP-06-47 185.40 301.40 (EOH) 116.00 0.35 0.09

---------------------------------------------------------------------

including 275.50 301.40 (EOH) 25.90 0.47 0.13

---------------------------------------------------------------------

CP-06-48 Did not intersect porphyry mineralization

April 4, 2006: MARKET HALT (Share price between .70 and .89 the

week preceding the halt) Opens at 2.30 and closes at

3.03.

April 5, 2006: Aurelian Intersects 237 Metres Averaging 4.14 g/t of

Gold and 60 Metres Averaging 3.42 g/t in Initial Drill Program at the New FDN Epithermal Gold-Silver Discovery

April 7, 2006: MARKET HALT

April 7, 2006 $10,000,000 PP Announced

April 27, 2006: PP closed. $20,000,000 actually raised.

May 12, 2006: Option granted to Directors and employees

May 24, 2006: Shareholder protection plan

June 2, 2006: HALT

June 2, 2006: Aurelian Intersects 204.80 Metres Averaging 8.40 g/t

of Gold at the FDN Epithermal Gold-Silver Discovery

Stock jumps from $6.80 to $20.00 between June 1 and 6th. Short sellers still working night shift at Wal-mart to pay losses.

________________________________________________________________

Jetzt NOT.V:

September 14, 2006: Restart dilling at Windfall Lake

November 29, 2006: Trading HALT

December 1, 2006: Noront Intersects More Hi-Grade at Windfall Lake

The assayed, weighted average of the three assay tests for the six individual samples over the 4.80 meters (15.7 feet) were:

1792.9 g/t (52.30 oz/t), 800.1 g/t (23.33 oz/t) from the fire assays and 1327.9 g/t (38.74 oz/t) for the metallic screening assay.

December 7, 2006: Noront Engages IBK Capital Corp. for the Private

Placement of Units and Flow Through Common Shares

December 8, 2006: Noront Issues stock options Directors and employees

December 21, 2006: Noront completes $15,000,000 PP

December 22, 2006: Shareholder rights (protection) plan

Jetzt stehen noch Resultate von 8 Bohrlöchern aus.

Na, sind die Parallelen deutlich geworden ?

Wenn nur Annäherungsweise ähnliche Resultate bekanntgegeben werden können, sollte es eine 2. Aurelian geben.

Meiner Meinung nach noch viel besser, da in einem politisch sicheren Gebiet (das hat ARU in letzter Zeit einiges an SP gekostet).

Also heißt es: weiter warten und "Top, die Wette gilt" (IMO ist dies keine heiße Luft mehr und mit ein wenig Glück auch kein "One-Hole-Wonder" !

Gruß,

Fantomas

Man beachte den fast identischen (nur viel schnelleren) Verlauf bei NORONT:

ARU.V

January 26, 2006: ARU announces drilling for Condor Project

March 22, 2006: ARU announces results (average)

CP-05-46 241.00 298.35(EOH) 57.35 0.29 0.04

---------------------------------------------------------------------

CP-06-47 185.40 301.40 (EOH) 116.00 0.35 0.09

---------------------------------------------------------------------

including 275.50 301.40 (EOH) 25.90 0.47 0.13

---------------------------------------------------------------------

CP-06-48 Did not intersect porphyry mineralization

April 4, 2006: MARKET HALT (Share price between .70 and .89 the

week preceding the halt) Opens at 2.30 and closes at

3.03.

April 5, 2006: Aurelian Intersects 237 Metres Averaging 4.14 g/t of

Gold and 60 Metres Averaging 3.42 g/t in Initial Drill Program at the New FDN Epithermal Gold-Silver Discovery

April 7, 2006: MARKET HALT

April 7, 2006 $10,000,000 PP Announced

April 27, 2006: PP closed. $20,000,000 actually raised.

May 12, 2006: Option granted to Directors and employees

May 24, 2006: Shareholder protection plan

June 2, 2006: HALT

June 2, 2006: Aurelian Intersects 204.80 Metres Averaging 8.40 g/t

of Gold at the FDN Epithermal Gold-Silver Discovery