NORONT RES. (NOT.V): Spektakuläre Funde (Gold,Kupfer,Uran,Metalle) - 500 Beiträge pro Seite (Seite 2)

eröffnet am 11.12.06 23:17:19 von

neuester Beitrag 14.04.22 13:52:34 von

neuester Beitrag 14.04.22 13:52:34 von

Beiträge: 3.139

ID: 1.099.646

ID: 1.099.646

Aufrufe heute: 0

Gesamt: 329.901

Gesamt: 329.901

Aktive User: 0

ISIN: CA65626P1018 · WKN: A0CAKK

1,0900

CAD

0,00 %

0,0000 CAD

Letzter Kurs 06.04.22 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8947 | +11,85 | |

| 205,00 | +10,81 | |

| 2,6100 | +9,66 | |

| 0,6200 | +8,77 | |

| 5,1500 | +8,42 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 183,20 | -19,30 | |

| 1,1367 | -22,67 | |

| 12,000 | -25,00 | |

| 8,3600 | -39,81 | |

| 46,06 | -98,04 |

Antwort auf Beitrag Nr.: 32.487.786 von WilliamTell am 19.11.07 22:09:45Ich hab zwar nicht 8.6 Mio Shares

ich auch nicht !

gruss mike

ich auch nicht !

gruss mike

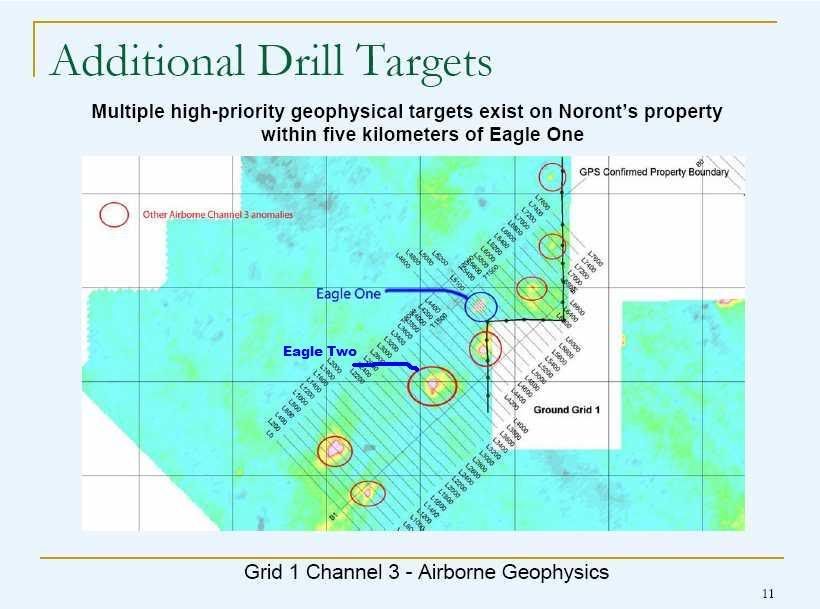

Mal ein paar Bilder von Windfall, dem Camp und dem Rampenbau:

http://www.norontresources.com/investor.html

Gruß,

Fantomas

http://www.norontresources.com/investor.html

Gruß,

Fantomas

Noront Resources added to the list of presenters at The Richmond Club's first all day investment conference in Toronto on November 28, 2007

Posted by: AGORACOM on November 21, 2007 12:09P

http://agoracom.com/ir/Noront/messages/638263#message

Hallo Mike,

danke für die Aufnahme der 3 neuen Area-Player in James Bay in Deinen RT-Thread !

1. Hawk Uranium (HUI.V)

2. Goldeye Resources (GGY.V) (Nein, hat nichts mit 007 zu tun)

3. Tribute Minerals (TBM.V)

Besonders das Board of Directors der beiden letztgenannten Firmen hat es mir angetan: hochkarätig, viel Erfahrung (vor allem zwei der Direktoren) und nun auch klar, warum beide Firmen sehr extensiv in James Bay gestaked haben.

Aber seht doch selbst:

Tribute:

http://www.tributeminerals.com/abo_tri.html

Goldeye (Rubrik "people" links anklicken):

http://www.goldeye.ca/

Gruß und auf eine fulminante Woche mit Noront (wie gesagt: FESTHALTEN !)

Fantomas

danke für die Aufnahme der 3 neuen Area-Player in James Bay in Deinen RT-Thread !

1. Hawk Uranium (HUI.V)

2. Goldeye Resources (GGY.V) (Nein, hat nichts mit 007 zu tun)

3. Tribute Minerals (TBM.V)

Besonders das Board of Directors der beiden letztgenannten Firmen hat es mir angetan: hochkarätig, viel Erfahrung (vor allem zwei der Direktoren) und nun auch klar, warum beide Firmen sehr extensiv in James Bay gestaked haben.

Aber seht doch selbst:

Tribute:

http://www.tributeminerals.com/abo_tri.html

Goldeye (Rubrik "people" links anklicken):

http://www.goldeye.ca/

Gruß und auf eine fulminante Woche mit Noront (wie gesagt: FESTHALTEN !)

Fantomas

Hier noch ein bißchen Hintergrundinformation zu Mineralogie und verschiedenen Erzkörpern:

http://northernminer.com/Tools/Geology101/geo101pg5.asp#Porp…

Gruß,

Fantomas

http://northernminer.com/Tools/Geology101/geo101pg5.asp#Porp…

Gruß,

Fantomas

Antwort auf Beitrag Nr.: 32.560.959 von Fantomas96 am 25.11.07 18:12:37Dieser Artikel ist besonders interessant im Zusammenhang mit Noronts CHINA ONE Projekt in der Mongolei (diverse Andeutungen von Richard Nemis lassen hier auf eine sehr positive Überraschung hoffen):

http://www.norontresources.com/investor/china-one/2007-May2-…

Noront hat hier bereits in 2003 100% Rechte an 5,16 km2 Claims in der Mongolei erworben und hat dann über ein Agreement mit einer Gruppe von Privatpersonen schließlich ein 50% Joint Venture mit Newport Gold akzeptiert (Newport muß $ 750.000 in 3 Jahren an Explorationsaufwendungen aufbringen und zusätzlich 800.000 Aktien an Noront zahlen). Klingt irgendwie bekannt ? (s. James Bay).

Bisherige grab samples haben 1715.8 g/mt Gold (mit \"visible gold\") und 11.9 g/mt Gold geliefert. Zudem enthielten sie mehr als 1% Kupfer (Malachit Mineralisation).

Samples aus 2004 brachten Ergebnisse von 0.81 bis 21.14 g/mt Gold und Kupfergehalten von über 1%.

Weitere Untersuchungen ergaben ein mineralisiertes Gebiet von ca. 600m x 260m Ausdehnung.

In größerer Tiefe wurde zudem Chalcopyrit (s. DE) und ansteigende Goldgehalte festgestellt.

Da könnten auch sehr interessante Ergebnisse des Drillings auf uns zukommen.

Gruß,

Fantomas

http://www.norontresources.com/investor/china-one/2007-May2-…

Noront hat hier bereits in 2003 100% Rechte an 5,16 km2 Claims in der Mongolei erworben und hat dann über ein Agreement mit einer Gruppe von Privatpersonen schließlich ein 50% Joint Venture mit Newport Gold akzeptiert (Newport muß $ 750.000 in 3 Jahren an Explorationsaufwendungen aufbringen und zusätzlich 800.000 Aktien an Noront zahlen). Klingt irgendwie bekannt ? (s. James Bay).

Bisherige grab samples haben 1715.8 g/mt Gold (mit \"visible gold\") und 11.9 g/mt Gold geliefert. Zudem enthielten sie mehr als 1% Kupfer (Malachit Mineralisation).

Samples aus 2004 brachten Ergebnisse von 0.81 bis 21.14 g/mt Gold und Kupfergehalten von über 1%.

Weitere Untersuchungen ergaben ein mineralisiertes Gebiet von ca. 600m x 260m Ausdehnung.

In größerer Tiefe wurde zudem Chalcopyrit (s. DE) und ansteigende Goldgehalte festgestellt.

Da könnten auch sehr interessante Ergebnisse des Drillings auf uns zukommen.

Gruß,

Fantomas

Neben Rumours über ein PP über CAD 10,00 (15 Mio. Aktien) mit JP Morgan oder Morgan Stanley (wäre ein echter Hammer), hier noch der Link zum Interview auf BNN mit Peter Hodson (Senior Portfolio Manager von Sprott Asset Management) und seiner Aussage zu Noront (geht in Part 1 zu 12:40 min):

- sehr solider Boden bei CAD 4,00 gefunden

- "they are doing the right things"

- "we like this play"

- Sprott hält ca. 6% an Noront

- bei weiteren top Drill-Ergebnissen potentieller Vervielfacher, auf Nachfrage nennt Peter mögliche $ 20 (!!!) bei weiteren "step-out hits" mit ähnlich guten Gehalten

Tja, das wäre ja zu schön, um wahr zu sein, oder ?

Part 1:

http://broadband.bnn.ca/bnn/?sid=205&vid=23084

Part 2:

http://broadband.bnn.ca/bnn/?sid=205&vid=23087

Gruß,

Fantomas

- sehr solider Boden bei CAD 4,00 gefunden

- "they are doing the right things"

- "we like this play"

- Sprott hält ca. 6% an Noront

- bei weiteren top Drill-Ergebnissen potentieller Vervielfacher, auf Nachfrage nennt Peter mögliche $ 20 (!!!) bei weiteren "step-out hits" mit ähnlich guten Gehalten

Tja, das wäre ja zu schön, um wahr zu sein, oder ?

Part 1:

http://broadband.bnn.ca/bnn/?sid=205&vid=23084

Part 2:

http://broadband.bnn.ca/bnn/?sid=205&vid=23087

Gruß,

Fantomas

http://www.agoracom.com/ir/Noront/messages/642597#message

in situ value, why noront is worth more then most think, #4 and #5 of 5

Posted by: jsq on November 26, 2007 08:25PM

hello friends,

on 10/26/07 we covered why a typical rule of thumb is that the in situ value of the minerals in the ground is often valued around 10% in terms of shareholder market cap. this is based on historical experience in the mining community of what it costs to get the ore out of the ground and converted to shareholder wealth.

as mentioned, in my view, noront IS MUCH DIFFERENT from a "typical" valuation model. and as such obviously worth more than the 10% often accorded average mining firms. this was noted and explained in #1 covering "grade of ore" on 10/26/07, we continued to discuss why in:

2. type of ore

3. quantity of ore (or tonnage)

which was posted on 11/8/07.

(if you have not already had a chance to read these 2 earlier posts you can still do so by clicking on the photo of errol, above left, that will take you to my list of prior posts, go down to the 10/26/07 post click and read, then later move to the 11/8/07 post, click and read. the two posts have a cumulative 100 or so thumbs up so far, so some readers have found the 2 earlier posts informative.)

okay, sorry to be so slow with #4 and #5, which follows below. the wife and i have been busy, relatives etc.

the next two discussion points, #4 and #5, are fairly easy.

(also before i forget: rockaur and one other geologist expert on this site, whose name escapes me - my apologies, are both excellent and most helpful in understanding the geology of double eagle. a big thanks to both of them for helping us with their explanations and modeling. i know enough to know they know what they are talking about and greatly appreciate their sharing)

onto more new stuff:

4. where the ore is located geographically.

the double eagle ore is located in canada. canada is one of, if not, the most forward thinking and helpful countries in the world which to build a mine. with solid and reasonable governments at both the local and national level in terms of mining when compared to many other countries. yes we are all aware that nobody is perfect but canada is at the top of the list when it comes to mining when compared to other countries.

this means if we are lucky and find a minable quantity of platinum and related group metals, which is my big hope. we will have something very very special. one of the very rare mines of platinum group metals, hopefully with the bulk being platinum, in a safe secure country. about 90% of pgm's are mined in such bastions (tongue firmly in cheek) of mine owners rights and safe investing as south africa and russia, ouch!.

even if we fail at pgm's going forward and JUST have a major nickle and copper find we are better off having it in canada then most other countries of the world when it comes to a government respecting rule of law and shareholders (mine owners) rights.

the only negative, and it will not remain a negative if the tonnage continues to prove up, is the location related to proximity to roads, infrastructure, smelters, etc. this is a minor and largely irrelevant issue IF enough ore is found. at a certain level of tonnage found, the cost of moving in the plant and facilities to build out a mine and process the ore will be spread over a large enough base as to be minor to the overall cost per ton. if this were to remain a small deposit and nothing else is found in the area, it is a major issue. i know which way i am betting.

if you have ever had great assets destroyed or severely value impaired (i have many times) by

greedy grasping governments you will appreciate the value additive feature of having a mine in canada.

in a nutshell, a mine in canada, all other things being equal is worth more then a mine in most other countries.

5. where the ore is located on the site

this is also easy. the double eagle ore is found close to surface intially and then apparently dips. this helped us find it quickly and cheaply once the drill was in the right place. with little overburden to remove regarding the close to surface ore this will allow any mine operator to begin operations at that point and quickly begin mining profitable ore instead of waste rock. this will allow the mine owner to more rapidly recover their investment and pay off the bank debt. and as detailed in #1 from the 10/26/07 post, the quicker you pay off the loans of the mine the more value is added to the mine due to the way banks control the mine owner.

so far the ore appears to be following a "traceable pattern" for lack of a better description, it is not a massively fractured system at this time. so you can easily follow it as you mine the ore to depth.

unrelated to in situ, but possibly of interest to others:

i have read every post on this noront site and done quite a bit of other due dilegence. as such i have not sold a single share. i still very much like what i see and understand. the drills still have to step out and further expand the tonnage from what we currently have had explained per news releases and the annual meeting teleconference. from what i understand about this business after more then 30 years of studying and investing in the markets i am comfortable holding pending further drill results.

i have not tried to trade this security for a very good reason, one great press release and it may be almost impossible to get back in from a psychological point of view. the human psychology of trading fills many worthwhile books. you can read jesse livermore, van tharp, jim sinclair, and jim rogers among others if you really want a great education. they all discuss what happens if you get out of position.

when i say i have not sold a single share it is because i am afraid to miss out by being out of position if a great news release should come out.

i have traded on the floor at the chicago board of trade - one of the worlds major exchanges, as such i am not averse to trading nor am i lacking in the skills of a successfull trader according to some.

my forte is fundamental analysis but i have also reviewed and tested or tried many many hundreds of systems and technical indicators. some of them have a place for CERTAIN investments at CERTAIN times. maybe you have found the "perfect system or indicator" that has eluded other investors for so long? good for you if you have.

yet it is also known that some investments are what are called "rich pots" to use a poker analogy. another analogy that i see today with noront, whether at $4, $5, $6 OR $7 is the risk is dimes to the downside and dollars to the upside. yeah i know $7 to $4 was dollars but i think you get the point and for me there is still a very valid point to what was just written. future news releases will of course alter this concept.

there are certain investments where you do not have to optimize the swings of the share price to make a lot of money and you may find yourself regretting trying to be to clever. that is why i am sitting tight till proven right or wrong by the drill. i can live with the recent move from $7.05 or so down to $3.80 or so. i did not like it or enjoy it. can i live with getting clever and selling at x and seeing it run to 4x or 6x or 10x or ???x, when my work has told me what i need to know??

i have placed my bet and till further drill results i am willing to back it with patience in addition to my $. you may see things differently and more power to you, thats what makes a market.

each individual has his own skill level, understanding, and circumstances, so what is right for me may be wrong for you. you have to make that decision for yourself, it is your money. every investor needs to take sole responsibility for their investments. when you look in the mirror each morning who you see is who YOU have to live with. my experience was that as soon as i took full responsibility for ALL of my trading decisions and the blame and accolades that went with MY decisions i became a much better trader. you may find this insight useful.

from what the press releases say, my understanding of nickel and related deposits, etc. i am sitting tight pending further news.

i am happy with the joint ventures to date etc.

also windfall and the other properties provide an added layer of comfort to my psyche.

additionally, being from and living in the united states. it is obvious that this is still mostly a canada story. very few down this way have a clue. for example look at the tsx-v volume in noront on american thanksgiving day thursday 11/22/07. no drop in volume on the canadian exchange as american investors were off eating turkey and ham. why? easy, there are likely very few american investors involved with noront stock at this time, they were not missed because they are not in this play yet in a big way. (fyi american investors noront shares are mostly traded on the canadian exchanges via their american brokers - some pink sheet trades exist but look at the volume, not much to speak of in the pinks for noront).

this is GREAT news as it means, if this perspective is correct, that a large amount of buying power will be unleashed once the story is understood (or promoted) down in the u.s. of a.

other points of interest and good news for noront, "THE BIG 4" involvement over at BMK and thus, the area. and "THE BIG SIX" talking with noront. (whether it is 4, 5, 6, or 7 etc majors talking with noront lets call them "THE BIG SIX" for simplicity.

if noront continues to prove up the find at double eagle, the above mentioned groups, to some degree, will turn on each other and the price of noront stock will be optimized. out of the 10 or so big hitters mentioned above it will be every man for himself and 2 or 3 of the 10 or so players will seriously step into the fray if noront finds enough ore. right now "THE BIG 4" and "THE BIG 6" are all kicking tires, AND strategizing, based on what the news indicates.

once again, don't believe what i or anyone writes, do your own due dilegence, verify your facts to see what i and many others think we see. this is the most encouraging thing i can say to my friends here at agoracom.

all the best.

be right and sit tight.

regards,

jsq

Gruß,

Fantomas

Antwort auf Beitrag Nr.: 32.577.057 von Fantomas96 am 27.11.07 00:27:22So, die "rumour mill" hatte teilweise Recht:

eine der weltweit bedeutendsten Investmentbanken, JP Morgan, ist bei Noront "an Bord gegangen".

Zwar nicht zwecks Beteiligung, sondern als Berater.

Neben der top Canada-Firma IBK jetzt also ein internationales Schwergewicht dabei. Richard holt sich Expertise und Beziehungen für ein JV/Takeover für Double Eagle.

Ich glaube, ein Großer ist bereits "am anderen Ende" von JP Morgan mit im Boot.

Jetzt bin ich mal auf die Konditionen gespannt, denn momentan fehlen Drill-Ergebnisse und Tonnage.

Aber man kann beruhigt abwarten (und Morgen ist ja auch noch ein Tag, was war doch da gleich am 28.?

).

).

Gruß,

eine der weltweit bedeutendsten Investmentbanken, JP Morgan, ist bei Noront "an Bord gegangen".

Zwar nicht zwecks Beteiligung, sondern als Berater.

Neben der top Canada-Firma IBK jetzt also ein internationales Schwergewicht dabei. Richard holt sich Expertise und Beziehungen für ein JV/Takeover für Double Eagle.

Ich glaube, ein Großer ist bereits "am anderen Ende" von JP Morgan mit im Boot.

Jetzt bin ich mal auf die Konditionen gespannt, denn momentan fehlen Drill-Ergebnisse und Tonnage.

Aber man kann beruhigt abwarten (und Morgen ist ja auch noch ein Tag, was war doch da gleich am 28.?

).

).Gruß,

Erst Hodson von Sprott, heute JP Morgan und dazu gute Coverage:

http://ca.today.reuters.com/news/newsArticle.aspx?type=busin…

_______________________

http://www.globeinvestor.com/servlet/story/ROC.20071127.2007…

________________________

http://finance.sympatico.msn.ca/investing/news/breakingnews/…

________________________

Noront stock jumps as it examines "alternatives"

Tue Nov 27, 2007 3:20 PM EST

TORONTO (Reuters) - Smelling a takeover, investors drove the stock of Noront Resources Ltd (NOT.V: Quote) up more than 10 percent on Tuesday after the junior mining explorer said J.P. Morgan Securities Inc had signed on to evaluate "strategic alternatives to maximize shareholder value."

Shares of the small Canadian firm have soared since it announced drilling results in late August showing high-grade nickel and copper finds at its Double Eagle project in northern Ontario, near James Bay.

Noront stock was up 55 Canadian cents, or 10.9 percent, at C$5.60 Tuesday afternoon on the Toronto Stock Exchange's small-cap Venture Exchange.

Richard Nemis, the chief executive, said in a statement the company's discoveries are assets "that will be seen as attractive development opportunities by several global mining companies."

JPMorgan will aim to unlock "unrecognized value in the company's stock price," and co-ordinate talks on a potential acquisition of the company, Noront said.

Since the Double Eagle discovery, a flock of other explorers are staking claims in the area.

Nemis told Reuters last month the area has geological similarities to the big nickel strikes at Voisey's Bay, the giant property in Eastern Canada that is now owned by Brazil's CVRD (VALE5.SA: Quote).

(Reporting by Jonathan Spicer; Editing by Rob Wilson)

Gruß,

Fantomas

http://ca.today.reuters.com/news/newsArticle.aspx?type=busin…

_______________________

http://www.globeinvestor.com/servlet/story/ROC.20071127.2007…

________________________

http://finance.sympatico.msn.ca/investing/news/breakingnews/…

________________________

Noront stock jumps as it examines "alternatives"

Tue Nov 27, 2007 3:20 PM EST

TORONTO (Reuters) - Smelling a takeover, investors drove the stock of Noront Resources Ltd (NOT.V: Quote) up more than 10 percent on Tuesday after the junior mining explorer said J.P. Morgan Securities Inc had signed on to evaluate "strategic alternatives to maximize shareholder value."

Shares of the small Canadian firm have soared since it announced drilling results in late August showing high-grade nickel and copper finds at its Double Eagle project in northern Ontario, near James Bay.

Noront stock was up 55 Canadian cents, or 10.9 percent, at C$5.60 Tuesday afternoon on the Toronto Stock Exchange's small-cap Venture Exchange.

Richard Nemis, the chief executive, said in a statement the company's discoveries are assets "that will be seen as attractive development opportunities by several global mining companies."

JPMorgan will aim to unlock "unrecognized value in the company's stock price," and co-ordinate talks on a potential acquisition of the company, Noront said.

Since the Double Eagle discovery, a flock of other explorers are staking claims in the area.

Nemis told Reuters last month the area has geological similarities to the big nickel strikes at Voisey's Bay, the giant property in Eastern Canada that is now owned by Brazil's CVRD (VALE5.SA: Quote).

(Reporting by Jonathan Spicer; Editing by Rob Wilson)

Gruß,

Fantomas

NEWS - Noront Resources Ltd. (TSX-V: NOT) Noront's Financial Advisor and VP of IBK Capital Michael White outlines Noront's Double Eagle Nickel Discovery in the James Bay Lowlands

Posted by: AGORACOM on November 30, 2007 10:31AM

Toronto, Ontario CANADA, November 30, 2007 - Richmond Club, Noront's portfolio of projects, including diagrams, as presented at the Richmond Club's November 28, 2007 Resource meeting are available by pasting the following link to your browser:

http://media.richmondclub.com/Luncheon/NorontNov2807.htm

Investors and interested parties were brought up to date by Michael White, Financial Advisor to Noront Resources Ltd., during his presentation to the Richmond Club November 28, 2007, including an update on the Double Eagle Nickel Discovery in the James Bay Lowlands. An airborne geophysical survey is currently being flown for the Company over its entirety, at 100 metre line centres. The detailed survey will yield greater definition and resolution of anomalies than those defined by the earlier survey flown at 300-metre line spacing in 2003. It is being completed by Aeroquest International using the AeroTEM II helicopter-borne time domain system and it is anticipated that preliminary results will be available to the Company in early December.

In anticipation of receiving the detailed airborne geophysical results, the Company has commenced a property-wide line cutting program, to facilitate the completion of ground geophysical surveys. These will include horizontal-loop electromagnetic (HLEM),magnetic and possibly gravity surveys. The intent of the ground surveys is to further refine the location, tenor and nature of the airborne geophysical anomalies in preparation for diamond drilling. The ground geophysical survey will commence immediately following the completion of the line cutting.

The Company is also sampling 2 critical drill holes that were completed earlier on the Property. Both of the drill holes intersected thick sections of komatiitic rocks (up to 180 metres) that were only sampled locally. One of the holes FW-06-03, completed on the Freewest JV portion of the Property, intersected high-grade chrome mineralization with anomalous nickel, copper and platinum-group-element mineralization within peridotite. Petrographic and geochemical analyses of the drill core will yield additional information on the nickel-copper-PGE mineralizing system in preparation for diamond drilling.

Videos from over 200 other companies are available at www.richmondclub.com. The Richmond Club is a media company that showcases companies, that it feels, are undervalued, have high growth potential and therefore have an excellent chance of out-performing the market over a 1-2 year period, at its monthly luncheon meetings.

The Richmond Club Index shows an average of 42% growth in the stock price of the 38 companies that presented at our luncheon meetings over the last twelve months. Our index is based on equal weighting of the 38 presenting companies.

If you would like to receive an invitation to our upcoming, luncheon meetings, please send and email to: mailto: sbarber@richmondclub.com with the words "New Member" in the subject line.

http://agoracom.com/ir/Noront/messages/647264#message

Re: If you take the 3D image

Posted by: Rockaur on November 30, 2007 12:47PM

In response to: If you take the 3D image by bravekind

BK,

ya pretty close....I've extended it down plunge a little more than IBK did

here's a view looking east (same as IBK)

Rockaur

http://agoracom.com/ir/Noront/messages/647529#message

Posted by: Rockaur on November 30, 2007 12:47PM

In response to: If you take the 3D image by bravekind

BK,

ya pretty close....I've extended it down plunge a little more than IBK did

here's a view looking east (same as IBK)

Rockaur

http://agoracom.com/ir/Noront/messages/647529#message

New McFaulds Map...

Posted by: Iroh on December 01, 2007 01:06PM

Here is a link to a new map on Spider website, updated on 26th Nov...more browns

http://www.spiderresources.com/McFaulds_Nov26_contours.jpg

Iroh

http://agoracom.com/ir/Noront/messages/648378#message

Posted by: Iroh on December 01, 2007 01:06PM

Here is a link to a new map on Spider website, updated on 26th Nov...more browns

http://www.spiderresources.com/McFaulds_Nov26_contours.jpg

Iroh

http://agoracom.com/ir/Noront/messages/648378#message

Antwort auf Beitrag Nr.: 32.632.434 von mike32 am 30.11.07 20:37:36Hi

was ist drann an der akupunktierten Leber? 20 Dollares?

habe schon viele solcher 3D Bilder gesehen, ein Corpus und Akkupunktur, verstehe aber net ganz, was das bedeutet. Dieses Teil liegt im NOT Areal, das wie ein Kästchen auf einem Lottozettel aussieht. Was ist mit den Nachbarn wie Fancamp,Probe und Freewest?

was ist mit UC und Spider? Chancen ?

Thx für Einschätzungen!

Grüsse

was ist drann an der akupunktierten Leber? 20 Dollares?

habe schon viele solcher 3D Bilder gesehen, ein Corpus und Akkupunktur, verstehe aber net ganz, was das bedeutet. Dieses Teil liegt im NOT Areal, das wie ein Kästchen auf einem Lottozettel aussieht. Was ist mit den Nachbarn wie Fancamp,Probe und Freewest?

was ist mit UC und Spider? Chancen ?

Thx für Einschätzungen!

Grüsse

Antwort auf Beitrag Nr.: 32.638.776 von Tiger_DRC am 01.12.07 21:28:33Hallo Tiger,

bist Du aus dem Congo ?

Die "akupunktierte Leber" ist der Versuch einer Abbildung von Noront´s Eagle One Deposit auf dem Double Eagle Claim.

Die "Akupunkturnadeln" sind die Bohrlöcher.

Aber das hast Du sicherlich schon gewußt.

Tja mit den Dollars und den Area Plays ist das so eine Sache:

wenn diese Leber größer und breiter in der Tiefe wird (nach Süden), wie momentan vermutet, dann warte mal noch ca. 6-12 Monate, wenn Du Noront-Aktien besitzt (auch wenn erst in den letzten Wochen gekauft), Du wirst es nicht bereuen.

Wenn einer der Area Plays positive Funde macht, dann "brennt" der "Ring of Fire" sowieso gewaltig und alle werden profitieren.

Solange ist aber alles Spekulation und nur Noront hat die "goods" bis jetzt und ist ein relativ sicherer Kandidat.

Momentan drillt nur BMK, Anfang 2008 FWR,UC,SPQ,PRB,FNC(?) und einige andere JV-Partner wollen starten.

Das wird auf jeden Fall ein spannendes Jahr für James Bay.

Bezüglich der Area Plays möchte ich noch auf den Thread

Thread: FAKTENTHREAD: JAMES BAY LOWLANDS (firmenunabhängige Übersicht)

verweisen.

Viel Spaß beim lesen.

Gruß,

Fantomas

bist Du aus dem Congo ?

Die "akupunktierte Leber" ist der Versuch einer Abbildung von Noront´s Eagle One Deposit auf dem Double Eagle Claim.

Die "Akupunkturnadeln" sind die Bohrlöcher.

Aber das hast Du sicherlich schon gewußt.

Tja mit den Dollars und den Area Plays ist das so eine Sache:

wenn diese Leber größer und breiter in der Tiefe wird (nach Süden), wie momentan vermutet, dann warte mal noch ca. 6-12 Monate, wenn Du Noront-Aktien besitzt (auch wenn erst in den letzten Wochen gekauft), Du wirst es nicht bereuen.

Wenn einer der Area Plays positive Funde macht, dann "brennt" der "Ring of Fire" sowieso gewaltig und alle werden profitieren.

Solange ist aber alles Spekulation und nur Noront hat die "goods" bis jetzt und ist ein relativ sicherer Kandidat.

Momentan drillt nur BMK, Anfang 2008 FWR,UC,SPQ,PRB,FNC(?) und einige andere JV-Partner wollen starten.

Das wird auf jeden Fall ein spannendes Jahr für James Bay.

Bezüglich der Area Plays möchte ich noch auf den Thread

Thread: FAKTENTHREAD: JAMES BAY LOWLANDS (firmenunabhängige Übersicht)

verweisen.

Viel Spaß beim lesen.

Gruß,

Fantomas

!

Dieser Beitrag wurde moderiert. Grund: Beleidigung

Antwort auf Beitrag Nr.: 32.639.175 von Tiger_DRC am 02.12.07 01:13:24Benutzername: Tiger_DRC (Mitgliedschaft durch User beendet)

Registriert seit: [ seit 13.850 Tagen ]

Benutzer ist momentan: Offline seit dem 02.12.2007 um 13:39

Schwachsinn posten und dann Tschüss !

Registriert seit: [ seit 13.850 Tagen ]

Benutzer ist momentan: Offline seit dem 02.12.2007 um 13:39

Schwachsinn posten und dann Tschüss !

Antwort auf Beitrag Nr.: 32.640.330 von Blanca_die_Haesin am 02.12.07 14:42:58nichtmal das ist echt 13.850 sind 38 Jahre.... da gab´s sicher kein WO

Antwort auf Beitrag Nr.: 32.640.330 von Blanca_die_Haesin am 02.12.07 14:42:58Schwachsinn posten und dann Tschüss !

dto. !!!!!!!!!!!!!!!!!!

o.G.,

mike

dto. !!!!!!!!!!!!!!!!!!

o.G.,

mike

Nachdem Richard Nemis vor ein paar Wochen von Noront als ein Buch mit 20 Kapiteln sprach, das gerade erst begonnen wurde, möchte ich hier mal die ersten drei Kapitel aus meiner Sicht einstellen:

NORONT TRILOGIE

1. Kapitel: Historie

Noront ist an einem wichtigen Punkt der langfristigen Entwicklung beim Double Eagle Projekt angekommen.

Die nächsten Wochen werden sehr entscheidend sein.

Und hier ist meine Meinung warum:

anfänglich hat Noront einen absoluten Zufallstreffer mit dem Double Eagle Projekt in James Bay Lowlands gelandet.

In dem Gebiet haben mehrere Explorer-Firmen seit vielen Jahren nach wirtschaftlich abbaubaren Ressourcen gesucht und zwischen 2002 und 2006 diverse elektromagnetische Bodenuntersuchungen (aus Flugzeugen mit Spezialkameras) durchgeführt, die dann von physischen Bodenuntersuchungen (sog. grab sampling/trenching) weiterverfolgt wurden.

Typischerweise wurden in der Region durch die geologische Gesteinsformation sog. VMS (Volcanogetic Massive Sulphides)-Vorkommen vermutet.

Insgesamt 10 dieser VMS-Deposits hat das Spider/KWG-Joint Venture in den letzten Jahren erfolgreich durch Bohrungen bestätigt (leider nur kleine, aber hochgradige Vorkommen, die für sich genommen nicht von besonderer ökonomischer Bedeutung waren, daher auch die sehr geringen Marktkapitalisierungen der Firmen).

Durch diese Funde ging man davon aus, daß dieses Gebiet, wenn überhaupt, VMS-Deposits beherbergt (diese enthalten für gewöhnlich Kupfer,Blei,Zink,Gold und Silber).

Diese sind durch die luftgestützten, elektromagnetischen Aufnahmen an sog. Konduktoren (conductors) zu erkennen, die von einer elektromagnetischen Anomalie umgeben sind (also der Veränderung der Magnetisierung im Boden). Bis zu einer Tiefe von ca. 150m sind derartige Bodenstrukturveränderungen durch diese Aufnahmen zu erkennen.

Es erfordert jedoch höchste geologische Fachkenntnis, die Konduktoren und dazugehörigen elektromagnetischen Signale richtig zu interpretieren.

In Fall der VMS-Vorkommen verbindet man mit einem Konduktor ein elektromagnetisches "Tief", da diese polymetallischen Vorkommen häufig von felsisch-vulkanogenen Gesteinsformationen (sog. felsic volcanics) umschlossen sind, die an sich nur sehr schwach magnetisch sind.

Also wurde über Jahre hinweg bei den elektromagnetischen Bodenaufnahmen nach starken Konduktoren mit assoziierten magnetischen "Tiefs" gesucht.

Bis Noront kam !

Die Geologen, allen voran Neil Novak, sahen sich die Aufnahmen ihrer im Mai 2007 frisch erworbenen zwei Claims von Greenstone/Condor (für 400.000 Aktien und 1% Net Smelter Royalty) näher an und entdeckten einen interessanten Konduktor.

Leider befand der sich am Rand eines elektromanetisches "HOCHS", daß normalerweise in diesem Gebiet mit magnetischem Graphit-Gestein (magnetic mafic rock) in Verbindung gebracht wird und in dieser geologischen Umgebung keine Erzvorkommen enthält.

Da dieser Konduktor aber sehr ausgeprägt war und sehr weit am Rand des elektromagnetischen "Hochs" lag, entschloß man sich dennoch zu einer Bohrung.

Denn bis zum Jahresende mußte mindestens eine Bohrung durchgeführt werden, da ansonsten die Kaufbedingungen nicht erfüllt worden wären und die Claims wieder an den Eigentümer zurückgefallen wären.

Und siehe da: VOLLTREFFER !

Zum Erstaunen aller brachte dieses "Discovery Hole" (NOT 07-01) verblüffende Werte von polymetallischem Gestein auf großer

Länge ans Tageslicht.

Was war passiert ?

Der ansonsten stark magnetisierte "mafic rock" beinhaltete hier in James Bay nicht Graphit (nahezu wertlos) sondern bestand aus sog. Peridotit, daß hier Chalcopyrit (Kupfer-Sulfid) und Pentlandit (Nickel-Sulfid) umgab. Nach der weiteren Analyse der Bohrkerne wurden auch noch sehr starke Gehalte aus dem Bereich der Platin-Gruppen-Metalle (Platin,Palladium), wie sie sonst nur in großen Minen in Südafrika und Rußland (siehe meine Ausführungen zu PGM-Minen in diesem Thread) vorkommen, sowie Gold und Silber festgestellt.

Ein sog. MMS-Deposit (mafic rock hosted magmatic sulphide deposit) war entdeckt worden. Und was für eins !

Dieser, sowie weitere ähnliche Funde erklären den Preissprung von Noront von CAD 0,40 auf über CAD 4,00 innerhalb von wenigen Wochen (bisheriges ATH CAD 7,05 / aktuell CAD 5,16).

Danach brach ein Vulkan an "Claim-staking" los, denn alle wollten sich Land sichern, da man nun mehr von diesen Vorkommen in James Bay vermutete.

ENDE KAPITEL 1

NORONT TRILOGIE

1. Kapitel: Historie

Noront ist an einem wichtigen Punkt der langfristigen Entwicklung beim Double Eagle Projekt angekommen.

Die nächsten Wochen werden sehr entscheidend sein.

Und hier ist meine Meinung warum:

anfänglich hat Noront einen absoluten Zufallstreffer mit dem Double Eagle Projekt in James Bay Lowlands gelandet.

In dem Gebiet haben mehrere Explorer-Firmen seit vielen Jahren nach wirtschaftlich abbaubaren Ressourcen gesucht und zwischen 2002 und 2006 diverse elektromagnetische Bodenuntersuchungen (aus Flugzeugen mit Spezialkameras) durchgeführt, die dann von physischen Bodenuntersuchungen (sog. grab sampling/trenching) weiterverfolgt wurden.

Typischerweise wurden in der Region durch die geologische Gesteinsformation sog. VMS (Volcanogetic Massive Sulphides)-Vorkommen vermutet.

Insgesamt 10 dieser VMS-Deposits hat das Spider/KWG-Joint Venture in den letzten Jahren erfolgreich durch Bohrungen bestätigt (leider nur kleine, aber hochgradige Vorkommen, die für sich genommen nicht von besonderer ökonomischer Bedeutung waren, daher auch die sehr geringen Marktkapitalisierungen der Firmen).

Durch diese Funde ging man davon aus, daß dieses Gebiet, wenn überhaupt, VMS-Deposits beherbergt (diese enthalten für gewöhnlich Kupfer,Blei,Zink,Gold und Silber).

Diese sind durch die luftgestützten, elektromagnetischen Aufnahmen an sog. Konduktoren (conductors) zu erkennen, die von einer elektromagnetischen Anomalie umgeben sind (also der Veränderung der Magnetisierung im Boden). Bis zu einer Tiefe von ca. 150m sind derartige Bodenstrukturveränderungen durch diese Aufnahmen zu erkennen.

Es erfordert jedoch höchste geologische Fachkenntnis, die Konduktoren und dazugehörigen elektromagnetischen Signale richtig zu interpretieren.

In Fall der VMS-Vorkommen verbindet man mit einem Konduktor ein elektromagnetisches "Tief", da diese polymetallischen Vorkommen häufig von felsisch-vulkanogenen Gesteinsformationen (sog. felsic volcanics) umschlossen sind, die an sich nur sehr schwach magnetisch sind.

Also wurde über Jahre hinweg bei den elektromagnetischen Bodenaufnahmen nach starken Konduktoren mit assoziierten magnetischen "Tiefs" gesucht.

Bis Noront kam !

Die Geologen, allen voran Neil Novak, sahen sich die Aufnahmen ihrer im Mai 2007 frisch erworbenen zwei Claims von Greenstone/Condor (für 400.000 Aktien und 1% Net Smelter Royalty) näher an und entdeckten einen interessanten Konduktor.

Leider befand der sich am Rand eines elektromanetisches "HOCHS", daß normalerweise in diesem Gebiet mit magnetischem Graphit-Gestein (magnetic mafic rock) in Verbindung gebracht wird und in dieser geologischen Umgebung keine Erzvorkommen enthält.

Da dieser Konduktor aber sehr ausgeprägt war und sehr weit am Rand des elektromagnetischen "Hochs" lag, entschloß man sich dennoch zu einer Bohrung.

Denn bis zum Jahresende mußte mindestens eine Bohrung durchgeführt werden, da ansonsten die Kaufbedingungen nicht erfüllt worden wären und die Claims wieder an den Eigentümer zurückgefallen wären.

Und siehe da: VOLLTREFFER !

Zum Erstaunen aller brachte dieses "Discovery Hole" (NOT 07-01) verblüffende Werte von polymetallischem Gestein auf großer

Länge ans Tageslicht.

Was war passiert ?

Der ansonsten stark magnetisierte "mafic rock" beinhaltete hier in James Bay nicht Graphit (nahezu wertlos) sondern bestand aus sog. Peridotit, daß hier Chalcopyrit (Kupfer-Sulfid) und Pentlandit (Nickel-Sulfid) umgab. Nach der weiteren Analyse der Bohrkerne wurden auch noch sehr starke Gehalte aus dem Bereich der Platin-Gruppen-Metalle (Platin,Palladium), wie sie sonst nur in großen Minen in Südafrika und Rußland (siehe meine Ausführungen zu PGM-Minen in diesem Thread) vorkommen, sowie Gold und Silber festgestellt.

Ein sog. MMS-Deposit (mafic rock hosted magmatic sulphide deposit) war entdeckt worden. Und was für eins !

Dieser, sowie weitere ähnliche Funde erklären den Preissprung von Noront von CAD 0,40 auf über CAD 4,00 innerhalb von wenigen Wochen (bisheriges ATH CAD 7,05 / aktuell CAD 5,16).

Danach brach ein Vulkan an "Claim-staking" los, denn alle wollten sich Land sichern, da man nun mehr von diesen Vorkommen in James Bay vermutete.

ENDE KAPITEL 1

2. KAPITEL: GEGENWART

Richard Nemis, der CEO von Noront, prägte den Begriff "RING OF FIRE", weil das mögliche Explorationsgebiet einem großen Kreis ähnelt, in dem bei weiteren Funden wirklich ein großes "Feuer" ausbricht.

Jetzt begann die Zeit der "Area Plays":

alle nahen und entfernten Nachbarn von Noront schossen mit ihrer Marktkapitalisierung in die Höhe, die kanadische Börse verzeichnete Traumumsätze.

Und es kamen ständig neue Player dazu, es wurde neues Land

"gestaked", Joint-Ventures geschlossen, Finanzierungsrunden durchgeführt und nun beginnen viele Firmen mit dem vielen, neuen Geld mit ihren eigenen Drillprogrammen.

Und vor allem begann man, die historischen elektromagnetischen Bodenaufnahmen neu zu interpretieren. Man sucht jetzt nach starken Konduktoren mit elektromanetischen "HOCHS" (und nicht mehr "TIEFS"). Zudem wurden diverse neue Luftaufnahmen gestartet, nun mit besserer Auflösung und besserer Technologie (50m-Linien statt 200-300m-Linien) und Helikopter-gestützt (höhere Genauigkeit im Vergleich zu Flugzeugen, da niedriger fliegend).

James Bay ist ein "hot spot" geworden, ein mögliches neues "mining camp" in Kanada.

Findet jedoch Noront nicht mehr viel und auch die anderen Firmen nichts, dann ist der "Traum" auch wieder ganz schnell zu Ende und das Feuer im Ring erlischt.

Daher auch die große Volatilität nach den ersten Bohrergebnissen, denn keiner weiß, ob es sich hier an einem sehr abgeschiedenen Ort in Kanada wirklich um große, ökonomisch abbaubare Vorkommen handelt.

ENDE KAPITEL 2

Richard Nemis, der CEO von Noront, prägte den Begriff "RING OF FIRE", weil das mögliche Explorationsgebiet einem großen Kreis ähnelt, in dem bei weiteren Funden wirklich ein großes "Feuer" ausbricht.

Jetzt begann die Zeit der "Area Plays":

alle nahen und entfernten Nachbarn von Noront schossen mit ihrer Marktkapitalisierung in die Höhe, die kanadische Börse verzeichnete Traumumsätze.

Und es kamen ständig neue Player dazu, es wurde neues Land

"gestaked", Joint-Ventures geschlossen, Finanzierungsrunden durchgeführt und nun beginnen viele Firmen mit dem vielen, neuen Geld mit ihren eigenen Drillprogrammen.

Und vor allem begann man, die historischen elektromagnetischen Bodenaufnahmen neu zu interpretieren. Man sucht jetzt nach starken Konduktoren mit elektromanetischen "HOCHS" (und nicht mehr "TIEFS"). Zudem wurden diverse neue Luftaufnahmen gestartet, nun mit besserer Auflösung und besserer Technologie (50m-Linien statt 200-300m-Linien) und Helikopter-gestützt (höhere Genauigkeit im Vergleich zu Flugzeugen, da niedriger fliegend).

James Bay ist ein "hot spot" geworden, ein mögliches neues "mining camp" in Kanada.

Findet jedoch Noront nicht mehr viel und auch die anderen Firmen nichts, dann ist der "Traum" auch wieder ganz schnell zu Ende und das Feuer im Ring erlischt.

Daher auch die große Volatilität nach den ersten Bohrergebnissen, denn keiner weiß, ob es sich hier an einem sehr abgeschiedenen Ort in Kanada wirklich um große, ökonomisch abbaubare Vorkommen handelt.

ENDE KAPITEL 2

3. KAPITEL: ZUKUNFT / WEITERE KAPITEL

Je mehr ich lese und über das Gebiet und die geologische Situation erfahre, desto mehr bin ich allerdings überzeugt, daß das Feuer hier in spätestens 6 Monaten richtig brennen wird.

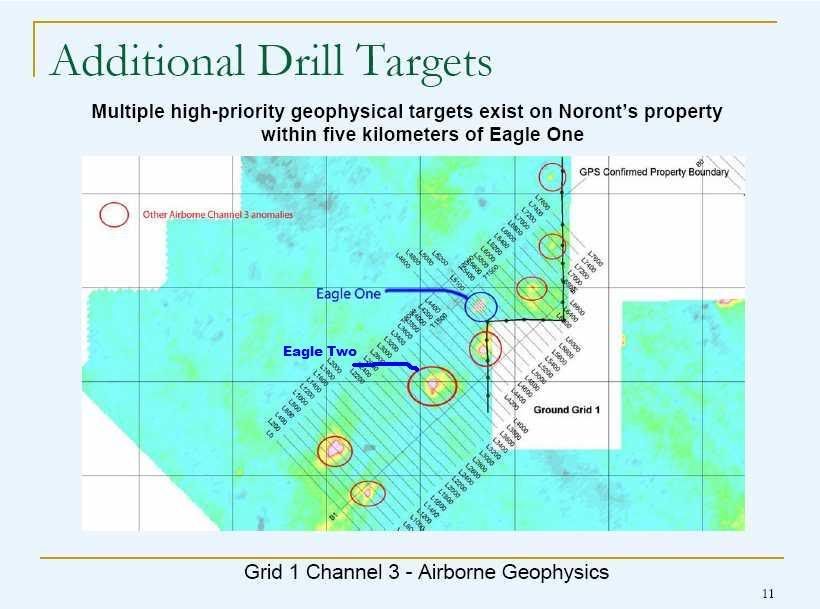

Dazu nur ein Auszug aus einigen dieser elektromagnetischen Bodenaufnahmen rund um den Eagle One Fund auf Noront´s Double Eagle Claim:

Karte 1

Hier sieht man deutlich den Fund (eingekreist) und dann eine gelbe Linie, die mehrere ähnlich starke Konduktoren mit assoziierten elektromanetischen "HOCHS" verbindet.

Ebenfalls zu sehen ist, daß sich dieser "Trend" vollständig auf Noront Claims befindet und das Fancamp-Gebiet nur streift.

Vom Eagle One-Fund bewegt sich der Trend ca. 300m in südwestliche Richtung (Noront hat durch Bohrungen bisher 170m Länge nachgewiesen), macht dann eine Biegung nach Süden und danach wieder eine Kurve nach Südwesten, wo er sich dann ca. 2000m in südlicher Richtung fortsetzt.

Karte 2

Dieser Kartenausschnitt zeigt die Trendlinie anhand geologischer und elektromagnetischer Informationen.

Man sieht genau, daß sie immer am Rand der magnetischen "Hoch"-Anomalien verläuft.

Karte 3

Schließlich zeigt dieser Kartenausschnitt aus Noront´s Richmond-Club-Präsentation der letzten Woche die Trendlinie in sehr vereinfachter Form und stellt durch die Verbindung von A über B nach C den möglichen Verlauf des Deposits dar (vielleicht handelt es sich hier sogar um "TRIPLE EAGLE" !).

Sollte dieses Deposit tatsächlich diesen Verlauf haben (was nur durch weitere step-out Bohrungen in südlicher Richtung nachgewiesen werden kann), dann hätten wir es hier mit einer "Strike"-Länge von ca. 2400m zu tun.

Sollte dies mit ähnlichen Erzgehalten wie die bisherigen 12 Bohrungen bestätigt werden können, sind die bisher nachgewiesenen 3-5 Mio. Tonnen mineralhaltiges Gestein schnell Vergangenheit !

Dann reden wir hier über ein Vielfaches von 10 Mio. Tonnen und ein sog. "World Class Deposit" (welches per definition einen Gesteinswert (GMV=gross metal value) von mindestens $ 10 Milliarden nach heutigen Preisen enthalten muß.

Zudem muß der Erzkörper ökonomisch abbaubar sein, um einen diskontierten Marktwert (NPV=net present value) von 10%-20% des GMV zu erzielen, also $ 1-2 Milliarden).

Nach heutigen Erkenntnissen hat Noront (nur für Double Eagle und man kann es nicht oft genug betonen, Windfall und die anderen Projekte sind NICHT enthalten):

- im pessimistischstem Fall ein NPV von 3 Mio. Tonnen x $ 800/t x 10% = $ 240 Mio.

- im optimistischstem Fall ein NPV von 7 Mio. Tonnen x $1000/t x 20% = $ 1,4 Mrd.

Und wie geschrieben, wir haben bisher 170m Erzkörper nachgewiesen.

Seht nochmal auf die gelbe Trendlinie: sollte die in der gesamten Länge zutreffend den Erzkörper beschreiben, heißt daß eine Länge von ca. 2400m !

Jetzt kann jeder selber weiterrechnen !

Viel Spaß und viele Grüße.

Je mehr ich lese und über das Gebiet und die geologische Situation erfahre, desto mehr bin ich allerdings überzeugt, daß das Feuer hier in spätestens 6 Monaten richtig brennen wird.

Dazu nur ein Auszug aus einigen dieser elektromagnetischen Bodenaufnahmen rund um den Eagle One Fund auf Noront´s Double Eagle Claim:

Karte 1

Hier sieht man deutlich den Fund (eingekreist) und dann eine gelbe Linie, die mehrere ähnlich starke Konduktoren mit assoziierten elektromanetischen "HOCHS" verbindet.

Ebenfalls zu sehen ist, daß sich dieser "Trend" vollständig auf Noront Claims befindet und das Fancamp-Gebiet nur streift.

Vom Eagle One-Fund bewegt sich der Trend ca. 300m in südwestliche Richtung (Noront hat durch Bohrungen bisher 170m Länge nachgewiesen), macht dann eine Biegung nach Süden und danach wieder eine Kurve nach Südwesten, wo er sich dann ca. 2000m in südlicher Richtung fortsetzt.

Karte 2

Dieser Kartenausschnitt zeigt die Trendlinie anhand geologischer und elektromagnetischer Informationen.

Man sieht genau, daß sie immer am Rand der magnetischen "Hoch"-Anomalien verläuft.

Karte 3

Schließlich zeigt dieser Kartenausschnitt aus Noront´s Richmond-Club-Präsentation der letzten Woche die Trendlinie in sehr vereinfachter Form und stellt durch die Verbindung von A über B nach C den möglichen Verlauf des Deposits dar (vielleicht handelt es sich hier sogar um "TRIPLE EAGLE" !).

Sollte dieses Deposit tatsächlich diesen Verlauf haben (was nur durch weitere step-out Bohrungen in südlicher Richtung nachgewiesen werden kann), dann hätten wir es hier mit einer "Strike"-Länge von ca. 2400m zu tun.

Sollte dies mit ähnlichen Erzgehalten wie die bisherigen 12 Bohrungen bestätigt werden können, sind die bisher nachgewiesenen 3-5 Mio. Tonnen mineralhaltiges Gestein schnell Vergangenheit !

Dann reden wir hier über ein Vielfaches von 10 Mio. Tonnen und ein sog. "World Class Deposit" (welches per definition einen Gesteinswert (GMV=gross metal value) von mindestens $ 10 Milliarden nach heutigen Preisen enthalten muß.

Zudem muß der Erzkörper ökonomisch abbaubar sein, um einen diskontierten Marktwert (NPV=net present value) von 10%-20% des GMV zu erzielen, also $ 1-2 Milliarden).

Nach heutigen Erkenntnissen hat Noront (nur für Double Eagle und man kann es nicht oft genug betonen, Windfall und die anderen Projekte sind NICHT enthalten):

- im pessimistischstem Fall ein NPV von 3 Mio. Tonnen x $ 800/t x 10% = $ 240 Mio.

- im optimistischstem Fall ein NPV von 7 Mio. Tonnen x $1000/t x 20% = $ 1,4 Mrd.

Und wie geschrieben, wir haben bisher 170m Erzkörper nachgewiesen.

Seht nochmal auf die gelbe Trendlinie: sollte die in der gesamten Länge zutreffend den Erzkörper beschreiben, heißt daß eine Länge von ca. 2400m !

Jetzt kann jeder selber weiterrechnen !

Viel Spaß und viele Grüße.

Antwort auf Beitrag Nr.: 32.651.706 von Fantomas96 am 03.12.07 20:46:09Hallo Fantomas96,

tolle Arbeit mal wieder !

gruss mike

PS.: BM

tolle Arbeit mal wieder !

gruss mike

PS.: BM

http://www.agoracom.com/ir/Noront/messages/651126#message

Re: SANTA: Makin' a list, checkin' it twice

Posted by: glorieux on December 04, 2007 01:55PM

In response to: SANTA: Makin' a list, chec... by jonboy

I have tried yesterday and today to get a hold of Mr Nemis or Mr. Novak and they are always in meetings. Today, they are in meetings together. There seems to be lots of activity. I know someone posted earlier that as of a few minutes ago, no assays had arrived. Would they say to someone that assays were in, a halt is imminent and that the share price may climb? I personnally cannot see them saying this. But I think it is important for everyone to know that our boys are working hard right now, they are very busy and things (good to great) will be announced shortly.

I see the price just dipping and have to admit it is hard not buy more shares right now...I do have a breaking point and I will buy more if we reach it. All of you should think what is your price? How low does this thing have to go, for you to buy more shares? I have a number and we are not there yet but getting closer. If you are not buying more shares no matter what, at least hold on tight to those shares you have right now.

Glorieux

Nachkaufen,wenn kritischer Punkt erreicht ist, aber auf jeden Fall NICHT verkaufen !

Ganz meine Meinung.

Gruß,

Fantomas

und weiter:

http://www.agoracom.com/ir/Noront/messages/651285#message

honestly not trying to pump, but

Posted by: d12 on December 04, 2007 03:38PM

could there be a better time to enter this play??? If i didn't already have all my money wrapped into it, i would be buying much more. It is plain to see that this stock is down below fair value simply because there have been no NR's for weeks. It wouldn't take me long to realize this if i was a potential buyer. News is around the corner so it wouldn't take much to make a quick buck or start a long term investment. Again, i am not trying to pump this at all, but if i was looking of a good place to start trading, both for short or long term, this would be it.

Gruß,

Fantomas

http://www.agoracom.com/ir/Noront/messages/651285#message

honestly not trying to pump, but

Posted by: d12 on December 04, 2007 03:38PM

could there be a better time to enter this play??? If i didn't already have all my money wrapped into it, i would be buying much more. It is plain to see that this stock is down below fair value simply because there have been no NR's for weeks. It wouldn't take me long to realize this if i was a potential buyer. News is around the corner so it wouldn't take much to make a quick buck or start a long term investment. Again, i am not trying to pump this at all, but if i was looking of a good place to start trading, both for short or long term, this would be it.

Gruß,

Fantomas

http://www.agoracom.com/ir/Noront/messages/651397#message

A few things to chew on, while we wait...

Posted by: herbertwiebe on December 04, 2007 04:51PM

2 drill rigs running at DE. Additional 2 rigs scheduled for January, 2008. I also read that there is a plan to add 2 more drills on the DE around springtime...

Thinking...

If there is no more to this play than the 300ish meter ore body that is being drilled right now, why would Mr. Nemis be ordering a total of "6" (please correct me if I am wrong) drilling rigs to be turning drills by the spring??? I don't think it would take that long to finish drilling the "Eagle 1" anomoly and I personally don't think it would require 6 rigs to finish it either.

I am going to make a pure speculative guess here, based on nothing more than the fact that Mr. Nemis is Mr. Conservative with his shareholders money and go out on a limb and say that he just might know what lies to the south of Eagle 1. I really believe that Mr. Nemis knows that there is nickel in that 1800 meter or 2400 meter magnetic anomoly (depending on which news release you read) and I will even go out further on that limb to say I think that JP Morgan might know what is out there as well.

How could Mr. Conservative be so "cock sure" of what is about to happen to his little stock that he never seems to get down regarding his share price??? I think it is because he knows what is going to happen in the next 12 - 18 months. How else could IBK make an announcement that Noront will probably be taken out by a MAJOR in the next 12 - 18 months??? Seems to me that this is not the kind of statement Mr. Nemis has made in the past. Mr. Conservative would just go his merry way and point to the drill results, just like he did when he hit 58 ounces / ton of gold over 4.7 meters at windfall lake. Unbelievable numbers but did he say anything about being taken out by a major then??? NOT.

Mustangman, Donnypee, Oskee, and everyone else suggesting patience, I BELIEVE YOU ARE RIGHT!!!

I think I will be looking at early retirement in about 15ish months... with maybe a ski trip planned with the family IN AUSTRIA.

Just a few things to think about, while we wait for news...

God Bless all NOT shareholders.

Herb

Gruß,

Fantomas

A few things to chew on, while we wait...

Posted by: herbertwiebe on December 04, 2007 04:51PM

2 drill rigs running at DE. Additional 2 rigs scheduled for January, 2008. I also read that there is a plan to add 2 more drills on the DE around springtime...

Thinking...

If there is no more to this play than the 300ish meter ore body that is being drilled right now, why would Mr. Nemis be ordering a total of "6" (please correct me if I am wrong) drilling rigs to be turning drills by the spring??? I don't think it would take that long to finish drilling the "Eagle 1" anomoly and I personally don't think it would require 6 rigs to finish it either.

I am going to make a pure speculative guess here, based on nothing more than the fact that Mr. Nemis is Mr. Conservative with his shareholders money and go out on a limb and say that he just might know what lies to the south of Eagle 1. I really believe that Mr. Nemis knows that there is nickel in that 1800 meter or 2400 meter magnetic anomoly (depending on which news release you read) and I will even go out further on that limb to say I think that JP Morgan might know what is out there as well.

How could Mr. Conservative be so "cock sure" of what is about to happen to his little stock that he never seems to get down regarding his share price??? I think it is because he knows what is going to happen in the next 12 - 18 months. How else could IBK make an announcement that Noront will probably be taken out by a MAJOR in the next 12 - 18 months??? Seems to me that this is not the kind of statement Mr. Nemis has made in the past. Mr. Conservative would just go his merry way and point to the drill results, just like he did when he hit 58 ounces / ton of gold over 4.7 meters at windfall lake. Unbelievable numbers but did he say anything about being taken out by a major then??? NOT.

Mustangman, Donnypee, Oskee, and everyone else suggesting patience, I BELIEVE YOU ARE RIGHT!!!

I think I will be looking at early retirement in about 15ish months... with maybe a ski trip planned with the family IN AUSTRIA.

Just a few things to think about, while we wait for news...

God Bless all NOT shareholders.

Herb

Gruß,

Fantomas

Nichts mehr los in D !

Keine Umsätze, keine Postings, kein Interesse !

Na dann warten wir mal alle auf das "very nice Christmas present" !

Gruß,

Fantomas

Keine Umsätze, keine Postings, kein Interesse !

Na dann warten wir mal alle auf das "very nice Christmas present" !

Gruß,

Fantomas

Antwort auf Beitrag Nr.: 32.678.691 von Fantomas96 am 05.12.07 23:54:10na aber gelesen wird immerhin

hab grad nen depotfrust.... märkte grün depot rot... die letzten tage (wohl zu viele juniorminen drin)

hab grad nen depotfrust.... märkte grün depot rot... die letzten tage (wohl zu viele juniorminen drin)

Antwort auf Beitrag Nr.: 32.678.691 von Fantomas96 am 05.12.07 23:54:10Moin!

Lese sehr gern eure Postings, Interesse ist natürlich da. Werde morgen noch etwas aufstocken (verbilligen).

Macht weiter so mit dem Informationsfluss. Viele stille Mitleser sind euch sehr dankbar !

LG!

Daytrader12

Lese sehr gern eure Postings, Interesse ist natürlich da. Werde morgen noch etwas aufstocken (verbilligen).

Macht weiter so mit dem Informationsfluss. Viele stille Mitleser sind euch sehr dankbar !

LG!

Daytrader12

Warum claimt Noront in der Mitte / im Norden des Ring of fire ?

http://www.agoracom.com/ir/Noront/messages/653469#message

Re: next time

Posted by: pw on December 06, 2007 11:49AM

In response to: next time by HSS

I have very little geology background, but during my conversation with Mr. Nemis yesterday, he pointed out repetitively that the "Ring of Fire" is very similar to Sudbury. Sudbury basin is the only mining district believed to have been created by a huge meteor, not volcanic nature.

The meteor that hit sudbury is believed to be about 10 km in diameter, and the impact was equivalent to 100s of billion nuclear bombs, the ground heat vaporized the meteor, and the immense impact had melted the rocks 15 km down below and had created hundreds of mines around the basin today.

The true nature of McFaulds Lake won't be fully understood for some time, but the "Ring" shaped anomalies do resemble more of a meteor crater, pending to more mineralization to be found around the Ring. If you ask me what would be in the middle, I would hypothesize that there may be rich mineralization down below but covered by thick overburdens from hundreds of meters to a few kilometers.

~p

Posted by: HSS on December 06, 2007 04:22AM

when anybody sees RN can you ask him why he is claiming in the North of the ring and have intress in het middle north of the ring?. I think that question is important.

Gruß,

Fantomas

http://www.agoracom.com/ir/Noront/messages/653469#message

Re: next time

Posted by: pw on December 06, 2007 11:49AM

In response to: next time by HSS

I have very little geology background, but during my conversation with Mr. Nemis yesterday, he pointed out repetitively that the "Ring of Fire" is very similar to Sudbury. Sudbury basin is the only mining district believed to have been created by a huge meteor, not volcanic nature.

The meteor that hit sudbury is believed to be about 10 km in diameter, and the impact was equivalent to 100s of billion nuclear bombs, the ground heat vaporized the meteor, and the immense impact had melted the rocks 15 km down below and had created hundreds of mines around the basin today.

The true nature of McFaulds Lake won't be fully understood for some time, but the "Ring" shaped anomalies do resemble more of a meteor crater, pending to more mineralization to be found around the Ring. If you ask me what would be in the middle, I would hypothesize that there may be rich mineralization down below but covered by thick overburdens from hundreds of meters to a few kilometers.

~p

Posted by: HSS on December 06, 2007 04:22AM

when anybody sees RN can you ask him why he is claiming in the North of the ring and have intress in het middle north of the ring?. I think that question is important.

Gruß,

Fantomas

Zur geologischen Situation von James Bay

http://www.agoracom.com/ir/McFaulds/messages/653461#message

Re: The Rings Central Core

Posted by: alcollard on December 06, 2007 11:44AM

In response to: The Rings Central Core by the deputy

Hi deputy,

Not sure who posted this originally, but here is a write up on the geology of McFaulds Lake:

Geological Theory/Facts of Genesis of McFaulds Lake:

I seldom say this, In my view this post, with the up to date Geological information contained herein , is a must “keeper” to cut and paste, for future reference, to those interested/invested in the McFaulds Area….this post has taken weeks to research and put together….

Information credit will be given to their Sources, accordingly, and in all cases referred to herein, these are their professional opinions, based on their interpretations of fact findings studies , to which , I have then added/applied my kowledge/information/opinions of the McFaulds Area…I have decided to post this information, knowing that I have met their requirements, which are proper “credit” and non commercial use…proper credits are listed below, and as you all know/may know, I have not /and am not being paid by anyone to post on these forums.. .I do so simply to provide information and my considered opinions…..just your usual cautionary statements…

The Purchase of

MNDM Publications

MNDM Publication Sales

Local: (705) 670-5691

Toll Free: 1-888-415-9845, ext. 5691

(inside Canada, United States

I will begin with Prof. A.J. Naldrett, world renowned Geology professor and probably “THE” or one of , the world experts on MMS , Ni Cu PGEs …

I met Prof. Naldrett of a few occasions and attended a good number of his lectures on MMS Ni Cu PGEs, in Toronto, and have read much of his written papers on said subject, long before McFaulds came along….I will not go into very complex and extremely difficult geological terms and theories..I will try to describe some theories here, as simple as possible, under the circumstances of the very complex subject of geology in general and super complex McFaulds geology in particular….

Below are 3 general “findings” by Prof. Naldrett of his studies of worldwide MMS Ni Cu PGEs deposits :

"Magmatic Ni-Cu sulfide deposits form as the result of the segregation and concentration of droplets of liquid sulfide from mafic or ultramafic magma.When most major Ni-Cu sulfide deposits, including those at Kambalda, Western Australia, are viewed in the light of studies at Noril'sk, Sudbury, Jinchuan and Voice’s Bay, three factors become apparent:

(i) the concentration of sulfides in channels or conduits through which much magma has flowed (feeder conduits for intrusions are much more prospective targets for exploration than the base of the intrusions themselves);

(ii) (ii) the interaction of the source magma with country rocks, either leading to the incorporation of sulfur, or the felsification of the magma in question;

(iii) (iii) fractional crystallisation of sulfide liquid giving rise to Cu-rich ores which may be far removed from the 'source' ore.

Anthony J. Naldrett Key factors in Genesis of MMS Ni Cu PGE implications for exploration."

The first point is relatively simple , and as I have posted previously, that these NI Cu PGEs sulfides are accumulated and deposited in magma conduits or “feeders” conduits for much larger intrusions, wherein successive introductions of Magmas have occurred…BUT once you have ‘prospected “ and found these magma conduits mineralized with Ni Cu PGEs , then many Geologists recommend drilling much deeper for the “source” (parent) magma responsible for these deposits as these deeper bases of the Magma are usually also “mineralized”…especially in the case of McFaulds, wherein good evidence exists of the regional.presence of Chromite layers , and enxtensive titomagnetite layers, that are good evidence for the proposition that very HOT, Dynamic Magmas , existed at McFaulds, and were responsible for the mineralized “feeder conduits” the type of Dynamic Magmas that could host Massive Nickel Sulfides, near or at their base….more on dynamic magmas and their “plumes” in another post some time…

from BMK news and my discussions :

That these thick madfic gabbro-ultramafic sills have high nickel and possible Platinum Group Element (PGE) potential has now been proved by the presence of nickel sulphide in more than one place, as well as the regional presence of chromitites and laterally extensive titanomagnetite layers evidence for hot magmas of the type that may host large massive nickel sulphide deposits near their base.

The second point is extremely important and very relevant to the formation of McFaulds area deposits, which would include the Speatacular NOT discovery, and the BMK Ni discovery, and of course hopefully many more as yet hopefully undiscovered discoveries…

"(ii) the interaction of the source magma with country rocks, either leading to the incorporation of sulfur, or the felsification of the magma in question;"

So then from this statement we conclude that in order for magmatic sulfides to concentrate in one area and remain in situ, either Sulfur from the surrounding country rock, or more importantly as in McFaulds case, “Felsification” with the contact magmas…

We have all heard and read many/most of the uninformed and geologically ignorant posters/doubters refer to the “granodiorite, which they describe as having limited NOT’s ore bodies. …..Nothing could be further from the “truth/facts”…

You will recall that in most all NOT drill holes to date, the mineralization ended in “ granodiorite”…It is my opinion, that , what existed prior to the NOT mineralization event, was Large “granite” bodies as the country rock…these “granites” are/were in fact all felsic, containing up to 65%to 90% of quartz and alkai felspars, therefore they are felsic. The “feslsificatiion” referred to above, potentially occurred when the “mafic” parent magma, probably a gabbro, came into contact withand mixed with the “granites” country rocks and assimilated and transformed it into “grano-diorite”, thereby felsification of the Parent Magma in question..so that diorite part, is the “mafic” component parts of the parent gabbro? magma, which assimilated with the “granites” felsic country rock , then transformed them into “granodiorites”. This felsification,into the Granodiorite, in my opinion in this case is what created the “trap” for the Ni Cu PGEs sulfides, in situ, which accumulated near the edges of this process….

So the “granodiorite” is GOOD news, since that was part of the Parent magma, and the “trap” for the Ni Cu PGEs mineralization in NOT’s Area discovery…Thus the granodiorite does not limit NOT’s Spectacular discovery, or many likely future such discoveries in the McFaulds area…….

The third point is:

"(iii) fractional crystallisation of sulfide liquid giving rise to Cu-rich ores which may be far removed from the 'source' ore. "

As most of you know, SPQ has discovered many, more than 10 so called VMS deposits containing Cu and Zn…However some of their discoveries were only Cu with no Zinc…some were as much as 8% Cu…..this leads me to believe That those Cu only discoveries , were as the result of “fractional crystallisation” of the parent magma/s that gave rise to Ni ores, which may be far removed from the source(parent) ore…

Implications of this“fractional crystallization” for McFaulds may be;

1. These rich Cu only discoveries made by SPQ are part of the magmatic processes which gave rise to the Ni Cu PGEs of NOT and likely many other such deposits along the belt at McFaulds..

Alternatively, these SPQ Cu only discoveries give potentially, some evidence that such Ni Cu PGEs deposits also exist in SPQ claims, both east and west, since these Cu discoveries were made some 25 Kms east, and 25 Kms west ,and away from NOT’s Ni Cu PGEs deposit.

Further confirmation of these Ni deposits, spread out throughout McFaulds belt, comes from BMK who discovered a 93 Ft. section of drill core assaying about .40% Ni., in their MacNNUGET claims some 25 Kms west and away from NOT, which BMK is drilling now…

2. Thus there is both evidence for a GIANT parent magma, for the entire McFaulds area, or more likely,a series of Large mafic magma intrusions which potentially gave rise to a series of Ni Cu PGEs deposits, and farther away potentially the Cu only deposits and potentially, Massive Sulfides Ni deposits at their base, as above noted….

Here are some other very important and NEW findings/interpretations about the Geology/Geological setting for McFaulds…this information is borrowed from MNMD, Ont Gov. Open File Report-OFR 6192, Scott and Rainsford, 2006, from Aeromagnetic data , and revised terrain maps….this report is their interpretation of the data collected…

I would advise anyone who is serious about learning more on McFaulds Geology, to obtain a copy of said repot, (doesn’t cost much), but it gives you much additional information/data, a great number of maps and other illustrations data and information for the entire Hudson’s Bay/James Bay Lowlands etc…I am only going to quote a couple of items in this post, of this very large and informative geological/geophysical report, which I consider very important indeed…which as I read the fine print, is allowed, provided one gives the report “credit”, and it is for non commercial use, as noted above…

OFR 6192 Scott, Rainsford…2006

From Aeromagnetic data, and revised terrain maps…

Some features to note:

-" The merging of greenstone belts of Uchi domain and Oxford-Stull domain under the James Bay Lowland;"

Of course, these is a very complex set of Geological factors which cannot be explained easily,

Or ascertained to any degree in one study, however, certain assumptions may be theorized, such as the reason why these 2 distinctive Geological Units have “merged” under the James Bay Lowlands…This MAY indicate some evidence for plate tectonics, more particular “subduction zones” or crustal growths thru “rift”which have “merged” these 2 UNITS together..

Some other potential evidence for this “subduction zone” and crustal growth is stated below, wherein an “INDENTOR” taken to mean an indentation, or a lowering of the James Bay lowlands terrane, as compared to the surrounding rocks, sometimes referred to in Geology as similar to a Graben…additional important data from this statement below is that this “indentor” is flanked on each side by FAULTS…you will see this more clearly if you obtain the full report…

Now the “GRABEN” concept/idea is my opinion, since the geological definition of Graben is

“ an elongated depressed crustal unit, or block, that is bounded by “faults” on it’s sides”…it may or may not be expressed as a “rift valley”….

How my “GRABEN” description importantly relates to the Ni Cu PGEs mineralization is somewhat clear, since some of the World’s largest Ni Cu PGEs deposits like Norlisk in Russia occur within these types of “GRABEN” or “indentors” "low lands" ..At Norlisk it is described by Naldrett as a 3.5 Km thick “volcanic basin” in/near the axis or keel of an anticline formation, that is thought to have brought these deposits to near surface…these Norlisk deposits are world class and account for LARGE portion of Ni Cu and of course PGE’s..Russia being the world’s MAJOR producer of Palladium…you will also notice a number of “DOMES” and anticlines in and around the McFaulds lake area from the Geo maps posted…

- A large indentor-like feature underlies the James Bay Lowland, flanked by faults; -

Debate has grown as to the AGE of these MMS intrusions…The statement from the said report below, may shed some light into this discussion…I have read and that some samples taken from the McFaulds and adjoining areas, area were dated from 2737 to 2696…A;though I previously posted that these rocks were Proterozoic,, or earlier, that was not exactly correct. They are about 200 Million years older… The Archean age ranges from 3.8 to 2.5 Billion years old…the youngest known as late Archean 2.9 to 2.5 Billion years old.. Proterozoic age starts after 2.5 Bill…so the dates quoted in some reports show that some of these intrusive rocks underlying the Paleozoic limestone are of late Archean ages aound 2.7 Billion years old,…some of the surrounding rocks are of early Archean ages 50+ more years older……From reading may publications, and mapping of World MMS Ni Cu PGEs deposits, especially from Prof. Naldrett, it seems that the older the rocks the higher the sulfide content of Ni etc…, since the theory is that the earth’s Mantle, was somewhat more HOT Dynamic and Violent , than it is today, as it is very very slowly cooling…so AGE may be a plus for McFaulds…and interesting side note of these world MMS deposits maps, is that Canada has been unusually blessed with a higher proportion of these deposits , than other countries…

In conclusion, I have believed for some time that the Potential for Large and rich deposits of Ni Cu PGEs at McFaulds is/has been Great!..…As more geological data , interpretation and especially drilling comes forth, I believe again the words of Mr. Nemis “THE RING OF FIRE ( The McFaulds area) WILL BE LARGER THAN VOISEY’S BAY”…the structure and Geology are there, the Ni Cu PGE’s are there, at least proven to exist thru 50 Kms belt of McFaulds, while others potentially to be found and extending Mfaulds further…

from SPQ’s VMS discoveries some 25 Kms away East from NOT’s discovery, to the BMK Ni MS discovery last year 20+ Kms away West of NOT’s discovery….now all that is left is the very important “drilling” to actually outline and “prove” the orebodies…Good luck to all McFaulds Lake Players….

ALL of the above as usual ….In My Considered Opinion…pls do your won D.D….

Gruß,

Fantomas

http://www.agoracom.com/ir/McFaulds/messages/653461#message

Re: The Rings Central Core

Posted by: alcollard on December 06, 2007 11:44AM

In response to: The Rings Central Core by the deputy

Hi deputy,

Not sure who posted this originally, but here is a write up on the geology of McFaulds Lake:

Geological Theory/Facts of Genesis of McFaulds Lake:

I seldom say this, In my view this post, with the up to date Geological information contained herein , is a must “keeper” to cut and paste, for future reference, to those interested/invested in the McFaulds Area….this post has taken weeks to research and put together….

Information credit will be given to their Sources, accordingly, and in all cases referred to herein, these are their professional opinions, based on their interpretations of fact findings studies , to which , I have then added/applied my kowledge/information/opinions of the McFaulds Area…I have decided to post this information, knowing that I have met their requirements, which are proper “credit” and non commercial use…proper credits are listed below, and as you all know/may know, I have not /and am not being paid by anyone to post on these forums.. .I do so simply to provide information and my considered opinions…..just your usual cautionary statements…

The Purchase of

MNDM Publications

MNDM Publication Sales

Local: (705) 670-5691

Toll Free: 1-888-415-9845, ext. 5691

(inside Canada, United States

I will begin with Prof. A.J. Naldrett, world renowned Geology professor and probably “THE” or one of , the world experts on MMS , Ni Cu PGEs …

I met Prof. Naldrett of a few occasions and attended a good number of his lectures on MMS Ni Cu PGEs, in Toronto, and have read much of his written papers on said subject, long before McFaulds came along….I will not go into very complex and extremely difficult geological terms and theories..I will try to describe some theories here, as simple as possible, under the circumstances of the very complex subject of geology in general and super complex McFaulds geology in particular….

Below are 3 general “findings” by Prof. Naldrett of his studies of worldwide MMS Ni Cu PGEs deposits :

"Magmatic Ni-Cu sulfide deposits form as the result of the segregation and concentration of droplets of liquid sulfide from mafic or ultramafic magma.When most major Ni-Cu sulfide deposits, including those at Kambalda, Western Australia, are viewed in the light of studies at Noril'sk, Sudbury, Jinchuan and Voice’s Bay, three factors become apparent:

(i) the concentration of sulfides in channels or conduits through which much magma has flowed (feeder conduits for intrusions are much more prospective targets for exploration than the base of the intrusions themselves);

(ii) (ii) the interaction of the source magma with country rocks, either leading to the incorporation of sulfur, or the felsification of the magma in question;

(iii) (iii) fractional crystallisation of sulfide liquid giving rise to Cu-rich ores which may be far removed from the 'source' ore.

Anthony J. Naldrett Key factors in Genesis of MMS Ni Cu PGE implications for exploration."

The first point is relatively simple , and as I have posted previously, that these NI Cu PGEs sulfides are accumulated and deposited in magma conduits or “feeders” conduits for much larger intrusions, wherein successive introductions of Magmas have occurred…BUT once you have ‘prospected “ and found these magma conduits mineralized with Ni Cu PGEs , then many Geologists recommend drilling much deeper for the “source” (parent) magma responsible for these deposits as these deeper bases of the Magma are usually also “mineralized”…especially in the case of McFaulds, wherein good evidence exists of the regional.presence of Chromite layers , and enxtensive titomagnetite layers, that are good evidence for the proposition that very HOT, Dynamic Magmas , existed at McFaulds, and were responsible for the mineralized “feeder conduits” the type of Dynamic Magmas that could host Massive Nickel Sulfides, near or at their base….more on dynamic magmas and their “plumes” in another post some time…

from BMK news and my discussions :