Apple - unaufhaltsamer Aufstieg - wie lange noch? (Seite 1717)

eröffnet am 18.01.05 13:14:58 von

neuester Beitrag 01.05.24 10:01:08 von

neuester Beitrag 01.05.24 10:01:08 von

Beiträge: 49.513

ID: 944.638

ID: 944.638

Aufrufe heute: 65

Gesamt: 4.620.092

Gesamt: 4.620.092

Aktive User: 0

ISIN: US0378331005 · WKN: 865985 · Symbol: AAPL

171,54

USD

+1,32 %

+2,24 USD

Letzter Kurs 17:03:59 Nasdaq

Neuigkeiten

04:30 Uhr · wallstreetONLINE Redaktion |

| Apple Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

17:00 Uhr · BNP Paribas Anzeige |

16:39 Uhr · dpa-AFX |

16:19 Uhr · Der Aktionär TV |

Werte aus der Branche Hardware

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,5100 | +21,13 | |

| 0,5270 | +9,11 | |

| 2,3600 | +9,01 | |

| 3,9400 | +6,78 | |

| 3,9100 | +6,25 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5400 | -2,41 | |

| 14,400 | -2,70 | |

| 15,300 | -3,77 | |

| 6,4200 | -14,29 | |

| 18,000 | -14,61 |

Beitrag zu dieser Diskussion schreiben

We do remember of course:

>Apple has already committed to significant shares repurchases in excess of $51 billion, but Icahn wants more.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

>Apple has already committed to significant shares repurchases in excess of $51 billion, but Icahn wants more.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

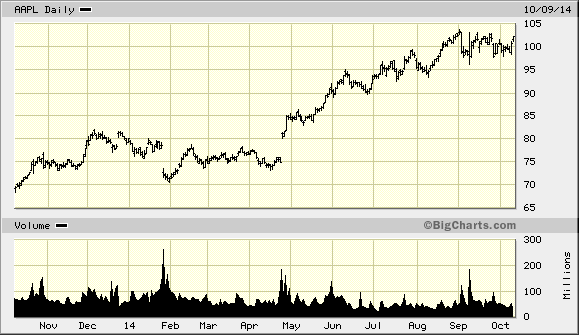

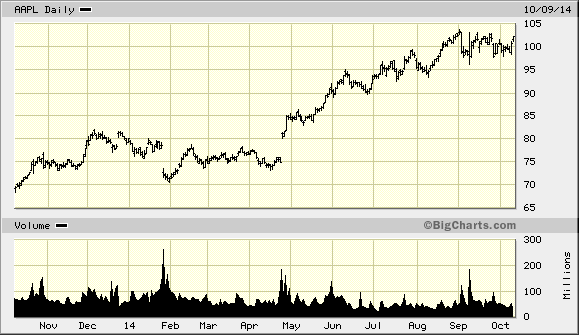

Just take a look at this...same as my saying as of late.... .

.

>The open letter contains a variety of metrics to justify the position, but the underlying message is that Apple is a screaming buy. The question for investors , of course, is whether these seemingly outrageously claims are even remotely justifiable, or if simply the fact that they have been made is enough to drive the stock higher.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

.

.>The open letter contains a variety of metrics to justify the position, but the underlying message is that Apple is a screaming buy. The question for investors , of course, is whether these seemingly outrageously claims are even remotely justifiable, or if simply the fact that they have been made is enough to drive the stock higher.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

Antwort auf Beitrag Nr.: 47.992.408 von IngChris am 10.10.14 00:49:24Very good... ....but how high can for now Mr. Icahn drive Apple shares?

....but how high can for now Mr. Icahn drive Apple shares?

How High Can Icahn Drive Apple Shares?

Oct. 9, 2014 5:50 PM ET | 13 comments | About: Apple Inc. (AAPL)

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Summary

Activist investor Carl Icahn is calling for increased Apple share repurchaes.

Icahn places a price target of $203 on shares.

Despite Icahn's projection being likely too high, Apple looks attractive here.

Anyone familiar with Apple (NASDAQ:AAPL) is likely equally familiar with the regular voice of activist investor Carl Icahn whispering in the ears of CEO Tim Cook and other top managers. In a recent letter to the company, Icahn implores Cook to institute an accelerated buyback program given his belief that the stock is massively undervalued: he places fair value at roughly $203 per share - roughly twice its current trading price. The open letter contains a variety of metrics to justify the position, but the underlying message is that Apple is a screaming buy. The question for investors, of course, is whether these seemingly outrageously claims are even remotely justifiable, or if simply the fact that they have been made is enough to drive the stock higher. While I do not share Icahn's level of exuberance, I continue to be a buyer of Apple at current levels.

Icahn on Apple

It is important to remember when considering Icahn's comments on Apple shares that he owns roughly 53 million shares, meaning that positive price moves for Apple are highly profitable for his position. With that in mind, Icahn urges the company to take action: "Given the persistently excessive liquidity of $133 billion net cash on Apple's balance sheet, we ask you to present to the rest of the board our request for the company to make a tender offer, which would meaningfully accelerate and increase the magnitude of share repurchases." Apple has already committed to significant shares repurchases in excess of $51 billion, but Icahn wants more.

He makes very clear that he is not criticizing Cook's stewardship of the company, but rather singing the praises of Apple's new product launches:

The intention of this letter is to communicate two things to you: (1) given the earnings growth we forecast for Apple, we continue to think that the market misunderstands and dramatically undervalues Apple and (2) the excess liquidity the company continues to hold on its balance sheet affords the company an amazing opportunity to take further advantage of this valuation disconnect by accelerating share repurchases.

By the numbers, Icahn sees a 44% increase in earnings off a 25% increase in revenues immediately, driven by new product releases. This is to be followed by earnings increases of approximately 30% in each of 2016 and 2017. These estimates mean that Icahn's projections for 2015 are roughly double analyst consensus on the revenue number and triple of the earnings side.

Putting It in Context

The most obvious question is whether Icahn's assessment of the company and the stock is correct, particularly when it is so different from the consensus. Given Apple's recent hiccups with the latest iOS release and a few issues with the iPhone 6, my projections are more in keeping with the consensus. The surrender to finally adopt a larger screen has put Apple in a great position with the new devices, particularly heading into the holidays, but on supply matters alone, Icahn's numbers seems hard to fathom.

Despite the questions raised by Icahn's projections, the fact that he is making so much positive noise may, in itself, serve as a positive catalyst for shares. He is a master of grabbing public attention, and this type of conversation is good for Apple, particularly from a share price perspective. Ultimately, while I believe a price target of $203 cannot be justified, I maintain a positive outlook on Apple and I'm a buyer at current levels.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

....but how high can for now Mr. Icahn drive Apple shares?

....but how high can for now Mr. Icahn drive Apple shares?How High Can Icahn Drive Apple Shares?

Oct. 9, 2014 5:50 PM ET | 13 comments | About: Apple Inc. (AAPL)

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Summary

Activist investor Carl Icahn is calling for increased Apple share repurchaes.

Icahn places a price target of $203 on shares.

Despite Icahn's projection being likely too high, Apple looks attractive here.

Anyone familiar with Apple (NASDAQ:AAPL) is likely equally familiar with the regular voice of activist investor Carl Icahn whispering in the ears of CEO Tim Cook and other top managers. In a recent letter to the company, Icahn implores Cook to institute an accelerated buyback program given his belief that the stock is massively undervalued: he places fair value at roughly $203 per share - roughly twice its current trading price. The open letter contains a variety of metrics to justify the position, but the underlying message is that Apple is a screaming buy. The question for investors, of course, is whether these seemingly outrageously claims are even remotely justifiable, or if simply the fact that they have been made is enough to drive the stock higher. While I do not share Icahn's level of exuberance, I continue to be a buyer of Apple at current levels.

Icahn on Apple

It is important to remember when considering Icahn's comments on Apple shares that he owns roughly 53 million shares, meaning that positive price moves for Apple are highly profitable for his position. With that in mind, Icahn urges the company to take action: "Given the persistently excessive liquidity of $133 billion net cash on Apple's balance sheet, we ask you to present to the rest of the board our request for the company to make a tender offer, which would meaningfully accelerate and increase the magnitude of share repurchases." Apple has already committed to significant shares repurchases in excess of $51 billion, but Icahn wants more.

He makes very clear that he is not criticizing Cook's stewardship of the company, but rather singing the praises of Apple's new product launches:

The intention of this letter is to communicate two things to you: (1) given the earnings growth we forecast for Apple, we continue to think that the market misunderstands and dramatically undervalues Apple and (2) the excess liquidity the company continues to hold on its balance sheet affords the company an amazing opportunity to take further advantage of this valuation disconnect by accelerating share repurchases.

By the numbers, Icahn sees a 44% increase in earnings off a 25% increase in revenues immediately, driven by new product releases. This is to be followed by earnings increases of approximately 30% in each of 2016 and 2017. These estimates mean that Icahn's projections for 2015 are roughly double analyst consensus on the revenue number and triple of the earnings side.

Putting It in Context

The most obvious question is whether Icahn's assessment of the company and the stock is correct, particularly when it is so different from the consensus. Given Apple's recent hiccups with the latest iOS release and a few issues with the iPhone 6, my projections are more in keeping with the consensus. The surrender to finally adopt a larger screen has put Apple in a great position with the new devices, particularly heading into the holidays, but on supply matters alone, Icahn's numbers seems hard to fathom.

Despite the questions raised by Icahn's projections, the fact that he is making so much positive noise may, in itself, serve as a positive catalyst for shares. He is a master of grabbing public attention, and this type of conversation is good for Apple, particularly from a share price perspective. Ultimately, while I believe a price target of $203 cannot be justified, I maintain a positive outlook on Apple and I'm a buyer at current levels.

http://seekingalpha.com/article/2552135-how-high-can-icahn-d…

....in etwa so .....

Dear Mr. Cook,

My target for Apple-Shares is USD 144,44.

Please help to reach this til July 2015.

best regards

Arno nym

Dear Mr. Cook,

My target for Apple-Shares is USD 144,44.

Please help to reach this til July 2015.

best regards

Arno nym

Antwort auf Beitrag Nr.: 47.992.366 von IngChris am 10.10.14 00:39:08Ja mach mal bitte... .

.

.

.

Antwort auf Beitrag Nr.: 47.992.366 von IngChris am 10.10.14 00:39:08Nein .... im Ernst - ich werde wohl auch eine Brief an T.Cook schreiben ....

Antwort auf Beitrag Nr.: 47.992.273 von auriga am 10.10.14 00:13:12Na ja - vielleicht will er ja verdoppeln ...

Antwort auf Beitrag Nr.: 47.992.231 von IngChris am 09.10.14 23:59:20Naja OK....aber I.C. hält ja schon ca. 1% an AAPL....ich glaube nicht dass er beim aktuellen SP ein solches Angebot sehr schätzen würde...Lach...reich wird man anders....Angenehme Nachtruhe.

Antwort auf Beitrag Nr.: 47.990.212 von auriga am 09.10.14 20:22:43

Also für USD 203.- /Share kann Icahn meine Aktien haben - da geb´ ich ihm sogar noch 3% Skonto ...

Zitat von auriga: Icahn hält eine Bewertung von 203 Dollar für angemessen. rtr

Quelle: Handelsblatt Online

http://www.wiwo.de/unternehmen/it/beruechtigter-investor-car…

Also für USD 203.- /Share kann Icahn meine Aktien haben - da geb´ ich ihm sogar noch 3% Skonto ...

Zugegeben ist die Einschätzung von C Ica(h)n nicht gerade konservativ zu nennen. Ohne Frage aber ein sehr interessanter Denkanstoß. Das ist der Punkt...zwinkern.

17:06 Uhr · dpa-AFX · Apple |

17:00 Uhr · BNP Paribas · Advanced Micro DevicesAnzeige |

16:39 Uhr · dpa-AFX · Apple |

16:19 Uhr · Der Aktionär TV · Apple |

15:44 Uhr · BörsenNEWS.de · Amgen |

14:57 Uhr · dpa-AFX · Apple |

08:33 Uhr · Jochen Stanzl · Apple |

04:30 Uhr · wallstreetONLINE Redaktion · Apple |

01.05.24 · dpa-AFX · Apple |

| Zeit | Titel |

|---|---|

| 11.02.24 | |

| 18.01.24 | |

| 27.11.23 | |

| 05.11.23 | |

| 22.08.23 | |

| 04.08.23 | |

| 02.07.23 |