Petrel Res PLC - Auf in die Charts! - 500 Beiträge pro Seite

eröffnet am 26.02.07 09:09:55 von

neuester Beitrag 20.05.08 12:10:38 von

neuester Beitrag 20.05.08 12:10:38 von

Beiträge: 42

ID: 1.114.358

ID: 1.114.358

Aufrufe heute: 0

Gesamt: 16.780

Gesamt: 16.780

Aktive User: 0

ISIN: IE0001340177 · WKN: 694395 · Symbol: PET

0,0225

GBP

+9,76 %

+0,0020 GBP

Letzter Kurs 03.05.24 London

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.300,00 | +23,81 | |

| 0,8529 | +22,54 | |

| 34,02 | +20,81 | |

| 0,8000 | +14,29 | |

| 19,650 | +11,77 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,145 | -8,89 | |

| 4,6700 | -10,19 | |

| 6,4900 | -10,97 | |

| 4,2000 | -11,39 | |

| 0,7400 | -22,11 |

raiso

raiso

An alle Petrel-Neulinge:

Der Preis für Petrel wird in London "gemacht".

Bitte achtet auf die RT-Kurse an dieser Stelle.

Glück auf!

raiso

Der Preis für Petrel wird in London "gemacht".

Bitte achtet auf die RT-Kurse an dieser Stelle.

Glück auf!

raiso

Hier ist ein TOPLINK über Pressemitteilungen

zum aktuellen Stand des Ölgesetzes:

http://www.newsnow.co.uk/newsfeed/?name=Iraq+-+Oil

raiso

zum aktuellen Stand des Ölgesetzes:

http://www.newsnow.co.uk/newsfeed/?name=Iraq+-+Oil

raiso

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

... mal Faktor Pfundkurs ca. 1,48:

raiso

raiso

In London wird der Kurs gemacht!!!

>>> Bei RNS => Verdopplung wahrscheinlich!

raiso

>>> Bei RNS => Verdopplung wahrscheinlich!

raiso

80k ...

raiso

raiso

Iraq Oil, Gas & Petrochemical Summit

>>> Die Entscheidung am 28.-30.Mai 2007 in Amman!

http://www.iraqdevelopmentprogram.org/idp/events/iog/index.h…

raiso

>>> Die Entscheidung am 28.-30.Mai 2007 in Amman!

http://www.iraqdevelopmentprogram.org/idp/events/iog/index.h…

raiso

RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS RNS

Petrel Resources PLC

13 March 2007

Petrel Resources PLC announces that it was informed today that Man Financial

Limited is interested in 2,614,095 ordinary shares in the Company, representing

3.78 per cent. of the issued share capital.

This information is provided by RNS

The company news service from the London Stock Exchange

raiso

Petrel Resources PLC

13 March 2007

Petrel Resources PLC announces that it was informed today that Man Financial

Limited is interested in 2,614,095 ordinary shares in the Company, representing

3.78 per cent. of the issued share capital.

This information is provided by RNS

The company news service from the London Stock Exchange

raiso

Es wird wieder gekauft:

raiso

raiso

raiso

Amman to host Iraq oil summit

Posted: Monday, March 19, 2007

Jordan's capital Amman will host the Iraq Oil, Gas, Petrochemical & Electricity Summit in May.

The summit, to be held from May 28 to 30, 2007, will welcome representation from the Iraqi ministries of Oil, Industry & Minerals and Electricity, as well as the Iraq Energy Council, Investment Promotion Agency and the Kurdistan Regional Government (KRG) Ministry for Natural Resources.

It will also host many of the state companies operating under the Iraqi Ministry of Oil and senior representatives from the Iraq Reconstruction Management Office (IRMO), said an official spokesman.

For the most important sectors of the Iraqi economy, this historic landmark event will be the first of its kind since the formation of Iraq's Unity Government, with these key decision makers participating with the full intent of establishing relationships and entering into contractual negotiations with all international operators wishing to be part of both the upstream and downstream sectors.

Iraq has the world's second largest proven oil reserves and the government is now finalising its new hydrocarbon laws, following the declaration of the investment laws for the extractive industries.

More information on how to register for the summit is available at www.iraqdevelopmentprogram.org/idp/events/iog/index.htm´

TradeArabia News Service

raiso

Posted: Monday, March 19, 2007

Jordan's capital Amman will host the Iraq Oil, Gas, Petrochemical & Electricity Summit in May.

The summit, to be held from May 28 to 30, 2007, will welcome representation from the Iraqi ministries of Oil, Industry & Minerals and Electricity, as well as the Iraq Energy Council, Investment Promotion Agency and the Kurdistan Regional Government (KRG) Ministry for Natural Resources.

It will also host many of the state companies operating under the Iraqi Ministry of Oil and senior representatives from the Iraq Reconstruction Management Office (IRMO), said an official spokesman.

For the most important sectors of the Iraqi economy, this historic landmark event will be the first of its kind since the formation of Iraq's Unity Government, with these key decision makers participating with the full intent of establishing relationships and entering into contractual negotiations with all international operators wishing to be part of both the upstream and downstream sectors.

Iraq has the world's second largest proven oil reserves and the government is now finalising its new hydrocarbon laws, following the declaration of the investment laws for the extractive industries.

More information on how to register for the summit is available at www.iraqdevelopmentprogram.org/idp/events/iog/index.htm´

TradeArabia News Service

raiso

Freitag = Petreltag

Sunday Tribune Article 19/3/07

IRISH oil exploration company Petrel Resources has revealed that it plans to upgrade its current deals with the Iraqi government to production sharing agreements once the country's new petroleum law is passed.

"With regards to our development field in the south, we could work there now, " said the company's managing director, David Horgan.

Petrel are confident that the government will ratify its claim to the oil rights for a large chunk of land in the western Iraq, Western Desert Block 6.

The company may also aim to get a 'super giant' oilfield, which would yield over 10 billion barrels of oil. The new law would end the legal limbo in the Iraqi oil industry, which did not allow foreign oil companies to enter into production agreements there.

Petrel currently has contracts to study the Merjan oil field in central Iraq and to assist the state to bring the Subba & Luhais oil field in southern Iraq under production. Although the law does not specify the terms of production agreements, Horgan said that it was likely that Petrel would get 60 to 70% of the oil produced by its fields until it had recovered the cost of its investment and 20% after that.

However, Jon Marks, editor of Iraq Focus, a London-based specialist newsletter aimed at the oil industry, said it was unclear whether it was safe enough to extract oil at Petrel's proposed fields.

"There has been a decrease in violence in Baghdad due to the US push but it has been displaced to other areas, " he said. Marks added that there was a good chance that insurgents would start attacking foreign oil contractors. Although Petrel's proposed fields were the best geological prospect in Iraq, few other oil companies were confident of extracting oil outside the relatively stable Kurdish area in the north of the country.

raiso

Sunday Tribune Article 19/3/07

IRISH oil exploration company Petrel Resources has revealed that it plans to upgrade its current deals with the Iraqi government to production sharing agreements once the country's new petroleum law is passed.

"With regards to our development field in the south, we could work there now, " said the company's managing director, David Horgan.

Petrel are confident that the government will ratify its claim to the oil rights for a large chunk of land in the western Iraq, Western Desert Block 6.

The company may also aim to get a 'super giant' oilfield, which would yield over 10 billion barrels of oil. The new law would end the legal limbo in the Iraqi oil industry, which did not allow foreign oil companies to enter into production agreements there.

Petrel currently has contracts to study the Merjan oil field in central Iraq and to assist the state to bring the Subba & Luhais oil field in southern Iraq under production. Although the law does not specify the terms of production agreements, Horgan said that it was likely that Petrel would get 60 to 70% of the oil produced by its fields until it had recovered the cost of its investment and 20% after that.

However, Jon Marks, editor of Iraq Focus, a London-based specialist newsletter aimed at the oil industry, said it was unclear whether it was safe enough to extract oil at Petrel's proposed fields.

"There has been a decrease in violence in Baghdad due to the US push but it has been displaced to other areas, " he said. Marks added that there was a good chance that insurgents would start attacking foreign oil contractors. Although Petrel's proposed fields were the best geological prospect in Iraq, few other oil companies were confident of extracting oil outside the relatively stable Kurdish area in the north of the country.

raiso

raiso

Production Sharing Agreement 01/5/07

RNS Number:8331V

Petrel Resources PLC

01 May 2007

PETREL RESOURCES PLC

Petrel awarded Production Sharing Agreement in Jordan

* Petrel awarded PSA by Jordanian government covering East Safawi Block

* Highly prospective exploration territory, close to producing fields in both

Syria and Jordan

* 3 year exploration programme agreed, commencing with seismic interpretation

and acquisition to define drilling targets

Petrel Resources, the AIM-listed oil explorer and developer operating in Iraq,

has finalised a Production Sharing Agreement (PSA) on the East Safawi Block in

Jordan. The PSA Effective Date will be May 1st when it will be published in the

Official Gazette of Jordan.

The East Safawi Block forms part of the oil and gas prospective Arabian Desert.

The East Safawi block adjoins the producing gas field at Risha and neighbouring

oil producing blocks in Syria. The oil targets are in shallow formations and

there are well-established gas plays at deeper levels.

The Jordanian Production Sharing terms are world class. The contractor receives

60% of oil production - or gas equivalent - up to 10,000 barrels daily, with a

sliding scale to a 35% share of production over 100,000 barrels daily oil

equivalent.

The agreement allows for a 3 year first phase exploration. Initial work includes

seismic reprocessing and reinterpretation and new seismic. Targets identified

will be followed up by drilling. Work already completed by Petrel on the block

suggests a number of drillable targets. Drilling is expected to take place in

late 2008 - early 2009, depending on operational developments.

Jordan is a stable constitutional monarchy. The Jordanian authorities are

pro-business. Jordan is part of the Arab gas pipeline project and will be both a

contributor and reliable access route for Middle Eastern gas exports to Europe.

Petrel Managing Director, David Horgan, commented:

'This is a good block, in a highly prospective area: the Arabian Desert has both

oil and gas potential. With great terms already in place, we are starting work

straight away, reprocessing and acquiring seismic to identify drilling targets.

Winning the East Safawi Production Sharing Agreement is the culmination of three

years work with the Jordanian authorities. Terms are world-class, especially

for oil. Jordan is an excellent business location: secure, friendly and

pro-business, which geographically and geologically fits well into Petrel's

Iraq-centred strategy".

raiso

RNS Number:8331V

Petrel Resources PLC

01 May 2007

PETREL RESOURCES PLC

Petrel awarded Production Sharing Agreement in Jordan

* Petrel awarded PSA by Jordanian government covering East Safawi Block

* Highly prospective exploration territory, close to producing fields in both

Syria and Jordan

* 3 year exploration programme agreed, commencing with seismic interpretation

and acquisition to define drilling targets

Petrel Resources, the AIM-listed oil explorer and developer operating in Iraq,

has finalised a Production Sharing Agreement (PSA) on the East Safawi Block in

Jordan. The PSA Effective Date will be May 1st when it will be published in the

Official Gazette of Jordan.

The East Safawi Block forms part of the oil and gas prospective Arabian Desert.

The East Safawi block adjoins the producing gas field at Risha and neighbouring

oil producing blocks in Syria. The oil targets are in shallow formations and

there are well-established gas plays at deeper levels.

The Jordanian Production Sharing terms are world class. The contractor receives

60% of oil production - or gas equivalent - up to 10,000 barrels daily, with a

sliding scale to a 35% share of production over 100,000 barrels daily oil

equivalent.

The agreement allows for a 3 year first phase exploration. Initial work includes

seismic reprocessing and reinterpretation and new seismic. Targets identified

will be followed up by drilling. Work already completed by Petrel on the block

suggests a number of drillable targets. Drilling is expected to take place in

late 2008 - early 2009, depending on operational developments.

Jordan is a stable constitutional monarchy. The Jordanian authorities are

pro-business. Jordan is part of the Arab gas pipeline project and will be both a

contributor and reliable access route for Middle Eastern gas exports to Europe.

Petrel Managing Director, David Horgan, commented:

'This is a good block, in a highly prospective area: the Arabian Desert has both

oil and gas potential. With great terms already in place, we are starting work

straight away, reprocessing and acquiring seismic to identify drilling targets.

Winning the East Safawi Production Sharing Agreement is the culmination of three

years work with the Jordanian authorities. Terms are world-class, especially

for oil. Jordan is an excellent business location: secure, friendly and

pro-business, which geographically and geologically fits well into Petrel's

Iraq-centred strategy".

raiso

Sehr interessanter Artikel!

http://www.resourceinvestor.com/pebble.asp?relid=31524

Die PR ist gut:

Petrel PSA Deal Shows New Attraction in Jordan Oil

By Sven Ridley-Wordich

07 May 2007 at 12:09 PM GMT-04:00

AMSTERDAM (ResourceInvestor.com) -- Irish-based oil and gas minnow Petrel Resources has reported that it has finalized a Production Sharing Agreement (PSA) on the East Safawi Block in Jordan.

The junior has struck a deal entailing a three-year exploration phase, which includes seismic work such as reprocessing and reinterpretation of existing data and acquiring new geophysical data. At the same time, Petrel will assess the option of an all-out drilling program late 2007 – early 2008. Petrel’s coup is remarkable as until now only majors, such as Petrobras or independents have been able to access the rather attractive undeveloped oil and gas reserves of Jordan.

Due to changes to the oil law, Jordan has become a very attractive area to operate. Analysts have stated that current PSA regulations have made Jordan to one of the top most attractive acreage holders in the world. In the new PSAs, Jordan awards concession holders 60% of total oil production or its equivalent in natural gas. The latter is feasible up to a production volume of 10,000 bpd of crude oil. Production volumes higher than 10,000 bpd are receiving a sliding scale to 35% share of production over 100,000 barrels of oil equivalent per day.

The new Petrel PSA is for the East Safawi Block, which is part of the highly oil and gas prospective Arabian Desert. Petrel is very optimistic about the potential, as the block borders a producing gas field at Risha and neighbouring oil producing blocks in Syria. Based on existing seismic interpretation, Petrel already has identified oil targets in shallow formations, with several gas plays at hand.

Petrel’s entering into Jordan follows several other major oil and gas companies setting up shop in Jordan. The Middle Eastern country always has been regarded as uninteresting due to security reasons and the lack of highly prospective areas. These assessments have, however, changed dramatically as of late.

After discovering a vast oil shale reserve, Jordan has entered into the same league as Canada. Jordan has become one of the top most attractive investment and operational acreage holders in regards to oil shale and heavy oil developments. Due to increased crude oil prices and the lack of accessible new reserves elsewhere, interest has been growing to develop the country’s oil shale.

Brazilian oil and gas major Petrobras has signed a memorandum of understanding (MoU) in March 2007 with Jordan’s Natural Resources Authority (NRA) for a feasibility study for the exploration of oil shale reserves. The Brazilian major will assess the commercial viability of surface oil shale deposits in the Attarat umm Ghudran block in the centre of the kingdom.

At the same time, the NRA has been discussing with British-Dutch oil and gas major Shell [NYSE:RDS-B] the option of exploration and production of deep oil shale deposits. This would be the fourth MoU signed by the NRA lately for oil shale developments.

Oil Shale Energy of Jordan, the local/UK joint venture Jordan Energy & Mining and a Saudi/local consortium International Corporation for Oil Shale Investment are also currently setting up assessments. Jordan’s Ministry of Energy and Mineral Resources has already stated that it could be presenting a new oil shale licensing round soon. The government is pursuing the development of 24 known surface oil shale deposits that contain more than 50 billion tonnes of geological reserves.

raiso

http://www.resourceinvestor.com/pebble.asp?relid=31524

Die PR ist gut:

Petrel PSA Deal Shows New Attraction in Jordan Oil

By Sven Ridley-Wordich

07 May 2007 at 12:09 PM GMT-04:00

AMSTERDAM (ResourceInvestor.com) -- Irish-based oil and gas minnow Petrel Resources has reported that it has finalized a Production Sharing Agreement (PSA) on the East Safawi Block in Jordan.

The junior has struck a deal entailing a three-year exploration phase, which includes seismic work such as reprocessing and reinterpretation of existing data and acquiring new geophysical data. At the same time, Petrel will assess the option of an all-out drilling program late 2007 – early 2008. Petrel’s coup is remarkable as until now only majors, such as Petrobras or independents have been able to access the rather attractive undeveloped oil and gas reserves of Jordan.

Due to changes to the oil law, Jordan has become a very attractive area to operate. Analysts have stated that current PSA regulations have made Jordan to one of the top most attractive acreage holders in the world. In the new PSAs, Jordan awards concession holders 60% of total oil production or its equivalent in natural gas. The latter is feasible up to a production volume of 10,000 bpd of crude oil. Production volumes higher than 10,000 bpd are receiving a sliding scale to 35% share of production over 100,000 barrels of oil equivalent per day.

The new Petrel PSA is for the East Safawi Block, which is part of the highly oil and gas prospective Arabian Desert. Petrel is very optimistic about the potential, as the block borders a producing gas field at Risha and neighbouring oil producing blocks in Syria. Based on existing seismic interpretation, Petrel already has identified oil targets in shallow formations, with several gas plays at hand.

Petrel’s entering into Jordan follows several other major oil and gas companies setting up shop in Jordan. The Middle Eastern country always has been regarded as uninteresting due to security reasons and the lack of highly prospective areas. These assessments have, however, changed dramatically as of late.

After discovering a vast oil shale reserve, Jordan has entered into the same league as Canada. Jordan has become one of the top most attractive investment and operational acreage holders in regards to oil shale and heavy oil developments. Due to increased crude oil prices and the lack of accessible new reserves elsewhere, interest has been growing to develop the country’s oil shale.

Brazilian oil and gas major Petrobras has signed a memorandum of understanding (MoU) in March 2007 with Jordan’s Natural Resources Authority (NRA) for a feasibility study for the exploration of oil shale reserves. The Brazilian major will assess the commercial viability of surface oil shale deposits in the Attarat umm Ghudran block in the centre of the kingdom.

At the same time, the NRA has been discussing with British-Dutch oil and gas major Shell [NYSE:RDS-B] the option of exploration and production of deep oil shale deposits. This would be the fourth MoU signed by the NRA lately for oil shale developments.

Oil Shale Energy of Jordan, the local/UK joint venture Jordan Energy & Mining and a Saudi/local consortium International Corporation for Oil Shale Investment are also currently setting up assessments. Jordan’s Ministry of Energy and Mineral Resources has already stated that it could be presenting a new oil shale licensing round soon. The government is pursuing the development of 24 known surface oil shale deposits that contain more than 50 billion tonnes of geological reserves.

raiso

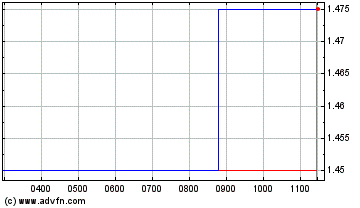

Tageschart

raiso

raiso

Petrel Resources Production Sharing Agreement

RNS Number:9736W

Petrel Resources PLC

22 May 2007

PETREL RESOURCES PLC

PRODUCTION SHARING AGREEMENT IN JORDAN FINALISED

* East Safawi Block is prospective exploration territory, close to producing

fields

* 3 year exploration programme agreed, commencing with technical analysis and

seismic to define drilling targets

Further to the announcement on 1 May, Petrel Resources, the AIM-listed oil

explorer and developer operating in Iraq, confirms finalisation of a Production

Sharing Agreement (PSA) on the East Safawi Block in Jordan. King Abdullah of

the Hashemite Kingdom of Jordan attended the ceremony, where a total of $2.5

billion of investment was announced by the Jordanian authorities.

East Safawi forms part of the prospective Arabian Desert. The East Safawi block

adjoins the producing gas field at Risha and oil producing blocks in Syria. The

oil targets are in shallow formations and there are well-established gas plays

at depth.

Jordanian Production Sharing terms are clear and attractive. The contractor

receives 60% of oil production - or gas equivalent - up to 10,000 barrels daily,

with a sliding scale to a 35% share of production over 100,000 barrels daily oil

equivalent. There were no material objections to the Petrel contract in

parliament or elsewhere.

The agreement envisages a 3 year first phase exploration. Initial work includes

seismic reprocessing and reinterpretation and new seismic. Targets identified

are expected to be drilled in 2008/09, depending on operational developments.

Jordan is a stable constitutional monarchy. Building on the success of his

father King Hussein, King Abdullah personally attended the East Safawi and other

signing ceremonies, which underlined Jordan's commitment to responsible

international investment.

Jordan's success, based on pro-business policies, is a model for the region.

Even political turbulence in neighbouring countries has been turned to advantage

by Jordan, which has attracted outstanding entrepreneurs and investment.

Historically, a concern was that Jordan is most prospective for gas. This is

now seen as an advantage, due to the massive international increase in demand

for natural gas, both in the region and further. With the Arab gas pipeline

project well advanced, and planned to extend to Turkey and into the European

network, Jordan will be both a supplier and reliable access route for Middle

Eastern gas exports to Europe.

Petrel Managing Director, David Horgan, commented:

'East Safawi is prospective: analysis reinforced our belief that the Arabian

Desert has considerable oil and gas potential.

At a time of resource nationalism elsewhere, we are heartened by Jordanian

consensus in favour of this project. There were no objections in Parliament or

the mainstream media to Petrel's contract. His Majesty publicly demonstrated

commitment by hosting the signing ceremony - giving comfort to citizens and

investors.

Winning the East Safawi Production Sharing Agreement is the culmination of three

years work. Terms are world-class, especially for oil. Jordan is both secure

and pro-business, complementing Petrel's Iraq-centred strategy'.

Contacts:

David Horgan, Managing Director + 353 87 292 3500

John Teeling, Chairman + 353 1 8332833

College Hill

Paddy Blewer +44 (0)20 7457 2074

Nick Elwes

Blue Oar Securities

John Wakefield +44 (0) 117 93300

Directors: John Teeling, Chairman, David Horgan, Managing, Guy Delbes (FR), Stefano Borghi (ITL), Jim Finn, Company

Secretary

Registered Office: 162 Clontarf Road, Dublin 3, Ireland

raiso

Iraqi politicians agree deal on sharing oil, says Kurd minister

Michael Howard in Sulaymaniya

Thursday June 21, 2007

The Guardian

Iraq\'s Kurdish leaders said last night they had struck an important deal with the central government in Baghdad over a law to divide up Iraq\'s oil revenues, which is seen by the Bush administration as one of the benchmarks in attempts to foster national reconciliation.

Ashti Hawrami, the minister for natural resources in the Kurdistan regional government, told the Guardian the text had been finalised late last night after 48 hours of \"tough bargaining\" with Baghdad. The deal represented \"a genuine revenue sharing agreement\" that was transparent and would benefit all the people of Iraq and help pull the country together, he said.

raiso

Michael Howard in Sulaymaniya

Thursday June 21, 2007

The Guardian

Iraq\'s Kurdish leaders said last night they had struck an important deal with the central government in Baghdad over a law to divide up Iraq\'s oil revenues, which is seen by the Bush administration as one of the benchmarks in attempts to foster national reconciliation.

Ashti Hawrami, the minister for natural resources in the Kurdistan regional government, told the Guardian the text had been finalised late last night after 48 hours of \"tough bargaining\" with Baghdad. The deal represented \"a genuine revenue sharing agreement\" that was transparent and would benefit all the people of Iraq and help pull the country together, he said.

raiso

Petrel Resources says Iraq oil projects on track despite turmoil UPDATE

(Adds interview with managing director)

LONDON (Thomson Financial) - Petrel Resources PLC said its oil fields in

southern Iraq are on track to be on stream by 2010, despite mounting violence

and unrest in the country.

The fields -- Subba and Luhais -- are capable of pumping up to 240,000

barrels a day, said Petrel, the contractor for the 197 mln usd project.

Petrel said it continues to search for more projects in war-torn Iraq and is

looking forward to the passage of the Hydrocarbon Law, which it believes will

open up "significant opportunities" for the company.

"We have worked in Iraq for eight years and understand the potential and the

need for oil development in the country," said chairman John Teeling.

"The imminent passing of the Hydrocarbon Law will offer numerous development

opportunities. With the backing of our partner, the Japanese giant Itochu Corp,

we hope to participate in these developments," he said.

The long-awaited Hydrocarbon Law, expected to be passed this year, aims to

open up Iraq's vast but largely undeveloped oil industry to foreign investors.

In 2006 Petrel and Itochu signed a strategic alliance agreement covering

future exploration work in Iraq.

Itochu assisted Petrel in the exploration and technical study of the Merjan

field. The technical and geological review of the field has been completed and

the results submitted to the Iraqi authorities.

Petrel's managing director David Horgan told Thomson Financial News in an

interview that the group is unperturbed by the political uncertainty that has

prevailed after the fall of Saddam Hussein in 2003.

"We're not worried about politics in Iraq. We've worked with the fifth

government in Iraq, (plus) four years under Saddam," he said.

Petrel's projects have not been affected by the escalating insurgency,

Horgan said, describing the southern part as a "much safer" place than the

northern and central areas.

"We're happy to stay in Iraq over the long term. We don't see any reason why

things won't work out in the end," he stressed.

The group found Iraqi oil officials "very honourable" and are only hoping to

adopt the "best practice" standards in order to attract more foreign capital,

said Horgan.

Iraq's proven oil reserves stand at about 115 bln barrels, and are the

world's third largest after those of Saudi Arabia and Iran. The cost of

producing oil in the country, estimated at below 2 usd a barrel, is probably the

lowest in the world, according to industry experts.

Several companies have sought alliances with Petrel, Horgan said, noting

that Itochu will be top of its list should it decide to get a partner in future

contracts, including Block 6.

The 10,000 square kilometre Block 6, located in the western desert, is

believed to be holding around 3-5 bln barrels of oil.

Petrel gave an update on its Iraqi projects after it unveiled a pretax loss

of 415,570 eur in 2006, against a loss of 481,535 eur previously. It has yet to

make revenues.

At 1.41 pm, Petrel shares were unchanged at 61 pence.

raiso

(Adds interview with managing director)

LONDON (Thomson Financial) - Petrel Resources PLC said its oil fields in

southern Iraq are on track to be on stream by 2010, despite mounting violence

and unrest in the country.

The fields -- Subba and Luhais -- are capable of pumping up to 240,000

barrels a day, said Petrel, the contractor for the 197 mln usd project.

Petrel said it continues to search for more projects in war-torn Iraq and is

looking forward to the passage of the Hydrocarbon Law, which it believes will

open up "significant opportunities" for the company.

"We have worked in Iraq for eight years and understand the potential and the

need for oil development in the country," said chairman John Teeling.

"The imminent passing of the Hydrocarbon Law will offer numerous development

opportunities. With the backing of our partner, the Japanese giant Itochu Corp,

we hope to participate in these developments," he said.

The long-awaited Hydrocarbon Law, expected to be passed this year, aims to

open up Iraq's vast but largely undeveloped oil industry to foreign investors.

In 2006 Petrel and Itochu signed a strategic alliance agreement covering

future exploration work in Iraq.

Itochu assisted Petrel in the exploration and technical study of the Merjan

field. The technical and geological review of the field has been completed and

the results submitted to the Iraqi authorities.

Petrel's managing director David Horgan told Thomson Financial News in an

interview that the group is unperturbed by the political uncertainty that has

prevailed after the fall of Saddam Hussein in 2003.

"We're not worried about politics in Iraq. We've worked with the fifth

government in Iraq, (plus) four years under Saddam," he said.

Petrel's projects have not been affected by the escalating insurgency,

Horgan said, describing the southern part as a "much safer" place than the

northern and central areas.

"We're happy to stay in Iraq over the long term. We don't see any reason why

things won't work out in the end," he stressed.

The group found Iraqi oil officials "very honourable" and are only hoping to

adopt the "best practice" standards in order to attract more foreign capital,

said Horgan.

Iraq's proven oil reserves stand at about 115 bln barrels, and are the

world's third largest after those of Saudi Arabia and Iran. The cost of

producing oil in the country, estimated at below 2 usd a barrel, is probably the

lowest in the world, according to industry experts.

Several companies have sought alliances with Petrel, Horgan said, noting

that Itochu will be top of its list should it decide to get a partner in future

contracts, including Block 6.

The 10,000 square kilometre Block 6, located in the western desert, is

believed to be holding around 3-5 bln barrels of oil.

Petrel gave an update on its Iraqi projects after it unveiled a pretax loss

of 415,570 eur in 2006, against a loss of 481,535 eur previously. It has yet to

make revenues.

At 1.41 pm, Petrel shares were unchanged at 61 pence.

raiso

David Horgan im Interview vor der Irak-Kommission am 08.06.07:

http://www.channel4.com/news/microsites/I/the_iraq_commissio…

raiso

http://www.channel4.com/news/microsites/I/the_iraq_commissio…

raiso

raiso

Antwort auf Beitrag Nr.: 31.048.714 von raiso am 06.08.07 12:01:14Hey raiso, schön dich zu "sehen"

So langsam trägt das Ding Früchte...

So langsam trägt das Ding Früchte...

Kurdish region passes own oil law

Web posted at: 8/7/2007 3:30:41

Source ::: REUTERS

ARBIL, Iraq • Iraq\'s largely autonomous Kurdish region passed its own oil law yesterday, despite Iraq\'s parliament having failed to pass a national law after months of negotiations by the country\'s main political blocs.

Kurdish officials stressed that it had been drawn up in line with the national constitution and did not contradict the federal law, which Iraq\'s leaders agreed on July 3 but has not yet been sent to parliament.

The draft federal oil law is now in limbo while the national parliament is on its summer break for the month of August. No date has been set to debate it.

Iraq has the world\'s third-largest oil reserves, which are mainly in the north and the south of the country.

The national hydrocarbon law is seen as pivotal by Washington to reconciling warring Iraqis, rebuilding Iraq\'s shattered economy and attracting foreign investment.

After a week-long debate, Kurdish lawmakers passed the Petroleum Law of the Kurdistan Region unanimously.

\"We have freedom and now we have a law that enables us to make new projects and sign new contracts for the benefit of our people,\" Kurdistan\'s Minister for Natural Resources, Ashti Hawrami said.

\"There is no problem with the previous contracts that we signed already before issuing this law, but we will review them to persuade all of them that these contracts are legal.\"

The Kurdistan region has signed several agreements with foreign companies.

The Kurdish law provides for the establishment of the Kurdistan National Oil Company and says \"the regional government shall share revenue derived from petroleum with all the people of Iraq.\"

Kurdistan forced renegotiation of the national hydrocarbon law, fearing that it gave the federal government too much control over oil exploration, revenue-sharing and negotiating contracts with foreign companies.

Web posted at: 8/7/2007 3:30:41

Source ::: REUTERS

ARBIL, Iraq • Iraq\'s largely autonomous Kurdish region passed its own oil law yesterday, despite Iraq\'s parliament having failed to pass a national law after months of negotiations by the country\'s main political blocs.

Kurdish officials stressed that it had been drawn up in line with the national constitution and did not contradict the federal law, which Iraq\'s leaders agreed on July 3 but has not yet been sent to parliament.

The draft federal oil law is now in limbo while the national parliament is on its summer break for the month of August. No date has been set to debate it.

Iraq has the world\'s third-largest oil reserves, which are mainly in the north and the south of the country.

The national hydrocarbon law is seen as pivotal by Washington to reconciling warring Iraqis, rebuilding Iraq\'s shattered economy and attracting foreign investment.

After a week-long debate, Kurdish lawmakers passed the Petroleum Law of the Kurdistan Region unanimously.

\"We have freedom and now we have a law that enables us to make new projects and sign new contracts for the benefit of our people,\" Kurdistan\'s Minister for Natural Resources, Ashti Hawrami said.

\"There is no problem with the previous contracts that we signed already before issuing this law, but we will review them to persuade all of them that these contracts are legal.\"

The Kurdistan region has signed several agreements with foreign companies.

The Kurdish law provides for the establishment of the Kurdistan National Oil Company and says \"the regional government shall share revenue derived from petroleum with all the people of Iraq.\"

Kurdistan forced renegotiation of the national hydrocarbon law, fearing that it gave the federal government too much control over oil exploration, revenue-sharing and negotiating contracts with foreign companies.

Nur noch 24 Tage...!!!!!!!!!!!!!

Iraq Ministry official invites international

companies to explore Iraq’s petrochem sector

Companies seeking to explore

commercial opportunities throughout

Iraq's petrochemical sector should look to

attend the forthcoming Iraq Oil, Gas,

Petrochemical & Electricity Summit,

which will take place in Dubai on

2-4 September 2007.

The summit will welcome a senior level delegation from the Iraqi Ministry of Industry & Minerals,

to be led by H.E. Fawzi Al-Hariri, Iraqi Minister of Industry & Minerals, who will be attending the

summit with a delegation of senior deputies and including the Director General for

Petrochemicals, the Director General for Petrochemical Industries and the Director General for

Petrochemical Investments.

H.E. Widad Osman, Minister of Industry for the Kurdistan Regional Government (KRG), will

also be attending the summit with a ministerial delegation.

These key decision makers will participate at the landmark summit, the first of its kind to bring

ministers and other senior officials to establish relationships and enter into contractual

negotiations with international energy operators.

These high level officials will be outlining requirements for the petrochemical sector, covering

issues such as refinery and petrochemical integration, feedstock flexibility and production

availability for petrochemical production, as well as focusing on new petrochemical projects.

The officials will also be making themselves available to hold private consultations with senior

executives from the pre-eminent energy operators. Only the best-in-breed companies will be

represented at board level at the summit, building the relationships that are crucial to the future

of Iraq's energy sector. The event has already attracted the leaders in this field including Exxon,

Chevron, BP, Basell, ABB, Siemens, BASF and Shell, to name but a few.

http://www.ameinfo.com/128683.html

raiso

Iraq Ministry official invites international

companies to explore Iraq’s petrochem sector

Companies seeking to explore

commercial opportunities throughout

Iraq's petrochemical sector should look to

attend the forthcoming Iraq Oil, Gas,

Petrochemical & Electricity Summit,

which will take place in Dubai on

2-4 September 2007.

The summit will welcome a senior level delegation from the Iraqi Ministry of Industry & Minerals,

to be led by H.E. Fawzi Al-Hariri, Iraqi Minister of Industry & Minerals, who will be attending the

summit with a delegation of senior deputies and including the Director General for

Petrochemicals, the Director General for Petrochemical Industries and the Director General for

Petrochemical Investments.

H.E. Widad Osman, Minister of Industry for the Kurdistan Regional Government (KRG), will

also be attending the summit with a ministerial delegation.

These key decision makers will participate at the landmark summit, the first of its kind to bring

ministers and other senior officials to establish relationships and enter into contractual

negotiations with international energy operators.

These high level officials will be outlining requirements for the petrochemical sector, covering

issues such as refinery and petrochemical integration, feedstock flexibility and production

availability for petrochemical production, as well as focusing on new petrochemical projects.

The officials will also be making themselves available to hold private consultations with senior

executives from the pre-eminent energy operators. Only the best-in-breed companies will be

represented at board level at the summit, building the relationships that are crucial to the future

of Iraq's energy sector. The event has already attracted the leaders in this field including Exxon,

Chevron, BP, Basell, ABB, Siemens, BASF and Shell, to name but a few.

http://www.ameinfo.com/128683.html

raiso

AGM Reminder

16 August 2007

WHEN: Wednesday 22nd August 2007

TIME: 12 Noon

WHERE: Westbury Hotel, Off Grafton Street, Dublin 2.

Dear Shareholder

After official business, David Horgan, will make a presentation on the current state of activities in Iraq.

The AGM will be preceded at 11am by the AGM of Connemara Mining Company. You are most welcome to attend.

Yours sincerely

John J Teeling

Chairman

16 August 2007

WHEN: Wednesday 22nd August 2007

TIME: 12 Noon

WHERE: Westbury Hotel, Off Grafton Street, Dublin 2.

Dear Shareholder

After official business, David Horgan, will make a presentation on the current state of activities in Iraq.

The AGM will be preceded at 11am by the AGM of Connemara Mining Company. You are most welcome to attend.

Yours sincerely

John J Teeling

Chairman

Independent.ie

Petrel aims to resist advances of majors

By Ciaran Byrne

Wednesday August 22 2007

http://www.independent.ie/business/irish/petrel-aims-to-resi…

The world's biggest oil companies are jockeying for position ahead of the expected passing of the country's new hydrocarbon laws.

A scramble for Iraq's vast energy resources is expected with the putting in place of the first legal framework for investing in the country's energy.

Major global firms have stayed away from Iraq, which has the world's third-largest oil reserves, because of the continuing bloody insurgency and lack of legal protections.

Companies such as Shell and BP have banned their personnel from Iraq but smaller companies such as Petrel, based in Dublin, have continued to operate there.

Operators

Now, the big players are expected to woo the smaller operators or even take them over - but Petrel is determined to ignore the overtures.

The company, which holds its agm in Dublin today, has been operating in Iraq since 1999 and employs 13 contractors in the country.

It has contracts worth $200m and managing director David Horgan expects the Iraqi government to ratify its claim to the oil rights for a large chunk of land in western Iraq.

Petrel, which is backed by Japanese industrial giant Itochu, is also hoping to win the rights to a "super giant" oilfield, which could yield over 10bn barrels of oil.

Mr Horgan told the Irish Independent: "We've been approached countless times and resisted. We have a sugar daddy ourselves (Itochu) and they fund half our overheads.

"We've been here since '99 and we're in a sweet spot for what's about to happen. We're an Irish firm with no baggage and we want to stay independent."

Mr Horgan rejected statements by some observers that the oil laws will trigger an unseemly scramble for rights that will have no benefit for ordinary Iraqi people.

He said: "We want to move forward. Many people are unemployed and lack the skills. We employ Iraqis on the ground and we want to make more progress."

Iraq has discovered reserves of 115bn barrels, of which only 40bn barrels have been developed. There are large parts of the country that remain unexplored.

"It was a high-risk strategy for some of these small companies to get involved in Iraq," said one London-based energy analyst at a private investment bank.

"But that's what they do - go where nobody else will go and get the head start. If the legal issues are sorted out, they will look quite attractive."

- Ciaran Byrne

Petrel aims to resist advances of majors

By Ciaran Byrne

Wednesday August 22 2007

http://www.independent.ie/business/irish/petrel-aims-to-resi…

The world's biggest oil companies are jockeying for position ahead of the expected passing of the country's new hydrocarbon laws.

A scramble for Iraq's vast energy resources is expected with the putting in place of the first legal framework for investing in the country's energy.

Major global firms have stayed away from Iraq, which has the world's third-largest oil reserves, because of the continuing bloody insurgency and lack of legal protections.

Companies such as Shell and BP have banned their personnel from Iraq but smaller companies such as Petrel, based in Dublin, have continued to operate there.

Operators

Now, the big players are expected to woo the smaller operators or even take them over - but Petrel is determined to ignore the overtures.

The company, which holds its agm in Dublin today, has been operating in Iraq since 1999 and employs 13 contractors in the country.

It has contracts worth $200m and managing director David Horgan expects the Iraqi government to ratify its claim to the oil rights for a large chunk of land in western Iraq.

Petrel, which is backed by Japanese industrial giant Itochu, is also hoping to win the rights to a "super giant" oilfield, which could yield over 10bn barrels of oil.

Mr Horgan told the Irish Independent: "We've been approached countless times and resisted. We have a sugar daddy ourselves (Itochu) and they fund half our overheads.

"We've been here since '99 and we're in a sweet spot for what's about to happen. We're an Irish firm with no baggage and we want to stay independent."

Mr Horgan rejected statements by some observers that the oil laws will trigger an unseemly scramble for rights that will have no benefit for ordinary Iraqi people.

He said: "We want to move forward. Many people are unemployed and lack the skills. We employ Iraqis on the ground and we want to make more progress."

Iraq has discovered reserves of 115bn barrels, of which only 40bn barrels have been developed. There are large parts of the country that remain unexplored.

"It was a high-risk strategy for some of these small companies to get involved in Iraq," said one London-based energy analyst at a private investment bank.

"But that's what they do - go where nobody else will go and get the head start. If the legal issues are sorted out, they will look quite attractive."

- Ciaran Byrne

Petrel Resources AGM Statement

RNS Number:6383C

Petrel Resources PLC

22 August 2007

Highlights of the Managing Director's Statement

Petrel Resources AGM

Dublin

22nd August, 2007

The expected passage of the Iraqi Hydrocarbon Law opens the door to full

participation by private companies in exploring for and developing Iraqi oil.

Iraq is one of the last great under explored and under developed onshore oil

provinces. The exploration success rate is high. Iraq's oil bearing structures

are large with straightforward reservoirs and low geological and engineering

risks. The deep horizons which provide most production in neighbouring Saudi

Arabia, Kuwait and Iran have to date been largely untouched in Iraq.

In normal circumstances a state oil company would limit foreign involvement, but

Iraq's rare circumstances require attractive terms to entice foreign investment

and technology. Our competitive advantage is our relationships built up over 10

years. We have the capacity and the ability to increase quickly recoveries from

existing reservoirs and to add new barrels to Iraq's reserves.

Petrel has been active in Iraq for the last decade. The successful management

of the large Subba & Luhais oil field development in Southern Iraq shows that

dedicated contractors can operate on the ground. To date, we have suffered no

direct incidents and have enjoyed the warm cooperation of local communities.

The Iraqi authorities and especially the Ministry of Oil, continue to be

committed to and supportive of our efforts.

Petrel continues to have favourable backing from suppliers. Our Iraqi and

international staff have shown exceptional dedication and flexibility. Apart

from on the ground activities, they have produced tenders for the development of

oil and gas fields which are considered the technical benchmark by the relevant

bodies. Our Technical Cooperation Agreement analysis and technology transfer

was also judged first rate. Our pioneering exploration work in the Western

desert blended local expertise with state of the art technology.

In Itochu, our Japanese partner, we have the long term support of one of the

world's largest downstream oil players.

Our shareholders have shown long term commitment in the face of sanctions and

war. Though political uncertainty remains, Iraq now has a sovereign elected

government committed to developing its hydrocarbons. Legal title to risk

sharing agreements will soon be a reality.

Petrel is demonstrating that it can operate in the oil rich South of Iraq. We

will continue to aggressively deepen and broaden our activities in this region.

All resolutions were passed at the meeting.

Contacts:

David Horgan, Managing Director + 353 87 292 3500

John Teeling, Chairman + 353 1 8332833

College Hill

Paddy Blewer +44 (0)20 7457 2074

Nick Elwes

Blue Oar Securities Plc

John Wakefield +44 (0) 117 933 0020

Simon Moynagh

www.petrelresources.com

Notes to Editors:

Petrel Resources is focused on the long-term objective of exploring for and

developing Iraqi oil & gas, in close cooperation with the Iraqi Ministry of Oil.

Petrel is the international company most active in Iraq since 2003. It

operates the largest Engineering Procurement and Supervision of Construction

(EPC) contract at the Subba & Luhais oil fields near Basra.

Petrel also operates the Merjan oil field Technical Cooperation Agreement in

partnership with Japanese conglomerate Itochu-Cieco.

Petrel has been working on Block 6 since 2002. Block 6 is the choice 10,000 sq

km block in the Iraqi Western Desert, with large structures and high potential

for Mesozoic oil and Paleozoic gas and condensate.

Petrel was launched under current management in 1997 and listed on the AIM in

August 2000. It has 1,800 shareholders, and is capitalised at approximately

#65m.

This information is provided by RNS

The company news service from the London Stock Exchange

RNS Number:6383C

Petrel Resources PLC

22 August 2007

Highlights of the Managing Director's Statement

Petrel Resources AGM

Dublin

22nd August, 2007

The expected passage of the Iraqi Hydrocarbon Law opens the door to full

participation by private companies in exploring for and developing Iraqi oil.

Iraq is one of the last great under explored and under developed onshore oil

provinces. The exploration success rate is high. Iraq's oil bearing structures

are large with straightforward reservoirs and low geological and engineering

risks. The deep horizons which provide most production in neighbouring Saudi

Arabia, Kuwait and Iran have to date been largely untouched in Iraq.

In normal circumstances a state oil company would limit foreign involvement, but

Iraq's rare circumstances require attractive terms to entice foreign investment

and technology. Our competitive advantage is our relationships built up over 10

years. We have the capacity and the ability to increase quickly recoveries from

existing reservoirs and to add new barrels to Iraq's reserves.

Petrel has been active in Iraq for the last decade. The successful management

of the large Subba & Luhais oil field development in Southern Iraq shows that

dedicated contractors can operate on the ground. To date, we have suffered no

direct incidents and have enjoyed the warm cooperation of local communities.

The Iraqi authorities and especially the Ministry of Oil, continue to be

committed to and supportive of our efforts.

Petrel continues to have favourable backing from suppliers. Our Iraqi and

international staff have shown exceptional dedication and flexibility. Apart

from on the ground activities, they have produced tenders for the development of

oil and gas fields which are considered the technical benchmark by the relevant

bodies. Our Technical Cooperation Agreement analysis and technology transfer

was also judged first rate. Our pioneering exploration work in the Western

desert blended local expertise with state of the art technology.

In Itochu, our Japanese partner, we have the long term support of one of the

world's largest downstream oil players.

Our shareholders have shown long term commitment in the face of sanctions and

war. Though political uncertainty remains, Iraq now has a sovereign elected

government committed to developing its hydrocarbons. Legal title to risk

sharing agreements will soon be a reality.

Petrel is demonstrating that it can operate in the oil rich South of Iraq. We

will continue to aggressively deepen and broaden our activities in this region.

All resolutions were passed at the meeting.

Contacts:

David Horgan, Managing Director + 353 87 292 3500

John Teeling, Chairman + 353 1 8332833

College Hill

Paddy Blewer +44 (0)20 7457 2074

Nick Elwes

Blue Oar Securities Plc

John Wakefield +44 (0) 117 933 0020

Simon Moynagh

www.petrelresources.com

Notes to Editors:

Petrel Resources is focused on the long-term objective of exploring for and

developing Iraqi oil & gas, in close cooperation with the Iraqi Ministry of Oil.

Petrel is the international company most active in Iraq since 2003. It

operates the largest Engineering Procurement and Supervision of Construction

(EPC) contract at the Subba & Luhais oil fields near Basra.

Petrel also operates the Merjan oil field Technical Cooperation Agreement in

partnership with Japanese conglomerate Itochu-Cieco.

Petrel has been working on Block 6 since 2002. Block 6 is the choice 10,000 sq

km block in the Iraqi Western Desert, with large structures and high potential

for Mesozoic oil and Paleozoic gas and condensate.

Petrel was launched under current management in 1997 and listed on the AIM in

August 2000. It has 1,800 shareholders, and is capitalised at approximately

#65m.

This information is provided by RNS

The company news service from the London Stock Exchange

raiso

Das Zocker-Ding wird schon bald zum Pennystock mutieren. Rette sich, wer kann!!

Antwort auf Beitrag Nr.: 33.945.468 von Cichla am 22.04.08 19:21:54

Das Zocker-Ding wird schon bald zum Pennystock mutieren. Rette sich, wer kann!!

Weil du das sagst wird die Aktie bestimmt nicht fallen.

Kannst ja gerne auf einen fallenden Kurs spekulieren wenn du möchtest.

Das Zocker-Ding wird schon bald zum Pennystock mutieren. Rette sich, wer kann!!

Weil du das sagst wird die Aktie bestimmt nicht fallen.

Kannst ja gerne auf einen fallenden Kurs spekulieren wenn du möchtest.

Meister Horgan spricht zur Lage im Ölmarkt...

... und der Pet-Kurs steigt!

Market tired of speculation means Opec's oil bubble is about to burst

David Horgan

http://www.tribune.ie/article.tvt?_scope=Tribune%2FBusiness%…

WE'RE in a speculative bubble for oil. Prices have soared and volatility increased. The higher the price, the greater the future premium. The market is about financial speculation, rather than a mechanism for consumers and producers to hedge risk.

This bubble will burst suddenly when hot money tires of the speculation and exits. Sudden price falls often happen. Demand is softening while new supply and substitutes emerge.

But we won't return to cheap oil. The Saudi Oil Minister's view that the new base level is under $80 is about right. This gives high returns to conventional oil projects and underwrites unconventional fuels and alternatives, which we need.

It's worth remembering that 2004 changed the markets. Industry observers were not surprised at price rises following the Iraq war: supply was tight in 2004. Invasion of Iraq, threats to Iran and strikes elsewhere raised the spectre of supply interruptions. Demand was exploding in 'Chindia' but also strong in Ireland and the USA. The situation has since changed: every year since 2005 consensus demand forecasts have been revised downwards - and now run at a third of normal. There's still demand growth in developing countries but it's subdued. If Chinese drove as much as say South Koreans, world consumption would rise by 12% - yet few Chinese seem keen to buy expensive fuel.

Opec cannot impose a ceiling The history of oil markets is about attempts to manage price - usually successfully. This effort collapsed since 2004, when prices surged through the 'Opec band'. Since physical trade became divorced from financial trade what can Opec or consumers do?

Opec is too afraid of a price collapse to act.

Opec can impose a floor but not a ceiling. The market will have to bust. We will not revert to the pre-bubble situation. The market will evolve into a more balanced but still not-cheap and volatile market.

But why do speculators now lead rather than follow? There have always been speculators and traders - but traditionally they have been specialists, aligned with real players. What's new AP is the emergence of 'Black Box' or momentum traders using technical analysis to exploit futures markets trends, by going long or short.

In classical theory they should increase volatility but not price.

But why are the speculators so bullish?

Bullish sentiment reflects longer term concerns: growth driving oil demand, worries about developing and transporting known reserves and worries about "peak oil".

When Colin Campbell published his 1999 book few punters took it seriously. They preferred the Economist's view that oil would fall to $7. Now peak oil has become fashionable. But the supply curve at $120 differs from that of $20. We passed peak production of conventional cheap onshore oil in 2001, but output has continued to grow due to higher recoveries from existing reservoirs, substitutes and especially exploring deeper offshore. We have used 46% of conventional oil but only 27% of the total including heavy oil, enhanced recovery and yet-to-find.

The world as a whole is different to individual fields: an undulating plateau is more likely than a precipitous decline. (David Horgan is MD of Petrel Resources)

raiso

... und der Pet-Kurs steigt!

Market tired of speculation means Opec's oil bubble is about to burst

David Horgan

http://www.tribune.ie/article.tvt?_scope=Tribune%2FBusiness%…

WE'RE in a speculative bubble for oil. Prices have soared and volatility increased. The higher the price, the greater the future premium. The market is about financial speculation, rather than a mechanism for consumers and producers to hedge risk.

This bubble will burst suddenly when hot money tires of the speculation and exits. Sudden price falls often happen. Demand is softening while new supply and substitutes emerge.

But we won't return to cheap oil. The Saudi Oil Minister's view that the new base level is under $80 is about right. This gives high returns to conventional oil projects and underwrites unconventional fuels and alternatives, which we need.

It's worth remembering that 2004 changed the markets. Industry observers were not surprised at price rises following the Iraq war: supply was tight in 2004. Invasion of Iraq, threats to Iran and strikes elsewhere raised the spectre of supply interruptions. Demand was exploding in 'Chindia' but also strong in Ireland and the USA. The situation has since changed: every year since 2005 consensus demand forecasts have been revised downwards - and now run at a third of normal. There's still demand growth in developing countries but it's subdued. If Chinese drove as much as say South Koreans, world consumption would rise by 12% - yet few Chinese seem keen to buy expensive fuel.

Opec cannot impose a ceiling The history of oil markets is about attempts to manage price - usually successfully. This effort collapsed since 2004, when prices surged through the 'Opec band'. Since physical trade became divorced from financial trade what can Opec or consumers do?

Opec is too afraid of a price collapse to act.

Opec can impose a floor but not a ceiling. The market will have to bust. We will not revert to the pre-bubble situation. The market will evolve into a more balanced but still not-cheap and volatile market.

But why do speculators now lead rather than follow? There have always been speculators and traders - but traditionally they have been specialists, aligned with real players. What's new AP is the emergence of 'Black Box' or momentum traders using technical analysis to exploit futures markets trends, by going long or short.

In classical theory they should increase volatility but not price.

But why are the speculators so bullish?

Bullish sentiment reflects longer term concerns: growth driving oil demand, worries about developing and transporting known reserves and worries about "peak oil".

When Colin Campbell published his 1999 book few punters took it seriously. They preferred the Economist's view that oil would fall to $7. Now peak oil has become fashionable. But the supply curve at $120 differs from that of $20. We passed peak production of conventional cheap onshore oil in 2001, but output has continued to grow due to higher recoveries from existing reservoirs, substitutes and especially exploring deeper offshore. We have used 46% of conventional oil but only 27% of the total including heavy oil, enhanced recovery and yet-to-find.

The world as a whole is different to individual fields: an undulating plateau is more likely than a precipitous decline. (David Horgan is MD of Petrel Resources)

raiso

Antwort auf Beitrag Nr.: 34.130.535 von raiso am 20.05.08 09:37:36Meister Horgan spricht zur Lage im Ölmarkt...

... und der Pet-Kurs steigt!

... und der Pet-Kurs steigt!

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -1,15 | |

| -3,23 | |

| +0,17 | |

| +0,60 | |

| +2,92 | |

| +0,91 | |

| -0,14 | |

| -1,07 | |

| 0,00 | |

| +3,17 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 112 | ||

| 58 | ||

| 56 | ||

| 39 | ||

| 31 | ||

| 30 | ||

| 17 | ||

| 16 | ||

| 16 | ||

| 13 |