Priceline.com - Asset light + cashflow stark - 500 Beiträge pro Seite

eröffnet am 30.01.10 11:28:30 von

neuester Beitrag 28.02.20 09:50:49 von

neuester Beitrag 28.02.20 09:50:49 von

Beiträge: 138

ID: 1.155.647

ID: 1.155.647

Aufrufe heute: 0

Gesamt: 18.157

Gesamt: 18.157

Aktive User: 0

ISIN: US09857L1089 · WKN: A2JEXP · Symbol: PCE1

3.350,00

EUR

+0,81 %

+27,00 EUR

Letzter Kurs 08:14:25 Tradegate

Neuigkeiten

| Booking mit starken Zahlen – Bullenalarm?Anzeige |

04.05.24 · Sharedeals |

03.05.24 · dpa-AFX |

03.05.24 · dpa-AFX |

03.05.24 · dpa-AFX |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,8250 | +297,52 | |

| 6,1500 | +54,52 | |

| 0,5070 | +26,28 | |

| 1,9900 | +15,70 | |

| 3,9400 | +11,30 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,4800 | -5,34 | |

| 1,3000 | -5,80 | |

| 0,7500 | -6,25 | |

| 0,5400 | -8,47 | |

| 1,7360 | -20,37 |

26.01.2010 14:46

Priceline.com To Webcast 4th Quarter 2009 Financial Results On February 17

NORWALK, Conn., Jan. 26 /PRNewswire-FirstCall/ -- Priceline.com® announced today that it intends to hold a conference call to discuss its 4th quarter and full-year 2009 financial results on February 17, 2010, at 4:30 p.m. ET. The event will be webcast live and the audio will be available for seven days thereafter at http://www.priceline.com/ in the Investor Relations Section.

Priceline.com To Webcast 4th Quarter 2009 Financial Results On February 17

NORWALK, Conn., Jan. 26 /PRNewswire-FirstCall/ -- Priceline.com® announced today that it intends to hold a conference call to discuss its 4th quarter and full-year 2009 financial results on February 17, 2010, at 4:30 p.m. ET. The event will be webcast live and the audio will be available for seven days thereafter at http://www.priceline.com/ in the Investor Relations Section.

On Thursday March 4, 2010, 10:16 am

NORWALK, Conn. (AP) -- Priceline.com Inc. said Thursday that it plans a private offering of up to $500 million convertible senior notes due 2015.

The online travel company plans to use the offering's net proceeds to buy back up to $100 million of its outstanding shares in privately negotiated, off-market transactions. Funds may also be used for general corporate purposes such as buybacks, acquisitions or to repay outstanding debt.

Priceline.com expects to give initial buyers a 30-day option to purchase up to an additional $75 million notes to cover any overallotments.

The company's board also approved the repurchase of up to $500 million shares of its common stock, including up to $100 million shares to be bought back concurrently with the offering.

Last month Priceline.com said its fourth-quarter profit more than doubled as revenue grew sharply amid an improving economy that had more people booking trips.

Shares of Priceline.com fell $1.89 to $233.93 in morning trading.

NORWALK, Conn. (AP) -- Priceline.com Inc. said Thursday that it plans a private offering of up to $500 million convertible senior notes due 2015.

The online travel company plans to use the offering's net proceeds to buy back up to $100 million of its outstanding shares in privately negotiated, off-market transactions. Funds may also be used for general corporate purposes such as buybacks, acquisitions or to repay outstanding debt.

Priceline.com expects to give initial buyers a 30-day option to purchase up to an additional $75 million notes to cover any overallotments.

The company's board also approved the repurchase of up to $500 million shares of its common stock, including up to $100 million shares to be bought back concurrently with the offering.

Last month Priceline.com said its fourth-quarter profit more than doubled as revenue grew sharply amid an improving economy that had more people booking trips.

Shares of Priceline.com fell $1.89 to $233.93 in morning trading.

Komisch, nix los hier ?

Die Aktie ist doch top gelaufen die letzten 5 Jahre trotz Krise !

Die Aktie ist doch top gelaufen die letzten 5 Jahre trotz Krise !

Antwort auf Beitrag Nr.: 39.354.950 von SuperInsider am 17.04.10 01:42:16...crass und ich hatte vor 6Jahren dieses Teil mal bei 20 Eur

verkauft...2000Stücke...aaaaaaa

man soll halt doch durchhalten...

Mist!

verkauft...2000Stücke...aaaaaaa

man soll halt doch durchhalten...

Mist!

bärenstark!

NORWALK, Conn., Aug. 3 /PRNewswire-FirstCall/ -- Priceline.com Incorporated today reported its financial results for the 2nd quarter 2010. Gross travel bookings for the 2nd quarter, which refers to the total dollar value, generally inclusive of all taxes and fees, of all travel services purchased by consumers, were $3.4 billion, an increase of 43.3% over a year ago.

Priceline.com had revenues in the 2nd quarter of $767.4 million, a 27.1% increase over a year ago. The Company's international operations contributed revenues in the 2nd quarter of $322.6 million, a 63.3% increase versus a year ago (approximately 68% on a local currency basis). Priceline.com's gross profit for the 2nd quarter was $445.3 million, a 45.9% increase from the prior year. The Company's international operations contributed gross profit in the 2nd quarter of $321.8 million, a 63.6% increase versus a year ago (approximately 68% growth on a local currency basis). The Company's operating income in the 2nd quarter 2010 was $173.2 million, a 58.3% increase from the prior year. Priceline.com had GAAP net income for the 2nd quarter of $115.0 million or $2.26 per diluted share, which compares to $67.0 million or $1.38 per diluted share in the same period a year ago.

Pro forma EBITDA for the 2nd quarter was $204.2 million, an increase of 61.8% over the prior year. Pro forma net income in the 2nd quarter was $158.2 million or $3.09 per diluted share, compared to $2.02 per share a year ago. First Call analyst consensus for the 2nd quarter 2010 was $2.65 per diluted share. The section below entitled "Non-GAAP Financial Measures" provides a definition and information about the use of pro forma financial measures in this press release and the attached financial and statistical supplement reconciles pro forma financial information with priceline.com's financial results under GAAP.

"Second quarter performance by the Priceline group of companies was once again driven by strong growth in our global hotel reservations, where we believe we gained market share for another quarter," said Jeffery H. Boyd, Priceline's President and CEO. "The group achieved a combined 48% year-over-year growth in hotel room nights booked. International gross travel bookings increased by 59% compared to prior year, or 67% on a local currency basis, due to increasing travel demand and an improvement in room rates. Domestic gross travel bookings grew by 20% driven by strong growth in hotel reservations. Growth in airline tickets and domestic rental car days was modest as our Name Your Own Price® airline and rental car services were hampered by reductions in capacity by suppliers."

"In May 2010, we acquired TravelJigsaw, a growing international car hire service, which has contributed $43.9 million of gross travel bookings in the 2nd quarter since acquisition. The TravelJigsaw business showed continued growth in the second quarter and we look forward to working with the team to build the business."

Looking forward, Mr. Boyd said, "We are pleased with the hotel transaction growth we are seeing worldwide, which we believe is being driven by geographic expansion, solid execution in promoting improved conversion on our websites and benefits of group-wide cooperation on integration initiatives. These factors, combined with growing Internet commerce and travel in some of our newer markets, resulted in resilience in the face of economic volatility and periodic travel disruptions, and we believe provide a foundation for growth over the long-term."

The Company also reiterated its expectation that gross travel bookings growth rates would progressively decline in the second half of 2010 as it compares to periods of relatively stronger business performance in the 2nd half of 2009.

Priceline.com said it was targeting the following for 3rd quarter 2010: -- Year-over-year increase in total gross travel bookings of approximately 33% - 38%. -- Year-over-year increase in international gross travel bookings of approximately 46% - 51% (an increase of approximately 57.5% - 62.5% on a local currency basis). -- Year-over-year increase in domestic gross travel bookings of approximately 13%. -- Year-over-year increase in revenue of approximately 29% - 34%. -- Year-over-year increase in gross profit of approximately 43% - 48%. -- Pro forma EBITDA of approximately $327 million to $337 million. -- Pro forma net income of between $4.78 and $4.98 per diluted share. Pro forma guidance for the 3rd quarter 2010: -- excludes non-cash amortization expense of acquisition-related intangibles, -- excludes non-cash stock-based compensation expense, -- excludes non-cash interest expense and gains or losses on early debt extinguishment, if any, related to cash settled convertible debt, -- excludes the impact, if any, of charges or benefits associated with judgments, rulings and/or settlements related to hotel occupancy tax proceedings, -- excludes non-cash income tax expense and reflects the impact on income taxes of certain of the pro forma adjustments, -- includes the additional impact of the pro forma adjustments described above on net income and loss attributable to noncontrolling interests, -- includes the anti-dilutive impact of the "Conversion Spread Hedges" (see "Non-GAAP Financial Measures" below) on diluted common shares outstanding related to outstanding convertible notes, and -- includes the dilutive impact of additional shares of unvested restricted stock, restricted stock units and performance share units because pro forma net income has been adjusted to exclude stock-based compensation.

In addition, pro forma EBITDA excludes depreciation and amortization expense, interest income, interest expense, equity in income and loss of investees, net income and loss attributable to noncontrolling interest, income taxes and includes the impact of foreign currency transactions and other expenses.

When aggregated, the foregoing adjustments are expected to increase pro forma EBITDA over GAAP net income by approximately $121 million in the 3rd quarter 2010. In addition, the foregoing adjustments are expected to increase pro forma net income over GAAP net income by approximately $38 million in the 3rd quarter 2010. On a per share basis, the Company estimates GAAP net income of approximately $4.06 to $4.26 per diluted share for the 3rd quarter 2010.

NORWALK, Conn., Aug. 3 /PRNewswire-FirstCall/ -- Priceline.com Incorporated today reported its financial results for the 2nd quarter 2010. Gross travel bookings for the 2nd quarter, which refers to the total dollar value, generally inclusive of all taxes and fees, of all travel services purchased by consumers, were $3.4 billion, an increase of 43.3% over a year ago.

Priceline.com had revenues in the 2nd quarter of $767.4 million, a 27.1% increase over a year ago. The Company's international operations contributed revenues in the 2nd quarter of $322.6 million, a 63.3% increase versus a year ago (approximately 68% on a local currency basis). Priceline.com's gross profit for the 2nd quarter was $445.3 million, a 45.9% increase from the prior year. The Company's international operations contributed gross profit in the 2nd quarter of $321.8 million, a 63.6% increase versus a year ago (approximately 68% growth on a local currency basis). The Company's operating income in the 2nd quarter 2010 was $173.2 million, a 58.3% increase from the prior year. Priceline.com had GAAP net income for the 2nd quarter of $115.0 million or $2.26 per diluted share, which compares to $67.0 million or $1.38 per diluted share in the same period a year ago.

Pro forma EBITDA for the 2nd quarter was $204.2 million, an increase of 61.8% over the prior year. Pro forma net income in the 2nd quarter was $158.2 million or $3.09 per diluted share, compared to $2.02 per share a year ago. First Call analyst consensus for the 2nd quarter 2010 was $2.65 per diluted share. The section below entitled "Non-GAAP Financial Measures" provides a definition and information about the use of pro forma financial measures in this press release and the attached financial and statistical supplement reconciles pro forma financial information with priceline.com's financial results under GAAP.

"Second quarter performance by the Priceline group of companies was once again driven by strong growth in our global hotel reservations, where we believe we gained market share for another quarter," said Jeffery H. Boyd, Priceline's President and CEO. "The group achieved a combined 48% year-over-year growth in hotel room nights booked. International gross travel bookings increased by 59% compared to prior year, or 67% on a local currency basis, due to increasing travel demand and an improvement in room rates. Domestic gross travel bookings grew by 20% driven by strong growth in hotel reservations. Growth in airline tickets and domestic rental car days was modest as our Name Your Own Price® airline and rental car services were hampered by reductions in capacity by suppliers."

"In May 2010, we acquired TravelJigsaw, a growing international car hire service, which has contributed $43.9 million of gross travel bookings in the 2nd quarter since acquisition. The TravelJigsaw business showed continued growth in the second quarter and we look forward to working with the team to build the business."

Looking forward, Mr. Boyd said, "We are pleased with the hotel transaction growth we are seeing worldwide, which we believe is being driven by geographic expansion, solid execution in promoting improved conversion on our websites and benefits of group-wide cooperation on integration initiatives. These factors, combined with growing Internet commerce and travel in some of our newer markets, resulted in resilience in the face of economic volatility and periodic travel disruptions, and we believe provide a foundation for growth over the long-term."

The Company also reiterated its expectation that gross travel bookings growth rates would progressively decline in the second half of 2010 as it compares to periods of relatively stronger business performance in the 2nd half of 2009.

Priceline.com said it was targeting the following for 3rd quarter 2010: -- Year-over-year increase in total gross travel bookings of approximately 33% - 38%. -- Year-over-year increase in international gross travel bookings of approximately 46% - 51% (an increase of approximately 57.5% - 62.5% on a local currency basis). -- Year-over-year increase in domestic gross travel bookings of approximately 13%. -- Year-over-year increase in revenue of approximately 29% - 34%. -- Year-over-year increase in gross profit of approximately 43% - 48%. -- Pro forma EBITDA of approximately $327 million to $337 million. -- Pro forma net income of between $4.78 and $4.98 per diluted share. Pro forma guidance for the 3rd quarter 2010: -- excludes non-cash amortization expense of acquisition-related intangibles, -- excludes non-cash stock-based compensation expense, -- excludes non-cash interest expense and gains or losses on early debt extinguishment, if any, related to cash settled convertible debt, -- excludes the impact, if any, of charges or benefits associated with judgments, rulings and/or settlements related to hotel occupancy tax proceedings, -- excludes non-cash income tax expense and reflects the impact on income taxes of certain of the pro forma adjustments, -- includes the additional impact of the pro forma adjustments described above on net income and loss attributable to noncontrolling interests, -- includes the anti-dilutive impact of the "Conversion Spread Hedges" (see "Non-GAAP Financial Measures" below) on diluted common shares outstanding related to outstanding convertible notes, and -- includes the dilutive impact of additional shares of unvested restricted stock, restricted stock units and performance share units because pro forma net income has been adjusted to exclude stock-based compensation.

In addition, pro forma EBITDA excludes depreciation and amortization expense, interest income, interest expense, equity in income and loss of investees, net income and loss attributable to noncontrolling interest, income taxes and includes the impact of foreign currency transactions and other expenses.

When aggregated, the foregoing adjustments are expected to increase pro forma EBITDA over GAAP net income by approximately $121 million in the 3rd quarter 2010. In addition, the foregoing adjustments are expected to increase pro forma net income over GAAP net income by approximately $38 million in the 3rd quarter 2010. On a per share basis, the Company estimates GAAP net income of approximately $4.06 to $4.26 per diluted share for the 3rd quarter 2010.

Antwort auf Beitrag Nr.: 40.137.987 von R-BgO am 12.09.10 16:27:03Heisa, was ist denn heute hier los??

voll die Granate das Teil ...

vor 4 Jahren noch umme 20 USD und vor 2 Wochen ATH bei 430 USD .... geil ...

vor 4 Jahren noch umme 20 USD und vor 2 Wochen ATH bei 430 USD .... geil ...

Diese Aktie macht mich krank!

Ich hatte sie mal zwischenzeitlich im Depot und bin mit zarten Gewinnen wieder raus.

Bei 5 Euroebbes hatte ich sie gekauft.

Der mir entgangene Gewinn liegt zur Zeit bei 4600%.

Eigentlich hilft mir nur noch der Dachboden!

Ich hatte sie mal zwischenzeitlich im Depot und bin mit zarten Gewinnen wieder raus.

Bei 5 Euroebbes hatte ich sie gekauft.

Der mir entgangene Gewinn liegt zur Zeit bei 4600%.

Eigentlich hilft mir nur noch der Dachboden!

Antwort auf Beitrag Nr.: 40.897.915 von Raconteur am 20.01.11 18:55:42ja ja ... da könnte man sich in den Allerwertesten bei ......

ich glaube ich werde mal ne Runde short gehen ... hier steht eigentlich ne Korrektur an ....

ich glaube ich werde mal ne Runde short gehen ... hier steht eigentlich ne Korrektur an ....

Launch of Trefis Coverage on Priceline – Stock Sensitivity to Hotel Bookings Market Share

Priceline ( PCLN ) is one of the leading online travel agencies offering consumers a wide range of travel services including bookings for hotel stays, airline tickets, car rentals, cruises and vacation packages. Priceline is the second largest travel online travel service provider in the world behind Expedia ( EXPE ).

Priceline enables customers to purchase travel services under a traditional price-disclosed model or through its proprietary Name Your Own Price service. Name Your Own Price allows customers with flexibility on date, time of travel, or supplier choice to bid for hotel room stays, air tickets, or other travel services. Priceline matches these bids with discounted (but otherwise undisclosed) fares offered by travel suppliers, and determines whether to accept the bid.

Launch of Coverage on Priceline; $452 Price Estimate

We've launched coverage of Priceline with a $452 Trefis price estimate , a slight premium to market price, which has jumped more than 100% over the past year. We estimate that hotel bookings generate over 90% of Priceline's stock value, while air ticket bookings constitute less than 3%. Advertising contributes 1% and Priceline's net cash balance accounts for the remaining 4.5%.

Much of our estimated value for the company is attributable to broad market expectations of continuing growth in bookings at Priceline. Below we highlight one area of downside risk to potential investors - Priceline's market share in hotel room bookings.

Priceline's Share of Hotel Room Bookings

Priceline has been able to grow its market share in hotel room bookings over the past few years through increasing penetration of international bookings. We anticipate that Priceline will continue its share gains in the years ahead, albeit at a more moderate pace. Expanding internet access in international markets, along with Priceline's established position in these regions through subsidiary websites like Booking.com and Agoda, should bolster the company's growth prospects in this segment. However, competitors like Expedia, Orbitz ( OWW ) and Travelocity possess greater financial resources to facilitate inorganic growth in these markets, so competitive pressure could mitigate Priceline's market share upside going forward.

We currently project that Priceline's market share in hotel room bookings will increase form an estimated 2% at year-end 2010 to 3% by the end of our forecast period. However, accelerating competitive pressures could threaten these growth prospects. To highlight Priceline's sensitivity to this key metric, we estimate that, should Priceline's market share only reach 2.5% by the end of our forecast period (vs. our 3% base projection), it could generate 12% downside to our $452 price estimate .

ich bin auch short ist absolut übertrieben das ding

kursziel 50 usd !!!!!

MFG

hoffen wir aber das sie net erst 999 erreicht !!!

ich bin short und bleibe short scheiß teil ist doch nur so ne art reisebüro, da gibts tausende davon , die zahlen sind 100 % getürkt !!!

wenns rauskommt sind sie bei 0,00

kursziel 50 usd !!!!!

MFG

hoffen wir aber das sie net erst 999 erreicht !!!

ich bin short und bleibe short scheiß teil ist doch nur so ne art reisebüro, da gibts tausende davon , die zahlen sind 100 % getürkt !!!

wenns rauskommt sind sie bei 0,00

jungs Jungs mal ehrlich wo sollen den die ganzen buchungen herkommen ? es gibt tausende reisebüros im internet also warum priceline ?

Das ding ist von vorne bis hinten ne Bilanzfälschung !!!!

Achtung usd 0,00 ist das Kursziel also seit nicht so blöde und kauft hier noch zu 473 USD !!!!!

MFG

Ich bin heute richtig short rein bei 476,50 Grüßle

Kursziel 0,00

Das ding ist von vorne bis hinten ne Bilanzfälschung !!!!

Achtung usd 0,00 ist das Kursziel also seit nicht so blöde und kauft hier noch zu 473 USD !!!!!

MFG

Ich bin heute richtig short rein bei 476,50 Grüßle

Kursziel 0,00

Antwort auf Beitrag Nr.: 41.262.488 von meisterfu am 24.03.11 19:53:11Hi, mit welchem Zertie biste short. Also ich denke ist

auch an der Zeit zu shorten. Und wenn die Firma wirklich

nicht astrein ist, kann man sich ne goldene Nase verdienen

mit shorten. Aber wie kommst Du drauf, dass da was gefaked ist ?

auch an der Zeit zu shorten. Und wenn die Firma wirklich

nicht astrein ist, kann man sich ne goldene Nase verdienen

mit shorten. Aber wie kommst Du drauf, dass da was gefaked ist ?

das mit dem fake sagt mir mein bauchgefühl, ich hatte schon zahlreiche solche fälle in den letzten 20 jahren vom neuen Markt ( an dem von 100 Unternehmen mindestens 20-30 Fakes waren) bis hin zu amerika wo fast jedes 3 Unternehmen Bilanzfälschung betreibt.

Das sollte man niemals vergessen !!!!

nur investoren die 20 Jahre Börsenerfahrung haben, kennen sich mit dem thema gut aus. Ich sage nur Enron und konsorten.

Mal ehrlich mein bauch sagt mit by Letstravel.com hats nicht geklappt, expedia.de kämpft, und Reisebüros im Internet gibts wie sand am meer,

Für mich der größte Betrug die Kiste, insbesondere bei 515 Dollar !!!

MFG übrigens da handele ich CFD S

keine Optionscheine

Das sollte man niemals vergessen !!!!

nur investoren die 20 Jahre Börsenerfahrung haben, kennen sich mit dem thema gut aus. Ich sage nur Enron und konsorten.

Mal ehrlich mein bauch sagt mit by Letstravel.com hats nicht geklappt, expedia.de kämpft, und Reisebüros im Internet gibts wie sand am meer,

Für mich der größte Betrug die Kiste, insbesondere bei 515 Dollar !!!

MFG übrigens da handele ich CFD S

keine Optionscheine

Antwort auf Beitrag Nr.: 41.307.265 von meisterfu am 01.04.11 23:53:12Also ich buche OFT über booking.com; das ist jedes Mal Umsatz für priceline...

Solltest sie nicht mit irgendeinem China-Mist verwechseln...

Solltest sie nicht mit irgendeinem China-Mist verwechseln...

Nein ist schon ok ich sag auch gar nicht das da nix geht, aber es scheint mir total überzogen zu sein, und der börsenwert ist bei 15 MRD USD nun,

Jetzt mal ohne scheiß kann ein reisebüro mehr wert sein als daimler Benz ?

Das ist wieder so ein total verückter mist wie am neuen Markt.

Das erwachen kommt dan wieder wenn die Aktie wieder auf Normalwert von 10-30 USD zurückkommt, dann begreift es jeder wieder, das hier eine totale übertreibung im Kurs vorliegt.

Und wie du ja sagtest, es gibt 1000 Reisebüros im Internet.

Ich selbst buche da auch ab und zu, ich über skyscanner.com oder de

kennst den schon ? gehört der auch priceline ?

Ich weiß nix ganz sicher über die aktie, will sie auch nicht schlechtreden, aber mir scheint sie zu gut geloffen zu sein.

Es ist für mich unerklärlich wie ein Reisebüro 15 MRD wert ist das

sind 15000 MIO

Ist das Euch klar ?

Und P.S Immer noch kann hinter jeden Aktie eine Bilanzfälschung stecken, das sollte man immer einplanen .

Das Risiko bei US Aktien liegt bei 1:4 ca für eine Bilanzfälschung also 25 %

Summa summarum :

Aktie ist sehr Teuer bei 515 USD, der markt ist sauhart umkämpft mit 1000 anbietern, der wert ist fast 15 MRD ( 2 mal so viel wie die Commerzbank !!!!!)

Und 25 % Risiko einer Bilanzfälschung !!

Das Ergibt für mich :

Diese Aktie ist der klarste Short auser Tepco.

MFG

Jetzt mal ohne scheiß kann ein reisebüro mehr wert sein als daimler Benz ?

Das ist wieder so ein total verückter mist wie am neuen Markt.

Das erwachen kommt dan wieder wenn die Aktie wieder auf Normalwert von 10-30 USD zurückkommt, dann begreift es jeder wieder, das hier eine totale übertreibung im Kurs vorliegt.

Und wie du ja sagtest, es gibt 1000 Reisebüros im Internet.

Ich selbst buche da auch ab und zu, ich über skyscanner.com oder de

kennst den schon ? gehört der auch priceline ?

Ich weiß nix ganz sicher über die aktie, will sie auch nicht schlechtreden, aber mir scheint sie zu gut geloffen zu sein.

Es ist für mich unerklärlich wie ein Reisebüro 15 MRD wert ist das

sind 15000 MIO

Ist das Euch klar ?

Und P.S Immer noch kann hinter jeden Aktie eine Bilanzfälschung stecken, das sollte man immer einplanen .

Das Risiko bei US Aktien liegt bei 1:4 ca für eine Bilanzfälschung also 25 %

Summa summarum :

Aktie ist sehr Teuer bei 515 USD, der markt ist sauhart umkämpft mit 1000 anbietern, der wert ist fast 15 MRD ( 2 mal so viel wie die Commerzbank !!!!!)

Und 25 % Risiko einer Bilanzfälschung !!

Das Ergibt für mich :

Diese Aktie ist der klarste Short auser Tepco.

MFG

priceline.com Booking.com, ein international agierender Hotelreservierungsservice sowie Agoda.com, ein asiatischer online-Hotelreservierungsservice. Zu den unternehmenseigenen Webseiten gehören Travelweb.com, Lowestfare.com, RentalCars.com sowie BreezeNet.com. Priceline.com bietet außerdem Lizenznehmern die Möglichkeit, das Geschäftsmodell zu übernehmen.

Ich muss mich korriegieren aktuell 19,1 MRD Börsenwert das ist fast 3 mal soviel wie die commerzbank !!!!!!

Das ist so was von bescheuert hoch 10 !!!!

Alle die sich geärgert haben die aktie bei 20 herzugeben, dennen kann ich nur raten, ihr könnt jetzt noch viel mehr verdienen, wenn ihr draufklopft das ding wird von 515 auf 10 wieder runterstürzen.

Traue ihr sogar ne 0 zu, wenn Bilanzfälschung entdeckt wird !!!

MFG

Ich muss mich korriegieren aktuell 19,1 MRD Börsenwert das ist fast 3 mal soviel wie die commerzbank !!!!!!

Das ist so was von bescheuert hoch 10 !!!!

Alle die sich geärgert haben die aktie bei 20 herzugeben, dennen kann ich nur raten, ihr könnt jetzt noch viel mehr verdienen, wenn ihr draufklopft das ding wird von 515 auf 10 wieder runterstürzen.

Traue ihr sogar ne 0 zu, wenn Bilanzfälschung entdeckt wird !!!

MFG

Antwort auf Beitrag Nr.: 41.308.532 von meisterfu am 02.04.11 17:52:03Wenn Du Shorts suchst, schau' Dir doch mal CCME, ABAT, RINO, etc. an

ich suche große unternehmen keine pink sheets, welche die über 10 MRD wert sind und trotzdem noch ein kgv von über 50-100 (oder gar keines haben, oder verschuldet sind wie die sau)

aber keine Banken !

aber keine Banken !

Zitat von meisterfu: priceline.com Booking.com, ein international agierender Hotelreservierungsservice sowie Agoda.com, ein asiatischer online-Hotelreservierungsservice. Zu den unternehmenseigenen Webseiten gehören Travelweb.com, Lowestfare.com, RentalCars.com sowie BreezeNet.com. Priceline.com bietet außerdem Lizenznehmern die Möglichkeit, das Geschäftsmodell zu übernehmen.

Ich muss mich korriegieren aktuell 19,1 MRD Börsenwert das ist fast 3 mal soviel wie die commerzbank !!!!!!

Das ist so was von bescheuert hoch 10 !!!!

Alle die sich geärgert haben die aktie bei 20 herzugeben, dennen kann ich nur raten, ihr könnt jetzt noch viel mehr verdienen, wenn ihr draufklopft das ding wird von 515 auf 10 wieder runterstürzen.Traue ihr sogar ne 0 zu, wenn Bilanzfälschung entdeckt wird !!!

MFG

stimmt nicht, wer bei 20 verkauft hat, dem sind inzwischen fast 2.500% entgangen.

wer aber bei 515 short geht und bei 10 zurückkauft, hat gerade mal 98% gewonnen.

mit shorten kann man vielleicht ein paar euros machen, aber das große geld wird nur auf der longseite gemacht.

Antwort auf Beitrag Nr.: 41.316.637 von meisterfu am 04.04.11 20:56:20na, wie lief' Dein short bisher?

Antwort auf Beitrag Nr.: 41.317.390 von steven_trader am 04.04.11 23:26:24stimmt nicht, wer bei 20 verkauft hat, dem sind inzwischen fast 2.500% entgangen.

wer aber bei 515 short geht und bei 10 zurückkauft, hat gerade mal 98% gewonnen.

mit shorten kann man vielleicht ein paar euros machen, aber das große geld wird nur auf der longseite gemacht.

Milchmädchenrechnung .....

wenn ich mit 100 Aktien bei 700 USD bis 100 short gehe habe ich einen Gewinn per share von 600 USD

wenn ich mit 100 Aktien bei 100 USD bis 700 USD long gegangen bin habe ich auch einen Gewinn per share von 600 USD

da schert mich der prozentuale Gewinn mächtig wenig ......

short WL .... das Teil fällt auch irgendwann ....

wer aber bei 515 short geht und bei 10 zurückkauft, hat gerade mal 98% gewonnen.

mit shorten kann man vielleicht ein paar euros machen, aber das große geld wird nur auf der longseite gemacht.

Milchmädchenrechnung .....

wenn ich mit 100 Aktien bei 700 USD bis 100 short gehe habe ich einen Gewinn per share von 600 USD

wenn ich mit 100 Aktien bei 100 USD bis 700 USD long gegangen bin habe ich auch einen Gewinn per share von 600 USD

da schert mich der prozentuale Gewinn mächtig wenig ......

short WL .... das Teil fällt auch irgendwann ....

Apple, Priceline and Google race to hit $1,000-a-share mark

Talk about Apple being the next stock to hit $1,000 highlights a race on Wall Street to reach that milestone.

Priceline, Apple, Google and Intuitive Surgical are in a four-way battle to see which will be the first Standard & Poor's 500 stock to break the $1,000-a-share barrier.

Wednesday, Priceline (PCLN) was $745.90, Google (GOOG) $635.15, Apple (AAPL) $624.31 and Intuitive Surgical (ISRG), which makes robotics for minimally invasive surgery, $543.97.

"It's the new ego boost, to get a stock to $1,000," says Jon Johnson of StockSplits.net. A stock's price, by itself, doesn't indicate how expensively or cheaply valued a company's shares are. And talk of $1,000 might be premature for any of these stocks. Online travel firm Priceline, the closest , is 25% away. Still, investors are starting to think about $1,000 due to:

•Updates to price targets. As Priceline and Apple blow past existing price targets, analysts are making adjustments. Topeka Capital Research this week put a $1,000 price target on Apple. Analyst Mike Olson at Piper Jaffray says Priceline could top $1,000 a share in two years or less.

Talk about Apple being the next stock to hit $1,000 highlights a race on Wall Street to reach that milestone.

Priceline, Apple, Google and Intuitive Surgical are in a four-way battle to see which will be the first Standard & Poor's 500 stock to break the $1,000-a-share barrier.

Wednesday, Priceline (PCLN) was $745.90, Google (GOOG) $635.15, Apple (AAPL) $624.31 and Intuitive Surgical (ISRG), which makes robotics for minimally invasive surgery, $543.97.

"It's the new ego boost, to get a stock to $1,000," says Jon Johnson of StockSplits.net. A stock's price, by itself, doesn't indicate how expensively or cheaply valued a company's shares are. And talk of $1,000 might be premature for any of these stocks. Online travel firm Priceline, the closest , is 25% away. Still, investors are starting to think about $1,000 due to:

•Updates to price targets. As Priceline and Apple blow past existing price targets, analysts are making adjustments. Topeka Capital Research this week put a $1,000 price target on Apple. Analyst Mike Olson at Piper Jaffray says Priceline could top $1,000 a share in two years or less.

ich werde mit meinem short Einstieg noch etwas warten .... scheint mir noch zu früh

die wollen den long way der 4 Großen noch melken bis jmd die 1000 USD erreicht ... das ist ein Spiel ... sonst nix

schätze wenn einer von denen in die Nähe der 1000 USD kommt + der Markt dann noch schwächelt gibt´s den Megshort des Jahrhunderts ....

die wollen den long way der 4 Großen noch melken bis jmd die 1000 USD erreicht ... das ist ein Spiel ... sonst nix

schätze wenn einer von denen in die Nähe der 1000 USD kommt + der Markt dann noch schwächelt gibt´s den Megshort des Jahrhunderts ....

!

Dieser Beitrag wurde von HotMod moderiert. Grund: auf eigenen Wunsch des Users

ca -10% in einigen Tagen ......... hat´s begonnen ???????

schätze ich habe den optimalen Einstieg verpasst .....

am 9.4. bei 775 USD ... heute bei 685 ....

am 9.4. bei 775 USD ... heute bei 685 ....

akt 625 USD .... gut 20% vom Hoch bereits gefallen ....

jetzt 648 - das dürfte sich zum Kauf eignen. Ist ein Trendfolger und der Stockastic im überverkauften Bereich. Das sooltnachoben drehen.

Ein Langfristinvest

Na "meisterfu" man hört nichts mehr -Luft raus- beim shorten :-))

Ein Langfristinvest

Na "meisterfu" man hört nichts mehr -Luft raus- beim shorten :-))

Antwort auf Beitrag Nr.: 43.373.247 von kiki99 am 11.07.12 11:21:29sorry, aber ein long-Einstieg käme für mich akt nicht in Frage

entweder geht das Teil noch eine Zeit seitwärts oder wir machen bald mal nen Haken nach unten

immer mal auf Apple gucken ... dann weiß man wo die Reise hin geht ...

entweder geht das Teil noch eine Zeit seitwärts oder wir machen bald mal nen Haken nach unten

immer mal auf Apple gucken ... dann weiß man wo die Reise hin geht ...

Seit eineinhalb Jahren sind Einige, wenn man den Postings glauben kann, short.

In der Zwischenzeit müssen die ja einen Batzen Geld verdient haben!

In der Zwischenzeit müssen die ja einen Batzen Geld verdient haben!

über 14% im Minus heute .........

Ahead of the Bell: Priceline.com

Posted: Aug 08, 2012 2:15 PM Updated: Aug 08, 2012 2:15 PM

NEW YORK (AP) - Shares of Priceline.com Inc. may be "dead money" in the near term, a Citi analyst on Wednesday, but he urged investors to pick up more shares in preparation for a recovery.

The Norwalk, Conn., discount travel website operator's stock tumbled 15 percent in electronic trading before the opening bell Wednesday. The company warned late Tuesday that the weakening European economy was weighing on results in the current quarter, and its predictions for profit and revenue fell short of Wall Street forecasts.

Much of Priceline's business is based on European travel.

Investors reacted so negatively to the results for several reasons, said Citi's Mark Mahaney in a note to clients. Priceline missed its high-end international bookings expectations for the first time in more than three years, its third-quarter expectations imply recession-level booking trends overseas and its domestic bookings fell under those of competitor Expedia Inc. for the second consecutive quarter.

Mahaney trimmed his earnings estimates for the year and cut his price target on the stock by 13 percent. But said he still thinks the shares a good value at their current level. At his new price target of $740, he's predicting a stock-market gain of nearly 9 percent from Tuesday's close of $679.80.

The analyst now believes Priceline will earn $30.19 per share in 2012, compared with an earlier estimate of $31.95. Analysts, on average, expect $31.02, according to FactSet. He also cut his earnings forecasts for the company through 2014.

Still, Mahaney said he remains upbeat about Priceline's long-term potential and kept his "Buy" rating on the stock. Growth in Asian and Latin America, new rental car offerings and U.S. hotel market share gains will drive the shares despite the slowdown in Europe, he said.

Shares dropped $101.05, or 15 percent, to $578.75 in premarket trading Wednesday. The stock has gained 45 percent this year.

Ahead of the Bell: Priceline.com

Posted: Aug 08, 2012 2:15 PM Updated: Aug 08, 2012 2:15 PM

NEW YORK (AP) - Shares of Priceline.com Inc. may be "dead money" in the near term, a Citi analyst on Wednesday, but he urged investors to pick up more shares in preparation for a recovery.

The Norwalk, Conn., discount travel website operator's stock tumbled 15 percent in electronic trading before the opening bell Wednesday. The company warned late Tuesday that the weakening European economy was weighing on results in the current quarter, and its predictions for profit and revenue fell short of Wall Street forecasts.

Much of Priceline's business is based on European travel.

Investors reacted so negatively to the results for several reasons, said Citi's Mark Mahaney in a note to clients. Priceline missed its high-end international bookings expectations for the first time in more than three years, its third-quarter expectations imply recession-level booking trends overseas and its domestic bookings fell under those of competitor Expedia Inc. for the second consecutive quarter.

Mahaney trimmed his earnings estimates for the year and cut his price target on the stock by 13 percent. But said he still thinks the shares a good value at their current level. At his new price target of $740, he's predicting a stock-market gain of nearly 9 percent from Tuesday's close of $679.80.

The analyst now believes Priceline will earn $30.19 per share in 2012, compared with an earlier estimate of $31.95. Analysts, on average, expect $31.02, according to FactSet. He also cut his earnings forecasts for the company through 2014.

Still, Mahaney said he remains upbeat about Priceline's long-term potential and kept his "Buy" rating on the stock. Growth in Asian and Latin America, new rental car offerings and U.S. hotel market share gains will drive the shares despite the slowdown in Europe, he said.

Shares dropped $101.05, or 15 percent, to $578.75 in premarket trading Wednesday. The stock has gained 45 percent this year.

ROUNDUP/Milliardenübernahme unter Reiseportalen: Priceline schluckt Kayak

Bei den Buchungsportalen für Hotels, Flüge und Mietautos werden die Karten neu gemischt: Priceline.com will den Konkurrenten Kayak für 1,8 Milliarden Dollar (1,4 Mrd Euro) kaufen. Die Verwaltungsräte beider US-Unternehmen seien sich einig über das Geschäft, erklärte Priceline am späten Donnerstag.

Kayak ist eine Preissuchmaschine für Reisen. Hier lassen sich Angebote zahlreicher Anbieter direkt miteinander vergleichen. Vor allem in den USA ist Kayak populär, es gibt aber auch eine deutschsprachige Website. Das Online-Reisebüro Priceline ist in Europa über die Tochter Booking.com aktiv.

Die Wettbewerbshüter und vor allem die Kayak-Aktionäre müssen bei der Übernahme noch mitziehen. Priceline bietet 500 Millionen Dollar in bar und den Rest der Summe in eigenen Aktien. Pro Kayak-Anteilsschein sollen 40 Dollar fließen, das ist ein Aufschlag von 29 Prozent auf den Schlusskurs vom Donnerstag. Die Aktie rückte nachbörslich entsprechend nach. Der Kurs der Priceline-Aktie sank dagegen leicht.

Kayak war erst im Juli an die Börse gegangen. Dass Priceline jetzt zuschlägt, wird als Angriff auf die Branchengröße Expedia gewertet. Konkurrent Expedia hatte seine Reisesuchmaschine und Bewertungsplattform abgespalten und Ende 2011 an die Börse gebracht. Priceline ist in den USA unter anderem durch Werbung mit "Raumschiff Enterprise"-Star William Shatner (Captain Kirk) bekanntgeworden.

Priceline-Chef Jeffery Boyd räumte in einem Interview mit dem "Wall Street Journal" zwar ein, dass man Kayak vor dem Börsengang hätten deutlich billiger kriegen können - die Aktie war damals noch zu einem Ausgabepreis von 26 Dollar verkauft worden. Zugleich fühle man sich als Investor jetzt viel sicherer, weil Kayak den harten Platzierungsprozess durchlebt habe. Boyd hob unter anderem die mobile Software von Kayak hervor./das/DP/stk

Bei den Buchungsportalen für Hotels, Flüge und Mietautos werden die Karten neu gemischt: Priceline.com will den Konkurrenten Kayak für 1,8 Milliarden Dollar (1,4 Mrd Euro) kaufen. Die Verwaltungsräte beider US-Unternehmen seien sich einig über das Geschäft, erklärte Priceline am späten Donnerstag.

Kayak ist eine Preissuchmaschine für Reisen. Hier lassen sich Angebote zahlreicher Anbieter direkt miteinander vergleichen. Vor allem in den USA ist Kayak populär, es gibt aber auch eine deutschsprachige Website. Das Online-Reisebüro Priceline ist in Europa über die Tochter Booking.com aktiv.

Die Wettbewerbshüter und vor allem die Kayak-Aktionäre müssen bei der Übernahme noch mitziehen. Priceline bietet 500 Millionen Dollar in bar und den Rest der Summe in eigenen Aktien. Pro Kayak-Anteilsschein sollen 40 Dollar fließen, das ist ein Aufschlag von 29 Prozent auf den Schlusskurs vom Donnerstag. Die Aktie rückte nachbörslich entsprechend nach. Der Kurs der Priceline-Aktie sank dagegen leicht.

Kayak war erst im Juli an die Börse gegangen. Dass Priceline jetzt zuschlägt, wird als Angriff auf die Branchengröße Expedia gewertet. Konkurrent Expedia hatte seine Reisesuchmaschine und Bewertungsplattform abgespalten und Ende 2011 an die Börse gebracht. Priceline ist in den USA unter anderem durch Werbung mit "Raumschiff Enterprise"-Star William Shatner (Captain Kirk) bekanntgeworden.

Priceline-Chef Jeffery Boyd räumte in einem Interview mit dem "Wall Street Journal" zwar ein, dass man Kayak vor dem Börsengang hätten deutlich billiger kriegen können - die Aktie war damals noch zu einem Ausgabepreis von 26 Dollar verkauft worden. Zugleich fühle man sich als Investor jetzt viel sicherer, weil Kayak den harten Platzierungsprozess durchlebt habe. Boyd hob unter anderem die mobile Software von Kayak hervor./das/DP/stk

Antwort auf Beitrag Nr.: 46.592.785 von R-BgO am 09.03.14 12:42:17na klar ...

habe nach langer Zdeit nochmal an die Aktie gedacht + nachgeschaut

und siehe da ... das Teil ist weiter gigantisch gestiegen ... Respekt

schön das Börse keine Einbahnstrasse ist .... der Megashort wird irgendwann starten

aber bis dahin geht es wohl noch ein Stück bergauf ... :O

Investor-Info

Priceline.com

Im Höhenflug

Die weltgrößte Online-Reiseagentur überzeugt seit Jahren mit kräftigen Wachstumsraten. Der eingeschlagene Kurs dürfte beibehalten werden: Von 2013 bis 2017 ist mit einer Umsatzverdopplung auf zehn Milliarden Euro zu rechnen. Der Gewinn wird voraussichtlich stärker auf knapp vier Milliarden Euro zulegen. Angesichts der Wachstumsraten ist die Aktie nicht zu teuer. Favorit im Online-Segment.

http://www.finanzen.net/nachricht/aktien/Tourismus-boomt-Rei…

habe nach langer Zdeit nochmal an die Aktie gedacht + nachgeschaut

und siehe da ... das Teil ist weiter gigantisch gestiegen ... Respekt

schön das Börse keine Einbahnstrasse ist .... der Megashort wird irgendwann starten

aber bis dahin geht es wohl noch ein Stück bergauf ... :O

Investor-Info

Priceline.com

Im Höhenflug

Die weltgrößte Online-Reiseagentur überzeugt seit Jahren mit kräftigen Wachstumsraten. Der eingeschlagene Kurs dürfte beibehalten werden: Von 2013 bis 2017 ist mit einer Umsatzverdopplung auf zehn Milliarden Euro zu rechnen. Der Gewinn wird voraussichtlich stärker auf knapp vier Milliarden Euro zulegen. Angesichts der Wachstumsraten ist die Aktie nicht zu teuer. Favorit im Online-Segment.

http://www.finanzen.net/nachricht/aktien/Tourismus-boomt-Rei…

Als Hotelfachmann bin ich total begeistert von Priceline.

Warum? Weil eigentlich fast jede Online Buchung für ein Hotelzimmer bei uns über booking.com reinkommt. Ich würde sogar schätzen, der Anteil liegt bei 90%. (Rest teilt sich Expedia mit HRS, sehr wenige von Orbitz)

1680 US$ Kursziel:

http://amigobulls.com/articles/priceline-q1-2014-beats-estim…

Viele Werte aus dem Nasdaq haben stark korrigiert, während Priceline eher wenig abgegeben hat. Da sieht man, dass die Big Boys in den USA den Wert weiterhin nach oben pushen werden. Seit dieser Woche bin ich auch investiert.

Warum? Weil eigentlich fast jede Online Buchung für ein Hotelzimmer bei uns über booking.com reinkommt. Ich würde sogar schätzen, der Anteil liegt bei 90%. (Rest teilt sich Expedia mit HRS, sehr wenige von Orbitz)

1680 US$ Kursziel:

http://amigobulls.com/articles/priceline-q1-2014-beats-estim…

Viele Werte aus dem Nasdaq haben stark korrigiert, während Priceline eher wenig abgegeben hat. Da sieht man, dass die Big Boys in den USA den Wert weiterhin nach oben pushen werden. Seit dieser Woche bin ich auch investiert.

priceline kauft Opentable: http://www.handelsblatt.com/unternehmen/handel-dienstleister…

Zahlen sind weiter bombastisch...

Bewertung immer noch sehr hoch, aber relativ günstiger werdend...

Bewertung immer noch sehr hoch, aber relativ günstiger werdend...

Antwort auf Beitrag Nr.: 47.825.264 von R-BgO am 19.09.14 14:34:56

wenn ebola ein thema wird/bleibt, gibt das hier ein Gemetzel.

Massive Reisebeschränkungen nicht nur, aber auch in Nordamerika, Einbruch bei Flugreisen, Hotel- und Mietwagenbuchungen, etc.

Zitat von R-BgO: Zahlen sind weiter bombastisch...

Bewertung immer noch sehr hoch, aber relativ günstiger werdend...

wenn ebola ein thema wird/bleibt, gibt das hier ein Gemetzel.

Massive Reisebeschränkungen nicht nur, aber auch in Nordamerika, Einbruch bei Flugreisen, Hotel- und Mietwagenbuchungen, etc.

Antwort auf Beitrag Nr.: 47.930.944 von Cashlover am 02.10.14 13:34:16das träfe andere aber härter als priceline...

Antwort auf Beitrag Nr.: 47.931.091 von R-BgO am 02.10.14 13:44:50

da hast du sicher recht, aber bei pcln dürfte, angesichts der Entwicklung der letzten 5 Jahre, eine hohe Tendenz zu Gewinnmitnahmen bestehen.

pcln war ja lange Zeit ein shortie-Massengrab, mich wundert bisschen, dass jetzt, wo es eine reale Gefahr für den Kurs gibt, hier keine Bären mehr aufkreuzen.

Zitat von R-BgO: das träfe andere aber härter als priceline...

da hast du sicher recht, aber bei pcln dürfte, angesichts der Entwicklung der letzten 5 Jahre, eine hohe Tendenz zu Gewinnmitnahmen bestehen.

pcln war ja lange Zeit ein shortie-Massengrab, mich wundert bisschen, dass jetzt, wo es eine reale Gefahr für den Kurs gibt, hier keine Bären mehr aufkreuzen.

War auch draußen und langsam wird die Aktie wieder fair bewertet, würde aber noch versuchen den Boden abzuwarten.

Hier noch eine Analyse zu Priceline:

http://www.investresearch.net/priceline-aktie/

Hier noch eine Analyse zu Priceline:

http://www.investresearch.net/priceline-aktie/

ziemlich zurück gekommen vom Hoch ...

wird noch weiter gehen nach einer Pause

wird noch weiter gehen nach einer Pause

Kurs jetzt über 1.000 Euro!

Zahlen kamen heute, ein weiteres Mal bombastisch stark.

So langsam traue ich ihnen zu, sich auch auf Dauer gegen Google behaupten zu können...

Zahlen kamen heute, ein weiteres Mal bombastisch stark.

So langsam traue ich ihnen zu, sich auch auf Dauer gegen Google behaupten zu können...

Ja im Hotelbereich deutet es sich an, dass Booking den Markt dominieren wird und mit Opentable und Kayak haben sie weitere starke Marken und Produkte!

The Priceline Group Announces Additional Investment in Ctrip

May 26, 2015NORWALK, Conn., May 26, 2015 /PRNewswire/ -- The Priceline Group Inc. (NASDAQ: PCLN) today announced that it will invest an additional $250 million in Ctrip.com International, Ltd. (NASDAQ: CTRP) ("Ctrip"), China's leading online travel company. The investment will be made via a convertible bond and Ctrip has granted permission to The Priceline Group to increase its ownership in Ctrip through the acquisition of Ctrip's American depositary shares in the open market so that, when combined with the shares issuable upon conversion of the new bond and the $500 million convertible bond issued to The Priceline Group in August 2014, The Priceline Group may hold up to 15% of Ctrip's outstanding shares.

This investment follows a commercial relationship established between the two companies in 2012, which was expanded in August 2014 along with the $500 million investment by The Priceline Group. Immediately following issuance of the new $250 million bond and assuming conversion of the two bonds, The Priceline Group will own securities representing approximately 10.5% of Ctrip's outstanding shares.

The two companies will continue their existing commercial partnership, whereby accommodations inventory is cross-promoted between the brands.

"Ctrip continues to be a very important partner for The Priceline Group in China, and we look forward to continuing to build upon that partnership," said Darren Huston, CEO of Booking.com and President & CEO of The Priceline Group. "We consider Ctrip a market leader in China and we're investing in a company and a team that we believe fits well with our long-term view of China as a market and the Chinese people as global travelers."

James Liang, Chairman and CEO of Ctrip said, "Today's news aligns with our continued commitment to drive our existing commercial agreement with The Priceline Group forward in order to deliver more value for travelers seeking great accommodations all over the world."

Antwort auf Beitrag Nr.: 49.121.633 von R-BgO am 19.02.15 19:52:19

Wie siehst du das Wachstum in den kommenden Jahren? Ist eine allmähliche Marktsättigung erkennbar?

Netflix ist auch profitabel, hat aber höherere Bewertungen. hast du auch eine Einschätzung zu Netflix?

In wie weit konkurrieren die mit Google?

Priceline ist sehr profitabel im Unterschied zu Tesla oder Twitter.Wie siehst du das Wachstum in den kommenden Jahren? Ist eine allmähliche Marktsättigung erkennbar?

Netflix ist auch profitabel, hat aber höherere Bewertungen. hast du auch eine Einschätzung zu Netflix?

Antwort auf Beitrag Nr.: 49.856.089 von R-BgO am 27.05.15 12:55:58

Betrachtet man die vergangenen Jahre...

dann geht das Umsatzwachstum langam zurück, das Gewinn ist tendenziell höher und liegt konstant bei ca. 30%.

Antwort auf Beitrag Nr.: 49.887.910 von kainza am 01.06.15 12:22:13

Antwort: bisher wohl noch eher wenig, aber es besteht ein Dauerrisiko, dass das zur Gefahr wird (siehe z.B. kürzlich Änderung des Algorithmus für die Ad-Präsentation, die zumindest von einigen Playern als Problem thematisiert wurde);

sehe priceline aber als einen der Stärksten Marktteilnehmer und würde deswegen Probleme bei ihnen zuletzt erwarten

wichtig ist auch, dass ein großerTeil des Traffics inzwischen direkt auf die PCL-Seiten zu gehen scheint und nicht erst über GOOG läuft...

würde die Frage eher umgekehrt stellen:

inwieweit konkurriert Google mit priceline?Antwort: bisher wohl noch eher wenig, aber es besteht ein Dauerrisiko, dass das zur Gefahr wird (siehe z.B. kürzlich Änderung des Algorithmus für die Ad-Präsentation, die zumindest von einigen Playern als Problem thematisiert wurde);

sehe priceline aber als einen der Stärksten Marktteilnehmer und würde deswegen Probleme bei ihnen zuletzt erwarten

wichtig ist auch, dass ein großerTeil des Traffics inzwischen direkt auf die PCL-Seiten zu gehen scheint und nicht erst über GOOG läuft...

Antwort auf Beitrag Nr.: 49.887.910 von kainza am 01.06.15 12:22:13Thread: Netflix - Internet-DVD-Verleiher

Umsatzwachstum und Gewinnwachstum immer noch dick im zweistelligen Bereich

Aber die Aktie läuft seit 2 Jahren fast seitwärts. Wann kommt der nächste Ausbruch? Ich sehe Einstiegskurse. Auf USD-Basis laufen wir seit 2 Jahren seitwärts.

Nur der schwache Euro hat einen leichten Anstieg bewirkt.Für Priceline ist aber der $ maßgebend. Daher verstehe ich

nicht, dass so ein guter Wachstumswert seit 2 Jahren auf der

Stelle tritt.

In dieser Zeit wachsen Umsatz und Gewinn von Priceline jeweils

um ca. 50%. Das zweistellige Wachstum soll auch weitergehen.

Für mich nur eine Frage der Zeit, dass Priceline einen Ausbruch startet.

Das Wachstum hatte sich in diesem Jahr etwas verringert. Dies zeigten die 9 Monatszahlen.

Nur noch knapp zweistelliger Zuwachs.

Tendenz oder einmalig?

Nur noch knapp zweistelliger Zuwachs.

Tendenz oder einmalig?

Infos zum C-trip Engagement

http://ir.pricelinegroup.com/secfiling.cfm?filingid=1104659-… Airbnb eine Bedrohung?:

http://www.valuewalk.com/2015/11/airbnb-hurting-hotels/

Antwort auf Beitrag Nr.: 51.332.874 von R-BgO am 18.12.15 13:07:34

Wenn jemand bei Priceline nicht mehr bucht, dann fällt der Umsatz doch auch beim Hotel weg.

Verstehe ich nicht ganz..

warum sollen Hotels weniger betroffen sein als die Buchungsplattform?Wenn jemand bei Priceline nicht mehr bucht, dann fällt der Umsatz doch auch beim Hotel weg.

Antwort auf Beitrag Nr.: 51.345.516 von kainza am 21.12.15 11:59:01einfach den Artikel lesen...

dann versteht man es

dann versteht man es

Antwort auf Beitrag Nr.: 51.346.707 von R-BgO am 21.12.15 15:16:40

AirBnB greift also tiefer in das Geschäftsmodel von Priceline ein.

Priceline stockte erst bei Ctrip auf.

Bin gespannt, wann AirBnB an die Börse kommt.

O.K.

ist das der Grund, dass sich Priceline nicht mehr so gut entwickelt (auf Dollarniveau laufen die seitwärts)?AirBnB greift also tiefer in das Geschäftsmodel von Priceline ein.

Priceline stockte erst bei Ctrip auf.

Bin gespannt, wann AirBnB an die Börse kommt.

Priceline wirbt Personal von Salesforce ab....

Lynn M. Vojvodich Named to The Priceline Group's Board of DirectorsNORWALK, Conn., Dec. 21, 2015 /PRNewswire/ -- The Board of Directors of The Priceline Group Inc. (NASDAQ: PCLN) today announced that it has named Lynn M. Vojvodich, Executive Vice President and Chief Marketing officer of salesforce.com, inc., as The Priceline Group's newest Director, effective January 1, 2016.

Ms. Vojvodich, who has served as the Chief Marketing Officer of salesforce.com, since 2013, leads the company's global marketing organization and is responsible for driving market leadership, global awareness, demand generation, strategic events and communications. Prior to her role at salesforce.com, Ms. Vojvodich served as a partner at Andreessen Horowitz where she helped companies build their go-to-market strategies. Ms. Vojvodich has served in various roles at organizations including Bain & Company, Microsoft, and Terracotta—where she held her first Chief Marketing Officer role. Ms. Vojvodich began her career as a mechanical engineer after receiving her undergraduate degree at Stanford University in Product Design and Mechanical Engineering. She also holds an MBA from Harvard Business School.

"An engineer by training, Lynn is analytical and data-driven, and as a marketer, she knows how to apply these skills to shape the customer experience," said Jeff Boyd, Chairman of The Priceline Group. "Her 20+ years of experience will bring tremendous value to our Board and we are thrilled to welcome Lynn to the team."

"The Priceline Group is one of the largest ecommerce companies globally, focused on the intersection of data science and customer experience through six brands that have immense potential," said Vojvodich. "I am thrilled to join such a great company and honored to serve on its esteemed Board."

About The Priceline Group

The Priceline Group (NASDAQ: PCLN) is the world leader in online travel and related services, provided to consumers and local partners in over 220 countries and territories through six primary brands: Booking.com, priceline.com, KAYAK, agoda.com, rentalcars.com and OpenTable. The Priceline Group's mission is to help people experience the world. For more information visit PricelineGroup.com.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/lynn-m-vojvodich-nam…

SOURCE The Priceline Group

Solange Priceline nicht solche Schlagzeilen provoziert, bin ich ganz entspsannt ...

http://www.stern.de/panorama/stern-crime/airbnb--deutsche-to…

http://www.stern.de/panorama/stern-crime/airbnb--deutsche-to…

Antwort auf Beitrag Nr.: 51.359.028 von elmago am 23.12.15 11:26:56

AMSTERDAM, December 23, 2015 /PRNewswire/ --

Today the German competition authority, the Bundeskartellamt (BKartA) issued a prohibition decision against Booking.com, an operating business of The Priceline Group [NASDAQ: PCLN], in respect of its narrow MFN clauses in its agreements with accommodation partners in Germany. Booking.com strongly contests the BKartA's arguments and intends to appeal the BKartA's decision.

The BKartA is the sole competition authority in Europe to prohibit narrow parity clauses in agreements between online travel companies and hotels.

The national competition authorities (NCAs) in France, Italy, Sweden, Ireland, the UK, Poland, Greece, Denmark, Hungary, the Netherlands and Switzerland have all publicly stated that the changes that Booking.com made to its agreements with hotels in July 2015 to remove its 'wide price parity' and availability parity clauses satisfied their competition concerns. These changes were made pursuant to the narrow MFN commitments accepted by the French, Italian and Swedish competition authorities in April 2015 which were found to promote a more competitive environment for online travel companies to the benefit of hotels and consumers.

There are no material characteristics of the German market that distinguish it from the online travel company markets in France, Italy and Sweden that justify the BKartA taking a different approach from the NCAs in those countries and others across Europe.

"We believe this decision is flawed because it does not recognize the immense benefits that online travel brands like Booking.com bring to both consumers and accommodations," said Gillian Tans, President of Booking.com. "Companies like ours bring transparency, choice and value to global travellers by aggregating information for hundreds of thousands of properties. We do not only save consumers time and money, we serve as a highly cost-efficient marketing channel for most hotels that could not otherwise afford to market their brand to domestic and international consumers. Narrow parity was put in place to ensure that consumers don't have to check hundreds of hotel websites in order to get the best price, allowing sites like Booking.com and others to achieve advertising efficiencies on behalf of hotels."

Booking.com strongly believes it can continue to add value to its hotel partners and offer customers the best booking experience. Booking.com will continue to work with hotel partners to offer their rooms at highly competitive prices. Booking.com has full confidence that hotels will reward Booking.com with the best rates, conditions and availability in return for the variety of customers it can deliver. By being able to offer highly competitive rates, consumers can conveniently and efficiently make a booking through Booking.com with a hotel of their choice. The diversity and quality of hotels available on Booking.com mean that a customer can always find a hotel which meets their needs, for the right price. To show our confidence in being able to offer the best price, Booking.com guarantees that it will match the price difference under its Best Price Guarantee.

The reasoning and key conclusions in the BKartA's decision are not only in direct conflict with the findings of the French, Italian and Swedish NCAs (as supported or endorsed by a majority of the NCAs in Europe). Booking.com believes that the BKartA has failed to conduct a proper investigation of the competitive effects of the narrow MFN. The BKartA decision to prohibit the narrow MFN is heavily reliant on the conclusions in the HRS case - which was in relation to wide MFNs. The BKartA has simply ignored, without any justification, the substantial body of evidence submitted by Booking.com which shows that the narrow MFN does not restrict competition and is actually pro-competitive by bringing about substantial efficiency benefits for hotels and consumers. Moreover, BKartA has failed to coordinate with other NCAs and failed to ensure uniform application of competition law across the EU.

Booking.com will, however, co-operate with the BKartA's order to remove narrow MFNs from its contracts with German accommodations, pending the outcome of Booking.com's appeal of the BKartA's decision. Booking.com will waive enforcement of its existing narrow parity provisions with German accommodations with immediate effect and will amend its standard terms and other agreements with German accommodations ultimately by 31 January 2016. Booking.com will nonetheless work hard with all hotels to ensure the best customer experience on Booking.com.

Elsewhere in Europe, Booking.com continues to retain its narrow MFN for prices and booking conditions - meaning that hotels must offer the same rates and booking conditions on Booking.com as they do on their own direct online channels or as marketed by the hotel online (e.g., hotel's own websites or meta search engine).

FOR PRESS INFORMATION:

Booking.com is the world leader in booking hotel and other accommodations online. It guarantees the best prices for any type of property - from small independents to five-star luxury. Guests can access the Booking.com website anytime, anywhere from their desktops, mobile phones and tablet devices, and they don't pay booking fees - ever. The Booking.com website is available in 42 languages, offers over 840,000 hotels and accommodations including more than 390,000 vacation rental properties and covers over 83,000 destinations in 221+ countries and territories worldwide. It features over 65 million reviews written by guests after their stay, and attracts online visitors from both leisure and business markets around the globe. With over 17 years of experience and a team of over 10,000 dedicated employees in 173+ offices worldwide, Booking.com operates its own in-house customer service team, which is available 24/7 to assist guests in their native languages and ensure an exceptional customer experience.

Established in 1996, Booking.com B.V. owns and operates Booking.com™, and is part of The Priceline Group (NASDAQ: PCLN). Follow us on Twitter, Google+ and Pinterest, like us on Facebook, or learn more at http://www.booking.com.

Booking.com Public Relations: mediarelations@booking.com

Priceline Group Public Relations: Leslie Cafferty - leslie.cafferty@pricelinegroup.com

Da sind andere Probleme...

Booking.com Announces Intent to Appeal Bundeskartellamt RulingAMSTERDAM, December 23, 2015 /PRNewswire/ --

Today the German competition authority, the Bundeskartellamt (BKartA) issued a prohibition decision against Booking.com, an operating business of The Priceline Group [NASDAQ: PCLN], in respect of its narrow MFN clauses in its agreements with accommodation partners in Germany. Booking.com strongly contests the BKartA's arguments and intends to appeal the BKartA's decision.

The BKartA is the sole competition authority in Europe to prohibit narrow parity clauses in agreements between online travel companies and hotels.

The national competition authorities (NCAs) in France, Italy, Sweden, Ireland, the UK, Poland, Greece, Denmark, Hungary, the Netherlands and Switzerland have all publicly stated that the changes that Booking.com made to its agreements with hotels in July 2015 to remove its 'wide price parity' and availability parity clauses satisfied their competition concerns. These changes were made pursuant to the narrow MFN commitments accepted by the French, Italian and Swedish competition authorities in April 2015 which were found to promote a more competitive environment for online travel companies to the benefit of hotels and consumers.

There are no material characteristics of the German market that distinguish it from the online travel company markets in France, Italy and Sweden that justify the BKartA taking a different approach from the NCAs in those countries and others across Europe.

"We believe this decision is flawed because it does not recognize the immense benefits that online travel brands like Booking.com bring to both consumers and accommodations," said Gillian Tans, President of Booking.com. "Companies like ours bring transparency, choice and value to global travellers by aggregating information for hundreds of thousands of properties. We do not only save consumers time and money, we serve as a highly cost-efficient marketing channel for most hotels that could not otherwise afford to market their brand to domestic and international consumers. Narrow parity was put in place to ensure that consumers don't have to check hundreds of hotel websites in order to get the best price, allowing sites like Booking.com and others to achieve advertising efficiencies on behalf of hotels."

Booking.com strongly believes it can continue to add value to its hotel partners and offer customers the best booking experience. Booking.com will continue to work with hotel partners to offer their rooms at highly competitive prices. Booking.com has full confidence that hotels will reward Booking.com with the best rates, conditions and availability in return for the variety of customers it can deliver. By being able to offer highly competitive rates, consumers can conveniently and efficiently make a booking through Booking.com with a hotel of their choice. The diversity and quality of hotels available on Booking.com mean that a customer can always find a hotel which meets their needs, for the right price. To show our confidence in being able to offer the best price, Booking.com guarantees that it will match the price difference under its Best Price Guarantee.

The reasoning and key conclusions in the BKartA's decision are not only in direct conflict with the findings of the French, Italian and Swedish NCAs (as supported or endorsed by a majority of the NCAs in Europe). Booking.com believes that the BKartA has failed to conduct a proper investigation of the competitive effects of the narrow MFN. The BKartA decision to prohibit the narrow MFN is heavily reliant on the conclusions in the HRS case - which was in relation to wide MFNs. The BKartA has simply ignored, without any justification, the substantial body of evidence submitted by Booking.com which shows that the narrow MFN does not restrict competition and is actually pro-competitive by bringing about substantial efficiency benefits for hotels and consumers. Moreover, BKartA has failed to coordinate with other NCAs and failed to ensure uniform application of competition law across the EU.

Booking.com will, however, co-operate with the BKartA's order to remove narrow MFNs from its contracts with German accommodations, pending the outcome of Booking.com's appeal of the BKartA's decision. Booking.com will waive enforcement of its existing narrow parity provisions with German accommodations with immediate effect and will amend its standard terms and other agreements with German accommodations ultimately by 31 January 2016. Booking.com will nonetheless work hard with all hotels to ensure the best customer experience on Booking.com.

Elsewhere in Europe, Booking.com continues to retain its narrow MFN for prices and booking conditions - meaning that hotels must offer the same rates and booking conditions on Booking.com as they do on their own direct online channels or as marketed by the hotel online (e.g., hotel's own websites or meta search engine).

FOR PRESS INFORMATION:

Booking.com is the world leader in booking hotel and other accommodations online. It guarantees the best prices for any type of property - from small independents to five-star luxury. Guests can access the Booking.com website anytime, anywhere from their desktops, mobile phones and tablet devices, and they don't pay booking fees - ever. The Booking.com website is available in 42 languages, offers over 840,000 hotels and accommodations including more than 390,000 vacation rental properties and covers over 83,000 destinations in 221+ countries and territories worldwide. It features over 65 million reviews written by guests after their stay, and attracts online visitors from both leisure and business markets around the globe. With over 17 years of experience and a team of over 10,000 dedicated employees in 173+ offices worldwide, Booking.com operates its own in-house customer service team, which is available 24/7 to assist guests in their native languages and ensure an exceptional customer experience.

Established in 1996, Booking.com B.V. owns and operates Booking.com™, and is part of The Priceline Group (NASDAQ: PCLN). Follow us on Twitter, Google+ and Pinterest, like us on Facebook, or learn more at http://www.booking.com.

Booking.com Public Relations: mediarelations@booking.com

Priceline Group Public Relations: Leslie Cafferty - leslie.cafferty@pricelinegroup.com

Antwort auf Beitrag Nr.: 51.359.028 von elmago am 23.12.15 11:26:56

Das sind die netten Überraschungen...

AirBnB hat ja schon eine gigantische vorbörsliche Bewertung...

im Nov noch bei fast 1470 USD + total überbewertet ...

nun 1014 USD + bald wieder bei 500 USD ........

Mahlzeit ..

nun 1014 USD + bald wieder bei 500 USD ........

Mahlzeit ..

Antwort auf Beitrag Nr.: 51.672.424 von Elrond am 05.02.16 21:57:27

das lehrt Dich vielleicht Demut

Wie "ermittelst" Du denn eigentlich dass PCLN "überbewertet" ist?

bei 500$ hätten wir ein KGV von rund 10; ich wäre da definitiv auf der Käuferseite...

kleiner Tipp:

lies' Dir mal Deine eigenen Postings weiter oben im Thread durch;das lehrt Dich vielleicht Demut

Wie "ermittelst" Du denn eigentlich dass PCLN "überbewertet" ist?

bei 500$ hätten wir ein KGV von rund 10; ich wäre da definitiv auf der Käuferseite...

Trotz gestiegenem Dollar und Konkurrenz vor allem durch AirBnB hat Priceline die Analystenschätzungen (11.80 $) mit 12.63 $ für Q4 in 2015 übertroffen.

Der Ausblick für das laufende Quartal ist ebenfalls gut.

Schaumermal wie PCLN heute an Wall Street abgeht

Der Ausblick für das laufende Quartal ist ebenfalls gut.

Schaumermal wie PCLN heute an Wall Street abgeht

Antwort auf Beitrag Nr.: 51.767.683 von elmago am 17.02.16 14:24:27

wo ist Elrond?

die spitzen Ohren polieren...?

Ja ist eine top Firma und dafür fair bewertet. Bin da mit meinem Wiki Digitale Revolution auch dabei. Das Hotelbuchungsgeschäft ist einfach eine Gelddruckmaschine

Immer noch unterm fairen KGV von 32:

wusste ich nicht:

http://www.nytimes.com/2011/05/08/travel/08prac-grouptravel.…However, most do-it-yourself planners head straight to the Internet. The go-to site is Hotelplanner.com, which specializes in group bookings (Kayak and Travelocity use it for their group hotel arrangements, as well). Fill in your preferences and Hotelplanner will return bids from its 40,000 partner hotels, which include InterContinental, Hilton, Starwood, Best Western and Hyatt. “All of our rates need to be lower than what that hotel is offering as an individual rate on that day,” said Tim Hentschel, the site’s chief executive. What’s more, Hotelplanner offers rate protection if prices drop, and also has some cash-back promotions.

Is a Priceline Acquisition of TripAdvisor Becoming More Feasible?

Rani Molla and Tara Lachapelle, Bloomberg - Jun 06, 2016 6:00 pm

https://skift.com/2016/06/06/is-a-priceline-acquisition-of-t…

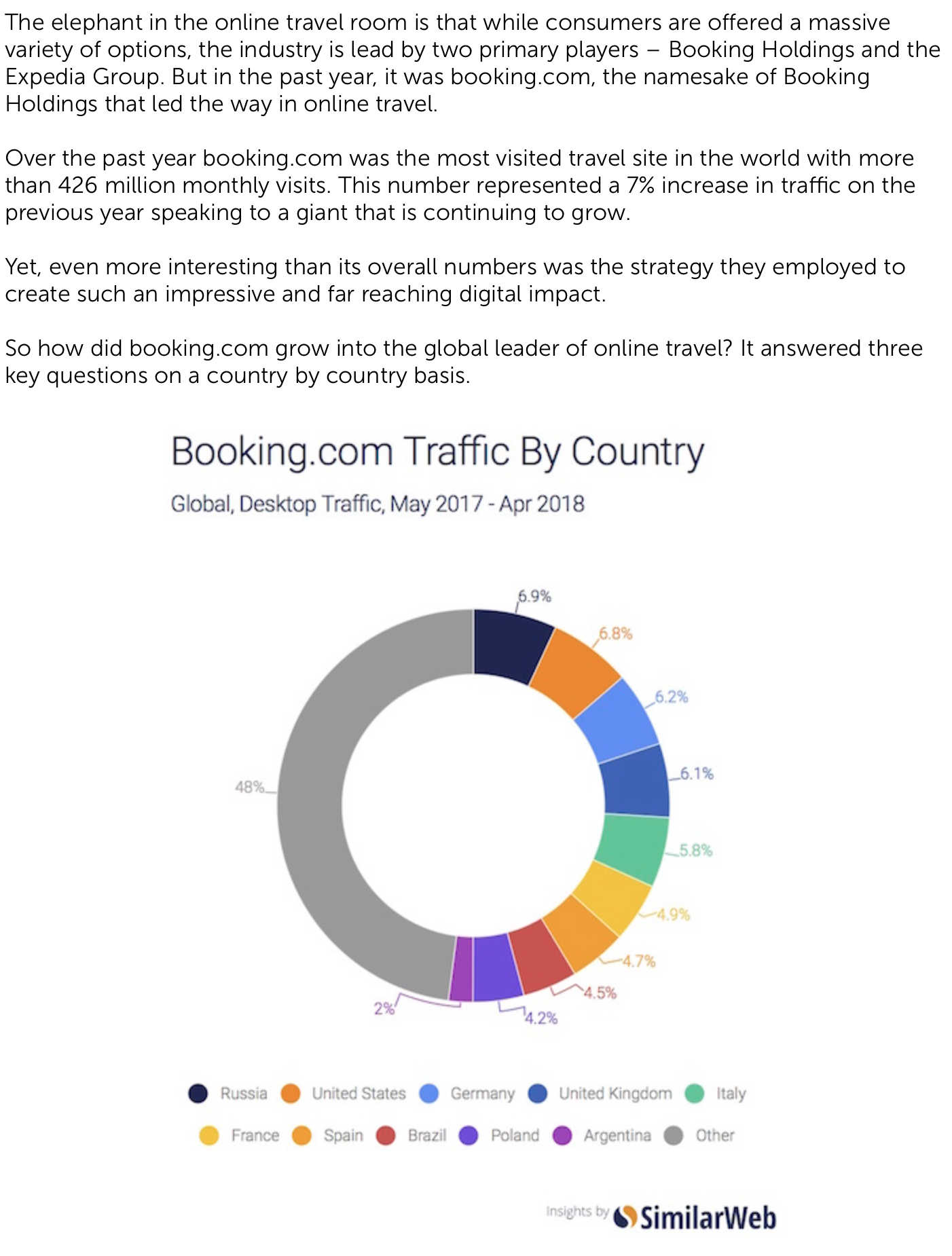

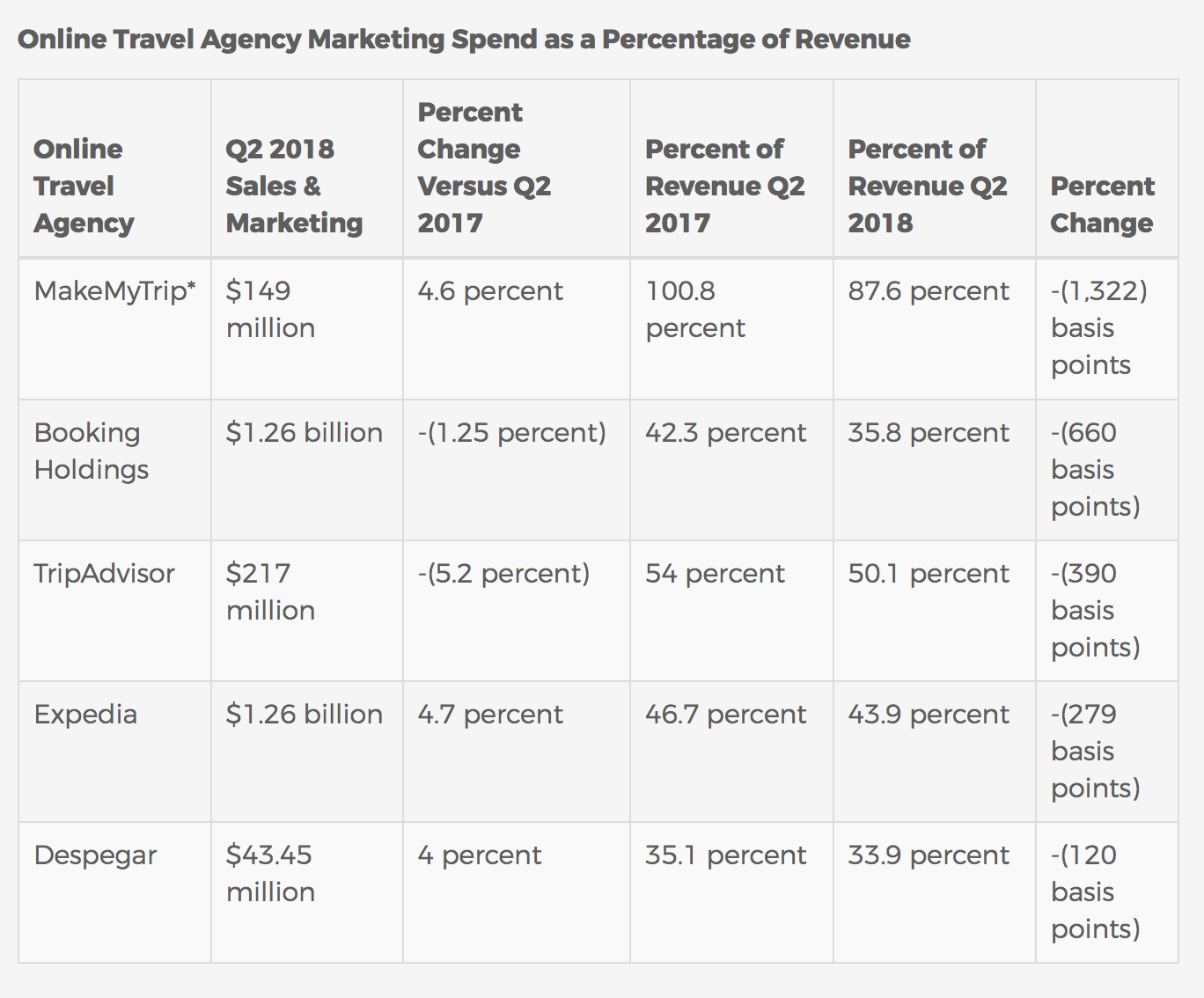

Priceline Group is a huge internet company that continues to grow, is immensely profitable and usually over-delivers on its forecasts. Yet cutthroat competition in the online travel industry has left its stock looking dull lately.

The $64 billion behemoth and its fiercest rival, $16 billion Expedia, have been going head to head for the best assets, as newer vacation-rental entrants like HomeAway and Airbnb — valued at almost $26 billion in its latest funding round — take some market share. Most of the big takeover candidates have already been bought up: Kayak and Booking.com are owned by Priceline, which has also been investing in businesses abroad such as China’s Ctrip.com, while Travelocity, Orbitz and HomeAway have all sold to Expedia. In fact, the September completion of the Orbitz deal allowed Expedia to reclaim the No. 1 position in online bookings.

Priceline sought to broaden its reach in 2014 by acquiring OpenTable, a restaurant-booking service rather than a travel site. But as you can see in the chart below, that pricey $2.4 billion acquisition has had little impact on Priceline shares. They’ve risen about 7 percent since the deal closed, compared with a 36 percent surge in Expedia’s stock over the span.

It hasn’t helped that France, a major travel destination, was the target of terrorist attacks in November, and that China’s smog is turning off tourists. But to boot, Priceline’s CEO resigned in April after the company learned that he had an inappropriate relationship with an employee. And last week, the head of the Priceline.com unit also quit for a job outside of the travel industry. Jeffrey Boyd, Priceline’s chairman who was previously CEO from 2002 to 2013, is running the company while the board searches for a permanent CEO replacement.

On the one hand, Boyd may not want to make any big changes ahead of new management coming in. However, no one knows the company better than he does and there’s a deal opportunity he might not want to miss — or let Expedia get a hold of. That would be TripAdvisor.

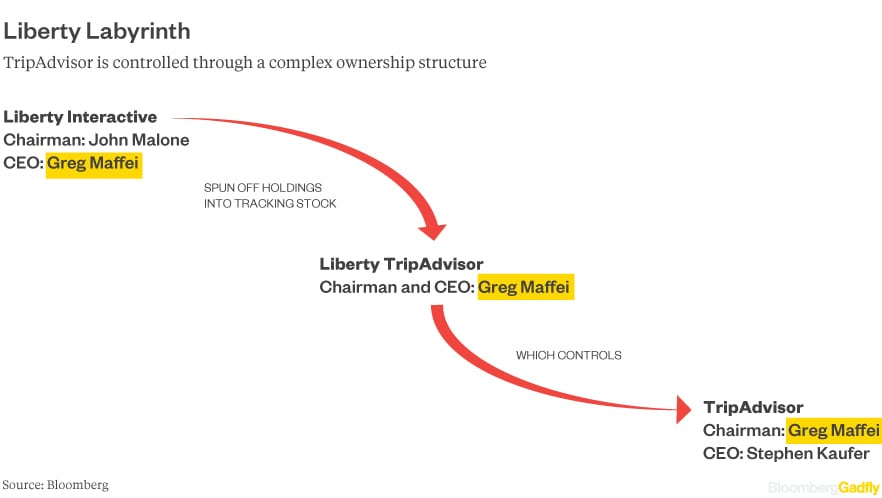

Valued at $10 billion, TripAdvisor (ticker symbol TRIP) is the industry’s last major publicly traded target in the U.S. The business was actually spun off from Expedia in 2011 because it had been growing far faster than Expedia’s main operations. But now, the trend is moving back toward consolidation and scale — and no doubt both Priceline and Expedia have had their eye on TripAdvisor. Investors in this space need something to get excited about, and recent weakness in TripAdvisor’s shares (mostly due to the aforementioned industry headwinds) means it may be a good time to pounce.

Expedia and TripAdvisor are still somewhat connected. Billionaires John Malone and Barry Diller control Expedia, while Malone’s business partner Greg Maffei effectively controls TripAdvisor through the Liberty TripAdvisor tracking stock, which was created in 2014 — a move that some thought signaled Malone and Maffei were opening the door to some sort of deal. That said, the ownership structure does make an acquisition of TripAdvisor a bit more complex than a typical M&A transaction.

Furthermore, even though TripAdvisor’s shares (and the tracking stock) have dropped 20 percent this year, a takeover still wouldn’t be cheap. The company is valued at 34 times its trailing 12-month Ebitda, a slightly higher multiple than Kayak fetched in its sale to Priceline. And with a takeover premium, a TripAdvisor acquisition would be nearing the steep 45 times Ebitda that Priceline paid for OpenTable. But in return, a buyer — be it Priceline or Expedia — could gain precious market share and expand its global footprint:

Whether Malone, Maffei and Boyd would work out a deal is just speculation at this point. But Priceline could use some excitement, perhaps in the form of a TRIP.

Rani Molla and Tara Lachapelle, Bloomberg - Jun 06, 2016 6:00 pm

https://skift.com/2016/06/06/is-a-priceline-acquisition-of-t…

Priceline Group is a huge internet company that continues to grow, is immensely profitable and usually over-delivers on its forecasts. Yet cutthroat competition in the online travel industry has left its stock looking dull lately.

The $64 billion behemoth and its fiercest rival, $16 billion Expedia, have been going head to head for the best assets, as newer vacation-rental entrants like HomeAway and Airbnb — valued at almost $26 billion in its latest funding round — take some market share. Most of the big takeover candidates have already been bought up: Kayak and Booking.com are owned by Priceline, which has also been investing in businesses abroad such as China’s Ctrip.com, while Travelocity, Orbitz and HomeAway have all sold to Expedia. In fact, the September completion of the Orbitz deal allowed Expedia to reclaim the No. 1 position in online bookings.

Priceline sought to broaden its reach in 2014 by acquiring OpenTable, a restaurant-booking service rather than a travel site. But as you can see in the chart below, that pricey $2.4 billion acquisition has had little impact on Priceline shares. They’ve risen about 7 percent since the deal closed, compared with a 36 percent surge in Expedia’s stock over the span.