Axmin - Goldjunior in Afrika - 500 Beiträge pro Seite

eröffnet am 21.11.10 11:54:43 von

neuester Beitrag 29.05.19 14:39:50 von

neuester Beitrag 29.05.19 14:39:50 von

Beiträge: 441

ID: 1.161.345

ID: 1.161.345

Aufrufe heute: 0

Gesamt: 19.562

Gesamt: 19.562

Aktive User: 0

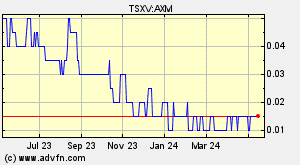

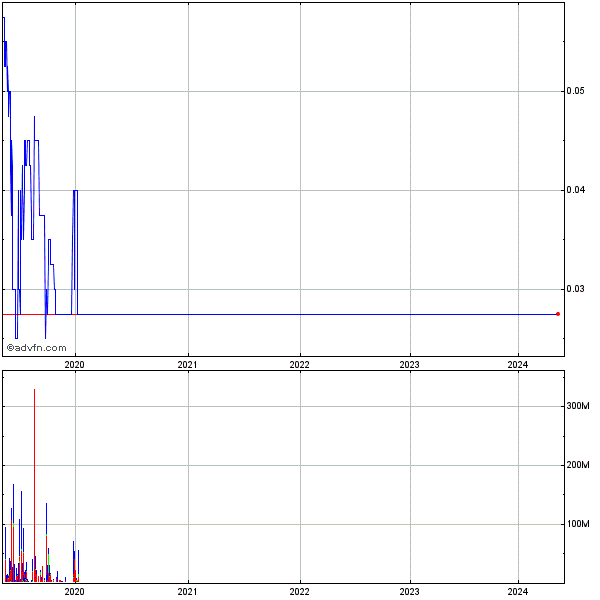

ISIN: CA05461V2012 · WKN: A1JUGD

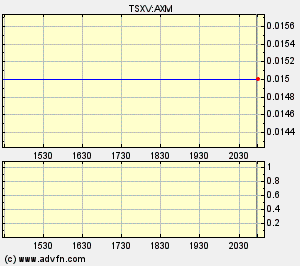

0,0105

EUR

+20,00 %

+0,0018 EUR

Letzter Kurs 11:11:44 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,1500 | +21,75 | |

| 0,5800 | +16,00 | |

| 0,5025 | +14,46 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2090 | -5,91 | |

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 1,1500 | -9,45 | |

| 3,3200 | -9,78 |

http://www.stockhouse.com/tools/?page=%2FFinancialTools%2Fsn…

http://www.axmininc.com/site/OperationsProjectsnbsp/Resource…

Axmin ist ein Invest wert, wenn Gold weiter mitspielt.

Start Ende 2012/2013 geplant.

Kurschance vs. noch ausstehende Finanzierungen müsste man noch mal abwägen, aber selbst dieses Risiko ist vertret- und (im Worst Case) aussitzbar.

http://www.axmininc.com/site/OperationsProjectsnbsp/Resource…

Axmin ist ein Invest wert, wenn Gold weiter mitspielt.

Start Ende 2012/2013 geplant.

Kurschance vs. noch ausstehende Finanzierungen müsste man noch mal abwägen, aber selbst dieses Risiko ist vertret- und (im Worst Case) aussitzbar.

aktuelle MarketCap ist schon etwas höher, als in der Präsentation (stammt aus dem August)

AXM is Trading with a Markete Cap of $75 Million

16.8 million tonnes Proven & Probable mineral resource at a grade of 2.4 g/t for 1.28 million oz of gold

35.5 million tonnes of Measured & indicated mineral resources at a grade of 2.1 g/t for 2.40 million oz of gold

30.1 million tonnes of inferred mineral resources at a grade of 1.6 g/t for 1.97 million oz of gold

Updated Bankabale feasibility due soon for 200,000 oz Production Model per annum

AXM is Trading with a Markete Cap of $75 Million

16.8 million tonnes Proven & Probable mineral resource at a grade of 2.4 g/t for 1.28 million oz of gold

35.5 million tonnes of Measured & indicated mineral resources at a grade of 2.1 g/t for 2.40 million oz of gold

30.1 million tonnes of inferred mineral resources at a grade of 1.6 g/t for 1.97 million oz of gold

Updated Bankabale feasibility due soon for 200,000 oz Production Model per annum

Antwort auf Beitrag Nr.: 40.561.138 von XIO am 21.11.10 12:04:41siehe auch dazu hier.

http://shareknow.net/companies/1170

bei Summary einen Haken rein und Calculate klickern

http://shareknow.net/companies/1170

bei Summary einen Haken rein und Calculate klickern

Ein Investment kommt für mich nicht in Frage. Sieht sehr riskant aus. Hier ist viel Spekulation im Spiel.

Antwort auf Beitrag Nr.: 40.561.818 von Aktienkrieger am 21.11.10 15:52:38Ich sehe die grössten Risiken:

1. Goldpreis... alles über 1.200 ist psychiologisch ok, darunter besteht die Gefahr, auf 800 USD abzutauchen.

2. Einhaltung des Zeitplans: enorm wichtig für das Anlegervertrauen in das Management

3. Finanzbedarf: hier kann man sich gut an Semafo und Avion orientieren.

4. politische bedingungen können sich ändern, vor allem wenn externe Großereignisse, wie die letzte krise eintreten.

Ich sags mal, wie ich das sehe: Avion folgt Semafo und Axmin folgt Avion.

als ich auf semafo aufmerksam wurde, lag der Kurs bei unter 1 CAD und war schon mal bei 4 CAD.

Sobald die Produktion in trockenen Tüchern war, ging es nur noch aufwärts.

1. Goldpreis... alles über 1.200 ist psychiologisch ok, darunter besteht die Gefahr, auf 800 USD abzutauchen.

2. Einhaltung des Zeitplans: enorm wichtig für das Anlegervertrauen in das Management

3. Finanzbedarf: hier kann man sich gut an Semafo und Avion orientieren.

4. politische bedingungen können sich ändern, vor allem wenn externe Großereignisse, wie die letzte krise eintreten.

Ich sags mal, wie ich das sehe: Avion folgt Semafo und Axmin folgt Avion.

als ich auf semafo aufmerksam wurde, lag der Kurs bei unter 1 CAD und war schon mal bei 4 CAD.

Sobald die Produktion in trockenen Tüchern war, ging es nur noch aufwärts.

Antwort auf Beitrag Nr.: 40.562.279 von XIO am 21.11.10 17:58:31Hi

Mal eine frage.

Ist der verkauf vom Kofi gold proj. , an avr schon durch ???

Find auf der HP nichts diesbezueglich.

Gruss

Mal eine frage.

Ist der verkauf vom Kofi gold proj. , an avr schon durch ???

Find auf der HP nichts diesbezueglich.

Gruss

Antwort auf Beitrag Nr.: 40.584.576 von sonnenscheinhero am 24.11.10 18:24:17das war doch bereits im März

Antwort auf Beitrag Nr.: 40.584.576 von sonnenscheinhero am 24.11.10 18:24:17PS. kuckst du hier:

http://uk.advfn.com/p.php?pid=nmona&article=42208892&symbol=…

http://uk.advfn.com/p.php?pid=nmona&article=42208892&symbol=…

order steht

AXMIN Closes Its C$10 Million Non-Brokered Private Placement

http://uk.advfn.com/p.php?pid=nmona&article=45400116&symbol=…

http://uk.advfn.com/p.php?pid=nmona&article=45400116&symbol=…

"Zurück auf Los" könnte man mit Blick auf die anstehende Machbarkeitsstudie sagen, die sehr positiv ausfallen dürfte. Ob es indes ratsam ist, bereits jetzt, vor der noch anstehenden großen Finanzierung, einzusteigen, wird die Zukunft zeigen. Andererseits ist die Aktie auch unter Berücksichtigung des EK-Anteils der Projektfinanzierung für einen 200k oz p.a. Produzenten sehr moderat bewertet. Wobei ein Abschlag aufgrund der Produktionsferne natürlich berücksichtigt werden muß.

Antwort auf Beitrag Nr.: 40.604.600 von MFC500 am 28.11.10 15:51:39Dabei sein ist alles.. kleine Position jetzt rein - erspart die große Position in 2 Jahren.

Ob es jetzt nochmal ins Minus geht oder nicht, bzw. bissl volatil wird, spielt dann auch keine Rolle mehr.

Der Goldpreis bestimmt fast allein das Schicksal.

Ob es jetzt nochmal ins Minus geht oder nicht, bzw. bissl volatil wird, spielt dann auch keine Rolle mehr.

Der Goldpreis bestimmt fast allein das Schicksal.

Antwort auf Beitrag Nr.: 40.605.335 von XIO am 28.11.10 20:54:09Endlich hat jemand auch einen Tread zu Axmin eröffnet...

Bin auch seit längerem dabei Einstiegskurs < 10 cents. Habe aber gestern nochmals aufgestockt. mein bauchgefühl sagt mir, dass hier bald kurse über 17 cent zu sehen sind.

Ich sehe in Axmin wenig Risiko, da bereits tiefe bewertung und hohe ressourcen. Zudem haben Sie eine Schweizer Firma beseite die finanzkräftig ist.

Nur das Minenleben passt mir nicht beim Projekt passandro in CAR....

Bin auch seit längerem dabei Einstiegskurs < 10 cents. Habe aber gestern nochmals aufgestockt. mein bauchgefühl sagt mir, dass hier bald kurse über 17 cent zu sehen sind.

Ich sehe in Axmin wenig Risiko, da bereits tiefe bewertung und hohe ressourcen. Zudem haben Sie eine Schweizer Firma beseite die finanzkräftig ist.

Nur das Minenleben passt mir nicht beim Projekt passandro in CAR....

Antwort auf Beitrag Nr.: 40.605.335 von XIO am 28.11.10 20:54:09Der Abschlag ist übrigens nicht, weil die Produktion noch in der Ferne liegt, sondern Länderrisiko CAR. CAR hat zudem keine einzige Goldmine...Axmin hätte die erste in CAR

Antwort auf Beitrag Nr.: 40.615.288 von commodityleviathan am 30.11.10 13:54:02schlimmer wie congo gehts nimmer.. ich hab auch ein paar Banro... dagegen ist die CAR wie die schweiz

Antwort auf Beitrag Nr.: 40.618.870 von XIO am 30.11.10 20:41:29Ja dieser Meinung bin ich auch...im Jahr 2007 fand einmal eine UNO Mission statt...Momentan alles im Lot.

Banro? Banro ist auf meiner Einkaufsliste. Ist auch spottbillig.

Banro? Banro ist auf meiner Einkaufsliste. Ist auch spottbillig.

Antwort auf Beitrag Nr.: 40.561.100 von XIO am 21.11.10 11:54:43SALVE XIO!

War lange aus dem Resourcen-Geschäft. Wir hatten mal Überschneidungen, als ich ein wenig in Afren investiert war und oilgascoal.com betrieb. Ui, das ist schon lange her.

Diese Axmin lag ja lange verweist bei W:O.

Ist sicher interessant mehr Infos zu sammeln. Unter anderem scheinen die knapp 1% an Avion Gold zu halten, nachdem man ein Bohrgebiet verkauft hat.

http://www.aviongoldcorp.com/News/News-Details/2010/AvionInc…

Letztlich sind die aber noch ziemlich weit von der Produktion weg. Und Zentralafrika ist ein Land mit Dürren und Despoten.

Petronius

War lange aus dem Resourcen-Geschäft. Wir hatten mal Überschneidungen, als ich ein wenig in Afren investiert war und oilgascoal.com betrieb. Ui, das ist schon lange her.

Diese Axmin lag ja lange verweist bei W:O.

Ist sicher interessant mehr Infos zu sammeln. Unter anderem scheinen die knapp 1% an Avion Gold zu halten, nachdem man ein Bohrgebiet verkauft hat.

http://www.aviongoldcorp.com/News/News-Details/2010/AvionInc…

Letztlich sind die aber noch ziemlich weit von der Produktion weg. Und Zentralafrika ist ein Land mit Dürren und Despoten.

Petronius

Theoretisch geht es in 1.5 Jahren mit der Produktion beim Passendro - Projekt los.

Ich vergleiche die Chartverläufe und Firmenentwicklung mit Semafo und Avion, von daher bin ich der Meinung, daß man sich jetzt langsam mit einer ersten Tranche dem Risiko angemessen positionieren kann.. selbst wenn es nur ein paar Hundert Euro/CAD sind könnte es sich in 3 Jahren ausgesprochen lohnen, dies getan zu haben.

Ich vergleiche die Chartverläufe und Firmenentwicklung mit Semafo und Avion, von daher bin ich der Meinung, daß man sich jetzt langsam mit einer ersten Tranche dem Risiko angemessen positionieren kann.. selbst wenn es nur ein paar Hundert Euro/CAD sind könnte es sich in 3 Jahren ausgesprochen lohnen, dies getan zu haben.

Antwort auf Beitrag Nr.: 40.759.454 von Petronius am 24.12.10 00:20:45Das 1 Prozent an Avion müsste mittlerweile ein hübscher Betrag geworden sein:

Antwort auf Beitrag Nr.: 40.760.420 von XIO am 24.12.10 13:44:06

moin XIO,

denke auch, daß nach vollzogener PP bzw. heutiger news

ne 1. posi ins depot genommen werden kann........dies jedoch

als LOOOONG- invest ansehen sollte

moin XIO,

denke auch, daß nach vollzogener PP bzw. heutiger news

ne 1. posi ins depot genommen werden kann........dies jedoch

als LOOOONG- invest ansehen sollte

Antwort auf Beitrag Nr.: 40.773.916 von hbg55 am 29.12.10 15:44:38Habe heute zu 2,-CAD meinen Avion Einstand rausgenommen und in Axmin angelegt.

Jetzt hoffe ich mal, daß der Stock relativ zügig auf wenigstens 150 Mio MK + x kommt.

Jetzt hoffe ich mal, daß der Stock relativ zügig auf wenigstens 150 Mio MK + x kommt.

betreffs der heutigen news. der 1 prozent-Anteil an AVR müsste sich heute weiter ausgebaut haben:

In consideration for 100% of AXMIN's interest in the nine permits that make up the Kofi Gold Project, Avion has agreed to pay an aggregate amount of C$500,000 and 4,500,000 shares of Avion, of which C$81,250 has been received and 731,250 shares of Avion have been issued. In total AXMIN will receive C$325,000 cash and 2.925 million shares of Avion for its interest in the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, 25% of which has been paid. The remaining 75% will be paid in three additional tranches three months, 12 months and 18 months from the date of closing. The closing of the remaining five concessions will take place once closing conditions are satisfied.

des weiteren steht ja noch was an:

The sale of the Kofi Gold Project does not include AXMIN's Satifara permit which was the subject of a joint venture agreement in February 2009 with SEMOS, a joint venture between IAMGOLD Corporation and AngloGold Ashanti that operates the Sadiola Mine in Mali.

In consideration for 100% of AXMIN's interest in the nine permits that make up the Kofi Gold Project, Avion has agreed to pay an aggregate amount of C$500,000 and 4,500,000 shares of Avion, of which C$81,250 has been received and 731,250 shares of Avion have been issued. In total AXMIN will receive C$325,000 cash and 2.925 million shares of Avion for its interest in the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, 25% of which has been paid. The remaining 75% will be paid in three additional tranches three months, 12 months and 18 months from the date of closing. The closing of the remaining five concessions will take place once closing conditions are satisfied.

des weiteren steht ja noch was an:

The sale of the Kofi Gold Project does not include AXMIN's Satifara permit which was the subject of a joint venture agreement in February 2009 with SEMOS, a joint venture between IAMGOLD Corporation and AngloGold Ashanti that operates the Sadiola Mine in Mali.

Antwort auf Beitrag Nr.: 40.775.816 von XIO am 29.12.10 20:35:46

....verstehe, SO hab ichs vor knapp nem jahr auch gemacht mit ´GQ`

drum halte ICH diesmal meine last AVRs - denke aber, daß AXM vor

nem spannenden 2011 steht

....verstehe, SO hab ichs vor knapp nem jahr auch gemacht mit ´GQ`

drum halte ICH diesmal meine last AVRs - denke aber, daß AXM vor

nem spannenden 2011 steht

Antwort auf Beitrag Nr.: 40.776.182 von hbg55 am 29.12.10 21:44:41werde AVR ebenfalls weiter halten... einstand sichern ist bei mir aber quasi pflichtveranstaltung.. naja, bei nem EK von 0.55 CAD tats noch besonders weh, sich von einem Minderheitsanteil zu lösen

hast Du ne Info, wie hoch die aktuelle MK von AVR ist?.. und demnach der anteil von AXM

hast Du ne Info, wie hoch die aktuelle MK von AVR ist?.. und demnach der anteil von AXM

Antwort auf Beitrag Nr.: 40.776.199 von XIO am 29.12.10 21:48:48verlass mich mal auf CNBC- infos, wonach wir akt. ne MK von

cad-mios 745,- haben.........und die aussichten haben sich mit

heutiger news NICHT grad verschlechtert

http://data.cnbc.com/quotes/avr.to

cad-mios 745,- haben.........und die aussichten haben sich mit

heutiger news NICHT grad verschlechtert

http://data.cnbc.com/quotes/avr.to

mit knapp 1mio vol. gings auf TH ausm handel.......

Recent Trades - Last 10 of 73

Time ET Ex Price Change Volume Buyer Seller Markers

15:58:22 V 0.13 0.01 8,000 85 Scotia 9 BMO Nesbitt K

15:54:21 V 0.13 0.01 10,000 85 Scotia 1 Anonymous K

15:54:21 V 0.13 0.01 500 85 Scotia 85 Scotia K

15:44:17 V 0.13 0.01 498 9 BMO Nesbitt 36 Latimer E

15:43:57 V 0.13 0.01 9,500 9 BMO Nesbitt 85 Scotia K

15:39:45 V 0.13 0.01 140,500 9 BMO Nesbitt 85 Scotia K

15:39:45 V 0.13 0.01 44,500 80 National Bank 85 Scotia K

15:34:43 V 0.13 0.01 5,500 80 National Bank 2 RBC K

15:34:24 V 0.13 0.01 4,000 99 Jitney 2 RBC K

15:34:24 V 0.13 0.01 4,000 99 Jitney 2 RBC K

Recent Trades - Last 10 of 73

Time ET Ex Price Change Volume Buyer Seller Markers

15:58:22 V 0.13 0.01 8,000 85 Scotia 9 BMO Nesbitt K

15:54:21 V 0.13 0.01 10,000 85 Scotia 1 Anonymous K

15:54:21 V 0.13 0.01 500 85 Scotia 85 Scotia K

15:44:17 V 0.13 0.01 498 9 BMO Nesbitt 36 Latimer E

15:43:57 V 0.13 0.01 9,500 9 BMO Nesbitt 85 Scotia K

15:39:45 V 0.13 0.01 140,500 9 BMO Nesbitt 85 Scotia K

15:39:45 V 0.13 0.01 44,500 80 National Bank 85 Scotia K

15:34:43 V 0.13 0.01 5,500 80 National Bank 2 RBC K

15:34:24 V 0.13 0.01 4,000 99 Jitney 2 RBC K

15:34:24 V 0.13 0.01 4,000 99 Jitney 2 RBC K

Antwort auf Beitrag Nr.: 40.776.854 von hbg55 am 30.12.10 00:49:1315:39:45 V 0.13 0.01 140,500 9 BMO Nesbitt 85 Scotia K

und? Das sind etwas über 18.000 Dollar.

und? Das sind etwas über 18.000 Dollar.

Antwort auf Beitrag Nr.: 40.777.071 von MFC500 am 30.12.10 07:57:10

GENAU.....´kleinvieh´ macht auch dreck

GENAU.....´kleinvieh´ macht auch dreck

Hi XIO - ich finde Axmin sehr attraktiv und aufgrund der nachgewiesenen Ressourcen von insgesamt ca. 3 Mio Unzen Gold auch unterbewertet.....

der hohe Aktienbestand ist nicht soooo optimal - vielleicht gibt es hier aber auch mal eine optische Korrektur

ansonsten haben sie durch den Deal mit Avion erstmal gute Vorraussetzungen um ihr Projekt Passendro mit Druck vorran treiben zu können..........

was bekommen sie für die offiziellen 670k Unzen:

500k $ Cash

und

4,5 Mio Aktien von Avion - alles in allem ca. 9,5 Mio $ (Stand heute)

sicherlich für Avion ein besseres Geschäft (jede Unze wurde mit ca.14$ bezahlt) - aber alleine hätte Axmin daraus keine Mine hinbekommen, zumal der Fokus auf Passendro liegt

alles in allem kann Axmin deutlich entspannter sein Projekt vorrantreiben, fällige Konzessionsgebühren etc. bezahlen

da die Aktien in Tranchen und nachundnach geleifert werden könnte sich der Erlös für Axmin noch deutlich positiver entwickeln, wenn Avion weiter wächst und der Aktienkurs steigt.........

bin mit einer ersten Posi an Board und gespannt was so geht die nächsten Monate

AXMIN closes Kofi gold permits sale

2010-12-29 10:09 ET - News Release

Mr. George Roach reports

AXMIN CLOSES SALE OF FOUR PERMITS IN THE KOFI GOLD PROJECT, MALI TO AVION GOLD CORPORATION

AXMIN Inc. has closed the sale to Avion Gold Corp. of the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, which are the key permits within the Kofi gold project. In March, 2010, AXMIN entered into an agreement to sell its interest in the Kofi gold project and all ancillary permits in Mali to Avion (see the company's news in Stockwatch on March 31, 2010). It is expected that the transfer of the remaining five permits within the Kofi gold project will close within 30 days. The sale of the Kofi gold project does not include AXMIN's Satifara permit, which was the subject of a joint venture agreement in February, 2009, with SEMOS, a joint venture between Iamgold Corp. and AngloGold Ashanti that operates the Sadiola mine in Mali.

In consideration for 100 per cent of AXMIN's interest in the nine permits that make up the Kofi gold project, Avion has agreed to pay a total amount of $500,000 and 4.5 million shares of Avion, of which $81,250 has been received and 731,250 shares of Avion have been issued. In total, AXMIN will receive $325,000 cash and 2,925,000 shares of Avion for its interest in the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, 25 per cent of which has been paid. The remaining 75 per cent will be paid in three additional tranches three months, 12 months and 18 months from the date of closing. The closing of the remaining five concessions will take place once closing conditions are satisfied.

President and chief executive officer of AXMIN, George Roach, comments, "AXMIN is committed and focused on the development of the Passendro project in Central African Republic, and the value that we receive from this sale will be fully applied to that end."

We seek Safe Harbor.

der hohe Aktienbestand ist nicht soooo optimal - vielleicht gibt es hier aber auch mal eine optische Korrektur

ansonsten haben sie durch den Deal mit Avion erstmal gute Vorraussetzungen um ihr Projekt Passendro mit Druck vorran treiben zu können..........

was bekommen sie für die offiziellen 670k Unzen:

500k $ Cash

und

4,5 Mio Aktien von Avion - alles in allem ca. 9,5 Mio $ (Stand heute)

sicherlich für Avion ein besseres Geschäft (jede Unze wurde mit ca.14$ bezahlt) - aber alleine hätte Axmin daraus keine Mine hinbekommen, zumal der Fokus auf Passendro liegt

alles in allem kann Axmin deutlich entspannter sein Projekt vorrantreiben, fällige Konzessionsgebühren etc. bezahlen

da die Aktien in Tranchen und nachundnach geleifert werden könnte sich der Erlös für Axmin noch deutlich positiver entwickeln, wenn Avion weiter wächst und der Aktienkurs steigt.........

bin mit einer ersten Posi an Board und gespannt was so geht die nächsten Monate

AXMIN closes Kofi gold permits sale

2010-12-29 10:09 ET - News Release

Mr. George Roach reports

AXMIN CLOSES SALE OF FOUR PERMITS IN THE KOFI GOLD PROJECT, MALI TO AVION GOLD CORPORATION

AXMIN Inc. has closed the sale to Avion Gold Corp. of the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, which are the key permits within the Kofi gold project. In March, 2010, AXMIN entered into an agreement to sell its interest in the Kofi gold project and all ancillary permits in Mali to Avion (see the company's news in Stockwatch on March 31, 2010). It is expected that the transfer of the remaining five permits within the Kofi gold project will close within 30 days. The sale of the Kofi gold project does not include AXMIN's Satifara permit, which was the subject of a joint venture agreement in February, 2009, with SEMOS, a joint venture between Iamgold Corp. and AngloGold Ashanti that operates the Sadiola mine in Mali.

In consideration for 100 per cent of AXMIN's interest in the nine permits that make up the Kofi gold project, Avion has agreed to pay a total amount of $500,000 and 4.5 million shares of Avion, of which $81,250 has been received and 731,250 shares of Avion have been issued. In total, AXMIN will receive $325,000 cash and 2,925,000 shares of Avion for its interest in the Kofi Nord, Kofi Dabora, Walia (ACGRI) and Dianissi concessions, 25 per cent of which has been paid. The remaining 75 per cent will be paid in three additional tranches three months, 12 months and 18 months from the date of closing. The closing of the remaining five concessions will take place once closing conditions are satisfied.

President and chief executive officer of AXMIN, George Roach, comments, "AXMIN is committed and focused on the development of the Passendro project in Central African Republic, and the value that we receive from this sale will be fully applied to that end."

We seek Safe Harbor.

Antwort auf Beitrag Nr.: 40.777.205 von hbg55 am 30.12.10 08:44:05Genau meine Meinung, ich bin sowieso nur mit relativ kleinen Positionne in Explorern drinne.

Mehr kann ich mir auch gar nicht leisten.. hab ziemlich viele "kleine" Positionen am laufen.

Mehr kann ich mir auch gar nicht leisten.. hab ziemlich viele "kleine" Positionen am laufen.

Antwort auf Beitrag Nr.: 40.777.538 von grasgruener am 30.12.10 09:57:26Die Geschichte mit der hohen Aktienanzahl.. naja.. seh ich relativ gelassen, denn soo unmöglich hoch ist deren Anzahl bei AXM noch nicht. Man muss es mal auf die projekte verteilt betrachten.

Was zählt, ist, daß man ab seinem Einstiegspunkt das Glück hat, von weiterer übermässiger Dilution verschont zu bleiben... ein bissl Grundrauschen in der Aktiendruckpresse lässt sich eh nicht vermeiden, bzw ich kenne keinen wachsenden Explorer, welcher nicht dilutiert.

Rein vom Chartverlauf sieht es so schlecht nämlich nicht aus, den typischen Einbruch vor Produktionsbeginn im Lebenszyklus eines Rohstoffwertes erleben wir gerade.

Mit Glück gehts gleich ins Plus,, andersrum ist es auch möglich daß die MK je nach krisenfestigkeit bis an die Cash/Kotzgrenze sinkt (siehe Moto Goldmines im letzten Jahr, oder gerade brandaktuell der Total-Einbruch bei Anaconda Mining.)

Interessant wird, ob sich bei der Finanzierung der Mine in der CAR auch ein paar Banken bereit erklären, mit einem Kredit das Projekt wenigstens teilweise zu finanzieren.

Und genau hier setze ich auf die zunehmende Risikobereitschaft von Banken, in Afrika zu investieren.

Bin vor 3, J5ahren in Afren rein (Nigeria), als dort einige Ölpipelines brannten, trotzdem hat der Laden einen 200 Mio kredit bekommen.. sowas hebt die Stimmung.

Für AXM seh ich als grösste Risiken den Goldpreis.. der muß schön weiter oben bleiben (wobei die avisierten Produktionskosten von unter 400$ sensationell gut werden), und die politische Stabilität in der CAR und Mali.

Zu guter letzt sollte man auch daran denken, wer hinter Axmin steht:

http://www.addax-oryx.com/uk/index.html

Was zählt, ist, daß man ab seinem Einstiegspunkt das Glück hat, von weiterer übermässiger Dilution verschont zu bleiben... ein bissl Grundrauschen in der Aktiendruckpresse lässt sich eh nicht vermeiden, bzw ich kenne keinen wachsenden Explorer, welcher nicht dilutiert.

Rein vom Chartverlauf sieht es so schlecht nämlich nicht aus, den typischen Einbruch vor Produktionsbeginn im Lebenszyklus eines Rohstoffwertes erleben wir gerade.

Mit Glück gehts gleich ins Plus,, andersrum ist es auch möglich daß die MK je nach krisenfestigkeit bis an die Cash/Kotzgrenze sinkt (siehe Moto Goldmines im letzten Jahr, oder gerade brandaktuell der Total-Einbruch bei Anaconda Mining.)

Interessant wird, ob sich bei der Finanzierung der Mine in der CAR auch ein paar Banken bereit erklären, mit einem Kredit das Projekt wenigstens teilweise zu finanzieren.

Und genau hier setze ich auf die zunehmende Risikobereitschaft von Banken, in Afrika zu investieren.

Bin vor 3, J5ahren in Afren rein (Nigeria), als dort einige Ölpipelines brannten, trotzdem hat der Laden einen 200 Mio kredit bekommen.. sowas hebt die Stimmung.

Für AXM seh ich als grösste Risiken den Goldpreis.. der muß schön weiter oben bleiben (wobei die avisierten Produktionskosten von unter 400$ sensationell gut werden), und die politische Stabilität in der CAR und Mali.

Zu guter letzt sollte man auch daran denken, wer hinter Axmin steht:

http://www.addax-oryx.com/uk/index.html

eine gute Zusammenfassung des Hauptprojektes gibt es hier:

CAR officials in show of support for Axmin gold project

5th October 2010

http://www.miningweekly.com/article/car-ministers-in-push-to…

CAR officials in show of support for Axmin gold project

5th October 2010

http://www.miningweekly.com/article/car-ministers-in-push-to…

Wenige Stunden vor Jahresende ordentlich Umsatz.

Bislang sind 1,5 Mio Shares über den Tisch gegangen!

Da das Invest noch auf fundamental etwas wackeligen Beinen steht, zählt jedes Prozentchen!

Bislang sind 1,5 Mio Shares über den Tisch gegangen!

Da das Invest noch auf fundamental etwas wackeligen Beinen steht, zählt jedes Prozentchen!

interessante Volumenzunahme, kleiner Ausbruch über 0.20CAD in Kürze würde gut in den Kram passen.

Antwort auf Beitrag Nr.: 40.777.884 von XIO am 30.12.10 10:59:16Danke XIO für die Info´s! und ein gesundes neues Jahr!

Antwort auf Beitrag Nr.: 40.784.243 von XIO am 31.12.10 21:14:11die Volumenzunahme deutet in der Tat auf eine "ausgeprägte Kursreaktion" in der nächsten Zeit hin........

Antwort auf Beitrag Nr.: 40.784.513 von grasgruener am 01.01.11 10:39:30dir auch ein erfolgreiches Jahr 2011

im SH-Avion Thread hat jemand einen (in unserem Sinne) netten Diskussionsbeitrag gepostet:

>CompareAvion who essentially was created less than 3 years ago and got intoproduction within 18 months to Axmin who've been around for 10 years andhave not yet built a mine. With BFS due out in 2011 at the current SPthere's no way they can finance a mine without huge dilution. BTW thatJohn Embry quote is from January 2008. I see Charles Oliver went from adon't buy in July to a Buy recommendation in November which most likelymeans he needs people to sell his sharestoo. There's no comparison between Axmin and Avion. Avion hasaccomplished more in two and half years than Axmin has in a decade. <

I agree that avion has done good. Avion has taken over the failed assets of Nevsun in Mali. If you add in Nevsun's involvement you will find that these Mali assets have also been under development for 10+ years. To compare like with like you should take into account the change in top management of Axmin that happened early in 2010 with the merger between Afnat and Axmin. The management of Afnat is now in charge. I would contend that the clock for the new Axmin got reset 8 months ago and there has already been substantial progress since. In 2 years the Passendro mine will be in production at the rate of 200,000 oz per year and Axmin's market cap will be $1 billion+. I am confident that AVR's market cap will be considerably less than 10x that of AXM at that point, ie. axmin will outperform avion going forward.

Your other negatives about dilution and share structure are red herrings. It is share price to cash flow or market cap to cash flow that really counts. I have factored a reasonable amount of dilution to finance the new mine and made the case for Axmin to cash flow 16 cents per share (more than the current share price) in 2013 when Passendro goes into production. This will result in a dramatic re-rating of the share price.

im SH-Avion Thread hat jemand einen (in unserem Sinne) netten Diskussionsbeitrag gepostet:

>CompareAvion who essentially was created less than 3 years ago and got intoproduction within 18 months to Axmin who've been around for 10 years andhave not yet built a mine. With BFS due out in 2011 at the current SPthere's no way they can finance a mine without huge dilution. BTW thatJohn Embry quote is from January 2008. I see Charles Oliver went from adon't buy in July to a Buy recommendation in November which most likelymeans he needs people to sell his sharestoo. There's no comparison between Axmin and Avion. Avion hasaccomplished more in two and half years than Axmin has in a decade. <

I agree that avion has done good. Avion has taken over the failed assets of Nevsun in Mali. If you add in Nevsun's involvement you will find that these Mali assets have also been under development for 10+ years. To compare like with like you should take into account the change in top management of Axmin that happened early in 2010 with the merger between Afnat and Axmin. The management of Afnat is now in charge. I would contend that the clock for the new Axmin got reset 8 months ago and there has already been substantial progress since. In 2 years the Passendro mine will be in production at the rate of 200,000 oz per year and Axmin's market cap will be $1 billion+. I am confident that AVR's market cap will be considerably less than 10x that of AXM at that point, ie. axmin will outperform avion going forward.

Your other negatives about dilution and share structure are red herrings. It is share price to cash flow or market cap to cash flow that really counts. I have factored a reasonable amount of dilution to finance the new mine and made the case for Axmin to cash flow 16 cents per share (more than the current share price) in 2013 when Passendro goes into production. This will result in a dramatic re-rating of the share price.

hier nocmal ein interessanter Artikel, welcher ganz gut erklärt, warum.. wieso, weshalb die 2008 Aktie so abgeschmiert ist.

http://www.minesite.com/nc/minews/singlenews/article/is-an-i…

Mittlerweile haben wir unsere Mining Lizenz, die zusätzliche Eisenerzgeschichte ist auch interessant, auch wenn für AXM da nicht allzuviel zu holen sein wird.

http://www.minesite.com/nc/minews/singlenews/article/is-an-i…

Mittlerweile haben wir unsere Mining Lizenz, die zusätzliche Eisenerzgeschichte ist auch interessant, auch wenn für AXM da nicht allzuviel zu holen sein wird.

der Start ins neue Jahr fängt in Kanada ja zumindest schon mal gut an.

Hoffentlich hält`s.

Hoffentlich hält`s.

Antwort auf Beitrag Nr.: 40.796.908 von XIO am 04.01.11 16:01:59lesezeichen & watchlist

Danke Euch für die Infos... werde mir den Wert mal genauer anschauen.

cheers

Danke Euch für die Infos... werde mir den Wert mal genauer anschauen.

cheers

wer gibt einen aus?

Aurafrique, a subsidiary of Axmin, will begin working the open-cast mine at Bambari at ... If the project moves forward smoothly Axmin is likely to obtain a ...

http://www.africaintelligence.com/AMA/exploration-production…" target="_blank" rel="nofollow ugc noopener">http://www.africaintelligence.com/AMA/exploration-production…

Aurafrique, a subsidiary of Axmin, will begin working the open-cast mine at Bambari at ... If the project moves forward smoothly Axmin is likely to obtain a ...

http://www.africaintelligence.com/AMA/exploration-production…" target="_blank" rel="nofollow ugc noopener">http://www.africaintelligence.com/AMA/exploration-production…

Antwort auf Beitrag Nr.: 40.798.784 von XIO am 04.01.11 19:17:25PS, siehe auch

http://www.finanznachrichten.de/nachrichten-2010-09/17893680…

zum Gold noch ne hübsche Nebeneinnahme ... nicht schlecht

http://www.finanznachrichten.de/nachrichten-2010-09/17893680…

zum Gold noch ne hübsche Nebeneinnahme ... nicht schlecht

Antwort auf Beitrag Nr.: 40.798.784 von XIO am 04.01.11 19:17:25???

Want to read more? Please consider subscribing or opening an e-wallet to continue.

Want to read more? Please consider subscribing or opening an e-wallet to continue.

Antwort auf Beitrag Nr.: 40.798.894 von MFC500 am 04.01.11 19:32:07komm, Du gibst einen aus

der letzte Trade - 500 Shares zu 0.15.. das war doch ein Fake.. wer macht denn sowas... 75 Dollar um den Kurs zu drücken....tss.

was solls, 11% sind auch OK

was solls, 11% sind auch OK

Antwort auf Beitrag Nr.: 40.799.235 von XIO am 04.01.11 20:15:33ok, jetzt hab ich´s kapiert

Antwort auf Beitrag Nr.: 40.800.201 von XIO am 04.01.11 22:36:30so, nochwas zur Berliner Mond-Taxe:

0,15CAD = 0,113€

0,15CAD = 0,113€

in meinem Alter funktionieren die Synapsen nicht mehr so richtig

Berlin kann man als Handelsplatz vergessen!

Berlin kann man als Handelsplatz vergessen!

Schade, ich finde nix weiter über diese BVI-basierende Ferrum Resources Ltd.

Nicht daß die ein "Risiko"-Ableger der Schweizer Ferrum ch sind.

Nicht daß die ein "Risiko"-Ableger der Schweizer Ferrum ch sind.

Hallo zusammen,

habe Axmin gerade auf meine Watschliste gesetzt und verbleibe am Rand. Scheint nicht schlecht zu sein, aber Order lohnt sich wohl nur in Can, oder? Die gehandelten Aktienstückzahlen in den letzten Monaten lassen auf mehr hoffen!

Wenn man bedenkt von wo Axmin kam!

habe Axmin gerade auf meine Watschliste gesetzt und verbleibe am Rand. Scheint nicht schlecht zu sein, aber Order lohnt sich wohl nur in Can, oder? Die gehandelten Aktienstückzahlen in den letzten Monaten lassen auf mehr hoffen!

Wenn man bedenkt von wo Axmin kam!

.... was für Umsätze in 2003/ 04!!!

.... was für Umsätze in 2003/ 04!!!

Antwort auf Beitrag Nr.: 40.802.155 von wulfen40 am 05.01.11 11:23:31ja, ich vermute auch, ein Großteil derer, die damals für den Umsatz sorgten, sind immer noch drin.

Als Markt würde ich Kanada auch bevorzugen (obwohl es sich bei z.B. bei Avion hier in D-Land auch gute entwickelt hat, aber das ist wohl erfolgsabhängig).

Hab meine Shares jedanfalls in Kanada erworben.

Als Markt würde ich Kanada auch bevorzugen (obwohl es sich bei z.B. bei Avion hier in D-Land auch gute entwickelt hat, aber das ist wohl erfolgsabhängig).

Hab meine Shares jedanfalls in Kanada erworben.

Und endlich mal auf Tageshoch geschlossen:

Das lässt hoffen... evtl schafft AXM gleich den Sprung in die nächste "Dimension", ohne nochmal den EK (bei mir 0,13 CAD) wiederzusehen.

Das lässt hoffen... evtl schafft AXM gleich den Sprung in die nächste "Dimension", ohne nochmal den EK (bei mir 0,13 CAD) wiederzusehen.

Antwort auf Beitrag Nr.: 40.807.314 von XIO am 05.01.11 22:09:14 schaut gut aus für den Sprung über die 0,20 CAD - darüber gibt es erstmal keine Schranken!

schaut gut aus für den Sprung über die 0,20 CAD - darüber gibt es erstmal keine Schranken!

schaut gut aus für den Sprung über die 0,20 CAD - darüber gibt es erstmal keine Schranken!

schaut gut aus für den Sprung über die 0,20 CAD - darüber gibt es erstmal keine Schranken!

Antwort auf Beitrag Nr.: 40.807.426 von grasgruener am 05.01.11 22:34:11biste dabei?

Antwort auf Beitrag Nr.: 40.807.483 von XIO am 05.01.11 22:48:10aber natürlich!

Central African Republic: Country outlook

September 1st 2010

http://www.eiu.com/index.asp?layout=VWArticleVW3&article_id=…

ECONOMIC GROWTH: Activity in the mining sector is set to pick up in the CAR, driven by the strong recovery in global demand for minerals. In August the government awarded a Canadian company, Axmin, a 25-year mining licence for its Passendro gold project, which is owned by its subsidiary, Aurafrique. Under the agreement, the government will receive a signature bonus of US$11m, in addition to shares in Axmin and a 2.25% royalty on sales of gold from the mine. Now that it has the licence in hand, Axmin confirmed that it would immediately proceed with the development of its Passendro project. Exploratory work in 2008-09 estimated the project's reserves at 2m troy oz of gold, and the first production could start as early as 2012. A French nuclear group, Areva, has announced that it will start work on its Bakouma uranium deposit, located 100 km north of Bangassou, by the end of the year. The deposit has estimated reserves of 40,000 tonnes of ore, of which 17,000 tonnes are of high quality, and Areva intends the mine to reach full production by 2014. However, several issues remain outstanding, notably what proportion of the mine's infrastructure costs and energy supply will be paid for by either Areva or the government. The CAR is set to receive its first substantial investment from China, following an announcement on July 27th that two Chinese groups—Yanchang Petroleum and Poly Group—had signed an agreement to jointly explore for oil and gas in Block B, located in north-western CAR. The block lies close to oil reserves in neighbouring Chad, which are currently being exploited by a US company, ExxonMobil. Yanchang Petroleum will hold a controlling interest in the block, whose potential reserves have not been disclosed. The CAR government is also keen to licence the adjacent Block C, as well as to re-licence Block A, which has been the focus of a dispute with a US-based oil company, RSM Production. The International Centre for the Settlement of Investment Disputes, an arbitration panel of the World Bank, is expected to rule on the dispute. An Indian company, Jaguar, has launched two projects in the CAR, which represent the first major Indian investments in the country. In early August construction started on a cement factory, Société centrafricaine de cimenterie, which is expected to start producing 400 tonnes of cement per day in mid-2011, helping to reduce the high cost of cement imports to the landlocked CAR. At the same time a new company, Société nationale de transport urbain, has been launched, which will provide public transport in Bangui and its suburbs using 100 Indian-built buses.

September 1st 2010

http://www.eiu.com/index.asp?layout=VWArticleVW3&article_id=…

ECONOMIC GROWTH: Activity in the mining sector is set to pick up in the CAR, driven by the strong recovery in global demand for minerals. In August the government awarded a Canadian company, Axmin, a 25-year mining licence for its Passendro gold project, which is owned by its subsidiary, Aurafrique. Under the agreement, the government will receive a signature bonus of US$11m, in addition to shares in Axmin and a 2.25% royalty on sales of gold from the mine. Now that it has the licence in hand, Axmin confirmed that it would immediately proceed with the development of its Passendro project. Exploratory work in 2008-09 estimated the project's reserves at 2m troy oz of gold, and the first production could start as early as 2012. A French nuclear group, Areva, has announced that it will start work on its Bakouma uranium deposit, located 100 km north of Bangassou, by the end of the year. The deposit has estimated reserves of 40,000 tonnes of ore, of which 17,000 tonnes are of high quality, and Areva intends the mine to reach full production by 2014. However, several issues remain outstanding, notably what proportion of the mine's infrastructure costs and energy supply will be paid for by either Areva or the government. The CAR is set to receive its first substantial investment from China, following an announcement on July 27th that two Chinese groups—Yanchang Petroleum and Poly Group—had signed an agreement to jointly explore for oil and gas in Block B, located in north-western CAR. The block lies close to oil reserves in neighbouring Chad, which are currently being exploited by a US company, ExxonMobil. Yanchang Petroleum will hold a controlling interest in the block, whose potential reserves have not been disclosed. The CAR government is also keen to licence the adjacent Block C, as well as to re-licence Block A, which has been the focus of a dispute with a US-based oil company, RSM Production. The International Centre for the Settlement of Investment Disputes, an arbitration panel of the World Bank, is expected to rule on the dispute. An Indian company, Jaguar, has launched two projects in the CAR, which represent the first major Indian investments in the country. In early August construction started on a cement factory, Société centrafricaine de cimenterie, which is expected to start producing 400 tonnes of cement per day in mid-2011, helping to reduce the high cost of cement imports to the landlocked CAR. At the same time a new company, Société nationale de transport urbain, has been launched, which will provide public transport in Bangui and its suburbs using 100 Indian-built buses.

Antwort auf Beitrag Nr.: 40.807.426 von grasgruener am 05.01.11 22:34:11neja.. heute mit relativ wenig volumen runtergeprügelt

ich hasse diese letzte-Minute Trades mit gerimgem Umsatz, aber gleich mal nen ganzen cent runter...

...wenn ich den erwische

ich hasse diese letzte-Minute Trades mit gerimgem Umsatz, aber gleich mal nen ganzen cent runter...

...wenn ich den erwische

es scheint, Axmin hat Kasse gemacht:

Hintergrundinfo:

http://www.axmininc.com/site/Newsnbsp/News2010/Apr3010.aspx

AfNat Resources Limited is a Bermuda incorporated company listed on the Alternative Investment Market of the London Stock Exchange. AfNat has interests in mineral exploration projects in Mozambique and Zambia and has investments in Niger Uranium Limited and in Copper Development Corporation, a private company with a controlling stake in the Hinoba-an Copper Project in the Philippines. More information on AfNat can be found at www.afnatresources.com.

http://www.copperdevelopmentcorp.com/investors/shareinformat…

Holdings of Significant Shareholders

As of 13 December 2010 the Company is aware of the following persons who hold, directly or indirectly, voting rights representing 3% or more of the issued share capital of the Company to which voting rights are attached:Name Number of Ordinary Shares Percentage of issued share capital

Senator Sidecar Master Fund LP

35,748,571

15.89%

MSD Energy Investments, LP

21,400,000

9.51%

Tocqueville Gold1

17,874,284

7.95%

Luxor Capital Partners Offshore Master Fund LP2

14,733,220

6.55%

Haywood Securities Inc.

10,392,840

4.62%

Chiropo Company SA

9,725,000

4.32%

AfNat Resources Limited

9,571,427

4.25%[/red]

Luxor Capital Partners LP2

9,432,235

4.19%

Libra Advisors LLC3

7,149,714

3.18%

Solfotara Mining Corp.

7,029,334

3.12%

>>>>> so jetzt:

http://www.advfn.com/p.php?pid=nmona&article=45916797

"on 6 January 2011 that Senator Sidecar Master Fund LP ("Senator Sidecar Master Fund") acquired a beneficial interest in an additional 9 571,427 ordinary shares in" [CDC].

man achte auf die Anzahl der Shares

Hintergrundinfo:

http://www.axmininc.com/site/Newsnbsp/News2010/Apr3010.aspx

AfNat Resources Limited is a Bermuda incorporated company listed on the Alternative Investment Market of the London Stock Exchange. AfNat has interests in mineral exploration projects in Mozambique and Zambia and has investments in Niger Uranium Limited and in Copper Development Corporation, a private company with a controlling stake in the Hinoba-an Copper Project in the Philippines. More information on AfNat can be found at www.afnatresources.com.

http://www.copperdevelopmentcorp.com/investors/shareinformat…

Holdings of Significant Shareholders

As of 13 December 2010 the Company is aware of the following persons who hold, directly or indirectly, voting rights representing 3% or more of the issued share capital of the Company to which voting rights are attached:Name Number of Ordinary Shares Percentage of issued share capital

Senator Sidecar Master Fund LP

35,748,571

15.89%

MSD Energy Investments, LP

21,400,000

9.51%

Tocqueville Gold1

17,874,284

7.95%

Luxor Capital Partners Offshore Master Fund LP2

14,733,220

6.55%

Haywood Securities Inc.

10,392,840

4.62%

Chiropo Company SA

9,725,000

4.32%

AfNat Resources Limited

9,571,427

4.25%[/red]

Luxor Capital Partners LP2

9,432,235

4.19%

Libra Advisors LLC3

7,149,714

3.18%

Solfotara Mining Corp.

7,029,334

3.12%

>>>>> so jetzt:

http://www.advfn.com/p.php?pid=nmona&article=45916797

"on 6 January 2011 that Senator Sidecar Master Fund LP ("Senator Sidecar Master Fund") acquired a beneficial interest in an additional 9 571,427 ordinary shares in" [CDC].

man achte auf die Anzahl der Shares

Antwort auf Beitrag Nr.: 40.824.092 von XIO am 08.01.11 00:03:02PS:

CDC at £0.315 x 9571427 = £ 3.015.000

or CAD 4.650.750 equivalent

CDC at £0.315 x 9571427 = £ 3.015.000

or CAD 4.650.750 equivalent

Handstand in der Kochschule

Hab´die Axmin schon lange und vergessen warum gekauft.

Mit Afnet gab´s da mal fuer Axmin 2008?? eine Rettungsaktion.

Das kam mir vor wie 2 Blinde, die sich am Steuer eines PKW abloesen.

Bin voller Begeisterung weiter dabei, meine Demenz macht mich gluecklich.

Merrex ist auch so ein Schaetzchen, kraft Alzheimer dauerhappy mit Merrex.

meine das alles woertlich ernst mit Axmin und Merrex, beides kurzfristige 5-bagger.

08.01.2011

Hab´die Axmin schon lange und vergessen warum gekauft.

Mit Afnet gab´s da mal fuer Axmin 2008?? eine Rettungsaktion.

Das kam mir vor wie 2 Blinde, die sich am Steuer eines PKW abloesen.

Bin voller Begeisterung weiter dabei, meine Demenz macht mich gluecklich.

Merrex ist auch so ein Schaetzchen, kraft Alzheimer dauerhappy mit Merrex.

meine das alles woertlich ernst mit Axmin und Merrex, beides kurzfristige 5-bagger.

08.01.2011

Antwort auf Beitrag Nr.: 40.826.301 von Tsuba am 08.01.11 19:00:00Du bist mit Deinen Axmin momentan noch in den Miesen, oder wie schaut`s aus?

Antwort auf Beitrag Nr.: 40.826.716 von XIO am 08.01.11 21:54:28

gerade nachgeschaut pius 40%.

Zur Zeit redet Axmin fast nur ueber Passendero.

Da waren frueher noch andere Baustellen.

Dann kam Afnet und es wurde vollends unuebersichtlich.

Tappe ziemlich im Nebel, werde aber Halten.

gerade nachgeschaut pius 40%.

Zur Zeit redet Axmin fast nur ueber Passendero.

Da waren frueher noch andere Baustellen.

Dann kam Afnet und es wurde vollends unuebersichtlich.

Tappe ziemlich im Nebel, werde aber Halten.

Antwort auf Beitrag Nr.: 40.827.451 von Tsuba am 09.01.11 10:42:44na, das ist doch gut!

Ich vermute, Axmin ist gerade dabei, das Eigenkapital für die Bilanzen aufzuhübschen.

Letztendlich benötigt man doch fast nur noch die Finanzierung der Mine.

Da liegt zwar für Aktienhalter ein Risiko, aber auch eine Chance, da ich glaube, daß sie versuchen werden, die nächste Finanzierungsrunde mit höheren Aktienpreisen zu realisieren.

Wenn das z.B. zum Preis von 25-30 Cent passiert, hätten sie eine Marktkapitalisierung von 140 Mio und wir hätten da bereits locker unseren einstand rein.

Ich vermute, Axmin ist gerade dabei, das Eigenkapital für die Bilanzen aufzuhübschen.

Letztendlich benötigt man doch fast nur noch die Finanzierung der Mine.

Da liegt zwar für Aktienhalter ein Risiko, aber auch eine Chance, da ich glaube, daß sie versuchen werden, die nächste Finanzierungsrunde mit höheren Aktienpreisen zu realisieren.

Wenn das z.B. zum Preis von 25-30 Cent passiert, hätten sie eine Marktkapitalisierung von 140 Mio und wir hätten da bereits locker unseren einstand rein.

schönes Ding mit 15 cent

jetzt gehts los!

wirklich

wirklich

Antwort auf Beitrag Nr.: 40.841.198 von XIO am 11.01.11 17:39:13 schaut wirklich gut aus!

schaut wirklich gut aus!

schaut wirklich gut aus!

schaut wirklich gut aus!

habe ein sehr interessantes Posting gefunden:

http://www.stockhouse.com/Bullboards/MessageDetailThread.asp…

http://www.stockhouse.com/Bullboards/MessageDetailThread.asp…

I spent $30 on a very long call with The new CEO Mr. Roach during which I asked him the questions that I as a 35 years veteran of the markets including `investmentbanking' thought appropriate

I grilled him and he is:

sharp top notch I bought 500,000 shares

give it 18 months The government is pushing axm to get into production....the govenment has over 20 million shrares and 20 m warrants

expect 3-5 times your money

It is wired Swiss connection will buy the gold for swiss ETF's

Schnellzusammenfassung:

Website:

http://www.axmininc.com

Timeline:

14/6/10: Reverse Take over of AIM listed African Natural Resources (AFNR)

9/8/10: Mining license granted for Passendero Gold Project, CAR

7/9/10: Axmin grants Iron rights from Bamabari 1, CAR, to Ferrum Resources

Feb 2011: Closure of sale of remaining 5 Kofi Gold Permits to Avion Gold

mid-2011: Funding in place for gold mine development, Passendero (Bambari 1)

Website:

http://www.axmininc.com

Timeline:

14/6/10: Reverse Take over of AIM listed African Natural Resources (AFNR)

9/8/10: Mining license granted for Passendero Gold Project, CAR

7/9/10: Axmin grants Iron rights from Bamabari 1, CAR, to Ferrum Resources

Feb 2011: Closure of sale of remaining 5 Kofi Gold Permits to Avion Gold

mid-2011: Funding in place for gold mine development, Passendero (Bambari 1)

das Volumen heute spricht schon fast für die 0,20 CAD

Antwort auf Beitrag Nr.: 40.841.364 von grasgruener am 11.01.11 17:57:56ja sieht noch besser aus....

.18 cad

noch besser, dass axmin meine grösste Position im Depot einnimmt

hoffen wir, dass axmin nicht wieder zurückfällt auf die .15 sondern kurs auf die .20 nimmt.

weiter so!

.18 cad

noch besser, dass axmin meine grösste Position im Depot einnimmt

hoffen wir, dass axmin nicht wieder zurückfällt auf die .15 sondern kurs auf die .20 nimmt.

weiter so!

...bei wieder 0.15 steig ich ein!

Hoffe ich.....

Hoffe ich.....

Antwort auf Beitrag Nr.: 40.843.524 von manffreddoo am 11.01.11 22:37:19warum denn jetzt schon so zitterlich.. siehst du nicht das große Bild?

OK, Gewinn realisieren, aber warum hast du alles rausgenommen?

Das Momentum ist optimal, nahezu auf TH geschlossen.. das spricht sich rum und meistens geht es dann ordentlich weiter hoch!

Ich verkauf auch mal was, aber nicht jetzt, wo es läuft, denke eher so an 26 cent, da hätt ich meinen Einstand rein.!

OK, Gewinn realisieren, aber warum hast du alles rausgenommen?

Das Momentum ist optimal, nahezu auf TH geschlossen.. das spricht sich rum und meistens geht es dann ordentlich weiter hoch!

Ich verkauf auch mal was, aber nicht jetzt, wo es läuft, denke eher so an 26 cent, da hätt ich meinen Einstand rein.!

Snapshot des heutigen Verlaufs (kein RT) +28% fürs Familienalbum  :

:

:

:

wo soll ich kaufen?

Germany oder Kanada?

M.

Germany oder Kanada?

M.

Antwort auf Beitrag Nr.: 40.845.517 von manffreddoo am 12.01.11 10:55:49canada iss liquider, D geht - aber seit heute ein Riesenspread , das war die letzten tage nicht

gleich zu Beginn schon ordentliche Stücke...........

Recent Trades - All 0 today

Time ET Ex Price Change Volume Buyer Seller Markers

09:37:31 V 0.18 0.00 20,000 99 Jitney 124 Questrade K

09:37:28 V 0.18 0.00 10,000 99 Jitney 124 Questrade K

09:37:24 V 0.18 0.00 10,000 99 Jitney 124 Questrade K

09:37:23 V 0.18 0.00 400 7 TD Sec 36 Latimer E

09:36:19 V 0.18 0.00 200,000 79 CIBC 85 Scotia K

09:36:19 V 0.18 0.00 50,000 1 Anonymous 85 Scotia K

09:34:39 V 0.18 0.00 10,000 9 BMO Nesbitt 73 Cormark K

09:34:39 V 0.18 0.00 790,000 1 Anonymous 73 Cormark K

09:33:33 V 0.18 0.00 10,000 1 Anonymous 7 TD Sec K

09:33:33 V 0.18 0.00 6,000 1 Anonymous 7 TD Sec K

Recent Trades - All 0 today

Time ET Ex Price Change Volume Buyer Seller Markers

09:37:31 V 0.18 0.00 20,000 99 Jitney 124 Questrade K

09:37:28 V 0.18 0.00 10,000 99 Jitney 124 Questrade K

09:37:24 V 0.18 0.00 10,000 99 Jitney 124 Questrade K

09:37:23 V 0.18 0.00 400 7 TD Sec 36 Latimer E

09:36:19 V 0.18 0.00 200,000 79 CIBC 85 Scotia K

09:36:19 V 0.18 0.00 50,000 1 Anonymous 85 Scotia K

09:34:39 V 0.18 0.00 10,000 9 BMO Nesbitt 73 Cormark K

09:34:39 V 0.18 0.00 790,000 1 Anonymous 73 Cormark K

09:33:33 V 0.18 0.00 10,000 1 Anonymous 7 TD Sec K

09:33:33 V 0.18 0.00 6,000 1 Anonymous 7 TD Sec K

AXMIN Strengthens Balance Sheet from Sale of Non-Core Assets

TORONTO, ONTARIO--(Marketwire - Jan. 12, 2011) - AXMIN Inc. (TSX VENTURE:AXM) is pleased to report that it has profitably disposed of 9.6 million shares of Copper Development Corporation (AIM:CDC) for net proceeds of approximately C$4.3 million. The sale represents AXMIN's entire position in CDC and helps to further strengthen the Company's financial position. This transaction followed CDC's successful listing on the AIM Exchange in December 2010. CDC's principal asset is its controlling stake in the Hinoba-an Copper Project in the Philippines.

This sale is the most recent of a series of transactions to realize value for non-core assets and focus the Company on the development of its premier asset, the Passendro Gold Project, the first modern gold mine in the Central African Republic ("CAR"). These transactions include:

Completion of the sale of CDC for net proceeds of approximately C$4.3MM;

Closing on the transfer of four of nine licences in the Kofi Project to Avion Gold Corporation for 65% of C$500,000 cash and 4.5 million shares of Avion, paid in four tranches, (see press release December 29, 2010); closure of the remaining five licences to follow; and,

Completion of the sale of AXMIN's interest in Niger Uranium Limited for net proceeds of approximately C$1.1 million.

Proceeds from these transactions are sufficient to cover the costs of the revalidated feasibility study, on target for completion early in the first quarter of 2011 and the second tranche of the bonus payment due to the CAR Government in April 2011. AXMIN also repaid its outstanding loan and accrued interest to its significant shareholder AOG Holdings BV in the sum of C$1.74 million, resulting in AXMIN being debt free.

President and CEO of AXMIN, Mr. George Roach, comments, "These recent transactions and the funds received from the November 2010 C$10 million financing have restored much needed financial strength to the Company at a key juncture in its next stage of development. We are in the midst of promising discussions to secure debt facilities to build the Passendro mine, as we demonstrate to our shareholders and other stakeholders the unrealized value in this tremendous asset and our ability to bring it into production."

About AXMIN

AXMIN is a Canadian exploration and development company with a strong focus on central and West Africa. AXMIN has projects in Central African Republic, Mali, Mozambique, Sierra Leone and Senegal. AXMIN is positioned to grow in value as it progresses its Passendro Gold Project towards development and builds on its project pipeline focusing on transitioning from an explorer to producer. For more information regarding AXMIN visit our website at www.axmininc.com.

This press release includes certain "Forward-Looking Statements." All statements, other than statements of historical fact included herein, including without limitation, statements regarding future plans and objectives of AXMIN; and statements regarding the ability to develop and achieve production at Passendro, to revalidate the BFS and to satisfy the terms of the Mining Licence as negotiated, are forward-looking statements that involve various risks and uncertainties.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from AXMIN's expectations have been disclosed under the heading "Risk Factors" and elsewhere in AXMIN's documents filed from time-to-time with the TSX Venture Exchange and other regulatory authorities. AXMIN disclaims any intention or obligation to update or revise any forward-looking statements whether resulting from new information, future events or otherwise, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact

AXMIN Inc.

George Roach

President & CEO

+44 779 626 3999

or

AXMIN Inc.

Judy Webster

Manager Investor Relations

416 368 0993 ext 221

ir@axmininc.com

www.axmininc.com

Click here to see all recent news from this company

TORONTO, ONTARIO--(Marketwire - Jan. 12, 2011) - AXMIN Inc. (TSX VENTURE:AXM) is pleased to report that it has profitably disposed of 9.6 million shares of Copper Development Corporation (AIM:CDC) for net proceeds of approximately C$4.3 million. The sale represents AXMIN's entire position in CDC and helps to further strengthen the Company's financial position. This transaction followed CDC's successful listing on the AIM Exchange in December 2010. CDC's principal asset is its controlling stake in the Hinoba-an Copper Project in the Philippines.

This sale is the most recent of a series of transactions to realize value for non-core assets and focus the Company on the development of its premier asset, the Passendro Gold Project, the first modern gold mine in the Central African Republic ("CAR"). These transactions include:

Completion of the sale of CDC for net proceeds of approximately C$4.3MM;

Closing on the transfer of four of nine licences in the Kofi Project to Avion Gold Corporation for 65% of C$500,000 cash and 4.5 million shares of Avion, paid in four tranches, (see press release December 29, 2010); closure of the remaining five licences to follow; and,

Completion of the sale of AXMIN's interest in Niger Uranium Limited for net proceeds of approximately C$1.1 million.

Proceeds from these transactions are sufficient to cover the costs of the revalidated feasibility study, on target for completion early in the first quarter of 2011 and the second tranche of the bonus payment due to the CAR Government in April 2011. AXMIN also repaid its outstanding loan and accrued interest to its significant shareholder AOG Holdings BV in the sum of C$1.74 million, resulting in AXMIN being debt free.

President and CEO of AXMIN, Mr. George Roach, comments, "These recent transactions and the funds received from the November 2010 C$10 million financing have restored much needed financial strength to the Company at a key juncture in its next stage of development. We are in the midst of promising discussions to secure debt facilities to build the Passendro mine, as we demonstrate to our shareholders and other stakeholders the unrealized value in this tremendous asset and our ability to bring it into production."

About AXMIN

AXMIN is a Canadian exploration and development company with a strong focus on central and West Africa. AXMIN has projects in Central African Republic, Mali, Mozambique, Sierra Leone and Senegal. AXMIN is positioned to grow in value as it progresses its Passendro Gold Project towards development and builds on its project pipeline focusing on transitioning from an explorer to producer. For more information regarding AXMIN visit our website at www.axmininc.com.

This press release includes certain "Forward-Looking Statements." All statements, other than statements of historical fact included herein, including without limitation, statements regarding future plans and objectives of AXMIN; and statements regarding the ability to develop and achieve production at Passendro, to revalidate the BFS and to satisfy the terms of the Mining Licence as negotiated, are forward-looking statements that involve various risks and uncertainties.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from AXMIN's expectations have been disclosed under the heading "Risk Factors" and elsewhere in AXMIN's documents filed from time-to-time with the TSX Venture Exchange and other regulatory authorities. AXMIN disclaims any intention or obligation to update or revise any forward-looking statements whether resulting from new information, future events or otherwise, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact

AXMIN Inc.

George Roach

President & CEO

+44 779 626 3999

or

AXMIN Inc.

Judy Webster

Manager Investor Relations

416 368 0993 ext 221

ir@axmininc.com

www.axmininc.com

Click here to see all recent news from this company

Bin jetzt doch ,statt ursprünglich mit 0,15 mit 0,18can in Toronto rein. Sollte noch nicht zu spät sein,wenn ich auch den Start vor ein paar Tagen verschlafen habe?

Wie hoch könnte der Wert im günstigsten Fall noch laufen?

Wer wagt ne fundierte Prognose?

M.

Wie hoch könnte der Wert im günstigsten Fall noch laufen?

Wer wagt ne fundierte Prognose?

M.

Antwort auf Beitrag Nr.: 40.848.299 von manffreddoo am 12.01.11 16:05:37Tendenz nach oben, aber noch ziemlich volatil, auch intraday.. daher auf keinen Fall mit SL arbeiten!!!

Ich spekuliere darauf, daß die nächste Finanzierungsrunde auch vom Management erst angestrebt wird, wenn der Kurs ein höheres Level ereicht hat.

also mindestens mitt-Zwanziger oder Dreißiger Bereich.

Ich spekuliere darauf, daß die nächste Finanzierungsrunde auch vom Management erst angestrebt wird, wenn der Kurs ein höheres Level ereicht hat.

also mindestens mitt-Zwanziger oder Dreißiger Bereich.

Der Kurs hat die 0.18 von gestern tapfer verteidigt, damit hätt ich dann heute im Verlauf des Abends doch nicht gerechnet :-)

Das Beste aus der heutigen News:

Proceeds from these transactions are sufficient to cover the costs of:

1. the revalidated feasibility study, on target for completion early in the first quarter of 2011

2. the second tranche of the bonus payment due to the CAR Government in April 2011.

3. AXMIN also repaid its outstanding loan and accrued interest to its significant shareholder AOG Holdings BV in the sum of C$1.74 million, resulting in AXMIN being debt free.

Google:

Die Erlöse aus diesen Transaktionen sind ausreichend, um die Kosten zu decken:

1. der erneuerten Machbarkeitsstudie für die Fertigstellung Anfang im ersten Quartal des Jahres 2011

2. die zweite Tranche der Bonuszahlung aufgrund der CAR Regierung im April 2011.

3. AXMIN auch ihre ausstehenden Kreditbetrages zurückgezahlt und der aufgelaufenen Zinsen auf ihre bedeutenden Aktionär AOG Holdings BV in Höhe von C $ 1.740.000, was AXMIN wird schuldenfrei.

.

.

Proceeds from these transactions are sufficient to cover the costs of:

1. the revalidated feasibility study, on target for completion early in the first quarter of 2011

2. the second tranche of the bonus payment due to the CAR Government in April 2011.

3. AXMIN also repaid its outstanding loan and accrued interest to its significant shareholder AOG Holdings BV in the sum of C$1.74 million, resulting in AXMIN being debt free.

Google:

Die Erlöse aus diesen Transaktionen sind ausreichend, um die Kosten zu decken:

1. der erneuerten Machbarkeitsstudie für die Fertigstellung Anfang im ersten Quartal des Jahres 2011

2. die zweite Tranche der Bonuszahlung aufgrund der CAR Regierung im April 2011.

3. AXMIN auch ihre ausstehenden Kreditbetrages zurückgezahlt und der aufgelaufenen Zinsen auf ihre bedeutenden Aktionär AOG Holdings BV in Höhe von C $ 1.740.000, was AXMIN wird schuldenfrei.

.

.

Antwort auf Beitrag Nr.: 40.851.831 von XIO am 12.01.11 23:18:33PS.

We are in the midst of promising discussions to secure debt facilities to build the Passendro mine

We are in the midst of promising discussions to secure debt facilities to build the Passendro mine

große Blöcke werden heute gekauft, sehr schön anzusehen

:

:

:

:

Antwort auf Beitrag Nr.: 40.858.334 von XIO am 13.01.11 20:15:50hast du mal fix nen RT ?

Antwort auf Beitrag Nr.: 40.858.355 von websin am 13.01.11 20:19:17

Antwort auf Beitrag Nr.: 40.858.414 von XIO am 13.01.11 20:26:40danke!

Antwort auf Beitrag Nr.: 40.858.429 von websin am 13.01.11 20:29:21ich freue mich wie Sau....

hab das Axmin Invest aus meinem herausgenommenen Einstand vom Avion-Gewinn finanziert.. also quasi umsonst. und jetzt nähert sich der Wert in nicht mal 2 Monaten seinen ersten 100%

hab das Axmin Invest aus meinem herausgenommenen Einstand vom Avion-Gewinn finanziert.. also quasi umsonst. und jetzt nähert sich der Wert in nicht mal 2 Monaten seinen ersten 100%

Antwort auf Beitrag Nr.: 40.858.568 von XIO am 13.01.11 20:51:50Die Story liest sich sehr interessant, der Vergleich mit der Konkurrenz sehr spannend.

Bin mit an Board. Danke für die ausf. Recherchearbeit in diesem Thread und den Hinweis im TL Thread

Hoffe der EK ~0,20 CAD wird bald Geschichte sein

Bin mit an Board. Danke für die ausf. Recherchearbeit in diesem Thread und den Hinweis im TL Thread

Hoffe der EK ~0,20 CAD wird bald Geschichte sein

Antwort auf Beitrag Nr.: 40.858.568 von XIO am 13.01.11 20:51:50...und Herzl. Glückwunsch  bin ja Sponsor des akt. Kurses

bin ja Sponsor des akt. Kurses

bin ja Sponsor des akt. Kurses

bin ja Sponsor des akt. Kurses

Antwort auf Beitrag Nr.: 40.858.593 von websin am 13.01.11 20:55:21ach du warst das mit den 488.0000 zu 0.20

Antwort auf Beitrag Nr.: 40.858.647 von XIO am 13.01.11 21:03:28nicht ganz

ich bin traurig sehe meinen ungeraden trade auf http://de.advfn.com/p.php?pid=trades&symbol=TX^AXM nicht mehr

so...müde..ab auffe couch! was ein stress-kauf

wie ist deine prognose bis 04.2011?

Vg, WEBSIN

ich bin traurig sehe meinen ungeraden trade auf http://de.advfn.com/p.php?pid=trades&symbol=TX^AXM nicht mehr

so...müde..ab auffe couch! was ein stress-kauf

wie ist deine prognose bis 04.2011?

Vg, WEBSIN

Antwort auf Beitrag Nr.: 40.858.739 von websin am 13.01.11 21:16:04vorsichtige Prognose:

Mit langsam abnehmender intraday-volatilität (die ganzen kleinanleger, welche 2010 zw. 8 und 12 cent gekauft haben, weden wohl erstmal verständlicherweise etwas von ihrem einsatz sichern, und das wird noch bissl anhalten...) wird der sharepreis in richtung 30 cent gehen.

Dem auf AXM zukommenden Finanzbedarf für die Mine steht als positiv ausgleichendes argument die momentan eklatante unterbewertung der qualifiziert nachgewiesenen resourcen entgegen.

Daher traue ich AXM eine MK von 250 -300 Mio mindestens zu, bevor hier grössere Kapitalmaßnahmen anlaufen.

Es hängt auch ein bischen davon ab, ob man einen soft-start mit 100.000 Unc wählt , oder gleich das volle programm realisiert.

Mit langsam abnehmender intraday-volatilität (die ganzen kleinanleger, welche 2010 zw. 8 und 12 cent gekauft haben, weden wohl erstmal verständlicherweise etwas von ihrem einsatz sichern, und das wird noch bissl anhalten...) wird der sharepreis in richtung 30 cent gehen.

Dem auf AXM zukommenden Finanzbedarf für die Mine steht als positiv ausgleichendes argument die momentan eklatante unterbewertung der qualifiziert nachgewiesenen resourcen entgegen.

Daher traue ich AXM eine MK von 250 -300 Mio mindestens zu, bevor hier grössere Kapitalmaßnahmen anlaufen.

Es hängt auch ein bischen davon ab, ob man einen soft-start mit 100.000 Unc wählt , oder gleich das volle programm realisiert.

hab mal gerade wegen einer neuen Präsentation per Email angefragt:

>>>Consider we are expecting the revalidated Feasibility Study for Passendro at the end of this month

most of the slides will need to be updated but failing that this is the marketing show we are using this month<<<

.. den 2. Satzteil könnte mir mal bitte freundlicherweise jemand richtig übersetzen ich komme nicht ganz klar damit....

thx

>>>Consider we are expecting the revalidated Feasibility Study for Passendro at the end of this month

most of the slides will need to be updated but failing that this is the marketing show we are using this month<<<

.. den 2. Satzteil könnte mir mal bitte freundlicherweise jemand richtig übersetzen ich komme nicht ganz klar damit....

thx

Antwort auf Beitrag Nr.: 40.859.410 von XIO am 13.01.11 22:50:29na dann glück auf

Antwort auf Beitrag Nr.: 40.859.410 von XIO am 13.01.11 22:50:29 läuft ja sehr gut !

läuft ja sehr gut !

Danke für deine Recherche!

den 2.Satz verstehe ich so: sie hoffen die Überarbeitung zu schaffen - aber es überschneidet sich mit einer Marketingshow an der sie diesen Monat veranstalten wollen ?

also quasi doppelte Arbeit die man sich sparen könnte - ergo hoffen sie das die FS schneller fertig ist

läuft ja sehr gut !

läuft ja sehr gut !Danke für deine Recherche!

den 2.Satz verstehe ich so: sie hoffen die Überarbeitung zu schaffen - aber es überschneidet sich mit einer Marketingshow an der sie diesen Monat veranstalten wollen ?

also quasi doppelte Arbeit die man sich sparen könnte - ergo hoffen sie das die FS schneller fertig ist

Sehr stabil mit 0,20 an der tsx.

Das ist nicht schlecht für den heutigen Tag!

Das ist nicht schlecht für den heutigen Tag!

Antwort auf Beitrag Nr.: 40.866.604 von manffreddoo am 14.01.11 22:12:340.195 sind es geworden

Eine supi-Woche hat Axmin da hingelegt!

Mit der Gewissheit, daß AXM die geupdatete Fesab-Study noch in diesem verbleibenden Monat zu publishen gedenkt, dürften die Erwartungen in ein weiteres Ansteigen des Sharepreises berechtigt sein.

Eine supi-Woche hat Axmin da hingelegt!

Mit der Gewissheit, daß AXM die geupdatete Fesab-Study noch in diesem verbleibenden Monat zu publishen gedenkt, dürften die Erwartungen in ein weiteres Ansteigen des Sharepreises berechtigt sein.

ganz vergessen:

AXM January 2011 Praesentation

http://www.mediafire.com/?5656i7ttb8agrbi

da wird wohl noch mal ein Update kommen...

siehe: >>>most of the slides will need to be updated<<<

AXM January 2011 Praesentation

http://www.mediafire.com/?5656i7ttb8agrbi

da wird wohl noch mal ein Update kommen...

siehe: >>>most of the slides will need to be updated<<<

Valuation at 3/1/2011 shareprice of C$0.14

na das war heute ja mal ein unerwartetes finish

Antwort auf Beitrag Nr.: 40.884.322 von XIO am 18.01.11 22:14:22wenn am Tagesende hoher Umsatz und Plus, dann ist sehr oft was gutes in der Pipeline.........

... Hallo zusammen,

... Hallo zusammen,da ich AXMIN seit ca 6 Wochen auf meiner Watchliste habe - bin ich jetzt auch mit dabei.

wulfen40

Antwort auf Beitrag Nr.: 40.888.479 von wulfen40 am 19.01.11 14:52:57willkommen im club

Antwort auf Beitrag Nr.: 40.888.708 von websin am 19.01.11 15:17:55 ... Danke, Danke!

... Danke, Danke!

Kursverlauf Kanada: Da hat doch tatsächlich einer für 19,50 $ verkauft?!???

19.01.2011 15:30:00 E 0,1950 100

19.01.2011 15:30:00 M 0,2000 49.000

19.01.2011 15:30:00 M 0,2000 7.000

19.01.2011 15:30:00 M 0,2000 17.500

19.01.2011 15:30:00 M 0,2000 500

19.01.2011 15:30:00 M 0,2000 10.000

... Danke, Danke!

... Danke, Danke!Kursverlauf Kanada: Da hat doch tatsächlich einer für 19,50 $ verkauft?!???

19.01.2011 15:30:00 E 0,1950 100

19.01.2011 15:30:00 M 0,2000 49.000

19.01.2011 15:30:00 M 0,2000 7.000

19.01.2011 15:30:00 M 0,2000 17.500

19.01.2011 15:30:00 M 0,2000 500

19.01.2011 15:30:00 M 0,2000 10.000

Schau gerade in mein Depot, die +29,57 % sind ja real in FFM.

Ich dachte W.O hat 'nen Fehler!

Naja bei einem Spread von 32,6%

32,6%  ja auch kein Wunder

ja auch kein Wunder

Ich dachte W.O hat 'nen Fehler!

Naja bei einem Spread von

32,6%

32,6%  ja auch kein Wunder

ja auch kein Wunder

sauber

Das ist heute echt super.

Nachdem soviele Goldwerte so verprügelt wurden!!!!

Das macht Lust......auf mehr.

Nachdem soviele Goldwerte so verprügelt wurden!!!!

Das macht Lust......auf mehr.

Antwort auf Beitrag Nr.: 40.899.055 von manffreddoo am 20.01.11 21:20:34das is goilllll

morgen gleich mal noch mal bitte

morgen gleich mal noch mal bitte

axmin heute 4,4 mio shares aus dem Buy und nur 2 mio aus dem Bid.. sehr gut

Plus 61% in Frankfurt!

Sind das Witzkurse?

Sind das Witzkurse?

Antwort auf Beitrag Nr.: 40.901.539 von manffreddoo am 21.01.11 11:08:07Spread - bedingt - stimmt schon!

Frankfurt G 0,123 € B 0,203 € 65,04%

Wer dort kauft ist selber Schuld. Spread an der TSX= 2,3%

Frankfurt G 0,123 € B 0,203 € 65,04%

Wer dort kauft ist selber Schuld. Spread an der TSX= 2,3%

Antwort auf Beitrag Nr.: 40.901.930 von websin am 21.01.11 11:55:39viele können in Canada nicht - staune aber wegen der krummem Posi.......

nunja, egal - bei den Aussichten

nunja, egal - bei den Aussichten

Antwort auf Beitrag Nr.: 40.902.167 von grasgruener am 21.01.11 12:26:55dass man nicht kann, kann aber geändert werden (in den meisten fällen)

heilmittel: flatex, lynx etc.

...spassvogel gefrühstückt heute

heilmittel: flatex, lynx etc.

...spassvogel gefrühstückt heute

Antwort auf Beitrag Nr.: 40.902.324 von websin am 21.01.11 12:47:18ein bisschen Spass muss sein.......!

auf mittlere Sicht wird es wohl auc egal sein, ob man nun für 0,18/0,20/oder0,22 gekauft hat........

auf mittlere Sicht wird es wohl auc egal sein, ob man nun für 0,18/0,20/oder0,22 gekauft hat........

Antwort auf Beitrag Nr.: 40.902.343 von grasgruener am 21.01.11 12:49:14das wäre ja toll. sind eigentlich viele von euch mit einsand unter .10 cad?

What investors can expect from elections in CAR

After much delay the citizens of the Central African Republic (CAR) are set to head to the polls on Sunday, but the implications for miners in the region are still unclear.

Francois Bozize, the current president, is favored to win. Even if he should, however,

Onlookers say stability won't come easily to the landlocked nation which sits just north of the Democratic Republic of the Congo.

"The outlook overall is fairly grim," Roddy Barclay, an analyst with Control Risk says via telephone from London. "I think the election will be more of a challenge than an opportunity as we are unlikely to see any significant improvement. After the elections are over, weak state institutions and corruption will continue to characterize the country."

Barclay also points out the opposition parties are already arguing that voter's lists have been completed only recently and that they have had merely two weeks to campaign.

"Bozize has all the benefits of incumbency and he is controlling the electoral process," Barclay says. Although, he concedes, the president has managed to broaden his political base by bringing former rebels in as his advisors.

Despite that move, Bozize's government is seen as maintaining control over the south western and south central parts of the country - areas that surround the capital of Bangui.

Toronto-based gold junior, Axmin (AXM-V) has its Passendro gold project located in south-central region of the country, and has not reported any difficulties with rebel groups over its many years of operating in the country. The company is currently in the midst of updating its feasibility study on Passendro as it looks to drive the project into production.

South African based Randgold Resources (GOLD-N, RRS-L) and French-based Areva, also have interests in the country.

The former French colony of 4.6 million people is rich in gold, uranium and diamonds.

As for positives that an election could bring, Barclay was cautious with his optimism.

"The best case scenarios is that there is no major violence and that Bozize wins by a large enough margin that challenges are silenced out and he can continue with security sector reform," he says. "It will be crucial for him to impose governance outside of Bangui."

On the other side, Barclay frames the worse case scenario as having a shambolic election followed by numerous challenges and an armed coup.

While he says such a scenario can't be entirely ruled out he believes the chances of it occurring are low.

"Most likely what will happen is that the country will muddle through messy challenges with vocal opposition saying the government is not credible," he says.

Bozize seized power in 2003 through a coup, and then was elected to the office in 2005.

While there is a total of five presidential candidates, only two are considered legitimate contenders: Ange Felix Patasse and Martin Ziguele.