Babcock & Wilcox Announces Second Quarter 2017 Results - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 10.08.17 21:43:19 von

neuester Beitrag 15.10.20 12:57:04 von

neuester Beitrag 15.10.20 12:57:04 von

Beiträge: 58

ID: 1.259.115

ID: 1.259.115

Aufrufe heute: 0

Gesamt: 1.645

Gesamt: 1.645

Aktive User: 0

ISIN: US05614L2097 · WKN: A2PN0R · Symbol: UBW1

1,0100

EUR

+2,54 %

+0,0250 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

25.04.24 · Business Wire (engl.) |

22.04.24 · Business Wire (engl.) |

15.04.24 · Business Wire (engl.) |

10.04.24 · Business Wire (engl.) |

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 99,97 | +44,88 | |

| 890,00 | +14,32 | |

| 18,500 | +13,50 | |

| 1.154,50 | +12,61 | |

| 1.200,00 | +11,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,780 | -6,93 | |

| 9.000,00 | -9,09 | |

| 24,37 | -10,44 | |

| 1.202,04 | -14,08 | |

| 30,00 | -25,00 |

Babcock & Wilcox Enterprises, Inc. ("B&W") (NYSE: BW) announced today second quarter 2017 revenues of $349.8 million, a decrease of $33.4 million, or 8.7%, compared to the second quarter of 2016. GAAP earnings per share in …

Lesen Sie den ganzen Artikel: Babcock & Wilcox Announces Second Quarter 2017 Results

Lesen Sie den ganzen Artikel: Babcock & Wilcox Announces Second Quarter 2017 Results

Meine Damen und Herren,

- 69% wg. Renewable -110.9USD --> renewable waste to energy projects --> Müllverbrennung auf gut Deutsch.

Gibt einfach keine Fachkräfte mehr; siehe: "European Renewable Energy Project" aus:

http://investors.babcock.com/press-releases/press-release-de…

Auftragseingang Industrial +138% !

Mal ne kleine "Chapter 11"-Position hier als Beobachtung zugelegt. Sie haben sofort wieder einen revolving credit bekommen.

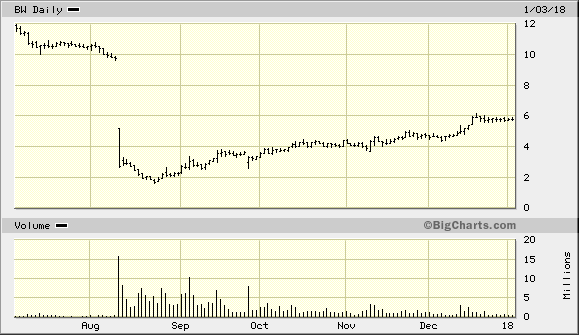

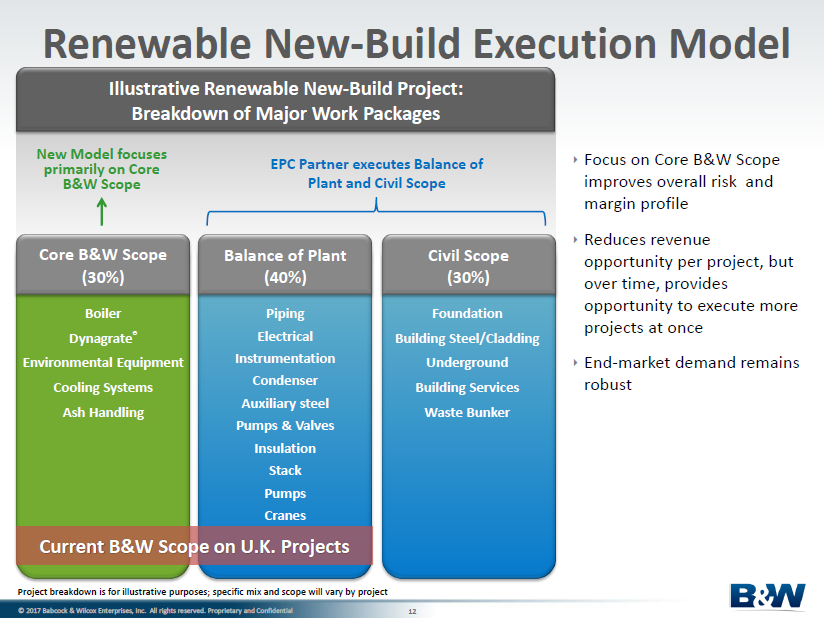

Verpartnerung für BOP (Balance of plant) und Civil Engineering --> das ist so Richtung GEA, um es mal ganz vorsichtig zu erklären.

Ich gehe in der Eile davon aus, dass American Industrial Partners sich die Bücher und den Hintergrund sehr genau angesehen haben.

("private equity firm specializing in investments in turnarounds; leveraged buyouts; management buyouts; corporate divestitures, PIPES, structured preferred equity investments; recapitalizations; equity bridging transactions; strategic add-on acquisitions; going-private transactions; debt with warrants; carve-outs; international expansion; re-financings; project management and finance...")

So ist das eben im Projektgeschäft. Wobei es mit BW ja schon länger bergab geht.

Eigentlich gleich nach dem Spinoff vom Nukleargeschäft.

Hier trennen sich die letzten nicht so risikobereiten Insti's.

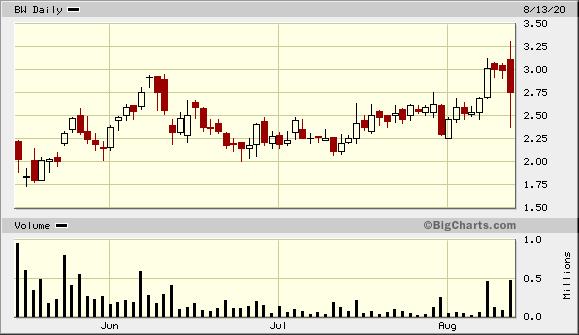

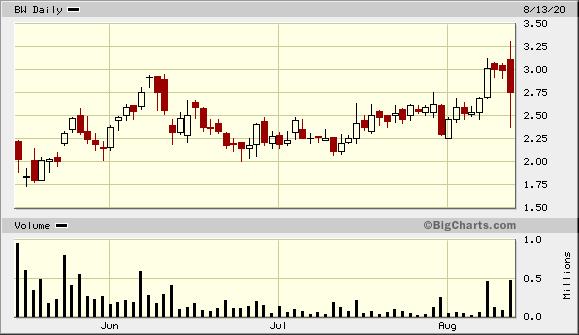

Kurs könnte noch nachtröpfeln (< USD3) die nächsten Wochen, so wie beim letzten Mal.

- 69% wg. Renewable -110.9USD --> renewable waste to energy projects --> Müllverbrennung auf gut Deutsch.

Gibt einfach keine Fachkräfte mehr; siehe: "European Renewable Energy Project" aus:

http://investors.babcock.com/press-releases/press-release-de…

Auftragseingang Industrial +138% !

Mal ne kleine "Chapter 11"-Position hier als Beobachtung zugelegt. Sie haben sofort wieder einen revolving credit bekommen.

Verpartnerung für BOP (Balance of plant) und Civil Engineering --> das ist so Richtung GEA, um es mal ganz vorsichtig zu erklären.

Ich gehe in der Eile davon aus, dass American Industrial Partners sich die Bücher und den Hintergrund sehr genau angesehen haben.

("private equity firm specializing in investments in turnarounds; leveraged buyouts; management buyouts; corporate divestitures, PIPES, structured preferred equity investments; recapitalizations; equity bridging transactions; strategic add-on acquisitions; going-private transactions; debt with warrants; carve-outs; international expansion; re-financings; project management and finance...")

So ist das eben im Projektgeschäft. Wobei es mit BW ja schon länger bergab geht.

Eigentlich gleich nach dem Spinoff vom Nukleargeschäft.

Hier trennen sich die letzten nicht so risikobereiten Insti's.

Kurs könnte noch nachtröpfeln (< USD3) die nächsten Wochen, so wie beim letzten Mal.

Antwort auf Beitrag Nr.: 55.501.659 von faultcode am 10.08.17 21:43:19

Ein möglicher Hintergrund für den zeitweise dramatischen Absturz eines USD1.5b-Umsatz-Unternehmens (12m), sei in den fehlenden Köpfen im Mittelmanagement zu suchen, die bei Entlassung von CEO (die zweite dramatische Fehleinschätzung in 6m) und Co. nachrücken könnten.

Das industrielle Projektgeschäft verläuft eben nicht besonders linear - wird aber (immer noch) fälschlicherweise so geplant und auch verstanden.

Ich habe sowas selten gesehen...

Das Waste to Energy-Geschäft ist absolut ausbaufähig - auch noch in den USA (keine Müllhalden mehr --> Müllverbrennung wie auch in Deutschland...)

=> siehe: http://www.babcock.com/en/industry/waste-to-energy

Wobei es schon so ist, dass international BW auch auf knallharten Wettbewerb trifft, da ja z.B. in Europa viele traditionelle Anlagenbauer in der Vergangenheit sich bedingt durch "Green Energy" andere Standbeine suchen mussten...

nun schon +8...20% bei Eröffnung als technische Reaktion

=> Kurs wird sich wohl um die USD3.0 einschwingen --> EXTREMST-VOLATILITÄT!Ein möglicher Hintergrund für den zeitweise dramatischen Absturz eines USD1.5b-Umsatz-Unternehmens (12m), sei in den fehlenden Köpfen im Mittelmanagement zu suchen, die bei Entlassung von CEO (die zweite dramatische Fehleinschätzung in 6m) und Co. nachrücken könnten.

Das industrielle Projektgeschäft verläuft eben nicht besonders linear - wird aber (immer noch) fälschlicherweise so geplant und auch verstanden.

Ich habe sowas selten gesehen...

Das Waste to Energy-Geschäft ist absolut ausbaufähig - auch noch in den USA (keine Müllhalden mehr --> Müllverbrennung wie auch in Deutschland...)

=> siehe: http://www.babcock.com/en/industry/waste-to-energy

Wobei es schon so ist, dass international BW auch auf knallharten Wettbewerb trifft, da ja z.B. in Europa viele traditionelle Anlagenbauer in der Vergangenheit sich bedingt durch "Green Energy" andere Standbeine suchen mussten...

guter Hintergrund

https://seekingalpha.com/article/4099778-babcock-and-wilcox-… heute auch wieder -10 ... -8% (sehr hohe Intraday-Vola)

Der Markt geht tatsächlich von einer Insolvenz (ohne verwertbare Insolvenz-Masse) aus...=> never try to catch a falling knife...

Verkaufen werde ich meine Kleinstposition aber auch nicht, weil so was in der Vergangenheit sich oft genug als Wendepunkt herausstellte.

Shorts: auch auf http://shortsqueeze.com weiss man (noch) nichts Genaues (ohne Konto dort meinerseits).

Auf StockTwits wird permanent ein Boden gesucht (der bei USD1.90 hat ja auch nicht gehalten):

=> ich gehe allerdings nun davon aus, dass die Aktie in den Penny-Stock-Bereich geshortet werden soll, ja geradezu muss für eine (notwendige) Kapitulation - und dort auch ein Zeitlang verbleiben muss

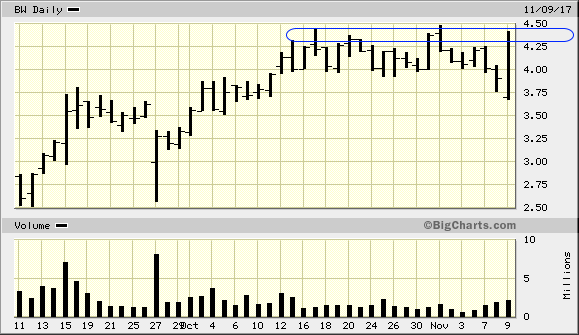

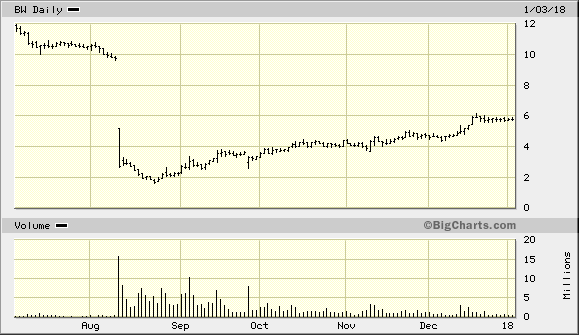

Antwort auf Beitrag Nr.: 55.586.383 von faultcode am 23.08.17 21:40:08diese Woche zurück auf USD3 vom Supertief --> mMn sind wir damit vorerst im neutralen Bereich - und damit "langweilig" --> warten auf News...

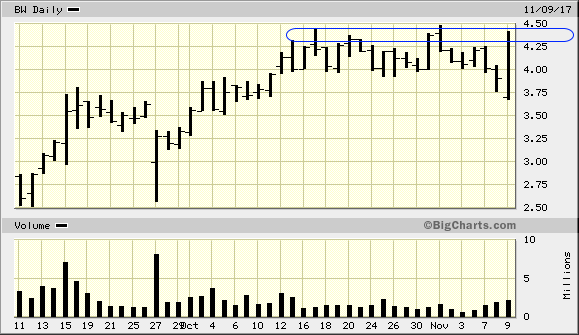

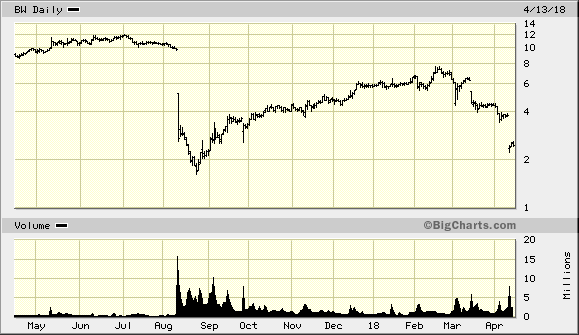

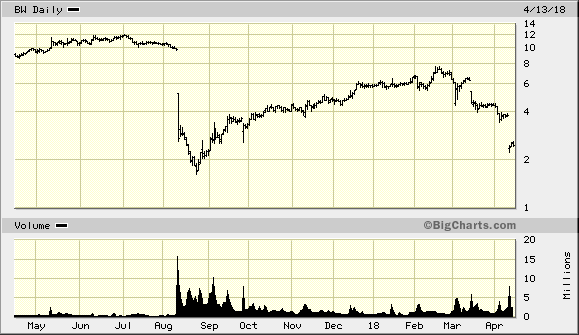

Was für ein selten regelmässiger Chart

...und noch schöner: absolut niemand, kein Mensch oder Maschine, weiss das vorher.

Antwort auf Beitrag Nr.: 55.889.146 von faultcode am 05.10.17 19:13:26

=> das fällt heute auf, da z.Z. > +9.5%

=> bei sowas - aus dem Nichts - weiss man als kleiner, ausserstehender Retail-Investor nie, ob da nicht wieder einige Tiere gleicher sind als andere Tiere.

noch keine Termine festgelegt zwecks Q3-Zahlen etc.

alles noch leer in der Zukunft: http://investors.babcock.com/events-and-presentations/defaul…=> das fällt heute auf, da z.Z. > +9.5%

=> bei sowas - aus dem Nichts - weiss man als kleiner, ausserstehender Retail-Investor nie, ob da nicht wieder einige Tiere gleicher sind als andere Tiere.

Antwort auf Beitrag Nr.: 55.889.215 von faultcode am 05.10.17 19:24:20

gerade USD4.2N

=>

=> ich warte noch bis die vorherigen Spitzen bei ca. USD4.45 herausgenommen wurden. Dreimal muss es nach oben "anklopfen".

=> einmal noch Luft holen, dann kann der Kurs nach oben ausbrechen.. vor Ende 2017?

2017Q3...

...sieht man nicht mehr im Chart --> alles verdaut?gerade USD4.2N

=>

=> ich warte noch bis die vorherigen Spitzen bei ca. USD4.45 herausgenommen wurden. Dreimal muss es nach oben "anklopfen".

=> einmal noch Luft holen, dann kann der Kurs nach oben ausbrechen.. vor Ende 2017?

Antwort auf Beitrag Nr.: 56.146.895 von faultcode am 09.11.17 20:27:30

..und nun auch mit neuer Aufsicht:

http://investors.babcock.com/press-releases/press-release-de…

=>

...BW announced today that it has appointed Brian R. Kahn, Henry E. Bartoli and Matthew E. Avril to the Company’s Board of Directors.

=> 2017Q3-Zahlen: http://investors.babcock.com/press-releases/press-release-de…

- U.K. Renewable new-build projects continue to advance

- Cost-savings actions targeting $45 million in annual savings underway

- Evaluating strategic alternatives for MEGTEC and Universal

=> aber immer noch: EV-to-EBITDA -1.53 (lt. GF)

=> aus der 2017-11-Präsentation zur Verkleinerung des Geschäfts-Modells => die BoP soll in Zukunft auch wegfallen (nachdem Siemens, ABB und Co. aber ähnliche Strategien verfolgen (*), also weg vom EPC-Geschäft - oder wie Siemens und ABB vornehmlich nur als Lösungsprovider für EPC's aufzutreten, müsste sich ja auf dem Weltmarkt eine echte Lücke für das eigentliche EPC-Geschäft auftun - im Sinne eines grossen, globalen EPC-Anbieters - und wer soll in Zukunft als GU, also Generalunternehmer, bei solchen Projekten auftreten??? Die Chinesen??? => zukünftig werden konventionelle Qualitäts-Kraftwerke richtig teuer werden in Planung, Konstruktion und IBN => d.h. in jedem Fall > EUR1m pro 1MW):

(*)

https://www.siemens.com/global/en/home/products/energy/topic…

http://new.abb.com/channel-partners/business/engineering-pro…

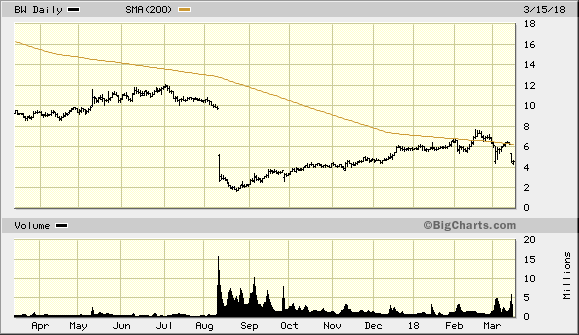

so war..

..das mit dem Anklopfen in der Tat:

..und nun auch mit neuer Aufsicht:

http://investors.babcock.com/press-releases/press-release-de…

=>

...BW announced today that it has appointed Brian R. Kahn, Henry E. Bartoli and Matthew E. Avril to the Company’s Board of Directors.

=> 2017Q3-Zahlen: http://investors.babcock.com/press-releases/press-release-de…

- U.K. Renewable new-build projects continue to advance

- Cost-savings actions targeting $45 million in annual savings underway

- Evaluating strategic alternatives for MEGTEC and Universal

=> aber immer noch: EV-to-EBITDA -1.53 (lt. GF)

=> aus der 2017-11-Präsentation zur Verkleinerung des Geschäfts-Modells => die BoP soll in Zukunft auch wegfallen (nachdem Siemens, ABB und Co. aber ähnliche Strategien verfolgen (*), also weg vom EPC-Geschäft - oder wie Siemens und ABB vornehmlich nur als Lösungsprovider für EPC's aufzutreten, müsste sich ja auf dem Weltmarkt eine echte Lücke für das eigentliche EPC-Geschäft auftun - im Sinne eines grossen, globalen EPC-Anbieters - und wer soll in Zukunft als GU, also Generalunternehmer, bei solchen Projekten auftreten??? Die Chinesen??? => zukünftig werden konventionelle Qualitäts-Kraftwerke richtig teuer werden in Planung, Konstruktion und IBN => d.h. in jedem Fall > EUR1m pro 1MW):

(*)

https://www.siemens.com/global/en/home/products/energy/topic…

http://new.abb.com/channel-partners/business/engineering-pro…

Babcock & Wilcox Initiates Executive Transition --> Alt-CEO weg!

http://investors.babcock.com/press-releases/press-release-de…=>

- Leslie C. Kass appointed Chief Executive Officer --> eine Frau: http://www.babcock.com/about/management

- E. James (Jim) Ferland to serve as Executive Chairman bis Juni 2018

cf. Beitrag Nr. 3 --> CEO-Wechsel kommt nun nicht so überraschend

...Alt-CEO Jim Ferland will work closely with Ms. Kass, the management team and the Board in the role of Executive Chairman until he steps down from the Board on June 30, 2018 per his current employment agreement...

=> kein Dankeswort an ihn!

=> aber: BW -2.2% runter erstmal

nebenbei: immer noch +41% in den letzten 3 Monaten...

> USD7

---> das ist neues Hoch seit dem Crash!2017Q4 results: Thursday, March 1, 2018 is expected to be issued after the market close that day

...und wie auf StockTwits jemand bemerkte --> nun oberhalb der SMA200-Linie:

=> tja, wer hätte das wirklich gedacht im August 2017 ?

2017Q4 --> BW USD4.65 -27.89% After Hours

http://investors.babcock.com/press-releases/press-release-de…http://s22.q4cdn.com/178702546/files/doc_presentations/2018/…

=>

Introducing 2018 Outlook

On a consolidated basis, the Company is providing 2018 guidance as follows:

Revenue in the range of $1.5 billion to $1.7 billion

Adjusted EBITDA to be in the range of $75 million to $95 million(1)

(1) As more fully described in Exhibit 2, management is unable to reconcile without unreasonable effort the Company's forecasted range of adjusted EBITDA for the full year to a comparable GAAP range.

The Company is providing 2018 revenue and gross margin guidance by segment(2) as follows:

Power: revenue down 5% to flat compared to 2017; gross margin approximately 20%

Renewable: revenue up 5% to 10% compared to 2017; gross margin greater than 10%

Industrial: revenue up 14% to 19% compared to 2017; gross margin approaching 20%

(2) Segment gross margin guidance is presented on a pro forma basis, reflecting the adoption of FASB ASU 2017-07, under which the non-service cost components of net periodic benefit cost will be presented in other income rather than in cost of operations. The Company will adopt this standard in 2018. The impact of the new standard will primarily impact the Company's Power segment. On a pro forma basis, Power segment gross margin guidance would compare to 20.8% in 2017...

Antwort auf Beitrag Nr.: 57.165.555 von faultcode am 02.03.18 00:50:43

http://investors.babcock.com/press-releases/press-release-de…

=>

...Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced today that it has fixed March 15, 2018 as the record date for determination of shareholders entitled to participate in B&W’s common stock rights offering (the "Rights Offering").

Each shareholder will receive one right (each, a "Right") for each whole share of common stock held of record as of the record date. The subscription price for all shares of common stock issued pursuant to the Rights Offering will be $3.00 per share.

The initial offering materials for the Rights Offering will indicate that the Rights are non-transferable and may not be purchased or sold. Additional terms and conditions of the Rights Offering will be announced and provided in the offering materials.

As previously disclosed, B&W has received a commitment letter from Vintage Capital Management, LLC to backstop the Rights Offering.

The Rights Offering is subject to the effectiveness of a post-effective amendment to B&W’s existing Registration Statement on Form S-3 filed with the Securities and Exchange Commission, which will be filed in the near term. The Registration Statement is not complete and may be changed. Shares of common stock issuable in the Rights Offering may not be sold nor may offers to buy such common stock be accepted prior to the time the amendment to the Registration Statement becomes effective...

Kapitalerhöhung also 1 Right : 1 new share soweit ich das erkennen kann

=> noch liegt man - trotz allem - diesmal auf 3m-Sicht vorne.

jetzt mit Kapitalerhöhung

March 05, 2018http://investors.babcock.com/press-releases/press-release-de…

=>

...Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced today that it has fixed March 15, 2018 as the record date for determination of shareholders entitled to participate in B&W’s common stock rights offering (the "Rights Offering").

Each shareholder will receive one right (each, a "Right") for each whole share of common stock held of record as of the record date. The subscription price for all shares of common stock issued pursuant to the Rights Offering will be $3.00 per share.

The initial offering materials for the Rights Offering will indicate that the Rights are non-transferable and may not be purchased or sold. Additional terms and conditions of the Rights Offering will be announced and provided in the offering materials.

As previously disclosed, B&W has received a commitment letter from Vintage Capital Management, LLC to backstop the Rights Offering.

The Rights Offering is subject to the effectiveness of a post-effective amendment to B&W’s existing Registration Statement on Form S-3 filed with the Securities and Exchange Commission, which will be filed in the near term. The Registration Statement is not complete and may be changed. Shares of common stock issuable in the Rights Offering may not be sold nor may offers to buy such common stock be accepted prior to the time the amendment to the Registration Statement becomes effective...

Kapitalerhöhung also 1 Right : 1 new share soweit ich das erkennen kann

=> noch liegt man - trotz allem - diesmal auf 3m-Sicht vorne.

Antwort auf Beitrag Nr.: 57.190.723 von faultcode am 05.03.18 16:44:25

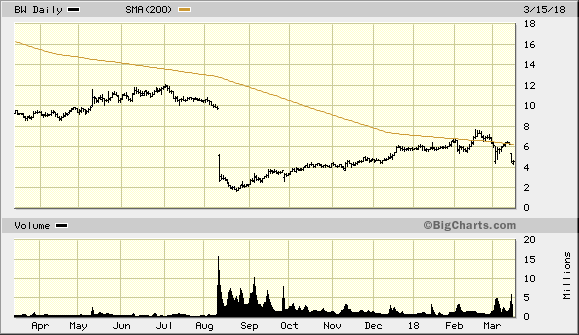

-23%

(neuer) Grund mir z.Z. unbekannt.

Antwort auf Beitrag Nr.: 57.278.134 von faultcode am 14.03.18 16:53:23hab nochmal nachgelegt; obwohl mich der Verlust des EPC-Geschäftes schon etwas stört.

MDR z.B. ist mir da nicht universell genug, zu sehr in O&G.

MDR z.B. ist mir da nicht universell genug, zu sehr in O&G.

Antwort auf Beitrag Nr.: 57.278.347 von faultcode am 14.03.18 17:04:40

=> Short Percent of Float: 28.08 %

Shares float sind aber nur 28.0M = ~63.5% --> cf. https://finance.yahoo.com/quote/BW/key-statistics?p=BW

-28% schon

http://shortsqueeze.com/?symbol=bw&submit=Short+Quote%E2%84%…=> Short Percent of Float: 28.08 %

Shares float sind aber nur 28.0M = ~63.5% --> cf. https://finance.yahoo.com/quote/BW/key-statistics?p=BW

Antwort auf Beitrag Nr.: 57.048.207 von faultcode am 16.02.18 21:20:58

=> USD4.5 nach unten scheinen zu halten vor der KE nächste Woche...

=> USD4.5 nach unten scheinen zu halten vor der KE nächste Woche...

Troubles deepen at Babcock & Wilcox as SEC launches investigation

15.3.https://www.bizjournals.com/charlotte/news/2018/03/15/troubl…

=>

New troubles arise for Charlotte-based Babcock & Wilcox Enterprises Inc. as the U.S. Securities & Exchange Commission has opened an investigation into accounting for the company’s troubled Renewable Segment.

The company reported operating losses of $68.1 million in 2016 and $128.2 million in 2017. The surprise announcement early last year of the steep 2016 losses sent stock values tumbling for the company, and it has yet to regain its footing.

On Thursday, the company acknowledged it has received an SEC subpoena “in connection with an investigation into the accounting charges and related matters involving our Renewable segment in 2016 and 2017.”

The company says its is cooperating with the investigation. It has not yet responded to a request for additional information about the subpoena. The SEC does not comment on investigations.

Other issues

The filing says B&W (NYSE: BW) got the subpoena this month, but it is not more specific about when it came. The stock price dropped 28% on March 14, closing at $4.51. That is down from $6.26 at the close of March 13.

That could be some indication of when the subpoena came. Thursday the stock dropped just 3 cents a share to close a $4.48. The company’s filing was not made until after the market closed.

B&W faces a shareholder suit accusing the company, former CEO Jim Ferland and Chief Financial Officer Jenny Apker of fraud in intentionally misleading investors about the problems in the Renewable Segment. The company replaced Ferland with another top executive, Leslie Kass, last month.

The defendants are due to respond to the shareholder complaint March 26.

Meanwhile, Warren Lichtenstein’s Steel Partners Holdings, which tried to purchase the company in December, disclosed Thursday that it acquired almost 460,000 additional B&W shares in the last week to boost its stake to more than 6,993,000 shares, or 15.9% of the outstanding stock.

The spurned suitor is the largest shareholder in the company, outstripping Brian Kahn’s Vintage Capital Management, which has a 14.9% stake. Vintage has made a brace of agreements with B&W that will give it five directors on the company’s nine-member board going into its annual meeting in May.

B&W Commences Rights Offering

http://investors.babcock.com/press-releases/press-release-de…=>

... CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (the “Company”) (NYSE:BW) announced today that it commenced a rights offering (“Rights Offering”) originally announced on March 1, 2018.

Pursuant to the Rights Offering, the Company is distributing to holders of the Company’s common shares one nontransferable subscription right (a “Right”) to purchase 1.4 common shares for each common share held as of 5:00 p.m., New York City time, on March 15, 2018 (the “Rights Distribution Record Date”) at a price of $3.00 per common share (the “Subscription Price”).

The Company will not issue any fractional common shares in the Rights Offering and exercises of Rights will be rounded down to the nearest whole common share. In addition, the Company will not issue fractional Rights, or pay cash in lieu of fractional Rights.

The Rights may be exercised at any time during the subscription period, which will commence on March 19, 2018. The Rights will expire if they are not exercised by 5:00 p.m., New York City time, on April 10, 2018, unless the Company extends the Rights Offering period.

The Company expects to issue 62,128,141 common shares in connection with the Rights Offering, including any common shares issued to Vintage Capital Management, LLC, a significant shareholder of the Company (“Vintage”), as backstop purchaser.

The Company expects to mail subscription certificates evidencing the Rights and a copy of the prospectus supplement for the Rights Offering to shareholders as of the Rights Distribution Record Date beginning on or about March 19, 2018.

The Company is conducting the Rights Offering to raise proceeds, along with borrowings under its first lien revolving credit facility, to repay in full all of the indebtedness outstanding and the Company’s other obligations under its second lien term loan...

Antwort auf Beitrag Nr.: 57.288.883 von faultcode am 15.03.18 15:37:41

=> auch sieht man oben exemplarisch perfekt nach starken, abrupten Kursbewegungen, dass es sehr sinnvoll ist, die "3-Tage-Regel" zu beachten - hier auf der Longseite nach dem Dienstag letzter Woche:

--> an die ich mich selber aus Ungeduld nicht hielt

--> https://www.wallstreet-online.de/diskussion/1259115-11-20/ba…

--> https://www.wallstreet-online.de/diskussion/1259115-11-20/ba…

=> ein (für mich) deutliches Indiz, dass der Aktienmarkt (wie Finanzmärkte im allgemeinen) ein "Gedächtnis" auf den verschiedenen Zeitebenen hat (vielleicht nicht immer in jedem Markt auf jeder Zeitebene - aber das ist eine andere Geschichte...)

die USD4 halten..

.., wenn auch nur mit Fehl-Durchbrüchen gestern --> so was schmeisst einige Trader vorzeitig raus:

=> auch sieht man oben exemplarisch perfekt nach starken, abrupten Kursbewegungen, dass es sehr sinnvoll ist, die "3-Tage-Regel" zu beachten - hier auf der Longseite nach dem Dienstag letzter Woche:

--> an die ich mich selber aus Ungeduld nicht hielt

--> https://www.wallstreet-online.de/diskussion/1259115-11-20/ba…

--> https://www.wallstreet-online.de/diskussion/1259115-11-20/ba…=> ein (für mich) deutliches Indiz, dass der Aktienmarkt (wie Finanzmärkte im allgemeinen) ein "Gedächtnis" auf den verschiedenen Zeitebenen hat (vielleicht nicht immer in jedem Markt auf jeder Zeitebene - aber das ist eine andere Geschichte...)

Antwort auf Beitrag Nr.: 57.190.723 von faultcode am 05.03.18 16:44:25

http://investors.babcock.com/press-releases/press-release-de…

=>

April 10, 2018

CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE: BW) today provided an investor update, and announced that it amended the terms of and extended the expiration date for its pending common stock rights offering.

Rights Offering

B&W has amended its rights offering to:

* Increase its size to $248 million;

* Lower the per share subscription price from $3.00 to $2.00;

* Increase the number of shares issuable per right to 2.8 from 1.4; and

* extend the expiration date from April 10, 2018 to April 30, 2018.

=> diese USD2.0 sind nun damit im Visier:

--> hier's ein wirklich interessante Short-Quote entstanden: Short Percent to Float 27.78%

https://www.shortpainbot.com/?s=bw

B&W Provides Update and Amends Rights Offering

..und mit Anpassung (nach unten) bereits:http://investors.babcock.com/press-releases/press-release-de…

=>

April 10, 2018

CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE: BW) today provided an investor update, and announced that it amended the terms of and extended the expiration date for its pending common stock rights offering.

Rights Offering

B&W has amended its rights offering to:

* Increase its size to $248 million;

* Lower the per share subscription price from $3.00 to $2.00;

* Increase the number of shares issuable per right to 2.8 from 1.4; and

* extend the expiration date from April 10, 2018 to April 30, 2018.

=> diese USD2.0 sind nun damit im Visier:

--> hier's ein wirklich interessante Short-Quote entstanden: Short Percent to Float 27.78%

https://www.shortpainbot.com/?s=bw

B&W MEGTEC Awarded Contract to Supply Coating Equipment to Maker of Lithium-Ion Batteries

BW ist auch in Zukunftsmärkten unterwegs; z.B.24.4.

https://www.enhancedonlinenews.com/news/eon/20180424005286/e…

=>

Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced today that its subsidiary, Babcock & Wilcox MEGTEC (B&W MEGTEC), has been awarded a contract for more than $15 million to design and supply battery coating equipment to K.R. ENERGY Group subsidiary FIB S.r.l. for a lithium-ion battery manufacturing facility currently under construction in Teverola, Italy.

B&W MEGTEC will supply equipment for mixing systems, anode and cathode coating lines, and slitting systems, as well as general contracting and plant start-up services. The plant will produce energy storage systems for homes, businesses and electric vehicles.

“We continue to see substantial opportunities for B&W MEGTEC in the global lithium ion battery technology market,” said Kenneth Zak, Senior Vice President, B&W MEGTEC. “From electric automobile batteries to home and industrial-scale energy storage, this is a robust and rapidly growing market. We thank K.R. Energy and FIB S.r.l. for choosing us for this important project.”

B&W MEGTEC’s proprietary lithium-ion battery electrode coating process uses a simultaneous two-sided horizontal tensioned-web coating method and a patented air flotation dryer. This entire coating and drying method increases efficiency and reduces waste. Benefits of the two-side coating process include improved quality, lower capital and operating costs, and more effective and efficient operation than other traditional coaters.

The contract was booked in the first quarter of 2018 and B&W MEGTEC has begun engineering and manufacturing work for the project and is scheduled to commission the plant in the second quarter of 2019.

B&W Announces Completion of Rights Offering

http://investors.babcock.com/press-releases/press-release-de…=>...

Subscribers in the rights offering, including Vintage Capital Management, LLC (“Vintage”), subscribed for approximately 100.9 common shares, or 81.2% of the approximately 124.3 million common shares available, pursuant to their basic subscription privileges.

Pursuant to the rights offering and the transactions contemplated by the standby purchase agreement between B&W and Vintage, Vintage also purchased the remaining 23.4 common shares available in the rights offering pursuant to its backstop commitment.

The rights offering generated aggregate gross proceeds of approximately $248.5 million. B&W expects to use a substantial portion of the net proceeds from the rights offering to repay in full all of the indebtedness outstanding and its other obligations under its second lien term loan. B&W intends to use the remaining proceeds for working capital purposes.

B&W expects the subscription agent to distribute the common shares purchased in the rights offering on or about Thursday, May 3, 2018...

https://www.shortpainbot.com/?s=bw

=>

Short Percent to Float: 29.1%

Babcock & Wilcox Announces First Quarter 2018 Results

http://investors.babcock.com/press-releases/press-release-de…=>

...

- Reaffirming 2018 guidance

- U.K. Renewable projects progressing towards completion

- MEGTEC and Universal strategic processes ongoing

- Raised $248.5 million through rights offering; repaid second-lien term loan

CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. ("B&W") (NYSE: BW) announced today first quarter 2018 revenues of $311.4 million, a decrease of $79.7 million, or 20%, compared to the first quarter of 2017.

GAAP earnings per share in first quarter 2018 were a loss of $2.73 compared to a loss per share of $0.14 in first quarter 2017. Adjusted earnings per share were a loss of $2.19 for the three months ended March 31, 2018 compared to an adjusted earnings per share of $0.04 in the prior-year period.

GAAP net loss in first quarter 2018 was $120.3 million compared to $6.8 million in first quarter 2017. Adjusted EBITDA was negative $61.6 million compared to positive $8.4 million in the prior year period. A reconciliation of historical non-GAAP results is provided in the exhibits to this release.

“Performance in our Power and Industrial segments was generally in line with our expectations in first quarter. However, the performance in these segments was overshadowed by the previously announced cost increases on our B&W Vølund new-build contracts," said Leslie C. Kass, President and Chief Executive Officer.

“We are making progress toward completion at each of our Renewable new-build project sites and are seeking potential recoveries to mitigate losses. In Power, we had strong bookings, and Industrial profitability is beginning to improve.

“With the support of our shareholders, we raised $248.5 million through the recently completed rights offering, allowing us to repay our second-lien term loan, which combined with the potential sales of MEGTEC and Universal, puts us on a path to having a much-improved balance sheet.

All of the members of the management team, including the recently appointed Chief Implementation Officer, are driving efficiencies and cost reductions throughout the organization in an effort to produce improved financial results while maintaining our ability to continue serving our customers with high-quality and reliable engineered equipment, parts, and services.”

--> beim CR hab ich nichts bekommen - kleine formale Panne; kann in den USA recht schnell ins Aus führen.

after-hours: -3.85%

Antwort auf Beitrag Nr.: 57.722.425 von faultcode am 09.05.18 00:04:15

http://investors.babcock.com/press-releases/press-release-de…

=>

CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (“B&W”) (NYSE: BW) confirmed that it had received a non-binding indication of interest from Steel Partners, which beneficially owns 17.8% of B&W’s outstanding common stock, to acquire B&W in a transaction in which B&W shareholders would receive between $3.00 and $3.50 per share in cash.

The non-binding indication of interest assumes the acquisition of all of B&W’s businesses, including its MEGTEC and Universal businesses. B&W announced last year that it was exploring strategic options for those businesses.

B&W said that its Board of Directors will review the Steel Partners non-binding indication of interest to determine the course of action it believes to be in the best interests of B&W and its stockholders.

There can be no assurance that the non-binding indication of interest will result in a transaction or on what basis or terms any transaction may occur. B&W does not intend to comment further with respect to the non-binding indication of interest unless and until further developments warrant.

unverbindliches Übernahme-Angebot zu USD3

B&W Confirms Receipt of Steel Partners Non-Binding Indication of Interesthttp://investors.babcock.com/press-releases/press-release-de…

=>

CHARLOTTE, N.C.--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (“B&W”) (NYSE: BW) confirmed that it had received a non-binding indication of interest from Steel Partners, which beneficially owns 17.8% of B&W’s outstanding common stock, to acquire B&W in a transaction in which B&W shareholders would receive between $3.00 and $3.50 per share in cash.

The non-binding indication of interest assumes the acquisition of all of B&W’s businesses, including its MEGTEC and Universal businesses. B&W announced last year that it was exploring strategic options for those businesses.

B&W said that its Board of Directors will review the Steel Partners non-binding indication of interest to determine the course of action it believes to be in the best interests of B&W and its stockholders.

There can be no assurance that the non-binding indication of interest will result in a transaction or on what basis or terms any transaction may occur. B&W does not intend to comment further with respect to the non-binding indication of interest unless and until further developments warrant.

Antwort auf Beitrag Nr.: 57.824.159 von faultcode am 24.05.18 15:47:45

=>

Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced that it had signed a definitive agreement to sell its MEGTEC and Universal businesses to Dürr AG (“Dürr”) for $130 million, subject to adjustment.

Proceeds from the transaction will largely be used to reduce outstanding balances under the Company’s bank credit facilities, improving its balance sheet and financial flexibility. Going forward, the Company’s strategic focus will continue to be on optimizing its market-leading portfolio of equipment, technology and services for the power generation industry and driving efficiencies and cost reductions throughout the organization.

As part of the Dürr organization, these businesses will be well positioned to continue to serve their customers around the world with high-quality products.

The sale is expected to close in third quarter 2018 and is subject to the satisfaction of customary closing conditions.

MEGTEC nun auch verkauft an Dürr!

http://investors.babcock.com/press-releases/press-release-de…=>

Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced that it had signed a definitive agreement to sell its MEGTEC and Universal businesses to Dürr AG (“Dürr”) for $130 million, subject to adjustment.

Proceeds from the transaction will largely be used to reduce outstanding balances under the Company’s bank credit facilities, improving its balance sheet and financial flexibility. Going forward, the Company’s strategic focus will continue to be on optimizing its market-leading portfolio of equipment, technology and services for the power generation industry and driving efficiencies and cost reductions throughout the organization.

As part of the Dürr organization, these businesses will be well positioned to continue to serve their customers around the world with high-quality products.

The sale is expected to close in third quarter 2018 and is subject to the satisfaction of customary closing conditions.

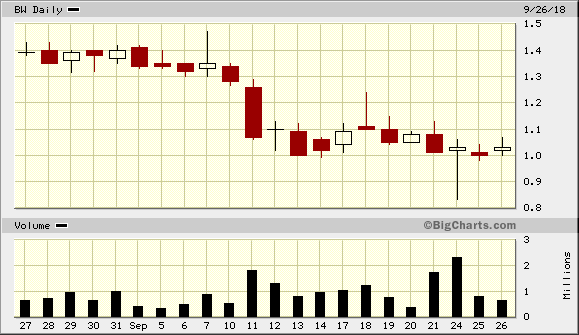

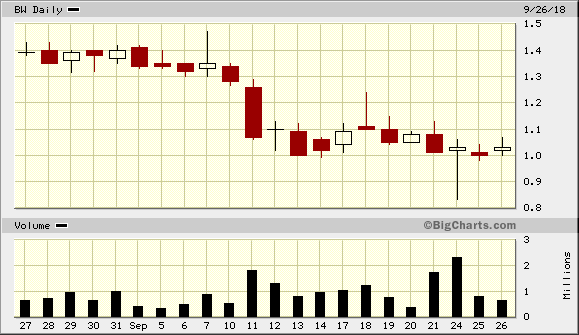

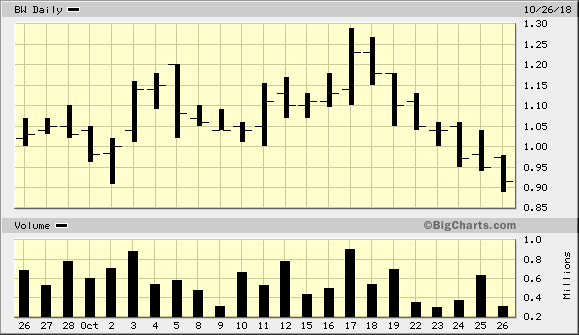

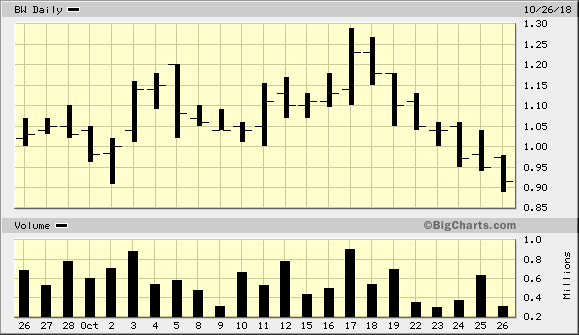

Bullish Abandoned Baby ???

=> war das ein mittelfristiger Boden?

--> morgen grün?

Antwort auf Beitrag Nr.: 58.788.215 von faultcode am 25.09.18 02:04:33hält zunächst einmal:

Chartpattern-Name oben ist falsch: ist ein Dragonfly Doji (bullish): https://www.investopedia.com/terms/d/dragonfly-doji.asp

Chartpattern-Name oben ist falsch: ist ein Dragonfly Doji (bullish): https://www.investopedia.com/terms/d/dragonfly-doji.asp

Antwort auf Beitrag Nr.: 58.992.087 von faultcode am 18.10.18 13:38:29...und wieder weg --> new low:

Antwort auf Beitrag Nr.: 59.068.594 von faultcode am 26.10.18 19:01:11

=>

...Babcock & Wilcox Enterprises, Inc. ("B&W") (NYSE: BW) announced today third quarter 2018 revenues of $295.0 million, a decrease of $61.9 million, or 17.3%, compared to the third quarter of 2017.

GAAP net loss, inclusive of discontinued operations, in third quarter 2018 was $105.7 million compared to $114.3 million in third quarter 2017; GAAP net loss from continuing operations in third quarter 2018 was $104.1 million compared to $114.6 million in third quarter 2017. Adjusted EBITDA was negative $26.4 million compared to negative $14.4 million in the prior year period.

All numbers referred to in this release are on a continuing operations basis, unless otherwise noted. A reconciliation of adjusted EBITDA to the most directly comparable GAAP measure is provided in the exhibits to this release.

"We have continued to make progress toward completing our Renewable loss projects. While we recognized increased estimated costs in the third quarter, at the end of October we turned over one of the projects, a biomass plant in Denmark, to the customer and anticipate turning over four more of the projects by the end of this year, shortly after completing trial operations," said Leslie C. Kass, President and Chief Executive Officer. "We intend to provide updates when the remaining projects are turned over as we continue to drive toward their completion."

"In addition, after concluding our strategic planning process, we have increased our previous cost savings target of $54 million in annualized savings to a new target of $62 million, $38 million of which we began to implement in the second and third quarters," Kass continued. "We are already seeing the benefits of our initial cost savings program and expect to implement additional cost savings initiatives for $24 million beginning in the fourth quarter. Finally, recent amendments to our revolving credit facility, in conjunction with completed divestitures and ongoing strategic actions, are designed to provide adequate liquidity as we finish construction on the Renewable loss projects. As we look forward, we continue to target adjusted EBITDA of approximately $100 million for our Power segment in 2019, and we expect the combined impact of our strategic actions, cost reductions and completion of the Renewable loss projects to drive improved profitability and cash flow next year. "...

=> so, so,...

Babcock & Wilcox Announces Third Quarter 2018 Results

https://investors.babcock.com/press-releases/press-release-d…=>

...Babcock & Wilcox Enterprises, Inc. ("B&W") (NYSE: BW) announced today third quarter 2018 revenues of $295.0 million, a decrease of $61.9 million, or 17.3%, compared to the third quarter of 2017.

GAAP net loss, inclusive of discontinued operations, in third quarter 2018 was $105.7 million compared to $114.3 million in third quarter 2017; GAAP net loss from continuing operations in third quarter 2018 was $104.1 million compared to $114.6 million in third quarter 2017. Adjusted EBITDA was negative $26.4 million compared to negative $14.4 million in the prior year period.

All numbers referred to in this release are on a continuing operations basis, unless otherwise noted. A reconciliation of adjusted EBITDA to the most directly comparable GAAP measure is provided in the exhibits to this release.

"We have continued to make progress toward completing our Renewable loss projects. While we recognized increased estimated costs in the third quarter, at the end of October we turned over one of the projects, a biomass plant in Denmark, to the customer and anticipate turning over four more of the projects by the end of this year, shortly after completing trial operations," said Leslie C. Kass, President and Chief Executive Officer. "We intend to provide updates when the remaining projects are turned over as we continue to drive toward their completion."

"In addition, after concluding our strategic planning process, we have increased our previous cost savings target of $54 million in annualized savings to a new target of $62 million, $38 million of which we began to implement in the second and third quarters," Kass continued. "We are already seeing the benefits of our initial cost savings program and expect to implement additional cost savings initiatives for $24 million beginning in the fourth quarter. Finally, recent amendments to our revolving credit facility, in conjunction with completed divestitures and ongoing strategic actions, are designed to provide adequate liquidity as we finish construction on the Renewable loss projects. As we look forward, we continue to target adjusted EBITDA of approximately $100 million for our Power segment in 2019, and we expect the combined impact of our strategic actions, cost reductions and completion of the Renewable loss projects to drive improved profitability and cash flow next year. "...

=> so, so,...

Antwort auf Beitrag Nr.: 59.173.458 von faultcode am 08.11.18 23:09:41

https://investors.babcock.com/press-releases/press-release-d…

=>

-- New Management Team is Focused on Enhancing Shareholder Value

-- Kenny Young Appointed Chief Executive Officer

-- Lou Salamone Appointed Executive Vice President of Finance

-- Henry E. Bartoli Appointed Chief Strategy Officer, Remains a Director

BARBERTON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (“B&W”) (NYSE:BW) announced today that Kenny Young has been appointed Chief Executive Officer of the Company, effective immediately.

Leslie Kass, who has served as Chief Executive Officer since February 2018, is leaving B&W to pursue other opportunities.

Additionally, B&W announced Lou Salamone has been appointed to serve as Executive Vice President of Finance and with the expectation that he will transition to the role of Chief Financial Officer in the near term.

B&W also announced that Henry E. Bartoli will serve as Chief Strategy Officer and will remain a member of the Board of Directors as a non-independent director. Robert Caruso will continue to serve as Chief Implementation Officer.

The executive changes put in place a proven leadership team with a combination of turnaround expertise and power industry experience and are intended to unlock value from B&W’s various segments and lead to increased shareholder returns. The new management team has been granted equity awards that begin to vest when the price of B&W’s common stock reaches $2.25 per share.

“We thank Leslie for her efforts in reshaping the Company’s various segments, accelerating the exit of a difficult European construction business, and relocating the corporate headquarters. We appreciate her support during this transition and wish her the best in her new endeavors,” said Matt Avril, Chairman of the B&W Board of Directors.

“This is the next step in the Board’s efforts to increase equity value for all of our shareholders.

Kenny and Lou led the successful turnaround at LCC International, a global telecom engineering and infrastructure services company, and we look forward to their contributions at Babcock & Wilcox,” added Mr. Avril.

“Combined with Henry’s extensive industry experience, this new leadership team is intended to help the Company leverage its broad capabilities while driving efforts to achieve improved financial performance for all of our stakeholders.”

“Babcock & Wilcox, through its employees and subsidiaries, has created tremendous brand equity and a unique market position. Unlocking our products and technical expertise, within each of our operational brands and segments, creates a competitive differentiation. I am excited to step into the role of Chief Executive Officer,” said Mr. Young.

“I look forward to working closely with our customers and employees in support of their efforts to drive and enhance product quality, improve our operational capabilities and create incremental value for our customers through higher levels of technology and performance. Henry, Lou and I have a great opportunity to leverage our financial and industry experience and are motivated to strengthen our business and generate greater returns for our shareholders.”

In the newly created position of Chief Strategy Officer, Mr. Bartoli will advise the senior management team and oversee the execution of market and operational strategies across the Company.

--> na ja, ~+7% ist jetzt auch nicht gerade die Welt bei diesem ausgebombten Wert

Babcock & Wilcox Announces Management Transition

November 19, 2018https://investors.babcock.com/press-releases/press-release-d…

=>

-- New Management Team is Focused on Enhancing Shareholder Value

-- Kenny Young Appointed Chief Executive Officer

-- Lou Salamone Appointed Executive Vice President of Finance

-- Henry E. Bartoli Appointed Chief Strategy Officer, Remains a Director

BARBERTON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (“B&W”) (NYSE:BW) announced today that Kenny Young has been appointed Chief Executive Officer of the Company, effective immediately.

Leslie Kass, who has served as Chief Executive Officer since February 2018, is leaving B&W to pursue other opportunities.

Additionally, B&W announced Lou Salamone has been appointed to serve as Executive Vice President of Finance and with the expectation that he will transition to the role of Chief Financial Officer in the near term.

B&W also announced that Henry E. Bartoli will serve as Chief Strategy Officer and will remain a member of the Board of Directors as a non-independent director. Robert Caruso will continue to serve as Chief Implementation Officer.

The executive changes put in place a proven leadership team with a combination of turnaround expertise and power industry experience and are intended to unlock value from B&W’s various segments and lead to increased shareholder returns. The new management team has been granted equity awards that begin to vest when the price of B&W’s common stock reaches $2.25 per share.

“We thank Leslie for her efforts in reshaping the Company’s various segments, accelerating the exit of a difficult European construction business, and relocating the corporate headquarters. We appreciate her support during this transition and wish her the best in her new endeavors,” said Matt Avril, Chairman of the B&W Board of Directors.

“This is the next step in the Board’s efforts to increase equity value for all of our shareholders.

Kenny and Lou led the successful turnaround at LCC International, a global telecom engineering and infrastructure services company, and we look forward to their contributions at Babcock & Wilcox,” added Mr. Avril.

“Combined with Henry’s extensive industry experience, this new leadership team is intended to help the Company leverage its broad capabilities while driving efforts to achieve improved financial performance for all of our stakeholders.”

“Babcock & Wilcox, through its employees and subsidiaries, has created tremendous brand equity and a unique market position. Unlocking our products and technical expertise, within each of our operational brands and segments, creates a competitive differentiation. I am excited to step into the role of Chief Executive Officer,” said Mr. Young.

“I look forward to working closely with our customers and employees in support of their efforts to drive and enhance product quality, improve our operational capabilities and create incremental value for our customers through higher levels of technology and performance. Henry, Lou and I have a great opportunity to leverage our financial and industry experience and are motivated to strengthen our business and generate greater returns for our shareholders.”

In the newly created position of Chief Strategy Officer, Mr. Bartoli will advise the senior management team and oversee the execution of market and operational strategies across the Company.

--> na ja, ~+7% ist jetzt auch nicht gerade die Welt bei diesem ausgebombten Wert

B&W Awarded Significant Contract To Provide Boilers for Canadian Oil Sands Project

December 04, 2018BARBERTON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW) announced today that its subsidiary, The Babcock & Wilcox Company, has been awarded a significant contract to provide five industrial water-tube boilers to Imperial for its Aspen oil sands project in Alberta, Canada.

B&W will design and supply the five MCFM 200-120 model boilers, which feature the company’s exclusive multi-circulation boiler technology, and modularized auxiliary components to provide steam for Imperial’s steam assisted gravity drainage (SAGD) bitumen extraction operation.

“As oil sands producers ramp up operations in Alberta, B&W is well-positioned to provide steam generation technologies tailored to their specific needs,” said B&W Power segment Senior Vice President Mark Low. “Our modularized industrial boilers can operate on a variety of fuels and will be used to recover energy from turbine exhaust gas. Our connection-ready boiler configuration minimizes site construction cost and schedule and can be adapted to the unique operating conditions found in oil sands projects.”...

Antwort auf Beitrag Nr.: 59.359.772 von faultcode am 04.12.18 14:49:38

investors.babcock.com/press-releases/press-release-details/2…

=>

... “Since joining B&W in late November, B&W Executive Vice President of Finance Louis Salamone, B&W Chief Strategy Officer Henry Bartoli, and I, along with B&W Chief Implementation Officer Robert Caruso, Interim B&W Chief Financial Officer Joel Mostrom and others, have conducted daily reviews and updates of B&W’s various Renewable projects in Europe and have visited a number of them,” said B&W Chief Executive Officer Kenneth Young. “These four projects are now operational and are in various stages of performance and reliability testing. Based on our continued reviews and discussions with customers, we anticipate turnover of these projects will take place at various times during the first and second quarters of 2019.”

“These four plants have reached active operational status and are generating steam heat and delivering electricity to the grid,” Young said. “Our DynaGrate® combustion grate systems are performing as expected and a few of the Renewable plants have achieved operational output of 100 to 105 percent.”

“We are currently making adjustments and modifications to maximize performance for our customers, and a few of the sites are now, or will be, shifting into reliability and performance testing over the next several weeks,” he continued. “We are working closely with our customers and financial institutions to move effectively through various handover and testing processes, procedures, documentation, punch lists, and test/certifications and anticipate final turnover and transition into maintenance phases within the first and second quarters of 2019. Two of these plants also will shift into 15-year operational and maintenance contracts with Babcock & Wilcox Vølund.” ...

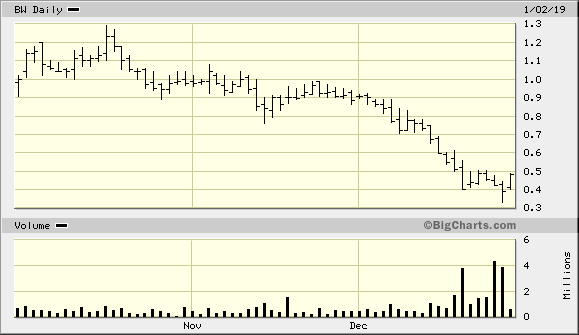

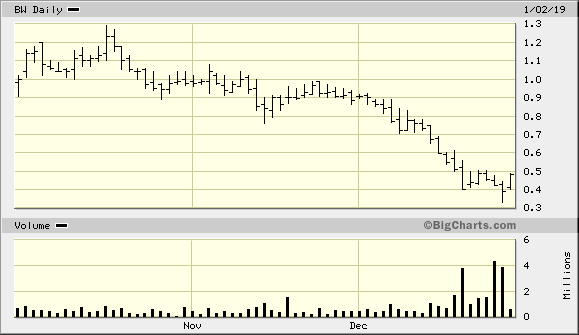

=> starkes Volumen am Boden??

=> daß dieser geringe Kurs auf Dauer nicht NYSE-kompatibel ist, ist auch klar

--> da wird man wohl was machen müssen

B&W Provides Interim Project Update

December 31, 2018 investors.babcock.com/press-releases/press-release-details/2…

=>

... “Since joining B&W in late November, B&W Executive Vice President of Finance Louis Salamone, B&W Chief Strategy Officer Henry Bartoli, and I, along with B&W Chief Implementation Officer Robert Caruso, Interim B&W Chief Financial Officer Joel Mostrom and others, have conducted daily reviews and updates of B&W’s various Renewable projects in Europe and have visited a number of them,” said B&W Chief Executive Officer Kenneth Young. “These four projects are now operational and are in various stages of performance and reliability testing. Based on our continued reviews and discussions with customers, we anticipate turnover of these projects will take place at various times during the first and second quarters of 2019.”

“These four plants have reached active operational status and are generating steam heat and delivering electricity to the grid,” Young said. “Our DynaGrate® combustion grate systems are performing as expected and a few of the Renewable plants have achieved operational output of 100 to 105 percent.”

“We are currently making adjustments and modifications to maximize performance for our customers, and a few of the sites are now, or will be, shifting into reliability and performance testing over the next several weeks,” he continued. “We are working closely with our customers and financial institutions to move effectively through various handover and testing processes, procedures, documentation, punch lists, and test/certifications and anticipate final turnover and transition into maintenance phases within the first and second quarters of 2019. Two of these plants also will shift into 15-year operational and maintenance contracts with Babcock & Wilcox Vølund.” ...

=> starkes Volumen am Boden??

=> daß dieser geringe Kurs auf Dauer nicht NYSE-kompatibel ist, ist auch klar

--> da wird man wohl was machen müssen

SPLP hat knapp 18% Anteil

Babcock & Wilcox Enterprises Late Tuesday Reported Q4 EPS $(1.35) Down From $(0.95) YoY, Sales $222.912M Miss $295M Estimate

10:39 am ET April 3, 2019 (Benzinga)

Babcock & Wilcox Enterprises, Inc. Common Stock (NYSE:BW) reported quarterly losses of $(1.35) per share. This is a 42.11 percent decrease over losses of $(0.95) per share from the same period last year.

The company reported quarterly sales of $222.912 million which missed the analyst consensus estimate of $295 million by 24.44 percent. This is a 45.38 percent decrease over sales of $408.1 million the same period last year.

10:39 am ET April 3, 2019 (Benzinga)

Babcock & Wilcox Enterprises, Inc. Common Stock (NYSE:BW) reported quarterly losses of $(1.35) per share. This is a 42.11 percent decrease over losses of $(0.95) per share from the same period last year.

The company reported quarterly sales of $222.912 million which missed the analyst consensus estimate of $295 million by 24.44 percent. This is a 45.38 percent decrease over sales of $408.1 million the same period last year.

B&W Announces New Financing Agreement; Settlements Reached on Remaining European Vølund Loss Contracts

.

wegen:

https://investors.babcock.com/press-releases/press-release-d…

=>

• Company now positioned to return to profitability by unlocking the value of its core businesses

• Agreement provides a $150 million term loan and additional $15 million incremental facility

• Settlements significantly reduce and limit risks and obligations on European Vølund loss contracts

...

--> allerdngs:

In connection with the amendment, the Company has agreed to seek shareholder approval to increase the number of its authorized shares, execute within six months a $50 million rights offering at $0.30 per share (the proceeds of which will be used for repayment of a portion of the new debt) and, immediately thereafter, exchange $35.1 million of the last out term loan held by Vintage Capital Management LLC for common stock at $0.30 per share, issue approximately 16.7 million warrants, each to purchase one share of common stock for $0.01 per share, and execute a 1:10 reverse stock split.

=> da wird die heutige Euphorie auch wieder abkühlen, was auch schon der Fall ist im Tages-Chart

Babcock & Wilcox Enterprises Announces First Quarter 2019 Results

9.5.https://investors.babcock.com/press-releases/press-release-d…

=>

- The Babcock & Wilcox segment increased revenues by 18.5% and adjusted EBITDA by 115%

-The SPIG segment returned to profitability and increased adjusted EBITDA by $8 million

- Consolidated operating loss was $74.5 million lower, and adjusted EBITDA improved by $72.7 million

BARBERTON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox Enterprises, Inc. ("B&W Enterprises") (NYSE: BW) announced today first quarter 2019 revenues of $231.9 million, a decrease of $21.2 million, or 8.4%, compared to the first quarter of 2018.

The decrease was primarily the result of several EPC contracts being in the final stages of completion in the first quarter of 2019. GAAP net loss from continuing operations in first quarter 2019 improved to $49.9 million compared to $116.8 million in first quarter 2018. Adjusted EBITDA also improved by $72.7 million to negative $5.0 million compared to negative $77.6 million in the prior year period.

All amounts referred to in this release are on a continuing operations basis, unless otherwise noted. A reconciliation of adjusted EBITDA to the most directly comparable GAAP measure is provided in the exhibits to this release.

"Our performance in the first quarter of 2019 reflects the impact of the strategic actions we have taken over the past several months. Combined with the settlements we reached in March 2019 and our additional financing, we have momentum on our path to profitability," said Kenneth Young, Chief Executive Officer.

"Our Babcock & Wilcox segment continues to perform well, and our change in strategy for the SPIG segment is beginning to drive results. As 2019 progresses, we expect the core strengths of our businesses to continue to become more visible to our customers and shareholders. We are also making progress on our cost-savings initiatives, and looking forward, we continue to target a run-rate adjusted EBITDA of approximately $100 million as we exit 2020, not including corporate overhead."

“Over the past six months, our customers and employees have seen a major transformation at Babcock & Wilcox Enterprises and are responding positively as we have made significant changes to improve our business and have shared new information about our strategic path to profitability," Young continued.

"We are optimistic as we see new opportunities emerging as a result of our recent efforts. Going forward, we expect to see improvement each quarter as our cost-savings initiatives continue to impact bottom-line results and as we minimize EPC contract losses under the terms of the settlements we achieved in March 2019. Our dedicated employees continue to deliver world-class products and services that reflect the strengths of our more than 150-year heritage. We are laser-focused on delivering high-quality technologies that provide solutions for our customers and strong results for our shareholders."...

Rekapitalisierung und Reverse Stick split (bei Zustimmung der Aktionäre)

neue Präsentation Mai 2019: -- pitch zur Rekapitalisierung

=> also ein Reverse Stock split soll kommen --> nach meiner Erfahrung, wenn überhaupt, dann erst danach - mit zeitl. Abstand - kaufen (keine Empfehlung; nur Hinweis)

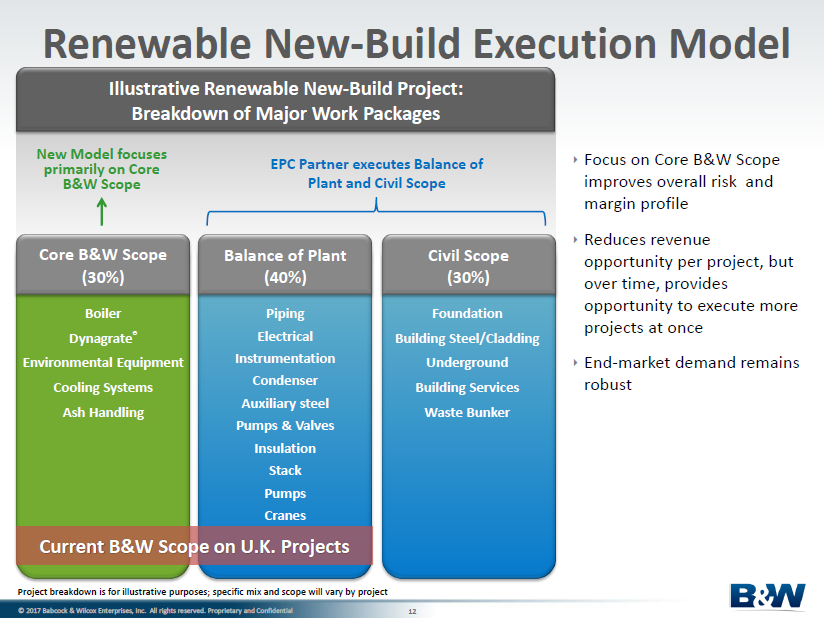

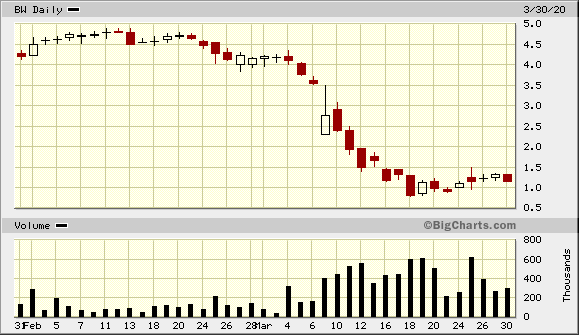

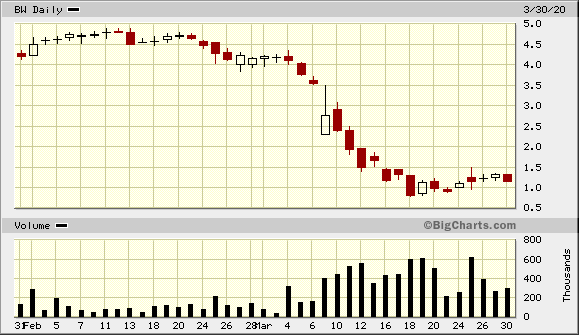

=> Chart 1Y:

Babcock & Wilcox Announces Rights Offering For Common Stock

17.6.https://www.wallstreet-online.de/nachricht/11538869-babcock-…

=>

...Babcock & Wilcox Enterprises, Inc. ("B&W" or the “Company”) (NYSE: BW) announced today that its Board of Directors has approved a record date and subscription period for the rights offering originally announced on April 5, 2019. Assuming B&W’s registration statement relating to the rights offering is declared effective, the Company will distribute to each holder of the Company’s common stock one non-transferable subscription right to purchase 0.986896 shares of the Company’s common stock at a price of $0.30 per whole share for each share of the Company’s common stock held as of 5:00 p.m., New York City time, on June 27, 2019 (the “rights offering record date”).

The Company will not issue any fractional shares of the Company’s common stock in the rights offering, and all exercises of subscription rights will be rounded to the nearest whole share. In addition, the Company will not issue fractional subscription rights or pay cash in lieu of fractional subscription rights. The subscription rights may be exercised at any time during the subscription period, which will commence on June 28, 2019. The subscription rights will expire if they are not exercised by 5:00 p.m., New York City time, on July 18, 2019, unless the Company extends the rights offering subscription period.

The Company expects to issue 166,666,667 shares of its common stock in connection with the rights offering, including any shares issued to B. Riley FBR, Inc., a significant shareholder of the Company (“B. Riley”), as backstop exchange purchaser.

The Company expects to mail subscription certificates evidencing the subscription rights and a copy of the prospectus for the rights offering to shareholders as of the rights offering record date beginning on or about June 28, 2019. The Company expects to use the proceeds from the rights offering to partially repay indebtedness outstanding under the Tranche A-3 last-out term loans provided through its U.S. credit agreement....

=> also ziemlich genau eine "Halbierung" für Alt-Aktionäre

Antwort auf Beitrag Nr.: 60.833.162 von faultcode am 18.06.19 14:49:06

=>

...Babcock & Wilcox Enterprises, Inc. ("B&W" or the “Company”) (NYSE: BW) announced today that its board of directors approved a one-for-ten reverse stock split of the outstanding and treasury shares of the Company’s common stock.

The reverse stock split was previously approved by a majority of the Company’s stockholders at the Company’s annual meeting of stockholders held on June 14, 2019. The reverse stock split, which is expected to become effective after the market closes on July 23, 2019, will follow the completion of the previously announced rights offering.

Once effective, every 10 shares of the Company’s outstanding and treasury common stock will automatically be converted into one share of common stock. No fractional shares will be issued if, as a result of the reverse stock split, a stockholder would otherwise become entitled to a fractional share.

Instead, stockholders who would otherwise hold fractional shares will be entitled to cash payments (without interest) in respect of such fractional shares. The reverse stock split will not impact any stockholder’s percentage ownership of the Company, subject to the treatment of fractional shares.

Following the reverse stock split, the number of outstanding and treasury shares of the Company’s common stock will be reduced by a factor of 10....

--> Symbol "BW" bleibt

Babcock & Wilcox Announces One-for-Ten Reverse Stock Split

https://www.wallstreet-online.de/nachricht/11598839-babcock-…=>

...Babcock & Wilcox Enterprises, Inc. ("B&W" or the “Company”) (NYSE: BW) announced today that its board of directors approved a one-for-ten reverse stock split of the outstanding and treasury shares of the Company’s common stock.

The reverse stock split was previously approved by a majority of the Company’s stockholders at the Company’s annual meeting of stockholders held on June 14, 2019. The reverse stock split, which is expected to become effective after the market closes on July 23, 2019, will follow the completion of the previously announced rights offering.

Once effective, every 10 shares of the Company’s outstanding and treasury common stock will automatically be converted into one share of common stock. No fractional shares will be issued if, as a result of the reverse stock split, a stockholder would otherwise become entitled to a fractional share.

Instead, stockholders who would otherwise hold fractional shares will be entitled to cash payments (without interest) in respect of such fractional shares. The reverse stock split will not impact any stockholder’s percentage ownership of the Company, subject to the treatment of fractional shares.

Following the reverse stock split, the number of outstanding and treasury shares of the Company’s common stock will be reduced by a factor of 10....

--> Symbol "BW" bleibt

Antwort auf Beitrag Nr.: 61.012.541 von faultcode am 12.07.19 13:58:257.1./12.1.

B&W Announces Key Step Toward Debt Refinancing

https://investors.babcock.com/press-releases/press-release-d…

...

Babcock & Wilcox Enterprises, Inc. (NYSE: BW) (B&W) announced today that the Company has amended its Credit Agreement to extend the deadline to take certain required corporate actions related to refinancing from January 10, 2020 to January 20, 2020 and to maintain the current sublimit on borrowing under the company’s revolving credit facility portion of the Agreement.

As previously disclosed, the Company is required to refinance by March 15, 2020. B&W is in broader negotiations with creditors to refinance the current senior debt and extend maturity which is anticipated to be completed on or before January 20, 2020.

“This interim amendment is a collaborative first step toward a comprehensive debt refinancing on an accelerated timeframe. With the assistance of B. Riley FBR, Inc. and our existing senior lender syndicate, we expect to further amend our Credit Agreement by January 20, 2020, well in advance of our March 15, 2020 requirement,” said Kenneth Young, B&W Chief Executive Officer.

“We are pleased that our lenders recognize the momentum we have achieved through our turnaround efforts and the opportunities we have that leverage our technologies and core businesses. We look forward to finalizing an agreement that provides long-term restructuring of the company’s debt, a critical next step following the Company’s return to profitability in the second and third quarters of 2019, and a position of strength with our core markets and customers. We expect our financial results for the fourth quarter of 2019 will continue to demonstrate this strength and provide further confidence in our objectives for 2020.”

...

--> Post-Reverse Stock split:

B&W Announces Key Step Toward Debt Refinancing

https://investors.babcock.com/press-releases/press-release-d…

...

Babcock & Wilcox Enterprises, Inc. (NYSE: BW) (B&W) announced today that the Company has amended its Credit Agreement to extend the deadline to take certain required corporate actions related to refinancing from January 10, 2020 to January 20, 2020 and to maintain the current sublimit on borrowing under the company’s revolving credit facility portion of the Agreement.

As previously disclosed, the Company is required to refinance by March 15, 2020. B&W is in broader negotiations with creditors to refinance the current senior debt and extend maturity which is anticipated to be completed on or before January 20, 2020.

“This interim amendment is a collaborative first step toward a comprehensive debt refinancing on an accelerated timeframe. With the assistance of B. Riley FBR, Inc. and our existing senior lender syndicate, we expect to further amend our Credit Agreement by January 20, 2020, well in advance of our March 15, 2020 requirement,” said Kenneth Young, B&W Chief Executive Officer.

“We are pleased that our lenders recognize the momentum we have achieved through our turnaround efforts and the opportunities we have that leverage our technologies and core businesses. We look forward to finalizing an agreement that provides long-term restructuring of the company’s debt, a critical next step following the Company’s return to profitability in the second and third quarters of 2019, and a position of strength with our core markets and customers. We expect our financial results for the fourth quarter of 2019 will continue to demonstrate this strength and provide further confidence in our objectives for 2020.”

...

--> Post-Reverse Stock split:

Antwort auf Beitrag Nr.: 62.351.144 von faultcode am 12.01.20 15:39:10die heutige BW ist da nicht mehr mit drin:

<Godda ultra supercritical thermal power plant, India>

--> siehe AR2018:

• sold our equity method investments in Babcock & Wilcox Beijing Company, Ltd. ("BWBC"), a joint venture in China, and Thermax Babcock & Wilcox Energy Solutions Private Limited ("TBWES"), a joint venture in India, and settled related contractual claims, resulting in proceeds of $21.1 million in the second quarter of 2018 and $15.0 million in the third quarter of 2018, espectively;

...

As of December 31, 2018, we do not have any remaining investments in equity method investees...

<Godda ultra supercritical thermal power plant, India>

Zitat von faultcode: ...

Contractors involved

The engineering, procurement and construction contract for the project was awarded to SepcoIII, a construction company based in China, in April 2018.

The boiler technology will be provided by Babcock & Wilcox Beijing, while the turbo-generators will be designed by General Electric (GE)....

--> siehe AR2018:

• sold our equity method investments in Babcock & Wilcox Beijing Company, Ltd. ("BWBC"), a joint venture in China, and Thermax Babcock & Wilcox Energy Solutions Private Limited ("TBWES"), a joint venture in India, and settled related contractual claims, resulting in proceeds of $21.1 million in the second quarter of 2018 and $15.0 million in the third quarter of 2018, espectively;

...

As of December 31, 2018, we do not have any remaining investments in equity method investees...

3.2.

B&W Announces Comprehensive Debt Refinancing Agreement as Financial Performance Improves

https://investors.babcock.com/press-releases/press-release-d…

• Provides $200 million commitment to fully refinance existing revolving credit facility

• Provides an initial $30 million of working capital

• Provides new $30 million revolving credit facility in May 2020

• New maturity date is January 2022

• Company expects fourth quarter 2019 results to significantly outperform the third quarter, with a return to positive GAAP consolidated operating income for the first time in 3 years

...

B&W Announces Comprehensive Debt Refinancing Agreement as Financial Performance Improves

https://investors.babcock.com/press-releases/press-release-d…

• Provides $200 million commitment to fully refinance existing revolving credit facility

• Provides an initial $30 million of working capital

• Provides new $30 million revolving credit facility in May 2020

• New maturity date is January 2022

• Company expects fourth quarter 2019 results to significantly outperform the third quarter, with a return to positive GAAP consolidated operating income for the first time in 3 years

...

Antwort auf Beitrag Nr.: 62.564.068 von faultcode am 03.02.20 12:58:3224.2.

B&W SPIG Awarded $18 Million Cooling Technologies Upgrade Contract

...

SPIG S.p.A. (SPIG), a subsidiary of Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW), has been awarded a contract to provide cooling technologies and associated services for an industrial facility. The total contract value is more than $18 million over approximately 10 years.

“SPIG’s advanced cooling technologies are well-suited for the rigorous conditions of the oil, gas and petrochemical industries,” said SPIG Managing Director Alberto Galantini. “Our engineering expertise and advanced technical services make us industry leaders in this sector. Under this agreement, we will provide the technology and services to improve the plant’s cooling capacity.”

SPIG fiberglass-reinforced plastic (FRP) cooling towers provide high strength, weather resistance, long-term performance, light weight, and dimensional stability, with noise and vibration absorption. SPIG FRP cooling towers also provide flexible solutions and reduced assembly times.

...

B&W SPIG Awarded $18 Million Cooling Technologies Upgrade Contract

...

SPIG S.p.A. (SPIG), a subsidiary of Babcock & Wilcox Enterprises, Inc. (B&W) (NYSE:BW), has been awarded a contract to provide cooling technologies and associated services for an industrial facility. The total contract value is more than $18 million over approximately 10 years.

“SPIG’s advanced cooling technologies are well-suited for the rigorous conditions of the oil, gas and petrochemical industries,” said SPIG Managing Director Alberto Galantini. “Our engineering expertise and advanced technical services make us industry leaders in this sector. Under this agreement, we will provide the technology and services to improve the plant’s cooling capacity.”

SPIG fiberglass-reinforced plastic (FRP) cooling towers provide high strength, weather resistance, long-term performance, light weight, and dimensional stability, with noise and vibration absorption. SPIG FRP cooling towers also provide flexible solutions and reduced assembly times.

...

12.3.

Babcock & Wilcox Announces Preliminary Unaudited Q4 and Full Year 2019 Results

https://investors.babcock.com/press-releases/press-release-d…

...

Babcock & Wilcox Enterprises, Inc. (NYSE:BW) (B&W or the “Company”) today announced preliminary, unaudited fourth quarter 2019 and full-year 2019 financial results. The Company is providing these preliminary results in light of current market volatility and coronavirus concerns.

B&W anticipates it will report fourth quarter 2019 GAAP operating income from continuing operations in the range of $8.2 million to $10.2 million, returning to profitability on a GAAP income basis for the quarter for the first time since the third quarter of 2016. The Company expects to report adjusted EBITDA in the range of positive $17.5 million to $19.5 million for the fourth quarter of 2019.

For 2019, the Company anticipates it will report full-year GAAP operating loss in the range of $31.7 million to $29.2 million and adjusted EBITDA in the range of positive $31.0 million to $33.5 million, returning to full-year profitability on an adjusted EBITDA basis.

The Company anticipates the first quarter of 2020 will be profitable on a GAAP operating income and adjusted EBITDA basis.

...

Babcock & Wilcox Announces Preliminary Unaudited Q4 and Full Year 2019 Results

https://investors.babcock.com/press-releases/press-release-d…

...

Babcock & Wilcox Enterprises, Inc. (NYSE:BW) (B&W or the “Company”) today announced preliminary, unaudited fourth quarter 2019 and full-year 2019 financial results. The Company is providing these preliminary results in light of current market volatility and coronavirus concerns.

B&W anticipates it will report fourth quarter 2019 GAAP operating income from continuing operations in the range of $8.2 million to $10.2 million, returning to profitability on a GAAP income basis for the quarter for the first time since the third quarter of 2016. The Company expects to report adjusted EBITDA in the range of positive $17.5 million to $19.5 million for the fourth quarter of 2019.

For 2019, the Company anticipates it will report full-year GAAP operating loss in the range of $31.7 million to $29.2 million and adjusted EBITDA in the range of positive $31.0 million to $33.5 million, returning to full-year profitability on an adjusted EBITDA basis.

The Company anticipates the first quarter of 2020 will be profitable on a GAAP operating income and adjusted EBITDA basis.

...

Antwort auf Beitrag Nr.: 62.977.322 von faultcode am 12.03.20 13:02:5130.3.

Babcock & Wilcox Enterprises Announces Results for Fourth Quarter and Full Year 2019

https://investors.babcock.com/press-releases/press-release-d…

Q4 2019 Highlights:

- GAAP consolidated operating income improved by $147.7 million quarter-over-quarter to positive income of $10.0 million

- Company generated earnings per share of $0.26 and consolidated adjusted EBITDA of $19.3 million

- Vølund segment returned to profitability on an adjusted EBITDA basis

Full Year 2019 Highlights:

- GAAP consolidated operating income improved by $397.2 million year-over-year to a loss of $29.4 million

- Company generated consolidated adjusted EBITDA of $33.3 million, returning to full-year profitability on an adjusted EBITDA basis

- All segments generated positive adjusted gross profit for the year

...

"Before we began to feel the effects of COVID-19, the business was progressing as planned in the first quarter of 2020. However, like many companies around the world, the global COVID-19 pandemic and the many measures taken by local and national governments to control its spread continue to impact our operations, and we are not able to fully predict the extent or timing of the impact. Many projects are delayed or deferred as our customers are also following local or national restrictions. We have implemented work-at-home mandates in many locations and we are deemed an essential business, so we can continue operations and support when requested."

...

COVID-19 Impact

The global COVID-19 pandemic has disrupted business operations, trade, commerce, financial and credit markets, and daily life throughout the world. The Company's business has been adversely impacted by the measures taken by local governments and others to control the spread of this virus. Its headquarters and the headquarters of the Babcock & Wilcox segment in Akron, Ohio, the headquarters of the Vølund & Other Renewable segment in Denmark and the headquarters of the SPIG segment in Italy (among other locations where the Company and its customers, vendors and suppliers operate) are currently subject to lock-down or shelter-in-place orders under local ordinances, with employees continuing to work remotely if possible.