Babcock & Wilcox -- von Dampf bis Industrie-Batterien

eröffnet am 15.10.20 12:55:49 von

neuester Beitrag 23.03.24 09:10:38 von

neuester Beitrag 23.03.24 09:10:38 von

Beiträge: 15

ID: 1.332.408

ID: 1.332.408

Aufrufe heute: 0

Gesamt: 1.363

Gesamt: 1.363

Aktive User: 0

ISIN: US05614L2097 · WKN: A2PN0R · Symbol: BW

1,0400

USD

+4,00 %

+0,0400 USD

Letzter Kurs 02:04:01 NYSE

Neuigkeiten

25.04.24 · Business Wire (engl.) |

22.04.24 · Business Wire (engl.) |

15.04.24 · Business Wire (engl.) |

10.04.24 · Business Wire (engl.) |

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 37,40 | +10,00 | |

| 12,000 | +8,89 | |

| 4,3300 | +8,32 | |

| 2,8300 | +8,02 | |

| 33,00 | +7,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,6800 | -10,00 | |

| 11,444 | -11,15 | |

| 490,00 | -18,33 | |

| 5,9400 | -20,80 | |

| 3,9200 | -93,57 |

Beitrag zu dieser Diskussion schreiben

Jemand drin?

Bin bei 0,77 EUR eingestiegen

😎🤠

😎🤠

Bin bei 0,77 EUR eingestiegen

😎🤠

😎🤠

"Strategic business realignment" hin zu Services, weg von Large new build projects: https://www.wallstreet-online.de/nachricht/17530799-babcock-… (*)

=> -50%

(*)

...

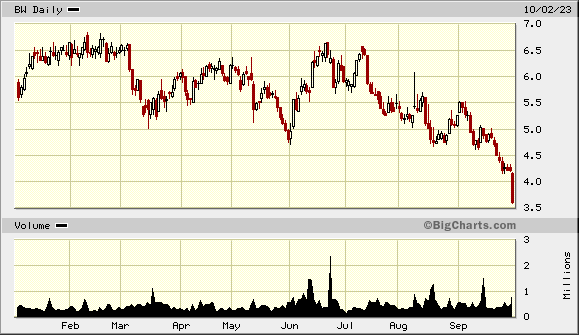

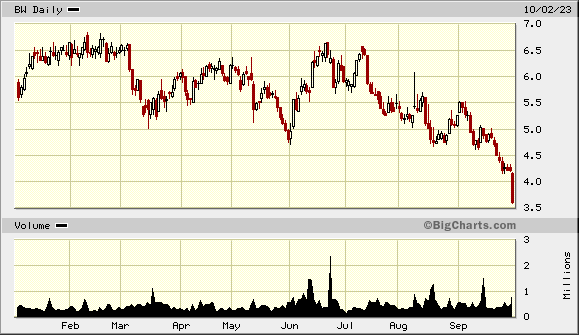

Net loss in the third quarter of 2023 was $12.3 million, compared to a net loss of $12.8 million in the third quarter of 2022. Loss per share in the third quarter of 2023 was $0.18 compared to a loss per share of $0.15 in the third quarter of 2022.

Operating income in the third quarter of 2023 was $5.5 million compared to operating loss of $2.7 million in the third quarter of 2022. Adjusted EBITDA was $20.0 million compared to $13.0 million in the third quarter of 2022.

Bookings in the third quarter of 2023 were $198 million. Ending backlog was $507 million, which is a 9% decrease compared to backlog at the end of the third quarter of 2022.

All amounts referred to in this release are on a continuing operations basis, unless otherwise noted.

...

=> -50%

(*)

...

Net loss in the third quarter of 2023 was $12.3 million, compared to a net loss of $12.8 million in the third quarter of 2022. Loss per share in the third quarter of 2023 was $0.18 compared to a loss per share of $0.15 in the third quarter of 2022.

Operating income in the third quarter of 2023 was $5.5 million compared to operating loss of $2.7 million in the third quarter of 2022. Adjusted EBITDA was $20.0 million compared to $13.0 million in the third quarter of 2022.

Bookings in the third quarter of 2023 were $198 million. Ending backlog was $507 million, which is a 9% decrease compared to backlog at the end of the third quarter of 2022.

All amounts referred to in this release are on a continuing operations basis, unless otherwise noted.

...

Autsch!

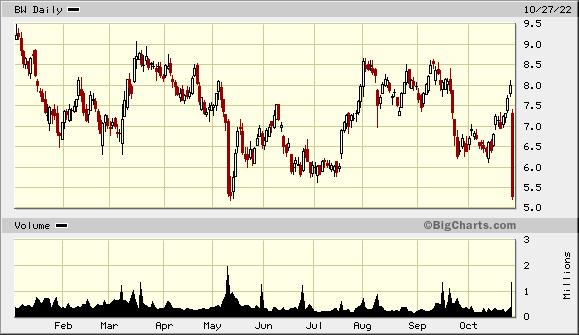

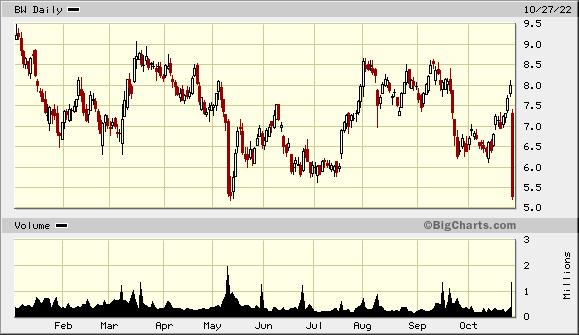

Babcock & Wilcox heute mit einem -1/3-Kracher wegen "Revised 2022 Adjusted EBITDA Target" u.a.:

https://www.wallstreet-online.de/nachricht/16115378-babcock-…

...

Despite near-term macroeconomic and geopolitical headwinds, demand remains elevated, supported by a strong backlog and a robust pipeline of more than $7.5 billion of identified global project opportunities. The Company anticipates that full year 2023 adjusted EBITDA will range from $100 million to $120 million.

“We are seeing strong demand coupled with a significant backlog level. Looking forward, we remain confident in our visibility for new booking opportunities,” said B&W Chairman and Chief Executive Officer Kenneth Young. “This supports our expectations for continued growth in 2023 with our stated target of $100 million to $120 million in adjusted EBITDA.”

Full year 2022 adjusted EBITDA target is now expected to be $70 million to $80 million. This lowered adjustment reflects the delay of revenue recognition on certain projects, primarily due to global supply chain pressures and shortages caused by geopolitical issues and the war in Ukraine. The Company expects a stronger fourth quarter with adjusted EBITDA of $25 million to $30 million.

“While we continue to work relentlessly to mitigate the current market challenges that impacted our near-term expectations, we are seeing signs of recovery across all our segments,” Young continued. “Importantly, our revised target is not due to project performance-related issues but primarily the impact of the timing of projects, parts and services due to supply chain headwinds that impact our customers as well as B&W, thus deferring the expected timing of our revenue recognition. Domestically, we are seeing strong recovery towards a normalized trend in our Parts and Services business. We are also seeing signs of recovery from some of the global supply chain challenges affecting B&W and our customers.”

...

https://www.wallstreet-online.de/nachricht/16115378-babcock-…

...

Despite near-term macroeconomic and geopolitical headwinds, demand remains elevated, supported by a strong backlog and a robust pipeline of more than $7.5 billion of identified global project opportunities. The Company anticipates that full year 2023 adjusted EBITDA will range from $100 million to $120 million.

“We are seeing strong demand coupled with a significant backlog level. Looking forward, we remain confident in our visibility for new booking opportunities,” said B&W Chairman and Chief Executive Officer Kenneth Young. “This supports our expectations for continued growth in 2023 with our stated target of $100 million to $120 million in adjusted EBITDA.”

Full year 2022 adjusted EBITDA target is now expected to be $70 million to $80 million. This lowered adjustment reflects the delay of revenue recognition on certain projects, primarily due to global supply chain pressures and shortages caused by geopolitical issues and the war in Ukraine. The Company expects a stronger fourth quarter with adjusted EBITDA of $25 million to $30 million.

“While we continue to work relentlessly to mitigate the current market challenges that impacted our near-term expectations, we are seeing signs of recovery across all our segments,” Young continued. “Importantly, our revised target is not due to project performance-related issues but primarily the impact of the timing of projects, parts and services due to supply chain headwinds that impact our customers as well as B&W, thus deferring the expected timing of our revenue recognition. Domestically, we are seeing strong recovery towards a normalized trend in our Parts and Services business. We are also seeing signs of recovery from some of the global supply chain challenges affecting B&W and our customers.”

...

2021Q2: https://investors.babcock.com/press-releases/press-release-d…

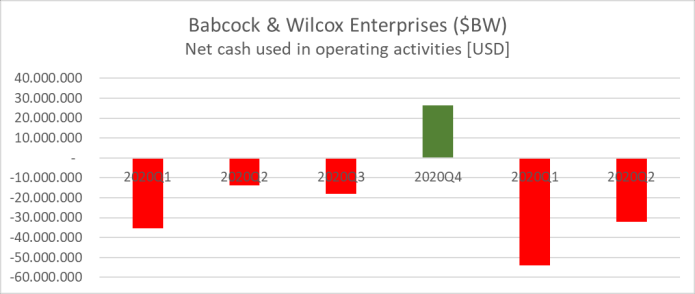

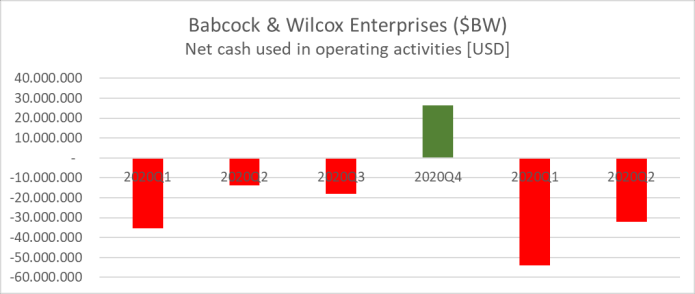

--> ich finde das Zahlenwerk übel:

<grün = positiver Net Operating Cash Flow>

..aber dem Markt gefällt es

Über "Strong Second Quarter with Significant Year-Over-Year Improvements in Revenue, Net Income, and Adjusted EBITDA" kommen die Algos nicht hinaus

"Year-Over-Year Improvements in Revenue, Net Income, and Adjusted EBITDA" haben viele Unternehmen gehabt aus naheliegenden Gründen und manche haben dabei sogar operativ Geld verdient.

Wie üblich: mit dem "Umwelt-Tralala" verdient BW kein Geld, sondern mit dem traditionellen "Babcock & Wilcox Thermal"-Geschäft:

• 67% der Umsätze werden dort noch immer gemacht (2021Q2)

Man muss schon genauer hinschauen, wie hier z.B.:

Babcock & Wilcox Renewable segment revenues were $38.3 million for the second quarter of 2021, compared to $43.5 million in the second quarter of 2020.

The reduction in revenue is primarily driven by large project start delays due to the adverse global effects of COVID-19 in the second quarter of 2021 coupled with the completion of prior-year large service and licensing projects and loss contracts that have not been replaced.

MMn wird auch in den nächsten Quartalen das Geld zu diesen Leuten fließen:

On May 7, 2021 the Company closed an underwritten registered public offering of 4,000,000 shares of its 7.75% Series A Cumulative Perpetual Preferred Stock (the "Preferred Stock") for gross proceeds of approximately $100 million...

On May 26, 2021, the Company completed the sale of an additional 444,700 shares of its Preferred Stock at an offering price of $25.00 per share for net proceeds of approximately $10.7 million after deducting underwriting fees.

As previously disclosed, on June 1, 2021, the Company entered into an agreement with B. Riley whereby the Company issued B. Riley 2,916,880 shares of Preferred Stock and paid $0.4 million in cash, and paid $0.9 million in cash to B. Riley for accrued interest due, in exchange for a deemed prepayment of $73.3 million of the Company's existing term loans.

...

Subsequent to June 30, 2021 and as of August 12, 2021, the Company issued additional shares of its Preferred Stock for net proceeds of $5.9 million and additional Senior Notes for net proceeds of $12.9 million under the relevant At-The-Market ("ATM") sales agreements.

CEO Young u.a.: "We remain dedicated to increasing shareholder value through both organic and inorganic growth while driving a worldwide transformation to a green environmental future."

--> ich ahne dabei nichts Gutes als Kleinaktionär

Ich glaube (mittlerweile) nämlich einfach, daß die globale Wettbewerbs-Situation für BW beinhart ist, v.a. im Bereich "green environmental future".

Denn dort treffen sie auch zu Hause in den USA auf Dickschiffe, wie Baker Hughes und andere (Ex-)Öl- und Gaslieferanten, die sich am großen "ESG-Kuchen" beteiligen wollen.

Wahrscheinlich verkaufe ich meinen Restbestand morgen in den kleinen Upmove hinein.

--> ich finde das Zahlenwerk übel:

<grün = positiver Net Operating Cash Flow>

..aber dem Markt gefällt es

Über "Strong Second Quarter with Significant Year-Over-Year Improvements in Revenue, Net Income, and Adjusted EBITDA" kommen die Algos nicht hinaus

"Year-Over-Year Improvements in Revenue, Net Income, and Adjusted EBITDA" haben viele Unternehmen gehabt aus naheliegenden Gründen und manche haben dabei sogar operativ Geld verdient.

Wie üblich: mit dem "Umwelt-Tralala" verdient BW kein Geld, sondern mit dem traditionellen "Babcock & Wilcox Thermal"-Geschäft:

• 67% der Umsätze werden dort noch immer gemacht (2021Q2)

Man muss schon genauer hinschauen, wie hier z.B.:

Babcock & Wilcox Renewable segment revenues were $38.3 million for the second quarter of 2021, compared to $43.5 million in the second quarter of 2020.

The reduction in revenue is primarily driven by large project start delays due to the adverse global effects of COVID-19 in the second quarter of 2021 coupled with the completion of prior-year large service and licensing projects and loss contracts that have not been replaced.

MMn wird auch in den nächsten Quartalen das Geld zu diesen Leuten fließen:

On May 7, 2021 the Company closed an underwritten registered public offering of 4,000,000 shares of its 7.75% Series A Cumulative Perpetual Preferred Stock (the "Preferred Stock") for gross proceeds of approximately $100 million...

On May 26, 2021, the Company completed the sale of an additional 444,700 shares of its Preferred Stock at an offering price of $25.00 per share for net proceeds of approximately $10.7 million after deducting underwriting fees.

As previously disclosed, on June 1, 2021, the Company entered into an agreement with B. Riley whereby the Company issued B. Riley 2,916,880 shares of Preferred Stock and paid $0.4 million in cash, and paid $0.9 million in cash to B. Riley for accrued interest due, in exchange for a deemed prepayment of $73.3 million of the Company's existing term loans.

...

Subsequent to June 30, 2021 and as of August 12, 2021, the Company issued additional shares of its Preferred Stock for net proceeds of $5.9 million and additional Senior Notes for net proceeds of $12.9 million under the relevant At-The-Market ("ATM") sales agreements.

CEO Young u.a.: "We remain dedicated to increasing shareholder value through both organic and inorganic growth while driving a worldwide transformation to a green environmental future."

--> ich ahne dabei nichts Gutes als Kleinaktionär

Ich glaube (mittlerweile) nämlich einfach, daß die globale Wettbewerbs-Situation für BW beinhart ist, v.a. im Bereich "green environmental future".

Denn dort treffen sie auch zu Hause in den USA auf Dickschiffe, wie Baker Hughes und andere (Ex-)Öl- und Gaslieferanten, die sich am großen "ESG-Kuchen" beteiligen wollen.

Wahrscheinlich verkaufe ich meinen Restbestand morgen in den kleinen Upmove hinein.

etwas dick aufgetragen:

25.5.

Babcock & Wilcox Announces ClimateBright™ Decarbonization Technologies Platform to Reduce Global Greenhouse Gas Emissions

https://investors.babcock.com/press-releases/press-release-d…

• Proven Technology Captures CO2 While Producing Hydrogen

• Application for Wide Range of Industries

AKRON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox ("B&W") (NYSE: BW), a leading innovator in clean energy technologies, announces its ClimateBright™ suite of revolutionary decarbonization technologies designed to help utilities and industry aggressively combat greenhouse gas emissions and climate change. ClimateBright™ technologies further strengthen B&W’s commitment to clean energy progress and to helping customers worldwide address the most significant environmental challenge in industrial processes and energy generation.

“Our ClimateBright™ technologies can change the world,” ( ) said Kenneth Young, B&W Chairman and Chief Executive Officer. “The United Nations has set a goal of net-zero greenhouse gas emissions by 2050 and that is supported by more than 100 countries. Through advanced research and development, combined with joint efforts with the U.S. Department of Energy and various universities, B&W has unparalleled experience in clean energy solutions – backed by more than 90 active patents for carbon capture alone – and has the expertise and technology to lead the world’s next industrial revolution toward a zero-carbon future. We are currently working with many clients to determine the best carbon capture solution based on their specific needs.”

) said Kenneth Young, B&W Chairman and Chief Executive Officer. “The United Nations has set a goal of net-zero greenhouse gas emissions by 2050 and that is supported by more than 100 countries. Through advanced research and development, combined with joint efforts with the U.S. Department of Energy and various universities, B&W has unparalleled experience in clean energy solutions – backed by more than 90 active patents for carbon capture alone – and has the expertise and technology to lead the world’s next industrial revolution toward a zero-carbon future. We are currently working with many clients to determine the best carbon capture solution based on their specific needs.”

B&W’s ClimateBrightTM suite of technologies can capture CO2 and includes the ability to produce hydrogen. These technologies have application for a wide range of industries including energy production, food manufacturing, steel, cement, oil and gas, pharmaceutical, petrochemical, carbon black, and pulp and paper.

B&W’s ClimateBrightTM solutions include:

• BrightLoopTM technology to produce hydrogen, steam or syngas from a variety of fuels or feedstocks while isolating CO2 for capture or other industrial purposes

• SolveBrightTM regenerable solvent technology for carbon capture processes

• OxyBrightTM combustion process ideal for CO2 isolation and sequestration applications

• BrightGenTM hydrogen combustion technology

....

25.5.

Babcock & Wilcox Announces ClimateBright™ Decarbonization Technologies Platform to Reduce Global Greenhouse Gas Emissions

https://investors.babcock.com/press-releases/press-release-d…

• Proven Technology Captures CO2 While Producing Hydrogen

• Application for Wide Range of Industries

AKRON, Ohio--(BUSINESS WIRE)-- Babcock & Wilcox ("B&W") (NYSE: BW), a leading innovator in clean energy technologies, announces its ClimateBright™ suite of revolutionary decarbonization technologies designed to help utilities and industry aggressively combat greenhouse gas emissions and climate change. ClimateBright™ technologies further strengthen B&W’s commitment to clean energy progress and to helping customers worldwide address the most significant environmental challenge in industrial processes and energy generation.

“Our ClimateBright™ technologies can change the world,” (

) said Kenneth Young, B&W Chairman and Chief Executive Officer. “The United Nations has set a goal of net-zero greenhouse gas emissions by 2050 and that is supported by more than 100 countries. Through advanced research and development, combined with joint efforts with the U.S. Department of Energy and various universities, B&W has unparalleled experience in clean energy solutions – backed by more than 90 active patents for carbon capture alone – and has the expertise and technology to lead the world’s next industrial revolution toward a zero-carbon future. We are currently working with many clients to determine the best carbon capture solution based on their specific needs.”

) said Kenneth Young, B&W Chairman and Chief Executive Officer. “The United Nations has set a goal of net-zero greenhouse gas emissions by 2050 and that is supported by more than 100 countries. Through advanced research and development, combined with joint efforts with the U.S. Department of Energy and various universities, B&W has unparalleled experience in clean energy solutions – backed by more than 90 active patents for carbon capture alone – and has the expertise and technology to lead the world’s next industrial revolution toward a zero-carbon future. We are currently working with many clients to determine the best carbon capture solution based on their specific needs.”B&W’s ClimateBrightTM suite of technologies can capture CO2 and includes the ability to produce hydrogen. These technologies have application for a wide range of industries including energy production, food manufacturing, steel, cement, oil and gas, pharmaceutical, petrochemical, carbon black, and pulp and paper.

B&W’s ClimateBrightTM solutions include:

• BrightLoopTM technology to produce hydrogen, steam or syngas from a variety of fuels or feedstocks while isolating CO2 for capture or other industrial purposes

• SolveBrightTM regenerable solvent technology for carbon capture processes

• OxyBrightTM combustion process ideal for CO2 isolation and sequestration applications

• BrightGenTM hydrogen combustion technology

....

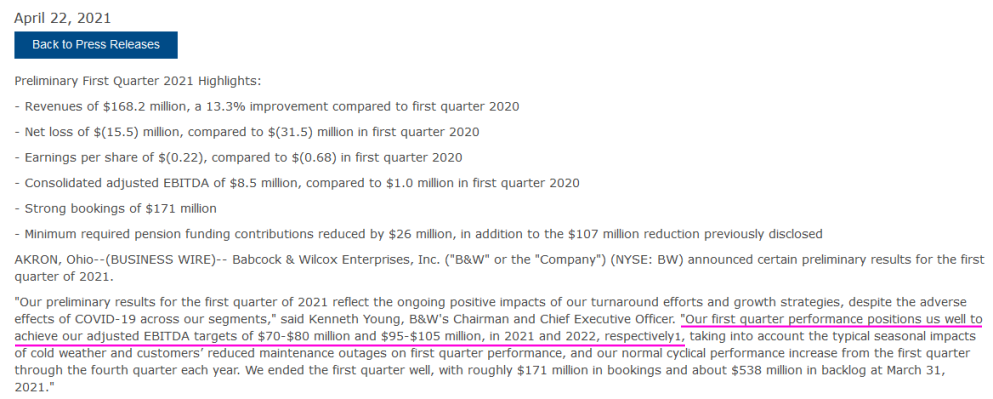

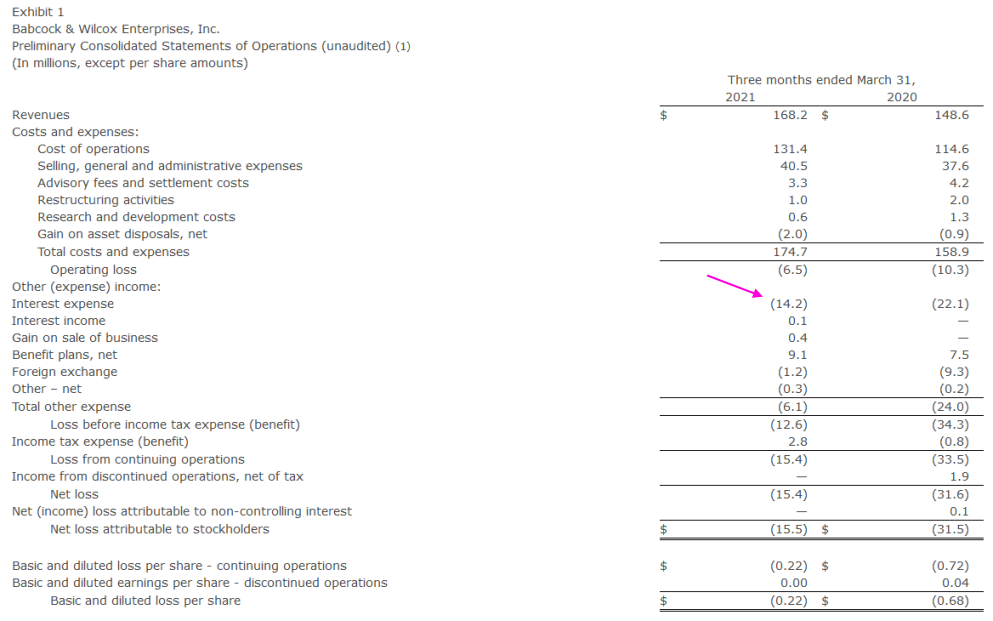

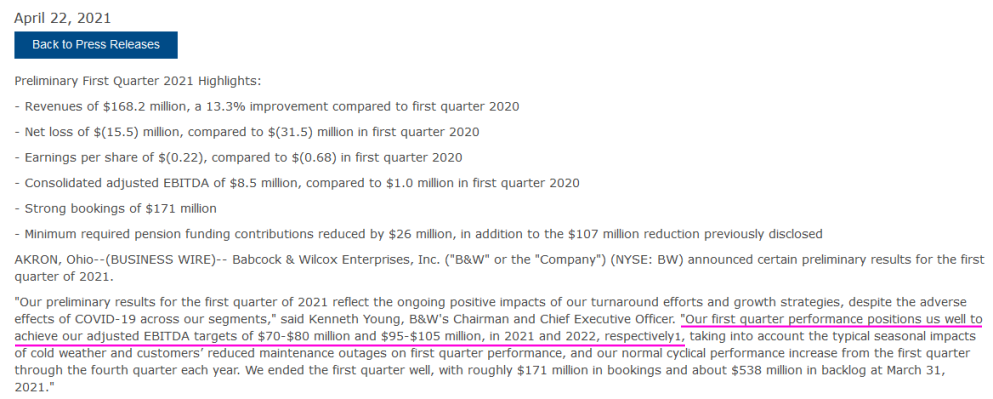

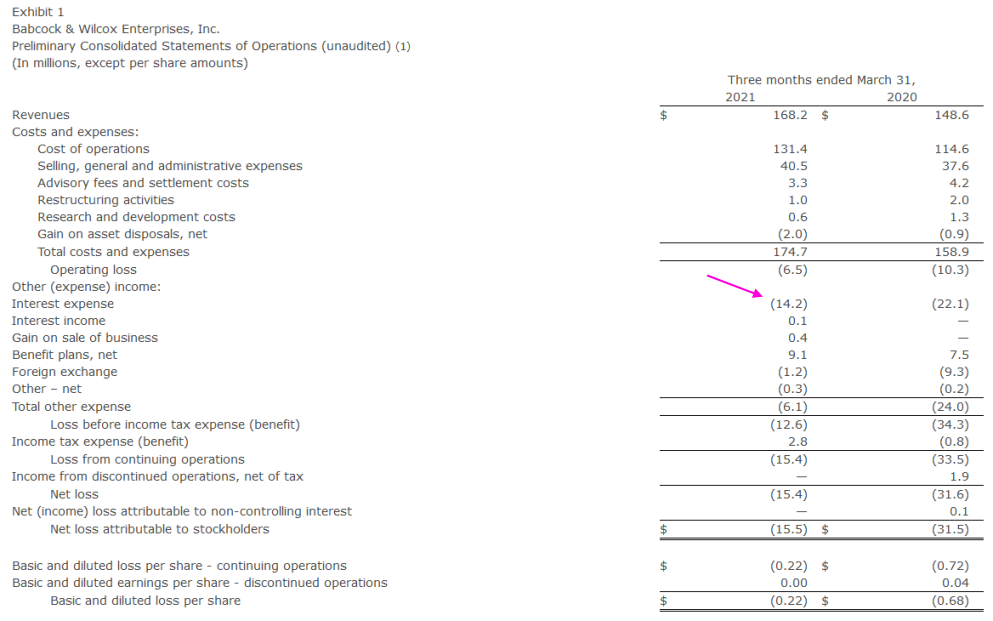

Antwort auf Beitrag Nr.: 67.740.655 von faultcode am 08.04.21 15:44:05https://investors.babcock.com/press-releases/press-release-d…

...

...

...

...

Antwort auf Beitrag Nr.: 66.916.238 von faultcode am 09.02.21 22:21:16ich nehme hier mal Teilgewinne mit und lasse den Rest bis auf Weiteres liegen.

Fundamental gesehen ist dieser zyklische Anlagenbauer auch schon wieder erhöht bewertet mMn, da man ja immer noch einen ganzen Sack Schulden mit sich herumschleppen muss.

Oder so gesagt: die nächsten +100% werden (viel) langwieriger werden mMn, also die letzten +100%

Fundamental gesehen ist dieser zyklische Anlagenbauer auch schon wieder erhöht bewertet mMn, da man ja immer noch einen ganzen Sack Schulden mit sich herumschleppen muss.

Oder so gesagt: die nächsten +100% werden (viel) langwieriger werden mMn, also die letzten +100%

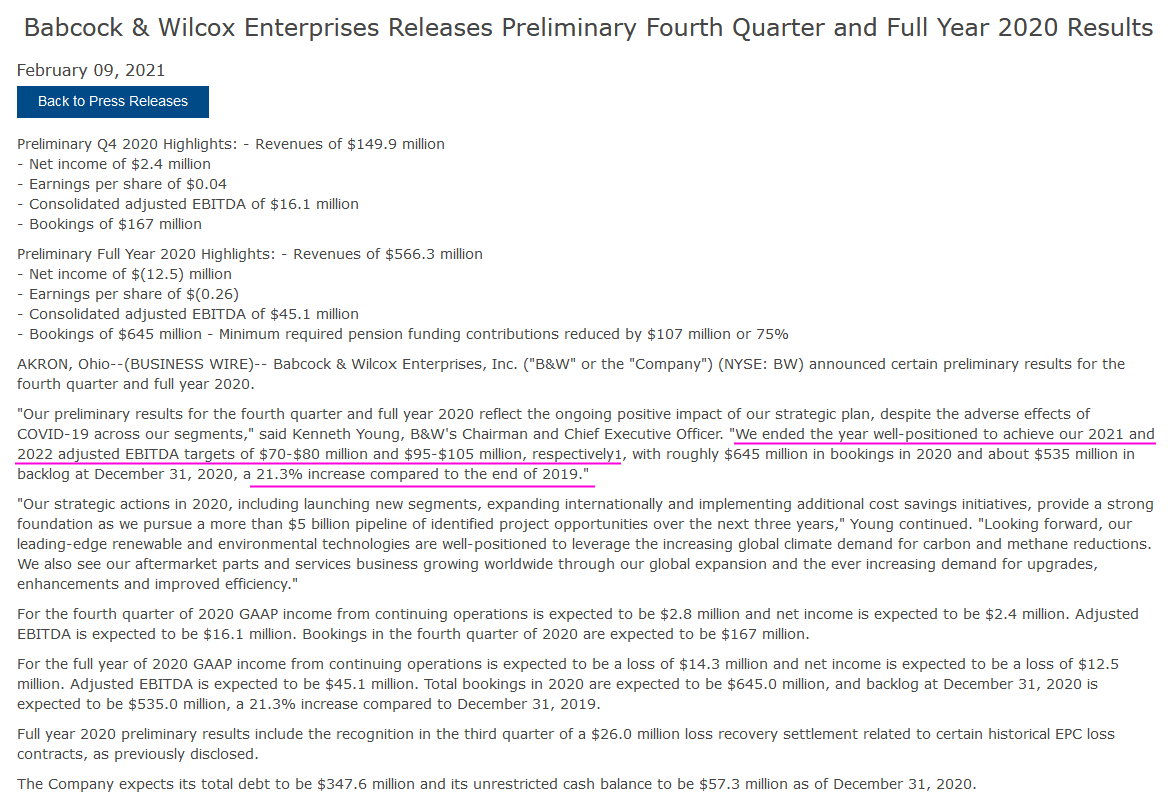

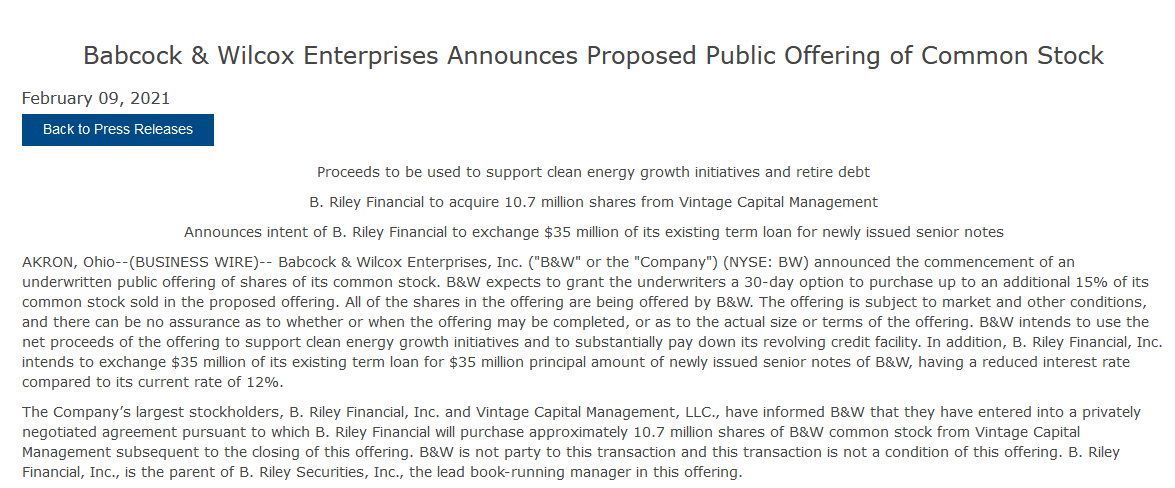

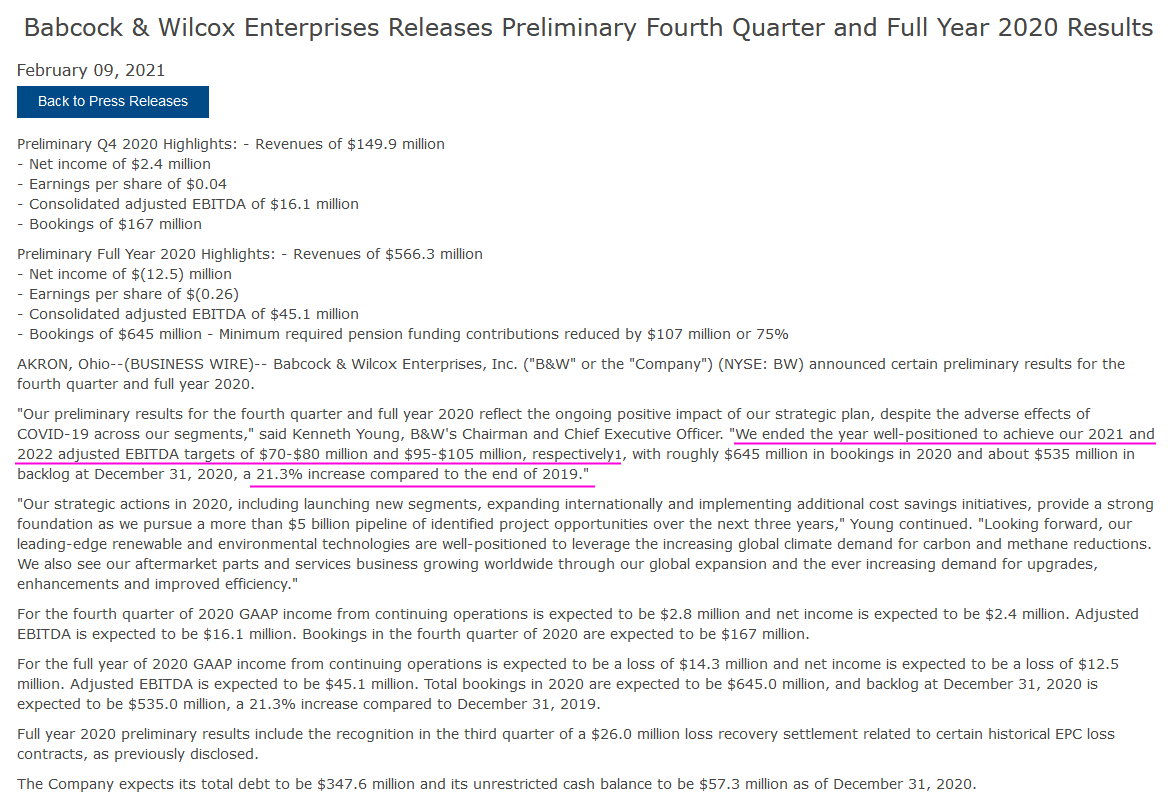

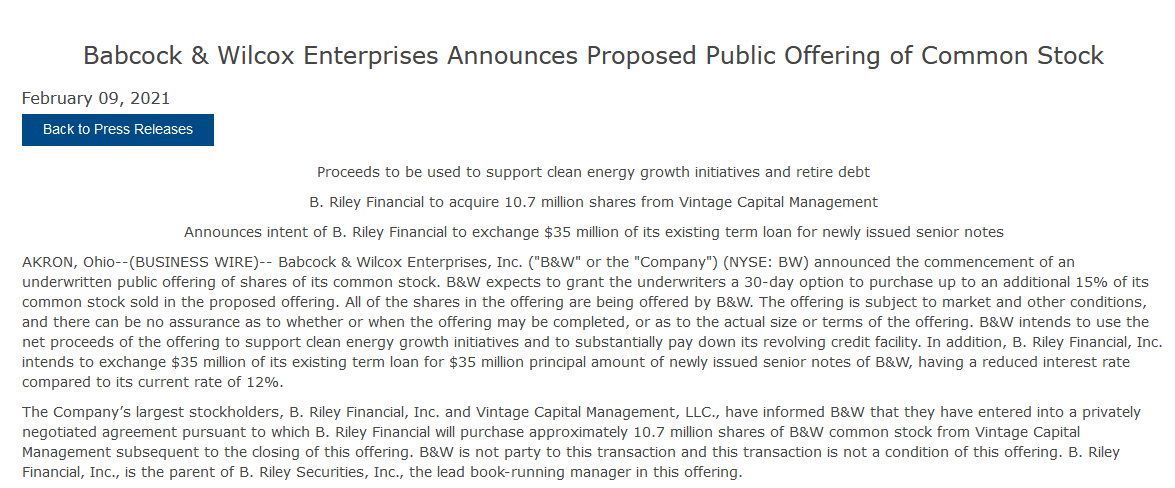

Antwort auf Beitrag Nr.: 65.890.311 von faultcode am 30.11.20 15:52:03https://investors.babcock.com/press-releases/press-release-d…

...

aber dann gab's noch eine KE, die offensichtlich bereits durchsickerte (heute -7%)

...

https://investors.babcock.com/press-releases/press-release-d…

...

aber dann gab's noch eine KE, die offensichtlich bereits durchsickerte (heute -7%)

...

https://investors.babcock.com/press-releases/press-release-d…

Wir steigen kontinuierlich und niemand interessiert es?