Cenovus Energy - Die letzten 30 Beiträge

eröffnet am 15.09.19 01:49:31 von

neuester Beitrag 08.12.23 14:17:09 von

neuester Beitrag 08.12.23 14:17:09 von

Beiträge: 49

ID: 1.311.773

ID: 1.311.773

Aufrufe heute: 0

Gesamt: 3.411

Gesamt: 3.411

Aktive User: 0

ISIN: CA15135U1093 · WKN: A0YD8C · Symbol: CVE

28,42

CAD

-0,28 %

-0,08 CAD

Letzter Kurs 09.05.24 Toronto

Neuigkeiten

02.05.24 · globenewswire |

01.05.24 · globenewswire |

25.04.24 · globenewswire |

03.04.24 · wO Chartvergleich |

27.02.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2760 | +37,95 | |

| 1,1500 | +27,78 | |

| 1,0400 | +18,18 | |

| 8,2500 | +16,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,4000 | -9,43 | |

| 2,0500 | -9,69 | |

| 850,20 | -12,51 | |

| 11,790 | -12,67 | |

| 1,5200 | -20,63 |

Beitrag zu dieser Diskussion schreiben

7.12.

Ottawa orders emissions cuts of up to 38% for oil and gas companies

Caps a historic first for a fossil-fuel producing country, energy minister says

https://financialpost.com/commodities/energy/oil-gas/canada-…

...

Producers will be allowed the flexibility to emit up to a level of about 20 per cent to 23 per cent below 2019 levels through the ability to buy carbon offsets or pay into a fund that promotes decarbonization in the sector if their emissions exceed the cap.

The cap will go down over time until Canada’s economy reaches net zero in 2050. Thursday’s announcement is a framework that lays out the plan, with more details to be released in draft regulations in the middle of next year, Guilbeault said. Those regulations will narrow down an exact emissions target for 2030, he said.

...

Ottawa orders emissions cuts of up to 38% for oil and gas companies

Caps a historic first for a fossil-fuel producing country, energy minister says

https://financialpost.com/commodities/energy/oil-gas/canada-…

...

Producers will be allowed the flexibility to emit up to a level of about 20 per cent to 23 per cent below 2019 levels through the ability to buy carbon offsets or pay into a fund that promotes decarbonization in the sector if their emissions exceed the cap.

The cap will go down over time until Canada’s economy reaches net zero in 2050. Thursday’s announcement is a framework that lays out the plan, with more details to be released in draft regulations in the middle of next year, Guilbeault said. Those regulations will narrow down an exact emissions target for 2030, he said.

...

25.9.

Canadian Oil Exports Surge With World Hunting for OPEC Alternatives

https://www.bnnbloomberg.ca/canadian-oil-exports-surge-with-…

...

Less demand from US refineries coincides with the end of maintenance season at Alberta’s oil fields, bringing back output that was down for part of summer. The extra volume comes amid a supply squeeze around the world after Saudi Arabia and Russia curtailed production, upending flows and boosting Canadian oil prices. Canadian crude earlier this week hit the narrowest discount to Nymex West Texas Intermediate futures in two months, according to Link Data Services.

...

3.8.

Canadian Oil-Sands Output Poised to Jump as Pipeline Project Nears Finish

https://www.bnnbloomberg.ca/canadian-oil-sands-output-poised…

...

Canadian oil-sands producers including Canadian Natural Resources Ltd. and Cenovus Energy Inc. are rushing to expand production to fill the biggest new pipeline project in more than a decade.

Canadian Natural will raise output from its Primrose site by 25,000 barrels a day in the current quarter and boost production at its Kirby oil-sands operation by 15,000 barrels a day in the fourth quarter, the company said Thursday. Cenovus plans to start up its Narrows Lake oil-sands site, an extension of its Christina Lake operation, in early 2025.

Alberta’s oil producers will have the ability to ship an extra 590,000 barrels of crude a day to the Pacific Coast next year — the biggest jump in the province’s oil-export capacity in more than a decade — after an expansion of the the Trans Mountain Pipeline begins service. The increase is a welcome turnabout for companies that have suffered for years from discounted prices because of a lack of pipeline space.

“This industry has a great habit of expanding to fill pipeline capacity,” Cenovus Chief Operating Officer Jonathan McKenzie said of Trans Mountain on a call this week. “That’ll be filled, I think, in relatively short order over the coming years.”

Canadian Oil-Sands Output Poised to Jump as Pipeline Project Nears Finish

https://www.bnnbloomberg.ca/canadian-oil-sands-output-poised…

...

Canadian oil-sands producers including Canadian Natural Resources Ltd. and Cenovus Energy Inc. are rushing to expand production to fill the biggest new pipeline project in more than a decade.

Canadian Natural will raise output from its Primrose site by 25,000 barrels a day in the current quarter and boost production at its Kirby oil-sands operation by 15,000 barrels a day in the fourth quarter, the company said Thursday. Cenovus plans to start up its Narrows Lake oil-sands site, an extension of its Christina Lake operation, in early 2025.

Alberta’s oil producers will have the ability to ship an extra 590,000 barrels of crude a day to the Pacific Coast next year — the biggest jump in the province’s oil-export capacity in more than a decade — after an expansion of the the Trans Mountain Pipeline begins service. The increase is a welcome turnabout for companies that have suffered for years from discounted prices because of a lack of pipeline space.

“This industry has a great habit of expanding to fill pipeline capacity,” Cenovus Chief Operating Officer Jonathan McKenzie said of Trans Mountain on a call this week. “That’ll be filled, I think, in relatively short order over the coming years.”

28.7.

UPDATE 3-Cenovus Energy criticizes Canadian gov't plans to cut emissions as profits surge

https://finance.yahoo.com/news/1-cenovus-energy-profit-jumps…

...

Cenovus Energy reported a near 11-fold surge in second-quarter profit on Thursday and boosted capital spending and production forecasts, but warned Canadian government plans to cap oil and gas emissions could lead to production being shut in.

Oil prices have scaled multi-year highs this year as Western sanctions against major exporter Russia squeeze an already under-supplied market. Brent crude, the global benchmark, was last trading at over $107 a barrel.

Calgary-based Cenovus, Canada's No. 2 oil and gas producer, said it will increase capital investment by C$400 million ($311.58 million) this year to C$3.3 billion to C$3.7 billion, and raise production by 15,000 barrels of oil equivalent per day (boepd) to 780,000 to 810,000 boepd.

Around C$100 million of the increased spending is due to inflation, with the remainder going to oil sands projects and restarting the West White Rose offshore project in Atlantic Canada.

However, Cenovus remains committed to shareholder returns and will focus on incremental production increases rather than large scale projects, Chief Executive Alex Pourbaix said.

He also criticized federal government plans to cap and cut emissions from Canada's oil and gas sector. Last week the government outlined two options to help cut emissions to 42% below 2005 levels by 2030, which Pourbaix said would not be possible.

"I would say either of those options are more ambitious than what can reasonably be achieved," Pourbaix told a conference call. "I am very worried that if we remain on this path, it could lead to shutting in production, and at a time when the world is literally crying out for more oil and gas production."

Cenovus' production fell to 761,500 boepd in the second quarter, from 765,900 boepd a year earlier due to planned turnarounds. However production is expected to rise beyond 800,000 boepd in the second half of 2022.

Net earnings rose to C$2.43 billion ($1.90 billion), or C$1.19 Canadian cents per share, for the three months ended June 30, from C$224 million, or 11 Canadian cents per share, a year earlier. ($1 = 1.2838 Canadian dollars)

...

UPDATE 3-Cenovus Energy criticizes Canadian gov't plans to cut emissions as profits surge

https://finance.yahoo.com/news/1-cenovus-energy-profit-jumps…

...

Cenovus Energy reported a near 11-fold surge in second-quarter profit on Thursday and boosted capital spending and production forecasts, but warned Canadian government plans to cap oil and gas emissions could lead to production being shut in.

Oil prices have scaled multi-year highs this year as Western sanctions against major exporter Russia squeeze an already under-supplied market. Brent crude, the global benchmark, was last trading at over $107 a barrel.

Calgary-based Cenovus, Canada's No. 2 oil and gas producer, said it will increase capital investment by C$400 million ($311.58 million) this year to C$3.3 billion to C$3.7 billion, and raise production by 15,000 barrels of oil equivalent per day (boepd) to 780,000 to 810,000 boepd.

Around C$100 million of the increased spending is due to inflation, with the remainder going to oil sands projects and restarting the West White Rose offshore project in Atlantic Canada.

However, Cenovus remains committed to shareholder returns and will focus on incremental production increases rather than large scale projects, Chief Executive Alex Pourbaix said.

He also criticized federal government plans to cap and cut emissions from Canada's oil and gas sector. Last week the government outlined two options to help cut emissions to 42% below 2005 levels by 2030, which Pourbaix said would not be possible.

"I would say either of those options are more ambitious than what can reasonably be achieved," Pourbaix told a conference call. "I am very worried that if we remain on this path, it could lead to shutting in production, and at a time when the world is literally crying out for more oil and gas production."

Cenovus' production fell to 761,500 boepd in the second quarter, from 765,900 boepd a year earlier due to planned turnarounds. However production is expected to rise beyond 800,000 boepd in the second half of 2022.

Net earnings rose to C$2.43 billion ($1.90 billion), or C$1.19 Canadian cents per share, for the three months ended June 30, from C$224 million, or 11 Canadian cents per share, a year earlier. ($1 = 1.2838 Canadian dollars)

...

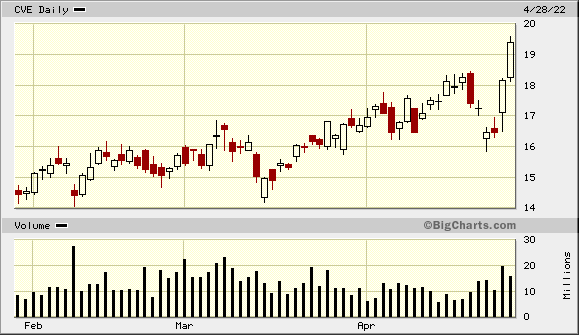

Antwort auf Beitrag Nr.: 71.770.937 von faultcode am 13.06.22 17:36:52<hier auch eine Teilgewinn-Mitnahme>

Antwort auf Beitrag Nr.: 71.452.001 von faultcode am 28.04.22 23:45:10Cenovus acquiring outstanding 50% interest in Sunrise oil sands asset

https://www.cenovus.com/news/news-releases/2022/06-13-2022-c…

Calgary, Alberta (June 13, 2022) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has reached an agreement to purchase the remaining 50% of the Sunrise oil sands project in northern Alberta from bp. Total consideration for the transaction includes $600 million in cash, a variable payment with a maximum cumulative value of $600 million expiring after two years, and Cenovus’s 35% position in the undeveloped Bay du Nord project offshore Newfoundland and Labrador.

The transaction has an effective date of May 1, 2022 and is anticipated to close in the third quarter of this year, subject to closing conditions and normal purchase price adjustments.

Full ownership of Sunrise further enhances Cenovus’s core strength in the oil sands. Sunrise has been operated by the company since the beginning of 2021, following the Husky Energy transaction, and Cenovus is now in the early stages of applying its oil sands operating model at this asset.

“Acquiring the remaining working interest in Sunrise enables us to fully benefit from the significant optimization opportunities available,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “By applying Cenovus’s advanced operating techniques, we expect to increase production at Sunrise while driving down sustaining capital, operating costs and emissions intensity.”

Cenovus currently operates Sunrise and owns 50% of the asset through the Sunrise Oil Sands Partnership, with bp. Current production from the asset is approximately 50,000 barrels per day (bbls/d), and the company expects to achieve nameplate capacity of 60,000 bbls/d through a multi-year development program. The acquisition is expected to be immediately accretive to adjusted funds flow and cash from operating activities.

2022 Guidance

Cenovus’s corporate guidance dated April 26, 2022 does not reflect this acquisition. The company plans to update guidance with its second quarter results in July 2022.

...

https://www.cenovus.com/news/news-releases/2022/06-13-2022-c…

Calgary, Alberta (June 13, 2022) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has reached an agreement to purchase the remaining 50% of the Sunrise oil sands project in northern Alberta from bp. Total consideration for the transaction includes $600 million in cash, a variable payment with a maximum cumulative value of $600 million expiring after two years, and Cenovus’s 35% position in the undeveloped Bay du Nord project offshore Newfoundland and Labrador.

The transaction has an effective date of May 1, 2022 and is anticipated to close in the third quarter of this year, subject to closing conditions and normal purchase price adjustments.

Full ownership of Sunrise further enhances Cenovus’s core strength in the oil sands. Sunrise has been operated by the company since the beginning of 2021, following the Husky Energy transaction, and Cenovus is now in the early stages of applying its oil sands operating model at this asset.

“Acquiring the remaining working interest in Sunrise enables us to fully benefit from the significant optimization opportunities available,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “By applying Cenovus’s advanced operating techniques, we expect to increase production at Sunrise while driving down sustaining capital, operating costs and emissions intensity.”

Cenovus currently operates Sunrise and owns 50% of the asset through the Sunrise Oil Sands Partnership, with bp. Current production from the asset is approximately 50,000 barrels per day (bbls/d), and the company expects to achieve nameplate capacity of 60,000 bbls/d through a multi-year development program. The acquisition is expected to be immediately accretive to adjusted funds flow and cash from operating activities.

2022 Guidance

Cenovus’s corporate guidance dated April 26, 2022 does not reflect this acquisition. The company plans to update guidance with its second quarter results in July 2022.

...

Antwort auf Beitrag Nr.: 71.306.097 von faultcode am 07.04.22 14:23:13Elliott will beim Nachbarn "aufräumen":

28.4.

Elliott calls for Suncor strategic review, board changes

https://www.msn.com/en-ca/money/topstories/elliott-calls-for…

=>

ein starkes Q1 half gestern auch. Das war aber auch zu erwarten gewesen:

...

The company’s Board of Directors has approved tripling the base dividend starting with the second quarter of 2022, as well as a plan for additional increases to shareholder returns.

Beyond the base dividend increase, Cenovus will target to return 50% of quarterly excess free funds flow to shareholders when reported net debt is less than $9 billion. The company will do this through share buybacks and/or variable dividends while also continuing to pay down the balance sheet. Cenovus has adopted an ultimate net debt target of $4 billion. When reported net debt is at the $4 billion floor, Cenovus will target to return 100% of that quarter’s excess free funds flow to shareholders through share buybacks and/or variable dividends.

...

https://www.cenovus.com/news/news-releases/2022/04-27-2022-C…

28.4.

Elliott calls for Suncor strategic review, board changes

https://www.msn.com/en-ca/money/topstories/elliott-calls-for…

=>

ein starkes Q1 half gestern auch. Das war aber auch zu erwarten gewesen:

...

The company’s Board of Directors has approved tripling the base dividend starting with the second quarter of 2022, as well as a plan for additional increases to shareholder returns.

Beyond the base dividend increase, Cenovus will target to return 50% of quarterly excess free funds flow to shareholders when reported net debt is less than $9 billion. The company will do this through share buybacks and/or variable dividends while also continuing to pay down the balance sheet. Cenovus has adopted an ultimate net debt target of $4 billion. When reported net debt is at the $4 billion floor, Cenovus will target to return 100% of that quarter’s excess free funds flow to shareholders through share buybacks and/or variable dividends.

...

https://www.cenovus.com/news/news-releases/2022/04-27-2022-C…

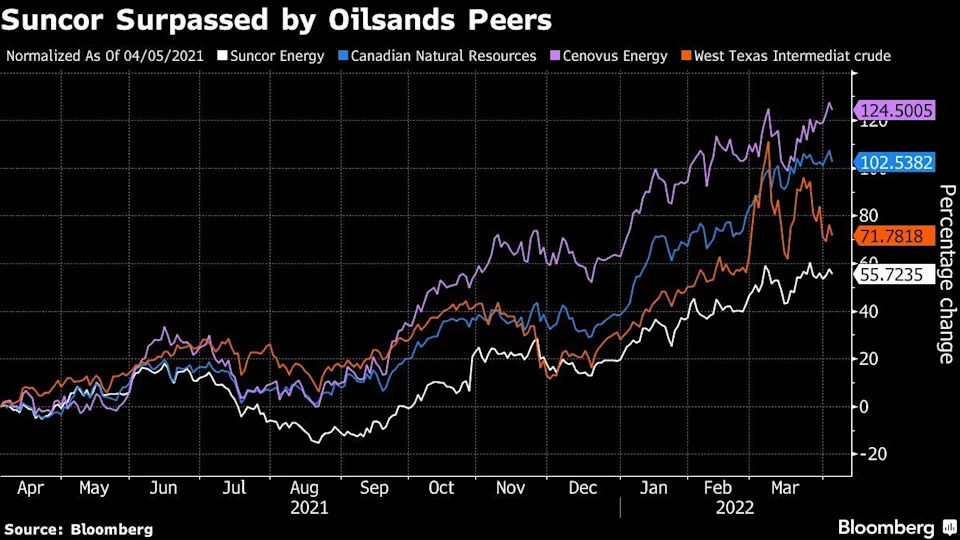

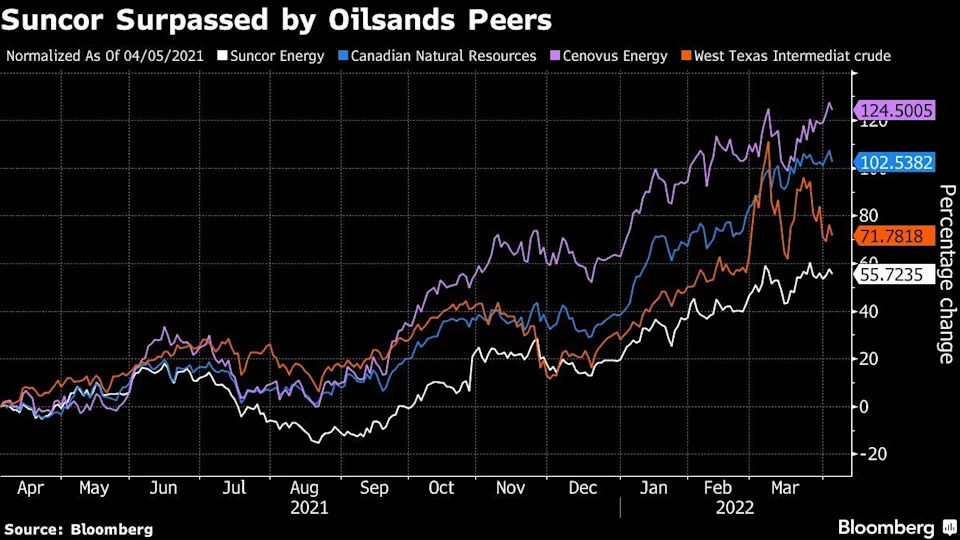

CVE, das richtige Pferdchen:

...

“Why would I own Suncor when I can own Cenovus?” said Eric Nuttall, a senior portfolio manager at Ninepoint Partners, adding that a string of safety issues need to be addressed before the stock’s performance improves.

...

6.4.

Suncor Shares Go From First to Worst in Canada Oil-Sands Boom

https://finance.yahoo.com/news/suncor-shares-first-worst-can…

...

“Why would I own Suncor when I can own Cenovus?” said Eric Nuttall, a senior portfolio manager at Ninepoint Partners, adding that a string of safety issues need to be addressed before the stock’s performance improves.

...

6.4.

Suncor Shares Go From First to Worst in Canada Oil-Sands Boom

https://finance.yahoo.com/news/suncor-shares-first-worst-can…

24.3.

Canada Will Boost Oil Exports as World Shuns Russian Supply

https://finance.yahoo.com/news/canada-boost-oil-exports-worl…

...

Canada will increase oil and gas exports by the equivalent of 300,000 barrels a day to help nations that are trying to shift away from Russian supplies, the country’s resources minister said.

Energy producers can raise shipments of crude by 200,000 barrels a day and natural gas by the equivalent of 100,000 by year-end by accelerating planned projects to expand output, Jonathan Wilkinson said Thursday at a press conference in Paris.

Canada and the U.S. already have the pipeline capacity to handle the extra volumes, with some of the extra oil expected to be shipped to Europe via the Gulf Coast, he said.

“Canada indicated to our European friends that we will work to help them in the current situation that they find themselves,” he said.

The Canadian government is also in discussions with European countries about eventually supplying them with liquefied natural gas, but any export facility would need to be eventually convertible to exporting hydrogen as part of a planned pivot away from hydrocarbons, Wilkinson said.

Canada has no LNG export terminals yet, but a consortium that includes Shell Plc and Malaysia’s Petroliam Nasional Bhd is building a large one on the Canada’s west coast that is expected to be ready by the middle of the decade.

...

"friends"

Canada Will Boost Oil Exports as World Shuns Russian Supply

https://finance.yahoo.com/news/canada-boost-oil-exports-worl…

...

Canada will increase oil and gas exports by the equivalent of 300,000 barrels a day to help nations that are trying to shift away from Russian supplies, the country’s resources minister said.

Energy producers can raise shipments of crude by 200,000 barrels a day and natural gas by the equivalent of 100,000 by year-end by accelerating planned projects to expand output, Jonathan Wilkinson said Thursday at a press conference in Paris.

Canada and the U.S. already have the pipeline capacity to handle the extra volumes, with some of the extra oil expected to be shipped to Europe via the Gulf Coast, he said.

“Canada indicated to our European friends that we will work to help them in the current situation that they find themselves,” he said.

The Canadian government is also in discussions with European countries about eventually supplying them with liquefied natural gas, but any export facility would need to be eventually convertible to exporting hydrogen as part of a planned pivot away from hydrocarbons, Wilkinson said.

Canada has no LNG export terminals yet, but a consortium that includes Shell Plc and Malaysia’s Petroliam Nasional Bhd is building a large one on the Canada’s west coast that is expected to be ready by the middle of the decade.

...

"friends"

Antwort auf Beitrag Nr.: 70.796.180 von Nissie am 10.02.22 14:07:50nichts mMn: https://www.bgandg.com/cve

Denn: diese Corporate litigation boutique möchte oder kann nicht einmal sagen - wie in viel konkreteren Fällen üblich - von wann bis wann möglicherweise betroffene Aktienkäufe getätigt sein sollen

Aber auch Bronstein, Gewirtz & Grossman ist offenbar zu Ohren gekommen, daß bei CVE der Rubel derzeit rollt

Denn: diese Corporate litigation boutique möchte oder kann nicht einmal sagen - wie in viel konkreteren Fällen üblich - von wann bis wann möglicherweise betroffene Aktienkäufe getätigt sein sollen

Aber auch Bronstein, Gewirtz & Grossman ist offenbar zu Ohren gekommen, daß bei CVE der Rubel derzeit rollt

Bronstein, Gewirtz & Grossman, LLC benachrichtigt Cenovus Energy Inc. (CVE) Investoren der Untersuchung

https://stockhouse.com/news/newswire/2022/02/09/oil-giant-s-…

Was soll das denn? Ob da überhaupt was bei rumkommt?

https://stockhouse.com/news/newswire/2022/02/09/oil-giant-s-…

Was soll das denn? Ob da überhaupt was bei rumkommt?

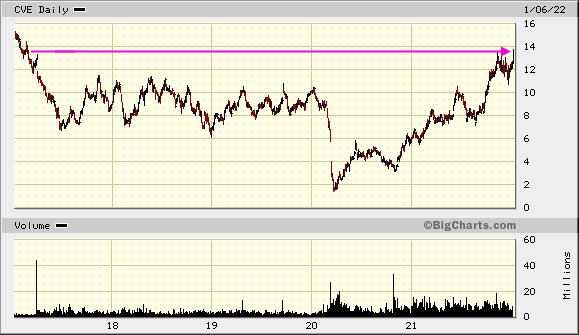

Antwort auf Beitrag Nr.: 70.422.481 von faultcode am 06.01.22 17:44:00...

ConocoPhillips still owns 100 million shares in Cenovus, according to data compiled by Bloomberg, after acquiring 208 million shares as part of the 2017 deal. ConocoPhillips has said it would completely unwind its position by the end of 2022.

“The damage to the stock on the heels of that deal was warranted,” Eight Capital analyst Phil Skolnick said by phone, adding the price was high and the ConocoPhillips share block created an overhang on the stock.

Skolnick said Cenovus’ new management team has helped reset the perception of the stock, which is up 101% over the last year as oil prices have risen and debt has been repaid. Cenovus didn’t respond to a request for comment.

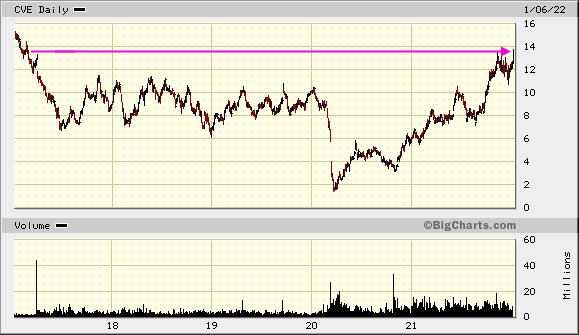

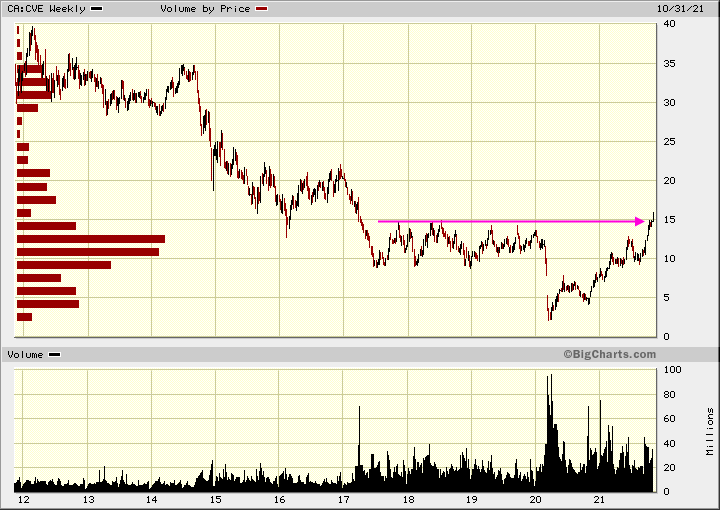

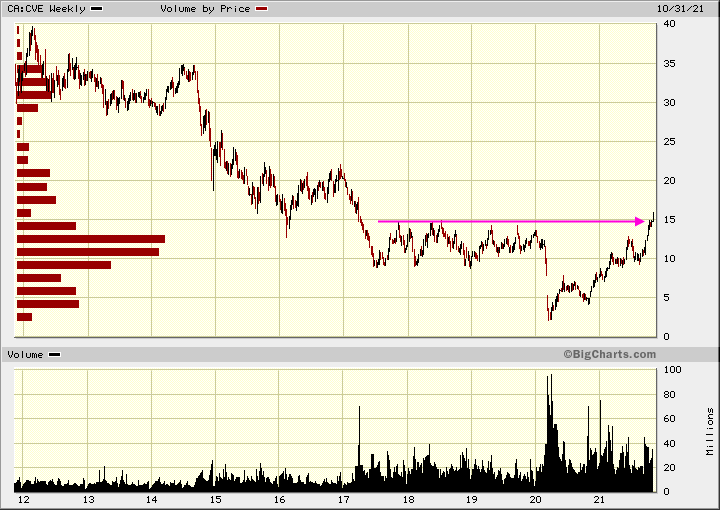

6.1.

Cenovus Shares Hit Highs Not Seen Since 2017 ConocoPhillips Deal

https://finance.yahoo.com/news/cenovus-shares-hit-highs-not-…

ConocoPhillips still owns 100 million shares in Cenovus, according to data compiled by Bloomberg, after acquiring 208 million shares as part of the 2017 deal. ConocoPhillips has said it would completely unwind its position by the end of 2022.

“The damage to the stock on the heels of that deal was warranted,” Eight Capital analyst Phil Skolnick said by phone, adding the price was high and the ConocoPhillips share block created an overhang on the stock.

Skolnick said Cenovus’ new management team has helped reset the perception of the stock, which is up 101% over the last year as oil prices have risen and debt has been repaid. Cenovus didn’t respond to a request for comment.

6.1.

Cenovus Shares Hit Highs Not Seen Since 2017 ConocoPhillips Deal

https://finance.yahoo.com/news/cenovus-shares-hit-highs-not-…

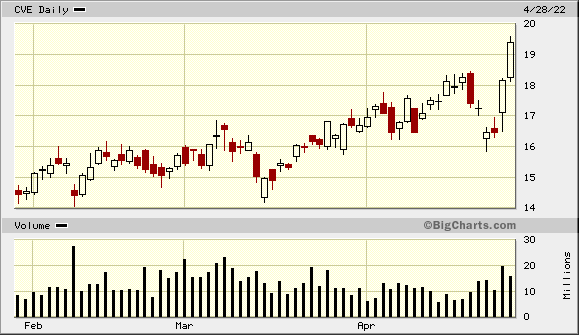

4-Jahreshoch:

CAPEX

8.12.

Cenovus Energy plans $2.6B-$3B capital spending budget for 2022

https://www.bnnbloomberg.ca/cenovus-energy-plans-2-6b-3b-cap…

...

Cenovus Energy Inc. has increased its capital spending budget for next year, against the backdrop of a global commodity boom that has pushed Canadian oil production to all-time record levels.

As part of its annual investor day Wednesday, the Calgary-based energy company announced a capital spending budget between $2.6 billion and $3 billion for next year. It said it will also reduce emissions by 35 per cent by the end of 2035, with the long-term goal of getting to net-zero greenhouse gas emissions by 2050.

Cenovus' capital spending plan is up from its guidance for between $2.3 billion and $2.7 billion this year.

The company also said it plans to allocate about 50 per cent of its excess cash flow in 2022 to shareholder returns. Remaining excess cash flow will be put toward the goal of reducing the company's net debt to below $8 billion.

...

8.12.

Cenovus Energy plans $2.6B-$3B capital spending budget for 2022

https://www.bnnbloomberg.ca/cenovus-energy-plans-2-6b-3b-cap…

...

Cenovus Energy Inc. has increased its capital spending budget for next year, against the backdrop of a global commodity boom that has pushed Canadian oil production to all-time record levels.

As part of its annual investor day Wednesday, the Calgary-based energy company announced a capital spending budget between $2.6 billion and $3 billion for next year. It said it will also reduce emissions by 35 per cent by the end of 2035, with the long-term goal of getting to net-zero greenhouse gas emissions by 2050.

Cenovus' capital spending plan is up from its guidance for between $2.3 billion and $2.7 billion this year.

The company also said it plans to allocate about 50 per cent of its excess cash flow in 2022 to shareholder returns. Remaining excess cash flow will be put toward the goal of reducing the company's net debt to below $8 billion.

...

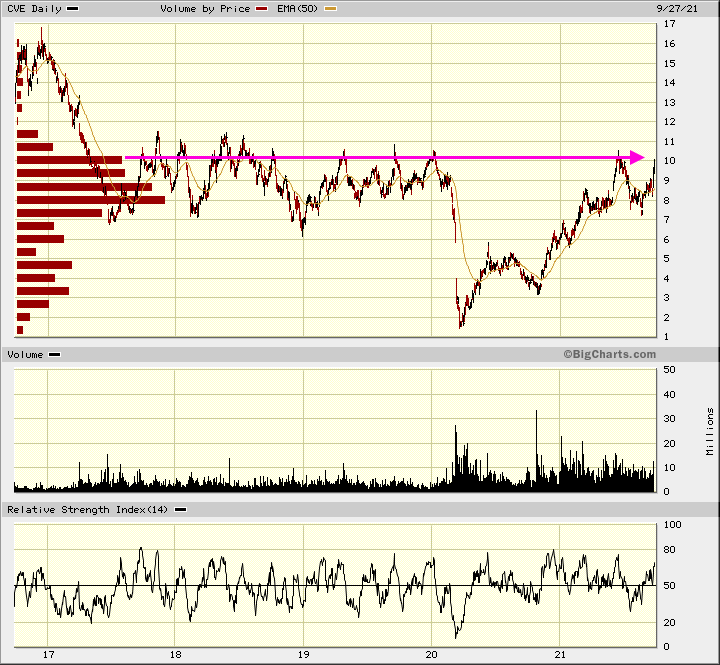

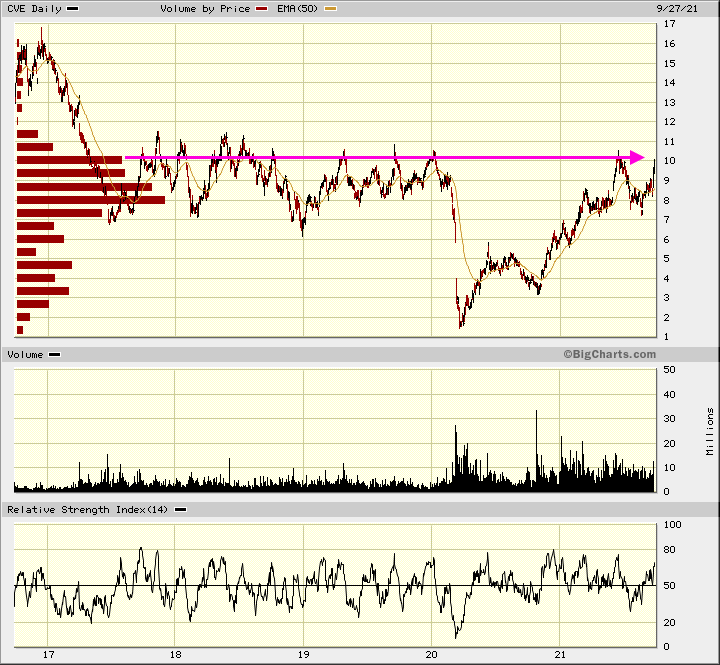

Antwort auf Beitrag Nr.: 69.794.811 von faultcode am 03.11.21 17:44:32der RSI|14d nun am Glühen, aber sonst so:

3.11.

Cenovus Swings to Profit in Q3, Doubles Dividend

https://www.tipranks.com/news/cenovus-swings-to-profit-in-q3…

...

Cenovus Energy (CVE), a Canadian oil and natural gas producer, reported a profit in the third quarter of 2021 compared to a loss a year ago thanks to higher production and recovery in demand for oil.

Cash from operating activities came in at C$2.14 billion in the third quarter, nearly three times higher than in the prior-year quarter. Adjusted funds flow increased from C$407 million (C$0.33 per share) to C$2.34 billion (C$1.16 per share) in the quarter ended September 30.

Net income amounted to C$551 million (C$0.27 per share) in Q3 2021, up from a loss of C$194 million (C$0.16 per share) in Q3 2020.

Total upstream production reached 804,800 barrels of oil equivalent per day (boe/d) in the third quarter, up 70.6% from 471,799 boe/d a year earlier. Downstream throughput nearly tripled to 554,100 barrels per day.

Cenovus president and CEO Alex Pourbaix said, “Our outstanding operating and financial results this quarter showcase the strength of our business and demonstrate that we deliver on our commitments. With our C$10 billion net debt target largely achieved, we’re able to take these important steps to increase returns for our shareholders.

“Our free funds flow capacity will support swiftly advancing toward our longer‐term net debt target of less than C$8 billion, while balancing growth in shareholder returns.”

...

Cenovus Swings to Profit in Q3, Doubles Dividend

https://www.tipranks.com/news/cenovus-swings-to-profit-in-q3…

...

Cenovus Energy (CVE), a Canadian oil and natural gas producer, reported a profit in the third quarter of 2021 compared to a loss a year ago thanks to higher production and recovery in demand for oil.

Cash from operating activities came in at C$2.14 billion in the third quarter, nearly three times higher than in the prior-year quarter. Adjusted funds flow increased from C$407 million (C$0.33 per share) to C$2.34 billion (C$1.16 per share) in the quarter ended September 30.

Net income amounted to C$551 million (C$0.27 per share) in Q3 2021, up from a loss of C$194 million (C$0.16 per share) in Q3 2020.

Total upstream production reached 804,800 barrels of oil equivalent per day (boe/d) in the third quarter, up 70.6% from 471,799 boe/d a year earlier. Downstream throughput nearly tripled to 554,100 barrels per day.

Cenovus president and CEO Alex Pourbaix said, “Our outstanding operating and financial results this quarter showcase the strength of our business and demonstrate that we deliver on our commitments. With our C$10 billion net debt target largely achieved, we’re able to take these important steps to increase returns for our shareholders.

“Our free funds flow capacity will support swiftly advancing toward our longer‐term net debt target of less than C$8 billion, while balancing growth in shareholder returns.”

...

Antwort auf Beitrag Nr.: 68.821.377 von faultcode am 19.07.21 22:37:22Setup für weiteren Move nach oben:

Forward P/E: 7.5 laut Refinitiv

27.9.

Cenovus and Headwater announce bought deal secondary offering of Headwater common shares worth approximately $114 million

https://money.tmx.com/en/quote/CVE/news/4790478336188182/Cen…

...

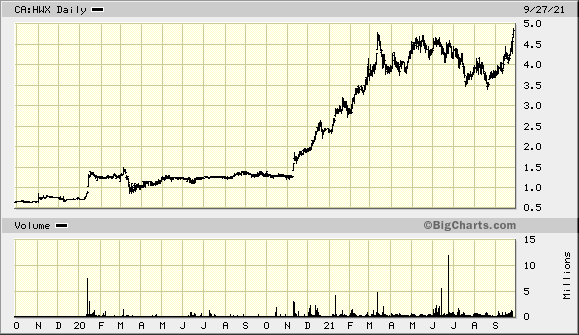

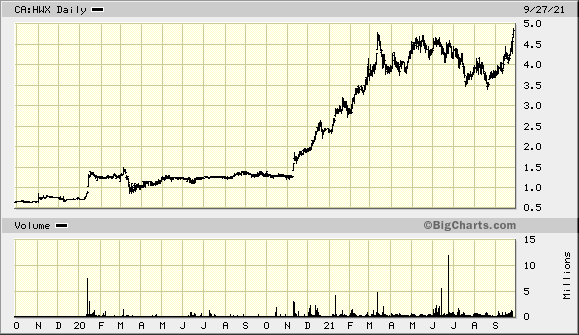

Headwater Exploration (HWX) wird mittlerweile zu sehr steilen Multiples mMn gehandelt -- das Secondary offering macht also Sinn:

...

Cenovus is selling the Common Shares as part of its plan to reduce net debt levels towards its $10 billion interim target and accelerate shareholder returns. Through its active development plan and early success, Headwater has accelerated the value generated from the Marten Hills asset and continues to progress its exploration program. The Offering will expand Headwater's free-trading float and is expected to provide new and existing shareholders with enhanced trading liquidity.

...

Forward P/E: 7.5 laut Refinitiv

27.9.

Cenovus and Headwater announce bought deal secondary offering of Headwater common shares worth approximately $114 million

https://money.tmx.com/en/quote/CVE/news/4790478336188182/Cen…

...

Headwater Exploration (HWX) wird mittlerweile zu sehr steilen Multiples mMn gehandelt -- das Secondary offering macht also Sinn:

...

Cenovus is selling the Common Shares as part of its plan to reduce net debt levels towards its $10 billion interim target and accelerate shareholder returns. Through its active development plan and early success, Headwater has accelerated the value generated from the Marten Hills asset and continues to progress its exploration program. The Offering will expand Headwater's free-trading float and is expected to provide new and existing shareholders with enhanced trading liquidity.

...

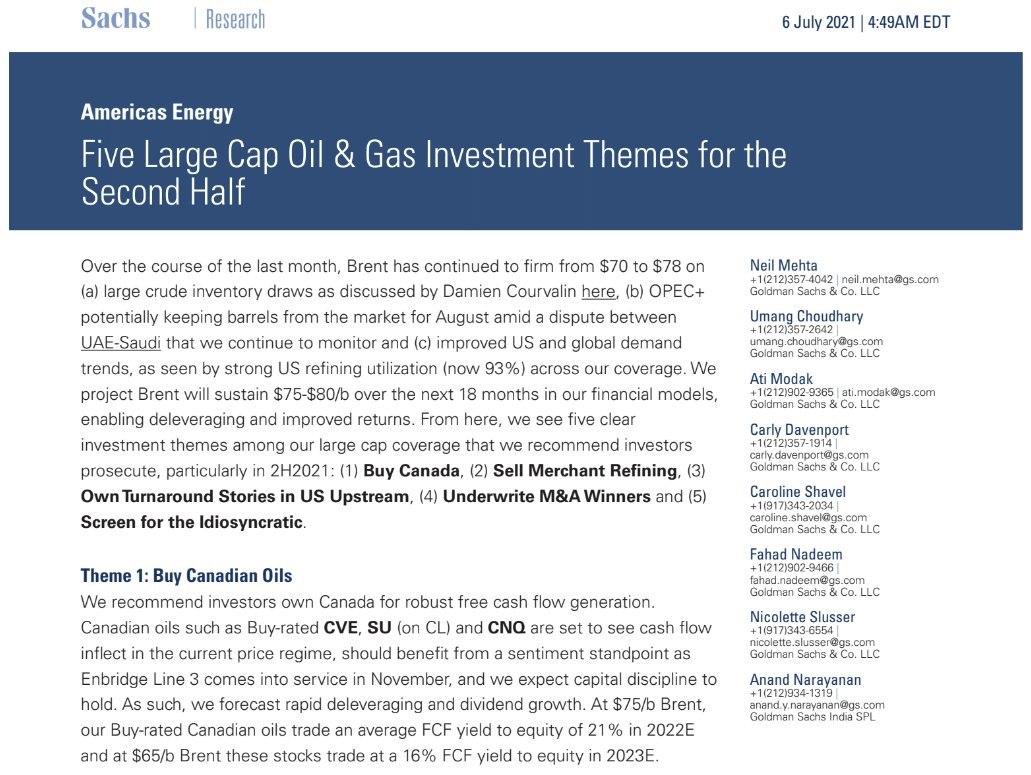

Antwort auf Beitrag Nr.: 68.447.225 von faultcode am 08.06.21 23:46:33

https://twitter.com/StitchCapital/status/1414362535826923528

https://twitter.com/StitchCapital/status/1414362535826923528

die Analysten kommen mit Upgrades fast nicht mehr hinterher:

2021-06-08 16:15:00 GMT DJ Cenovus Energy Inc Price Target Raised to C$14.50/Share From C$12.00 by JP Morgan

ansonsten:

...

https://seekingalpha.com/article/4433764-cenovus-energy-big-…

2021-06-08 16:15:00 GMT DJ Cenovus Energy Inc Price Target Raised to C$14.50/Share From C$12.00 by JP Morgan

ansonsten:

...

https://seekingalpha.com/article/4433764-cenovus-energy-big-…

17.5.

Oilsands firms expected to spur $60 billion in cash flow over two years

https://boereport.com/2021/05/17/oilsands-firms-expected-to-…

A group of five large Canadian oilsands companies are expected to generate about $60 billion in net cash flow over the next two years and spend only half of it on dividends and capital expenditures, leaving the rest for debt repayment and sharing with shareholders.

In a report, analyst William Lacey of ATB Capital Markets says the companies are expected to duplicate their sterling financial performance of the first quarter of 2021 for the rest of this year and in 2022, provided that benchmark West Texas Intermediate oil prices remain near US$60 per barrel.

The five companies, Canadian Natural Resources Ltd., Suncor Energy Inc., Imperial Oil Ltd., Cenovus Energy Inc. and MEG Energy Corp., are expected to bring in $59 billion more in cash than they spend on operations, from which about $23.2 billion will go to capital budgets and about $9 billion to dividends.

The report says that will leave about $26.8 billion to pay down debt, buy back shares for cancellation and use to increase dividends.

Lacey says the five companies have been consistent in setting debt and shareholder return targets for all near-term cash flow rather than spending on growing output organically or through buying other companies or assets.

The report says the Canadian firms are attractive for investors in comparison with American rivals because they are more heavily weighted toward oil production.

“Assuming that WTI prices remain in the realm of US$60 per barrel, we believe that the combination of material free cash flow yields and exceptionally low (stock) valuations will be too attractive for generalist investors to look past, especially in light of ongoing inflationary pressures and the resultant rotation towards tangible assets,” the report concludes.

Oilsands firms expected to spur $60 billion in cash flow over two years

https://boereport.com/2021/05/17/oilsands-firms-expected-to-…

A group of five large Canadian oilsands companies are expected to generate about $60 billion in net cash flow over the next two years and spend only half of it on dividends and capital expenditures, leaving the rest for debt repayment and sharing with shareholders.

In a report, analyst William Lacey of ATB Capital Markets says the companies are expected to duplicate their sterling financial performance of the first quarter of 2021 for the rest of this year and in 2022, provided that benchmark West Texas Intermediate oil prices remain near US$60 per barrel.

The five companies, Canadian Natural Resources Ltd., Suncor Energy Inc., Imperial Oil Ltd., Cenovus Energy Inc. and MEG Energy Corp., are expected to bring in $59 billion more in cash than they spend on operations, from which about $23.2 billion will go to capital budgets and about $9 billion to dividends.

The report says that will leave about $26.8 billion to pay down debt, buy back shares for cancellation and use to increase dividends.

Lacey says the five companies have been consistent in setting debt and shareholder return targets for all near-term cash flow rather than spending on growing output organically or through buying other companies or assets.

The report says the Canadian firms are attractive for investors in comparison with American rivals because they are more heavily weighted toward oil production.

“Assuming that WTI prices remain in the realm of US$60 per barrel, we believe that the combination of material free cash flow yields and exceptionally low (stock) valuations will be too attractive for generalist investors to look past, especially in light of ongoing inflationary pressures and the resultant rotation towards tangible assets,” the report concludes.

7.5.

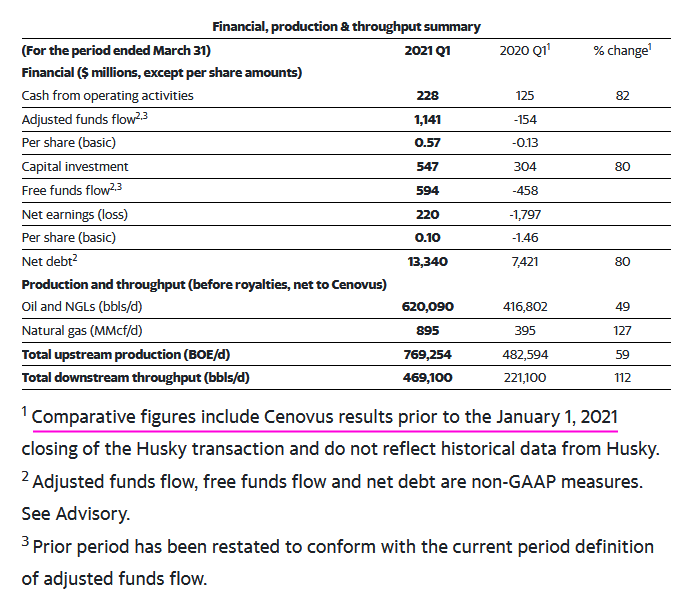

Cenovus makes strong progress on Husky integration and synergies

https://finance.yahoo.com/news/cenovus-makes-strong-progress…

...

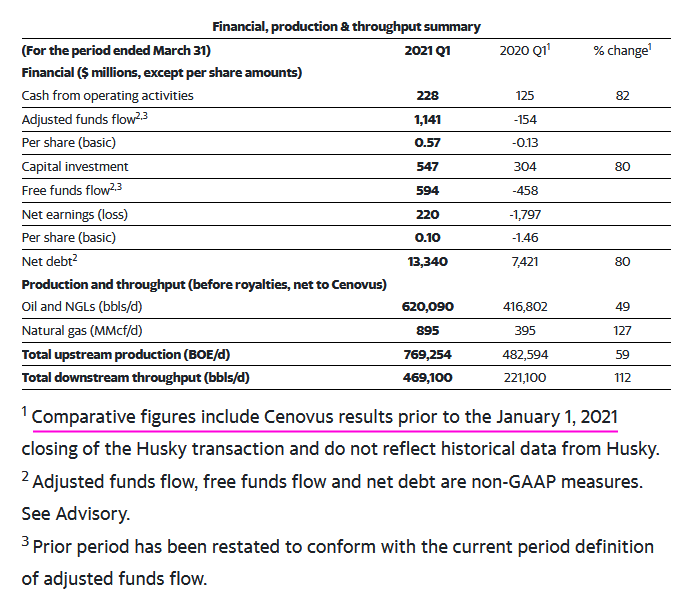

Generates $1.1 billion in adjusted funds flow in first quarter 2021

CALGARY, Alberta, May 07, 2021 (GLOBE NEWSWIRE) -- Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered solid operating and financial performance in the company’s inaugural quarter of operations following the acquisition of Husky Energy Inc. on January 1.

With its disciplined and methodical approach to integrating Husky’s assets, the company has made significant progress in the first three months of the year and is firmly on track to deliver on its targeted acquisition synergies and 2021 budget and production guidance. Cenovus produced nearly 770,000 barrels of oil equivalent per day (BOE/d) in the quarter, and generated adjusted funds flow of more than $1.1 billion, cash from operating activities of $228 million, free funds flow of $594 million and net earnings of $220 million.

“With the extensive due diligence we undertook prior to the acquisition of Husky, and our experience since the close of the acquisition, we’re highly confident we’ll deliver at least $1 billion in synergies this year and reach our planned $1.2 billion in annual run-rate synergies by the end of 2021,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “If the current commodity price environment is sustained, we expect to approach our $10 billion net debt target this year, prior to the benefit of any asset sales.”

...

...

Cenovus makes strong progress on Husky integration and synergies

https://finance.yahoo.com/news/cenovus-makes-strong-progress…

...

Generates $1.1 billion in adjusted funds flow in first quarter 2021

CALGARY, Alberta, May 07, 2021 (GLOBE NEWSWIRE) -- Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered solid operating and financial performance in the company’s inaugural quarter of operations following the acquisition of Husky Energy Inc. on January 1.

With its disciplined and methodical approach to integrating Husky’s assets, the company has made significant progress in the first three months of the year and is firmly on track to deliver on its targeted acquisition synergies and 2021 budget and production guidance. Cenovus produced nearly 770,000 barrels of oil equivalent per day (BOE/d) in the quarter, and generated adjusted funds flow of more than $1.1 billion, cash from operating activities of $228 million, free funds flow of $594 million and net earnings of $220 million.

“With the extensive due diligence we undertook prior to the acquisition of Husky, and our experience since the close of the acquisition, we’re highly confident we’ll deliver at least $1 billion in synergies this year and reach our planned $1.2 billion in annual run-rate synergies by the end of 2021,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “If the current commodity price environment is sustained, we expect to approach our $10 billion net debt target this year, prior to the benefit of any asset sales.”

...

...

Energy is now the largest sector in the GS Retail Favorites basket after its latest monthly rebalance.

https://twitter.com/GavinSBaker/status/1362007827678699522

https://twitter.com/GavinSBaker/status/1362007827678699522

Antwort auf Beitrag Nr.: 66.594.128 von faultcode am 25.01.21 13:43:1228.1.

Cenovus ups 2021 oil production and spending forecast after Husky deal

https://ca.finance.yahoo.com/news/cenovus-forecasts-higher-2…

...

Canada's Cenovus Energy Inc on Thursday forecast higher production and spending for 2021 after its purchase of rival Husky Energy but stressed its focus on cutting debt as the oil industry rebounds from the depths of the COVID-19 pandemic.

Cenovus agreed to buy rival Husky last year to create Canada's No. 3 oil and gas producer, as historically low oil prices caused by a collapse in fuel demand due to COVID-19 and a price war between Saudi Arabia and Russia forced the industry to consolidate.

The Calgary-based company said it will spend between C$2.3 billion ($1.8 billion) and C$2.7 billion this year, up from a 2020 forecast of C$750 million to C$850 million. The vast majority, C$2.1 billion, of that spending will go toward maintenance capital required to keep existing production flowing.

Forecast production also jumped as a result of the Husky acquisition to between 730,000 and 780,000 barrels of oil equivalent per day (boepd), up from a 2020 production forecast of 432,000-486,000 boepd.

Like many of its competitors in the Canadian oil patch, Cenovus will use free cash flow to pay down debt and repair balance sheets that were battered by the oil price rout last year. The company is aiming to reduce net debt to less than C$10 billion from around C$12 billion right after the Husky deal.

"We have been banging one drum here pretty hard and it is balance sheet, balance sheet, balance sheet. That's where our focus is going to be at least until we get comfortably below that C$10 billion number," Cenovus Chief Executive Alex Pourbaix said on a conference call with analysts.

Pourbaix said one of the best ways for Cenovus to accelerate balance sheet recovery would be by divesting assets and the company was "laser focused" on that opportunity.

...

Cenovus ups 2021 oil production and spending forecast after Husky deal

https://ca.finance.yahoo.com/news/cenovus-forecasts-higher-2…

...

Canada's Cenovus Energy Inc on Thursday forecast higher production and spending for 2021 after its purchase of rival Husky Energy but stressed its focus on cutting debt as the oil industry rebounds from the depths of the COVID-19 pandemic.

Cenovus agreed to buy rival Husky last year to create Canada's No. 3 oil and gas producer, as historically low oil prices caused by a collapse in fuel demand due to COVID-19 and a price war between Saudi Arabia and Russia forced the industry to consolidate.

The Calgary-based company said it will spend between C$2.3 billion ($1.8 billion) and C$2.7 billion this year, up from a 2020 forecast of C$750 million to C$850 million. The vast majority, C$2.1 billion, of that spending will go toward maintenance capital required to keep existing production flowing.

Forecast production also jumped as a result of the Husky acquisition to between 730,000 and 780,000 barrels of oil equivalent per day (boepd), up from a 2020 production forecast of 432,000-486,000 boepd.

Like many of its competitors in the Canadian oil patch, Cenovus will use free cash flow to pay down debt and repair balance sheets that were battered by the oil price rout last year. The company is aiming to reduce net debt to less than C$10 billion from around C$12 billion right after the Husky deal.

"We have been banging one drum here pretty hard and it is balance sheet, balance sheet, balance sheet. That's where our focus is going to be at least until we get comfortably below that C$10 billion number," Cenovus Chief Executive Alex Pourbaix said on a conference call with analysts.

Pourbaix said one of the best ways for Cenovus to accelerate balance sheet recovery would be by divesting assets and the company was "laser focused" on that opportunity.

...

21.1.

Biden administration suspends new oil, gas drilling permits on federal land

Move could be the first step in an eventual goal to ban all leases and permits to drill on federal land

https://www.marketwatch.com/story/biden-administration-suspe…

...

The Biden administration announced Thursday a 60-day suspension of new oil and gas leasing and drilling permits for U.S. lands and waters as officials moved quickly to reverse Trump administration policies on energy and the environment.

The suspension, part of a broad review of programs at the Department of Interior, went into effect immediately under an order signed Wednesday by Acting Interior Secretary Scott de la Vega. It follows Democratic President Joe Biden’s campaign pledge to halt new drilling on federal lands and end the leasing of publicly owned energy reserves as part of his plan to address climate change.

The order did not ban new drilling outright. It includes an exception giving a small number of senior Interior officials — the secretary, deputy secretary, solicitor and several assistant secretaries — authority to approve actions that otherwise would be suspended.

The order also applies to coal leases and permits, and blocks the approval of new mining plans. Land sales or exchanges and the hiring of senior-level staff at the agency also were suspended.

Under former President Donald Trump, federal agencies prioritized energy development and eased environmental rules to speed up drilling permits as part of the Republican’s goal to end reliance on foreign energy supplies and boost domestic production. Trump consistently downplayed the dangers of climate change, which Biden has made a top priority.

On his first day in office, Biden signed a series of executive orders that underscored his different approach — rejoining the Paris Climate Accord, revoking approval of the Keystone XL oil pipeline from Canada and telling agencies to immediately review dozens of Trump-era rules on science, the environment and public health.

The Interior Department order did not limit existing oil and gas operations under valid leases, meaning activity won’t come to a sudden halt on the millions of acres of lands in the West and offshore in the Gulf of Mexico where much drilling is concentrated. Its effect could be further blunted by companies that stockpiled enough drilling permits in Trump’s final months to allow them to keep pumping oil and gas for years.

But Biden’s move could be the first step in an eventual goal to ban all leases and permits to drill on federal land. Mineral leasing laws state that federal lands are for many uses, including extracting oil and gas, but the Democrat could set out to rewrite those laws, said Kevin Book, managing director at Clearview Energy Partners.

The administration’s announcement drew a quick backlash from Republicans and oil industry trade groups. They said limiting access to publicly owned energy resources would mean more foreign oil imports, lost jobs and fewer tax revenues.

...

Biden administration suspends new oil, gas drilling permits on federal land

Move could be the first step in an eventual goal to ban all leases and permits to drill on federal land

https://www.marketwatch.com/story/biden-administration-suspe…

...

The Biden administration announced Thursday a 60-day suspension of new oil and gas leasing and drilling permits for U.S. lands and waters as officials moved quickly to reverse Trump administration policies on energy and the environment.

The suspension, part of a broad review of programs at the Department of Interior, went into effect immediately under an order signed Wednesday by Acting Interior Secretary Scott de la Vega. It follows Democratic President Joe Biden’s campaign pledge to halt new drilling on federal lands and end the leasing of publicly owned energy reserves as part of his plan to address climate change.

The order did not ban new drilling outright. It includes an exception giving a small number of senior Interior officials — the secretary, deputy secretary, solicitor and several assistant secretaries — authority to approve actions that otherwise would be suspended.

The order also applies to coal leases and permits, and blocks the approval of new mining plans. Land sales or exchanges and the hiring of senior-level staff at the agency also were suspended.

Under former President Donald Trump, federal agencies prioritized energy development and eased environmental rules to speed up drilling permits as part of the Republican’s goal to end reliance on foreign energy supplies and boost domestic production. Trump consistently downplayed the dangers of climate change, which Biden has made a top priority.

On his first day in office, Biden signed a series of executive orders that underscored his different approach — rejoining the Paris Climate Accord, revoking approval of the Keystone XL oil pipeline from Canada and telling agencies to immediately review dozens of Trump-era rules on science, the environment and public health.

The Interior Department order did not limit existing oil and gas operations under valid leases, meaning activity won’t come to a sudden halt on the millions of acres of lands in the West and offshore in the Gulf of Mexico where much drilling is concentrated. Its effect could be further blunted by companies that stockpiled enough drilling permits in Trump’s final months to allow them to keep pumping oil and gas for years.

But Biden’s move could be the first step in an eventual goal to ban all leases and permits to drill on federal land. Mineral leasing laws state that federal lands are for many uses, including extracting oil and gas, but the Democrat could set out to rewrite those laws, said Kevin Book, managing director at Clearview Energy Partners.

The administration’s announcement drew a quick backlash from Republicans and oil industry trade groups. They said limiting access to publicly owned energy resources would mean more foreign oil imports, lost jobs and fewer tax revenues.

...

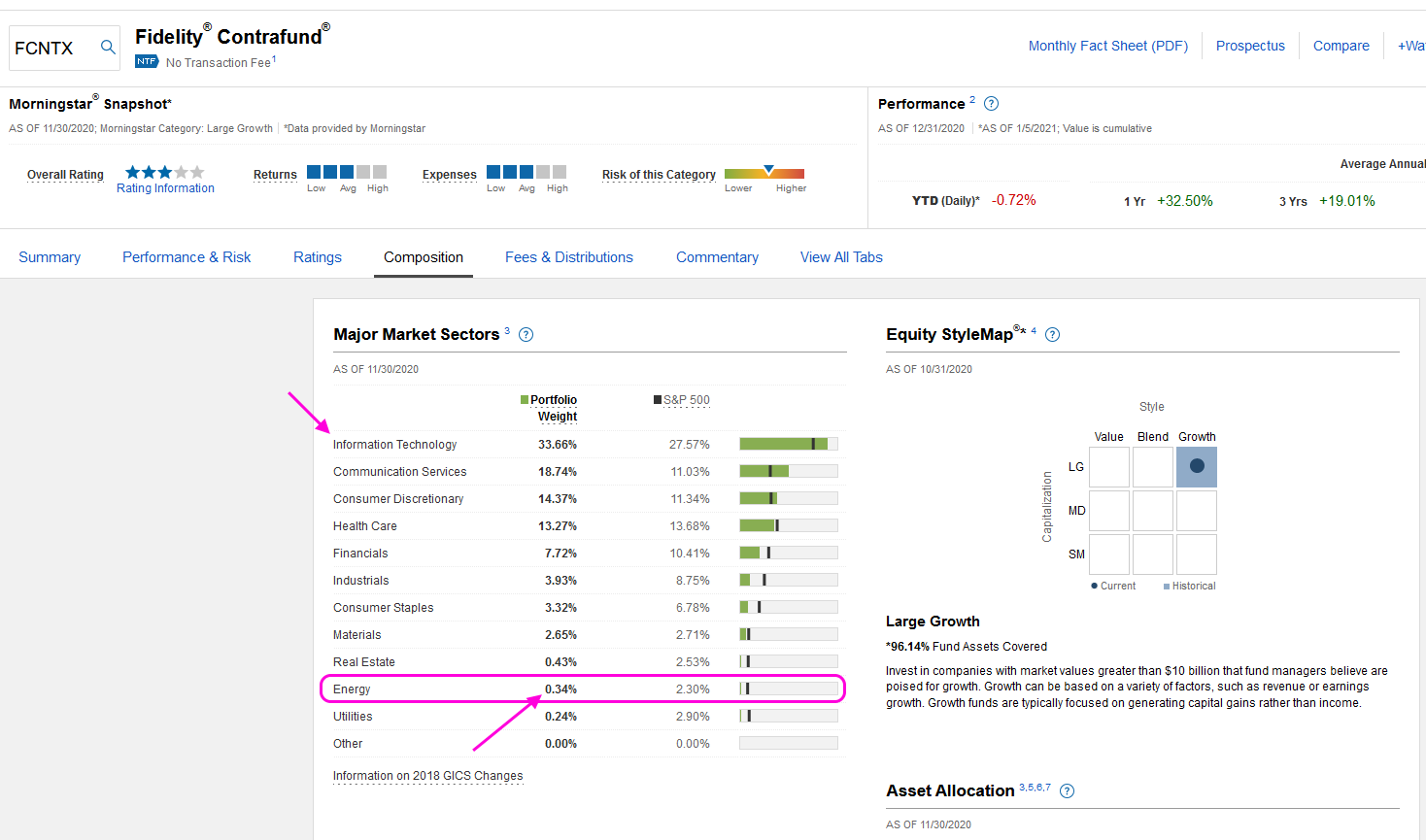

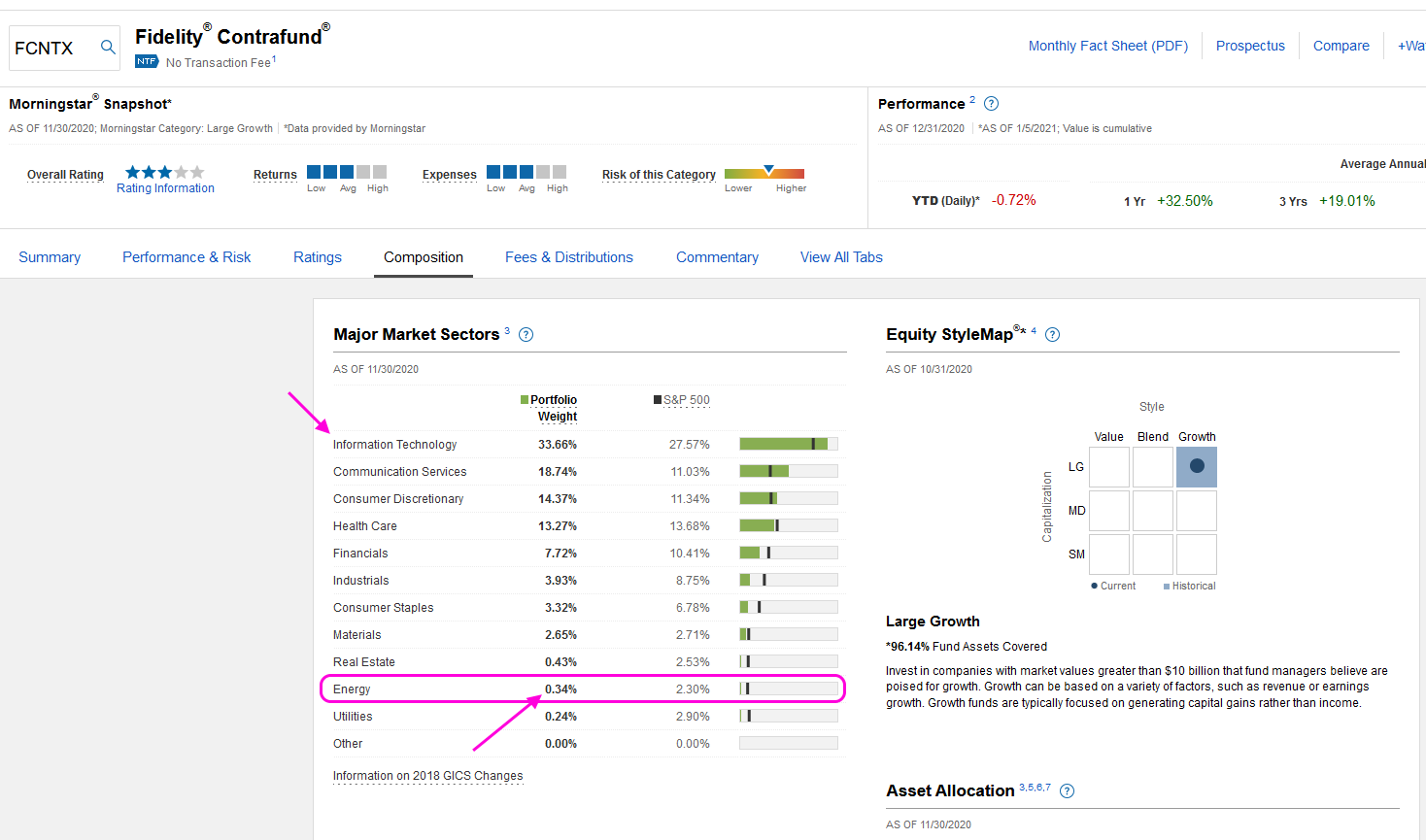

Große Fonds (in den USA) sind teilweise dramatisch unterinvestiert in Energy. Auch eben vermutlich ökobewegt ("ESG").

Z.B. FCNTX -- Fidelity Contrafund: Morningstar Category: Large Growth

Fund Inception: 5/17/1967

Portfolio Net Assets ($M): $136,386.45

Holding #1: Amazon.com mit > 9%

bei den letzten beiden Blasen wurde er für neue Konten geschlossen:

• Fund Closed to New Accounts: This fund is closed to new investors. 4/28/2006 - 12/15/2008

• Fund Closed to New Accounts: This fund is closed to new investors. 4/3/1998 - 12/15/2000

https://fundresearch.fidelity.com/mutual-funds/composition/3…

Z.B. FCNTX -- Fidelity Contrafund: Morningstar Category: Large Growth

Fund Inception: 5/17/1967

Portfolio Net Assets ($M): $136,386.45

Holding #1: Amazon.com mit > 9%

bei den letzten beiden Blasen wurde er für neue Konten geschlossen:

• Fund Closed to New Accounts: This fund is closed to new investors. 4/28/2006 - 12/15/2008

• Fund Closed to New Accounts: This fund is closed to new investors. 4/3/1998 - 12/15/2000

https://fundresearch.fidelity.com/mutual-funds/composition/3…

Cenovus Energy