Calumet Specialty Products Partners -- die "U.S.-Fuchs Petrolub"

eröffnet am 12.11.19 12:24:28 von

neuester Beitrag 21.08.22 15:01:55 von

neuester Beitrag 21.08.22 15:01:55 von

Beiträge: 7

ID: 1.315.235

ID: 1.315.235

Aufrufe heute: 0

Gesamt: 338

Gesamt: 338

Aktive User: 0

ISIN: US1314761032 · WKN: A0H1BP · Symbol: CLMT

16,220

USD

+0,12 %

+0,020 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

29.02.24 · Business Wire (engl.) |

29.02.24 · Business Wire (engl.) |

28.02.24 · Business Wire (engl.) |

28.02.24 · Business Wire (engl.) |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0500 | +31,25 | |

| 0,9000 | +21,62 | |

| 7,2300 | +12,62 | |

| 2,1700 | +11,28 | |

| 0,9270 | +8,17 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5497 | -6,48 | |

| 1,2100 | -7,28 | |

| 0,8800 | -8,33 | |

| 4,2000 | -11,39 | |

| 2,4400 | -27,38 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 69.602.598 von faultcode am 15.10.21 01:30:01

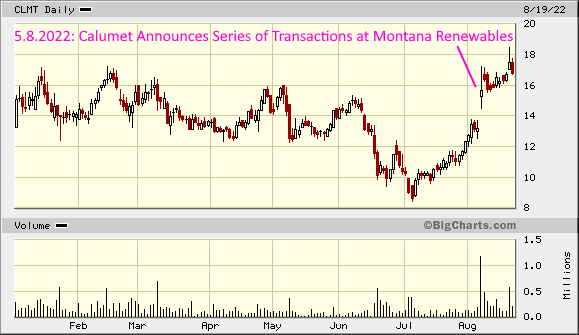

..und in 2022 bislang:

5.8.

Calumet Announces Series of Transactions at Montana Renewables

https://finance.yahoo.com/news/calumet-announces-series-tran…

Zitat von faultcode: was für ein Lauf in 2021:

..und in 2022 bislang:

5.8.

Calumet Announces Series of Transactions at Montana Renewables

https://finance.yahoo.com/news/calumet-announces-series-tran…

Schon wieder faultcode... Interssant, dass wir über die gleichen Dinge stolpern.

Wenn ich es richtig sehe, gab´s hier auch Insider Käufe. Falls Calumet delevern kann, gibt es hier durchaus Potential. Die größten Gewinne gibt es in Situationen, wo man sich von "total hoffnungslos" auf "ganz schön kacke" verbessern kann.

Bin hier noch nicht drin, ist aber auf der Watchlist.

Wenn ich es richtig sehe, gab´s hier auch Insider Käufe. Falls Calumet delevern kann, gibt es hier durchaus Potential. Die größten Gewinne gibt es in Situationen, wo man sich von "total hoffnungslos" auf "ganz schön kacke" verbessern kann.

Bin hier noch nicht drin, ist aber auf der Watchlist.

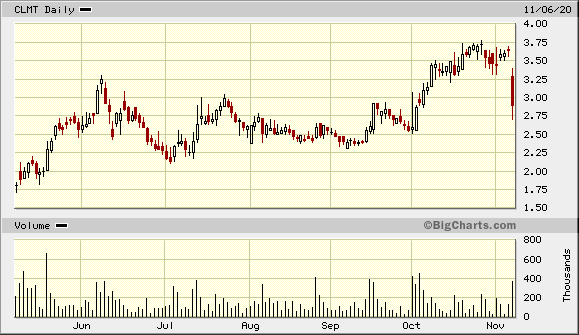

Antwort auf Beitrag Nr.: 65.621.648 von faultcode am 06.11.20 18:08:47

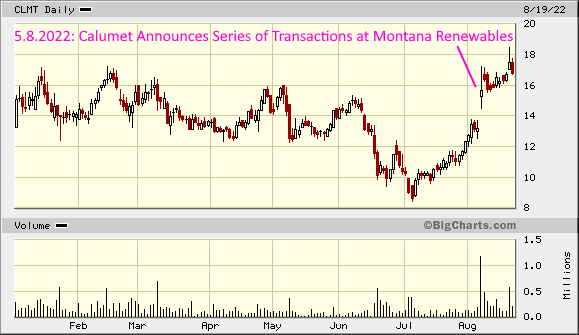

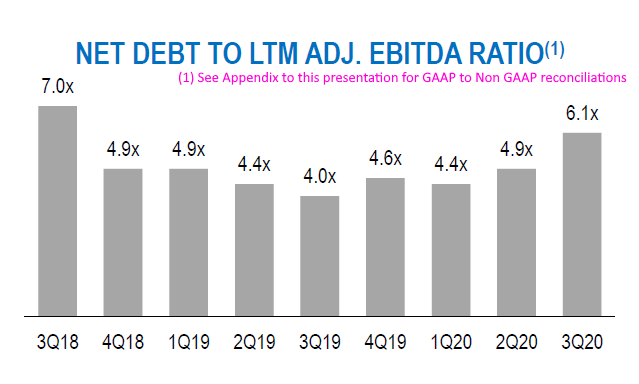

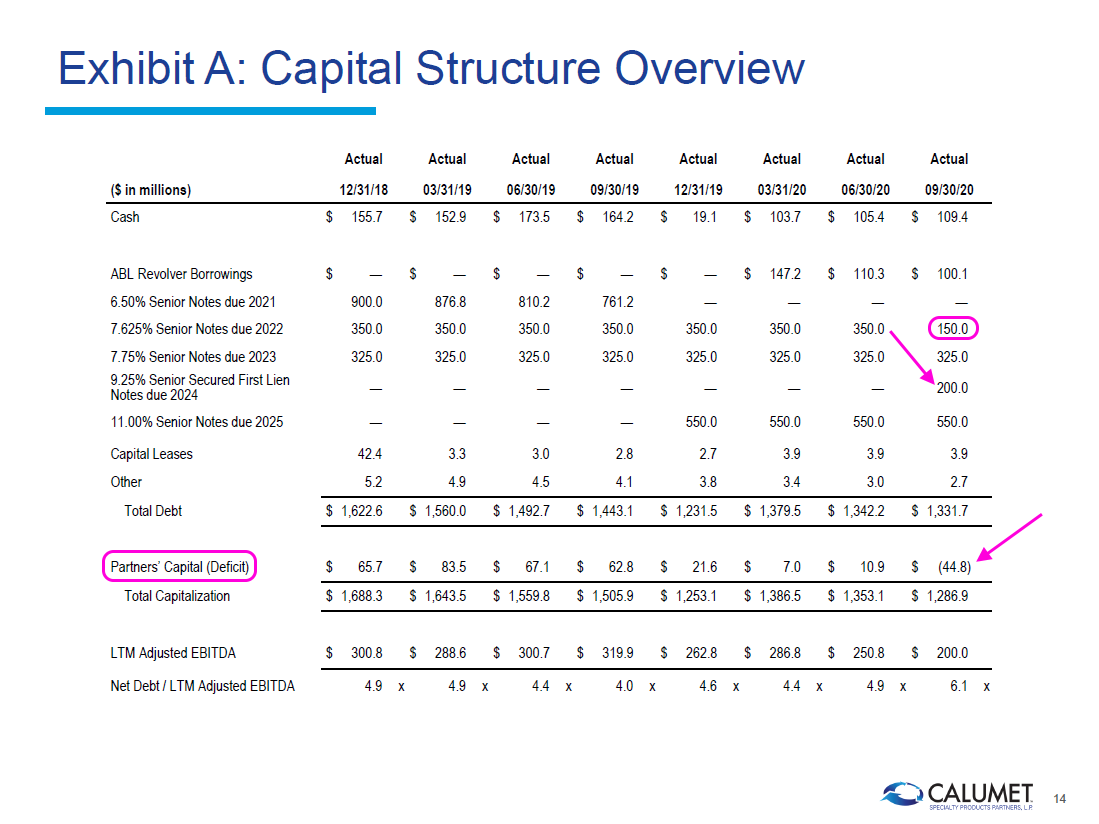

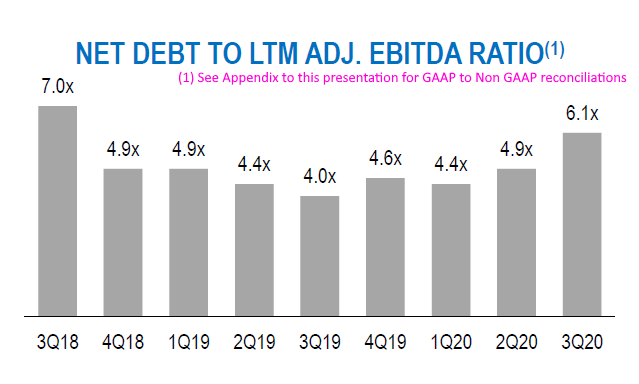

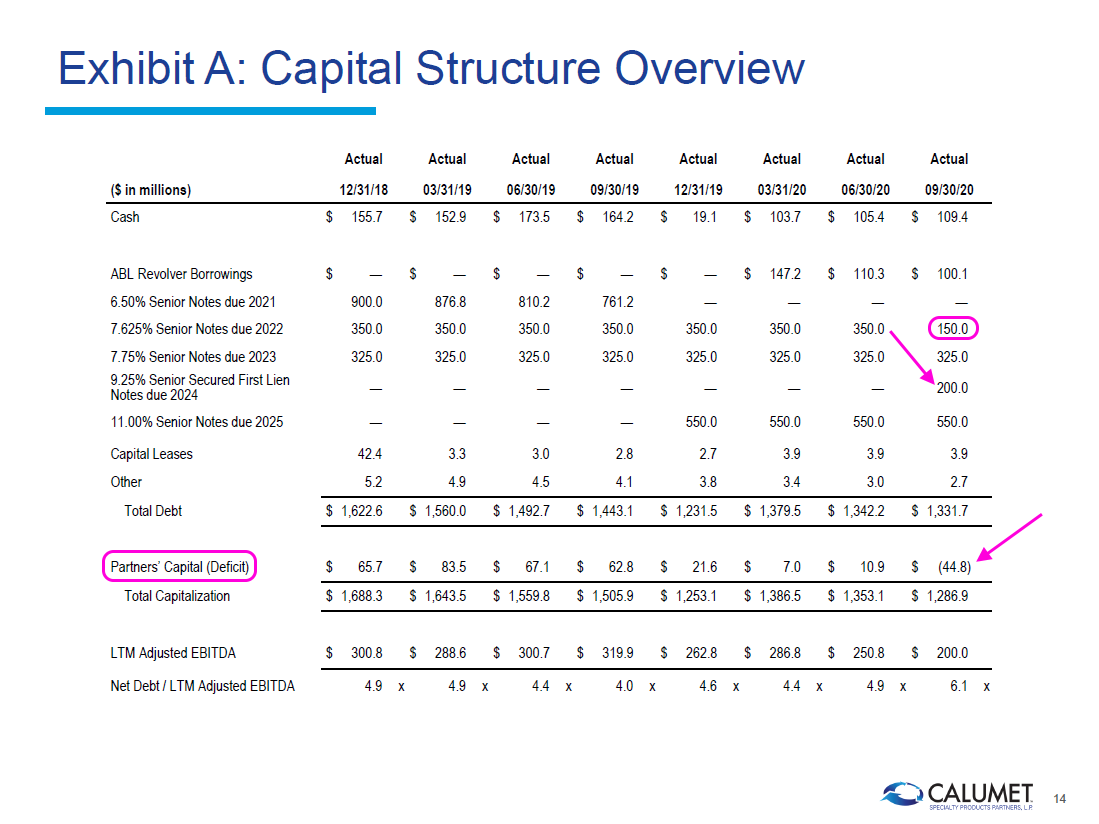

Aber auch ein Blick hier lässt einen an CEO-Aussagen wie "These decisive actions, together with our resilient Specialties business, have allowed us to progress through the pandemic with positive free cash flow. This significant accomplishment allows us to focus on maximizing the opportunity that we expect recovering markets will present and leaves us with even stronger operating leverage looking forward." mMn zweifeln:

=> das Partners’ Capital ist seit mindestens Ende 2018 zum ersten Mal ins Negative abgerutscht, auf nun -44.8m U.D. dollar

Man hat sich etwas Luft verschafft und in 2021 steht nichts Größeres an. Aber dann!?!

=> im Grunde genommen spricht der CEO die Unit holders nicht mehr an, sondern hier geht es mMn auf absehbare Zeit nur noch um die Gläubiger:

We are required to report Consolidated Cash Flow to the holders of our 2022 Notes, 2023 Notes, 2024 Secured Notes, and 2025 Notes and Consolidated EBITDA to the lenders under our revolving credit facility, and these measures are used by them to determine our compliance with certain covenants governing those debt instruments.

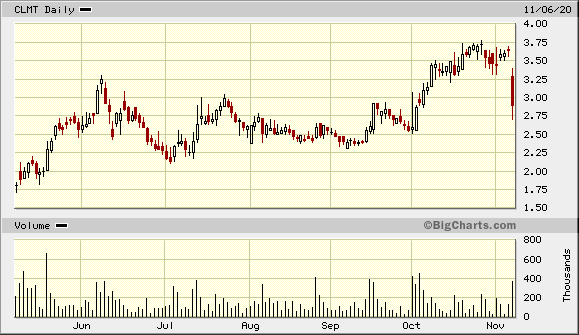

Ich sage nicht, daß hier in ~12m die Lichter ausgehen; aber ich bin damit raus.

Wenn Corona nicht so schnell zurückgeht (in den USA), bekommt man die Units mMn auch wieder für <<USD3. Dann kann man es sich immer noch überlegen mit Long.

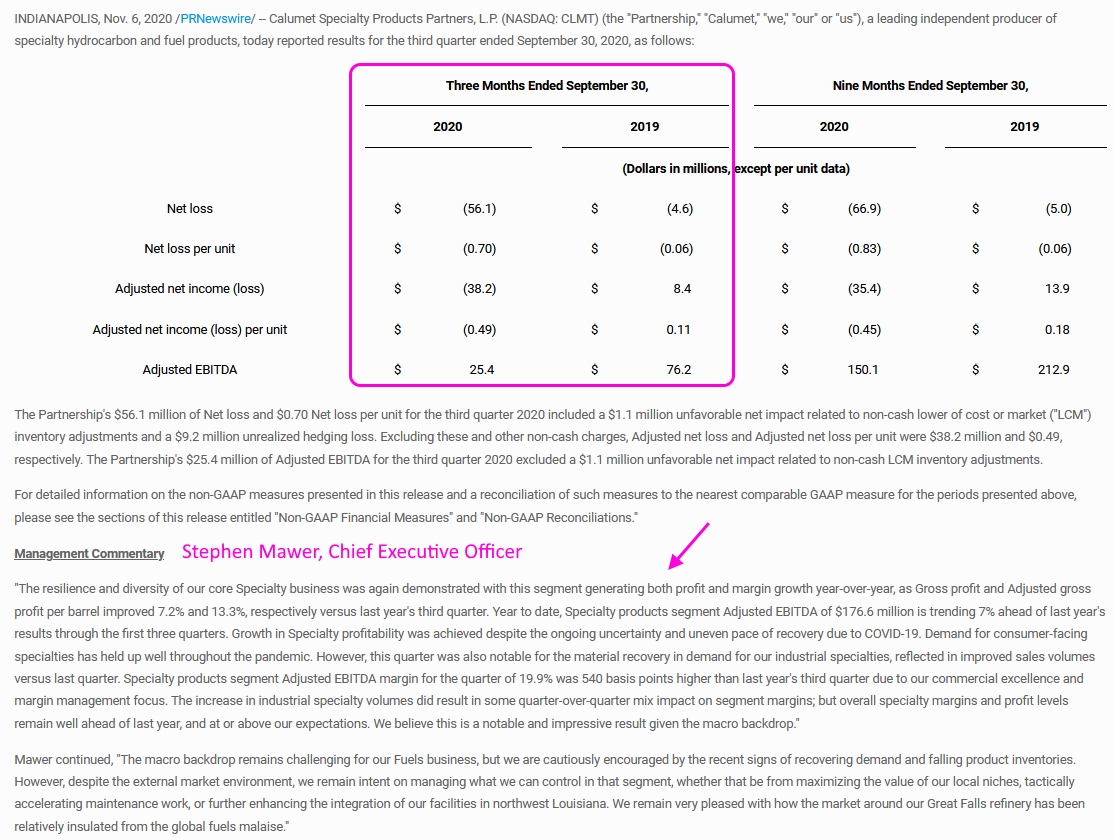

2020Q3 (2)

das 10-Q ist nocht nicht da.Aber auch ein Blick hier lässt einen an CEO-Aussagen wie "These decisive actions, together with our resilient Specialties business, have allowed us to progress through the pandemic with positive free cash flow. This significant accomplishment allows us to focus on maximizing the opportunity that we expect recovering markets will present and leaves us with even stronger operating leverage looking forward." mMn zweifeln:

=> das Partners’ Capital ist seit mindestens Ende 2018 zum ersten Mal ins Negative abgerutscht, auf nun -44.8m U.D. dollar

Man hat sich etwas Luft verschafft und in 2021 steht nichts Größeres an. Aber dann!?!

=> im Grunde genommen spricht der CEO die Unit holders nicht mehr an, sondern hier geht es mMn auf absehbare Zeit nur noch um die Gläubiger:

We are required to report Consolidated Cash Flow to the holders of our 2022 Notes, 2023 Notes, 2024 Secured Notes, and 2025 Notes and Consolidated EBITDA to the lenders under our revolving credit facility, and these measures are used by them to determine our compliance with certain covenants governing those debt instruments.

Ich sage nicht, daß hier in ~12m die Lichter ausgehen; aber ich bin damit raus.

Wenn Corona nicht so schnell zurückgeht (in den USA), bekommt man die Units mMn auch wieder für <<USD3. Dann kann man es sich immer noch überlegen mit Long.

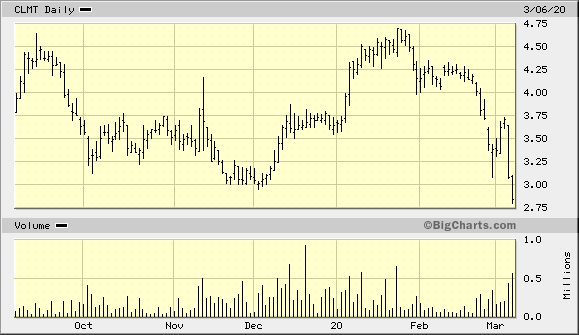

Antwort auf Beitrag Nr.: 62.913.774 von faultcode am 06.03.20 23:56:44

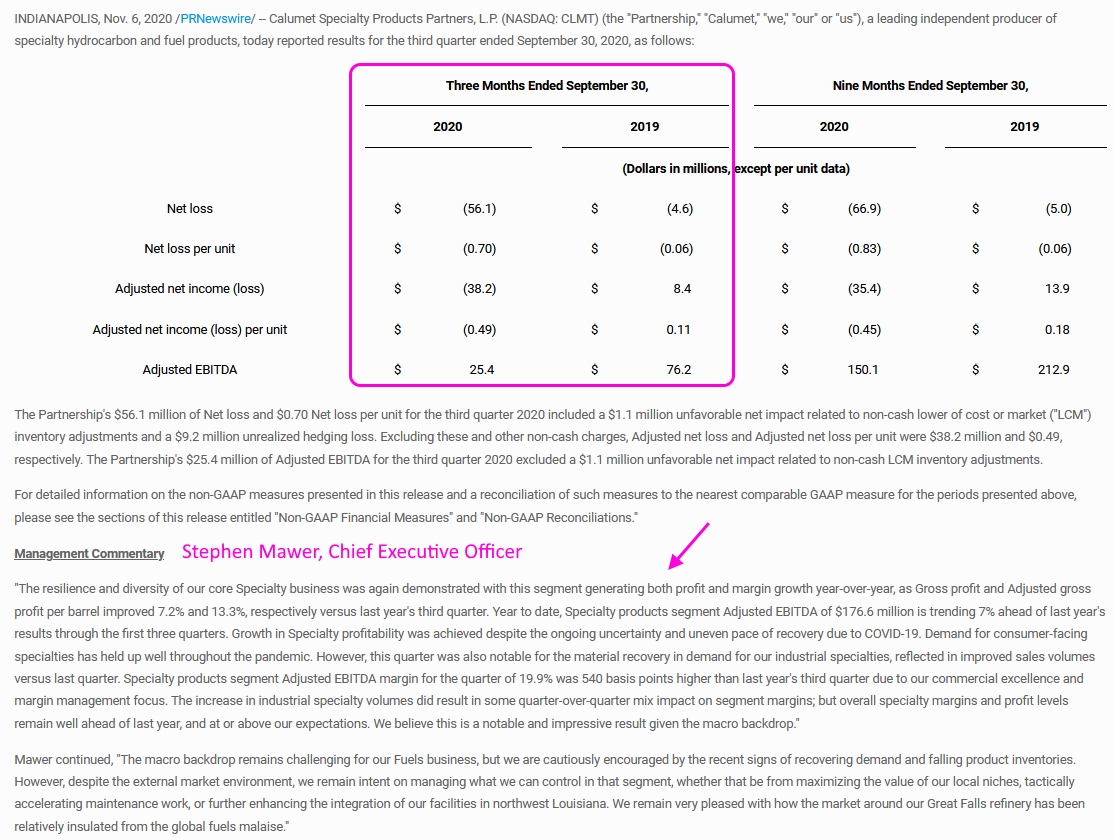

..und das v.a. vor dem Hintergrund der letzten, großen Umbauten im Unternehmen. Alles ist hier "adjusted" und das eben nicht ohne Grund (*)

=> Folge: eine Klatsche:

nebenbei: in der News oben steht nur "Mawer" (~), nicht mal "Stephen Mawer" oder daß das der CEO sein könnte

(*) ohne die beiden Groß-Verkäufe, Superior refinery in 2017 und San Antonio Refinery in 2019, wäre hier nämlich schon Schicht im Schacht

(~) aus Link oben, Beitrag Nr. 2:

Steve Mawer Background

Steve Mawer brings significant industry experience. He currently serves as Chairman of ClimeCo Corporation, an environmental commodities development and management company and on the Board of Directors of Zenith Energy Management, LLC, a midstream company. He also serves as a member of the advisory board of Heritage Environmental Services.

He retired as president of Koch Supply & Trading and as a senior member of the Koch Industries management team in 2014 following a 27-year career in commodities trading, risk management and refining operations. In addition to global commodities trading, Steve brings manufacturing expertise as former head of Koch's European refining operations.

2020Q3 (1)

die Zahlen passen nicht zu dem, was der CEO dazu sagt:

..und das v.a. vor dem Hintergrund der letzten, großen Umbauten im Unternehmen. Alles ist hier "adjusted" und das eben nicht ohne Grund (*)

=> Folge: eine Klatsche:

nebenbei: in der News oben steht nur "Mawer" (~), nicht mal "Stephen Mawer" oder daß das der CEO sein könnte

(*) ohne die beiden Groß-Verkäufe, Superior refinery in 2017 und San Antonio Refinery in 2019, wäre hier nämlich schon Schicht im Schacht

(~) aus Link oben, Beitrag Nr. 2:

Steve Mawer Background

Steve Mawer brings significant industry experience. He currently serves as Chairman of ClimeCo Corporation, an environmental commodities development and management company and on the Board of Directors of Zenith Energy Management, LLC, a midstream company. He also serves as a member of the advisory board of Heritage Environmental Services.

He retired as president of Koch Supply & Trading and as a senior member of the Koch Industries management team in 2014 following a 27-year career in commodities trading, risk management and refining operations. In addition to global commodities trading, Steve brings manufacturing expertise as former head of Koch's European refining operations.

Antwort auf Beitrag Nr.: 61.899.800 von faultcode am 12.11.19 12:24:285.3.

Calumet Specialty Products Partners, L.P. Announces CEO Transition

Steve Mawer to take over as new Chief Executive Officer on June 1, 2020

http://calumetspecialty.investorroom.com/2020-03-05-Calumet-…

Calumet Specialty Products Partners, L.P. (NASDAQ: CLMT) (the "Company," the "Partnership" or "Calumet"), a leading independent producer of specialty hydrocarbon and fuel products, today announced that Tim Go notified the Board of Directors of Calumet that he plans to resign as Chief Executive Officer (CEO) effective June 1, 2020 to pursue other interests closer to his family in Texas. Steve Mawer, a current board member, has been appointed to take over as CEO upon successful completion of an orderly transition process.

...

--> doof:

Calumet Specialty Products Partners, L.P. Announces CEO Transition

Steve Mawer to take over as new Chief Executive Officer on June 1, 2020

http://calumetspecialty.investorroom.com/2020-03-05-Calumet-…

Calumet Specialty Products Partners, L.P. (NASDAQ: CLMT) (the "Company," the "Partnership" or "Calumet"), a leading independent producer of specialty hydrocarbon and fuel products, today announced that Tim Go notified the Board of Directors of Calumet that he plans to resign as Chief Executive Officer (CEO) effective June 1, 2020 to pursue other interests closer to his family in Texas. Steve Mawer, a current board member, has been appointed to take over as CEO upon successful completion of an orderly transition process.

...

--> doof:

..allerdings mit existenziellen Problemen seit dem allgemeinen Verfall der Rohölpreise 2016 -- und viel kleiner

Ist immer noch eine U.S. M.L.P. -- also Obacht

11.11.

Calumet Specialty Products Partners, L.P. Announces Strategic Divestiture of San Antonio Refinery and Related Assets

http://calumetspecialty.investorroom.com/2019-11-11-Calumet-…

=>

...

Transaction Highlights:

• $63 million sale price plus net working capital and inventories

• Release of $38 million balance sheet liability

• Further de-levers the company

• Reduces annual maintenance capital spending, improving future cash flow

"The divestment of the San Antonio refinery represents another step forward in Calumet's strategic transformation," said Tim Go, Chief Executive Officer of Calumet. "This transaction further de-levers Calumet's balance sheet, reduces earnings volatility by lowering our exposure to fuels refining, and allows the Partnership to focus its time and capital more intently on our higher-return core Specialty Products business."

...

--> mMn ist das der radikalste Schnitt in das bisherigen Geschäftsmodell seit dem Verkauf der Superior refinery/WI in 2017 für USD492m

=>

Ist immer noch eine U.S. M.L.P. -- also Obacht

11.11.

Calumet Specialty Products Partners, L.P. Announces Strategic Divestiture of San Antonio Refinery and Related Assets

http://calumetspecialty.investorroom.com/2019-11-11-Calumet-…

=>

...

Transaction Highlights:

• $63 million sale price plus net working capital and inventories

• Release of $38 million balance sheet liability

• Further de-levers the company

• Reduces annual maintenance capital spending, improving future cash flow

"The divestment of the San Antonio refinery represents another step forward in Calumet's strategic transformation," said Tim Go, Chief Executive Officer of Calumet. "This transaction further de-levers Calumet's balance sheet, reduces earnings volatility by lowering our exposure to fuels refining, and allows the Partnership to focus its time and capital more intently on our higher-return core Specialty Products business."

...

--> mMn ist das der radikalste Schnitt in das bisherigen Geschäftsmodell seit dem Verkauf der Superior refinery/WI in 2017 für USD492m

=>