Prodways Group SA - Ausrüster für 3D-Druck - 500 Beiträge pro Seite

eröffnet am 20.12.20 16:53:38 von

neuester Beitrag 11.08.21 16:16:35 von

neuester Beitrag 11.08.21 16:16:35 von

Beiträge: 9

ID: 1.336.657

ID: 1.336.657

Aufrufe heute: 1

Gesamt: 2.830

Gesamt: 2.830

Aktive User: 0

ISIN: FR0012613610 · WKN: A2DQ77 · Symbol: 5PD

0,6790

EUR

+0,44 %

+0,0030 EUR

Letzter Kurs 06.05.24 Tradegate

Werte aus der Branche Maschinenbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8130 | +14,35 | |

| 84,98 | +14,17 | |

| 2.066,75 | +12,41 | |

| 5,5800 | +11,94 | |

| 9,7700 | +10,65 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,1200 | -9,84 | |

| 3,5300 | -9,95 | |

| 6,0400 | -9,99 | |

| 43,20 | -13,36 | |

| 14,850 | -25,71 |

Kurzporträt:

Die Prodways-Gruppe ist eines der führenden europäischen Unternehmen, das sich auf den 3D-Druck für die Luft- und Raumfahrt, Medizin-, Dental-, Automobil- und andere Industrien spezialisiert hat. Es handelt sich um einen additiven Herstellungsprozess, bei dem physikalische Objekte durch Übereinanderlegen verschiedener Materialschichten erzeugt werden. 2019 gliedert sich der Nettoumsatz (vor konzerninternen Eliminierungen) nach Aktivitäten wie folgt auf:

- Vertrieb von 3D-Konstruktionssoftware, Konstruktion, Montage und Verkauf von Maschinen und dazugehöriger Ausrüstung (62,5%): 3D-Drucker, Reinigungsstationen, UV-Öfen, Flüssigharze, Polymerpulver usw.;

- Entwurf und Herstellung von 3D-Druckteilen aus Kunststoff und Metall (37,5%).

Der Nettoumsatz ist geografisch wie folgt verteilt: Frankreich (68%), Europa (19,5%), Nordamerika (9,8%) und andere (2,7%).

Mitarbeiteranzahl : 505 Personen.

Quelle: https://ch.marketscreener.com/kurs/aktie/PRODWAYS-GROUP-3485…

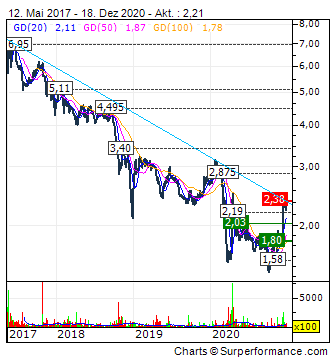

Chart:

Es ging Jahrelang tendenziell runter mit dem Kurs.

Und das könnte auch so weitergehen.

Interessant wird es nur, wenn der Kurs durch die Kante ausbricht.

Wo er sich jetzt in der Nähe der Kante befindet, muss man beobachten wie er sich verhält.

Logo:

Die Prodways-Gruppe ist eines der führenden europäischen Unternehmen, das sich auf den 3D-Druck für die Luft- und Raumfahrt, Medizin-, Dental-, Automobil- und andere Industrien spezialisiert hat. Es handelt sich um einen additiven Herstellungsprozess, bei dem physikalische Objekte durch Übereinanderlegen verschiedener Materialschichten erzeugt werden. 2019 gliedert sich der Nettoumsatz (vor konzerninternen Eliminierungen) nach Aktivitäten wie folgt auf:

- Vertrieb von 3D-Konstruktionssoftware, Konstruktion, Montage und Verkauf von Maschinen und dazugehöriger Ausrüstung (62,5%): 3D-Drucker, Reinigungsstationen, UV-Öfen, Flüssigharze, Polymerpulver usw.;

- Entwurf und Herstellung von 3D-Druckteilen aus Kunststoff und Metall (37,5%).

Der Nettoumsatz ist geografisch wie folgt verteilt: Frankreich (68%), Europa (19,5%), Nordamerika (9,8%) und andere (2,7%).

Mitarbeiteranzahl : 505 Personen.

Quelle: https://ch.marketscreener.com/kurs/aktie/PRODWAYS-GROUP-3485…

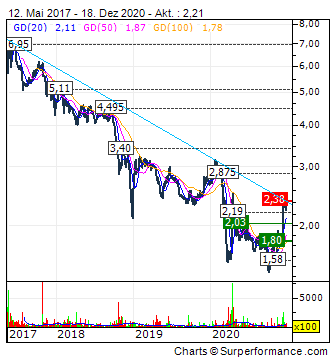

Chart:

Es ging Jahrelang tendenziell runter mit dem Kurs.

Und das könnte auch so weitergehen.

Interessant wird es nur, wenn der Kurs durch die Kante ausbricht.

Wo er sich jetzt in der Nähe der Kante befindet, muss man beobachten wie er sich verhält.

Logo:

3D Printing Software Market by Manufacturers, Regions, Type and Application

Major companies listed in the market:

ZBrush

Trimble

Autodesk

Sylvain Huet

Maxon

3D Systems

Materialise

Stratasys

EOS

Tinkercad

Ultimaker

Dassault Systemes

Siemens

Prodways Group

Voxeljet

Exone

Protolabs

PTC

Zortrax

3D Printing Software Market

Quelle: https://www.mccourier.com/3d-printing-software-market-by-man…

Major companies listed in the market:

ZBrush

Trimble

Autodesk

Sylvain Huet

Maxon

3D Systems

Materialise

Stratasys

EOS

Tinkercad

Ultimaker

Dassault Systemes

Siemens

Prodways Group

Voxeljet

Exone

Protolabs

PTC

Zortrax

3D Printing Software Market

Quelle: https://www.mccourier.com/3d-printing-software-market-by-man…

Zack:

🎵

🎵

Antwort auf Beitrag Nr.: 66.184.873 von Malecon am 23.12.20 21:54:02Der "Kerl" wird mir langsam unheimlich... Hoffe du verlierst nicht so schnell deine Lust an WO und dem Teilen deiner Anlagen, Empfehlungen und Stock-Picks... 👏

Prodways : 3D Materials division recorded major successes in the field of Medical applications

https://www.marketscreener.com/quote/stock/PRODWAYS-GROUP-34…

https://www.marketscreener.com/quote/stock/PRODWAYS-GROUP-34…

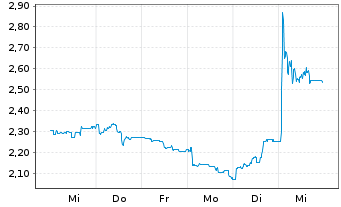

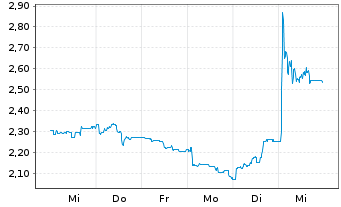

In 2020 hat sie eine Adam&Eve Double Bottom Formation gebildet

Antwort auf Beitrag Nr.: 66.616.004 von DanydaWiedo am 26.01.21 15:39:01Nach einem durchwachsenden COVID-19 Jahr, ist der Ausblick für 2021 sehr positiv !

Sollte der Kurs nochmal unter 3€ fallen, werde ich nachkaufen.

so long

Only

FINANCIAL NEWS RELEASE

2021/03/16 8:15 PM

FULL-YEAR 2020 RESULTS: RECOVERY DYNAMIC STARTED IN THE SECOND HALF, STRONG AMBITIONS FOR THE COMING YEARS

Read press release

Activity 2020: many commercial and operational successes in challenging environment

Commercial successes and major partnerships signed, particularly in the medical industry

Implementation of new innovative solutions confirming the position of Prodways as a key player in 3D Printing for industrial production

Operational transformation set to drive performance starting 2021

New organization of printer production to create synergies and improve profitability

Increased material production capacity for the medical industry by +50%

Uptrend in the second half of 2020 despite the second lockdown

Revenue down by -€6 million compared to the second half of 2019, vs -€8 million in the first half

Positive EBITDA of €1.9 million despite the decrease in revenue

Limited decrease in Income from ordinary activities of -€0.4 million vs the second half of 2019

Outlook: Prodways well positioned in a high potential market

Target 2021: double-digit revenue growth

Strong growth of the 3D printing market expected to reach approximately €100 billion by 20291

Unique strategic positioning opening the way for strong medium-term ambitions.

2020 activity: many successes despite a difficult context

Commercial successes and partnerships signed

In the context of a wait-and-see market, Prodways Group demonstrated its ability to continue its activities and sign new orders and partnerships. The strategy implemented for several years, which today makes it possible to harness the entire 3D printing value chain (machines, materials, software and manufacturing), has delivered success in multiple areas.

Prodways signed a contract in the first half for the sale of liquid resins with several European dental specialists, using materials specifically developed for this industry, such as PLASTCure Model liquid resin, which provides a very high degree of precision for mass production. Two customers acquired a fleet of ProMaker LD10 and LD20 machines to increase their production by more than one million orthodontic aligners per year. This positive trend continued in early 2021 with the signature of a four-year agreement with a leading global player in the dental industry, focusing on the development and supply of 3D resins for applications such as castable resin, individual impression trays, aesthetic fittings, surgical guides or temporary crowns and bridges. These products, solutions and services are sold in more than 100 countries through a network of distributors and partners.

These industrial customers should consume several dozen tons of materials once their production has stabilized, reflecting the growing use of 3D printing in this industry.

The commercial dynamic is also tangible in the jewelry industry, with two contracts to equip two customers with a dozen machines each, as well as in 3D modeling software distribution, which won an unprecedented record contract in 2020.

The Group also recorded two new commercial successes in its range of printers using powder sintering technology. Two international industrial customers in Spain and the United States, in the steel and food packaging industries respectively, each ordered a ProMaker P1000X printer, enabling the 3D printing of parts in materials with high mechanical performance. This last order was secured by Solidscape, Prodways' American subsidiary, acquired two years ago, and thus materializes the commercial synergies being implemented in the Machine division since this acquisition.

Implementation of new innovative solutions delivering sector-leading accuracy and speed for industrial production

In the first half, Prodways launched a new business line for the integration of Cloud solutions from the Dassault Systèmes 3DEXPERIENCE® platform, both in Europe and in North America, through the acquisition of a non-controlling interest in XD Innovation for the latter region. Prodways is thus positioned as one of the only manufacturers of industrial 3D printers in the world to offer software expertise to master the creation, modification and simulation of 3D files, which are major assets for customers. Cloud technologies, which are reaching maturity, are opportunities to gain market share on a global level in this business which offers strong recurring business.

In the second half, the Group announced new innovative features integrated into its range of compact 3D printers MOVINGLight® ProMaker LD Series: Super-Resolution 3D based on a new generation of algorithms and post-processing by centrifuge for aligners production. These improvements allow for an improved surface finish, a faster manufacturing time and a better recycling rate of the non-polymerized material. This printer range can now achieve precision beyond its native performance of 42 micrometers while increasing production speed by 30%.

These features have translated into two commercial successes with the Polish company Brightalign, which recently acquired two new machines for the production of its orthodontic aligners, and the Italian company GEO which has just confirmed a recent order for two machines.

Prodways thus confirms its position as a key player in industrial production, offering its customers unique solutions to increase their productivity and improve their results.

Operational transformation set to drive performance from 2021

To consolidate the ramp-up of the business for several years, with revenues that have more than doubled over the past three years, and to meet future demand in a very buoyant market, Prodways has been gradually setting up a new organization for the production of its machines since the end of 2020. This transformation will make it possible to achieve synergies between its business lines, improve profitability by reducing the fixed cost structure and thus focus on the development of new high-potential markets. Manufacturing of the SLS and MovingLight printers, historically located in the Paris region, will be transferred to the sites of Merrimack in the United States for the MovingLight printers, which already manufactures the Solidscape models (in particular the S-Series line) and Annecy for the SLS printers, where the workshops of the Products division are located (design and manufacturing of parts on demand and medical applications). Four French sites have been grouped together in Annecy.

In addition, in view of the good commercial prospects for medical applications, the Group has once again increased its production capacity in order to meet the growing demand in this industry. The capacity has increased by 50% in eight months and can now reach 100 tons per year. This high-margin business is one of the Group's main growth drivers.

This transformation will deliver results in 2021 with an uptrend in sales and revenue growth.

Results for 2020: continued recovery in the second half of 2020

(€ million) H1 2019 H2 2019 FY 2019 H1 2020 H2 2020 FY 2020 Change

H2 2020

vs H2 2019 Change

FY 2020

vs. FY 2019

Revenues 35.3 36.0 71.3 26.8 30.4 57.2 -5.6 -14.1

EBITDA2 2.6 2.7 5.3 1.4 1.9 3.3 -0.8 -2.0

Income from ordinary activities3 -1.0 -0.5 -1.5 -2.9 -0.9 -3.8 -0.4 -2.3

Operating income -2.4 -1.3 -3.8 -10.0 -4.8 -14.8 -3.5 -11.0

Financial result -0.1 -0.2 -0.3 -0.2 -0.1 -0.3 +0.1 -0.0

Net income group share -2.8 -1.4 -4.2 -8.7 -5.3 -13.9 -3.8 -9.7

The consolidated financial statements for 2020 were approved by the Board of Directors which met on March 16, 2021. The financial statements have been reviewed by the Statutory Auditors and their reports are in the process of being issued.

Consolidated revenue at December 31, 2020 amounted to €57.2 million, down by 20% compared to 2019 due to the health crisis. Business recovery began in the second half of the year for all activities, down -€5.6 million compared to 2019, versus -€8.5 million in the first half of 2020.

EBITDA amounted to €1.9 million in the second half, down only €0.8 million versus €1.1 million in the first half. In full-year 2020 it totaled €3.3 million, just €2 million below the performance in 2019 despite a decrease in revenue of €14.1 million.

The decrease in depreciation, amortization and provisions in the second half (€2.8 million, i.e. -14% compared to the second half of 2019) also contributed to the increase in operating income, which amounted to -€0.9 million.

Other operating income items amounted to -€11 million in 2020 compared with -€2.4 million in 2019 and had no effect on cash for the main part. Due to the unusual context of the health crisis, the Group performed in-depth reviews of the value of all its assets this summer. Impairment losses were recorded with respect to inventory, R&D projects and intangible assets recognized at fair value at the time of acquisition. These factors largely explain the drop in operating income of €11 million in 2020.

Net result in group share amounted to -€13.9 million in 2020.

Performance by division4

The Systems division – which comprises 3D software, 3D printers and related materials and services – achieved revenue of €36 million in 2020 (-20% vs. 2019). Revenues are still affected by deferred investments by customers, both for machines and software, with very good performance in materials sales at the end of 2020. This largely recurring business recorded market share gains, up by 26% in the fourth quarter compared to last year.

Despite the decrease in revenue, EBITDA was only slightly down by €0.4 million over the year and stood at around €3 million. It benefited from the division's structuring, cost reduction and implementation of government initiative measures in France, Germany and the United States. EBITDA margin was 8.0%, an improvement since 2019 (7.4%).

The Products division – including the design and manufacture of on-demand parts and medical applications – recorded revenue of €21 million in 2020 (-22% compared to the previous year). Medical activities (audiology, chiropody and dentistry), which were on pause during 3 months in the first half of the year, recovered well and posted good performance at the end of the year, with a fourth quarter 2020 in line with the level of 2019.

EBITDA margin returned to above 10% in the second half of the year, on track to quickly get back to the levels of 2019.

Sound financial position

Cash flow from operations improved significantly since the end of June 2020 but remained slightly negative (-€0.2 million compared to -€1 million at end-June). However, this change was largely offset by the significant drop in working capital requirement (-95%). Operating cash flow reached €4.4 million in 2020.

The Group used State-Guaranteed Loans in the amount of €8.4 million. At December 31, 2020, available cash amounted to €22.5 million. Net cash and cash equivalents5 were €5.8 million, versus net cash and cash equivalents of €9.6 million at December 31, 2019.

Outlook: Prodways well positioned in a high potential market

A deep, fast-growing 3D printing market with a positive structural outlook

The economic crisis that hit the 3D printing market in 2020 does not call into question the structural fundamentals of the industry which remain very positive. The growing adoption of 3D solutions for the production of functional components, whether finished products or components, tools or spare parts, will result in strong market growth over the next years. The application possibilities are very broad and can address all sectors on a global scale.

Latest projections6 anticipate strong market growth in the coming years, reaching an estimated size of €100 billion by 2029 (compared to around €10 billion in 2020). These growth forecasts led to strong growth in the securities of US companies in the industry (close to +300% average growth in one year7) which has not yet materialized in Europe.

Strategic positioning to benefit from promising trends

In this environment, Prodways Group is very well positioned thanks to the strategy implemented since its creation in 2013 around 3 main axes:

Control over the entire 3D printing value chain: machines, materials, software and manufacturing, enhanced in 2020 with new features on its printers and a new software offering.

Technology excellence offered for industrial production, offering unique performance in terms of precision and speed.

Development of new partnerships with the ambition to address new large-scale applications in the upcoming years, such as optics or precision casting. The three-year partnership with Essilor, aimed at developing the MOVINGLight® 3D printing technology for spectacle lenses, is an example. A new milestone was reached in early 2021 with the installation of a second Prodways printer.

Thanks to this positioning, Prodways is one of the European leaders in its industry, a specialist in professional and industrial 3D printing. The Group is one of the few players able to offer an integrated model with turnkey solutions for industrial production, offering greater precision and speed than market standards.

2021 guidance and future ambition

Drawing on its strengths, Prodways has set itself strong ambitions for the upcoming years:

In the short term, if the health context does not further deteriorate, Prodways has set itself a target of double-digit revenue growth for 2021, benefiting in particular from the good trends in the Products business.

At the same time, the profitability of the Company is expected to post a strong improvement starting from the first half of 2021.

In the medium term, the Group is aiming for strong growth across its business lines, supported by a fast-growing market and its unique strategic positioning.

Conference call on Wednesday, March 17, 2021 at 8:30 am CET

The presentation will be available on the Prodways Group website: www.prodways-group.com, under “Financial Information”.

On Wednesday, September 17, 2021, Raphaël Gorgé, Executive Chairman, Olivier Strebelle, Chief Executive Officer, and Laurent Cardin, Chief Financial Officer, will comment to the financial community on the Prodways Group full-year results and will answer questions from analysts during a conference call in English starting at 8:30 am (Paris time).

To participate in the conference call, you may dial any of the following telephone numbers approximately ten minutes prior to the scheduled start time:

France: +33 (0)1 72 72 74 03

United Kingdom: +44 (0)2 07 19 43 759

Germany: +49 (0)6 92 22 22 54 29

Access code: 12014036#

A replay will be available as soon as possible on the Prodways Group investors' website, under "Financial Information".

About Prodways Group

Prodways Group is a specialist in industrial and professional 3D printing with a unique positioning as an integrated European player. The Group has developed right across the 3D printing value chain (software, machines, materials, parts & services) with a high value added technological industrial solution. Prodways Group offers a wide range of 3D printing systems and premium composite, hybrid and powder materials (SYSTEMS division). The company also manufactures and markets parts on demand, prototypes and small production run 3D printed items in plastic and metal (PRODUCTS division). The Group targets a significant number of sectors, from aeronautics to healthcare.

Listed on Euronext Paris, the Group reported in 2019 revenue of €57 million.

Prodways Group is a Groupe Gorgé company.

For further information: www.prodways-group.com

INVESTOR CONTACTS

Anne-Pauline Petureaux

Investor relations

Tel : +33 (0)1 53 67 36 94/apetureaux@actus.fr

PRESS CONTACTS

Manon Clairet

Financial press relations

Tel: +33 (0)1 53 67 36 73/mclairet@actus.fr

Disclaimer

Releases from Prodways Group may contain forward-looking declarations with statements of objectives. These forward-looking statements reflect the current expectations of Prodways Group. Their realization, however, depends on known or unknown risks, uncertainties and other factors that may cause actual results, performance or events to differ significantly from those previously anticipated. The risks and uncertainties that might affect the Group's future ability to achieve its targets are reiterated and presented in detail in our Annual financial report on Prodways Group's website (www.prodways-group.com). This list of risks, uncertainties and other factors is not exhaustive. Other unanticipated, unknown or unpredictable factors may also have significant negative effects on the achievement of our objectives. The current release and the information contained therein do not constitute an offer to sell or to subscribe, nor a solicitation for an order to purchase or subscribe to shares in Prodways Group or in any subsidiaries thereof listed in whatsoever country.

Sollte der Kurs nochmal unter 3€ fallen, werde ich nachkaufen.

so long

Only

FINANCIAL NEWS RELEASE

2021/03/16 8:15 PM

FULL-YEAR 2020 RESULTS: RECOVERY DYNAMIC STARTED IN THE SECOND HALF, STRONG AMBITIONS FOR THE COMING YEARS

Read press release

Activity 2020: many commercial and operational successes in challenging environment

Commercial successes and major partnerships signed, particularly in the medical industry

Implementation of new innovative solutions confirming the position of Prodways as a key player in 3D Printing for industrial production

Operational transformation set to drive performance starting 2021

New organization of printer production to create synergies and improve profitability

Increased material production capacity for the medical industry by +50%

Uptrend in the second half of 2020 despite the second lockdown

Revenue down by -€6 million compared to the second half of 2019, vs -€8 million in the first half

Positive EBITDA of €1.9 million despite the decrease in revenue

Limited decrease in Income from ordinary activities of -€0.4 million vs the second half of 2019

Outlook: Prodways well positioned in a high potential market

Target 2021: double-digit revenue growth

Strong growth of the 3D printing market expected to reach approximately €100 billion by 20291

Unique strategic positioning opening the way for strong medium-term ambitions.

2020 activity: many successes despite a difficult context

Commercial successes and partnerships signed

In the context of a wait-and-see market, Prodways Group demonstrated its ability to continue its activities and sign new orders and partnerships. The strategy implemented for several years, which today makes it possible to harness the entire 3D printing value chain (machines, materials, software and manufacturing), has delivered success in multiple areas.

Prodways signed a contract in the first half for the sale of liquid resins with several European dental specialists, using materials specifically developed for this industry, such as PLASTCure Model liquid resin, which provides a very high degree of precision for mass production. Two customers acquired a fleet of ProMaker LD10 and LD20 machines to increase their production by more than one million orthodontic aligners per year. This positive trend continued in early 2021 with the signature of a four-year agreement with a leading global player in the dental industry, focusing on the development and supply of 3D resins for applications such as castable resin, individual impression trays, aesthetic fittings, surgical guides or temporary crowns and bridges. These products, solutions and services are sold in more than 100 countries through a network of distributors and partners.

These industrial customers should consume several dozen tons of materials once their production has stabilized, reflecting the growing use of 3D printing in this industry.

The commercial dynamic is also tangible in the jewelry industry, with two contracts to equip two customers with a dozen machines each, as well as in 3D modeling software distribution, which won an unprecedented record contract in 2020.

The Group also recorded two new commercial successes in its range of printers using powder sintering technology. Two international industrial customers in Spain and the United States, in the steel and food packaging industries respectively, each ordered a ProMaker P1000X printer, enabling the 3D printing of parts in materials with high mechanical performance. This last order was secured by Solidscape, Prodways' American subsidiary, acquired two years ago, and thus materializes the commercial synergies being implemented in the Machine division since this acquisition.

Implementation of new innovative solutions delivering sector-leading accuracy and speed for industrial production

In the first half, Prodways launched a new business line for the integration of Cloud solutions from the Dassault Systèmes 3DEXPERIENCE® platform, both in Europe and in North America, through the acquisition of a non-controlling interest in XD Innovation for the latter region. Prodways is thus positioned as one of the only manufacturers of industrial 3D printers in the world to offer software expertise to master the creation, modification and simulation of 3D files, which are major assets for customers. Cloud technologies, which are reaching maturity, are opportunities to gain market share on a global level in this business which offers strong recurring business.

In the second half, the Group announced new innovative features integrated into its range of compact 3D printers MOVINGLight® ProMaker LD Series: Super-Resolution 3D based on a new generation of algorithms and post-processing by centrifuge for aligners production. These improvements allow for an improved surface finish, a faster manufacturing time and a better recycling rate of the non-polymerized material. This printer range can now achieve precision beyond its native performance of 42 micrometers while increasing production speed by 30%.

These features have translated into two commercial successes with the Polish company Brightalign, which recently acquired two new machines for the production of its orthodontic aligners, and the Italian company GEO which has just confirmed a recent order for two machines.

Prodways thus confirms its position as a key player in industrial production, offering its customers unique solutions to increase their productivity and improve their results.

Operational transformation set to drive performance from 2021

To consolidate the ramp-up of the business for several years, with revenues that have more than doubled over the past three years, and to meet future demand in a very buoyant market, Prodways has been gradually setting up a new organization for the production of its machines since the end of 2020. This transformation will make it possible to achieve synergies between its business lines, improve profitability by reducing the fixed cost structure and thus focus on the development of new high-potential markets. Manufacturing of the SLS and MovingLight printers, historically located in the Paris region, will be transferred to the sites of Merrimack in the United States for the MovingLight printers, which already manufactures the Solidscape models (in particular the S-Series line) and Annecy for the SLS printers, where the workshops of the Products division are located (design and manufacturing of parts on demand and medical applications). Four French sites have been grouped together in Annecy.

In addition, in view of the good commercial prospects for medical applications, the Group has once again increased its production capacity in order to meet the growing demand in this industry. The capacity has increased by 50% in eight months and can now reach 100 tons per year. This high-margin business is one of the Group's main growth drivers.

This transformation will deliver results in 2021 with an uptrend in sales and revenue growth.

Results for 2020: continued recovery in the second half of 2020

(€ million) H1 2019 H2 2019 FY 2019 H1 2020 H2 2020 FY 2020 Change

H2 2020

vs H2 2019 Change

FY 2020

vs. FY 2019

Revenues 35.3 36.0 71.3 26.8 30.4 57.2 -5.6 -14.1

EBITDA2 2.6 2.7 5.3 1.4 1.9 3.3 -0.8 -2.0

Income from ordinary activities3 -1.0 -0.5 -1.5 -2.9 -0.9 -3.8 -0.4 -2.3

Operating income -2.4 -1.3 -3.8 -10.0 -4.8 -14.8 -3.5 -11.0

Financial result -0.1 -0.2 -0.3 -0.2 -0.1 -0.3 +0.1 -0.0

Net income group share -2.8 -1.4 -4.2 -8.7 -5.3 -13.9 -3.8 -9.7

The consolidated financial statements for 2020 were approved by the Board of Directors which met on March 16, 2021. The financial statements have been reviewed by the Statutory Auditors and their reports are in the process of being issued.

Consolidated revenue at December 31, 2020 amounted to €57.2 million, down by 20% compared to 2019 due to the health crisis. Business recovery began in the second half of the year for all activities, down -€5.6 million compared to 2019, versus -€8.5 million in the first half of 2020.

EBITDA amounted to €1.9 million in the second half, down only €0.8 million versus €1.1 million in the first half. In full-year 2020 it totaled €3.3 million, just €2 million below the performance in 2019 despite a decrease in revenue of €14.1 million.

The decrease in depreciation, amortization and provisions in the second half (€2.8 million, i.e. -14% compared to the second half of 2019) also contributed to the increase in operating income, which amounted to -€0.9 million.

Other operating income items amounted to -€11 million in 2020 compared with -€2.4 million in 2019 and had no effect on cash for the main part. Due to the unusual context of the health crisis, the Group performed in-depth reviews of the value of all its assets this summer. Impairment losses were recorded with respect to inventory, R&D projects and intangible assets recognized at fair value at the time of acquisition. These factors largely explain the drop in operating income of €11 million in 2020.

Net result in group share amounted to -€13.9 million in 2020.

Performance by division4

The Systems division – which comprises 3D software, 3D printers and related materials and services – achieved revenue of €36 million in 2020 (-20% vs. 2019). Revenues are still affected by deferred investments by customers, both for machines and software, with very good performance in materials sales at the end of 2020. This largely recurring business recorded market share gains, up by 26% in the fourth quarter compared to last year.

Despite the decrease in revenue, EBITDA was only slightly down by €0.4 million over the year and stood at around €3 million. It benefited from the division's structuring, cost reduction and implementation of government initiative measures in France, Germany and the United States. EBITDA margin was 8.0%, an improvement since 2019 (7.4%).

The Products division – including the design and manufacture of on-demand parts and medical applications – recorded revenue of €21 million in 2020 (-22% compared to the previous year). Medical activities (audiology, chiropody and dentistry), which were on pause during 3 months in the first half of the year, recovered well and posted good performance at the end of the year, with a fourth quarter 2020 in line with the level of 2019.

EBITDA margin returned to above 10% in the second half of the year, on track to quickly get back to the levels of 2019.

Sound financial position

Cash flow from operations improved significantly since the end of June 2020 but remained slightly negative (-€0.2 million compared to -€1 million at end-June). However, this change was largely offset by the significant drop in working capital requirement (-95%). Operating cash flow reached €4.4 million in 2020.

The Group used State-Guaranteed Loans in the amount of €8.4 million. At December 31, 2020, available cash amounted to €22.5 million. Net cash and cash equivalents5 were €5.8 million, versus net cash and cash equivalents of €9.6 million at December 31, 2019.

Outlook: Prodways well positioned in a high potential market

A deep, fast-growing 3D printing market with a positive structural outlook

The economic crisis that hit the 3D printing market in 2020 does not call into question the structural fundamentals of the industry which remain very positive. The growing adoption of 3D solutions for the production of functional components, whether finished products or components, tools or spare parts, will result in strong market growth over the next years. The application possibilities are very broad and can address all sectors on a global scale.

Latest projections6 anticipate strong market growth in the coming years, reaching an estimated size of €100 billion by 2029 (compared to around €10 billion in 2020). These growth forecasts led to strong growth in the securities of US companies in the industry (close to +300% average growth in one year7) which has not yet materialized in Europe.

Strategic positioning to benefit from promising trends

In this environment, Prodways Group is very well positioned thanks to the strategy implemented since its creation in 2013 around 3 main axes:

Control over the entire 3D printing value chain: machines, materials, software and manufacturing, enhanced in 2020 with new features on its printers and a new software offering.

Technology excellence offered for industrial production, offering unique performance in terms of precision and speed.

Development of new partnerships with the ambition to address new large-scale applications in the upcoming years, such as optics or precision casting. The three-year partnership with Essilor, aimed at developing the MOVINGLight® 3D printing technology for spectacle lenses, is an example. A new milestone was reached in early 2021 with the installation of a second Prodways printer.

Thanks to this positioning, Prodways is one of the European leaders in its industry, a specialist in professional and industrial 3D printing. The Group is one of the few players able to offer an integrated model with turnkey solutions for industrial production, offering greater precision and speed than market standards.

2021 guidance and future ambition

Drawing on its strengths, Prodways has set itself strong ambitions for the upcoming years:

In the short term, if the health context does not further deteriorate, Prodways has set itself a target of double-digit revenue growth for 2021, benefiting in particular from the good trends in the Products business.

At the same time, the profitability of the Company is expected to post a strong improvement starting from the first half of 2021.

In the medium term, the Group is aiming for strong growth across its business lines, supported by a fast-growing market and its unique strategic positioning.

Conference call on Wednesday, March 17, 2021 at 8:30 am CET

The presentation will be available on the Prodways Group website: www.prodways-group.com, under “Financial Information”.

On Wednesday, September 17, 2021, Raphaël Gorgé, Executive Chairman, Olivier Strebelle, Chief Executive Officer, and Laurent Cardin, Chief Financial Officer, will comment to the financial community on the Prodways Group full-year results and will answer questions from analysts during a conference call in English starting at 8:30 am (Paris time).

To participate in the conference call, you may dial any of the following telephone numbers approximately ten minutes prior to the scheduled start time:

France: +33 (0)1 72 72 74 03

United Kingdom: +44 (0)2 07 19 43 759

Germany: +49 (0)6 92 22 22 54 29

Access code: 12014036#

A replay will be available as soon as possible on the Prodways Group investors' website, under "Financial Information".

About Prodways Group

Prodways Group is a specialist in industrial and professional 3D printing with a unique positioning as an integrated European player. The Group has developed right across the 3D printing value chain (software, machines, materials, parts & services) with a high value added technological industrial solution. Prodways Group offers a wide range of 3D printing systems and premium composite, hybrid and powder materials (SYSTEMS division). The company also manufactures and markets parts on demand, prototypes and small production run 3D printed items in plastic and metal (PRODUCTS division). The Group targets a significant number of sectors, from aeronautics to healthcare.

Listed on Euronext Paris, the Group reported in 2019 revenue of €57 million.

Prodways Group is a Groupe Gorgé company.

For further information: www.prodways-group.com

INVESTOR CONTACTS

Anne-Pauline Petureaux

Investor relations

Tel : +33 (0)1 53 67 36 94/apetureaux@actus.fr

PRESS CONTACTS

Manon Clairet

Financial press relations

Tel: +33 (0)1 53 67 36 73/mclairet@actus.fr

Disclaimer

Releases from Prodways Group may contain forward-looking declarations with statements of objectives. These forward-looking statements reflect the current expectations of Prodways Group. Their realization, however, depends on known or unknown risks, uncertainties and other factors that may cause actual results, performance or events to differ significantly from those previously anticipated. The risks and uncertainties that might affect the Group's future ability to achieve its targets are reiterated and presented in detail in our Annual financial report on Prodways Group's website (www.prodways-group.com). This list of risks, uncertainties and other factors is not exhaustive. Other unanticipated, unknown or unpredictable factors may also have significant negative effects on the achievement of our objectives. The current release and the information contained therein do not constitute an offer to sell or to subscribe, nor a solicitation for an order to purchase or subscribe to shares in Prodways Group or in any subsidiaries thereof listed in whatsoever country.

Es läuft soweit gut, kann man sich nicht beschweren.

Auf der Suche nach Alternativen zu 3D Systems, Stratasys bin ich auf dieses Unternehmen gestoßen. Die erstgenannten Unternehmen gehen nach den Quartalszahlen rasant nach oben und hier tut sich einfach nichts. Die Zahlen sehen doch gut aus. Habe ich da irgendetwas verpasst? 🤔

Wie auch immer, eine erste Position habe ich mir heute unter 2,8 EUR gegönnt...

https://www.prodways-group.com/en/investors/financial-news-r…

Wie auch immer, eine erste Position habe ich mir heute unter 2,8 EUR gegönnt...

https://www.prodways-group.com/en/investors/financial-news-r…

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,18 | |

| +0,34 | |

| -0,10 | |

| +1,21 | |

| +0,70 | |

| 0,00 | |

| +1,77 | |

| +0,48 | |

| +0,74 | |

| +0,21 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 272 | ||

| 82 | ||

| 76 | ||

| 70 | ||

| 51 | ||

| 45 | ||

| 43 | ||

| 43 | ||

| 40 | ||

| 35 |