Whitehaven Coal

eröffnet am 28.05.21 13:30:38 von

neuester Beitrag 19.01.24 14:46:11 von

neuester Beitrag 19.01.24 14:46:11 von

Beiträge: 103

ID: 1.348.181

ID: 1.348.181

Aufrufe heute: 0

Gesamt: 3.156

Gesamt: 3.156

Aktive User: 0

ISIN: AU000000WHC8 · WKN: A0MSK7

4,6235

EUR

-0,95 %

-0,0445 EUR

Letzter Kurs 25.04.24 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,59 | -98,01 |

Beitrag zu dieser Diskussion schreiben

19.1.

Whitehaven Coal posts strong Q2, mulls Blackwater mine stake sale

https://www.miningweekly.com/article/whitehaven-coal-posts-s…

...

Australia's Whitehaven Coal reported a near 4% rise in quarterly production on Friday, helped by strong performance at its open-cut mines, and said it was exploring a potential stake sale in the Blackwater mine.

Whitehaven said it was exploring a potential sell-down of about 20% of Blackwater to global steel producers as strategic joint venture partners.

The miner had acquired the Blackwater and Daunia mines from BHP Group in a $4.1-billion deal last October, and expects the acquisition to complete in early April.

Whitehaven kept its coal production and sales guidance for fiscal 2024 unchanged, but said its Maules Creek and Gunnedah open-cut mines were now tracking towards the top end of its guidance range.

...

"It looks like the company is adjusting to a period of softer demand and sticky cost pressures. It's a move towards greater efficiency amid what's likely to be a cyclical downturn in demand," said Kyle Rodda, a senior financial market analyst at Capital.com.

...

Whitehaven Coal posts strong Q2, mulls Blackwater mine stake sale

https://www.miningweekly.com/article/whitehaven-coal-posts-s…

...

Australia's Whitehaven Coal reported a near 4% rise in quarterly production on Friday, helped by strong performance at its open-cut mines, and said it was exploring a potential stake sale in the Blackwater mine.

Whitehaven said it was exploring a potential sell-down of about 20% of Blackwater to global steel producers as strategic joint venture partners.

The miner had acquired the Blackwater and Daunia mines from BHP Group in a $4.1-billion deal last October, and expects the acquisition to complete in early April.

Whitehaven kept its coal production and sales guidance for fiscal 2024 unchanged, but said its Maules Creek and Gunnedah open-cut mines were now tracking towards the top end of its guidance range.

...

"It looks like the company is adjusting to a period of softer demand and sticky cost pressures. It's a move towards greater efficiency amid what's likely to be a cyclical downturn in demand," said Kyle Rodda, a senior financial market analyst at Capital.com.

...

Guten Abend,

Frage in die Runde, wie wird der Kauf von Daunia und Blackwater gesehen? Ich bin letzte Woche eingestiegen weil ich mir erhoffe ein ähnliches Entschuldungsszenario wie bei Stanmore Resources mit zu machen. Naja die BMC Anlagen waren einiges günstiger ich meine 1,1 Mrd AUD für 80% bei 12Mio Jahresproduktion aber hauptsächlich PCI. Ich meine die beiden Anlagen machen 20Mio p.a. Hauptsächlich HHC, weobei Blackwater eine komplizierte Geologie aufweisen soll, ähnlich wie Curragh von Coronado mit mieser Performance. Wobei WHC sicher das bessere Management hat. Wie seht ihr die Sache?

Frage in die Runde, wie wird der Kauf von Daunia und Blackwater gesehen? Ich bin letzte Woche eingestiegen weil ich mir erhoffe ein ähnliches Entschuldungsszenario wie bei Stanmore Resources mit zu machen. Naja die BMC Anlagen waren einiges günstiger ich meine 1,1 Mrd AUD für 80% bei 12Mio Jahresproduktion aber hauptsächlich PCI. Ich meine die beiden Anlagen machen 20Mio p.a. Hauptsächlich HHC, weobei Blackwater eine komplizierte Geologie aufweisen soll, ähnlich wie Curragh von Coronado mit mieser Performance. Wobei WHC sicher das bessere Management hat. Wie seht ihr die Sache?

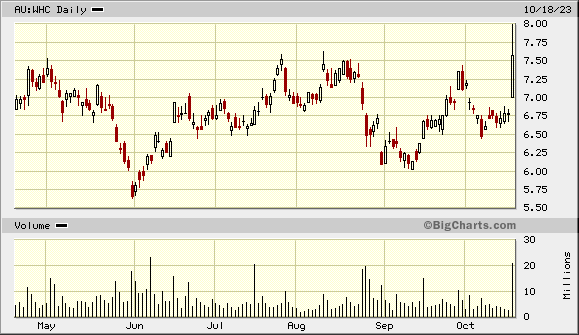

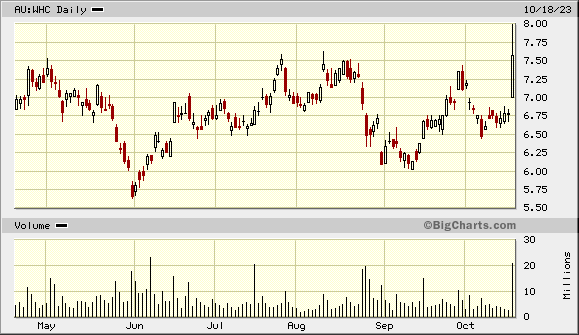

18.10.

BHP to Sell Coking Coal Mines to Whitehaven for $3.2 Billion

https://finance.yahoo.com/news/whitehaven-buy-two-bhp-coking…

...

BHP Group Ltd. agreed to sell two Australian coking coal operations to Whitehaven Coal Ltd. for at least $3.2 billion, as the world’s biggest miner extends its withdrawal from fossil fuels.

Whitehaven will pay $3.2 billion for the assets, along with additional payments of up to $900 million contingent on realized pricing exceeding agreed thresholds, it said in a statement Wednesday. It is also considering selling a minority stake in the assets to global steel producers through a joint venture, it added.

Shares of Whitehaven in Sydney closed 11% higher for the biggest jump since October 2020. Trading in the shares was halted during the morning, and resumed after the company released its statement. BHP finished up 0.7%.

...

=>

BHP to Sell Coking Coal Mines to Whitehaven for $3.2 Billion

https://finance.yahoo.com/news/whitehaven-buy-two-bhp-coking…

...

BHP Group Ltd. agreed to sell two Australian coking coal operations to Whitehaven Coal Ltd. for at least $3.2 billion, as the world’s biggest miner extends its withdrawal from fossil fuels.

Whitehaven will pay $3.2 billion for the assets, along with additional payments of up to $900 million contingent on realized pricing exceeding agreed thresholds, it said in a statement Wednesday. It is also considering selling a minority stake in the assets to global steel producers through a joint venture, it added.

Shares of Whitehaven in Sydney closed 11% higher for the biggest jump since October 2020. Trading in the shares was halted during the morning, and resumed after the company released its statement. BHP finished up 0.7%.

...

=>

26.8.

World struggles to break coal habit despite looming climate risk

Demand for black rock surges on Ukraine war, post-COVID recovery and heat waves

https://asia.nikkei.com/Spotlight/Datawatch/World-struggles-…

...

Despite growing climate concerns, the world continues to depend on coal as a power source, with more coal-fired capacity created than retired every year.

China, the world's biggest consumer of coal for power, now generates more electricity from the hydrocarbon than at any time in the past five years as its economy recovers from the COVID-19 pandemic and a summer heat wave swells energy demand.

In Europe, many countries have reversed their policy for phasing out power from coal in the face of shortages of natural gas caused by Russia's invasion of Ukraine.

China is responsible for about 30% of global emissions of carbon dioxide. It relies on coal for more than half of its electricity, with its average daily coal power generation rising 14.2% in July from a year earlier, according to an estimate by Kayrros, a satellite-based data research company in France.

...

World struggles to break coal habit despite looming climate risk

Demand for black rock surges on Ukraine war, post-COVID recovery and heat waves

https://asia.nikkei.com/Spotlight/Datawatch/World-struggles-…

...

Despite growing climate concerns, the world continues to depend on coal as a power source, with more coal-fired capacity created than retired every year.

China, the world's biggest consumer of coal for power, now generates more electricity from the hydrocarbon than at any time in the past five years as its economy recovers from the COVID-19 pandemic and a summer heat wave swells energy demand.

In Europe, many countries have reversed their policy for phasing out power from coal in the face of shortages of natural gas caused by Russia's invasion of Ukraine.

China is responsible for about 30% of global emissions of carbon dioxide. It relies on coal for more than half of its electricity, with its average daily coal power generation rising 14.2% in July from a year earlier, according to an estimate by Kayrros, a satellite-based data research company in France.

...

3.7.

China’s Importing So Much Coal That Local Miners Are Suffering

https://finance.yahoo.com/news/china-importing-much-coal-loc…

...

China’s coal buyers should slow purchases from abroad to avoid hurting domestic suppliers, the China Coal Transport and Distribution Association has recommended.

Asia’s largest economy imported 182 million tons of the fuel in the first five months of the year, almost 90% more than the same period in 2022, customs data show. The purchases were driven by the prospect of a hotter-than-usual summer, Beijing’s determination to minimize blackouts, and a drop in seaborne coal prices.

...

The CCTD is concerned about the growing impact on domestic coal miners, suggesting in a statement on the weekend that companies “control the scale and pace” of imports after an industry summit last week. Power plants, sitting on high inventories, have turned down some term volumes from local miners, suggesting that overall supply may remain ample in the second half, the association said.

The price of coal at Newcastle in Australia, the benchmark for seaborne supplies, is now about a third of what it was in early September. While prices of Chinese coal have also fallen, the premium buyers must pay for seaborne fuel dropped to around $13.50 a ton a month ago, making the imports more attractive. It can take up to a month for coal to be shipped to China, depending on where it’s coming from.

...

China’s Importing So Much Coal That Local Miners Are Suffering

https://finance.yahoo.com/news/china-importing-much-coal-loc…

...

China’s coal buyers should slow purchases from abroad to avoid hurting domestic suppliers, the China Coal Transport and Distribution Association has recommended.

Asia’s largest economy imported 182 million tons of the fuel in the first five months of the year, almost 90% more than the same period in 2022, customs data show. The purchases were driven by the prospect of a hotter-than-usual summer, Beijing’s determination to minimize blackouts, and a drop in seaborne coal prices.

...

The CCTD is concerned about the growing impact on domestic coal miners, suggesting in a statement on the weekend that companies “control the scale and pace” of imports after an industry summit last week. Power plants, sitting on high inventories, have turned down some term volumes from local miners, suggesting that overall supply may remain ample in the second half, the association said.

The price of coal at Newcastle in Australia, the benchmark for seaborne supplies, is now about a third of what it was in early September. While prices of Chinese coal have also fallen, the premium buyers must pay for seaborne fuel dropped to around $13.50 a ton a month ago, making the imports more attractive. It can take up to a month for coal to be shipped to China, depending on where it’s coming from.

...

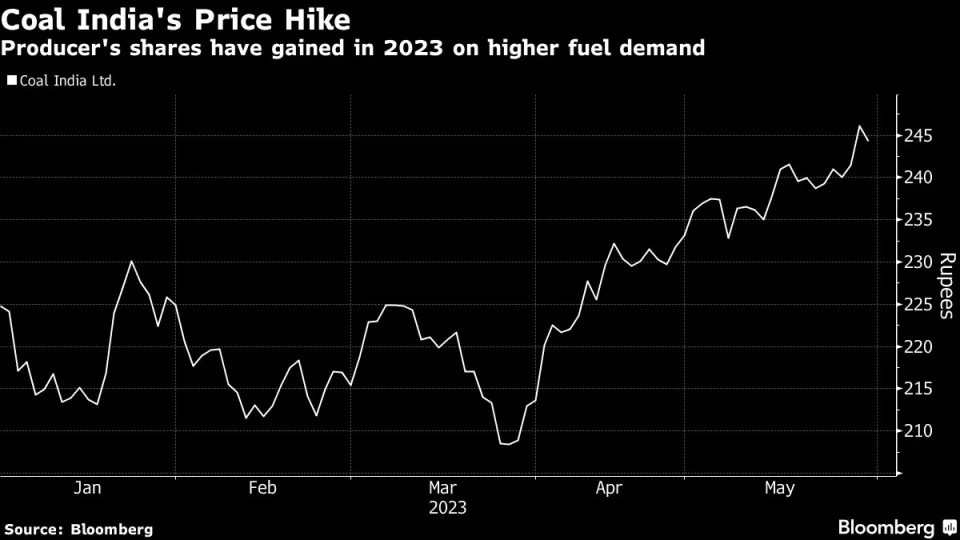

31.5.

World’s Top Coal Miner Hikes Prices as Wage Bill Surges

https://finance.yahoo.com/news/world-biggest-coal-miner-boos…

...

Prices of the top nine grades of thermal coal will rise by 8% from Wednesday, the company said in a statement, in a move that’s aimed at lifting revenue to help offset the impact of the rising cost of non-executive salaries.

The increase involves higher-quality categories of coal used mainly by industrial customers rather than by power plants to generate electricity, meaning the price hike shouldn’t have a major impact on energy bills. India relies on coal for about 70% of its electricity generation.

Coal India’s management has been aiming to lift prices for months amid higher costs of diesel and after it finalized a 19% salary increase for its non-executive staff, an agreement that will lift an annual wage bill that was about $4.9 billion in 2022.

“The price revision is well below our expectations,” said Rahul Kailash Jain, an analyst at Mumbai-based Systematix Shares & Stocks India. “It doesn’t even cover the rise in salaries.”

...

23.5.

China Buys More Australian Coal as Appetite for Quality Builds

https://finance.yahoo.com/news/china-buys-more-australian-co…

...

Australian coal continues to make inroads among Chinese buyers, adding to pressure on domestic prices, with new shipments climbing to their highest level since Beijing halted imports in the fall of 2020.

That ban ended at the start of this year and China’s appetite for the high-quality coal supplied by Australia is gaining momentum amid concerns that rising domestic production includes too much lower-grade fuel. Australian cargoes in April of mostly thermal coal for power plants surged 75% from the prior month to 3.89 million tons, according to Chinese customs data.

That puts Australia’s share of imports at 10%, almost double the level seen in March. Although a bigger volume of Australian coal was recorded in November 2021, those were previous shipments stranded by the ban that took as long as a year to clear customs.

At the same time, Russia’s coal exports to China dropped from the record level hit in March, as did its crude oil shipments. Seaborne Russian gas cargoes also fell from the previous month. The moderation in sales comes as Russian leaders visit Shanghai on Tuesday to help cement Moscow’s importance as a supplier of commodities to its eastern neighbor and strategic partner.

China’s total coal purchases fell slightly in April to 40.68 million tons, although that was still their third-highest tally ever and shipments have increased 89% over the year to date. The benchmark price at the port of Qinhuangdao has dropped to its lowest since the start of last year as the rising tide of imports lands at a time of seasonally weak demand.

...

China Buys More Australian Coal as Appetite for Quality Builds

https://finance.yahoo.com/news/china-buys-more-australian-co…

...

Australian coal continues to make inroads among Chinese buyers, adding to pressure on domestic prices, with new shipments climbing to their highest level since Beijing halted imports in the fall of 2020.

That ban ended at the start of this year and China’s appetite for the high-quality coal supplied by Australia is gaining momentum amid concerns that rising domestic production includes too much lower-grade fuel. Australian cargoes in April of mostly thermal coal for power plants surged 75% from the prior month to 3.89 million tons, according to Chinese customs data.

That puts Australia’s share of imports at 10%, almost double the level seen in March. Although a bigger volume of Australian coal was recorded in November 2021, those were previous shipments stranded by the ban that took as long as a year to clear customs.

At the same time, Russia’s coal exports to China dropped from the record level hit in March, as did its crude oil shipments. Seaborne Russian gas cargoes also fell from the previous month. The moderation in sales comes as Russian leaders visit Shanghai on Tuesday to help cement Moscow’s importance as a supplier of commodities to its eastern neighbor and strategic partner.

China’s total coal purchases fell slightly in April to 40.68 million tons, although that was still their third-highest tally ever and shipments have increased 89% over the year to date. The benchmark price at the port of Qinhuangdao has dropped to its lowest since the start of last year as the rising tide of imports lands at a time of seasonally weak demand.

...

27.2.

Key Coal Port Adds More Evidence China Trade Curbs Have Eased

https://finance.yahoo.com/news/key-coal-port-adds-more-00295…

...

A major coal port in Australia said vessels bound for China had arrived at the facility this month, adding more evidence of an easing of curbs on sales to the top consuming nation.

“There are early signs that the informal ban on Australian coal imports to China may be in the process of being removed,” Dalrymple Bay Infrastructure Ltd., which operates the world’s largest metallurgical coal export facility in Queensland, said Monday in a statement.

...

Key Coal Port Adds More Evidence China Trade Curbs Have Eased

https://finance.yahoo.com/news/key-coal-port-adds-more-00295…

...

A major coal port in Australia said vessels bound for China had arrived at the facility this month, adding more evidence of an easing of curbs on sales to the top consuming nation.

“There are early signs that the informal ban on Australian coal imports to China may be in the process of being removed,” Dalrymple Bay Infrastructure Ltd., which operates the world’s largest metallurgical coal export facility in Queensland, said Monday in a statement.

...

Coal prices are seeing some ‘softness’ right now, says mining company

https://www.cnbc.com/video/2023/02/16/coal-prices-are-seeing…

https://www.cnbc.com/video/2023/02/16/coal-prices-are-seeing…