Wird Zustieg von SAN GOLD zum Meilenstein für kanad. LAURION (LME) - 500 Beiträge pro Seite

eröffnet am 14.10.09 19:33:39 von

neuester Beitrag 23.07.13 23:06:13 von

neuester Beitrag 23.07.13 23:06:13 von

Beiträge: 152

ID: 1.153.678

ID: 1.153.678

Aufrufe heute: 0

Gesamt: 3.837

Gesamt: 3.837

Aktive User: 0

ISIN: CA5193221010 · WKN: A0LHML · Symbol: LME

0,3850

CAD

-1,28 %

-0,0050 CAD

Letzter Kurs 25.04.24 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 29,98 | +18,24 | |

| 16,050 | +17,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,59 | -98,01 |

October 08, 2009

Laurion Mineral Exploration Inc. announces LOI with San Gold Corporation

Laurion Mineral Exploration Inc. (TSXV: LME) announces strategic repositioning with San Gold Corporation (TSXV: SGR), in the Davidson-Tisdale and North Tisdale Property

TORONTO, October 8, 2009 -- Laurion Mineral Exploration Inc. ("Laurion") and San Gold Corporation ("San Gold") are pleased to announce the signing of a Letter of Intent ("LOI") with respect to the purchase of Laurion's property interests in the Tisdale

Township (collectively the "Tisdale Properties"), which is composed of Laurion's 31.5% interest in the Davidson-Tisdale property and Laurion's 100% interest in the North Tisdale property.

The LOI confirms San Gold's intention to acquire Laurion's Tisdale Properties in consideration for CAD$1,000,000 and 1,000,000 common shares of San Gold (collectively the "Purchase Price"). The Corporation will retain a 2% NSR on the North Tisdale Claims. A formal agreement will be entered into between Laurion and San Gold upon completion of standard due diligence, expected to take approximately 60 days. The completion of the proposed acquisition by San Gold is conditional upon both Laurion and San Gold receiving all necessary regulatory and corporate approvals.

Laurion's continuing vision is to realize shareholder value and wealth through monetization of its projects and potential discoveries through partnerships with significant players with ready capital and production expertise. San Gold is a strong partner in all these respects and a significant gold producer. As a San Gold shareholder, Laurion would become a stakeholder in one of Manitoba's largest gold producers. San Gold's shareholders have been rewarded with progressive share appreciation as the company has advanced the development of the high grade low-cost Hinge deposit.

The gold price trend is, and has been, steadily moving upwards. The 250-day moving average price of gold has defined the long term trend and, following one consolidation after another, new highs have been the order of the day. The markets remain bullish for gold, and so have been rewarding low-cost gold producers.

As a potential stakeholder in San Gold (the production company), Laurion (the exploration company) will be better positioned to generate greater shareholder value by directing its exploration expertise towards near-term production gold mining properties, versus grass roots properties. Although Laurion's primary exploration focus will be the identification of gold deposits, its exploration horizon will also encompass base metals and PGEs. Laurion is actively pursuing and assessing viable prospective projects.

About Laurion Mineral Exploration Inc.

Laurion is an exploration specialist company with key interests in highly prospective properties in Ontario as follows:

a. a 100% interest in 35 patented gold mineral claims located in the Geraldton-Beardmore Gold Camp, 120 km northeast of Thunder Bay;

b. a 100% interest in 55 unpatented base metal mining claims (589 units) in Fortune, Enid-Massey, Cote and Turnbull Townships (9,542 hectares) all located in Ontario;

c. 100% interest in 4 unpatented base metal mining claims (52 units) in Clary Township located 50 km west of the town of Temagami and 105km north west of North Bay, Ontario; and,

d. five groups of base metal claims located within Ontario known as (i) the Midlothian project and (ii) the Raymond project, each located in the Gowganda Area, (iii) the Fox Mountain property, (iv) the Graydon Lake property and (v) the Dorothea project all located in the Nipigon Area (collectively the "Alliance Projects"). The Alliance Projects are owned 51% by Laurion and 49% by Kiska Metals Corporation.

Laurion recently completed two diamond drill holes on the Midlothian project to test two conductor targets revealed through a geophysical re-interpretation of the VTEM data from the heliborne survey conducted in spring 2008.

FOR FURTHER INFORMATION, CONTACT:

Laurion Mineral Exploration Inc.

Cynthia Le Sueur-Aquin - President

Tel: 1-705-788-9186 -- Fax: 1-705-788-9187 - Website: www.laurion.ca

CHF Investor Relations

Jeanny So - Director of Operations

Email: jeanny@chfir.com

Tel: (416) 868-1079 x 225 - Website: www.chfir.com

To receive Company press releases, please email jeanny@chfir.com and mention "Laurion News" on the subject line.

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

You can view the Previous News Releases item: Thu Sep 10, 2009, Laurion Mineral Exploration Inc. Announces Warrant Extension And Repricing For The October 2007 Financing

RT...cad 0,065

...und HIER ne übersicht der für MICH ausgesprochen

reizvollen projects........allesamt in CAN !!!

http://www.laurion.ca/s/Projects.asp

reizvollen projects........allesamt in CAN !!!

http://www.laurion.ca/s/Projects.asp

schlossen handel gestern mit nachfolg. trades........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:24:27 V 0.065 - 17,000 85 Scotia 85 Scotia K

15:15:43 V 0.065 - 10,000 19 Desjardins 36 Latimer K

15:05:55 V 0.065 - 10,000 19 Desjardins 2 RBC K

14:45:42 V 0.065 - 10,000 19 Desjardins 7 TD Sec K

14:45:42 V 0.065 - 16,000 19 Desjardins 7 TD Sec K

14:31:55 V 0.065 - 4,000 19 Desjardins 7 TD Sec K

14:31:55 V 0.065 - 1,000 19 Desjardins 7 TD Sec K

13:07:59 V 0.065 - 19,000 19 Desjardins 2 RBC K

13:07:59 V 0.065 - 8,000 7 TD Sec 2 RBC K

10:57:54 V 0.065 - 250 89 Raymond James 79 CIBC E

...denke mal, daß int. von der seitenlinie NICHT mehr lange

mit zustieg warten sollten

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:24:27 V 0.065 - 17,000 85 Scotia 85 Scotia K

15:15:43 V 0.065 - 10,000 19 Desjardins 36 Latimer K

15:05:55 V 0.065 - 10,000 19 Desjardins 2 RBC K

14:45:42 V 0.065 - 10,000 19 Desjardins 7 TD Sec K

14:45:42 V 0.065 - 16,000 19 Desjardins 7 TD Sec K

14:31:55 V 0.065 - 4,000 19 Desjardins 7 TD Sec K

14:31:55 V 0.065 - 1,000 19 Desjardins 7 TD Sec K

13:07:59 V 0.065 - 19,000 19 Desjardins 2 RBC K

13:07:59 V 0.065 - 8,000 7 TD Sec 2 RBC K

10:57:54 V 0.065 - 250 89 Raymond James 79 CIBC E

...denke mal, daß int. von der seitenlinie NICHT mehr lange

mit zustieg warten sollten

Antwort auf Beitrag Nr.: 38.178.439 von hbg55 am 14.10.09 19:33:39

...mal ein int. SH- beitrag dazu..........

Nice Area Play and Gold Investment Play

I bought a few shares as an area play when Kodiak was hot a couple years ago... I just relooked at the properties etc and see what I liked.. They have a nice group of properties in the Beardmore/Geraldton area and even more properties in the Timmins area..

They could sell off some properties like they are doing now (and get almost their maket cap back) or be used as an area play in either location. As gold heats up the Timmins area, you will have the speculators looking for low priced stocks to push..

They will be an area play company with a million shares of San Gold (currently 3.24 per share..)...

I'm going to keep this one on my radar..

...mal ein int. SH- beitrag dazu..........

Nice Area Play and Gold Investment Play

I bought a few shares as an area play when Kodiak was hot a couple years ago... I just relooked at the properties etc and see what I liked.. They have a nice group of properties in the Beardmore/Geraldton area and even more properties in the Timmins area..

They could sell off some properties like they are doing now (and get almost their maket cap back) or be used as an area play in either location. As gold heats up the Timmins area, you will have the speculators looking for low priced stocks to push..

They will be an area play company with a million shares of San Gold (currently 3.24 per share..)...

I'm going to keep this one on my radar..

Laurion Mineral Exploration Inc. Receives TSX Venture Exchange Approval for the Sale of the Tisdale Properties

8:30 AM ET, October 16, 2009

TORONTO, ONTARIO, Oct 16, 2009 (Marketwire via COMTEX)

-- Laurion Mineral Exploration Inc. ("Laurion") (LME) is pleased to report that it has received conditional approval from the TSX Venture Exchange for the proposed acquisition by San Gold Corporation ("San Gold") with respect to the purchase of Laurion's property interests in the Tisdale Township (collectively the "Tisdale Properties"), which is composed of Laurion's 31.5% interest in the Davidson-Tisdale property and Laurion's 100% interest in the North Tisdale property.

On October 8, 2009, Laurion and San Gold announced that they had entered in to an Letter of Intent confirming San Gold's intension to acquire Laurion's Tisdale Properties in exchange in consideration of CAD$1,000,000 and 1,000,000 common shares of San Gold (collectively the "Purchase Price"). The Corporation will retain a 2% NSR on the North Tisdale Claims. A formal agreement will be entered into between Laurion and San Gold upon completion of standard due diligence, expected to take approximately 60 days.

Laurion intends to use the proceeds of the sale of the Tisdale Properties for the acquisition of an advanced stage project. Laurion considers that it will be better positioned to generate greater shareholder value by directing its exploration expertise towards near-term production gold mining properties, versus grass roots properties.

About Laurion Mineral Exploration Inc.

Laurion is an exploration specialist company with key interests in highly prospective properties in Ontario. Laurion's primary exploration focus will be the identification of gold deposits; its exploration horizon will also encompass base metals and PGEs.

To receive Company press releases, please email jeanny@chfir.com and mention "Laurion News" on the subject line.

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

Laurion - Issued and Outstanding Common Shares - 66,043,683

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc.

Cynthia Le Sueur-Aquin

President

1-705-788-9186

1-705-788-9187 (FAX)

www.laurion.ca

CHF Investor Relations

Jeanny So

Director of Operations

(416) 868-1079 x 225

jeanny@chfir.com

www.chfir.com

Copyright (C) 2009 Marketwire. All rights reserved.

Antwort auf Beitrag Nr.: 38.193.679 von hbg55 am 16.10.09 14:57:23

...darauf haben die börsianer gewartet.....kurs hebt UPPPPP

Time Ex Price Change Volume Buyer Seller Markers

09:31:04 V 0.075 +0.01 10,000 7 TD Sec 7 TD Sec K

09:31:04 V 0.075 +0.01 25,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 500 89 Raymond James 79 CIBC E

09:30:00 V 0.07 +0.005 4,000 19 Desjardins 1 Anonymous K

09:30:00 V 0.07 +0.005 13,000 79 CIBC 79 CIBC K

09:30:00 V 0.07 +0.005 10,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 14,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 20,000 7 TD Sec 7 TD Sec KL

...darauf haben die börsianer gewartet.....kurs hebt UPPPPP

Time Ex Price Change Volume Buyer Seller Markers

09:31:04 V 0.075 +0.01 10,000 7 TD Sec 7 TD Sec K

09:31:04 V 0.075 +0.01 25,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 500 89 Raymond James 79 CIBC E

09:30:00 V 0.07 +0.005 4,000 19 Desjardins 1 Anonymous K

09:30:00 V 0.07 +0.005 13,000 79 CIBC 79 CIBC K

09:30:00 V 0.07 +0.005 10,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 14,000 7 TD Sec 7 TD Sec K

09:30:00 V 0.07 +0.005 20,000 7 TD Sec 7 TD Sec KL

Antwort auf Beitrag Nr.: 38.193.679 von hbg55 am 16.10.09 14:57:23....üüüübrigens.......die restl. 68,5 % an diesem projekt liegen

bei VG GOLD, die den geplatnen zustieg von SGR mit ´freuden´

kommentieren.......

October 13, 2009, Toronto, Ontario VG Gold Corp., (TSX:VG), (FRANKFURT:VN3), is pleased that San Gold Corporation has signed a Letter of Intent to acquire Laurion Minerals’ 31.5% interest in the Davidson-Tisdale project located in Timmins, Ontario, as announced on October 8, 2009.

VG Gold owns 68.5% of Davidson-Tisdale, one of four key properties that VG Gold holds in the Timmins Camp.

http://www.vggoldcorp.com/pressreleases/09/10132009.pdf

...mit diesem finanzstarken partner sollte eine zügige weiterentwicklung des int. proj. gewährleistet sein

bei VG GOLD, die den geplatnen zustieg von SGR mit ´freuden´

kommentieren.......

October 13, 2009, Toronto, Ontario VG Gold Corp., (TSX:VG), (FRANKFURT:VN3), is pleased that San Gold Corporation has signed a Letter of Intent to acquire Laurion Minerals’ 31.5% interest in the Davidson-Tisdale project located in Timmins, Ontario, as announced on October 8, 2009.

VG Gold owns 68.5% of Davidson-Tisdale, one of four key properties that VG Gold holds in the Timmins Camp.

http://www.vggoldcorp.com/pressreleases/09/10132009.pdf

...mit diesem finanzstarken partner sollte eine zügige weiterentwicklung des int. proj. gewährleistet sein

Antwort auf Beitrag Nr.: 38.205.556 von hbg55 am 19.10.09 14:30:20

...für MICH erstaunlich, daß kurs bislang soooo wenig darauf reagierte....evtl. ja mit beginn der neuen börsenwoche

...für MICH erstaunlich, daß kurs bislang soooo wenig darauf reagierte....evtl. ja mit beginn der neuen börsenwoche

Antwort auf Beitrag Nr.: 38.205.575 von hbg55 am 19.10.09 14:34:26

...ein SH- user komm. status ähnlich.......

Market cap

Market cap LME @ 6c is $4 mln

SGR deal value @ $3 per share is $4 mln

The rest of the properties is for FREE:

Sturgeon River Mine free of charge, you get it for nothing.....how much should it be i don't know but more for sure.

Take a look at the neighbours market cap:

ONT $34 mln

RMK $39 mln

KXL $51 mln

How on earth can this mine go for free?????????

Gowganda Project #1 - The Midlothian Property a nickel property for free

A similar property HNC goes for a $15 mln market cap

Nipigon, Enid-Massey and Clary go for zilch, for nada, for FREE

How could LME be so undervalued???????????

...ein SH- user komm. status ähnlich.......

Market cap

Market cap LME @ 6c is $4 mln

SGR deal value @ $3 per share is $4 mln

The rest of the properties is for FREE:

Sturgeon River Mine free of charge, you get it for nothing.....how much should it be i don't know but more for sure.

Take a look at the neighbours market cap:

ONT $34 mln

RMK $39 mln

KXL $51 mln

How on earth can this mine go for free?????????

Gowganda Project #1 - The Midlothian Property a nickel property for free

A similar property HNC goes for a $15 mln market cap

Nipigon, Enid-Massey and Clary go for zilch, for nada, for FREE

How could LME be so undervalued???????????

mit heutiger news erwacht unser baby.....bzw weckt stark

zunehmendes interesse.......

Laurion Mineral 11,285,150 warrants extended

2009-11-03 18:06 ET - Miscellaneous

The TSX Venture Exchange has consented to the extension in the expiry date of the following warrants.

Private placement

Number of warrants: 11,285,150

Original expiry date of warrants: Nov. 16, 2009

New expiry date of warrants: Nov. 16, 2010

Exercise price of warrants: 20 cents

zunehmendes interesse.......

Laurion Mineral 11,285,150 warrants extended

2009-11-03 18:06 ET - Miscellaneous

The TSX Venture Exchange has consented to the extension in the expiry date of the following warrants.

Private placement

Number of warrants: 11,285,150

Original expiry date of warrants: Nov. 16, 2009

New expiry date of warrants: Nov. 16, 2010

Exercise price of warrants: 20 cents

Antwort auf Beitrag Nr.: 38.320.175 von hbg55 am 04.11.09 17:41:30

sind inzwischen kurz vor 2,5mios vol..........

Time Ex Price Change Volume Buyer Seller Markers

12:07:05 V 0.06 +0.01 20,000 7 TD Sec 7 TD Sec K

12:07:05 V 0.06 +0.01 39,000 7 TD Sec 1 Anonymous K

12:07:05 V 0.06 +0.01 1,000 7 TD Sec 36 Latimer K

11:57:52 V 0.06 +0.01 49,000 27 Dundee 36 Latimer K

11:51:21 V 0.06 +0.01 5,000 7 TD Sec 36 Latimer K

11:47:50 V 0.06 +0.01 45,000 7 TD Sec 36 Latimer K

11:47:50 V 0.06 +0.01 14,000 7 TD Sec 79 CIBC K

11:47:50 V 0.06 +0.01 20,000 7 TD Sec 124 Questrade K

11:47:50 V 0.06 +0.01 1,000 7 TD Sec 99 Jitney K

11:47:50 V 0.06 +0.01 20,000 7 TD Sec 124 Questrade K

sind inzwischen kurz vor 2,5mios vol..........

Time Ex Price Change Volume Buyer Seller Markers

12:07:05 V 0.06 +0.01 20,000 7 TD Sec 7 TD Sec K

12:07:05 V 0.06 +0.01 39,000 7 TD Sec 1 Anonymous K

12:07:05 V 0.06 +0.01 1,000 7 TD Sec 36 Latimer K

11:57:52 V 0.06 +0.01 49,000 27 Dundee 36 Latimer K

11:51:21 V 0.06 +0.01 5,000 7 TD Sec 36 Latimer K

11:47:50 V 0.06 +0.01 45,000 7 TD Sec 36 Latimer K

11:47:50 V 0.06 +0.01 14,000 7 TD Sec 79 CIBC K

11:47:50 V 0.06 +0.01 20,000 7 TD Sec 124 Questrade K

11:47:50 V 0.06 +0.01 1,000 7 TD Sec 99 Jitney K

11:47:50 V 0.06 +0.01 20,000 7 TD Sec 124 Questrade K

Laurion Mineral Exploration Inc. - Issuance of stock options

2:06 PM ET, November 20, 2009

TORONTO, Nov. 20, 2009 (Canada NewsWire via COMTEX) --

Laurion - Issued and Outstanding Common Shares - 66,043,683

-----------------------------------------------------------

Laurion Mineral Exploration Inc. (TSXV: LME) (the "Corporation") is announcing that it has granted a total of 1,350,000 stock options (the "Options") to its board of directors (the "Board"). The Corporation's Compensation Committee issued the Options to the Board as compensation for each directors' respective contributions to the Corporation over the last year.

The Options have a five year term and an exercise price of $0.10. Forty-percent (40%) of the Options vested immediately, thirty-percent (30%) will vest on the first anniversary of their date of grant and the remaining thirty-percent (30%) will vest on the second anniversary of their date of grant. The Options were granted on November 19, 2009.

About Laurion Mineral Exploration Inc.

Laurion is an exploration company with key interests in highly prospective properties in Ontario. Laurion's primary exploration focus will be the identification of gold deposits; its exploration horizon will also encompass base metals and PGEs.

"Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc., Cynthia Le Sueur-Aquin - President, Tel: (705)

788-9186, Fax: (705) 788-9187, Website: www.laurion.ca; CHF Investor Relations,

Jeanny So - Director of Operations, Email: jeanny@chfir.com, Tel: (416) 868-1079 x

225, Website: www.chfir.com; To receive Company press releases, please email

jeanny@chfir.com and mention "Laurion News" on the subject line.

Copyright (C) 2009 CNW Group. All rights reserved.

Antwort auf Beitrag Nr.: 38.434.131 von hbg55 am 22.11.09 19:13:37

mit dieser meldung im rücken, sehen wir lebhaften handel

zum wochenauftakt.......

mit dieser meldung im rücken, sehen wir lebhaften handel

zum wochenauftakt.......

Antwort auf Beitrag Nr.: 38.440.257 von hbg55 am 23.11.09 19:05:41

...und mit anstieg des GOLD- preises sowie des 1mio- SGR- anteils

(siehe #1 ) dürften wir alsbald den 0,10ner- widerstand hinter

uns lassen

...und mit anstieg des GOLD- preises sowie des 1mio- SGR- anteils

(siehe #1 ) dürften wir alsbald den 0,10ner- widerstand hinter

uns lassen

Antwort auf Beitrag Nr.: 38.440.286 von hbg55 am 23.11.09 19:09:53

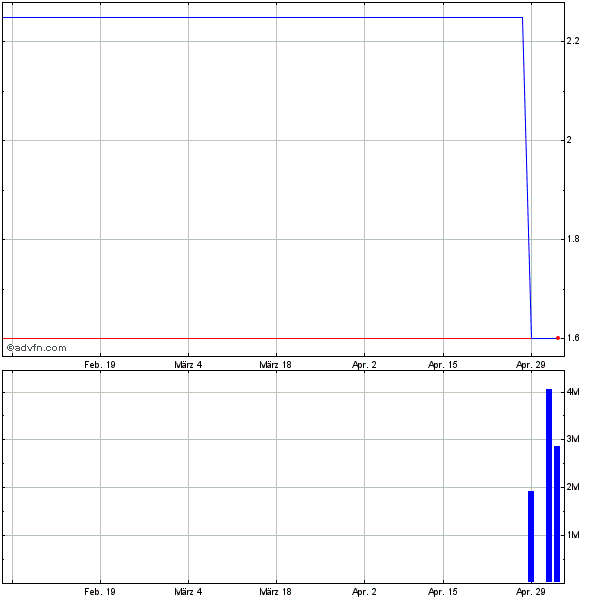

...nur allein der SGR- anteil hat akt. schon

nen wert von cad-mios 3,83

diese entwicklung ist erstaunlicherweise beim LME- kurs

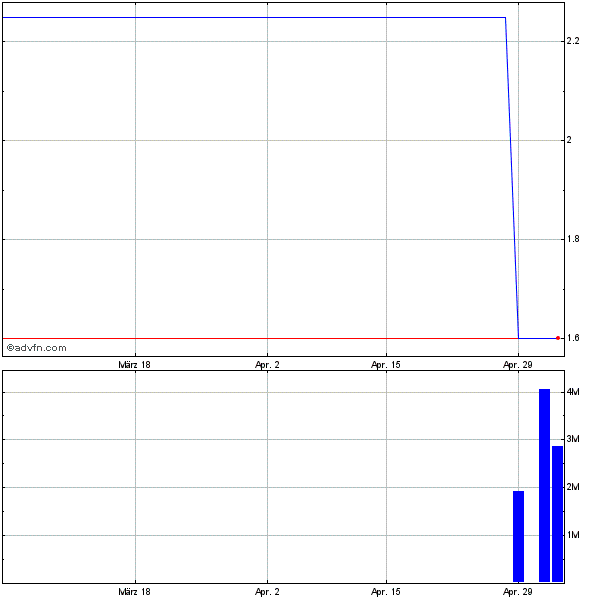

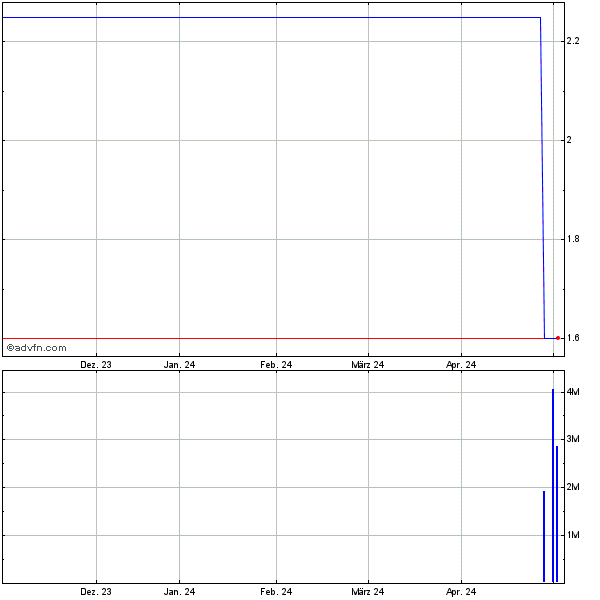

noch kaum nachgebildet wie nachfolg. monats- chart zeigt....

denke mal, nicht mehr lange !!!!

...nur allein der SGR- anteil hat akt. schon

nen wert von cad-mios 3,83

diese entwicklung ist erstaunlicherweise beim LME- kurs

noch kaum nachgebildet wie nachfolg. monats- chart zeigt....

denke mal, nicht mehr lange !!!!

Antwort auf Beitrag Nr.: 38.444.936 von hbg55 am 24.11.09 13:57:36

...JETZT hat SGR- anteil schon nen wert von 4,1 cadmios

GOLD- preis inzwischen auf usd 1215,15 gesprungen

...JETZT hat SGR- anteil schon nen wert von 4,1 cadmios

GOLD- preis inzwischen auf usd 1215,15 gesprungen

Antwort auf Beitrag Nr.: 38.495.597 von hbg55 am 02.12.09 16:34:05

....welch ein SCHNÄPPCHEN - nur allein der SGR- besitz

hat damit schon nen höheren wert als die akt. MK unsres

babys von grad mal cadmios 3,63

....welch ein SCHNÄPPCHEN - nur allein der SGR- besitz

hat damit schon nen höheren wert als die akt. MK unsres

babys von grad mal cadmios 3,63

Antwort auf Beitrag Nr.: 38.495.729 von hbg55 am 02.12.09 16:45:46

...mit heutiger meldung wird das aussichtsreiche invest

auch von einer breiteren masse offenbar ´entdeckt´....

TORONTO, Jan. 22, 2010 (Canada NewsWire via COMTEX) -- Issued and Outstanding Common Shares - 66,043,683

Laurion Mineral Exploration Inc. ("Laurion") is pleased to announce the closing of the sale of all of its property interests (the "Assets") in the Tisdale Township, Ontario, to San Gold Corporation ("San Gold") further to the agreement reached with San Gold and press released on October 8, 2009.

The Assets sold to San Gold consist of Laurion's 31.5% interest in the Davidson-Tisdale property (the remaining 68.5% being owned by VG Gold Corp. (VG: TSX)), its 100% interest in the North Tisdale property and the surface rights owned by Laurion related thereto.

In consideration for the sale of the Assets to San Gold, Laurion received cash compensation of $1,000,000 and 1,000,000 common shares in the capital of San Gold, which is being held in escrow, and also retained a 2% net smelter royalty on the North Tisdale property. The transaction remains subject to the satisfaction of certain conditions, including the final approval of the TSX Venture Exchange and the registration of applicable transfers. The consideration will be released from escrow upon the satisfaction of such conditions.

Laurion intends to use the proceeds of the sale to aggressively pursue suitable mineral property acquisitions.

About Laurion Mineral Exploration Inc.

The Corporation is an exploration specialist company with key interests in highly prospective properties in Ontario. The Corporation's primary exploration focus is the identification of gold deposits; its exploration horizon will also encompass base metals and PGEs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc., Cynthia Le Sueur-Aquin - President, Tel: (705)

788-9186, Fax: (705) 788-9187, Website: www.laurion.ca

Copyright (C) 2010 CNW Group. All rights reserved.

...mit heutiger meldung wird das aussichtsreiche invest

auch von einer breiteren masse offenbar ´entdeckt´....

TORONTO, Jan. 22, 2010 (Canada NewsWire via COMTEX) -- Issued and Outstanding Common Shares - 66,043,683

Laurion Mineral Exploration Inc. ("Laurion") is pleased to announce the closing of the sale of all of its property interests (the "Assets") in the Tisdale Township, Ontario, to San Gold Corporation ("San Gold") further to the agreement reached with San Gold and press released on October 8, 2009.

The Assets sold to San Gold consist of Laurion's 31.5% interest in the Davidson-Tisdale property (the remaining 68.5% being owned by VG Gold Corp. (VG: TSX)), its 100% interest in the North Tisdale property and the surface rights owned by Laurion related thereto.

In consideration for the sale of the Assets to San Gold, Laurion received cash compensation of $1,000,000 and 1,000,000 common shares in the capital of San Gold, which is being held in escrow, and also retained a 2% net smelter royalty on the North Tisdale property. The transaction remains subject to the satisfaction of certain conditions, including the final approval of the TSX Venture Exchange and the registration of applicable transfers. The consideration will be released from escrow upon the satisfaction of such conditions.

Laurion intends to use the proceeds of the sale to aggressively pursue suitable mineral property acquisitions.

About Laurion Mineral Exploration Inc.

The Corporation is an exploration specialist company with key interests in highly prospective properties in Ontario. The Corporation's primary exploration focus is the identification of gold deposits; its exploration horizon will also encompass base metals and PGEs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc., Cynthia Le Sueur-Aquin - President, Tel: (705)

788-9186, Fax: (705) 788-9187, Website: www.laurion.ca

Copyright (C) 2010 CNW Group. All rights reserved.

Laurion Announces Satisfaction of Conditions of Sale of Tisdale Properties to San Gold Corporation

10:02 AM ET, January 28, 2010

TORONTO, Jan. 28, 2010 (Canada NewsWire via COMTEX) -- Issued and Outstanding Common Shares - 66,043,683

Laurion Mineral Exploration Inc. ("Laurion") is pleased to announce the satisfaction of the conditions to the closing of the sale of its property interests (the "Assets") in the Tisdale Township, Ontario, to San Gold Corporation ("San Gold"), which closing was announced on January 21, 2010.

The Assets sold to San Gold consist of Laurion's 31.5% interest in the Davidson-Tisdale property (the remaining 68.5% being owned by VG Gold Corp. (VG: TSX)), its 100% interest in the North Tisdale property and the surface rights owned by Laurion related thereto.

In consideration for the sale of the Assets to San Gold, Laurion received cash compensation of $1,000,000 and 1,000,000 common shares in the capital of San Gold, which consideration was released from escrow, and also retained a 2% net smelter royalty on the North Tisdale property.

Laurion intends to use the proceeds of the sale to pursue mineral property acquisitions.

About Laurion Mineral Exploration Inc.

The Corporation is an exploration specialist company with key interests in highly prospective properties in Ontario. The Corporation's primary exploration focus is the identification of gold deposits; its exploration horizon will also encompass base metals and PGEs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release"

This news release includes certain forward-looking statements concerning the future performance of Laurion's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion cautions against placing undue reliance thereon. Neither Laurion nor its management assumes any obligation to revise or update these forward-looking statements.

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc., Cynthia Le Sueur-Aquin - President, Tel: (705)

788-9186, Fax: (705) 788-9187, Website: www.laurion.ca

Copyright (C) 2010 CNW Group. All rights reserved.

.....da heißts zeitig sich welche ins depot zu legen, um

später nicht nur ´zuschauen´ zu müssen

Antwort auf Beitrag Nr.: 38.867.724 von hbg55 am 02.02.10 22:12:35

....dazu mal 4 int. gesichtspunkte eines SH- users.........

First, Gold is up from the 1070.$ floor to 1110.$, out of the grey area and US$ reversing its course on a new down trend.

Second, Kodiac is to release soon drilling program on the Brenbar project 500 meters from Laurion's

100% owned Sturgeon River property.From last friday Kodiac news;

Details for upcoming drilling and exploration Kaby Lake, Brenbar and Sturgeon Bridge will be announced soon.

And from Kodiac last september news;

At the Brenbar project, located approximately 13 kilometres southwest of the Golden Mile, recent drilling intersected high grade gold mineralization associated with another large district-scale shear zone: Drill hole BB09-01 intersected 1.7 metres grading 10.35 gpt gold (0.30 opt) including 0.5 metres grading 32 gpt gold (0.93 opt). Additional drilling will begin shortly. The proximity of this high grade gold zone to the Golden Mile and Hercules project underscores the significance of this intercept: Discovery of a gold resource at Brenbar would compliment and enhance the economic potential of the Hercules project

Third; San Gold moving up with the POG, plus with two new discovery, like the double O7,

Fourth; Laurion has 66 millions s/o, with 7 millions shares owned by the insiders, so

there's 59 millions shares for trading.

The ASK at .065 with 1.6 millions is impressive, but it is the usual market action to try

to buy more at .06, I see it as a good sign from the market that it finally realise the up

side potential of LME. Probably there's a fake ask of one million shares..

....dazu mal 4 int. gesichtspunkte eines SH- users.........

First, Gold is up from the 1070.$ floor to 1110.$, out of the grey area and US$ reversing its course on a new down trend.

Second, Kodiac is to release soon drilling program on the Brenbar project 500 meters from Laurion's

100% owned Sturgeon River property.From last friday Kodiac news;

Details for upcoming drilling and exploration Kaby Lake, Brenbar and Sturgeon Bridge will be announced soon.

And from Kodiac last september news;

At the Brenbar project, located approximately 13 kilometres southwest of the Golden Mile, recent drilling intersected high grade gold mineralization associated with another large district-scale shear zone: Drill hole BB09-01 intersected 1.7 metres grading 10.35 gpt gold (0.30 opt) including 0.5 metres grading 32 gpt gold (0.93 opt). Additional drilling will begin shortly. The proximity of this high grade gold zone to the Golden Mile and Hercules project underscores the significance of this intercept: Discovery of a gold resource at Brenbar would compliment and enhance the economic potential of the Hercules project

Third; San Gold moving up with the POG, plus with two new discovery, like the double O7,

Fourth; Laurion has 66 millions s/o, with 7 millions shares owned by the insiders, so

there's 59 millions shares for trading.

The ASK at .065 with 1.6 millions is impressive, but it is the usual market action to try

to buy more at .06, I see it as a good sign from the market that it finally realise the up

side potential of LME. Probably there's a fake ask of one million shares..

....da wird HEUTE, trotz tiefroten gesamtmarkts, schön

zugeschanppt.......

Recent Trades - Last 10 of 16

Time ET Ex Price Change Volume Buyer Seller Markers

11:41:02 V 0.06 0.00 4,000 7 TD Sec 89 Raymond James K

11:40:47 V 0.06 0.00 1,000 7 TD Sec 89 Raymond James K

11:40:36 V 0.06 0.00 572 89 Raymond James 79 CIBC E

11:37:52 V 0.06 0.00 30,000 2 RBC 1 Anonymous K

11:33:53 V 0.06 0.00 98,000 2 RBC 79 CIBC K

11:33:53 V 0.06 0.00 19,000 2 RBC 19 Desjardins K

11:33:53 V 0.06 0.00 5,000 2 RBC 2 RBC K

11:33:53 V 0.06 0.00 28,000 2 RBC 2 RBC K

11:26:38 V 0.055 -0.005 500 89 Raymond James 124 Questrade E

11:26:38 V 0.055 -0.005 6,000 2 RBC 124 Questrade K

Laurion and Stroud Announce the Execution of a Letter of Intent for Option on Stroud's Leckie Lake Gold Property

9:00 AM ET, February 5, 2010

TORONTO, Feb. 5, 2010 (Canada NewsWire via COMTEX) -- Laurion Mineral Exploration Inc. (TSXV: LME) ("Laurion") and Stroud Resources Ltd. (TSXV: SDR) ("Stroud") are pleased to announce that they have executed a Letter of Intent ("LOI") for Laurion to receive an option to acquire up to 60% of the mineral rights of Stroud's undivided 100% legal interest in the Leckie Lake Gold Property (the "Property"), located 3 kilometres north of Temagami, Ontario.

The LOI contemplates that a definitive option agreement (the "Option Agreement") incorporating the LOI terms shall be completed and executed within 39 days of the date of execution of the LOI subject to Laurion completing due diligence to its satisfaction and both parties obtaining all necessary corporate and regulatory approvals, including the approval of the TSX Venture Exchange.

The LOI states that Laurion can acquire a 50% legal and beneficial interest in the mineral rights of the Property by making cash and share payments and incurring exploration expenditures totaling $2,850,000 (collectively, the "Initial Expenditures") over a 36 month period from the proposed closing date (the "Closing Date"). On the Closing Date, and included within the Initial Expenditures, Laurion would be required to make a cash payment of $25,000 and issue $50,000 worth of Laurion common shares.

The LOI further states that if Laurion obtains a 50% interest in the Property by completing the Initial Expenditures as contemplated above, Laurion shall have the option to increase its legal and beneficial interest in the Property from 50% to 60% upon Laurion making an additional payment of $1,000,000 within 9 months of the Closing Date.

The LOI further contemplates that Laurion will complete a NI 43-101 Technical Report on the Property within 180 days of the Closing Date and will be the Operator of the Property during the Option earn-in period and that if Laurion exercises its option to acquire a 50% legal interest in the Property pursuant to the Option Agreement, exploration of the Property will proceed by way of a joint venture between Laurion and Stroud.

Leckie Lake Gold Property

The Property is located in the Township of Strathy approximately 3 kilometres north of the town of Temagami, Ontario. Access to the Property is by Highway 11.

The Property consists of 12 contiguous claims, which cover an area of approximately 192 hectares.

The No. 1 zone on the Property is a steeply dipping fracture system that has been intensely altered by carbonates and quartz-rich fluids. Minor amounts of zinc, silver and copper are also present. Gold mineralization in the No. 1 zone is open along strike and at depth. A two-compartment shaft was sunk to 525 feet on the No. 1 zone and levels were established at 100 feet, 200 feet, 300 feet, 400 feet and 500 feet below surface.

The No. 2 zone on the Property is much less explored and is located west of the No. 1 zone. This zone joins with the No. 1 zone at depth and is also intensely altered. The No. 1 zone has been traced down to a depth of 750 feet. In addition, prospecting has uncovered seven additional gold showings.

The Property has been essentially dormant since 1996, when Stroud and Lacana Mining Corporation (which subsequently became Homestake Canada Inc. and is now a subsidiary of Barrick Gold Corporation), in a joint venture, carried out work including prospecting, geophysics and 63,483 feet of drilling on the Property between 1985 and 1996.

The Property is underlain by Archean mafic volcanics. The major structural feature is an east-northeast trending syncline. The Property is located on its northern limb. Gold mineralization discovered to date is within shear zones striking N30degreesW, subnormal to the regional strike. Alteration within the shear zones is essentially a broad zone of carbonatization surrounding silicification that hosts the quartz veins, sulphides (sphalerite, chalcopyrite, pyrite, and arsenopyrite) and gold mineralization.

George Coburn P.Geo., President and CEO of Stroud, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed the scientific and technical information concerning the Property contained in this news release.

About Stroud Resources Ltd.

Stroud is a junior resource company involved in the acquisition, exploration and development of mineral properties. Stroud holds a 3.75% interest in six natural gas and gas condensate wells and has two gold properties in Ontario Canada. Stroud is focusing its exploration activities on the Santo Domingo epithermal silver-gold project in Jalisco, Mexico.

About Laurion Mineral Exploration Inc.

Laurion is an exploration specialist company with key interests in highly prospective mining properties located in Ontario. Laurion's primary exploration focus is the identification of gold deposits; its exploration horizon also encompasses base metals and PGEs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain forward-looking statements concerning the future performance of Laurion's and Stroud's business, operations and financial performance and condition, as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and Laurion and Stroud caution against placing undue reliance thereon. Neither Laurion, Stroud nor their respective management assume any obligation to revise or update these forward-looking statements.

SOURCE: Laurion Mineral Exploration Inc.

Laurion Mineral Exploration Inc., Cynthia Le Sueur-Aquin - President, Tel: (705)

788-9186, Fax: (705) 788-9187, Website: www.laurion.ca; Stroud Resources Ltd., Mr.

George Coburn, President and CEO, Tel: (416) 362-4126, E-mail:

gcoburn@stroudresourcesltd.com, Website: www.stroudresourcesltd.com

Copyright (C) 2010 CNW Group. All rights reserved.

moin h5

da wollen wir doch mal abwarten und viiiiel tee trinken

da wollen wir doch mal abwarten und viiiiel tee trinken

Antwort auf Beitrag Nr.: 38.988.145 von runn64 am 22.02.10 19:18:21...hier, guck mal.....

...denke, daß wir da mit nem gewissen antrieb rechnen dürfen !!!

hat ja eine ähnliche konstruktion mit SGR wie wir sie von

GQ/ AVR schon kennen

...denke, daß wir da mit nem gewissen antrieb rechnen dürfen !!!

hat ja eine ähnliche konstruktion mit SGR wie wir sie von

GQ/ AVR schon kennen

Share Structure – March 2010

Shares Outstanding: 66 million

Market Cap: $ 3.963 million

Fully Diluted: 82.5 million

Options: 3,030,000

Warrants: 13,459,062

Insider Ownership: 7.67 million

...weitere infos auf akt. fact sheet.......

http://www.laurion.ca/i/pdf/FactSheet.pdf

Shares Outstanding: 66 million

Market Cap: $ 3.963 million

Fully Diluted: 82.5 million

Options: 3,030,000

Warrants: 13,459,062

Insider Ownership: 7.67 million

...weitere infos auf akt. fact sheet.......

http://www.laurion.ca/i/pdf/FactSheet.pdf

Antwort auf Beitrag Nr.: 39.062.942 von hbg55 am 04.03.10 19:51:59ja die strukturellen ähnlichkeiten sind bemerkenswert

schauen wir mal ob in Toronto weitere schweeeere investoren

gefallen an LME finden

hätte wiiiiiirklich nichts dagegen

hastu du gesehen was bei maxivada los war...

schauen wir mal ob in Toronto weitere schweeeere investoren

gefallen an LME finden

hätte wiiiiiirklich nichts dagegen

hastu du gesehen was bei maxivada los war...

Antwort auf Beitrag Nr.: 39.064.934 von runn64 am 05.03.10 01:44:38

........hastu du gesehen was bei maxivada los war...

was war GRUND dafür ????

........hastu du gesehen was bei maxivada los war...

was war GRUND dafür ????

....so die 0,055 scheinen wech zu sein......

Time Ex Price Change Volume Buyer Seller Markers

13:28:44 V 0.055 +0.005 60,000 44 Jones Gable 7 TD Sec K

11:41:15 V 0.055 +0.005 62,000 44 Jones Gable 2 RBC K

11:37:16 V 0.055 +0.005 10,000 44 Jones Gable 85 Scotia K

11:12:05 V 0.055 +0.005 20,000 44 Jones Gable 7 TD Sec K

11:12:05 V 0.055 +0.005 40,000 44 Jones Gable 85 Scotia K

11:12:05 V 0.055 +0.005 30,000 44 Jones Gable 124 Questrade K

11:12:05 V 0.055 +0.005 6,000 44 Jones Gable 1 Anonymous K

10:49:39 V 0.055 +0.005 1,000 19 Desjardins 1 Anonymous K

10:32:37 V 0.05 - 300 89 Raymond James 85 Scotia E

10:32:37 V 0.05 - 91,000 2 RBC 85 Scotia KL

Time Ex Price Change Volume Buyer Seller Markers

13:28:44 V 0.055 +0.005 60,000 44 Jones Gable 7 TD Sec K

11:41:15 V 0.055 +0.005 62,000 44 Jones Gable 2 RBC K

11:37:16 V 0.055 +0.005 10,000 44 Jones Gable 85 Scotia K

11:12:05 V 0.055 +0.005 20,000 44 Jones Gable 7 TD Sec K

11:12:05 V 0.055 +0.005 40,000 44 Jones Gable 85 Scotia K

11:12:05 V 0.055 +0.005 30,000 44 Jones Gable 124 Questrade K

11:12:05 V 0.055 +0.005 6,000 44 Jones Gable 1 Anonymous K

10:49:39 V 0.055 +0.005 1,000 19 Desjardins 1 Anonymous K

10:32:37 V 0.05 - 300 89 Raymond James 85 Scotia E

10:32:37 V 0.05 - 91,000 2 RBC 85 Scotia KL

Antwort auf Beitrag Nr.: 39.066.056 von hbg55 am 05.03.10 09:35:52mexivada:

gute grades bei letzten bohrungen

ein partner scheint mehr als in sicht zu sein

aber überzeuge dich selbst zumal die liegenschaften Mexicio,Nevada,KONGO vielversprächend sind

nimm dir etwas zeit zu recherschieren

die Mcap ist auch recht klein

gute grades bei letzten bohrungen

ein partner scheint mehr als in sicht zu sein

aber überzeuge dich selbst zumal die liegenschaften Mexicio,Nevada,KONGO vielversprächend sind

nimm dir etwas zeit zu recherschieren

die Mcap ist auch recht klein

die goldkonferenz in Zürich am 13.04 könnte was in gang setzen,

denn.... San Gold ist dort vertreten von dennen Laurion

ja einige hällt

denn.... San Gold ist dort vertreten von dennen Laurion

ja einige hällt

Antwort auf Beitrag Nr.: 39.302.441 von runn64 am 09.04.10 14:00:12

....gaaaanz so ists - versuch noch über ein abstauber-limit

paaar st. einzusammeln

....gaaaanz so ists - versuch noch über ein abstauber-limit

paaar st. einzusammeln

Antwort auf Beitrag Nr.: 39.302.574 von hbg55 am 09.04.10 14:16:02

...heute allerdings OHNE erfolg.........

Recent Trades - All 8 today

Time ET Ex Price Change Volume Buyer Seller Markers

15:48:55 V 0.055 0.01 9,000 9 BMO Nesbitt 7 TD Sec K

15:48:55 V 0.055 0.01 11,000 9 BMO Nesbitt 124 Questrade K

15:31:00 V 0.055 0.01 19,000 1 Anonymous 124 Questrade K

14:54:47 V 0.05 0.005 20,000 9 BMO Nesbitt 7 TD Sec K

14:44:13 V 0.05 0.005 50,000 9 BMO Nesbitt 33 Canaccord K

14:35:18 V 0.05 0.005 5,000 9 BMO Nesbitt 33 Canaccord K

14:35:18 V 0.05 0.005 20,000 9 BMO Nesbitt 33 Canaccord K

10:43:47 V 0.05 0.005 80,000 9 BMO Nesbitt 7 TD Sec KL

...heute allerdings OHNE erfolg.........

Recent Trades - All 8 today

Time ET Ex Price Change Volume Buyer Seller Markers

15:48:55 V 0.055 0.01 9,000 9 BMO Nesbitt 7 TD Sec K

15:48:55 V 0.055 0.01 11,000 9 BMO Nesbitt 124 Questrade K

15:31:00 V 0.055 0.01 19,000 1 Anonymous 124 Questrade K

14:54:47 V 0.05 0.005 20,000 9 BMO Nesbitt 7 TD Sec K

14:44:13 V 0.05 0.005 50,000 9 BMO Nesbitt 33 Canaccord K

14:35:18 V 0.05 0.005 5,000 9 BMO Nesbitt 33 Canaccord K

14:35:18 V 0.05 0.005 20,000 9 BMO Nesbitt 33 Canaccord K

10:43:47 V 0.05 0.005 80,000 9 BMO Nesbitt 7 TD Sec KL

...und zum wochenstart sehen wir nen fetten mio- trade.....eigentlich

wenig überraschend auf akt. schnäppchen- level....

Recent Trades - Last 10 of 11

Time ET Ex Price Change Volume Buyer Seller Markers

12:20:11 V 0.05 -0.005 500 89 Raymond James 79 CIBC E

12:20:11 V 0.05 -0.005 1,000 2 RBC 79 CIBC K

10:12:01 V 0.05 -0.005 10,000 2 RBC 1 Anonymous K

10:08:01 V 0.055 0.00 1,000 7 TD Sec 1 Anonymous K

10:08:01 V 0.055 0.00 1,000 7 TD Sec 89 Raymond James K

10:08:01 V 0.055 0.00 10,000 7 TD Sec 2 RBC K

10:08:01 V 0.055 0.00 8,000 7 TD Sec 7 TD Sec K

09:58:45 V 0.05 -0.005 500 89 Raymond James 7 TD Sec E

09:58:45 V 0.05 -0.005 950,000 2 RBC 7 TD Sec K

09:30:00 V 0.045 0.00 500 89 Raymond James 7 TD Sec E

wenig überraschend auf akt. schnäppchen- level....

Recent Trades - Last 10 of 11

Time ET Ex Price Change Volume Buyer Seller Markers

12:20:11 V 0.05 -0.005 500 89 Raymond James 79 CIBC E

12:20:11 V 0.05 -0.005 1,000 2 RBC 79 CIBC K

10:12:01 V 0.05 -0.005 10,000 2 RBC 1 Anonymous K

10:08:01 V 0.055 0.00 1,000 7 TD Sec 1 Anonymous K

10:08:01 V 0.055 0.00 1,000 7 TD Sec 89 Raymond James K

10:08:01 V 0.055 0.00 10,000 7 TD Sec 2 RBC K

10:08:01 V 0.055 0.00 8,000 7 TD Sec 7 TD Sec K

09:58:45 V 0.05 -0.005 500 89 Raymond James 7 TD Sec E

09:58:45 V 0.05 -0.005 950,000 2 RBC 7 TD Sec K

09:30:00 V 0.045 0.00 500 89 Raymond James 7 TD Sec E

Antwort auf Beitrag Nr.: 39.318.164 von hbg55 am 12.04.10 19:57:43

RBC scheint auch gemerkt zu haben, daß akt. MK niedriger ist

als nur allein schon die bewertung des 1mio- pakets an SGR

...wer rechnen kann, sollte nicht zuuuuu lange warten, um

es denen nachzumachen !!!!

RBC scheint auch gemerkt zu haben, daß akt. MK niedriger ist

als nur allein schon die bewertung des 1mio- pakets an SGR

...wer rechnen kann, sollte nicht zuuuuu lange warten, um

es denen nachzumachen !!!!

Antwort auf Beitrag Nr.: 39.307.659 von hbg55 am 10.04.10 11:45:09und bist zum zuge gekommen!?

Antwort auf Beitrag Nr.: 39.335.452 von runn64 am 14.04.10 19:01:58

...neeee, leider ´noch´ nicht, aber evtl find ich ja noch

nen gönner

...neeee, leider ´noch´ nicht, aber evtl find ich ja noch

nen gönner

Antwort auf Beitrag Nr.: 39.335.587 von hbg55 am 14.04.10 19:21:48

...und das dürfte nach heutiger meldung von SGR noch

unwahrscheinlicher werden........hier schaut mal...

San Gold Drills High Grade in New RL East Zone Including 4.9 Meters of 319 g/tonne

2:28 PM ET, April 22, 2010

BISSETT, MB, Apr 22, 2010 (Marketwire via COMTEX) -- Dale Ginn, CEO of San Gold Corporation (SGR) (PINKSHEETS: SGRCF) (OTCQX: SGRCF), is pleased to report exceptionally encouraging results from underground exploration drilling following up on the recent discovery of multiple new zones beyond the eastern extremities of the Rice Lake mine (see press releases dated Jan 25 and March 31, 2010). These zones, collectively known as RL East display remarkable widths as well as grade, are hosted within structures that trend upwards toward the high grade 007 zone near surface. Drill hole #28-10-53 cut 121 g/tonne (3.53 oz/ton) over 13.3 meters (44 ft) and included an extremely high grade segment of 319 g/tonne (9.30 oz/ton) over 4.9 m (15.9 ft) containing coarse visible gold. Drill hole #28-10-80 encountered 5 individual zones within a wider mineralized section of 50 meters (164 ft) grading 4.8 g/tonne (0.14 oz/ton).

New intersections are tabulated below:

Gold g/tonne

Hole # From (m) To (m) Length m (ft) (oz/ton) Zone/Lens

--------- ---------- ------ ------------------- ------------------ ---------

28-10-53 118.6 131.9 13.3 43.6 120.9 3.53 RL East

including 122.2 127.1 4.9 15.9 318.5 9.30 RL East

28-10-80 123.6 173.7 50.0 164.1 4.8 0.14 RL East

including 123.6 126.4 2.8 9.1 12.3 0.36 98 FW

including 135.8 140.0 4.2 13.5 5.5 0.16 98 FW

including 148.9 150.4 1.5 5.0 33.9 0.99 RL East

including 161.4 164.0 2.6 8.3 19.5 0.57 RL East

including 168.7 172.3 3.6 11.8 7.9 0.23 New

26-10-57 296.3 298.3 2.0 6.6 74.0 2.16 RL East

and 306.2 307.6 1.4 4.6 22.9 0.67 New

26-10-61 297.5 300.8 3.3 10.8 7.9 0.23 RL East

and 303.5 306.2 2.7 8.7 6.6 0.19 New

reviously released intersections now known to be RL East zone:

28-10-51 162.1 170.3 8.2 26.9 37.0 1.08 RL East

including 165.8 170.2 4.4 14.4 67.1 1.96 RL East

including 166.7 168.7 2.0 6.6 140.4 4.10 RL East

26-10-60 318.9 323.0 4.1 13.5 23.0 0.67 RL East

26-09-35 339.5 360.9 21.4 70.2 12.3 0.36 RL East

including 343.5 345.9 2.4 7.9 56.2 2.35 RL East

ale Ginn, CEO, stated; "San Gold mine geologists have produced one of the most impressive intersections ever within Rice Lake. Taking into account that this is exploration drilling outside of known Rice Lake mine extents, these results are truly remarkable. The mining team's efforts are demonstrating that this mineralized system is linked to our new surface zones and that our geological model produces results at depth as well as near surface. We look forward to closing this gap and taking a broader approach to a mineralized system that is fast becoming much larger than a collection of individual deposits."

The RL East and 98 zones are located along east-west shear structures that obliquely cross cut the Rice Lake mine host unit and extend into the hanging wall volcanic rocks that host the new near surface zones (Hinge, 007, L13 and Cohiba). The RL East zone is located approximately 150 meters (500 feet) to the east of the high grade "98" vein area currently under development and is beyond the recently discovered 98FW1 and FW2 zones (see press release dated January 20, 2010). The above drill holes are the first results from additional holes that were lengthened or initiated from new drill stations in order to reach the RL East area. Holes that appear out of sequence or do not appear are not yet drilled, logged, or were not long enough to reach RL East.

The main "98" vein above the 28th level (4500 ft below surface) has been developed to over 150 meters (500 feet) in length, has a known dip length of over 600 meters (2000 feet) and is open above the 26th level (4200 ft below surface). Mining is now underway in numerous stopes within this vein above the 29th and 28th levels. The wide spacing and correlation of drill holes within the 98FW and RL East zones are beginning to display similar dimensions as the main 98 vein described above. The numerous new veins being discovered to the southeast and in the footwall of the "98" vein are in previously unexplored areas as there has been no access to this ground in the past.

Sections, plans and diagrams related to this press release are available at the company's website www.sangoldcorp.com.

The above program was carried out by mine geologists under the supervision of D. Ginn, P.Geo., the Qualified Person for San Gold under National Instrument 43-101. Underground drill core samples and chip samples are assayed on site in the company's assay lab using the fire assay method with an AA and gravimetric finish. San Gold's quality control and assurance program includes the insertion of blanks and standards, the retention of pulps and rejects, and spot checks utilizing independent labs including TSL Laboratories in Saskatoon, SK and Accurassay Laboratories of Thunder Bay, ON. The core lengths are actual lengths as drilled and have not been adjusted for the true width of the mineralized zones. In instances where high grade intervals are combined resulting in lower grade, wider intervals, all assays are utilized including any internal waste which may have zero grade, as well, no top or bottom cutting factors are used.

For further information contact Dale Ginn, CEO of San Gold Corporation, at (204) 794-5818 or investor information at 1-800-321-8564 or visit www.sangoldcorp.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: San Gold Corporation

Dale Ginn

CEO of San Gold Corporation

(204) 794-5818

or

investor information

1-800-321-8564

www.sangoldcorp.com

Copyright (C) 2010 Marketwire. All rights reserved.

...und das dürfte nach heutiger meldung von SGR noch

unwahrscheinlicher werden........hier schaut mal...

San Gold Drills High Grade in New RL East Zone Including 4.9 Meters of 319 g/tonne

2:28 PM ET, April 22, 2010

BISSETT, MB, Apr 22, 2010 (Marketwire via COMTEX) -- Dale Ginn, CEO of San Gold Corporation (SGR) (PINKSHEETS: SGRCF) (OTCQX: SGRCF), is pleased to report exceptionally encouraging results from underground exploration drilling following up on the recent discovery of multiple new zones beyond the eastern extremities of the Rice Lake mine (see press releases dated Jan 25 and March 31, 2010). These zones, collectively known as RL East display remarkable widths as well as grade, are hosted within structures that trend upwards toward the high grade 007 zone near surface. Drill hole #28-10-53 cut 121 g/tonne (3.53 oz/ton) over 13.3 meters (44 ft) and included an extremely high grade segment of 319 g/tonne (9.30 oz/ton) over 4.9 m (15.9 ft) containing coarse visible gold. Drill hole #28-10-80 encountered 5 individual zones within a wider mineralized section of 50 meters (164 ft) grading 4.8 g/tonne (0.14 oz/ton).

New intersections are tabulated below:

Gold g/tonne

Hole # From (m) To (m) Length m (ft) (oz/ton) Zone/Lens

--------- ---------- ------ ------------------- ------------------ ---------

28-10-53 118.6 131.9 13.3 43.6 120.9 3.53 RL East

including 122.2 127.1 4.9 15.9 318.5 9.30 RL East

28-10-80 123.6 173.7 50.0 164.1 4.8 0.14 RL East

including 123.6 126.4 2.8 9.1 12.3 0.36 98 FW

including 135.8 140.0 4.2 13.5 5.5 0.16 98 FW

including 148.9 150.4 1.5 5.0 33.9 0.99 RL East

including 161.4 164.0 2.6 8.3 19.5 0.57 RL East

including 168.7 172.3 3.6 11.8 7.9 0.23 New

26-10-57 296.3 298.3 2.0 6.6 74.0 2.16 RL East

and 306.2 307.6 1.4 4.6 22.9 0.67 New

26-10-61 297.5 300.8 3.3 10.8 7.9 0.23 RL East

and 303.5 306.2 2.7 8.7 6.6 0.19 New

reviously released intersections now known to be RL East zone:

28-10-51 162.1 170.3 8.2 26.9 37.0 1.08 RL East

including 165.8 170.2 4.4 14.4 67.1 1.96 RL East

including 166.7 168.7 2.0 6.6 140.4 4.10 RL East

26-10-60 318.9 323.0 4.1 13.5 23.0 0.67 RL East

26-09-35 339.5 360.9 21.4 70.2 12.3 0.36 RL East

including 343.5 345.9 2.4 7.9 56.2 2.35 RL East

ale Ginn, CEO, stated; "San Gold mine geologists have produced one of the most impressive intersections ever within Rice Lake. Taking into account that this is exploration drilling outside of known Rice Lake mine extents, these results are truly remarkable. The mining team's efforts are demonstrating that this mineralized system is linked to our new surface zones and that our geological model produces results at depth as well as near surface. We look forward to closing this gap and taking a broader approach to a mineralized system that is fast becoming much larger than a collection of individual deposits."

The RL East and 98 zones are located along east-west shear structures that obliquely cross cut the Rice Lake mine host unit and extend into the hanging wall volcanic rocks that host the new near surface zones (Hinge, 007, L13 and Cohiba). The RL East zone is located approximately 150 meters (500 feet) to the east of the high grade "98" vein area currently under development and is beyond the recently discovered 98FW1 and FW2 zones (see press release dated January 20, 2010). The above drill holes are the first results from additional holes that were lengthened or initiated from new drill stations in order to reach the RL East area. Holes that appear out of sequence or do not appear are not yet drilled, logged, or were not long enough to reach RL East.

The main "98" vein above the 28th level (4500 ft below surface) has been developed to over 150 meters (500 feet) in length, has a known dip length of over 600 meters (2000 feet) and is open above the 26th level (4200 ft below surface). Mining is now underway in numerous stopes within this vein above the 29th and 28th levels. The wide spacing and correlation of drill holes within the 98FW and RL East zones are beginning to display similar dimensions as the main 98 vein described above. The numerous new veins being discovered to the southeast and in the footwall of the "98" vein are in previously unexplored areas as there has been no access to this ground in the past.

Sections, plans and diagrams related to this press release are available at the company's website www.sangoldcorp.com.

The above program was carried out by mine geologists under the supervision of D. Ginn, P.Geo., the Qualified Person for San Gold under National Instrument 43-101. Underground drill core samples and chip samples are assayed on site in the company's assay lab using the fire assay method with an AA and gravimetric finish. San Gold's quality control and assurance program includes the insertion of blanks and standards, the retention of pulps and rejects, and spot checks utilizing independent labs including TSL Laboratories in Saskatoon, SK and Accurassay Laboratories of Thunder Bay, ON. The core lengths are actual lengths as drilled and have not been adjusted for the true width of the mineralized zones. In instances where high grade intervals are combined resulting in lower grade, wider intervals, all assays are utilized including any internal waste which may have zero grade, as well, no top or bottom cutting factors are used.

For further information contact Dale Ginn, CEO of San Gold Corporation, at (204) 794-5818 or investor information at 1-800-321-8564 or visit www.sangoldcorp.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: San Gold Corporation

Dale Ginn

CEO of San Gold Corporation

(204) 794-5818

or

investor information

1-800-321-8564

www.sangoldcorp.com

Copyright (C) 2010 Marketwire. All rights reserved.

Antwort auf Beitrag Nr.: 38.867.724 von hbg55 am 02.02.10 22:12:35

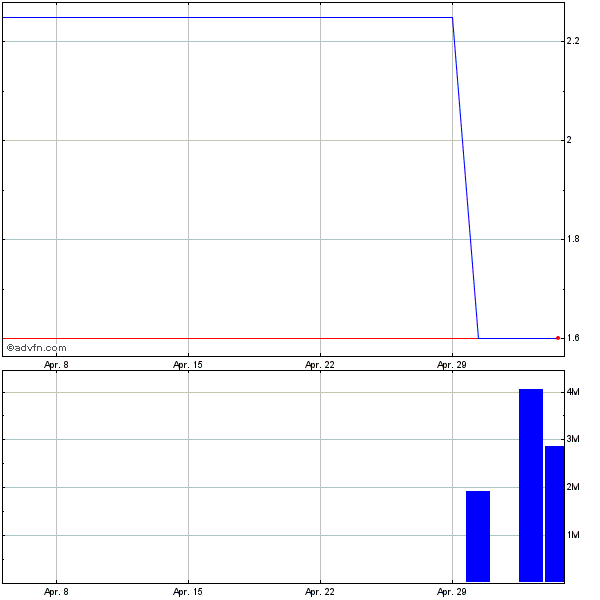

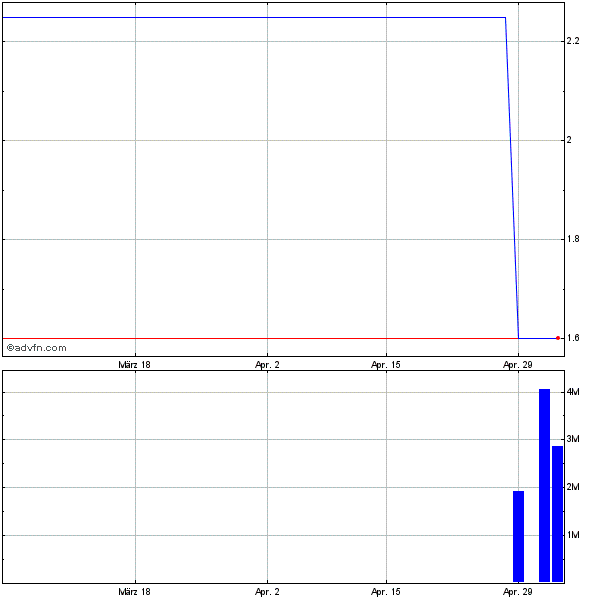

...SGR- mio-paket wächst und wächst

http://de.advfn.com/p.php?pid=staticchart&s=TSX%3ASGR&p=4&t=…

...SGR- mio-paket wächst und wächst

http://de.advfn.com/p.php?pid=staticchart&s=TSX%3ASGR&p=4&t=…

Antwort auf Beitrag Nr.: 39.436.365 von hbg55 am 30.04.10 19:44:53die noch wenigen stücke von SGR im freien handel werden

immer begehrten......womöglich klopfen da schon einige

BIG player an die türen der fund- manager, um sich deren

pakete zu sichern......immerhin sind 67 % in festen händen,

davon 55 % bei den instis....wie wir aus brandakt. pres. erfahren !!!!

http://sangoldcorp.com/assets/files/San%20Gold%20April%2024%…

immer begehrten......womöglich klopfen da schon einige

BIG player an die türen der fund- manager, um sich deren

pakete zu sichern......immerhin sind 67 % in festen händen,

davon 55 % bei den instis....wie wir aus brandakt. pres. erfahren !!!!

http://sangoldcorp.com/assets/files/San%20Gold%20April%2024%…

Goldpreis: Winkt eine langfristige Hausse?

29.04.2010 | 13:45 Uhr | Hahn, Rainer

RTE Stuttgart - (www.rohstoffe-go.de)

- Wenn das Szenario eintrifft, das die CPM Group in ihrem aktuellen Goldjahrbuch zeichnet, könnte der Goldpreis über einen langen Zeitraum gewaltige Unterstützung erhalten - und volatiler werden.

Die Analysten des Research-Hauses, das sich unter anderem auf den Rohstoffmarkt spezialisiert hat, erwarten, dass der gewaltiger globaler Umbruch in der Zusammensetzung der Investment-Portfolios weiter geht. Das geht aus dem jüngst veröffentlichten Gold-Jahrbuch der Experten hervor. Profiteur in diesem Fall ist der Goldpreis - und der soll es nach Meinung der CPM Group noch eine ganze Zeit lang bleiben.

Hinter dieser Prognose der CPM Group steckt kein kurzfristiger Modetrend, dem Investoren - wie sonst so gerne - nachlaufen. Es sind viel mehr die Erfahrungen der vergangenen Jahre, geprägt unter anderem vom Platzen der Dotcom-Blase sowie dem Desaster am US-Immobilienmarkt und seinen immensen Folgen für die Wirtschaft und Finanzsysteme, die die vergangenen Monate geprägt haben. Die Erfahrungen, die aktuell durch die Schuldenkrise Griechenlands weiter genährt werden, führen zur Umschichtung gewaltiger Summen in den Portfolios der Großanleger. Die Devise heißt: Raus aus Papierwerten wie Anleihen oder Aktien, rein in reale Werte wie Gold. Das Metall profitiert heute wie seit jeher von seinem Image als wertbeständige "Krisenwährung".

Angesichts der Summen, die global von Institutionellen Investoren, Zentralbanken oder Fonds bewegt werden, reichen schon kleine prozentuale Verschiebungen in der Asset Allocation, um auf Einzelmärkten gewaltige Nachfrageschübe auszulösen. So ist es nur auf den ersten Blick unspektakulär, dass CPM in den kommenden Jahren einen Anstieg des Goldanteils an den global gehaltenen Assets auf 1 Prozent oder sogar 2 Prozent erwartet. Tatsächlich bedeutete dies, dass Investoren in den kommenden Jahren hunderte Millionen von Goldunzen in die Tresore packen würden und dass eine entsprechende zusätzliche Nachfrage entstehen wird.

CPM erwartet, dass Investoren 2010 rund 39,8 Millionen Unzen Gold erwerben werden, fast 3 Millionen mehr als im vergangenen Jahr. Der Produktionsanstieg der Goldminen soll gerade einmal die Hälfte des Anstiegs decken, so die Prognose der Experten: Eine Förderung von 57,1 Millionen Unzen Gold wird erwartet, etwa 55,6 Millionen Unzen waren es im vergangenen Jahr.

Diese Zahlen muss man zudem noch in ein Gesamtbild einordnen. Experten prognostizieren einen Anstieg der Goldnachfrage nicht nur von Seiten der Finanzinvestoren, die ihre Portfolios umschichten. Der wachsende Wohlstand in Boomländern wie China und Indien lasse auch von dort die Goldnachfrage wachsen. Es wird zum Beispiel erwartet, dass China die Goldimporte deutlich aufstocken muss. Hinzu kommt der erwartete wirtschaftliche Aufschwung. Das bringe zusätzliche Nachfrage in den Markt. Dass eine Ausweitung der Minenproduktion oder das Recycling von "Altgold" diesen Nachfrageschub bedienen kann, glaube niemand ernsthaft. Erst recht nicht vor dem Hintergrund, dass unter anderem aufgrund der Finanzmarktkrise und der damit einher gehenden Probleme bei Projektfinanzierungen die Explorationsinvestitionen sinken sollen.

Was dies für den Goldpreis bedeuten kann, leuchtet schnell ein. Die auseinander klaffende Schere von Angebot und Nachfrage ist immer der beste Grund, an steigende Notierungen zu glauben. Da hier ein langfristiger Trend dahinter steckt, wenn die Prognosen der CPM Group und anderer Marktexperten zutreffen, wirkt das Argument umso schwerer. Für Investoren wird es aber nicht unbedingt einfacher, dafür aber nervenaufreibender. Bei CPM rechnen man aufgrund der Verschiebungen in den Portfolios der Großanleger, die sich bereits seit Jahren verstärkt dem Goldinvestment widmen und nun Bestände aus Gründen der Diversifikation mit hohen Gewinnen teilweise wieder abbauen, mit einer verstärkten Volatilität beim Goldpreis.

29.04.2010 | 13:45 Uhr | Hahn, Rainer

RTE Stuttgart - (www.rohstoffe-go.de)

- Wenn das Szenario eintrifft, das die CPM Group in ihrem aktuellen Goldjahrbuch zeichnet, könnte der Goldpreis über einen langen Zeitraum gewaltige Unterstützung erhalten - und volatiler werden.

Die Analysten des Research-Hauses, das sich unter anderem auf den Rohstoffmarkt spezialisiert hat, erwarten, dass der gewaltiger globaler Umbruch in der Zusammensetzung der Investment-Portfolios weiter geht. Das geht aus dem jüngst veröffentlichten Gold-Jahrbuch der Experten hervor. Profiteur in diesem Fall ist der Goldpreis - und der soll es nach Meinung der CPM Group noch eine ganze Zeit lang bleiben.

Hinter dieser Prognose der CPM Group steckt kein kurzfristiger Modetrend, dem Investoren - wie sonst so gerne - nachlaufen. Es sind viel mehr die Erfahrungen der vergangenen Jahre, geprägt unter anderem vom Platzen der Dotcom-Blase sowie dem Desaster am US-Immobilienmarkt und seinen immensen Folgen für die Wirtschaft und Finanzsysteme, die die vergangenen Monate geprägt haben. Die Erfahrungen, die aktuell durch die Schuldenkrise Griechenlands weiter genährt werden, führen zur Umschichtung gewaltiger Summen in den Portfolios der Großanleger. Die Devise heißt: Raus aus Papierwerten wie Anleihen oder Aktien, rein in reale Werte wie Gold. Das Metall profitiert heute wie seit jeher von seinem Image als wertbeständige "Krisenwährung".

Angesichts der Summen, die global von Institutionellen Investoren, Zentralbanken oder Fonds bewegt werden, reichen schon kleine prozentuale Verschiebungen in der Asset Allocation, um auf Einzelmärkten gewaltige Nachfrageschübe auszulösen. So ist es nur auf den ersten Blick unspektakulär, dass CPM in den kommenden Jahren einen Anstieg des Goldanteils an den global gehaltenen Assets auf 1 Prozent oder sogar 2 Prozent erwartet. Tatsächlich bedeutete dies, dass Investoren in den kommenden Jahren hunderte Millionen von Goldunzen in die Tresore packen würden und dass eine entsprechende zusätzliche Nachfrage entstehen wird.

CPM erwartet, dass Investoren 2010 rund 39,8 Millionen Unzen Gold erwerben werden, fast 3 Millionen mehr als im vergangenen Jahr. Der Produktionsanstieg der Goldminen soll gerade einmal die Hälfte des Anstiegs decken, so die Prognose der Experten: Eine Förderung von 57,1 Millionen Unzen Gold wird erwartet, etwa 55,6 Millionen Unzen waren es im vergangenen Jahr.

Diese Zahlen muss man zudem noch in ein Gesamtbild einordnen. Experten prognostizieren einen Anstieg der Goldnachfrage nicht nur von Seiten der Finanzinvestoren, die ihre Portfolios umschichten. Der wachsende Wohlstand in Boomländern wie China und Indien lasse auch von dort die Goldnachfrage wachsen. Es wird zum Beispiel erwartet, dass China die Goldimporte deutlich aufstocken muss. Hinzu kommt der erwartete wirtschaftliche Aufschwung. Das bringe zusätzliche Nachfrage in den Markt. Dass eine Ausweitung der Minenproduktion oder das Recycling von "Altgold" diesen Nachfrageschub bedienen kann, glaube niemand ernsthaft. Erst recht nicht vor dem Hintergrund, dass unter anderem aufgrund der Finanzmarktkrise und der damit einher gehenden Probleme bei Projektfinanzierungen die Explorationsinvestitionen sinken sollen.

Was dies für den Goldpreis bedeuten kann, leuchtet schnell ein. Die auseinander klaffende Schere von Angebot und Nachfrage ist immer der beste Grund, an steigende Notierungen zu glauben. Da hier ein langfristiger Trend dahinter steckt, wenn die Prognosen der CPM Group und anderer Marktexperten zutreffen, wirkt das Argument umso schwerer. Für Investoren wird es aber nicht unbedingt einfacher, dafür aber nervenaufreibender. Bei CPM rechnen man aufgrund der Verschiebungen in den Portfolios der Großanleger, die sich bereits seit Jahren verstärkt dem Goldinvestment widmen und nun Bestände aus Gründen der Diversifikation mit hohen Gewinnen teilweise wieder abbauen, mit einer verstärkten Volatilität beim Goldpreis.

TORONTO, May 3 /CNW/ - Laurion Mineral Exploration Inc. (TSXV: LME) ("Laurion") is pleased to announce that it has filed its Audited Consolidated Financial Statements and its Management's Discussion and Analysis for the year ended December 31, 2009 ("MD&A") on SEDAR (www.sedar.com). To review these documents, please visit Laurion's website, at http://www.laurion.ca/i/pdf/2009YE_FS.pdf.

Laurion incurred a loss from operations for the year ended December 31, 2009 of $408,783 or $0.01 per share. This compares to a loss of $1,197,511 or $0.02 per share for the year ended December 31, 2008.

In its MD&A, Laurion announced that on January 21, 2010, it completed the sale of all its mining property interests in the Tisdale Township, Ontario (the "Tisdale Claims") to San Gold Corporation ("San Gold"). In consideration for the Tisdale Claims, Laurion received cash compensation of $1,000,000 and 1,000,000 common shares in the capital of San Gold (the "San Gold Common Shares"), and retained a 2% net smelter royalty on a portion of the Tisdale Claims known as the Tisdale Property.

The San Gold Common Shares are subject to a 4 month hold period expiring on May 21, 2010. On October 8, 2009, which was the date Laurion and San Gold entered into the Letter of Intent with respect to the above transaction, the San Gold Common Shares were trading at $3.03; the San Gold Common Shares had a market price of $4.35 at the end of trading on April 30, 2010.

Laurion holds a total of 13,859,062 warrants which if exercised Laurion would receive an aggregate of approximately $1,136,872 as payment for the underlying securities.

Laurion is focused on identifying prospective advanced stage projects to add to its property portfolio and has retained the services of three consultants to assist it with evaluating mining properties and projects located in the United States. Laurion has also retained the services of geological consulting company GeoVector Management Inc. ("GeoVector") to manage and direct Laurion's exploration programs.

About Laurion Mineral Exploration Inc.

Laurion is an exploration company with key interests in prospective mining properties located in Ontario. Laurion's primary exploration focus is the identification of gold deposits; its exploration horizon also encompasses base metals and PGEs.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.