Apple - unaufhaltsamer Aufstieg - wie lange noch? (Seite 1702)

eröffnet am 18.01.05 13:14:58 von

neuester Beitrag 01.05.24 10:01:08 von

neuester Beitrag 01.05.24 10:01:08 von

Beiträge: 49.513

ID: 944.638

ID: 944.638

Aufrufe heute: 113

Gesamt: 4.620.140

Gesamt: 4.620.140

Aktive User: 4

ISIN: US0378331005 · WKN: 865985 · Symbol: AAPL

173,20

USD

+2,30 %

+3,90 USD

Letzter Kurs 21:49:11 Nasdaq

Neuigkeiten

04:30 Uhr · wallstreetONLINE Redaktion |

| Apple Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

17:50 Uhr · wO Newsflash |

17:06 Uhr · dpa-AFX |

17:00 Uhr · BNP Paribas Anzeige |

Werte aus der Branche Hardware

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,5100 | +21,13 | |

| 4,1025 | +13,09 | |

| 2,3575 | +9,14 | |

| 2,1600 | +6,93 | |

| 11,580 | +6,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 15,730 | -2,42 | |

| 1,1050 | -2,64 | |

| 1,3450 | -3,93 | |

| 6,5000 | -13,22 | |

| 18,000 | -14,61 |

Beitrag zu dieser Diskussion schreiben

Kurze Zusammenfassung auf DAF

Im vergangenen Vierteljahr hat der Konzern rund 8,5 Milliarden US-Dollar verdient, was einem Anstieg von 13% im Vergleich zum Vorjahr entspricht. Der Umsatz kletterte um 12% auf 42 Milliarden US-Dollar. Grund für die gute Bilanz war der Verkaufsstart des iPhone 6. Bislang wurden 39 Millionen Geräte verkauft. Auch bei den iMacs wurde ein Absatzplus verzeichnet.

Apple-Aktie: Erwartungen übertroffen - Umsatzrekord

21.10.2014 07:56

http://www.daf.fm/video/apple-aktie-erwartungen-uebertroffen…

Im vergangenen Vierteljahr hat der Konzern rund 8,5 Milliarden US-Dollar verdient, was einem Anstieg von 13% im Vergleich zum Vorjahr entspricht. Der Umsatz kletterte um 12% auf 42 Milliarden US-Dollar. Grund für die gute Bilanz war der Verkaufsstart des iPhone 6. Bislang wurden 39 Millionen Geräte verkauft. Auch bei den iMacs wurde ein Absatzplus verzeichnet.

Apple-Aktie: Erwartungen übertroffen - Umsatzrekord

21.10.2014 07:56

http://www.daf.fm/video/apple-aktie-erwartungen-uebertroffen…

Apple Q-Ergebnis, Heute + 2.14 % bei 99.76 $

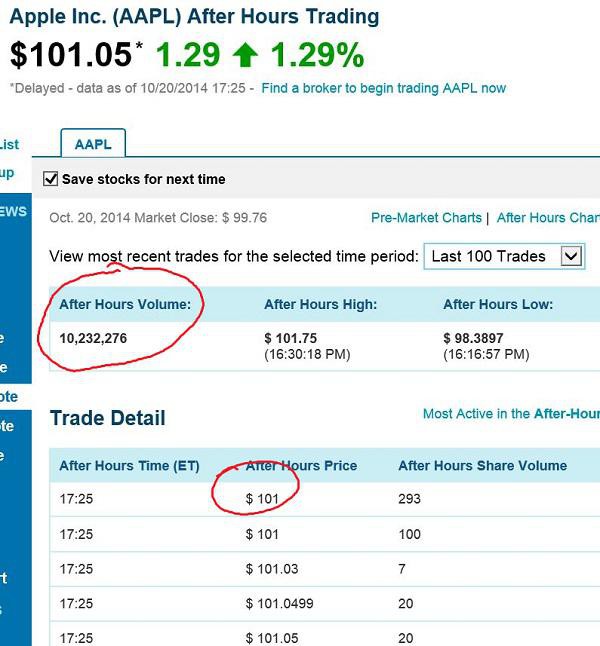

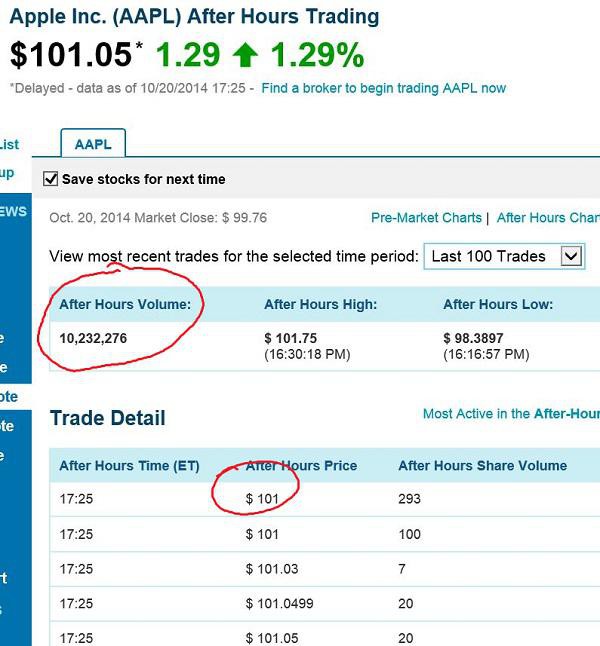

Komm vom Theater nach Hause, und Apple erwartet mich erwartungsgemäss wieder mit einem sehr guten Qurtals-Abschluss, Merci, mein Apple Shares-Konto grünt und grünt, als wäre der Frühling bereits angebrochen. Aber selbst der "Koloss Apple" wird von der Finanz-Mafia, der Hedge-Fonds und Investment-Banken, noch hin und her "bugsiert", sodass der Kurs erst kürzlich von 102.80 $ bis auf 95.45 $ runtergeprügelt resp. spekuliert wurde. Dass auch ein Blinder Apple-Inverstierter jetzt sofort erkennen konnte, ja musste, dass alles unter 97 $ günstige Zukaufskurse sind, haben hoffentlich viele auch benützt, denn Apple notiert After Hour natürlich schon wieder

über 101.18 $, und wird in Zukunft jetzt auch darüber bleiben, meine Meinung.

Mein Kursziel 130 $ innert 6 Monaten.

Luigi tanz für alle Apple Investierten hier ein Freudentänzchen zu Zweit;

Apple Inc. (AAPL) After Hours Trading

$ 101.18

*

+ 1.42

+ 1.42%

*Delayed - data as of 10/20/2014 19:06 -

Read more: http://www.nasdaq.com/symbol/aapl/after-hours#ixzz3GjOHyqc1

So wie einem das Licht nicht ohne die Dunkelheit bewusst würde,

so gibt es keine Situation,

in der nicht etwas POSITIVES zu entdecken wäre.

Frei nach I Ging

Komm vom Theater nach Hause, und Apple erwartet mich erwartungsgemäss wieder mit einem sehr guten Qurtals-Abschluss, Merci, mein Apple Shares-Konto grünt und grünt, als wäre der Frühling bereits angebrochen. Aber selbst der "Koloss Apple" wird von der Finanz-Mafia, der Hedge-Fonds und Investment-Banken, noch hin und her "bugsiert", sodass der Kurs erst kürzlich von 102.80 $ bis auf 95.45 $ runtergeprügelt resp. spekuliert wurde. Dass auch ein Blinder Apple-Inverstierter jetzt sofort erkennen konnte, ja musste, dass alles unter 97 $ günstige Zukaufskurse sind, haben hoffentlich viele auch benützt, denn Apple notiert After Hour natürlich schon wieder

über 101.18 $, und wird in Zukunft jetzt auch darüber bleiben, meine Meinung.

Mein Kursziel 130 $ innert 6 Monaten.

Luigi tanz für alle Apple Investierten hier ein Freudentänzchen zu Zweit;

Apple Inc. (AAPL) After Hours Trading

$ 101.18

*

+ 1.42

+ 1.42%

*Delayed - data as of 10/20/2014 19:06 -

Read more: http://www.nasdaq.com/symbol/aapl/after-hours#ixzz3GjOHyqc1

So wie einem das Licht nicht ohne die Dunkelheit bewusst würde,

so gibt es keine Situation,

in der nicht etwas POSITIVES zu entdecken wäre.

Frei nach I Ging

Monday, October 20, 2014, 02:07 pm PT (05:07 pm ET)

Notes of interest from Apple's Q4 2014 conference call

Feature By AppleInsider Staff

Apple blew away market expectations in reporting the results of its fourth fiscal quarter of 2014 on Monday, propelled by a new quarterly record for the iPhone and new all-time record for the Mac. Following the announcement, executives from the company participated in a conference call with analysts and the media, and notes of interest follow.

Apple earned $8.5 billion in profit on revenue of $42.12 billion in the September frame. It reported shipments of 39.27 million iPhones, 5.5 million Macs, and 12.3 million iPads.

Participating in Monday's call were Apple Chief Executive Tim Cook, and recently-appointed Chief Financial Officer Luca Maestri.

Highlights

●Cook noted that Apple recently introduced two new product categories: Apple Pay and Apple Watch

●Strongest revenue growth rate in seven quarters

●Cook said iPhone 6 and 6 Plus demand was strong, but legacy models also proved popular

●Demand for the new iPhones is "far outstripping supply," and Apple doesn't know when they'll be able to catch up

●

●Apple saw its strongest ever Mac sales, and its largest market share since 1995

●The company returned $17 billion to investors the Sept. quarter alone, $45 billion over the last year

●Apple ended the quarter with $155.2 billion in cash, down $9.3 billion sequentially

●Starting next quarter, Apple Pay revenue will fall under the "Services" category, iPods will be measured under "Other Products"

●Apple Watch will also be included with Apple TV, iPods and other products, Cook said the categories were created based on today's current revenue

Apple's iPhone business

Apple exited the quarter severely behind on demand for both the iPhone 6 and iPhone 6 Plus.

iPhone sales grew 16 percent, but underlying demand was even stronger.

Unit sales in the U.S. grew 17 percent year over year, and in Western Europe they were up 20 percent.

Even stronger growth in Latin America and the Middle East. Sales more than doubled in Eastern Europe.

Apple was below its target range of 4-6 weeks of channel inventory.

Apple had a 69 percent share of the U.S. commercial smartphone market. Maestri cited a survey that said 75 percent of enterprises looking to buy in the September quarter will choose iPhone.

Due to growth in emerging markets, Apple will begin targeting iPhone channel inventory in the 5-7 week range.

Cook said that "it's clear" that Apple is "not nearly balanced" when it comes to supply and demand. "We're not even on the same planet."

"It's very unusual to see every country having a marked improvement over the previous year, and that's what we're seeing on iPhones," Cook said.

"We do not envision, as of today, being able to achieve the extra inventory in the channel that we believe is needed," he said. Apple is changing its channel inventory policy because the channel tends to be a long process in emerging markets.

"It's hard to tell when you're at a point when you're selling everything you're making," Cook said of assessing demand. "It's a good problem to have."

Cook still sees a large opportunity for people buying their first iPhone, and he thinks that opportunity increases with the iPhone 6 and 6 Plus. He also expects a high number of upgrades from previous iPhone owners.

Average selling price of the iPhone in the September quarter was $603. Unit growth of 16 percent year over year compares to the prior quarter at 13 percent.

Apple Pay

On Apple Pay, Cook said Apple is focused on consumer experience as well as security and privacy. He said other mobile payments systems are about monetizing user data, but Apple is interested in that.

"We think we will sell more devices, because we think it's a killer feature," Cook said of Apple Pay. "It's far better than reaching in your pocket book and the card that you're looking for, and half the time it not working."

Apple does not charge the customer or the merchant for the benefit, but there are terms between Apple and the issuing banks.

"We will be reporting Apple Pay in the services line item on the data sheet, and so we see it as an incredible service that is the most customer centric mobile payment system that there is," Cook said. "We're very proud of it, and we can't wait to sign on more retailers and also extend it around the world."

Apple's Mac business

Mac sales grew almost 1 million from a year ago to reach a new all-time high.

Back to school sales were strong, as were sales in emerging markets, where sales were up 46 percent.

Maestri said Mac gains were mostly in portables: MacBook Pro, MacBook Air.

Apple ended the quarter with Mac channel inventory slightly below its 4-5 week target range.

Mac was an "absolutely blow-away quarter," "stunning," Cook said. Notebooks and back to school drove sales.

"If you went out to college campuses right now, you would see a lot of new Mac notebooks, based on the sales," the CEO said.

"To be up 21 percent in a market that's shrinking, it doesn't get any better than that," Cook said.

Cook admitted some people will look at a Mac and iPad, and opt for Mac. Others will look at iPhone and iPad and choose iPhone. He said he's OK with both of those.

"I'm very bullish on where we can take iPad over time."

Apple's iPad business

IBM's new iOS-based mobile solutions, as part of its enterprise agreement with Apple, will begin rolling out next month. They will be available in the following markets: banking, government, insurance, retail, travel and transportation, and telecommunications.

Hundreds of corporations around the world have expressed interest since the IBM deal was announced. Apple is currently working with over 50 of them for mobile deployment solutions.

Apple reduced iPad channel inventory by 500,000 by the end of the June quarter in anticipation of October's refresh.

The company continues to see strong adoption of the iPad in the corporate market.

On declining sales, Cook said market watchers should focus on the big picture rather than the last 90 days.

"I view it as a speed bump, not a huge issue," he said. "That said, we want to grow. We don't like negative numbers on these things."

He doesn't think the tablet market is saturated.

Cook noted that the country that sold the lowest percentage of iPads to people who never bought an iPad before, the number was 50 percent. The range goes from 50 to over 70 percent.

"When I look at first time buyer rates in that area, that's not a saturated market," he said.

"People hold on to their iPads longer than they do a phone. And because we've only been in this business four years, we don't know what the upgrade cycle will be for people."

"The deeper the apps go in the enterprise, the more it opens up avenues in the enterprise," Cook said.

Apple's iTunes business

Revenue from iTunes was $5.4 billion in September, up 22 percent year over year.

The number of registered app developers has grown by 22 percent over the last year, rapidly approaching 10 million.

Apple's retail business

Store revenue last quarter was $5.1 billion, up 15 percent from a year ago. A new Sept. quarter record.

Opened 10 new stores, completed the remodels of 3 stores.

Projecting 25 new store openings in fiscal 2015, about 3/4 of which will be outside the U.S.

Five more remodelings are expected.

Average revenue per store was $11.9 million, compared to $10.9 million a year ago.

Over 18,000 visitors were seen per store, per week.

http://appleinsider.com/articles/14/10/20/notes-of-interest-…

Notes of interest from Apple's Q4 2014 conference call

Feature By AppleInsider Staff

Apple blew away market expectations in reporting the results of its fourth fiscal quarter of 2014 on Monday, propelled by a new quarterly record for the iPhone and new all-time record for the Mac. Following the announcement, executives from the company participated in a conference call with analysts and the media, and notes of interest follow.

Apple earned $8.5 billion in profit on revenue of $42.12 billion in the September frame. It reported shipments of 39.27 million iPhones, 5.5 million Macs, and 12.3 million iPads.

Participating in Monday's call were Apple Chief Executive Tim Cook, and recently-appointed Chief Financial Officer Luca Maestri.

Highlights

●Cook noted that Apple recently introduced two new product categories: Apple Pay and Apple Watch

●Strongest revenue growth rate in seven quarters

●Cook said iPhone 6 and 6 Plus demand was strong, but legacy models also proved popular

●Demand for the new iPhones is "far outstripping supply," and Apple doesn't know when they'll be able to catch up

●

●Apple saw its strongest ever Mac sales, and its largest market share since 1995

●The company returned $17 billion to investors the Sept. quarter alone, $45 billion over the last year

●Apple ended the quarter with $155.2 billion in cash, down $9.3 billion sequentially

●Starting next quarter, Apple Pay revenue will fall under the "Services" category, iPods will be measured under "Other Products"

●Apple Watch will also be included with Apple TV, iPods and other products, Cook said the categories were created based on today's current revenue

Apple's iPhone business

Apple exited the quarter severely behind on demand for both the iPhone 6 and iPhone 6 Plus.

iPhone sales grew 16 percent, but underlying demand was even stronger.

Unit sales in the U.S. grew 17 percent year over year, and in Western Europe they were up 20 percent.

Even stronger growth in Latin America and the Middle East. Sales more than doubled in Eastern Europe.

Apple was below its target range of 4-6 weeks of channel inventory.

Apple had a 69 percent share of the U.S. commercial smartphone market. Maestri cited a survey that said 75 percent of enterprises looking to buy in the September quarter will choose iPhone.

Due to growth in emerging markets, Apple will begin targeting iPhone channel inventory in the 5-7 week range.

Cook said that "it's clear" that Apple is "not nearly balanced" when it comes to supply and demand. "We're not even on the same planet."

"It's very unusual to see every country having a marked improvement over the previous year, and that's what we're seeing on iPhones," Cook said.

"We do not envision, as of today, being able to achieve the extra inventory in the channel that we believe is needed," he said. Apple is changing its channel inventory policy because the channel tends to be a long process in emerging markets.

"It's hard to tell when you're at a point when you're selling everything you're making," Cook said of assessing demand. "It's a good problem to have."

Cook still sees a large opportunity for people buying their first iPhone, and he thinks that opportunity increases with the iPhone 6 and 6 Plus. He also expects a high number of upgrades from previous iPhone owners.

Average selling price of the iPhone in the September quarter was $603. Unit growth of 16 percent year over year compares to the prior quarter at 13 percent.

Apple Pay

On Apple Pay, Cook said Apple is focused on consumer experience as well as security and privacy. He said other mobile payments systems are about monetizing user data, but Apple is interested in that.

"We think we will sell more devices, because we think it's a killer feature," Cook said of Apple Pay. "It's far better than reaching in your pocket book and the card that you're looking for, and half the time it not working."

Apple does not charge the customer or the merchant for the benefit, but there are terms between Apple and the issuing banks.

"We will be reporting Apple Pay in the services line item on the data sheet, and so we see it as an incredible service that is the most customer centric mobile payment system that there is," Cook said. "We're very proud of it, and we can't wait to sign on more retailers and also extend it around the world."

Apple's Mac business

Mac sales grew almost 1 million from a year ago to reach a new all-time high.

Back to school sales were strong, as were sales in emerging markets, where sales were up 46 percent.

Maestri said Mac gains were mostly in portables: MacBook Pro, MacBook Air.

Apple ended the quarter with Mac channel inventory slightly below its 4-5 week target range.

Mac was an "absolutely blow-away quarter," "stunning," Cook said. Notebooks and back to school drove sales.

"If you went out to college campuses right now, you would see a lot of new Mac notebooks, based on the sales," the CEO said.

"To be up 21 percent in a market that's shrinking, it doesn't get any better than that," Cook said.

Cook admitted some people will look at a Mac and iPad, and opt for Mac. Others will look at iPhone and iPad and choose iPhone. He said he's OK with both of those.

"I'm very bullish on where we can take iPad over time."

Apple's iPad business

IBM's new iOS-based mobile solutions, as part of its enterprise agreement with Apple, will begin rolling out next month. They will be available in the following markets: banking, government, insurance, retail, travel and transportation, and telecommunications.

Hundreds of corporations around the world have expressed interest since the IBM deal was announced. Apple is currently working with over 50 of them for mobile deployment solutions.

Apple reduced iPad channel inventory by 500,000 by the end of the June quarter in anticipation of October's refresh.

The company continues to see strong adoption of the iPad in the corporate market.

On declining sales, Cook said market watchers should focus on the big picture rather than the last 90 days.

"I view it as a speed bump, not a huge issue," he said. "That said, we want to grow. We don't like negative numbers on these things."

He doesn't think the tablet market is saturated.

Cook noted that the country that sold the lowest percentage of iPads to people who never bought an iPad before, the number was 50 percent. The range goes from 50 to over 70 percent.

"When I look at first time buyer rates in that area, that's not a saturated market," he said.

"People hold on to their iPads longer than they do a phone. And because we've only been in this business four years, we don't know what the upgrade cycle will be for people."

"The deeper the apps go in the enterprise, the more it opens up avenues in the enterprise," Cook said.

Apple's iTunes business

Revenue from iTunes was $5.4 billion in September, up 22 percent year over year.

The number of registered app developers has grown by 22 percent over the last year, rapidly approaching 10 million.

Apple's retail business

Store revenue last quarter was $5.1 billion, up 15 percent from a year ago. A new Sept. quarter record.

Opened 10 new stores, completed the remodels of 3 stores.

Projecting 25 new store openings in fiscal 2015, about 3/4 of which will be outside the U.S.

Five more remodelings are expected.

Average revenue per store was $11.9 million, compared to $10.9 million a year ago.

Over 18,000 visitors were seen per store, per week.

http://appleinsider.com/articles/14/10/20/notes-of-interest-…

Dividend History

Dividend History (amounts NOT split adjusted)

http://investor.apple.com/dividends.cfm

Dividend History (amounts NOT split adjusted)

Declared Record ........Payable ........Amount Type

Oct 20, 2014 Nov 10, 2014 Nov 13, 2014 $.47 Regular Cash

http://investor.apple.com/dividends.cfm

Zumindest sind die Zahlen kein Grund, dass der Gesamtmarkt noch mehr absackt.

Vielleicht reichen die Zahlen für einen kleinen Gesamtmarktanstieg aus. Dann sind die 110 $ in Sichtweite.

Und das wäre schlecht für das theoretische Doppeltopp.

Und gut für alle Langfristanleger.

Vielleicht reichen die Zahlen für einen kleinen Gesamtmarktanstieg aus. Dann sind die 110 $ in Sichtweite.

Und das wäre schlecht für das theoretische Doppeltopp.

Und gut für alle Langfristanleger.

Apple Reports Fourth Quarter Results

Strong iPhone, Mac & App Store Sales Drive Record September Quarter Revenue & Earnings

CUPERTINO, California—October 20, 2014—Apple® today announced financial results for its fiscal 2014 fourth quarter ended September 27, 2014. The Company posted quarterly revenue of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per diluted share. These results compare to revenue of $37.5 billion and net profit of $7.5 billion, or $1.18 per diluted share, in the year-ago quarter. Gross margin was 38 percent compared to 37 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

Apple’s board of directors has declared a cash dividend of $.47 per share of the Company’s common stock. The dividend is payable on November 13, 2014, to shareholders of record as of the close of business on November 10, 2014.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” said Tim Cook, Apple’s CEO. “With amazing innovations in our new iPhones, iPads and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the holidays with Apple’s strongest product lineup ever. We are also incredibly excited about Apple Watch and other great products and services in the pipeline for 2015.”

“Our strong business performance drove EPS growth of 20 percent and a record $13.3 billion in cash flow from operations in the September quarter,” said Luca Maestri, Apple’s CFO. “We continued to execute aggressively against our capital return program, spending over $20 billion in the quarter and bringing cumulative returns to $94 billion.”

Apple is providing the following guidance for its fiscal 2015 first quarter:

●revenue between $63.5 billion and $66.5 billion

●gross margin between 37.5 percent and 38.5 percent

●operating expenses between $5.4 billion and $5.5 billion

●other income/(expense) of $325 million

tax rate of 26.5 percent

Apple will provide live streaming of its Q4 2014 financial results conference call beginning at 2:00 p.m. PDT on October 20, 2014 at www.apple.com/quicktime/qtv/earningsq414. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue, gross margin, operating expenses, other income/(expense), and tax rate. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 28, 2013, its Form 10-Q for the quarter ended December 28, 2013, its Form 10-Q for the quarter ended March 29, 2014, its Form 10-Q for the quarter ended June 28, 2014, and its Form 10-K for the fiscal year ended September 27, 2014 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

Press Contact:

Kristin Huguet

Apple

khuguet@apple.com

(408) 974-2414

Investor Relations Contacts:

Nancy Paxton

Apple

paxton1@apple.com

(408) 974-5420

Joan Hoover

Apple

hoover1@apple.com

(408) 974-4570

Apple, the Apple logo, Mac, Mac OS and Macintosh are trademarks of Apple. Other company and product names may be trademarks of their respective owners.

http://www.apple.com/pr/library/2014/10/20Apple-Reports-Four…

Strong iPhone, Mac & App Store Sales Drive Record September Quarter Revenue & Earnings

CUPERTINO, California—October 20, 2014—Apple® today announced financial results for its fiscal 2014 fourth quarter ended September 27, 2014. The Company posted quarterly revenue of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per diluted share. These results compare to revenue of $37.5 billion and net profit of $7.5 billion, or $1.18 per diluted share, in the year-ago quarter. Gross margin was 38 percent compared to 37 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

Apple’s board of directors has declared a cash dividend of $.47 per share of the Company’s common stock. The dividend is payable on November 13, 2014, to shareholders of record as of the close of business on November 10, 2014.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” said Tim Cook, Apple’s CEO. “With amazing innovations in our new iPhones, iPads and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the holidays with Apple’s strongest product lineup ever. We are also incredibly excited about Apple Watch and other great products and services in the pipeline for 2015.”

“Our strong business performance drove EPS growth of 20 percent and a record $13.3 billion in cash flow from operations in the September quarter,” said Luca Maestri, Apple’s CFO. “We continued to execute aggressively against our capital return program, spending over $20 billion in the quarter and bringing cumulative returns to $94 billion.”

Apple is providing the following guidance for its fiscal 2015 first quarter:

●revenue between $63.5 billion and $66.5 billion

●gross margin between 37.5 percent and 38.5 percent

●operating expenses between $5.4 billion and $5.5 billion

●other income/(expense) of $325 million

tax rate of 26.5 percent

Apple will provide live streaming of its Q4 2014 financial results conference call beginning at 2:00 p.m. PDT on October 20, 2014 at www.apple.com/quicktime/qtv/earningsq414. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue, gross margin, operating expenses, other income/(expense), and tax rate. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 28, 2013, its Form 10-Q for the quarter ended December 28, 2013, its Form 10-Q for the quarter ended March 29, 2014, its Form 10-Q for the quarter ended June 28, 2014, and its Form 10-K for the fiscal year ended September 27, 2014 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

Press Contact:

Kristin Huguet

Apple

khuguet@apple.com

(408) 974-2414

Investor Relations Contacts:

Nancy Paxton

Apple

paxton1@apple.com

(408) 974-5420

Joan Hoover

Apple

hoover1@apple.com

(408) 974-4570

Apple, the Apple logo, Mac, Mac OS and Macintosh are trademarks of Apple. Other company and product names may be trademarks of their respective owners.

http://www.apple.com/pr/library/2014/10/20Apple-Reports-Four…

Antwort auf Beitrag Nr.: 48.088.750 von IngChris am 20.10.14 23:30:26Geht weiter... .

.

http://www.nasdaq.com/symbol/aapl/after-hours

.

.http://www.nasdaq.com/symbol/aapl/after-hours

etwa 90 min nachbörslicher Handel - ganz schönes Volumen!

Da kann man sich ja schon freuen, wenn morgen die Börsen starten ......

Da kann man sich ja schon freuen, wenn morgen die Börsen starten ......

Das meint die New York Times

IPhone 6 Propels Apple Profit to Record

By BRIAN X. CHENOCT. 20, 2014

SAN FRANCISCO — Apple’s biggest cash cow, the iPhone, is gaining weight.

Sales of iPhones, including the new, big-screen iPhone 6 models released last month, helped carry Apple to a record-breaking quarter, with $8.5 billion in profit, the company said on Monday.

The company’s profit for its fiscal fourth quarter was 13.3 percent higher than the same quarter a year ago. Revenue over the quarter was $42.1 billion, up from $37.4 billion in the same period last year.

Over all, Apple sold 39 million iPhones over the quarter, a significant bump from the 33.8 million it sold in the same period last year.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” Timothy D. Cook, Apple’s chief executive, said in a statement.

The revenue was above the expectations of Wall Street analysts. They had expected revenue of $39.9 billion, according to a survey of analysts by Thomson Reuters. Apple’s $1.42 per share profit also exceed analyst expectations for $1.31 a share.

Year after year, iPhone sales have steadily grown, even though overall sales of smartphones are slowing in developed markets like the United States and parts of Europe. To achieve growth, Apple recently made a series of aggressive moves with the iPhone. Last year, Apple for the first time released two new iPhone models instead of just one. Last month, Apple again released two new iPhones, this time with bigger screens.

On top of that, Apple has teamed up with phone carriers in important markets, particularly China. Late last year, Apple reached an agreement to start selling iPhones with China Mobile, the largest carrier in the world, with about 800 million subscribers.

The larger iPhone 6 and iPhone 6 Plus smartphones got a strong reaction early. In the first weekend that the new iPhones went on sale in September, Apple sold 10 million of the devices, up from the nine million new iPhones sold last year on their opening weekend.

The story hasn’t been the same for the iPad. The company on Monday said it sold 12.3 million iPads over the quarter, down from 14 million in the same quarter last year. The company’s iPad sales were down in the previous quarter, too.

http://www.nytimes.com/2014/10/21/technology/iphone-6-propel…

IPhone 6 Propels Apple Profit to Record

By BRIAN X. CHENOCT. 20, 2014

SAN FRANCISCO — Apple’s biggest cash cow, the iPhone, is gaining weight.

Sales of iPhones, including the new, big-screen iPhone 6 models released last month, helped carry Apple to a record-breaking quarter, with $8.5 billion in profit, the company said on Monday.

The company’s profit for its fiscal fourth quarter was 13.3 percent higher than the same quarter a year ago. Revenue over the quarter was $42.1 billion, up from $37.4 billion in the same period last year.

Over all, Apple sold 39 million iPhones over the quarter, a significant bump from the 33.8 million it sold in the same period last year.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” Timothy D. Cook, Apple’s chief executive, said in a statement.

The revenue was above the expectations of Wall Street analysts. They had expected revenue of $39.9 billion, according to a survey of analysts by Thomson Reuters. Apple’s $1.42 per share profit also exceed analyst expectations for $1.31 a share.

Year after year, iPhone sales have steadily grown, even though overall sales of smartphones are slowing in developed markets like the United States and parts of Europe. To achieve growth, Apple recently made a series of aggressive moves with the iPhone. Last year, Apple for the first time released two new iPhone models instead of just one. Last month, Apple again released two new iPhones, this time with bigger screens.

On top of that, Apple has teamed up with phone carriers in important markets, particularly China. Late last year, Apple reached an agreement to start selling iPhones with China Mobile, the largest carrier in the world, with about 800 million subscribers.

The larger iPhone 6 and iPhone 6 Plus smartphones got a strong reaction early. In the first weekend that the new iPhones went on sale in September, Apple sold 10 million of the devices, up from the nine million new iPhones sold last year on their opening weekend.

The story hasn’t been the same for the iPad. The company on Monday said it sold 12.3 million iPads over the quarter, down from 14 million in the same quarter last year. The company’s iPad sales were down in the previous quarter, too.

http://www.nytimes.com/2014/10/21/technology/iphone-6-propel…

Antwort auf Beitrag Nr.: 48.088.630 von IngChris am 20.10.14 23:11:03...und Apple Pay läuft gerade an ......

17:50 Uhr · wO Newsflash · Honeywell International |

17:06 Uhr · dpa-AFX · Apple |

17:00 Uhr · BNP Paribas · Advanced Micro DevicesAnzeige |

16:39 Uhr · dpa-AFX · Apple |

16:19 Uhr · Der Aktionär TV · Apple |

15:44 Uhr · BörsenNEWS.de · Amgen |

14:57 Uhr · dpa-AFX · Apple |

08:33 Uhr · Jochen Stanzl · Apple |

04:30 Uhr · wallstreetONLINE Redaktion · Apple |

01.05.24 · dpa-AFX · Apple |

| Zeit | Titel |

|---|---|

| 11.02.24 | |

| 18.01.24 | |

| 27.11.23 | |

| 05.11.23 | |

| 22.08.23 | |

| 04.08.23 | |

| 02.07.23 |