Apple - unaufhaltsamer Aufstieg - wie lange noch? (Seite 1703)

eröffnet am 18.01.05 13:14:58 von

neuester Beitrag 03.05.24 01:36:19 von

neuester Beitrag 03.05.24 01:36:19 von

Beiträge: 49.520

ID: 944.638

ID: 944.638

Aufrufe heute: 48

Gesamt: 4.620.371

Gesamt: 4.620.371

Aktive User: 2

ISIN: US0378331005 · WKN: 865985 · Symbol: AAPL

183,70

USD

+8,51 %

+14,40 USD

Letzter Kurs 01:47:22 Nasdaq

Neuigkeiten

Erwartungen übertroffen: Apple sprengt alle Dimensionen: 110 Milliarden US-Dollar für Aktienrückkäufe!(2) 02.05.24 · wallstreetONLINE Redaktion |

| Apple Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

00:02 Uhr · IG Europe Anzeige |

Werte aus der Branche Hardware

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,5100 | +21,13 | |

| 4,1125 | +13,37 | |

| 4,3700 | +11,76 | |

| 2,3625 | +9,38 | |

| 183,70 | +8,51 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3400 | -4,29 | |

| 7,3700 | -6,94 | |

| 1,7219 | -9,32 | |

| 6,5100 | -13,08 | |

| 18,000 | -14,61 |

Beitrag zu dieser Diskussion schreiben

Dividend History

Dividend History (amounts NOT split adjusted)

http://investor.apple.com/dividends.cfm

Dividend History (amounts NOT split adjusted)

Declared Record ........Payable ........Amount Type

Oct 20, 2014 Nov 10, 2014 Nov 13, 2014 $.47 Regular Cash

http://investor.apple.com/dividends.cfm

Zumindest sind die Zahlen kein Grund, dass der Gesamtmarkt noch mehr absackt.

Vielleicht reichen die Zahlen für einen kleinen Gesamtmarktanstieg aus. Dann sind die 110 $ in Sichtweite.

Und das wäre schlecht für das theoretische Doppeltopp.

Und gut für alle Langfristanleger.

Vielleicht reichen die Zahlen für einen kleinen Gesamtmarktanstieg aus. Dann sind die 110 $ in Sichtweite.

Und das wäre schlecht für das theoretische Doppeltopp.

Und gut für alle Langfristanleger.

Apple Reports Fourth Quarter Results

Strong iPhone, Mac & App Store Sales Drive Record September Quarter Revenue & Earnings

CUPERTINO, California—October 20, 2014—Apple® today announced financial results for its fiscal 2014 fourth quarter ended September 27, 2014. The Company posted quarterly revenue of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per diluted share. These results compare to revenue of $37.5 billion and net profit of $7.5 billion, or $1.18 per diluted share, in the year-ago quarter. Gross margin was 38 percent compared to 37 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

Apple’s board of directors has declared a cash dividend of $.47 per share of the Company’s common stock. The dividend is payable on November 13, 2014, to shareholders of record as of the close of business on November 10, 2014.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” said Tim Cook, Apple’s CEO. “With amazing innovations in our new iPhones, iPads and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the holidays with Apple’s strongest product lineup ever. We are also incredibly excited about Apple Watch and other great products and services in the pipeline for 2015.”

“Our strong business performance drove EPS growth of 20 percent and a record $13.3 billion in cash flow from operations in the September quarter,” said Luca Maestri, Apple’s CFO. “We continued to execute aggressively against our capital return program, spending over $20 billion in the quarter and bringing cumulative returns to $94 billion.”

Apple is providing the following guidance for its fiscal 2015 first quarter:

●revenue between $63.5 billion and $66.5 billion

●gross margin between 37.5 percent and 38.5 percent

●operating expenses between $5.4 billion and $5.5 billion

●other income/(expense) of $325 million

tax rate of 26.5 percent

Apple will provide live streaming of its Q4 2014 financial results conference call beginning at 2:00 p.m. PDT on October 20, 2014 at www.apple.com/quicktime/qtv/earningsq414. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue, gross margin, operating expenses, other income/(expense), and tax rate. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 28, 2013, its Form 10-Q for the quarter ended December 28, 2013, its Form 10-Q for the quarter ended March 29, 2014, its Form 10-Q for the quarter ended June 28, 2014, and its Form 10-K for the fiscal year ended September 27, 2014 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

Press Contact:

Kristin Huguet

Apple

khuguet@apple.com

(408) 974-2414

Investor Relations Contacts:

Nancy Paxton

Apple

paxton1@apple.com

(408) 974-5420

Joan Hoover

Apple

hoover1@apple.com

(408) 974-4570

Apple, the Apple logo, Mac, Mac OS and Macintosh are trademarks of Apple. Other company and product names may be trademarks of their respective owners.

http://www.apple.com/pr/library/2014/10/20Apple-Reports-Four…

Strong iPhone, Mac & App Store Sales Drive Record September Quarter Revenue & Earnings

CUPERTINO, California—October 20, 2014—Apple® today announced financial results for its fiscal 2014 fourth quarter ended September 27, 2014. The Company posted quarterly revenue of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per diluted share. These results compare to revenue of $37.5 billion and net profit of $7.5 billion, or $1.18 per diluted share, in the year-ago quarter. Gross margin was 38 percent compared to 37 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

Apple’s board of directors has declared a cash dividend of $.47 per share of the Company’s common stock. The dividend is payable on November 13, 2014, to shareholders of record as of the close of business on November 10, 2014.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” said Tim Cook, Apple’s CEO. “With amazing innovations in our new iPhones, iPads and Macs, as well as iOS 8 and OS X Yosemite, we are heading into the holidays with Apple’s strongest product lineup ever. We are also incredibly excited about Apple Watch and other great products and services in the pipeline for 2015.”

“Our strong business performance drove EPS growth of 20 percent and a record $13.3 billion in cash flow from operations in the September quarter,” said Luca Maestri, Apple’s CFO. “We continued to execute aggressively against our capital return program, spending over $20 billion in the quarter and bringing cumulative returns to $94 billion.”

Apple is providing the following guidance for its fiscal 2015 first quarter:

●revenue between $63.5 billion and $66.5 billion

●gross margin between 37.5 percent and 38.5 percent

●operating expenses between $5.4 billion and $5.5 billion

●other income/(expense) of $325 million

tax rate of 26.5 percent

Apple will provide live streaming of its Q4 2014 financial results conference call beginning at 2:00 p.m. PDT on October 20, 2014 at www.apple.com/quicktime/qtv/earningsq414. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue, gross margin, operating expenses, other income/(expense), and tax rate. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 28, 2013, its Form 10-Q for the quarter ended December 28, 2013, its Form 10-Q for the quarter ended March 29, 2014, its Form 10-Q for the quarter ended June 28, 2014, and its Form 10-K for the fiscal year ended September 27, 2014 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

Press Contact:

Kristin Huguet

Apple

khuguet@apple.com

(408) 974-2414

Investor Relations Contacts:

Nancy Paxton

Apple

paxton1@apple.com

(408) 974-5420

Joan Hoover

Apple

hoover1@apple.com

(408) 974-4570

Apple, the Apple logo, Mac, Mac OS and Macintosh are trademarks of Apple. Other company and product names may be trademarks of their respective owners.

http://www.apple.com/pr/library/2014/10/20Apple-Reports-Four…

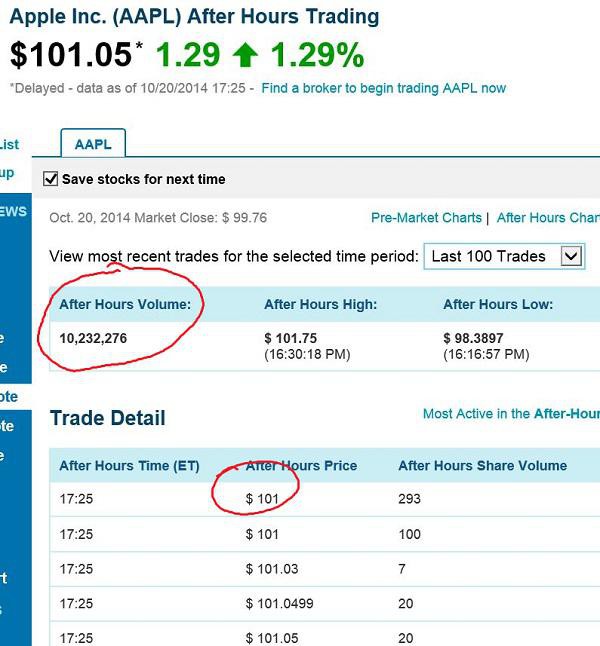

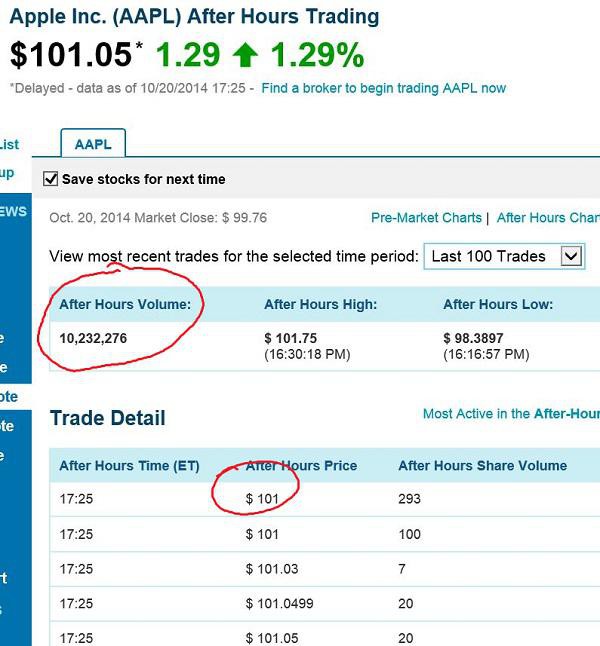

Antwort auf Beitrag Nr.: 48.088.750 von IngChris am 20.10.14 23:30:26Geht weiter... .

.

http://www.nasdaq.com/symbol/aapl/after-hours

.

.http://www.nasdaq.com/symbol/aapl/after-hours

etwa 90 min nachbörslicher Handel - ganz schönes Volumen!

Da kann man sich ja schon freuen, wenn morgen die Börsen starten ......

Da kann man sich ja schon freuen, wenn morgen die Börsen starten ......

Das meint die New York Times

IPhone 6 Propels Apple Profit to Record

By BRIAN X. CHENOCT. 20, 2014

SAN FRANCISCO — Apple’s biggest cash cow, the iPhone, is gaining weight.

Sales of iPhones, including the new, big-screen iPhone 6 models released last month, helped carry Apple to a record-breaking quarter, with $8.5 billion in profit, the company said on Monday.

The company’s profit for its fiscal fourth quarter was 13.3 percent higher than the same quarter a year ago. Revenue over the quarter was $42.1 billion, up from $37.4 billion in the same period last year.

Over all, Apple sold 39 million iPhones over the quarter, a significant bump from the 33.8 million it sold in the same period last year.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” Timothy D. Cook, Apple’s chief executive, said in a statement.

The revenue was above the expectations of Wall Street analysts. They had expected revenue of $39.9 billion, according to a survey of analysts by Thomson Reuters. Apple’s $1.42 per share profit also exceed analyst expectations for $1.31 a share.

Year after year, iPhone sales have steadily grown, even though overall sales of smartphones are slowing in developed markets like the United States and parts of Europe. To achieve growth, Apple recently made a series of aggressive moves with the iPhone. Last year, Apple for the first time released two new iPhone models instead of just one. Last month, Apple again released two new iPhones, this time with bigger screens.

On top of that, Apple has teamed up with phone carriers in important markets, particularly China. Late last year, Apple reached an agreement to start selling iPhones with China Mobile, the largest carrier in the world, with about 800 million subscribers.

The larger iPhone 6 and iPhone 6 Plus smartphones got a strong reaction early. In the first weekend that the new iPhones went on sale in September, Apple sold 10 million of the devices, up from the nine million new iPhones sold last year on their opening weekend.

The story hasn’t been the same for the iPad. The company on Monday said it sold 12.3 million iPads over the quarter, down from 14 million in the same quarter last year. The company’s iPad sales were down in the previous quarter, too.

http://www.nytimes.com/2014/10/21/technology/iphone-6-propel…

IPhone 6 Propels Apple Profit to Record

By BRIAN X. CHENOCT. 20, 2014

SAN FRANCISCO — Apple’s biggest cash cow, the iPhone, is gaining weight.

Sales of iPhones, including the new, big-screen iPhone 6 models released last month, helped carry Apple to a record-breaking quarter, with $8.5 billion in profit, the company said on Monday.

The company’s profit for its fiscal fourth quarter was 13.3 percent higher than the same quarter a year ago. Revenue over the quarter was $42.1 billion, up from $37.4 billion in the same period last year.

Over all, Apple sold 39 million iPhones over the quarter, a significant bump from the 33.8 million it sold in the same period last year.

“Our fiscal 2014 was one for the record books, including the biggest iPhone launch ever with iPhone 6 and iPhone 6 Plus,” Timothy D. Cook, Apple’s chief executive, said in a statement.

The revenue was above the expectations of Wall Street analysts. They had expected revenue of $39.9 billion, according to a survey of analysts by Thomson Reuters. Apple’s $1.42 per share profit also exceed analyst expectations for $1.31 a share.

Year after year, iPhone sales have steadily grown, even though overall sales of smartphones are slowing in developed markets like the United States and parts of Europe. To achieve growth, Apple recently made a series of aggressive moves with the iPhone. Last year, Apple for the first time released two new iPhone models instead of just one. Last month, Apple again released two new iPhones, this time with bigger screens.

On top of that, Apple has teamed up with phone carriers in important markets, particularly China. Late last year, Apple reached an agreement to start selling iPhones with China Mobile, the largest carrier in the world, with about 800 million subscribers.

The larger iPhone 6 and iPhone 6 Plus smartphones got a strong reaction early. In the first weekend that the new iPhones went on sale in September, Apple sold 10 million of the devices, up from the nine million new iPhones sold last year on their opening weekend.

The story hasn’t been the same for the iPad. The company on Monday said it sold 12.3 million iPads over the quarter, down from 14 million in the same quarter last year. The company’s iPad sales were down in the previous quarter, too.

http://www.nytimes.com/2014/10/21/technology/iphone-6-propel…

Antwort auf Beitrag Nr.: 48.088.630 von IngChris am 20.10.14 23:11:03...und Apple Pay läuft gerade an ......

.....und da ist noch nicht einmal eine einzige "Watch" verkauft ....

Eigentlich nur gute Nachrichten.....

- Zahlen haben die Erwartungen übertroffen

- Apple Pay hat die Feuertaufe bestanden

....und das auch noch ....

AT&T Inc (T) Will Carry Apple's (AAPL) iPad Air 2, iPad mini 3

AT&T Inc (NYSE: T) announced that it will offer iPad Air 2 with Wi-Fi + Cellular and iPad mini 3 with Wi-Fi + Cellular. Customers can take their new iPads virtually everywhere and get high speed access to the data and content they care about most on the nation's most reliable 4G LTE network.2

http://www.streetinsider.com/Corporate+News/AT%26T+Inc+%28T%…

- Zahlen haben die Erwartungen übertroffen

- Apple Pay hat die Feuertaufe bestanden

....und das auch noch ....

AT&T Inc (T) Will Carry Apple's (AAPL) iPad Air 2, iPad mini 3

AT&T Inc (NYSE: T) announced that it will offer iPad Air 2 with Wi-Fi + Cellular and iPad mini 3 with Wi-Fi + Cellular. Customers can take their new iPads virtually everywhere and get high speed access to the data and content they care about most on the nation's most reliable 4G LTE network.2

http://www.streetinsider.com/Corporate+News/AT%26T+Inc+%28T%…

Antwort auf Beitrag Nr.: 48.088.525 von IngChris am 20.10.14 22:52:41Here we go...

.

.

http://events.apple.com.edgesuite.net/14lkjbsdpihjbfvpihbasd…

.

.http://events.apple.com.edgesuite.net/14lkjbsdpihjbfvpihbasd…

00:02 Uhr · IG Europe · AppleAnzeige |

02.05.24 · dpa-AFX · Apple |

02.05.24 · dpa-AFX · Apple |

Erwartungen übertroffen: Apple sprengt alle Dimensionen: 110 Milliarden US-Dollar für Aktienrückkäufe!(2) 02.05.24 · wallstreetONLINE Redaktion · Apple |

02.05.24 · wO Newsflash · Honeywell International |

02.05.24 · dpa-AFX · Apple |

02.05.24 · dpa-AFX · Apple |

| Zeit | Titel |

|---|---|

| 01:29 Uhr | |

| 11.02.24 | |

| 18.01.24 | |

| 27.11.23 | |

| 05.11.23 | |

| 22.08.23 | |

| 04.08.23 | |

| 02.07.23 |