Corvus Gold (KOR) - Neue Chance nach Spin Out - 500 Beiträge pro Seite

eröffnet am 08.09.10 18:50:35 von

neuester Beitrag 24.11.21 12:05:31 von

neuester Beitrag 24.11.21 12:05:31 von

Beiträge: 756

ID: 1.159.811

ID: 1.159.811

Aufrufe heute: 0

Gesamt: 56.406

Gesamt: 56.406

Aktive User: 0

ISIN: CA2210131058 · WKN: A1C4C5

3,2300

USD

+0,62 %

+0,0200 USD

Letzter Kurs 18.01.22 Nasdaq

Neuigkeiten

Guten Abend liebe Gold Bugs!

Seit 30. August wird Corvus Gold gehandelt.

Symbol an der TSX : KOR

WKN in Stuttgart und Berlin: A1C4C5

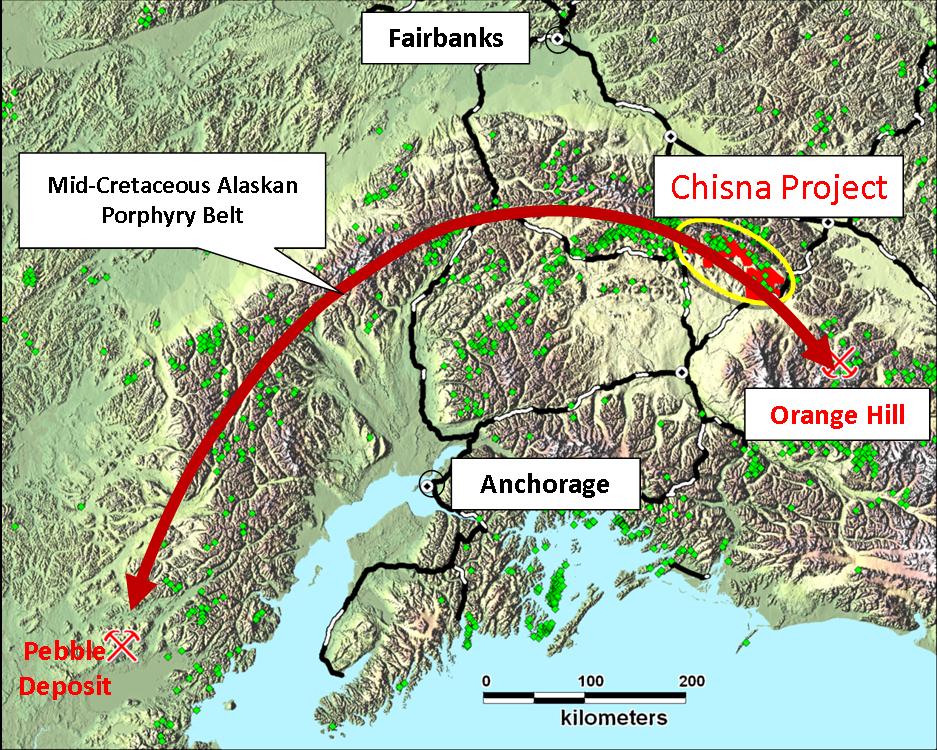

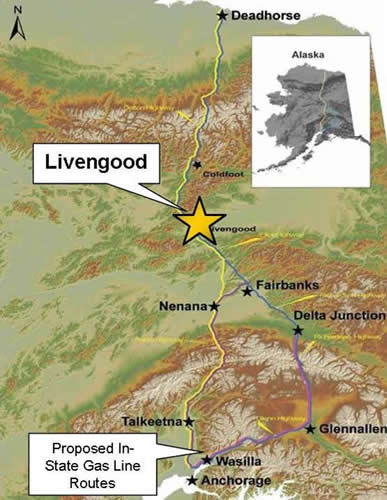

Es handelt sich um ein Spin Out von International Tower Hill Mines (ITH). ITH hat mit dem Livengood Projekt in Alaska eine der größten Goldentdeckungen der letzten 20 Jahre.

http://www.ithmines.com/s/home.asp

Mit ITH konnte man dementsprechend sehr gutes Geld verdienen.

Meiner Meinung nach, bietet Corvus eine interessante Chance.

In die neue Firma wurden 4 Projekte in Alaska und 1 Projekt in Nevada eingebracht.

- North Bullfrog (Nevada)

Hier ist diesen Winter ein 10.000 m Bohrprogramm geplant

- Die 4 Projekte in Alaska werden mit JV Partnern bearbeitet, die dafür Explorationskosten in den nächsten Jahren übernehmen.

Corvus verfügt aktuell über 3 Mio. CA$ Cash sowie

336.000 Unzen Ressourcen nach NI43-101.

Der Börsenwert beträgt aktuell ca. 22,5 Mio. CA$

Alles weitere hier: http://www.corvusgold.com/

Das Team von ITH ist hier natürlich auch wieder an Bord.

Seit 30. August wird Corvus Gold gehandelt.

Symbol an der TSX : KOR

WKN in Stuttgart und Berlin: A1C4C5

Es handelt sich um ein Spin Out von International Tower Hill Mines (ITH). ITH hat mit dem Livengood Projekt in Alaska eine der größten Goldentdeckungen der letzten 20 Jahre.

http://www.ithmines.com/s/home.asp

Mit ITH konnte man dementsprechend sehr gutes Geld verdienen.

Meiner Meinung nach, bietet Corvus eine interessante Chance.

In die neue Firma wurden 4 Projekte in Alaska und 1 Projekt in Nevada eingebracht.

- North Bullfrog (Nevada)

Hier ist diesen Winter ein 10.000 m Bohrprogramm geplant

- Die 4 Projekte in Alaska werden mit JV Partnern bearbeitet, die dafür Explorationskosten in den nächsten Jahren übernehmen.

Corvus verfügt aktuell über 3 Mio. CA$ Cash sowie

336.000 Unzen Ressourcen nach NI43-101.

Der Börsenwert beträgt aktuell ca. 22,5 Mio. CA$

Alles weitere hier: http://www.corvusgold.com/

Das Team von ITH ist hier natürlich auch wieder an Bord.

Ich habe den Zug bei ITH ja verpasst, vl gehts ja hiermit im Anschluss weiter.

Antwort auf Beitrag Nr.: 40.120.376 von lucia30 am 08.09.10 18:50:35Das Team von ITH ist hier natürlich auch wieder an Bord.

Du meinst jetzt sicherlich Jeff Pontius & Co , oder?

Du meinst jetzt sicherlich Jeff Pontius & Co , oder?

Corvus Gold (TSE: KOR)

Press Release Source: Corvus Gold Inc. On Wednesday September 8, 2010, 2:53 pm EDT

Corvus Gold Inc. Announces the Appointment of Management & Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 8, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce the appointment of the following directors and management, effective August 25, 2010. Directors include: Jeffrey Pontius (Chairman), Steven Aaker, Daniel Carriere, Edward Yarrow, Anthony Drescher and Rowland Perkins. Key members of management include:

-- Jeffrey Pontius: Chief Executive Officer

-- Russell Myers: President

-- Lawrence Talbot: Vice President and General Counsel

-- Michael Kinley: Chief Financial Officer

-- Marla Ritchie: Corporate Secretary

-- Quentin Mai: Manager - Corporate Communications

-- Shirley Zhou: Manager - Corporate Communications

...

Quelle: http://finance.yahoo.com/news/Corvus-Gold-Inc-Announces-the-…

Corvus Gold Inc. Announces the Appointment of Management & Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 8, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce the appointment of the following directors and management, effective August 25, 2010. Directors include: Jeffrey Pontius (Chairman), Steven Aaker, Daniel Carriere, Edward Yarrow, Anthony Drescher and Rowland Perkins. Key members of management include:

-- Jeffrey Pontius: Chief Executive Officer

-- Russell Myers: President

-- Lawrence Talbot: Vice President and General Counsel

-- Michael Kinley: Chief Financial Officer

-- Marla Ritchie: Corporate Secretary

-- Quentin Mai: Manager - Corporate Communications

-- Shirley Zhou: Manager - Corporate Communications

...

Quelle: http://finance.yahoo.com/news/Corvus-Gold-Inc-Announces-the-…

Antwort auf Beitrag Nr.: 40.122.425 von Teffie am 09.09.10 06:06:07Muss natürlich die News über meine neue "Tochter" auch verfolgen und mitlesen

*ankersetz*

*ankersetz*

Antwort auf Beitrag Nr.: 40.121.874 von Illex08 am 08.09.10 22:28:44Zum Beispiel ...

Casey zu Corvus:

RECOMMENDATION UPDATE

Comments: Casey Research Senior Metals Analyst Louis James just returned from a trip to see KOR's Chisna project in Alaska and to meet with the company's management and technical people. A more detailed report will be published in the next International Speculator. For now, we'll summarize by saying that Louis was very favorably impressed by the company's People and believes the company's top projects have genuine merit. KOR does not have much by way of 43-101-compliant resources in hand, but it has more value in work commitments from JV partners than the value the market is giving the entire company in MCap. More important is that the targets are big game -- the company is pursuing a "go bi or go home" strategy, largely paid for with OPM. This is a highly speculative play, but one with high potential as well, and relatively low near-term risk.

Consequently, we're changing our recommendation from Hold to Buy on Weakness, with the 60-cent range looking good for a first tranche, for those who did not get shares for free from the spin-out from ITH.

dr.a

dr.a

RECOMMENDATION UPDATE

Comments: Casey Research Senior Metals Analyst Louis James just returned from a trip to see KOR's Chisna project in Alaska and to meet with the company's management and technical people. A more detailed report will be published in the next International Speculator. For now, we'll summarize by saying that Louis was very favorably impressed by the company's People and believes the company's top projects have genuine merit. KOR does not have much by way of 43-101-compliant resources in hand, but it has more value in work commitments from JV partners than the value the market is giving the entire company in MCap. More important is that the targets are big game -- the company is pursuing a "go bi or go home" strategy, largely paid for with OPM. This is a highly speculative play, but one with high potential as well, and relatively low near-term risk.

Consequently, we're changing our recommendation from Hold to Buy on Weakness, with the 60-cent range looking good for a first tranche, for those who did not get shares for free from the spin-out from ITH.

dr.a

dr.a

Antwort auf Beitrag Nr.: 40.163.438 von dr.a am 16.09.10 17:43:40Vielen Dank.

die letzten 10 trades vom 17.09.2010

16:10:00 T 0.79 0.08 44,500

0.08 44,500 1 Anonymous 72 Credit Suisse

1 Anonymous 72 Credit Suisse

15:58:51 T 0.72 0.01 500 13 Instinet 1 Anonymous

15:58:39 T 0.72 0.01 500 1 Anonymous 1 Anonymous

15:58:36 T 0.72 0.01 500 13 Instinet 1 Anonymous

15:58:28 T 0.72 0.01 3,500 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 18,000 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 1,000 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 500 1 Anonymous 2 RBC

15:58:19 T 0.72 0.01 1,500 1 Anonymous 2 RBC

15:58:13 T 0.71 0.00 400 74 GMP 19 Desjardins

keusix

16:10:00 T 0.79

0.08 44,500

0.08 44,500 1 Anonymous 72 Credit Suisse

1 Anonymous 72 Credit Suisse 15:58:51 T 0.72 0.01 500 13 Instinet 1 Anonymous

15:58:39 T 0.72 0.01 500 1 Anonymous 1 Anonymous

15:58:36 T 0.72 0.01 500 13 Instinet 1 Anonymous

15:58:28 T 0.72 0.01 3,500 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 18,000 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 1,000 1 Anonymous 1 Anonymous

15:58:22 T 0.72 0.01 500 1 Anonymous 2 RBC

15:58:19 T 0.72 0.01 1,500 1 Anonymous 2 RBC

15:58:13 T 0.71 0.00 400 74 GMP 19 Desjardins

keusix

Na,

das sieht doch schon Mal gut aus:

das sieht doch schon Mal gut aus:

Antwort auf Beitrag Nr.: 40.195.082 von married am 22.09.10 21:36:24Gibts fundamentale Gründe oder bevorstehende News wegen des Anstiegs?

Antwort auf Beitrag Nr.: 40.202.483 von Schmelzi26 am 24.09.10 06:25:57

Mir nicht bekannt.

Vielleicht hatte jeder auf die großen Abverkäufe der big holders gewartet

und selbst schon mal "vorsorglich" welche gegeben.

Oder der Kurs wird jetzt hochgezogen um diesen Abverkauf bei einem höheren level

beginnen zu können.

Oder es ist ganz einfach der POG .....

Mir nicht bekannt.

Vielleicht hatte jeder auf die großen Abverkäufe der big holders gewartet

und selbst schon mal "vorsorglich" welche gegeben.

Oder der Kurs wird jetzt hochgezogen um diesen Abverkauf bei einem höheren level

beginnen zu können.

Oder es ist ganz einfach der POG .....

Antwort auf Beitrag Nr.: 40.202.499 von married am 24.09.10 06:51:24oder man zieht den preis für ein pp nach oben um einen guten preis für wenige neue shares erzielen zu können.

nur so eine idee.

keusix

morsche!

nur so eine idee.

keusix

morsche!

Antwort auf Beitrag Nr.: 40.202.502 von keusix am 24.09.10 06:52:42

Früher hatte man das aber andersherum angegangen.

Bei den uns bekannten involvierten "Privat"-Investoren.

Guten Morgen und Gute Geschäfte heute !

Früher hatte man das aber andersherum angegangen.

Bei den uns bekannten involvierten "Privat"-Investoren.

Guten Morgen und Gute Geschäfte heute !

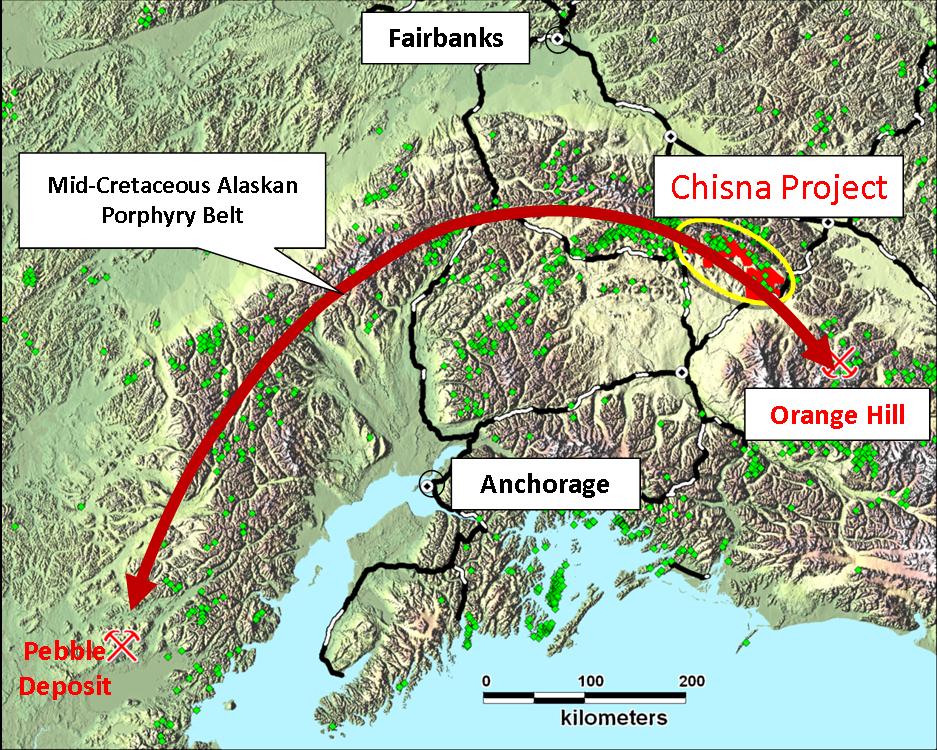

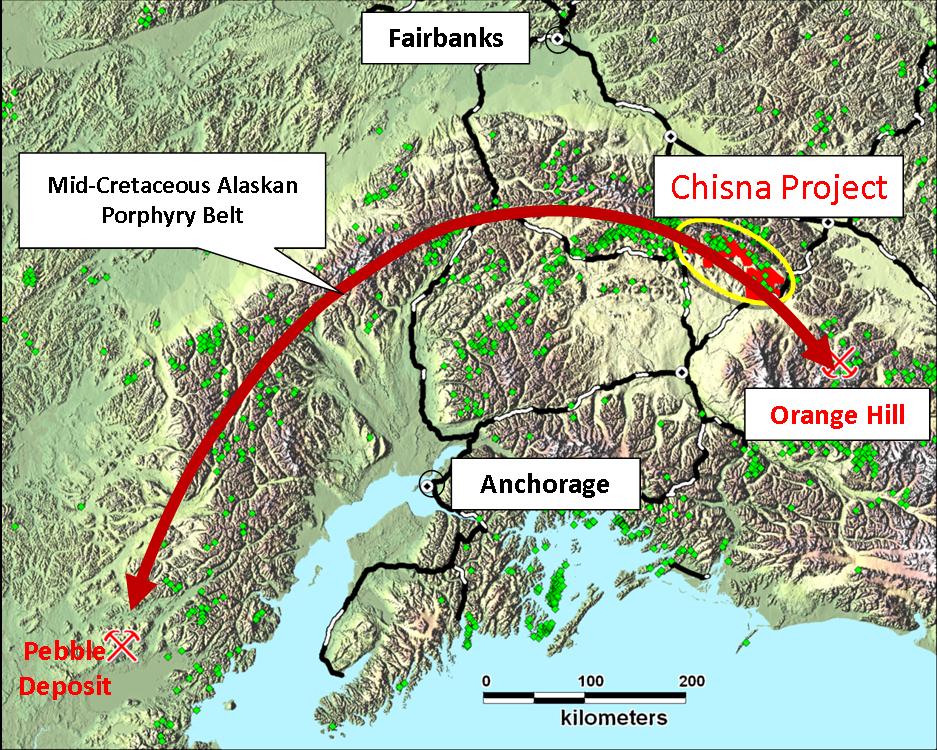

ca. entfernung livengood zu chisna

hoffentlich funzt die darstellung. wenn icht sorry!

hoffentlich funzt die darstellung. wenn icht sorry!

in der oberen grafik sentsprecht 1cm = 50km und in der unteren 1cm = ca. 125km.

somit kann sich jeder ca. die entfernung selber ausrechnen.

keusix

somit kann sich jeder ca. die entfernung selber ausrechnen.

keusix

Antwort auf Beitrag Nr.: 40.202.509 von married am 24.09.10 06:59:03

sorry für die kleinen rechtschreibfehler, aber im eifer des gefechts passiert es schonmal

keusix

keusix

Guten Abend!

Danke für Eure Beiträge.

Schauen wir mal ob der "goldige" Herbst für KOR auch schon positive Entwicklungen bringt.

Danke für Eure Beiträge.

Schauen wir mal ob der "goldige" Herbst für KOR auch schon positive Entwicklungen bringt.

Antwort auf Beitrag Nr.: 40.208.843 von lucia30 am 24.09.10 22:23:05

Schauen wir mal ob der "goldige" Herbst für KOR auch schon positive Entwicklungen bringt.

Ocean Park completes Phase 1 drilling at Chisna

2010-09-27 11:45 ET - News Release

See News Release (C-OCP) Ocean Park Ventures Corp

Mr. Paul Matysek reports

OCEAN PARK VENTURES ANNOUNCES PHASE ONE DRILLING CONCLUDES AT CHISNA, NEW COPPER GOLD TARGETS IDENTIFIED

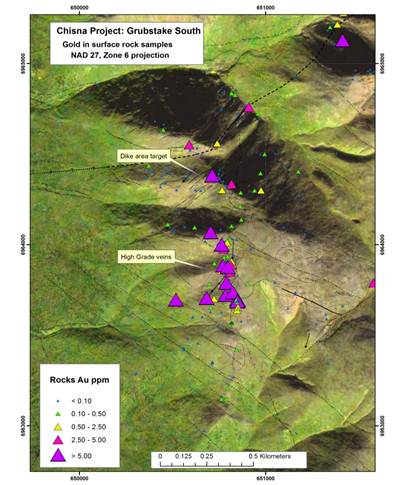

Ocean Park Ventures Corp. has successfully concluded the the first phase of its diamond drill program at the Chisna project located in the Chistochina mining district of south-central Alaska, 350 kilometres northeast of the city of Anchorage.

The 2010 exploration program, which included 2,926 metres (9,600 feet) of diamond drilling, has successfully identified a large number of copper-gold targets, two of which were drill tested as part of the Phase 1 drill program. These results expand the known styles of mineralization to include porphyry copper-gold-molybdenum, skarn copper-iron and skarn copper-gold targets as well as structurally controlled gold-copper mineralization. Assay results for drilling and most surface rock and soil sampling are pending.

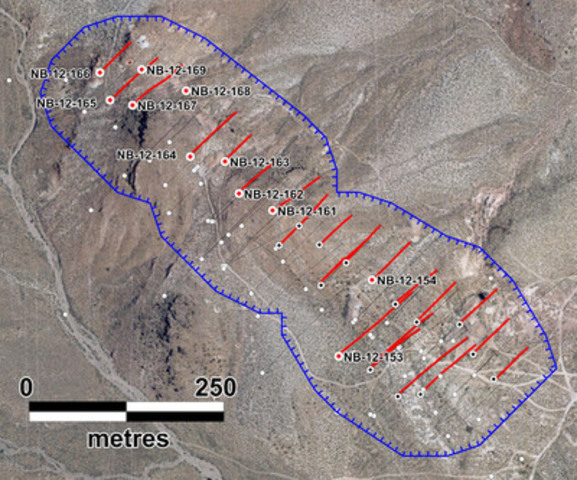

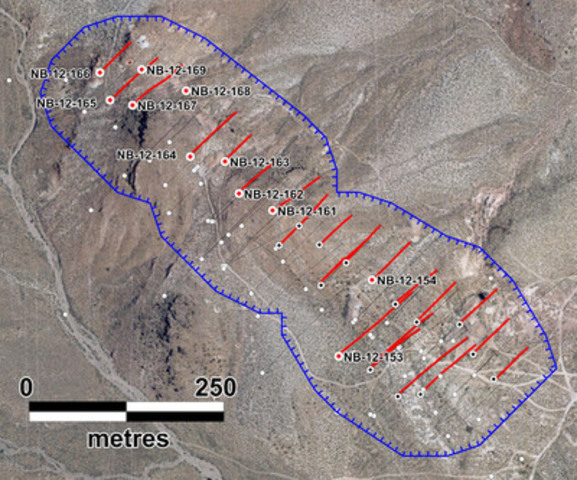

Completed geophysical surveys include airborne ZTEM surveying covering 75% of the Chisna property, ground-based magnetotelluric (MT) and three dimensional induced polarization (3D-IP) chargeability-resistivity surveying and inversion modeling over selected target areas. Field mapping and mineralized target identification are ongoing as weather permits.

Schauen wir mal ob der "goldige" Herbst für KOR auch schon positive Entwicklungen bringt.

Ocean Park completes Phase 1 drilling at Chisna

2010-09-27 11:45 ET - News Release

See News Release (C-OCP) Ocean Park Ventures Corp

Mr. Paul Matysek reports

OCEAN PARK VENTURES ANNOUNCES PHASE ONE DRILLING CONCLUDES AT CHISNA, NEW COPPER GOLD TARGETS IDENTIFIED

Ocean Park Ventures Corp. has successfully concluded the the first phase of its diamond drill program at the Chisna project located in the Chistochina mining district of south-central Alaska, 350 kilometres northeast of the city of Anchorage.

The 2010 exploration program, which included 2,926 metres (9,600 feet) of diamond drilling, has successfully identified a large number of copper-gold targets, two of which were drill tested as part of the Phase 1 drill program. These results expand the known styles of mineralization to include porphyry copper-gold-molybdenum, skarn copper-iron and skarn copper-gold targets as well as structurally controlled gold-copper mineralization. Assay results for drilling and most surface rock and soil sampling are pending.

Completed geophysical surveys include airborne ZTEM surveying covering 75% of the Chisna property, ground-based magnetotelluric (MT) and three dimensional induced polarization (3D-IP) chargeability-resistivity surveying and inversion modeling over selected target areas. Field mapping and mineralized target identification are ongoing as weather permits.

Corvus Gold Inc. On Wednesday September 29, 2010, 9:01 am

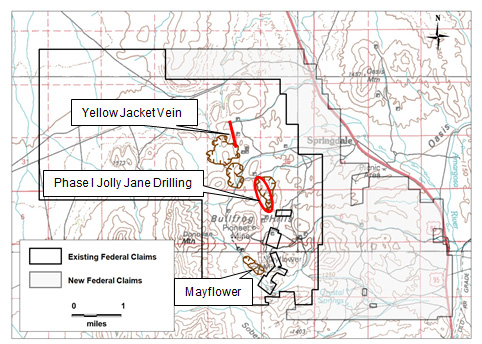

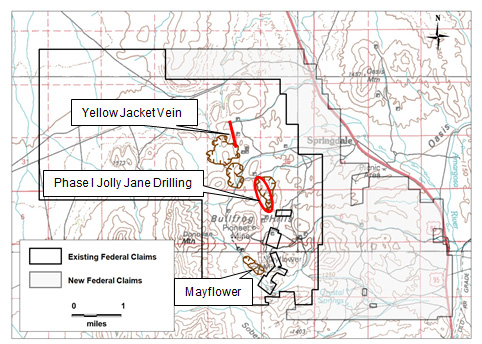

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 29, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce that they have contracted Eklund Drilling Company, Inc. of Reno, Nevada to undertake a 10,000 metre reverse circulation drilling program at the North Bullfrog Gold Project, Nevada. Drilling is scheduled to begin in mid-October. The North Bullfrog Project targets low-sulphidation epithermal-style gold mineralization of a style similar to that at the Bullfrog mine operated by Barrick Gold Corporation until 1998 and located 8 kilometres to the south.

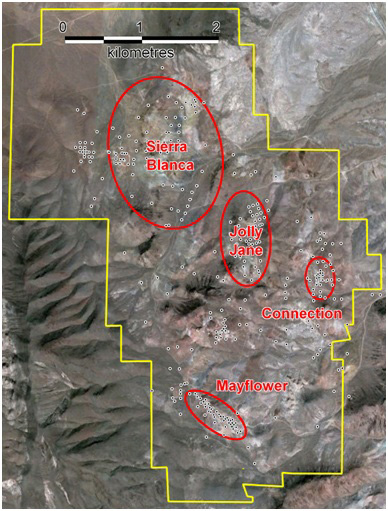

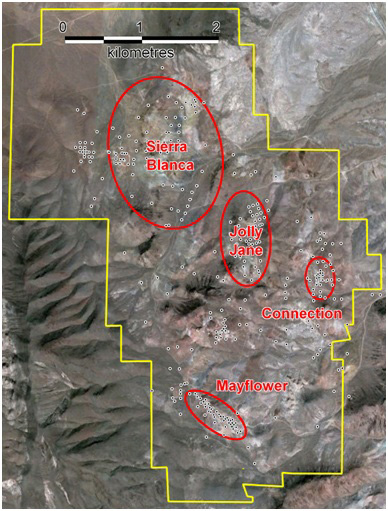

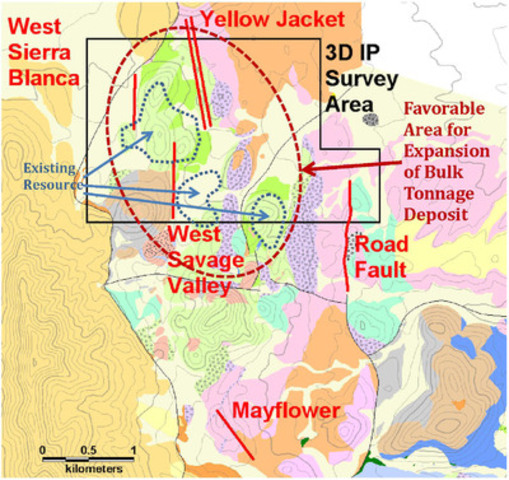

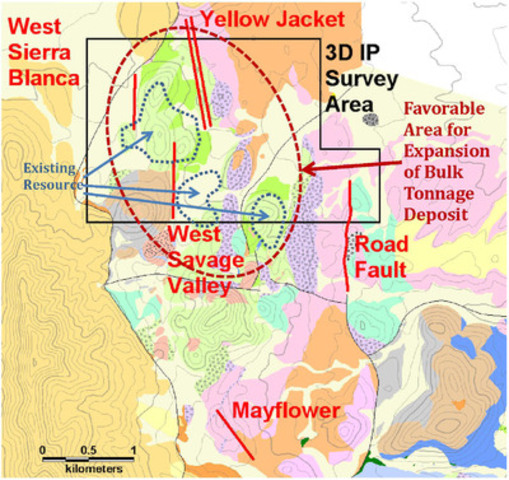

Drilling will focus on expanding the current NI 43-101 estimated Indicated gold resource of 2,202,000 tonnes at an average grade of 0.88 g/t (57,086 contained ounces), plus an additional Inferred gold resource of 950,000 tonnes at an average grade of 0.78 g/t (23,793 contained ounces), both at a cutoff grade of 0.5 g/t gold. The initial phase will test three primary targets areas: Sierra Blanca, Jolly Jane and Connection, all of which have had past drilling in the 1990's when gold was at approx. USD 400 per ounce. This historic drilling, which was undertaken by Barrick and Cordex Exploration Company, defined extensive zones of low grade mineralization in thick volcanic units (To view Figure 1: Overview of the North Bullfrog Project, please visit the following link: http://media3.marketwire.com/docs/kor-map1.pdf). This target type is similar in setting to the Round Mountain Gold Deposit located 150 miles to the north as well as the historic Bullfrog gold mine. The program will test two other priority target areas with significant gold mineralization in historic drill holes and, as time permits, will also test some wildcat targets.

Priority Phase I Target Areas

Sierra Blanca

In the Sierra Blanca area both disseminated bulk tonnage and high-grade vein-style targets are present. Historical drilling, including drilling by International Tower Hill Mines Ltd. in 2007, has defined broad zones of gold mineralization in the altered volcanics. In addition, vein mineralization is present in the north-south trending structural zones that have hosted historic high-grade production. Drilling will also target projections of the bulk tonnage and high-grade zones under cover to the east and south of the main target area in the Savage Valley.

Jolly Jane

Historical drilling in the Jolly Jane area in the 1990's by Barrick encountered disseminated mineralization over wide intervals within favourable host lithology. In addition, key deep structural zones have been identified and targeted as possible high-grade feeders to the disseminated system.

Connection

The Connection Prospect has returned several 10-20 metre intercepts in the +1 g/t gold range in the historical drilling. Mineralization in the Connection areas is hosted in a debris flow unit and has not been followed up since its discovery in the 1990's. The Phase I work will address the confirmation of the existing mineralization and initial testing of other new targets to the west.

About North Bullfrog

The North Bullfrog Project is owned 100% by Corvus and covers 24 square kilometres of United States federal unpatented and leased patented claims (Figure 1). The property is located near Beatty, Nevada, 8 kilometres north of Barrick's former Bullfrog mine.

Gold was first discovered on the North Bullfrog property in 1904 and approximately 112,000 ounces of gold and 869,000 ounces of silver were produced from narrow high-grade veins. Historical exploration was focused on these high grade veins and, in addition, on the broad zones of lower grade mineralization hosted in adularia altered ash flow tuffs discovered during such initial historical exploration.

The current exploration program will focus on both defining the large bulk tonnage potential of the project as well as also testing favourable structural projections of high-grade vein system which may be hidden under cover. The Company's development concept is to develop multiple deposits (bulk tonnage and high-grade) which can be feed into a central processing facility.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the Chairman and CEO and holds common shares and incentive stock options.

The work program at North Bullfrog was designed and supervised by Russell Myers, President of Corvus and Mark Reischman, the Nevada Exploration Manager for Corvus, who are together responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project photograph the core from each individual borehole prior to preparing the split core. On-site personnel at the project log and track all samples prior to sealing and shipping. All sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assay. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control is further assured by the use of international and in-house standards. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Alaska and Nevada, which controls a number of exploration projects representing a spectrum from early stage to the advanced gold projects. Corvus is committed to building shareholder value through new discoveries and leveraging those discoveries via partner funding into carried and or royalty interests that provide its shareholders significant exposure to produced gold to maximize the value for their investment.

On behalf of Corvus Gold Inc.

Jeffrey A. Pontius, Chairman and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential for the expansion of the estimated resources at North Bullfrog, the potential for the operation of a central processing facility to treat North Bullfrog mineralization, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Information Circular of International Tower Hill Mines Ltd. dated July 9, 2010 in respect of the ITH Special Meeting held on August 12, 2010. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Caution Regarding Adjacent or Similar Mineral Properties

This news release contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the SEC set forth in SEC Industry Guide 7 strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company's properties.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Contact:

Quentin MaiCorvus Gold Inc.Manager - Corporate Communications1-888-770-7488 (toll free) or (604) 683-3246(604) 408-7499 (FAX)qmai@corvusgold.comwww.corvusgold.com

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 29, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce that they have contracted Eklund Drilling Company, Inc. of Reno, Nevada to undertake a 10,000 metre reverse circulation drilling program at the North Bullfrog Gold Project, Nevada. Drilling is scheduled to begin in mid-October. The North Bullfrog Project targets low-sulphidation epithermal-style gold mineralization of a style similar to that at the Bullfrog mine operated by Barrick Gold Corporation until 1998 and located 8 kilometres to the south.

Drilling will focus on expanding the current NI 43-101 estimated Indicated gold resource of 2,202,000 tonnes at an average grade of 0.88 g/t (57,086 contained ounces), plus an additional Inferred gold resource of 950,000 tonnes at an average grade of 0.78 g/t (23,793 contained ounces), both at a cutoff grade of 0.5 g/t gold. The initial phase will test three primary targets areas: Sierra Blanca, Jolly Jane and Connection, all of which have had past drilling in the 1990's when gold was at approx. USD 400 per ounce. This historic drilling, which was undertaken by Barrick and Cordex Exploration Company, defined extensive zones of low grade mineralization in thick volcanic units (To view Figure 1: Overview of the North Bullfrog Project, please visit the following link: http://media3.marketwire.com/docs/kor-map1.pdf). This target type is similar in setting to the Round Mountain Gold Deposit located 150 miles to the north as well as the historic Bullfrog gold mine. The program will test two other priority target areas with significant gold mineralization in historic drill holes and, as time permits, will also test some wildcat targets.

Priority Phase I Target Areas

Sierra Blanca

In the Sierra Blanca area both disseminated bulk tonnage and high-grade vein-style targets are present. Historical drilling, including drilling by International Tower Hill Mines Ltd. in 2007, has defined broad zones of gold mineralization in the altered volcanics. In addition, vein mineralization is present in the north-south trending structural zones that have hosted historic high-grade production. Drilling will also target projections of the bulk tonnage and high-grade zones under cover to the east and south of the main target area in the Savage Valley.

Jolly Jane

Historical drilling in the Jolly Jane area in the 1990's by Barrick encountered disseminated mineralization over wide intervals within favourable host lithology. In addition, key deep structural zones have been identified and targeted as possible high-grade feeders to the disseminated system.

Connection

The Connection Prospect has returned several 10-20 metre intercepts in the +1 g/t gold range in the historical drilling. Mineralization in the Connection areas is hosted in a debris flow unit and has not been followed up since its discovery in the 1990's. The Phase I work will address the confirmation of the existing mineralization and initial testing of other new targets to the west.

About North Bullfrog

The North Bullfrog Project is owned 100% by Corvus and covers 24 square kilometres of United States federal unpatented and leased patented claims (Figure 1). The property is located near Beatty, Nevada, 8 kilometres north of Barrick's former Bullfrog mine.

Gold was first discovered on the North Bullfrog property in 1904 and approximately 112,000 ounces of gold and 869,000 ounces of silver were produced from narrow high-grade veins. Historical exploration was focused on these high grade veins and, in addition, on the broad zones of lower grade mineralization hosted in adularia altered ash flow tuffs discovered during such initial historical exploration.

The current exploration program will focus on both defining the large bulk tonnage potential of the project as well as also testing favourable structural projections of high-grade vein system which may be hidden under cover. The Company's development concept is to develop multiple deposits (bulk tonnage and high-grade) which can be feed into a central processing facility.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the Chairman and CEO and holds common shares and incentive stock options.

The work program at North Bullfrog was designed and supervised by Russell Myers, President of Corvus and Mark Reischman, the Nevada Exploration Manager for Corvus, who are together responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project photograph the core from each individual borehole prior to preparing the split core. On-site personnel at the project log and track all samples prior to sealing and shipping. All sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assay. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control is further assured by the use of international and in-house standards. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Alaska and Nevada, which controls a number of exploration projects representing a spectrum from early stage to the advanced gold projects. Corvus is committed to building shareholder value through new discoveries and leveraging those discoveries via partner funding into carried and or royalty interests that provide its shareholders significant exposure to produced gold to maximize the value for their investment.

On behalf of Corvus Gold Inc.

Jeffrey A. Pontius, Chairman and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential for the expansion of the estimated resources at North Bullfrog, the potential for the operation of a central processing facility to treat North Bullfrog mineralization, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Information Circular of International Tower Hill Mines Ltd. dated July 9, 2010 in respect of the ITH Special Meeting held on August 12, 2010. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Caution Regarding Adjacent or Similar Mineral Properties

This news release contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the SEC set forth in SEC Industry Guide 7 strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company's properties.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Contact:

Quentin MaiCorvus Gold Inc.Manager - Corporate Communications1-888-770-7488 (toll free) or (604) 683-3246(604) 408-7499 (FAX)qmai@corvusgold.comwww.corvusgold.com

Corvus Gold (TSE: KOR)

Ocean Park Ventures Corp. Intersects Copper and Gold Mineralization in First Drill Holes at the POW Target, Chisna Project, Alaska

Thu Sep 30, 6:03 AM

Email Story IM Story Printable View

Highlights include: 23 meters of 0.38% Copper, 0.43g/t Gold and 7.5 g/t Silver

(including 2.1 metres @ 1.7g/t gold, 4.4% copper and 21.8g/t silver)

September 30, 2010, Vancouver, BC – Paul Matysek, acting President and Chairman of Ocean Park Ventures Corp. (TSX Venture - OCP) is pleased to announce the successful conclusion of the Phase 1 diamond drill program at the Chisna Project located in the Chistochina Mining District of south-central Alaska, 350 km northeast of the city of Anchorage.

The Chisna Project is a Joint Venture between Ocean Park's wholly owned subsidiary Ocean Park Alaska Corp. and Corvus Gold Inc. (“Corvus”)(TSX: KOR.TO). Ocean Park's 51 % interest in the Joint Venture is earned by its US$20M contribution for exploration expenditures over a 5 year period. Ocean Park may earn an additional 19% by producing a bankable feasibility that delineates a mining project on the Chisna property that produces at least 300,000 gold equivalent ounces per year.

The Summer 2010 exploration program, which included 2,926 metres (9600 feet) of diamond drilling, soil and rock sampling, airborne ZTEM surveying and ground-based magnetotelluric (MT) with three dimensional induced polarization (3D-IP) chargeability-resistivity surveying and inversion modeling over selected target areas. The program has successfully identified a large number of copper-gold targets, two of which were drill tested as part of the Phase 1 drill program. This work has identified several styles of mineralization within the nearly 10,000 square kilometre Chisna land package, including porphyry copper-gold-molybdenum, skarn copper-iron and copper-gold targets as well as structurally controlled gold-copper mineralization.

POW Target

Assays from one of the three drill holes into the POW target (PW-10-02) returned 23 meters of 0.38% copper, 0.43 g/t gold and 7.5 g/t silver, including 2.1 metres @ 1.7 g/t gold, 4.4% copper and 21.8 g/t silver. The first drill hole (POW-10-01) returned an oxidized and variably faulted interval over 23.8 meters of 0.13% Cu, 0.16 g/t Au and 2.8g/t Ag. The third hole was lost in a fault zone prior to reaching the targeted down dip mineralization.

Nachricht stark gekürzt

Thu Sep 30, 6:03 AM

Email Story IM Story Printable View

Highlights include: 23 meters of 0.38% Copper, 0.43g/t Gold and 7.5 g/t Silver

(including 2.1 metres @ 1.7g/t gold, 4.4% copper and 21.8g/t silver)

September 30, 2010, Vancouver, BC – Paul Matysek, acting President and Chairman of Ocean Park Ventures Corp. (TSX Venture - OCP) is pleased to announce the successful conclusion of the Phase 1 diamond drill program at the Chisna Project located in the Chistochina Mining District of south-central Alaska, 350 km northeast of the city of Anchorage.

The Chisna Project is a Joint Venture between Ocean Park's wholly owned subsidiary Ocean Park Alaska Corp. and Corvus Gold Inc. (“Corvus”)(TSX: KOR.TO). Ocean Park's 51 % interest in the Joint Venture is earned by its US$20M contribution for exploration expenditures over a 5 year period. Ocean Park may earn an additional 19% by producing a bankable feasibility that delineates a mining project on the Chisna property that produces at least 300,000 gold equivalent ounces per year.

The Summer 2010 exploration program, which included 2,926 metres (9600 feet) of diamond drilling, soil and rock sampling, airborne ZTEM surveying and ground-based magnetotelluric (MT) with three dimensional induced polarization (3D-IP) chargeability-resistivity surveying and inversion modeling over selected target areas. The program has successfully identified a large number of copper-gold targets, two of which were drill tested as part of the Phase 1 drill program. This work has identified several styles of mineralization within the nearly 10,000 square kilometre Chisna land package, including porphyry copper-gold-molybdenum, skarn copper-iron and copper-gold targets as well as structurally controlled gold-copper mineralization.

POW Target

Assays from one of the three drill holes into the POW target (PW-10-02) returned 23 meters of 0.38% copper, 0.43 g/t gold and 7.5 g/t silver, including 2.1 metres @ 1.7 g/t gold, 4.4% copper and 21.8 g/t silver. The first drill hole (POW-10-01) returned an oxidized and variably faulted interval over 23.8 meters of 0.13% Cu, 0.16 g/t Au and 2.8g/t Ag. The third hole was lost in a fault zone prior to reaching the targeted down dip mineralization.

Nachricht stark gekürzt

Antwort auf Beitrag Nr.: 40.239.928 von gruenbob am 30.09.10 14:01:28

Nachricht stark gekürzt

So wie die Reaktion darauf:

Bzw. vom Partner OCP

Nachricht stark gekürzt

So wie die Reaktion darauf:

Bzw. vom Partner OCP

Antwort auf Beitrag Nr.: 40.239.928 von gruenbob am 30.09.10 14:01:28Highlights include: 23 meters of 0.38% Copper, 0.43g/t Gold and 7.5 g/t Silver

(including 2.1 metres @ 1.7g/t gold, 4.4% copper and 21.8g/t silver)

wenn ich dieses Bohrergebnis analysiere komme ich zu folgendem Schluss:

Kupfer gibt es nur in diesen 210 cm mit 4,4%, in den restlichen 20,9 metern gibt es gar kein Kupfer, für den Rest von 20,9 m komme ich auf einen rechnerischen negativen Kupfergehalt von -0,024%.

Die gleiche Rechnung für Gold: In den restlichen 20,9 m ein Goldgehalt von 0,3g und Silber bei 6,06g.

Daher kann man glaube ich dieses Bohrergebnis getrost als non-event abbuchen, man hat 2,1 m Mineralisiertes Material gefunden, der Rest ist deutlich unter einem wie auch immer gearteten cut-off.

Der negative Kupferwert zeigt mal wieder die Akrobatik:

4,35% Kupfer (was man als untersten Wert bei der Angabe 4,4% erwarten dürfte) / 23m *2,1m = 0,397%

Ein einfacher Dreisatz, meine Herren!

Wie dann im Gesamtintervall nur 0,38% Kupfer vorhanden sein kann ist mir schleierhaft.

Also bleibt nur der Schluss: Die Meldung ist falsch formuliert.

(including 2.1 metres @ 1.7g/t gold, 4.4% copper and 21.8g/t silver)

wenn ich dieses Bohrergebnis analysiere komme ich zu folgendem Schluss:

Kupfer gibt es nur in diesen 210 cm mit 4,4%, in den restlichen 20,9 metern gibt es gar kein Kupfer, für den Rest von 20,9 m komme ich auf einen rechnerischen negativen Kupfergehalt von -0,024%.

Die gleiche Rechnung für Gold: In den restlichen 20,9 m ein Goldgehalt von 0,3g und Silber bei 6,06g.

Daher kann man glaube ich dieses Bohrergebnis getrost als non-event abbuchen, man hat 2,1 m Mineralisiertes Material gefunden, der Rest ist deutlich unter einem wie auch immer gearteten cut-off.

Der negative Kupferwert zeigt mal wieder die Akrobatik:

4,35% Kupfer (was man als untersten Wert bei der Angabe 4,4% erwarten dürfte) / 23m *2,1m = 0,397%

Ein einfacher Dreisatz, meine Herren!

Wie dann im Gesamtintervall nur 0,38% Kupfer vorhanden sein kann ist mir schleierhaft.

Also bleibt nur der Schluss: Die Meldung ist falsch formuliert.

Corvus Gold Inc. (KOR)

Exchange: Toronto Stock Exchange

$1.010 Oct 1, 2010, 3:59 PM EDT Change: 0.160 (18.82%)Volume: 954,020

Ein netter Wochenschluss.

Exchange: Toronto Stock Exchange

$1.010 Oct 1, 2010, 3:59 PM EDT Change: 0.160 (18.82%)Volume: 954,020

Ein netter Wochenschluss.

auf eine gute woche

Antwort auf Beitrag Nr.: 40.259.005 von Onkel Dagobert am 04.10.10 13:18:34Bisher beginnt die Woche für KOR ja ganz nett (trotz allgemeiner Konsolidierung bei den Goldaktien):

1.10

Change: +0.09

Volume: 844,803

Percent Change: +8.91%

Meiner Meinung nach konnte man bei Doug Casey folgendes lesen:

Corvus Gold (T.KOR, C$0.90 on 9/28, 33.6M SO, 36.6M FD, C$30.2M MCap, www.corvusgold.com)—The understanding I gained visiting KOR is that Russell Myers (VP Ex for THM, president for KOR) is the real deal, and so are the properties he’s working on. Russell is a calm, competent geologist, not a promoter, and has assembled a team that knows what it’s doing. A few of the projects have modest resources already, but all have large, “go big or go home” potential, with a lot of Other People’s Money doing the heavy lifting now, except on North Bullfrog in Nevada (not JV’ed). At the Chisna project where I kicked rocks, the JV partner is spending $20 million to earn 50%, with a $6 million commitment for the first year – a fantastic deal for KOR. It’s possible to get hurt buying this stock, should the company and its partners strike out repeatedly, but there are many kicks at the can, all with huge potential payouts. I’m in.

Danke an michel74

1.10

Change: +0.09

Volume: 844,803

Percent Change: +8.91%

Meiner Meinung nach konnte man bei Doug Casey folgendes lesen:

Corvus Gold (T.KOR, C$0.90 on 9/28, 33.6M SO, 36.6M FD, C$30.2M MCap, www.corvusgold.com)—The understanding I gained visiting KOR is that Russell Myers (VP Ex for THM, president for KOR) is the real deal, and so are the properties he’s working on. Russell is a calm, competent geologist, not a promoter, and has assembled a team that knows what it’s doing. A few of the projects have modest resources already, but all have large, “go big or go home” potential, with a lot of Other People’s Money doing the heavy lifting now, except on North Bullfrog in Nevada (not JV’ed). At the Chisna project where I kicked rocks, the JV partner is spending $20 million to earn 50%, with a $6 million commitment for the first year – a fantastic deal for KOR. It’s possible to get hurt buying this stock, should the company and its partners strike out repeatedly, but there are many kicks at the can, all with huge potential payouts. I’m in.

Danke an michel74

Press Release Source: Corvus Gold Inc. On Wednesday October 6, 2010, 9:00 am EDT

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 6, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce that Raven Gold Alaska Inc., a subsidiary of Corvus ("Raven Gold"), has entered into a formal Exploration, Development and Mine Operating Agreement with Terra Gold Corporation ("Terra Gold"), a subsidiary of Terra Mining Corporation ("TMC"), to advance the Terra property in Alaska to production. Terra Gold has proposed an aggressive program to advance the project toward production. Their proposed program consists of additional diamond drilling and the collection and processing of a bulk sample to evaluate the recovery characteristics of the mineralization.

"We are very excited about finalizing the agreement with Terra Gold Corporation," said Russell Myers, the President of Corvus. "We believe that Terra Gold has the technical expertise to successfully take the Terra project to production and to fully realize the value of this high-grade gold-silver asset, which has the potential to provide a significant income stream to Corvus in the near-term."

About the Terra Project

High-grade gold mineralization was discovered in low-sulphidation epithermal veins at Terra in 1998. The project was advanced by drilling in 2005 by AngloGold Ashanti (U.S.A.) Exploration Inc. and in 2006 and 2007 by International Tower Hill Mines Ltd. ("ITH"). The Terra property consists of 236 State of Alaska Mining Claims (approximately 130 km(2)), of which 5 are held under lease from an individual and the balance are owned 100% by Raven Gold.

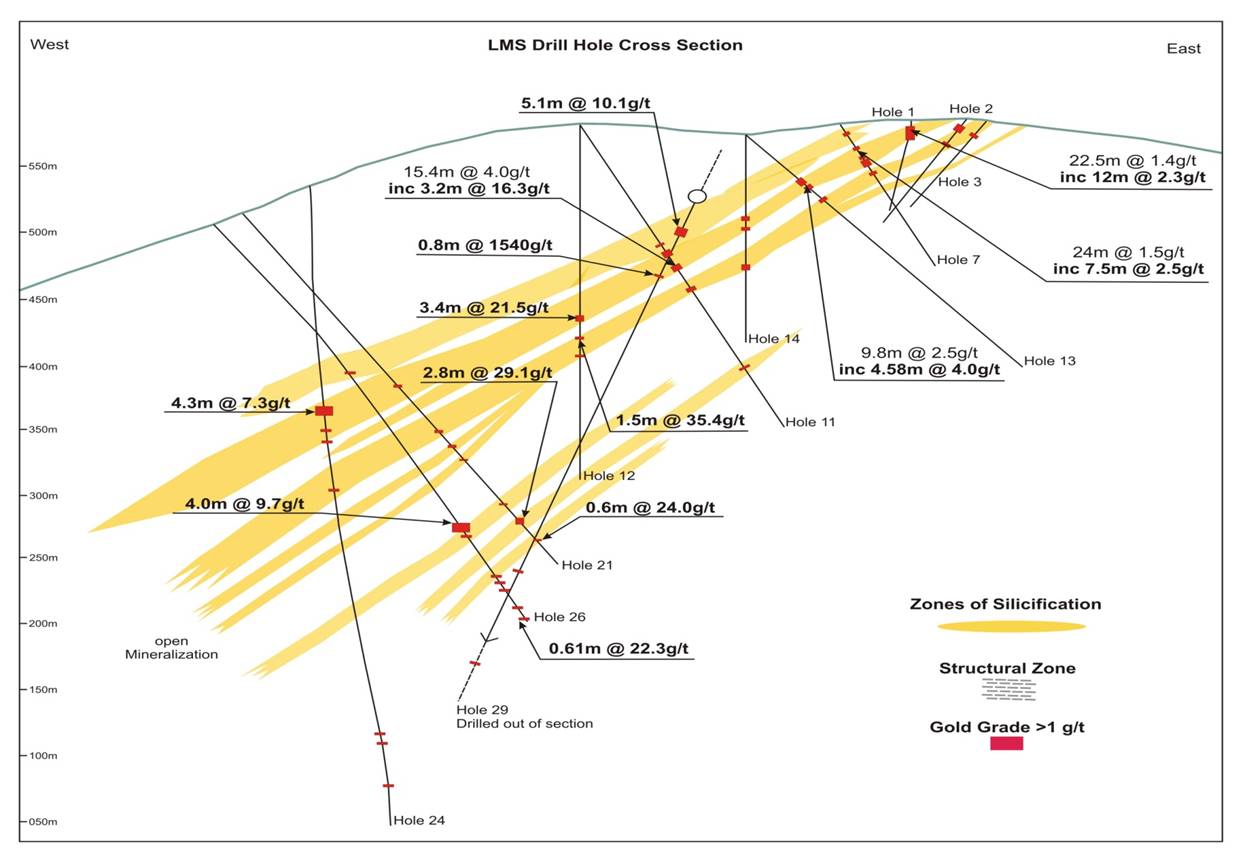

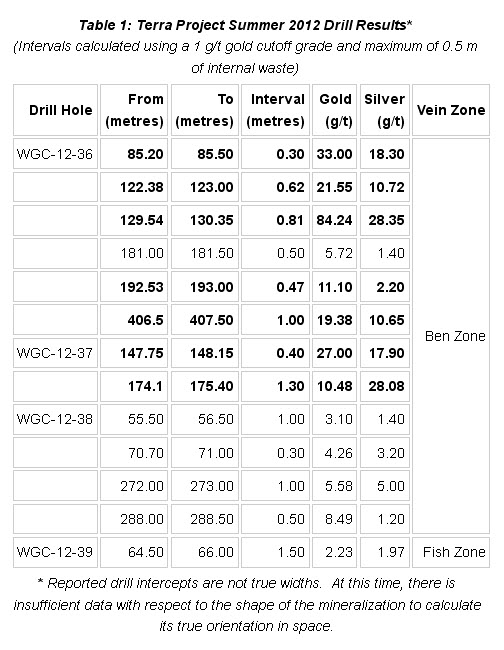

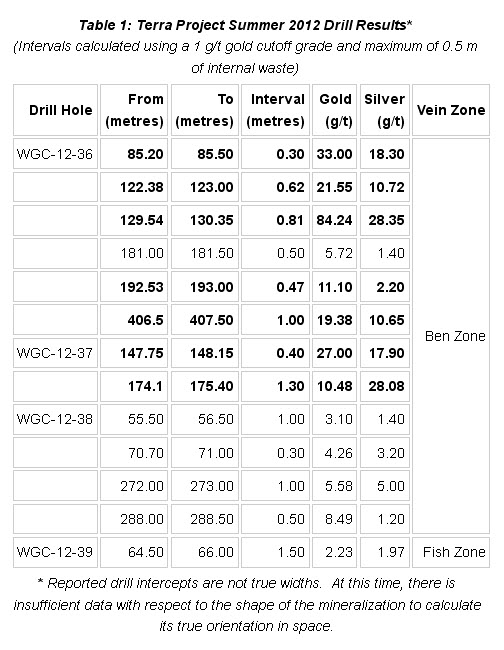

Drilling and surface sampling of the Ben Vein has defined high-grade gold mineralization over a strike distance of over 2 kilometres, with additional high-grade veins known over a total of 5 kilometres of strike (to view Figure 1, please click here: http://media3.marketwire.com/docs/KOR1006m.pdf). The Ben Vein mineralization is continuous down dip to the limits of drilling (approximately 350 metres vertically) without noticeable change in grade (Table 1). A number of other mineral occurrences have been identified on the property but have not yet been tested by drilling.

Work by ITH resulted in the completion of a NI 43-101 compliant estimated Inferred Resource of 428,000 tonnes at a grade of 12.2 g/t gold (168,000 contained gold ounces) and 23.1 g/t silver (318,000 contained silver ounces), at a cutoff grade of 5.0 g/t gold on the Ben Vein, and the resource remains open along strike and down dip. The Ben Vein will be the immediate focus of the 2011 development program proposed by Terra Gold.

Table 1 Ben Vein Deposit - Summary of all Drill Holes in the Deposit (true thickness calculated for each interval, over all Ag-Au ratio is 2-1) Hole # From (metres) To (metres) True Thickness (metres) Gold (g/t)TR-05-01 7.47 8.53 0.81 140.75TR-05-02 12.04 13.87 0.65 4.66TR-05-03 31.85 33.53 0.54 11.19TR-05-04 110.34 111.25 0.83 6.61TR-05-11 105.77 110.95 3.83 10.19TR-05-12 190.2 193.24 1.40 8.79TR-06-16 118.17 122.38 3.78 4.40TR-06-17 128.69 132.89 3.02 22.24TR-07-18 146.94 149.35 1.38 2.90TR-07-19 144.53 148.5 3.11 1.75TR-07-20 125.7 134.72 6.62 4.05TR-07-21 176.12 177 0.47 3.08TR-07-22 153.92 157.33 2.05 10.44TR-07-23 173.4 176.83 2.64 3.69TR-07-24 198.28 201.47 2.65 3.70TR-07-25 162.15 163.04 0.66 16.00TR-07-26 62.01 64.22 2.50 12.00TR-07-27 99.22 103.34 2.10 17.81TR-07-28 109.51 113.23 2.10 8.24TR-07-31 132.9 142.4 5.50 6.26

Joint Venture Agreement

The joint venture agreement, dated effective September 15th, 2010, provides that Terra Gold will have an initial 51% interest in the Terra Property, subject to Terra Gold funding an aggregate of USD 6,000,000 in direct exploration and development expenditures on or before December 31, 2013, with the initial USD 1,000,000 being required prior to December 31, 2011. As part of the funding, Terra Gold will pay Raven Gold an aggregate of USD 200,000 as payment for the camp and equipment previously constructed by ITH and acquired by Raven Gold. In addition, Terra is required to pay to ITH, the former holder of the Terra property, an aggregate of USD 300,000 (of which USD 50,000 has been paid and an additional USD 100,000 is due on or before December 31, 2011) in stages to December 31, 2012, and Terra Gold/TMC are required to deliver to ITH an aggregate of 750,000 common shares of TMC prior to December 31, 2012, with the initial 250,000 common shares due on or before September 15, 2011. In addition Terra Gold has granted Raven a sliding scale "Net Smelter Royalty" (NSR) between 0.5% and 5% on all precious metal production for the Terra property and a 1% NSR royalty on all base metal production. If Terra Gold fails to fund any portion of the initial first year commitment and eventual three year commitment, or if the required payments and shares are not delivered to ITH, Raven Gold will be entitled to terminate the agreement and retain 100% of the property.

After it has completed its initial USD 6,000,000 contribution, Terra Gold will have the option to increase its interest in the project by 29% (to 80% total) by funding an additional USD 3,050,000 of development work. To exercise such option, Terra Gold/TMC will be required to pay ITH an additional USD 150,000 and deliver an additional 250,000 common shares of TMC. Following Terra Gold having completed its initial contribution (if it does not elect to acquire an additional 29% interest) or having earned an 80% interest (if it does), each party will be required to contribute its pro rata shares of further expenditures. Should the interest of Raven be diluted below 10% as a consequence of it not funding its proportionate share of the joint venture expenditures, the residual interest of Raven Gold interest will be converted to an additional property wide 1% NSR royalty on all metals produced.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

The ITH work programs at Terra were designed and supervised by Russell Myers, the Vice-President, Exploration of ITH and the President of Corvus. On-site personnel at the project photographed the core from each individual borehole prior to preparing the split core. On-site personnel at the project logged and tracked all samples prior to sealing and shipping. All sample shipments were sealed and shipped to ALS Chemex in Fairbanks, Alaska, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assay. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision were monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control was further assured by the use of international and in-house standards. Finally, representative blind duplicate samples were forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Alaska and Nevada, which controls a number of exploration projects representing a spectrum from early stage to the advanced gold projects. Corvus is committed to building shareholder value through new discoveries and leveraging those discoveries via partner funding into carried or royalty interests that provide its shareholders significant exposure to produced gold to maximize the value for their investment.

On behalf of Corvus Gold Inc.

Jeffrey A. Pontius, Chairman and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential for the expansion of the estimated resources at Terra, the potential for any production at the Terra project, the potential commencement of any development of a mine at Terra following a production decision, the potential for any income stream to accrue to Raven Gold or Corvus from the Terra property (either in the near term or at all), business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company or its joint venture partners may produce or plan to produce, the Company's or any of its joint venture partners' inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's or any of its joint venture partners' inability to produce minerals from its properties successfully or profitably, to continue its or their projected growth, to raise the necessary capital or to be fully able to implement its or their business strategies, and other risks and uncertainties disclosed in the Information Circular of International Tower Hill Mines Ltd. dated July 9, 2010 in respect of the ITH Special Meeting held on August 12, 2010. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Contact:

Quentin MaiCorvus Gold Inc.Manager - Corporate Communications1-888-770-7488 (toll free) or (604) 683-3246(604) 408-7499 (FAX)qmai@corvusgold.comShirley ZhouCorvus Gold Inc.Manager - Corporate Communications1-888

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 6, 2010) - Corvus Gold Inc. ("Corvus" or the "Company") (TSX:KOR - News) is pleased to announce that Raven Gold Alaska Inc., a subsidiary of Corvus ("Raven Gold"), has entered into a formal Exploration, Development and Mine Operating Agreement with Terra Gold Corporation ("Terra Gold"), a subsidiary of Terra Mining Corporation ("TMC"), to advance the Terra property in Alaska to production. Terra Gold has proposed an aggressive program to advance the project toward production. Their proposed program consists of additional diamond drilling and the collection and processing of a bulk sample to evaluate the recovery characteristics of the mineralization.

"We are very excited about finalizing the agreement with Terra Gold Corporation," said Russell Myers, the President of Corvus. "We believe that Terra Gold has the technical expertise to successfully take the Terra project to production and to fully realize the value of this high-grade gold-silver asset, which has the potential to provide a significant income stream to Corvus in the near-term."

About the Terra Project

High-grade gold mineralization was discovered in low-sulphidation epithermal veins at Terra in 1998. The project was advanced by drilling in 2005 by AngloGold Ashanti (U.S.A.) Exploration Inc. and in 2006 and 2007 by International Tower Hill Mines Ltd. ("ITH"). The Terra property consists of 236 State of Alaska Mining Claims (approximately 130 km(2)), of which 5 are held under lease from an individual and the balance are owned 100% by Raven Gold.

Drilling and surface sampling of the Ben Vein has defined high-grade gold mineralization over a strike distance of over 2 kilometres, with additional high-grade veins known over a total of 5 kilometres of strike (to view Figure 1, please click here: http://media3.marketwire.com/docs/KOR1006m.pdf). The Ben Vein mineralization is continuous down dip to the limits of drilling (approximately 350 metres vertically) without noticeable change in grade (Table 1). A number of other mineral occurrences have been identified on the property but have not yet been tested by drilling.

Work by ITH resulted in the completion of a NI 43-101 compliant estimated Inferred Resource of 428,000 tonnes at a grade of 12.2 g/t gold (168,000 contained gold ounces) and 23.1 g/t silver (318,000 contained silver ounces), at a cutoff grade of 5.0 g/t gold on the Ben Vein, and the resource remains open along strike and down dip. The Ben Vein will be the immediate focus of the 2011 development program proposed by Terra Gold.

Table 1 Ben Vein Deposit - Summary of all Drill Holes in the Deposit (true thickness calculated for each interval, over all Ag-Au ratio is 2-1) Hole # From (metres) To (metres) True Thickness (metres) Gold (g/t)TR-05-01 7.47 8.53 0.81 140.75TR-05-02 12.04 13.87 0.65 4.66TR-05-03 31.85 33.53 0.54 11.19TR-05-04 110.34 111.25 0.83 6.61TR-05-11 105.77 110.95 3.83 10.19TR-05-12 190.2 193.24 1.40 8.79TR-06-16 118.17 122.38 3.78 4.40TR-06-17 128.69 132.89 3.02 22.24TR-07-18 146.94 149.35 1.38 2.90TR-07-19 144.53 148.5 3.11 1.75TR-07-20 125.7 134.72 6.62 4.05TR-07-21 176.12 177 0.47 3.08TR-07-22 153.92 157.33 2.05 10.44TR-07-23 173.4 176.83 2.64 3.69TR-07-24 198.28 201.47 2.65 3.70TR-07-25 162.15 163.04 0.66 16.00TR-07-26 62.01 64.22 2.50 12.00TR-07-27 99.22 103.34 2.10 17.81TR-07-28 109.51 113.23 2.10 8.24TR-07-31 132.9 142.4 5.50 6.26

Joint Venture Agreement

The joint venture agreement, dated effective September 15th, 2010, provides that Terra Gold will have an initial 51% interest in the Terra Property, subject to Terra Gold funding an aggregate of USD 6,000,000 in direct exploration and development expenditures on or before December 31, 2013, with the initial USD 1,000,000 being required prior to December 31, 2011. As part of the funding, Terra Gold will pay Raven Gold an aggregate of USD 200,000 as payment for the camp and equipment previously constructed by ITH and acquired by Raven Gold. In addition, Terra is required to pay to ITH, the former holder of the Terra property, an aggregate of USD 300,000 (of which USD 50,000 has been paid and an additional USD 100,000 is due on or before December 31, 2011) in stages to December 31, 2012, and Terra Gold/TMC are required to deliver to ITH an aggregate of 750,000 common shares of TMC prior to December 31, 2012, with the initial 250,000 common shares due on or before September 15, 2011. In addition Terra Gold has granted Raven a sliding scale "Net Smelter Royalty" (NSR) between 0.5% and 5% on all precious metal production for the Terra property and a 1% NSR royalty on all base metal production. If Terra Gold fails to fund any portion of the initial first year commitment and eventual three year commitment, or if the required payments and shares are not delivered to ITH, Raven Gold will be entitled to terminate the agreement and retain 100% of the property.

After it has completed its initial USD 6,000,000 contribution, Terra Gold will have the option to increase its interest in the project by 29% (to 80% total) by funding an additional USD 3,050,000 of development work. To exercise such option, Terra Gold/TMC will be required to pay ITH an additional USD 150,000 and deliver an additional 250,000 common shares of TMC. Following Terra Gold having completed its initial contribution (if it does not elect to acquire an additional 29% interest) or having earned an 80% interest (if it does), each party will be required to contribute its pro rata shares of further expenditures. Should the interest of Raven be diluted below 10% as a consequence of it not funding its proportionate share of the joint venture expenditures, the residual interest of Raven Gold interest will be converted to an additional property wide 1% NSR royalty on all metals produced.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

The ITH work programs at Terra were designed and supervised by Russell Myers, the Vice-President, Exploration of ITH and the President of Corvus. On-site personnel at the project photographed the core from each individual borehole prior to preparing the split core. On-site personnel at the project logged and tracked all samples prior to sealing and shipping. All sample shipments were sealed and shipped to ALS Chemex in Fairbanks, Alaska, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assay. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision were monitored by the analysis of reagent blanks, reference material and replicate samples. Quality control was further assured by the use of international and in-house standards. Finally, representative blind duplicate samples were forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Alaska and Nevada, which controls a number of exploration projects representing a spectrum from early stage to the advanced gold projects. Corvus is committed to building shareholder value through new discoveries and leveraging those discoveries via partner funding into carried or royalty interests that provide its shareholders significant exposure to produced gold to maximize the value for their investment.

On behalf of Corvus Gold Inc.

Jeffrey A. Pontius, Chairman and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the discovery and delineation of mineral deposits/resources/reserves, the potential for the expansion of the estimated resources at Terra, the potential for any production at the Terra project, the potential commencement of any development of a mine at Terra following a production decision, the potential for any income stream to accrue to Raven Gold or Corvus from the Terra property (either in the near term or at all), business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company or its joint venture partners may produce or plan to produce, the Company's or any of its joint venture partners' inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's or any of its joint venture partners' inability to produce minerals from its properties successfully or profitably, to continue its or their projected growth, to raise the necessary capital or to be fully able to implement its or their business strategies, and other risks and uncertainties disclosed in the Information Circular of International Tower Hill Mines Ltd. dated July 9, 2010 in respect of the ITH Special Meeting held on August 12, 2010. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Cautionary Note Regarding References to Resources and Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM.

United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

Contact:

Quentin MaiCorvus Gold Inc.Manager - Corporate Communications1-888-770-7488 (toll free) or (604) 683-3246(604) 408-7499 (FAX)qmai@corvusgold.comShirley ZhouCorvus Gold Inc.Manager - Corporate Communications1-888

News

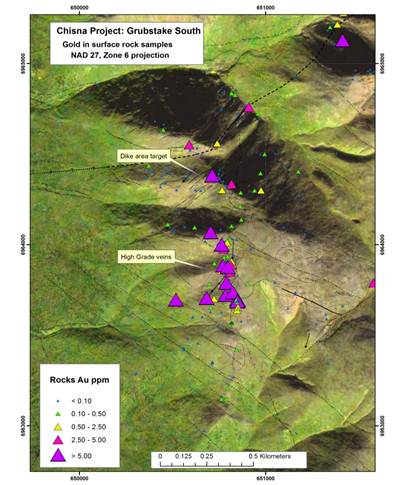

Corvus Gold Inc. Announces Initial Drilling Results from Grubstake Target, Chisna Copper-Gold Project, Alaska

October 13, 2010

Identifies Large Porphyry Complex with Significant Copper and Gold Mineralization